Exhibit 99.1

Our Plan for Enhancing Stockholder Value at Firsthand Technology Value Fund, Inc. Nasdaq: SVVC

STRICTLY CONFIDENTIAL PAGE 1 The materials contained herein (the “Materials”) represent the opinions of Star Equity Fund, LP and the other participants named in the proxy solicitation (collectively, the “Star Equity”) and are based on publicly available information with respect to Firsthand Technology Value Fund, Inc . (the “Company”) . Star Equity recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with Star Equity’s conclusions . Star Equity reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such changes . Star Equity disclaims any obligation to update the information or opinions contained herein . Certain financial projections and statements made herein have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) or other regulatory authorities and from other third - party reports . There is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein . The estimates, projections and potential impact of the opportunities identified by Star Equity herein are based on assumptions that Star Equity believes to be reasonable as of the date of the Materials, but there can be no assurance or guarantee that actual results or performance of the Company will not differ, and such differences may be material . The Materials are provided merely as information and are not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security . Certain members of Star Equity currently beneficially own, and/or have an economic interest in, securities of the Company . It is possible that there will be developments in the future (including changes in price of the Company’s securities) that cause one or more members of Star Equity from time to time to sell all or a portion of their holdings of the Company in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities . To the extent that Star Equity discloses information about its position or economic interest in the securities of the Company in the Materials, it is subject to change and Star Equity expressly disclaims any obligation to update such information . The Materials contain forward - looking statements . All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opportunity,” “estimate,” “plan,” “may,” “will,” “projects,” “targets,” “forecasts,” “seeks,” “could,” and similar expressions are generally intended to identify forward - looking statements . The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of the Materials and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such projected results and statements . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Star Equity . Although Star Equity believes that the assumptions underlying the projected results or forward - looking statements are reasonable as of the date of the Materials, any of the assumptions could be inaccurate and therefore, there can be no assurance that the projected results or forward - looking statements included herein will prove to be accurate . In light of the significant uncertainties inherent in the projected results and forward - looking statements included herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected results and forward - looking statements will be achieved . Star Equity will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward - looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events . Unless otherwise indicated herein, Star Equity has not sought or obtained consent from any third party to use any statements, photos or information indicated herein as having been obtained or derived from statements made or published by third parties . Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein . No warranty is made as to the accuracy of data or information obtained or derived from filings made with the SEC by the Company or from any third - party source . All trade names, trademarks, service marks, and logos herein are the property of their respective owners who retain all proprietary rights over their use . Disclaimer

STRICTLY CONFIDENTIAL PAGE 2 It Is Time for Change at Firsthand Technology Value Fund (SVVC) SVVC Shareholders have endured years of value destruction under the incumbent directors In our view: • The incumbent directors are entrenched, and their interests are misaligned with those of shareholders • SVVC has maintained an egregiously anti - shareholder investment management agreement with Firsthand Capital Management • The SVVC Board has ignored displays of shareholder frustration • The SVVC Board has maintained anti - shareholder bylaws discouraging shareholder participation at the Company Star Equity Fund’s nominees will bring to the SVVC Board the experience necessary to effectuate meaningful change for the benefit of all shareholders

STRICTLY CONFIDENTIAL PAGE 3 The Incumbent SVVC Directors Have Overseen Colossal Value Destruction at SVVC

