Table of Contents

As filed with the Securities and Exchange Commission on July 16, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

APRIA HEALTHCARE GROUP INC.

(Exact name of registrant as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

Delaware (State or other jurisdiction of | 8082 (Primary Standard Industrial | 33-0488566 (I.R.S. Employer |

26220 Enterprise Court,

Lake Forest, CA 92630

(949) 639-2000

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Robert S. Holcombe, Esq.

Executive Vice President, General Counsel and Secretary

Apria Healthcare Group Inc.

26220 Enterprise Court

Lake Forest, California 92630

(949) 639-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Edward P. Tolley III, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

(212) 455-2000

Approximate date of commencement of proposed exchange offers:As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x (Do not check if a smaller reporting company) | Small reporting company ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issue Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be | Proposed Maximum Offering Price Per Note | Proposed Offering Price(1) | Amount of Registration Fee | ||||

11.25% Senior Secured Notes due 2014 (Series A-1 Notes) | $700,000,000 | 100% | $700,000,000 | $49,910.00 | ||||

Guarantees of 11.25% Senior Secured Notes due 2014 (Series A-1 Notes)(2) | (3) | (3) | (3) | (3) | ||||

12.375% Senior Secured Notes due 2014 (Series A-2 Notes) | $317,500,000 | 100% | $317,500,000 | $22,637.75 | ||||

Guarantees of 12.375 Senior Secured Notes due 2014 (Series A-2 Notes)(2) | (3) | (3) | (3) | (3) | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | See inside facing page for additional registrant guarantors. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Additional Registrant Guarantors

Exact Name of Registrant Guarantor as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant Guarantor’s Principal Executive Offices | |||

Apria Healthcare of New York State, Inc. | New York | 16-1031905 | 26220 Enterprise Court Lake Forest, CA 92630 (949) 639-2000 | |||

Apria Healthcare, Inc. | Delaware | 33-0057155 | 26220 Enterprise Court Lake Forest, CA 92630 (949) 639-2000 | |||

ApriaCare Management Systems, Inc. | Delaware | 33-0675340 | 26220 Enterprise Court Lake Forest, CA 92630 (949) 639-2000 | |||

ApriaDirect.Com, Inc. | Delaware | 27-2820256 | 26220 Enterprise Court Lake Forest, CA 92630 (949) 639-2000 | |||

Coram Alternate Site Services, Inc. | Delaware | 76-0215922 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Clinical Trials, Inc. | Delaware | 58-2160656 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Alabama | Delaware | 58-1813484 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Florida | Delaware | 58-1949695 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Greater D.C. | Delaware | 58-2035129 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Greater New York | New York | 58-1844719 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Indiana | Delaware | 58-1813491 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Massachusetts | Delaware | 33-0532814 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Mississippi | Delaware | 58-1813479 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Nevada | Delaware | 58-1972771 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of New York | New York | 33-0458457 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of North Texas | Delaware | 33-0556959 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Northern California | Delaware | 58-1972773 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Table of Contents

Exact Name of Registrant Guarantor as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant Guarantor’s Principal Executive Offices | |||

Coram Healthcare Corporation of South Carolina | Delaware | 58-1813494 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Southern California | Delaware | 58-2006708 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Southern Florida | Delaware | 58-1949686 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare Corporation of Utah | Delaware | 95-4446209 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Healthcare of Wyoming, L.L.C. | Delaware | 84-1463833 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Homecare of Minnesota, Inc. | Delaware | 58-1874630 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Service Corporation | Delaware | 58-1910054 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram Specialty Infusion Services, Inc. | Delaware | 58-1813486 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

Coram, Inc. | Delaware | 84-1300129 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

CoramRx, LLC | Delaware | 25-1923172 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

H.M.S.S., Inc. | Delaware | 76-0005650 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

T2Medical, Inc. | Delaware | 59-2405366 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

HealthInfusion, Inc. | Florida | 65-0163627 | 555 17th Street, Suite 1500 Denver, CO 80202 (303) 292-4973 | |||

AHNY-DME LLC | New York | 27-2955068 | 26220 Enterprise Court Lake Forest, CA 92630 (949) 639-2000 | |||

AHNY-IV LLC | New York | 27-2954951 | 26220 Enterprise Court Lake Forest, CA 92630 (949) 639-2000 | |||

Table of Contents

The information in this prospectus is not complete and may be changed. We may not issue the exchange notes in the exchange offers until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where such offer or sale is not permitted.

Subject to Completion, dated July 16, 2010

| PRELIMINARY PROSPECTUS |

Apria Healthcare Group Inc.

Offers to Exchange

$700,000,000 aggregate principal amount of 11.25% Senior Secured Notes due 2014 (Series A-1) (the “exchange Series A-1 Notes”), which have been registered under the Securities Act of 1933, as amended (the “Securities Act”), for any and all outstanding 11.25% Senior Secured Notes due 2014 (Series A-1) (the “outstanding Series A-1 Notes”).

$317,500,000 aggregate principal amount of 12.375% Senior Secured Notes due 2014 (Series A-2) (the “exchange Series A-2 Notes” and, together with the exchange Series A-1 Notes, the “exchange notes”), which have been registered under the Securities Act, for any and all outstanding 12.375% Senior Secured Notes due 2014 (Series A-2) (the “outstanding Series A-2 Notes” and, together with the outstanding Series A-1 Notes, the “outstanding notes”).

The exchange notes will be fully and unconditionally guaranteed on a senior secured basis by our existing and future wholly-owned domestic subsidiaries that guarantee our existing senior secured asset-based revolving credit facility and the outstanding notes.

We are conducting the exchange offers in order to provide you with an opportunity to exchange your unregistered outstanding notes for freely tradeable exchange notes that have been registered under the Securities Act.

The Exchange Offers

| • | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradeable. |

| • | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the applicable exchange offer. |

| • | The exchange offers expire at 5:00 p.m., New York City time, on , 2010 which is the 21st business day after the date of this prospectus. |

| • | The exchange of outstanding notes for exchange notes in the exchange offers will not be a taxable event for U.S. federal income tax purposes. |

| • | The terms of the exchange notes to be issued in the exchange offers are substantially identical to the outstanding notes, except that the exchange notes will be freely tradeable. |

Results of the Exchange Offers:

| • | The exchange notes may be sold in the over-the-counter-market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market. |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offers, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

You should carefully consider the “Risk Factors” beginning on page 24 of this prospectus before participating in the exchange offers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offers or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2010.

