October 31, 2016 Approaching Commercialization Exhibit 99.2

Important Notice Not an Offer for Securities This presentation does not constitute an offer, invitation, solicitation or recommendation with respect to the purchase or sale of any security in the Company nor does it constitute financial product advice nor take into account your investment objectives, taxation situation, financial situation or needs. An investor must not act on the basis of any matter contained in this presentation but must make its own assessment of the Company and conduct its own investigations and analysis. Information is a Synopsis Only This presentation only contains a synopsis of information on the Company and, accordingly, no reliance may be placed for any purpose whatsoever on the sufficiency or completeness of such information. Information presented in this presentation is subject to change without notice and REVA does not have any responsibility or obligation to inform you of any matter arising or coming to their notice after the date of this presentation, which may affect any matter in the presentation. Forward-Looking Statements This presentation contains or may contain forward-looking statements that are based on management's beliefs, assumptions and expectations and on information currently available to management. All statements that are not statements of historical fact, including those statements that address future operating performance and events or developments that we expect or anticipate will occur in the future, are forward-looking statements, such as those statements regarding our ability to obtain regulatory approvals, timely and successfully complete our clinical trials, protect our intellectual property position, commercialize our products if and when approved, develop and commercialize new products, recruit and retain our key personnel, and estimates regarding our capital requirements and financial performance, including profitability. You should not place undue reliance on these forward-looking statements. Although management believes these forward-looking statements are reasonable as and when made, forward-looking statements are subject to a number of risks and uncertainties that may cause our actual results to vary materially from those expressed in the forward-looking statements, including the risks and uncertainties that are described in the "Risk Factors" section of our Annual Report on Form 10-K filed with the United States Securities and Exchange Commission (the “SEC”) on March 10, 2016, and as may be updated in our periodic reports thereafter. Any forward-looking statements in this presentation speak only as of the date when made. REVA does not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Disclaimer This presentation and any supplemental materials have been prepared by the Company based on available information. The information contained in this presentation is an overview and does not contain all information necessary to make an investment decision. Although reasonable care has been taken to ensure the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of such information and opinions and no reliance should be placed on such information or opinions. To the maximum extent permitted by law, none of the Company, or any of its members, directors, officers, employees, or agents or advisers, nor any other person accepts any liability whatsoever for any loss, however arising, from the use of the presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability arising from fault or negligence on the part of the Company or any of its directors, officers, employees, or agents.

Executive Summary Poised to enter large $4B global coronary stent market Fantom® – the next generation bioresorbable scaffold (BRS) Differentiated advantages for physicians – “performs like metal” Compelling & intuitive value proposition for patients – “treats then disappears” Demonstrated Clinical Success Excellent acute procedural success Strong safety profile with Low Major Adverse Cardiac Events (MACE) Expected CE Mark Approval in Q4 Application submitted, audits completed, manufacturing ready Building focused sales capability Next Milestone: CE Mark Approval

REVA Profile ASX listed (RVA:AX), SEC registered Market Cap: ~$420 million USD Supported by strong institutional investors and strategics Leveraging proprietary polymer Primary patent extends thru 2029 Exclusive rights to all vascular and embolic applications > 300 US & Foreign Patents HQ: San Diego, CA 58 employees An advanced biomaterials company focused on commercializing Fantom®, a next generation bioresorbable scaffold for treating cardiovascular disease

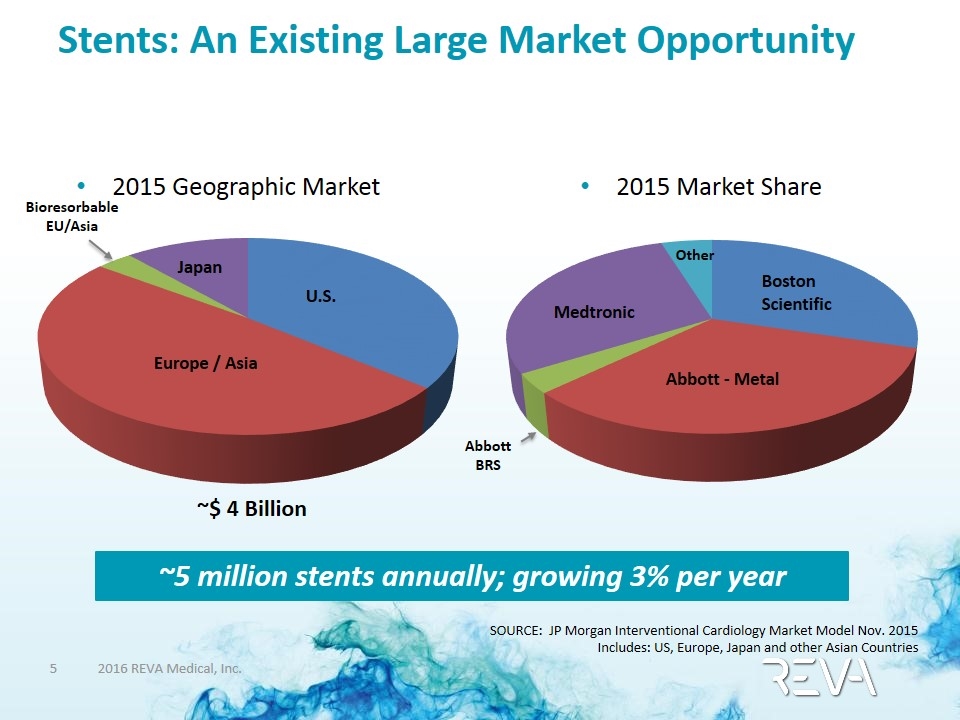

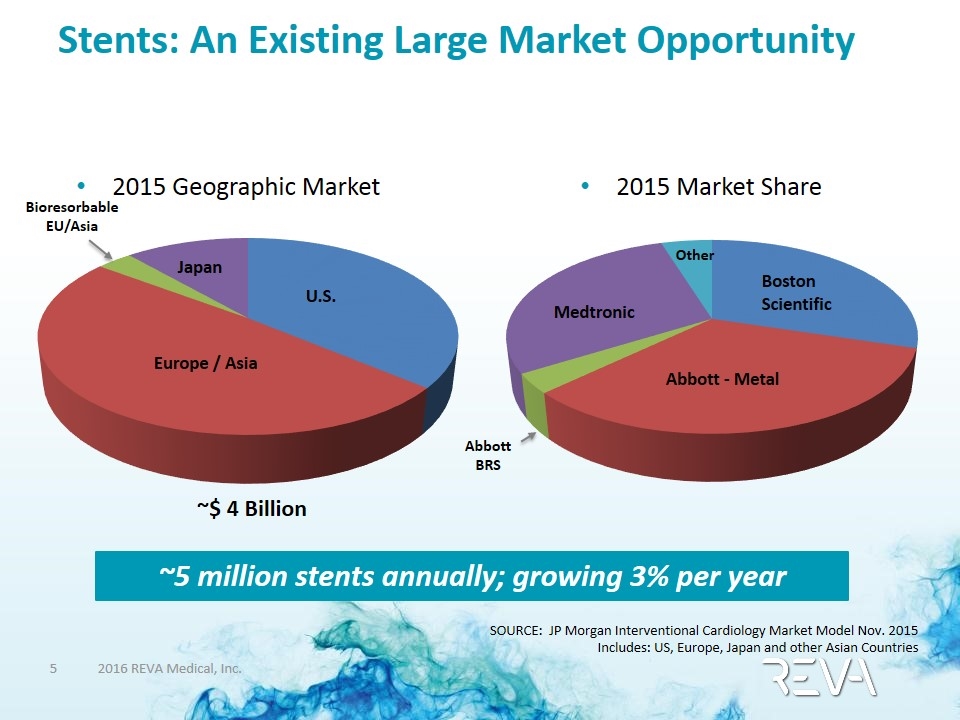

Stents: An Existing Large Market Opportunity 2015 Geographic Market SOURCE: JP Morgan Interventional Cardiology Market Model Nov. 2015 Includes: US, Europe, Japan and other Asian Countries 2015 Market Share ~5 million stents annually; growing 3% per year U.S. Europe / Asia Japan Bioresorbable EU/Asia Boston Scientific Abbott - Metal Medtronic Abbott BRS Other ~$ 4 Billion

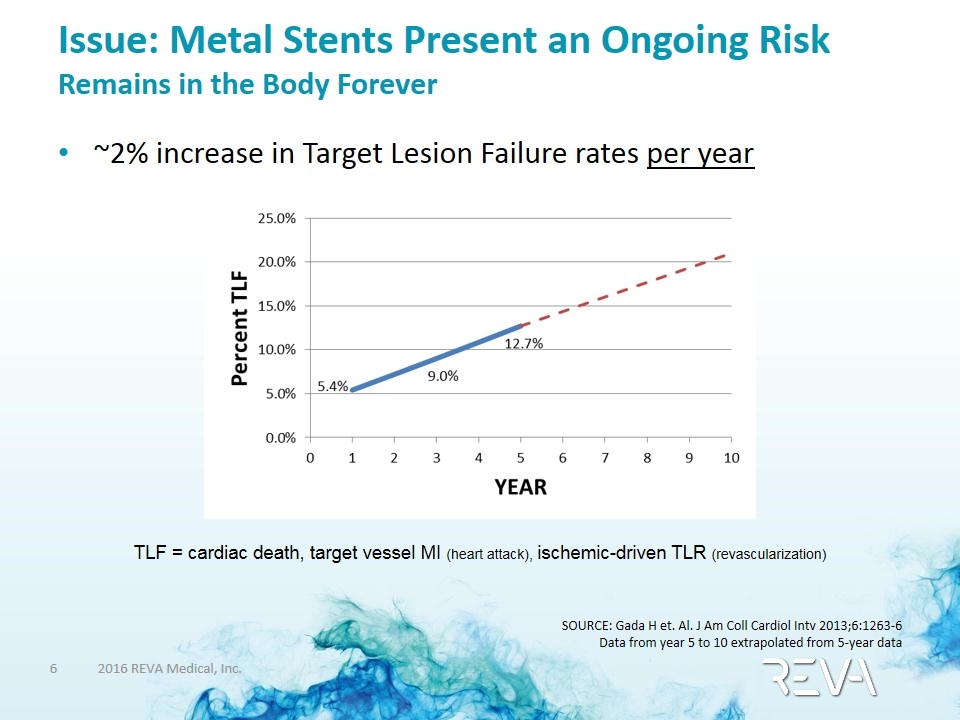

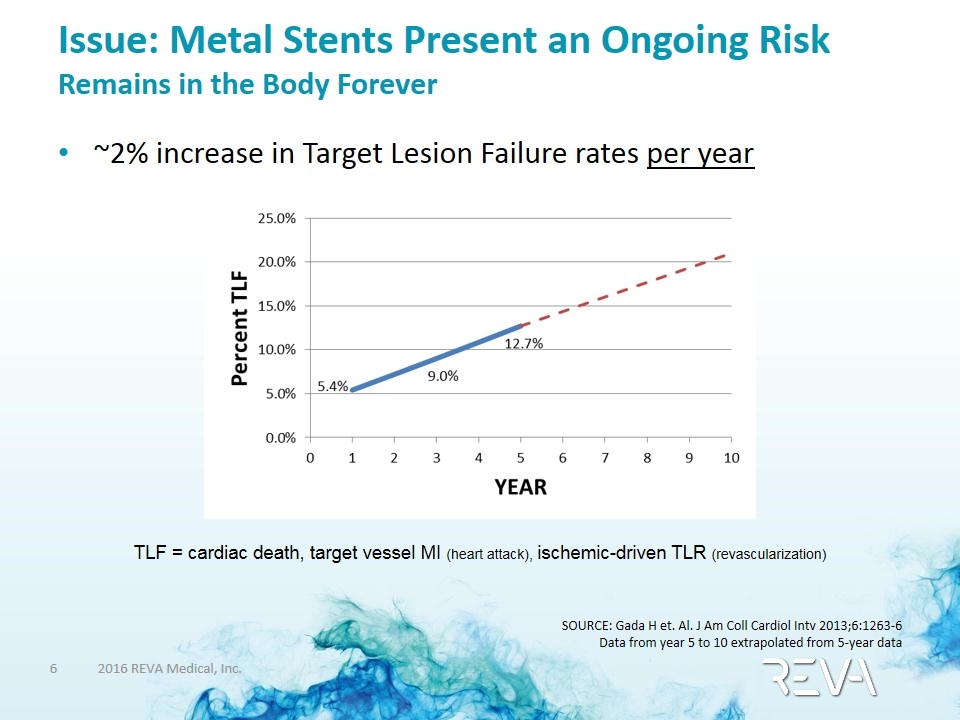

Issue: Metal Stents Present an Ongoing Risk Remains in the Body Forever ~2% increase in Target Lesion Failure rates per year SOURCE: Gada H et. Al. J Am Coll Cardiol Intv 2013;6:1263-6 Data from year 5 to 10 extrapolated from 5-year data TLF = cardiac death, target vessel MI (heart attack), ischemic-driven TLR (revascularization)