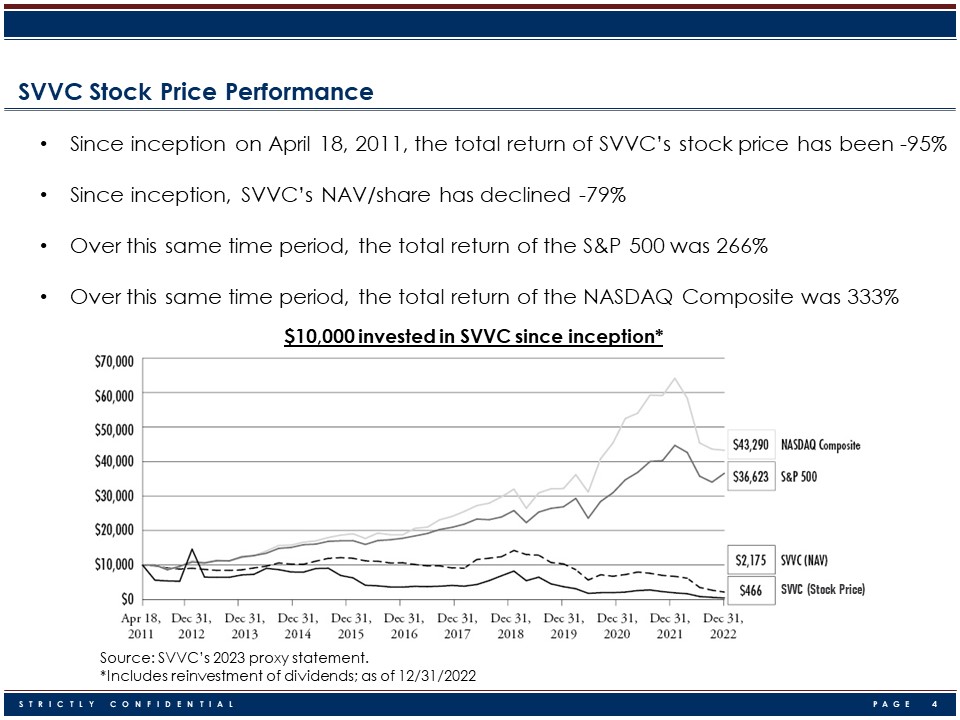

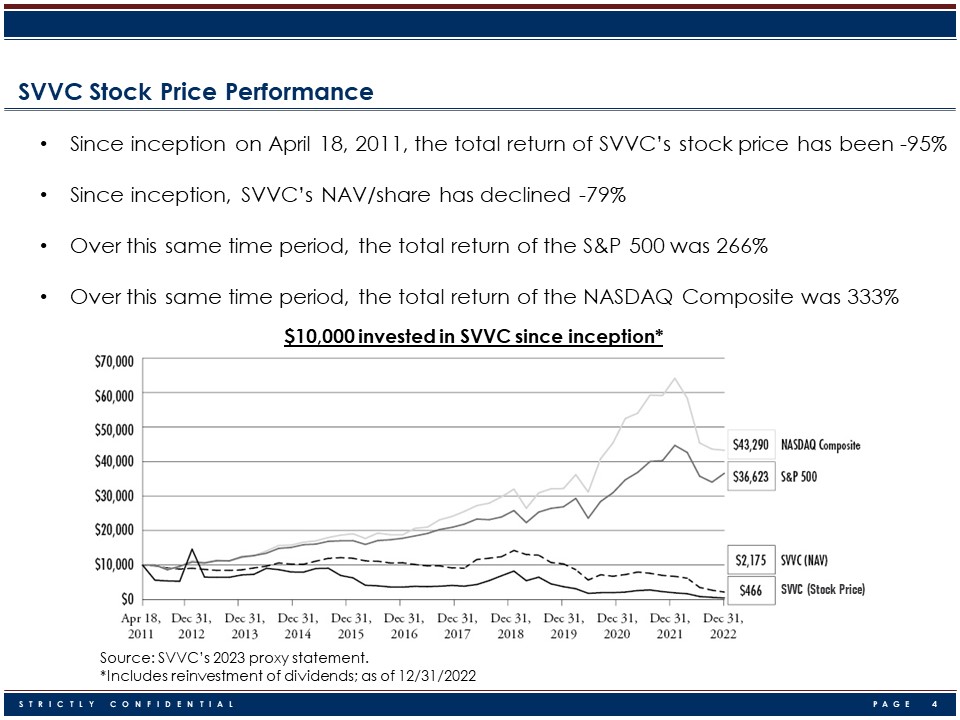

STRICTLY CONFIDENTIAL PAGE 4 SVVC Stock Price Performance $10,000 invested in SVVC since inception* Source: SVVC’s 2023 proxy statement. *Includes reinvestment of dividends; as of 12/31/2022 • Since inception on April 18, 2011, the total return of SVVC’s stock price has been - 95% • Since inception, SVVC’s NAV/share has declined - 79% • Over this same time period, the total return of the S&P 500 was 266% • Over this same time period, the total return of the NASDAQ Composite was 333% SVVC (Stock Price)