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. This prospectus may be used only for the purposes for which it has been published and no person has been authorized to give any information not contained herein. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

| Page | ||

| ii | ||

| ii | ||

| ii | ||

| iii | ||

| 1 | ||

| 24 | ||

| 47 | ||

| 49 | ||

| 50 | ||

| 51 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 53 | |

| 92 | ||

| 120 | ||

| 147 | ||

| 150 | ||

| 153 | ||

| 163 | ||

| 239 | ||

| 242 | ||

| 249 | ||

| 251 | ||

| 252 | ||

| 252 | ||

| 252 | ||

| F-1 |

i

Table of Contents

This prospectus includes forward-looking statements regarding, among other things, our plans, strategies and prospects, both business and financial. These statements are based on the beliefs and assumptions of our management. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning our possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates” or similar expressions.

Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements. You should understand that the following important factors, in addition to those discussed in “Risk Factors” and elsewhere in this prospectus, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements:

| • | trends and developments affecting the collectibility of accounts receivable; |

| • | government legislative and budget developments that could continue to affect reimbursement levels; |

| • | potential reductions in reimbursement rates by government and third-party payors; |

| • | the effectiveness of our operating systems and controls; |

| • | healthcare reform and the effect of federal and state healthcare regulations; |

| • | economic and political events, international conflicts and natural disasters; |

| • | our ability to implement our outsourcing and other cost savings initiatives and to realize the projected benefits of these initiatives; |

| • | acquisition-related risks; and |

| • | the items discussed under “Risk Factors” in this prospectus. |

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. We undertake no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Information included in this prospectus about the healthcare industry, including our general expectations concerning this industry, is based on estimates prepared using data from various sources and on assumptions made by us. We believe data regarding this industry are inherently imprecise, but based on our understanding of the market in which we compete, we believe that such data are generally indicative of this industry. Our estimates, in particular as they relate to our general expectations concerning this industry, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption “Risk Factors.” Accordingly, you should not place undue reliance on the market and industry data included in this prospectus.

This prospectus contains some of our trademarks, trade names and service marks. Each one of these trademarks, trade names or service marks is either (i) our registered trademark, (ii) a trademark for which we have a pending application, (iii) a trade name or service mark for which we claim common law rights or (iv) a registered trademark or application for registration which we have been licensed by a third party to use. All other trademarks, trade names or service marks of any other company appearing in this prospectus belong to their respective owners.

ii

Table of Contents

As used in this prospectus, unless otherwise noted or the context otherwise requires, references to “Company,” “we,” “us,” and “our” are to Apria Healthcare Group Inc., a Delaware corporation, and its subsidiaries; references to “Apria” and the “Issuer” are to Apria Healthcare Group Inc., exclusive of its subsidiaries; references to “Merger Sub” are to Sky Merger Sub Corporation, a Delaware corporation; references to “Holdings” are to Apria Holdings LLC, a Delaware limited liability company, exclusive of its subsidiaries; references to “Sky Acquisition” are to “Sky Acquisition LLC”, a Delaware limited liability company, exclusive of its subsidiaries; references to “Blackstone” and the “Sponsor” are to Blackstone Capital Partners V L.P.; references to the “Investor Group” are, collectively, to Blackstone and certain funds affiliated with Blackstone, Dr. Norman C. Payson and certain other members of our management; and references to “home medical equipment,” “durable medical equipment” and “DME” are used synonymously.

The term “outstanding notes” refers to the outstanding 11.25% Senior Secured Notes due 2014 (Series A-1) and 12.375% Senior Secured Notes due 2014 (Series A-2). The term “exchange notes” refers to the 11.25% Senior Secured Notes due 2014 (Series A-1) and 12.375% Senior Secured Notes due 2014 (Series A-2), as registered under the Securities Act. The term “Series A-1 Notes” refers collectively to the outstanding Series A-1 Notes and the exchange Series A-1 Notes; the term “Series A-2 Notes” refers collectively to the outstanding Series A-2 Notes and the exchange Series A-2 Notes; and the term “Notes” refers collectively to the outstanding notes and the exchange notes.

We completed the acquisition of Coram, Inc. (“Coram”) on December 3, 2007. Historical financial information of the Company presented herein includes the results of Coram from the date of the acquisition and does not include the results of Coram prior to the date of the acquisition.

On June 18, 2008, Sky Acquisition and Merger Sub entered into an agreement and plan of merger with Apria (the “Merger Agreement”). Pursuant to the Merger Agreement, on October 28, 2008, Merger Sub merged with and into Apria, with Apria being the surviving corporation following the merger (the “Merger”). As a result of the Merger, the Investor Group beneficially owns all of Apria’s issued and outstanding capital stock.

The initial borrowings under Apria’s senior secured bridge credit agreement dated October 28, 2008 (the “senior secured bridge credit agreement”) and the credit agreement governing our senior secured asset-based revolving credit facility, dated October 28, 2008 (as amended from time to time, the “ABL Facility”), the equity investment by the Investor Group and the repayment of all outstanding indebtedness under our senior secured revolving credit facility, dated November 23, 2004, as amended (the “2004 senior secured revolving credit facility”), and Apria’s credit facility, dated June 18, 2008 (the “Interim Facility”), are collectively referred to in this prospectus as the “Original Financing.” The offerings of outstanding notes, the repayment of approximately $1,010.0 million of borrowings under Apria’s senior secured bridge credit agreement, plus accrued and unpaid interest, and the payment of related fees and expenses with the proceeds of the offerings of the outstanding notes, together with cash on hand, are collectively referred to in this prospectus as the “Refinancing.” The Merger, the Original Financing and the Refinancing are collectively referred to in this prospectus as the “Transactions.” For a more complete description of the Transactions, see “The Transactions” and “Description of Other Indebtedness.”

The term “Successor” refers to the Company following the Merger and the term “Predecessor” refers to the Company prior to the Merger.

Unless the context otherwise requires, the financial information presented herein is the financial information of Apria on a consolidated basis together with its subsidiaries.

iii

Table of Contents

This summary highlights information about us and the exchange offers contained in greater detail elsewhere in this prospectus. This summary is not complete and may not contain all of the information that may be important to you. You should carefully read the entire prospectus, especially the information presented under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before participating in the exchange offers.

Our Company

General

We are a quality, cost-efficient provider of home healthcare products and services in the United States, offering a comprehensive range of home respiratory therapy, home infusion therapy and home medical equipment services to over two million patients annually in all 50 states through approximately 500 locations. We hold market-leading positions across all of our major service lines—making us a leader in the homecare market. By targeting the managed care segment of the population, we are better positioned than many of our competitors to minimize risks associated with changes in Medicare/Medicaid reimbursement rates. We are focused on being the industry’s highest-quality provider of homecare services, while maintaining our commitment to being a low-cost operator. Our integrated product and service offerings, combined with our national scale and strong reputation, provide us with a strategic advantage in attracting clients, which include almost all of the national and regional managed care and government payors in the United States, and in retaining our referral base of more than 70,000 physicians, discharge planners, hospitals and third-party payors. For the year ended December 31, 2009 and for the three months ended March 31, 2010 our net revenues were $2,094.6 million and $508.9 million, respectively.

