SUPPLEMENTAL INFORMATION

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2014

GENERAL INFORMATION

Unless the context indicates otherwise, references in the accompanying financial information (the "Supplemental") to the "Corporation" refer to General Growth Properties, Inc. and references to "GGP" or the "Company" refer to the Corporation, its direct and indirect subsidiaries, and consolidated and unconsolidated entities. Additionally, where reference is made to "GAAP", this refers to accounting principles generally accepted in the United States of America.

PROPERTY INFORMATION

The Company has presented information on its consolidated and unconsolidated properties ("Proportionate" or "at share") in certain schedules included within this Supplemental. This form of presentation offers insights into the financial performance and condition of the Company as a whole, given the significance of the Company's unconsolidated property operations that are owned through investments accounted for under the equity method.

NON-GAAP MEASURES

This Supplemental makes reference to net operating income (“NOI”), earnings before interest, taxes, depreciation and amortization ("EBITDA"), and funds from operations (“FFO”). NOI is defined as income from property operations after operating expenses have been deducted, but prior to deducting financing, administrative and income tax expenses. EBITDA is defined as NOI less certain property management and administrative expenses, net of management fees and other operational items. FFO is defined as net income (loss) attributable to common stockholders in accordance with GAAP, excluding impairment write-downs on depreciable real estate, gains (or losses) from cumulative effects of accounting changes, extraordinary items and sales of properties, less preferred unit distributions and preferred stock dividends, plus real estate related depreciation and amortization including adjustments for unconsolidated entities. NOI, EBITDA and FFO are presented in the Supplemental on a Proportionate basis, which includes GGP’s share of consolidated and unconsolidated properties. As GGP conducts substantially all of its business through GGP Operating Partnership, GGP Limited Partnership and GGP Nimbus Limited Partnership (the “Operating Partnerships”, which are 99% owned by GGP) and since the limited common units of the Operating Partnerships are included in total diluted weighted average FFO per share amounts, all FFO amounts in this Supplemental reflect the FFO of the Operating Partnerships.

In order to present GGP's operations in a manner most relevant to its operations, Company NOI, Company EBITDA, and Company FFO have been presented to exclude certain non-cash and non-recurring revenue and expenses. Same Store Company NOI is presented to exclude the periodic effects of acquisitions of new properties, reductions in ownership as a result of sales or other transactions, and certain redevelopments and other properties. Company NOI, EBITDA, FFO and derivations thereof, are not alternatives to GAAP operating income (loss) or net income (loss) attributable to common stockholders. For reference, as an aid in understanding management's computation of Company NOI, EBITDA, and FFO, a reconciliation of Company NOI to consolidated operating income, Company EBITDA, and Company FFO to net income (loss) in accordance with GAAP has been included in the "Reconciliation of Non-GAAP to GAAP Financial Measures" schedule.

|

| | | |

| | Page | | Page |

| Financial Overview | | Asset Transactions: | |

| GAAP Financial Statements: | | Summary of Transactions | 15 |

| Consolidated Balance Sheets | 1 | Discontinued Operations | 16 |

| Consolidated Statements of Operations | 2 | | |

| | | Portfolio Operating Metrics: | |

| Proportionate Financial Statements: | | Key Operating Performance Indicators | 17 |

| Proportionate Balance Sheets | 3 | Signed Leases All Less Anchors | 18 |

| Overview | 4 | Lease Expiration Schedule and Top Ten Tenants | 19 |

| Company NOI, EBITDA, and FFO | 5-6 | Property Schedule | 20-26 |

| Reconciliation of Non-GAAP to GAAP Financial Measures | 7-8 | | |

| | | Miscellaneous: | |

| Debt: | | Capital Information | 27 |

| Debt Summary, at Share | 9 | Change in Total Common and Equivalent Shares | 28 |

| Maturity Schedule | 10 | Development Summary | 29-30 |

| Debt Detail, at Share | 11-14 | Capital Expenditures | 31 |

| | | Corporate Information | 32 |

| | | Glossary of Terms | 33 |

This presentation contains forward-looking statements. Actual results may differ materially from the results suggested by these forward-looking statements for a number of reasons. Readers are referred to the documents filed by General Growth Properties, Inc. with the Securities and Exchange Commission, which further identify the important risk factors which could cause actual results to differ materially from the forward-looking statements in this Supplemental. The Company disclaims any obligation to update any forward-looking statements.

SELECT SCHEDULE DEFINITIONS

|

| | |

| Page | Schedule | Description |

| Proportionate Financial Schedules: | |

| 3 | Proportionate Balance Sheet | The proportionate balance sheet adjusts GGP's GAAP balance sheet for noncontrolling interests and adds the Company's proportionate share of assets and liabilities related to investments accounted for under the equity method. |

| 4 | Overview | Summary of Company NOI, Same Store NOI, Company EBITDA and Company FFO on a proportionate basis. |

| 5-6 | Company NOI, EBITDA and FFO | Proportionate Results and FFO for the three and six months ended June 30, 2014 and 2013 adjusts GGP's consolidated results and FFO for noncontrolling interests and adds the Company's proportionate share of certain revenues and expenses included in NOI, EBITDA and FFO as defined in the Basis of Presentation. Company NOI, EBITDA and FFO exclude certain non-cash and non-recurring revenues and expenses that may not be indicative of future operations. |

| Portfolio Operating Metrics: | |

| 17 | Key Operating Performance Indicators | Certain retail properties operating measures presented on a comparable basis.

See Glossary of Terms for detailed descriptions. |

| 20-26 | Property Schedule | By Property, gross leasable area detail, including: Anchor tenant listing Ownership percentage Gross leasable area by space type (mall, anchor, strip center, office) Occupancy percentage

See Glossary of Terms for detailed descriptions. |

|

|

| GAAP Financial Statements |

Consolidated Balance Sheets

(In thousands)

|

| | | | | | | |

| | June 30, 2014 | | December 31, 2013 |

| | | | |

| Assets: | | | |

| Investment in real estate: | | | |

| Land | $ | 4,297,767 |

| | $ | 4,320,597 |

|

| Buildings and equipment | 18,237,236 |

| | 18,270,748 |

|

| Less accumulated depreciation | (2,099,755 | ) | | (1,884,861 | ) |

| Construction in progress | 471,791 |

| | 406,930 |

|

| Net property and equipment | 20,907,039 |

| | 21,113,414 |

|

| Investment in and loans to/from Unconsolidated Real Estate Affiliates | 2,580,966 |

| | 2,407,698 |

|

| Net investment in real estate | 23,488,005 |

| | 23,521,112 |

|

| Cash and cash equivalents | 242,007 |

| | 577,271 |

|

| Accounts and notes receivable, net | 594,011 |

| | 478,899 |

|

| Deferred expenses, net | 179,120 |

| | 189,452 |

|

| Prepaid expenses and other assets | 873,416 |

| | 995,569 |

|

| Total assets | $ | 25,376,559 |

| | $ | 25,762,303 |

|

| Liabilities: | | | |

| Mortgages, notes and loans payable | $ | 15,909,223 |

| | $ | 15,672,437 |

|

| Investment in Unconsolidated Real Estate Affiliates | 18,416 |

| | 17,405 |

|

| Accounts payable and accrued expenses | 839,386 |

| | 970,995 |

|

| Dividend payable | 140,440 |

| | 134,476 |

|

| Deferred tax liabilities | 28,367 |

| | 24,667 |

|

| Tax indemnification liability | 321,958 |

| | 321,958 |

|

| Junior Subordinated Notes | 206,200 |

| | 206,200 |

|

| Total liabilities | 17,463,990 |

| | 17,348,138 |

|

| Redeemable noncontrolling interests: | | | |

| Preferred | 145,811 |

| | 131,881 |

|

| Common | 113,892 |

| | 97,021 |

|

| Total redeemable noncontrolling interests | 259,703 |

| | 228,902 |

|

| Equity: | | | |

| Preferred stock | 242,042 |

| | 242,042 |

|

| Stockholders' equity | 7,329,791 |

| | 7,861,079 |

|

| Noncontrolling interests in consolidated real estate affiliates | 81,033 |

| | 82,142 |

|

| Total equity | 7,652,866 |

| | 8,185,263 |

|

| Total liabilities and equity | $ | 25,376,559 |

| | $ | 25,762,303 |

|

Consolidated Statements of Operations

(In thousands, except per share)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

| | | | | | | | |

| Revenues: | | | | | | | |

| Minimum rents | $ | 390,419 |

| | $ | 385,512 |

| | $ | 784,998 |

| | $ | 779,407 |

|

| Tenant recoveries | 185,382 |

| | 173,782 |

| | 367,201 |

| | 357,856 |

|

| Overage rents | 5,388 |

| | 6,372 |

| | 15,209 |

| | 17,721 |

|

| Management fees and other corporate revenues | 17,717 |

| | 17,307 |

| | 34,403 |

| | 33,239 |

|

| Other | 18,717 |

| | 16,570 |

| | 44,380 |

| | 35,573 |

|

| Total revenues | 617,623 |

| | 599,543 |

| | 1,246,191 |

| | 1,223,796 |

|

| Expenses: |

| | | | | | |

| Real estate taxes | 58,816 |

| | 52,372 |

| | 116,173 |

| | 119,538 |

|

| Property maintenance costs | 14,452 |

| | 14,952 |

| | 36,427 |

| | 37,908 |

|

| Marketing | 4,961 |

| | 5,764 |

| | 10,765 |

| | 12,268 |

|

| Other property operating costs | 82,980 |

| | 84,469 |

| | 169,882 |

| | 170,244 |

|

| Provision for doubtful accounts | 2,732 |

| | 629 |

| | 4,973 |

| | 2,383 |

|

| Property management and other costs | 40,107 |

| | 41,558 |

| | 85,071 |

| | 81,897 |

|

| General and administrative | 28,232 |

| | 13,124 |

| | 39,831 |

| | 24,057 |

|

| Depreciation and amortization | 177,430 |

| | 188,038 |

| | 351,201 |

| | 379,745 |

|

| Total expenses | 409,710 |

| | 400,906 |

| | 814,323 |

| | 828,040 |

|

| Operating income | 207,913 |

| | 198,637 |

| | 431,868 |

| | 395,756 |

|

| Interest and dividend income | 4,856 |

| | 298 |

| | 11,147 |

| | 889 |

|

| Interest expense | (175,494 | ) | | (186,902 | ) | | (354,924 | ) | | (377,417 | ) |

