As filed with the Securities and Exchange Commission on February 13, 2014

Registration No. 333-168129

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 8

TO FORM S-11

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

CNL HEALTHCARE PROPERTIES, INC.

(Exact name of registrant as specified in its governing instruments)

CNL Center at City Commons

450 South Orange Avenue

Orlando, Florida 32801

Telephone: (407) 650-1000

(Address, including zip code, and telephone number, including

area code, of the registrant’s principal executive offices)

Stephen H. Mauldin

President and Chief Executive Officer

CNL Healthcare Properties, Inc.

CNL Center at City Commons

450 South Orange Avenue

Orlando, Florida 32801

Telephone: (407) 650-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Richard E. Baltz, Esq. Neil M. Goodman, Esq. Arnold & Porter LLP 555 Twelfth Street, N.W. Washington, DC 20004-1206 Telephone: (202) 942-5000 | | Peter E. Reinert, Esq. Lowndes, Drosdick, Doster, Kantor & Reed, P.A. 215 North Eola Drive Orlando, Florida 32801 Telephone: (407) 843-4600 |

Approximate date of commencement of proposed sale to public: As soon as practicable after the registration statement becomes effective.

If any of the securities being registered in this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box.x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering.¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering.¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| | |

| Large accelerated filer¨ | | Accelerated filer¨ |

| Non-accelerated filerx (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

This Post-Effective Amendment No. 8 consists of the following:

| | — | | The registrant’s prospectus dated April 17, 2013, previously filed pursuant to Rule 424(b)(3) on April 17, 2013 and re-filed herewith; |

| | — | | Supplement No. 2 dated February , 2014, filed herewith, which will be delivered as an unattached document; and |

| | — | | Part II to this Post-Effective Amendment No. 8, filed herewith. |

CNL HEALTHCARE PROPERTIES, INC.

SUPPLEMENT NO. 2

DATED FEBRUARY 13, 2014

TO

PROSPECTUS DATED APRIL 17, 2013

This Supplement No. 2 (the “Supplement”) should be read in conjunction with the prospectus of CNL Healthcare Properties, Inc. dated April 17, 2013, and the additional information incorporated by reference herein and described under the heading “Incorporation of Certain Information By Reference.” This Supplement replaces all prior stickers and supplements to the prospectus. Unless otherwise defined herein, capitalized terms used herein have the same meanings as in the prospectus. The terms “we,” “our,” “us” and the “Company” means CNL Healthcare Properties, Inc., CHP Partners, LP, a wholly-owned subsidiary and our operating partnership, and/or our other subsidiaries or affiliates. The purpose of this Supplement is to update and amend certain information contained in the prospectus.

TABLE OF CONTENTS

| | | | | | | | |

| | | Supplement Page No. | | | Prospectus – Related

Section/Page No. | |

PROSPECTUS SUMMARY | | | | | | | | |

Cover Page | | | 1 | | | | | |

Our Business | | | 1 | | | | 1 | |

Recent Developments | | | 1 | | | | 1 | |

Properties Summary | | | 6 | | | | 5 | |

Risk Factors | | | 8 | | | | 8 | |

Our REIT Status | | | 11 | | | | 10 | |

Our Management | | | 11 | | | | 10 | |

Compensation of Our Advisor and Affiliates | | | 12 | | | | 14,19 | |

Our Offering | | | 12 | | | | 20 | |

Our Distribution Policy | | | 13 | | | | 21 | |

Our Distribution Reinvestment Plan | | | 13 | | | | 21 | |

Our Redemption Plan | | | 13 | | | | 21,22 | |

Our Valuation Policy | | | 14 | | | | 22 | |

Our Exit Strategy | | | 15 | | | | 22 | |

RISK FACTORS | | | 15 | | | | 23,24,31,54,57 | |

ESTIMATED USE OF PROCEEDS | | | 18 | | | | 60 | |

MANAGEMENT COMPENSATION | | | 20 | | | | 62,67,68 | |

BUSINESS | |

| 21

|

| |

| 78,79,81,93,94

97,100,101,102 |

|

PRIOR PERFORMANCE SUMMARY | | | 46 | | | | 115 | |

SELECTED FINANCIAL DATA | | | 50 | | | | 120 | |

MANAGEMENT | | | 53 | | | | 122,123,125,126,128 | |

SECURITY OWNERSHIP | | | 54 | | | | 128 | |

DETERMINATION OF OUR OFFERING PRICE AND ESTIMATED NET ASSET VALUE PER SHARE | | | 54 | | | | 128 | |

THE ADVISOR AND THE ADVISORY AGREEMENT | | | 59 | | | | 130,139,140 | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | 60 | | | | 143 | |

SUMMARY OF DISTRIBUTION REINVESTMENT PLAN | | | 64 | | | | 145 | |

SUMMARY OF REDEMPTION PLAN | | | 65 | | | | 147,150 | |

DISTRIBUTION POLICY | | | 66 | | | | 150,151,152,153 | |

SUMMARY OF THE CHARTER AND BYLAWS | | | 69 | | | | 154 | |

FEDERAL INCOME TAX CONSIDERATIONS | | | 77 | | | | 164,167,176,185 | |

PLAN OF DISTRIBUTION | | | 78 | | | | 187,188,190 | |

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | | | 79 | | | | 196 | |

EXPERTS | | | 81 | | | | 197 | |

| | |

Prior Performance Tables – Addendum to Appendix A | | | | | | | | |

i

PROSPECTUS SUMMARY

Cover Page

The following replaces in its entirety the first sentence of the Cover Page of the prospectus.

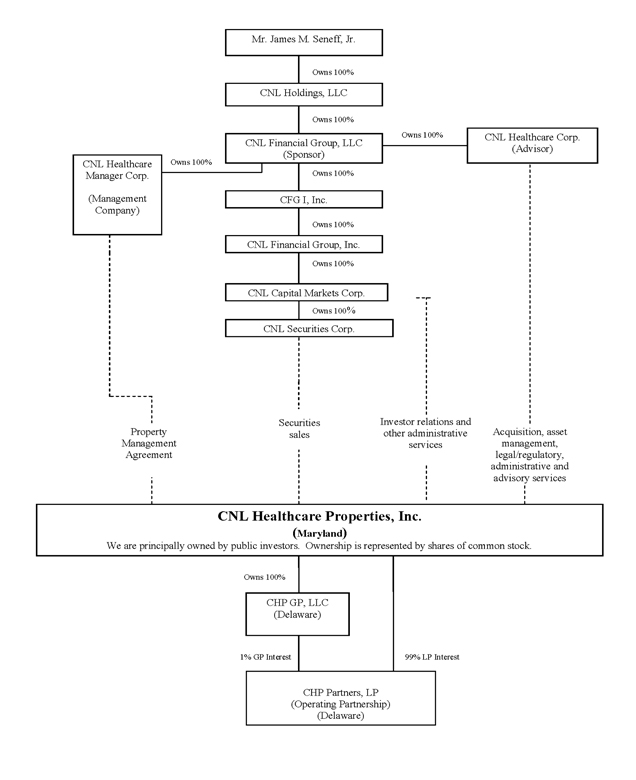

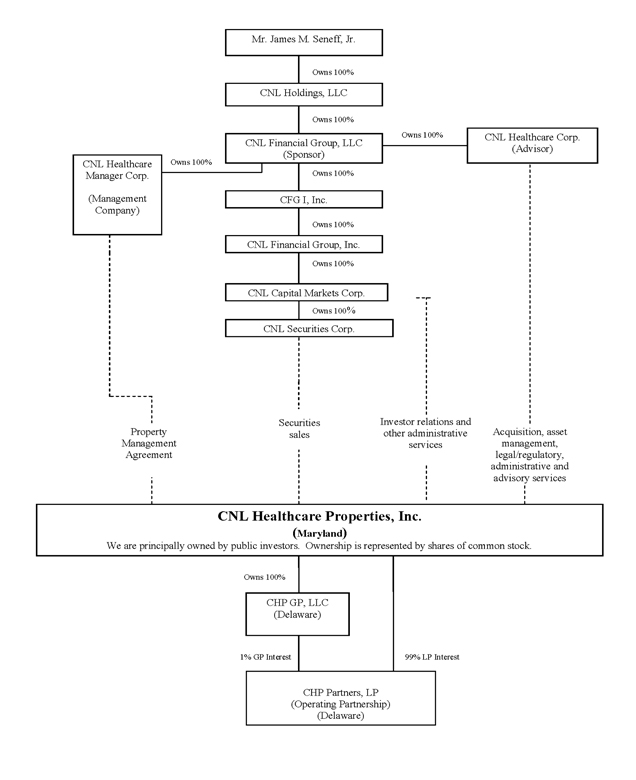

CNL Healthcare Properties, Inc., is a Maryland corporation sponsored by CNL Financial Group, LLC which has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

Our Business

The following replaces in its entirety the section entitled “PROSPECTUS SUMMARY—Our Business” on page 1 of the prospectus.

