UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-54685

CNL Healthcare Properties, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 27-2876363 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

CNL Center at City Commons 450 South Orange Avenue Orlando, Florida | | 32801 |

| (Address of principal executive offices) | | (Zip Code) |

| |

Registrant’s telephone number, including area code (407) 650-1000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares of common stock of the registrant outstanding as of August 4, 2014 was 82.5 million.

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

INDEX

| PART I | FINANCIAL INFORMATION |

| Item 1. | Financial Statements |

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands, except per share data)

| | | | | | | | |

| | | June 30,

2014 | | | December 31,

2013 | |

ASSETS | | | | | | | | |

Real estate assets: | | | | | | | | |

Real estate investment properties, net (including VIEs $89,936 and $72,053, respectively) | | $ | 1,208,711 | | | $ | 848,791 | |

Real estate under development, including land (including VIEs $15,734 and $16,210, respectively) | | | 16,674 | | | | 17,409 | |

| | | | | | | | |

Total real estate assets, net | | | 1,225,385 | | | | 866,200 | |

| | |

Intangibles, net (including VIEs $4,139 and $4,535, respectively) | | | 84,375 | | | | 52,400 | |

Cash (including VIEs $576 and $727, respectively) | | | 64,773 | | | | 44,209 | |

Investments in unconsolidated entities | | | 16,514 | | | | 18,438 | |

Loan costs, net (including VIEs $1,133 and $912, respectively) | | | 10,233 | | | | 7,919 | |

Other assets (including VIEs $587 and $21, respectively) | | | 8,085 | | | | 6,445 | |

Deposits | | | 6,896 | | | | 8,892 | |

Note receivable from related party | | | 6,046 | | | | 3,949 | |

Deferred rent (including VIEs $185 and $104, respectively) | | | 4,037 | | | | 2,782 | |

Restricted cash (including VIEs $257 and $257, respectively) | | | 5,680 | | | | 2,839 | |

| | | | | | | | |

Total assets | | $ | 1,432,024 | | | $ | 1,014,073 | |

| | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | |

Liabilities: | | | | | | | | |

Mortgage and other notes payable (including VIEs $62,757 and $52,596, respectively) | | $ | 599,424 | | | $ | 438,107 | |

Revolving credit facility | | | 210,615 | | | | 98,500 | |

Other liabilities (including VIEs $1,410 and $939, respectively) | | | 21,250 | | | | 7,243 | |

Accounts payable and accrued expenses (including VIES $373 and $309, respectively) | | | 14,050 | | | | 7,887 | |

Due to related parties (including VIEs $86 and $112, respectively) | | | 4,420 | | | | 3,308 | |

Accrued development costs (including VIEs $3,060 and $7,047, respectively) | | | 3,060 | | | | 7,047 | |

| | | | | | | | |

Total liabilities | | | 852,819 | | | | 562,092 | |

| | | | | | | | |

Commitments and contingencies (Note 15) | | | | | | | | |

| | |

Redeemable noncontrolling interests | | | 568 | | | | — | |

Stockholders’ equity: | | | | | | | | |

Preferred stock, $0.01 par value per share, 200,000 shares authorized; none issued or outstanding | | | — | | | | — | |

Excess shares, $0.01 par value per share, 300,000 shares authorized; none issued or outstanding | | | — | | | | — | |

Common stock, $0.01 par value per share, 1,120,000 shares authorized; 78,005 and 58,308 shares issued and 77,811 and 58,218 shares outstanding, respectively | | | 778 | | | | 582 | |

Capital in excess of par value | | | 666,009 | | | | 500,361 | |

Accumulated loss | | | (55,406 | ) | | | (30,580 | ) |

Accumulated distributions | | | (30,715 | ) | | | (17,423 | ) |

Accumulated other comprehensive loss | | | (2,029 | ) | | | (959 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 578,637 | | | | 451,981 | |

| | | | | | | | |

Total liabilities and equity | | $ | 1,432,024 | | | $ | 1,014,073 | |

| | | | | | | | |

The abbreviation VIEs above means variable interest entities.

See accompanying notes to condensed consolidated financial statements.

1

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | Quarter Ended

June 30, | | | Six Months Ended

June 30, | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Revenues: | | | | | | | | | | | | | | | | |

Rental income from operating leases | | $ | 10,363 | | | $ | 4,069 | | | $ | 20,085 | | | $ | 7,553 | |

Resident fees and services | | | 30,518 | | | | 4,527 | | | | 52,474 | | | | 8,845 | |

Tenant reimbursement income | | | 1,379 | | | | 10 | | | | 2,830 | | | | 10 | |

Interest income on note receivable from related party | | | 204 | | | | 3 | | | | 350 | | | | 3 | |

| | | | | | | | | | | | | | | | |

Total revenues | | | 42,464 | | | | 8,609 | | | | 75,739 | | | | 16,411 | |

| | | | | | | | | | | | | | | | |

| | | | |

Expenses: | | | | | | | | | | | | | | | | |

Property operating expenses | | | 22,567 | | | | 3,331 | | | | 38,987 | | | | 6,548 | |

General and administrative | | | 1,935 | | | | 1,568 | | | | 3,692 | | | | 2,677 | |

Acquisition fees and expenses | | | 4,792 | | | | 2,366 | | | | 11,997 | | | | 2,944 | |

Asset management fees | | | 1,049 | | | | 598 | | | | 2,819 | | | | 1,587 | |

Property management fees | | | 2,124 | | | | 485 | | | | 3,760 | | | | 941 | |

Contingent purchase price consideration adjustment | | | (1,321 | ) | | | — | | | | (1,321 | ) | | | — | |

Depreciation and amortization | | | 14,699 | | | | 2,563 | | | | 26,561 | | | | 4,882 | |

| | | | | | | | | | | | | | | | |

Total expenses | | | 45,845 | | | | 10,911 | | | | 86,495 | | | | 19,579 | |

| | | | |

Operating loss | | | (3,381 | ) | | | (2,302 | ) | | | (10,756 | ) | | | (3,168 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Other income (expense): | | | | | | | | | | | | | | | | |

Interest and other income | | | 12 | | | | 1 | | | | 20 | | | | 2 | |

Interest expense and loan cost amortization | | | (7,570 | ) | | | (1,680 | ) | | | (13,105 | ) | | | (4,915 | ) |

Equity in earnings (loss) of unconsolidated entities | | | (1,362 | ) | | | 1,182 | | | | (1,013 | ) | | | 1,460 | |

| | | | | | | | | | | | | | | | |

Total other expense | | | (8,920 | ) | | | (497 | ) | | | (14,098 | ) | | | (3,453 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Loss before income taxes | | | (12,301 | ) | | | (2,799 | ) | | | (24,854 | ) | | | (6,621 | ) |

Income tax benefit (expense) | | | (2 | ) | | | (31 | ) | | | 28 | | | | (18 | ) |

| | | | | | | | | | | | | | | | |

Net loss | | $ | (12,303 | ) | | $ | (2,830 | ) | | $ | (24,826 | ) | | $ | (6,639 | ) |

| | | | | | | | | | | | | | | | |

Less: Net loss attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders | | $ | (12,303 | ) | | $ | (2,830 | ) | | $ | (24,826 | ) | | $ | (6,639 | ) |

| | | | | | | | | | | | | | | | |

Net loss per share of common stock (basic and diluted) | | $ | (0.17 | ) | | $ | (0.09 | ) | | $ | (0.37 | ) | | $ | (0.23 | ) |

| | | | | | | | | | | | | | | | |

Weighted average number of shares of common stock outstanding (basic and diluted) | | | 72,858 | | | | 32,486 | | | | 67,979 | | | | 28,432 | |

| | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

2

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (UNAUDITED)

(in thousands)

| | | | | | | | | | | | | | | | |

| | | Quarter Ended

June 30, | | | Six Months Ended

June 30, | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

| | | | |

Net loss | | $ | (12,303 | ) | | $ | (2,830 | ) | | $ | (24,826 | ) | | $ | (6,639 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Other comprehensive income (loss): | | | | | | | | | | | | | | | | |

Unrealized loss on derivative financial instruments | | | (723 | ) | | | — | | | | (946 | ) | | | — | |

