Exhibit 99.1

Investor Presentation January 2019 NASDAQ: TPNL

3PEA International Investor Presentation IMPORTANT NOTICES FORWARD LOOKING STATEMENTS AND USE OF NON - GAAP FINANCIAL INFORMATION . This presentation may include "forward - looking statements." To the extent that the information presented in this presentation discusses financial projections, information, or expectations about the Company’s business plans, results of operations, returns on equity, markets, or otherwise makes statements about future events, such statements are forward - looking. Such forward - looking statements can be identified by the use of words such as “should,” “may,” “intends,” “anticipates,” “believes,” “estimates,” “projects,” “forecasts,” “expects,” “plans,” and “proposes.” Although the Company believes that the expectations reflected in these forward - looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward - looking statements. You are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading "Risk Factors" and elsewhere our 2017 Form 10 - K. Forward - looking statements speak only as of the date of the document in which they are contained, and the Company does not undertake any duty to update any forward - looking statements except as may be required by law. This presentation also includes adjusted EBITDA, a non - GAAP financial measure, that is not prepared in accordance with, nor an alternative to, financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, adjusted EBITDA is not based on any standardized methodology prescribed by GAAP and is not necessarily comparable to similarly - titled measures presented by other companies. A reconciliation of these measures to the most directly comparable GAAP measure is included in the Appendix to this presentation. 2 2

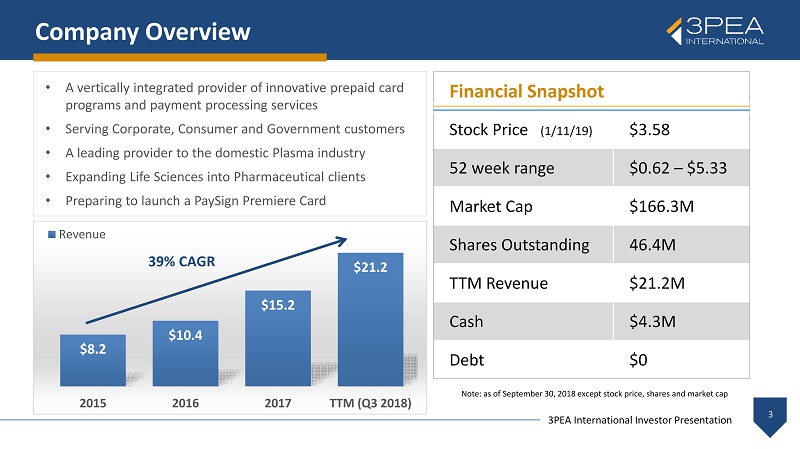

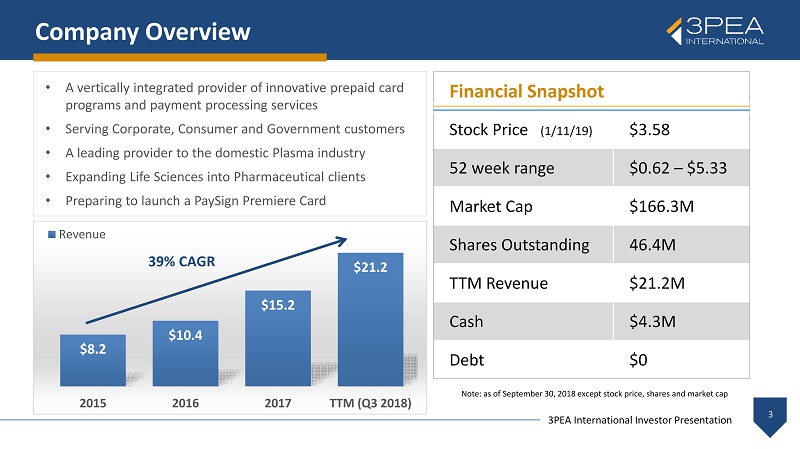

3PEA International Investor Presentation Company Overview Note: as of September 30, 2018 except stock price, shares and market cap 3 $8.2 $10.4 $15.2 $21.2 2015 2016 2017 TTM (Q3 2018) Revenue 39% CAGR • A vertically integrated provider of innovative prepaid card programs and payment processing services • Serving Corporate, Consumer and Government customers • A leading provider to the domestic Plasma industry • Expanding Life Sciences into Pharmaceutical clients • Preparing to launch a PaySign Premiere Card Financial Snapshot Stock Price (1/11/19) $3.58 52 week range $0.62 – $5.33 Market Cap $166.3M Shares Outstanding 46.4M TTM Revenue $21.2M Cash $4.3M Debt $0

3PEA International Investor Presentation Fast growing, high margin profitable business with predictable recurring revenues Highly accomplished and experienced management team and board Superior client retention and service quality Strong Cash Flows and no Debt Large market opportunity in Corporate Incentives and GPR with high barriers to entry 4 Leading proprietary PaySign ® pre - paid technology platform Investment Highlights

3PEA International Investor Presentation Our Recent Milestones Q3 2018 revenue and earnings grew 60% YOY 5 August 2018 • Listed on NASDAQ as TPNL May 2018 • Appointed Dan Henry as the Chairman of the Board September 2018 • 2 Million+ cardholders • 244 card programs December 2017 • 1.5 Million+ cardholders • 205 card programs

