united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

| Investment Company Act file number: | 811-22436 | |

EntrepreneurShares Series Trust

(Exact name of registrant as specified in charter)

175 Federal Street, Suite #875

Boston, MA 02110 |

| (Address of principal executive offices) | | (Zip code) |

Dr. Joel M. Shulman

175 Federal Street, Suite #875

Boston, MA 02110

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 1-617-917-2605 | |

| Date of fiscal year end: | June 30 | |

| | | |

| Date of reporting period: | December 31, 2024 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

ERShares Global Entrepreneurs

Institutional Class (ENTIX)

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about ERShares Global Entrepreneurs (the "Fund") for the period of July 1, 2024 through December 31, 2024. You can find additional information about the Fund at https://entrepreneurshares.com/investor-resources/. You can also request this information by contacting us at 877-271-8811.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $54 | 0.98% |

|---|

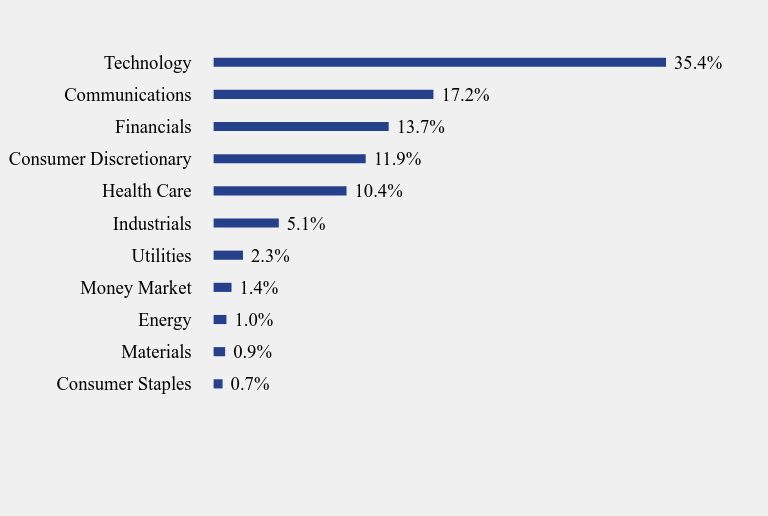

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Consumer Staples | 0.7% |

| Materials | 0.9% |

| Energy | 1.0% |

| Money Market | 1.4% |

| Utilities | 2.3% |

| Industrials | 5.1% |

| Health Care | 10.4% |

| Consumer Discretionary | 11.9% |

| Financials | 13.7% |

| Communications | 17.2% |

| Technology | 35.4% |

| Net Assets | $41,584,887 |

|---|

| Number of Portfolio Holdings | 60 |

|---|

| Advisory Fee (net of waivers) | $115,784 |

|---|

| Portfolio Turnover | 47% |

|---|

No material changes occurred during the period ended December 31, 2024.

ERShares Global Entrepreneurs (ENTIX)

Semi-Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://entrepreneurshares.com/investor-resources/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

ERShares Private-Public Crossover ETF

(XOVR) Nasdaq Stock Market, LLC

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about ERShares Private-Public Crossover ETF (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://entrepreneurshares.com/investor-resources/. You can also request this information by contacting us at 877-271-8811. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| ERShares Private-Public Crossover ETF | $41 | 0.75% |

|---|

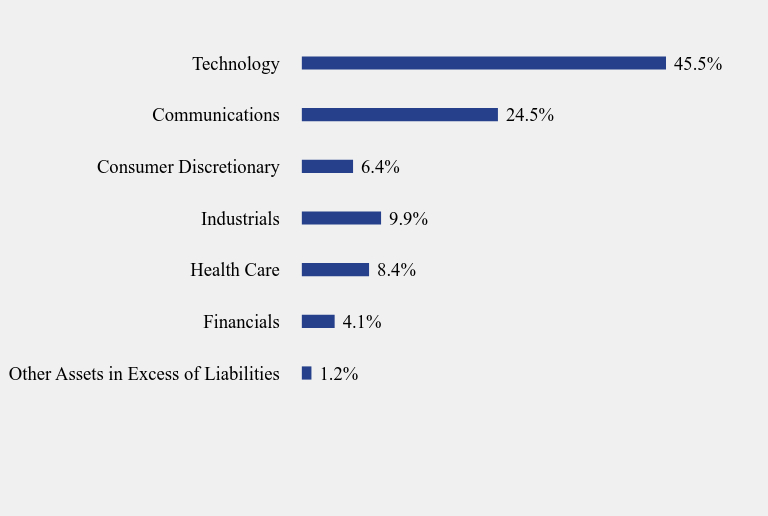

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.2% |

| Financials | 4.1% |

| Health Care | 8.4% |

| Industrials | 9.9% |

| Consumer Discretionary | 6.4% |

| Communications | 24.5% |

| Technology | 45.5% |

| Net Assets | $205,670,660 |

|---|

| Number of Portfolio Holdings | 32 |

|---|

| Advisory Fee | $414,705 |

|---|

| Portfolio Turnover | 55% |

|---|

This is a summary of certain changes to the Fund since July 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 28, 2025 or upon request at 877-271-8811.

Effective August 29, 2024, the Fund's name was changed from "ERShares Entrepreneurs ETF" to "ERShares Private-Public Crossover ETF." Additionally, the Fund's ticker symbol was changed from "ENTR" to "XOVR."

ERShares Private-Public Crossover ETF (XOVR)

Semi-Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://entrepreneurshares.com/investor-resources/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

(b) Not applicable

Item 2. Code of Ethics.

Not applicable – disclosed with annual report

Item 3. Audit Committee Financial Expert.

Not applicable – disclosed with annual report

Item 4. Principal Accountant Fees and Services.

Not applicable – disclosed with annual report

Item 5. Audit Committee of Listed Registrants.

Not applicable – disclosed with annual report

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

EntrepreneurShares Series Trust™

ERShares Global Entrepreneurs (ENTIX)

Semi-Annual Financial Statements and Additional Information

December 31, 2024

ERShares Global Entrepreneurs

Schedule of Investments

December 31, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks — 93.78% | | | | | | | | |