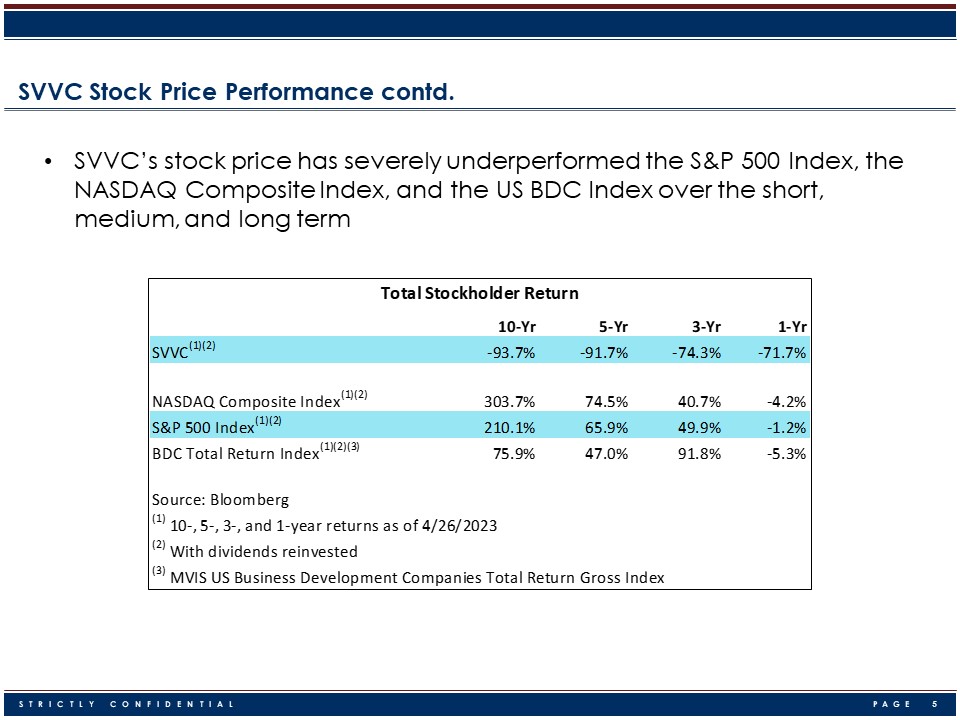

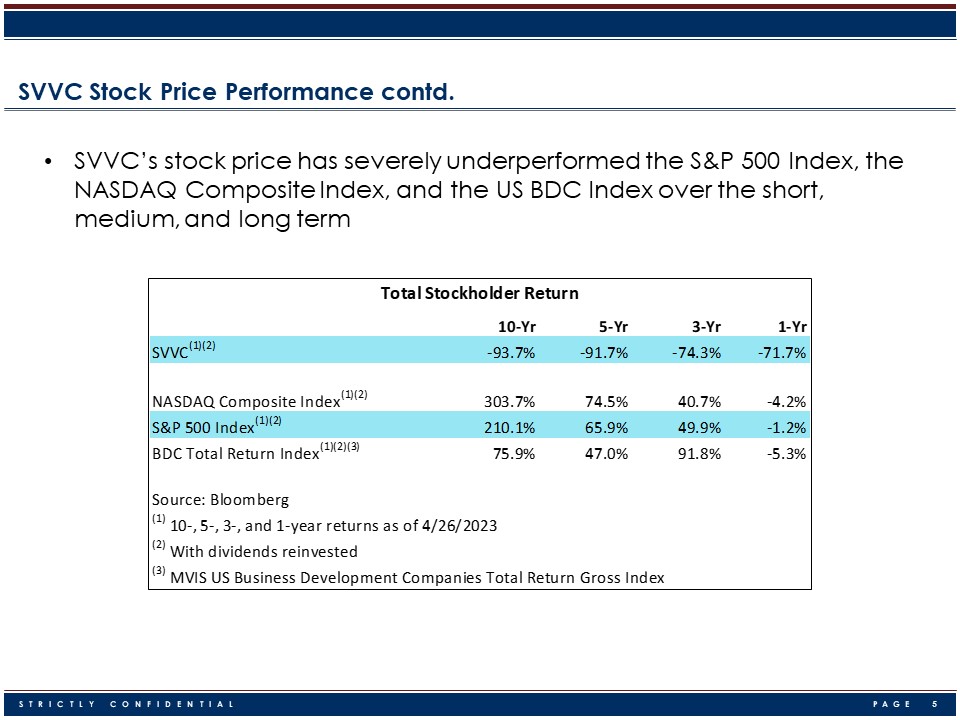

STRICTLY CONFIDENTIAL PAGE 5 SVVC Stock Price Performance contd. • SVVC’s stock price has severely underperformed the S&P 500 Index, the NASDAQ Composite Index, and the US BDC Index over the short, medium, and long term 10-Yr 5-Yr 3-Yr 1-Yr SVVC (1)(2) -93.7% -91.7% -74.3% -71.7% NASDAQ Composite Index (1)(2) 303.7% 74.5% 40.7% -4.2% S&P 500 Index (1)(2) 210.1% 65.9% 49.9% -1.2% BDC Total Return Index (1)(2)(3) 75.9% 47.0% 91.8% -5.3% Source: Bloomberg (1) 10-, 5-, 3-, and 1-year returns as of 4/26/2023 (2) With dividends reinvested (3) MVIS US Business Development Companies Total Return Gross Index Total Stockholder Return

STRICTLY CONFIDENTIAL PAGE 6 SVVC Stock Price Performance contd. SVVC’s stock continues to trade at a significant discount to its NAV/share • The huge discount to NAV implies the market believes: o NAV/share is significantly overstated o NAV/share is going to decline in the future, or BOTH 0.00 0.10 0.20 0.30 0.40 0.50 0.60 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 SVVC: Share Price/NAV

STRICTLY CONFIDENTIAL PAGE 7 0.00 5.00 10.00 15.00 20.00 25.00 30.00 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 SVVC: Share Price vs NAV Share Price NAV SVVC Stock Price Performance contd. • SVVC has consistently traded below its stated NAV/share • We believe any 1940 Act company (BDC, REIT, Closed - End Fund) that doesn’t pay regular dividends is likely to trade at a discount to NAV • We believe SVVC’s strategy of VC investing is flawed for a BDC structure