Unrealized gain (loss) on derivative financial instruments of equity method investments | | | (98 | ) | | | 211 | | | | (124 | ) | | | 131 | |

| | | | | | | | | | | | | | | | |

Total other comprehensive income (loss) | | | (821 | ) | | | 211 | | | | (1,070 | ) | | | 131 | |

| | | | | | | | | | | | | | | | |

| | | | |

Comprehensive loss | | | (13,124 | ) | | | (2,619 | ) | | | (25,896 | ) | | | (6,508 | ) |

| | | | | | | | | | | | | | | | |

Less: Comprehensive loss attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Comprehensive loss attributable to common stockholders | | $ | (13,124 | ) | | $ | (2,619 | ) | | $ | (25,896 | ) | | $ | (6,508 | ) |

| | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

3

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND REDEEMABLE NONCONTROLLING INTEREST

Six Months Ended June 30, 2014 (unaudited) and the Year Ended December 31, 2013

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Accumulated | | | | | | | | | |

| | | Common Stock | | | Capital in | | | | | | | | | Other | | | Total | | | | | Redeemable | |

| | | Number | | | Par | | | Excess of | | | Accumulated | | | Accumulated | | | Comprehensive | | | Stockholders’ | | | | | Noncontrolling | |

| | | of Shares | | | Value | | | Par Value | | | Loss | | | Distributions | | | Loss | | | Equity | | | | | Interest | |

Balance at December 31, 2012 | | | 18,446 | | | $ | 184 | | | $ | 156,200 | | | $ | (12,480 | ) | | $ | (3,253 | ) | | $ | — | | | $ | 140,651 | | | | | $ | — | |

Subscriptions received for common stock through public offering and reinvestment plan | | | 38,798 | | | | 388 | | | | 386,975 | | | | — | | | | — | | | | — | | | | 387,363 | | | | | | — | |

Stock distributions | | | 1,063 | | | | 11 | | | | (11 | ) | | | — | | | | — | | | | — | | | | — | | | | | | — | |

Redemptions of common stock | | | (89 | ) | | | (1 | ) | | | (826 | ) | | | — | | | | — | | | | — | | | | (827 | ) | | | | | — | |

Stock issuance and offering costs | | | — | | | | — | | | | (41,977 | ) | | | — | | | | — | | | | — | | | | (41,977 | ) | | | | | — | |

Net loss | | | — | | | | — | | | | — | | | | (18,100 | ) | | | — | | | | — | | | | (18,100 | ) | | | | | — | |

Other comprehensive loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (959 | ) | | | (959 | ) | | | | | — | |

Cash distributions, declared and paid or reinvested ($0.39996 per share) | | | — | | | | — | | | | — | | | | — | | | | (14,170 | ) | | | — | | | | (14,170 | ) | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2013 | | | 58,218 | | | | 582 | | | | 500,361 | | | | (30,580 | ) | | | (17,423 | ) | | | (959 | ) | | | 451,981 | | | | | | — | |

Subscriptions received for common stock through public offering and reinvestment plan | | | 18,713 | | | | 187 | | | | 188,944 | | | | — | | | | — | | | | — | | | | 189,131 | | | | | | — | |

Stock distributions | | | 984 | | | | 10 | | | | (10 | ) | | | — | | | | — | | | | — | | | | — | | | | | | — | |

Redemptions of common stock | | | (104 | ) | | | (1 | ) | | | (945 | ) | | | — | | | | — | | | | — | | | | (946 | ) | | | | | —�� | |

Stock issuance and offering costs | | | — | | | | — | | | | (20,341 | ) | | | — | | | | — | | | | — | | | | (20,341 | ) | | | | | — | |

Cash distributions declared and paid or reinvested ($0.2028 per share) | | | — | | | | — | | | | — | | | | — | | | | (13,292 | ) | | | — | | | | (13,292 | ) | | | | | — | |

Distribution to holder of promoted interest | | | — | | | | — | | | | (2,000 | ) | | | — | | | | — | | | | — | | | | (2,000 | ) | | | | | — | |

Net loss | | | — | | | | — | | | | — | | | | (24,826 | ) | | | — | | | | — | | | | (24,826 | ) | | | | | — | |

Other comprehensive loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1,070 | ) | | | (1,070 | ) | | | | | — | |

Contribution from redeemable noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | | 568 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at June 30, 2014 | | | 77,811 | | | $ | 778 | | | $ | 666,009 | | | $ | (55,406 | ) | | $ | (30,715 | ) | | $ | (2,029 | ) | | $ | 578,637 | | | | | $ | 568 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements

4

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands)

| | | | | | | | |

| | | Six Months Ended

June 30, | |

| | | 2014 | | | 2013 | |

Operating activities: | | | | | | | | |

Net cash flows provided by operating activities | | $ | 11,312 | | | $ | 3,176 | |

| | | | | | | | |

| | |

Investing activities: | | | | | | | | |

Acquisition of properties | | | (353,383 | ) | | | (69,455 | ) |

Development of properties | | | (22,111 | ) | | | (6,391 | ) |

Issuance of note receivable to related party | | | (1,964 | ) | | | (1,813 | ) |

Investment in unconsolidated entities | | | — | | | | (12,176 | ) |

Changes in restricted cash | | | (2,820 | ) | | | (782 | ) |

Capital expenditures | | | (1,461 | ) | | | (79 | ) |

Payment of tenant improvements and leasing costs | | | (310 | ) | | | — | |

Deposits on real estate | | | (6,266 | ) | | | (4,359 | ) |

| | | | | | | | |

Net cash flows used in investing activities | | | (388,315 | ) | | | (95,055 | ) |

| | | | | | | | |

| | |

Financing activities: | | | | | | | | |

Subscriptions received for common stock through public offering | | | 181,867 | | | | 174,852 | |

Payment of stock issuance and offering costs | | | (19,919 | ) | | | (18,525 | ) |

Distributions to stockholders, net of distribution reinvestments | | | (6,027 | ) | | | (2,322 | ) |

Distribution to holder of promoted interest | | | (2,000 | ) | | | — | |

Contribution from redeemable noncontrolling interest | | | 568 | | | | — | |

Redemptions of common stock | | | (380 | ) | | | (219 | ) |

Draws under revolving credit facility | | | 112,115 | | | | — | |

Proceeds from mortgage and other notes payable | | | 138,061 | | | | 92,616 | |

Principal payments on mortgage and other notes payable | | | (4,031 | ) | | | (115,910 | ) |

Lender deposits | | | (215 | ) | | | (67 | ) |

Payment of loan costs | | | (2,472 | ) | | | (1,693 | ) |

| | | | | | | | |

Net cash flows provided by financing activities | | | 397,567 | | | | 128,732 | |

| | | | | | | | |

| | |

Net increase in cash | | | 20,564 | | | | 36,853 | |

Cash at beginning of period | | | 44,209 | | | | 18,262 | |

| | | | | | | | |

Cash at end of period | | $ | 64,773 | | | $ | 55,115 | |

| | | | | | | | |

| | |

Supplemental disclosure of non-cash investing and financing activities: | | | | | | | | |

Amounts incurred but not paid (including amounts due to related parties): | | | | | | | | |

Stock issuance and offering costs | | $ | 1,175 | | | $ | 851 | |

| | | | | | | | |

Loan costs | | $ | 394 | | | $ | 169 | |

| | | | | | | | |

Investment in unconsolidated entities | | $ | 220 | | | $ | — | |

| | | | | | | | |

Capital expenditures | | $ | 62 | | | $ | — | |

| | | | | | | | |

Accrued development costs | | $ | 3,060 | | | $ | 2,222 | |

| | | | | | | | |

Redemptions payable | | $ | 688 | | | $ | 205 | |

| | | | | | | | |

Assumption of mortgage note payable on acquisition of property | | $ | (27,286 | ) | | $ | — | |

| | | | | | | | |

Contingent purchase price consideration | | $ | (8,500 | ) | | $ | — | |

| | | | | | | | |

Unrealized gain (loss) on derivative financial instruments | | $ | (2,029 | ) | | $ | 131 | |

| | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

5

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

CNL Healthcare Properties, Inc. (the “Company”) is a Maryland corporation incorporated on June 8, 2010 that elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes beginning with the year ended December 31, 2012.