| Gain on Foreign Currency | 3,772 |

| | — |

| | 8,955 |

| | — |

|

| Warrant liability adjustment | — |

| | — |

| | — |

| | (40,546 | ) |

| Gain from change in control of investment properties | — |

| | 219,784 |

| | — |

| | 219,784 |

|

| Loss on extinguishment of debt | — |

| | (27,159 | ) | | — |

| | (36,478 | ) |

| Income before income taxes, equity in income of Unconsolidated Real Estate Affiliates, discontinued operations, noncontrolling interests and preferred stock dividends | 41,047 |

| | 204,658 |

| | 97,046 |

| | 161,988 |

|

| Provision for income taxes | (3,944 | ) | | (1,382 | ) | | (7,636 | ) | | (1,523 | ) |

| Equity in income of Unconsolidated Real Estate Affiliates | 19,320 |

| | 13,987 |

| | 26,477 |

| | 27,181 |

|

| Equity in income of Unconsolidated Real Estate Affiliates - gain on investment | — |

| | — |

| | — |

| | 3,448 |

|

| Income from continuing operations | 56,423 |

| | 217,263 |

| | 115,887 |

| | 191,094 |

|

| Discontinued operations: | | | | | | | |

| Income (loss) from discontinued operations, including gains (losses) on dispositions | 120,666 |

| | (3,340 | ) | | 126,410 |

| | (11,803 | ) |

| Gain on extinguishment of debt | — |

| | — |

| | 66,680 |

| | 25,894 |

|

|

| | | | | | | | | | | | | | | |

| Discontinued operations, net | 120,666 |

| | (3,340 | ) | | 193,090 |

| | 14,091 |

|

| Net income | 177,089 |

| | 213,923 |

| | 308,977 |

| | 205,185 |

|

| Allocation to noncontrolling interests | (3,365 | ) | | (4,548 | ) | | (7,217 | ) | | (7,336 | ) |

| Net income attributable to GGP | 173,724 |

| | 209,375 |

| | 301,760 |

| | 197,849 |

|

| Preferred stock dividends | (3,984 | ) | | (3,984 | ) | | (7,968 | ) | | (6,109 | ) |

| Net income attributable to common stockholders | $ | 169,740 |

| | $ | 205,391 |

| | $ | 293,792 |

| | $ | 191,740 |

|

| Basic Income Per Share: | | | | | | | |

| Continuing operations | $ | 0.06 |

| | $ | 0.22 |

| | $ | 0.11 |

| | $ | 0.19 |

|

| Discontinued operations | 0.14 |

| | — |

| | 0.22 |

| | 0.01 |

|

| Total basic income per share | $ | 0.20 |

| | $ | 0.22 |

| | $ | 0.33 |

| | $ | 0.20 |

|

| Diluted Income Per Share: | | | | | | | |

| Continuing operations | $ | 0.05 |

| | $ | 0.21 |

| | $ | 0.11 |

| | $ | 0.19 |

|

| Discontinued operations | 0.13 |

| | — |

| | 0.20 |

| | 0.01 |

|

| Total diluted income per share | $ | 0.18 |

| | $ | 0.21 |

| | $ | 0.31 |

| | $ | 0.20 |

|

|

|

| Proportionate Financial Statements |

PROPORTIONATE FINANCIAL STATEMENTS

Proportionate Balance Sheets

(In thousands)

|

| | | | | | | | | | | | | | | | | | | | |

| | | As of June 30, 2014 | | As of December 31, 2013 |

| | | GAAP | | Noncontrolling Interests | | GGP Share of Unconsolidated Real Estate Affiliates | | GGP Total Share | | GGP Total Share |

| | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| Investment in real estate: | | | | | | | | | | |

| Land | | $ | 4,297,767 |

| | $ | (31,475 | ) | | $ | 705,865 |

| | $ | 4,972,157 |

| | $ | 4,990,338 |

|

| Buildings and equipment | | 18,237,236 |

| | (169,521 | ) | | 5,862,541 |

| | 23,930,256 |

| | 23,645,676 |

|

| Less accumulated depreciation | | (2,099,755 | ) | | 22,539 |

| | (1,036,503 | ) | | (3,113,719 | ) | | (2,819,385 | ) |

| Construction in progress | | 471,791 |

| | — |

| | 31,289 |

| | 503,080 |

| | 429,553 |

|

| Net property and equipment | | 20,907,039 |

| | (178,457 | ) | | 5,563,192 |

| | 26,291,774 |

| | 26,246,182 |

|

| Investment in and loans to/from Unconsolidated Real Estate Affiliates | | 2,580,966 |

| | — |

| | (2,580,966 | ) | | — |

| | — |

|

| Net investment in real estate | | 23,488,005 |

| | (178,457 | ) | | 2,982,226 |

| | 26,291,774 |

| | 26,246,182 |

|

| Cash and cash equivalents | | 242,007 |

| | (5,302 | ) | | 141,886 |

| | 378,591 |

| | 697,536 |

|

| Accounts and notes receivable, net | | 594,011 |

| | (2,078 | ) | | 68,461 |

| | 660,394 |

| | 549,021 |

|

| Deferred expenses, net | | 179,120 |

| | (1,028 | ) | | 141,264 |

| | 319,356 |

| | 314,860 |

|

| Prepaid expenses and other assets | | 873,416 |

| | (12,792 | ) | | 213,297 |

| | 1,073,921 |

| | 1,169,423 |

|

| Total assets | | $ | 25,376,559 |

| | $ | (199,657 | ) | | $ | 3,547,134 |

| | $ | 28,724,036 |

| | $ | 28,977,022 |

|

| Liabilities: | | | | | | | | | | |

| Mortgages, notes and loans payable | | $ | 15,909,223 |

| | $ | (109,511 | ) | | $ | 3,367,688 |

| | $ | 19,167,400 |

| | $ | 18,788,230 |

|

| Investment in Unconsolidated Real Estate Affiliates | | 18,416 |

| | — |

| | (18,416 | ) | | — |

| | — |

|

| Accounts payable and accrued expenses | | 839,386 |

| | (9,113 | ) | | 197,826 |

| | 1,028,099 |

| | 1,187,810 |

|

| Dividend payable | | 140,440 |

| | — |

| | — |

| | 140,440 |

| | 134,476 |

|

| Deferred tax liabilities | | 28,367 |

| | — |

| | 36 |

| | 28,403 |

| | 24,697 |

|

| Tax indemnification liability | | 321,958 |

| | — |

| | — |

| | 321,958 |

| | 303,586 |

|

| Junior Subordinated Notes | | 206,200 |

| | — |

| | — |

| | 206,200 |

| | 206,200 |

|

| Total liabilities | | 17,463,990 |

| | (118,624 | ) | | 3,547,134 |

| | 20,892,500 |

| | 20,644,999 |

|

| Redeemable noncontrolling interests: | | | | | | | | | | |

| Preferred | | 145,811 |

| | — |

| | — |

| | 145,811 |

| | 131,881 |

|

| Common | | 113,892 |

| | — |

| | — |

| | 113,892 |

| | 97,021 |

|

| Total redeemable noncontrolling interests | | 259,703 |

| | — |

| | — |

| | 259,703 |

| | 228,902 |

|

| Equity: | | | | | | | | | | |

| Preferred stock | | 242,042 |

| | — |

| | — |

| | 242,042 |

| | 242,042 |

|

| Stockholders' equity | | 7,329,791 |

| | — |

| | — |

| | 7,329,791 |

| | 7,861,079 |

|

| Noncontrolling interests in consolidated real estate affiliates | | 81,033 |

| | (81,033 | ) | | — |

| | — |

| | — |

|

| Total equity | | 7,652,866 |

| | (81,033 | ) | | — |

| | 7,571,833 |

| | 8,103,121 |

|

| Total liabilities and equity | | $ | 25,376,559 |

| | $ | (199,657 | ) | | $ | 3,547,134 |

| | $ | 28,724,036 |

| | $ | 28,977,022 |

|

PROPORTIONATE FINANCIAL STATEMENTS

Overview

(In thousands, except per share)

|

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, 2014 | June 30, 2013 | Percentage Change | | June 30, 2014 | June 30, 2013 | Percentage Change |

| | | | | | | | | |

Same Store NOI 1 | | $ | 536,920 |

| $ | 511,566 |

| 5.0 | % | | $ | 1,070,978 |

| $ | 1,016,272 |

| 5.4 | % |

Non-Same Store 2 | | 11,748 |

| 14,752 |

| n/a |

| | 23,138 |

| 30,808 |

| n/a |

|

Company NOI 3 | | 548,668 |

| 526,318 |

| 4.2 | % | | 1,094,116 |

| 1,047,080 |

| 4.5 | % |

| | | | | | | | | |

Company EBITDA 3 | | 506,563 |

| 482,609 |

| 5.0 | % | | 1,005,085 |

| 961,874 |

| 4.5 | % |

| | | | | | | | | |

Company FFO 3 | | 297,553 |

| 266,200 |

| 11.8 | % | | 589,974 |

| 518,739 |

| 13.7 | % |

| Company FFO per diluted share | | $ | 0.31 |

| $ | 0.27 |

| 17.7 | % | | $ | 0.62 |

| $ | 0.52 |

| 19.5 | % |

| Weighted average diluted common shares outstanding | | 945,559 |

| 995,879 |

| | | 949,217 |

| 997,573 |

| |

| | | | | | | | | |

| |

| 1. | Total termination fees were $3.9 million and $2.9 million for the three months ended June 30, 2014 and 2013, respectively. Total termination fees were $8.9 million and $9.0 million for the six months ended June 30, 2014 and 2013, respectively. |

| |

| 2. | Non-Same Store includes the periodic effects of acquisitions of new properties, reductions in ownership as a result of sales or other transactions, and certain redevelopments and other properties. Included in Non- Same Store is 49.9% of the operations of The Grand Canal Shoppes through May 15, 2013. See Property Schedule on pages 20-26 for individual property details. |

3.Refer to pages 5-6 (Company NOI, EBITDA and FFO).