We have two operating segments, (1) home respiratory therapy and home medical equipment and (2) home infusion therapy. Within the two operating segments there are three core service lines: home respiratory therapy, home medical equipment and home infusion therapy. Through these service lines we provide patients with a variety of clinical and administrative support services and related products and supplies, most of which are prescribed by a physician as part of a care plan. We provide substantial benefits to both patients and payors by allowing patients to receive necessary care and services in the comfort of their own home while reducing the cost of treatment. Our services include:

| • | providing in-home clinical respiratory care, infusion nursing and pharmaceutical management services; |

| • | educating patients and caregivers about health conditions or illnesses and providing written instructions about home safety, self-care and the proper use of equipment; |

| • | monitoring patients’ individualized treatment plans; |

| • | reporting patient progress and status to the physician and/or managed care organization; |

| • | providing in-home delivery, set-up and maintenance of equipment and/or supplies; and |

| • | processing claims to third-party payors and billing/collecting patient co-pays and deductibles. |

Home Respiratory Therapy and Home Medical Equipment($1,169.6 million and $278.3 million, or 55.8% and 54.7%, of our net revenues for the year ended December 31, 2009 and the three months ended March 31, 2010, respectively)

Home Respiratory Therapy

We are the largest provider of home respiratory therapies in the United States to the managed care market serving approximately 1.5 million patients annually through our nationwide distribution platform that includes

1

Table of Contents

approximately 400 locations. We offer a full range of home respiratory therapy products and services, from the simplest nebulizer and oxygen concentrator to the most complex ventilator. Our services offer a compelling relative cost advantage to our patients and payors. For example, in-home oxygen treatment costs for a Medicare patient are on average less than $7 per day. Patients utilize our products to treat a variety of conditions, including:

| • | chronic obstructive pulmonary diseases (“COPD”), such as emphysema and chronic bronchitis (the fourth leading cause of death in the U.S.); |

| • | respiratory conditions associated with nervous system disorders or injuries, such as Lou Gehrig’s disease and quadriplegia; |

| • | congestive heart failure; and |

| • | lung cancer. |

By focusing our efforts primarily on the managed care population, we limit our exposure to the highly-regulated Medicare respiratory business, which is subject to changes in coverage, payment and pricing guidelines. As an example, Medicare oxygen accounted for less than 10% and 11% of our total net revenues for the year ended December 31, 2009 and three months ended March 31, 2010, respectively.

We employ a nationwide clinical staff of more than 800 respiratory care professionals, including home respiratory therapists who provide direct patient care, monitoring and 24-hour support services under physician-directed treatment plans and in accordance with our proprietary acuity program. We derive revenues from the provision of oxygen systems, ventilators, respiratory assist devices, and Continuous Positive Airway Pressure (“CPAP”) and bi-level devices, as well as from the provision of infant apnea monitors, nebulizers, home-delivered respiratory medications and related services.

We are also the largest provider of sleep apnea devices, including CPAP/bi-level devices, and patient support services in the United States. The incidence and diagnosis of Obstructive Sleep Apnea (“OSA”) continues to increase in the United States. We believe that the strength of our position in this market is partly due to our significant presence in the managed care market, since OSA largely affects adults between the ages of 35 and 55 rather than the population served by Medicare. To manage our significant new and recurring patient volumes in a cost-effective, clinically sound manner, we developed an innovative care model called the “CPAP Center at Apria Healthcare.” This branch-based model allows Apria’s respiratory care practitioners to educate, on a timely and efficient basis, newly-diagnosed patients about their condition, the equipment and accessories their physician has prescribed for them, and the long-term importance of complying with the physician’s order. The model includes both one-on-one patient education and teaching performed in group settings, depending on the geographic area of the country and the patient’s payor’s contractual preferences.

Home Medical Equipment

As the leading provider of home medical equipment in the United States, we supply a wide range of products to help improve the quality of life for patients with special needs. Our integrated service approach allows patients, hospital and physician referral sources and managed care organizations accessing either our home respiratory or home infusion therapy services to also access needed home medical equipment through a single source. The use of home medical equipment provides a significant relative cost advantage to our patients and payors. For example, on average, it costs $50 per day to create an in-home hospital room versus approximately $1,500 per day for in-patient hospital care, according to the Centers for Medicare and Medicaid Services (“CMS”). Basic categories of equipment are:

| • | manual wheelchairs and ambulatory equipment, such as canes, crutches and walkers; |

| • | hospital room equipment, such as hospital beds and bedside commodes; |

2

Table of Contents

| • | bathroom equipment, such as bath and shower benches, elevated toilet seats and toilet, tub or wall grab bars; |

| • | phototherapy systems, such as blankets, wraps or treatment beds for babies with jaundice; and |

| • | support surfaces, such as pressure pads and mattresses, for patients at risk for developing pressure sores or decubitus ulcers. |

In May 2008, we announced a preferred provider agreement with Smith & Nephew plc, a leading provider of negative pressure wound therapy (“NPWT”), to provide NPWT services and products in the United States. NPWT is a topical treatment intended to promote healing in acute and chronic wounds affected by conditions including diabetes, arterial insufficiency and venous insufficiency.

Home Infusion Therapy ($925.0 million and $230.6 million, or 44.2% and 45.3%, of our net revenues for the year ended December 31, 2009 and three months ended March 31, 2010, respectively)

Through our acquisition of Coram in December 2007, we are the leading provider of home infusion therapy services in the United States—serving approximately 100,000 patients annually through 72 infusion pharmacy locations nationwide. We provide patients with intravenous and injectable medications and clinical services at home or in one of our 62 ambulatory infusion suites nationwide. We employ nursing clinicians who assess patients before their discharge from the hospital whenever possible, and then develop, in conjunction with the physician, a plan of care. Our home infusion products offer a compelling relative cost advantage to our patients and payors. For example, we believe that a home intravenous antibiotic program in a Medicare managed care plan costs significantly less than the cost to provide that service in a hospital setting.

Home infusion therapy is used to administer drugs and other therapeutic agents directly into the body through various types of catheters or tubing. Our services are frequently used to treat patients with infectious diseases, cancer, gastrointestinal diseases, chronic or acute pain syndromes, immune deficiencies, cardiovascular disease or chronic genetic diseases, and those who require therapies associated with bone marrow or solid organ transplantation. We employ licensed pharmacists and registered nurses who specialize in the delivery of home infusion therapy. They are able to respond to emergencies and questions regarding therapy 24 hours a day, seven days a week and provide initial and ongoing training and education to the patient and caregiver. Other support services include supply replenishment, pump management, preventive maintenance, assistance with insurance questions and outcome reporting.

