UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 812-13797

AB ACTIVE ETFs, INC.

(Exact name of registrant as specified in charter)

66 Hudson Boulevard East

New York, New York 10005

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

66 Hudson Boulevard East

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: November 30, 2024

Date of reporting period: November 30, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Please scan QR code for

Fund Information

AB International Low Volatility Equity ETF

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the AB International Low Volatility Equity ETF (the “Fund ”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ILOW-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB International Low Volatility Equity ETF | $53 | 0.52% |

|---|

Prior to commencing operations, the Fund acquired the assets and liabilities of AB International Low Volatility Equity Portfolio (a "Predecessor Fund"), a series of AB Cap Fund, Inc., and adopted the accounting and performance history of that fund (a "Reorganization"), as of the close of business on July 12, 2024.The Fund has the same investment objective, strategies, policies and portfolio management team as the Predecessor Fund.

The performance of the Predecessor Fund shown below has not been adjusted to reflect the lower fees and expenses that will be incurred by the Fund. The advisory fees paid, disclosed below includes the impact of advisory fee waiver arrangement of the Predecessor Fund. The Predecessor Fund was a mutual fund, and the average annual total returns as shown below are based on NAV per share, and are not based on market prices for an ETF share as traded on an exchange. Predecessor Fund performance is based on the performance of Advisor Class shares. Prior to the Fund's acquisition of the Predecessor Fund, the other share classes of the Predecessor Fund were converted into Advisor Class shares.

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period ended November 30, 2024, the Fund outperformed the Morgan Stanley Capital International Europe, Australasia and the Far East (“MSCI EAFE”) Index (the "benchmark"), before sales charges.. Overall sector allocation and security selection contributed to performance, relative to the benchmark. Security selection within consumer staples and consumer discretionary contributed the most, while selection within real estate and health care detracted. In terms of sector allocation, an overweight to financials and an underweight to materials added to gains and offset losses from an overerweight to energy and an underweight to health care. Country allocation (a result of bottom-up security analysis combined with fundamental research) contributed, led by an overweight to Japan; an underweight to Australia detracted.

Top contributors to performance:

Top detractors from performance:

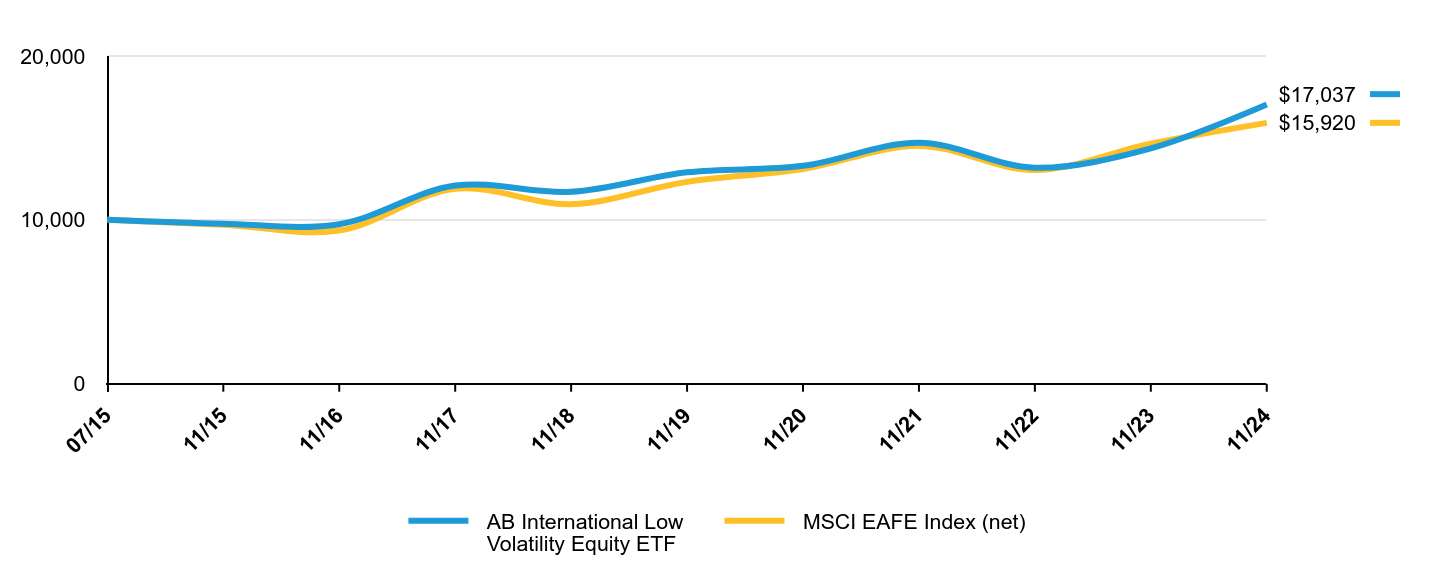

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund , or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB International Low Volatility Equity ETF | MSCI EAFE Index (net) |

|---|

| 07/15 | $10,000 | $10,000 |

|---|

| 11/15 | $9,760 | $9,706 |

|---|

| 11/16 | $9,734 | $9,351 |

|---|

| 11/17 | $12,093 | $11,901 |

|---|

| 11/18 | $11,710 | $10,956 |

|---|

| 11/19 | $12,900 | $12,319 |

|---|

| 11/20 | $13,296 | $13,104 |

|---|

| 11/21 | $14,713 | $14,515 |

|---|

| 11/22 | $13,185 | $13,042 |

|---|

| 11/23 | $14,366 | $14,655 |

|---|

| 11/24 | $17,037 | $15,920 |

|---|

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Since Inception 07/29/15 |

|---|

| AB International Low Volatility Equity ETF | 18.59% | 5.72% | 5.87% |

|---|

| MSCI EAFE Index (net) | 11.88% | 5.89% | -3.49% |

|---|

The Fund ’s past performance is not a good predictor of the Fund ’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/ILOW-A for the most recent performance information.

| Net Assets | $825,953,183 |

|---|

| # of Portfolio Holdings | 89 |

|---|

| Portfolio Turnover Rate | 14% |

|---|

| Total Advisory Fees Paid | $1,770,709 |

|---|

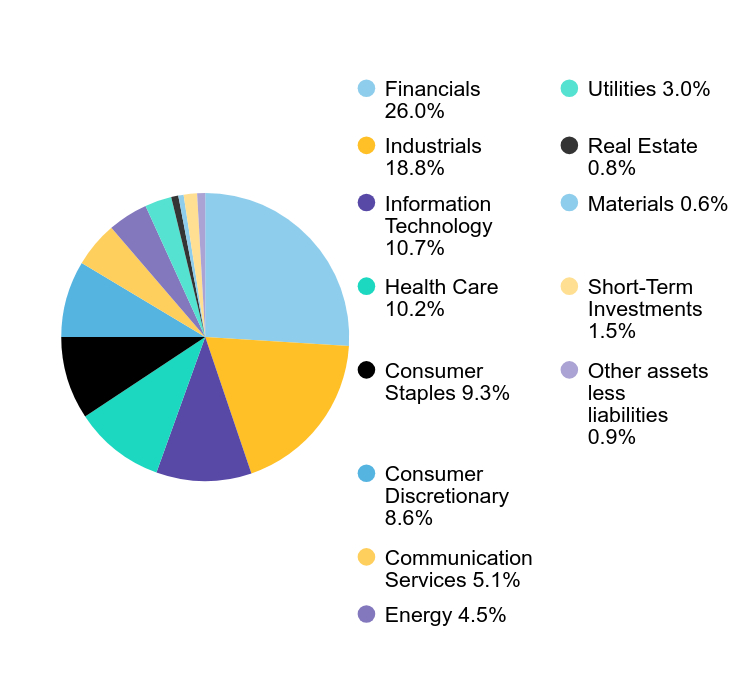

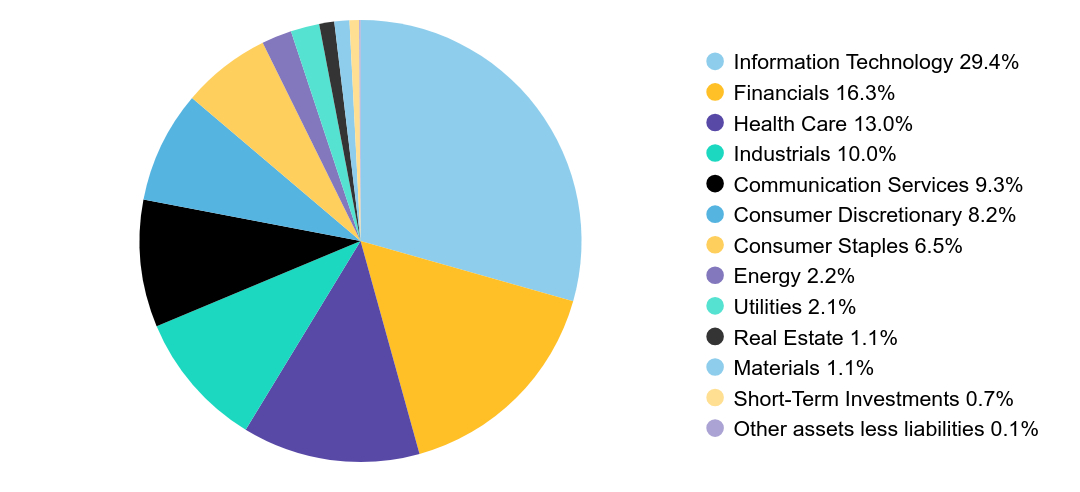

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Novo Nordisk A/S - Class B | $24,980,497 | 3.0% |

| Shell PLC | $21,667,521 | 2.6% |

| Constellation Software, Inc./Canada | $20,780,736 | 2.5% |

| Oversea-Chinese Banking Corp., Ltd. | $18,894,830 | 2.3% |

| RELX PLC (London) | $17,858,995 | 2.2% |

| SAP SE | $16,793,566 | 2.0% |

| NatWest Group PLC | $16,585,087 | 2.0% |

| London Stock Exchange Group PLC | $16,261,440 | 2.0% |

| Tesco PLC | $15,784,385 | 1.9% |

| Prysmian SpA | $15,560,466 | 1.9% |

| Total | $185,167,523 | 22.4% |

| Value | Value |

|---|

| Financials | 26.0% |

| Industrials | 18.8% |

| Information Technology | 10.7% |

| Health Care | 10.2% |

| Consumer Staples | 9.3% |

| Consumer Discretionary | 8.6% |

| Communication Services | 5.1% |

| Energy | 4.5% |

| Utilities | 3.0% |

| Real Estate | 0.8% |

| Materials | 0.6% |

| Short-Term Investments | 1.5% |

| Other assets less liabilities | 0.9% |

| Value | Value |

|---|

| United Kingdom | 20.6% |

| Japan | 15.8% |

| Netherlands | 7.5% |

| Germany | 6.5% |

| United States | 6.3% |

| Canada | 6.1% |

| Italy | 5.0% |

| Singapore | 4.2% |

| France | 4.2% |

| Switzerland | 3.6% |

| Denmark | 3.0% |

| Spain | 2.8% |

| Finland | 2.4% |

| Australia | 1.8% |

| Others | 7.8% |

| Short-Term Investments | 1.5% |

| Other assets less liabilities | 0.9% |

Availability of Additional Information

You can find additional information on the Fund ’s website at https://www.abfunds.com/link/AB/ILOW-A, including the Fund 's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund ’s Advisory Agreement

Information regarding the Fund ’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund ’s website https://www.abfunds.com/link/AB/ILOW-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Short Duration High Yield ETF

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the AB Short Duration High Yield ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SYFI-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Short Duration High Yield ETF | $39 | 0.39% |

|---|

Prior to commencing operations, the Fund acquired the assets and liabilities of AB Short Duration High Yield Portfolio (a “Predecessor Fund”), a series of AB Bond Fund, Inc., and adopted the accounting and performance history of that fund (a “Reorganization”), as of the close of business on June 7, 2024.

The Fund has the same investment objective, strategies, policies and portfolio management team as the Predecessor Fund.

The performance of the Predecessor Fund shown below has not been adjusted to reflect the lower fees and expenses that will be incurred by the Fund. The Predecessor Fund was a mutual fund, and the average annual total returns as shown below are based on NAV per share, and are not based on market prices for an ETF share as traded on an exchange. Predecessor Fund performance is based on the performance of Advisor Class shares. Prior to the Fund's acquisition of the Predecessor Fund, the other share classes of the Predecessor Fund were converted into Advisor Class shares.

How did the Fund perform last year? What affected the Fund’s performance?

Over the 12-month period, the portfolio underperformed the Bloomberg US High Yield 1-5 Year Cash Pay 2% Total Return Index (the “benchmark“), before sales charges. Security selection detracted the most from relative performance, mainly from selections in consumer non-cyclicals, media, telecommunications and services that outweighed gains from selections in energy, other consumer cyclicals and finance. Yield-curve positioning in the US also detracted, particularly from underweights to the six-month and two-year parts of the curve, which were partially offset by a gain from an overweight to the five-year part of the curve. At the country allocation level, off-benchmark exposure to the eurozone contributed to relative performance. Currency decisions did not impact investment results during the period.

Treasury futures were used to manage duration and yield-curve positioning, while currency forwards were used to hedge currency risk. Credit default swaps were used to maintain overall account risk relative to benchmark and to actively take single issuer exposure. Purchased options were used to hedge tail risk; written options were utilized to hedge tail risk via put spreads.

