Net Asset Value Presentation February 2017 Exhibit 99.1

General Notices This is not an offer to sell nor a solicitation of an offer to buy shares of the REIT. This piece is for general information purposes only and does not constitute legal, tax, investment or other professional advice on any subject matter. Information provided is not all-inclusive and should not be relied upon as being all-inclusive. This presentation may include forward-looking statements. Forward-looking statements are based on current expectations and may be identified by words such as believes, expects, may, could and terms of similar substance, and speak only as of the date made. Actual results could differ materially from those expressed or implied in the REIT’s forward-looking statements. Important factors, among others, that could cause the REIT's actual results to differ materially from those in its forward-looking statements include those identified in the Risk Factors described below. Investors should not place undue reliance on forward-looking statements. The REIT is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by law. An investment in the REIT the REIT is subject to significant risks, some of which are summarized below in the “Risk Factors” section of this piece. See also, “Risk Factors” in the REIT’s public filings for a more detailed description of the risks associated with an investment in the REIT.

Risk Factors Investing in a non-traded REIT is a higher-risk, longer term investment and is not suitable for all investors. Due to the risks involved in the ownership of real estate, there is no guarantee of any return on investment. The shares may lose value or investors could lose their entire investment. The shares are not FDIC-insured, nor bank guaranteed. Non-traded REITs are illiquid. There is no public trading market for the shares. The REIT has no obligation to list on any public securities market and does not expect to list the shares in the near future. Stockholders will bear the economic risks of an investment in the shares for a substantial and indefinite period. If investors are able to sell their shares, it would likely be at a substantial loss of the amount invested. There are significant limitations on the redemption of investors’ shares under the REIT’s Amended and Restated Redemption Plan. Funds available for redemption, if any, are within the REIT’s sole discretion and are not expected to exceed the proceeds of the REIT’s Distribution Reinvestment Plan, unless the board of directors chooses to use other sources to redeem shares. The REIT can determine not to redeem any shares, or only a portion of the shares for which redemption is requested. In no event will more than 5 percent of the outstanding shares be redeemed in any 12-month period. The REIT may suspend, terminate or modify the redemption plan at any time. If the REIT fails to maintain its qualification as a REIT for any taxable year, it will be subject to federal income tax on taxable income at regular corporate rates. In such event, net earnings available for investment or distributions would be reduced.

Risk Factors Since April 1, 2013, the advisor and its affiliated property manager have provided expense support to the REIT, and foregoing the payment of fees in cash in exchange for shares of restricted stock for services as defined in the Expense Support and Restricted Stock Agreement. The expense support amount is calculated and determined on a cumulative year-to-date basis and may be terminated at any time by the advisor. Decreases in the support amount from the advisor will reduce our cash flow available for distributions and other costs. The use of leverage to acquire assets may hinder the REIT’s ability to pay distributions and/or decrease the value of stockholders’ investment in the event income from or the value of the property securing the debt declines. There are significant risks associated with the senior housing and healthcare sectors including market risk impacting demand, litigation risk and the cost of being responsive to changing government regulations. The REIT’s success in these sectors is dependent, in part, upon the ability to evaluate local conditions, identify appropriate opportunities, and find qualified tenants or, where properties are acquired through a taxable REIT subsidiary, to engage and retain qualified independent managers. The REIT relies on its advisor and the advisor’s affiliates to select the REIT’s properties and to conduct the REIT’s operations. The REIT is obligated to pay substantial fees to its advisor, managing dealer, property manager and their respective affiliates based upon agreements which have not been negotiated at arm’s length, and some of which are payable based upon factors other than the quality of services. These fees could influence their advice and judgment in performing services. Currently, the REIT is incurring fees and expenses, some of which will need to be reimbursed to its advisor and affiliates. Certain officers and directors of the advisor also serve as the REIT’s officers and directors, as well as officers and directors of competing programs, resulting in conflicts of interest. Those persons could take actions more favorable to other entities.

