UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to§240.14a-12 |

REVA Medical, Inc.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14(a)-6(i)(1) and 0-11. |

| | |

| | | | Title of each class of securities to which transaction applies: |

| | | | Aggregate number of securities to which transaction applies: |

| | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (sets forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | Proposed maximum aggregate value of transaction: |

| | | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | Form, Schedule or Registration Statement No.: |

| | | | Filing Party: |

| | | | Date Filed: |

March 9, 2016

Dear Stockholders:

We cordially invite you to attend a special meeting of the stockholders of REVA Medical, Inc. or the “Special Meeting.” The meeting will be held March 22, 2016, at 2:30 p.m. Pacific Daylight Time (which is 8:30 a.m. 23 March 2016 Australia Eastern Daylight Time), at the offices of DLA Piper (US) LLP, located at 4365 Executive Drive, Suite 1100, San Diego, California, U.S.A.

As we previously announced, we have entered into a First Amendment to Convertible Note Deed dated February 11, 2016 (the “Amendment”) pursuant to which we have agreed to make certain modifications to the Convertible Note Deed dated September 25, 2014 (the “Note Deed”) and entered into by and among the Company and Goldman Sachs International (“Goldman Sachs”) and Senrigan Master Fund (“Senrigan” and, together with Goldman Sachs, the “Noteholders”) as the holders of the 250 Convertible Notes (each with a face value of US$100,000) (collectively, the “Notes”) issued under the Note Deed. The Amendment only takes effect in the event that we obtain a new approval under Australian Securities Exchange (“ASX”) Listing Rule 7.1 with respect to the issue of the Notes and the issue of shares on conversion of the Notes; therefore, we have scheduled a special meeting of stockholders to seek the requisite approval. The proposed modifications set forth in the Amendment are as follows:

| | 1) | The Notes issued under the Note Deed, in the face amount of US$25.0 million, currently automatically convert to common stock upon our receipt of a CE Mark on ourFantom® scaffold combined with a CDI trading price of at least A$0.60 for at least twenty consecutive trading days. |

The proposed modification would add a third condition that our common stock also be listed on NASDAQ (or another securities exchange acceptable to the Noteholders) for an automatic conversion of the Notes to occur.

| | 2) | The Noteholders currently may elect to have us redeem some or all of the Notes on January 14, 2017, if the Notes have not otherwise been converted or redeemed by such date. |

The proposed modification would extend this early redemption date to June 30, 2017, thereby providing additional time for the Company to satisfy the necessary requirements for an automatic conversion of the Notes before the Noteholders’ optional redemption right becomes effective.

Other than these two modifications, the Note Deed as approved by stockholders on October 30, 2014 remains unchanged. A summary of certain key terms of the Note Deed is included as Annex B to the Proxy Statement.

In order to approve the modifications, the ASX has requested that our stockholders re-approve the issue of the Notes, which we issued on November 14, 2014 following stockholder approval of the Note Deed and the contemplated security issuances thereunder. Accordingly, we are asking stockholders to approve the following proposals:

| | 1) | For the purposes of ASX Listing Rule 7.1 and for all other purposes, to re-approve the issue of the Notes and issue of shares of the Company’s common stock upon conversion of the Notes pursuant to the Note Deed, as proposed to be amended pursuant to the Amendment as described further in this Proxy Statement; and |

| | 2) | To approve an adjournment of the Special Meeting, if necessary or appropriate, to permit solicitation of additional proxies in favor of Proposal 1. |

Our Board of Directors unanimously recommends that our stockholders vote “FOR” both of these proposals.

