AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON DECEMBER 1, 2015 REGISTRATION STATEMENT NO. 333-200192 UNITED STATES SECURITIES AND EXCHANGE COMMMISSION Washington, D.C. 20549 PRE-EFFECTIVE AMENDMENT NO. 3 TO FORM S-3 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 FIRST NBC BANK HOLDING COMPANY (Exact name of registrant as specified in its charter) Louisiana 14-1985604 (State of incorporation or organization) (I.R.S. Employer Identification Number) 210 Baronne Street New Orleans, Louisiana 70112 (Address of principal executive officers and zip code) Ashton J. Ryan, Jr. President and Chief Executive Officer First NBC Bank Holding Company 210 Baronne Street New Orleans, Louisiana 70112 (504) 566-8000 (Name, address, including zip code, and telephone number, including area code, of agent for service) With a copy to: Geoffrey S. Kay, Esq. Fenimore, Kay, Harrison & Ford, LLP 812 San Antonio Street, Suite 600 Austin, Texas 78701 (512) 583-5909 Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective. If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box If this form is a post-effective amendment to a registration statement pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

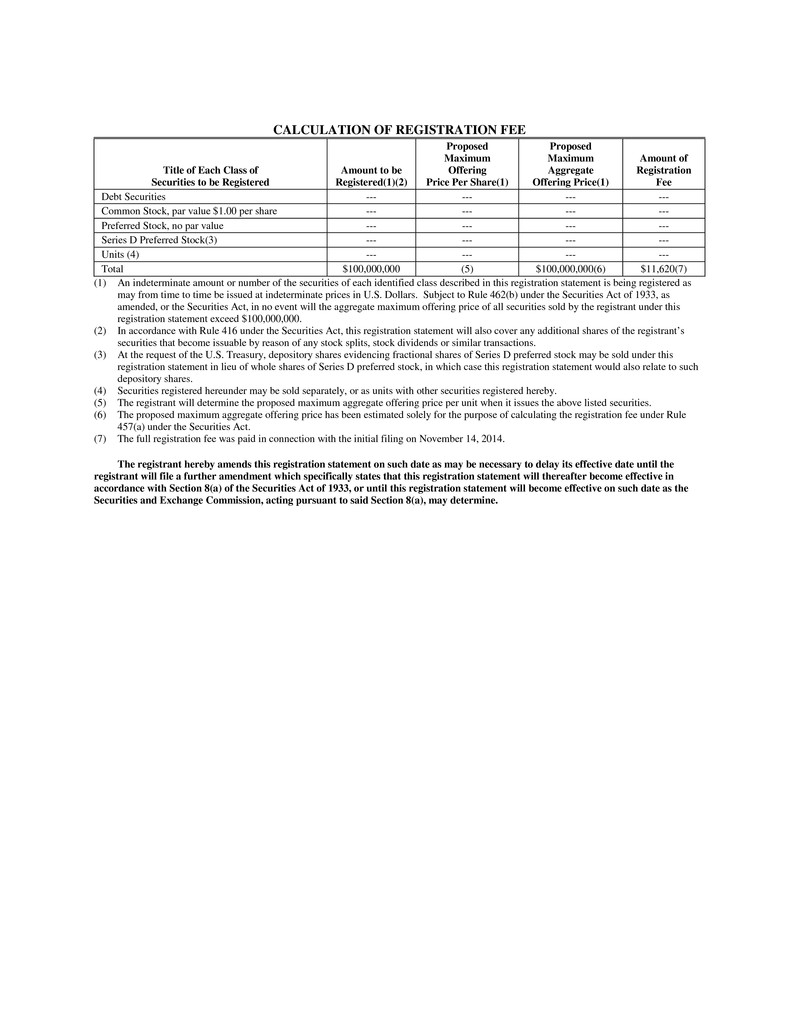

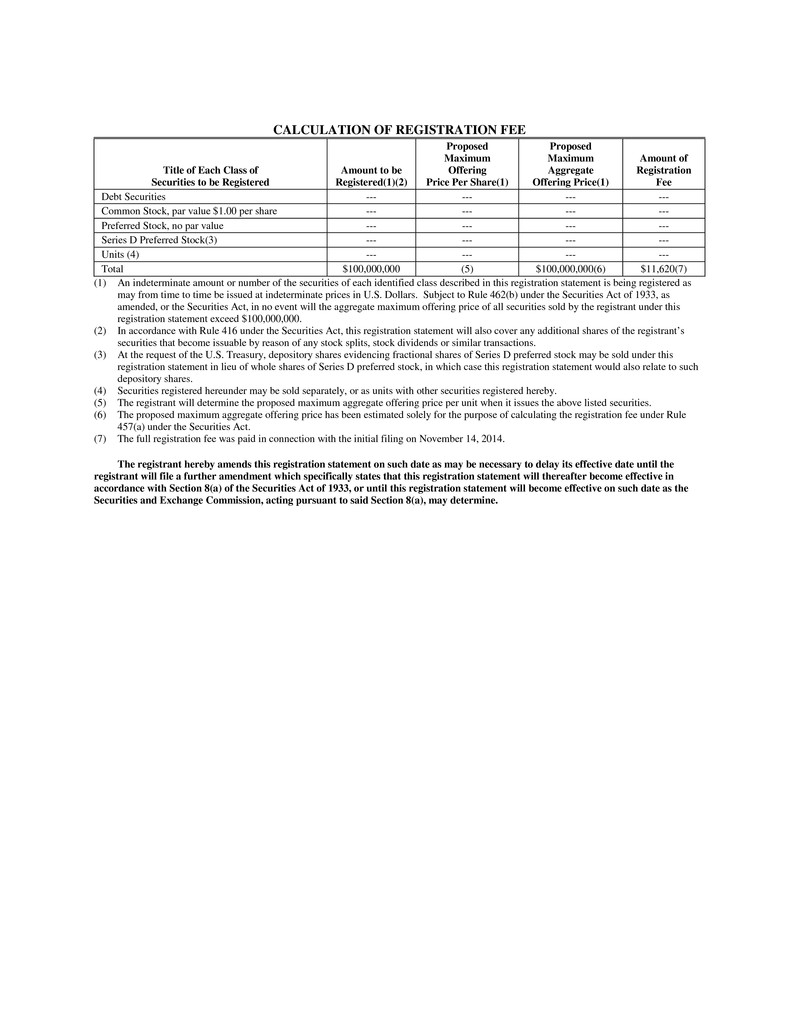

CALCULATION OF REGISTRATION FEE Title of Each Class of Securities to be Registered Amount to be Registered(1)(2) Proposed Maximum Offering Price Per Share(1) Proposed Maximum Aggregate Offering Price(1) Amount of Registration Fee Debt Securities --- --- --- --- Common Stock, par value $1.00 per share --- --- --- --- Preferred Stock, no par value --- --- --- --- Series D Preferred Stock(3) --- --- --- --- Units (4) --- --- --- --- Total $100,000,000 (5) $100,000,000(6) $11,620(7) (1) An indeterminate amount or number of the securities of each identified class described in this registration statement is being registered as may from time to time be issued at indeterminate prices in U.S. Dollars. Subject to Rule 462(b) under the Securities Act of 1933, as amended, or the Securities Act, in no event will the aggregate maximum offering price of all securities sold by the registrant under this registration statement exceed $100,000,000. (2) In accordance with Rule 416 under the Securities Act, this registration statement will also cover any additional shares of the registrant’s securities that become issuable by reason of any stock splits, stock dividends or similar transactions. (3) At the request of the U.S. Treasury, depository shares evidencing fractional shares of Series D preferred stock may be sold under this registration statement in lieu of whole shares of Series D preferred stock, in which case this registration statement would also relate to such depository shares. (4) Securities registered hereunder may be sold separately, or as units with other securities registered hereby. (5) The registrant will determine the proposed maximum aggregate offering price per unit when it issues the above listed securities. (6) The proposed maximum aggregate offering price has been estimated solely for the purpose of calculating the registration fee under Rule 457(a) under the Securities Act. (7) The full registration fee was paid in connection with the initial filing on November 14, 2014. The registrant hereby amends this registration statement on such date as may be necessary to delay its effective date until the registrant will file a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