Risk Factors The REIT has paid and intends to continue to pay distributions on a quarterly basis; however, there is no guarantee of the amount of future distributions, or if distributions can be sustained at all. The amount and basis of distributions are determined by and at the discretion of the board of directors and are dependent upon a number of factors, including but not limited to, expected and actual net operating cash flow, funds from operations, financial condition, capital requirements, avoidance of volatility of distributions, and retaining qualification as a REIT for federal income tax purposes. To date, the REIT has experienced cumulative net losses, and accordingly, not all distributions have been funded from earnings. Until the REIT generates sufficient operating cash flow or funds from operations, the REIT may continue to pay distributions from other sources and/or in stock. Funding distributions from offering proceeds or borrowings will reduce cash available for investment, may lower investors’ overall return, and is not sustainable. Stock distributions paid to earlier investors will be dilutive to later investors. The REIT has not established a limit on the extent to which it may use borrowings, offering proceeds or stock to pay distributions. Development properties initially reduced the portfolio's cash flows including funds available for distributions, increased financing expenses and were subject to greater risks for obtaining government permits and staying on schedule for construction deadlines. CNL Healthcare Properties has experienced net operating losses, which are improving and expected to be temporary. It is believed the strategy to invest in development properties will ultimately result in a better long-term investment outcome for the portfolio.

Our estimated net asset value per share is based upon subjective judgments, assumptions and opinions which may or may not turn out to be correct. You should not rely upon our estimated net asset value as representative of the amount that might be paid to you for your shares in a market transaction, or in a liquidity event. In determining our estimated net asset value per share, we relied upon a valuation of our portfolio of properties as of Dec. 31, 2016. Valuations and appraisals of our properties are estimates of fair value and may not necessarily correspond to realizable value upon the sale of such properties. Therefore, the estimated present value to the REIT of our equity in our portfolio may not reflect the amount that would be realized upon a sale of each of our properties. We intend to conduct annual year end valuations in accordance with our valuation policy. If we do not perform a subsequent calculation of the net asset value per share of our shares, you may not be able to determine the net asset value of your shares on an ongoing basis. The estimated net asset value (NAV) per share is only an estimate and is based on numerous assumptions and estimates with respect to industry, business, economic and regulatory conditions, all of which are subject to changes. Throughout the valuation process, the valuation committee, the REIT’s advisor and senior members of management reviewed, confirmed and approved the processes and methodologies and their consistency with real estate industry standards and best practices. Valuation Disclosures

Timeline Portfolio Overview Estimated Net Asset Valuation Welcome

……… Inception September End of final public offering 2013 2014 2015 2016 2017 2018 No later than 2018 the board of directors will begin to consider strategic options December Majority invested 2011 February Announce fourth estimated NAV April-June Last development projected to open November Announce second estimated NAV December Announce first estimated NAV The timeframe for the REIT’s liquidity event is not known. The estimated NAV per share is a snapshot in time and is not necessarily indicative of the value the company or stockholders may receive if the company were to list its shares or liquidate its assets, now or in the future. Final acquisition February Announced third estimated NAV $10.04

Portfolio Overview As of Dec. 31, 2016 1 The estimated NAV per share is only an estimate and is based on a number of assumptions and estimates which are subject to changes. Therefore, these estimates cannot be used to calculate or infer shareholder returns. Throughout the valuation process, the valuation committee, our advisor and senior members of management reviewed, confirmed and approved the processes and methodologies and their consistency with real estate industry standards and best practices. For the nine months ended Sept. 30, 2016, approximately 96 percent of cash distributions were covered by operating cash flow and 4 percent were funded by other sources, which could include borrowings and/or proceeds from the Distribution Reinvestment Plan. The REIT’s distribution is subsidized by expense waivers that will be reimbursed to the advisor in the form of restricted stock. The REIT has experienced losses that are anticipated to be temporary and due to several properties under development. For the years ended Dec. 31, 2015, 2014 and 2013, approximately 45, 34 and 13 percent, respectively, of total distributions were covered by operating cash flow and approximately 55, 66 and 87 percent, respectively, were funded by offering proceeds. For the years ended Dec. 31, 2012 and 2011, the REIT’s first two years of operations, distributions were not covered by operating cash flow and were 100 percent funded by offering proceeds. Distributions are not guaranteed in frequency or amount. $9.13 $9.52 $10.58 $9.75 $10.04 Offering closed to new investors

Portfolio Overview As of Dec. 31, 2016 Assets Under Management ($M) 1 CNL Healthcare Properties’ total real estate investment is approximately $2.97 billion of the approximately $3.0 billion collective real estate investment of the REIT and its joint venture partners. $3.0 Billion Geographic Diversification (144 assets across 34 states)