The Company is externally advised by CNL Healthcare Corp. (the “Advisor”) and its property manager is CNL Healthcare Manager Corp. (the “Property Manager”), each of which is a Florida corporation and a wholly owned subsidiary of CNL Financial Group, LLC, the Company’s sponsor. CNL Financial Group, LLC is an affiliate of CNL Financial Group, Inc. (“CNL”). The Advisor is responsible for managing the Company’s affairs on a day-to-day basis and for identifying and making acquisitions and investments on behalf of the Company pursuant to an advisory agreement among the Company, the operating partnership and the Advisor. Substantially all of the Company’s acquisition, operating, administrative and certain property management services are provided by affiliates of the Advisor and the Property Manager. In addition, third-party sub-property managers have been engaged by the Company to provide certain property management services.

On June 27, 2011, the Company commenced its initial public offering of up to $3.0 billion of common stock (the “Offering”), including shares being offered from its distribution reinvestment plan (the “Reinvestment Plan”), pursuant to a registration statement on Form S-11 under the Securities Act of 1933, as amended. The shares were initially being offered at $10 per share and effective December 11, 2013 are being offered at $10.14 per share, or $9.64 per share pursuant to the Reinvestment Plan. The Company plans to extend the Offering through the effective date of a subsequent registration statement for a follow-on offering.

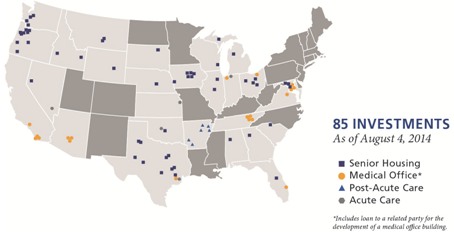

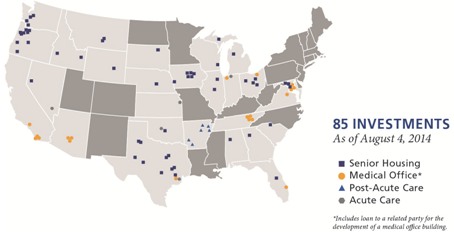

The Company’s investment focus is on acquiring a diversified portfolio of healthcare real estate or real estate-related assets, primarily in the United States, within the senior housing, medical office, post-acute care and acute care asset classes. The types of senior housing that the Company may acquire include active adult communities (age-restricted and age-targeted housing), independent and assisted living facilities, continuing care retirement communities, and memory care facilities. The types of medical offices that the Company may acquire include medical office buildings, specialty medical and diagnostic service facilities, surgery centers, outpatient rehabilitation facilities, and other facilities designed for clinical services. The types of post-acute care facilities that the Company may acquire include skilled nursing facilities, long-term acute care hospitals and inpatient rehabilitative facilities. The types of acute care facilities that the Company may acquire include general acute care hospitals and specialty surgical hospitals. The Company views, manages and evaluates its portfolio homogeneously as one collection of healthcare assets with a common goal to maximize revenues and property income regardless of the asset class or asset type.

The Company primarily expects to lease its properties to third-party tenants under triple-net or similar lease structures, where the tenant bears all or substantially all of the costs including cost increases, for real estate taxes, utilities, insurance and ordinary repairs. However, the Company may also invest through other strategic investment types aimed to maximize stockholder value by generating sustainable cash flow growth and increasing the value of the Company’s healthcare assets, including leasing properties to wholly-owned taxable REIT subsidiaries (“TRS”) and engaging independent third-party managers under management agreements to operate the properties as permitted under REIT Investment Diversification and Empowerment Act of 2007 (“RIDEA”). In addition, the Company expects most investments will be wholly owned, although, the Company has and may continue to invest through partnerships with other entities where the Company believes it is appropriate and beneficial. The Company has and expects to continue to invest in new property developments or properties which have not reached full stabilization. Finally, the Company also may invest in and originate mortgage, bridge or mezzanine loans or in entities that make investments similar to the foregoing investment types. The Company generally makes loans to the owners of properties to enable them to acquire land, buildings, or to develop property. In exchange, the owner generally grants the Company a first lien or collateralized interest in a participating mortgage collateralized by the property or by interests in the entity that owns the property.

6

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation and Consolidation — The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all of the information and note disclosures required by generally accepted accounting principles in the United States (“GAAP”). The unaudited condensed consolidated financial statements reflect all normal recurring adjustments, which, in the opinion of management, are necessary for the fair statement of the Company’s results for the interim period presented. Operating results for the quarter or six months ended June 30, 2014 may not be indicative of the results that may be expected for the year ending December 31, 2014. Amounts as of December 31, 2013 included in the unaudited condensed consolidated financial statements have been derived from audited consolidated financial statements as of that date but do not include all disclosures required by GAAP. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013.

The accompanying unaudited condensed consolidated financial statements include the Company’s accounts, the accounts of wholly owned subsidiaries or subsidiaries for which the Company has a controlling interest, the accounts of variable interest entities (“VIEs”) in which the Company is the primary beneficiary, and the accounts of other subsidiaries over which the Company has a controlling financial interest. All material intercompany accounts and transactions have been eliminated in consolidation.

In accordance with the guidance for the consolidation of VIEs, the Company analyzes its variable interests, including loans, leases, guarantees, and equity investments, to determine if the entity in which it has a variable interest is a variable interest entity (“VIE”). The Company’s analysis includes both quantitative and qualitative reviews. The Company bases its quantitative analysis on the forecasted cash flows of the entity, and its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and financial agreements. The Company also uses its quantitative and qualitative analyses to determine if it is the primary beneficiary of the VIE, and if such determination is made, it includes the accounts of the VIE in its consolidated financial statements.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, the reported amounts of revenues and expenses during the reporting periods and the disclosure of contingent liabilities. For example, significant assumptions are made in the allocation of purchase price, the analysis of real estate impairments, the valuation of contingent assets and liabilities, and the valuation of restricted stock shares issued to the Advisor or Property Manager. Accordingly, actual results could differ from those estimates.

Promoted Interest Distributions — The Company accounts for distributions to holders of promoted interests in a manner similar to noncontrolling interests. The Company identifies the distributions to holders of promoted interests separately within the accompanying condensed consolidated statements of equity. During the six months ended June 30, 2014, the Company made distributions of approximately $2.0 million to a holder of promoted interest related to HarborChase of Villages Crossing, which has been recorded as a reduction to capital in excess of par value in the accompanying condensed consolidated statements of stockholders’ equity and redeemable noncontrolling interest.

Redeemable Noncontrolling Interest—The Company entered into a joint venture agreement with a third party and acquired a 95% membership interest. The Company’s joint venture partner acquired a 5% noncontrolling interest that includes a put option of its membership to the Company upon the occurrence of certain events that are not solely within the control of the Company and at price that is determinable upon exercising the option. The Company classifies redeemable equity securities in accordance with Accounting Standard Update (“ASU”) No. 2009-04, “Liabilities (Topic 480): Accounting for Redeemable Equity Instruments,” which requires that redeemable equity securities be classified outside of permanent stockholders’ equity. Accordingly, the Company has classified these redeemable equity securities as redeemable noncontrolling interest within the accompanying condensed consolidated balance sheets and condensed consolidated statements of stockholders’ equity and redeemable noncontrolling interest.

7

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 2. | Summary of Significant Accounting Policies (continued) |

Adopted Accounting Pronouncements — In February 2013, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2013-04, “Liabilities (Topic 405): Obligations Resulting from Joint and Several Liability Arrangements for Which the Total Amount of the Obligation is Fixed at the Reporting Date.” This update clarified the guidance in subtopic 405 and requires entities to measure obligations resulting from joint and several liability arrangements for which total obligation is fixed at the reporting date. Entities are required to measure the obligation as the amount that the reporting entity agreed to pay on the basis of its arrangement among its co-obligors plus any additional amount the reporting entity expects to pay on behalf of its co-obligors. Additionally, the guidance requires entities to disclose the nature and amount of the obligations as well as other information about those obligations. Effective January 1, 2014, the Company adopted this ASU. The adoption of this update did not have a material impact on the Company’s financial position, results of operations or cash flows.