A Better Solution: Bioresorbable Scaffolds (BRS) Safety: May reduce long-term TLF rates Treatment Flexibility: Preserves future options Vasomotion: Returns vessel to its natural state Anti-coagulation: Long-term need eliminated Intuitive and Compelling Value Proposition Patient Demand Will Drive Adoption

BRS Named Top 10 Medical Innovation of 2017 Fantom – The Next Generation BRS SOURCE: Cleveland Clinic Top 10 Medical Innovations, 2017 14th Annual Cleveland Clinic Medical Innovation Summit

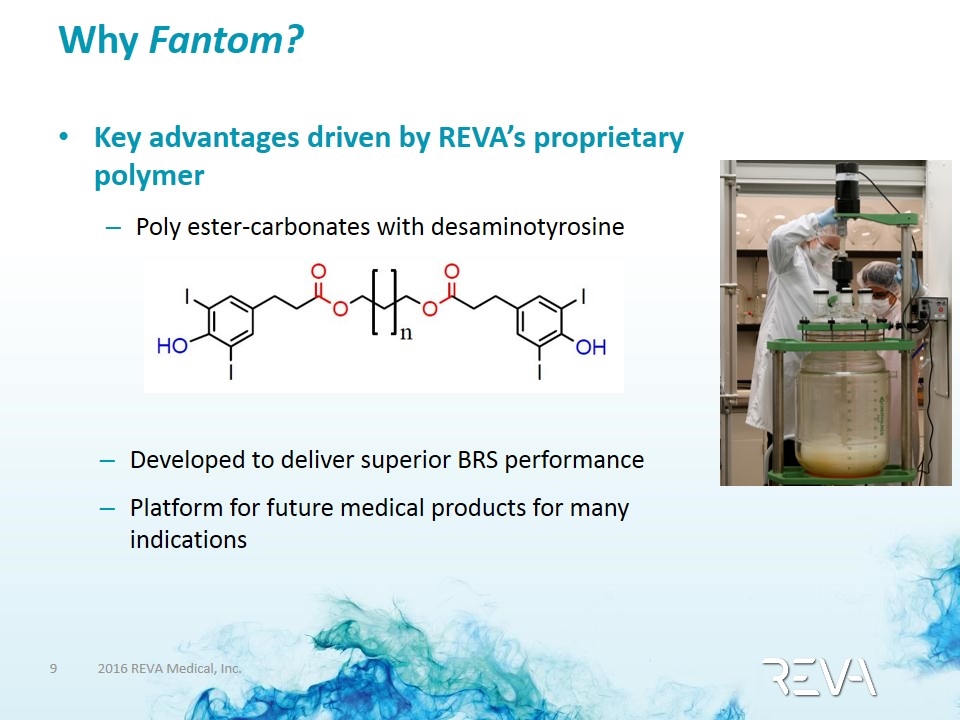

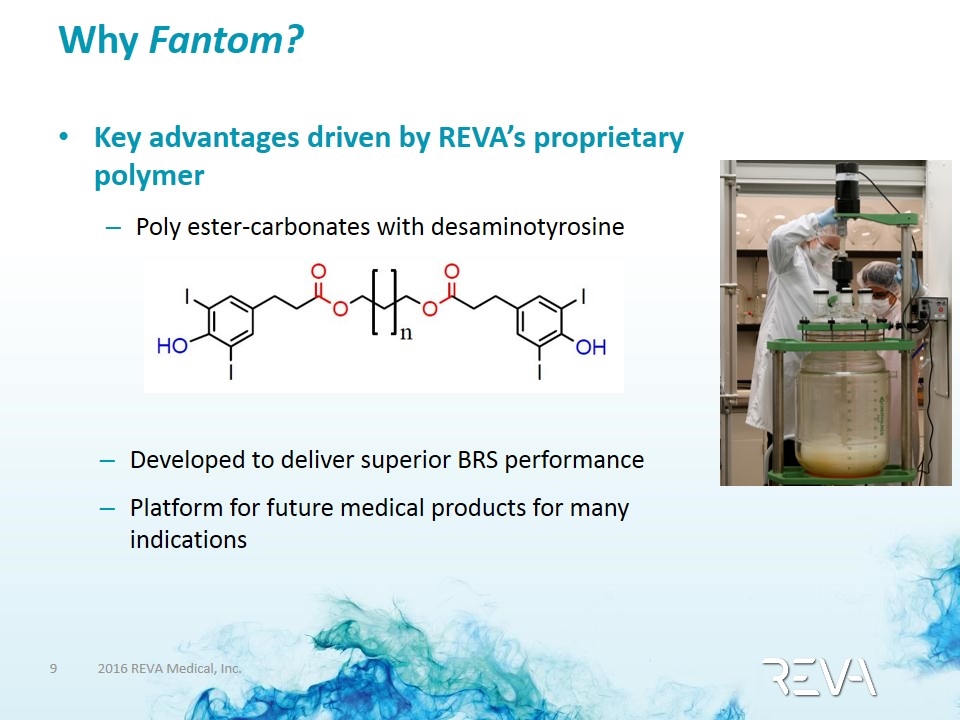

Why Fantom? Key advantages driven by REVA’s proprietary polymer Key advantages driven by REVA’s proprietary polymer Poly ester-carbonates with desaminotyrosine Developed to deliver superior BRS performance Platform for future medical products for many indications

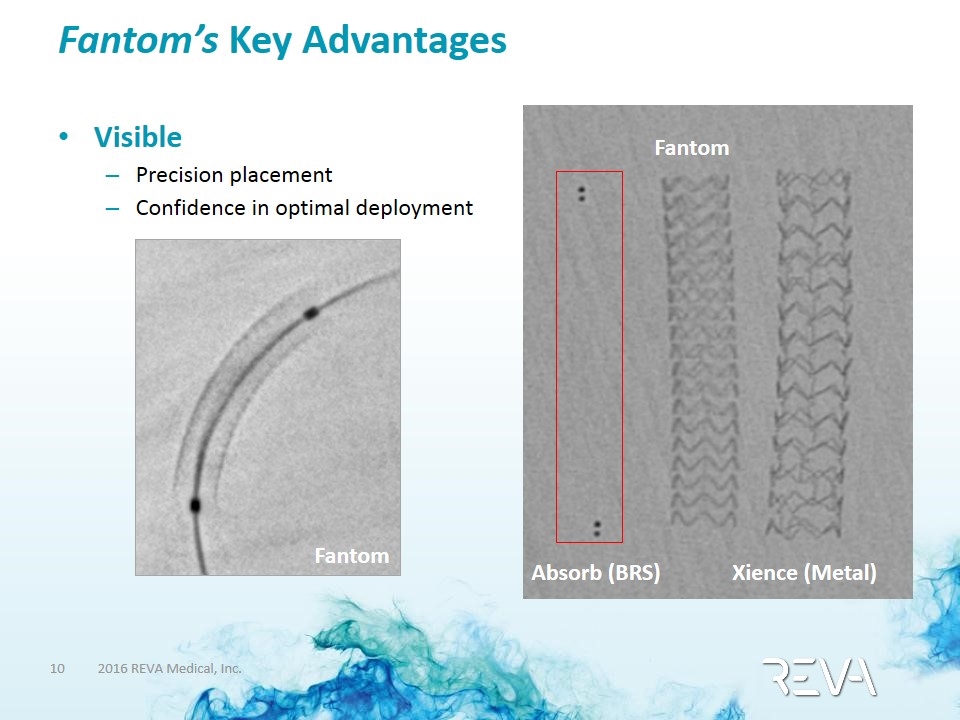

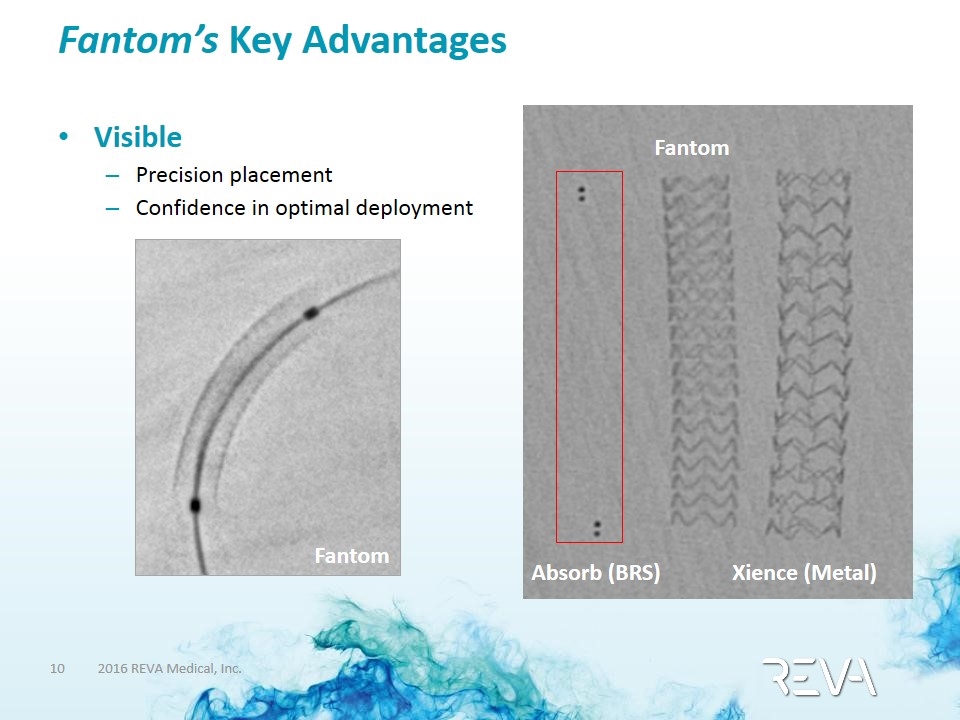

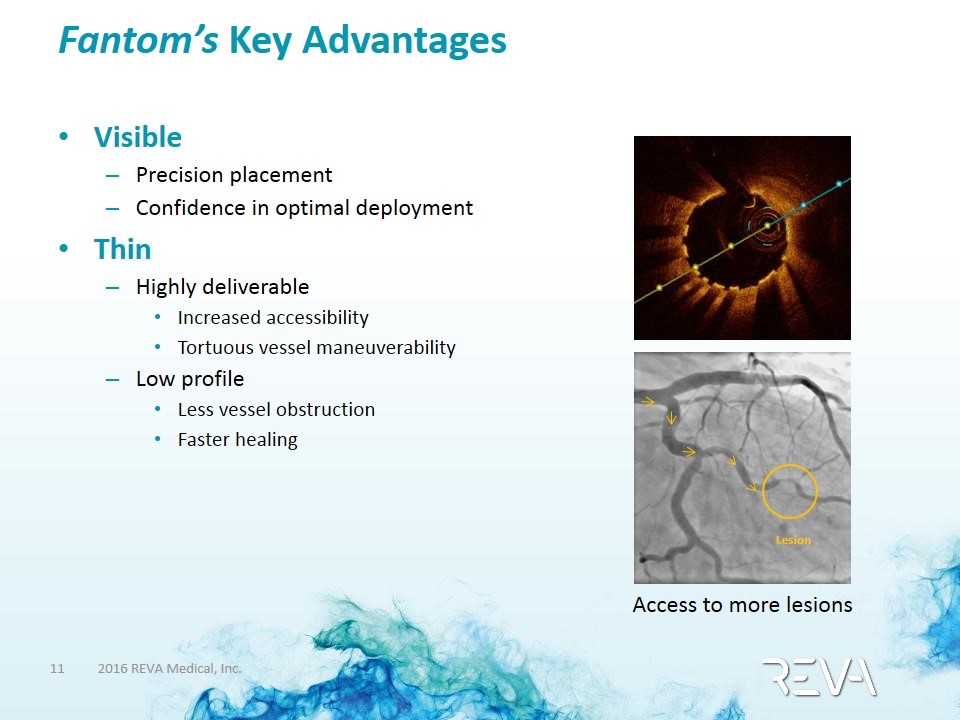

Fantom’s Key Advantages advantages driven by REVA’s proprietary polymer Visible Precision placement Confidence in optimal deployment Fantom Fantom Xience (Metal) Absorb (BRS)