Portfolio Overview As of Dec. 31, 2016 HarborChase of Shorewood Watercrest at Katy Cobalt Rehabilitation Hospital New Orleans HarborChase of Shorewood

Portfolio Overview As of Dec. 31, 2016 MOB Composition (by investment basis) Acute & Post-acute 10%

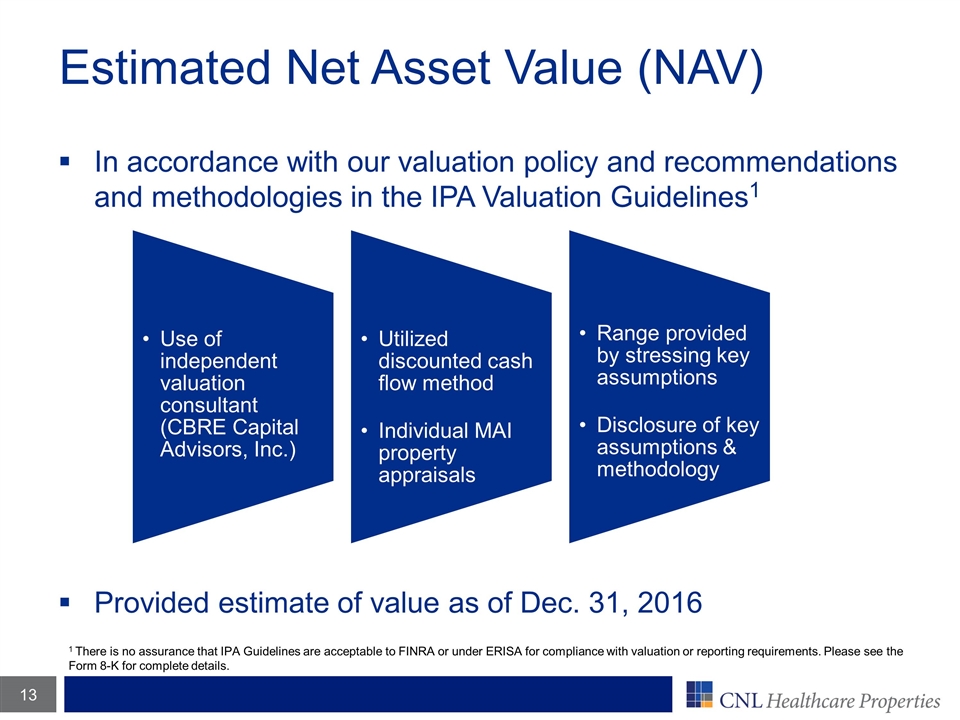

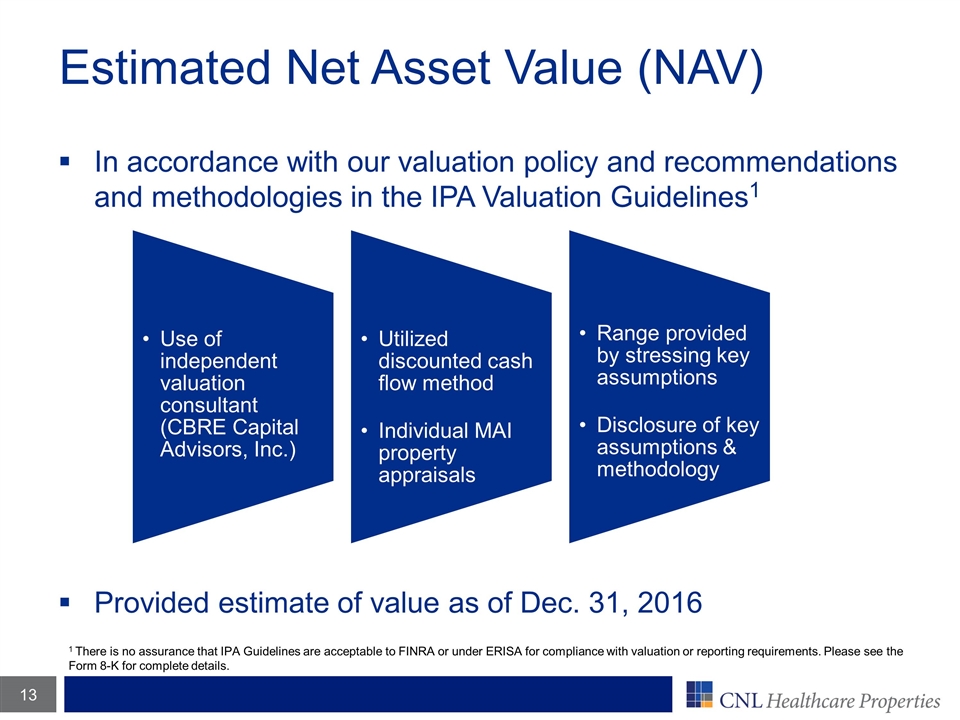

In accordance with our valuation policy and recommendations and methodologies in the IPA Valuation Guidelines1 Provided estimate of value as of Dec. 31, 2016 Estimated Net Asset Value (NAV) 1 There is no assurance that IPA Guidelines are acceptable to FINRA or under ERISA for compliance with valuation or reporting requirements. Please see the Form 8-K for complete details. Utilized discounted cash flow method Disclosure of key assumptions & methodology Individual MAI property appraisals Range provided by stressing key assumptions Use of independent valuation consultant (CBRE Capital Advisors, Inc.)