STRICTLY CONFIDENTIAL PAGE 8 SVVC’s Investment Performance Has Been Dismal

STRICTLY CONFIDENTIAL PAGE 9 SVVC Investment Performance Company Primary Industry Investment Cost Basis Value Gain/Loss EQX Capital, Inc. Equipment Leasing Common Stock $20,000 $11,130 ($8,870) EQX Capital, Inc. Equipment Leasing Preferred Stock - Series A $1,950,000 $865,995 ($1,084,005) Hera Systems, Inc. Aerospace Convertible Note due Dec 2024 @ 5% $1,200,000 $1,200,000 $0 Hera Systems, Inc. Aerospace Convertible Note due Dec 2022 @ 10% $5,359,791 $5,359,791 $0 Hera Systems, Inc. Aerospace Preferred Stock $11,237,102 $384,068 ($10,853,034) Hera Systems, Inc. Aerospace Preferred Stock Warrants $0 $953,891 $953,891 Intraop Medical Corp. Medical Devices Convertible Note due Dec 2022 @ 15% $22,811,129 $14,039,406 ($8,771,723) Intraop Medical Corp. Medical Devices Preferred Stock - Series C $26,299,938 $0 ($26,299,938) Intraop Medical Corp. Medical Devices Term Note due Dec 2022 @ 8% $5,000,000 $3,077,315 ($1,922,685) Kyma, Inc. Advanced Materials Convertible Note due Mar 2023 @ 10% $100,000 $100,000 $0 Lyncean Technologies, Inc. Semiconductor Equipment Preferred Stock - Series B $1,000,000 $0 ($1,000,000) Revasum, Inc. Semiconductor Equipment CDIs $9,268,219 $3,520,496 ($5,747,723) Silicon Genesis Corp. Intellectual Property Common Stock $169,045 $111 ($168,934) Silicon Genesis Corp. Intellectual Property Preferred Stock $8,187,698 $737,112 ($7,450,586) Silicon Genesis Corp. Intellectual Property Common Stock Warrants $6,678 $1 ($6,677) UCT Coatings, Inc. Advanced Materials Common Stock $662,235 $337,500 ($324,735) Wrightspeed, Inc. Automotive Common Stock $7,460,851 $546 ($7,460,305) Wrightspeed, Inc. Automotive Preferred Stock $17,355,887 $1,049,478 ($16,306,409) Wrightspeed, Inc. Automotive Preferred Stock Warrants $0 $3,232 $3,232 Wrightspeed, Inc. Automotive Convertible Note due Dec 2022 @ 12% $24,029,015 $7,809,430 ($16,219,585) Investment Company Fidelity Investments Money Market Treasury Portfolio $672,422 $672,422 $0 Total Investments $142,790,010 $40,121,924($102,668,086) Liabilities in Excess of Other Assets (Accrued/Unpaid Management Fee) -$9,512,333 NAV $30,609,591 SVVC investment portfolio as of December 31, 2022 • SVVC’s current portfolio has unrealized losses of over $100 million , representing a 72% decline from cost basis.

STRICTLY CONFIDENTIAL PAGE 10 SVVC Has Underperformed its Peers and Trades at a Larger Discount to NAV than do its Peers