We believe we are also a leading provider of enteral nutrition in the United States. Enteral nutrition, or “tube feeding,” is prescribed to patients whose gastrointestinal system is malfunctioning or who suffer from neurological conditions, swallowing disorders or malnutrition attributable to stroke, cancer or other conditions. In recent years, advances in enteral nutrition have enabled more adults and children to have their nutritional and caloric needs met by tube feeding, as opposed to more invasive and expensive therapies.

Recent Developments

Announcement of Single Payment Amounts (“SPAs”) and Initiation of Contract Offer Process Related to Round 1 Rebid of the Medicare DMEPOS Competitive Bidding Program

In early July 2010, CMS announced the new SPAs for each of the product categories included in the Round 1 Rebid. CMS then began the contracting process with suppliers by issuing contract offer letters to qualified providers. We received contract offers for a substantial majority of the bids we submitted. We did not receive contract offers for certain product categories in certain competitive bidding areas (“CBAs”), but the process will

3

Table of Contents

not be completed until September 2010. Approximately $21 million of our net revenues for the fiscal year ended December 31, 2009 was generated by the products and CBAs included in the Round 1 Rebid. We estimate that the initial results of the Round 1 Rebid would reduce our net revenues in the fiscal year ending December 31, 2011 by approximately $8.0 million, assuming the current contract offers and no changes in volume. Assuming that Round 2 would include the same product categories and bidding rules and the markets currently being proposed by CMS, we estimate that approximately $110 million of our net revenues for the fiscal year ending December 31, 2011 would be subject to competitive bidding. Although the bidding process for Round 2 is currently scheduled to commence in 2011, the new Round 2 rates and guidelines are not scheduled to take effect until January 2013. Therefore, we cannot estimate the impact of potential Round 2 rate reductions on our business until more specific information is published by CMS and its contractors.

Enactment of a Comprehensive Healthcare Reform Package

In March 2010, the Federal government enacted a comprehensive healthcare reform package (the “Reform Package”) which consists of the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010. See “Risks Relating to Our Business—Continued Reductions in Medicare and Medicaid Reimbursement Rates and the Comprehensive Healthcare Reform Package Could Have a Material Adverse Effect on Our Results of Operations and Financial Condition.”

Reorganization of the Senior Leadership Structure of our Home Respiratory Therapy and Home Medical Equipment Segment

In February 2010, we finalized a decision to reorganize the senior leadership structure of the home respiratory therapy and home medical equipment segment. As part of this reorganization, Lawrence A. Mastrovich, President, Home Respiratory Therapy and Home Medical Equipment segment, resigned and his responsibilities were assumed by other senior executives.

Industry Overview

The home healthcare market, which is projected to generate revenues of approximately $75 billion in the United States in 2010, comprises a broad range of products and services—including respiratory therapy, home infusion therapy, home medical equipment, home healthcare nursing, orthotics and prosthetics and general medical supplies—and is expected to grow at a compounded annual growth rate of 7.4% from 2008 through 2013 according to CMS. The markets that we serve—home respiratory therapy (14% of the home healthcare market), infusion therapy (9%) and home medical equipment (5%)—accounted for approximately $15 billion in revenues in 2008 according to the 2008 IBISWorld Industry Report. Our industry is highly-fragmented and is served by approximately 12,000 competitors.

We benefit from the following trends within the home healthcare market:

| • | Favorable industry dynamics. Favorable demographic trends and the continued shift to in-home healthcare have resulted in patient volume growth across our core service lines and are expected to continue to drive growth. As the baby boomer population ages and life expectancy increases, the elderly—who comprise the vast majority of our patients—will represent a higher percentage of the overall population. According to a 2008 U.S. Census Bureau projection, the U.S. population aged 55 and over is expected to grow at approximately twice the average rate of population growth from 76.5 million, or 25% of the population, in 2010 to 112 million, or 30% of the population, by 2030. An aging population, the continued prevalence of smoking, increasing obesity rates and higher diagnosis rates have |

4

Table of Contents

collectively driven growth across our service lines (including Coram) from 2005 to 2008—home respiratory therapy (patient growth of 14%), sleep apnea (patient growth of 21%) and infusion (patient growth of 14%, excluding enteral). |

| • | Compelling in-home economics. By 2017, the nation’s healthcare spending is projected to increase to $4.3 trillion, growing at an average annual rate of 6.7%, according to CMS. The rising cost of healthcare has caused many payors to look for ways to contain costs and home healthcare is increasingly sought out as an attractive, cost-effective, clinically appropriate alternative to expensive facility-based care. For example, in-home oxygen treatment costs for a Medicare patient are on average less than $7 per day. |

| • | Increased prevalence of in-home treatments.Improved technology has resulted in a wider variety of treatments being administered in patients’ homes. These improvements have allowed for earlier patient discharge and have lengthened the portion of the recuperation period spent outside of an institutional setting. In addition, medical advancements have also made medical equipment more simple, adaptable and cost-effective for use in the home. |

| • | Preference for in-home care.Many patients prefer the convenience and typical cost advantages of home healthcare over institutional care as it provides patients with greater independence, increased responsibility and improved responsiveness to treatment. A December 2007 national telephone survey conducted by Harris Interactive found that over 82% of the respondents expressed a preference for homecare over institutional care, and that preference is even more prevalent among the age 55+ population (91%). The same poll found that 74% of adults surveyed agreed that homecare is part of the solution to the problem of rapidly increasing Medicare spending for seniors in the United States. |

| • | Development of new infused and injectable drugs.There is a significant number of new infusion or injectable drugs in the development pipeline. We believe this proliferation of medications, many of which are for chronic conditions that require long-term treatment, will drive further increases in home infusion therapy utilization and referrals to our ambulatory infusion suites. |

Our Competitive Strengths

Leading Market Positions with a Compelling Value Proposition

With approximately 11,400 employees and a national distribution footprint of approximately 500 locations that serve patients in all 50 states, we are the largest provider of home healthcare services in the United States. We are the market leader in infusion therapy and sleep apnea devices, the leading respiratory provider to the managed care market and the leading provider of home medical equipment. We believe that our national platform, comprehensive product line and leading reputation provide us with a greater opportunity than our competitors to attract more customers as our industry continues to grow. Our national presence and scale enables us to frequently obtain preferred provider status from other national and regional managed care payors, negotiate better terms with vendors and leverage our fixed overhead costs. For example, we are a preferred provider for a comprehensive list of home respiratory and medical equipment products and services to many managed care organizations and, for some of these payors, we are the exclusive provider. We believe we are better suited to service large managed care accounts due to our extensive branch network, state of the art logistics systems, national coverage of payors’ members, competitive pricing, comprehensive product line, accreditation from The Joint Commission and the Accreditation Commission for Health Care (the “ACHC” and, together with The Joint Commission, the “Commissions”), and our ability to connect electronically with payors’ systems. We have leveraged this competitive advantage to gain share in the managed care market.