Top contributors to performance:

Top detractors from performance:

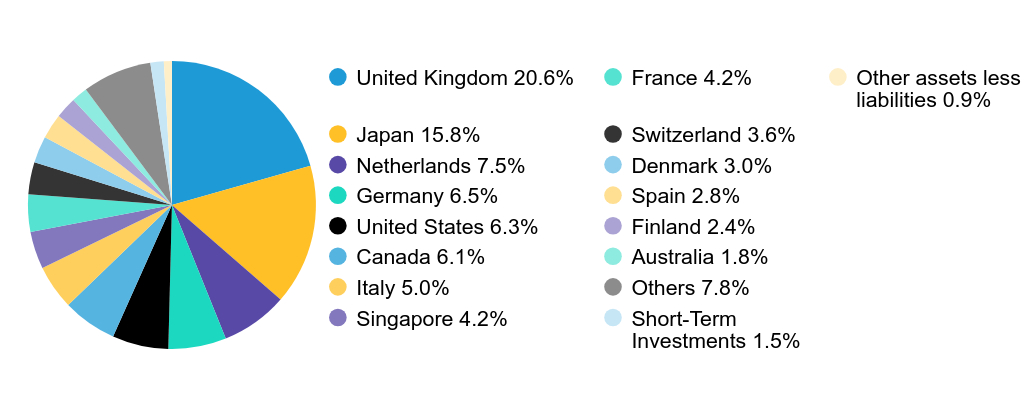

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Short Duration High Yield ETF | Bloomberg U.S. Corporate Bond Index | Bloomberg U.S. High Yield 1-5 Year Cash Pay 2% Total Return Index |

|---|

| 11/14 | $10,000 | $10,000 | $10,000 |

|---|

| 11/15 | $10,033 | $10,016 | $9,590 |

|---|

| 11/16 | $10,724 | $10,475 | $10,697 |

|---|

| 11/17 | $11,235 | $11,120 | $11,541 |

|---|

| 11/18 | $11,305 | $10,782 | $11,843 |

|---|

| 11/19 | $12,188 | $12,491 | $12,509 |

|---|

| 11/20 | $12,677 | $13,710 | $13,075 |

|---|

| 11/21 | $13,152 | $13,637 | $13,930 |

|---|

| 11/22 | $12,221 | $11,529 | $13,337 |

|---|

| 11/23 | $13,286 | $11,939 | $14,465 |

|---|

| 11/24 | $14,647 | $12,972 | $16,216 |

|---|

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| AB Short Duration High Yield ETF | 10.25% | 3.67% | 3.89% |

|---|

| Bloomberg U.S. Corporate Bond Index | 8.66% | 0.76% | 2.64% |

|---|

| Bloomberg U.S. High Yield 1-5 Year Cash Pay 2% Total Return Index | 12.10% | 5.33% | 4.95% |

|---|

The addition of the Bloomberg U.S. Corporate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/SYFI-A for the most recent performance information.

| Net Assets | $754,350,983 |

|---|

| # of Portfolio Holdings | 666 |

|---|

| Portfolio Turnover Rate | 4% |

|---|

| Total Advisory Fees Paid | $465,670 |

|---|

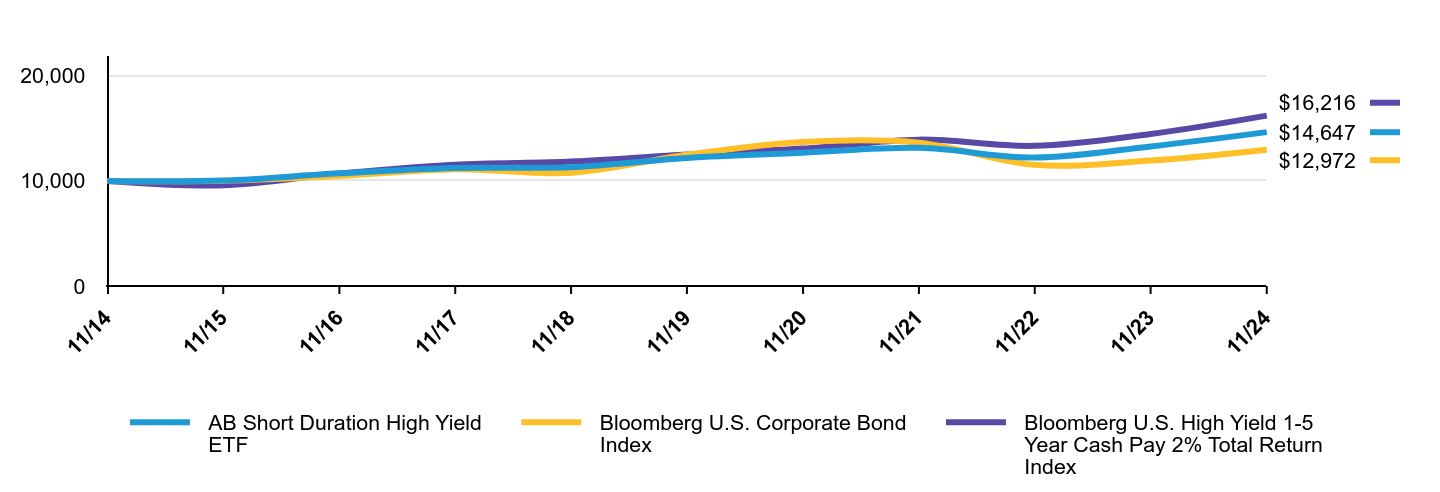

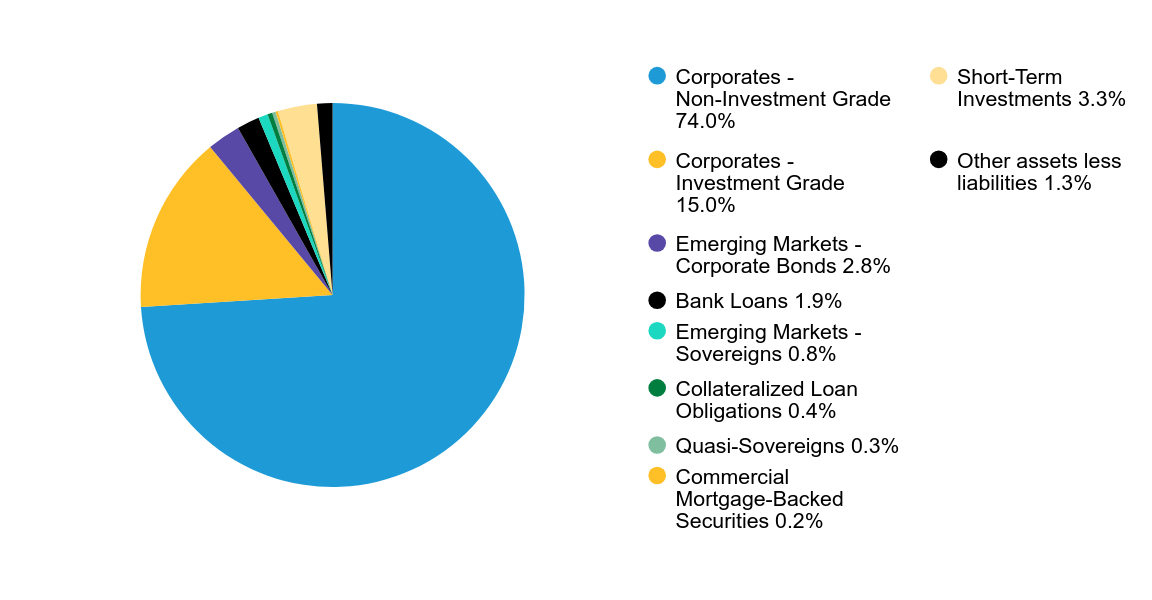

Graphical Representation of Holdings

| |

|---|

| Corporates - Non-Investment Grade | 74.0% |

| Corporates - Investment Grade | 15.0% |

| Emerging Markets - Corporate Bonds | 2.8% |

| Bank Loans | 1.9% |

| Emerging Markets - Sovereigns | 0.8% |

| Collateralized Loan Obligations | 0.4% |

| Quasi-Sovereigns | 0.3% |

| Commercial Mortgage-Backed Securities | 0.2% |

| Short-Term Investments | 3.3% |

| Other assets less liabilities | 1.3% |

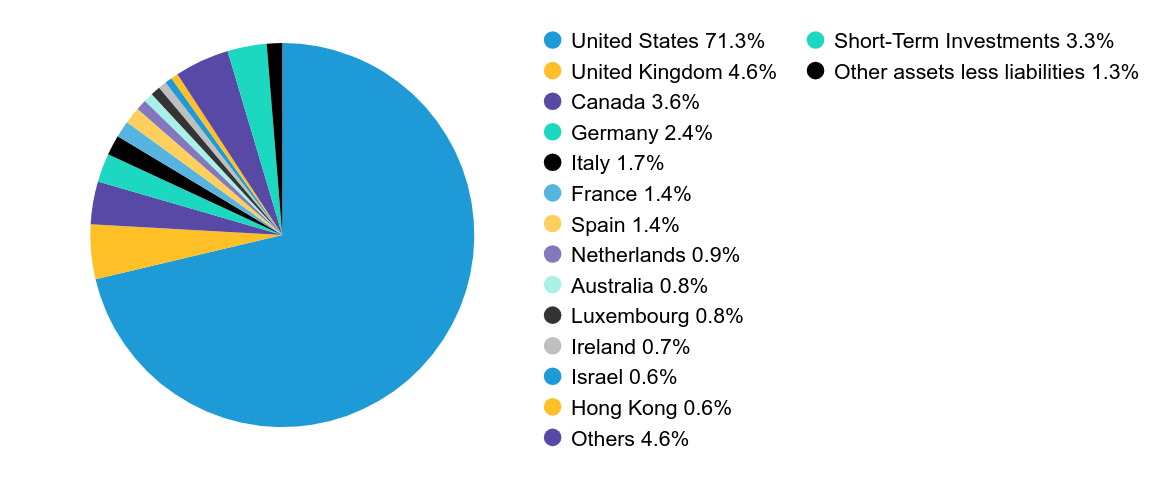

| Value | Value |

|---|

| United States | 71.3% |

| United Kingdom | 4.6% |

| Canada | 3.6% |

| Germany | 2.4% |

| Italy | 1.7% |

| France | 1.4% |

| Spain | 1.4% |

| Netherlands | 0.9% |

| Australia | 0.8% |

| Luxembourg | 0.8% |

| Ireland | 0.7% |

| Israel | 0.6% |

| Hong Kong | 0.6% |

| Others | 4.6% |

| Short-Term Investments | 3.3% |

| Other assets less liabilities | 1.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/SYFI-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/SYFI-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

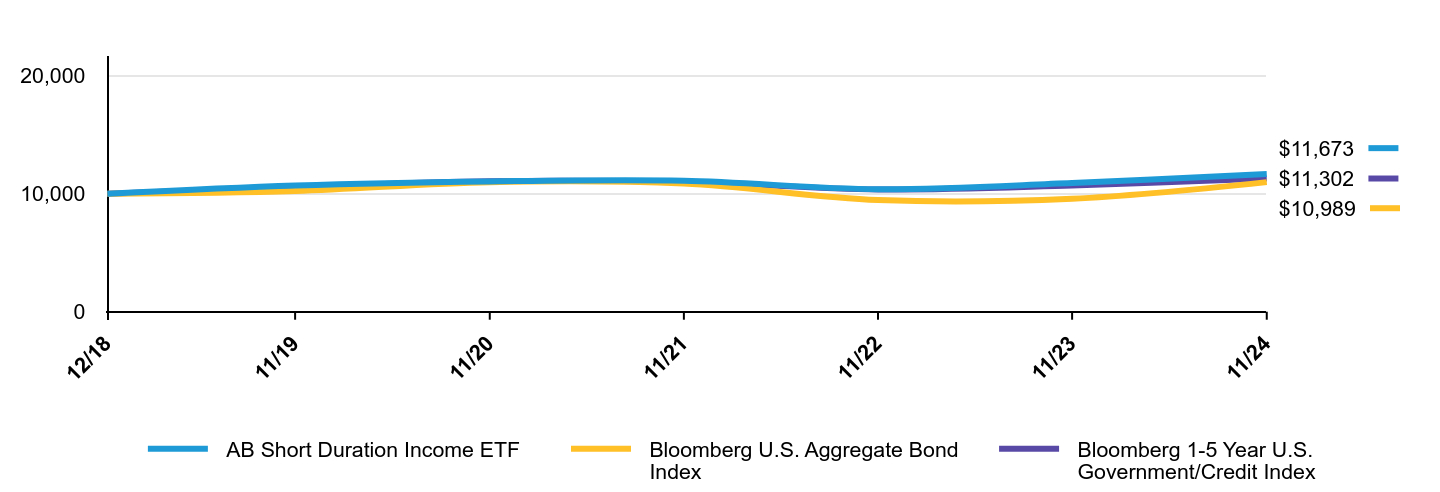

AB Short Duration Income ETF

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the AB Short Duration Income ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https:/www.abfunds.com/link/AB/SDFI-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Short Duration Income ETF | $30 | 0.30% |

|---|

Prior to commencing operations, the Fund acquired the assets and liabilities of AB Short Duration Income Portfolio (a "Predecessor Fund"), a series of AB Bond Fund, Inc., and adopted the accounting and performance history of that fund (a "Reorganization"), as of the close of business on June 7, 2024.The Fund has the same investment objective, strategies, policies and portfolio management team as the Predecessor Fund.

The performance of the Predecessor Fund shown below has not been adjusted to reflect the lower fees and expenses that will be incurred by the Fund. The Predecessor Fund was a mutual fund, and the average annual total returns as shown below are based on NAV per share, and are not based on market prices for an ETF share as traded on an exchange. Predecessor Fund performance is based on the performance of Advisor Class shares. Prior to the Fund's acquisition of the Predecessor Fund, the other share classes of the Predecessor Fund were converted into Advisor Class shares.