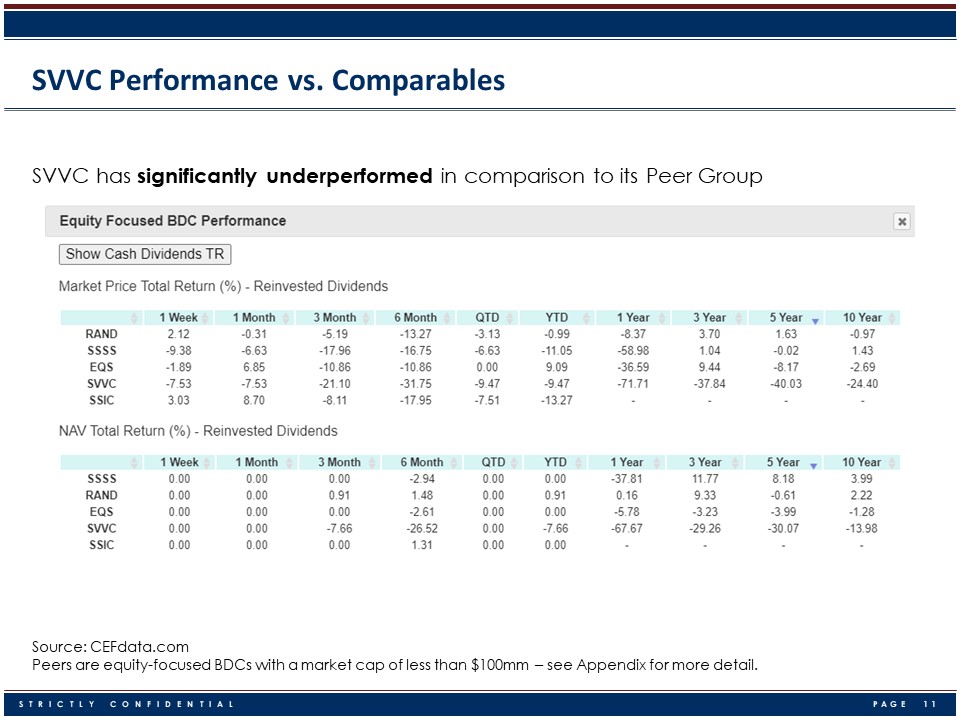

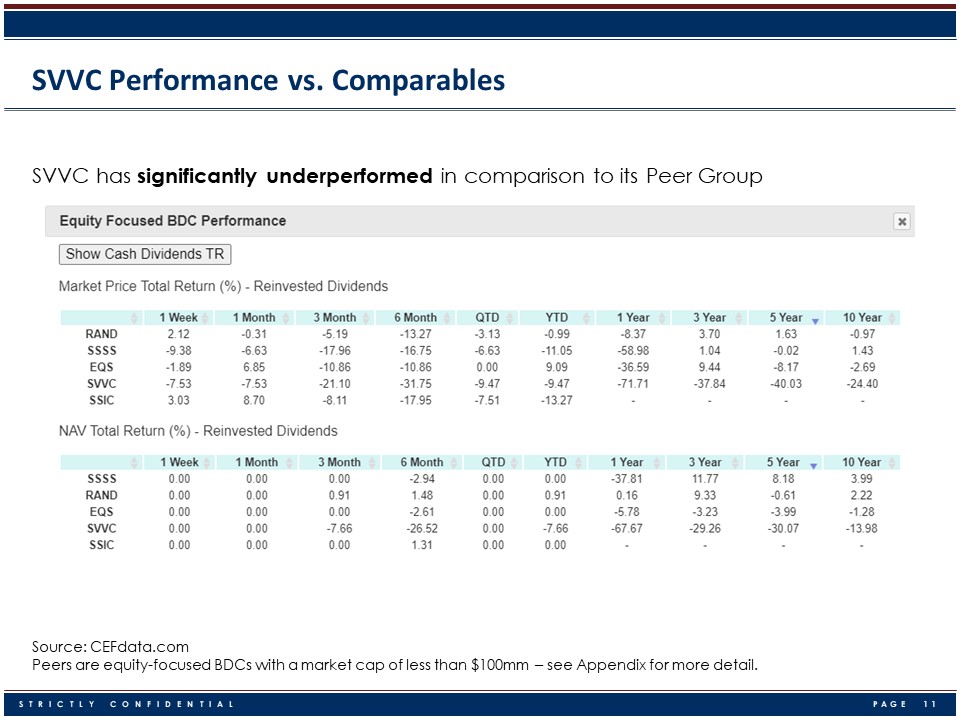

STRICTLY CONFIDENTIAL PAGE 11 SVVC Performance vs. Comparables SVVC Total Return vs. Peers as of 5/5/23 Source: CEFdata.com Peers are equity - focused BDCs with a market cap of less than $100mm – see Appendix for more detail. SVVC has significantly underperformed in comparison to its Peer Group

STRICTLY CONFIDENTIAL PAGE 12 SVVC Performance vs. Comparables contd. SVVC Total Return vs. Peers SVVC stock price has significantly underperformed in comparison to its Peer Group Source: CEFdata.com Peers are equity - focused BDCs with a market cap of less than $100mm – see Appendix for more detail.

STRICTLY CONFIDENTIAL PAGE 13 SVVC’s Incumbent Directors are Entrenched and Misaligned

STRICTLY CONFIDENTIAL PAGE 14 Incumbent Directors are Not Aligned with Shareholders • The incumbent independent directors hold very little stock in the company, and thus do not have “skin in the game” • We believe this contributes to the Board’s complacency around the horrendous performance of SVVC’s investments and stock price • The independent directors collectively own a paltry ~$2,500 - worth of SVVC shares despite an average Board tenure of 11 years Source: SVVC’s 2023 proxy statement.

STRICTLY CONFIDENTIAL PAGE 15 The Incumbent Directors Have Ignored Repeated Displays of Shareholder Frustration

STRICTLY CONFIDENTIAL PAGE 16 The Incumbent Directors Have Consistently Ignored Shareholders The Incumbent directors have entirely ignored frustrated shareholders and has used its anti - shareholder bylaws to thwart participation at the Company: • For the 2020 Annual Meeting, fellow shareholder Donald R. Chambers submitted a proposal urging shareholders to vote “WITHHOLD” on director candidates and “AGAINST” the Company’s “say on pay” proposal • In May 2021, fellow shareholder Rawleigh Ralls issued a press release urging the Board to terminate the investment management agreement and even offered to help transition the investment manager free of charge • For the 2021 Annual Meeting, Mr. Chambers submitted a binding proposal to terminate all investment advisory and management agreements between SVVC and FCM • In January 2022, fellow shareholder Scott Klarquist published a 2 - part presentation urging shareholders to vote “WITHHOLD” on incumbent directors, “AGAINST” say on pay, and “FOR” any proposal to terminate the investment management agreement • In March 2022, Mr. Klarquist announced his intent to solicit proxies, but his nomination was rejected by the Company for vague reasons • For the 2022 Annual Meeting, Mr. Chambers submitted a binding proposal to terminate all investment advisory and management agreements between SVVC and FCM • For the 2023 Annual Meeting, Mr. Chambers submitted a non - binding proposal to terminate the investment management agreement between SVVC and FCM