CNL Healthcare Properties, Inc., or the “Company,” is a Maryland corporation incorporated on June 8, 2010 which has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. CNL Healthcare Properties, Inc. was formerly known as CNL Healthcare Trust, Inc., but changed its name effective as of December 26, 2012.

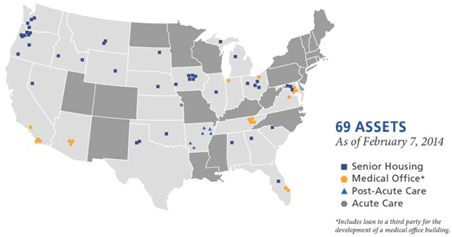

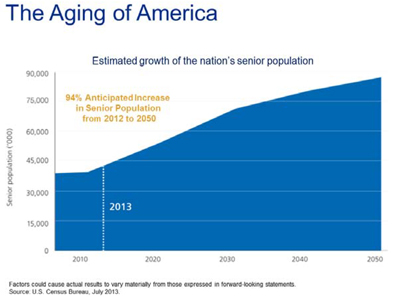

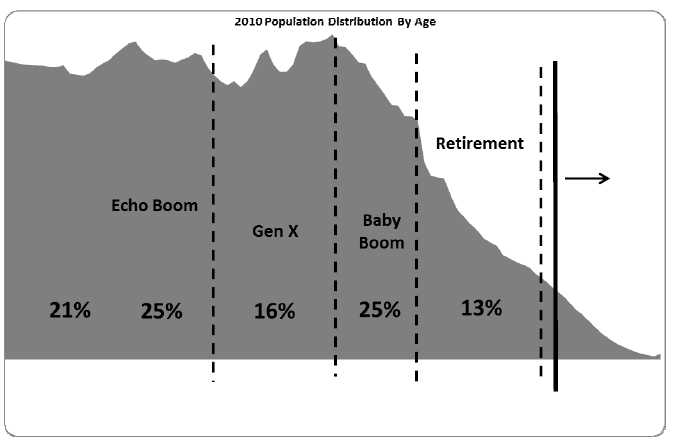

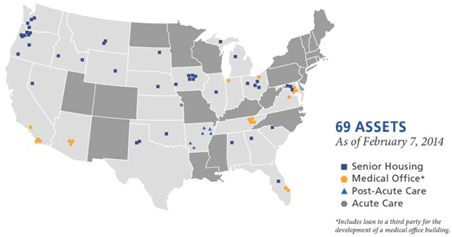

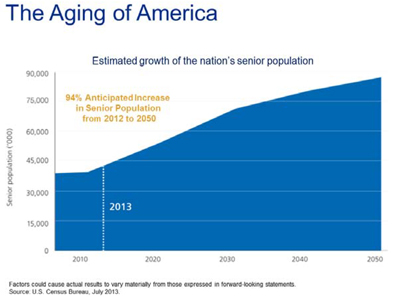

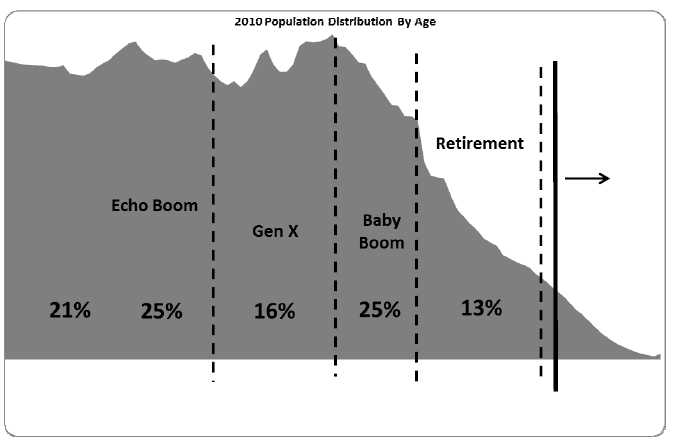

CNL Healthcare Properties, Inc. is sponsored by CNL Financial Group, LLC, referred to herein as the “sponsor.” We own and manage a portfolio of real estate that we believe will generate a current return and provide long-term value to our stockholders. In particular, we focus on acquiring properties primarily in the United States within the senior housing, medical office facility, acute and post-acute care facility sectors, including both stabilized and development properties, as well as other types of income-producing real estate and real estate-related securities and loans. We view, manage and evaluate our portfolio homogeneously as one collection of healthcare assets with a common goal to maximize revenues and property income regardless of the asset class or asset type.

Asset classes we may acquire within the senior housing sector include active adult communities (age-restricted or age-targeted housing), independent and assisted living facilities, continuing care retirement communities, memory care facilities and skilled nursing. Asset classes we may acquire within the medical office facility sector include , physicians’ offices, specialty medical and diagnostic service facilities, walk-in clinics, outpatient surgery centers, pharmaceutical and medical supply manufacturing facilities, laboratories, research facilities and medical marts. The types of post-acute care facilities that we may acquire include skilled nursing facilities, long-term acute care hospitals and inpatient rehabilitative facilities. The types of acute care facilities that we may acquire include general acute care hospitals and specialty surgical hospitals.

We generally lease our senior housing properties and certain other properties to our wholly owned taxable REIT subsidiaries (each a “TRS” and collectively “TRSs”) with management performed by independent third-party managers. We also lease or will lease certain properties to third-party tenants under triple net leases. We generally enter into long-term, triple net leases with third-party tenants or operators of our healthcare properties and certain of our senior housing properties. Further, we may invest in real estate-related securities, including securities issued by other real estate companies, and commercial mortgage-backed securities. We also may invest in and originate mortgage, bridge and mezzanine loans or in entities that make investments similar to the foregoing.

Our office is located at 450 South Orange Avenue, Orlando, Florida 32801. Our telephone number is (407) 650-1000.

Recent Developments

The following supersedes and replaces in its entirety the section entitled “PROSPECTUS SUMMARY — Recent Developments,” which begins on page 1 of the prospectus:

1

Status of Offering

We commenced our initial offering of shares of our common stock on June 27, 2011. We plan to extend this offering through the earlier of December 24, 2014 or the effective date of a subsequent registration statement. As of December 31, 2013, we had accepted investors’ subscriptions for, and issued, approximately 58.2 million shares of our common stock pursuant to our offering resulting in aggregate subscription proceeds of approximately $568.3 million. As of December 31, 2013, we have issued approximately 1.0 million shares pursuant to our distribution reinvestment plan resulting in proceeds of approximately $9.4 million. As of December 31, 2013, approximately 226.8 million shares of our common stock remain available for sale in our initial offering, and 14.0 million shares of our common stock remain available for issuance under our distribution reinvestment plan. We reserve the right to reallocate the shares we are offering between the initial offering and the distribution reinvestment plan.

Valuation, Estimated Net Asset Value Per Share and Offering Price

On November 25, 2013, the audit committee of our board of directors approved the engagement of CBRE Capital Advisors, Inc. (“CBRE Cap”), an investment banking firm that specializes in providing real estate financial services, to provide property-level and aggregate valuation analyses of the Company and a range for the estimated net asset value per share of our common stock.

On December 6, 2013, our board of directors unanimously approved $9.13 as the estimated net asset value per share of our common stock as of September 30, 2013 based on 47,970,049 shares of our stock outstanding as of that date. Also, on that date our board of directors unanimously approved a new offering price of $10.14 per share for the purchase of shares of our common stock effective December 11, 2013. In making its determination of the estimated net asset value and the offering price, the board of directors considered other information provided by our advisor.

All references to the offering price throughout the prospectus should be considered to be updated to reflect the new offering price.

Distribution Policy

On December 6, 2013, our board of directors also determined to increase the amount of monthly cash distributions to $0.0338 per share and together with monthly stock distributions of 0.0025 shares of common stock payable to all common stockholders of record as of the close of business on the first business day of each month. The change allows us to maintain our historical distribution rate of 4% cash and 3% stock on each outstanding share of our common stock based on the new public offering price. The increase in distributions took effect for stockholders of record on January 1, 2014 and will remain in effect until our board of directors determines otherwise.

Amended and Restated Redemption Plan

On December 6, 2013, our board of directors adopted an amendment and restatement of our redemption plan effective as of December 26, 2013.

Under the amended and restated redemption plan, all shares of common stock or fractions thereof that have been held for at least one year may now be submitted for redemption at an amount equal to our estimated net asset value per share as of the redemption date; provided, however, that the redemption price may not exceed an amount equal to the lesser of (i) the then current public offering price for our shares of common stock (other than the price at which shares are sold under our distribution reinvestment plan) during the period of any on-going public offering; and (ii) the purchase price paid by the stockholder.

Property Manager Expense Support and Restricted Stock Agreement and Amendment of Expense Support Agreements

On August 27, 2013, we entered into a property manager expense support and restricted stock agreement effective July 1, 2013 with our property manager pursuant to which, in the event the advisor’s expense support amount does not meet a certain threshold, the property manager agreed to accept payment in the form of forfeitable restricted shares of our common stock in lieu of cash for services rendered and applicable property management fees and specified

2

expenses we owe to the property manager under the property management and leasing agreement in an amount equal to such shortfall.

