REVA Medical Corporate Presentation November 2017 ©2017 REVA Medical CC100021 Rev. B Exhibit 99.1

Important Notice Not an Offer for Securities This presentation does not constitute an offer, invitation, solicitation or recommendation with respect to the purchase or sale of any security in the Company nor does it constitute financial product advice nor take into account your investment objectives, taxation situation, financial situation or needs. An investor must not act on the basis of any matter contained in this presentation but must make its own assessment of the Company and conduct its own investigations and analysis. Information is a Synopsis Only This presentation only contains a synopsis of information on the Company and, accordingly, no reliance may be placed for any purpose whatsoever on the sufficiency or completeness of such information. Information presented in this presentation is subject to change without notice and REVA does not have any responsibility or obligation to inform you of any matter arising or coming to their notice after the date of this presentation, which may affect any matter in the presentation. Forward-Looking Statements This presentation contains or may contain forward-looking statements that are based on management's beliefs, assumptions and expectations and on information currently available to management. All statements that are not statements of historical fact, including those statements that address future operating performance and events or developments that we expect or anticipate will occur in the future, are forward-looking statements, such as those statements regarding the projections and timing surrounding our plans to commence commercial operations and sell products, conduct clinical trials, develop pipeline products, incur losses from operations, list our securities for sale on a U.S. stock exchange, and assess and obtain future financings for operating and capital requirements. Readers should not place undue reliance on forward-looking statements. Although management believes forward-looking statements are reasonable as and when made, forward-looking statements are subject to a number of risks and uncertainties that may cause actual results to vary materially from those expressed in forward-looking statements, including the risks and uncertainties that are described in the "Risk Factors" section of our Annual Report on Form 10-K filed with the US Securities and Exchange Commission (the “SEC”) on February 28, 2017, and as may be updated in our periodic reports thereafter. Any forward-looking statements in this presentation speak only as of the date when made. REVA does not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Disclaimer This presentation and any supplemental materials have been prepared by the Company based on available information. The information contained in this presentation is an overview and does not contain all information necessary to make an investment decision. Although reasonable care has been taken to ensure the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of such information and opinions and no reliance should be placed on such information or opinions. To the maximum extent permitted by law, none of the Company, or any of its members, directors, officers, employees, or agents or advisers, nor any other person accepts any liability whatsoever for any loss, however arising, from the use of the presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability arising from fault or negligence on the part of the Company or any of its directors, officers, employees, or agents. Fantom® is a product name that is registered by REVA

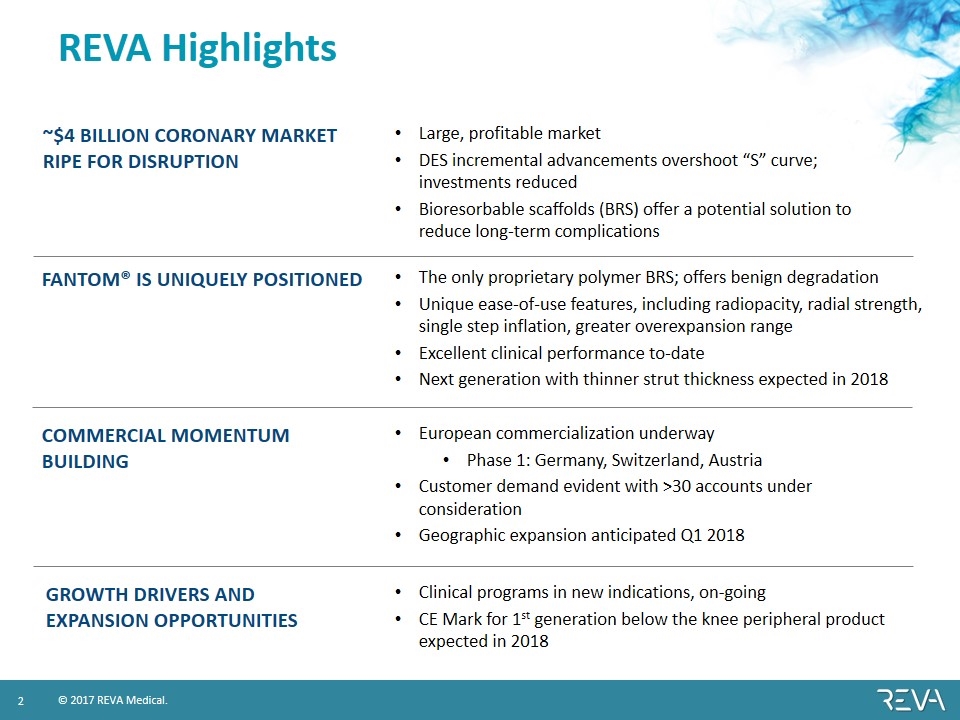

REVA Highlights ~$4 billion coronary market ripe for disruption Fantom® is uniquely positioned Commercial momentum building GROWTH DRIVERS AND Expansion OPPORTUNITIES Large, profitable market DES incremental advancements overshoot “S” curve; investments reduced Bioresorbable scaffolds (BRS) offer a potential solution to reduce long-term complications The only proprietary polymer BRS; offers benign degradation Unique ease-of-use features, including radiopacity, radial strength, single step inflation, greater overexpansion range Excellent clinical performance to-date Next generation with thinner strut thickness expected in 2018 European commercialization underway Phase 1: Germany, Switzerland, Austria Customer demand evident with >30 accounts under consideration Geographic expansion anticipated Q1 2018 Clinical programs in new indications, on-going CE Mark for 1st generation below the knee peripheral product expected in 2018

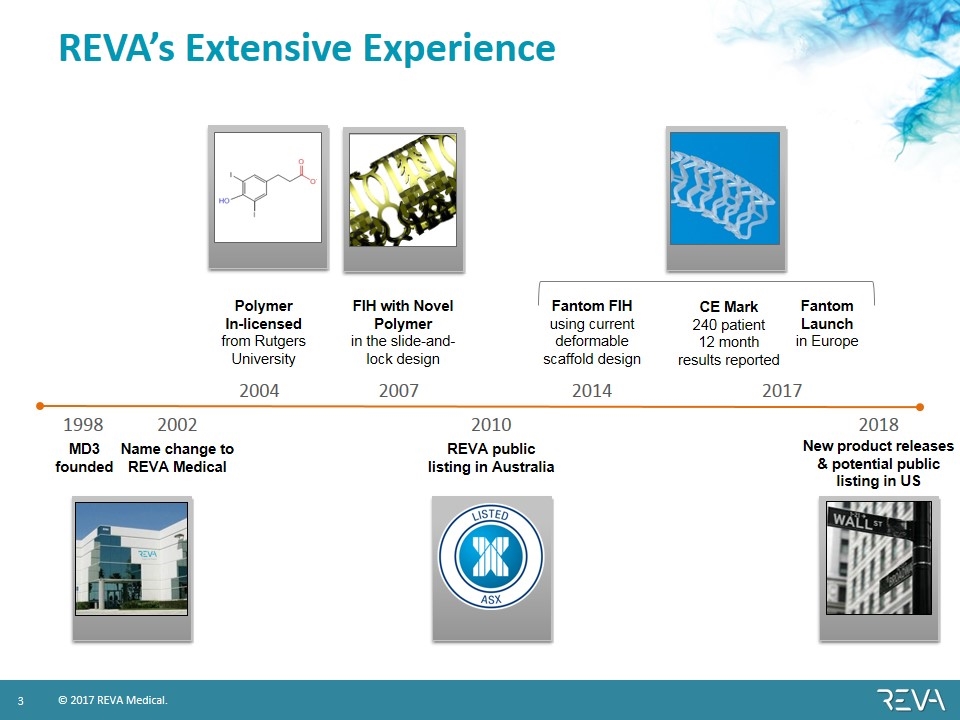

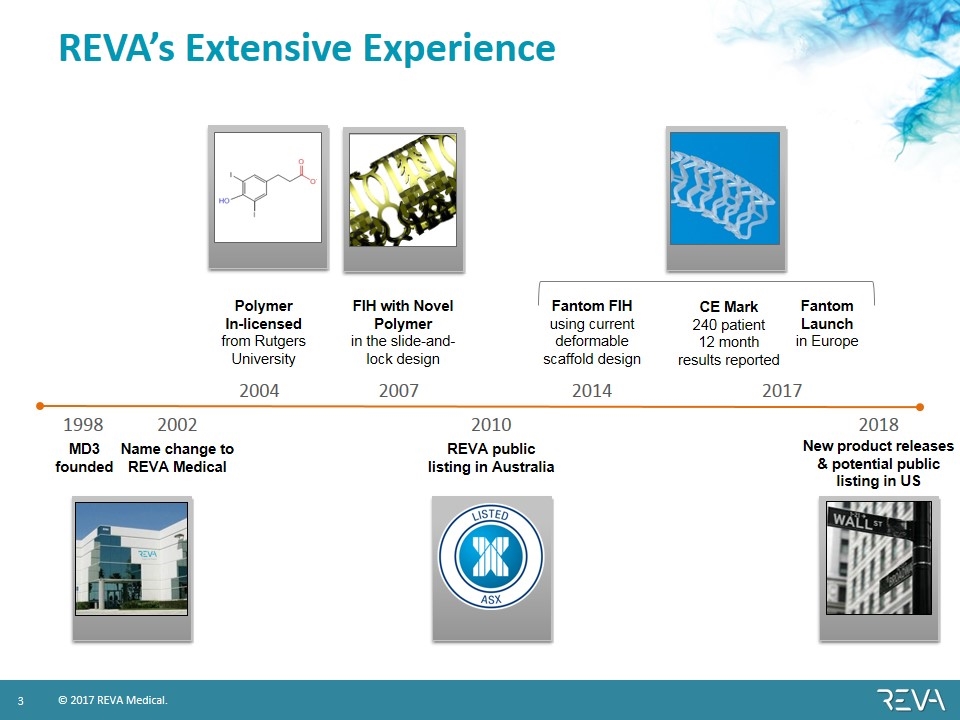

1998 2004 2007 2014 2017 MD3 founded FIH with Novel Polymer in the slide-and-lock design Fantom Launch in Europe Polymer In-licensed from Rutgers University Fantom FIH using current deformable scaffold design REVA’s Extensive Experience Name change to REVA Medical REVA public listing in Australia 2010 CE Mark 240 patient 12 month results reported 2018 2002 New product releases & potential public listing in US