STRICTLY CONFIDENTIAL PAGE 17 The Incumbent Directors Have Consistently Ignored Shareholders contd. • None of these proposals has ever been addressed by the Board, and SVVC’s bylaws make it so proposals must receive a majority of all outstanding (not those voted) shares to pass • SVVC’s 2020 Annual Meeting Results 8 - K disclosed 49% and 36% of votes cast voted “WITHHOLD” on the election of Kimun Lee and Kevin Landis, respectively o The Company also disclosed that 70% of votes cast voted “FOR” Proposal 3: a non - binding stockholder proposal that the board seek and pursue and all measures to enhance stockholder value • SVVC’s 2021 Annual Meeting Results 8 - K disclosed 59% of votes cast voted “WITHHOLD” on both Greg Burglin and Rodney Yee o The Company also disclosed that 62% of votes cast voted “FOR” Proposal 3: a binding stockholder proposal to terminate the investment advisory agreements between SVVC and Firsthand Capital Management • SVVC’s 2022 Annual Meeting Results 8 - K disclosed 65% of votes cast voted “WITHHOLD” on Nicholas Petredis o The Company also disclosed that 71% of votes cast voted “FOR” Proposal 3: a binding stockholder proposal to terminate the investment advisory agreements between SVVC and Firsthand Capital Management

STRICTLY CONFIDENTIAL PAGE 18 SVVC Maintains an Egregiously Anti - Shareholder Investment Management Agreement

STRICTLY CONFIDENTIAL PAGE 19 SVVC Maintains an egregiously Anti - Shareholder Investment Management Agreement • SVVC maintains an egregiously Anti - Shareholder investment management agreement with Firsthand Capital Management (“FCM”) o FCM is an affiliated party, an investment management firm run by Kevin Landis • We believe that this relationship represents a conflict of interest and has long been a source of value destruction at the Company • The nature of the agreement allows Kevin Landis and FCM to collect 2% of gross assets – ignoring share price performance entirely • This agreement incentivizes management to maintain a high accounting NAV which doesn’t seem to reflect economic performance as shown by consistent write - downs of SVVC’s NAV/share Source: SVVC’s 2022 Form 10 - K.

STRICTLY CONFIDENTIAL PAGE 20 • FCM has $9 million in accrued and unpaid management fees as of 12/31/2022 • We believe the Board should eliminate these accrued fees entirely given SVVC’s terrible performance SVVC Maintains an egregiously Anti - Shareholder Investment Management Agreement contd. Source: SVVC’s 2022 Form 10 - K.

STRICTLY CONFIDENTIAL PAGE 21 Star Equity’s Nominees are Highly Qualified, Highly Motivated, and Fully Prepared to Immediately Effectuate Meaningful Change at SVVC

STRICTLY CONFIDENTIAL PAGE 22 Star Equity Fund Nominee – Robert G. Pearse • Currently serves as a Managing Partner at Yucatan Rock Ventures, an investment and consulting firm, since 2012 • Previously, he served as VP of Strategy and Market Development for NetApp, Inc. (NASDAQ: NTAP), a publicly - traded computer storage and data management company, from 2005 - 2012 • He held previous leadership positions at Hewlett - Packard Company (n/k/a HP Inc. (NYSE: HPQ)), a leading global provider of personal computing and other access devices, from 1987 to 2004 including VP of Corporate Development from 2001 - 2004 • Mr. Pearse has previously served as a member of the board of directors of AmeriHoldings, Inc. (n/k/a Enveric Biosciences, Inc. (NASDAQ: ENVB)), a specialized SAP® cloud, digital and enterprise solutions company, from 2015 to August 2018; Novation Companies, Inc. (OTC: NOVC), a provider of outsourced health care staffing and related services, from 2015 to April 2018; Crossroads Systems Inc. (OTCQX: CRSS), an intellectual property licensing company, from 2013 to October 2017, including as Chairman of the Board from 2016 to October 2017; and Aviat Networks, Inc. (NASDAQ: AVNW), a global supplier of microwave networking solutions, from 2015 to 2016 • Mr. Pearse earned an M.B.A. in Finance and Strategy from the Stanford Graduate School of Business and a B.S. in Mechanical Engineering from the Georgia Institute of Technology We believe that Mr. Pearse’s business development and financial expertise and his extensive background in the technology sector will make him a valuable addition to the Board