OnNovember 21, 2013, each of the advisor expense support and restricted stock agreement and property manager expense support and restricted stock agreement were amended to continue through December 31, 2014 with successive one-year terms thereafter unless terminated by the advisor or the property manager, as applicable, upon thirty (30) days’ prior written notice.

Approval of Filing a Registration Statement for a Follow-On Offering

Our board of directors has approved the filing of another registration statement for our second offering. We expect to continue to sell shares in this offering until the earlier of December 24, 2014 or the effective date of such subsequent registration statement. However, our board of directors may terminate this offering at any time. This offering has been registered in every state in which we offer or sell shares. Generally, such registrations must be renewed annually. We may have to stop offering or selling shares in any state in which the registration is not renewed. In addition, we are not obligated to commence the sale of shares in a subsequent offering. If we pursue a subsequent offering, we could continue offering shares with the same or different terms and conditions. Nothing in our organizational documents prohibits us from engaging in additional subsequent public offerings of our shares of common stock.

Property Acquisitions

Pacific Northwest I Communities

On December 2, 2013, we, through various subsidiaries, acquired from various unaffiliated related sellers (collectively, the “PNWC Sellers”) 12 senior housing communities generally located in the Pacific Northwest region of the United States and Nevada (collectively, the “Pacific Northwest I Communities”) for an aggregate purchase price of approximately $302.3 million. The Pacific Northwest I Communities feature an aggregate of 1,408 residential units comprised of 486 independent living units, 790 assisted living units, and 132 specialty care or “memory care” units. See “Business — Properties — Pacific Northwest I Communities,” “Business — Borrowings — Pacific Northwest Communities” and “Business — Borrowings — Revolving Credit Facility” for further information.

Coral Springs Medical Office Buildings

On December 23, 2013, we, through a subsidiary, acquired a fee simple interest in two three-story, Class A medical office buildings adjacent to the Broward Health Coral Springs Medical Center located in Coral Springs, Florida (the “Coral Springs Medical Office Campus”) from an unaffiliated third party for an aggregate purchase price of approximately $31.0 million. The Coral Springs Medical Office Campus consists of approximately 90,596 square feet of total net rentable area and has an approximate current occupancy rate of 90% as of November 30, 2013. See “Business — Additional Acquisitions” and “Business — Borrowings — Revolving Credit Facility” for further information.

Chula Vista Medical Office Buildings

On December 23, 2013, we, through a subsidiary, acquired a fee simple interest in a three-story medical office building located in Chula Vista, California (the “Bay Medical Office Building”) from an unaffiliated third party for a purchase price of approximately $10.7 million. On January 21, 2013, we, through a subsidiary, acquired a fee simple interest in a four-story medical office building adjacent to the Bay Medical Office Building (the “Scripps Medical Office Building”) together with a ground lease for a portion of the related parking lot, from an unaffiliated third party for a purchase price of approximately $17.9 million. The Bay Medical Office Building was constructed in 1985 and renovated in 1999, and consists of approximately 36,092 square feet of total net rentable area. The Scripps Medical Office Building, constructed in 1975 and renovated in 1999 and 2009, consists of approximately 62,449 square feet of total net rentable area. Currently, both the Bay Medical Office Building and the Scripps Medical Office Building are 100% occupied. See “Business — Additional Acquisitions” and “Business — Borrowings — Revolving Credit Facility” for further information.

3

Pacific Northwest II Communities

On February 3, 2014, we, through various subsidiaries, acquired a portfolio of four senior housing communities featuring an aggregate of 457 residential units comprised of 136 independent living units, 297 assisted living units, and 24 specialty care or “memory care” units for an aggregate purchase price of approximately $88.3 million (the “Pacific Northwest II Communities”) from each of Vancouver Bridgewood, LLC, MWSH Yelm, LLC, Auburn Assisted Living, LLC and Longview Monticello, LLC. See “Business— Properties — Pacific Northwest II Communities” and “Business — Borrowings — Pacific Northwest Communities” for further information.

Wellmore of Tega Cay Development

On February 7, 2014, by way of an assignment of an existing real estate sale agreement from Maxwell Group, Inc. (“Maxwell Group”) to our subsidiary CHP Tega Cay SC Owner, LLC, we acquired approximately 12.5 acres of real property located in Tega Cay, South Carolina on which we intend to develop an approximately 175,000 square foot senior housing community (“Wellmore of Tega Cay”), based upon a construction budget of approximately $35.3 million. Wellmore of Tega Cay will be developed by the Maxwell Group and it is expected that it will also be operated by the Maxwell Group under the Wellmore brand. It is anticipated that Wellmore of Tega Cay will feature 80 assisted living units, 24 memory care units and 48 skilled nursing units. See “Business — Additional Acquisitions” and “Business — Borrowings — Wellmore of Tega Cay Development” for further information.

Entry into Definitive Agreements

South Bay II Communities

On October 7, 2013, we entered into an asset purchase agreement to acquire seven senior housing communities located in Texas and one senior housing community located in Illinois, for an aggregate purchase price of approximately $187.2 million, subject to adjustment: (i) in accordance with certain formulas on a property-by-property basis to account for any increases in the property’s performance for periods following January 1, 2013 through the closing date of the applicable property, and (ii) a formula to account for any increase in the capital gains tax rates from its level on December 31, 2013 through the closing date of the applicable property (the “South Bay II Communities”). We have posted a non-refundable $3.7 million deposit on these properties. At closing, approximately $2.4 million of the purchase price will be held in escrow for a period of nine months to guaranty the sellers’ representations and warranties under the purchase agreement. None of the below-named sellers are affiliates of us or our advisor, however, we previously acquired the South Bay Properties, a portfolio of senior housing communities and development land, from affiliates of South Bay.

The South Bay II Communities feature 859 total units comprised of 415 independent living units, 254 assisted living units, 132 memory care units, and 58 skilled nursing units, which have 72 beds. The average age of the communities is two years. The acquisition of each of these investments is subject to the fulfillment of certain conditions. There can be no assurance that any or all of the conditions will be satisfied or, if satisfied, that one or more of these investments will be acquired by us. The South Bay II Communities are expected to be managed by three unaffiliated operators.

The following table sets forth the names and locations of the South Bay II Communities, the name of the sellers, the numbers of units, and the purchase prices:

| | | | | | | | |

Names & Locations of Communities | | Sellers | | No. of

Units | | Approx.

Purchase Price

(in millions) | |

| | | |

Legacy Ranch Midland, TX (“Legacy Ranch”) | | Midland Care Group, LP | | 38 | | | $11.5 | |

Isle at Cedar Ridge Cedar Park, TX (“Isle at Cedar Ridge”) | | Cedar Park AL Group, LP | | 80 | | | $21.0 | |

4

| | | | | | | | |

Names & Locations of Communities | | Sellers | | No. of

Units | | Approx.

Purchase Price

(in millions) | |

| | | |

Isle at Watercrest – Bryan Bryan, TX (“Isle at Watercrest – Bryan”) | | Bryan AL Investors, LP | | 80 | | | $21.0 | |

Watercrest at Bryan Bryan, TX (“Watercrest at Bryan”) | | Bryan Senior Investors, LP | | 204 | | | $26.7 | |

Isle at Watercrest – Mansfield Mansfield, TX (“Isle at Watercrest – Mansfield”) | | Mansfield AL Group, LP | | 98 | | | $25.0 | |

Watercrest at Mansfield Mansfield, TX (“Watercrest at Mansfield”) | | Waterview at Mansfield Investors, L.P. | | 211 | | | $45.0 | |

The Park at Plainfield Plainfield, IL (“The Park at Plainfield”) | | Plainfield Care Group, LLC | | 110 | | | $26.5 | |

The Springs San Angelo, TX (“The Springs”) | | San Angelo Care Group, LP | | 38 | | | $10.5 | |

We will receive a credit against the purchase price of the Watercrest at Mansfield property for the expected assumption by us of a 10-year Federal Home Loan Mortgage Corporation loan in the approximate amount of $27.7 million, bearing a current interest rate of 4.68%. It is anticipated that we will finance the acquisition of the South Bay properties in part through an increase in our line of credit under our Revolving Credit Facility which we hope to close in the first quarter of 2014. See “BUSINESS — Borrowings — Revolving Line of Credit.”

Assuming that outstanding contingencies are satisfied, we anticipate closings for the South Bay II Communities in March through June of 2014.

Houston Orthopedic & Spine Hospital

On February 11, 2014, we, through a subsidiary, entered into an agreement to acquire a fee simple interest in a four-story single tenant, specialty surgical hospital known as the “Houston Orthopedic & Spine Hospital” and an adjacent four-story, multi-tenant, medical office building (collectively, the “Houston Orthopedic & Spine Hospital Campus” or “HOSH”), from an unaffiliated third party, for an aggregate purchase price of $80.0 million.