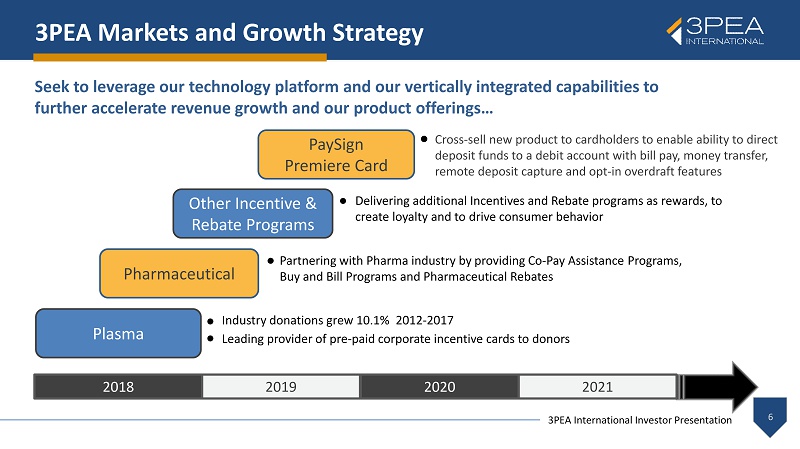

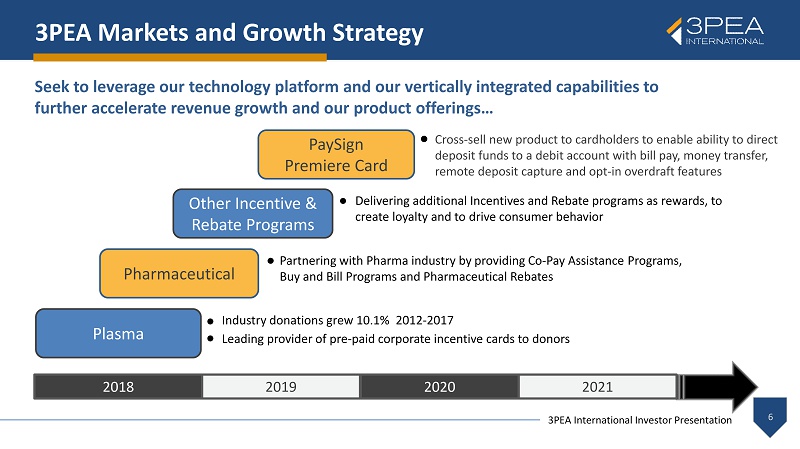

3PEA International Investor Presentation 3PEA Markets and Growth Strategy 6 2018 2020 2019 2021 Seek to leverage our technology platform and our vertically integrated capabilities to further accelerate revenue growth and our product offerings… Cross - sell new product to cardholders to enable ability to direct deposit funds to a debit account with bill pay, money transfer, remote deposit capture and opt - in overdraft features PaySign Premiere Card Delivering additional Incentives and Rebate programs as rewards, to create loyalty and to drive consumer behavior Other Incentive & Rebate Programs Partnering with Pharma industry by providing Co - Pay Assistance Programs, Buy and Bill Programs and Pharmaceutical Rebates Pharmaceutical Industry donations grew 10.1% 2012 - 2017 Leading provider of pre - paid corporate incentive cards to donors Plasma

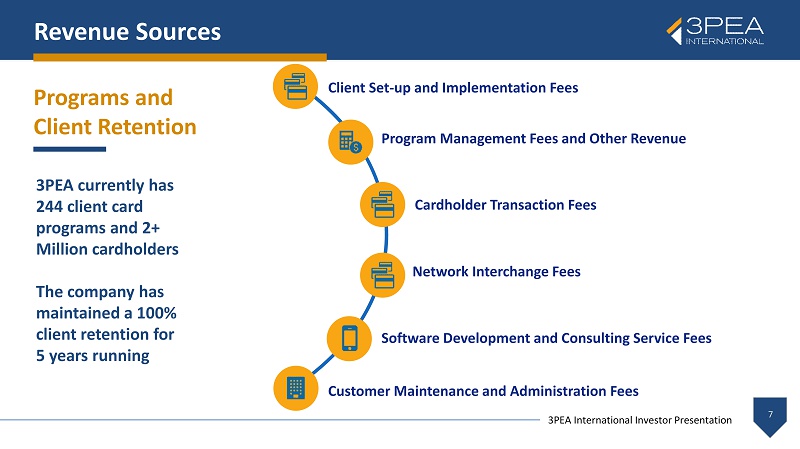

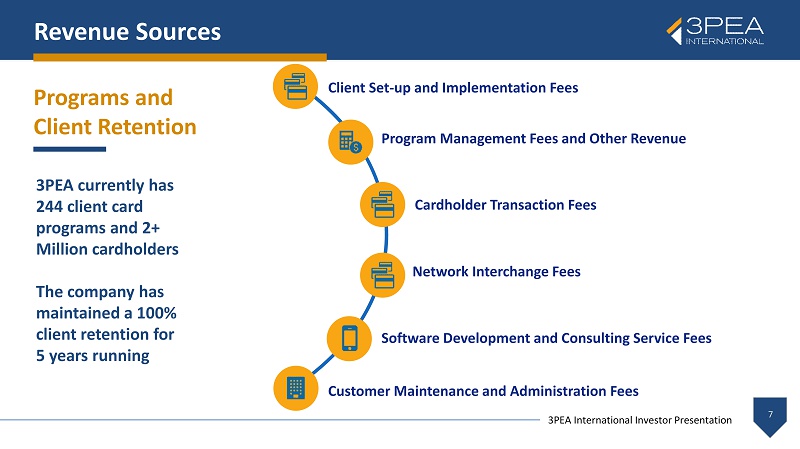

3PEA International Investor Presentation Client Set - up and Implementation Fees Program Management Fees and Other Revenue Customer Maintenance and Administration Fees Cardholder Transaction Fees Network Interchange Fees Revenue Sources 7 Software Development and Consulting Service Fees Programs and Client Retention 3PEA currently has 244 client card programs and 2+ Million cardholders The company has maintained a 100% client retention for 5 years running