In July 2013, the FASB issued ASU No. 2013-11, “Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a similar Tax Loss, or a Tax Credit Carryforward Exists.” This update clarified the guidance in subtopic 740 and requires entities to present an unrecognized tax benefit, or a portion of an unrecognized tax benefit in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward to the extent one is available. Effective January 1, 2014, the Company adopted this ASU. The adoption of this update did not have a material impact on the Company’s financial position, results of operations or cash flows.

Recent Accounting Pronouncements — In April 2014, the FASB issued ASU No. 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” This update changes the criteria for reporting discontinued operations where only disposals representing a strategic shift that has (or will have) a major effect on an entity’s operations and financial results, such as a major line of business or geographical area, should be presented as a discontinued operation. This ASU is effective prospectively for all disposals (or classifications as held for sale) of components of an entity that occur within annual periods beginning on or after December 15, 2014 with early adoption permitted. The Company has determined that the impact of this update will not have a material impact on the Company’s financial position, results of operations or cash flows.

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers,” as a new Accounting Standard Concept (“ASC”) topic (Topic 606). The core principle of this amendment is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard further provides guidance for any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets unless those contracts are within the scope of other standards (for example, lease contracts). This ASU 2014-09 is effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period, with earlier adoption not permitted. ASU 2014-09 can be adopted using one of two retrospective application methods: 1) retrospectively to each prior reporting period presented or 2) as a cumulative-effect adjustment as of the date of adoption. The Company is currently evaluating the amendments of ASU 2014-09; however, these amendments could potentially have a significant effect on the Company’s consolidated financial position, results of operations or cash flows.

Other recently issued accounting pronouncements did not, or are not believed by management to, have a material effect on the Company’s present or future consolidated financial statements.

8

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

Real Estate Investment Properties — During the six months ended June 30, 2014, the Company acquired the following 16 properties, which were comprised of 13 senior housing communities, two medical office buildings (“MOB”), and one acute care hospital:

| | | | | | | | | | |

Name | | Location | | Structure | | Date

Acquired | | Purchase Price | |

| | | | | (in thousands) | |

| | | | |

Acute Care | | | | | | | | | | |

Houston Orthopedic & Spine Hospital | | Bellaire, TX

(“Houston”) | | Triple-net Lease | | 6/2/2014 | | $ | 49,000 | |

| | | | |

Medical Office | | | | | | | | | | |

Scripps Medical Office Building | | Chula Vista, CA

(“San Diego”) | | Modified Lease | | 1/21/2014 | | | 17,863 | (1) |

Foundation Medical Office Building | | Bellaire, TX

(“Houston”) | | Modified Lease | | 6/2/2014 | | | 27,000 | |

| | | | |

Senior Housing | | | | | | | | | | |

Pacific Northwest II Communities | | | | | | | | | | |

Prestige Senior Living Auburn Meadows | | Auburn, WA

(“Seattle”) | | Managed | | 2/3/2014 | | | 21,930 | |

Prestige Senior Living Bridgewood | | Vancouver, WA

(“Portland”) | | Managed | | 2/3/2014 | | | 22,096 | |

Prestige Senior Living Monticello Park | | Longview, WA | | Managed | | 2/3/2014 | | | 27,360 | |

Prestige Senior Living Rosemont | | Yelm, WA | | Managed | | 2/3/2014 | | | 16,877 | |

Prestige Senior Living West Hills | | Corvallis, OR | | Managed | | 3/3/2014 | | | 14,986 | |

| | | | |

South Bay II Communities | | | | | | | | | | |

Isle at Cedar Ridge | | Cedar Park, TX

(“Austin”) | | Managed | | 2/28/2014 | | | 21,630 | |

HarborChase of Plainfield | | Plainfield, IL | | Managed | | 3/28/2014 | | | 26,500 | |

Legacy Ranch Alzheimer’s Special Care Center | | Midland, TX | | Managed | | 3/28/2014 | | | 11,960 | |

The Springs Alzheimer’s Special Care Center | | San Angelo, TX | | Managed | | 3/28/2014 | | | 10,920 | |

Isle at Watercrest – Bryan | | Bryan, TX | | Managed | | 4/21/2014 | | | 22,050 | |

Watercrest at Bryan | | Bryan, TX | | Managed | | 4/21/2014 | | | 28,035 | |

Isle at Watercrest – Mansfield | | Mansfield, TX

(“Dallas/Fort Worth”) | | Managed | | 5/5/2014 | | | 25,000 | |

Watercrest at Mansfield | | Mansfield, TX

(“Dallas/Fort Worth”) | | Managed | | 6/30/2014 | | | 45,000 | |

| | | | | | | | | | |

| | | | | | | | $ | 388,207 | |

| | | | | | | | | | |

FOOTNOTE:

| (1) | This acquisition is not considered material to the Company and as such no pro forma financial information has been included related to this property. |

9

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 3. | Acquisitions (continued) |

During the six months ended June 30, 2013, the Company acquired the following medical office building and six post-acute care facilities:

| | | | | | | | | | |

Medical Office | | | | | | | | | | |

LaPorte Cancer Center | | Westville, IN | | Modified Lease | | 6/14/2013 | | $ | 13,100 | |

| | | | |

Post-Acute Care | | | | | | | | | | |

Perennial Communities | | | | | | | | | | |

Batesville Healthcare Center | | Batesville, AR | | Triple-net Lease | | 5/31/2013 | | | 6,205 | |

Broadway Healthcare Center | | West Memphis, AR | | Triple-net Lease | | 5/31/2013 | | | 11,799 | |

Jonesboro Healthcare Center | | Jonesboro, AR | | Triple-net Lease | | 5/31/2013 | | | 15,232 | |

Magnolia Healthcare Center | | Magnolia, AR | | Triple-net Lease | | 5/31/2013 | | | 11,847 | |

Mine Creek Healthcare Center | | Nashville, AR | | Triple-net Lease | | 5/31/2013 | | | 3,374 | |

Searcy Healthcare Center | | Searcy, AR | | Triple-net Lease | | 5/31/2013 | | | 7,898 | |

| | | | | | | | | | |

| | | | | | | | $ | 69,455 | |

| | | | | | | | | | |

The following summarizes the purchase price allocation for the above properties, and the estimated fair values of the assets acquired and liabilities assumed (in thousands):

| | | | | | | | |

| | | June 30, 2014 | | | June 30, 2013 | |

| | |

Land and land improvements | | $ | 32,280 | | | $ | 3,000 | |

Buildings and building improvements | | | 313,838 | | | | 59,694 | |

Furniture, fixtures and equipment | | | 10,014 | | | | 3,549 | |

Intangibles(1) | | | 42,296 | | | | 3,212 | |

Other liabilities | | | (1,721 | ) | | | — | |

Assumed mortgage note payable | | | (27,286 | ) | | | — | |

| | | | | | | | |

Net assets acquired | | | 369,421 | | | | 69,455 | |

Contingent purchase price consideration(2) | | | (12,395 | ) | | | — | |

| | | | | | | | |

Total purchase price consideration | | $ | 357,026 | | | $ | 69,455 | |

| | | | | | | | |

FOOTNOTES:

| (1) | At the acquisition date, the weighted-average amortization period on the acquired lease intangibles was approximately 4.0 years and 11.4 years, respectively, for the six months ended June 30, 2014 and 2013. The acquired lease intangibles during the six months ended June 30, 2014 were comprised of approximately $38.1 million and $4.2 million of in-place lease intangibles and other lease intangibles, respectively, and the acquired lease intangibles during the six months ended June 20, 2013 were comprised of approximately $3.2 million of in-place lease intangibles. |

| (2) | Approximately $3.9 million of this amount has been paid during the quarter and six months ended June 30, 2014 with the remaining $8.5 million included in other liabilities on the accompanying condensed consolidated balance sheet as of June 30, 2014; refer to Note 9, “Contingent Purchase Price Consideration” for additional information. |

10

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 3. | Acquisitions (continued) |

The revenues and net loss (including deductions for acquisition fees and expenses and depreciation and amortization expense) attributable to the acquired properties included in the Company’s condensed consolidated statements of operations were approximately $12.1 million and $5.8 million, respectively, and $15.4 million and $12.0 million, respectively, for the quarter and six months ended June 30, 2014 and approximately $0.6 million and $1.6 million, respectively, for both the quarter and six months ended June 30, 2013.