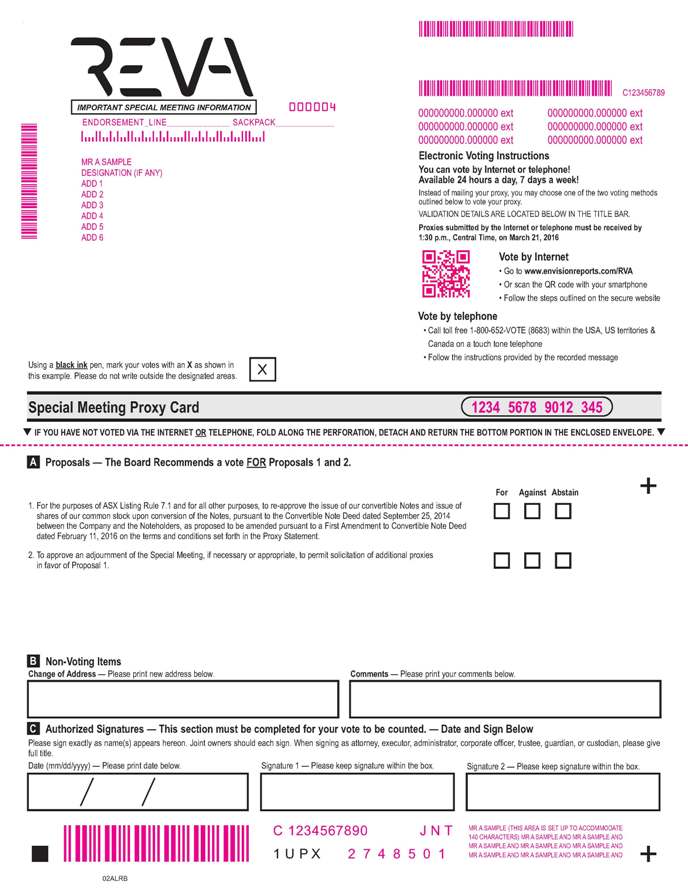

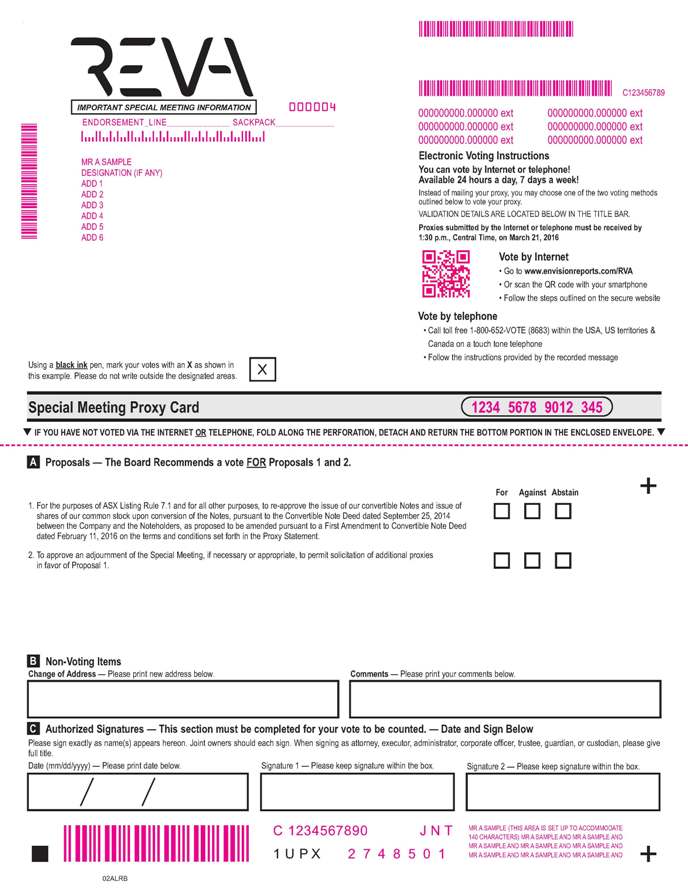

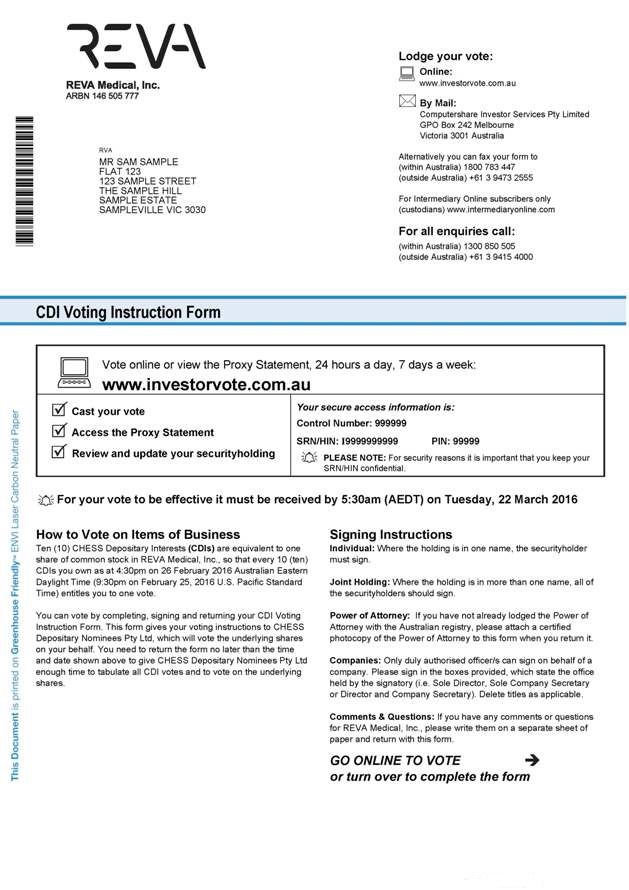

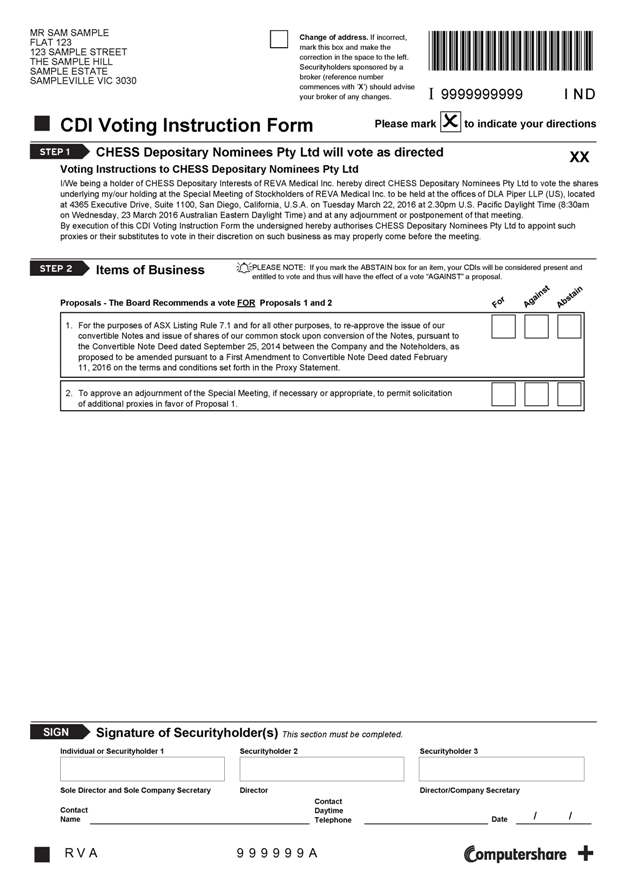

All stockholders are invited to attend the Special Meeting in person.Whether or not you expect to attend the Special Meeting, you are urged to vote or submit your proxy card or CDI Voting Instruction Form as soon as possible so that your shares can be voted at the Special Meeting in accordance with your instructions. Telephone and Internet voting are available. For specific instructions on voting, please refer to the instructions in the Notice of Special Meeting of Stockholders and the proxy card or CDI Voting Instruction Form (as applicable). If you hold your shares through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from them to vote your shares.

We look forward to seeing you at our Special Meeting of stockholders.

|

| Very Truly Yours, |

|

| /s/Robert B. Stockman |

| Robert B. Stockman |

| Chairman of the Board |

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held at 2:30 p.m. on March 22, 2016 (U.S. Pacific Daylight Time)

8:30 a.m. on 23 March 2016 (Australian Eastern Daylight Time)

Notice is hereby given that a Special Meeting of stockholders of REVA Medical, Inc. (“REVA” or the “Company”) will be held on March 22, 2016, at 2:30 p.m. U.S. Pacific Daylight Time (which is 8:30 a.m. 23 March 2016 Australian Eastern Daylight Time) at the offices of DLA Piper (US) LLP, located at 4365 Executive Drive, Suite 1100, San Diego, California, U.S.A., to vote on the following proposals:

| | 1) | For the purposes of Australian Securities Exchange (“ASX”) Listing Rule 7.1 and for all other purposes, to re-approve the issue of 250 Convertible Notes each with a face value of US$100,000 (collectively, the “Notes”) and issue of shares of the Company’s common stock upon conversion of the Notes pursuant to the Convertible Note Deed dated September 25, 2014 between the Company and Goldman Sachs International (“Goldman Sachs”) and Senrigan Master Fund (“Senrigan” and, together with Goldman Sachs, the “Noteholders”), as proposed to be amended pursuant to a First Amendment to Convertible Note Deed dated February 11, 2016 (the “Amendment”), and as described in this Proxy Statement; and |

| | 2) | To approve an adjournment of the Special Meeting, if necessary or appropriate, to permit solicitation of additional proxies in favor of Proposal 1. |

Certain voting exclusions pursuant to the ASX Listing Rules apply in respect of Proposal 1. These voting exclusions are set out in the accompanying Proxy Statement for the Special Meeting.

Our Board of Directors recommends that eligible stockholders voteFOR each proposal. You are entitled to vote only if you were a REVA stockholder as of 4:30 p.m. on 26 February 2016 Australia Eastern Daylight Time (which was 9:30 p.m. on February 25, 2016 U.S. Pacific Standard Time), the Record Date for the Special Meeting. This means that owners of common stock as of that date are entitled to vote at the Special Meeting and any adjournment or postponement of the meeting. Holders of CHESS Depositary Interests (“CDIs”) as of the close of business on the Record Date are entitled to receive notice of and to attend the meeting or any adjournment or postponement of the meeting and may instruct our CDI Depositary, CHESS Depositary Nominees Pty Ltd, (“CDN”), to vote the shares underlying their CDIs by following the instructions on the CDI Voting Instruction Form or by voting online atwww.investorvote.com.au. Doing so permits CDI holders to instruct CDN to vote on behalf of the CDI holders at the meeting in accordance with the instructions received via the CDI Voting Instruction Form or online. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 5751 Copley Drive, San Diego, California 92111, U.S.A.

The Proxy Statement that accompanies and forms part of this Notice of Special Meeting provides information about each matter to be considered. This Notice of Special Meeting and the Proxy Statement should be read in their entirety. If stockholders are in doubt as to how they should vote, they should seek advice from their legal counsel, accountant, solicitor, or other professional advisor prior to voting.

|

| By order of the Board of Directors: |

|

| /s/Katrina L. Thompson |

| Katrina L. Thompson |

| Chief Financial Officer and Secretary |

IMPORTANT:To ensure your shares are represented at the meeting, please vote (or, for CDI holders, direct CDN to vote) your shares via the Internet, by telephone, or by marking, signing, dating, and returning a proxy card or CDI Voting Instruction Form to the address specified. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares, except that CDI holders may only instruct CDN to vote on their behalf by completing and signing the CDI Voting Instruction Form or voting online and may not vote in person.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS:

This Proxy Statement is available at

www.envisionreports.com/RVA (for holders of shares) and at

www.investorvote.com.au (for holders of CDIs)

TABLE OF CONTENTS

i

REVA MEDICAL, INC.

5751 Copley Drive

San Diego, California 92111, U.S.A.

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

2:30 P.M. ON MARCH 22, 2016 (U.S. PACIFIC DAYLIGHT TIME)

8:30 A.M. ON 23 MARCH 2016 (AUSTRALIAN EASTERN DAYLIGHT TIME)

This Proxy Statement, along with a proxy card and CDI Voting Instruction Form,

is being made available to our stockholders on or about March 9, 2016

GENERAL INFORMATION

Why am I receiving these materials?

We have made these proxy materials available to you in connection with the solicitation by the Board of Directors (the “Board”) of REVA Medical, Inc. (the “Company” or “REVA”) of proxies to be voted at the special meeting of stockholders (the “Special Meeting”) to be held on March 22, 2016, at 2:30 p.m., U.S. Pacific Daylight Time (which is 8:30 a.m. on 23 March 2016 Australian Eastern Daylight Time) at the offices of DLA Piper (US) LLP, located at 4365 Executive Drive, Suite 1100, San Diego, California, U.S.A., and at any postponements or adjournments of the Special Meeting. If you held shares of our common stock as of 4:30 p.m. on 26 February 2016 Australian Eastern Daylight Time (which was 9:30 p.m. on February 25, 2016 U.S. Pacific Standard Time), which is the Record Date for the Special Meeting, you are invited to attend the Special Meeting and vote on the proposals described below under the heading “On what proposals am I voting?” Those persons holding CHESS Depositary Interests (“CDIs”) are entitled to receive notice of and to attend the Special Meeting and may instruct CHESS Depositary Nominees Pty Ltd. (“CDN”) to vote at the Special Meeting by following the instructions on the CDI Voting Instruction Form or by voting online atwww.investorvote.com.au.

On what proposals am I voting?

There are two proposals scheduled to be voted on at the Special Meeting:

| | • | | As requested by the ASX, to re-approve the issue of the Notes and shares of common stock issuable upon conversion of the Notes (for the purposes of ASX Listing Rule 7.1) pursuant to the Note Deed, as amended by the Amendment, and as described in this Proxy Statement; and |

| | • | | Approval of an adjournment of the Special Meeting, if necessary or appropriate, to permit solicitation of additional proxies in favor of the above proposal. |

Why is stockholder approval necessary for the amendment to the Note Deed?

Our securities are listed for sale on the Australian Securities Exchange (“ASX”) in the form of CDIs, each CDI representing one-tenth of a share of our common stock, and we are subject to the ASX rules and regulations. ASX Listing Rule 7.1 prohibits, subject to certain exceptions, a company from issuing or agreeing to issue securities that would represent more than 15% of the company’s ordinary securities on issue 12 months prior to the date of issue (or agreement to issue) of such securities, without prior approval of a company’s stockholders.

We issued US$25.0 million in aggregate principal amount of Notes to the Noteholders on November 14, 2014 in accordance with the provisions of the Note Deed. Under the Note Deed, one share of our common stock (equivalent to ten CDIs) will be issued upon conversion of each A$2.50 / US$2.17275 of the Notes (which is the initial conversion price under the Note Deed), for a total common stock issuance of up to 11,506,156 shares (equivalent to 115,061,558 CDIs), subject to any adjustment for anti-dilution protection provided for in the Note Deed.