PROPORTIONATE FINANCIAL STATEMENTS

Company NOI, EBITDA and FFO

For the Three Months Ended June 30, 2014 and 2013

(In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2014 | | Three Months Ended June 30, 2013 |

| | | Consolidated Properties | Noncontrolling Interests | Unconsolidated Properties | Proportionate | Adjustments 1 | Company | | Consolidated Properties | Noncontrolling Interests | Unconsolidated Properties | Proportionate | Adjustments | Company |

| Property revenues: | | | | | | | | | | | | | | |

Minimum rents 2 | | $ | 390,419 |

| $ | (4,659 | ) | $ | 101,588 |

| $ | 487,348 |

| $ | 4,569 |

| $ | 491,917 |

| | $ | 385,512 |

| $ | (3,643 | ) | $ | 89,328 |

| $ | 471,197 |

| $ | 5,181 |

| $ | 476,378 |

|

| Tenant recoveries | | 185,382 |

| (2,042 | ) | 42,393 |

| 225,733 |

| — |

| 225,733 |

| | 173,782 |

| (1,169 | ) | 40,634 |

| 213,247 |

| — |

| 213,247 |

|

| Overage rents | | 5,388 |

| (48 | ) | 2,063 |

| 7,403 |

| — |

| 7,403 |

| | 6,372 |

| (38 | ) | 1,705 |

| 8,039 |

| — |

| 8,039 |

|

| Other revenue | | 18,761 |

| (406 | ) | 3,306 |

| 21,661 |

| — |

| 21,661 |

| | 16,569 |

| (98 | ) | 3,777 |

| 20,248 |

| — |

| 20,248 |

|

| Total property revenues | | 599,950 |

| (7,155 | ) | 149,350 |

| 742,145 |

| 4,569 |

| 746,714 |

| | 582,235 |

| (4,948 | ) | 135,444 |

| 712,731 |

| 5,181 |

| 717,912 |

|

| Property operating expenses: | | | | | | | | | | | | | | |

| Real estate taxes | | 58,816 |

| (764 | ) | 13,168 |

| 71,220 |

| (1,401 | ) | 69,819 |

| | 52,372 |

| (530 | ) | 12,927 |

| 64,769 |

| (1,578 | ) | 63,191 |

|

| Property maintenance costs | | 14,452 |

| (125 | ) | 4,042 |

| 18,369 |

| — |

| 18,369 |

| | 14,952 |

| (96 | ) | 3,735 |

| 18,591 |

| — |

| 18,591 |

|

| Marketing | | 4,961 |

| (56 | ) | 1,574 |

| 6,479 |

| — |

| 6,479 |

| | 5,764 |

| (45 | ) | 1,665 |

| 7,384 |

| — |

| 7,384 |

|

| Other property operating costs | | 82,980 |

| (998 | ) | 19,907 |

| 101,889 |

| (1,274 | ) | 100,615 |

| | 84,469 |

| (557 | ) | 19,346 |

| 103,258 |

| (1,388 | ) | 101,870 |

|

| Provision for doubtful accounts | | 2,732 |

| (36 | ) | 68 |

| 2,764 |

| — |

| 2,764 |

| | 629 |

| (6 | ) | (65 | ) | 558 |

| — |

| 558 |

|

| Total property operating expenses | | 163,941 |

| (1,979 | ) | 38,759 |

| 200,721 |

| (2,675 | ) | 198,046 |

| | 158,186 |

| (1,234 | ) | 37,608 |

| 194,560 |

| (2,966 | ) | 191,594 |

|

| NOI | | $ | 436,009 |

| $ | (5,176 | ) | $ | 110,591 |

| $ | 541,424 |

| $ | 7,244 |

| $ | 548,668 |

| | $ | 424,049 |

| $ | (3,714 | ) | $ | 97,836 |

| $ | 518,171 |

| $ | 8,147 |

| $ | 526,318 |

|

| Management fees and other corporate revenues | | 17,717 |

| — |

| — |

| 17,717 |

| — |

| 17,717 |

| | 17,307 |

| — |

| — |

| 17,307 |

| — |

| 17,307 |

|

Property management and other costs 3 | | (40,107 | ) | 158 |

| (6,869 | ) | (46,818 | ) | — |

| (46,818 | ) | | (41,558 | ) | 153 |

| (6,221 | ) | (47,626 | ) | — |

| (47,626 | ) |

| General and administrative | | (28,232 | ) | — |

| (2,626 | ) | (30,858 | ) | 17,854 |

| (13,004 | ) | | (13,124 | ) | — |

| (266 | ) | (13,390 | ) | — |

| (13,390 | ) |

| EBITDA | | $ | 385,387 |

| $ | (5,018 | ) | $ | 101,096 |

| $ | 481,465 |

| $ | 25,098 |

| $ | 506,563 |

| | $ | 386,674 |

| $ | (3,561 | ) | $ | 91,349 |

| $ | 474,462 |

| $ | 8,147 |

| $ | 482,609 |

|

| Depreciation on non-income producing assets | | (3,801 | ) | — |

| — |

| (3,801 | ) | — |

| (3,801 | ) | | (3,021 | ) | — |

| — |

| (3,021 | ) | — |

| (3,021 | ) |

| Interest and dividend income | | 4,856 |

| 773 |

| 487 |

| 6,116 |

| (75 | ) | 6,041 |

| | 298 |

| — |

| 114 |

| 412 |

| — |

| 412 |

|

| Preferred unit distributions | | (2,232 | ) | — |

| — |

| (2,232 | ) | — |

| (2,232 | ) | | (2,336 | ) | — |

| — |

| (2,336 | ) | — |

| (2,336 | ) |

| Preferred stock dividends | | (3,984 | ) | — |

| — |

| (3,984 | ) | — |

| (3,984 | ) | | (3,984 | ) | — |

| — |

| (3,984 | ) | — |

| (3,984 | ) |

| Interest expense: | | | | | | | | | | | | | | |

| Mark-to-market adjustments on debt | | (692 | ) | (97 | ) | 374 |

| (415 | ) | 415 |

| — |

| | (2,974 | ) | (93 | ) | (78 | ) | (3,145 | ) | 3,145 |

| — |

|

| Write-off of mark-to-market adjustments on extinguished debt | | (2,451 | ) | — |

| — |

| (2,451 | ) | 2,451 |

| — |

| | (2,045 | ) | — |

| — |

| (2,045 | ) | 2,045 |

| — |

|

| Interest on existing debt | | (172,351 | ) | 1,907 |

| (35,859 | ) | (206,303 | ) | — |

| (206,303 | ) | | (181,883 | ) | 1,123 |

| (34,599 | ) | (215,359 | ) | — |

| (215,359 | ) |

| Gain on foreign currency | | 3,772 |

| — |

| — |

| 3,772 |

| (3,772 | ) | — |

| | — |

| — |

| — |

| — |

| — |

| — |

|

Loss on extinguishment of debt 4 | | — |

| — |

| — |

| — |

| — |

| — |

| | (27,159 | ) | — |

| — |

| (27,159 | ) | 27,159 |

| — |

|

| Provision for income taxes | | (3,944 | ) | 19 |

| (51 | ) | (3,976 | ) | 1,492 |

| (2,484 | ) | | (1,382 | ) | 18 |

| (70 | ) | (1,434 | ) | — |

| (1,434 | ) |

| FFO from discontinued operations | | 3,730 |

| — |

| — |

| 3,730 |

| 23 |

| 3,753 |

| | 407 |

| — |

| 5,507 |

| 5,914 |

| 3,399 |

| 9,313 |

|

| | | 208,290 |

| (2,416 | ) | 66,047 |

| 271,921 |

| 25,632 |

| 297,553 |

| | 162,595 |

| (2,513 | ) | 62,223 |

| 222,305 |

| 43,895 |

| 266,200 |

|

| Equity in FFO of Unconsolidated Properties and Noncontrolling Interests | | 63,631 |

| 2,416 |

| (66,047 | ) | — |

| — |

| — |

| | 59,710 |

| 2,513 |

| (62,223 | ) | — |

| — |

| — |

|

FFO 5 | | $ | 271,921 |

| $ | — |

| $ | — |

| $ | 271,921 |

| $ | 25,632 |

| $ | 297,553 |

| | $ | 222,305 |

| $ | — |

| $ | — |

| $ | 222,305 |

| $ | 43,895 |

| $ | 266,200 |

|

| | | | | | | | | | | | | | | |

| Company FFO per diluted share | | | | | | | $ | 0.31 |

| | | | | | | $ | 0.27 |

|

PROPORTIONATE FINANCIAL STATEMENTS

| |

| 1. | Adjustments primarily relate to the following: straight-line rent, above/below market lease amortization, amortizations of real estate tax stabilization agreement, amounts resulting from Urban litigation settlement, gain on foreign currency and the related provision for income taxes, and other non-comparable items. |

2.Adjustments include amounts for straight-line rent of ($21,184) and ($15,523) and above/below market lease amortization of $25,753 and $20,704 for the three months ended June 30, 2014 and 2013, respectively.

3.Unconsolidated amounts include our share of management fees paid by these properties. Revenues associated with these fees are included in consolidated management fees and other corporate revenues.

4.For the three months ended June 30, 2013, adjustments include $20.5 million in prepayment fees to retire unsecured notes, and $6.6 million in fees related to the refinancing of the secured corporate loan.

5.Proportionate FFO reflects FFO as defined by NAREIT.