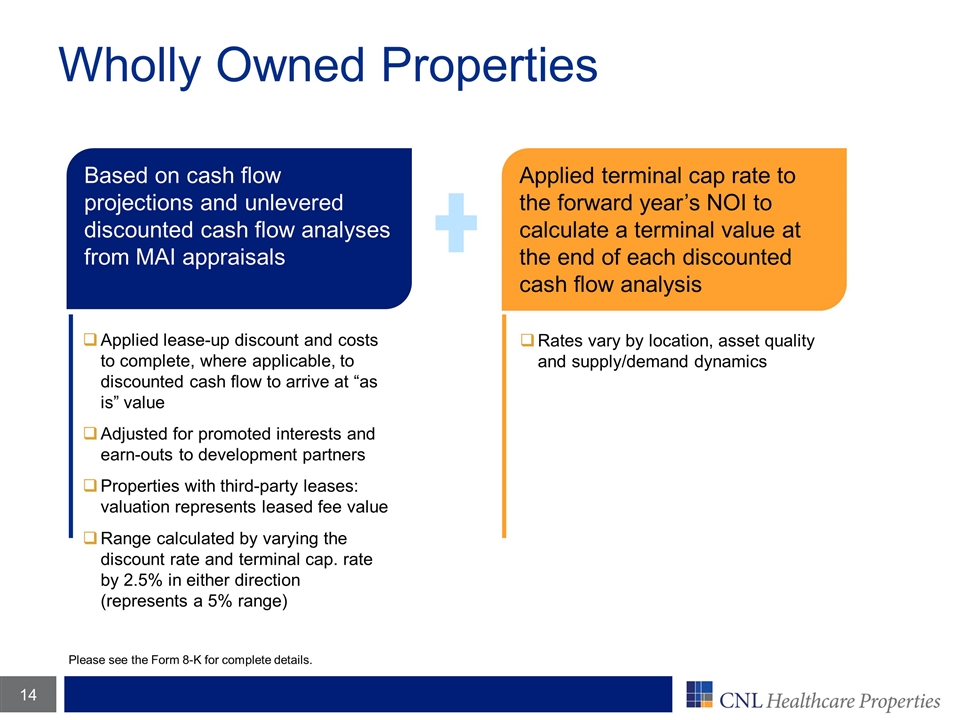

Wholly Owned Properties Based on cash flow projections and unlevered discounted cash flow analyses from MAI appraisals Applied terminal cap rate to the forward year’s NOI to calculate a terminal value at the end of each discounted cash flow analysis Applied lease-up discount and costs to complete, where applicable, to discounted cash flow to arrive at “as is” value Adjusted for promoted interests and earn-outs to development partners Properties with third-party leases: valuation represents leased fee value Range calculated by varying the discount rate and terminal cap. rate by 2.5% in either direction (represents a 5% range) Rates vary by location, asset quality and supply/demand dynamics Please see the Form 8-K for complete details.

