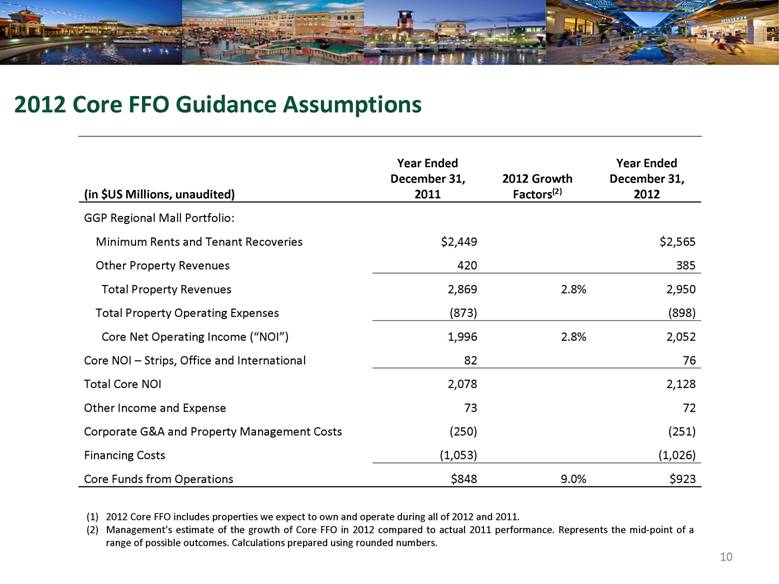

| Forward-Looking Statements and Non-GAAP Measures This presentation contains forward-looking statements. These statements relate to future events or to future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results, levels of activity, or performance to differ from those achievements expressed or implied by these forward-looking statements. The words “possible,” “propose,” “might,” “could,” “would,” “projects,” “plan,” “forecasts,” “anticipates,” “expect,” “intend,” “believe,” “seek,” or “may,” the negative of these terms and other comparable terminology, are intended to identify forward-looking statements, but are not the exclusive means of identifying them. Actual results may differ materially from the results suggested by these forward-looking statements, for a number of reasons, including, but not limited to, our ability to refinance, extend, restructure or repay near and intermediate term debt, our substantial level of indebtedness, our ability to raise capital through equity issuances, asset sales or the incurrence of new debt, retail and credit market conditions, impairments, our liquidity demands and retail and economic conditions. Readers are referred to the documents filed by General Growth Properties, Inc. ( "GGP") with the Securities and Exchange Commission (the "SEC"), which further identify important risk factors that could cause actual results to differ materially from the forward-looking statements in this presentation. Except as may be required by law, we disclaim any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise. The 2012 guidance included in this presentation reflects management’s view of current and future market conditions, including assumptions with respect to rental rates, occupancy levels and the earnings impact of the events referenced in this release and previously disclosed. The guidance also reflects management’s view of future capital market conditions, which is generally consistent with the current forward rates for LIBOR and U.S. Treasury bonds. The estimates do not include possible future gains or losses or the impact on operating results from other possible future property acquisitions or dispositions, possible capital markets activity or possible future impairment charges. EPS estimates may be subject to fluctuations as a result of several factors, including changes in the recognition of depreciation and amortization expense and any gains or losses associated with disposition activity. The 2012 guidance is a forward-looking statement. This presentation also makes reference to real estate property net operating income (“NOI”), earnings before interest, taxes, depreciation and amortization (“EBITDA”), and funds from operations (“FFO”). NOI is defined as income from property operations after operating expenses have been deducted, but prior to deducting financing, administrative and income tax expenses. EBITDA is defined as NOI less certain property management, administrative expenses and preferred unit distributions, net of management fees and other operational items. FFO is defined as net income (loss) attributable to common stockholders in accordance with GAAP, excluding gains (or losses) from cumulative effects of accounting changes, extraordinary items and sales of properties, plus real estate related depreciation and amortization and including adjustments for unconsolidated partnerships and joint ventures. NOI, EBITDA and FFO are presented in this presentation on a proportionate basis, which includes GGP’s share from consolidated and unconsolidated properties. As we conduct substantially all of our business through GGP Limited Partnership (the “Operating Partnership”, which is 99% owned by GGP) and we include the conversion of non-GGP limited common units of the Operating Partnership in the total diluted weighted average FFO per share amounts, all FFO amounts in this presentation reflect the FFO of the Operating Partnership. In order to present GGP’s operations in a manner most relevant to its future operations, Core NOI has been presented to exclude certain non-cash and non-recurring revenue and expenses. A reconciliation of NOI to Core NOI has been included in the Supplemental Information for the three and twelve months ended December 31, 2011, as furnished with the SEC. NOI is not an alternative to GAAP operating income (loss) or net income (loss) available to common stockholders. For reference, as an aid in understanding management’s computation of NOI, a reconciliation of NOI to consolidated operating income in accordance with GAAP has been included in the Supplemental. 2 |