Our acquisition of Coram in December 2007 has allowed us to further penetrate the specialty infusion market. With a significant number new infusion drugs in the pipeline and an increasing use of specialty infusion treatments, this market is expected to grow over the next few years. We are well-positioned in specialty infusion

5

Table of Contents

services, and have aggressively established relationships with pharmaceutical and biotech companies to obtain early access to drugs in various stages of clinical trials. We believe there are other cross-selling opportunities and synergies to be achieved by offering a diverse mix of services. We also believe that an integrated approach allows us to offer patients, hospital and physician referral sources and managed care organizations a highly-valued single source for respiratory therapy, specialty home infusion and home medical equipment.

Diversified Product and Customer Mix

We have one of the most comprehensive product lines and diversified customer mixes among our peers. Our broad product offering has affirmed our status as a leading provider in each market and has made us a more attractive partner to referral sources and payors, as we provide a one-stop solution for homecare products and services.

We contract with a substantial majority of the national managed care organizations���including United HealthCare Services, Aetna Health Management, Humana Health Plans and Kaiser Foundation Health Plan, as well as a large number of regional and local payors. All of our contracted managed care organizations combined service over 217 millionpeople.

The Coram acquisition enabled us to both expand our product offering in specialty infused drugs and rebalance our payor mix by reducing reliance on government payors such as Medicare and Medicaid while expanding relationships with managed care organizations. Managed care payors contributed approximately 72% and 70% of our net revenues for the year ended December 31, 2009 and the three months ended March 31, 2010 respectively, with no single contract accounting for more than 8% of net revenues during the same periods.

Proven Ability to Execute Cost Savings

We have successfully implemented a number of operational efficiency initiatives historically, which have helped to reduce our costs and significantly offset ongoing Medicare reimbursement changes. We launched a substantial cost reduction plan in late 2007 across a number of identified initiatives targeting approximately $198 million in expected annual savings, of which we have realized approximately $127 million through March 31, 2010.

Scalable and Diversified Platform for Home Healthcare Delivery

We currently provide service to more than 2 million patients through a national infrastructure that enables us to deliver services to patients in their homes. Through approximately 500 locations, we are able to deliver a wide variety of cost-effective products and services to various patient groups. We have successfully leveraged this distribution platform across a number of product and service offerings including CPAP/bi-level, enteral nutrition and NPWT devices, and we are using our nursing capacity to provide infusion services through our growing network of ambulatory infusion suites.

We historically supplied CPAP/bi-level devices to a large number of patients, but provided related accessories and supplies primarily on an as-needed basis. Patients who rely on CPAP and bi-level devices periodically require replacement accessories to ensure that they remain compliant to the therapy prescribed by their physician. These accessories include masks, tubing and supplies. Now in operation for over five years, a centralized customer care center for CPAP and bi-level patients provides support and information to patients so that they know what their payors cover in terms of replacement accessories and understand the health value of remaining compliant to their therapy over the long-term. Accessory net revenues were $155.9 million and $34.5 million and represented 47% and 46% of our total CPAP/bi-level net revenues for the year ended December 31, 2009 and the three months ended March 31, 2010, respectively.

6

Table of Contents

In May 2008, we announced a preferred provider agreement with Smith & Nephew plc to provide NPWT products, thus leveraging our existing branch delivery infrastructure and clinical expertise. Centralized patient intake and coordination of care is provided using the same service and systems platform as is used for the CPAP/bi-level direct marketing service program. Although the program is still in its developing stage, interest has been strong from managed care customers who would like to add the NPWT service to our existing contracts with them.

Experienced Management Team

We have a strong and experienced senior management team with over 200 years of combined experience spanning nearly every segment of the healthcare industry, including managed care, manufacturing, supply chain, procurement, home healthcare, acute care, skilled nursing and long-term care. With an average tenure of 20 years within the healthcare industry, this team possesses in-depth knowledge of our industry and the regulatory environment in which we operate, as well as our portfolio of home healthcare services.

Our Business Strategy

Our strategy is to position ourselves in the marketplace as a high-quality provider of a broad range of healthcare services and patient care management programs to our customers. The specific elements of our strategy are to:

| • | Grow profitable revenue and market share. We are focused on growing profitable revenues and increasing market share in our core home infusion therapy and home respiratory therapy service lines. We have undertaken a series of steps towards this end. Through our acquisition of Coram in December 2007, we considerably increased our home infusion capabilities and expanded our platform for further cross- selling opportunities. Since January 1, 2007, we have expanded our home respiratory therapy and home medical equipment sales force by 18%. This focus has allowed us to more effectively market our products and services to physicians, hospital discharge planners and managed care organizations. |

| • | Continue to participate in the managed care market. We participate in the managed care market as a long-term strategic customer group because we believe that our scale, expertise, nationwide presence and array of home healthcare products and services will enable us to sign preferred provider agreements with managed care organizations. Managed care represented approximately 70% of our total net revenues for the three months ended March 31, 2010. |

| • | Leverage our national distribution infrastructure.With approximately 500 locations and a robust platform supporting shared national services, we believe that we can efficiently add products, services and patients to our systems to grow our revenues and leverage our cost structure. For example, we have successfully leveraged this distribution platform across a number of product and service offerings, including a CPAP/bi-level supply replenishment program, enteral nutrition and NPWT services, and we are using our nursing capacity to provide infusion services through our growing network of ambulatory infusion suites. We seek to achieve margin improvements through operational initiatives focused on the continual reduction of costs and delivery of incremental efficiencies. At the same time, we believe that it is essential to consistently deliver superior customer service in order to increase referrals and retain existing patients. Performance improvement initiatives are underway in all aspects of our operations including customer service, patient satisfaction, logistics, supply chain, clinical services and billing/collections. We believe that by being responsive to the needs of our patients and payors we can provide ourselves with opportunities to take market share from our competitors. |

| • | Continue to lead the industry in accreditation. The Medicare Improvement for Patients Act of 2008 (“MIPPA”) made accreditation mandatory for Medicare providers of durable medical equipment, prosthetics, orthotics and supplies (“DMEPOS”), effective October 1, 2009, per CMS regulation. We |