2 EXPLANATORY NOTE This Amendment No. 3 is being filed solely for the purpose of correcting Exhibit 23.2 to Amendment No. 1 to this Registration Statement on Form S-3 (File No. 333-200192) and Exhibit 23.2 to Amendment No. 2 to this Registration Statement to include the conformed signature of Ernst & Young LLP. The corrected exhibits are included as Exhibit 23.2 and Exhibit 23.3, respectively, to this Amendment No. 3. This Amendment No. 3 does not modify any provisions of the preliminary prospectus constituting Part I of the Registration Statement or Items 13, 14, 15 or 17 of Part II of the Registration Statement. Accordingly, those portions have been omitted from this filing. ITEM 16. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES. The exhibits required to be filed as part of this registration statement are listed in the Exhibit Index attached hereto and are incorporated herein by reference.

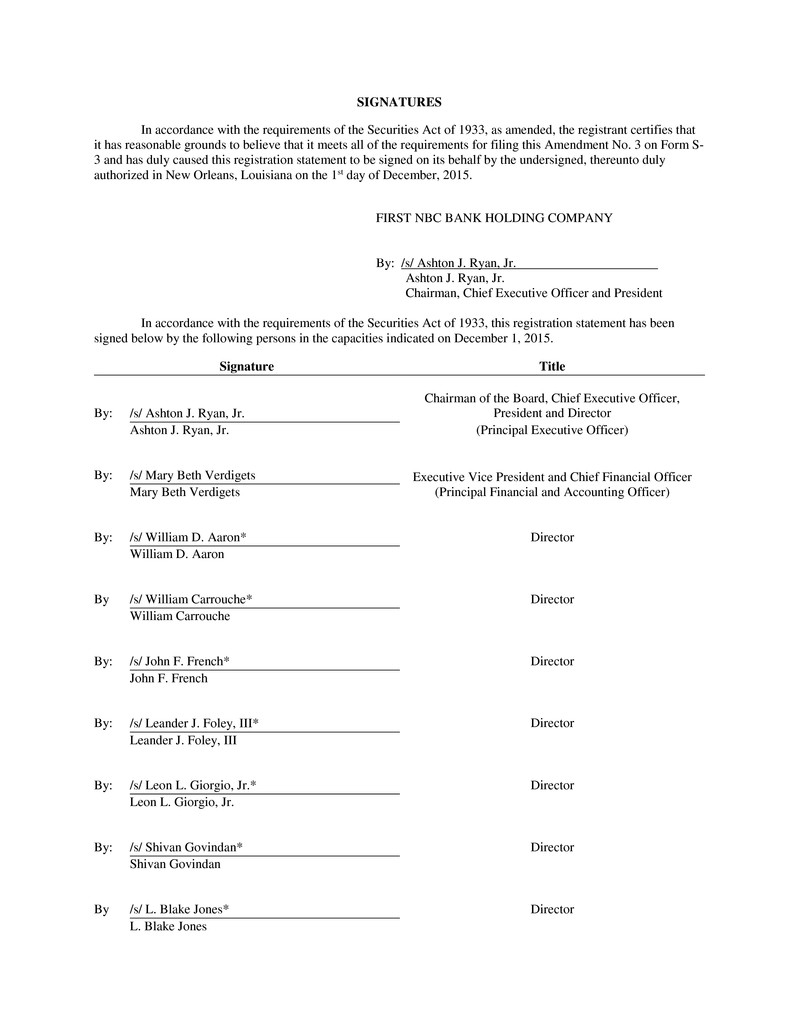

SIGNATURES In accordance with the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing this Amendment No. 3 on Form S- 3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in New Orleans, Louisiana on the 1st day of December, 2015. FIRST NBC BANK HOLDING COMPANY By: /s/ Ashton J. Ryan, Jr. Ashton J. Ryan, Jr. Chairman, Chief Executive Officer and President In accordance with the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the capacities indicated on December 1, 2015. Signature Title By: /s/ Ashton J. Ryan, Jr. Chairman of the Board, Chief Executive Officer, President and Director Ashton J. Ryan, Jr. (Principal Executive Officer) By: /s/ Mary Beth Verdigets Executive Vice President and Chief Financial Officer Mary Beth Verdigets (Principal Financial and Accounting Officer) By: /s/ William D. Aaron* Director William D. Aaron By /s/ William Carrouche* Director William Carrouche By: /s/ John F. French* Director John F. French By: /s/ Leander J. Foley, III* Director Leander J. Foley, III By: /s/ Leon L. Giorgio, Jr.* Director Leon L. Giorgio, Jr. By: /s/ Shivan Govindan* Director Shivan Govindan By /s/ L. Blake Jones* Director L. Blake Jones

Signature Title By: /s/ Louis V. Lauricella* Director Louis V. Lauricella By: /s/ Mark G. Merlo* Director Mark G. Merlo By: /s/ Dr. Charles C. Teamer* Director Dr. Charles C. Teamer By: /s/ Joseph F. Toomy* Director Joseph F. Toomy *By: /s/ Ashton J. Ryan, Jr. Ashton J. Ryan, Jr. Attorney-in-Fact