- 1 -

Our stockholders approved the Note Deed, the issuance of the Notes, the convertibility feature of the Notes, and the issuance of the shares of common stock upon conversion of the Notes at a special meeting of stockholders held on October 30, 2014.

However, because we have agreed, subject to obtaining requisite stockholder approval, to amend certain provisions of the Note Deed, and because the shares of common stock that potentially could be issued under the Note Deed could exceed 15% of our outstanding common stock (or CDI equivalents), the ASX has requested that the issue of the Notes and shares of common stock issuable upon conversion of the Notes be re-approved for the purposes of ASX Listing Rule 7.1.

What will be the consequences to the Company if stockholder approval of Proposal 1 is not obtained?

There are two proposed modifications of the Note Deed contained in the First Amendment to Convertible Note Deed dated February 11, 2016 (the “Amendment”), as follows:

| | • | | The Notes issued and outstanding under the Note Deed, in the face amount of US$25.0 million, currently automatically convert to common stock when we achieve both a CE Mark regulatory approval of ourFantom scaffold and a CDI trading price of at least A$0.60 for at least twenty consecutive trading days. |

The proposed modification would add a third condition that our common stock also be listed on NASDAQ (or another securities exchange acceptable to the holders of the Notes) in order for an automatic conversion of the Notes to occur.

| | • | | The holders of the Notes currently may elect at any time prior to December 15, 2016 to have the Company redeem some or all of the Notes on January 14, 2017, if the Notes have not otherwise been converted or redeemed by January 14, 2017. |

The proposed modification would extend the early redemption election date to June 30, 2017.

If stockholders do not approve Proposal 1, neither of the modifications would occur, the Amendment would not take effect, and the terms of the Note Deed will remain unchanged.In that circumstance, the original stockholder approval obtained for the issue of the Notes and the underlying shares will remain valid.

Our Board believes these modifications to the Note Deed are, on the whole, beneficial to the Company. In particular, because the Company does not currently expect to have sufficient cash on hand to redeem the Notes on January 14, 2017 absent completing an additional capital raising, the extension of the early redemption date provides flexibility for the Company as it allows additional time to either: (a) satisfy the necessary requirements for an automatic conversion of the Notes to occur before the Noteholders’ optional redemption right becomes effective or (b) obtain the cash necessary to redeem the Notes should any Noteholder elect to exercise that right.

What will be the consequences to the Company if stockholder approval of Proposal 2 is not obtained?

An adjournment of the Special Meeting may be needed if we do not receive sufficient proxies to declare a quorum present at the meeting or, even if a quorum is present, we believe we need to solicit additional votes in favor of Proposal 1. If stockholders do not approve an adjournment of the Special Meeting and if an adjournment is needed, the Company would be placed in a position to arrange another special meeting to seek stockholder approval of Proposal 1.

How does the Company’s Board recommend that I vote?

Our Board recommends that you vote your shares or direct CDN to vote your CDIs:

| | • | | “FOR” the re-approval of the issuance of the Notes and shares of common stock issuable upon conversion of the Notes, pursuant to the Note Deed, for purposes of ASX Listing Rule 7.1. This re-approval would allow the Amendment to take effect, as described in this Proxy Statement. |

| | • | | “FOR” the approval of an adjournment of the Special Meeting, if necessary or appropriate, to permit solicitation of additional proxies in favor of the above proposal. |

- 2 -

Why is the Board recommending approval of each Proposal?

In connection with discussions that took place and ultimately led to the February 12, 2016 option exercise by Goldman Sachs International (“Goldman Sachs”) to acquire 4,375,000 shares of the Company’s common stock, the Company and the Noteholders agreed to the Amendment to the Note Deed discussed under “What will be the consequences to the Company if stockholder approval of Proposal 1 is not obtained?” above, which is subject only to receipt of stockholder approval.

Our Board believes that, on balance, the Amendment is favorable to the Company and stockholders, particularly as pushing back the date of any early redemption election to June 30, 2017 will provide additional flexibility for the Company as we progress toward filing a CE Mark application in the third quarter of this year. As such, our Board recommends that stockholders approve Proposal 1.

Additionally, in order to ensure sufficient time to receive the necessary proxies to declare a quorum present at the Special Meeting (or to allow the Company more time to solicit additional votes in favor of Proposal 1, if necessary), our Board also recommends that stockholders approve Proposal 2.

Who is entitled to vote at the Special Meeting?

If you were a holder of REVA common stock, either as a stockholder of record or as the beneficial owner of shares held in street name, as of 4:30 p.m. on 26 February 2016 Australian Eastern Daylight Time (which was 9:30 p.m. on February 25, 2016 U.S. Pacific Standard Time), the Record Date for the Special Meeting, you may vote your shares at the Special Meeting. As of the Record Date, there were 42,535,986 shares of our common stock outstanding (equivalent to 425,359,860 CDIs assuming all shares of common stock were converted into CDIs on the Record Date). Each stockholder has one vote for each share of common stock held as of the Record Date. Each CDI holder is entitled to direct CDN to vote one share for every ten CDIs held by such holder. As summarized below, there are some distinctions between shares held of record and those owned beneficially and held in street name.

What does it mean to be a “stockholder of record?”

You are a “stockholder of record” if your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. As a stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Special Meeting. You may vote by Internet, telephone, or mail, as described below under the heading “How do I vote my shares of REVA common stock?” Holders of CDIs are entitled to receive notice of and to attend the Special Meeting and may direct CDN to vote at the Special Meeting by following the instructions on the CDI Voting Instruction Form or by voting online atwww.investorvote.com.au.

What does it mean to beneficially own shares in “street name?”

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, custodian, or other similar organization. If this is the case, proxy materials are forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or nominee how to vote your shares, and you are also invited to attend the Special Meeting. If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposals on which your broker does not have discretionary authority to vote (a “broker non-vote”).

Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares at the meeting. If you do not wish to vote in person or you will not be attending the Special Meeting, you may vote by proxy. You may vote by proxy by Internet or telephone, as described below under the heading “How do I vote my shares of REVA common stock?”

How many shares must be present or represented to conduct business at the Special Meeting?

The quorum requirement for holding the Special Meeting and transacting business is that holders of one-third of the voting power of the issued and outstanding shares of common stock of REVA entitled to vote must be present in person or represented by proxy. Abstentions are counted for the purpose of determining the presence of a quorum. As of the Record Date, there were 42,535,986 shares of our common stock outstanding, and each share is entitled to one vote at the Special Meeting.

- 3 -

What is the voting requirement to approve each of the proposals?

Proposal 1 — Re-approval under ASX Listing Rule 7.1 of the issue of shares upon conversion of the Notes

The proposal to re-approve the issue of the Notes and the shares of common stock issuable upon conversion of the Notes requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Special Meeting and voting on such proposal.

The Company will disregard any votes cast on Proposal 1 by:

| | • | | Goldman Sachs and Senrigan Master Fund (“Senrigan”); |

| | • | | any person who might obtain a benefit if Proposal 1 is approved (except a benefit solely in the capacity of a holder of common stock or CDIs); and, |

| | • | | any person associated with any of the above persons. |

However, the Company need not disregard a vote if:

| | • | | it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card; or |

| | • | | it is cast by the person chairing the meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy card to vote as the proxy decides. |

Other than Goldman Sachs and Senrigan, the Company is not aware of any other person who might obtain a benefit if Proposal 1 is passed (except a benefit solely in the capacity of a holder of common stock or CDIs). Our Chief Executive Officer, Regina Groves, was granted an option to purchase up to 330,000 shares of our common stock for US$8.31 per share on February 16, 2016. This grant occurred after Goldman Sachs exercised their option to purchase 4,375,000 shares of common stock and after we entered into the Amendment.

Proposal 2 — Approval of an adjournment of the Special Meeting, if necessary or appropriate, to permit solicitation of additional proxies in favor of Proposal 1

The proposal to approve an adjournment of the Special Meeting, if necessary or appropriate, requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Special Meeting and voting on such proposal.

Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” each proposal. Broker non-votes will have no direct effect on the outcome of these proposals.

How do I vote my shares of REVA common stock?

If you are a stockholder of record, you can vote in the following ways:

| | • | | By Internet: by following the Internet voting instructions included in the proxy card and Notice of Special Meeting of Stockholders at any time up until 5:30 a.m. on 22 March 2016 Australian Eastern Daylight Time (which is 11:30 a.m. on March 21, 2016 U.S. Pacific Daylight Time). |

| | • | | By Telephone: by following the telephone voting instructions included in the proxy card and Notice of Special Meeting of Stockholders at any time up until 5:30 a.m. on 22 March 2016 Australian Eastern Daylight Time (which is 11:30 a.m. on March 21, 2016 U.S. Pacific Daylight Time). |

| | • | | By Mail: by marking, dating, and signing your proxy card in accordance with the instructions on it and returning it by mail in thepre-addressed reply envelope. The proxy card must be received prior to the Special Meeting. |

If your shares are held through a benefit or compensation plan or in street name, your plan trustee or your bank, broker, or other nominee should give you instructions for voting your shares. In these cases, you may vote by Internet, telephone, or mail by submitting a Voting Instruction Form.