| Argentina — 1.95% | | | | | | | | |

| Consumer Discretionary — 1.95% | | | | | | | | |

| MercadoLibre, Inc.(a) | | | 477 | | | $ | 811,110 | |

| Total Argentina | | | | | | | 811,110 | |

| | | | | | | | | |

| Australia — 3.96% | | | | | | | | |

| Communications — 1.17% | | | | | | | | |

| SEEK Ltd. | | | 34,715 | | | | 484,940 | |

| | | | | | | | | |

| Health Care — 1.23% | | | | | | | | |

| Telix Pharmaceuticals Ltd.(a) | | | 33,555 | | | | 511,103 | |

| | | | | | | | | |

| Technology — 1.56% | | | | | | | | |

| Technology One Ltd. | | | 33,491 | | | | 649,008 | |

| Total Australia | | | | | | | 1,645,051 | |

| | | | | | | | | |

| Canada — 5.91% | | | | | | | | |

| Communications — 2.17% | | | | | | | | |

| Shopify, Inc.(a) | | | 8,508 | | | | 904,656 | |

| | | | | | | | | |

| Health Care — 2.00% | | | | | | | | |

| Well Health Technologies Corp.(a) | | | 174,806 | | | | 834,094 | |

| | | | | | | | | |

| Technology — 1.74% | | | | | | | | |

| Constellation Software, Inc. | | | 179 | | | | 553,415 | |

| Topicus.com, Inc. | | | 2,013 | | | | 170,176 | |

| | | | | | | | 723,591 | |

| Total Canada | | | | | | | 2,462,341 | |

| | | | | | | | | |

| Ireland — 2.89% | | | | | | | | |

| Health Care — 1.92% | | | | | | | | |

| Alkermes PLC(a) | | | 27,809 | | | | 799,787 | |

| | | | | | | | | |

| Industrials — 0.97% | | | | | | | | |

| Cimpress PLC(a) | | | 5,611 | | | | 402,421 | |

| Total Ireland | | | | | | | 1,202,208 | |

| | | | | | | | | |

| Israel — 4.38% | | | | | | | | |

| Technology — 4.38% | | | | | | | | |

| Check Point Software Technologies Ltd.(a) | | | 1,950 | | | | 364,065 | |

| Monday.com Ltd.(a) | | | 1,858 | | | | 437,448 | |

| Wix.com Ltd.(a) | | | 4,751 | | | | 1,019,327 | |

| Total Israel | | | | | | | 1,820,840 | |

| | | | | | | | | |

| Japan — 0.44% | | | | | | | | |

| Communications — 0.44% | | | | | | | | |

| GMO internet, Inc. | | | 10,774 | | | | 183,503 | |

| Total Japan | | | | | | | 183,503 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs

Schedule of Investments (continued)

December 31, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks — 93.78% (continued) | | | | | | | | |

| Jersey — 1.56% | | | | | | | | |

| Communications — 1.56% | | | | | | | | |

| Gambling.com Group Ltd.(a) | | | 46,080 | | | $ | 648,806 | |

| Total Jersey | | | | | | | 648,806 | |

| | | | | | | | | |

| Luxembourg — 2.53% | | | | | | | | |

| Communications — 2.53% | | | | | | | | |

| Spotify Technology SA(a) | | | 2,349 | | | | 1,050,896 | |

| Total Luxembourg | | | | | | | 1,050,896 | |

| | | | | | | | | |

| Singapore — 2.84% | | | | | | | | |

| Communications — 1.64% | | | | | | | | |

| Sea Ltd. - ADR(a) | | | 6,413 | | | | 680,419 | |

| | | | | | | | | |

| Consumer Staples — 0.67% | | | | | | | | |

| Wilmar International Ltd. | | | 123,149 | | | | 279,533 | |

| | | | | | | | | |

| Technology — 0.53% | | | | | | | | |

| Karooooo Ltd. | | | 4,865 | | | | 219,655 | |

| Total Singapore | | | | | | | 1,179,607 | |

| | | | | | | | | |

| Sweden — 1.64% | | | | | | | | |

| Communications — 0.85% | | | | | | | | |

| Embracer Group A.B.(a) | | | 128,765 | | | | 351,010 | |

| | | | | | | | | |

| Consumer Discretionary — 0.79% | | | | | | | | |

| Evolution Gaming Group A.B. | | | 4,269 | | | | 329,051 | |

| Total Sweden | | | | | | | 680,061 | |

| | | | | | | | | |

| Thailand — 0.84% | | | | | | | | |

| Technology — 0.84% | | | | | | | | |

| Fabrinet(a) | | | 1,581 | | | | 347,630 | |

| Total Thailand | | | | | | | 347,630 | |

| | | | | | | | | |

| United Kingdom — 1.34% | | | | | | | | |

| Financials — 1.34% | | | | | | | | |

| Hargreaves Lansdown PLC | | | 40,579 | | | | 557,825 | |

| Total United Kingdom | | | | | | | 557,825 | |

| | | | | | | | | |

| United States — 63.50% | | | | | | | | |

| Communications — 6.82% | | | | | | | | |

| Alphabet, Inc., Class A | | | 4,350 | | | | 823,455 | |

| AppLovin Corp., Class A(a) | | | 3,457 | | | | 1,119,480 | |

| Meta Platforms, Inc., Class A | | | 1,524 | | | | 892,318 | |

| | | | | | | | 2,835,253 | |

| Consumer Discretionary — 9.20% | | | | | | | | |

| Airbnb, Inc., Class A(a) | | | 2,793 | | | | 367,028 | |

| Amazon.com, Inc.(a) | | | 2,774 | | | | 608,588 | |

| DoorDash, Inc., Class A(a) | | | 5,231 | | | | 877,500 | |

| DraftKings, Inc., Class A(a) | | | 14,974 | | | | 557,033 | |

| Lennar Corp., Class A | | | 3,852 | | | | 525,297 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs

Schedule of Investments (continued)

December 31, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks — 93.78% (continued) | | | | | | | | |

| United States — 63.50% (continued) | | | | | | | | |

| Consumer Discretionary — 9.20% (continued) | | | | | | | | |

| Tesla, Inc.(a) | | | 2,214 | | | $ | 894,102 | |

| | | | | | | | 3,829,548 | |

| Energy — 0.95% | | | | | | | | |

| Valero Energy Corp. | | | 3,232 | | | | 396,211 | |

| | | | | | | | | |

| Financials — 10.00% | | | | | | | | |

| Coinbase Global, Inc., Class A(a) | | | 3,633 | | | | 902,074 | |

| KKR & Co., Inc. | | | 7,713 | | | | 1,140,830 | |

| Robinhood Markets, Inc., Class A(a) | | | 24,827 | | | | 925,054 | |

| Toast, Inc., Class A(a) | | | 32,666 | | | | 1,190,676 | |

| | | | | | | | 4,158,634 | |

| Health Care — 5.27% | | | | | | | | |

| Medpace Holdings, Inc.(a) | | | 1,981 | | | | 658,148 | |

| ResMed, Inc. | | | 3,005 | | | | 687,213 | |

| United Therapeutics Corp.(a) | | | 2,406 | | | | 848,933 | |

| | | | | | | | 2,194,294 | |

| Industrials — 1.68% | | | | | | | | |

| Clean Harbors, Inc.(a) | | | 3,044 | | | | 700,546 | |

| | | | | | | | | |

| Materials — 0.89% | | | | | | | | |

| Newmont Corp. | | | 9,942 | | | | 370,041 | |

| | | | | | | | | |

| Technology — 26.42% | | | | | | | | |

| Arista Networks, Inc.(a) | | | 5,068 | | | | 560,166 | |

| Block, Inc.(a) | | | 9,685 | | | | 823,128 | |

| Corpay, Inc.(a) | | | 2,470 | | | | 835,897 | |

| Crowdstrike Holdings, Inc.(a) | | | 1,289 | | | | 441,044 | |

| DocuSign, Inc.(a) | | | 7,500 | | | | 674,550 | |

| NVIDIA Corp. | | | 10,610 | | | | 1,424,817 | |

| Oracle Corp. | | | 4,060 | | | | 676,558 | |

| Palantir Technologies, Inc., Class A(a) | | | 11,069 | | | | 837,148 | |

| Palo Alto Networks, Inc.(a) | | | 2,826 | | | | 514,219 | |

| Pegasystems, Inc. | | | 11,229 | | | | 1,046,544 | |

| Salesforce, Inc. | | | 2,715 | | | | 907,706 | |

| Synopsys, Inc.(a) | | | 1,263 | | | | 613,010 | |

| Twilio, Inc., Class A(a) | | | 7,564 | | | | 817,517 | |

| Unity Software, Inc.(a) | | | 35,960 | | | | 808,021 | |

| | | | | | | | 10,980,325 | |

| Utilities — 2.27% | | | | | | | | |

| Vistra Energy Corp. | | | 6,846 | | | | 943,858 | |

| Total United States | | | | | | | 26,408,710 | |

| | | | | | | | | |

Total Common Stocks

(Cost $29,489,923) | | | | | | | 38,998,588 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs

Schedule of Investments (continued)

December 31, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| Partnership Shares — 4.81% | | | | | | | | |

| United States — 4.81% | | | | | | | | |

| Klarna, SPV(a)(b)(c)(d) | | | 2,451 | | | $ | 1,000,000 | |

| SPACEX, SPV(a)(b)(c)(d) | | | 5,405 | | | | 1,000,000 | |

Total Partnership Shares

(Cost $2,040,000) | | | | | | | 2,000,000 | |

| | | | | | | | | |

| Money Market Funds - 1.44% | | | | | | | | |

| Fidelity Investments Money Market Treasury Only Portfolio, Class I, 4.34%(e) | | | 600,001 | | | | 600,001 | |

Total Money Market Funds

(Cost $600,001) | | | | | | | 600,001 | |

| | | | | | | | | |

Total Investments — 100.03%

(Cost $32,129,924) | | | | | | | 41,598,589 | |

| Liabilities in Excess of Other Assets — (0.03)% | | | | | | | (13,702 | ) |

| Net Assets — 100.00% | | | | | | $ | 41,584,887 | |

| (a) | Non-income producing security. |

| (c) | Level 3 securities fair valued using significant unobservable inputs. |

| (d) | Restricted investment as to resale. |

| (e) | Rate disclosed is the seven day effective yield as of December 31, 2024. |

| ADR | - American Depositary Receipt |

| SPV | - Special Purpose Vehicle |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs

Statement of Assets and Liabilities

December 31, 2024 (Unaudited)

| Assets | | | |

| Investments, at cost | | $ | 32,129,924 | |

| Investments at fair value | | | 41,598,589 | |

| Dividends and interest receivable | | | 4,057 | |

| Tax reclaims receivable | | | 11,098 | |

| Prepaid expenses | | | 7,779 | |

| Total Assets | | | 41,621,523 | |

| | | | | |

| Liabilities | | | | |

| Payable to Advisor | | | 23,183 | |

| Payable to Trustees | | | 1,094 | |

| Accrued expenses and other liabilities | | | 12,359 | |

| Total Liabilities | | | 36,636 | |

| Net Assets | | $ | 41,584,887 | |

| | | | | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 52,905,967 | |

| Accumulated deficit | | | (11,321,080 | ) |

| Net Assets | | $ | 41,584,887 | |

| | | | | |

| Institutional Class | | | | |

| Net Assets | | $ | 41,584,887 | |

| Shares outstanding (unlimited number of shares authorized, $0.01 par value) | | | 2,561,959 | |

| Net asset value (NAV) and offering price per share | | $ | 16.23 | |

| Redemption price per share (NAV * 98%)(a) | | $ | 15.91 | |

| (a) | The Fund charges a 2.00% redemption fee on shares redeemed within five business days of purchase. Shares are redeemed at the NAV if held longer than five business days. See Note 8. |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs

Statement of Operations

For the six months ended December 31, 2024 (Unaudited)

| Investment Income | | | | |

| Dividend income (net of foreign taxes withheld of 7,732) | | $ | 74,389 | |

| Interest income | | | 14,287 | |

| Total investment income | | | 88,676 | |

| | | | | |

| Expenses | | | | |

| Advisory fees | | | 171,878 | |

| Fund accounting and administration fees | | | 26,047 | |

| Auditing fees | | | 8,019 | |

| Custodian fees | | | 6,088 | |

| Registration fees | | | 5,653 | |

| Transfer agent | | | 5,583 | |

| Legal fees | | | 4,930 | |

| Trustees' fees and expenses | | | 4,731 | |

| Shareholder reporting fees | | | 3,951 | |

| Insurance expense | | | 1,796 | |

| Pricing fees | | | 1,269 | |

| Miscellaneous | | | 5,612 | |

| Total expenses | | | 245,557 | |

| Fees contractually waived by Advisor | | | (56,094 | ) |

| Net operating expenses | | | 189,463 | |

| Net investment loss | | | (100,787 | ) |

| | | | | |

| Net Realized and Change in Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 3,123,722 | |

| Foreign currency transactions | | | (4,200 | ) |

| Net realized gain | | | 3,119,522 | |

| | | | | |

| Change in unrealized appreciation on: | | | | |

| Investments | | | 3,185,352 | |

| Foreign currency translations | | | 546 | |

| Net change in unrealized appreciation | | | 3,185,898 | |

| Net realized and change in unrealized appreciation on investments | | | 6,305,420 | |

| Net increase in net assets resulting from operations | | $ | 6,204,633 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs

Statements of Changes in Net Assets

| | | For the

Six Months Ended

December 31, 2024 | | | For the

Year Ended

June 30, 2024 | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment loss | | $ | (100,787 | ) | | $ | (59,426 | ) |

| Net realized gain on investments and foreign currency transactions | | | 3,119,522 | | | | 6,383,939 | |

| Net change in unrealized appreciation on investments and foreign currency translations | | | 3,185,898 | | | | 4,099,719 | |

| Net increase in net assets resulting from operations | | | 6,204,633 | | | | 10,424,232 | |

| | | | | | | | | |

| Distributions to Shareholders from Earnings: | | | | | | | | |

| Institutional Class | | | (251,881 | ) | | | (37,447 | ) |

| Total distributions to shareholders | | | (251,881 | ) | | | (37,447 | ) |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 26,015 | | | | 8,777 | |

| Reinvestment of distributions | | | 251,046 | | | | 37,346 | |

| Cost of shares redeemed | | | (86,662 | ) | | | (25,017,319 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | 190,399 | | | | (24,971,196 | ) |

| Total Increase (Decrease) in Net Assets | | | 6,143,151 | | | | (14,584,411 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 35,441,736 | | | | 50,026,147 | |

| End of period | | $ | 41,584,887 | | | $ | 35,441,736 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 1,582 | | | | 697 | |

| Shares issued in reinvestment of distributions | | | 15,114 | | | | 3,117 | |

| Shares redeemed | | | (6,058 | ) | | | (1,808,013 | ) |

| Net increase (decrease) in shares outstanding | | | 10,638 | | | | (1,804,199 | ) |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs - Institutional Class