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share chasses of the Fund outperformed the Bloomberg 1-5 Year US Government/Credit Index (the “benchmark”), before sales charges. Industry allocation was the primary contributor to performance, relative to the benchmark, from an underweight to US Treasuries and off-benchmark exposure to collateralized mortgage obligations, commercial mortgage-backed securities and collateral loan obligations that were partially offset by losses from exposure to investment-grade credit default swaps in the US. Security selection also contributed from selections in other asset-backed securities and energy. Overall yield-curve positioning in the US detracted from performance. Off-benchmark country allocation to the eurozone also added to performance. Currency decisions did not impact performance during the period.

The Fund used derivatives in the form of interest rate swaps, currency forwards and credit default swaps. Interest rate futures were used to manage and hedge duration risk and/or take active yield-curve positioning, while currency forwards were used to hedge foreign currency exposure. Credit default swaps were also used to effectively obtain high yield credit/sector exposure.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Short Duration Income ETF | Bloomberg U.S. Aggregate Bond Index | Bloomberg 1-5 Year U.S. Government/Credit Index |

|---|

| 12/18 | $10,000 | $10,000 | $10,000 |

|---|

| 11/19 | $10,704 | $10,244 | $10,565 |

|---|

| 11/20 | $11,049 | $10,990 | $11,067 |

|---|

| 11/21 | $11,106 | $10,863 | $10,995 |

|---|

| 11/22 | $10,392 | $9,468 | $10,369 |

|---|

| 11/23 | $10,914 | $9,580 | $10,707 |

|---|

| 11/24 | $11,673 | $10,989 | $11,302 |

|---|

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Since Inception 12/12/18 |

|---|

| AB Short Duration Income ETF | 6.95% | 1.68% | 2.63% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 6.88% | -0.01% | 1.59% |

|---|

| Bloomberg 1-5 Year U.S. Government/Credit Index | 5.56% | 1.36% | 2.07% |

|---|

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https:/www.abfunds.com/link/AB/SDFI-A for the most recent performance information.

| Net Assets | $88,503,364 |

|---|

| # of Portfolio Holdings | 383 |

|---|

| Portfolio Turnover Rate | 1% |

|---|

| Total Advisory Fees Paid | $21,800 |

|---|

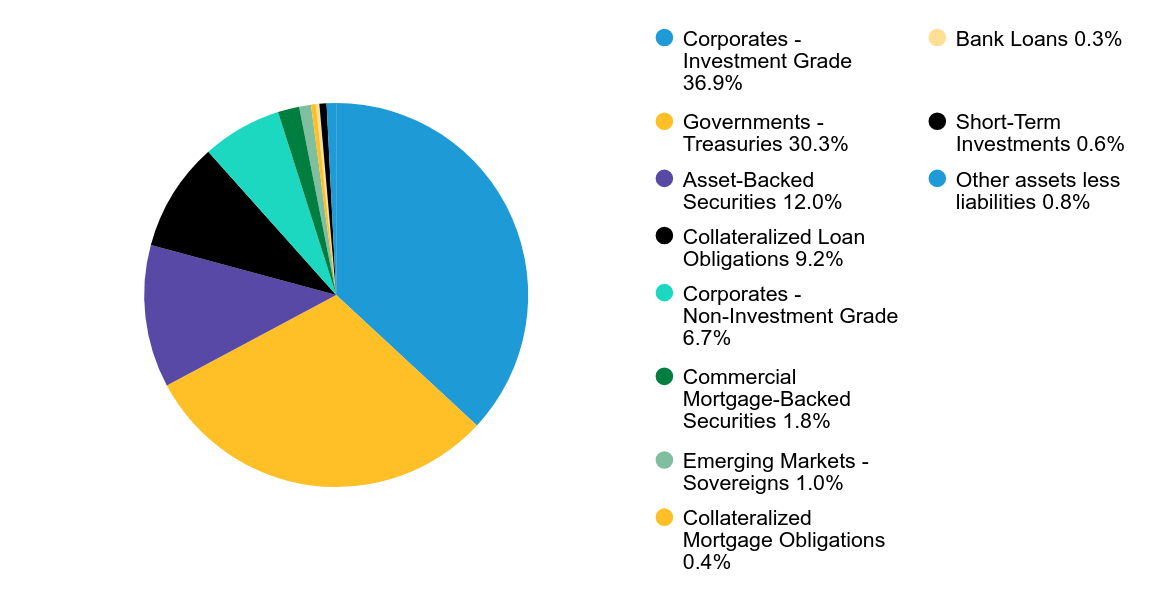

Graphical Representation of Holdings

| Value | Value |

|---|

| Corporates - Investment Grade | 36.9% |

| Governments - Treasuries | 30.3% |

| Asset-Backed Securities | 12.0% |

| Collateralized Loan Obligations | 9.2% |

| Corporates - Non-Investment Grade | 6.7% |

| Commercial Mortgage-Backed Securities | 1.8% |

| Emerging Markets - Sovereigns | 1.0% |

| Collateralized Mortgage Obligations | 0.4% |

| Bank Loans | 0.3% |

| Short-Term Investments | 0.6% |

| Other assets less liabilities | 0.8% |

Availability of Additional Information

You can find additional information on the Fund’s website at https:/www.abfunds.com/link/AB/SDFI-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https:/www.abfunds.com/link/AB/SDFI-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB Conservative Buffer ETF

Principal Listing Exchange: NASDAQ

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB Conservative Buffer ETF (the “Fund”) for the period of December 13, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/BUFC-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Conservative Buffer ETF | $71 | 0.69% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

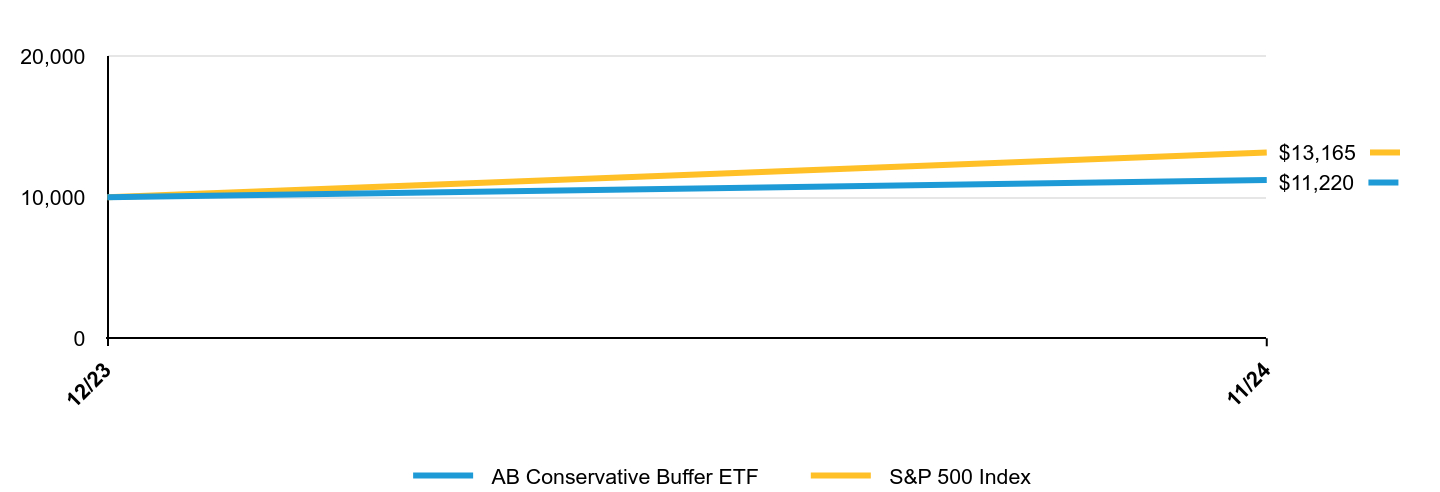

Since inception, the Fund returned 12.31% versus the Standard & Poor’s (“S&P”) 500 Index (the "benchmark") return of 31.65%, achieving its objective of providing market participation, up to a return cap and protecting against market declines of up to 15% over each three-month outcome period. The Fund holds a basket of options on the SPDR S&P 500 ETF, which reflects the S&P 500 Index with no active bets on sectors or asset classes.

The Fund used derivatives in the form of purchased options for hedging and investment purposes, which added to performance. Writing options were used for investment purposes, which detracted from performance.

Top contributors to performance:

As the reference asset, the SPDR S&P 500 ETF, appreciated over the inception period, the Fund participated up to the return cap, which resets at each three-month outcome period.

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Conservative Buffer ETF | S&P 500 Index |

|---|

| 12/23 | $10,000 | $10,000 |

|---|

| 11/24 | $11,220 | $13,165 |

|---|

Average Annual Total Returns

| AATR | Since Inception 12/13/23 |

|---|

| AB Conservative Buffer ETF | 12.31% |

|---|

| S&P 500 Index | 31.65% |

|---|

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/BUFC-A for the most recent performance information.

| Net Assets | $696,738,691 |

|---|

| # of Portfolio Holdings | 3 |

|---|

| Portfolio Turnover Rate | 0% |

|---|

| Total Advisory Fees Paid | $3,417,651 |

|---|

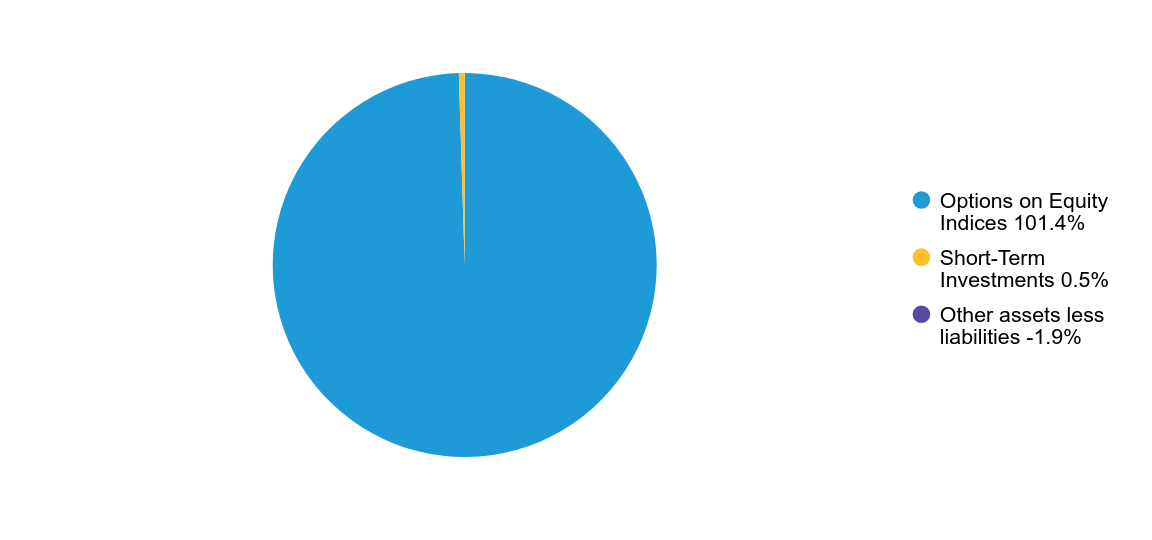

Graphical Representation of Holdings

| Value | Value |

|---|

| Options on Equity Indices | 101.4% |

| Short-Term Investments | 0.5% |

| Other assets less liabilities | -1.9% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/BUFC-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/BUFC-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Principal Listing Exchange: NASDAQ

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB Core Plus Bond ETF (the “Fund”) for the period of December 13, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/CPLS-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Core Plus Bond ETF | $32 | 0.32% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

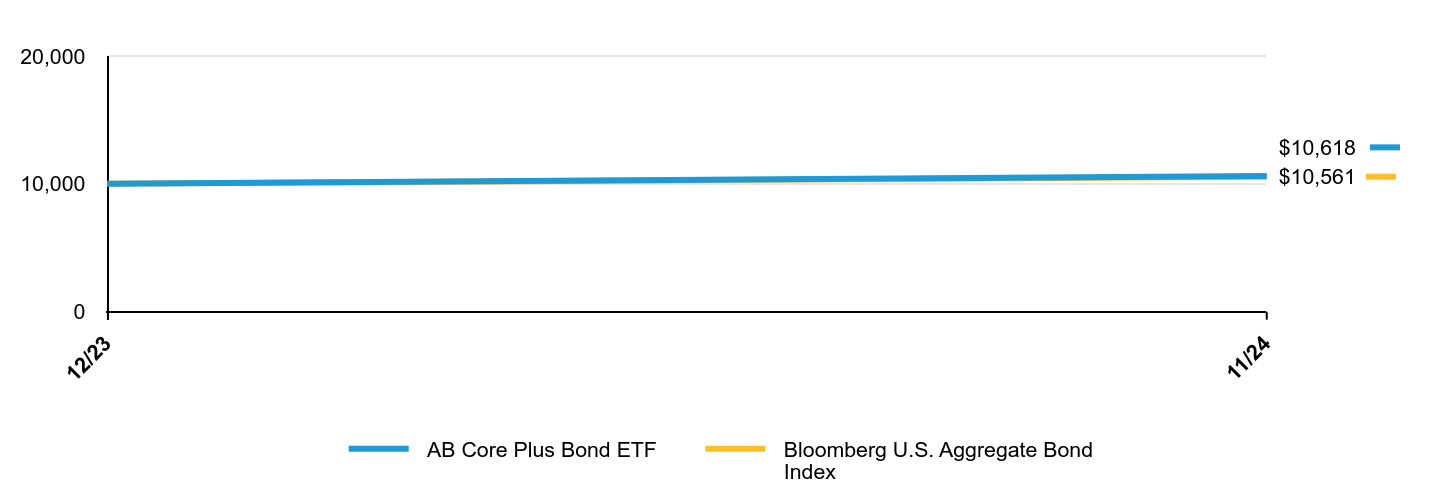

Since inception, the Fund has outperformed the Bloomberg U.S. Aggregate Bond Index (the “benchmark”). Security selection among investment-grade corporate bonds, underweight in mortgage-backed securities, and out-of-benchmark allocation to high-yield corporate bonds contributed, relative to the benchmark. Yield-curve positioning detracted marginally with portfolio running similar benchmark interest rate exposures. Country allocation and currency decisions did not impact performance during the period.