PROPORTIONATE FINANCIAL STATEMENTS

Company NOI, EBITDA and FFO

For the Six Months Ended June 30, 2014 and 2013

(In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2014 | | Six Months Ended June 30, 2013 |

| | | Consolidated Properties | Noncontrolling Interests | Unconsolidated Properties | Proportionate | Adjustments 1 | Company | | Consolidated Properties | Noncontrolling Interests | Unconsolidated Properties | Proportionate | Adjustments | Company |

| Property revenues: | | | | | | | | | | | | | | |

Minimum rents 2 | | $ | 784,998 |

| $ | (8,231 | ) | $ | 189,590 |

| $ | 966,357 |

| $ | 19,204 |

| $ | 985,561 |

| | $ | 779,407 |

| $ | (7,049 | ) | $ | 172,721 |

| $ | 945,079 |

| $ | 12,948 |

| $ | 958,027 |

|

| Tenant recoveries | | 367,201 |

| (3,343 | ) | 84,871 |

| 448,729 |

| — |

| 448,729 |

| | 357,856 |

| (2,354 | ) | 77,455 |

| 432,957 |

| — |

| 432,957 |

|

| Overage rents | | 15,209 |

| (116 | ) | 4,317 |

| 19,410 |

| — |

| 19,410 |

| | 17,721 |

| (112 | ) | 4,035 |

| 21,644 |

| — |

| 21,644 |

|

| Other revenue | | 44,425 |

| (500 | ) | 6,514 |

| 50,439 |

| — |

| 50,439 |

| | 35,573 |

| (193 | ) | 6,947 |

| 42,327 |

| — |

| 42,327 |

|

| Total property revenues | | 1,211,833 |

| (12,190 | ) | 285,292 |

| 1,484,935 |

| 19,204 |

| 1,504,139 |

| | 1,190,557 |

| (9,708 | ) | 261,158 |

| 1,442,007 |

| 12,948 |

| 1,454,955 |

|

| Property operating expenses: | | | | | | | | | | | | | | |

| Real estate taxes | | 116,173 |

| (1,320 | ) | 26,727 |

| 141,580 |

| (2,979 | ) | 138,601 |

| | 119,538 |

| (1,053 | ) | 25,479 |

| 143,964 |

| (3,156 | ) | 140,808 |

|

| Property maintenance costs | | 36,427 |

| (226 | ) | 9,627 |

| 45,828 |

| — |

| 45,828 |

| | 37,908 |

| (183 | ) | 7,865 |

| 45,590 |

| — |

| 45,590 |

|

| Marketing | | 10,765 |

| (113 | ) | 3,324 |

| 13,976 |

| — |

| 13,976 |

| | 12,268 |

| (117 | ) | 3,172 |

| 15,323 |

| — |

| 15,323 |

|

| Other property operating costs | | 169,882 |

| (1,519 | ) | 40,405 |

| 208,768 |

| (2,595 | ) | 206,173 |

| | 170,244 |

| (1,091 | ) | 36,795 |

| 205,948 |

| (2,764 | ) | 203,184 |

|

| Provision for doubtful accounts | | 4,973 |

| (35 | ) | 507 |

| 5,445 |

| — |

| 5,445 |

| | 2,383 |

| (48 | ) | 635 |

| 2,970 |

| — |

| 2,970 |

|

| Total property operating expenses | | 338,220 |

| (3,213 | ) | 80,590 |

| 415,597 |

| (5,574 | ) | 410,023 |

| | 342,341 |

| (2,492 | ) | 73,946 |

| 413,795 |

| (5,920 | ) | 407,875 |

|

| NOI | | $ | 873,613 |

| $ | (8,977 | ) | $ | 204,702 |

| $ | 1,069,338 |

| $ | 24,778 |

| $ | 1,094,116 |

| | $ | 848,216 |

| $ | (7,216 | ) | $ | 187,212 |

| $ | 1,028,212 |

| $ | 18,868 |

| $ | 1,047,080 |

|

| Management fees and other corporate revenues | | 34,403 |

| — |

| — |

| 34,403 |

| — |

| 34,403 |

| | 33,239 |

| — |

| — |

| 33,239 |

| — |

| 33,239 |

|

Property management and other costs 3 | | (85,071 | ) | 322 |

| (13,881 | ) | (98,630 | ) | — |

| (98,630 | ) | | (81,897 | ) | 305 |

| (12,290 | ) | (93,882 | ) | — |

| (93,882 | ) |

| General and administrative | | (39,831 | ) | 2 |

| (2,829 | ) | (42,658 | ) | 17,854 |

| (24,804 | ) | | (24,057 | ) | — |

| (506 | ) | (24,563 | ) | — |

| (24,563 | ) |

| EBITDA | | $ | 783,114 |

| $ | (8,653 | ) | $ | 187,992 |

| $ | 962,453 |

| $ | 42,632 |

| $ | 1,005,085 |

| | $ | 775,501 |

| $ | (6,911 | ) | $ | 174,416 |

| $ | 943,006 |

| $ | 18,868 |

| $ | 961,874 |

|

| Depreciation on non-income producing assets | | (6,527 | ) | — |

| — |

| (6,527 | ) | — |

| (6,527 | ) | | (6,115 | ) | — |

| — |

| (6,115 | ) | — |

| (6,115 | ) |

| Interest and dividend income | | 11,147 |

| 773 |

| 1,033 |

| 12,953 |

| (75 | ) | 12,878 |

| | 889 |

| (1 | ) | 208 |

| 1,096 |

| — |

| 1,096 |

|

| Preferred unit distributions | | (4,464 | ) | — |

| — |

| (4,464 | ) | — |

| (4,464 | ) | | (4,671 | ) | — |

| — |

| (4,671 | ) | — |

| (4,671 | ) |

| Preferred stock dividends | | (7,968 | ) | — |

| — |

| (7,968 | ) | — |

| (7,968 | ) | | (6,109 | ) | — |

| — |

| (6,109 | ) | — |

| (6,109 | ) |

| Interest expense: | | | | | | | | | | | | | | |

| Default interest | | — |

| — |

| — |

| — |

| — |

| — |

| | (1,306 | ) | — |

| — |

| (1,306 | ) | 1,306 |

| — |

|

| Mark-to-market adjustments on debt | | (2,212 | ) | (193 | ) | 742 |

| (1,663 | ) | 1,663 |

| — |

| | (5,575 | ) | (184 | ) | 82 |

| (5,677 | ) | 5,677 |

| — |

|

| Write-off of mark-to-market adjustments on extinguished debt | | (9,831 | ) | — |

| — |

| (9,831 | ) | 9,831 |

| — |

| | 5,160 |

| — |

| — |

| 5,160 |

| (5,160 | ) | — |

|

| Interest on existing debt | | (342,881 | ) | 3,014 |

| (71,379 | ) | (411,246 | ) | — |

| (411,246 | ) | | (375,696 | ) | 2,249 |

| (66,677 | ) | (440,124 | ) | — |

| (440,124 | ) |

| Gain on foreign currency | | 8,955 |

| — |

| — |

| 8,955 |

| (8,955 | ) | — |

| | — |

| — |

| — |

| — |

| — |

| — |

|

| Warrant liability adjustment | | — |

| — |

| — |

| — |

| — |

| — |

| | (40,546 | ) | — |

| — |

| (40,546 | ) | 40,546 |

| — |

|

Loss on extinguishment of debt 4 | | — |

| — |

| — |

| — |

| — |

| — |

| | (36,478 | ) | — |

| — |

| (36,478 | ) | 36,478 |

| — |

|

| Provision for income taxes | | (7,636 | ) | 38 |

| (145 | ) | (7,743 | ) | 3,542 |

| (4,201 | ) | | (1,523 | ) | 35 |

| (151 | ) | (1,639 | ) | — |

| (1,639 | ) |

FFO from discontinued operations 5 | | 72,188 |

| — |

| — |

| 72,188 |

| (65,771 | ) | 6,417 |

| | 27,316 |

| — |

| 7,640 |

| 34,956 |

| (20,529 | ) | 14,427 |

|

| | | 493,885 |

| (5,021 | ) | 118,243 |

| 607,107 |

| (17,133 | ) | 589,974 |

| | 330,847 |

| (4,812 | ) | 115,518 |

| 441,553 |

| 77,186 |

| 518,739 |

|

| Equity in FFO of Unconsolidated Properties and Noncontrolling Interests | | 113,222 |

| 5,021 |

| (118,243 | ) | — |

| — |

| — |

| | 110,706 |

| 4,812 |

| (115,518 | ) | — |

| — |

| — |

|

FFO 6 | | $ | 607,107 |

| $ | — |

| $ | — |

| $ | 607,107 |

| $ | (17,133 | ) | $ | 589,974 |

| | $ | 441,553 |

| $ | — |

| $ | — |

| $ | 441,553 |

| $ | 77,186 |

| $ | 518,739 |

|

| | | | | | | | | | | | | | | |

| Company FFO per diluted share | | | | | | | $ | 0.62 |

| | | | | | | $ | 0.52 |

|

| |

| 1. | Adjustments primarily relate to the following: straight-line rent, above/below market lease amortization, amortization of real estate tax stabilization agreement, amounts resulting from Urban litigation settlement, gain on foreign currency and the related provision for income taxes, and other non-comparable items. |

| |

| 2. | Adjustments include amounts for straight-line rent of ($30,681) and ($31,918) and above/below market lease amortization of $49,885 and $44,866 for the six months ended June 30, 2014 and 2013, respectively. |

| |

| 3. | Unconsolidated amounts include our share of management fees paid by these properties. Revenues associated with these fees are included in consolidated management fees and other corporate revenues. |

| |

| 4. | For the six months ended June 30, 2013, adjustments include $24.0 million in prepayment fees to retire unsecured notes, a $5.8 million prepayment penalty on a secured mortgage note and $6.6 million in fees related to the refinancing of the secured corporate loan. |

| |

| 5. | Company FFO includes FFO from discontinued operations. Adjustments includes gains on extinguishment of debt of $66,680 and $25,894 for the six months ended June 30, 2014 and 2013, respectively. |

| |

| 6. | Proportionate FFO reflects FFO as defined by NAREIT. |

PROPORTIONATE FINANCIAL STATEMENTS

Reconciliation of Non-GAAP to GAAP Financial Measures

(In thousands)

|

| | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, 2014 | June 30, 2013 | | June 30, 2014 | June 30, 2013 |

| | | | | | | |

| Reconciliation of Company NOI to GAAP Operating Income | | | | | | |

| Company NOI | | $ | 548,668 |

| $ | 526,318 |

| | $ | 1,094,116 |

| $ | 1,047,080 |

|

Adjustments for minimum rents, real estate taxes and other property operating costs 1 | | (7,244 | ) | (8,147 | ) | | (24,778 | ) | (18,868 | ) |

| Proportionate NOI | | 541,424 |

| 518,171 |

| | 1,069,338 |

| 1,028,212 |

|

| Unconsolidated Properties | | (110,591 | ) | (97,836 | ) | | (204,702 | ) | (187,212 | ) |

| Consolidated Properties | | 430,833 |

| 420,335 |

| | 864,636 |

| 841,000 |

|

| Management fees and other corporate revenues | | 17,717 |

| 17,307 |

| | 34,403 |

| 33,239 |

|

| Property management and other costs | | (40,107 | ) | (41,558 | ) | | (85,071 | ) | (81,897 | ) |

| General and administrative | | (28,232 | ) | (13,124 | ) | | (39,831 | ) | (24,057 | ) |

| Depreciation and amortization | | (177,430 | ) | (188,038 | ) | | (351,201 | ) | (379,745 | ) |

| Loss on sales of investment properties | | (44 | ) | — |

| | (44 | ) | — |

|

| Noncontrolling interest in operating income of Consolidated Properties and other | | 5,176 |

| 3,715 |

| | 8,976 |

| 7,216 |

|

| Operating income | | $ | 207,913 |

| $ | 198,637 |

| | $ | 431,868 |

| $ | 395,756 |

|

| | | | | | | |

| Reconciliation of Company EBITDA to GAAP Net Income Attributable to GGP | | | | | | |