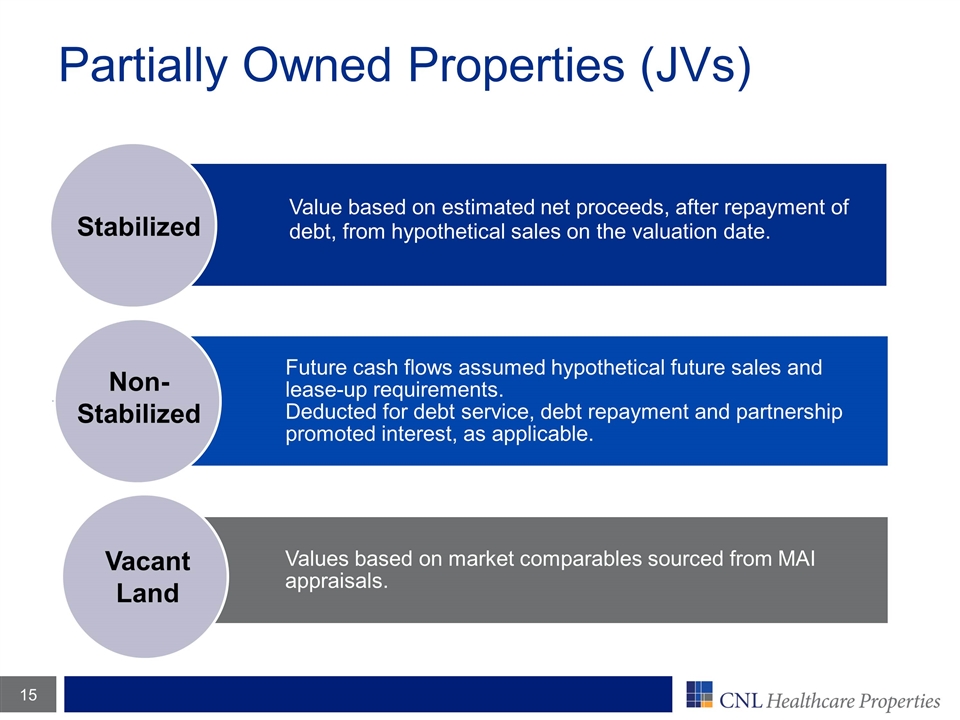

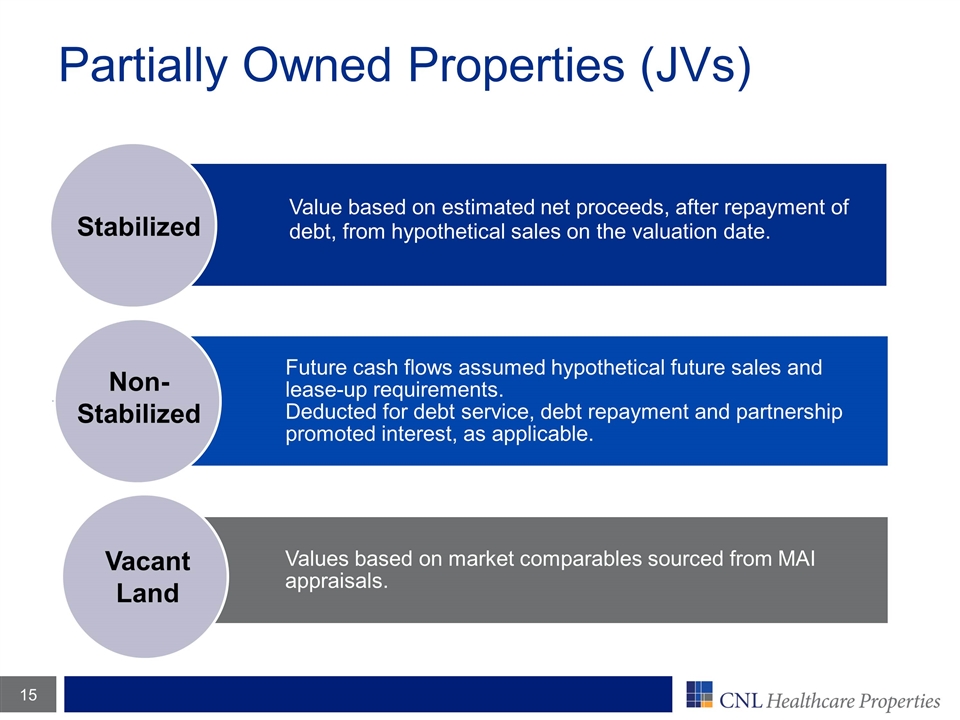

Partially Owned Properties (JVs) Stabilized Non- Stabilized Vacant Land Values based on market comparables sourced from MAI appraisals. Value based on estimated net proceeds, after repayment of debt, from hypothetical sales on the valuation date. Future cash flows assumed hypothetical future sales and lease-up requirements. Deducted for debt service, debt repayment and partnership promoted interest, as applicable.