The fund used derivatives in the form of treasury futures for hedging purposes.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Core Plus Bond ETF | Bloomberg U.S. Aggregate Bond Index |

|---|

| 12/23 | $10,000 | $10,000 |

|---|

| 11/24 | $10,618 | $10,561 |

|---|

Average Annual Total Returns

| AATR | Since Inception 12/13/23 |

|---|

| AB Core Plus Bond ETF | 6.19% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 5.61% |

|---|

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/CPLS-A for the most recent performance information.

| Net Assets | $55,382,988 |

|---|

| # of Portfolio Holdings | 458 |

|---|

| Portfolio Turnover Rate | 232% |

|---|

| Total Advisory Fees Paid | $140,742 |

|---|

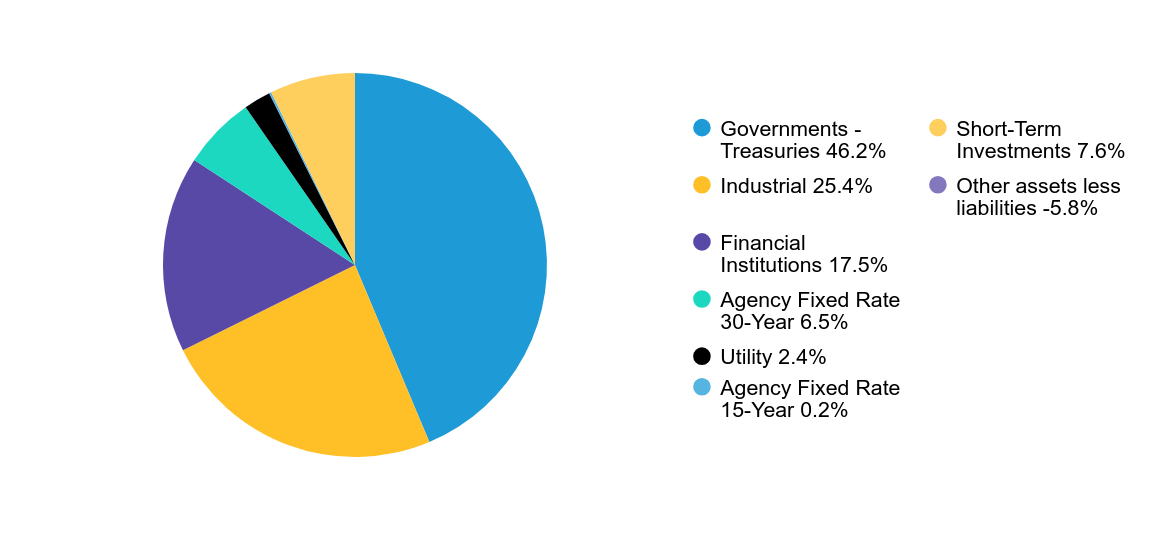

Graphical Representation of Holdings

| Value | Value |

|---|

| Governments - Treasuries | 46.2% |

| Industrial | 25.4% |

| Financial Institutions | 17.5% |

| Agency Fixed Rate 30-Year | 6.5% |

| Utility | 2.4% |

| Agency Fixed Rate 15-Year | 0.2% |

| Short-Term Investments | 7.6% |

| Other assets less liabilities | -5.8% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/CPLS-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/CPLS-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Principal Listing Exchange: NASDAQ

Please scan QR code for

Fund Information

Annual Shareholder Report

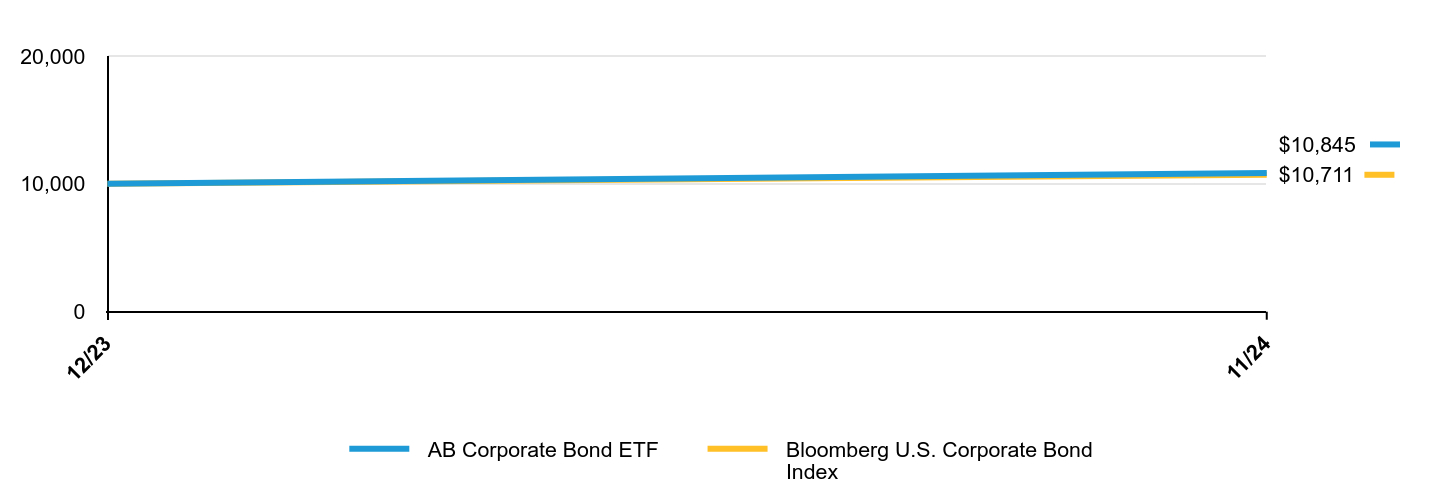

This annual shareholder report contains important information about the AB Corporate Bond ETF (the “Fund”) for the period of December 13, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/EYEG-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Corporate Bond ETF | $30 | 0.30% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

Since inception, the Fund has outperformed the Bloomberg US Corporate Bond Index (the “benchmark”). Security selection among investment-grade corporate bonds was the largest contributor, relative to the benchmark. Overall yield-curve positioning detracted, mostly from overweights to the five- to 20-year parts of the curve, which were partially offset by gains to the six-month and two-year parts of the curve. Currency decisions did not impact performance during the period.

The Fund used to treasury futures to hedge duration.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Corporate Bond ETF | Bloomberg U.S. Corporate Bond Index |

|---|

| 12/23 | $10,000 | $10,000 |

|---|

| 11/24 | $10,845 | $10,711 |

|---|

Average Annual Total Returns

| AATR | Since Inception 12/13/23 |

|---|

| AB Corporate Bond ETF | 8.24% |

|---|

| Bloomberg U.S. Corporate Bond Index | 7.11% |

|---|

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/EYEG-A for the most recent performance information.

| Net Assets | $25,358,442 |

|---|

| # of Portfolio Holdings | 364 |

|---|

| Portfolio Turnover Rate | 175% |

|---|

| Total Advisory Fees Paid | $71,874 |

|---|

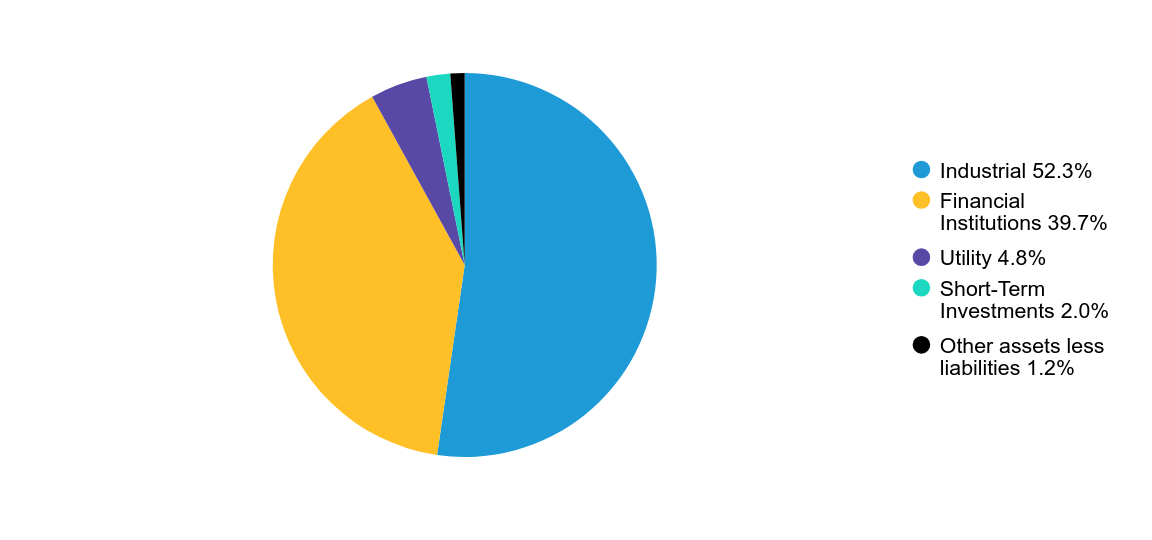

Graphical Representation of Holdings

| Value | Value |

|---|

| Industrial | 52.3% |

| Financial Institutions | 39.7% |

| Utility | 4.8% |

| Short-Term Investments | 2.0% |

| Other assets less liabilities | 1.2% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/EYEG-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/EYEG-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

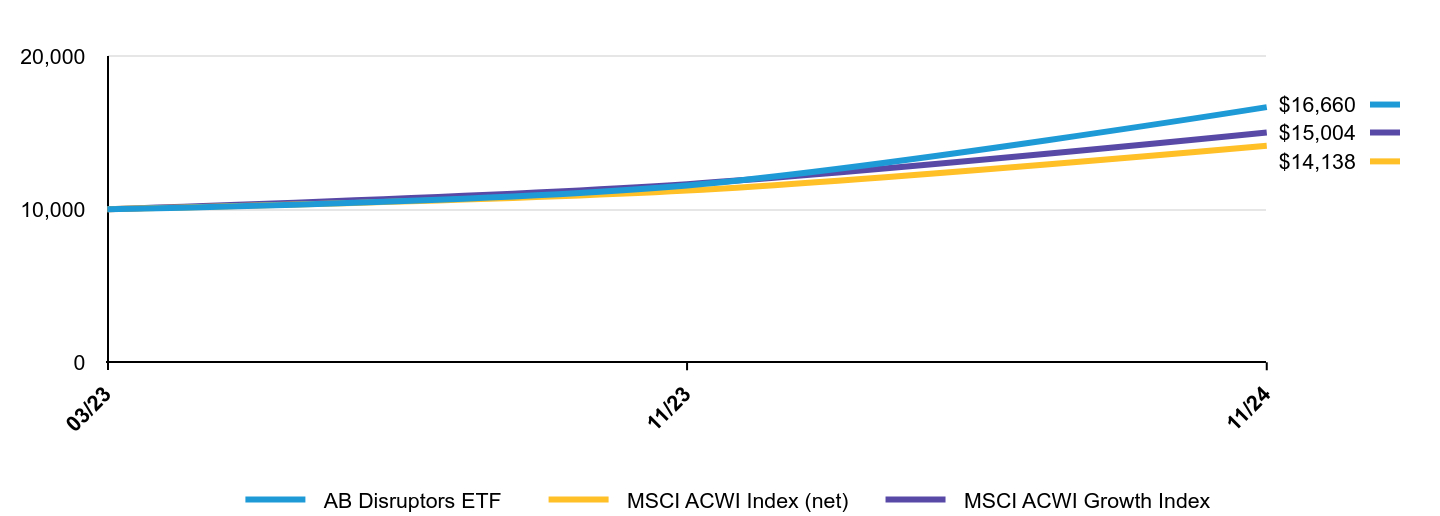

This annual shareholder report contains important information about the AB Disruptors ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/FWD-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Disruptors ETF | $79 | 0.65% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period ended November 30, 2024, the Fund outperformed the Morgan Stanley Capital International (“MSCI”) All Country World Index (“ACWI”) Growth (the “benchmark“), before sales charges. Overall security selection drove the outperformance led by selection within technology and industrials; selection within health care and real estate were the only negative sectors. Sector allocation also contributed: an underweight to consumer staples and an overweight to technology offset losses from underweight to communication services and an overweight to health care.

Top contributors to performance:

Top detractors from performance:

During the 12-month period, selection within, and allocation to, some sectors detracted from performance.