If you satisfy the admission requirements to the Special Meeting, as described below under the heading “How do I attend the Special Meeting?” you may vote your shares in person at the meeting. Even if you plan to attend the Special Meeting, we encourage you to vote in advance by Internet, telephone, or mail so that your vote will be counted in the event you later decide not to attend the Special Meeting. Shares held through a benefit or compensation plan cannot be voted in person at the Special Meeting.

- 4 -

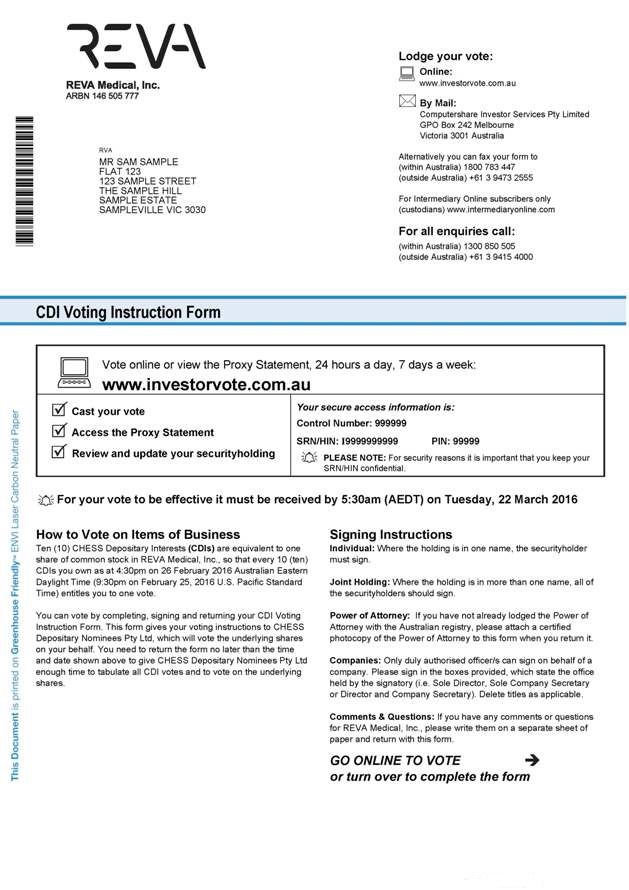

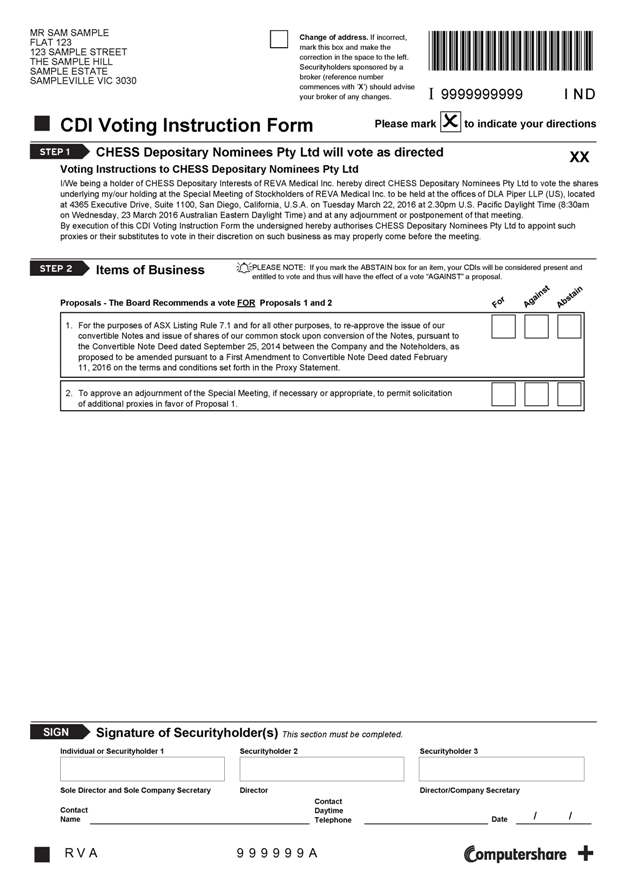

How do I vote if I hold CDIs?

Each CDI holder is entitled to direct CDN to vote one share for every ten CDIs held by such holder. Those persons holding CDIs are entitled to receive notice of and to attend the Special Meeting and any adjournment or postponement thereof, and may direct CDN to vote their underlying shares of common stock at the Special Meeting by voting online atwww.investorvote.com.au, or by returning the CDI Voting Instruction Form to Computershare, the agent we designated for the collection and processing of voting instructions from our CDI holders, no later than 5:30 a.m. on 22 March 2016 Australian Eastern Daylight Time (which is 11:30 a.m. on March 21, 2016 U.S. Pacific Daylight Time) in accordance with the instructions on such form. Doing so permits CDI holders to instruct CDN to vote on their behalf in accordance with their written directions.

Alternatively, CDI holders have the following options in order to vote at the Special Meeting:

| | • | | informing us that they wish to nominate themselves or another person to be appointed as CDN’s proxy for the purposes of attending and voting at the meeting; or |

| | • | | converting their CDIs into a holding of shares of our common stock and voting these at the meeting (however, if thereafter the former CDI holder wishes to sell their investment on ASX, it would be necessary to convert shares of common stock back into CDIs). This must be done prior to the record date for the meeting. |

As holders of CDIs will not appear on our share register as the legal holders of the shares of common stock, they will not be entitled to vote at our stockholder meetings unless one of the above steps is undertaken.

How do I attend the Special Meeting?

Admission to the Special Meeting is limited to our stockholders or holders of CDIs, one member of their respective immediate families, or their named representatives. We reserve the right to limit the number of immediate family members or representatives who may attend the meeting. Stockholders of record, holders of CDIs of record, immediate family member guests, and representatives will be required to present government-issued photo identification (e.g., driver’s license or passport) to gain admission to the Special Meeting.

To register to attend the Special Meeting, please contact REVA Investor Relations as follows:

| | • | | bye-mail atIR@revamedical.com; |

| | • | | by phone at (858) 966-3045 in the U.S. or at +61 3 9866 4722 in Australia; |

| | • | | by fax to (858) 966-3089; or, |

| | • | | by mail to Investor Relations at 5751 Copley Drive, San Diego, California 92111, U.S.A. |

Please include the following information in your request:

| | • | | your name and complete mailing address; |

| | • | | whether you require special assistance at the meeting; |

| | • | | if you will be naming a representative to attend the meeting on your behalf, the name, complete mailing address, and telephone number of that individual; |

| | • | | proof that you own shares of REVA’s common stock or hold CDIs as of the Record Date (such as a letter from your bank, broker, or other financial institution; a photocopy of a current brokerage, Computershare, or other account statement; or, a photocopy of a holding statement); and, |

| | • | | the name of your immediate family member guest, if one will accompany you. |

Please be advised that no cameras, recording equipment, electronic devices, large bags, briefcases, or packages will be permitted in the Special Meeting.

What does it mean if I receive more than one set of proxy materials?

It generally means you hold shares registered in multiple accounts. To ensure that all your shares are voted, please submit proxies or voting instructions for all of your shares.

- 5 -

May I change my vote or revoke my proxy?

Yes. If you are a stockholder of record, you may change your vote or revoke your proxy by:

| | • | | filing a written statement to that effect with our Corporate Secretary at or before the taking of the vote at the Special Meeting; |

| | • | | voting again via the Internet or telephone at a later time before the closing of those voting facilities at 5:30 a.m. on 22 March 2016 Australian Eastern Daylight Time (which is 11:30 a.m. on March 21, 2016 U.S. Pacific Daylight Time); |

| | • | | submitting a properly signed proxy card with a later date that is received at or prior to the Special Meeting; or, |

| | • | | attending the Special Meeting, revoking your proxy, and voting in person. |

The written statement or subsequent proxy should be delivered to REVA Medical, Inc., 5751 Copley Drive, San Diego, California 92111, U.S.A., Attention: Corporate Secretary, or hand delivered to the Corporate Secretary, before the taking of the vote at the Special Meeting. If you are a beneficial owner and hold shares through a broker, bank, or other nominee, you may submit new voting instructions by contacting your broker, bank, or other nominee. You may also change your vote or revoke your voting instructions in person at the Special Meeting if you obtain a signed proxy from the record holder (broker, bank, or other nominee) giving you the right to vote the shares.

If you are a holder of CDIs and you direct CDN to vote by completing the CDI Voting Instruction Form, you may revoke those directions by delivering to Computershare, no later than 5:30 a.m. on 22 March 2016 Australian Eastern Daylight Time (which is 11:30 a.m. on March 21, 2016 U.S. Pacific Daylight Time), a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent.

Can any other business be conducted at the Special Meeting?

No. Under our Bylaws and Delaware law, the business to be conducted at the Special Meeting will be limited to the purposes stated in the notice to stockholders provided with this proxy statement.

What happens if the Special Meeting is adjourned?

The Special Meeting may be adjourned for the purpose of, among other things, soliciting additional proxies. Any adjournment may be made from time to time with the approval of the affirmative vote of the holders of a majority of the outstanding shares, present in person or represented by proxy and entitled to vote at the Special Meeting. Under Delaware law, we are not required to notify stockholders of any adjournments of less than 30 days if the time and place of the adjourned meeting are announced at the meeting at which adjournment occurs, unless after the adjournment a new record date is fixed for the adjourned meeting. Unless a new record date is fixed, your proxy will still be valid and may be voted at the adjourned meeting. You will still be able to change or revoke your proxy until it is voted.