5

The following supersedes and replaces in its entirety the section entitled “PROSPECTUS SUMMARY — Properties Summary” on page 5 of the prospectus:

Properties Summary

The following information supersedes and replaces in its entirety the section entitled “BUSINESS” — Properties” beginning on page 7 of the prospectus.

The following table sets forth the asset name, location, asset type, acquisition date, year built and purchase price of each of the properties we owned as of February 7, 2014:

| | | | | | | | | | | | | | |

Name | | Location | | Asset Type | | Date

Acquired | | Year

Built/Renovated | | Purchase Price

(in millions) | |

| | | | | | |

Primrose Communities | | | | | | | | | | | | | | |

Primrose Retirement Community of Casper | | Casper, WY | | | | Senior Housing | | 02/16/12 | | 2004 | | | $18.8 | |

Sweetwater Retirement Community | | Billings, MT | | | | Senior Housing | | 02/16/12 | | 2006 | | | $16.3 | |

Primrose Retirement Community of Grand Island | | Grand Island, NE | | | | Senior Housing | | 02/16/12 | | 2005 | | | $13.3 | |

Primrose Retirement Community of Mansfield | | Mansfield, OH | | | | Senior Housing | | 02/16/12 | | 2007 | | | $18.0 | |

Primrose Retirement Community of Marion | | Marion, OH | | | | Senior Housing | | 02/16/12 | | 2006 | | | $17.7 | |

| | | | | | |

HarborChase of Villages Crossing(1) | | Lady Lake, FL | | | | Development –

Senior Housing | | 08/29/12 | | 2013 | | | $ 21.7 | |

| | | | | | |

Windsor Manor Communities(2) | | | | | | | | | | | | | | |

Windsor Manor of Vinton | | Vinton, IA | | | | Senior Housing | | 08/31/12 | | 2007 | | | $ 5.8 | |

Windsor Manor of Webster City | | Webster City, IA | | | | Senior Housing | | 08/31/12 | | 2010 | | | $ 6.8 | |

Windsor Manor of Nevada | | Nevada, IA | | | | Senior Housing | | 08/31/12 | | 2011 | | | $ 6.3 | |

| | | | | | |

Dogwood Forest of Acworth(3) | | Acworth, GA | | | | Development –

Senior Housing | | 12/18/12 | | 2014 | | | $ 21.8(4) | |

| | | | | | |

Primrose Communities II | | | | | | | | | | | | | | |

Primrose Retirement Community of Lima | | Lima, OH | | | | Senior Housing | | 12/19/12 | | 2007 | | | $18.6 | |

Primrose Retirement Community of Zanesville | | Zanesville, OH | | | | Senior Housing | | 12/19/12 | | 2008 | | | $19.1 | |

Primrose Retirement Community of Decatur | | Decatur, IL | | | | Senior Housing | | 12/19/12 | | 2009 | | | $18.1 | |

Primrose Retirement Community of Council Bluffs | | Council Bluffs, IA | | | | Senior Housing | | 12/19/12 | | 2007 | | | $12.9 | |

Primrose Retirement Community Cottages | | Aberdeen, SD | | | | Senior Housing | | 12/19/12 | | 1995 | | | $ 4.3 | |

| | | | | | |

Capital Health Communities | | | | | | | | | | | | | | |

Brookridge Heights | | Marquette, MI | | | | Senior Housing | | 12/21/12 | | 1998 | | | $13.5 | |

Curry House | | Cadillac, MI | | | | Senior Housing | | 12/21/12 | | 1996 | | | $13.5 | |

Symphony Manor | | Baltimore, MD | | | | Senior Housing | | 12/21/12 | | 2011 | | | $24.0 | |

Woodholme Gardens | | Pikesville, MD | | | | Senior Housing | | 12/21/12 | | 2010 | | | $17.1 | |

Tranquillity at Fredericktowne | | Frederick, MD | | | | Senior Housing | | 12/21/12 | | 2000 | | | $17.0 | |

| | | | | | |

Claremont Medical Office(5) | | Claremont, CA | | | | Medical Office | | 01/16/13 | | 2008 | | | $19.8 | |

| | | | | | |

Windsor Manor II Communities(2) | | | | | | | | | | | | | | |

Windsor Manor of Indianola | | Indianola, IA | | | | Senior Housing | | 04/02/13 | | 2004 | | | $ 5.7 | |

Windsor Manor of Grinnell | | Grinnell, IA | | | | Senior Housing | | 04/02/13 | | 2006 | | | $ 6.5 | |

6

| | | | | | | | | | | | |

Name | | Location | | Asset Type | | Date

Acquired | | Year

Built/Renovated | | Purchase Price

(in millions) | |

| | | | | |

Perennial Communities | | | | | | | | | | | | |

Batesville Healthcare Center | | Batesville, AR | | Post-Acute Care | | 05/31/13 | | 1975/1992 | | | $ 6.2 | |

Broadway Healthcare Center | | West Memphis, AR | | Post-Acute Care | | 05/31/13 | | 1994/2012 | | | $11.9 | |

Jonesboro Healthcare Center | | Jonesboro, AR | | Post-Acute Care | | 05/31/13 | | 2012 | | | $15.2 | |

Magnolia Healthcare Center | | Magnolia, AR | | Post-Acute Care | | 05/31/13 | | 2009 | | | $11.8 | |

Mine Creek Healthcare Center | | Nashville, AR | | Post-Acute Care | | 05/31/13 | | 1978 | | | $ 3.4 | |

Searcy Healthcare Center | | Searcy, AR | | Post-Acute Care | | 05/31/13 | | 1972/2009 | | | $ 7.9 | |

| | | | | |

LaPorte Cancer Center | | Westville, IN | | Medical Office | | 06/14/13 | | 2010 | | | $13.1 | |

| | | | | |

Knoxville Medical Office Properties | | | | | | | | | | | | |

Physicians Plaza A at North Knoxville Medical Center | | Powell, TN | | Medical Office | | 07/10/13 | | 2005 | | | $18.1 | |

Physicians Plaza B at North Knoxville Medical Center | | Powell, TN | | Medical Office | | 07/10/13 | | 2008 | | | $21.8 | |

Physicians Regional Medical Center – Central Wing Annex | | Knoxville, TN | | Medical Office | | 07/10/13 | | 2004 | | | $ 5.8 | |

Jefferson Medical Commons | | Jefferson City, TN | | Medical Office | | 07/10/13 | | 2001 | | | $11.6 | |

| | | | | |

HarborChase of Jasper | | Jasper, AL | | Senior Housing | | 08/01/13 | | 1998 | | | $ 7.3 | |

| | | | | |

Medical Portfolio I Properties | | | | | | | | | | | | |

Doctors Specialty Hospital | | Leawood, KS | | Acute Care | | 08/16/13 | | 2001 | | | $10.0 | |

John C. Lincoln Medical Office Plaza I | | Phoenix, AZ | | Medical Office | | 08/16/13 | | 1980 | | | $ 4.4 | |

John C. Lincoln Medical Office Plaza II | | Phoenix, AZ | | Medical Office | | 08/16/13 | | 1984 | | | $ 3.1 | |

North Mountain Medical Plaza | | Phoenix, AZ | | Medical Office | | 08/16/13 | | 1994 | | | $ 6.2 | |

Escondido Medical Arts Center | | Escondido, CA | | Medical Office | | 08/16/13 | | 1994 | | | $15.6 | |

Chestnut Commons Medical Office Building | | Elyria, OH | | Medical Office | | 08/16/13 | | 2008 | | | $20.7 | |

| | | | | |

South Bay I Properties | | | | | | | | | | | | |

The Club at Raider Ranch | | Lubbock, TX | | Senior Housing | | 08/29/13 | | 2009 | | | $30.0 | |

The Club at Raider Ranch Development(6) | | Lubbock, TX | | Senior Housing - Development | | 08/29/13 | | 2015 | | | $14.9(4) | |

The Isle at Raider Ranch | | Lubbock, TX | | Senior Housing | | 08/29/13 | | 2009 | | | $25.0 | |

| | | | | |

Town Village | | Oklahoma City, OK | | Senior Housing | | 08/29/13 | | 2002 | | | $22.5 | |

| | | | | |

Calvert Medical Office Properties | | | | | | | | | | | | |

Calvert Medical Office Building I, II, III | | Prince Frederick, MD | | Medical Office | | 08/30/13 | | 1991, 1999, 2000 | | | $16.4 | |

Calvert Medical Arts Center | | Prince Frederick, MD | | Medical Office | | 08/30/13 | | 2009 | | | $19.3 | |

Dunkirk Building | | Dunkirk, MD | | Medical Office | | 08/30/13 | | 1997 | | | $ 4.6 | |

| | | | | |

Pacific Northwest I Communities | | | | | | | | | | | | |

Huntington Terrace | | Gresham, OR | | Senior Housing | | 12/02/13 | | 2000/2010 | | | $15.0 | |