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Disruptors ETF | MSCI ACWI Index (net) | MSCI ACWI Growth Index |

|---|

| 03/23 | $10,000 | $10,000 | $10,000 |

|---|

| 11/23 | $11,546 | $11,210 | $11,633 |

|---|

| 11/24 | $16,660 | $14,138 | $15,004 |

|---|

Average Annual Total Returns

| AATR | 1 Year | Since Inception 03/22/23 |

|---|

| AB Disruptors ETF | 43.99% | 34.95% |

|---|

| MSCI ACWI Index (net) | 26.12% | 22.61% |

|---|

| MSCI ACWI Growth Index | 28.98% | 26.98% |

|---|

The addition of the MSCI ACWI Index (net) broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/FWD-A for the most recent performance information.

| Net Assets | $488,789,797 |

|---|

| # of Portfolio Holdings | 104 |

|---|

| Portfolio Turnover Rate | 163% |

|---|

| Total Advisory Fees Paid | $2,112,143 |

|---|

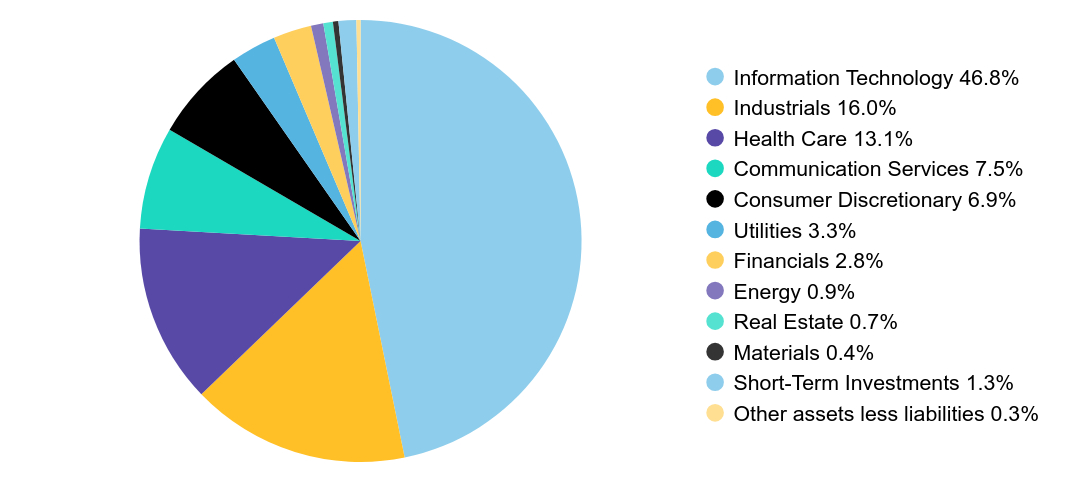

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| NVIDIA Corp. | $20,134,592 | 4.1% |

| Tesla, Inc. | $14,858,103 | 3.0% |

| Vistra Corp. | $12,113,315 | 2.5% |

| GE Vernova, Inc. | $9,217,369 | 1.9% |

| Oracle Corp. | $8,542,565 | 1.7% |

| Amazon.com, Inc. | $8,424,534 | 1.7% |

| Arista Networks, Inc. | $7,943,115 | 1.6% |

| Intuitive Surgical, Inc. | $7,816,724 | 1.6% |

| Netflix, Inc. | $7,642,529 | 1.6% |

| Shopify, Inc. - Class A | $7,174,945 | 1.5% |

| Total | $103,867,791 | 21.2% |

| Value | Value |

|---|

| Information Technology | 46.8% |

| Industrials | 16.0% |

| Health Care | 13.1% |

| Communication Services | 7.5% |

| Consumer Discretionary | 6.9% |

| Utilities | 3.3% |

| Financials | 2.8% |

| Energy | 0.9% |

| Real Estate | 0.7% |

| Materials | 0.4% |

| Short-Term Investments | 1.3% |

| Other assets less liabilities | 0.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/FWD-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/FWD-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Principal Listing Exchange: NYSE Arca

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Yield ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/HYFI-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB High Yield ETF | $42 | 0.40% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, the Fund underperformed the Bloomberg US Corporate HY 2% Issuer Capped Index (the “benchmark”), before sales charges. Security selection was the largest detractor, relative to the benchmark, from selections in telecommunications, services and banking, which were partially offset by gains from selections in energy. Industry allocation contributed, mainly from an overweight to banking. Yield-curve positioning also contributed, mostly from overweights to the five- and 10-year parts of the curve which partially offset losses from underweights in the six month- and two-year parts of the curve. Currency decisions did not have an impact performance during the period.

During the 12-month period, the Fund utilized derivatives in the form of treasury futures to manage duration and yield-curve positioning. Currency forwards were utilized to hedge currency risk. Credit default swaps were used to maintain overall account risk relative to the benchmark and to actively take a single issuer exposure.

Top contributors to performance:

Top detractors from performance:

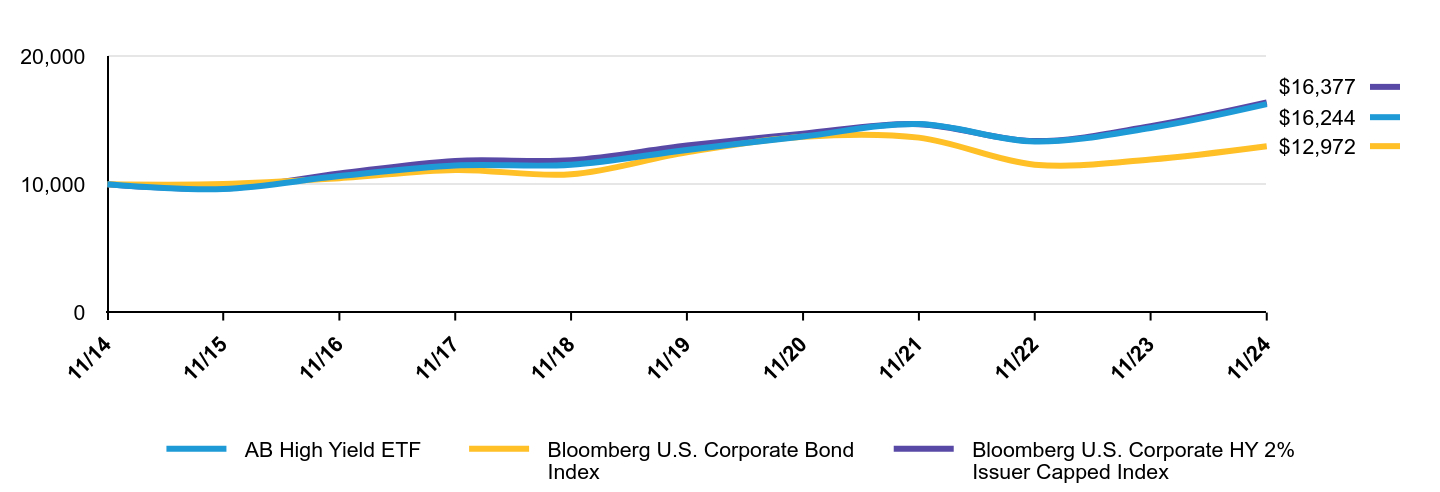

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB High Yield ETF | Bloomberg U.S. Corporate Bond Index | Bloomberg U.S. Corporate HY 2% Issuer Capped Index |

|---|

| 11/14 | $10,000 | $10,000 | $10,000 |

|---|

| 11/15 | $9,632 | $10,016 | $9,662 |

|---|

| 11/16 | $10,639 | $10,475 | $10,832 |

|---|

| 11/17 | $11,463 | $11,120 | $11,824 |

|---|

| 11/18 | $11,521 | $10,782 | $11,867 |

|---|

| 11/19 | $12,676 | $12,491 | $13,015 |

|---|

| 11/20 | $13,725 | $13,710 | $13,948 |

|---|

| 11/21 | $14,697 | $13,637 | $14,683 |

|---|

| 11/22 | $13,335 | $11,529 | $13,368 |

|---|

| 11/23 | $14,391 | $11,939 | $14,530 |

|---|

| 11/24 | $16,244 | $12,972 | $16,377 |

|---|

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| AB High Yield ETF | 12.21% | 4.96% | 4.91% |

|---|

| Bloomberg U.S. Corporate Bond Index | 8.66% | 0.76% | 2.64% |

|---|

| Bloomberg U.S. Corporate HY 2% Issuer Capped Index | 12.71% | 4.70% | 5.06% |

|---|

The addition of the Bloomberg U.S. Corporate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/HYFI-A for the most recent performance information.

| Net Assets | $175,106,687 |

|---|

| # of Portfolio Holdings | 772 |

|---|

| Portfolio Turnover Rate | 75% |

|---|

| Total Advisory Fees Paid | $510,547 |

|---|

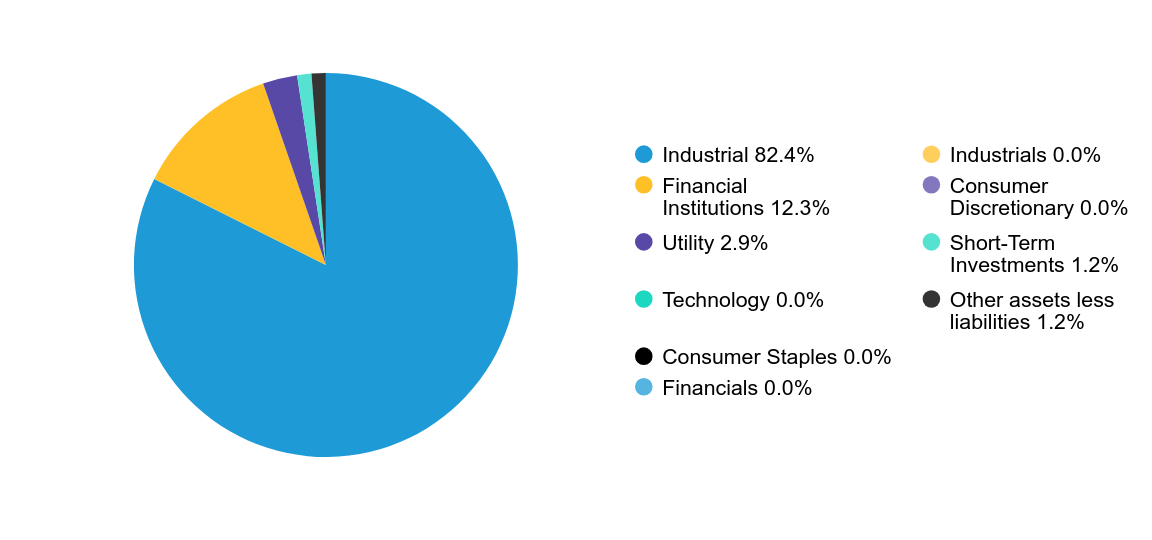

Graphical Representation of Holdings

| Value | Value |

|---|

| Industrial | 82.4% |

| Financial Institutions | 12.3% |

| Utility | 2.9% |

| Technology | 0.0% |

| Consumer Staples | 0.0% |

| Financials | 0.0% |

| Industrials | 0.0% |

| Consumer Discretionary | 0.0% |

| Short-Term Investments | 1.2% |

| Other assets less liabilities | 1.2% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/HYFI-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/HYFI-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB Tax-Aware Intermediate Municipal ETF

Principal Listing Exchange: NYSE Arca

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB Tax-Aware Intermediate Municipal ETF (the “Fund”) for the period of December 13, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/TAFM-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Tax-Aware Intermediate Municipal ETF | $28 | 0.28% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

Since inception, the Fund outperformed the Bloomberg Municipal Bond Index (the “benchmark”). Industry allocation and security selection contributed to performance, relative to the benchmark. Overweights to prepay energy and not-for-profit health care contributed, while underweights to single-family housing and toll roads/transit detracted. Security selection within not-for-profit health care and electric utility contributed, while an underweight to state general obligation and an overweight to local general obligation detracted. Yield-curve positioning detracted from performance.

The Fund used derivatives in the form of interest rate swaps for hedging purposes, which contributed to performance.

Top contributors to performance:

Top detractors from performance:

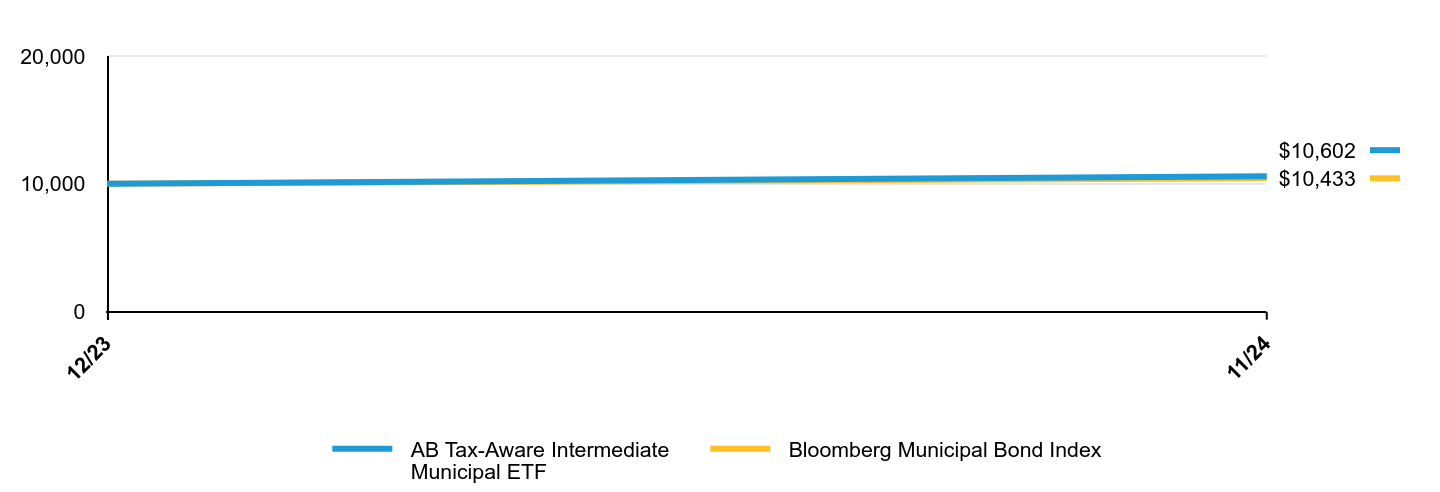

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Tax-Aware Intermediate Municipal ETF | Bloomberg Municipal Bond Index |

|---|

| 12/23 | $10,000 | $10,000 |

|---|

| 11/24 | $10,602 | $10,433 |

|---|

Average Annual Total Returns

| AATR | Since Inception 12/13/23 |

|---|

| AB Tax-Aware Intermediate Municipal ETF | 5.81% |

|---|

| Bloomberg Municipal Bond Index | 4.33% |

|---|

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/TAFM-A for the most recent performance information.