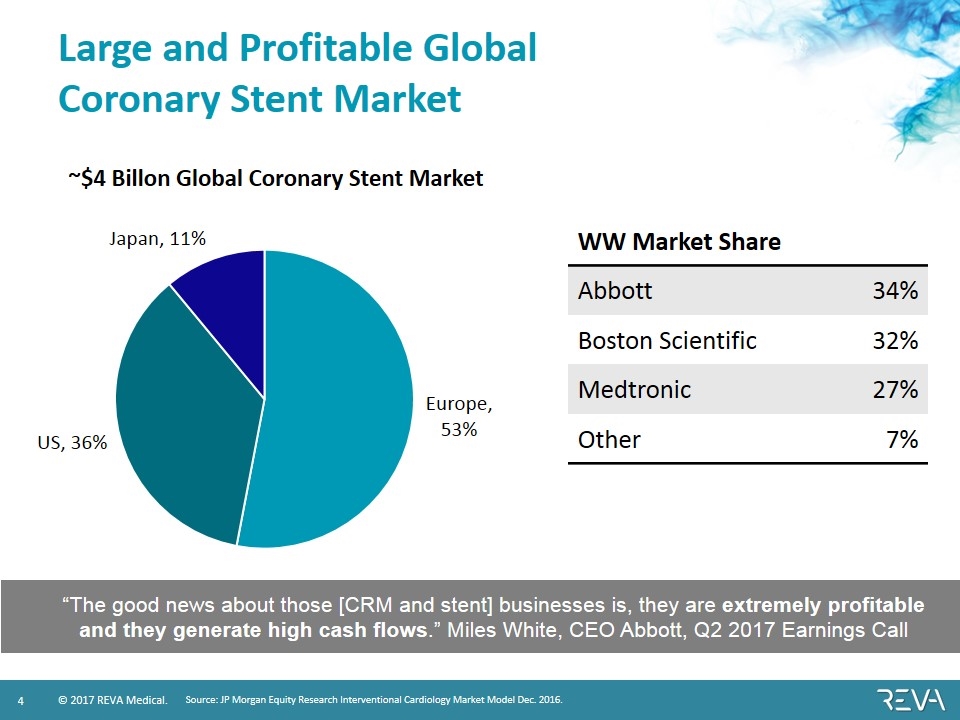

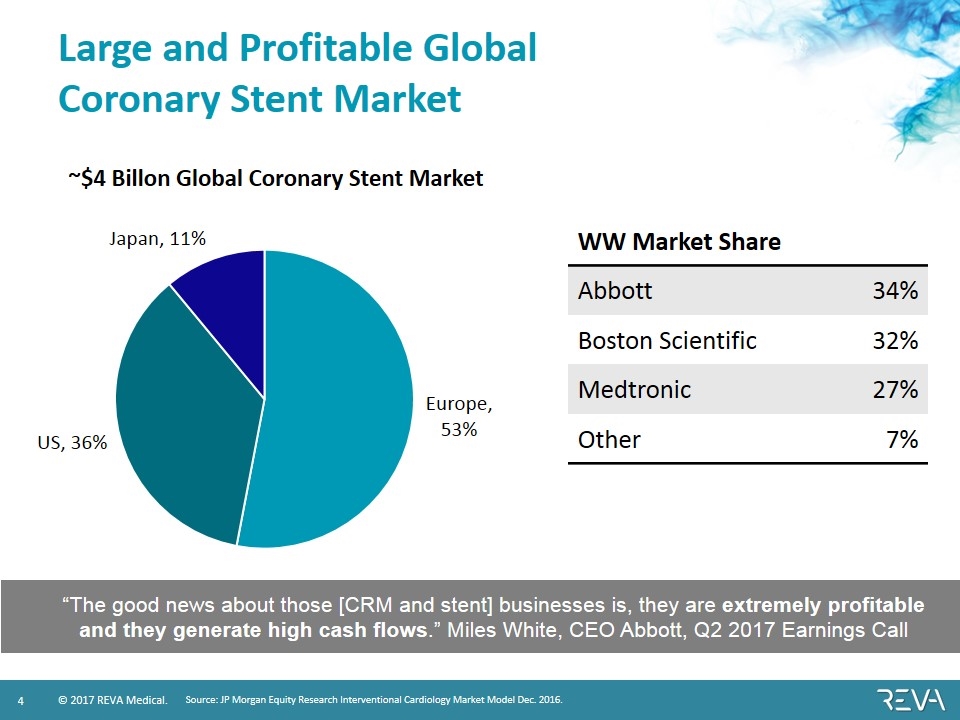

Large and Profitable Global Coronary Stent Market WW Market Share Abbott 34% Boston Scientific 32% Medtronic 27% Other 7% Source: JP Morgan Equity Research Interventional Cardiology Market Model Dec. 2016. “The good news about those [CRM and stent] businesses is, they are extremely profitable and they generate high cash flows.” Miles White, CEO Abbott, Q2 2017 Earnings Call

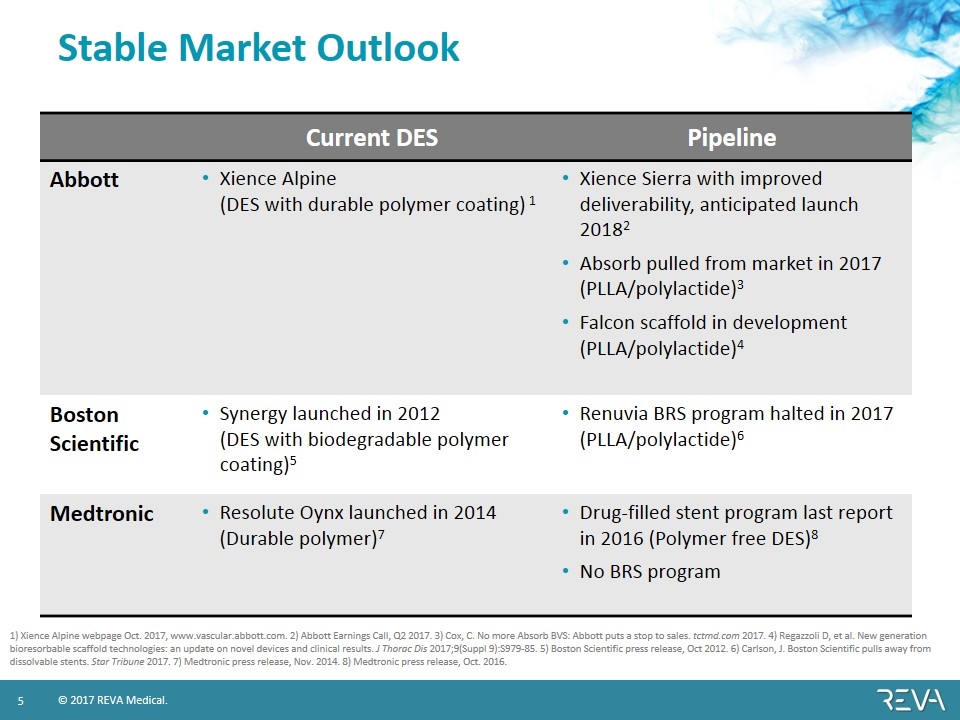

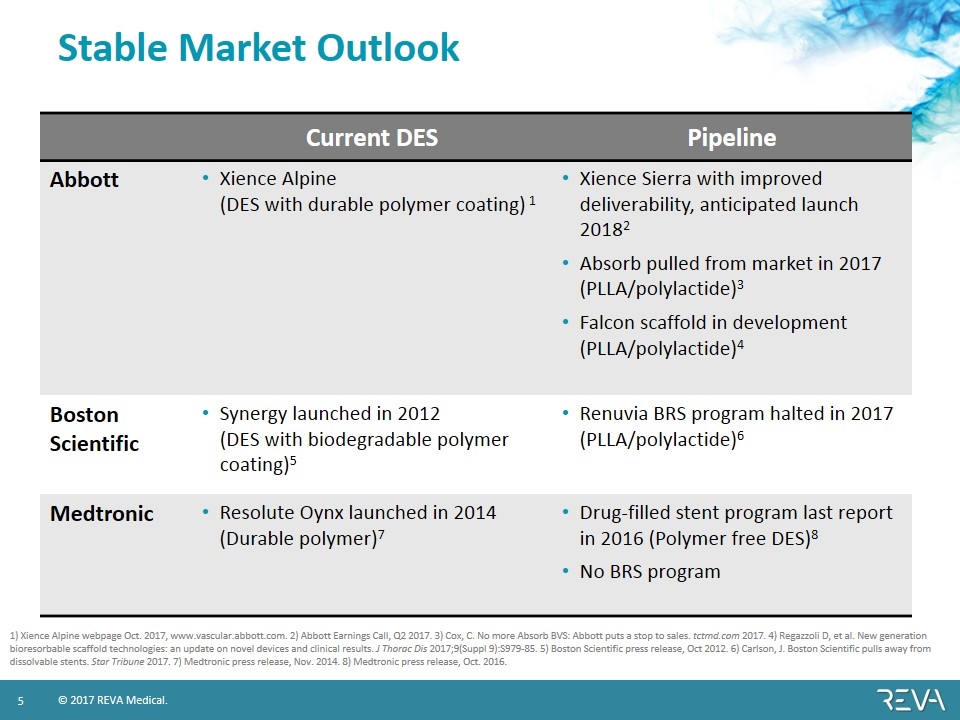

Stable Market Outlook Current DES Pipeline Abbott Xience Alpine (DES with durable polymer coating) 1 Xience Sierra with improved deliverability, anticipated launch 20182 Absorb pulled from market in 2017 (PLLA/polylactide)3 Falcon scaffold in development (PLLA/polylactide)4 Boston Scientific Synergy launched in 2012 (DES with biodegradable polymer coating)5 Renuvia BRS program halted in 2017 (PLLA/polylactide)6 Medtronic Resolute Oynx launched in 2014 (Durable polymer)7 Drug-filled stent program last report in 2016 (Polymer free DES)8 No BRS program 1) Xience Alpine webpage Oct. 2017, www.vascular.abbott.com. 2) Abbott Earnings Call, Q2 2017. 3) Cox, C. No more Absorb BVS: Abbott puts a stop to sales. tctmd.com 2017. 4) Regazzoli D, et al. New generation bioresorbable scaffold technologies: an update on novel devices and clinical results. J Thorac Dis 2017;9(Suppl 9):S979-85. 5) Boston Scientific press release, Oct 2012. 6) Carlson, J. Boston Scientific pulls away from dissolvable stents. Star Tribune 2017. 7) Medtronic press release, Nov. 2014. 8) Medtronic press release, Oct. 2016.