Financial Highlights

(For a share outstanding during each period)

| | | For the

Six Months Ended

December 31,

2024 (Unaudited) | | | For the

Year Ended

June 30, 2024 | | | For the

Year Ended

June 30, 2023 | | | For the

Year Ended

June 30, 2022 | | | For the

Year Ended

June 30, 2021 | | | For the

Year Ended

June 30, 2020 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 13.89 | | | $ | 11.49 | | | $ | 10.19 | | | $ | 21.82 | | | $ | 16.82 | | | $ | 15.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)(a) | | | (0.04 | ) | | | (0.01 | ) | | | 0.02 | | | | (0.10 | ) | | | (0.14 | ) | | | (0.08 | ) |

| Net realized and unrealized gain (loss) | | | 2.48 | | | | 2.42 | | | | 1.28 | | | | (7.22 | ) | | | 7.32 | | | | 1.61 | |

| Total from investment operations | | | 2.44 | | | | 2.41 | | | | 1.30 | | | | (7.32 | ) | | | 7.18 | | | | 1.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.10 | ) | | | (0.01 | ) | | | — | | | | (0.15 | ) | | | — | | | | — | |

| Net realized gains | | | — | | | | — | | | | — | | | | (4.16 | ) | | | (2.18 | ) | | | (0.49 | ) |

| Total distributions | | | (0.10 | ) | | | (0.01 | ) | | | — | | | | (4.31 | ) | | | (2.18 | ) | | | (0.49 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | | | | — | | | | — | | | | — | | | | — | (b) | | | — | (b) |

| Net asset value, end of period | | $ | 16.23 | | | $ | 13.89 | | | $ | 11.49 | | | $ | 10.19 | | | $ | 21.82 | | | $ | 16.82 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return(c) | | | 17.54 | %(d) | | | 20.97 | % | | | 12.76 | % | | | (39.05 | )% | | | 42.63 | % | | | 9.80 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 41,585 | | | $ | 35,442 | | | $ | 50,026 | | | $ | 45,168 | | | $ | 121,627 | | | $ | 51,234 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | 1.27 | %(e) | | | 1.15 | % | | | 1.17 | % | | | 1.37 | % | | | 1.44 | % | | | 1.49 | % |

| After fees waived/recouped | | | 0.98 | %(e) | | | 0.98 | % | | | 0.98 | % | | | 1.29 | % | | | 1.44 | % | | | 1.49 | % |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | (0.52 | )% | | | (0.28 | )% | | | (0.03 | )% | | | (0.70 | )% | | | (0.67 | )% | | | (0.51 | )% |

| After fees waived/recouped | | | (0.81 | )%(e) | | | (0.11 | )% | | | 0.16 | % | | | (0.63 | )% | | | (0.67 | )% | | | (0.51 | )% |

| Portfolio turnover rate | | | 47 | %(d) | | | 208 | % | | | 94 | % | | | 265 | % | | | 477 | %(f) | | | 61 | % |

| (a) | Based on average shares outstanding during the period. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total returns would have been lower/higher had certain expenses not been waived/recovered by the Advisor (see Note 3). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

| (d) | Not annualized. |

| (e) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs - Institutional Class

Financial Highlights

(For a share outstanding during each period)

| (f) | The Fund has experienced an unusual interest rate environment combined with volatile markets resulting from inflationary concerns. These two factors posed potential adverse effects to the Fund. Thus, the portfolio manager engaged in temporary defensive positions as well as positioned the Fund to take the best advantage of the environment it was facing. These two actions, combined with a reversion of the defensive positions, resulted in an increased turnover for the Fund. |

See accompanying notes which are an integral part of these financial statements.

ERShares Global Entrepreneurs

Notes to Financial Statements

December 31, 2024 (Unaudited)

EntrepreneurShares™ Series Trust, a Delaware statutory trust (the “Trust”), was formed on July 1, 2010, and has authorized capital of unlimited shares of beneficial interest. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and is authorized to issue multiple series and classes of shares. ERShares Global Entrepreneurs (the “Fund”, formerly known as EntrepreneurShares Global Fund) is classified as a “diversified” series, as defined in the 1940 Act. The Fund is an investment company and, accordingly, follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 – Investment Companies including Accounting Standards Update (“ASU”) 2013-08. The Fund commenced operations on November 11, 2010.

The investment objective of the Fund is long-term capital appreciation. The Fund seeks to achieve its objective by investing mainly in equity securities of global companies with market capitalizations that are above $300 million at the time of initial purchase and possess entrepreneurial characteristics, as determined by EntrepreneurShares, LLC, is the Fund’s Sub-Advisor (the “Sub-Advisor”), and Seaport Global Advisors, LLC, formerly known as Weston Capital Advisors, LLC, is the Fund’s investment advisor (the “Advisor”). Dr. Joel M. Shulman has been the Fund’s portfolio manager since November 11, 2010 and Managing Director of the Advisor and President of the Sub-Advisor.

The Fund has registered three classes of shares: Class A shares, Retail Class shares and Institutional Class shares. Each share represents an equal proportionate interest in the assets and liabilities belonging to the applicable class and is entitled to such dividends and distributions out of income belonging to the applicable class as are declared by the EntrepreneurShares Series Trust Board of Trustees (the “Board”). On matters that affect the Fund as a whole, each class has the same voting and other rights and preferences as any other class. On matters that affect only one class, only shareholders of that class may vote. Each class votes separately on matters affecting only that class, or on matters expressly required to be voted on separately by state or federal law. Shares of each class of a series have the same voting and other rights and preferences as the other classes and series of the Trust for matters that affect the Trust as a whole. Currently, only Institutional Class shares of the Fund are being offered.

The Fund operates as a single operating segment. The Fund’s income, expenses, assets, and performance are regularly monitored and assessed as a whole by the Advisor, who is responsible for the oversight functions of the Fund, using the information presented in the financial statements and financial highlights.

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”).The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies including Accounting Standards Update (“ASU”) 2013-08. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Regulatory Update

Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – The Securities and Exchange Commission adopted rule and form amendments that have resulted in changes to the design and delivery of shareholder reports of mutual funds and ETFs, requiring them to transmit concise and visually engaging streamlined annual and semi-annual reports to shareholders that highlight key information. Other information, including financial statements, no longer appears in a streamlined shareholder report but is available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR.

Investment Valuations

The following is a summary of the Fund’s pricing procedures. It is intended to be a general discussion and may not necessarily reflect all pricing procedures followed by the Fund.

In determining the net asset value (“NAV”) of the Fund’s shares, securities that are listed on a national securities exchange (other than the National Association of Securities Dealers’ Automatic Quotation System (“Nasdaq”) are valued at the last sale price on the day the valuation is made. Securities that are traded on Nasdaq under one of its three listing tiers, Nasdaq Global Select Market, Nasdaq Global Market and Nasdaq Capital Market, are valued at the Nasdaq Official Closing Price. Price information on listed securities is taken from the exchange where the security is primarily traded. Securities which are listed on an exchange but which are not traded on the valuation date are valued at the most recent bid price.

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

Unlisted securities held by the Fund are valued at the average of the quoted bid and ask prices in the over-the-counter market. Securities and other assets for which market quotations are not readily available are valued at their fair value in good faith by the Advisor, acting in its capacity as valuation designee pursuant to procedures established by and under the supervision of the Board.

Short-term investments with 61 days or more to maturity at time of purchase are valued at fair market value through the 61st day prior to maturity, based on quotations received from market makers or other appropriate sources; thereafter, they are generally valued at amortized cost. There is no definitive set of circumstances under which the Fund may elect to use fair value procedures to value a security. Types of securities that the Fund may hold for which fair value pricing might be required include, but are not limited to: (a) illiquid securities, including restricted securities and private placements for which there is no public market; (b) options not traded on a securities exchange; (c) securities of an issuer that has entered into a restructuring; (d) securities whose trading has been halted or suspended, as permitted by the SEC; (e) foreign securities, if an event or development has occurred subsequent to the close of the foreign market and prior to the close of regular trading on the New York Stock Exchange (“NYSE”) that would materially affect the value of the security; and (f) fixed income securities that have gone into default and for which there is not a current market value quotation.