| Net Assets | $92,476,022 |

|---|

| # of Portfolio Holdings | 196 |

|---|

| Portfolio Turnover Rate | 9% |

|---|

| Total Advisory Fees Paid | $99,610 |

|---|

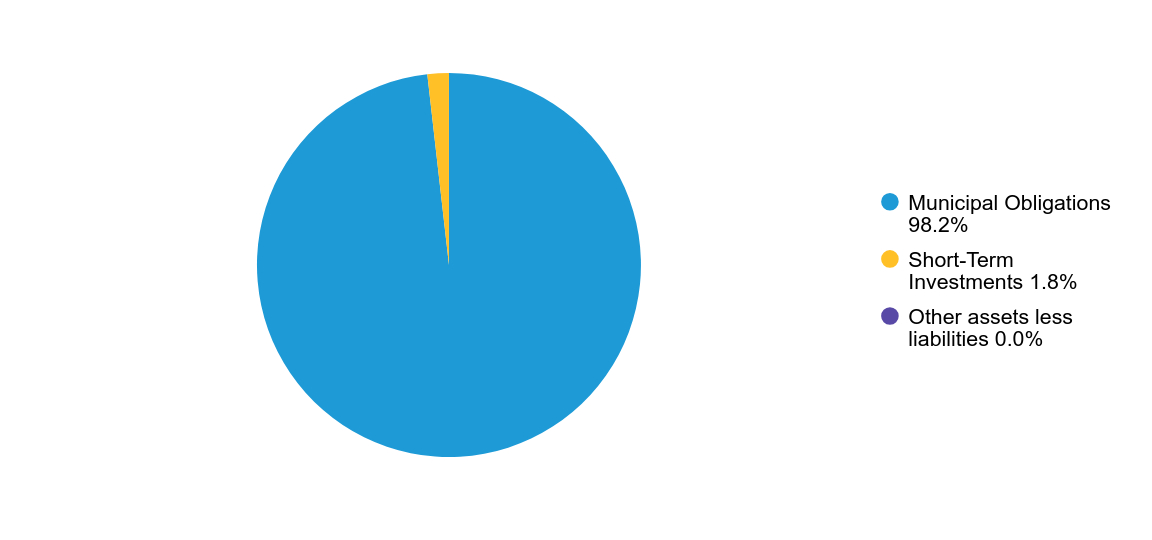

Graphical Representation of Holdings

| Value | Value |

|---|

| Municipal Obligations | 98.2% |

| Short-Term Investments | 1.8% |

| Other assets less liabilities | 0.0% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/TAFM-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/TAFM-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB Tax-Aware Long Municipal ETF

Principal Listing Exchange: NYSE

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB Tax-Aware Long Municipal ETF (the “Fund”) for the period of December 13, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/TAFL-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Tax-Aware Long Municipal ETF | $28 | 0.28% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

Since inception the Fund outperformed the Bloomberg Municipal Bond Index (the “benchmark”). Industry allocation and security selection, particularly allocations to state general obligation, not-for-profit health care and public higher education, contributed to performance, relative to the benchmark. Yield-curve positioning and security selection within single-family housing detracted from overall performance.

The Fund used derivatives in the form of interest rate swaps and credit default swaps for hedging purposes. Interest rate swaps contributed to performance, while credit default swaps detracted.

Top contributors to performance:

Top detractors from performance:

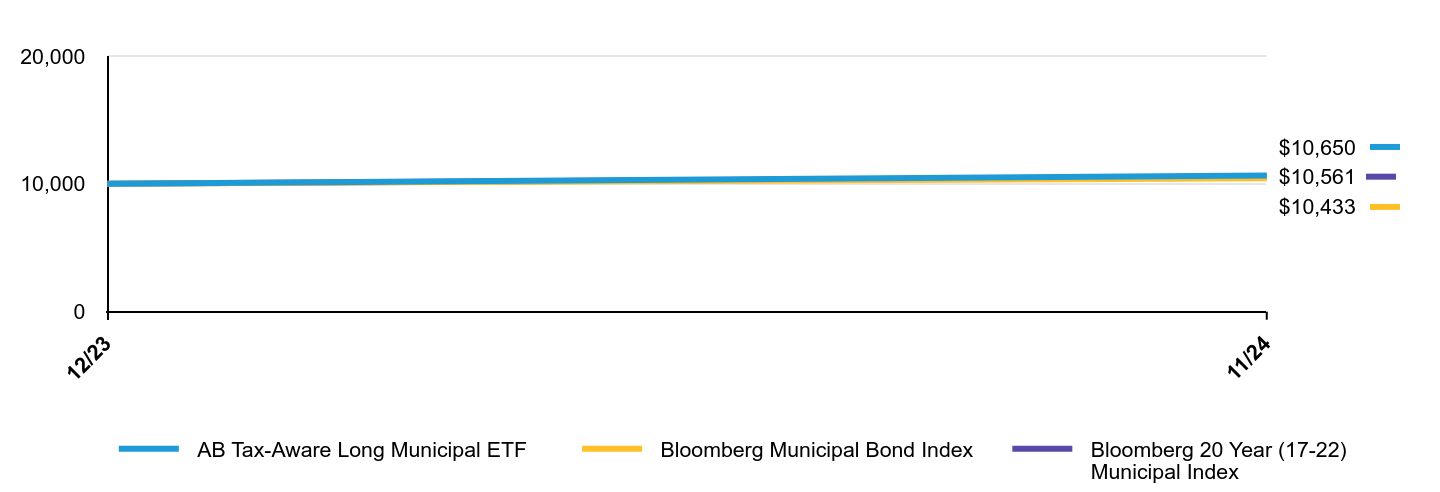

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Tax-Aware Long Municipal ETF | Bloomberg Municipal Bond Index | Bloomberg 20 Year (17-22) Municipal Index |

|---|

| 12/23 | $10,000 | $10,000 | $10,000 |

|---|

| 11/24 | $10,650 | $10,433 | $10,561 |

|---|

Average Annual Total Returns

| AATR | Since Inception 12/13/23 |

|---|

| AB Tax-Aware Long Municipal ETF | 6.19% |

|---|

| Bloomberg Municipal Bond Index | 4.33% |

|---|

| Bloomberg 20 Year (17-22) Municipal Index | 5.61% |

|---|

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/TAFL-A for the most recent performance information.

| Net Assets | $29,526,762 |

|---|

| # of Portfolio Holdings | 82 |

|---|

| Portfolio Turnover Rate | 12% |

|---|

| Total Advisory Fees Paid | $75,051 |

|---|

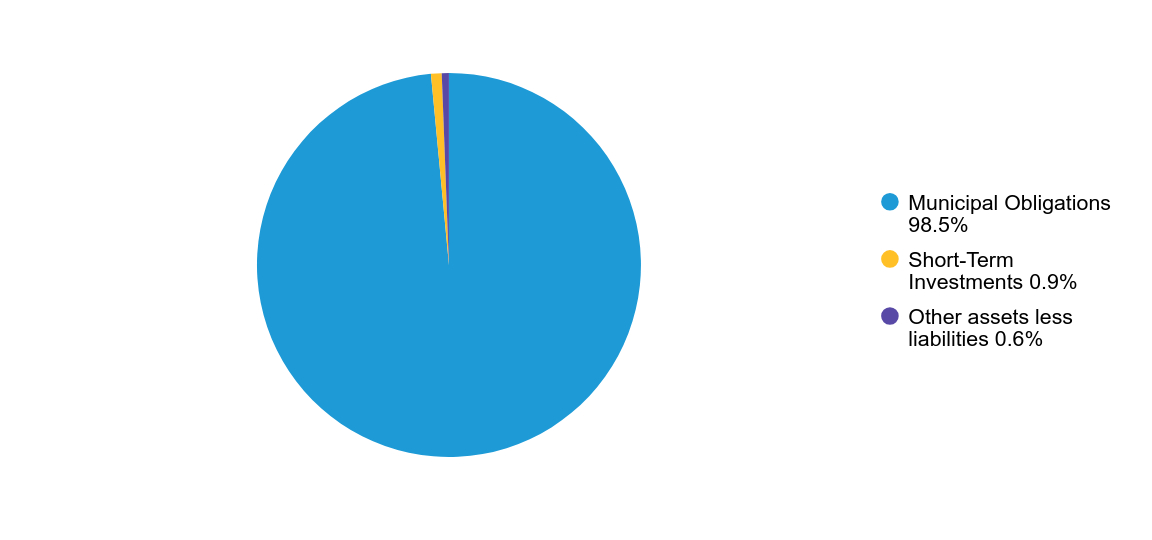

Graphical Representation of Holdings

| Value | Value |

|---|

| Municipal Obligations | 98.5% |

| Short-Term Investments | 0.9% |

| Other assets less liabilities | 0.6% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/TAFL-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/TAFL-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB Tax-Aware Short Duration Municipal ETF

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the AB Tax-Aware Short Duration Municipal ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/TAFI-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Tax-Aware Short Duration Municipal ETF | $28 | 0.27% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, the Fund outperformed the Bloomberg 1-5 Year Municipal Bond Index (the “benchmark”). Industry allocation and security selection, particularly allocation to corporate financials, state general obligation and miscellaneous revenue contributed to performance, relative to the benchmark. Yield-curve positioning detracted from performance.

The Fund used derivatives in the form of interest rate swaps for hedging purposes which added to performance.

Top contributors to performance:

Top detractors from performance:

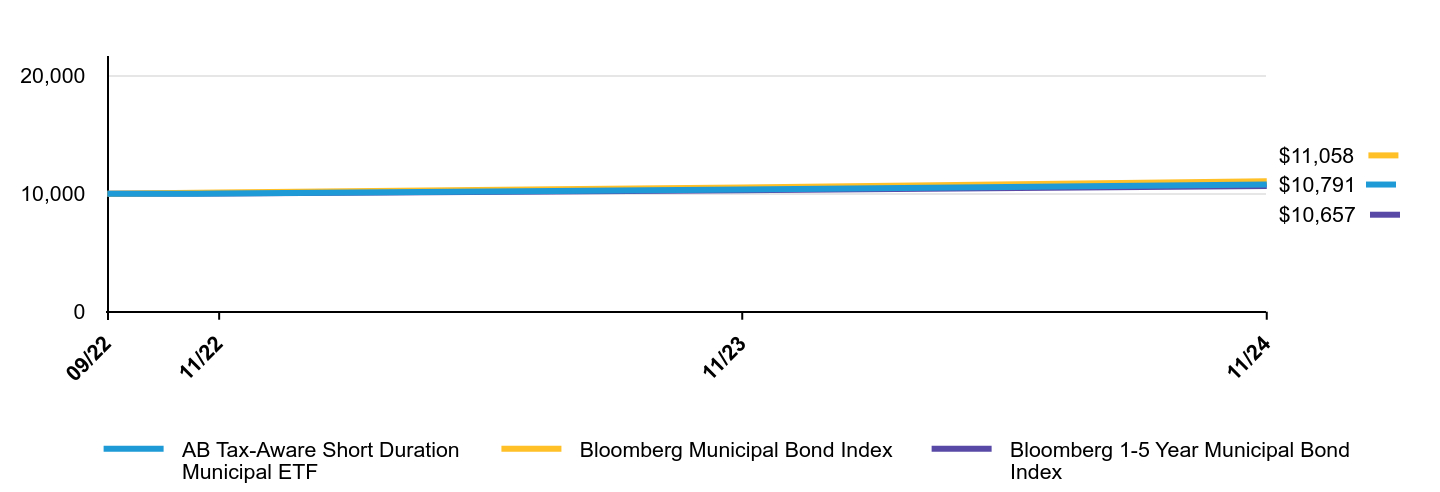

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Tax-Aware Short Duration Municipal ETF | Bloomberg Municipal Bond Index | Bloomberg 1-5 Year Municipal Bond Index |

|---|

| 09/22 | $10,000 | $10,000 | $10,000 |

|---|

| 11/22 | $10,022 | $10,106 | $10,031 |

|---|

| 11/23 | $10,364 | $10,539 | $10,308 |

|---|

| 11/24 | $10,791 | $11,058 | $10,657 |

|---|

Average Annual Total Returns

| AATR | 1 Year | Since Inception 09/14/22 |

|---|

| AB Tax-Aware Short Duration Municipal ETF | 4.14% | 3.50% |

|---|

| Bloomberg Municipal Bond Index | 4.93% | 4.64% |

|---|

| Bloomberg 1-5 Year Municipal Bond Index | 3.39% | 2.91% |

|---|

The addition of the Bloomberg Municipal Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/TAFI-A for the most recent performance information.