The following table presents the unaudited pro forma results of operations for the Company as if each of the properties were acquired as of January 1, 2013 and owned during the quarter and six months ended June 30, 2014 and 2013 (in thousands except per share data):

| | | | | | | | | | | | | | | | |

| | | (Unaudited)

Quarter Ended June 30, | | | (Unaudited)

Six Months Ended June 30, | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Revenues | | $ | 46,564 | | | $ | 23,664 | | | $ | 90,327 | | | $ | 47,106 | |

| | | | | | | | | | | | | | | | |

Net loss(1) | | $ | (8,930 | ) | | $ | (4,448 | ) | | $ | (19,291 | ) | | $ | (21,562 | ) |

| | | | | | | | | | | | | | | | |

Loss per share of common stock (basic and diluted) | | $ | (0.12 | ) | | $ | (0.10 | ) | | $ | (0.25 | ) | | $ | (0.53 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Weighted average number of shares of common stock outstanding (basic and diluted) (2) | | | 77,569 | | | | 44,912 | | | | 76,285 | | | | 40,858 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES:

| (1) | The unaudited pro forma results for the quarter and six months ended June 30, 2014, were adjusted to exclude approximately $4.3 million and $10.7 million, respectively, of acquisition related expenses directly attributable to the properties acquired during the quarter and six months ended June 30, 2014. The unaudited pro forma results for the six months ended June 30, 2013 were adjusted to include the approximate $10.7 million of acquisition related expenses, as if the properties acquired during the six months ended June 30, 2014 had been acquired on January 1, 2013. The unaudited pro forma results for the quarter and six months ended June 30, 2013 were both adjusted to exclude approximately $1.8 million of acquisition related expenses directly attributable to the properties acquired during the quarter and six months ended June 30, 2013. |

| (2) | As a result of the acquired properties being treated as operational since January 1, 2013, the Company assumed approximately 12.4 million shares were issued as of January 1, 2013. Consequently the weighted average shares outstanding was adjusted to reflect this amount of shares being issued on January 1, 2013 instead of actual dates on which the shares were issued, and such shares were treated as outstanding as of the beginning of the period presented. |

11

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 3. | Acquisitions (continued) |

Real Estate Under Development— In February 2014, the Company acquired a tract of land in Tega Cay, South Carolina for $2.8 million (“Wellmore of Tega Cay”). In connection with the acquisition, the Company entered into a development agreement with a third party developer for the construction and development of a continuing care retirement community with a maximum development budget of approximately $35.6 million, including the allocated purchase price of the land.

In June 2014, the Company entered into a joint venture agreement with a third party and acquired a 95% membership interest in a tract of land in Katy, Texas for $4.0 million (“Watercrest at Katy”) on which the joint venture plans to construct and develop an independent living community with a maximum development budget of approximately $38.2 million, including the allocated purchase price of the land. The Company determined that Watercrest at Katy is a VIE because it believes there is insufficient equity at risk due to the development nature of the joint venture. The Company is the primary beneficiary and managing member while the joint venture partner or its affiliates manage the development, construction and certain day-to-day operations of the property subject to the Company’s oversight. Pursuant to the joint venture agreement, distributions of operating cash flow will be distributed pro rata based on each member’s ownership interest until the members of the joint venture receive a specified minimum return on their invested capital, and thereafter, the respective co-venture partner will receive a disproportionately higher share of any remaining proceeds at varying levels based on the Company having received certain minimum threshold returns.

Under a promoted interest agreement with the respective developers, certain net operating income targets have been established which, upon meeting such targets, result in the developers being entitled to additional payments based on enumerated percentages of the assumed net proceeds of a deemed sale, subject to achievement of an established internal rate of return on the Company’s investment in the respective development. Refer to Note 7, “Variable Interest Entities,” for additional information.

| 4. | Real Estate Assets, net |

The gross carrying amount and accumulated depreciation of the Company’s real estate assets as of June 30, 2014 and December 31, 2013 are as follows (in thousands):

| | | | | | | | |

| | | June 30,

2014 | | | December 31,

2013 | |

Land and land improvements | | $ | 93,527 | | | $ | 59,208 | |

Building and building improvements | | | 1,112,591 | | | | 783,260 | |

Tenant improvements | | | 39 | | | | — | |

Furniture, fixtures and equipment | | | 33,190 | | | | 20,339 | |

Less: accumulated depreciation | | | (30,636 | ) | | | (14,016 | ) |

| | | | | | | | |

Real estate investment properties, net | | | 1,208,711 | | | | 848,791 | |

Real estate under development, including land | | | 16,674 | | | | 17,409 | |

| | | | | | | | |

Total real estate assets, net | | $ | 1,225,385 | | | $ | 866,200 | |

| | | | | | | | |

Depreciation expense on the Company’s real estate investment properties, net was approximately $9.0 million and $16.6 million for the quarter and six months ended June 30, 2014, respectively, and approximately $2.1 million and $3.9 million for the quarter and six months ended June 30, 2013, respectively.

12

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 4. | Real Estate Assets, net (continued) |

In June 2014, the Company completed the construction and development of a senior housing community in Acworth, Georgia (“Dogwood Forest of Acworth”). Dogwood Forest of Acworth opened to residents beginning in July 2014 and was considered placed into service as of June 30, 2014. As such, the asset values related to Dogwood Forest of Acworth are included in real estate investment properties, net in the accompanying condensed consolidated balance sheet as of June 30, 2014.

As of June 30, 2014, three of the Company’s senior housing communities have real estate under development with third-party developers as follows (in thousands):

| | | | | | | | | | |

Property Name and Location) | | Developer | | Real Estate

Development

Costs Incurred (1) | | | Remaining

Development

Budget (2) | |

| | | |

Raider Ranch (Lubbock, TX) | | South Bay Partners, Ltd | | $ | 3,369 | | | $ | 12,978 | |

Wellmore of Tega Cay (Tega Cay, SC) | | Maxwell Group, Inc. | | | 8,365 | | | | 28,531 | |

Watercrest at Katy (Katy, TX) | | South Bay Partners, Ltd | | | 4,940 | | | | 34,184 | |

| | | | | | | | | | |

Total | | | | $ | 16,674 | | | $ | 75,693 | |

| | | | | | | | | | |

FOOTNOTES:

| (1) | This amount represents land and total capitalized costs for GAAP purposes for the acquisition, development and construction of the senior housing community as of June 30, 2014. Amounts include investment services fees, asset management fees, interest expense and other costs capitalized during the development period. |

| (2) | This amount includes preleasing and marketing costs which will be expensed as incurred. |

The development budgets of the senior housing developments include the cost of the land, construction costs, development fees, financing costs, start-up costs and initial operating deficits of the respective properties. An affiliate of the developer of the respective community coordinates and supervises the management and administration of the development and construction. Each developer is responsible for any cost overruns beyond the approved development budget for the applicable project pursuant to a cost overrun guarantee. Refer to Note 7, “Variable Interest Entities,” for additional information.

13

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

The gross carrying amount and accumulated amortization of the Company’s intangible assets and liabilities as of June 30, 2014 and December 31, 2013 are as follows (in thousands):

| | | | | | | | |

| | | June 30,

2014 | | | December 31,

2013 | |

In-place lease intangibles | | $ | 87,732 | | | $ | 49,642 | |

Above-market lease intangibles | | | 7,909 | | | | 3,704 | |

Below-market ground lease intangibles | | | 4,153 | | | | 4,153 | |

Less: accumulated amortization | | | (15,419 | ) | | | (5,099 | ) |

| | | | | | | | |

Intangible assets, net | | $ | 84,375 | | | $ | 52,400 | |

| | | | | | | | |

| | |

Below-market lease intangibles | | $ | (4,337 | ) | | $ | (2,987 | ) |

Above-market ground lease intangibles | | | (317 | ) | | | (317 | ) |

Above-market mortgage note payable assumed | | | (371 | ) | | | — | |

Less: accumulated amortization | | | 463 | | | | 168 | |

| | | | | | | | |

Intangible liabilities, net (1) | | $ | (4,562 | ) | | $ | (3,136 | ) |

| | | | | | | | |

FOOTNOTES:

| (1) | Intangible liabilities, net are included in other liabilities in the accompanying condensed consolidated balance sheets. |

Amortization on the Company’s intangible assets was approximately $5.9 million and $10.3 million for the quarter and six months ended June 30, 2014, respectively, of which approximately $0.2 million and $0.4 million, respectively, was treated as a reduction of rental income from operating leases, approximately $0.03 million and $0.1 million, respectively, was treated as an increase of property operating expenses and approximately $5.7 million and $9.8 million, respectively, was included in depreciation and amortization. Amortization on the Company’s intangible assets was approximately $0.5 million and $1.0 million for the quarter and six months ended June 30, 2013, respectively, which was all included in depreciation and amortization.