Valuing securities at fair value involves greater reliance on judgment than securities that have readily available market quotations. There can be no assurance that the Fund could obtain the fair value price assigned to a security upon sale. Securities that are not listed on an exchange are valued by the Fund’s Advisor, under the supervision of the Board. There is no single standard for determining the fair value of a security. Rather, in determining the fair value of a security, the Advisor and the Board take into account the relevant factors and surrounding circumstances, which may include: (1) the nature and pricing history (if any) of the security; (2) whether any dealer quotations for the security are available; (3) possible valuation methodologies that could be used to determine the fair value of the security; (4) the recommendation of the portfolio manager of the Fund with respect to the valuation of the security; (5) whether the same or similar securities are held by other funds managed by the Advisor or other fund and the method used to price the security in those funds; (6) the extent to which the fair value to be determined for the security will result from the use of data or formulae produced by third parties independent of the Advisor; and (7) the liquidity or illiquidity of the market for the security.

Fair Value Measurement

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the year and expanded disclosure of valuation levels for major security types. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

Level 1: Unadjusted quoted prices in active markets for identical assets that the Fund has the ability to access at the measurement date;

Level 2: Observable inputs other than quoted prices included in Level 1 that are observable for the asset either directly or indirectly. These inputs may include quoted prices for identical instruments on inactive markets, quoted prices for similar instruments, interest rates, prepayment spreads, credit risk, yield curves, default rates, and similar data;

Level 3: Significant unobservable inputs for the asset to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions that a market participant would use in valuing the asset, and would be based on the best information available.

Inputs are used in applying the various valuation techniques and broadly refer to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data, which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

Investments whose values are based on quoted market prices in active markets, and are therefore classified within Level 1, include active listed equities and real estate investment trusts, and certain money market securities. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. During the six months ended December 31, 2024, the Fund did not hold any instrument which used significant unobservable inputs (Level 3)

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

in determining fair value. The tables below are a summary of the inputs used to value the Fund’s investments as of December 31, 2024.

| Valuation Inputs | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks* | | $ | 38,998,588 | | | $ | — | | | $ | — | | | $ | 38,998,588 | |

| Partnership Shares* | | | — | | | | — | | | | 2,000,000 | | | | 2,000,000 | |

| Money Market Funds | | | 600,001 | | | | — | | | | — | | | | 600,001 | |

| Total | | $ | 39,598,589 | | | $ | — | | | $ | 2,000,000 | | | $ | 41,598,589 | |

| * | For further information regarding security characteristics, please see the Schedules of Investments. |

The following is the activity in investments in which significant unobservable inputs (Level 3) were used in determining value as of December 31, 2024:

| | | Beginning

balance

June 30,

2024 | | | Amortization/

Accretion | | | Change in

unrealized

appreciation

(depreciation) | | | Balance as of

December 31, 2024 | |

| Partnership Shares | | $ | — | | | $ | — | | | $ | — | | | $ | 2,000,000 | |

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of December 31, 2024:

| Level 3 Investment | | Fair Value | | | Valuation Technique | | Unobservable Inputs | | Range of

Inputs/Average | | Impact to Valuation

From an Increase in Input |

| Klarna, SPV | | $ | 1,000,000 | | | Recent Transactions | | Transaction Price | | Not Applicable | | Increase |

| SPACEX, SPV | | $ | 1,000,000 | | | Recent Transactions | | Transaction Price | | Not Applicable | | Increase |

| Total | | $ | 2,000,000 | | | | | | | | | |

Restricted Securities – Restricted securities are securities that may be resold only upon registration under federal securities laws or in transactions exempt from such registration. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Many restricted securities may be resold in the secondary market in transactions exempt from registration. Such restricted securities may be determined to be liquid under criteria established by the Board. The restricted securities may be valued at the price provided by dealers in the secondary market or, if no market prices are available, the fair value as determined in good faith in accordance with the Fund’s Valuation Policies. Private Investments generally are restricted securities

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

that are subject to substantial holding periods and are not traded in public markets. The Fund may not be able to resell some of its investments for extended periods, which may be several years.

| Security Description | | Acquisition Date | | Cost | | | Value | | | % of Net Assets | |

| Klarna, SPV | | December 13, 2024 | | $ | 1,020,000 | | | $ | 1,000,000 | | | | 2.40 | % |

| SPACEX, SPV | | December 12, 2024 | | $ | 1,020,000 | | | $ | 1,000,000 | | | | 2.40 | % |

| | | | | $ | 2,040,000 | | | $ | 2,000,000 | | | | 4.80 | % |

Use of Estimates and Indemnifications

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these financial statements. Actual results could differ from those estimates.

In the normal course of business, the Trust, on behalf of the Fund, enters into contracts that contain a variety of representations which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown; however, the Trust has not had claims or losses pursuant to these contracts and the Trust expects any risk of loss to be remote.

Federal Income Taxes

The Fund intends to continue to qualify as “regulated investment companies” under Sub- chapter M of the Internal Revenue Code of 1986, as amended. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and net realized gains to shareholders.

The Fund has reviewed all open tax years and major jurisdictions and concluded that the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority for the six months ended December 31, 2024. The Fund would recognize interest and penalties, if any, related to uncertain tax benefits in the Statements of Operations. During the six months ended December 31, 2024, the Fund did not incur any interest or penalties. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities.

Distribution to Shareholders

The Fund intends to continue to distribute to their shareholders any net investment income and any net realized long or short-term capital gains, if any, at least annually. Distributions are recorded on the ex-dividend date. The Fund may periodically make reclassifications

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

among certain of their capital accounts as a result of the characterization of certain income and realized gains determined annually in accordance with federal tax regulations that may differ from U.S. GAAP.

Allocation of Expenses

Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds by or under the direction of the Board in such a manner as the Board determine to be fair and equitable.

Foreign Currency Transactions

The Fund’s and records are maintained in U.S. dollars. Foreign currency denominated transactions (i.e., fair value of investment securities, assets and liabilities, purchases and sales of investment securities and income and expenses) are translated into U.S. dollars at the current rate of exchange on the date of valuation. Purchases and sales of securities and income items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such fluctuations are included in net realized and unrealized gain or (loss) on investments in the Statements of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains (losses) realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest and foreign taxes withheld, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains (losses) arise from the changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

Investment Transactions and Investment Income

Throughout the reporting period, security transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, security transactions are accounted for on trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income, less any foreign tax withheld, is recognized on the ex-dividend date and interest income is recognized on an accrual basis, including amortization/accretion of premiums or discounts.

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

Securities Lending

The Fund may lend portfolio securities constituting up to 33-1/3% of its total assets (as permitted by the 1940 Act) to unaffiliated broker-dealers, banks or other recognized institutional borrowers of securities, provided that the borrower at all times maintains cash, U.S. government securities or equivalent collateral or provides an irrevocable letter of credit in favor of the Fund equal in value to at least 102% of the value of loaned domestic securities and 105% of the value of loaned foreign securities on a daily basis. During the time portfolio securities are on loan, the borrower pays the lending Fund an amount equivalent to any dividends or interest paid on such securities, and such Fund may receive an agreed-upon amount of interest income from the borrower who delivered equivalent collateral or provided a letter of credit. Loans are subject to termination at the option of a Fund or the borrower. The Fund may pay reasonable administrative and custodial fees in connection with a loan of portfolio securities and may pay a negotiated portion of the interest earned on the cash or equivalent collateral to the borrower or placing broker. The Fund does not have the right to vote securities on loan but could terminate the loan and regain the right to vote if that were considered important with respect to the investment.

The primary risk in securities lending is a default by the borrower during a sharp rise in price of the borrowed security resulting in a deficiency in the collateral posted by the borrower. The Fund will seek to minimize this risk by requiring that the value of the securities loaned be computed each day and additional collateral be furnished each day if required.