| Company EBITDA | | $ | 506,563 |

| $ | 482,609 |

| | $ | 1,005,085 |

| $ | 961,874 |

|

Adjustments for minimum rents, real estate taxes, other property operating costs, and general and administrative 1 | | (25,098 | ) | (8,147 | ) | | (42,632 | ) | (18,868 | ) |

| Proportionate EBITDA | | 481,465 |

| 474,462 |

| | 962,453 |

| 943,006 |

|

| Unconsolidated Properties | | (101,096 | ) | (91,349 | ) | | (187,992 | ) | (174,416 | ) |

| Consolidated Properties | | 380,369 |

| 383,113 |

| | 774,461 |

| 768,590 |

|

| Depreciation and amortization | | (177,430 | ) | (188,038 | ) | | (351,201 | ) | (379,745 | ) |

| Noncontrolling interest in NOI of Consolidated Properties | | 5,176 |

| 3,715 |

| | 8,976 |

| 7,216 |

|

| Interest and dividend income | | 4,856 |

| 298 |

| | 11,147 |

| 889 |

|

| Interest expense | | (175,494 | ) | (186,902 | ) | | (354,924 | ) | (377,417 | ) |

| Gain on foreign currency | | 3,772 |

| — |

| | 8,955 |

| — |

|

| Warrant liability adjustment | | — |

| — |

| | — |

| (40,546 | ) |

| Provision for income taxes | | (3,944 | ) | (1,382 | ) | | (7,636 | ) | (1,523 | ) |

| Equity in income of Unconsolidated Real Estate Affiliates | | 19,320 |

| 13,987 |

| | 26,477 |

| 27,181 |

|

| Equity in income of Unconsolidated Real Estate Affiliates - gain on investment | | — |

| — |

| | — |

| 3,448 |

|

| Discontinued operations | | 120,666 |

| (3,340 | ) | | 193,090 |

| 14,091 |

|

| Gains from changes in control of investment properties | | — |

| 219,784 |

| | — |

| 219,784 |

|

| Loss on extinguishment of debt | | — |

| (27,159 | ) | | — |

| (36,478 | ) |

| Loss on sales of investment properties | | (44 | ) | — |

| | (44 | ) | — |

|

| Allocation to noncontrolling interests | | (3,523 | ) | (4,701 | ) | | (7,541 | ) | (7,641 | ) |

| Net income attributable to GGP | | $ | 173,724 |

| $ | 209,375 |

| | $ | 301,760 |

| $ | 197,849 |

|

1.Refer to Pages 5-6 (Company NOI, EBITDA and FFO).

PROPORTIONATE FINANCIAL STATEMENTS

Reconciliation of Non-GAAP to GAAP Financial Measures

(In thousands)

|

| | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, 2014 | June 30, 2013 | | June 30, 2014 | June 30, 2013 |

| | | | | | | |

| Reconciliation of Company FFO to GAAP Net Income Attributable to GGP | | | | | | |

| Company FFO | | $ | 297,553 |

| $ | 266,200 |

| | $ | 589,974 |

| $ | 518,739 |

|

Adjustments for minimum rents, property operating expenses, market rate adjustments, debt extinguishment, income taxes and FFO from discontinued operations1 | | (25,632 | ) | (43,895 | ) | | 17,133 |

| (77,186 | ) |

| Proportionate FFO | | 271,921 |

| 222,305 |

| | 607,107 |

| 441,553 |

|

| Depreciation and amortization of capitalized real estate costs | | (220,367 | ) | (229,321 | ) | | (438,070 | ) | (459,631 | ) |

| Gain from change in control of investment properties | | — |

| 219,784 |

| | — |

| 219,784 |

|

| Preferred stock dividends | | 3,984 |

| 3,984 |

| | 7,968 |

| 6,109 |

|

| Gains (losses) on sales of investment properties | | 117,417 |

| (440 | ) | | 123,716 |

| 2,683 |

|

| Noncontrolling interests in depreciation of Consolidated Properties | | 2,266 |

| 1,788 |

| | 3,928 |

| 3,557 |

|

| Provision for impairment excluded from FFO of discontinued operations | | — |

| — |

| | — |

| (4,975 | ) |

| Redeemable noncontrolling interests | | (973 | ) | (1,483 | ) | | (1,637 | ) | (1,403 | ) |

| Depreciation and amortization of discontinued operations | | (524 | ) | (7,242 | ) | | (1,252 | ) | (9,828 | ) |

| Net income attributable to GGP | | $ | 173,724 |

| $ | 209,375 |

| | $ | 301,760 |

| $ | 197,849 |

|

| | | | | | | |

| Reconciliation of Equity in NOI of Unconsolidated Properties to GAAP Equity in Income of Unconsolidated Real Estate Affiliates | | | | | | |

| Equity in Unconsolidated Properties: | | | | | | |

| NOI | | $ | 110,591 |

| $ | 97,836 |

| | $ | 204,702 |

| $ | 187,212 |

|

| Net property management fees and costs | | (6,869 | ) | (6,221 | ) | | (13,881 | ) | (12,290 | ) |

| General and administrative and provisions for impairment | | (2,626 | ) | (266 | ) | | (2,829 | ) | (506 | ) |

| EBITDA | | 101,096 |

| 91,349 |

| | 187,992 |

| 174,416 |

|

| Net interest expense | | (34,998 | ) | (34,563 | ) | | (69,604 | ) | (66,387 | ) |

| Provision for income taxes | | (51 | ) | (70 | ) | | (145 | ) | (151 | ) |

| FFO of discontinued Unconsolidated Properties | | — |

| 5,507 |

| | — |

| 7,640 |

|

| FFO of Unconsolidated Properties | | 66,047 |

| 62,223 |

| | 118,243 |

| 115,518 |

|

| Depreciation and amortization of capitalized real estate costs | | (46,738 | ) | (48,240 | ) | | (93,396 | ) | (88,343 | ) |

| Other, including gain on sales of investment properties | | 11 |

| 4 |

| | 1,630 |

| 6 |

|

| Equity in income of Unconsolidated Real Estate Affiliates | | $ | 19,320 |

| $ | 13,987 |

| | $ | 26,477 |

| $ | 27,181 |

|

1.Refer to Page 5-6 (Company NOI, EBITDA and FFO).

SUMMARY, AT SHARE

As of June 30, 2014

(In thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Maturities | | |

| | | Coupon Rate | Proportionate Balance | Average Remaining Term (Years) | | 2014 | 2015 | 2016 | 2017 | 2018 | Subsequent | | Total |