Amortization on the Company’s intangible liabilities was approximately $0.2 million and $0.3 million for the quarter and six months ended June 30, 2014, of which approximately $0.2 million and $0.3 million, respectively, were treated as an increase of rental income from operating leases and approximately two thousand and four thousand, respectively, was treated as a reduction of property operating expenses. There was no amortization on the Company’s intangible liabilities for the quarter and six months ended June 30, 2013, respectively.

The estimated future amortization on the Company’s intangibles for the remainder of 2014, each of the next four years and thereafter, in the aggregate, as of June 30, 2014 is as follows (in thousands):

| | | | | | | | |

| | | Assets | | | Liabilities | |

2014 | | $ | 13,291 | | | $ | (357 | ) |

2015 | | | 24,461 | | | | (660 | ) |

2016 | | | 15,129 | | | | (613 | ) |

2017 | | | 5,043 | | | | (563 | ) |

2018 | | | 4,511 | | | | (491 | ) |

Thereafter | | | 21,940 | | | | (1,878 | ) |

| | | | | | | | |

| | $ | 84,375 | | | $ | (4,562 | ) |

| | | | | | | | |

As of June 30, 2014, the weighted average useful life of in-place leases was 3.2 years.

14

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

As of June 30, 2014, the Company owned 36 properties that were leased to tenants on a triple-net, net or modified gross basis, and accounted for as operating leases; of which, 20 are single-tenant properties that are 100% leased under operating leases and the remaining 16 are multi-tenant properties that are leased under operating leases. The Company’s leases had a weighted average remaining lease term of 7.3 years based on annualized base rents expiring between 2014 and 2030, subject to the tenants’ options to extend the lease periods ranging from two to ten years.

Under the terms of the Company’s triple-net lease agreements, each tenant is responsible for the payment of property taxes, general liability insurance, utilities, repairs and maintenance, including structural and roof maintenance expenses. Each tenant is expected to pay real estate taxes directly to taxing authorities. However, if the tenant does not pay, the Company will be liable. The total annualized property tax assessed on these properties is approximately $1.9 million.

Under the terms of the multi-tenant lease agreements that have third-party property managers, each tenant is responsible for the payment of their proportionate share of property taxes, general liability insurance, utilities, repairs and common area maintenance. These amounts are billed monthly and recorded as tenant reimbursement income in the accompanying consolidated statements of operations.

The following are future minimum lease payments to be received under non-cancellable operating leases for the remainder of 2014, each of the next four years and thereafter, as of June 30, 2014 (in thousands):

| | | | |

2014 | | $ | 21,335 | |

2015 | | | 41,579 | |

2016 | | | 39,560 | |

2017 | | | 38,776 | |

2018 | | | 38,203 | |

Thereafter | | | 155,174 | |

| | | | |

| | $ | 334,627 | |

| | | | |

The above future minimum lease payments to be received excludes tenant reimbursements, straight-line rent adjustments, amortization of above- and below-market lease intangibles and base rent attributable to any renewal options exercised by the tenants in the future.

15

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 7. | Variable Interest Entities |

Consolidated VIEs — As of June 30, 2014, the Company has 11 wholly-owned subsidiaries, which are VIEs due to following factors and circumstances:

| | (1) | Three of these subsidiaries are single property entities, designed to own and lease their respective properties to single tenants, for which buy-out options are held by the respective tenants that are formula based. |

| | (2) | Three of these subsidiaries are single property entities, designed to own and lease their respective properties to multiple tenants, which are subject to either a ground lease or an air rights lease that include buy-out and put options held by either the tenant or landlord under the applicable lease. |

| | (3) | Four of these subsidiaries are entities with real estate under development or completed developments in which the third-party developers have an opportunity to earn promoted interest payments after certain net operating income targets and internal rate of return targets have been met. |

| | (4) | One of these subsidiaries is a joint venture with real estate under development in which the third-party developer has an opportunity to earn promoted interest payments after certain net operating income targets and internal rate of return targets have been met. |

The Company determined it is the primary beneficiary and holds a controlling financial interest in each of the aforementioned property and development entities due to its power to direct the activities that most significantly impact the economic performance of the entities, as well as its obligation to absorb the losses and its right to receive benefits from these entities that could potentially be significant to these entities. As such, the transactions and accounts of these VIEs are included in the accompanying condensed consolidated financial statements.

The aggregate carrying amount and major classifications of the consolidated assets that can be used to settle obligations of the VIEs and liabilities of the consolidated VIEs that are non-recourse to the Company as of June 30, 2014 and December 31, 2013 are as follows (in thousands):

| | | | | | | | |

| | | June 30,

2014 | | | December 31,

2013 | |

Assets: | | | | | | | | |

Real estate investment properties, net | | $ | 89,936 | | | $ | 72,053 | |

| | | | | | | | |

Real estate under development, including land | | $ | 15,734 | | | $ | 16,210 | |

| | | | | | | | |

Intangibles, net | | $ | 4,139 | | | $ | 4,535 | |

| | | | | | | | |

Cash | | $ | 576 | | | $ | 727 | |

| | | | | | | | |

Loan costs, net | | $ | 1,133 | | | $ | 912 | |

| | | | | | | | |

Other | | $ | 1,029 | | | $ | 382 | |

| | | | | | | | |

| | |

Liabilities: | | | | | | | | |

Mortgages and other notes payable | | $ | 62,757 | | | $ | 52,596 | |

| | | | | | | | |

Other liabilities | | $ | 1,410 | | | $ | 939 | |

| | | | | | | | |

Accounts payable and accrued expenses | | $ | 373 | | | $ | 309 | |

| | | | | | | | |

Due to related parties | | $ | 86 | | | $ | 112 | |

| | | | | | | | |

Accrued development costs | | $ | 3,060 | | | $ | 7,047 | |

| | | | | | | | |

The Company’s maximum exposure to loss as a result of its involvement with these VIEs is limited to its net investment in these entities which totaled approximately $44.9 million as of June 30, 2014. The Company’s exposure is limited because of the non-recourse nature of the borrowings of the VIEs.

Unconsolidated VIEs — The Company determined that the borrowing entity under its note receivable from a related party represents a VIE due to the transaction structure; however, the borrower was determined to be the primary beneficiary. Refer to Note 11, “Related Party Arrangements” for additional information.