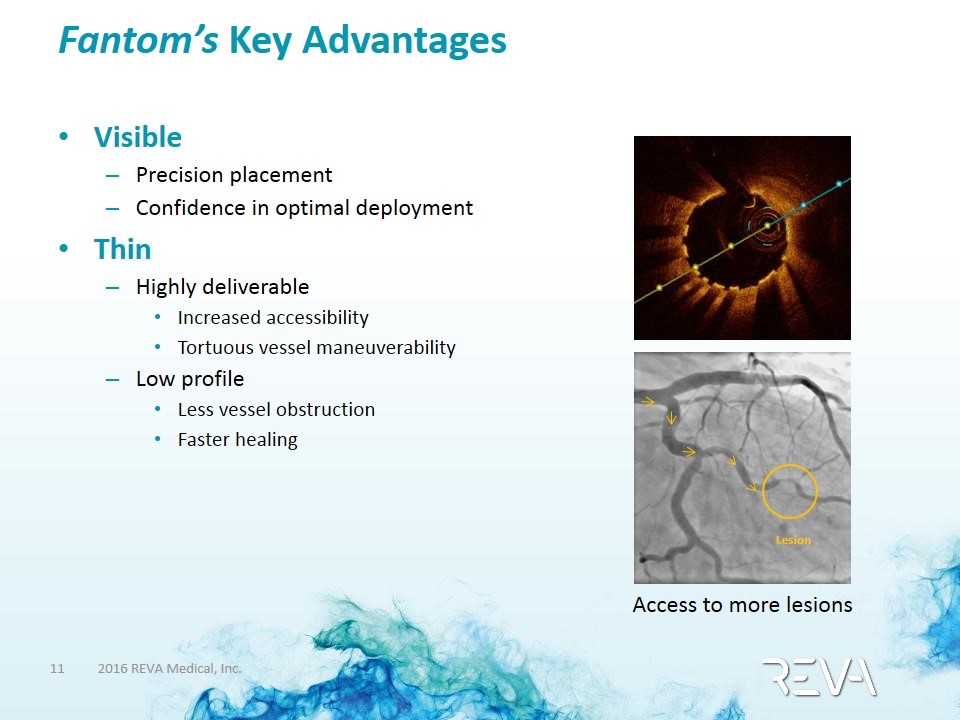

Fantom’s Key Advantages Key advantages driven by REVA’s proprietary polymer Visible Precision placement Confidence in optimal deployment Thin Highly deliverable Increased accessibility Tortuous vessel maneuverability Low profile Less vessel obstruction Faster healing Lesion Access to more lesions

Fantom’s Key Advantages Key advantages driven by REVA’s proprietary polymer Visible Precision placement Confidence in optimal deployment Thin Highly deliverable Increased accessibility Tortuous vessel maneuverability Low profile Less vessel obstruction Faster healing Easy to Use Simple single-step deployment Higher expansion tolerance Intra-procedural flexibility Straightforward, metal-like implant enables adoption without major changes to clinical practice

Fantom Performance Results from the FANTOM II Clinical Trial

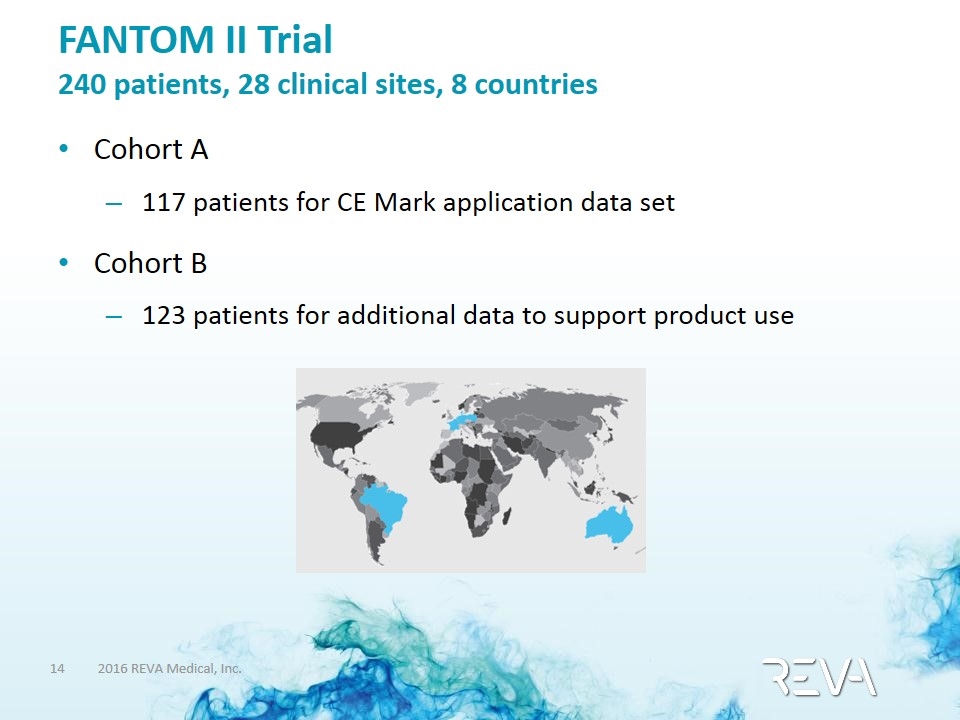

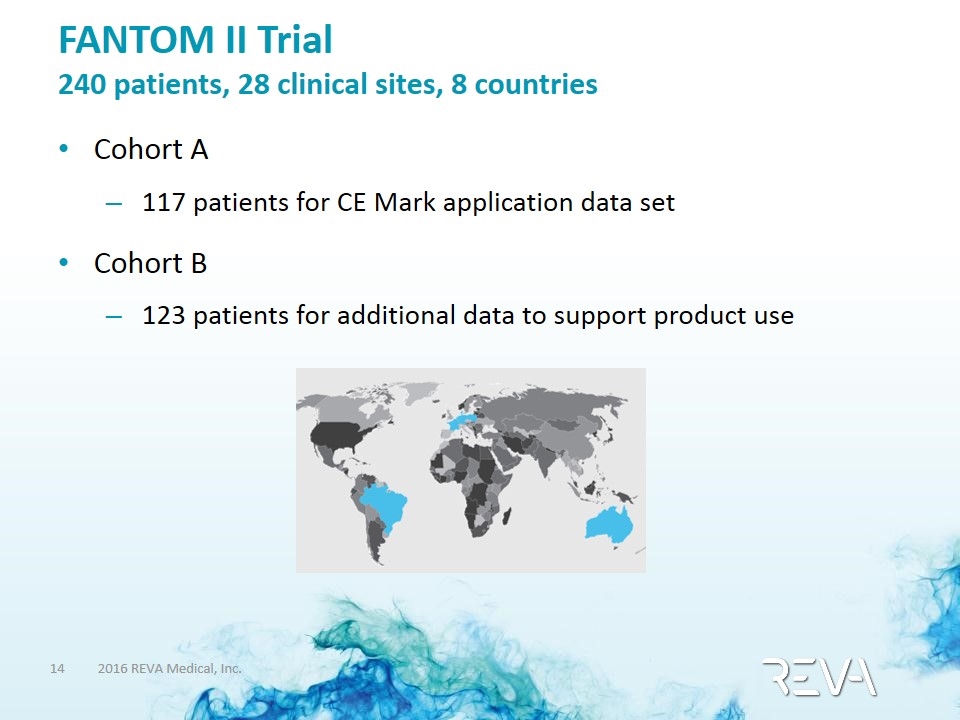

FANTOM II Trial 240 patients, 28 clinical sites, 8 countries Cohort A 117 patients for CE Mark application data set Cohort B 123 patients for additional data to support product use

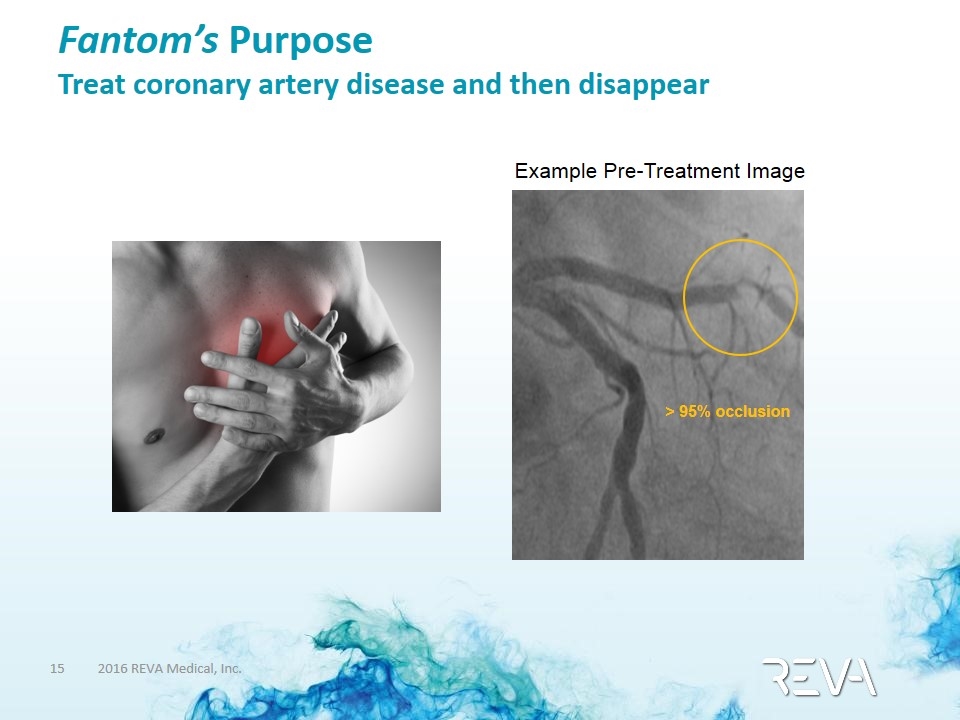

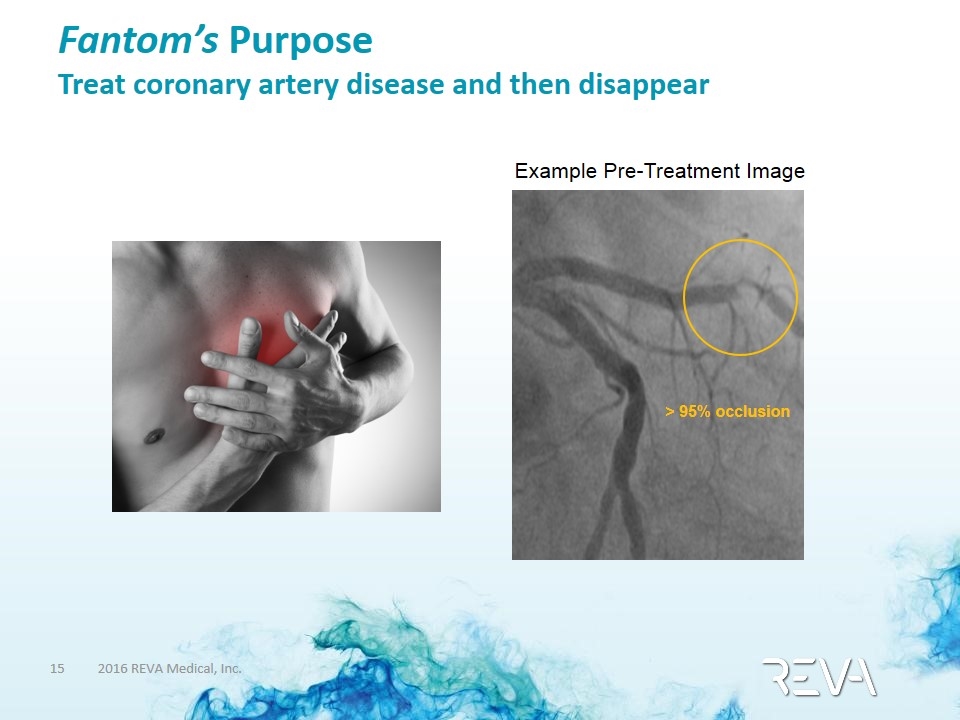

Fantom’s Purpose Treat coronary artery disease and then disappear > 95% occlusion Example Pre-Treatment Image