| Fixed Rate | | | | | | | | | | | | | |

| Property Level Consolidated | | 4.53% | $ | 13,563,264 |

| 7.4 |

| | $ | 1,255 |

| $ | 360,301 |

| $ | 547,033 |

| $ | 701,824 |

| $ | 118,892 |

| $ | 10,600,818 |

| | $ | 12,330,123 |

|

| Property Level Unconsolidated | | 4.50% | 3,016,218 |

| 6.5 |

| | — |

| 183,409 |

| 2,944 |

| 158,070 |

| 186,862 |

| 2,274,724 |

| | 2,806,009 |

|

| Corporate Consolidated | | 4.41% | 9,993 |

| 1.4 |

| | — |

| 573 |

| — |

| — |

| — |

| — |

| | 573 |

|

| Total Fixed Rate | | 4.52% | $ | 16,589,475 |

| 7.3 |

| | $ | 1,255 |

| $ | 544,283 |

| $ | 549,977 |

| $ | 859,894 |

| $ | 305,754 |

| $ | 12,875,542 |

| | $ | 15,136,705 |

|

| | | | | | | | | | | | | | |

| Variable Rate | | | | | | | | | | | | | |

Property Level Consolidated 1 | | 2.46% | $ | 2,116,291 |

| 4.2 |

| | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 1,571,973 |

| $ | 516,346 |

| | $ | 2,088,319 |

|

| Property Level Unconsolidated | | 2.84% | 346,250 |

| 4.2 |

| | — |

| — |

| — |

| 150,544 |

| 16,250 |

| 170,000 |

| | 336,794 |

|

| Junior Subordinated Notes Due 2036 | | 1.67% | 206,200 |

| 21.8 |

| | — |

| — |

| — |

| — |

| — |

| 206,200 |

| | 206,200 |

|

| Total Variable Rate | | 2.45% | $ | 2,668,741 |

| 5.5 |

| | $ | — |

| $ | — |

| $ | — |

| $ | 150,544 |

| $ | 1,588,223 |

| $ | 892,546 |

| | $ | 2,631,313 |

|

| | | | | | | | | | | | | | |

| Total | | 4.23% | $ | 19,258,216 |

| 7.0 |

| | $ | 1,255 |

| $ | 544,283 |

| $ | 549,977 |

| $ | 1,010,438 |

| $ | 1,893,977 |

| $ | 13,768,088 |

| | $ | 17,768,018 |

|

| | | | | | | | | | | | | | |

| | | | Total Amortization | | | $ | 87,618 |

| $ | 169,095 |

| $ | 196,331 |

| $ | 186,682 |

| $ | 169,851 |

| $ | 680,621 |

| | $ | 1,490,198 |

|

| | | | | | | | | Total Maturities and Amortization 2, 3 | | | $ | 19,258,216 |

|

1 Properties provide mortgage collateral as guarantors. The $1.4 billion corporate loan is cross collateralized.

2 Reconciliation to GGP Proportionate Mortgages, Notes, and Loans Payable:

|

| | | |

| Total Mortgages, Notes, and Other Payables, from above | $ | 19,258,216 |

|

| Market rate adjustments, net | 20,776 |

|

| Junior Subordinated Notes Due 2036 | (206,200) |

|

| Corporate Revolver | 81,800 |

|

| Other loans payable | 12,808 |

|

| Total | $ | 19,167,400 |

|

3 Reflects maturities and amortization for periods subsequent to June 30, 2014.

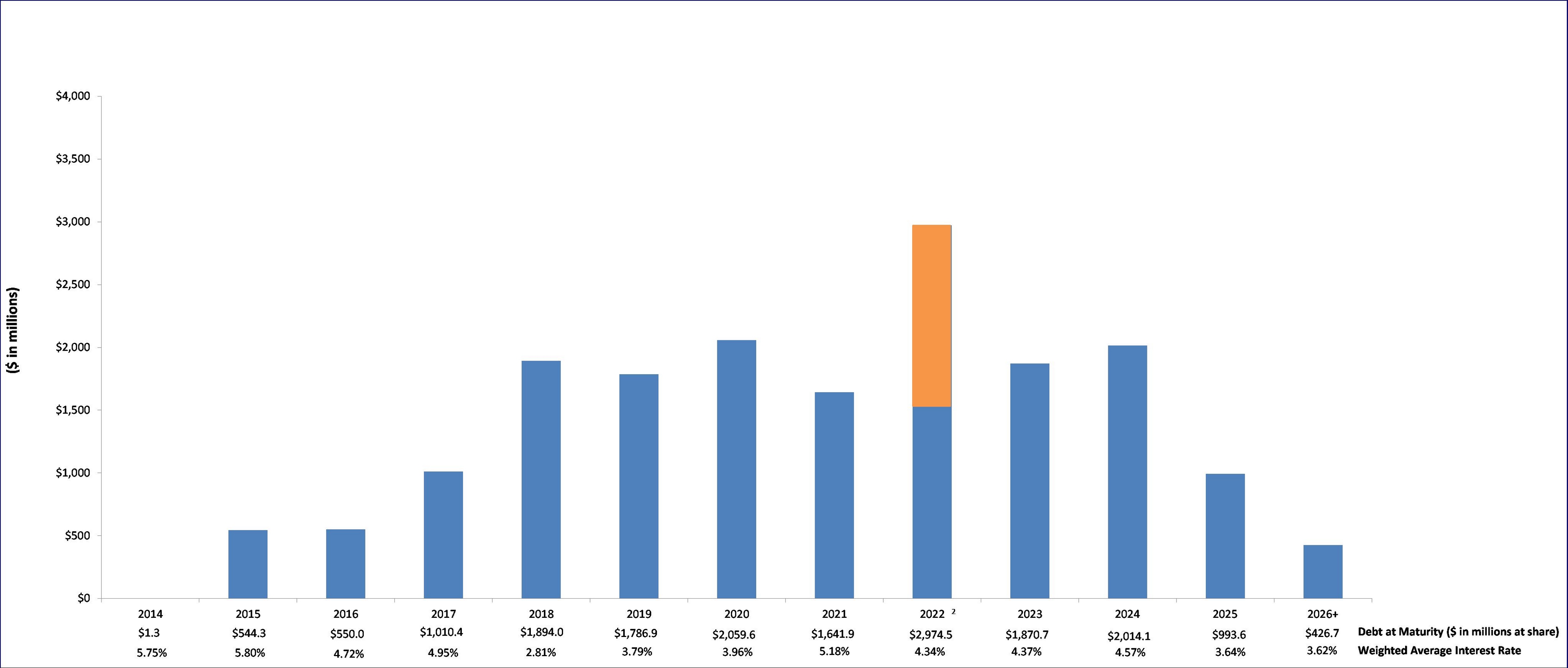

Maturity Schedule 1

1 Net present value of debt is $9.9 billion at 8% discount rate.

2 Maturities in 2022 include $1.4 billion for Ala Moana (presented with separate color).

Exhibit DETAIL, AT SHARE1

As of June 30, 2014

(In thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Amortization |

Property | | Own% | Proportionate Balance | Maturity Year 2 | Balloon Pmt at Maturity | Coupon Rate | Parent Recourse as of 6/30/2014 3 | | 2014 | 2015 | 2016 | 2017 | 2018 | Subsequent |

| Fixed Rate | | | | | | | | | | | | | | |

| Consolidated Property Level | | | | | | | | | | | | | | |

| Bayside Marketplace (Bond) | | 100% | $ | 1,255 |

| 2014 | $ | 1,255 |

| 5.75% | No | | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

|

| Boise Towne Plaza | | 100% | 9,159 |

| 2015 | 8,765 |

| 4.70% | No | | 194 |

| 200 |

| — |

| — |

| — |

| — |

|

| Paramus Park | | 100% | 93,289 |

| 2015 | 90,242 |

| 4.86% | No | | 1,389 |

| 1,658 |

| — |

| — |

| — |

| — |

|

| Peachtree Mall | | 100% | 79,545 |

| 2015 | 77,085 |

| 5.08% | No | | 1,318 |

| 1,142 |

| — |

| — |

| — |

| — |

|

| Quail Springs Mall | | 100% | 68,255 |

| 2015 | 66,864 |

| 6.74% | No | | 738 |

| 653 |

| — |

| — |

| — |

| — |

|

| The Shops at La Cantera | | 75% | 119,316 |

| 2015 | 117,345 |

| 5.95% | No | | 971 |

| 1,000 |

| — |

| — |

| — |

| — |

|

| Brass Mill Center | | 100% | 102,166 |

| 2016 | 93,347 |

| 4.55% | No | | 2,353 |

| 4,884 |

| 1,582 |

| — |

| — |

| — |

|

| Glenbrook Square | | 100% | 156,995 |

| 2016 | 141,325 |

| 4.91% | No | | 2,644 |

| 5,510 |

| 7,516 |

| — |

| — |

| — |

|

| Lakeside Mall | | 100% | 156,980 |

| 2016 | 144,451 |

| 4.28% | No | | 2,969 |

| 6,155 |

| 3,405 |

| — |

| — |

| — |

|

| Lincolnshire Commons | | 100% | 26,185 |

| 2016 | 24,629 |

| 5.98% | No | | 288 |

| 607 |

| 661 |

| — |

| — |

| — |

|

| Ridgedale Center | | 100% | 157,358 |

| 2016 | 143,281 |

| 4.86% | No | | 2,711 |

| 5,650 |

| 5,716 |

| — |

| — |

| — |

|

| Apache Mall | | 100% | 97,004 |

| 2017 | 91,402 |

| 4.32% | No | | 853 |

| 1,776 |

| 1,843 |

| 1,130 |

| — |

| — |

|

| Beachwood Place | | 100% | 216,605 |

| 2017 | 190,177 |

| 5.60% | No | | 3,172 |

| 6,656 |

| 9,274 |

| 7,326 |

| — |

| — |

|

| Eastridge (CA) | | 100% | 145,131 |

| 2017 | 127,418 |

| 5.79% | Yes - Partial | | 2,198 |

| 4,617 |

| 6,398 |

| 4,500 |

| — |

| — |

|

| Four Seasons Town Centre | | 100% | 84,692 |

| 2017 | 72,532 |

| 5.60% | No | | 1,777 |

| 3,722 |

| 4,940 |

| 1,721 |

| — |

| — |

|

| Mall of Louisiana | | 100% | 214,207 |

| 2017 | 191,409 |

| 5.81% | No | | 2,685 |

| 5,647 |

| 8,074 |

| 6,392 |

| — |

| — |

|

Provo Towne Center 4 | | 75% | 30,507 |

| 2017 | 28,886 |

| 4.53% | No | | 262 |

| 544 |

| 566 |

| 249 |

| — |

| — |

|

| Hulen Mall | | 100% | 128,597 |

| 2018 | 118,702 |

| 4.25% | No | | 1,067 |

| 2,221 |

| 2,304 |

| 2,421 |

| 1,882 |

| — |

|

| The Gallery at Harborplace - Other | | 100% | 8,122 |

| 2018 | 190 |

| 6.05% | No | | 911 |

| 1,907 |

| 2,026 |

| 2,152 |

| 936 |

| — |

|

| Coronado Center | | 100% | 199,389 |

| 2019 | 180,278 |

| 3.50% | No | | 1,856 |

| 3,829 |

| 3,948 |

| 4,110 |

| 4,258 |

| 1,110 |

|

| Governor's Square | | 100% | 70,936 |

| 2019 | 66,488 |

| 6.69% | No | | 431 |

| 906 |

| 969 |

| 1,035 |

| 1,107 |

| — |

|

| Oak View Mall | | 100% | 79,449 |

| 2019 | 74,467 |

| 6.69% | No | | 482 |

| 1,015 |

| 1,085 |

| 1,160 |

| 1,240 |

| — |

|

| Park City Center | | 100% | 188,845 |

| 2019 | 172,224 |

| 5.34% | No | | 1,484 |

| 3,119 |

| 3,264 |

| 3,473 |

| 3,666 |

| 1,615 |

|

| Fashion Place | | 100% | 226,730 |

| 2020 | 226,730 |

| 3.64% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Mall St. Matthews | | 100% | 186,662 |

| 2020 | 170,305 |

| 2.72% | No | | — |

| — |

| 1,985 |

| 4,067 |

| 4,181 |

| 6,124 |

|

| Newgate Mall | | 100% | 58,000 |

| 2020 | 58,000 |

| 3.69% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| The Mall In Columbia | | 100% | 350,000 |

| 2020 | 316,928 |

| 3.95% | No | | — |

| 1,532 |

| 6,279 |

| 6,531 |

| 6,794 |

| 11,936 |

|

| Town East Mall | | 100% | 160,270 |

| 2020 | 160,270 |

| 3.57% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Tucson Mall | | 100% | 246,000 |

| 2020 | 246,000 |

| 4.01% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Tysons Galleria | | 100% | 320,881 |

| 2020 | 282,081 |

| 4.06% | No | | 2,782 |

| 5,773 |

| 5,979 |

| 6,266 |

| 6,528 |

| 11,472 |

|

| Visalia Mall | | 100% | 74,000 |

| 2020 | 74,000 |

| 3.71% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Deerbrook Mall | | 100% | 147,123 |

| 2021 | 127,934 |

| 5.25% | No | | 1,189 |

| 2,497 |

| 2,612 |

| 2,776 |

| 2,928 |

| 7,187 |

|

| Fashion Show - Other | | 100% | 4,744 |

| 2021 | 1,577 |

| 6.06% | Yes - Full | | 174 |

| 364 |

| 386 |

| 411 |

| 437 |

| 1,395 |

|

| Fox River Mall | | 100% | 179,441 |

| 2021 | 156,373 |

| 5.46% | No | | 1,376 |

| 2,901 |

| 3,038 |

| 3,238 |

| 3,422 |

| 9,093 |

|

| Northridge Fashion Center | | 100% | 239,457 |

| 2021 | 207,503 |

| 5.10% | No | | 1,990 |

| 4,175 |

| 4,362 |

| 4,627 |

| 4,871 |

| 11,929 |

|

| Oxmoor Center | | 94% | 85,989 |

| 2021 | 74,781 |

| 5.37% | No | | 670 |

| 1,413 |

| 1,479 |

| 1,574 |

| 1,662 |

| 4,410 |

|

| Park Place | | 100% | 191,221 |

| 2021 | 165,815 |

| 5.18% | No | | 1,556 |

| 3,266 |

| 3,414 |

| 3,626 |

| 3,821 |

| 9,723 |

|

| Providence Place | | 94% | 345,273 |

| 2021 | 302,577 |

| 5.65% | No | | 2,572 |

| 5,423 |

| 5,687 |

| 6,077 |

| 6,434 |

| 16,503 |

|

| Rivertown Crossings | | 100% | 162,097 |

| 2021 | 141,356 |

| 5.52% | No | | 1,236 |

| 2,604 |

| 2,728 |

| 2,910 |

| 3,077 |

| 8,186 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Amortization |

Property | | Own% | Proportionate Balance | Maturity Year 2 | Balloon Pmt at Maturity | Coupon Rate | Parent Recourse as of 6/30/2014 3 | | 2014 | 2015 | 2016 | 2017 | 2018 | Subsequent |