16

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 8. | Unconsolidated Entities |

The following presents financial information for each of the Company’s unconsolidated entities as of and for the quarter and six months ended June 30, 2014 (in thousands):

| | | | | | | | | | | | | | | | |

| | | For the quarter ended June 30, 2014 | |

| | | Montecito | | | CHTSunIV (2) | | | Windsor

Manor | | | Total | |

Revenues | | $ | 537 | | | $ | — | | | $ | 2,418 | | | $ | 2,955 | |

| | | | | | | | | | | | | | | | |

Operating income | | $ | 151 | | | $ | — | | | $ | 9 | | | $ | 160 | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 50 | | | $ | — | | | $ | (647 | ) | | $ | (597 | ) |

| | | | | | | | | | | | | | | | |

Income allocable to other venture partners(1) | | $ | 5 | | | $ | — | | | $ | 754 | | | $ | 759 | |

| | | | | | | | | | | | | | | | |

Income (loss) allocable to the Company(1) | | $ | 45 | | | $ | — | | | $ | (1,401 | ) | | $ | (1,356 | ) |

Amortization of capitalized acquisition costs | | | (2 | ) | | | — | | | | (4 | ) | | | (6 | ) |

| | | | | | | | | | | | | | | | |

Equity in earnings (loss) of unconsolidated entities | | $ | 43 | | | $ | — | | | $ | (1,405 | ) | | $ | (1,362 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Distributions declared to the Company | | $ | 174 | | | $ | — | | | $ | 2,493 | (3) | | $ | 2,667 | |

| | | | | | | | | | | | | | | | |

Distributions received by the Company | | $ | 172 | | | $ | — | | | $ | 285 | | | $ | 457 | |

| | | | | | | | | | | | | | | | |

| |

| | | For the six months ended June 30, 2014 | |

| | | Montecito | | | CHTSunIV (2) | | | Windsor

Manor | | | Total | |

Revenues | | $ | 1,028 | | | $ | — | | | $ | 4,267 | | | $ | 5,295 | |

| | | | | | | | | | | | | | | | |

Operating income | | $ | 330 | | | $ | — | | | $ | 97 | | | $ | 427 | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 128 | | | $ | — | | | $ | (742 | ) | | $ | (614 | ) |

| | | | | | | | | | | | | | | | |

Income allocable to other venture partners(1) | | $ | 13 | | | $ | — | | | $ | 374 | | | $ | 387 | |

| | | | | | | | | | | | | | | | |

Income (loss) allocable to the Company(1) | | $ | 115 | | | $ | — | | | $ | (1,116 | ) | | $ | (1,001 | ) |

Amortization of capitalized acquisition costs | | | (4 | ) | | | — | | | | (8 | ) | | | (12 | ) |

| | | | | | | | | | | | | | | | |

Equity in earnings (loss) of unconsolidated entities | | $ | 111 | | | $ | — | | | $ | (1,124 | ) | | $ | (1,013 | ) |

| | | | |

Distributions declared to the Company | | $ | 346 | | | $ | — | | | $ | 2,777 | (3) | | $ | 3,123 | |

| | | | | | | | | | | | | | | | |

Distributions received by the Company | | $ | 343 | | | $ | — | | | $ | 664 | | | $ | 1,007 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES:

| (1) | Income (loss) is allocated between the Company and its joint venture partner using the HLBV method of accounting. |

| (2) | In July 2013, the Company completed the sale of its joint venture membership interest in CHTSunIV. |

| (3) | The distributions declared to the Company for the Windsor Manor joint venture during both the quarter and six months ended include approximately $2.2 million of capital proceeds from a debt refinancing; refer to “Off-Balance Sheet Arrangements” for additional information. |

17

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 8. | Unconsolidated Entities (continued) |

The following presents financial information for each of the Company’s unconsolidated entities as of and for the quarter and six months ended June 30, 2013 (in thousands):

| | | | | | | | | | | | | | | | |

| | | For the quarter ended June 30, 2013 | |

| | | Montecito (2) | | | CHTSunIV | | | Windsor

Manor (2) | | | Total | |

Revenues | | $ | 453 | | | $ | 12,183 | | | $ | 2,060 | | | $ | 14,696 | |

| | | | | | | | | | | | | | | | |

Operating income | | $ | 158 | (3) | | $ | 2,030 | | | $ | 86 | | | $ | 2,274 | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 54 | | | $ | 380 | | | $ | (319 | ) | | $ | 115 | |

| | | | | | | | | | | | | | | | |

Income (loss) allocable to other venture partners(1) | | $ | 5 | | | $ | (507 | ) | | $ | (588 | ) | | $ | (1,090 | ) |

| | | | | | | | | | | | | | | | |

Income allocable to the Company(1) | | $ | 49 | | | $ | 887 | | | $ | 269 | | | $ | 1,205 | |

Amortization of capitalized acquisition costs | | | (2 | ) | | | (18 | ) | | | (3 | ) | | | (23 | ) |

| | | | | | | | | | | | | | | | |

Equity in earnings of unconsolidated entities | | $ | 47 | | | $ | 869 | | | $ | 266 | | | $ | 1,182 | |

| | | | | | | | | | | | | | | | |

| | | | |

Distributions declared to the Company | | $ | 342 | | | $ | 1,508 | | | $ | 5 | | | $ | 1,855 | |

| | | | | | | | | | | | | | | | |

Distributions received by the Company | | $ | — | | | $ | 1,487 | | | $ | 175 | | | $ | 1,662 | |

| | | | | | | | | | | | | | | | |

| |

| | | For the six months ended June 30, 2013 | |

| | | Montecito(2) | | | CHTSunIV | | | Windsor

Manor (2) | | | Total | |

Revenues | | $ | 809 | | | $ | 24,107 | | | $ | 3,283 | | | $ | 28,199 | |

| | | | | | | | | | | | | | | | |

Operating income (loss) | | $ | (55 | )(3) | | $ | 3,603 | | | $ | 6 | | | $ | 3,554 | |

| | | | | | | | | | | | | | | | |

Net loss | | $ | (239 | ) | | $ | (46 | ) | | $ | (492 | ) | | $ | (777 | ) |

| | | | | | | | | | | | | | | | |

Loss allocable to other venture partners(1) | | $ | (24 | ) | | $ | (1,365 | ) | | $ | (894 | ) | | $ | (2,283 | ) |

| | | | | | | | | | | | | | | | |

Income (loss) allocable to the Company (1) | | $ | (215 | ) | | $ | 1,319 | | | $ | 402 | | | $ | 1,506 | |

Amortization of capitalized acquisition costs | | | (4 | ) | | | (36 | ) | | | (6 | ) | | | (46 | ) |

| | | | | | | | | | | | | | | | |

Equity in earnings (loss) of unconsolidated entities | | $ | (219 | ) | | $ | 1,283 | | | $ | 396 | | | $ | 1,460 | |

| | | | | | | | | | | | | | | | |

| | | | |

Distributions declared to the Company | | $ | 342 | | | $ | 2,990 | | | $ | 180 | | | $ | 3,512 | |

| | | | | | | | | | | | | | | | |

Distributions received by the Company | | $ | — | | | $ | 2,955 | | | $ | 224 | | | $ | 3,179 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES:

| (1) | Income (loss) is allocated between the Company and its joint venture partner using the HLBV method of accounting. |

| (2) | Represents operating results from the date of acquisition through the end of the periods presented. |

| (3) | Includes approximately $0.1 million and $0.5 million of non-recurring acquisition expenses incurred by the joint venture for the quarter and six months ended June 30, 2013, respectively. |

18

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 9. | Contingent Purchase Price Consideration |

Capital Health Communities

As of June 30, 2014, the Company determined the fair value of the Yield Guaranty to be $3.4 million, which was recorded as other assets in the accompanying condensed consolidated balance sheet. The following table provides a roll-forward of the fair value of the contingent purchase price consideration related to the Yield Guaranty on the Capital Health Communities for the quarter and six months ended June 30, 2014 and 2013 (in thousands):

| | | | | | | | | | | | | | | | |

| | | Quarter Ended

June 30, | | | Six Months Ended

June 30, | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Beginning balance | | $ | 2,188 | | | $ | 2,664 | | | $ | 4,488 | | | $ | 2,664 | |

Yield Guaranty payment received from seller | | | — | | | | — | | | | (2,300 | ) | | | — | |

Change in fair value | | | 1,321 | | | | — | | | | 1,321 | | | | — | |

| | | | | | | | | | | | | | | | |

Ending balance | | $ | 3,509 | | | $ | 2,664 | | | $ | 3,509 | | | $ | 2,664 | |

| | | | | | | | | | | | | | | | |

South Bay II Communities

In conjunction with the acquisition of the South Bay II Communities, the Company entered into an agreement with the sellers whereby the purchase price is adjusted in the event that certain net operating income targets are met. The additional consideration will be determined within three months of the acquisition date and be equal to (a) the baseline net operating income divided by the baseline capitalization rates (as defined in the purchase and sale agreement) less (b) the purchase price paid at closing. The following table provides a roll-forward of the fair value of the estimated contingent purchase price consideration related to the South Bay II Communities for the quarter and six months ended June 30, 2014 and 2013 (in thousands):

| | | | | | | | | | | | | | | | |

| | | Quarter Ended

June 30, | | | Six Months Ended

June 30, | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Beginning balance | | $ | (2,570 | ) | | $ | — | | | $ | — | | | $ | — | |

Contingent consideration in connection with acquisition | | | (9,825 | ) | | | — | | | | (12,395 | ) | | | — | |

Contingent consideration payment | | | 3,895 | | | | — | | | | 3,895 | | | | — | |

| | | | | | | | | | | | | | | | |

Ending balance | | $ | (8,500 | ) | | $ | — | | | $ | (8,500 | ) | | $ | — | |

| | | | | | | | | | | | | | | | |

Fair Value Measurements

The fair value of the contingent purchase price consideration was based on a then-current income approach that is primarily determined based on the present value and probability of future cash flows using internal underwriting models. The income approach further includes estimates of risk-adjusted rate of return and capitalization rates for each property. Since this methodology includes inputs that are less observable by the public and are not necessarily reflected in active markets, the measurements of the estimated fair value related to the Company’s contingent purchase price consideration are categorized as Level 3 on the three-level fair value hierarchy.