Arbor Place | | Medford, OR | | Senior Housing | | 12/02/13 | | 2003/2010 | | | $15.8 | |

Beaverton Hills | | Beaverton, OR | | Senior Housing | | 12/02/13 | | 2000/2011 | | | $12.9 | |

Billings | | Billings, MT | | Senior Housing | | 12/02/13 | | 2009 | | | $48.3 | |

Boise | | Boise, ID | | Senior Housing | | 12/02/13 | | 2007 | | | $40.0 | |

Five Rivers | | Tillamook, OR | | Senior Housing | | 12/02/13 | | 2002/2010 | | | $16.7 | |

High Desert | | Bend, OR | | Senior Housing | | 12/02/13 | | 2003/2011 | | | $13.6 | |

Idaho Falls | | Idaho Falls, ID | | Senior Housing | | 12/02/13 | | 2009 | | | $44.4 | |

Orchard Heights | | Salem, OR | | Senior Housing | | 12/02/13 | | 2002/2011 | | | $17.8 | |

Riverwood | | Tualatin, OR | | Senior Housing | | 12/02/13 | | 1999/2010 | | | $9.7 | |

7

| | | | | | | | | | | | |

Name | | Location | | Asset Type | | Date

Acquired | | Year

Built/Renovated | | Purchase Price

(in millions) | |

| | | | | |

Southern Hills | | Salem, OR | | Senior Housing | | 12/02/13 | | 2001/2011 | | | $12.9 | |

Sparks | | Sparks, NV | | Senior Housing | | 12/02/13 | | 2009 | | | $55.2 | |

| | | | | |

Coral Springs Medical Office Buildings | | | | | | | | | | | | |

Coral Springs Medical Office Building I | | Coral Springs, FL | | Medical Office | | 12/23/13 | | 2005 | | | $14.9 | |

Coral Springs Medical Office Building II | | Coral Springs, FL | | Medical Office | | 12/23/13 | | 2008 | | | $16.1 | |

| | | | | |

Chula Vista Medical Office Buildings | | | | | | | | | | | | |

Bay Medical Office Building | | Chula Vista, CA | | Medical Office | | 12/23/13 | | 1985/1999 | | | $10.7 | |

Scripps Medical Office Building | | Chula Vista, CA | | Medical Office | | 01/21/14 | | 1975 | | | $17.9 | |

| | | | | |

Pacific Northwest II Communities | | | | | | | | | | | | |

Auburn Meadows | | Auburn, WA | | Senior Housing | | 02/03/14 | | 2003/2010 | | | $21.9 | |

Bridgewood | | Vancouver, WA | | Senior Housing | | 02/03/14 | | 2001/2011 | | | $22.1 | |

Monticello Park | | Longview, WA | | Senior Housing | | 02/03/14 | | 2001/2010 | | | $27.4 | |

Rosemont | | Yelm, WA | | Senior Housing | | 02/03/14 | | 2004 | | | $16.9 | |

| | | | | |

Wellmore of Tega Cay(7) | | Tega Cay, SC | | Senior Housing – Development | | 02/07/14 | | 2015 | | | $35.3(4) | |

| (1) | Thedeveloper was Harbor Retirement Associates, LLC (“HRA”). The purchase price includes the cost of land and development cost. |

| (2) | We hold these properties through a 75% interest in a joint venture with HRGreen. |

| (3) | The developer is Solomon Senior Living Holdings, LLC. Estimated construction completion date is June 2014. |

| (4) | The purchase price includes the cost of land and the development budget. |

| (5) | We hold these properties through a 90% interest in a joint venture with MMAC Berkshire Claremont L.L.C. |

| (6) | The developer of a portion of land at The Club at Raider Ranch is South Bay Partners, Ltd. Estimated completion date is mid-year 2015. |

| (7) | The developer is Maxwell Group, Inc. Estimated construction completion date is mid-year 2015. |

The subsection entitled “Borrowings Summary” in the section entitled “PROSPECTUS SUMMARY — Borrowings” beginning on page 6 of the prospectus is deleted in its entirety.

Risk Factors

The following supersedes and replaces in its entirety the section entitled “PROSPECTUS SUMMARY — Risk Factors” which begins on page 8 of the prospectus.

An investment in our common stock is subject to significant risks that are described in more detail in the “Risk Factors” and “Conflicts of Interest” sections of this prospectus. If we are unable to effectively manage the impact of these risks, we may not meet our investment objectives and, therefore, you may lose some or all of your investment. We believe the following risks are most relevant to an investment in shares of our common stock:

| | — | | We and our advisor have limited operating histories and no established financing commitments for undesignated asset acquisitions or working capital. Additionally, the prior performance of real estate investment programs sponsored by our sponsor or affiliates of our sponsor may not be an indication of our future results. There is no assurance that we will be able to successfully achieve our investment objectives. |

| | — | | Any adverse changes in the financial results of other REITs sponsored by affiliates of CNL Financial Group could negatively impact our ability to raise capital. |

| | — | | We believe that the risks associated with our business may be more severe during periods of economic slowdown or recessions if these periods are accompanied by declining values in real estate. The current state of the economy and the implications of future potential weakening may negatively impact |

8

| | commercial real estate fundamentals, resulting in lower revenues and values for commercial properties that could decrease below the values paid for such properties. |

| | — | | The offering price of our shares is based on our estimated net asset value per share, plus selling commissions and marketing support fees, subjective judgments and assumptions and opinions by management, which may or may not be indicative of the price at which the shares would trade if they were listed or were actively traded by brokers. |

| | — | | We may not perform a subsequent calculation of our net asset value per share prior to the end of this offering, therefore, you may not be able to determine the net asset value of your shares on an ongoing basis during this offering. |

| | — | | In determining our estimated net asset value per share, we primarily relied upon a valuation of our portfolio of properties and value of our outstanding debt as of September 30, 2013. Valuations and appraisals of our properties and debt are estimates of fair value and may not necessarily correspond to realizable value upon the sale of such properties, therefore our estimated net asset value per share may not reflect the amount that would be realized upon a sale of each of our properties. |

| | — | | There is no current public trading market for our shares, and we cannot assure you that one will ever develop. We have no obligation to list our shares on any public securities market. Even if you are able to sell your shares, the price received for any shares could be less than what you paid for them or less than your proportionate value of the assets we own. |

| | — | | We have generated little, if any, cash flow from operations or funds from operations available for distribution. Our operating cash flow will be negatively impacted to the extent we invest in properties requiring significant capital, and our ability to make cash distributions may be negatively impacted, for the foreseeable future. |

| | — | | We have experienced net operating losses for each of the three years ended December 31, 2013 and may experience losses in the future. We cannot assure you that we will be profitable in the future, produce sufficient income to fund operating expenses or realize growth. |

| | — | | Although we have a redemption plan, redemptions will be limited and our board of directors may reject any request for redemption of shares or amend, suspend or terminate the plan at any time. Therefore, it may be difficult for you to sell your shares promptly or at all, including in the event of an emergency and, if you are able to sell your shares, you may have to sell them at a substantial discount from the public offering price. |

| | — | | This is a blind pool offering, which means we have not identified all of the assets to be acquired with the proceeds from this offering. Although we will supplement this prospectus as we make material acquisitions or commit to material acquisitions of properties or other investments, to the extent we have not yet acquired or identified Assets for acquisition at the time you make your investment decision, you will not have the opportunity to evaluate our investments prior to our making them. You must rely upon our advisor and our board of directors to implement our investment policies, to evaluate our investment opportunities and to structure the terms of our investments. |

| | — | | This is a “best efforts” offering, which means the managing dealer and the participating brokers selling the shares of our offering are only required to use their best efforts to sell our shares and are not required to sell any specific number of shares. If we raise substantially less than the maximum offering amount, we may not be able to invest in as diverse or extensive a portfolio of properties as we otherwise would. Your investment in our shares will be subject to greater risk to the extent that we have limited assets and limited diversification in our portfolio of investments. |

| | — | | We rely on our advisor, CNL Healthcare Corp., to make our investment decisions subject to approval by our board of directors. Our ability to achieve our investment objectives and to make distributions will depend on the performance of our advisor for the day-to-day management of our business and the selection of our real properties, loans and other investments for recommendation to our board of directors and for |