| Westlake Center - Land | | 100% | 2,437 |

| 2021 | 2,437 |

| 12.90% | Yes - Full | | — |

| — |

| — |

| — |

| — |

| — |

|

| White Marsh Mall | | 100% | 190,000 |

| 2021 | 190,000 |

| 3.66% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Ala Moana Center | | 100% | 1,400,000 |

| 2022 | 1,400,000 |

| 4.23% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Bellis Fair | | 100% | 90,503 |

| 2022 | 77,060 |

| 5.23% | No | | 724 |

| 1,524 |

| 1,594 |

| 1,694 |

| 1,786 |

| 6,121 |

|

| Coastland Center | | 100% | 126,276 |

| 2022 | 102,621 |

| 3.76% | No | | 1,214 |

| 2,509 |

| 2,594 |

| 2,707 |

| 2,812 |

| 11,819 |

|

| Coral Ridge Mall | | 100% | 110,155 |

| 2022 | 98,394 |

| 5.71% | No | | — |

| 349 |

| 1,448 |

| 1,533 |

| 1,623 |

| 6,808 |

|

| Greenwood Mall | | 100% | 63,000 |

| 2022 | 57,469 |

| 4.19% | No | | — |

| — |

| — |

| 420 |

| 1,054 |

| 4,057 |

|

| North Star Mall | | 100% | 329,054 |

| 2022 | 270,113 |

| 3.93% | No | | 3,107 |

| 6,440 |

| 6,666 |

| 6,973 |

| 7,256 |

| 28,499 |

|

| Rogue Valley Mall | | 100% | 55,000 |

| 2022 | 48,245 |

| 4.5% | No | | 0 |

| 137 |

| 852 |

| 899 |

| 941 |

| 3,926 |

|

Spokane Valley Mall 4 | | 75% | 45,793 |

| 2022 | 38,484 |

| 4.65% | No | | 382 |

| 800 |

| 833 |

| 879 |

| 921 |

| 3,494 |

|

| The Gallery at Harborplace | | 100% | 79,654 |

| 2022 | 68,096 |

| 5.24% | No | | 599 |

| 1,258 |

| 1,315 |

| 1,398 |

| 1,474 |

| 5,514 |

|

| The Oaks Mall | | 100% | 135,383 |

| 2022 | 112,842 |

| 4.55% | No | | 1,131 |

| 2,357 |

| 2,451 |

| 2,584 |

| 2,706 |

| 11,312 |

|

| The Shoppes at Buckland Hills | | 100% | 125,928 |

| 2022 | 107,820 |

| 5.19% | No | | 967 |

| 2,030 |

| 2,121 |

| 2,253 |

| 2,375 |

| 8,362 |

|

| The Streets at Southpoint | | 94% | 245,108 |

| 2022 | 207,909 |

| 4.36% | No | | 2,013 |

| 4,163 |

| 4,348 |

| 4,542 |

| 4,744 |

| 17,389 |

|

| Westroads Mall | | 100% | 152,914 |

| 2022 | 127,455 |

| 4.55% | No | | 1,275 |

| 2,663 |

| 2,769 |

| 2,919 |

| 3,056 |

| 12,777 |

|

| Augusta Mall | | 100% | 170,000 |

| 2023 | 170,000 |

| 4.36% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Boise Towne Square | | 100% | 134,044 |

| 2023 | 106,372 |

| 4.79% | No | | 1,204 |

| 2,495 |

| 2,618 |

| 2,746 |

| 2,880 |

| 15,729 |

|

| Crossroads Center (MN) | | 100% | 104,867 |

| 2023 | 83,026 |

| 3.25% | No | | 1,081 |

| 2,228 |

| 2,293 |

| 2,379 |

| 2,459 |

| 11,401 |

|

| Cumberland Mall | | 100% | 160,000 |

| 2023 | 160,000 |

| 3.67% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Meadows Mall | | 100% | 160,995 |

| 2023 | 118,726 |

| 3.96% | No | | 1,963 |

| 4,064 |

| 4,212 |

| 4,402 |

| 4,582 |

| 23,046 |

|

| Oglethorpe Mall | | 100% | 150,000 |

| 2023 | 136,166 |

| 3.90% | No | | — |

| — |

| — |

| — |

| 1,058 |

| 12,776 |

|

| Pecanland Mall | | 100% | 90,000 |

| 2023 | 75,750 |

| 3.88% | No | | — |

| 1,159 |

| 1,607 |

| 1,682 |

| 1,749 |

| 8,053 |

|

| Prince Kuhio Plaza | | 100% | 44,314 |

| 2023 | 35,974 |

| 4.10% | No | | 384 |

| 798 |

| 827 |

| 867 |

| 903 |

| 4,561 |

|

| Staten Island Mall | | 100% | 260,547 |

| 2023 | 206,942 |

| 4.77% | No | | 2,361 |

| 4,892 |

| 5,131 |

| 5,381 |

| 5,643 |

| 30,197 |

|

| Stonestown Galleria | | 100% | 180,000 |

| 2023 | 164,720 |

| 4.39% | No | | — |

| — |

| — |

| — |

| 462 |

| 14,818 |

|

| The Crossroads (MI) | | 100% | 99,216 |

| 2023 | 80,833 |

| 4.42% | No | | 789 |

| 1,645 |

| 1,708 |

| 1,799 |

| 1,881 |

| 10,561 |

|

| The Woodlands | | 100% | 257,513 |

| 2023 | 207,057 |

| 5.04% | No | | 2,272 |

| 4,716 |

| 4,959 |

| 5,215 |

| 5,484 |

| 27,810 |

|

| Baybrook Mall | | 100% | 250,000 |

| 2024 | 212,423 |

| 5.52% | No | | — |

| 821 |

| 3,402 |

| 3,595 |

| 3,798 |

| 25,961 |

|

| Fashion Show | | 100% | 835,000 |

| 2024 | 835,000 |

| 4.03% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Jordan Creek Town Center | | 100% | 218,532 |

| 2024 | 177,448 |

| 4.37% | No | | 1,749 |

| 3,645 |

| 3,783 |

| 3,980 |

| 4,160 |

| 23,767 |

|

| The Maine Mall | | 100% | 235,000 |

| 2024 | 235,000 |

| 4.66% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| The Parks At Arlington | | 100% | 250,000 |

| 2024 | 212,687 |

| 5.57% | No | | — |

| 814 |

| 3,371 |

| 3,564 |

| 3,767 |

| 25,797 |

|

| Woodbridge Center | | 100% | 250,000 |

| 2024 | 220,726 |

| 4.80% | No | | — |

| — |

| — |

| 2,395 |

| 3,777 |

| 23,102 |

|

| Pembroke Lakes Mall | | 100% | 260,000 |

| 2025 | 260,000 |

| 3.56% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Valley Plaza Mall | | 100% | 240,000 |

| 2025 | 206,847 |

| 3.75% | No | | — |

| — |

| — |

| — |

| 3,168 |

| 29,985 |

|

| Willowbrook Mall | | 100% | 360,000 |

| 2025 | 360,000 |

| 3.55% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| North Point Mall | | 100% | 250,000 |

| 2026 | 218,205 |

| 4.54% | No | | — |

| — |

| — |

| — |

| — |

| 31,795 |

|

| Providence Place - Other | | 94% | 37,907 |

| 2028 | 2,247 |

| 7.75% | No | | 1,508 |

| 1,628 |

| 1,757 |

| 1,897 |

| 1,825 |

| 27,045 |

|

| Provo Towne Center Land | | 75% | 2,249 |

| 2095 | 37 |

| 10.00% | Yes - Full | | — |

| — |

| — |

| — |

| — |

| 2,212 |

|

| Consolidated Property Level | | | $ | 13,563,264 |

| | $ | 12,330,123 |

| 4.53% | | | $ | 71,021 |

| $ | 146,501 |

| $ | 164,179 |

| $ | 146,475 |

| $ | 135,588 |

| $ | 569,377 |

|

| | | | | | | | | | | | | | | |

| Unconsolidated Property Level | | | | | | | | | | | | | | |

| Alderwood | | 50% | $ | 122,798 |

| 2015 | $ | 120,409 |

| 6.65% | No | | $ | 1,081 |

| $ | 1,308 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

|

| Pinnacle Hills Promenade | | 50% | 70,000 |

| 2015 | 63,000 |

| 5.57% | No | | 7,000 |

| — |

| — |

| — |

| — |

| — |

|

| Shane Plaza | | 50% | 3,035 |

| 2016 | 2,944 |

| 5.56% | No | | 29 |

| 62 |

| — |

| — |

| — |

| — |

|

| Center Pointe Plaza | | 50% | 6,033 |

| 2017 | 5,570 |

| 6.31% | No | | 86 |

| 183 |

| 194 |

| — |

| — |

| — |

|

Riverchase Galleria 5 | | 50% | 152,500 |

| 2017 | 152,500 |

| 4.50% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Amortization |

Property | | Own% | Proportionate Balance | Maturity Year 2 | Balloon Pmt at Maturity | Coupon Rate | Parent Recourse as of 6/30/2014 3 | | 2014 | 2015 | 2016 | 2017 | 2018 | Subsequent |

| Plaza Frontenac | | 55% | 28,600 |

| 2018 | 28,600 |

| 3.04% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Saint Louis Galleria | | 74% | 158,262 |

| 2018 | 158,262 |

| 3.44% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| First Colony Mall | | 50% | 92,500 |