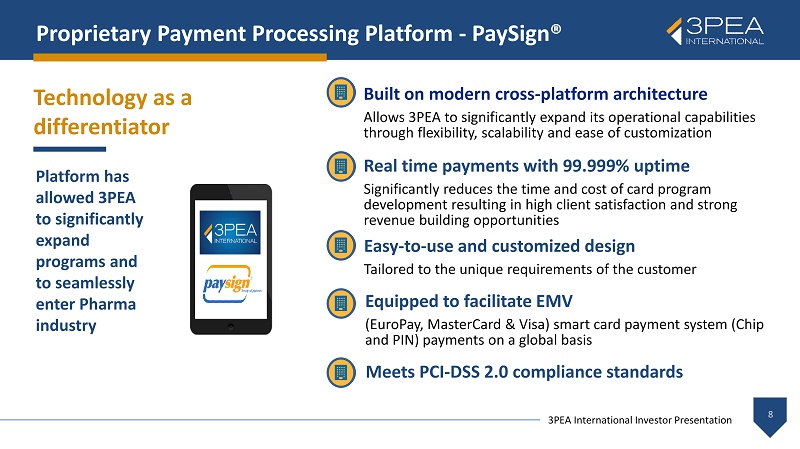

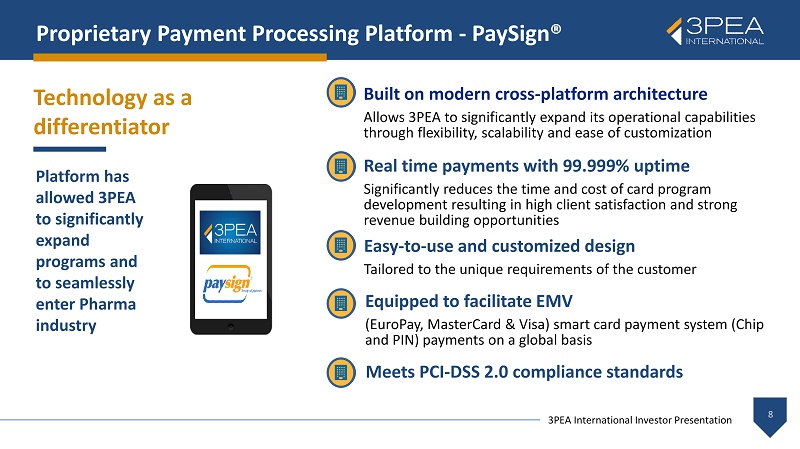

3PEA International Investor Presentation Platform has allowed 3PEA to significantly expand programs and to seamlessly enter Pharma industry Built on modern cross - platform architecture Allows 3PEA to significantly expand its operational capabilities through flexibility, scalability and ease of customization Real time payments with 99.999% uptime Significantly reduces the time and cost of card program development resulting in high client satisfaction and strong revenue building opportunities Easy - to - use and customized design Tailored to the unique requirements of the customer Equipped to facilitate EMV (EuroPay, MasterCard & Visa) smart card payment system (Chip and PIN) payments on a global basis Proprietary Payment Processing Platform - PaySign® 8 Meets PCI - DSS 2.0 compliance standards Technology as a differentiator