9

| | the management of our Assets and on the performance of our property manager for management of our properties. |

| | — | | We do not own our advisor or our property manager. The agreements with our advisor and property manager were not negotiated at arm’s length. We will pay substantial fees to our advisor, the managing dealer, our property manager and their respective affiliates, some of which are payable based upon factors other than the quality of services provided to us. These fees could influence their advice to us as well as their judgment in performing services for us. |

| | — | | Our board of directors determines our investment policies, including our policies regarding financing, growth, debt capitalization, REIT qualification and distributions. To the extent consistent with our investment objectives and limitations, a majority of our directors, including a majority of our independent directors, may amend or revise these and other policies without stockholder consent. |

| | — | | Until the proceeds from this offering are invested and generating operating cash flow or funds from operations sufficient to make distributions to our stockholders, we have determined to pay some or all of our cash distributions from other sources, such as from the proceeds of this offering, cash advances to us by our advisor, cash resulting from a deferral of asset management fees, and borrowings (including borrowings collateralized by our assets) in anticipation of future operating cash flow, which may reduce the amount of capital we ultimately invest in assets. We have not established any limit on the extent to which we may use borrowings or proceeds of this offering to pay distributions, and there will be no assurance that we will be able to sustain distributions at any level. We have made, and we may continue to make, distributions in the form of shares of our common stock, which will cause the interest of later investors in our stock to be diluted as a result of stock that has been distributed to earlier investors. We have not established any limits on the extent to which we may use borrowings or proceeds of this offering to pay distributions, and there will be no assurance that we will be able to sustain distributions at any level. |

| | — | | Our stockholders have no preemptive rights. If we commence a subsequent public offering of shares or securities convertible into shares, or otherwise issue additional shares, then investors purchasing shares in this offering who do not participate in future stock issuances will experience dilution in the percentage of their equity investment. Stockholders will not be entitled to vote on whether or not we engage in additional offerings. In addition, depending on the terms and pricing of an additional offering of our shares and the value of our properties, our stockholders may experience dilution in both the book value and fair value of their shares. Our board of directors has not yet determined whether it will engage in future offerings or other issuances of shares; however, it may do so if our board of directors determines that it is in our best interests. Other public REITs sponsored by CNL have engaged in multiple offerings. |

| | — | | Our directors are directors of other affiliated entities and our directors, other than our independent directors, are also directors of our advisor. Our officers also serve as officers of our advisor and some of our officers also serve as officers in affiliated programs. These directors and officers share their management time and services with us and the affiliated program, which invests and may invest in the same types of assets in which we may invest, and could take actions that are more favorable to the affiliated program than to us. |

| | — | | We have incurred substantial debt. Loans we obtain are collateralized by some or all of our properties or other assets, which puts those properties or other assets at risk of forfeiture if we are unable to pay our debts. Principal and interest payments on these loans reduce the amount of money that would otherwise be available for other purposes. |

| | — | | To satisfy one of the requirements for qualification as a REIT, our charter contains certain protective provisions, including a provision that prohibits any stockholder from owning more than 9.8%, by number or value, of any class or series of our outstanding capital stock during any time that we are qualified as a REIT. However, our charter also allows our board of directors to waive compliance with certain of these protective provisions, which may have the effect of jeopardizing our REIT status. |

10

| | — | | Real estate investments are subject to general downturns in the economy as well as downturns in specific geographic areas. We cannot predict what the occupancy level will be at a particular property or that any tenant or borrower will remain solvent. We also cannot predict the future value of our acquired properties or other assets. |

| | — | | We are subject to risks as a result of the recent economic conditions in both the United States and global credit markets. Volatility in the debt markets could affect our ability to obtain financing for acquisitions or other activities related to real estate assets and the number, diversification or value of our real estate assets. |

| | — | | We may not remain qualified as a REIT for federal income tax purposes, which would subject us to the payment of tax on our taxable income at corporate rates. We may be subject to income tax at corporate rates in certain circumstances such as in the event we foreclose on a defaulting borrower or terminate the lease on a defaulting third-party tenant. |

| | — | | If we hold and sell one or more properties through a taxable REIT subsidiary, or “TRS,” any operating profits and the gain from any such sale would be subject to a corporate-level tax, thereby reducing funds available for operations, distribution to our stockholders or reinvestment in new assets. Moreover, if the ownership of properties by a TRS causes the value in our TRS to exceed 25% of the value of all of our assets at the end of any calendar quarter, we may lose our status as a REIT. |

| | — | | FINRA’s proposed amendment to Rule 2340 would require, among other things, that per share estimated values of non-traded REITs be reported on customer account statements. Any significant changes to Rule 2340 could have a material impact on the timing of when we initially publish our per share value, which could impact. |

Our REIT Status

The following replaces in its entirety the section entitled “PROSPECTUS SUMMARY – Our REIT Status” on page 10 of the prospectus.

We elected to be treated as a REIT for U.S. federal income tax purposes beginning with our taxable year ended December 31, 2012. As a REIT, we generally will not be subject to U.S. federal income tax on income that we distribute to our stockholders. Under the Code, REITs are subject to numerous organizational and operational requirements, including a requirement that they distribute generally at least 90% of their taxable income. If we fail to qualify for taxation as a REIT in any year, our income for that year will be taxed at regular corporate rates, and we may be precluded from qualifying for taxation as a REIT for the four years following the year of our failure to qualify as a REIT. It is possible to discover that we failed to qualify as a REIT months or even years after the REIT earnings have been distributed. Even if we qualify as a REIT for federal income tax purposes, we will be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income and in certain other cases.

Our Management

The following replaces in its entirety the first full paragraph under the section entitled “PROSPECTUS SUMMARY – Our Management” which begins on page 10 of the prospectus.

We operate under the direction of our board of directors, the members of which owe us fiduciary duties and are accountable to us and our stockholders in accordance with the Maryland General Corporation Law. Our board of directors is responsible for the management and control of our business and affairs and has responsibility for reviewing our advisor’s performance at least annually. We currently have five members on our board of directors, three of whom are independent of our management, our advisor and our respective affiliates. Our directors are elected annually by our stockholders. Our board of directors has established an audit committee comprised of the independent directors.

11

Compensation of Our Advisor and Affiliates

The following sentence is added after the first sentence of the first paragraph in the section entitled “PROSPECTUS SUMMARY — Compensation of our Advisor and Affiliates” on page 14 of the prospectus.

For additional information concerning compensation paid to our advisor, other affiliates and related partners, see the section entitled “Certain Relationships and Related Transactions.”

The following sentence replaces the last sentence of the first paragraph in the section entitled “PROSPECTUS SUMMARY — Compensation of Our Advisor and Affiliates” on page 14 of the prospectus and the two bullet points following the sentence are deleted in their entirety.

The following replaces the last three sentences of the first paragraph in the section entitled “PROSPECTUS SUMMARY — Compensation of Our Advisor and Affiliates” on page 19 of the prospectus.

Pursuant to an amendment to the expense support and restricted stock agreement on November 21, 2013, the term of the agreement runs from April 1, 2013 through December 31, 2014 with successive one year terms thereafter, subject to the right of the advisor to terminate the agreement upon 30 days’ prior written notice. See “The Advisor and the Advisory Agreement — The Expense Support and Restricted Stock Agreement” for more information.

The following paragraph is added after the first full paragraph on page 19 of the prospectus under the section entitled “PROSPECTUS SUMMARY — Compensation of Our Advisor and Affiliates.”

On August 27, 2013, we entered into a property manager expense support and restricted stock agreement effective July 1, 2013 with our property manager pursuant to which, in the event the advisor’s expense support amount does not meet a certain threshold, the property manager agreed to accept payment in the form of forfeitable restricted shares of our common stock in lieu of cash for services rendered and applicable property management fees and specified expenses we owe to the property manager under the property management and leasing agreement in an amount equal to such shortfall. Pursuant to an amendment to the property manager expense support and restricted stock agreement on November 21, 2013, the term of the agreement runs from July 1, 2013 through December 31, 2014 with successive one-year terms thereafter, subject to the right of the property manager to terminate the agreement upon 30 days’ prior written notice. See “The Advisor and the Advisory Agreement — Property Manager Expense Support and Restricted Stock Agreement” for more information.

Our Offering

The following paragraph supersedes and replaces the first paragraph in the section entitled “PROSPECTUS SUMMARY — Our Offering” on page 20 of the prospectus.

We commenced our initial public offering of shares of our common stock on June 27, 2011. We plan to extend the offering through the earlier of December 24, 2014 or the effective date of a subsequent registration statement. As of December 31, 2013, we had accepted investors’ subscriptions for, and issued, approximately 58.2 million shares of our common stock pursuant to our offering resulting in aggregate subscription proceeds of approximately $568.3 million. As of December 31, 2013, we have issued approximately 1.0 million shares pursuant to our distribution reinvestment plan resulting in proceeds of approximately $9.4 million. As of December 31, 2013, approximately 226.8 million shares of our common stock remain available for sale in our initial offering, and 14.0 million shares of our common stock remain available for issuance under our distribution reinvestment plan. We reserve the right to reallocate the shares we are offering between the initial offering and the distribution reinvestment plan.

The first two sentences of the third paragraph in the section entitled “PROSPECTUS SUMMARY — Our Offering” on page 20 are deleted and replaced with the following:

We are offering a maximum of $3,000,000,000 of our common stock to the public through our managing dealer, CNL Securities Corp., a registered broker-dealer affiliated with CNL. The shares will be offered at $10.14 per share, unless our board of directors changes this price, in its sole discretion.