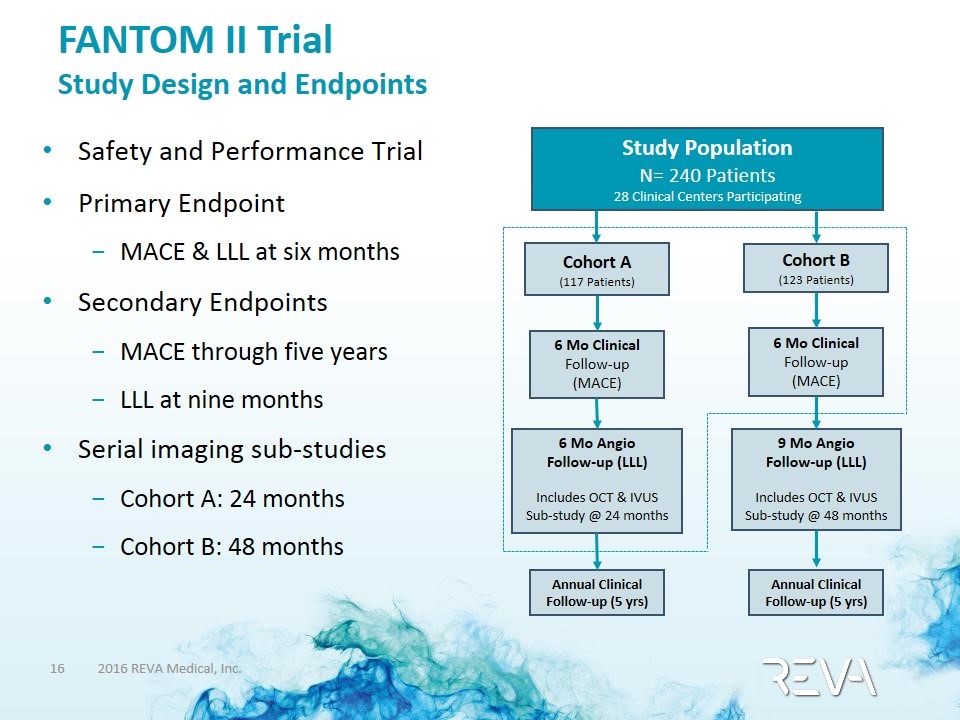

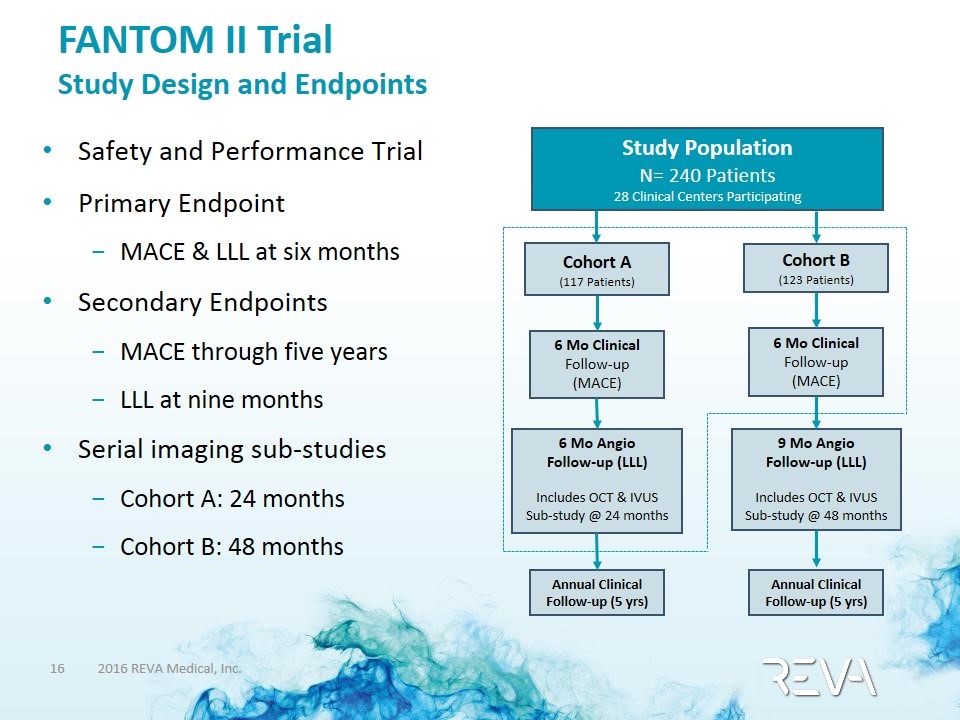

FANTOM II Trial Study Design and Endpoints Safety and Performance Trial Primary Endpoint MACE & LLL at six months Secondary Endpoints MACE through five years LLL at nine months Serial imaging sub-studies Cohort A: 24 months Cohort B: 48 months Study Population N= 240 Patients 28 Clinical Centers Participating Cohort A (117 Patients) 6 Mo Clinical Follow-up (MACE) Cohort B (123 Patients) 6 Mo Clinical Follow-up (MACE) 6 Mo Angio Follow-up (LLL) Includes OCT & IVUS Sub-study @ 24 months 9 Mo Angio Follow-up (LLL) Includes OCT & IVUS Sub-study @ 48 months Annual Clinical Follow-up (5 yrs) Annual Clinical Follow-up (5 yrs)

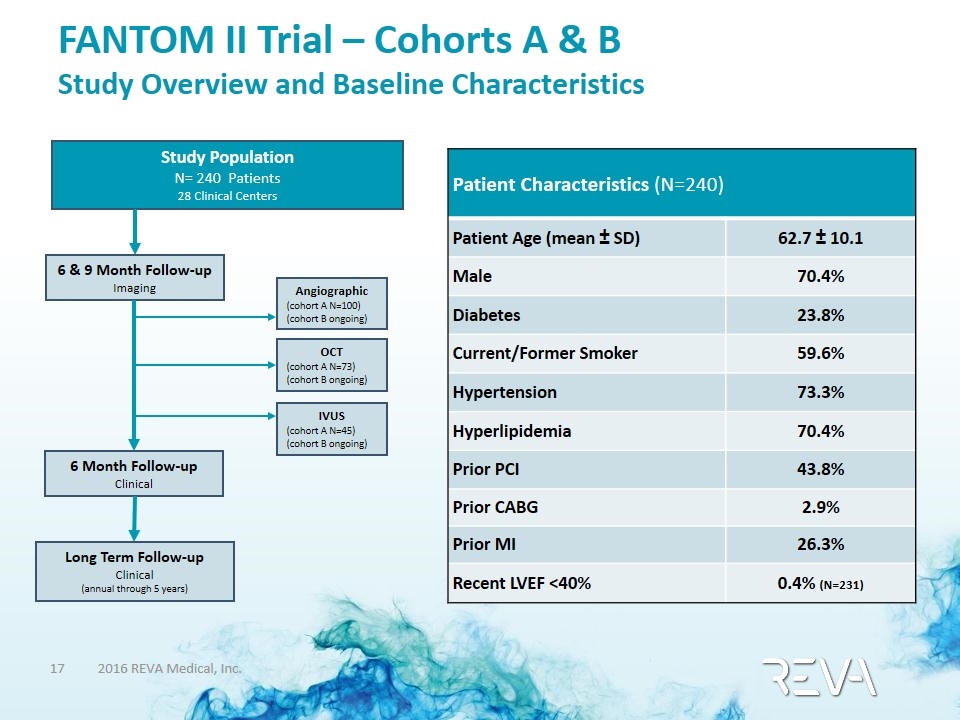

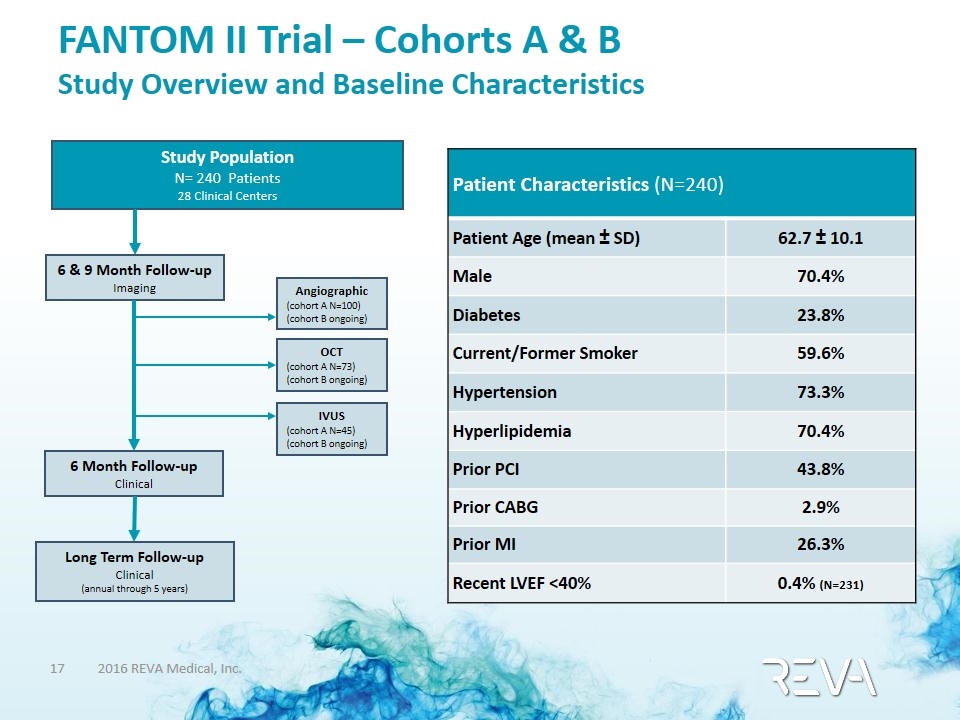

FANTOM II Trial – Cohorts A & B Study Overview and Baseline Characteristics Patient Characteristics (N=240) Patient Age (mean ± SD) 62.7 ± 10.1 Male 70.4% Diabetes 23.8% Current/Former Smoker 59.6% Hypertension 73.3% Hyperlipidemia 70.4% Prior PCI 43.8% Prior CABG 2.9% Prior MI 26.3% Recent LVEF <40% 0.4% (N=231) Study Population N= 240 Patients 28 Clinical Centers 6 & 9 Month Follow-up Imaging 6 Month Follow-up Clinical Angiographic (cohort A N=100) (cohort B ongoing) OCT (cohort A N=73) (cohort B ongoing) IVUS (cohort A N=45) (cohort B ongoing) Long Term Follow-up Clinical (annual through 5 years)