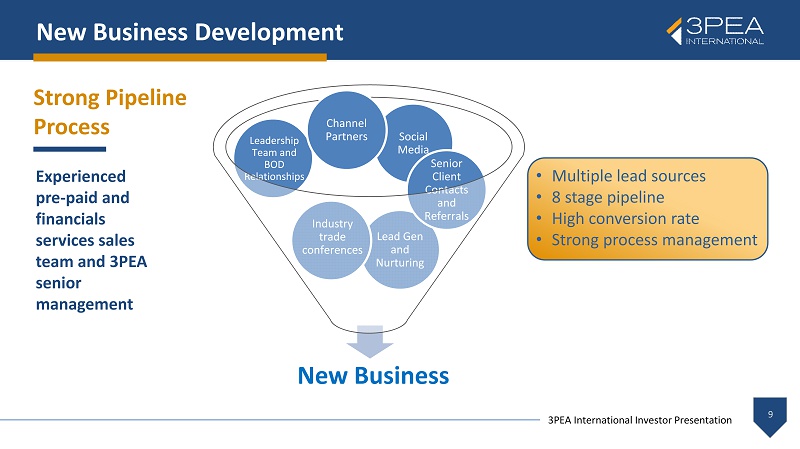

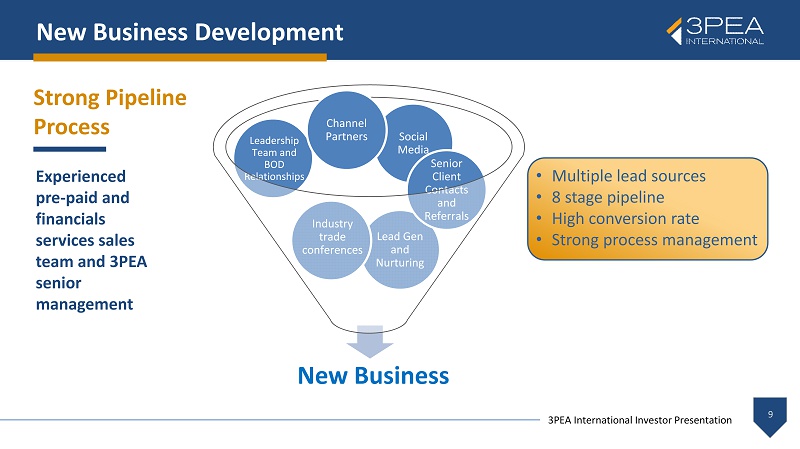

3PEA International Investor Presentation Social Media Leadership Team and BOD Relationships Lead Gen and Nurturing 9 New Business Development New Business Industry trade conferences Senior Client Contacts and Referrals • Multiple lead sources • 8 stage pipeline • High conversion rate • Strong process management Experienced pre - paid and financials services sales team and 3PEA senior management Strong Pipeline Process Channel Partners

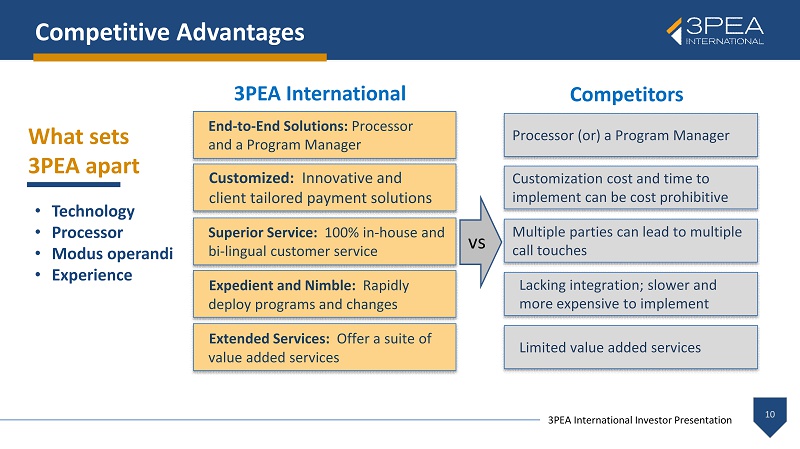

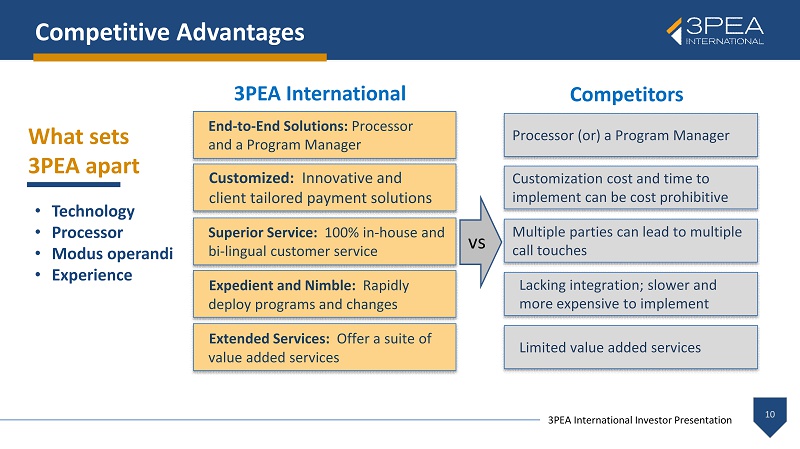

3PEA International Investor Presentation • Technology • Processor • Modus operandi • Experience Competitive Advantages What sets 3PEA apart End - to - End Solutions: Processor and a Program Manager Customized: Innovative and client tailored payment solutions Superior Service: 100% in - house and bi - lingual customer service Expedient and Nimble: Rapidly deploy programs and changes Extended Services: Offer a suite of value added services 3PEA International Processor (or) a Program Manager Customization cost and time to implement can be cost prohibitive Multiple parties can lead to multiple call touches Lacking integration; slower and more expensive to implement Limited value added services Competitors vs 10