12

Our Distribution Policy

The second through fifth paragraphs on page 21 of the prospectus in the section entitled “PROSPECTUS SUMMARY — Our Distribution Policy” are deleted in their entirety and replaced with the following:

Because of the effect of other items, including depreciation and amortization associated with real estate investments, distributions, in whole or in part, in any period may constitute a return of capital for federal tax purposes.

Distributions will be paid quarterly and will be calculated for each stockholder as of the first day of each month the stockholder has been a stockholder of record in such quarter. The cash distribution will be payable and the distribution of shares will be issued on or before the last day of the applicable quarter; however, in no circumstance will the cash distribution and the share distribution be made on the same day. Fractional shares of common stock accruing as distributions will be rounded to the nearest hundredth when issued on the distribution date.

Declarations of distributions pursuant to this policy began on the first day of November 2011 and will continue on the first day of each month thereafter. Distributions will be paid each calendar quarter thereafter as set forth above until such policy is terminated or amended by our board of directors.

We make distributions to stockholders pursuant to the provisions of our charter. On July 29, 2011, our board of directors authorized a distribution policy providing for monthly cash distributions of $0.0333 together with stock distributions of 0.0025 shares of common stock, which in the aggregate equaled an annualized distribution rate of 7.0% on each outstanding share of common stock (based on the $10.00 offering price at which we sold shares in our offering through December 11, 2013) payable to all common stockholders of record as of the close of business on the first business day of each month.

On December 6, 2013, our board of directors also determined to increase the amount of monthly cash distributions to $0.0338 per share together with monthly stock distributions of 0.0025 shares of common stock payable to all common stockholders of record as of the close of business on the first business day of each month beginning January 1, 2014. This change allows us to maintain our historical distribution rate of 4% cash and 3% stock on each outstanding share of common stock based on the new public offering price of $10.14 per share and was effective for stockholders of record on January 1, 2014.

As of September 30, 2013, we have declared and paid total cumulative cash distributions of approximately $12.3 million and issued approximately 920,139 shares of common stock as stock distributions.

Our board of directors declared a monthly cash distribution of $0.0333 and a monthly stock distribution of 0.0025 per share on October 1, 2013, November 1, 2013 and December 1, 2013, which were paid by December 31, 2013.

Our Distribution Reinvestment Plan

The following supersedes and replaces in full the sole paragraph under the section entitled “PROSPECTUS SUMMARY— Our Distribution Reinvestment Plan,” which appears on page 21 of the prospectus.

We have adopted a distribution reinvestment plan that will allow our stockholders to have the full amount of their distributions reinvested in additional shares of common stock that may be available. We have designated 5% of the shares in this offering as shares issuable pursuant to our distribution reinvestment plan for this purpose. As of December 31, 2013, we have issued approximately 980,657 shares of common stock pursuant to our distribution reinvestment plan. See “Summary of our Distribution Reinvestment Plan,” for further information.

Our Redemption Plan

The second bullet point in the section entitled “PROSPECTUS SUMMARY — Our Redemption Plan” on page 21 of the prospectus is deleted in its entirety and replaced with the following:

| | — | | under our redemption plan, all shares of common stock or fractions thereof that have been held for at least one year may be submitted for redemption at an amount equal to our estimated net asset value per share as of the redemption date; provided, however, that the redemption price shall not exceed an amount equal to the lesser of (i) the then current public offering price for our shares of common stock (other than the price |

13

| | at which shares are sold under our distribution reinvestment plan) during the period of any on-going public offering; and (ii) the purchase price paid by the stockholder. |

The following is added to the end of the section entitled “PROSPECTUS SUMMARY — Our Redemption Plan” on page 22 of the prospectus.

During the year ended December 31, 2011, we did not receive any redemption requests. During the year ended December 31, 2012, we received and redeemed one redemption request for 1,049 shares of common stock at a redemption price of $9.99 per share. During the year ended December 31, 2013, we received and redeemed 122 redemption requests for 89,410 shares of common stock at a redemption price of $9.25 per share. We received six redemption requests totaling 9,358 shares of common stock for the period January 1, 2014 through January 31, 2014 which will be paid in April 2014.

Our Valuation Policy

The following section entitled “PROSPECTUS SUMMARY — Our Valuation Policy,” is added after the section entitled “PROSPECTUS SUMMARY — Our Redemption Plan” beginning on page 22 of the prospectus.

We have adopted a valuation policy designed to follow recommendations of the Investment Program Association, a trade association for non-listed direct investment vehicles (the “IPA”), in the IPA Practice Guideline 2013-01, Valuations of Publicly Registered Non-Listed REITs, which was adopted by the IPA effective May 1, 2013. The purpose of our valuation policy is to establish guidelines to be followed in determining the net asset value per share of our common stock for regulatory and investor reporting and on-going evaluation of investment performance. “Net asset value” means the fair value of real estate, real estate-related investments and all other assets less the fair value of total liabilities. Our net asset value will be determined based on the fair value of our assets less liabilities under market conditions existing as of the time of valuation and assuming the allocation of the resulting net value among our stockholders after any adjustments for incentive, preferred or special interests, if applicable.

In accordance with our policy, the valuation committee of our board of directors, comprised of our independent directors, oversees our valuation process and engages one or more third-party valuation advisors to assist in the process of determining the net asset value per share of our common stock.

To assist our board of directors in its determination of the current offering price per share of our common stock for this offering, our board of directors engaged an investment banking firm, CBRE Capital Advisors, Inc. (“CBRE Cap”), that specializes in providing real estate financial services, to provide property-level and aggregate valuation analyses of the Company and a range for the net asset value per share of our common stock, and considered other information provided by our advisor. After taking into consideration the valuation analyses performed by CBRE Cap and certain other factors, our board of directors unanimously approved $9.13 as the estimated net asset value per share of our common stock as of September 30, 2013. The determination of the offering price of $10.14 by our board of directors was based on our estimated net asset value per share, plus selling commissions and marketing support fees for this offering.

In performing its analyses, CBRE Cap made numerous assumptions as of various points in time with respect to industry performance, general business, economic and regulatory conditions, current and future rental market for our operating properties and those in development and other matters, many of which are necessarily subject to change and beyond our control and the control of CBRE Cap. The analyses performed by CBRE Cap are not necessarily indicative of actual values, trading values or actual future results of our common stock that might be achieved, all of which may be significantly more or less favorable than suggested by its valuation report. The analyses do not purport to be appraisals or to reflect the prices at which the properties may actually be sold, and such estimates are inherently subject to uncertainty. CBRE Cap’s valuation report was not addressed to the public and may not be relied upon by any other person to establish an estimated value of our common stock. The actual value of our common stock may vary significantly depending on numerous factors that generally impact the price of securities, our financial condition and the state of the real estate industry more generally. Accordingly, with respect to the estimated net asset value per share of our common stock, neither we nor CBRE Cap can give any assurance that:

| | — | | a stockholder would be able to resell his or her shares at this estimated value; |

14

| | — | | a stockholder would ultimately realize distributions per share equal to our estimated net asset value per share upon liquidation of our assets and settlement of our liabilities or a sale of the Company; |

| | — | | our shares would trade at a price equal to or greater than the estimated net asset value per share if we listed them on a national securities exchange; or |

| | — | | the methodology used to estimate our net asset value per share would be acceptable to FINRA or under ERISA for compliance with its reporting requirements. |

For a detailed discussion of the determination of the offering price and net asset value per share of our common stock, including our valuation process and methodology, see “Determination of Our Offering Price and Estimated Net Asset Value Per Share.”

Our net asset value per share will be produced at least annually as of December 31 and disclosed as soon as possible after year end; provided, however, that the next valuation may be deferred, in the sole discretion of our board of directors, until after December 31, 2014. See “Determination of Our Offering Price and Estimated Net Asset Value Per Share.”

Our Exit Strategy

The following section entitled “PROSPECTUS SUMMARY — Our Exit Strategy,” replaces in its entirety the section entitled “PROSPECTUS SUMMARY — Our Exit Strategy” beginning on page 22 of the prospectus.

By 2018, our board of directors will begin consideration of various strategic options to provide our stockholders with liquidity of their investment, either in whole or in part. These options may include, but are not limited to, (i) a listing of our shares on a national securities exchange, (ii) our sale to, or merger with, another entity in a transaction which provides our investors with cash or securities of a publicly traded company, or (iii) the commencement of an orderly sale of our assets, outside the ordinary course of business and consistent with our objective of qualifying as a REIT, and the distribution of the proceeds thereof. We do not know at this time what circumstances will exist in the future and therefore we do not know what factors our board of directors will consider in determining whether to pursue a liquidity event in the future. Therefore, we have not established any pre-determined criteria. A liquidation of our assets or a sale of the company would require the approval of our stockholders.

RISK FACTORS

The first risk factor in the section “RISK FACTORS —Offering Related Risks” is deleted in its entirety and replaced with following new risk factors which supplement and should be read in conjunction with the section entitled “RISK FACTORS — Offering Related Risks” beginning on page 23 of the prospectus.

The offering price of our shares is based on our estimated net asset value per share, plus selling commissions and marketing support fees, and may not be indicative of the price at which our shares would trade if they were actively traded.

Our board of directors determined the offering price of our shares based upon a number of factors, but primarily based on the estimated per share value of our shares determined by our board of directors which utilized a valuation report from an independent investment banking firm that specializes in providing real estate financial services. Although we used guidelines recommended by the IPA for valuing issued or outstanding shares of non-traded real estate investment trusts such as us, our offering price may not be indicative of either the price at which our shares would trade if they were listed on a national exchange or actively traded by brokers or of the proceeds that a stockholder would receive if we were liquidated or dissolved and the proceeds were distributed to our stockholders.

Our share price is primarily based on the estimated per share value of our shares, but is also based upon subjective judgments, assumptions and opinions by management, which may or may not turn out to be correct. Therefore, our share price may not reflect the amount that might be paid to you for your shares in a market transaction.

15

Our current offering price is primarily based on our estimated net asset value per share, which was based, in part, on estimates of the values of our properties, consisting principally of illiquid real estate and other assets, and liabilities as of September 30, 2013. The valuation methodologies used by the independent investment banking firm retained by our board of directors to estimate the value of our properties and the estimated net asset value of our shares as of September 30, 2013, involved subjective judgments, assumptions and opinions, which may or may not turn out to be correct. Our board of directors also took into consideration selling commissions and marketing support fees of this offering in establishing the current share price. As a result of these, as well as other factors, our share price may not reflect the amount that might be paid to you for your shares in a market transaction.

In determining our estimated net asset value per share, we primarily relied upon a valuation of our portfolio of properties and debt as of September 30, 2013. Valuations and appraisals of our properties and outstanding debt are estimates of fair value and may not necessarily correspond to realizable value upon the sale of such properties. Therefore, our estimated net asset value per share may not reflect the amount that would be realized upon a sale of each of our properties.

For the purposes of calculating our estimated net asset value per share, we retained an investment banking firm as valuation expert to determine our estimated net asset value per share and the value of our properties and debt as of September 30, 2013. The valuation methodologies used to estimate the net asset value of our shares, as well as the value of our properties and outstanding debt, involved certain subjective judgments, including but not limited to, discounted cash flow analyses for wholly owned and partially owned properties. Ultimate realization of the value of an asset depends to a great extent on economic and other conditions beyond our control and the control of our advisor and our valuation expert. Further, valuations do not necessarily represent the price at which an asset would sell, since market prices of assets can only be determined by negotiation between a willing buyer and seller. Therefore, the valuations of our properties and our investments in real estate-related assets may not correspond to the realizable value upon a sale of those assets. Because the price you will pay for shares in this offering is primarily based on our estimated net asset value per share, you may pay more than realizable value for your investment when you purchase your shares or receive less than realizable value when you sell your shares.

We may not perform a subsequent calculation of our net asset value per share prior to the end of this offering. Therefore, you may not be able to determine the net asset value of your shares on an ongoing basis during this offering.

On December 6, 2013, our board of directors approved an estimated net asset value of $9.13 per share. We intend to use this net asset value as the estimated per share value of our shares until the next net asset value approved by our board of directors, which may not occur until after December 31, 2014. We will disclose future estimates of our net asset value to stockholders in our filings with the Commission. We may not calculate the net asset value per share prior to the end of this offering. Therefore, you may not be able to determine the net asset value of your shares on an ongoing basis during this offering.

The third risk factor in the section “RISK FACTORS —Offering Related Risks” on page 24 is deleted in its entirety and replaced with the following risk factor and should be read in conjunction with the section entitled “RISK FACTORS — Offering Related Risks” beginning on page 23 of the prospectus.

We have not had sufficient cash available from operations to pay distributions, and, therefore, we have paid distributions from the net proceeds of our offering. We may continue to pay distributions from sources other than our cash flow from operations, or funds from operations, and any such distributions may reduce the amount of cash we ultimately invest in assets, negatively impact the value of our stockholders’ investment and be dilutive to our stockholders.

To date, we have generated little, if any, cash flow from operations or funds from operations and do not expect to do so until we make substantial investments. Further, to the extent we invest in development or redevelopment projects, or in properties requiring significant capital, our ability to make cash distributions may be negatively affected, especially during our early stages of operations. Our organizational documents permit us to make distributions from any source, such as from the proceeds of our offering or other offerings, cash advances to us by our advisor, cash resulting from a deferral or waiver of asset management fees or expense reimbursements, and borrowings, which may be unsecured or secured by our assets, in anticipation of future net operating cash flow. Accordingly, until such time as we are generating operating cash flow or funds from operations, we have determined to pay all of our distributions from sources other than net operating

16

cash flows. We have not established any limit on the extent to which we may use alternate sources, including borrowings or proceeds of this and our prior offering, to pay distributions. Commencing in the fourth fiscal quarter of 2011, we have made cash distributions from offering proceeds, which is dilutive to our stockholders. To the extent we make cash distributions, or a portion thereof, from sources other than operating cash flow or funds from operations, we will have less capital available to invest in properties and other real estate-related assets, the book value per share may decline, and there will be no assurance that we will be able to sustain distributions at that level. Further, distributions that exceed cash flow from operations or funds from operations may not be sustainable. The use of offering proceeds to fund distributions benefits earlier investors who benefit from the investments made with funds raised later in this offering, while later investors may not benefit from all of the net offering proceeds raised from earlier investors. Distributions will be taxable as ordinary income to the stockholders to the extent such distributions are made from the Company’s current and accumulated earnings and profits. In addition, to the extent distributions exceed earnings and profits calculations on a tax basis, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain in the future.

The following risk factor is added to the end of the section entitled “RISK FACTORS —Company Related Risks” on page 31 of the prospectus.

Adverse changes in affiliated programs could also adversely affect our ability to raise capital.

CNL has one other public, non-traded, real estate investment program which has investment objectives similar to ours, CNL Lifestyle Properties, Inc. which is closed to new investors but still actively investing. Our sponsor also has two other public, non-traded real estate investment programs, CNL Growth Properties, Inc. which will be open to new investors through April 2014 and Global Income Trust, Inc., which is currently closed to new investors. Adverse results in the other REITs on the CNL Financial Group platform have the potential to affect our reputation among financial advisors and investors, which could affect our ability to raise capital.

The following risk factor supersedes and replaces in its entirety the first risk factor in the section entitled “RISK FACTORS —Tax Related Risks” on page 54 of the prospectus.

Failure to qualify as a REIT would adversely affect our operations and our ability to pay distributions to you.

We intend to operate as a REIT under the Internal Revenue Code and believe we have and will continue to operate as a REIT in such manner. However, qualification as a REIT involves the application of highly technical and complex Code provisions for which there are only limited judicial and administrative interpretations. The determination of various factual matters and circumstances not entirely within our control may also affect our ability to remain qualified as a REIT. If we fail to qualify as a REIT for any taxable year, (i) we will be subject to federal and state income tax, including any applicable alternative minimum tax, on our taxable income for that year at regular corporate rates, (ii) unless entitled to relief under relevant statutory provisions, we would generally be disqualified from taxation as a REIT for the four taxable years following the year of disqualification as a REIT; and (iii) distributions to stockholders would no longer qualify for the dividends paid deduction in computing our taxable income. If we do not qualify as a REIT, we would not be required to make distributions to stockholders as a non-REIT is not required to pay dividends to stockholders in order to maintain REIT status or avoid an excise tax. The additional income tax liability we would incur as a result of failing to qualify as a REIT would reduce our net earnings available for distributions to stockholders and also reduce the funds available for satisfying our obligations in general. If we fail to qualify as a REIT, we may be required to borrow funds or liquidate some investments in order to pay the applicable tax. As a result of all these factors, our failure to qualify as a REIT also could impair our ability to implement our business strategy and would adversely affect the value of our stock.

The following risk factor is added at the end of the risk factors on page 57 in the section entitled “RISK FACTORS —Tax Related Risks.”

The lease of qualified health care properties to a taxable REIT subsidiary is subject to special requirements.

We lease certain qualified health care properties to taxable REIT subsidiaries (or limited liability companies of which the taxable REIT subsidiaries are members), which lessees contract with managers (or related parties) to manage the health care operations at these properties. The rents from this taxable REIT subsidiary lessee structure are treated as

17

qualifying rents from real property if (1) they are paid pursuant to an arms-length lease of a qualified health care property with a taxable REIT subsidiary and (2) the manager qualifies as an eligible independent contractor (as defined in the Code). If any of these conditions are not satisfied, then the rents will not be qualifying rents and we might fail to meet the 95% and 75% gross income tests. See “Federal Income Tax Considerations — Requirements for Qualification as a REIT — Operational Requirements — Gross Income Tests” in the prospectus.

ESTIMATED USE OF PROCEEDS