7

Table of Contents

were the first durable medical equipment provider to seek and obtain voluntary accreditation from The Joint Commission. All of our locations are currently accredited by The Joint Commission and our home infusion therapy service line is also accredited by the ACHC. In 2007, we completed a nationwide independent triennial accreditation renewal process conducted by The Joint Commission and we have more than 15 years of continuous accreditation by The Joint Commission—longer than any other homecare provider. In late June 2010, The Joint Commission completed its most recent triennial survey of our respiratory/home medical equipment and infusion locations and is expected to renew our accreditation for another three years. |

| • | Execute our strategic initiatives to drive profitability.For the past several years, we have successfully engaged in a range of cost savings initiatives to ease pressure on our revenue that has been and continues to be caused by Medicare and Medicaid reimbursement changes. These initiatives are designed to improve customer service, delivery and vehicle routing services, streamline the billing and payment process, effectively manage purchasing costs and improve the overall experience of the patients we serve. We launched a substantial cost reduction plan in late 2007. To date, we have made significant progress across a number of the identified initiatives targeting expected annual savings of approximately $198 million, of which we realized approximately $127 million through March 31, 2010. |

Regulatory Overview

We are subject to extensive government regulation, including numerous laws that regulate reimbursement of products and services under various government programs. There are a number of legislative and regulatory activities in Congress, including the March 2010 passage of the Reform Package, and at the Department of Health and Human Services (“HHS”) and CMS, the federal government agency responsible for administering the Medicare and Medicaid programs, that affect or may affect government reimbursement policies for our products and services.

Healthcare Reform Package.In March 2010, the Federal government enacted the comprehensive healthcare Reform Package. Among many other provisions, the Reform Package expands the Medicaid program, mandates extensive insurance market reforms, creates new health insurance access points (e.g., insurance exchanges), provides certain insurance subsidies (e.g., premiums and cost sharing), imposes individual and employer health insurance requirements and makes a number of changes to the U.S. Internal Revenue Code of 1986, as amended (the “Code”).

There are a number of provisions in the Reform Package that may affect us. For example, the Reform Package requires certain pharmaceutical and medical device manufacturers to pay an excise tax to the government, which may, in turn, increase our costs for these products. The Reform Package also provides for cuts in some Medicare payments made to certain providers and to Medicare Part C (“Medicare Advantage”) plans, through which we contract to provide services to Medicare beneficiaries. Also included in the Reform Package is (i) an expansion of the Recovery Audit Contractor Program, (ii) certain fraud and abuse prevention measures and (iii) expanded regulatory authority concerning the types of conduct that can result in additional fines and penalties for those healthcare providers who do not comply with applicable laws and regulations. Furthermore, the Reform Package grants the Secretary of HHS authority to set a date by which certain providers and suppliers will be required to establish a compliance program.

The Reform Package makes a number of changes to how certain of our products and services will be reimbursed by Medicare. The Reform Package also makes changes to the Medicare durable medical equipment consumer price index adjustment for 2011 and each subsequent year based upon the Consumer Price Index (the “CPI”) reduced by a new productivity adjustment which may result in negative updates and includes changes to the Medicare DMEPOS competitive bidding program. Significantly, Round 2 of the competitive bidding program

8

Table of Contents

has been expanded from 70 to 91 of the largest metropolitan statistical areas (“MSAs”). The Reform Package also gives the Secretary of HHS the authority to apply competitive bid pricing to non-bid areas, but details of that process are unlikely to be understood until after CMS issues guidance or completes a related rulemaking process.

In an effort to further strengthen the integrity of the Medicare program, the Reform Package includes additional requirements concerning physician enrollment and certain mandatory face-to-face patient/physician visits in conjunction with the ordering of durable medical equipment. These provisions are likely to be the subject of rulemaking and are a high priority for the American Association for Homecare and other industry representative organizations. We expect the Administration to continue to enhance its oversight efforts, and we strive to incorporate any necessary changes into our overall corporate compliance and internal audit programs on a regular basis.

The effective dates of the various provisions within the Reform Package are staggered over the next several years, with some changes occurring immediately. Much of the interpretation of what the Reform Package requires will be subject to administrative rulemaking, the development of agency guidance and court interpretations.

Capped Rentals and Oxygen Equipment. The Deficit Reduction Act of 2005 (“DRA”) converted Medicare reimbursement for oxygen equipment from an ongoing rental method to a capped rental and rent-to-purchase methodology and limited reimbursement for rental of oxygen equipment to the current 36-month maximum. The DRA mandated that, after the 36-month rental period, the ownership of the equipment would transfer to the Medicare beneficiary.

MIPPA, which became law on July 15, 2008, while maintaining the 36-month rental cap, eliminated the mandatory title transfer for oxygen equipment. As a result, the equipment will continue to be owned by the oxygen provider for as long as the patient’s medical need exists, after which time it will be returned to the oxygen provider. Accordingly, because the 36-month rental period was retroactively applied to January 1, 2006, Medicare services provided on or after January 1, 2009 were the first Medicare claims for which the rental cap impacted Apria. In November 2008, CMS revised its regulations in order to be consistent with the provisions of the DRA and MIPPA. These regulations also set forth that CMS will not pay for any non-routine maintenance, oxygen tubing, cannulas and supplies after the 36-month rental period and that CMS will pay for certain routine maintenance and servicing activities after the 36-month rental cap. There may be future initiatives to implement a reduction to the capped rentals and/or monthly payment rate, but it is uncertain if such initiatives would ultimately be approved.

Competitive Bidding. The Medicare Prescription Drug, Improvement and Modernization Act of 2003 (“MMA”) mandated implementation of a competitive bidding program for certain DMEPOS. By statute, CMS was required to implement the competitive bidding program over time, with the first phase (“Round 1”) of competition occurring in 10 of the MSAs in 2007, launch of the program in 2008 and in 70 additional markets in 2009, and in additional markets after 2009. In 2007 and 2008, CMS accepted and reviewed bids to begin Round 1 of the competitive bidding program. Winning contract suppliers began providing services under Round 1 on July 1, 2008.

With the enactment of MIPPA in July 2008, the competitive bidding program was delayed and all contracts awarded under Round 1 were immediately terminated. The contracting process was restarted through the re-bidding process in October 2009 (the “Round 1 Rebid”). CMS also announced in June 2009 that the new payment rates resulting from the bid process will go into effect in the CBAs in January 2011. Currently, all beneficiaries in the fee-for-service Medicare program may use any provider in any geographic area to obtain durable medical equipment and oxygen therapy services and products. In addition to the delay of the competitive bidding program, MIPPA requires a number of programmatic reforms prior to re-launching the program. To offset the cost of, or “pay for,” the delay in the roll-out of the competitive bidding program, Congress adopted an

9

Table of Contents

average nationwide 9.5% payment reduction in the durable medical equipment fee schedule for product categories included in Round 1, effective January 1, 2009.