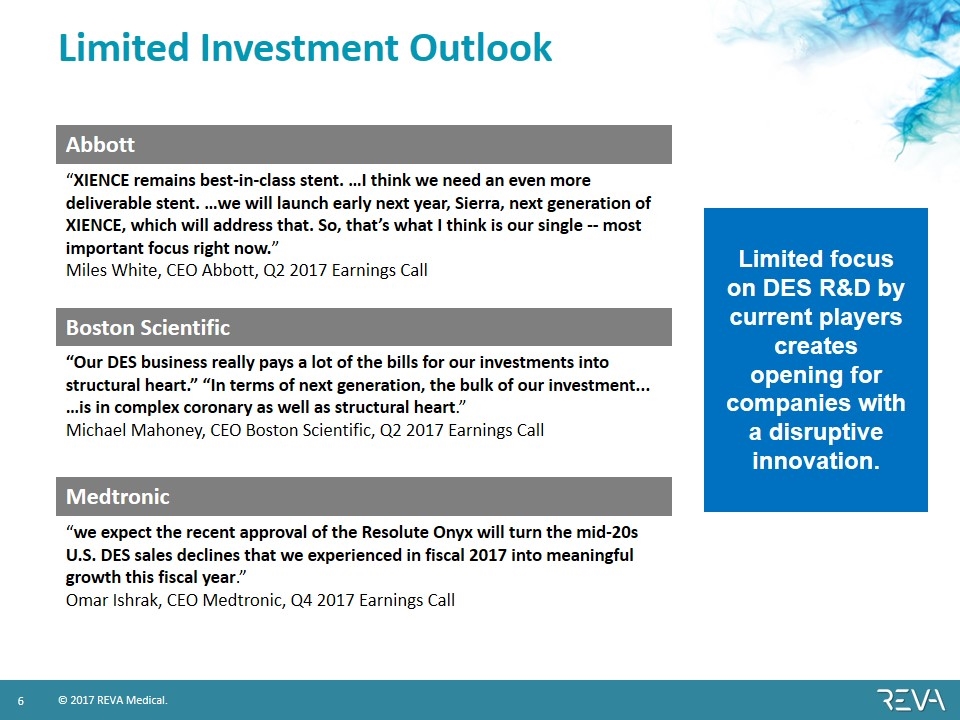

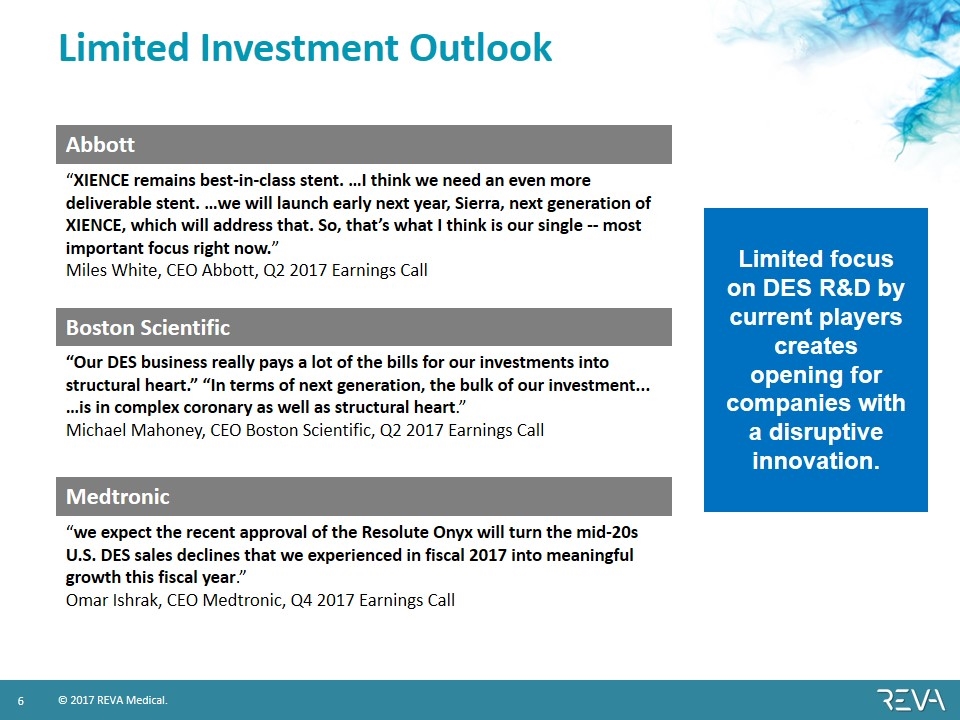

Limited Investment Outlook Abbott “XIENCE remains best-in-class stent. …I think we need an even more deliverable stent. …we will launch early next year, Sierra, next generation of XIENCE, which will address that. So, that’s what I think is our single -- most important focus right now.” Miles White, CEO Abbott, Q2 2017 Earnings Call Boston Scientific “Our DES business really pays a lot of the bills for our investments into structural heart.” “In terms of next generation, the bulk of our investment... …is in complex coronary as well as structural heart.” Michael Mahoney, CEO Boston Scientific, Q2 2017 Earnings Call Medtronic “we expect the recent approval of the Resolute Onyx will turn the mid-20s U.S. DES sales declines that we experienced in fiscal 2017 into meaningful growth this fiscal year.” Omar Ishrak, CEO Medtronic, Q4 2017 Earnings Call Limited focus on DES R&D by current players creates opening for companies with a disruptive innovation.

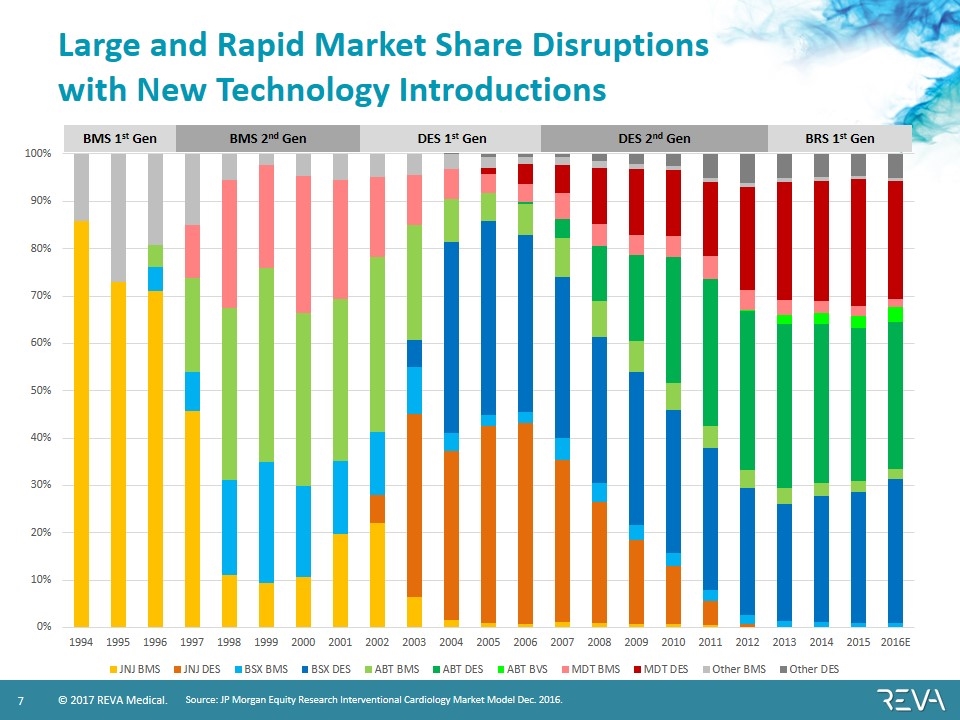

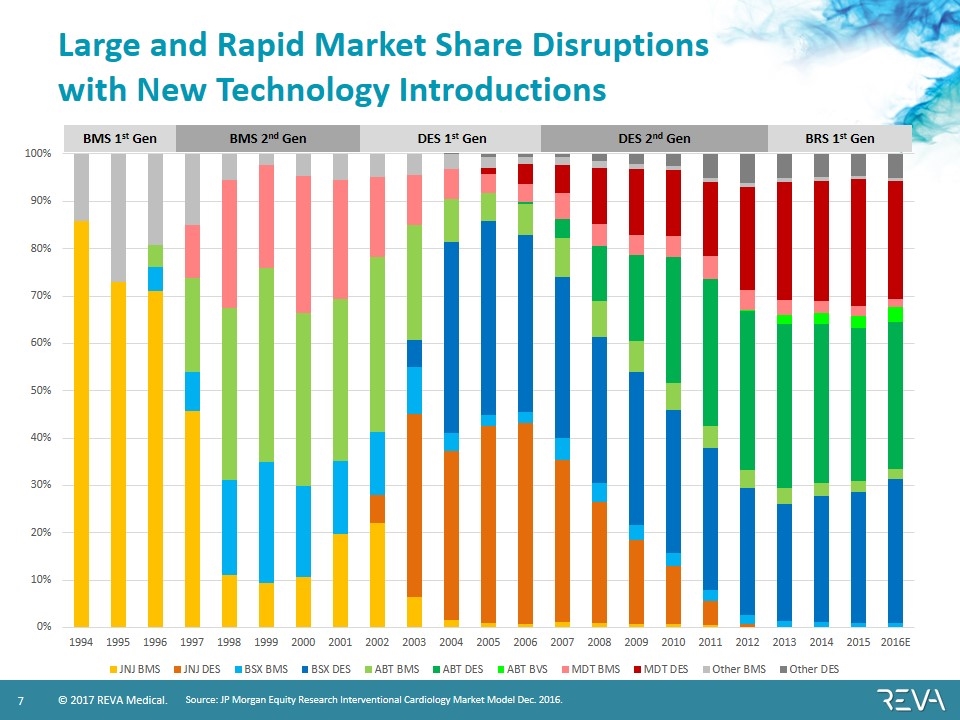

BMS 1st Gen BMS 2nd Gen DES 1st Gen DES 2nd Gen BRS 1st Gen Large and Rapid Market Share Disruptions with New Technology Introductions Source: JP Morgan Equity Research Interventional Cardiology Market Model Dec. 2016.