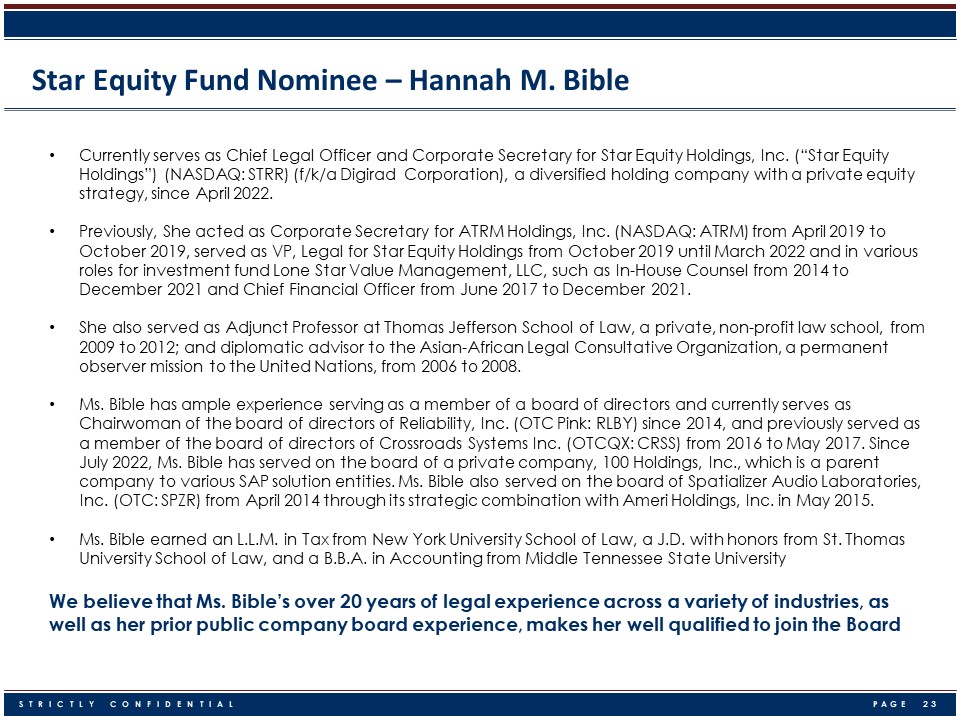

STRICTLY CONFIDENTIAL PAGE 23 Star Equity Fund Nominee – Hannah M. Bible • Currently serves as Chief Legal Officer and Corporate Secretary for Star Equity Holdings, Inc. (“Star Equity Holdings”) (NASDAQ: STRR) (f/k/a Digirad Corporation), a diversified holding company with a private equity strategy, since April 2022. • Previously, She acted as Corporate Secretary for ATRM Holdings, Inc. (NASDAQ: ATRM) from April 2019 to October 2019, served as VP, Legal for Star Equity Holdings from October 2019 until March 2022 and in various roles for investment fund Lone Star Value Management, LLC, such as In - House Counsel from 2014 to December 2021 and Chief Financial Officer from June 2017 to December 2021. • She also served as Adjunct Professor at Thomas Jefferson School of Law, a private, non - profit law school, from 2009 to 2012; and diplomatic advisor to the Asian - African Legal Consultative Organization, a permanent observer mission to the United Nations, from 2006 to 2008. • Ms. Bible has ample experience serving as a member of a board of directors and currently serves as Chairwoman of the board of directors of Reliability, Inc. (OTC Pink: RLBY) since 2014, and previously served as a member of the board of directors of Crossroads Systems Inc. (OTCQX: CRSS) from 2016 to May 2017. Since July 2022, Ms. Bible has served on the board of a private company, 100 Holdings, Inc., which is a parent company to various SAP solution entities. Ms. Bible also served on the board of Spatializer Audio Laboratories, Inc. (OTC: SPZR) from April 2014 through its strategic combination with Ameri Holdings, Inc. in May 2015. • Ms. Bible earned an L.L.M. in Tax from New York University School of Law, a J.D. with honors from St. Thomas University School of Law, and a B.B.A. in Accounting from Middle Tennessee State University We believe that Ms. Bible’s over 20 years of legal experience across a variety of industries, as well as her prior public company board experience, makes her well qualified to join the Board

STRICTLY CONFIDENTIAL PAGE 24 If Elected, Our Nominees Would Push For: 1. Immediate termination of the investment management agreement with FCM 2. Changing the anti - shareholder bylaws including the highly restrictive voting requirements on director nominees and shareholder proposals 3. Better facilitation of shareholder input and participation at the Company 4. Changing the strategy to one of a more traditional BDC: • Cease making venture capital investments • Instead issue interest - bearing loans to less speculative portfolio companies • Reinstate dividend in order to help stock price converge with NAV/share over time