Will representatives of the Company’s independent registered public accounting firm for the current and most recently completed fiscal year be at the meeting?

A representative of Grant Thornton LLP, our independent registered public accounting firm for the current and most recently completed fiscal year, is not expected to be present at the Special Meeting and will therefore be unable to make a statement or respond to questions.

Who will pay for the cost of soliciting proxies?

We will pay the cost of soliciting proxies, including the cost of preparing and mailing proxy materials. Proxies may be solicited on our behalf by directors, officers, or employees (for no additional compensation) in person or by telephone, electronic transmission, and facsimile transmission.

If we hire soliciting agents, we will pay them a reasonable fee for their services. We will not pay directors, officers, or other regular employees any additional compensation for their efforts to supplement our proxy solicitation. We anticipate that banks, brokerage houses, and other custodians, nominees, and fiduciaries may forward soliciting material to the beneficial owners of shares of common stock entitled to vote at the Special Meeting and that we will reimburse those persons for their out-of-pocket expenses incurred in this connection.

- 6 -

PROPOSAL 1 — RE-APPROVAL OF THE ISSUE OF THE NOTES AND SHARES OF COMMON

STOCK ISSUABLE UPON CONVERSION OF THE NOTES

Background

We are a pre-revenue stage company and our product development efforts have been funded with a variety of capital received from angel investors, venture capitalists, strategic partners, hedge funds, and the proceeds from our initial public offering of CDIs completed in December 2010. To further our development and testing efforts and to provide the capital to allow us to apply for CE Marking of ourFantom scaffold product, we entered into the Note Deed on September 24, 2014, pursuant to which we issued 250 Notes, each with a face value of US$100,000, to the Noteholders along with 8,750,000 options to purchase common stock on November 14, 2014. As of the date of this Proxy Statement all of the options have been exercised for cash, 4,375,000 of which were exercised by Senrigan on October 1, 2015 for total cash proceeds of US$9.5 million with the remainder exercised by Goldman Sachs on February 12, 2016 for total cash proceeds of US$11.4 million.

The Notes have a five-year life, bear interest at 7.54% per annum and convert into common stock at an initial conversion price of A$2.50 / US$2.17275 per share. Based on this initial conversion price, full conversion of all of the Notes would result in a maximum of 11,506,156 shares of our common stock (equivalent to 115,061,558 CDIs), subject to any adjustment for anti-dilution protection provided for in the Note Deed. The Notes rankpari passu in right of payment with all other existing and future unsecured and unsubordinated senior obligations of the Company (other than unsecured obligations preferred by mandatory provisions of law) and senior in right of payment to all existing and future subordinated obligations of the Company.

A summary of certain key terms of the Note Deed is set out in Annex B to this Proxy Statement. Further details about the terms of the Notes, as well as a copy of the Note Deed can be found in our proxy statement filed with the United States Securities and Exchange Commission (“SEC”) on October 14, 2014 (File Number 000-54192) (the “October 2014 Proxy Statement”).

The Amendment

In connection with discussions that ultimately led to the February 12, 2016 option exercise by Goldman Sachs, on February 11, 2016, we entered into the First Amendment to Convertible Note Deed (the “Amendment”), the effectiveness of which is subject to the receipt of stockholder approval. The Amendment provides for two modifications of the existing terms of the Notes and the Note Deed:

| | 1) | an amendment to extend the early redemption date to June 30, 2017, if the Notes have not otherwise been converted or redeemed by such date; and |

| | 2) | an amendment to require that our common stock also be listed on NASDAQ (or another securities exchange approved by the Noteholders) for an automatic conversion of the Notes to occur. |

None of the other terms of the Note Deed or options will be modified by the Amendment.

Each of Goldman Sachs and Senrigan, as the sole Noteholders, as well as our Board of Directors, has approved the Amendment, which has been executed by all parties and will become effective automatically if Proposal 1 is approved.

The Note Deed currently provides Noteholders with the option to require the Company to redeem some or all of the Notes on January 14, 2017, if the Notes have not previously been converted or redeemed by such date. However, as the Company will not have sufficient cash on hand to redeem the Notes on January 14, 2017, absent completing an additional capital raising, the Amendment would extend this early redemption date to June 30, 2017, by which time the Company expects that either: (a) the necessary requirements for an automatic conversion of the Notes will be satisfied or (b) it will have the necessary cash on hand should any Noteholder elect to exercise its optional redemption right. If the Amendment is approved, then at any time on or before June 1, 2017, a Noteholder may notify REVA in writing that it elects to have the Company redeem all or some of the Notes held by the Noteholder for an amount equal to face value (US$100,000 per Note), plus accrued interest (the “Redemption Amount”). If we receive such a notice, and a Note has not otherwise been converted, redeemed or cancelled, then we will be required to repay such Notes for the Redemption Amount, which will become immediately due and payable on June 30, 2017. If the Notes convert automatically prior to such date, the Noteholders will not have the ability to elect redemption of the Notes on June 30, 2017.

- 7 -

The Note Deed currently provides that the Notes shall automatically convert into our common stock in the event: (a) we receive CE Mark approval for ourFantom product and (b) the average daily volume weighted-average market price of our CDIs equals or exceeds A$0.60 for a period of 20 consecutive trading days. The Amendment would add a third condition that we complete the listing of our common stock on NASDAQ (or any other securities exchange approved by a majority of Noteholders) for an automatic conversion of the Notes to occur.

A copy of the Amendment is contained in Annex A to this Proxy Statement.

Our Board believes the modifications to the Note Deed are, on the whole, beneficial to the Company. The extension of the early redemption date provides flexibility for the Company as it allows additional time to either: (a) satisfy the necessary requirements for an automatic conversion of the Notes to occur before the Noteholders’ optional redemption right becomes effective or (b) obtain the cash necessary to redeem the Notes should any Noteholder elect to exercise that right. Also, even though a NASDAQ listing is not currently a pre-condition to automatic conversion of the Notes, the original terms of the Note Deed do require the Company to use reasonable efforts to list our common stock on NASDAQ or another securities exchange.

If Proposal 1 is passed, the remainder of the Note Deed will remain unchanged. However, it is worth noting that adding the NASDAQ listing as a new condition to automatic conversion may have the consequence of delaying such automatic conversion beyond what is contemplated by the terms of the existing Note Deed, which could in turn extend the period during which interest accrues on the Notes. Additionally, if the Company determined to conduct an equity capital raising at a price below current market value before triggering an automatic conversion of the Notes, this may implicate the anti-dilution provisions set forth in the Note Deed, which provisions may not otherwise have been triggered had the Notes previously been converted on the terms of the existing Note Deed.

ASX Listing Rules

ASX Listing Rule 7.1 broadly provides, subject to certain exceptions, that stockholder approval is required for the issuance of our securities where the securities proposed to be issued would represent more than 15% of our ordinary securities on issue 12 months prior to the date of issue of such securities. The shares of common stock (represented by CDIs) that may be issued on conversion of the Notes and on exercise of the options issued under the Note Deed would exceed the number of securities that can be issued pursuant to ASX Listing Rule 7.1 without obtaining stockholder approval. While stockholder approval for the issue of the Notes was obtained at the meeting held on October 30, 2014, ASX is of the view that the Amendment is a material amendment to the Notes and that the amendment therefore should not take effect unless a further stockholder approval is obtained.

In accordance with ASX Listing Rule 7.3, the following information is provided in relation to Proposal 1:

| | • | | 250 Notes were issued on November 14, 2014, and no additional Notes will be issued; |

| | • | | the number of shares of our common stock that may be issued on conversion of the Notes at the initial conversion price is determined by dividing the face value of a Note converted (translated from U.S. dollars into Australian dollars at the exchange rate fixed on the subscription date) by the conversion price in effect on the conversion date, subject to any adjustment of the conversion price as further described in the Note Deed (a copy of which is set out in Annex A to the October 2014 Proxy Statement). Based on the applicable exchange rate and the initial conversion price, the maximum number of shares of our common stock that may be issued on conversion of the Notes is 11,506,156 shares (equivalent to 115,061,558 CDIs). The maximum number of shares of our common stock that may be issued will increase if the conversion price is adjusted in accordance with the terms of the Note Deed, including upon certain reorganizations of share capital or issues of shares at less than the current market value; |

| | • | | each Note had an issue price of US$100,000; |

| | • | | the Notes were issued under a prospectus in accordance with the requirements of section 713 of the Australian Corporations Act 2001 (Cth) and lodged with the Australian Securities and Investments Commission (“ASIC”); |

| | • | | the issue of the Notes was made to Goldman Sachs and Senrigan; |

| | • | | a summary of certain key terms of the Note Deed is set out in Annex B to this Proxy Statement. Further details about the terms of the Notes, as well as a copy of the Note Deed can be found in the October 2014 Proxy Statement; and, |

| | • | | under the Note Deed, we may only use the funds received in respect of the Notes for operational and capital expenditures, working capital, redemption of the Notes, and payment of expenses associated with preparing the Note Deed and consummating the transactions contemplated by the Note Deed. |

- 8 -

Vote Required

Approval of Proposal 1 requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Special Meeting and voting on such proposal. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” this proposal. Broker non-votes will have no direct effect on the outcome of this proposal.