CBRE Cap created a valuation range by varying the discount rate utilized and the terminal cap. rate of each real estate asset Weighted average ranges of approximately 39bps were set on the discount rate and 36bps on the terminal cap. rate of each asset Represents an approximate 5% sensitivity on the discount rate and terminal cap. rate CBRE Cap utilized a Dec. 31, 2016, share count of 176.4 million1 Valuation Summary CBRE Valuation (Discount and Terminal Cap. Rates Based on MAI Appraisals) Sector Discount Rate Range Terminal Cap Rate Range Medical Office Properties 7.32% - 7.70% 6.43% - 6.76% Post-Acute & Acute Care Properties 8.84% - 9.29% 7.73% - 8.13% Senior Housing Properties 7.88% - 8.29% 7.05% - 7.41% Partially Owned/JV Properties 8.11% - 8.53% 7.32% - 7.69% 1 Includes restricted shares issued to the REIT’s advisor and property manager.

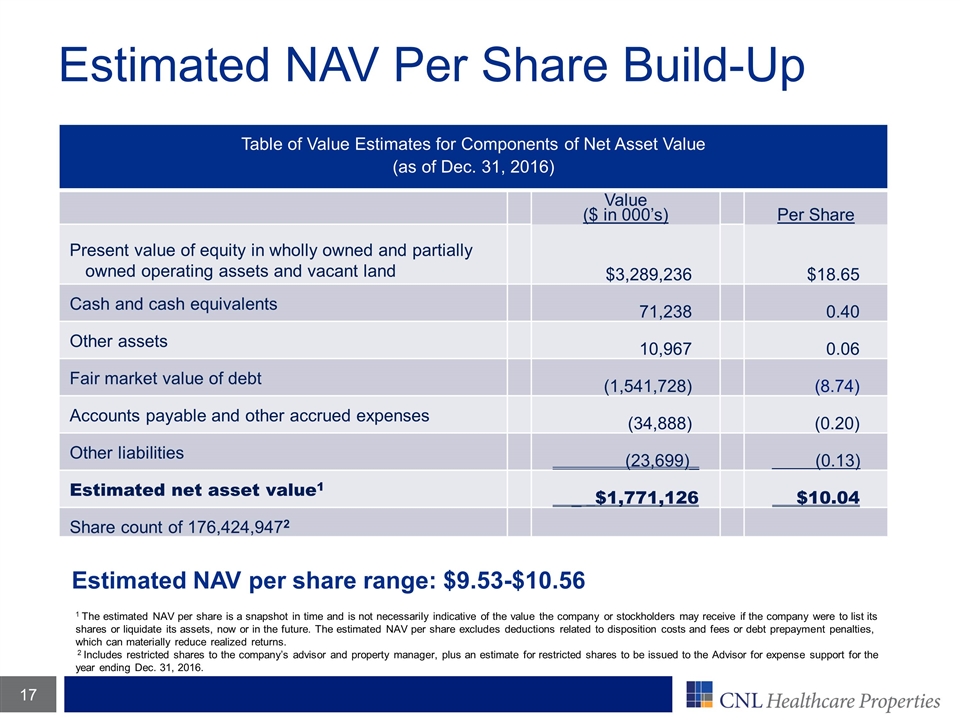

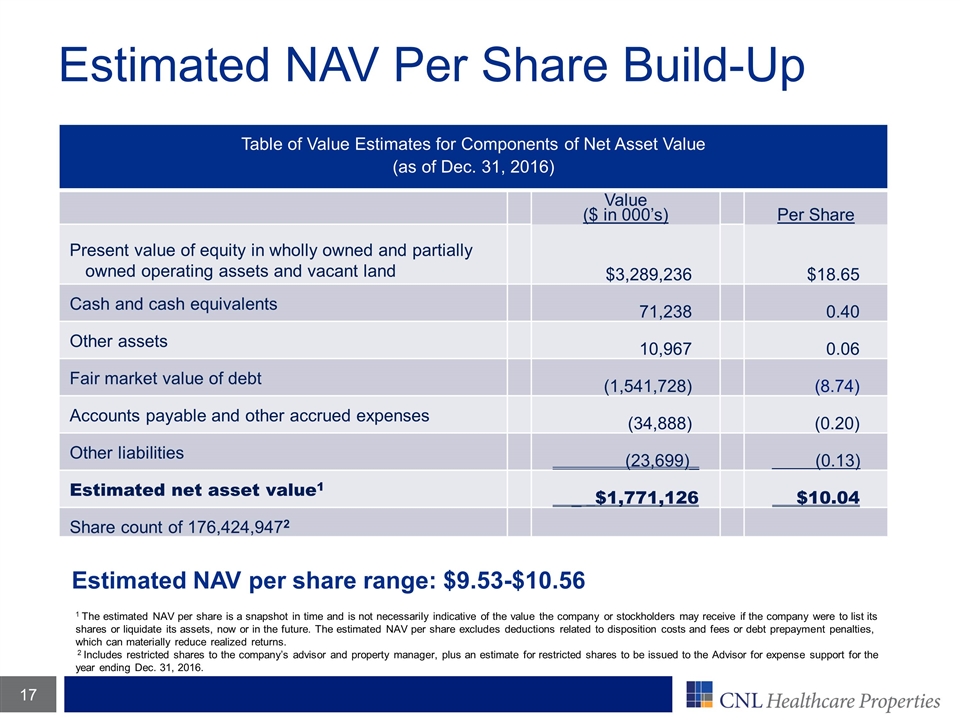

Estimated NAV Per Share Build-Up 1 The estimated NAV per share is a snapshot in time and is not necessarily indicative of the value the company or stockholders may receive if the company were to list its shares or liquidate its assets, now or in the future. The estimated NAV per share excludes deductions related to disposition costs and fees or debt prepayment penalties, which can materially reduce realized returns. 2 Includes restricted shares to the company’s advisor and property manager, plus an estimate for restricted shares to be issued to the Advisor for expense support for the year ending Dec. 31, 2016. Table of Value Estimates for Components of Net Asset Value (as of Dec. 31, 2016) Value ($ in 000’s) Per Share Present value of equity in wholly owned and partially owned operating assets and vacant land $3,289,236 $18.65 Cash and cash equivalents 71,238 0.40 Other assets 10,967 0.06 Fair market value of debt (1,541,728) (8.74) Accounts payable and other accrued expenses (34,888) (0.20) Other liabilities (23,699)_ (0.13) Estimated net asset value1 _ _$1,771,126 $10.04 Share count of 176,424,9472 Estimated NAV per share range: $9.53-$10.56