STRICTLY CONFIDENTIAL PAGE 25 APPENDIX

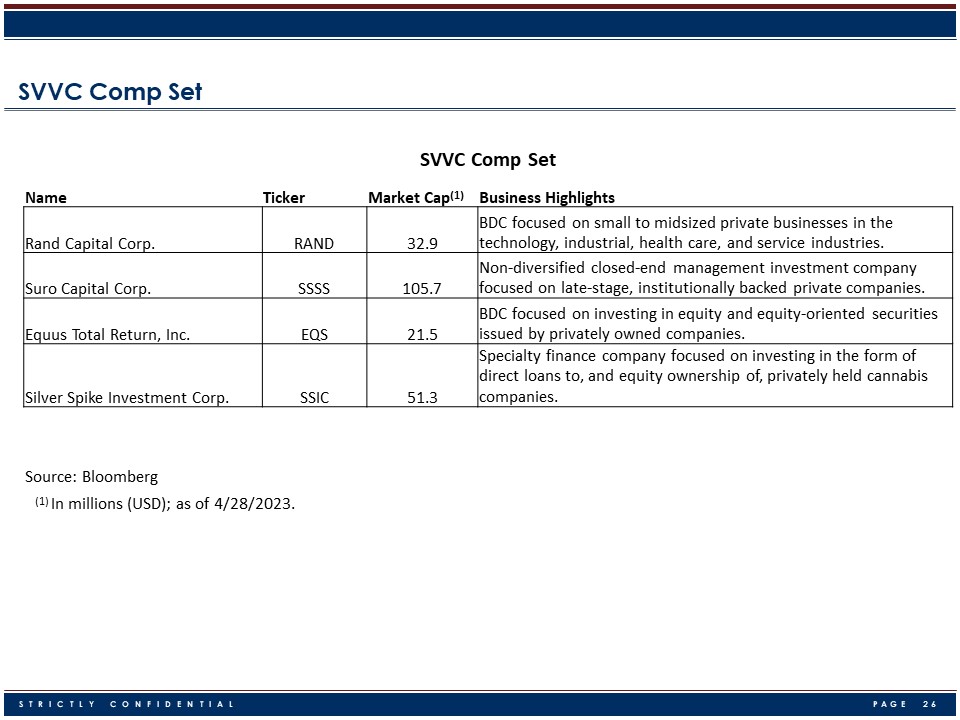

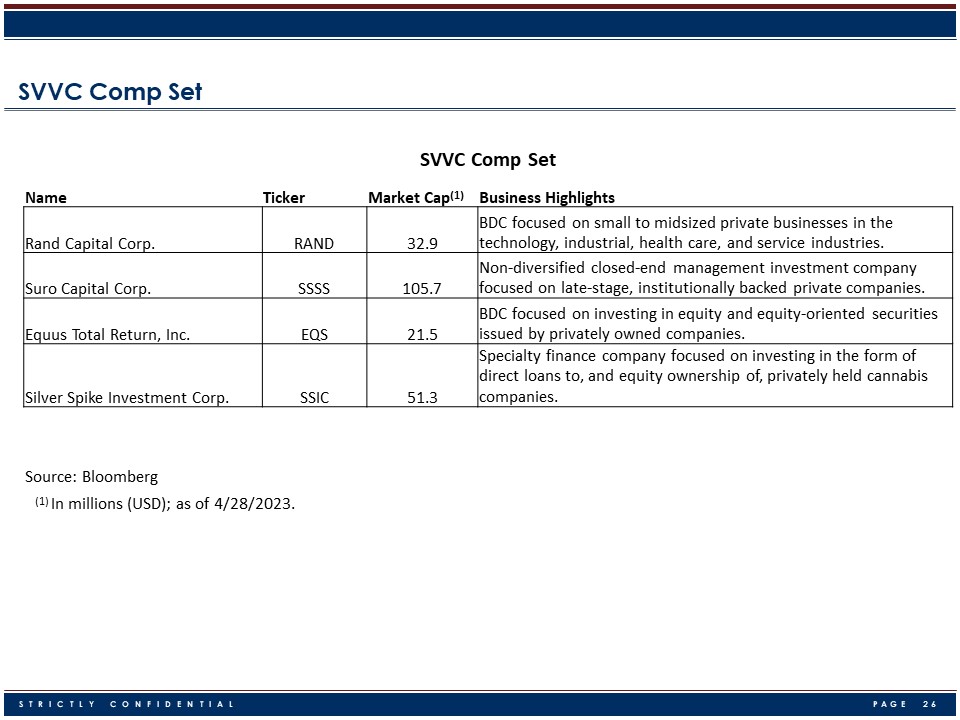

STRICTLY CONFIDENTIAL PAGE 26 SVVC Comp Set SVVC Comp Set Name Ticker Market Cap (1) Business Highlights Rand Capital Corp. RAND 32.9 BDC focused on small to midsized private businesses in the technology, industrial, health care, and service industries. Suro Capital Corp. SSSS 105.7 Non - diversified closed - end management investment company focused on late - stage, institutionally backed private companies. Equus Total Return, Inc. EQS 21.5 BDC focused on investing in equity and equity - oriented securities issued by privately owned companies. Silver Spike Investment Corp. SSIC 51.3 Specialty finance company focused on investing in the form of direct loans to, and equity ownership of, privately held cannabis companies. Source: Bloomberg (1) In millions (USD); as of 4/28/2023.