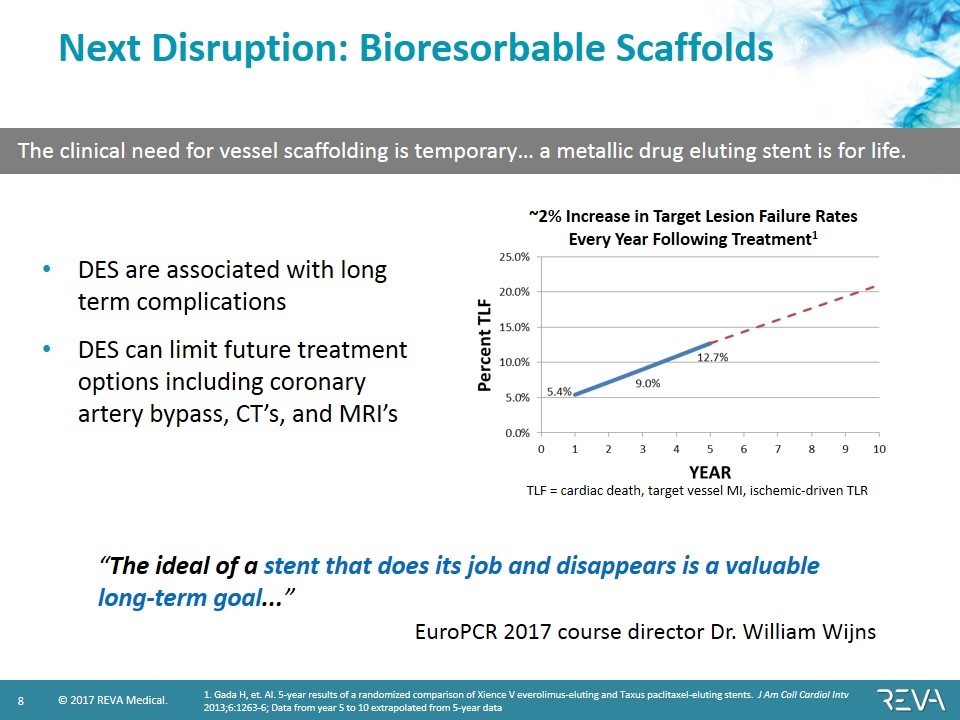

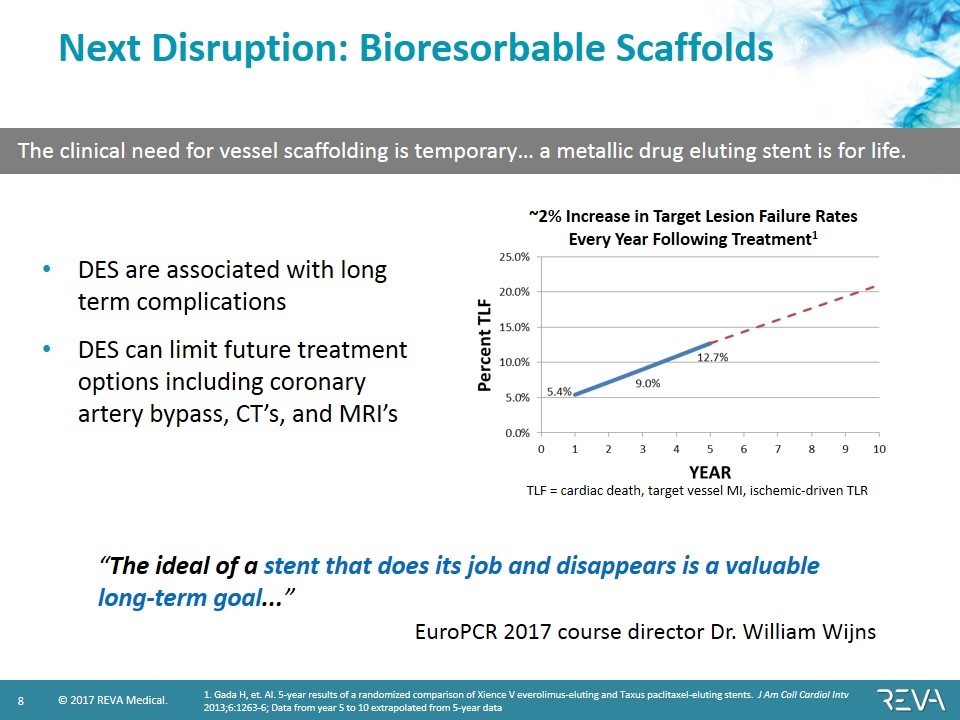

Next Disruption: Bioresorbable Scaffolds 1. Gada H, et. Al. 5-year results of a randomized comparison of Xience V everolimus-eluting and Taxus paclitaxel-eluting stents. J Am Coll Cardiol Intv 2013;6:1263-6; Data from year 5 to 10 extrapolated from 5-year data TLF = cardiac death, target vessel MI, ischemic-driven TLR ~2% Increase in Target Lesion Failure Rates Every Year Following Treatment1 DES are associated with long term complications DES can limit future treatment options including coronary artery bypass, CT’s, and MRI’s “The ideal of a stent that does its job and disappears is a valuable long-term goal...” EuroPCR 2017 course director Dr. William Wijns The clinical need for vessel scaffolding is temporary… a metallic drug eluting stent is for life.

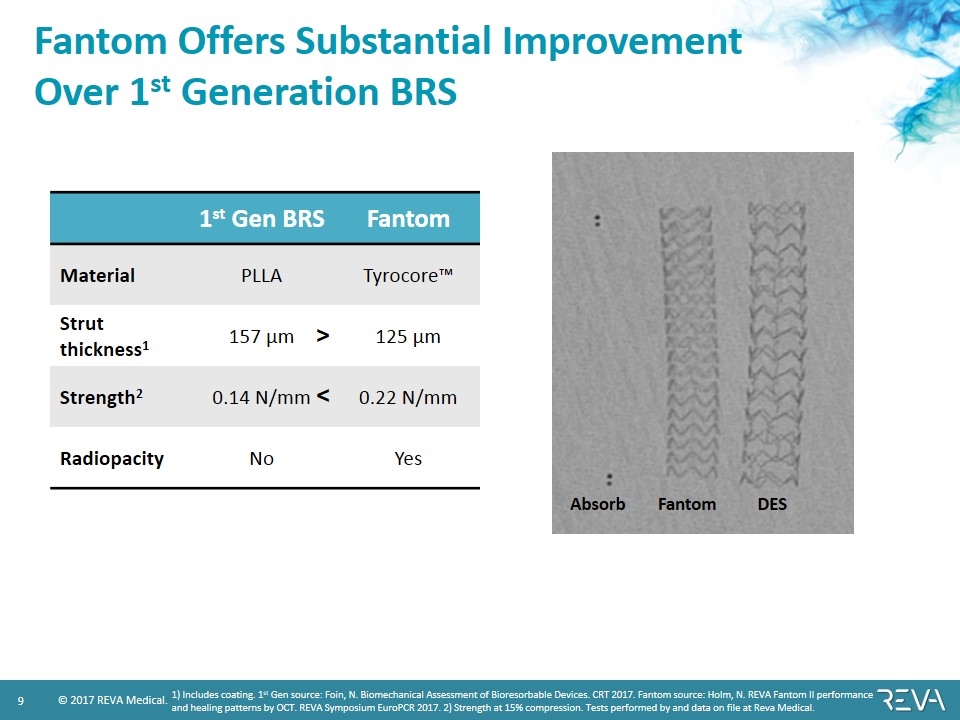

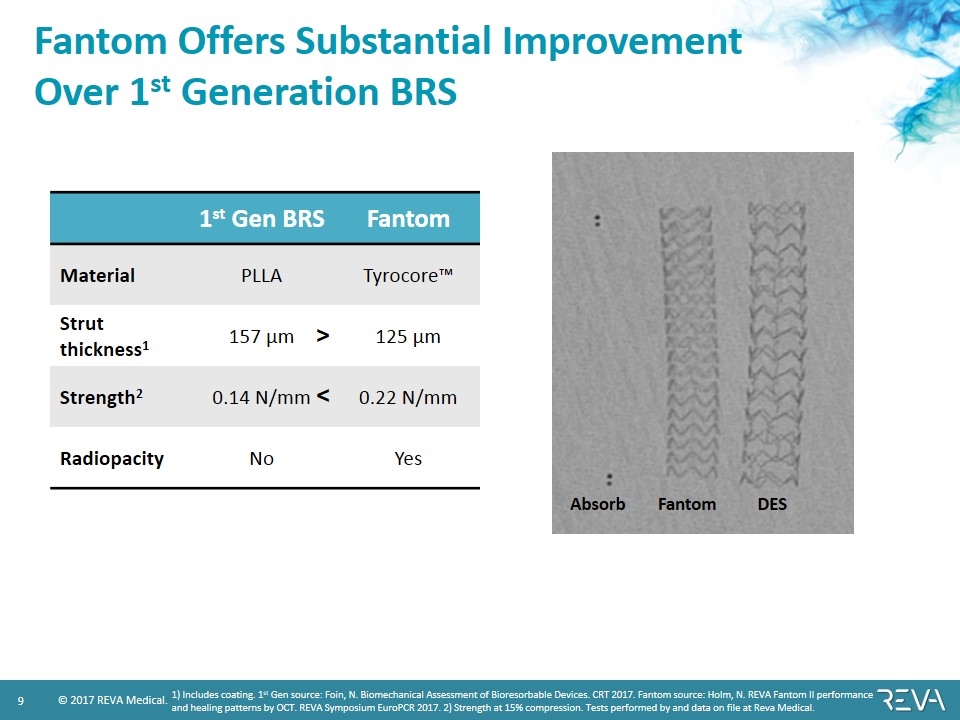

Fantom Offers Substantial Improvement Over 1st Generation BRS 1st Gen BRS Fantom Material PLLA Tyrocore™ Strut thickness1 157 µm 125 µm Strength2 0.14 N/mm 0.22 N/mm Radiopacity No Yes < > 1) Includes coating. 1st Gen source: Foin, N. Biomechanical Assessment of Bioresorbable Devices. CRT 2017. Fantom source: Holm, N. REVA Fantom II performance and healing patterns by OCT. REVA Symposium EuroPCR 2017. 2) Strength at 15% compression. Tests performed by and data on file at Reva Medical. DES Absorb Fantom