| 2019 | 84,321 |

| 4.50% | No | | 244 |

| 1,503 |

| 1,573 |

| 1,645 |

| 1,720 |

| 1,494 |

|

| Natick Mall | | 50% | 225,000 |

| 2019 | 209,699 |

| 4.60% | No | | — |

| 584 |

| 3,593 |

| 3,762 |

| 3,939 |

| 3,423 |

|

| The Grand Canal Shoppes | | 50% | 313,125 |

| 2019 | 313,125 |

| 4.24% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Christiana Mall | | 50% | 117,495 |

| 2020 | 108,697 |

| 5.10% | No | | — |

| 402 |

| 1,622 |

| 1,725 |

| 1,816 |

| 3,233 |

|

| Kenwood Towne Centre | | 70% | 156,462 |

| 2020 | 137,191 |

| 5.37% | No | | 1,263 |

| 2,659 |

| 2,784 |

| 2,964 |

| 3,131 |

| 6,470 |

|

| Oakbrook Center | | 48% | 202,725 |

| 2020 | 202,725 |

| 3.66% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Water Tower Place | | 47% | 88,797 |

| 2020 | 76,626 |

| 4.85% | No | | 844 |

| 1,751 |

| 1,837 |

| 1,928 |

| 2,024 |

| 3,787 |

|

| Northbrook Court | | 50% | 65,500 |

| 2021 | 56,811 |

| 4.25% | No | | 90 |

| 1,108 |

| 1,156 |

| 1,206 |

| 1,259 |

| 3,870 |

|

| Village of Merrick Park | | 55% | 97,619 |

| 2021 | 85,797 |

| 5.73% | No | | 719 |

| 1,520 |

| 1,595 |

| 1,706 |

| 1,808 |

| 4,474 |

|

| Whaler's Village | | 50% | 40,000 |

| 2021 | 40,000 |

| 5.42% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Willowbrook Mall (TX) | | 50% | 102,587 |

| 2021 | 88,965 |

| 5.13% | No | | 848 |

| 1,778 |

| 1,858 |

| 1,972 |

| 2,077 |

| 5,089 |

|

| Bridgewater Commons | | 35% | 105,000 |

| 2022 | 105,000 |

| 3.34% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Clackamas Town Center | | 50% | 108,000 |

| 2022 | 108,000 |

| 4.18% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Florence Mall | | 50% | 45,000 |

| 2022 | 45,000 |

| 4.15% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Carolina Place | | 50% | 87,500 |

| 2023 | 75,542 |

| 3.84% | No | | — |

| — |

| 757 |

| 1,567 |

| 1,630 |

| 8,004 |

|

| Galleria at Tyler | | 50% | 96,067 |

| 2023 | 76,716 |

| 5.05% | No | | 822 |

| 1,708 |

| 1,796 |

| 1,889 |

| 1,987 |

| 11,149 |

|

| Lake Mead and Buffalo | | 50% | 2,154 |

| 2023 | 27 |

| 7.20% | No | | 85 |

| 181 |

| 194 |

| 209 |

| 224 |

| 1,234 |

|

| Park Meadows | | 35% | 126,000 |

| 2023 | 112,734 |

| 4.60% | No | | — |

| — |

| — |

| — |

| 1,996 |

| 11,270 |

|

| The Shoppes at River Crossing | | 50% | 38,675 |

| 2023 | 35,026 |

| 3.75% | No | | — |

| | — |

| — |

| 510 |

| 3,139 |

|

| The Trails Village Center | | 50% | 6,023 |

| 2023 | 78 |

| 8.21% | No | | 228 |

| 485 |

| 527 |

| 571 |

| 620 |

| 3,514 |

|

| Union Square Portfolio | | 50% | 25,000 |

| 2023 | 25,000 |

| 5.12% | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Stonebriar Centre | | 50% | 140,000 |

| 2024 | 120,886 |

| 4.05% | No | | — |

| — |

| — |

| 804 |

| 2,477 |

| 15,833 |

|

| Altamonte Mall | | 50% | 80,000 |

| 2025 | 69,045 |

| 3.72% | No | | — |

| — |

| — |

| — |

| 1,062 |

| 9,893 |

|

| Towson Town Center | | 35% | 113,761 |

| 2025 | 97,713 |

| 3.82% | No | | — |

| — |

| — |

| — |

| 680 |

| 15,368 |

|

| Unconsolidated Property Level | | | $ | 3,016,218 |

| | $ | 2,806,009 |

| 4.50% | | | $ | 13,339 |

| $ | 15,232 |

| $ | 19,486 |

| $ | 21,948 |

| $ | 28,960 |

| $ | 111,244 |

|

| | | | | | | | | | | | | | | |

| Total Fixed - Property Level | | | $ | 16,579,482 |

| | $ | 15,136,132 |

| 4.52% | | | $ | 84,360 |

| $ | 161,733 |

| $ | 183,665 |

| $ | 168,423 |

| $ | 164,548 |

| $ | 680,621 |

|

| | | | | | | | | | | | | | | |

| Consolidated Corporate | | | | | | | | | | | | | | |

| Arizona Two (HHC) | | 100% | $ | 9,993 |

| 2015 | $ | 573 |

| 4.41% | Yes - Full | | $ | 3,258 |

| $ | 6,162 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

|

| Consolidated Corporate | | | $ | 9,993 |

| | $ | 573 |

| 4.41% | | | $ | 3,258 |

| $ | 6,162 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

|

| | | | | | | | | | | | | | | |

| Total Fixed Rate Debt | | | $ | 16,589,475 |

| | $ | 15,136,705 |

| 4.52% | | | $ | 87,618 |

| $ | 167,895 |

| $ | 183,665 |

| $ | 168,423 |

| $ | 164,548 |

| $ | 680,621 |

|

| | | | | | | | | | | | | | | |

| Variable Rate | | | | | | | | | | | | | | |

| Consolidated Property Level | | | | | | | | | | | | | | |

| Columbia Mall | | 100% | $ | 100,000 |

| 2018 | $ | 100,000 |

| Libor + 175 bps | Yes - Full | | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

|

Columbiana Centre 6 | | 100% | 130,816 |

| 2018 | 128,177 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 746 |

| 1,393 |

| 500 |

| — |

|

Eastridge (WY) 6 | | 100% | 48,228 |

| 2018 | 47,255 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 275 |

| 514 |

| 184 |

| — |

|

Grand Teton Mall 6 | | 100% | 48,859 |

| 2018 | 47,873 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 279 |

| 520 |

| 187 |

| — |

|

| Market Place Shopping Center | | 100% | 113,425 |

| 2018 | 113,425 |

| Libor + 240 bps | No | | — |

| — |

| — |

| — |

| — |

| — |

|

Mayfair 6 | | 100% | 347,813 |

| 2018 | 340,796 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 1,983 |

| 3,704 |

| 1,330 |

| — |

|

Mondawmin Mall 6 | | 100% | 81,011 |

| 2018 | 79,377 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 461 |

| 863 |

| 310 |

| — |

|

North Town Mall 6 | | 100% | 89,207 |

| 2018 | 87,407 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 509 |

| 950 |

| 341 |

| — |

|

Oakwood 6 | | 100% | 76,913 |

| 2018 | 75,362 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 438 |

| 819 |

| 294 |

| — |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Amortization |

Property | | Own% | Proportionate Balance | Maturity Year 2 | Balloon Pmt at Maturity | Coupon Rate | Parent Recourse as of 6/30/2014 3 | | 2014 | 2015 | 2016 | 2017 | 2018 | Subsequent |

Oakwood Center 6 | | 100% | 91,413 |

| 2018 | 89,569 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 520 |

| 974 |

| 350 |

| — |

|

Pioneer Place 6 | | 100% | 188,185 |

| 2018 | 184,389 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 1,072 |

| 2,004 |

| 720 |

| — |

|

Red Cliffs Mall 6 | | 100% | 30,261 |

| 2018 | 29,650 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 173 |

| 322 |

| 116 |

| — |

|

River Hills Mall 6 | | 100% | 76,283 |

| 2018 | 74,744 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 435 |

| 812 |

| 292 |

| — |

|

Sooner Mall 6 | | 100% | 78,931 |

| 2018 | 77,338 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 450 |

| 841 |

| 302 |

| — |

|

Southwest Plaza 6 | | 100% | 73,383 |

| 2018 | 71,902 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 418 |

| 782 |

| 281 |

| — |

|

The Shops at Fallen Timbers 6 | | 100% | 25,217 |

| 2018 | 24,709 |

| Libor + 250 bps | Yes - Full | | — |

| — |

| 143 |

| 269 |

| 96 |

| — |

|

| 830 North Michigan | | 100% | 85,000 |

| 2019 | 85,000 |

| Libor + 160 bps | No | | — |

| — |

| — |

| — |

| — |

| — |

|

Ala Moana Construction Loan 7 | | 100% | 153,846 |

| 2019 | 153,846 |

| Libor + 190 bps | Yes - Partial | | — |

| — |

| — |

| — |

| — |

| — |

|

| Lynnhaven Mall | | 100% | 235,000 |

| 2019 | 235,000 |

| Libor + 185 bps | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Westlake Center | | 100% | 42,500 |

| 2019 | 42,500 |

| Libor + 230 bps | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Consolidated Property Level | | | $ | 2,116,291 |

| | $ | 2,088,319 |

| 2.46% | | | $ | — |

| $ | — |

| $ | 7,902 |

| $ | 14,767 |

| $ | 5,303 |

| $ | — |

|

| | | | | | | | | | | | | | | |

| Unconsolidated Property Level | | | | | | | | | | | | | | |

| Glendale Galleria | | 50% | $ | 160,000 |

| 2017 | $ | 150,544 |

| Libor + 250 bps | No | | — |

| 1,200 |

| 4,764 |

| 3,492 |

| — |

| — |

|

| Union Square Portfolio | | 50% | 16,250 |

| 2018 | 16,250 |

| Libor + 400 bps | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| 685 Fifth Avenue | | 50% | 170,000 |

| 2019 | 170,000 |

| Libor + 275 bps | No | | — |

| — |

| — |

| — |

| — |

| — |

|

| Unconsolidated Property Level | | | $ | 346,250 |

| | $ | 336,794 |

| 2.84% | | | $ | — |

| $ | 1,200 |

| $ | 4,764 |

| $ | 3,492 |

| $ | — |

| $ | — |

|

| | | | | | | | | | | | | | | |

| Consolidated Corporate | | | | | | | | | | | | | | |

| Junior Subordinated Notes Due 2036 | | 100% | $ | 206,200 |

| 2036 | $ | 206,200 |