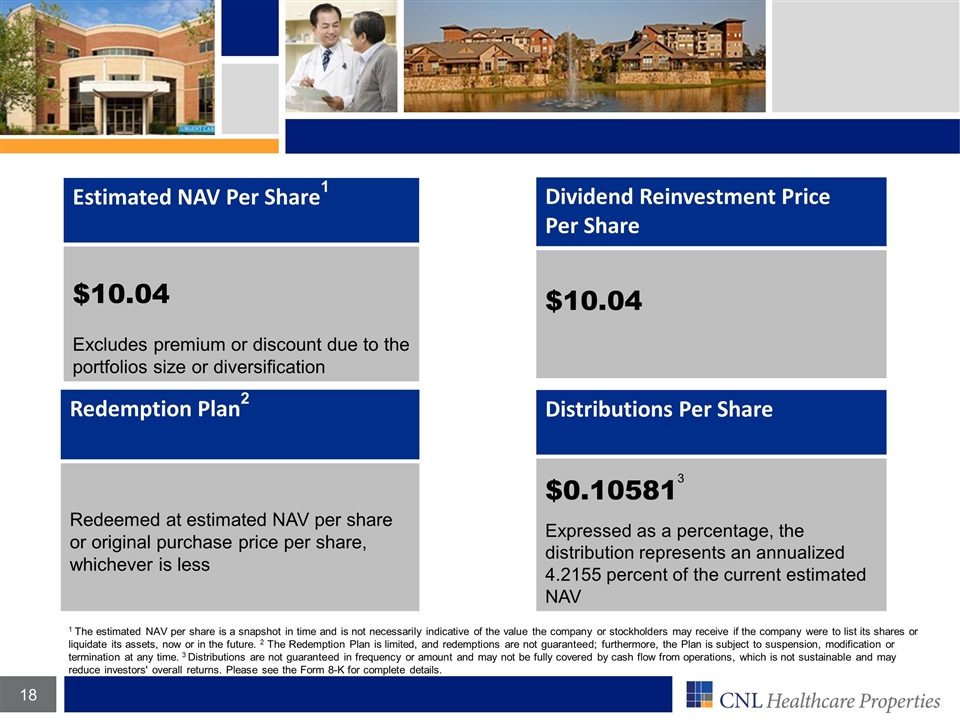

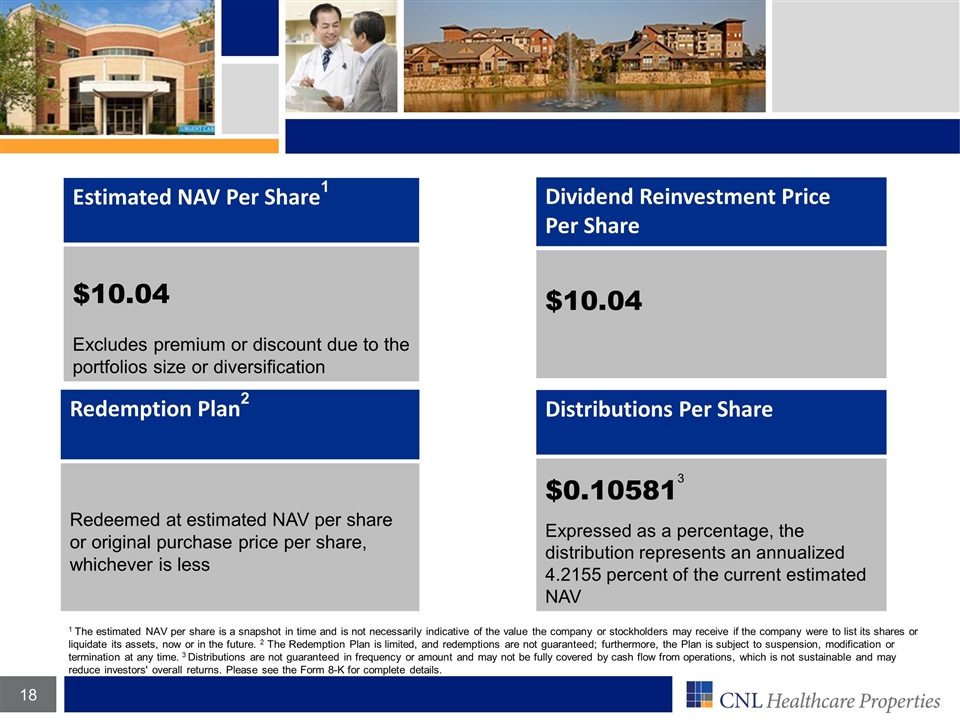

1 The estimated NAV per share is a snapshot in time and is not necessarily indicative of the value the company or stockholders may receive if the company were to list its shares or liquidate its assets, now or in the future. 2 The Redemption Plan is limited, and redemptions are not guaranteed; furthermore, the Plan is subject to suspension, modification or termination at any time. 3 Distributions are not guaranteed in frequency or amount and may not be fully covered by cash flow from operations, which is not sustainable and may reduce investors' overall returns. Please see the Form 8-K for complete details. Estimated NAV Per Share1 $10.04 Excludes premium or discount due to the portfolios size or diversification Dividend Reinvestment Price Per Share $10.04 Redemption Plan2 Redeemed at estimated NAV per share or original purchase price per share, whichever is less Distributions Per Share $0.105813 Expressed as a percentage, the distribution represents an annualized 4.2155 percent of the current estimated NAV

Complete our development projects and actively drive value-add projects. Maximize operating performance at the individual asset level. We will begin the process of considering various strategic liquidity options. What’s Next?1 1There is no assurance these objectives will be met. Forward-looking statements are based on current expectations and may be identified by words such as “believes,” “expects,” “may,” “could” and terms of similar substance, and speak only as of the date made. Actual results could differ materially due to risks and uncertainties that are beyond the company’s ability to control or accurately predict. Investors should not place undue reliance on forward-looking statements.

Questions & Answers To ask a question Press the 1 followed by the 4 on your telephone. You will hear a three toned prompt to acknowledge your request. To withdraw a question Press the 1 followed by the 3.