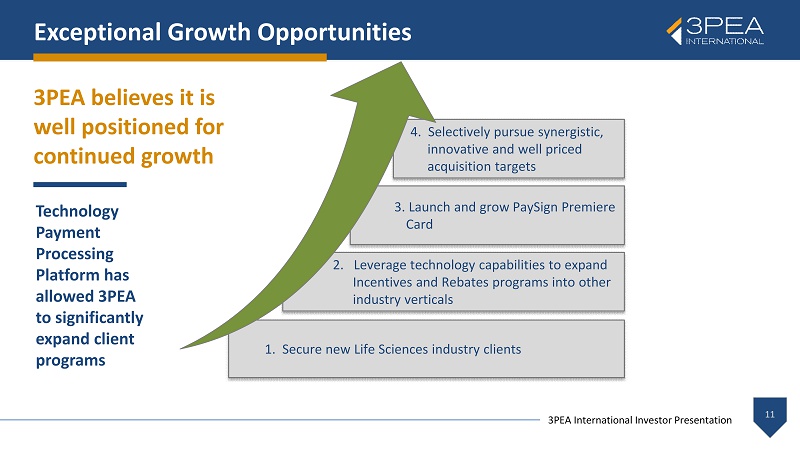

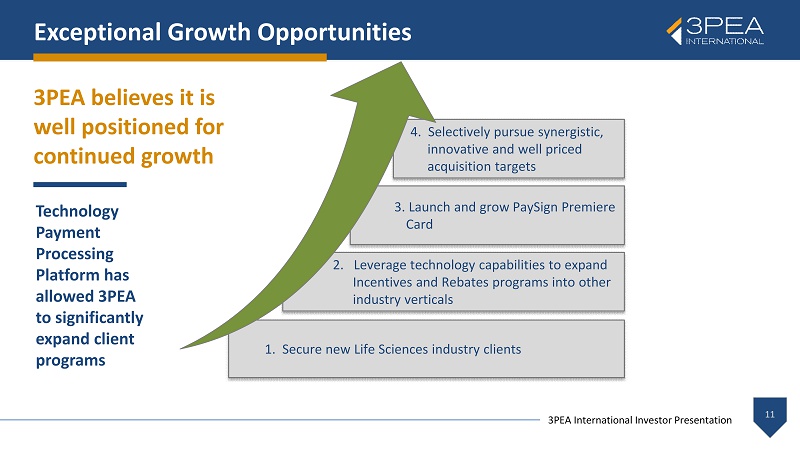

3PEA International Investor Presentation 1. Secure new Life Sciences industry clients Technology Payment Processing Platform has allowed 3PEA to significantly expand client programs Exceptional Growth Opportunities 11 3PEA believes it is well positioned for continued growth 4. Selectively pursue synergistic, innovative and well priced acquisition targets 3. Launch and grow PaySign Premiere Card 2. Leverage technology capabilities to expand Incentives and Rebates programs into other industry verticals

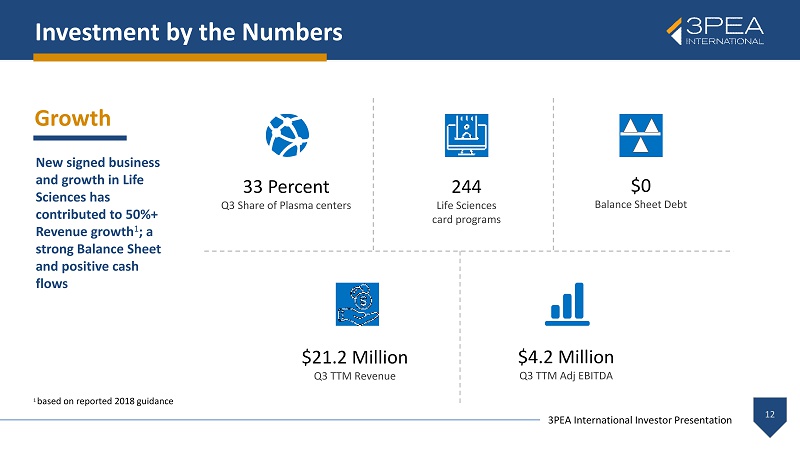

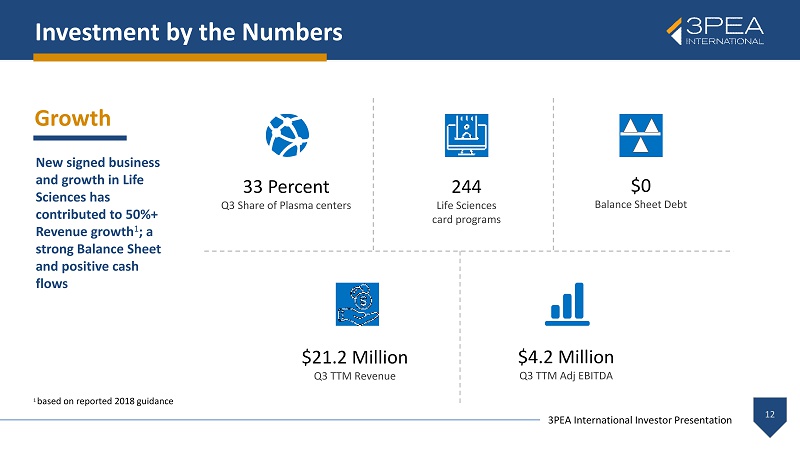

3PEA International Investor Presentation New signed business and growth in Life Sciences has contributed to 50%+ Revenue growth 1 ; a strong Balance Sheet and positive cash flows Investment by the Numbers 12 Growth $21.2 Million Q3 TTM Revenue $4.2 Million Q3 TTM Adj EBITDA 33 Percent Q3 Share of Plasma centers 244 Life Sciences card programs $0 Balance Sheet Debt 1 based on reported 2018 guidance