| Net Assets | $650,593,636 |

|---|

| # of Portfolio Holdings | 418 |

|---|

| Portfolio Turnover Rate | 29% |

|---|

| Total Advisory Fees Paid | $1,331,301 |

|---|

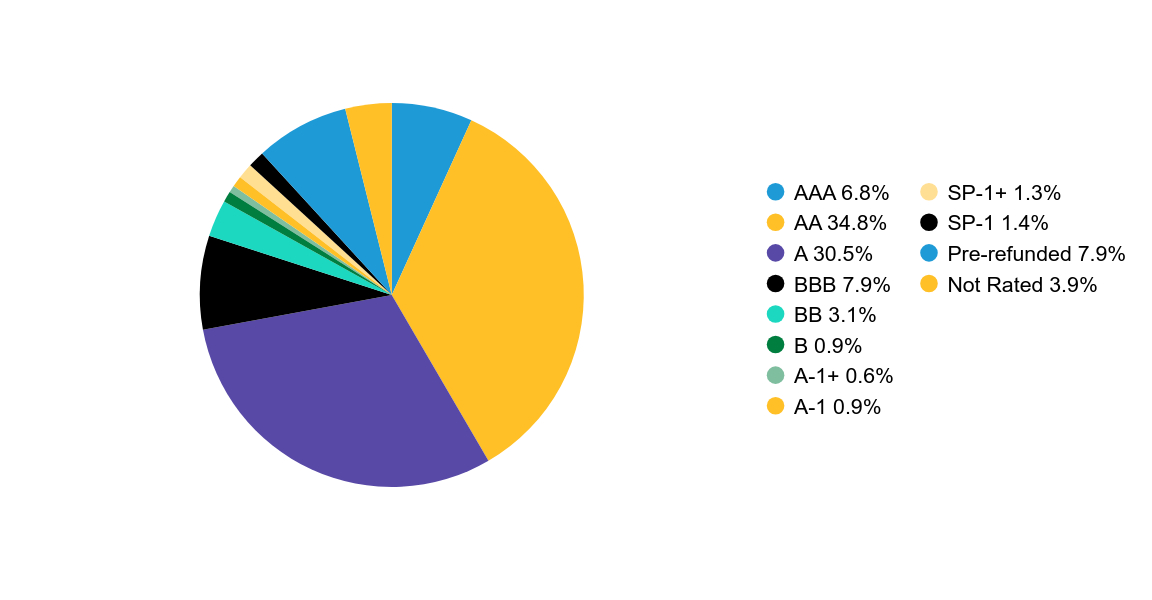

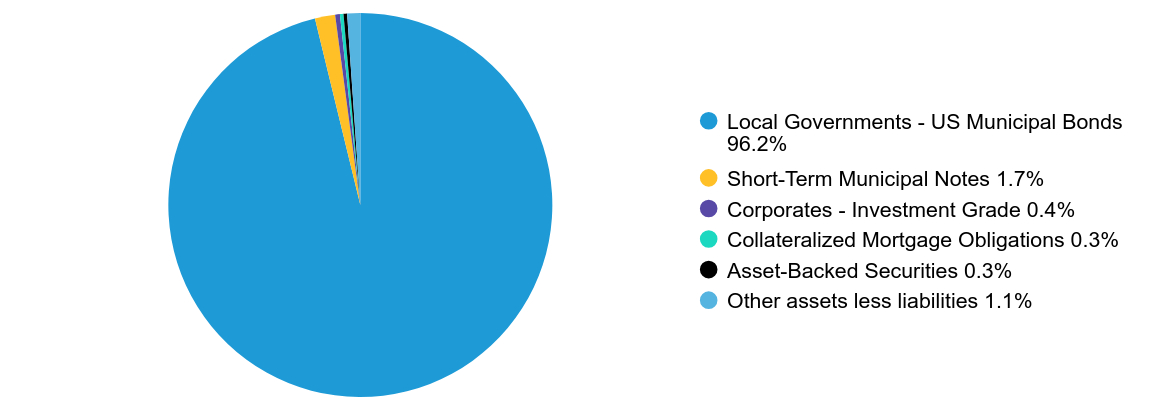

Graphical Representation of Holdings

Credit Rating BreakdownFootnote Reference*

| Value | Value |

|---|

| AAA | 6.8% |

| AA | 34.8% |

| A | 30.5% |

| BBB | 7.9% |

| BB | 3.1% |

| B | 0.9% |

| A-1+ | 0.6% |

| A-1 | 0.9% |

| SP-1+ | 1.3% |

| SP-1 | 1.4% |

| Pre-refunded | 7.9% |

| Not Rated | 3.9% |

| Footnote | Description |

Footnote* | The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Fund considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. Government securities and therefore are deemed high-quality investment grade by AllianceBernstein L.P. (the "Adviser"). If applicable, Not Applicable (N/A) includes non-credit worthy investments, such as equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| |

|---|

| Local Governments - US Municipal Bonds | 96.2% |

| Short-Term Municipal Notes | 1.7% |

| Corporates - Investment Grade | 0.4% |

| Collateralized Mortgage Obligations | 0.3% |

| Asset-Backed Securities | 0.3% |

| Other assets less liabilities | 1.1% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/TAFI-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/TAFI-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

AB Ultra Short Income ETF

Principal Listing Exchange: NYSE Arca

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB Ultra Short Income ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/YEAR-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB Ultra Short Income ETF | $25 | 0.24% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, the Fund outperformed the FTSE 3-Month US T-Bill Index (the “benchmark”), before sales charges. Sector allocation contributed to relative performance, from overweights to investment-grade corporate bonds and asset-backed securities. Yield-curve positioning was a minor detractor to overall performance.

During the 12-month period, the Fund used derivatives in the form of futures for hedging and investment purposes, which had no material impact

Top contributors to performance:

Top detractors from performance:

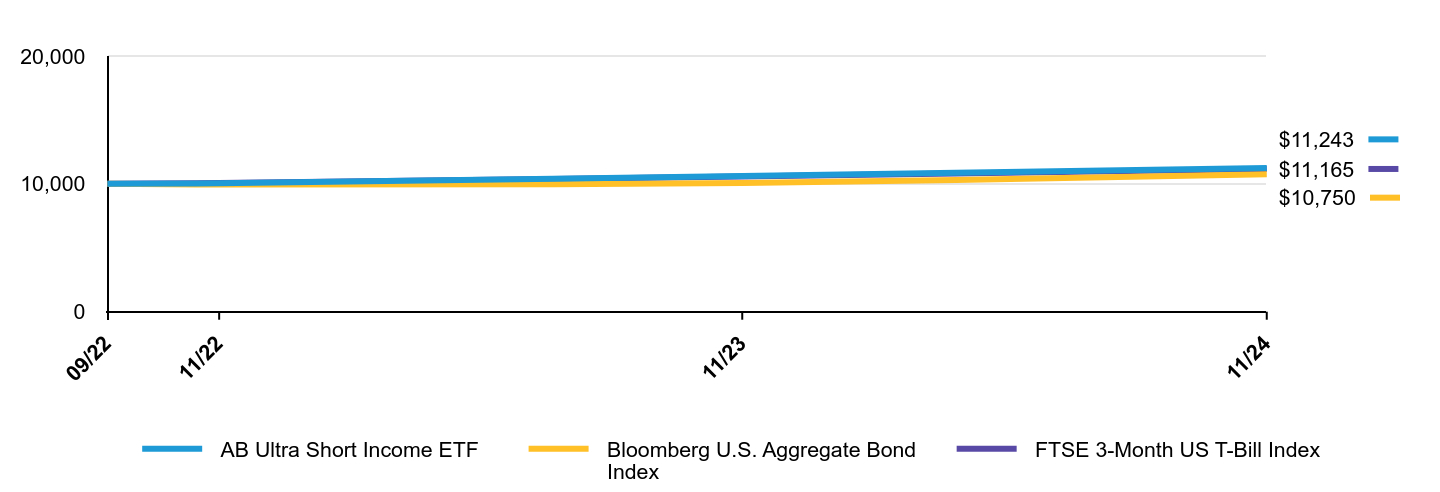

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB Ultra Short Income ETF | Bloomberg U.S. Aggregate Bond Index | FTSE 3-Month US T-Bill Index |

|---|

| 09/22 | $10,000 | $10,000 | $10,000 |

|---|

| 11/22 | $10,046 | $9,942 | $10,065 |

|---|

| 11/23 | $10,616 | $10,059 | $10,580 |

|---|

| 11/24 | $11,243 | $10,750 | $11,165 |

|---|

Average Annual Total Returns

| AATR | 1 Year | Since Inception 09/14/22 |

|---|

| AB Ultra Short Income ETF | 5.87% | 5.43% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 6.88% | 3.32% |

|---|

| FTSE 3-Month US T-Bill Index | 5.53% | 5.10% |

|---|

The addition of the Bloomberg U.S. Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as regulatorily required.

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/YEAR-A for the most recent performance information.

| Net Assets | $1,143,129,074 |

|---|

| # of Portfolio Holdings | 190 |

|---|

| Portfolio Turnover Rate | 59% |

|---|

| Total Advisory Fees Paid | $2,360,963 |

|---|

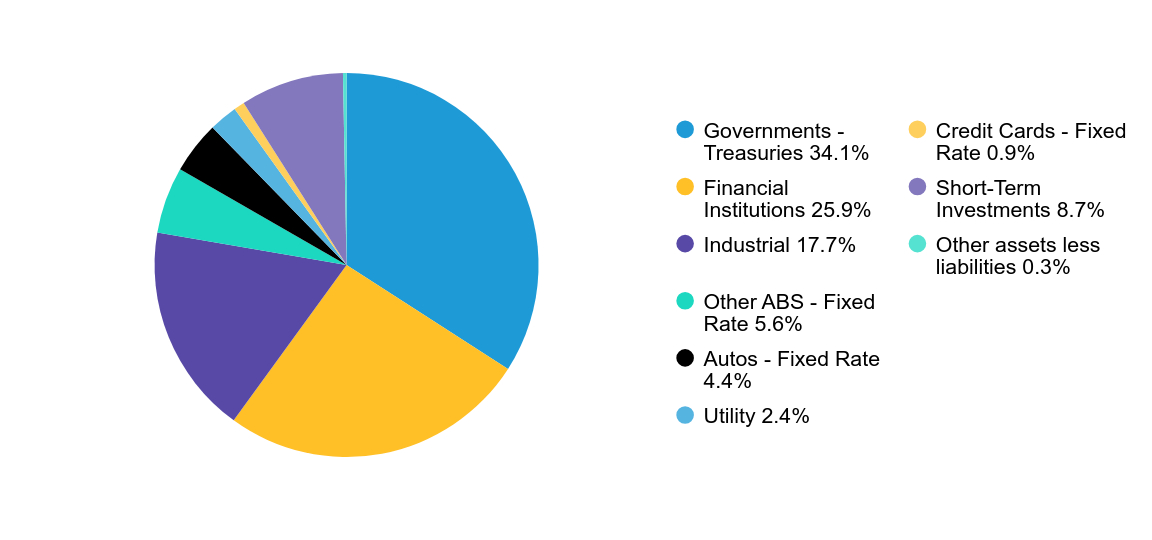

Graphical Representation of Holdings

| Value | Value |

|---|

| Governments - Treasuries | 34.1% |

| Financial Institutions | 25.9% |

| Industrial | 17.7% |

| Other ABS - Fixed Rate | 5.6% |

| Autos - Fixed Rate | 4.4% |

| Utility | 2.4% |

| Credit Cards - Fixed Rate | 0.9% |

| Short-Term Investments | 8.7% |

| Other assets less liabilities | 0.3% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/YEAR-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/YEAR-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the AB US High Dividend ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/HIDV-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB US High Dividend ETF | $53 | 0.45% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, the Fund out performed Standarad & Poor's ("S&P") 500 Total Return Index (the "benchmark"). Both security and sector selection contributed, relative to the benchmark. Within security selection, positions within Broadcom and Unum were the largest contributors, while holdings within Civitas Resources and LyondellBasell detracted the most. Overweights to utilities and financials contributed, while an underweight to technology and an overweight to materials detracted from overall performance.

Top contributors to performance:

Top detractors from performance:

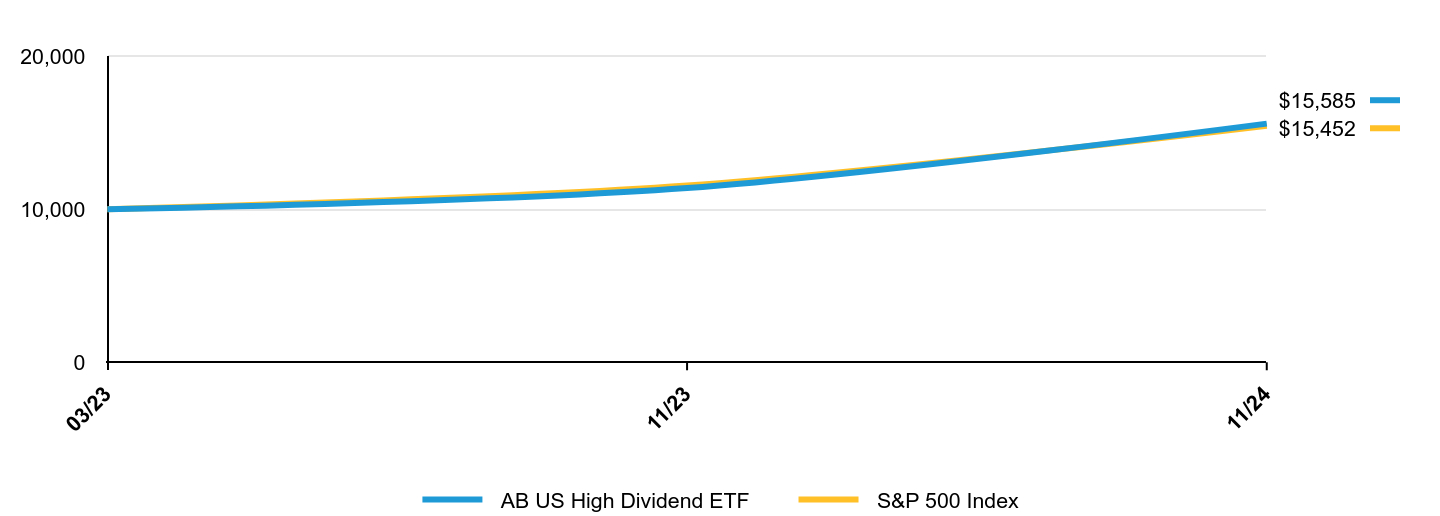

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB US High Dividend ETF | S&P 500 Index |

|---|

| 03/23 | $10,000 | $10,000 |

|---|

| 11/23 | $11,374 | $11,541 |

|---|

| 11/24 | $15,585 | $15,452 |

|---|

Average Annual Total Returns

| AATR | 1 Year | Since Inception 03/22/23 |

|---|

| AB US High Dividend ETF | 36.89% | 29.83% |

|---|

| S&P 500 Index | 33.89% | 29.20% |

|---|

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/HIDV-A for the most recent performance information.