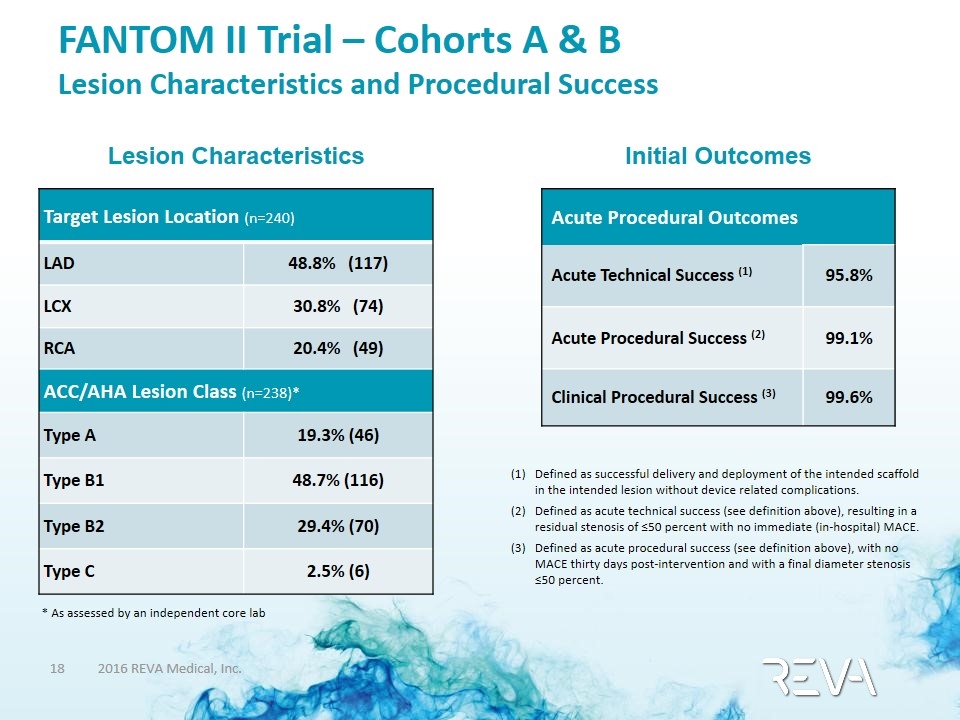

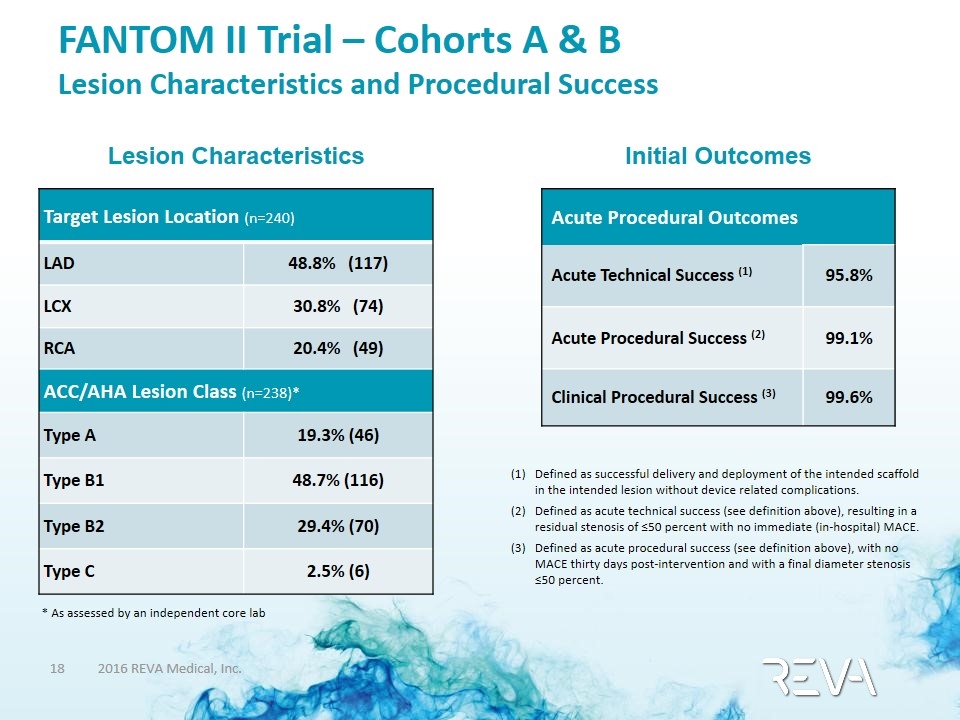

FANTOM II Trial – Cohorts A & B Lesion Characteristics and Procedural Success Target Lesion Location (n=240) LAD 48.8% (117) LCX 30.8% (74) RCA 20.4% (49) ACC/AHA Lesion Class (n=238)* Type A 19.3% (46) Type B1 48.7% (116) Type B2 29.4% (70) Type C 2.5% (6) Lesion Characteristics Initial Outcomes Acute Procedural Outcomes Acute Technical Success (1) 95.8% Acute Procedural Success (2) 99.1% Clinical Procedural Success (3) 99.6% Defined as successful delivery and deployment of the intended scaffold in the intended lesion without device related complications. Defined as acute technical success (see definition above), resulting in a residual stenosis of ≤50 percent with no immediate (in-hospital) MACE. Defined as acute procedural success (see definition above), with no MACE thirty days post-intervention and with a final diameter stenosis ≤50 percent. * As assessed by an independent core lab

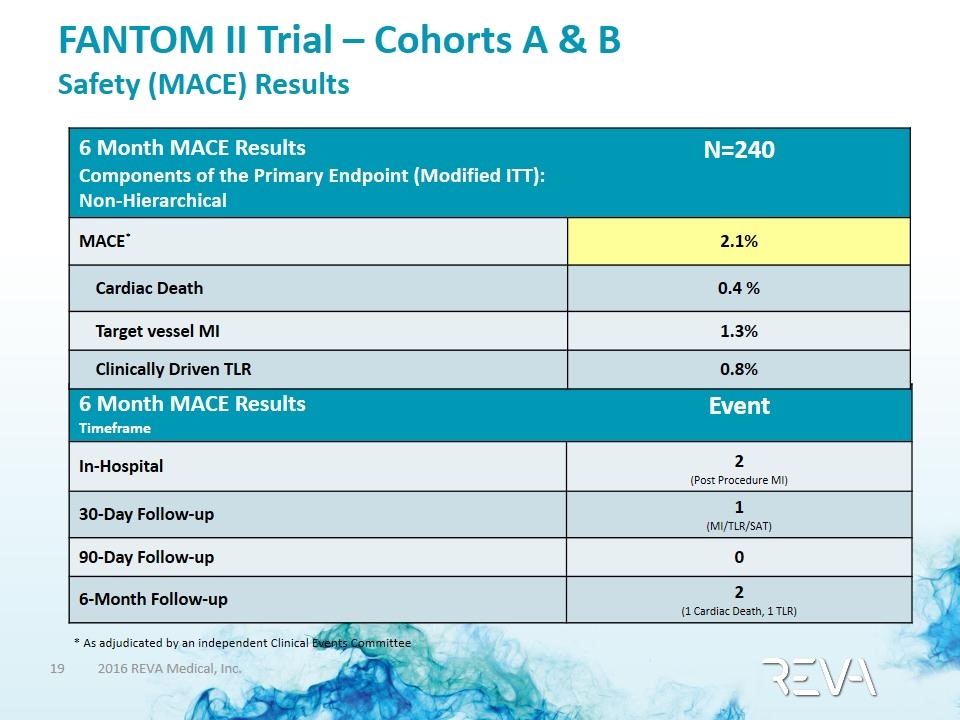

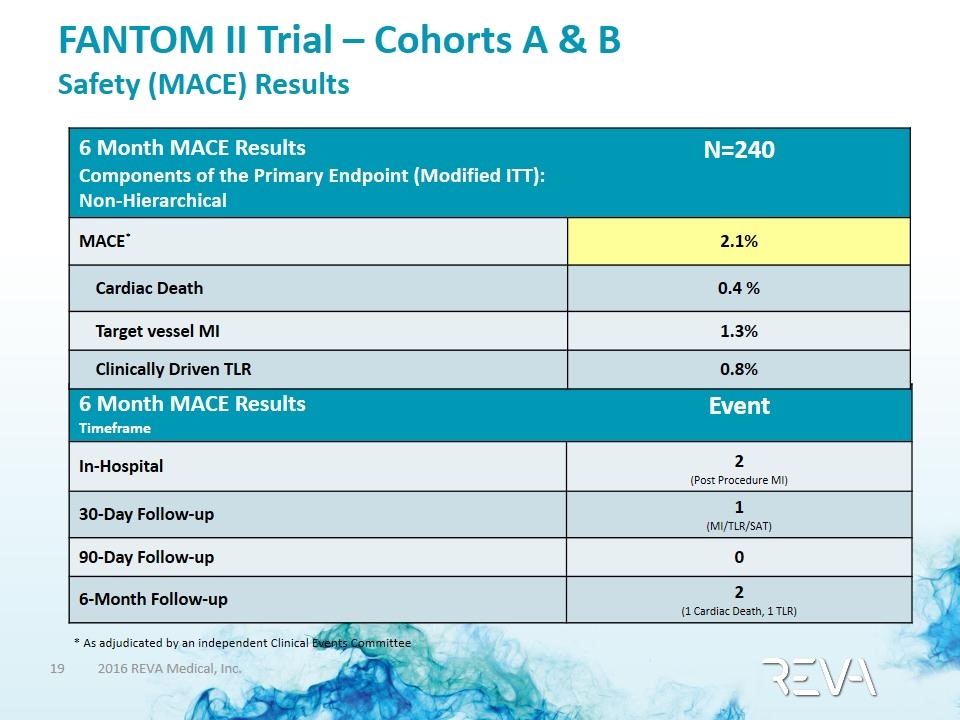

FANTOM II Trial – Cohorts A & B Safety (MACE) Results * As adjudicated by an independent Clinical Events Committee 6 Month MACE Results Timeframe Event In-Hospital 2 (Post Procedure MI) 30-Day Follow-up 1 (MI/TLR/SAT) 90-Day Follow-up 0 6-Month Follow-up 2 (1 Cardiac Death, 1 TLR) 6 Month MACE Results Components of the Primary Endpoint (Modified ITT): Non-Hierarchical N=240 MACE* 2.1% Cardiac Death 0.4 % Target vessel MI 1.3% Clinically Driven TLR 0.8%

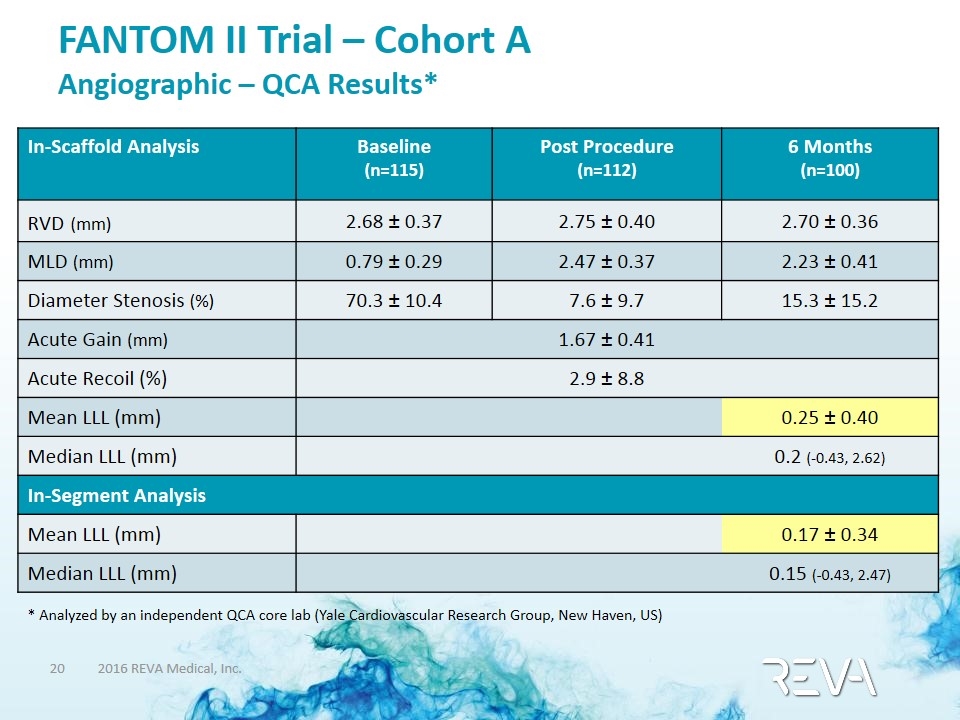

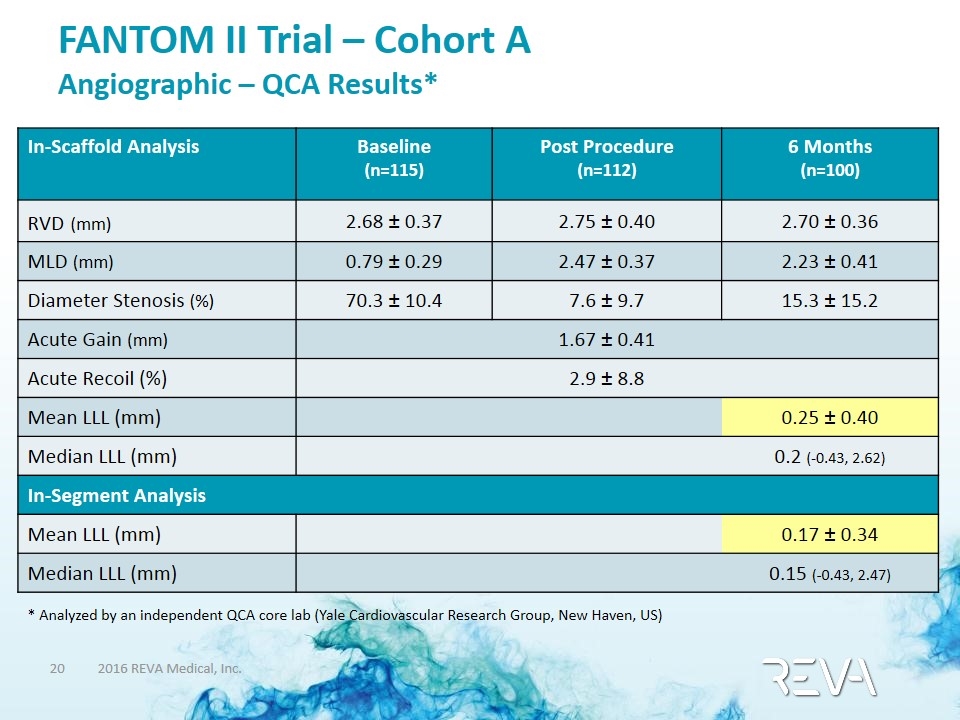

FANTOM II Trial – Cohort A Angiographic – QCA Results* In-Scaffold Analysis Baseline (n=115) Post Procedure (n=112) 6 Months (n=100) RVD (mm) 2.68 ± 0.37 2.75 ± 0.40 2.70 ± 0.36 MLD (mm) 0.79 ± 0.29 2.47 ± 0.37 2.23 ± 0.41 Diameter Stenosis (%) 70.3 ± 10.4 7.6 ± 9.7 15.3 ± 15.2 Acute Gain (mm) 1.67 ± 0.41 Acute Recoil (%) 2.9 ± 8.8 Mean LLL (mm) 0.25 ± 0.40 Median LLL (mm) 0.2 (-0.43, 2.62) In-Segment Analysis Mean LLL (mm) 0.17 ± 0.34 Median LLL (mm) 0.15 (-0.43, 2.47) * Analyzed by an independent QCA core lab (Yale Cardiovascular Research Group, New Haven, US)