Disclosures about Offsetting Assets and Liabilities

The Fund is required to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The guidance requires retrospective application for all comparative periods presented. Management has evaluated the impact on the financial statement disclosures and determined that there is no effect. As there are no master netting arrangements relating to the Fund’s participation in securities lending, and all amounts related to securities lending are presented gross on the Fund’s Statements of Assets and Liabilities, no additional disclosures have been made on behalf of the Fund. Please refer to the Securities Lending Note for additional disclosures related to securities lending, including collateral related to securities on loan.

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

Investment Advisory Agreement

The Advisor, a related party of the Fund, oversees the performance of the Fund and is responsible for overseeing the management of the investment portfolio of the Fund. These services are provided under the terms of an investment advisory agreement between the Trust and the Advisor, pursuant to which the Advisor receives an annual advisory fee equal to 0.89%. Through November 1, 2025, the Advisor has agreed to waive and/or reimburse the Fund for its advisory fee, and to the extent necessary, bear other expenses, to limit the total annualized expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business of the Institutional Class shares of the Fund to the amounts of 0.98% per annum of net assets attributable to such shares of the Fund.

The Advisor shall be permitted to recover expenses it has borne subsequent to the effective date of this agreement (whether through reduction of its advisory fee or otherwise) in later periods to the extent that the Fund’s expenses fall below the annual rates set forth above, given that such a rate is not greater than the rate that was in place at the time of the waiver, provided, however, that the Fund is not obligated to pay any such reimbursed fees more than three years after the expense was incurred by the Advisor.

Sub-Advisory services are provided to the Fund, pursuant to an agreement between the Advisor and Sub-Advisor. Under the terms of this sub-advisory agreement, the Advisor, not the Fund, compensates the Sub-Advisor based on the Fund’s average net assets. Certain officers of the Advisor are also officers of the Sub-Advisor. Dr. Shulman is a majority owner of both the Advisor and the Sub-Advisor. For the six months ended December 31, 2024, the Advisor earned a fee of $171,878 from the Fund. The Advisor waived $56,094 for the six month ended December 31, 2024.

Each waiver/expense payment by the Advisor is subject to recoupment by the Advisor from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

limitation in effect at the time of the recoupment. The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions are as follows:

| Recoverable Through | | | |

| June 30, 2025 | | $ | 34,224 | |

| June 30, 2026 | | | 86,600 | |

| June 30, 2027 | | | 86,186 | |

| December 31, 2027 | | | 56,094 | |

The Fund plans to distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year for financial reporting purposes may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

The tax character of distributions paid for the fiscal year ended June 30, 2024, the Fund’s most recent fiscal year end, were as follows:

| Distributions paid from: | | | | |

| Ordinary income(a) | | $ | 37,447 | |

| Total distributions paid | | $ | 37,447 | |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

The Fund designates long-term capital gain dividends, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits for the Fund related to net capital gains to zero for the tax year ended June 30, 2024.

Additionally, U.S. GAAP requires that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or the NAV per share.

At December 31, 2024, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes were as follows:

| Gross unrealized appreciation | | $ | 10,719,024 | |

| Gross unrealized depreciation | | | (1,290,359 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 9,428,665 | |

| Tax cost of investments | | $ | 32,129,924 | |

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

The table above may differ from the financial statements due to timing differences related to the deferral of losses primarily due to wash sales.

At June 30, 2024, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 251,693 | |

| Accumulated capital and other losses | | | (22,678,510 | ) |

| Unrealized appreciation on investments | | | 5,152,985 | |

| Total accumulated earnings | | $ | (17,273,832 | ) |

As of June 30, 2024, the Global Fund had short-term and long-term capital loss carryforwards available to offset future gains, not subject to expiration, in the amount of $16,716,693 and $5,961,816, respectively.

At December 31, 2024, certain officers of the Trust were also employees of the Advisor. However, these officers were not compensated directly by the Fund. Refer to Note 1 for more information.

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. As of December 31, 2024, for the benefit of its shareholders, MAC & Co., an affiliate of the Fund, held 93.30% of the total Fund shares outstanding.

| 7. | INVESTMENT TRANSACTIONS |

For the six months ended December 31, 2024, purchases and sales of investment securities, other than short-term investments, were as follows:

| | Purchases | | | Sales | |

| | $ | 18,652,781 | | | $ | 17,738,518 | |

There were no purchases or sales of long-term U.S. government obligations during the six months ended December 31, 2024.

The Fund imposes a redemption fee equal to 2% of the dollar value of the shares redeemed within five business days of the date of purchase. The redemption fee does not apply to shares purchased through reinvested distributions (dividends and capital gains) or through

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

the automatic investment plan, shares held in retirement plans (if the plans request a waiver of the fee), or shares redeemed through designated systematic withdrawal plans.

If the Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the volatility of the Fund’s NAV per share. For instance, economic or market factors, regulatory changes or other developments may negatively impact all companies in a particular sector, and therefore the value of the Fund’s portfolio will be adversely affected. As of December 31, 2024, the Fund had 35.47% of the value of its net assets invested in stocks within the Technology sector.

| 10. | FOREIGN SECURITIES RISK |

The Fund generally invests a significant portion of its total assets in securities principally traded in markets outside the U.S. The foreign markets in which the Fund invests in are sometimes open on days when the NYSE is not open and the Fund does not calculate its NAV, and sometimes are not open on days when the NYSE is open and the Fund does calculate its NAV. Even on days on which both the foreign market and the NYSE are open, several hours may pass between the time when trading in the foreign market closes and the time at which the Fund calculates its NAV. That is generally the case for markets in Europe, Asia, Australia and other far eastern markets; the regular closing time of foreign markets in North and South America is generally the same as the closing time of the NYSE and the time at which the Fund calculate its NAV.

Foreign stocks, as an asset class, may underperform U.S. stocks, and foreign stocks may be more volatile than U.S. stocks. Risks relating to investment in foreign securities (including, but not limited to, depository receipts and participation certificates) include: currency exchange rate fluctuation; less available public information about the issuers of securities; less stringent regulatory standards; lack of uniform accounting, auditing and financial reporting standards; and country risk including less liquidity, high inflation rates, unfavorable economic practices and political instability. The risks of foreign investments are typically greater in emerging and less developed markets.

ERShares Global Entrepreneurs

Notes to Financial Statements (continued)

December 31, 2024 (Unaudited)

| 11. | SUBSEQUENT EVENTS EVALUATION |

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Additional Information (Unaudited)

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the period covered by this report.

Proxy Disclosures

Not applicable.

Remuneration Paid to Directors, Officers and Others

Refer to the financial statements included herein.

Statement Regarding Basis for Approval of Investment Advisory Agreement

At a meeting of the Board of Trustees (the “Board”) held on August 14, 2024, all of the Trustees of EntrepreneurShares Series Trust (the “Trust”) met to discuss, among other things, the continuation of the investment advisory agreement for the ERShares Entrepreneurs ETF (formerly known as the ERShares Entrepreneur 30 ETF) (“Entrepreneurs ETF” or the “Fund”). In preparation for the meeting the Trustees reviewed materials addressing the review and consideration of the investment advisory agreement (the “Advisory Agreement”), which included a Gartenberg Memo to the Board from legal counsel, 15(c) analyses for the Fund, and the returns of the Fund and the Fund’s benchmark indices provided in the quarterly Board materials.

Capital Impact Advisors, LLC (the “Advisor”) is the investment adviser to the Fund. The Advisor is responsible for management of the investment portfolio of the Fund, and for overall management of the Fund’s business and affairs pursuant to the Advisory Agreement.