Voting Exclusion Statement

The Company will disregard any votes cast on Proposal 1 by:

| | • | | The Noteholders (being Goldman Sachs and Senrigan); |

| | • | | any person who might obtain a benefit if Proposal 1 is passed (except a benefit solely in the capacity of a holder of common stock or CDIs); and, |

| | • | | any person associated with any of the above persons. |

However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card, or it is cast by the person chairing the Special Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy card to vote as the proxy decides.

Other than the Noteholders, the Company is not aware of any other person who might obtain a benefit if Proposal 1 is passed (except a benefit solely in the capacity of a holder of common stock or CDIs). Our Chief Executive Officer, Regina Groves, was granted an option to purchase up to 330,000 shares of our common stock for US$8.31 per share on February 16, 2016. This grant occurred after Goldman Sachs exercised their option to purchase 4,375,000 shares of common stock and after we entered into the Amendment.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

STOCKHOLDERS VOTE “FOR” PROPOSAL 1.

PROPOSAL 2 — APPROVAL OF MEETING ADJOURNMENT, IF NEEDED

The Board seeks your approval to adjourn the Special Meeting, if necessary or appropriate, to permit the solicitation of additional proxies in favor of Proposal 1.

Approval of Proposal 2 requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Special Meeting and voting on such proposal.

If it is necessary to adjourn the Special Meeting, and the adjournment is for a period of less than 30 days, no notice of the time or place of the reconvened meeting will be given to our stockholders, other than an announcement made at the Special Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

STOCKHOLDERS VOTE “FOR” PROPOSAL 2.

- 9 -

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information about the beneficial ownership of our common stock (as converted and aggregated for any holdings in the form of CDIs) as of March 1, 2016 by:

| | • | | each stockholder known to beneficially own five percent or more of our stock (“principal stockholders”); |

| | • | | each of our directors and each of our named executive officers; and, |

| | • | | all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned and the percentage ownership by a person, shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of March 1, 2016 are deemed outstanding, but are not deemed outstanding for computing the percentage ownership of any other person. To our knowledge, except as set forth in the footnotes to this table and subject to applicable community property laws, each person named in the table has sole voting and investment power with respect to the shares set forth opposite such person’s name, based on information provided to us by such stockholders. Except as otherwise indicated, the address of each stockholder is c/o REVA Medical, Inc., 5751 Copley Drive, San Diego, California 92111, U.S.A.

| | | | | | | | |

Name and Address of Beneficial Owner | | Number of

Shares of

Common Stock (1) | | | Percent of

Common Stock (1) | |

Principal Stockholders: | | | | | | | | |

Senrigan Master Fund(2) | | | 11,518,308 | | | | 23.9 | % |

Goldman Sachs International(3) | | | 10,128,078 | | | | 21.0 | % |

Domain Partners(4) | | | 3,691,188 | | | | 8.7 | % |

Elliott Associates, L.P.(5) | | | 3,227,031 | | | | 7.6 | % |

Saints Capital Everest, L.P.(6) | | | 3,223,513 | | | | 7.6 | % |

Brookside Capital Partners Fund, LP(7) | | | 2,965,022 | | | | 7.0 | % |

Stephen Feinberg(8) | | | 2,884,426 | | | | 6.8 | % |

Medtronic, Inc.(9) | | | 2,635,479 | | | | 6.2 | % |

Directors and Named Executive Officers: | | | | | | | | |

Regina E. Groves | | | — | | | | — | |

Jeffrey A. Anderson(10) | | | 208,500 | | | | * | |

Donald K. Brandom, Ph.D.(11) | | | 383,050 | | | | * | |

Robert K. Schultz, Ph.D.(12) | | | 892,000 | | | | 2.1 | % |

Katrina L. Thompson(13) | | | 590,250 | | | | 1.4 | % |

Dr. Ross A. Breckenridge | | | 1,000 | | | | * | |

Brian H. Dovey (14)(15) | | | 3,796,188 | | | | 8.9 | % |

R. Scott Huennekens | | | — | | | | — | |

Anne Keating(15)(16) | | | 126,482 | | | | * | |

Gordon E. Nye(15) | | | 938,131 | | | | 2.2 | % |

Robert B. Stockman(17) | | | 2,962,336 | | | | 6.8 | % |

Robert Thomas(15)(18) | | | 180,000 | | | | * | |

All directors and executive officers as a group (14 persons) | | | 10,407,337 | | | | 22.8 | % |

| * | Indicates beneficial ownership of less than 1% of our shares of common stock |

| (1) | Number of shares owned as shown both in this table and the accompanying footnotes and percentage ownership is based on 42,535,986 shares of common stock (which is equivalent to 425,359,860 CDIs) outstanding on March 1, 2016. |

| (2) | Senrigan Master Fund is an investment vehicle managed by Senrigan Capital. Senrigan Capital is an asset management company founded by Nick Taylor in 2009 to focus on Asia Pacific event driven strategies. The firm invests in companies undergoing, or anticipated to undergo, transformative events, including mergers and acquisitions and capital markets transactions. Nick Taylor is the majority shareholder of Senrigan Capital. The business address of the Senrigan Master Fund is Ugland House, Grand Cayman, KY-1104, Cayman Islands. The number of shares of common stock beneficially owned by Senrigan Master Fund includes 5,753,078 shares issuable on conversion of the Notes held by it. |

- 10 -

| (3) | The address of Goldman Sachs International is c/o Goldman Sachs (Asia) L.L.C. 68th Floor, Cheung Kong Center, 2 Queen’s Road Central, Hong Kong. The number of shares of common stock beneficially owned by Goldman Sachs International includes 5,753,078 shares issuable on conversion of the Notes held by it. |

| (4) | The address of Domain Partners is One Palmer Square, Suite 515, Princeton, NJ 08542. 3,606,002 of the shares of common stock are held directly by Domain Partners V, L.P. and 85,186 of the shares are held directly by DP V Associates, L.P. One Palmer Square Associates V, L.L.C. is the general partner of Domain Partners V, L.P. and DP V Associates L.P.. The managing members of One Palmer Square Associates V, L.L.C. share voting and dispositive power with respect to the shares. The managing members of One Palmer Square Associates V, L.L.C. consist of James C. Blair, Brian H. Dovey, and Jesse I. Treu. Each of these individuals disclaims beneficial ownership except to the extent of their respective pecuniary interest therein. |

| (5) | The address of Elliott Associates, L.P. is 40 West 57th Street, 30th Floor, New York, NY 10019. Elliott Associates, L.P. has voting and dispositive power with respect to the shares. The general partners of Elliott Associates, L.P. are Paul E. Singer (“Singer”), Elliott Capital Advisors, L.P., a Delaware limited partnership (“Capital Advisors”), which is controlled by Singer, and Elliott Special GP, LLC, a Delaware limited liability company (“Special GP”), which is controlled by Singer. |

| (6) | The address of Saints Capital Everest, L.P. is 2020 Union Street, San Francisco, CA 94123. Saints Capital Everest, LLC is the general partner of Saints Capital Everest, L.P. and has voting and dispositive power with respect to the shares. The Managing Members of Saints Capital Everest, LLC consist of Scott Halsted, Ken Sawyer, and David Quinlivan. Each of these individuals disclaims beneficial ownership except to the extent of their respective pecuniary interest therein. |

| (7) | The address of Brookside Capital Partners Fund, L.P. is John Hancock Tower, 200 Clarendon St., Boston, MA 02116. 2,783,204 of the shares are held directly by Brookside Capital Partners Fund, LP and 181,818 of the shares are held by Brookside Capital Trading Fund L.P. |

| (8) | The address for Stephen Feinberg is c/o Cerberus Capital Management, L.P., 875 Third Avenue, New York, NY 10022. Cerberus America Series Two Holdings, LLC holds 27,232 shares of common stock, Cerberus International, Ltd. holds 1,036,056 shares of common stock, Cerberus Partners, L.P. holds 436,491 shares of common stock, Cerberus Series Four Holdings, LLC holds 1,089,068 shares of common stock, and Gabriel Assets, LLC (collectively with Cerberus America Series Two Holdings, LLC, Cerberus International, Ltd., Cerberus Partners, L.P. and Cerberus Series Four Holdings, LLC, the “Cerberus Entities”) holds 295,579 shares of common stock. Stephen Feinberg, through one or more entities, possesses the sole power to vote and the sole power to direct the disposition of all securities of REVA held by the Cerberus Entities. |

| (9) | The address of Medtronic, Inc. is 710 Medtronic Parkway, Minneapolis, MN 55432. |

| (10) | Includes options to purchase 197,500 shares that are immediately exercisable. |

| (11) | Includes options to purchase 292,500 shares that are immediately exercisable. |

| (12) | Includes 5,000 shares held by the Schultz Family Trust. Also includes options to purchase 554,500 shares that are immediately exercisable. |

| (13) | Includes options to purchase 440,925 shares that are immediately exercisable. |

| (14) | Includes 3,606,002 shares of common stock held by Domain Partners V, L.P., 85,186 shares of common stock held by DP V Associates, L.P. One Palmer Square Associates V, L.L.C. is the general partner of Domain Partners V, L.P. and DP V. Associates L.P. and has voting and dispositive power with respect to the shares. The managing members of One Palmer Square Associates V, L.L.C. consist of James C. Blair, Brian H. Dovey, and Jesse I. Treu. Mr. Dovey disclaims beneficial ownership except to the extent of his pecuniary interest therein. |

| (15) | Includes options to purchase 105,000 shares that are immediately exercisable. |

| (16) | Includes 21,482 shares held by Stratford Gem Pty Ltd., as trustee for the Anne Keating Super Fund. Ms. Keating is the beneficial owner and has voting and dispositive power with respect to these shares. |

| (17) | Includes 1,347,070 shares of common stock held by Kenneth Rainin Administrative Trust U/D/T Dated 3/26/1990 and 227,718 shares held by Mr. Stockman’s spouse Lisa Stockman. Mr. Stockman, along with Jennifer Rainin, are co-trustees of the Kenneth Rainin Administrative Trust U/D/T Dated 3/26/1990 and have voting and dispositive power with respect to these shares. Mr. Stockman disclaims beneficial ownership except to the extent of his pecuniary interest therein. Includes options to purchase 970,000 shares that are immediately exercisable. |

| (18) | Includes 75,000 shares held by two superannuation funds established by Mr. Thomas. Mr. Thomas is the beneficial owner and has voting and dispositive power with respect to these shares. |