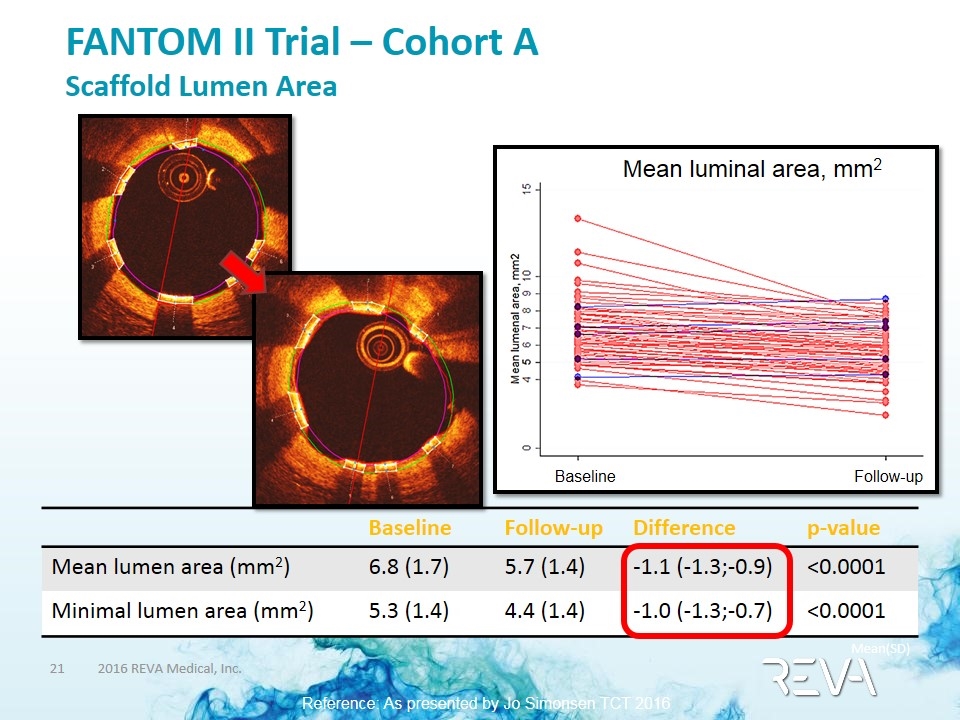

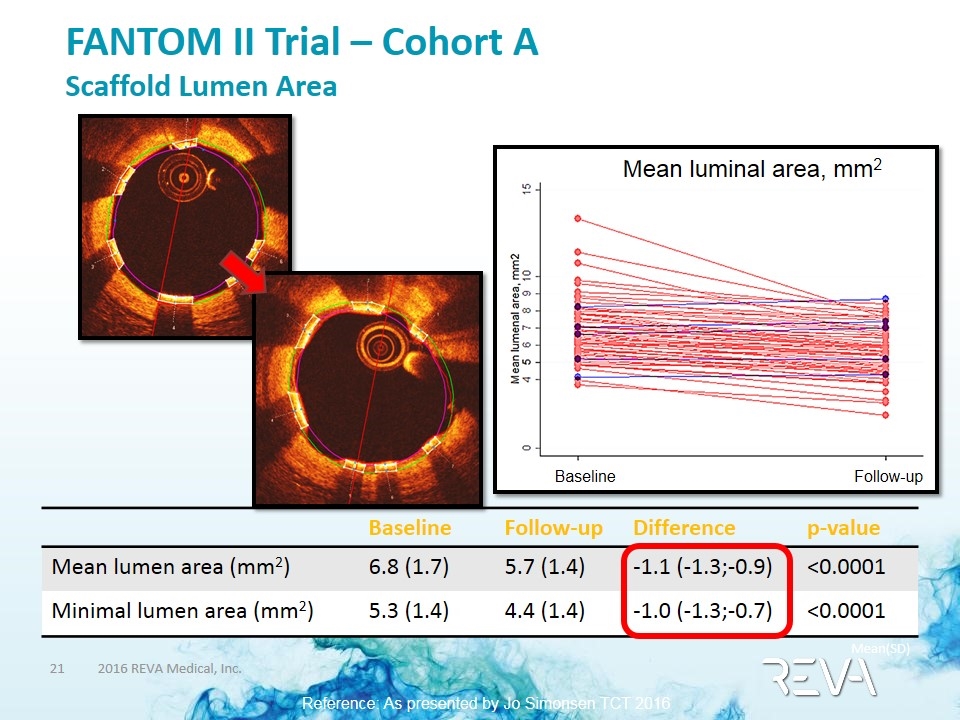

FANTOM II Trial – Cohort A Scaffold Lumen Area Baseline Follow-up Difference p-value Mean lumen area (mm2) 6.8 (1.7) 5.7 (1.4) -1.1 (-1.3;-0.9) <0.0001 Minimal lumen area (mm2) 5.3 (1.4) 4.4 (1.4) -1.0 (-1.3;-0.7) <0.0001 Mean luminal area, mm2 Baseline Follow-up Mean(SD) Reference: As presented by Jo Simonsen TCT 2016 PCI Research Aarhus University Hospital

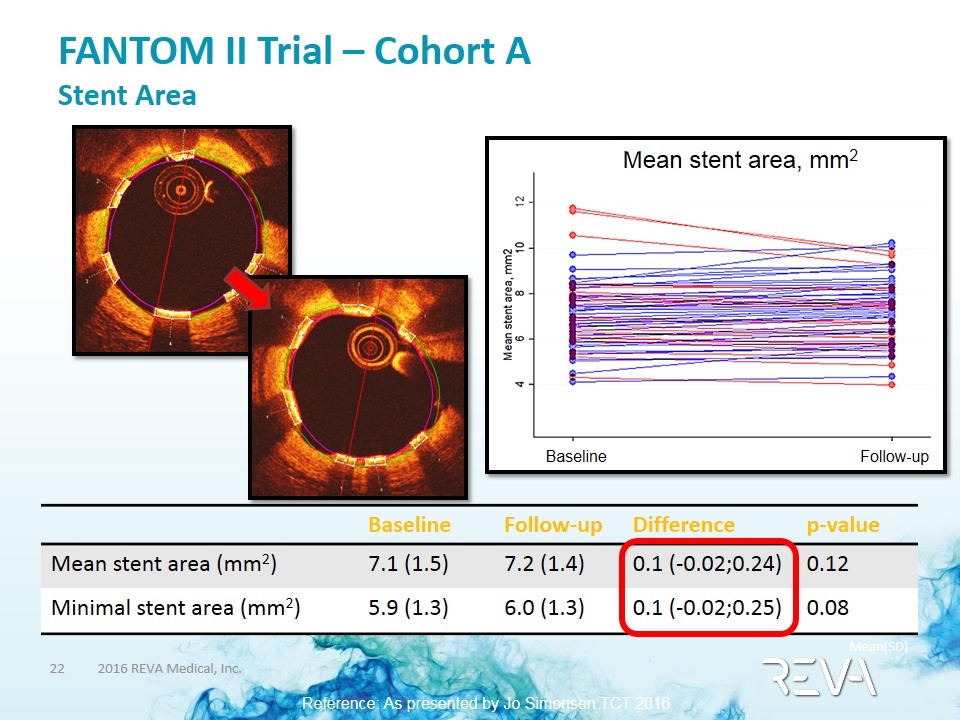

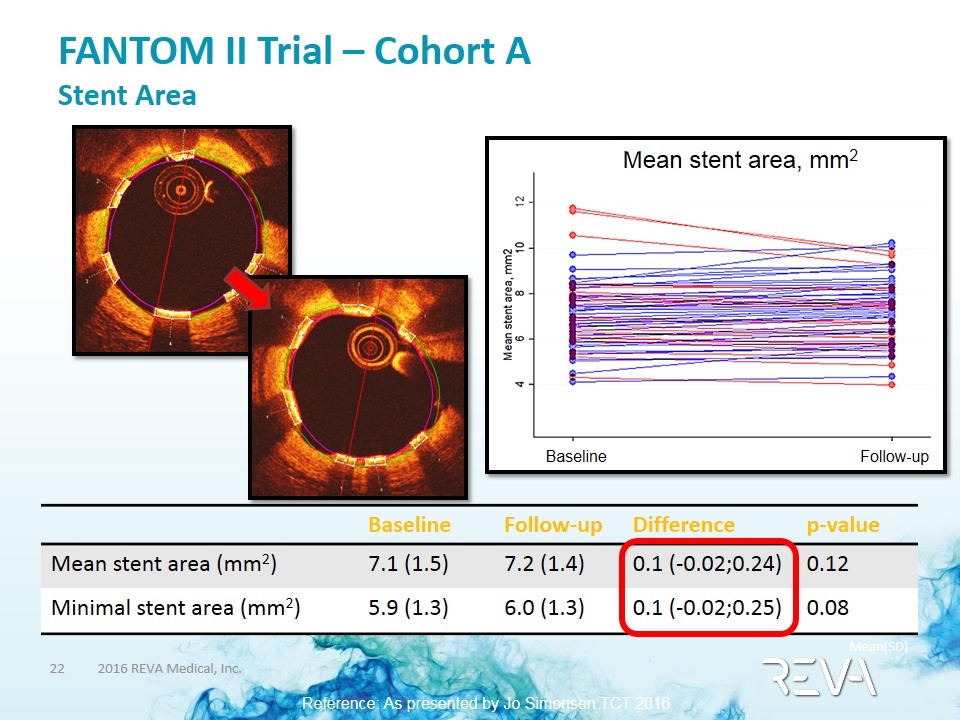

FANTOM II Trial – Cohort A Stent Area Baseline Follow-up Difference p-value Mean stent area (mm2) 7.1 (1.5) 7.2 (1.4) 0.1 (-0.02;0.24) 0.12 Minimal stent area (mm2) 5.9 (1.3) 6.0 (1.3) 0.1 (-0.02;0.25) 0.08 Mean stent area, mm2 Baseline Follow-up Mean(SD) Reference: As presented by Jo Simonsen TCT 2016 PCI Research Aarhus University Hospital

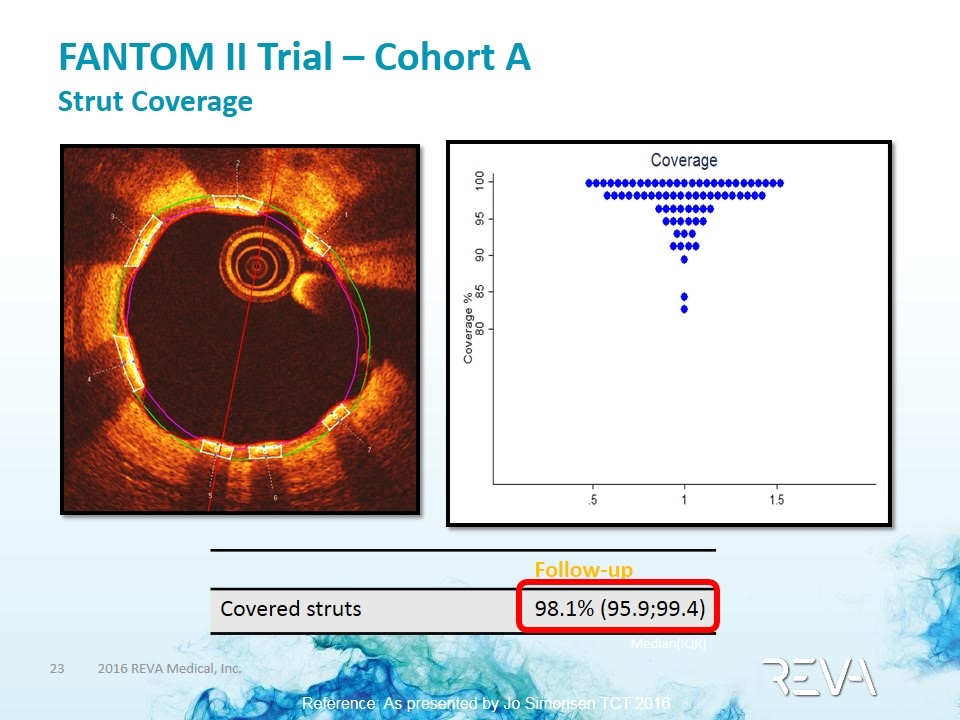

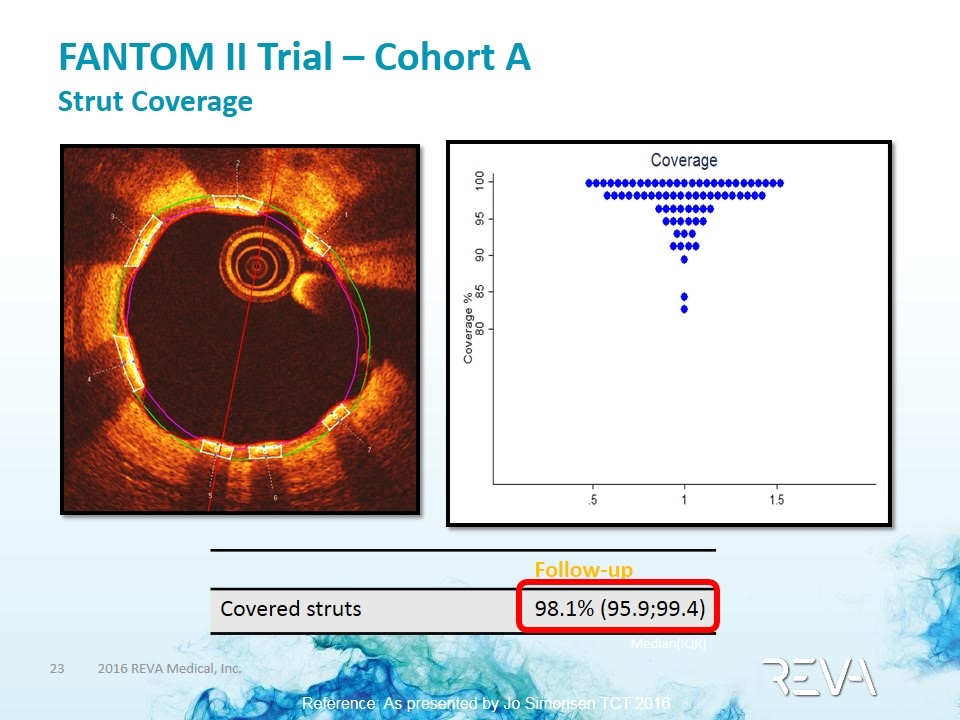

FANTOM II Trial – Cohort A Strut Coverage Follow-up Covered struts 98.1% (95.9;99.4) Median(IQR) Reference: As presented by Jo Simonsen TCT 2016 PCI Research Aarhus University Hospital

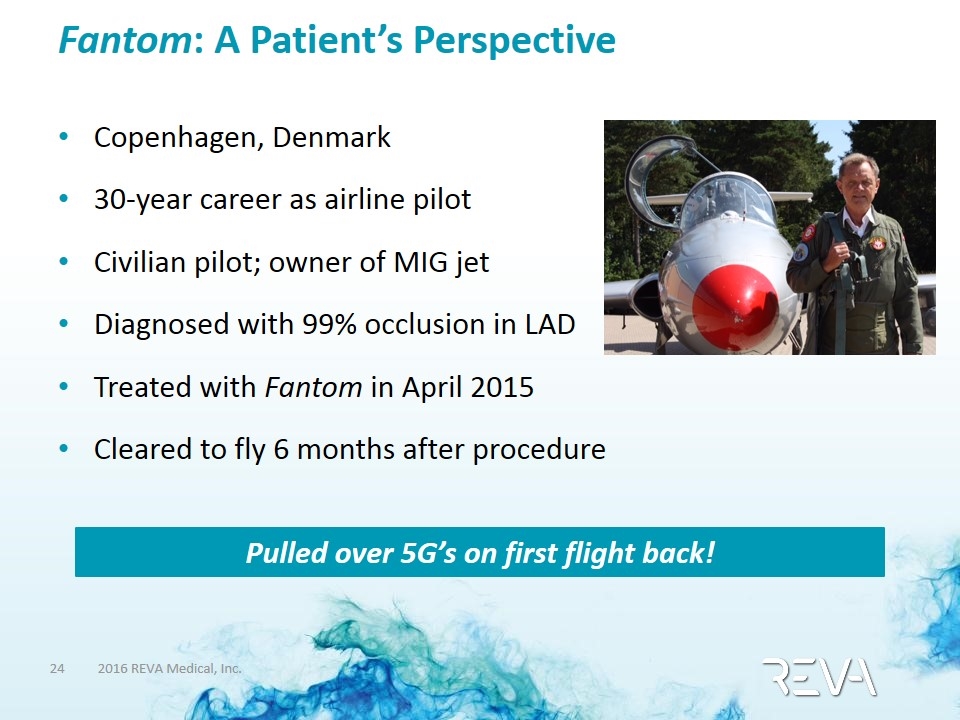

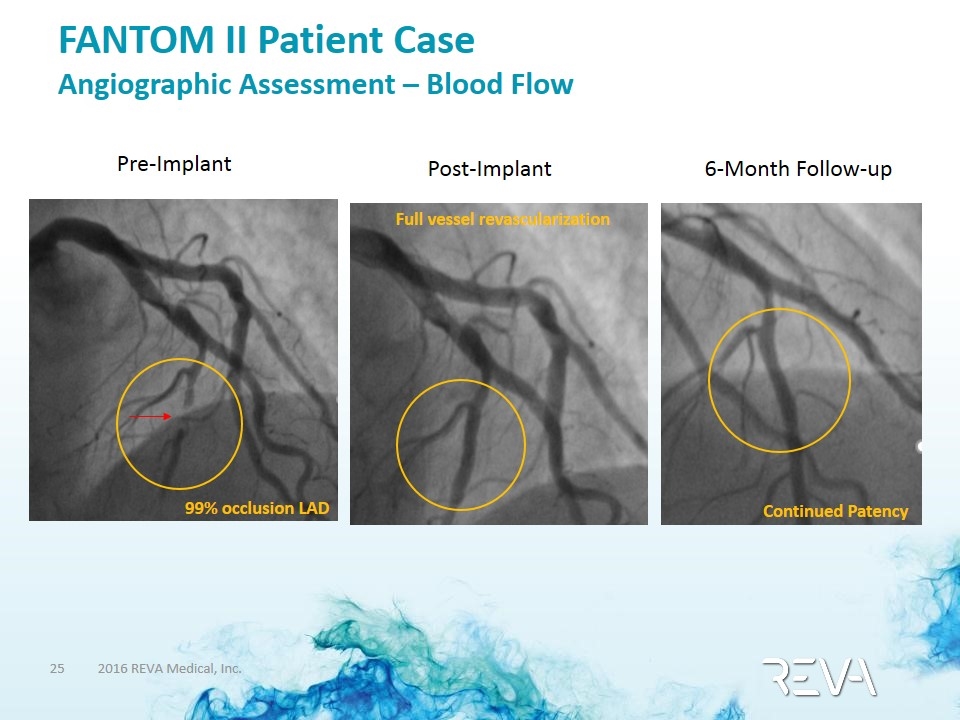

Fantom: A Patient’s Perspective Copenhagen, Denmark 30-year career as airline pilot Civilian pilot; owner of MIG jet Diagnosed with 99% occlusion in LAD Treated with Fantom in April 2015 Cleared to fly 6 months after procedure Pulled over 5G’s on first flight back!

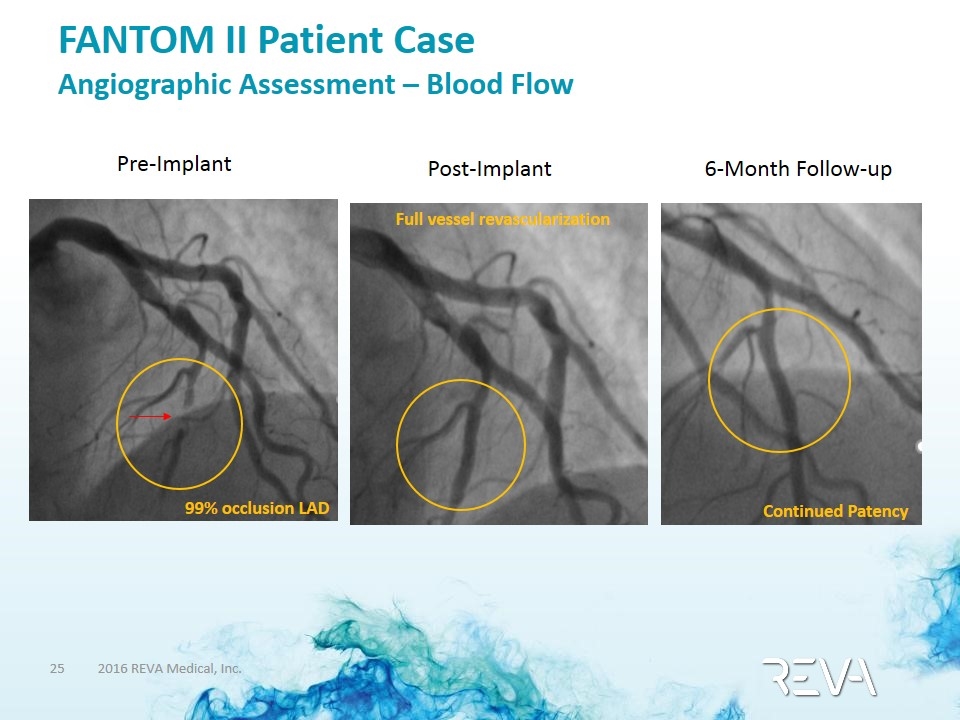

FANTOM II Patient Case Angiographic Assessment – Blood Flow 99% occlusion LAD Pre-Implant Post-Implant Full vessel revascularization 6-Month Follow-up Continued Patency

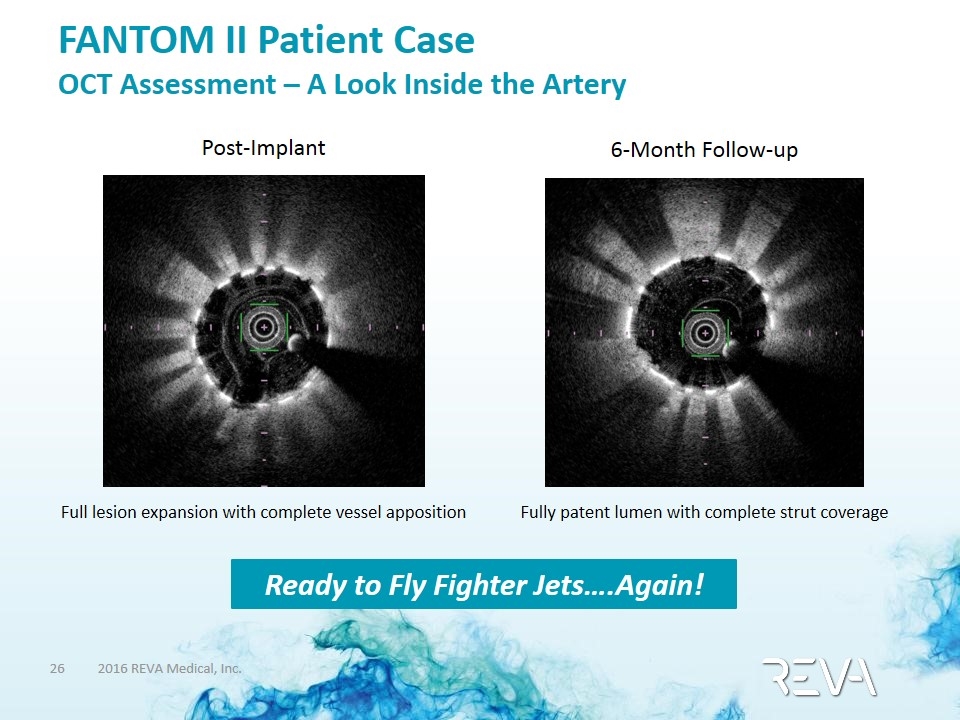

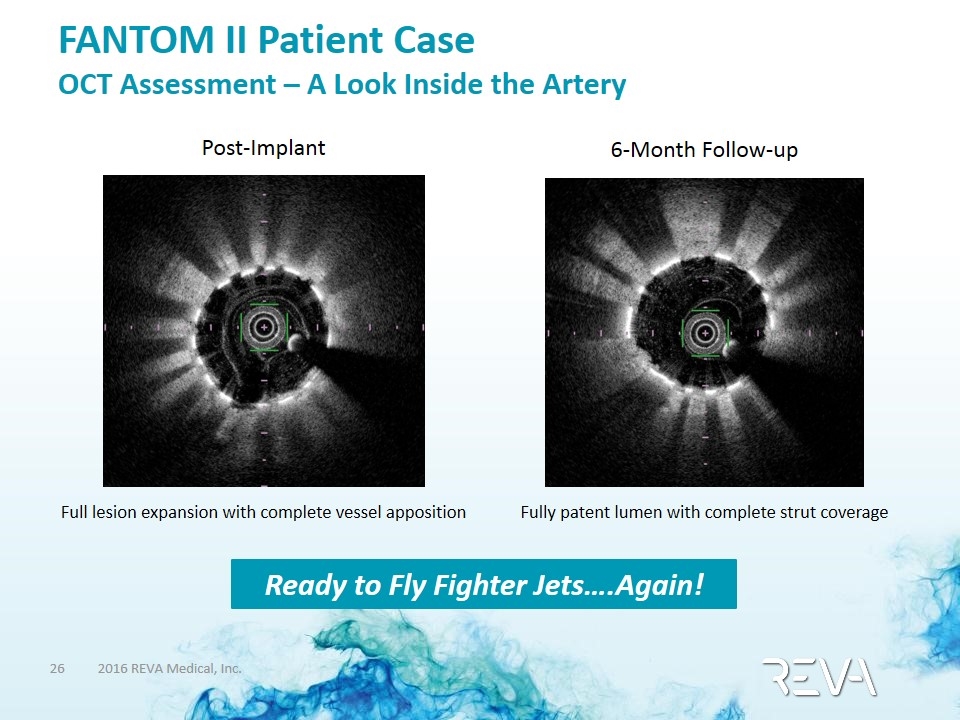

FANTOM II Patient Case OCT Assessment – A Look Inside the Artery Post-Implant Full lesion expansion with complete vessel apposition 6-Month Follow-up Fully patent lumen with complete strut coverage Ready to Fly Fighter Jets….Again!

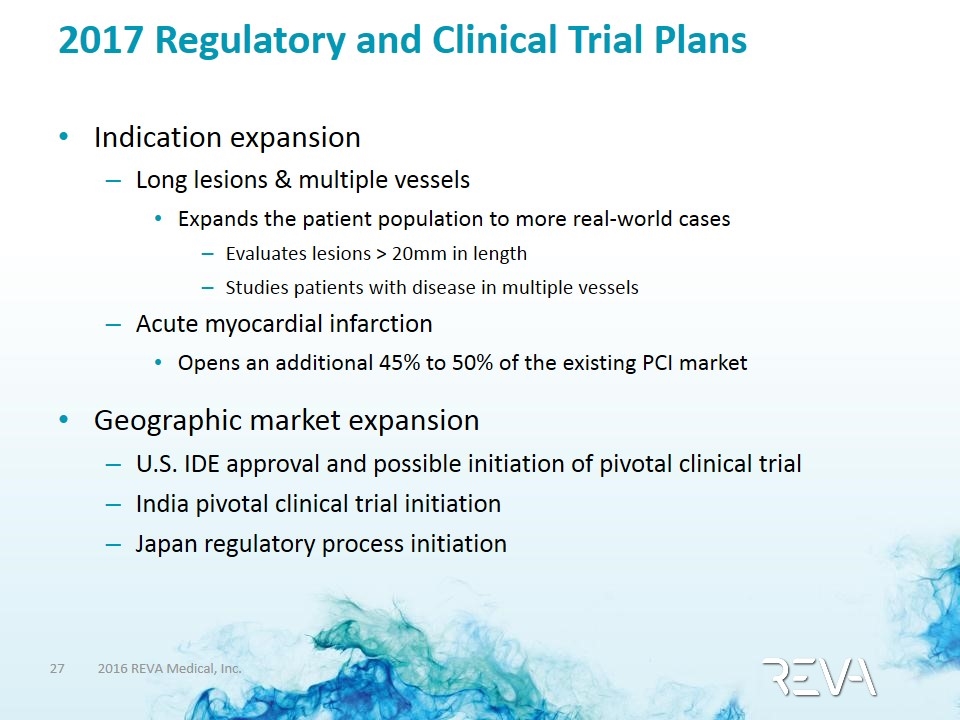

2017 Regulatory and Clinical Trial Plans Indication expansion Long lesions & multiple vessels Expands the patient population to more real-world cases Evaluates lesions > 20mm in length Studies patients with disease in multiple vessels Acute myocardial infarction Opens an additional 45% to 50% of the existing PCI market Geographic market expansion U.S. IDE approval and possible initiation of pivotal clinical trial India pivotal clinical trial initiation Japan regulatory process initiation

Preparing for Commercial Launch

Steps to CE Mark Approval Robust clinical data set to establish product safety CE Mark Application – completed August 2016 Facility ISO audit – successfully passed August 2016 Drug ISO audit – successfully passed October 2016 CE Mark Approval – expected before end of 2016 Commercialization Planned for H1’17

Commercialization Priorities Build sales/clinical team in Europe Ramp-up full operational capabilities Talent Systems Manufacturing scale Supply-chain alignment Commercialization anticipated H1’17

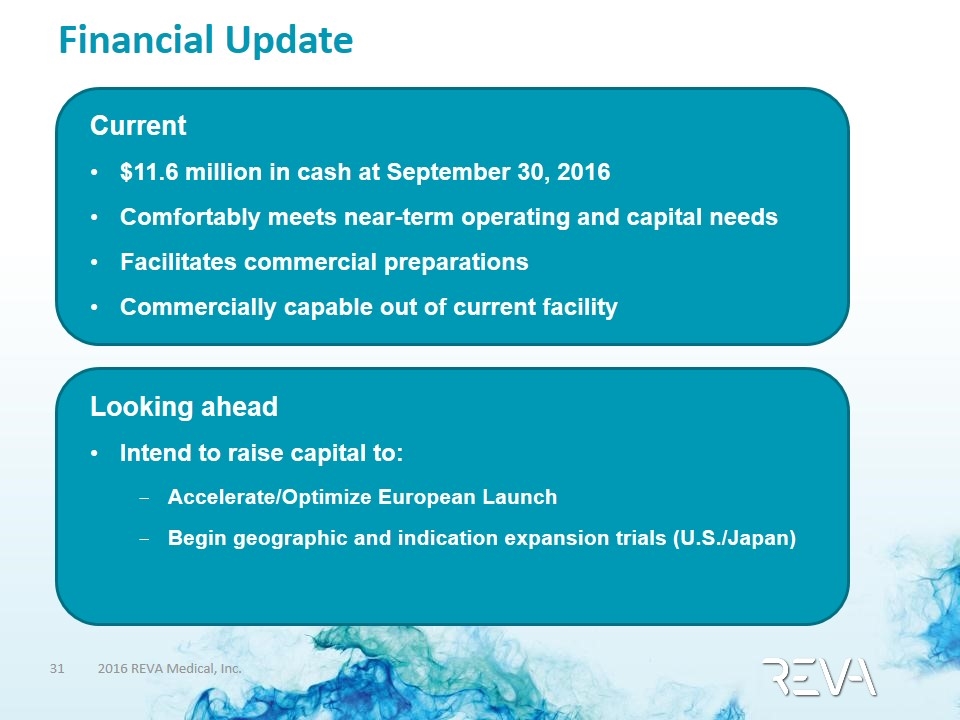

Financial Update Current $11.6 million in cash at September 30, 2016 Comfortably meets near-term operating and capital needs Facilitates commercial preparations Commercially capable out of current facility Looking ahead Intend to raise capital to: Accelerate/Optimize European Launch Begin geographic and indication expansion trials (U.S./Japan)

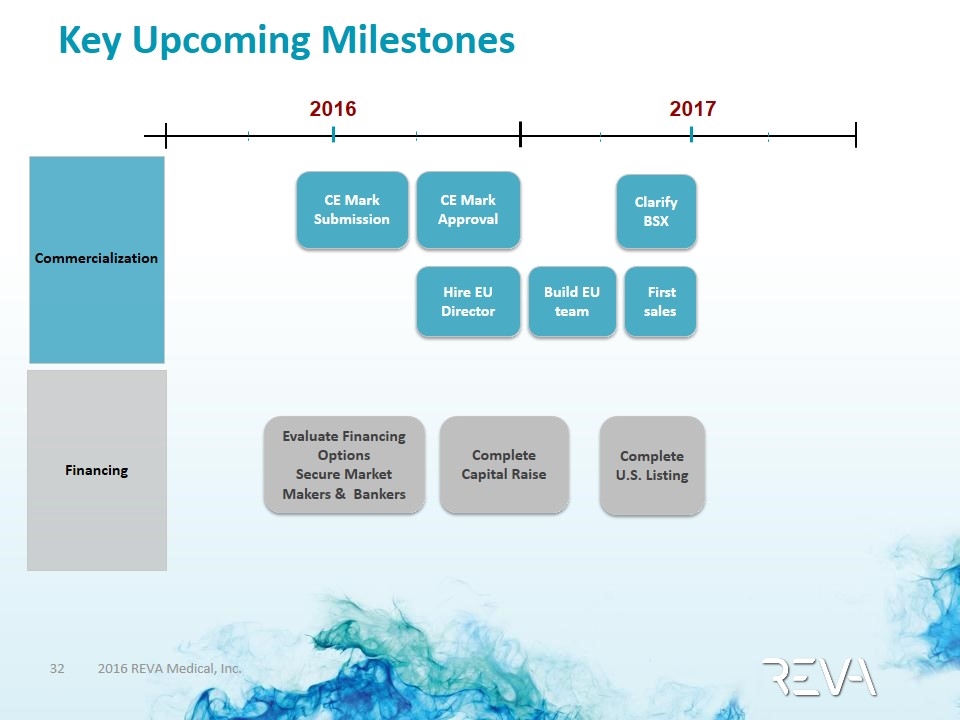

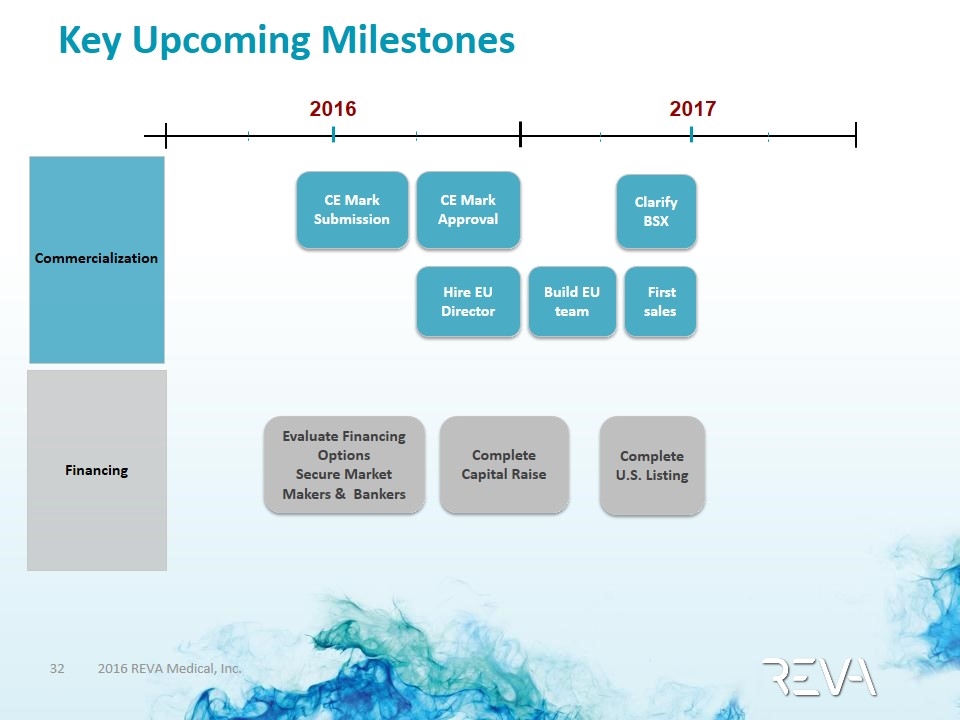

Key Upcoming Milestones 2016 2017 Complete U.S. Listing CE Mark Submission CE Mark Approval Hire EU Director Build EU team Evaluate Financing Options Secure Market Makers & Bankers First sales Clarify BSX Complete Capital Raise Commercialization Financing

Summary Excellent market opportunity: REVA’s proprietary product, Fantom, represents an important innovation in the ~$4 billion global coronary stent market Regulatory approvals underway: CE Mark application completed in August; CE Mark approval expected in Q4’16 Commercial launch: Initial launch expected in select markets in H1’17 Value proposition: Fantom offers compelling differentiated advantages for physicians and intuitive value for patients – adoption will be aided by patient demand Demonstrated clinical success: Excellent acute procedural success, rapid healing response, strong safety profile with low major adverse cardiac events Commercially capable: REVA expects to be able to meet commercial manufacturing needs from its 37,500 square foot state-of-the-art facility in San Diego, California Ready to bring the next generation BRS to market

Thank you