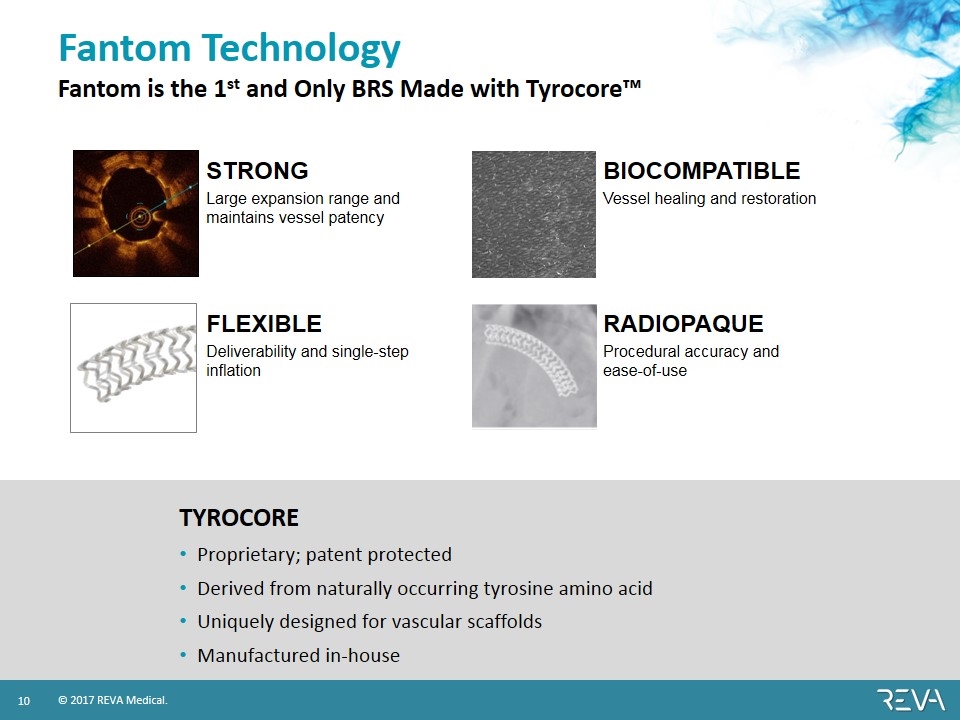

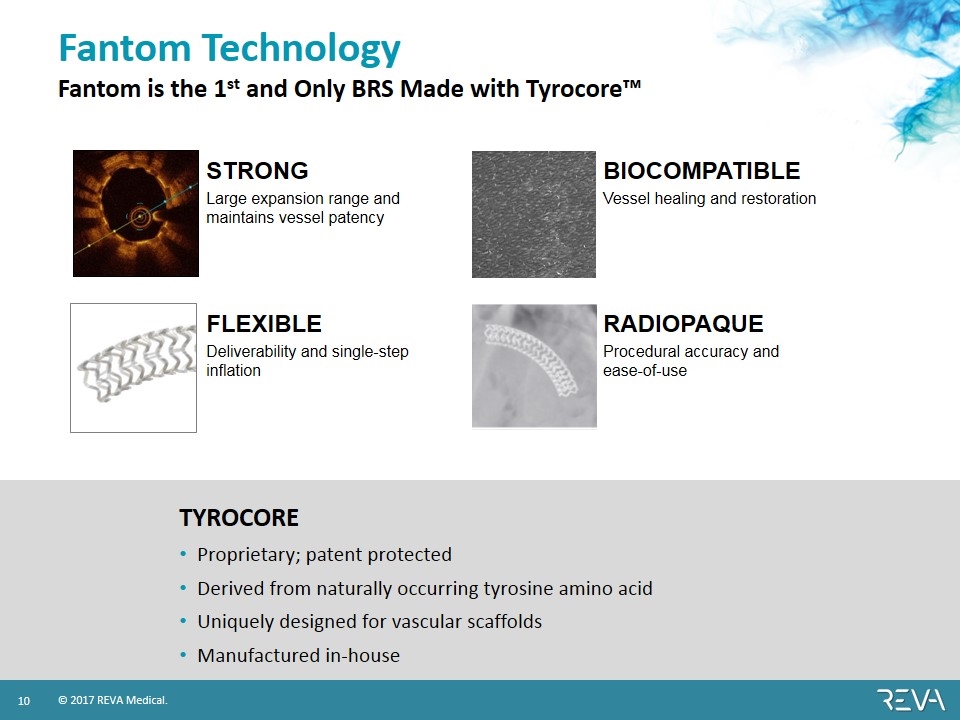

Fantom Technology Fantom is the 1st and Only BRS Made with Tyrocore™ TYROCORE Proprietary; patent protected Derived from naturally occurring tyrosine amino acid Uniquely designed for vascular scaffolds Manufactured in-house STRONG Large expansion range and maintains vessel patency FLEXIBLE Deliverability and single-step inflation RADIOPAQUE Procedural accuracy and ease-of-use BIOCOMPATIBLE Vessel healing and restoration

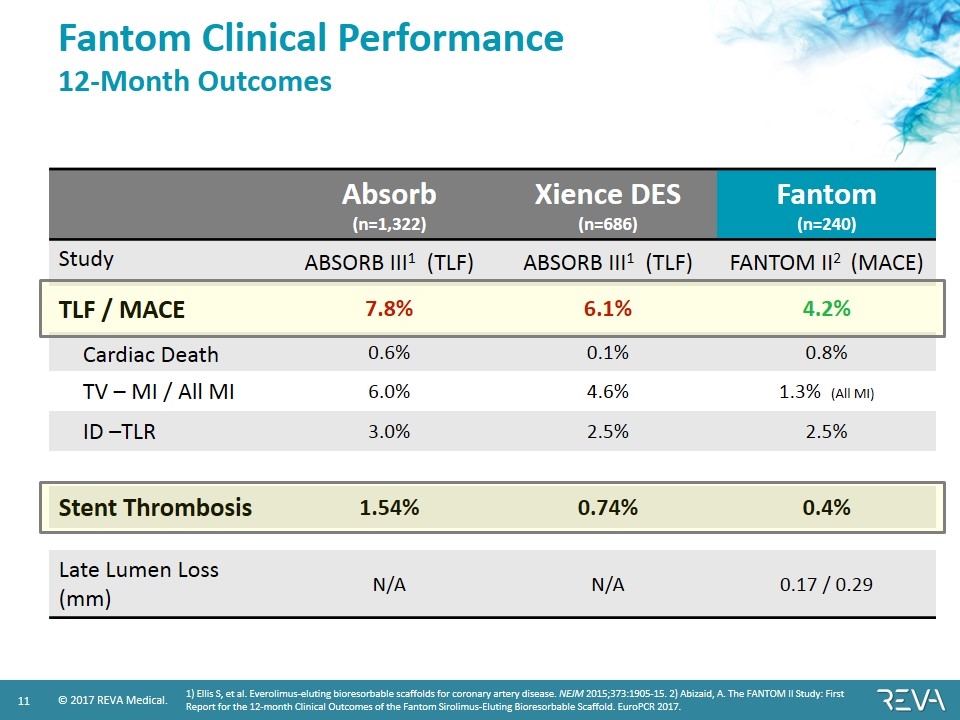

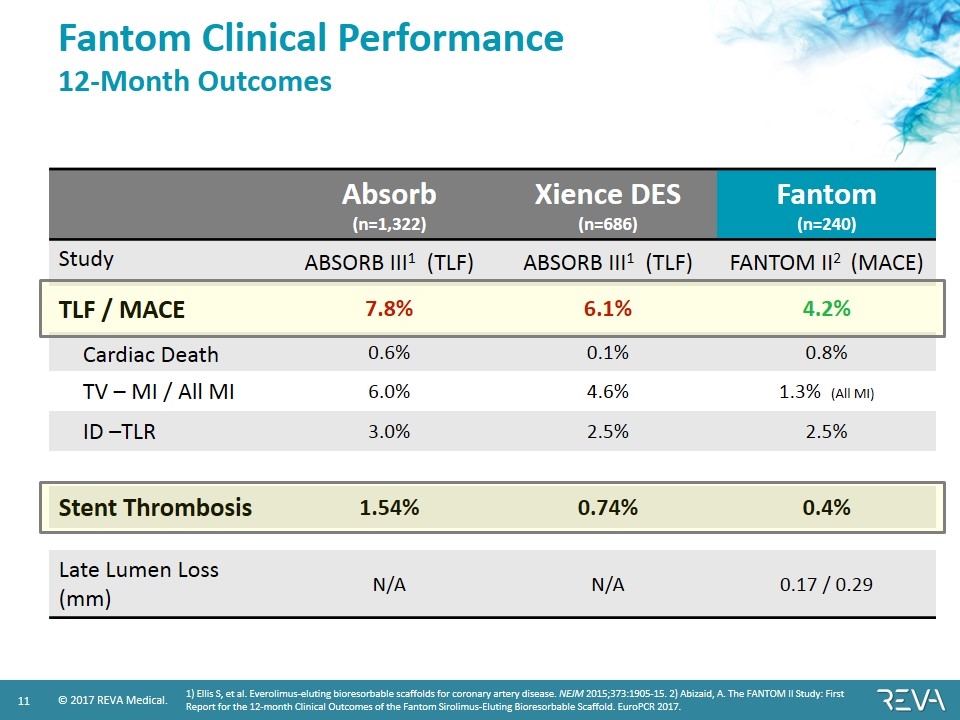

Fantom Clinical Performance 12-Month Outcomes Absorb (n=1,322) Xience DES (n=686) Fantom (n=240) Study ABSORB III1 (TLF) ABSORB III1 (TLF) FANTOM II2 (MACE) TLF / MACE 7.8% 6.1% 4.2% Cardiac Death 0.6% 0.1% 0.8% TV – MI / All MI 6.0% 4.6% 1.3% (All MI) ID –TLR 3.0% 2.5% 2.5% Stent Thrombosis 1.54% 0.74% 0.4% Late Lumen Loss (mm) N/A N/A 0.17 / 0.29 1) Ellis S, et al. Everolimus-eluting bioresorbable scaffolds for coronary artery disease. NEJM 2015;373:1905-15. 2) Abizaid, A. The FANTOM II Study: First Report for the 12-month Clinical Outcomes of the Fantom Sirolimus-Eluting Bioresorbable Scaffold. EuroPCR 2017.