| Net Assets | $25,457,354 |

|---|

| # of Portfolio Holdings | 108 |

|---|

| Portfolio Turnover Rate | 175% |

|---|

| Total Advisory Fees Paid | $61,235 |

|---|

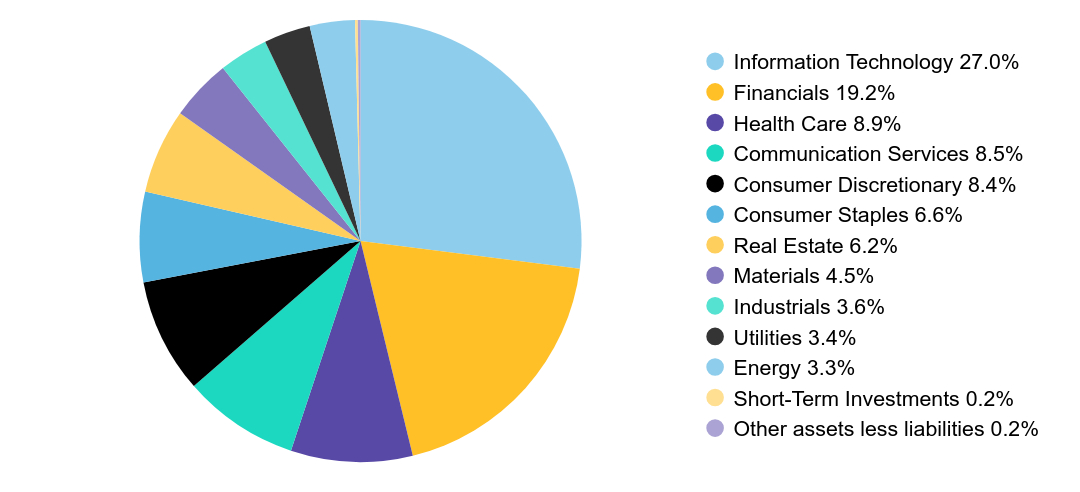

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Apple, Inc. | $1,852,361 | 7.3% |

| NVIDIA Corp. | $1,714,715 | 6.7% |

| Microsoft Corp. | $1,405,887 | 5.5% |

| Amazon.com, Inc. | $759,006 | 3.0% |

| Alphabet, Inc. - Class A | $480,494 | 1.9% |

| Meta Platforms, Inc. - Class A | $439,929 | 1.7% |

| Netflix, Inc. | $402,612 | 1.6% |

| Oracle Corp. | $341,954 | 1.3% |

| Merck & Co., Inc. | $335,209 | 1.3% |

| Tesla, Inc. | $326,521 | 1.3% |

| Total | $8,058,688 | 31.6% |

| Value | Value |

|---|

| Information Technology | 27.0% |

| Financials | 19.2% |

| Health Care | 8.9% |

| Communication Services | 8.5% |

| Consumer Discretionary | 8.4% |

| Consumer Staples | 6.6% |

| Real Estate | 6.2% |

| Materials | 4.5% |

| Industrials | 3.6% |

| Utilities | 3.4% |

| Energy | 3.3% |

| Short-Term Investments | 0.2% |

| Other assets less liabilities | 0.2% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/HIDV-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/HIDV-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB US Large Cap Strategic Equities ETF

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the AB US Large Cap Strategic Equities ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/LRGC-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB US Large Cap Strategic Equities ETF | $56 | 0.48% |

|---|

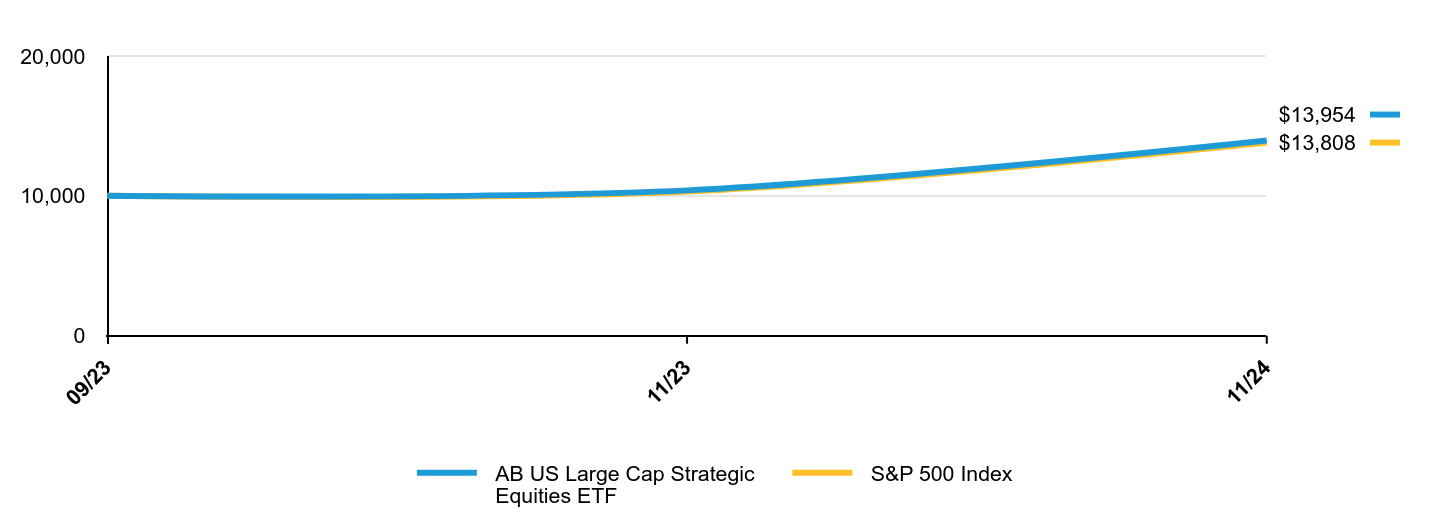

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period ended November 30, 2024, the Fund outperformed the Standard & Poor’s (“S&P”) 500 Index (the "benchmark"), before sales charges. Overall security selection was positive, while sector allocation was negative. Security selection within consumer staples and industrials added to gains, while selection within consumer discretionary and health care detracted. In terms of sector allocation, gains from an overweight to communication services and an underweight to energy were offset by an overweight to health care and an underweight to consumer discretionary, which detracted.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| AB US Large Cap Strategic Equities ETF | S&P 500 Index |

|---|

| 09/23 | $10,000 | $10,000 |

|---|

| 11/23 | $10,392 | $10,313 |

|---|

| 11/24 | $13,954 | $13,808 |

|---|

Average Annual Total Returns

| AATR | 1 Year | Since Inception 09/20/23 |

|---|

| AB US Large Cap Strategic Equities ETF | 34.20% | 32.02% |

|---|

| S&P 500 Index | 33.89% | 30.85% |

|---|

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/LRGC-A for the most recent performance information.

| Net Assets | $259,957,424 |

|---|

| # of Portfolio Holdings | 72 |

|---|

| Portfolio Turnover Rate | 19% |

|---|

| Total Advisory Fees Paid | $610,152 |

|---|

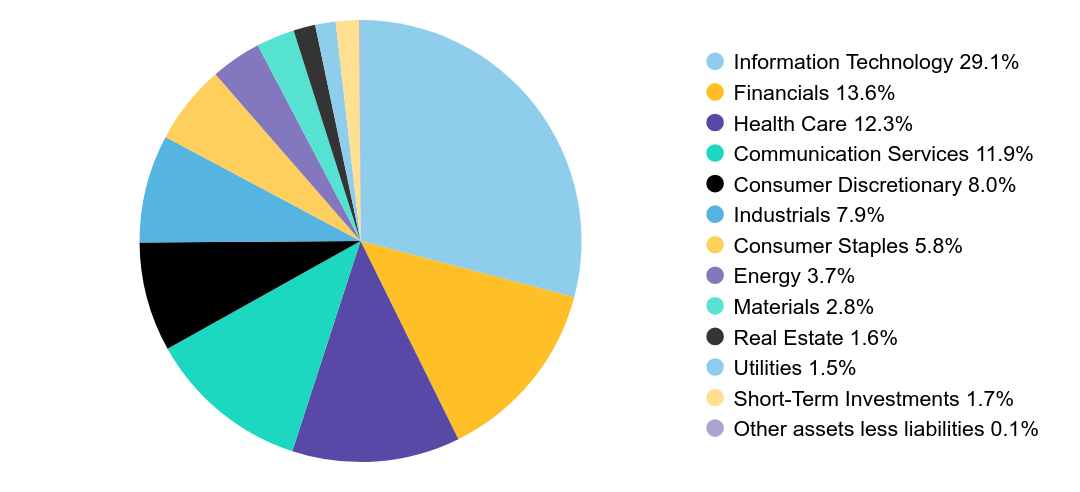

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Microsoft Corp. | $19,507,955 | 7.5% |

| NVIDIA Corp. | $18,422,504 | 7.1% |

| Alphabet, Inc. - Class C | $11,884,176 | 4.6% |

| Apple, Inc. | $11,819,034 | 4.5% |

| Amazon.com, Inc. | $10,999,460 | 4.2% |

| Visa, Inc. - Class A | $9,418,371 | 3.6% |

| Meta Platforms, Inc. - Class A | $8,837,062 | 3.4% |

| UnitedHealth Group, Inc. | $7,900,259 | 3.0% |

| Walmart, Inc. | $6,295,088 | 2.4% |

| Oracle Corp. | $5,711,741 | 2.2% |

| Total | $110,795,650 | 42.5% |

| Value | Value |

|---|

| Information Technology | 29.1% |

| Financials | 13.6% |

| Health Care | 12.3% |

| Communication Services | 11.9% |

| Consumer Discretionary | 8.0% |

| Industrials | 7.9% |

| Consumer Staples | 5.8% |

| Energy | 3.7% |

| Materials | 2.8% |

| Real Estate | 1.6% |

| Utilities | 1.5% |

| Short-Term Investments | 1.7% |

| Other assets less liabilities | 0.1% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/LRGC-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/LRGC-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

AB ETFs are distributed by Foreside Fund Services, LLC; Foreside is not related to AllianceBernstein or its affiliates.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

AB US Low Volatility Equity ETF

Principal Listing Exchange: NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the AB US Low Volatility Equity ETF (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/LOWV-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| AB US Low Volatility Equity ETF | $54 | 0.48% |

|---|

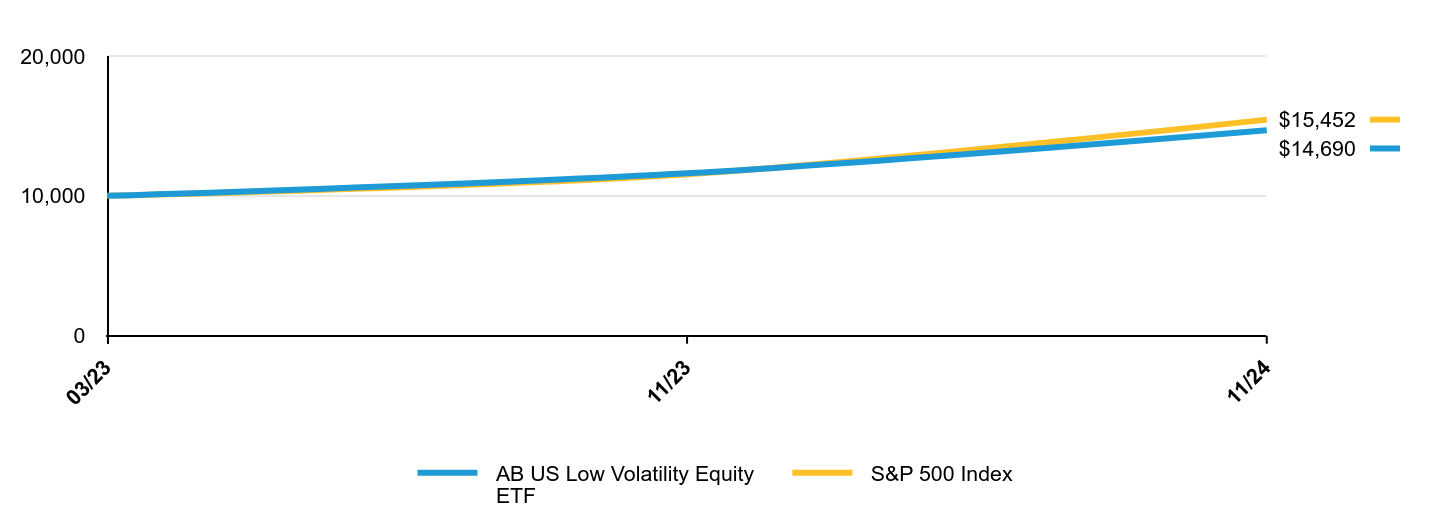

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period ended November 30, 2024, the Fund underperformed the Standard & Poor's (“S&P”) 500 Index (the “benchmark”). Overall security selection drove the underperformance. Selection within technology and financials detracted the most, while selection within health care and consumer staples contributed and offset some losses. Sector allocation was also negative. Gains from underweights to materials and energy were offset by losses from overweights to health care and utilities.

Top contributors to performance:

Top detractors from performance: