For additional details and information on this year’s valuation and process, I encourage you to visit our website at cnlhealthcareproperties.com to access our valuation presentation andForm 8-K, both of which were filed with the U.S. Securities & Exchange Commission.

Looking Ahead

As part of our continued strategic alternatives process, earlier this month we also entered into an agreement to sell four of our inpatient rehabilitation facilities to Global Medical REIT (NYSE: GMRE) for approximately $94 million. Our near-term priority is to complete the sales to both Global Medical REIT and to Welltower bymid-2019. As we have mentioned before and as you would expect, the pending sales are subject to customary closing conditions and other third-party consents. As such, there is no assurance if or when the sales will close. While we as a board and management team are focused on closing these transactions, we remain wholly committed to actively driving enhanced operational and financial performance in the balance of our seniors housing-centric portfolio.

All the while, we will also continue our ongoing work to maintain a strong balance sheet and financial condition, while managing expenses and operating efficiently as we continue our exploration and execution of liquidity alternatives. As always, thank you for your ongoing support and confidence in allowing us to serve you. Please contact your financial advisor or CNL Client Services at866-650-0650, option 3 with any questions you may have.

Sincerely,

Stephen H. Mauldin

President and Chief Executive Officer

cc: Financial advisors

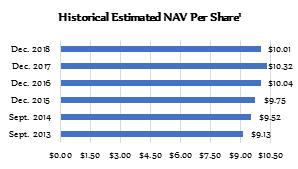

1 The estimated NAV per share is only an estimate and is based on several assumptions and estimates which can be considered inherently imprecise. The NAV is based on numerous assumptions with respect to industry, business, economic and regulatory conditions, all of which are subject to changes. Throughout the valuation process, the valuation committee, our advisor and senior members of management reviewed, confirmed and approved the processes and methodologies and their consistency with real estate industry standards and best practices.

Forward-looking statements are based on current expectations and may be identified by words such as believes, anticipates, expects, may, will, continues, could and terms of similar substance, and speak only as of the date made. Actual results could differ materially due to risks and uncertainties that are beyond the company’s ability to control or accurately predict. Shareholders and financial advisors should not place undue reliance on forward-looking statements.

2