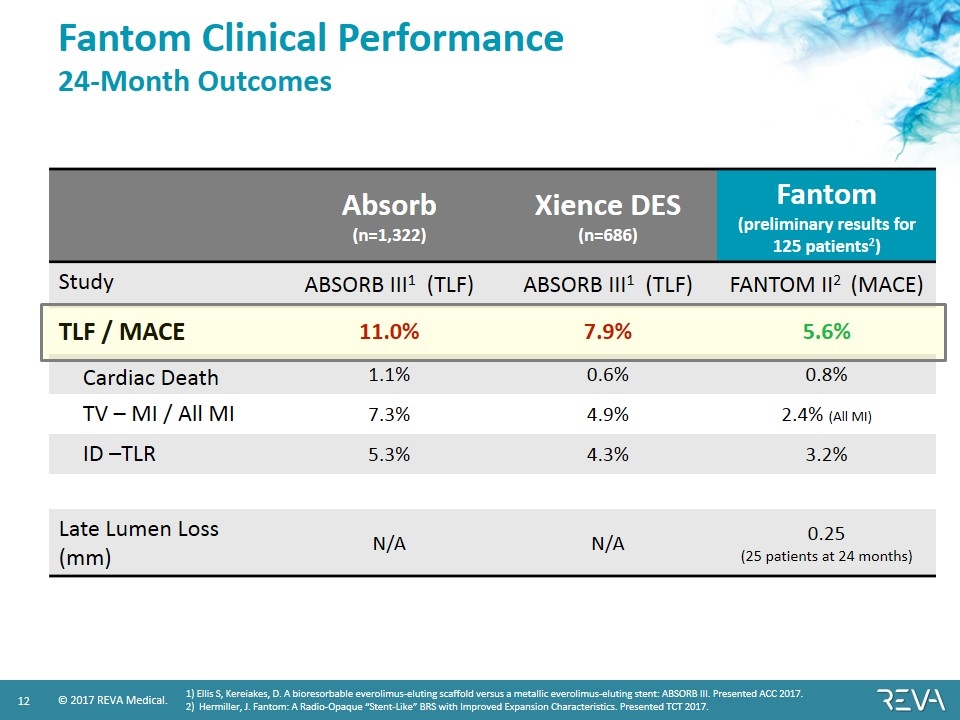

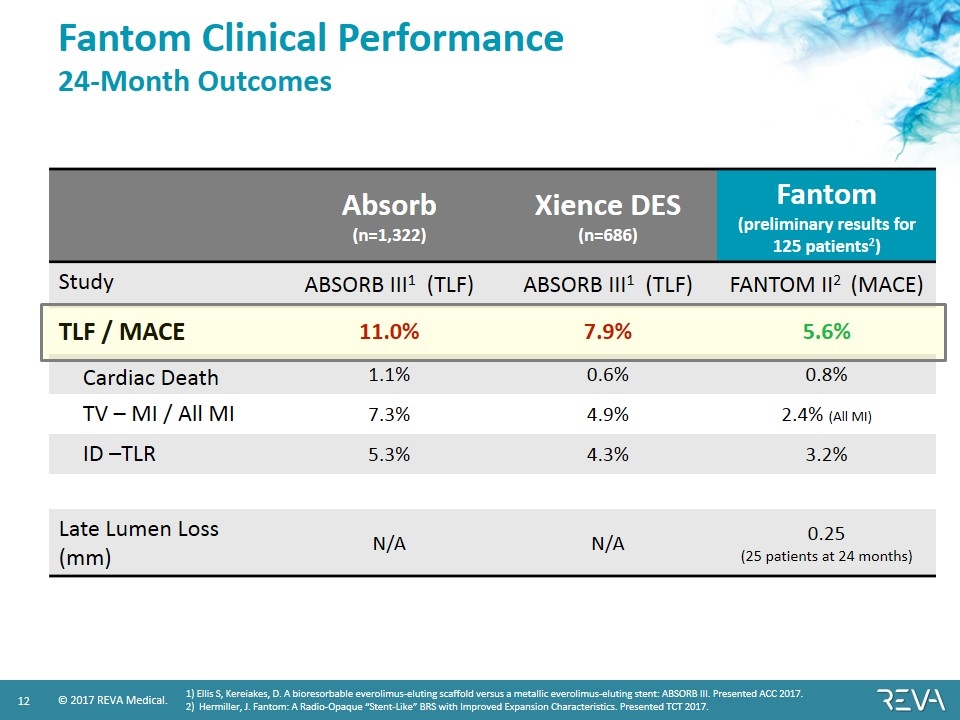

Fantom Clinical Performance 24-Month Outcomes Absorb (n=1,322) Xience DES (n=686) Fantom (preliminary results for 125 patients2) Study ABSORB III1 (TLF) ABSORB III1 (TLF) FANTOM II2 (MACE) TLF / MACE 11.0% 7.9% 5.6% Cardiac Death 1.1% 0.6% 0.8% TV – MI / All MI 7.3% 4.9% 2.4% (All MI) ID –TLR 5.3% 4.3% 3.2% Late Lumen Loss (mm) N/A N/A 0.25 (25 patients at 24 months) 1) Ellis S, Kereiakes, D. A bioresorbable everolimus-eluting scaffold versus a metallic everolimus-eluting stent: ABSORB III. Presented ACC 2017. 2) Hermiller, J. Fantom: A Radio-Opaque “Stent-Like” BRS with Improved Expansion Characteristics. Presented TCT 2017.