- 11 -

ADDITIONAL INFORMATION

Stockholder Proposals for 2016 Annual Meeting

Our 2016 annual general meeting of stockholders (the “2016 Annual Meeting”) is scheduled for 26 May 2016, Australian Eastern Standard Time. The deadline for submitting stockholder proposals for inclusion in our proxy statement for the 2016 Annual Meeting pursuant to Rule 14a-8 of the Securities Exchange Act of 1934 has passed. The deadline for bringing any business (including director nominations) before the 2016 Annual Meeting pursuant to amended and restated bylaws is between 90 and 120 days prior to the anniversary of the 2015 Annual Meeting; therefore, the deadline for bringing business (including director nominations) before the 2016 Annual Meeting was February 27, 2016.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available to the public online at the SEC’s website at www.sec.gov. You also may read and copy any SEC filings at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room.

We make available, free of charge on our website, all of our filings that are made electronically with the ASX and the SEC, including Forms 10-K, 10-Q, and 8-K. These materials can be found in the “Investors” section under “ASX Announcements” and “SEC Filings” of our website at www.revamedical.com. Copies of our 2014 10-K are also available without charge to stockholders upon written request addressed to: Corporate Secretary, REVA Medical, Inc., 5751 Copley Drive, San Diego, California 92111, U.S.A.

Incorporation by Reference

In certain circumstances, the SEC allows us to incorporate by reference the information we file with them. This allows us to disclose important information to you by referencing those filed documents.

We filed a definitive proxy statement with the SEC on October 14, 2014 (File Number 000-54192) in connection with the original issuance of the Notes and “Annex A – Convertible Note Deed” of that proxy statement is hereby incorporated by reference

- 12 -

We will provide without charge, to each person to whom a proxy is delivered, upon written or oral request of such person and by first class mail or other equally prompt means within one business day of receipt of such request, a copy of any and all of the information that has been incorporated by reference in this proxy statement. Such requests should be sent to: REVA Medical, Inc., 5751 Copley Drive, San Diego, California 92111, U.S.A., Attention: Corporate Secretary.

Householding of Special Meeting Materials

We have adopted “householding,” a procedure approved by the SEC under which our stockholders who share an address will receive a single copy of the Proxy Statement, or a single notice addressed to those stockholders. This procedure reduces printing costs and mailing fees, while also reducing the environmental impact of the distribution. If you reside at the same address as another stockholder and wish to receive a separate copy of the applicable materials, you may do so by making a written or oral request to: REVA Medical, Inc., 5751 Copley Drive, San Diego, CA 92111, U.S.A. Attention: Investor Relations; by calling, (858) 966-3045; or, by e-mailing toIR@revamedical.com. Upon your request, we will promptly deliver a separate copy to you. The Proxy Statement is also available atwww.envisionreports.com/RVA.

|

| By order of the Board of Directors, |

|

| /s/Katrina L. Thompson |

| Katrina L. Thompson |

| Chief Financial Officer and Secretary |

- 13 -

ANNEX A

FIRST AMENDMENT TO CONVERTIBLE NOTE DEED

A-1

FIRST AMENDMENT TO CONVERTIBLE NOTE DEED

THIS FIRST AMENDMENT TO CONVERTIBLE NOTE DEED (this “Amendment”), is made as of February 11, 2016, by and among REVA Medical, Inc. (the “Company”), and Goldman Sachs International and Senrigan Master Fund (the “Noteholders”), and is entered into with respect to the Convertible Note Deed, dated September 25, 2014, by and among the Company and the Noteholders (collectively, the “Deed”). Unless otherwise indicated, words and terms which are defined in the Deed shall have the same meaning where used herein.

RECITALS

WHEREAS, pursuant to clause 29.10 of the Deed, the Company and the Noteholders wish to, among other things, amend clauses 6.3 and 6.14.2 of the Deed;

WHEREAS, the effectiveness of this Amendment is subject only to the Company having received approval from its Securityholders, in accordance with ASX Listing Rule 7.1 (“Securityholder Approval”);

WHEREAS, the Noteholders have approved entering into this Amendment by Unanimous Resolution; and

WHEREAS, the Board has adopted a resolution approving entry into this Amendment.

NOW, THEREFORE, in consideration of the undertakings and the mutual agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, IT IS AGREED THAT:

1.Amendments to the Deed. Immediately upon (x) execution and delivery of this Amendment by the Company and the Noteholders and (y) receipt of the Securityholder Approval, the Deed is hereby amended as follows:

| | a. | Clause 6.3 of the Deed is hereby amended and restated in its entirety to read as follows: |

“At any time on or prior to June 1, 2017, a Noteholder may give the Company an irrevocable notice in writing electing to redeem all or some of the Notes held by the Noteholder for the Redemption Amount (Optional Redemption Notice). Upon receipt by the Company of such Optional Redemption Notice, and provided that a Note has not otherwise been Converted in accordance with clauses 6.9 to 6.13 (inclusive) or been redeemed or cancelled, the Company must, in respect of such Notes, redeem such Notes for the Redemption Amount, which will become immediately due and payable on June 30, 2017 (Optional Redemption Date), and pay the relevant Redemption Amount to the Noteholder on June 30, 2017 and the Notes so redeemed will be cancelled and incapable of being Converted

| | b. | Clause 6.14.2 of the Deed is hereby amended and restated in its entirety to read as follows: |

“the CE Mark Approval Event has occurred and the Company has completed the listing of its shares on NASDAQ or any other securities exchange approved by a Majority of Noteholders.”

2.Continued Validity of Deed. Except as amended by this Amendment, the Deed shall continue in full force and effect as originally constituted and are ratified and affirmed by the parties hereto.

A-2

3.Authorization. Each party represents to the others that the individual executing this Amendment on such party’s behalf is the duly appointed signatory of such party to this Amendment and that such individual is authorized to execute this Amendment by or on behalf of such party and to take all action required by the terms of this Amendment.

4.Securityholder Approval. Within 50 calendar days of the date of this Amendment, the Company shall (a) do all things necessary to seek Securityholder Approval for this Amendment and convene a meeting of Securityholders for that purpose and (b) use its best efforts to ensure that Securityholder Approval is obtained at that meeting. Following receipt of Securityholder Approval, the Company shall promptly, and in event within two (2) Business Days, provide written notice thereof to the Noteholders.

5.Captions. Section headings and numbers have been set forth herein for convenience only. Unless the contrary is compelled by the context, everything contained in each section applies equally to this entire Amendment.

6.No Novation. This Amendment is not intended to be, and shall not be construed to create, a novation or accord and satisfaction, and, except as otherwise provided herein, the Deed shall remain in full force and effect.

7.Severability. Each provision of this Amendment shall be severable from every other provision of this Amendment for the purpose of determining the legal enforceability of any specific provision.

8.Entire Agreement. This Amendment constitutes the entire agreement between the Company and the Noteholders with respect to the subject matter hereof and supersedes all prior and contemporaneous negotiations, communications, discussions and agreements concerning such subject matter.

9.Counterparts. This Amendment may be executed in any number of counterparts, and by Noteholders and Company in separate counterparts, each of which shall be an original, but all of which shall together constitute one and the same agreement.

10.Governing Law. This Amendment shall be governed by and construed in accordance with the laws of the State of Delaware without resort to the State’s conflicts of laws rules.

A-3

IN WITNESS WHEREOF the parties hereto, on the day and year first hereinbefore written, caused this Amendment to be dulyEXECUTED AS A DEEDand have hereunto set their hands and seals.

|

| Executed byREVA Medical, Inc. by its duly authorised officers: |

|

| /s/ Katrina L. Thompson, CFO |

| Signature of authorised officer |

|

| Katrina L. Thompson |

| Name of authorised officer (print) |

|

| Executed byGoldman Sachs International by its duly authorised officer: |

|

| /s/ Piers Curle |

| Signature of authorised officer |

|

| Piers Curle |

| Name of authorised officer (print) |

|

| Executed bySenrigan Master Fund by its duly authorised officer: |

|

| /s/ Christopher Nash |

| Signature of authorised officer |

|

| Christopher Nash |

| Name of authorised officer (print) |

A-4

ANNEX B

SUMMARY OF CERTAIN KEY TERMS OF THE NOTE DEED

(excluding terms related to previously exercised options)

B-1

SUMMARY OF CERTAIN KEY TERMS OF THE NOTE DEED

(excluding terms related to previously exercised options)

Note Deed: The Convertible Note Deed dated September 25, 2014, entered into by and among the Company and Goldman Sachs International (“Goldman Sachs”) and Senrigan Master Fund (“Senrigan” and, together with Goldman Sachs, the “Noteholders”) as the holders of the convertible notes (“Notes”).