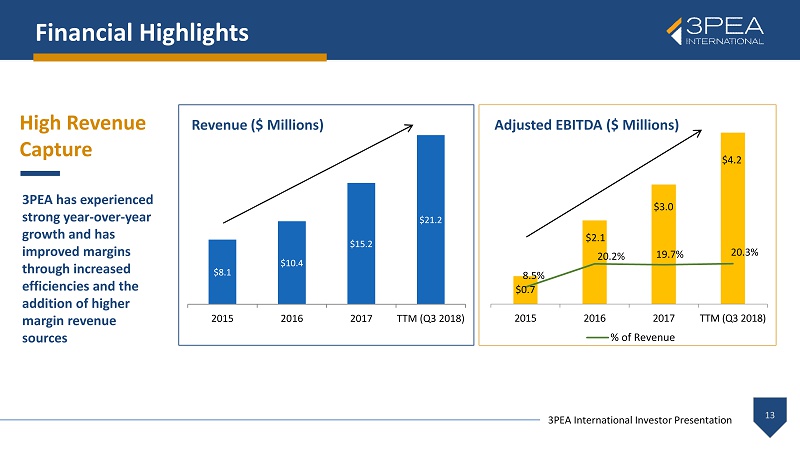

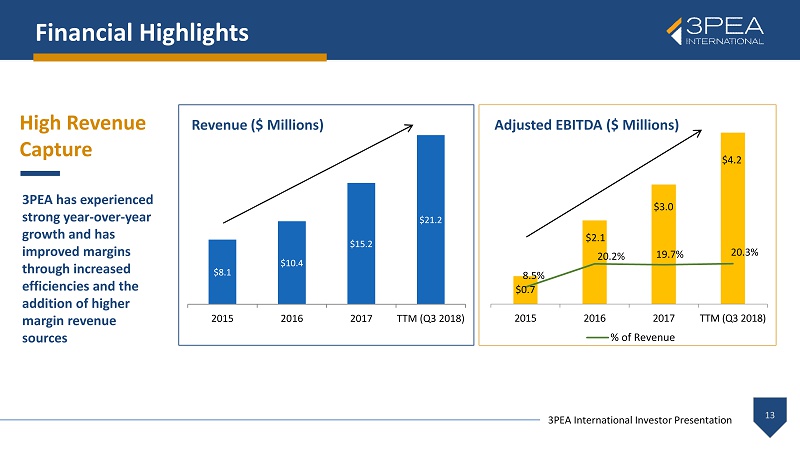

3PEA International Investor Presentation $8.1 $10.4 $15.2 $21.2 2015 2016 2017 TTM (Q3 2018) High Revenue Capture 3PEA has experienced strong year - over - year growth and has improved margins through increased efficiencies and the addition of higher margin revenue sources 13 $0.7 $2.1 $3.0 $4.2 8.5% 20.2% 19.7% 20.3% 2015 2016 2017 TTM (Q3 2018) % of Revenue Financial Highlights Revenue ($ Millions) Adjusted EBITDA ($ Millions)

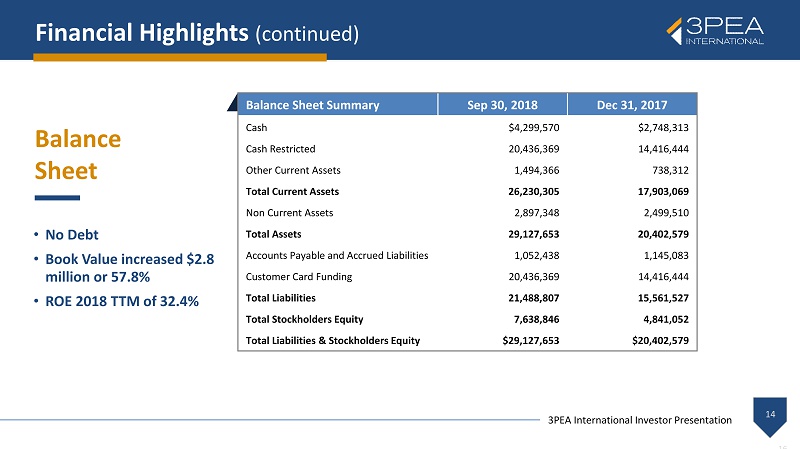

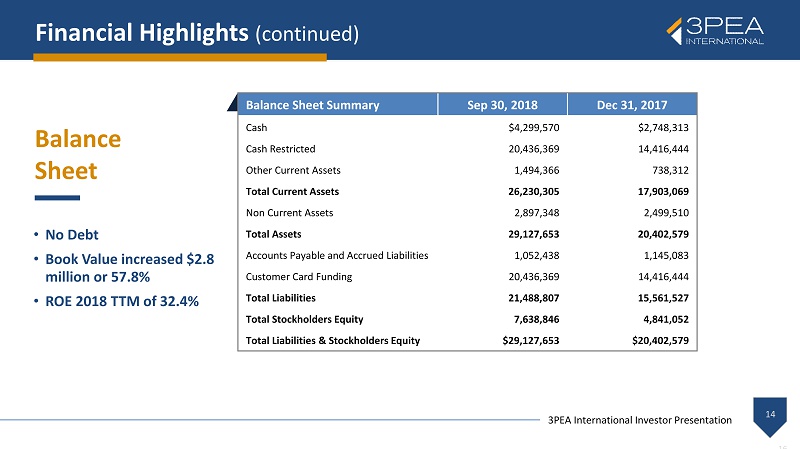

3PEA International Investor Presentation Balance Sheet 16 14 Balance Sheet Summary Sep 30, 2018 Dec 31, 2017 Cash $4,299,570 $2,748,313 Cash Restricted 20,436,369 14,416,444 Other Current Assets 1,494,366 738,312 Total Current Assets 26,230,305 17,903,069 Non Current Assets 2,897,348 2,499,510 Total Assets 29,127,653 20,402,579 Accounts Payable and Accrued Liabilities 1,052,438 1,145,083 Customer Card Funding 20,436,369 14,416,444 Total Liabilities 21,488,807 15,561,527 Total Stockholders Equity 7,638,846 4,841,052 Total Liabilities & Stockholders Equity $29,127,653 $20,402,579 • No Debt • Book Value increased $2.8 million or 57.8% • ROE 2018 TTM of 32.4% Financial Highlights (continued)