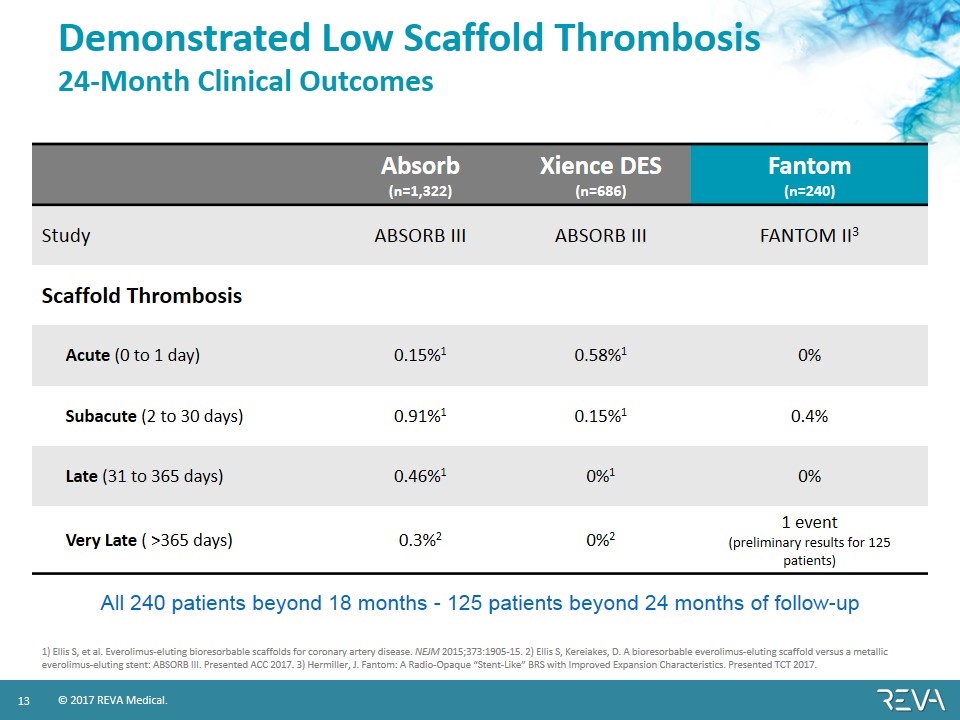

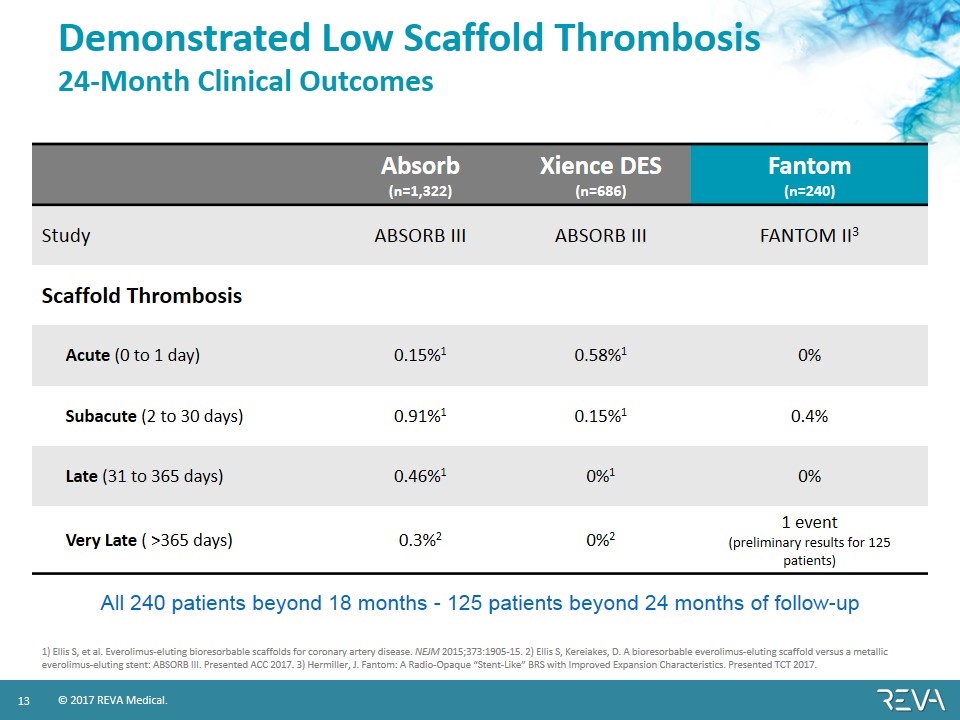

Demonstrated Low Scaffold Thrombosis 24-Month Clinical Outcomes Absorb (n=1,322) Xience DES (n=686) Fantom (n=240) Study ABSORB III ABSORB III FANTOM II3 Scaffold Thrombosis Acute (0 to 1 day) 0.15%1 0.58%1 0% Subacute (2 to 30 days) 0.91%1 0.15%1 0.4% Late (31 to 365 days) 0.46%1 0%1 0% Very Late ( >365 days) 0.3%2 0%2 1 event (preliminary results for 125 patients) 1) Ellis S, et al. Everolimus-eluting bioresorbable scaffolds for coronary artery disease. NEJM 2015;373:1905-15. 2) Ellis S, Kereiakes, D. A bioresorbable everolimus-eluting scaffold versus a metallic everolimus-eluting stent: ABSORB III. Presented ACC 2017. 3) Hermiller, J. Fantom: A Radio-Opaque “Stent-Like” BRS with Improved Expansion Characteristics. Presented TCT 2017. All 240 patients beyond 18 months - 125 patients beyond 24 months of follow-up

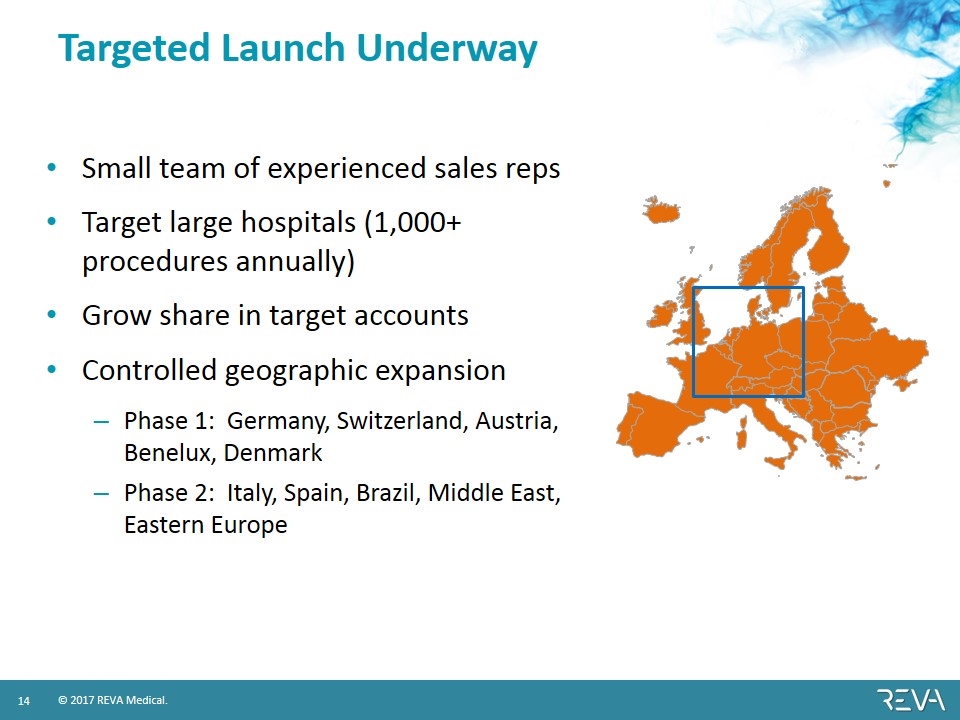

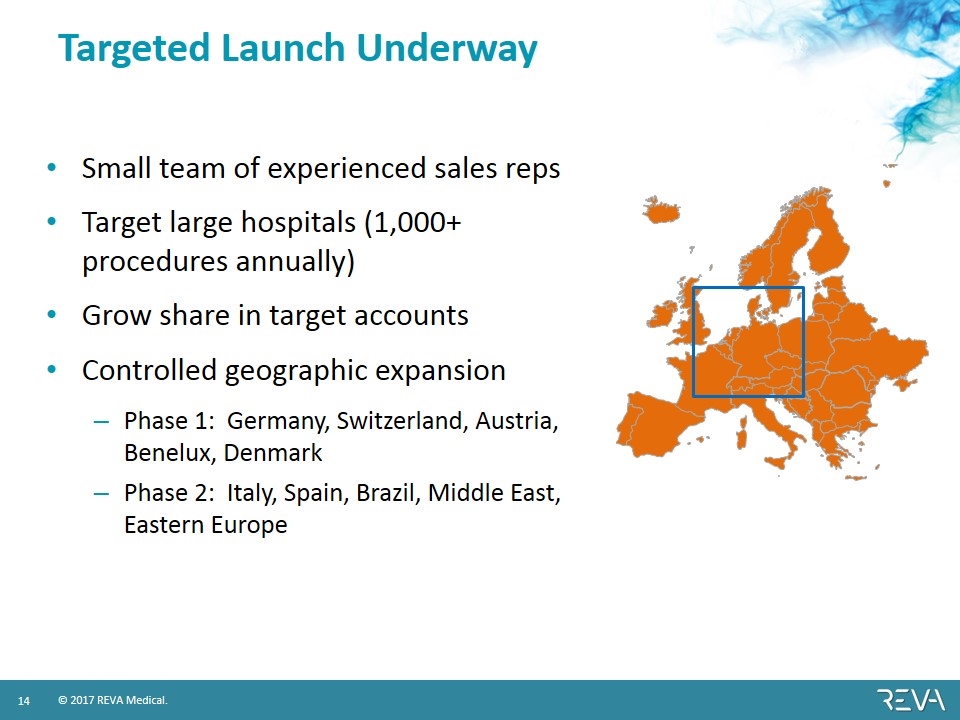

Targeted Launch Underway Small team of experienced sales reps Target large hospitals (1,000+ procedures annually) Grow share in target accounts Controlled geographic expansion Phase 1: Germany, Switzerland, Austria, Benelux, Denmark Phase 2: Italy, Spain, Brazil, Middle East, Eastern Europe

Attractive Market Opportunity with Manageable Investment SHARE GROWTH DRIVERS Clinical experience New product launch Indication expansion Long lesion, multi-vessel AMI DIRECT AND DISTRIBUTOR CHANNELS Direct in Phase 1 (<15 FTE’s) Distributor in Phase 2 1) Calculations based on estimated annual procedures at targeted hospitals.