19

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

The following table provides details of the Company’s indebtedness as of June 30, 2014 and December 31, 2013 (in thousands):

| | | | | | | | |

| | | June 30,

2014 | | | December 31,

2013 | |

Mortgages payable and other notes payable: | | | | | | | | |

Fixed rate debt | | $ | 377,591 | | | $ | 290,817 | |

Variable rate debt (1) | | | 221,833 | | | | 147,290 | |

| | | | | | | | |

Total mortgages and other notes payable | | | 599,424 | | | | 438,107 | |

Revolving Credit Facility | | | 210,615 | | | | 98,500 | |

| | | | | | | | |

Total borrowings | | $ | 810,039 | | | $ | 536,607 | |

| | | | | | | | |

FOOTNOTE:

| (1) | As of both June 30, 2014 and December 31, 2013, approximately $124.3 million has been swapped to fixed rates with notional amounts that begin to settle in 2015 and continue through the maturity date of the respective loan (ranging from 2016 through 2018). |

Maturities of indebtedness for the remainder of 2014 and each of the next four years and thereafter, in the aggregate, as of June 30, 2014 are as follows (in thousands):

| | | | |

2014 | | $ | 19,973 | |

2015 | | | 12,588 | |

2016 | | | 286,343 | |

2017 | | | 28,262 | |

2018 | | | 273,531 | |

Thereafter | | | 189,342 | |

| | | | |

| | $ | 810,039 | |

| | | | |

The Company financed a portion of the acquisitions described in Note 3, “Acquisitions,” through additional borrowings and loan assumptions. The following table provides details as of June 30, 2014 (in thousands):

| | | | | | | | | | |

Property and Related Loan Type | | Interest Rate at

June 30, 2014 (1) | | Payment Terms | | Maturity

Date(2) | | June 30,

2014 | |

| | | | |

Pacific Northwest II Communities; Mortgage Loan | | 4.30% per annum | | Monthly principal and interest payments based on a 30-year amortization schedule | | 12/5/2018 | | $ | 62,668 | |

| | | | |

Isle at Watercrest – Mansfield; Mortgage Loan | | 4.68% per annum | | Monthly principal and interest payments based on a total payment of $143,330 | | 6/1/2023 | | | 27,249 | |

| | | | | | | | | | |

| | | | Total fixed rate debt | | | | | 89,917 | |

| | | | | | | | | | |

| | | | |

CHP Partners, LP and CNL Healthcare Properties, Inc; Unsecured Bridge Loan | | LIBOR plus

8.00% per annum | | Monthly interest payments with principal due at maturity | | 8/18/2014 | | | 15,000 | |

| | | | |

Houston Orthopedic & Spine Hospital and Foundation MOB; Mortgage Loan | | LIBOR plus

2.85% per annum | | Monthly principal and interest payments based on a 30-year amortization schedule | | 6/1/2019 | | | 49,777 | |

| | | | | | | | | | |

| | | | Total variable rate debt | | | | $ | 64,777 | |

| | | | | | | | | | |

| | | | Total mortgages and other notes payable | | | | $ | 154,694 | |

| | | | | | | | | | |

20

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 10. | Indebtedness (continued) |

FOOTNOTES:

| (1) | The 30-day LIBOR was approximately 0.2% as June 30, 2014. |

| (2) | Represents the initial maturity date (or, as applicable, the maturity date as extended). The maturity date may be extended beyond the date shown subject to certain lender conditions. |

In February 2014, through its limited partnership, the Company modified the terms of its Revolving Credit Facility and exercised its option to increase the aggregate maximum principal amount available for borrowing from $120 million to $240 million. In April, the Company increased the aggregate maximum principal amount available to $275 million. The Company had approximately $112.1 million of additional borrowings on its Revolving Credit Facility during the six months ended June 30, 2014 that were used to finance acquisitions (primarily the South Bay II Communities). As of June 30, 2014, the Revolving Credit Facility is collateralized by 16 properties with an aggregate net book carrying value of approximately $324.6 million and the total availability was approximately $212.9 million. The Revolving Credit Facility has sizing requirements that govern the total amount that the Company may borrow at any given time based on the purchase price of the collateral and a metric of debt service coverage.

The Company’s Revolving Credit Facility contains affirmative, negative, and financial covenants which are customary for loans of this type, including without limitation: (i) limitations on incurrence of additional indebtedness; (ii) restrictions on payments of cash distributions except if required by REIT requirements; (iii) minimum occupancy levels for collateralized properties; (iv) minimum loan-to-value and debt service coverage ratios with respect to collateralized properties; (v) maximum leverage, secured recourse debt, and unimproved land/development property ratios; (vi) minimum fixed charge coverage ratio and minimum consolidated net worth, unencumbered liquidity, and equity raise requirements; (vii) limitations on certain types of investments and additional indebtedness; and (viii) minimum liquidity. The limitations on distributions includes a limitation on the extent of allowable distributions, which are not to exceed the greater of 95% of adjusted FFO (as defined per the loan agreement) or the minimum amount of distributions required to maintain the Company’s REIT status. As of June 30, 2014, the Company was in compliance with all affirmative, negative and financial covenants.

All of the Company’s mortgage and construction loans contain customary financial covenants and ratios; including (but not limited to) the following: debt service coverage ratio, minimum occupancy levels, limitations on incurrence of additional indebtedness, etc. As of June 30, 2014, the Company was in compliance with all financial covenants and ratios.

The fair market value and carrying value of the mortgage and other notes payable was approximately $583.2 million and $599.4 million, respectively, and both the fair market value and carrying value of the Revolving Credit Facility was $210.6 million as of June 30, 2014. The fair market value and carrying value of the mortgage and other notes payable was approximately $431.4 million and $438.1 million, respectively, and both the fair market value and carrying value of the Revolving Credit Facility was $98.5 million as of December 31, 2013. These fair market values are based on current rates and spreads the Company would expect to obtain for similar borrowings. Since this methodology includes inputs that are less observable by the public and are not necessarily reflected in active markets, the measurement of the estimated fair values related to the Company’s mortgage notes payable is categorized as level 3 on the three-level valuation hierarchy. The estimated fair value of accounts payable and accrued expenses approximates the carrying value as of June 30, 2014 and December 31, 2013 because of the relatively short maturities of the obligations.

21

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 (UNAUDITED)

| 11. | Related Party Arrangements |

The Company incurs operating expenses which, in general, relate to administration of the Company on an ongoing basis. Pursuant to the advisory agreement, the Advisor shall reimburse the Company the amount by which the total operating expenses paid or incurred by the Company exceed, in any four consecutive fiscal quarters (an “Expense Year”) commencing with the Expense Year ending June 30, 2013, the greater of 2% of average invested assets or 25% of net income (as defined in the advisory agreement) (the “Limitation”), unless a majority of the Company’s independent directors determines that such excess expenses are justified based on unusual and non-recurring factors (the “Expense Cap Test”). In performing the Expense Cap Test, the Company uses operating expenses on a GAAP basis after making adjustments for the benefit of expense support under the Expense Support Agreements. For the Expense Year ended June 30, 2014, the Company did not incur operating expenses in excess of the Limitation.

The Company maintains accounts totaling approximately $0.3 million and $0.4 million as of June 30, 2014 and December 31, 2013, respectively, at a bank in which the Company’s chairman serves as a director.