At the meeting, the Trustees had ample opportunity to consider matters they deemed relevant in considering the approval of the Advisory Agreement, and to request any additional information they considered reasonably necessary to their deliberations, without undue time constraints. In addition to the materials requested by the Trustees in connection with their consideration of the continuation of the Advisory Agreement, the Trustees received materials in advance of each regular quarterly meeting of the Board that provided information relating to the services provided by the Advisor.

The Board then reviewed and discussed the written materials that were provided in advance of the Meeting and deliberated on the renewal of the Advisory Agreement. The Board relied upon the advice of independent legal counsel and the Board’s own business judgment in determining the material factors to be considered in evaluating the Advisory Agreement and the weight to be given to each such factor. The conclusions reached by the Board were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the Advisory Agreement. In considering the renewal of the Advisory Agreement, the Board reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below.

Nature, Extent and Quality of Services. The Board reviewed materials provided by the Advisor related to the proposed renewal of the Advisory Agreement with respect to the Fund, including the Advisor’s respective Form ADV and related schedules, a description of the manner in which

Additional Information (Unaudited) (continued)

investment decisions were made and executed, a review of the personnel performing services for the Fund, including the individuals that primarily monitor and execute the investment process. The Board discussed the extent of the research capabilities, the quality of the compliance infrastructure and the experience of its investment advisory personnel. The Board noted that the Advisor was an experienced investment adviser with seasoned senior management and that the performance of the Fund was supported by the quality and experience of the staff.

Additionally, the Board received satisfactory responses from the representatives of the Advisor with respect to a series of important questions, including: whether the Advisor was involved in any lawsuits or pending regulatory actions; whether the advisory services provided to its other accounts would conflict with the advisory services provided to the Fund; whether there were procedures in place to adequately allocate trades among its respective clients; and whether the Advisor’s CCO had processes in place to review the portfolio managers’ performance of their duties to ensure compliance under its compliance program. The Board reviewed the information provided on the practices for monitoring compliance with the Fund’s investment limitations and discussed the compliance programs with the CCO of the Trust.

The Board noted that the CCO of the Trust continued to represent that the policies and procedures were reasonably designed to prevent violations of applicable federal securities laws. The Board also noted the Advisor’s representation that the prospectus and statement of additional information for the Fund accurately describe the investment strategies of the Fund. The Board then reviewed the capitalization of the Advisor based on financial information described by and representations made by the Advisor, and their respective representatives and concluded that the Advisor is sufficiently well-capitalized, or its principals have the ability to make additional contributions in order to meet its obligations to the Fund.

The Board concluded that the Advisor had sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to performing its duties under the Advisory Agreement and that the nature, overall quality and extent of the advisory services to be provided by the Advisor to the Fund were satisfactory.

The Board reviewed the performance, fee and expense information provided by Ultimus using data provided by Morningstar, Inc. (“Morningstar”). The Board considered the limitations with such a process, including that the categorization determined by Morningstar may or may not subjectively correlate with the Fund’s investment strategy or portfolio holdings. The Board noted that the historical data used in the 15(c) analyses was as of the reporting period ended June 30, 2024, and that as of that date Entrepreneurs ETF had approximately $$82.994 million in net assets.

Performance. The Board discussed Morningstar’s classification of the Entrepreneurs ETF. The Board also referred to the category analysis as of June 30, 2024, noting the average net assets for funds in the category. The Board reviewed the Entrepreneurs ETF’s one-year, three-year and five- year returns annualized returns and compared them to the peer group’s and Morningstar category’s average annualized returns for these same periods, noting the Fund had generally lagged the peer group, Morningstar Category and index, but that the one-year returns revealed a significant recovery of the strategy as the one-year returns significantly outperformed the comparative references. The Board noted the strategy had a long-term focus and that it seemed imprudent to suggest that the Advisor change course.

Additional Information (Unaudited) (continued)

Fees and Expenses. The Board reviewed the fee and expense information provided by the Advisor. The Board considered the limitations with such a process, including that the categorization determined by Morningstar may or may not subjectively correlate with the Fund’s investment strategy or portfolio holdings. The Board noted that the historical data used in the 15(c) analyses was as of the reporting period ended June 30, 2024.

The Board noted that the Entrepreneurs ETF’s management fee of 0.75%, which is structured as a unified fee and compared that to the peer group’s average management fee of 0.62%, noted that the total annual fund operating expense of 0.75% and compared that to the peer group’s average total annual fund operating expense of 0.62% and that the Fund’s management fee and expenses were within the reasonable range of fees as compared to its peers.

Profitability. The Board reviewed a profitability summary that was provided by the Advisor, indicating that profits were below the 50% margin. The Board further reviewed the Fund’s annual and semi-annual shareholder reports, which contained audited financial statements including gross revenues earned by the Advisor with respect to its management of the Fund. The Board noted that while the Advisor appeared to earn a profit with respect to its management of the Fund, the profits did not appear to be excessive.

Economies of Scale. The Board examined the Advisor’s effort to achieve economies of scale for the Fund to the benefit of the Fund’s shareholders. The Board determined that as the Fund’s assets increase, economies of scale could be realized and will be revisited later.

Conclusion

The Board weighed all of the factors presented to them in the Gartenburg Memo, the Morningstar analysis of returns and expense ratios, the returns of the benchmark indices, profitability analysis and discussions with the Advisor during the Board meeting to consider the renewal of the Advisory Agreement. Without paying particular weight to any one factor, the Board, including a majority of the Independent Trustees, determined the advisory fees were fair and reasonable for the services provided and it was in the best interest of shareholders to continue the Advisory Agreement for a one-year period.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, is available (1) without charge upon request by calling the Funds at (887) 271-8811 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

EntrepreneurShares Series Trust™

ERShares Private-Public Crossover ETF

(formerly known as “ERShares Entrepreneurs ETF”)

(XOVR)

The Fund is an exchange-traded fund. This means that shares of the Fund are listed on The Nasdaq Stock Market LLC and trade at market prices. The market price for the Fund’s shares may be different from its net asset value per share.

Semi-Annual Financial Statements and Additional Information

December 31, 2024

ERShares Private-Public Crossover ETF

Schedule of Investments

December 31, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks — 87.99% | | | | | | | | |

| Communications — 24.50% | | | | | | | | |

| Airbnb, Inc., Class A(a) | | | 45,032 | | | $ | 5,917,655 | |

| Alphabet, Inc., Class A | | | 59,094 | | | | 11,186,494 | |

| AppLovin Corp., Class A(a) | | | 37,245 | | | | 12,061,048 | |

| DoorDash, Inc., Class A(a) | | | 37,668 | | | | 6,318,807 | |

| Meta Platforms, Inc., Class A | | | 15,916 | | | | 9,318,977 | |

| Trade Desk, Inc. (The), Class A(a) | | | 47,469 | | | | 5,579,032 | |

| | | | | | | | 50,382,013 | |

| Consumer Discretionary — 6.42% | | | | | | | | |

| Copart, Inc.(a) | | | 100,332 | | | | 5,758,053 | |

| DraftKings, Inc., Class A(a) | | | 117,538 | | | | 4,372,414 | |

| Tesla, Inc.(a) | | | 7,599 | | | | 3,068,780 | |

| | | | | | | | 13,199,247 | |

| Financials — 3.15% | | | | | | | | |

| Robinhood Markets, Inc., Class A(a) | | | 173,613 | | | | 6,468,820 | |

| | | | | | | | | |

| Health Care — 8.40% | | | | | | | | |

| Medpace Holdings, Inc.(a) | | | 11,378 | | | | 3,780,113 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 6,148 | | | | 4,379,405 | |