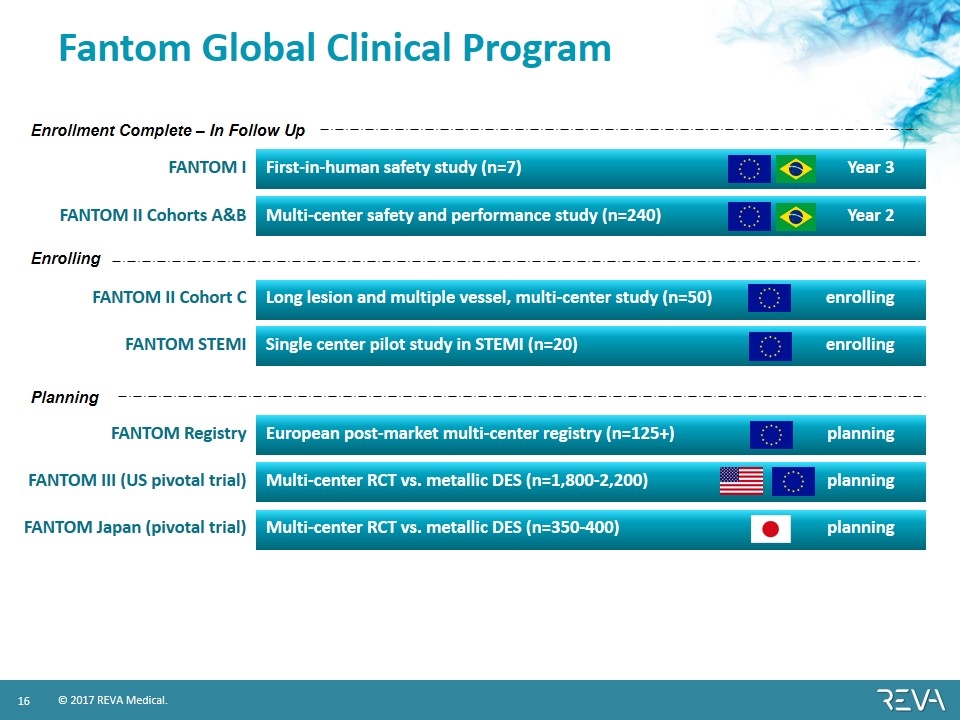

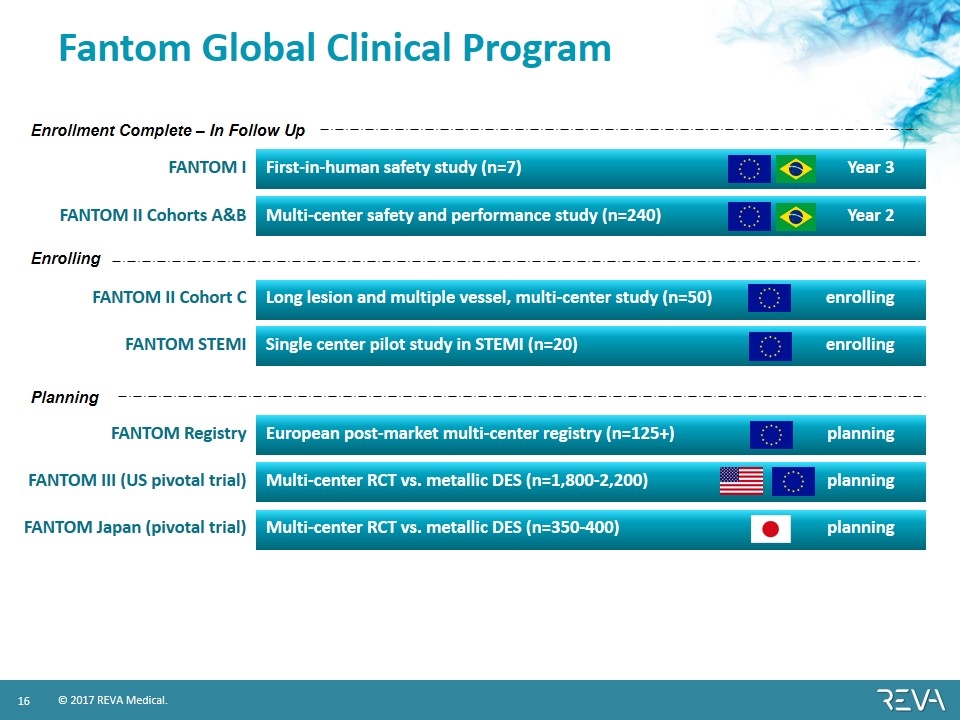

Fantom Global Clinical Program FANTOM I First-in-human safety study (n=7) Year 3 FANTOM II Cohorts A&B Multi-center safety and performance study (n=240) Year 2 FANTOM II Cohort C Long lesion and multiple vessel, multi-center study (n=50) enrolling FANTOM STEMI Single center pilot study in STEMI (n=20) enrolling FANTOM Registry European post-market multi-center registry (n=125+) planning FANTOM III (US pivotal trial) Multi-center RCT vs. metallic DES (n=1,800-2,200) planning FANTOM Japan (pivotal trial) Multi-center RCT vs. metallic DES (n=350-400) planning Enrollment Complete – In Follow Up Enrolling Planning

Expanding the Product Portfolio Launch Fantom Encore with market-leading 95 micron strut thickness in the 2.5 mm diameter Expand size matrix with longer and shorter scaffolds Develop larger diameter to treat more vessels Pursue below-the-knee indication Develop polymer for expanded peripheral artery applications

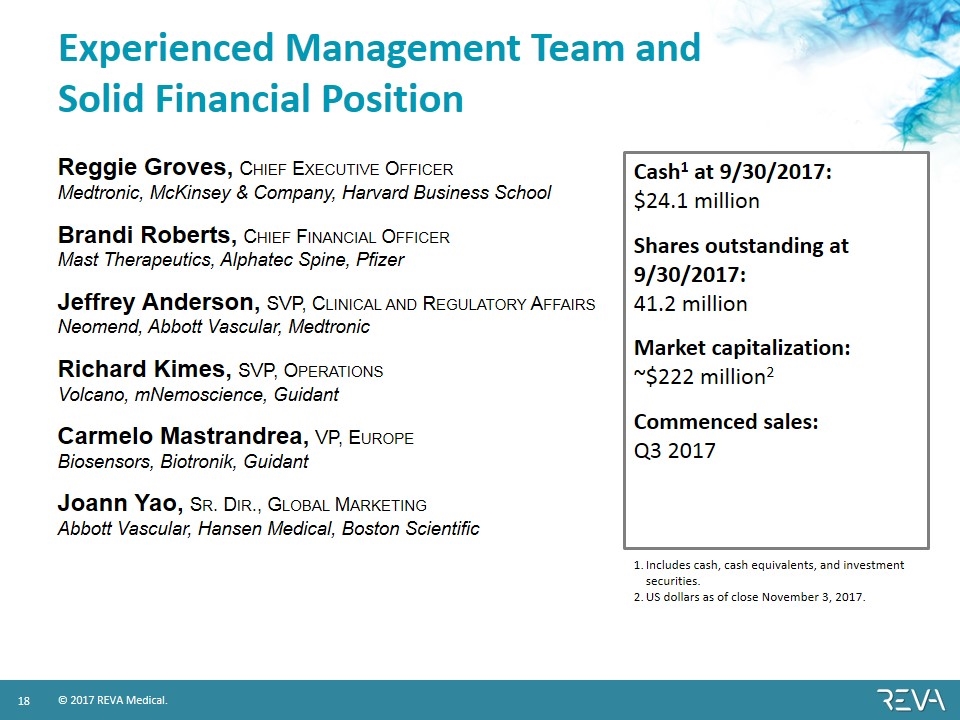

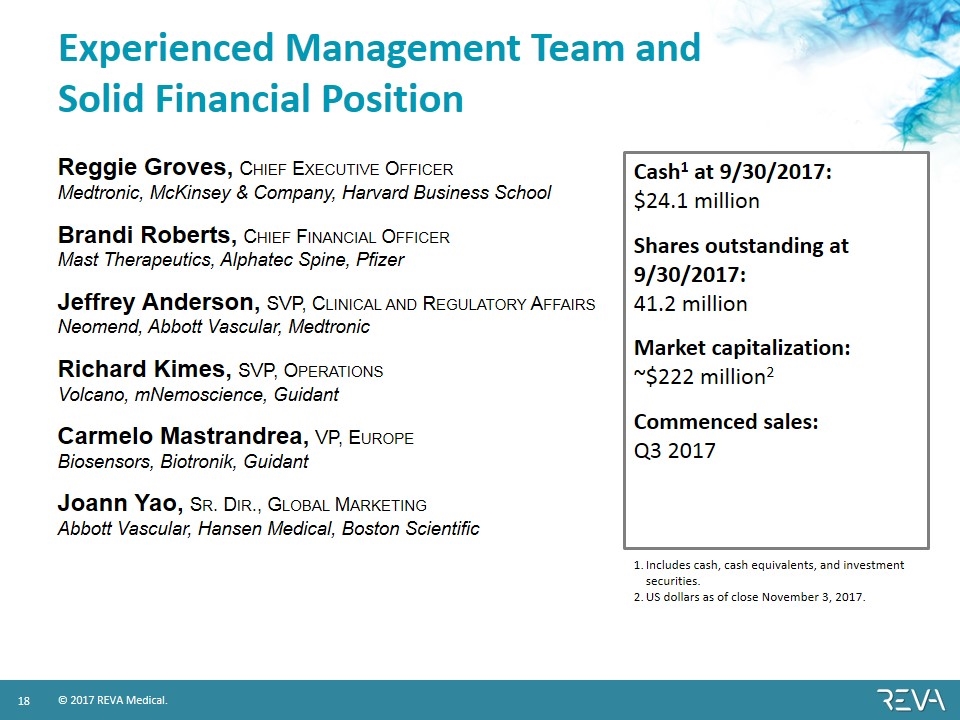

Experienced Management Team and Solid Financial Position Reggie Groves, Chief Executive Officer Medtronic, McKinsey & Company, Harvard Business School Brandi Roberts, Chief Financial Officer Mast Therapeutics, Alphatec Spine, Pfizer Jeffrey Anderson, SVP, Clinical and Regulatory Affairs Neomend, Abbott Vascular, Medtronic Richard Kimes, SVP, Operations Volcano, mNemoscience, Guidant Carmelo Mastrandrea, VP, Europe Biosensors, Biotronik, Guidant Joann Yao, Sr. Dir., Global Marketing Abbott Vascular, Hansen Medical, Boston Scientific Cash1 at 9/30/2017: $24.1 million Shares outstanding at 9/30/2017: 41.2 million Market capitalization: ~$222 million2 Commenced sales: Q3 2017 Includes cash, cash equivalents, and investment securities. US dollars as of close November 3, 2017.

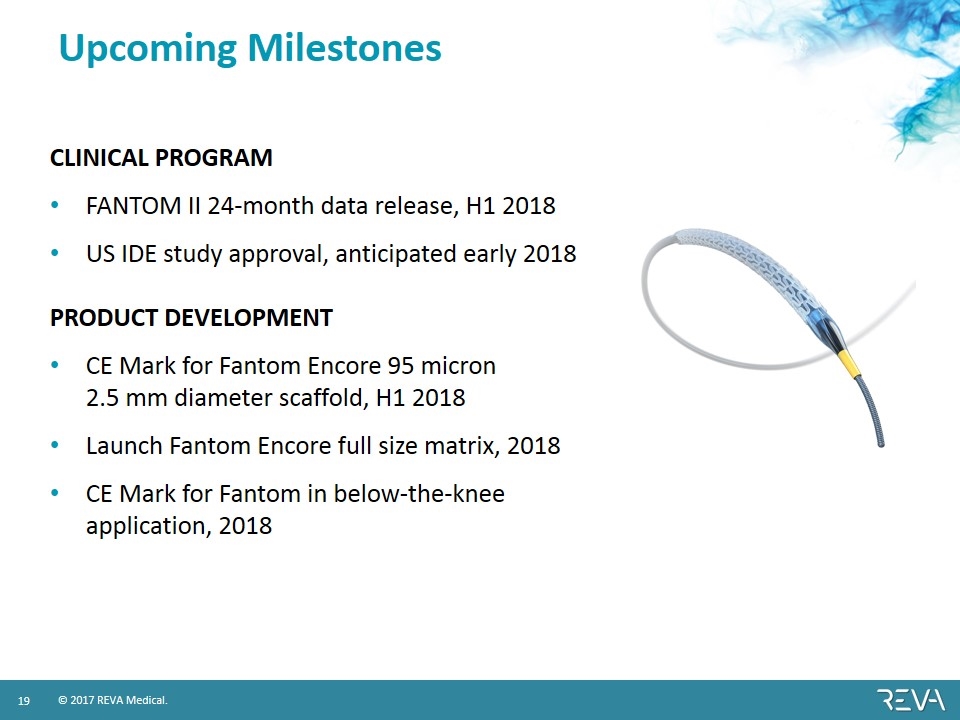

Upcoming Milestones CLINICAL PROGRAM FANTOM II 24-month data release, H1 2018 US IDE study approval, anticipated early 2018 PRODUCT DEVELOPMENT CE Mark for Fantom Encore 95 micron 2.5 mm diameter scaffold, H1 2018 Launch Fantom Encore full size matrix, 2018 CE Mark for Fantom in below-the-knee application, 2018

Fantom is not available for sale in the US. Fantom is not available for sale in all countries.