The Reform Package makes changes to the competitive bidding program. Significantly, Round 2 of the competitive bidding program has been expanded from 70 to 91 of the largest MSAs. CMS has announced that the effective date of the Round 2 pricing will be January 1, 2013; additional details concerning products to be included and other aspects of implementing Round 2 will not be fully known until after CMS completes a rulemaking process, which is currently scheduled for the summer or fall of 2010. The Reform Package also gives the Secretary of HHS the authority to apply competitive bid pricing to non-bid areas, but details of that process are unlikely to be understood until after CMS issues guidance or completes a related rulemaking process.

At a March 2010 Program Advisory and Oversight Committee (“PAOC”) meeting, CMS briefed the PAOC regarding the next round of the DMEPOS competitive bidding program. With review of Round 1 Rebid bids underway in March 2010, the briefing focused on certain aspects of Round 2, which is mandated by MIPPA to begin in 2011. In late June 2010, CMS published a Proposed Rule containing several provisions related to the competitive bidding program. The Proposed Rule included the proposed list of 21 additional MSAs to be included in Round 2, as well as provisions relating to the diabetic supply category. Those provisions include a proposed definition of “mail order” and “non-mail order” items and a proposal for providers to supply a minimum level of product choices to patients. The public comment period on the Proposed Rule will close in August and a Final Rule is expected in the fall of 2010. CMS expects to make additional changes to the program through the rulemaking process and anticipates that another proposed rule will be published in the summer of 2010, with a final rule to be published in the fall of 2010. Also, during the fall of 2010, CMS plans to announce the Round 2 product categories and begin pre-bidding supplier education. CMS anticipates that it will announce the Round 2 bidding schedule and begin the bidding process, with bidder registration, in the winter of 2011. CMS plans to complete the bid evaluation process, announce the SPAs and begin the contract process for Round 2 in the spring of 2012. In addition, CMS plans to announce the Round 2 contract suppliers in the summer of 2012. The new SPAs for Round 2 markets will take effect in January 2013.

In early July 2010, CMS announced the new SPAs for each of the product categories and each of the CBAs included in the Round 1 Rebid. CMS then began the contracting process with suppliers by issuing contract offer letters to qualified providers. This process is expected to take approximately two months, and CMS expects to announce the list of winners publicly in September 2010.

Reimbursement for Inhalation and Infusion Therapy Drugs. Beginning January 2005, Medicare Part B reimbursement for most drugs, including inhalation drugs, became based upon the manufacturer-reported average sales price (“ASP”) (subject to adjustment each quarter), plus 6%, plus a separate dispensing fee per patient episode. The Medicare reimbursement methodology for non-compounded, infused drugs administered through durable medical equipment, such as infusion pumps, was not affected by this MMA change and remains based upon either 95% of the October 1, 2003 Average Wholesale Price (“AWP”) or, for those drugs whose AWPs were not published in the applicable 2003 compendia, at 95% of the first published AWP.

In 2007 and 2008, changes were made by CMS to the reimbursement methodology for certain inhalation drugs. Beginning in the third quarter of 2007, CMS reimbursement for Xopenex® and albuterol was based on a blended ASP for these two products. Additionally, the Medicare, Medicaid, and State Children’s Health Insurance Program Extension Act of 2007 partially reversed the CMS regulatory decision regarding Xopenex and albuterol. As a result, beginning on April 1, 2008, Medicare began to reimburse providers for Xopenex by blending the ASP of Xopenex and albuterol, but it no longer reimbursed providers for albuterol at the blended price. Rather, albuterol is reimbursed using an albuterol-only ASP.

Since the financial impact of changes in Medicare reimbursement that have been enacted to date began on or before January 1, 2009, our results of operations for the year ended December 31, 2009 and for the three months ended March 31, 2010 include operations after the Medicare reimbursement changes took effect.

10

Table of Contents

The Transactions

On June 18, 2008, Apria, Sky Acquisition and Merger Sub entered into the Merger Agreement, pursuant to which, on October 28, 2008, Merger Sub merged with and into Apria, with Apria being the surviving corporation following the Merger. The Investor Group beneficially owns all of Apria’s issued and outstanding capital stock.

The initial borrowings under our senior secured bridge credit agreement and our ABL Facility, the equity investment by the Investor Group and the repayment of all outstanding indebtedness under our 2004 senior secured revolving credit facility and the Interim Facility are collectively referred to in this prospectus as the “Original Financing.” The offerings of the outstanding Series A-1 Notes and the outstanding Series A-2 Notes in May 2009 and August 2009, respectively, the repayment of approximately $1,010.0 million of borrowings under our senior secured bridge credit agreement, plus accrued and unpaid interest, and the payment of related fees and expenses with the proceeds of the offerings of the outstanding Series A-1 Notes and the outstanding Series A-2 Notes, together with cash on hand, are collectively referred to in this prospectus as the “Refinancing.” The Merger, the Original Financing and the Refinancing are collectively referred to in this prospectus as the “Transactions.” For a more complete description of the Transactions, see “The Transactions” and “Description of Other Indebtedness.”

11

Table of Contents

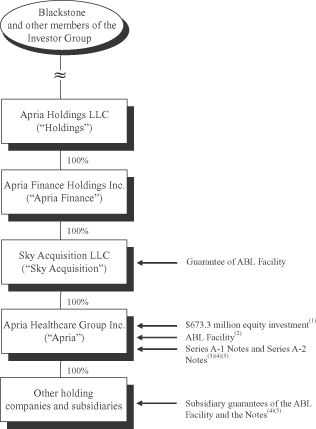

The following chart summarizes our organizational structure, equity ownership and our principal indebtedness as of the date of this prospectus. This chart is provided for illustrative purposes only and does not represent all legal entities of Apria and its consolidated subsidiaries or all obligations of such entities.