| ResMed, Inc. | | | 21,263 | | | | 4,862,635 | |

| United Therapeutics Corp.(a) | | | 12,038 | | | | 4,247,488 | |

| | | | | | | | 17,269,641 | |

| Technology — 45.52% | | | | | | | | |

| Appfolio, Inc., Class A(a) | | | 18,648 | | | | 4,600,835 | |

| Arista Networks, Inc.(a) | | | 60,577 | | | | 6,695,577 | |

| Corpay, Inc.(a) | | | 13,749 | | | | 4,652,937 | |

| Crowdstrike Holdings, Inc.(a) | | | 19,536 | | | | 6,684,438 | |

| Datadog, Inc., Class A(a) | | | 41,638 | | | | 5,949,654 | |

| MongoDB, Inc.(a) | | | 16,577 | | | | 3,859,291 | |

| Monolithic Power Systems, Inc. | | | 6,047 | | | | 3,578,010 | |

| NVIDIA Corp. | | | 79,601 | | | | 10,689,618 | |

| Oracle Corp. | | | 45,546 | | | | 7,589,785 | |

| Paylocity Holding Corp.(a) | | | 22,911 | | | | 4,570,057 | |

| Pure Storage, Inc., Class A(a) | | | 84,005 | | | | 5,160,427 | |

| Salesforce, Inc. | | | 25,183 | | | | 8,419,433 | |

| Samsara, Inc., Class A(a) | | | 99,935 | | | | 4,366,160 | |

| Synopsys, Inc.(a) | | | 11,474 | | | | 5,569,021 | |

| Toast, Inc., Class A(a) | | | 151,484 | | | | 5,521,591 | |

| Ubiquiti, Inc. | | | 17,288 | | | | 5,738,406 | |

| | | | | | | | 93,645,240 | |

Total Common Stocks

(Cost $160,882,294) | | | | | | | 180,964,961 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Private-Public Crossover ETF

Schedule of Investments (continued)

December 31, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| Partnership Shares — 10.83% | | | | | | | | |

| Klarna, SPV(a)(b)(c)(d) | | | 4,902 | | | $ | 2,000,000 | |

| SPACEX, SPV(a)(b)(c)(d) | | | 109,610 | | | | 20,277,778 | |

Total Partnership Shares

(Cost $19,890,000) | | | | | | | 22,277,778 | |

| | | | | | | | | |

Total Investments — 98.82%

(Cost $180,772,294) | | | | | | | 203,242,739 | |

| Other Assets in Excess of Liabilities — 1.18% | | | | | | | 2,427,921 | |

| Net Assets — 100.00% | | | | | | $ | 205,670,660 | |

| (a) | Non-income producing security. |

| (b) | Illiquid security. |

| (c) | Level 3 securities fair valued using significant unobservable inputs. |

| (d) | Restricted investment as to resale. |

SPV - Special Purpose Vehicle

See accompanying notes which are an integral part of these financial statements.

ERShares Private-Public Crossover ETF

Statement of Assets and Liabilities

December 31, 2024 (Unaudited)

| Assets | | | | |

| Investments, at cost | | $ | 180,772,294 | |

| Investments, at fair value | | | 203,242,739 | |

| Cash | | | 1,968,601 | |

| Receivable for fund shares sold | | | 552,693 | |

| Dividends and interest receivable | | | 21,484 | |

| Total Assets | | | 205,785,517 | |

| | | | | |

| Liabilities | | | | |

| Unified fee | | | 114,857 | |

| Total Liabilities | | | 114,857 | |

| Net Assets | | $ | 205,670,660 | |

| | | | | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 193,685,154 | |

| Accumulated earnings | | | 11,985,506 | |

| Net Assets | | $ | 205,670,660 | |

| | | | | |

| Net Assets | | $ | 205,670,660 | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 11,425,000 | |

| Net asset value (offering and redemption price per share) | | $ | 18.00 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Private-Public Crossover ETF

Statement of Operations

For the six months ended December 31, 2024 (Unaudited)

| Investment Income | | | | |

| Dividend income | | $ | 104,986 | |

| Interest income | | | 8,183 | |

| Total investment income | | | 113,169 | |

| | | | | |

| Expenses | | | | |

| Unified fee | | | 414,705 | |

| Total expenses | | | 414,705 | |

| Net investment loss | | | (301,536 | ) |

| | | | | |

| Net Realized and Change in Unrealized Gain on Investments | | | | |

| Net realized gain on: | | | | |

| Investments | | | 2,318,065 | |

| Investments in-kind | | | 4,789,309 | |

| Net realized gain | | | 7,107,374 | |

| | | | | |

| Change in unrealized appreciation on: | | | | |

| Investments | | | 5,079,626 | |

| Net realized and change in unrealized gain on investments | | | 12,187,000 | |

| Net increase in net assets resulting from operations | | $ | 11,885,464 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Private-Public Crossover ETF

Statements of Changes in Net Assets

| | | For the

Six Months Ended December 31, 2024 | | | For the

Year Ended

June 30, 2024 | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment loss | | $ | (301,536 | ) | | $ | (312,245 | ) |

| Net realized gain on investments and in-kind redemptions | | | 7,107,374 | | | | 9,815,604 | |

| Net change in unrealized appreciation on investments | | | 5,079,626 | | | | 9,331,959 | |

| Net increase in net assets resulting from operations | | | 11,885,464 | | | | 18,835,318 | |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Proceeds from shares issued | | | 132,203,602 | | | | 21,212,175 | |

| Cost of shares redeemed | | | (23,198,638 | ) | | | (776,012 | ) |

| Net increase in net assets resulting from capital transactions | | | 109,004,964 | | | | 20,436,163 | |

| Total Increase in Net Assets | | | 120,890,428 | | | | 39,271,481 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 84,780,232 | | | | 45,508,751 | |

| End of period | | $ | 205,670,660 | | | $ | 84,780,232 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Issued | | | 7,350,000 | | | | 1,775,000 | |

| Redeemed | | | (1,375,000 | ) | | | (50,000 | ) |

| Net increase in shares outstanding | | | 5,975,000 | | | | 1,725,000 | |

See accompanying notes which are an integral part of these financial statements.

ERShares Private-Public Crossover ETF

Financial Highlights

(For a share outstanding during each period)

| | | For the

Six Months Ended December 31,

2024 (Unaudited) | | | For the

Year Ended

June 30,

2024 | | | For the

Year Ended

June 30,

2023 | | | For the

Year Ended

June 30,

2022 | | | For the

Year Ended

June 30,

2021 | | | For the

Year Ended June 30,

2020 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 15.56 | | | $ | 12.22 | | | $ | 9.47 | | | $ | 26.35 | | | $ | 21.15 | | | $ | 17.49 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.01 | ) | | | (0.05 | ) | | | — | (a) | | | (0.13 | ) | | | (0.11 | ) | | | (0.01 | ) |

| Net realized and unrealized gain (loss) | | | 2.45 | | | | 3.39 | | | | 2.75 | | | | (8.03 | ) | | | 6.96 | | | | 3.68 | |

| Total from investment operations | | | 2.44 | | | | 3.34 | | | | 2.75 | | | | (8.16 | ) | | | 6.85 | | | | 3.67 | |