Face Value of Notes: Notes each have a face value of US$100,000.

Form and status: the Notes are direct, unsubordinated, unconditional and unsecured obligations of the Company in certificated form, and will at all times rankpari passu in right of payment with all other existing and future unsecured and unsubordinated senior obligations of the Company (other than unsecured obligations preferred by mandatory provisions of law) and senior in right of payment to all existing and future subordinated obligations of the Company.

Maturity: the Notes mature and shall be repaid in an amount equal to Face Value plus accrued Interest on the earlier to occur of an event of default (as defined in the Note Deed) or the date 60 months from the date of issue of the Notes unless a Note has been previously converted, redeemed, or cancelled.

Optional Redemption: under the existing terms of the notes, a Noteholder may elect to cause the Company to redeem all or some of its Notes which have not otherwise been converted, redeemed, or cancelled on the date that is 26 months after the date of issue of the Notes (which would be January 14, 2017), at an amount equal to Face Value plus accrued Interest, upon providing the Company with at least 30 calendar days prior written notice.We propose to amend this provision, as further described in the proxy statement. If Proposal 1 is approved, the early redemption date would be extended to June 30, 2017.

Redemption following a Change of Control Event: following the occurrence of certain change of control events, as further described in the Note Deed, each Noteholder may give the Company an irrevocable notice requiring the Company to redeem all or any part of their Notes for the greater of (a) the Face Value of the Notes plus accrued Interest or (b) the Cash Settlement Amount (defined under “Option Conversion” below), provided Noteholder gives written notice of its decision to redeem within five business days of the change of control event.

Stockholder rights: the Notes do not provide the holder voting rights or other rights as a stockholder of the Company unless and until converted.

Interest: interest accrues in respect of the Notes at the rate of 7.54% per annum (increased to 9.54% per annum if any payments are past due); provided that interest is payable only upon redemption of the Notes for cash. No interest is payable on any Note that is converted into shares of common stock (represented by CDIs) in accordance with the terms of the Note Deed.

Optional Conversion: at any time prior to the maturity date, a Noteholder may give the Company an irrevocable notice electing to convert (the “Conversion Notice”) all or some of the Notes held by the Noteholder and specifying the number of Notes the Noteholder is electing to convert into shares of the Company’s common stock (represented by CDIs).

The terms of the Notes contain provisions for the adjustment of the conversion price, which is initially A$2.50 per share of our common stock (or A$0.25 per CDI), subject to adjustment as described under “Adjustment of Conversion Price” below.

The number of shares of the Company’s common stock (equivalent to ten CDIs) to be issued upon conversion of the Notes is determined by dividing the face value of the Note converted (translated from U.S. dollars into Australian dollars at the exchange rate fixed on the subscription date for the Note) by the conversion price in effect on the conversion date.

Upon receipt of a Conversion Notice, the Company may, in lieu of issuing shares of common stock (represented by CDIs) to the Noteholder, give the Noteholder notice that the Company is electing to redeem the Notes subject to the Conversion Notice for an amount equal to the number of CDIs which would have been issued on conversion multiplied by the average daily volume-weighted average price on the ASX of the CDIs during the 20 trading days after receipt of the Conversion Notice (the “Cash Settlement Amount”).

B-2

Adjustment of Conversion Price (anti-dilution protection): the terms of the Notes contain provisions for the adjustment of the conversion price upon the occurrence of certain events, including reorganization of issued capital, certain dividends, distributions, and issuance by the Company of equity securities at a price below current market value. If such events occur, the conversion price will be adjusted in accordance with the terms of the Note Deed to ensure the economic value of the Notes is not adversely affected by the event.

Automatic Conversion: under the existing terms of the Notes, Noteholders shall automatically be deemed to have given the Company an irrevocable Conversion Notice in respect of all of the Notes then held by the Noteholder in the event that both (a) the average daily volume weighted-average price of the Company’s CDIs as traded on the ASX equals or exceeds A$0.60 for a period of 20 consecutive trading days and (b) the Company has received CE Mark approval for itsFantom product.We propose to amend this provision. If Proposal 1 is approved, the Note Deed Amendment would add a third condition that we complete the listing of our shares on NASDAQ (or another securities exchange approved by a majority of Noteholders) for an automatic conversion of the Notes to take place.

Restrictions on Transfer: subject to certain conditions, a Note or Option may be assigned or transferred to affiliates of the Noteholder, other Noteholders, and to any party that is not a competitor (as defined in the Note Deed) of the Company, provided that the Notes may be transferred to any person, including a competitor of the Company, either upon the occurrence of a change of control event or while an event of default subsists.

Restrictions on issuance of Equity Securities: for so long as any Notes remain outstanding, the Company may not raise additional capital through the sale or issuance of its equity securities (or securities convertible or exercisable for such securities) except (i) upon the exercise or conversion of securities currently outstanding, (ii) up to an aggregate of 8,700,000 shares of common stock upon the issuance of securities pursuant to the Company’s incentive equity plans, (iii) upon a stock split or stock dividend to all holders of the Company’s common stock, (iv) as contemplated in the context of an initial public offering of the Company shares of common stock and associated listing on NASDAQ or following such an offering, (v) to the extent, acting in good faith and in accordance with their fiduciary duties to the Company under applicable law, the directors of the Company form the view that the failure to make such an offering would be a breach of their fiduciary duties, or (v) in certain other limited circumstances set forth in the Note Deed.

Right of First Refusal: the Noteholders shall have a right of first offer and right of first refusal to acquire all or any portion of any finance debt (as defined in the Note Deed) that the Company determines to raise while the Notes remain outstanding, subject to certain limited exceptions.

Covenants: for so long as any Notes remain outstanding, the Company shall not take certain actions, including, among other things, (i) declaring or paying any dividend, (ii) issuing any finance debt (as defined in the Note Deed) in excess of $10,000,000, (iii) granting any security interest in respect of or dispose of the Company’s intellectual property, or (iv) substantially changing the general nature or scope of its business, subject to such exceptions as specified in the Note Deed.

NASDAQ Listing and Registration Rights: provisions of the Note Deed require the Company to use reasonable efforts to seek to list its common stock on NASDAQ as soon as practicable. Additionally, as a condition precedent to issue of the Notes and Options, the Company entered into an Amended and Restated Investors’ Rights Agreement with each Noteholder and each investor that was a party to the existing Amended and Restated Investors’ Rights Agreement with the Company dated December 16, 2010. The Amended and Restated Investors’ Rights Agreement is substantially in the form set forth in Schedule 8 to the Note Deed and provides each Noteholder, subject to the terms and conditions therein, with the right to require the Company to file a registration statement with the SEC in respect of any securities in the Company held by each such Noteholder to facilitate the sale of such securities on the same basis, and in the same circumstances, as each of the investors that are a party to the existing Amended and Restated Investors’ Rights Agreement.

Lock-Up Agreements: Robert B. Stockman (our Chairman) and Robert K. Schulz (our Chief Operating Officer and President) each have entered into Lock-Up Agreements with the Noteholders whereby each agreed for a period of two years from the date of issuance of the Notes, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale, file a registration statement with respect to, or otherwise dispose of (including entering into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequence of ownership interests) any shares or CDIs of the Company or any securities that are convertible into or exchangeable for, or that represent the right receive any shares or CDIs of the Company, subject to certain exceptions as further described in the form of Lock-Up Agreement in Schedule 7 of the Note Deed.

B-3

Modifications to Notes: provisions of the Notes may generally be modified, amended or waived by Noteholders that represent at least two-thirds of the outstanding principal face value amount of all outstanding Notes acting at a meeting or by written consent; provided, however, that unanimous consent of the Noteholders holding all of the outstanding Notes is required to, amongst other items, (i) extend the term of the Notes or their maturity date, (ii) reduce the amount of any payment of principal, interest, fees, or any other payment obligation of the Company, or (iii) change when and on what terms the Notes will convert or be redeemed, cancelled or otherwise repaid, or prepaid. The Noteholders have approved the Note Deed Amendment.

An “Event of Default” includes, in summary:

| | (a) | Failure to pay: a failure by the Company to pay an amount due under and in the manner required by the Note Deed; |

| | (b) | Cross default: finance debt of the Group that, in aggregate, exceeds US$1,000,000, is not paid when due or becomes due and payable prior to its maturity date; |

| | (c) | Revocation: an authorization, approval or consent material to the Company or its business is cancelled, repealed, revoked or terminated or has expired, amended or modified in a manner which is likely to have a material adverse effect (as defined in the Note Deed); |

| | (d) | Failure to perform: the Company or key management fails to perform any material obligation under the Note Deed, the Amended and Restated Investors’ Rights Agreement or the Lock-up Agreement; |

| | (e) | Misrepresentation: any warranty or representation made by the Company under the Note Deed becomes false or misleading or incorrect in any material respect when made; |