| (1) | Consists of a $673.3 million cash equity investment by the Investor Group in membership interests of our parent entities, which investment includes Dr. Payson’s co-investment. The proceeds of such investment were contributed to Merger Sub, which used such proceeds, together with other sources of funds, to fund the Merger and the related transactions. |

| (2) | Our ABL Facility is secured, subject to certain exceptions and permitted liens, (i) on a first-priority lien basis, by substantially all of our personal property consisting of accounts receivable, inventory, intercompany notes and intangible assets to the extent attached to the foregoing, and certain related assets and proceeds of the foregoing and (ii) on a second-priority lien basis, by all tangible and intangible assets that secure the Notes on a first-priority basis. See “Description of Other Indebtedness—Senior Secured Asset-Based Revolving Credit Facility.” |

| (3) | At the closing of the Merger, we borrowed an aggregate of $1,010.0 million under our senior secured bridge credit agreement. Apria used the proceeds of the offerings of the outstanding Series A-1 Notes and the outstanding Series A-2 Notes in May 2009 and August 2009, respectively, together with cash on hand, to repay all borrowings under the senior secured bridge credit agreement, plus accrued and unpaid interest, and to pay related fees and expenses. Our senior secured bridge credit agreement was terminated concurrently with the closing of the outstanding Series A-2 Notes offering. |

| (4) | The Notes and the related guarantees are secured by our assets, including (i) on a first-priority lien basis (subject to certain exceptions and permitted liens) by substantially all the tangible and intangible assets of Apria and its subsidiaries that are guarantors of the Series A-2 Notes (other than the collateral which secures our ABL Facility on a first-priority lien basis) and (ii) on a second-priority lien basis (subject to certain exceptions and permitted liens) by the collateral securing our ABL Facility on a first-priority lien basis. The Series A-1 Notes are entitled to a priority of payment over the Series A-2 Notes in certain circumstances. |

| (5) | The Notes are guaranteed on a senior secured basis by all of our existing wholly-owned domestic subsidiaries that guarantee the obligations under the ABL Facility and will be guaranteed by our future wholly-owned domestic subsidiaries, subject to certain exceptions. See “Description of Notes—Guarantees.” |

12

Table of Contents

We are incorporated in the State of Delaware. Our principal executive offices are located at 26220 Enterprise Court, Lake Forest, California 92630 and our telephone number is (949) 639-2000.

The Blackstone Group

The Blackstone Group, one of the world’s leading global investment and advisory firms, was founded in 1985. Through its different businesses, as of March 31, 2010, Blackstone had total fee-earning assets under management of approximately $98.1 billion. Blackstone’s alternative asset management businesses include the management of corporate private equity funds, real estate funds, funds of hedge funds, credit-oriented funds, collateralized loan obligation vehicles (CLOs) and closed-end mutual funds. Blackstone also provides various financial advisory services, including mergers and acquisition advisory, restructuring and reorganization advisory, and fund placement services.

13

Table of Contents

The Exchange Offers

General | On May 27, 2009 and August 13, 2009, respectively, the Issuer issued an aggregate of $700.0 million principal amount of 11.25% Senior Secured Notes due 2014 (Series A-1) and $317.5 million principal amount of 12.375% Senior Secured Notes due 2014 (Series A-2) in private offerings. In connection with the private offerings, the Issuer and the guarantors entered into registration rights agreements with the initial purchasers in which they agreed, among other things, to deliver this prospectus to you and to complete the exchange offers within 450 days after the date of issuance and sale of the outstanding Series A-2 Notes. |

You are entitled to exchange in the exchange offers your outstanding notes for exchange notes which are identical in all material respects to the outstanding notes except: |

| • | the exchange notes have been registered under the Securities Act; |

| • | the exchange notes are not entitled to any registration rights which are applicable to the outstanding notes under the registration rights agreements; and |

| • | certain additional interest rate provisions are no longer applicable. |

The Exchange Offers | The Issuer is offering to exchange: |

| • | $700.0 million principal amount of 11.25% Senior Secured Notes due 2014 (Series A-1), which have been registered under the Securities Act, for any and all of its outstanding 11.25% Senior Secured Notes due 2014 (Series A-1); and |

| • | $317.5 million principal amount of 12.375% Senior Secured Notes due 2014 (Series A-2), which have been registered under the Securities Act, for any and all of its outstanding 12.375% Senior Secured Notes due 2014 (Series A-2). |

| You may only exchange outstanding notes in a principal amount of $2,000 or in integral multiples of $1,000 in excess thereof. |

Resale | Based on an interpretation by the staff of the Securities and Exchange Commission (the “SEC”) set forth in no-action letters issued to third parties, the Issuer believes that the exchange notes issued pursuant to the exchange offers in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

14

Table of Contents

| • | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

| If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

| Any holder of outstanding notes who: |

| • | is our affiliate; |

| • | does not acquire exchange notes in the ordinary course of its business; or |

| • | tenders its outstanding notes in the exchange offers with the intention to participate, or for the purpose of participating, in a distribution of exchange notes; |

| cannot rely on the position of the staff of the SEC enunciated inMorgan Stanley & Co. Incorporated(available June 5, 1991) andExxon Capital Holdings Corporation(available May 13, 1988), as interpreted in the SEC’s letter toShearman & Sterling(available July 2, 1993), or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

Expiration Date | The exchange offers will expire at 5:00 p.m., New York City time, on , 2010, which is the 21st business day after the date of this prospectus, unless extended by us. The Issuer does not currently intend to extend the expiration date. |

Withdrawal | You may withdraw the tender of your outstanding notes at any time prior to the expiration of the applicable exchange offer. The Issuer will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offers. |

Interest on the exchange notes and the outstanding notes | Each exchange note will bear interest at their respective rate per annum set forth on the cover page of this prospectus from the most recent date to which interest has been paid on the outstanding notes. The interest will be payable semi-annually on May 1 and November 1. No interest will be paid on outstanding notes following their acceptance for exchange. |

Conditions to the Exchange Offers | The exchange offers are subject to customary conditions, which the Issuer may waive. See “The Exchange Offers—Conditions to the Exchange Offers.” |

15

Table of Contents

Procedures for Tendering Outstanding Notes | If you wish to participate in the exchange offers, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of such letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of such letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

| If you hold outstanding notes through The Depository Trust Company (“DTC”) and wish to participate in the exchange offers, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| • | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act or, if you are our affiliate, that you will comply with any applicable registration and prospectus delivery requirements of the Securities Act; |

| • | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

| • | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

Special Procedures for Beneficial Owners | If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offers, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

16

Table of Contents

Guaranteed Delivery Procedures | If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other required documents, or you cannot comply with the applicable procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests, prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

Effect on Holders of Outstanding Notes | As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offers, the Issuer and the guarantors will have fulfilled a covenant under the applicable registration rights agreement. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreements. If you do not tender your outstanding notes in the exchange offers, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture, except the Issuer and the guarantors will not have any further obligation to you to provide for the exchange and registration of the outstanding notes under the applicable registration rights agreement. To the extent that outstanding notes are tendered and accepted in the exchange offers, the trading market for remaining outstanding notes that are not so tendered and exchanged could be adversely affected. |

Consequences of Failure to Exchange | All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offers, the Issuer and the guarantors do not currently anticipate that they will register the outstanding notes under the Securities Act. |

Certain U.S. Federal Income Tax Considerations | The exchange of outstanding notes in the exchange offers will not be a taxable event for United States federal income tax purposes. See “Certain U.S. Federal Income Tax Considerations.” |

Use of Proceeds | The Issuer will not receive any cash proceeds from the issuance of exchange notes in the exchange offers. See “Use of Proceeds.” |