APPENDIX

3PEA International Investor Presentation ▪ Co - founded the Company in 2001; and d riving force behind the Company's significant growth and strategic direction ▪ Shaping the future of the business as a premier prepaid card services leader, delivering a strong value proposition for clien ts and over 2 million cardholders; oversees all financial, operational, technological and strategic decisions for the company, including: technolog y i nvestments, the evaluation of strategic acquisitions, new product development and the formation and cultivation of third - party relationships ▪ Served on the X - 9 committee which developed standards for the electronic payments industry alongside IBM, Diebold, First Data, K PMG, MasterCard, Melon Bank, Visa, Wells Fargo, the Federal Reserve and others ▪ Attended Cal - Poly San Luis Obispo where he majored in Bio - Science Mark Newcomer, President, CEO, and Vice Chairman of the Board of Directors Joan Herman, Chief Operating Officer and Director ▪ 30+ years of industry experience ▪ Previously at Sunrise Banks as Senior Vice President, Payments Division where she led the new prepaid business ▪ Prior experience includes various management positions in operations, product development and sales and marketing at UMB Bank , Heartland Bank, and Boatmen’s Bank ▪ Board member of the Network Branded Prepaid Card Association and serves as Treasurer Daniel Spence, Chief Technology Officer and Director ▪ Co - founded the Company in 2001 ▪ 30+ years of senior IT experience ▪ Prior experience includes Director of Technology Planning at the Associated Press, Project Manager of implementation of Medic are Easyclaim for ANZ Bank in Australia, Coca - Cola Business Operations & Business analyst for Australia Post Mark Attinger, Chief Financial Officer ▪ 30+ years of experience in Financial Services and BPO industries with concentration in Finance, Operations and executive lea der ship ▪ Prior experience includes CEO and CFO of Zxerex, CEO of Affina , and Vice President at American Express and Vice President at NextCard ▪ Bachelor of Science in Finance, minor in Accounting; and Masters in Business Administration (MBA) from Brigham Young Universi ty Leadership Team 16

3PEA International Investor Presentation ▪ 13+ years of legal experience in non - traditional banking ▪ Previously at Republic Bank & Trust Company (Louisville, KY) as Deputy General Counsel and Vice President where he managed al l l egal affairs for Republic’s non - traditional bank programs, including payments, small - dollar consumer lending, commercial lending and tax related products ▪ B.A. in Psychology and Philosophy from the University of Kentucky and J.D. from DePaul University College of Law in Chicago, Ill inois Robert Strobo, General Counsel, Chief Legal Officer and Secretary Dana Barciz, Chief Marketing Officer ▪ 25+ years experience in various marketing roles within the Fintech industry ▪ Former Senior Product Marketing Manager at Fiserv ▪ Former Vice President, Marketing, NYSE Governance Services Eric Trudeau, Chief Compliance Officer ▪ 20 years of experience working in the card industry, focusing on prepaid and credit products ▪ Previously with Global Cash Card, Inc., Sunrise Banks and Meta Payment Systems (a division of Meta Bank) ▪ Certified member (CAMS) of the Association of Certified Anti - Money Laundering Specialists. ▪ Bachelor of Science Degree from South Dakota University Egon Kardum, Chief Information Officer ▪ 30+ years experience in various technical roles providing enterprise IT services at several global companies ▪ Former Associate Director, Hosting Solutions Bristol - Myers Squibb ▪ Former Manager of Server Technology, The Associated Press Leadership Team (continued) 17

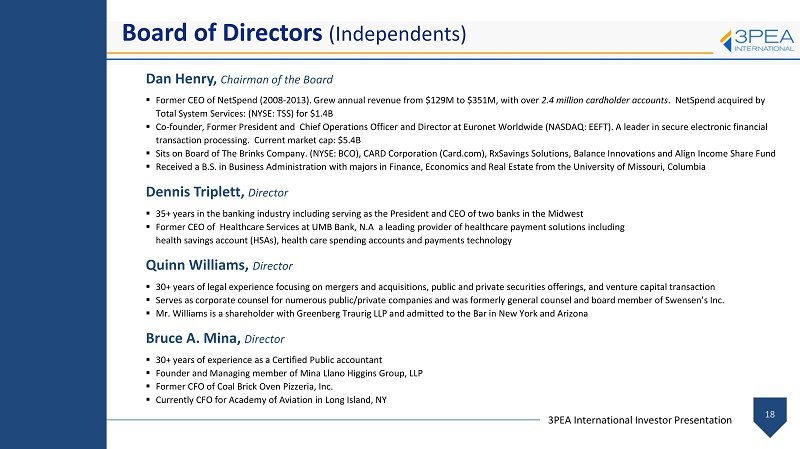

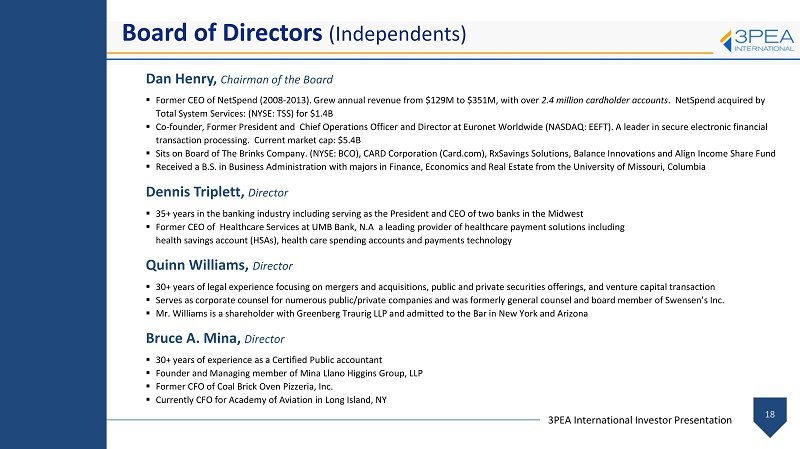

3PEA International Investor Presentation ▪ Former CEO of NetSpend (2008 - 2013). Grew annual revenue from $129M to $351M, with over 2.4 million cardholder accounts . NetSpend acquired by Total System Services: (NYSE: TSS) for $1.4B ▪ Co - founder, Former President and Chief Operations Officer and Director at Euronet Worldwide (NASDAQ: EEFT). A leader in secure electronic financial transaction processing. Current market cap: $5.4B ▪ Sits on Board of The Brinks Company. (NYSE: BCO), CARD Corporation (Card.com), RxSavings Solutions, Balance Innovations and A lig n Income Share Fund ▪ Received a B.S. in Business Administration with majors in Finance, Economics and Real Estate from the University of Missouri, Co lumbia Dan Henry, Chairman of the Board Dennis Triplett, Director Quinn Williams, Director ▪ 30+ years of legal experience focusing on mergers and acquisitions, public and private securities offerings, and venture capi tal transaction ▪ Serves as corporate counsel for numerous public/private companies and was formerly general counsel and board member of Swense n’s Inc. ▪ Mr. Williams is a shareholder with Greenberg Traurig LLP and admitted to the Bar in New York and Arizona ▪ 35+ years in the banking industry including serving as the President and CEO of two banks in the Midwest ▪ Former CEO of Healthcare Services at UMB Bank, N.A a leading provider of healthcare payment solutions including health savings account (HSAs), health care spending accounts and payments technology Bruce A. Mina, Director ▪ 30+ years of experience as a Certified Public accountant ▪ Founder and Managing member of Mina Llano Higgins Group, LLP ▪ Former CFO of Coal Brick Oven Pizzeria, Inc. ▪ Currently CFO for Academy of Aviation in Long Island, NY Board of Directors (Independents) 18

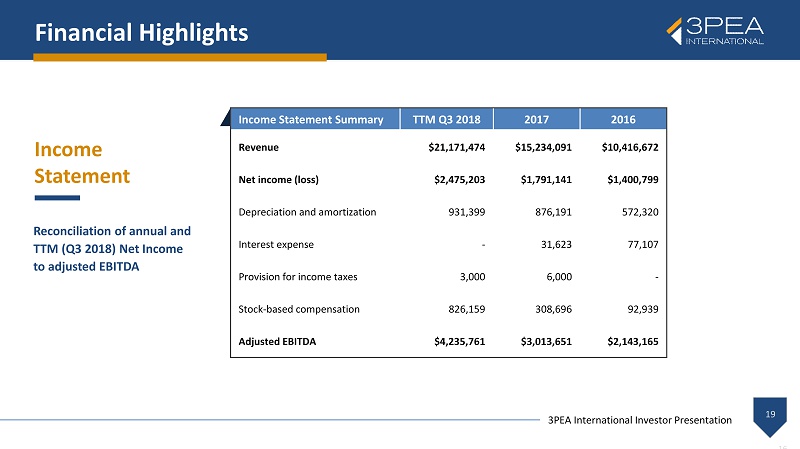

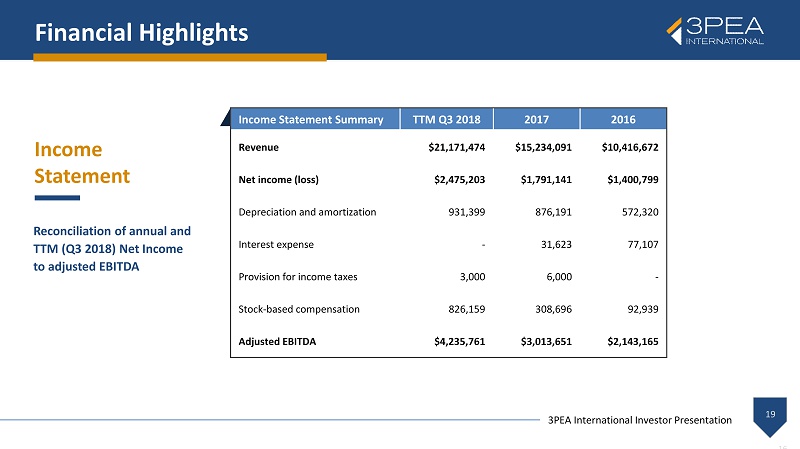

3PEA International Investor Presentation Income Statement 16 19 Reconciliation of annual and TTM (Q3 2018) Net Income to adjusted EBITDA Income Statement Summary TTM Q3 2018 2017 2016 Revenue $21,171,474 $15,234,091 $10,416,672 Net income (loss) $2,475,203 $1,791,141 $1,400,799 Depreciation and amortization 931,399 876,191 572,320 Interest expense - 31,623 77,107 Provision for income taxes 3,000 6,000 - Stock - based compensation 826,159 308,696 92,939 Adjusted EBITDA $4,235,761 $3,013,651 $2,143,165 Financial Highlights

Contact Information 3PEA International, Inc. 1700 W Horizon Ridge Parkway Suite 200 Henderson, NV Tel: (702) 453 - 2221 www.3PEA.com Company Contact Jim McCroy Tel: (702) 749 - 7269 IR@3PEA.com 3PEA International Investor Presentation