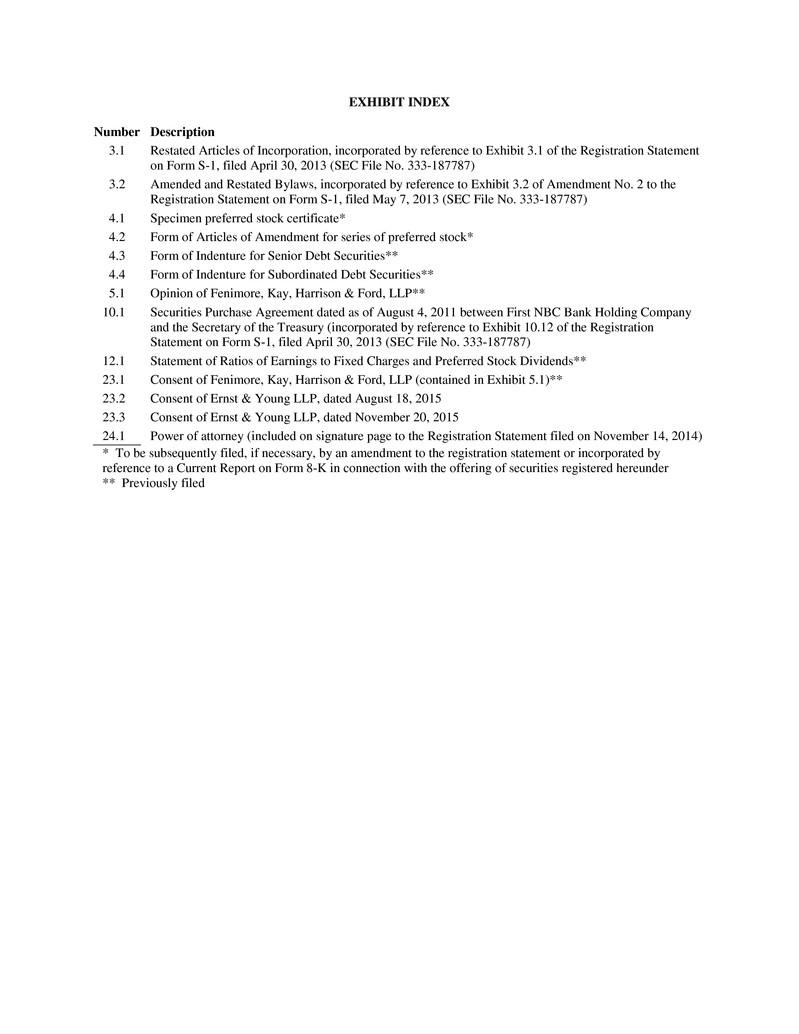

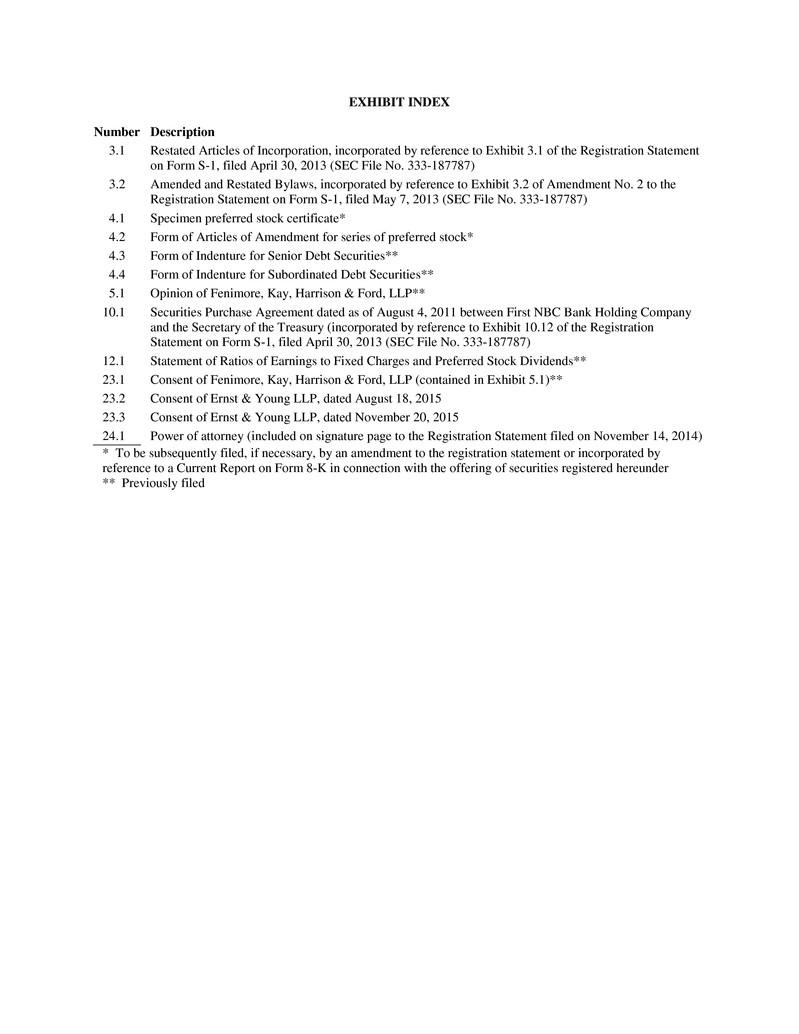

EXHIBIT INDEX Number Description 3.1 Restated Articles of Incorporation, incorporated by reference to Exhibit 3.1 of the Registration Statement on Form S-1, filed April 30, 2013 (SEC File No. 333-187787) 3.2 Amended and Restated Bylaws, incorporated by reference to Exhibit 3.2 of Amendment No. 2 to the Registration Statement on Form S-1, filed May 7, 2013 (SEC File No. 333-187787) 4.1 Specimen preferred stock certificate* 4.2 Form of Articles of Amendment for series of preferred stock* 4.3 Form of Indenture for Senior Debt Securities** 4.4 Form of Indenture for Subordinated Debt Securities** 5.1 Opinion of Fenimore, Kay, Harrison & Ford, LLP** 10.1 Securities Purchase Agreement dated as of August 4, 2011 between First NBC Bank Holding Company and the Secretary of the Treasury (incorporated by reference to Exhibit 10.12 of the Registration Statement on Form S-1, filed April 30, 2013 (SEC File No. 333-187787) 12.1 Statement of Ratios of Earnings to Fixed Charges and Preferred Stock Dividends** 23.1 Consent of Fenimore, Kay, Harrison & Ford, LLP (contained in Exhibit 5.1)** 23.2 Consent of Ernst & Young LLP, dated August 18, 2015 23.3 Consent of Ernst & Young LLP, dated November 20, 2015 24.1 Power of attorney (included on signature page to the Registration Statement filed on November 14, 2014) * To be subsequently filed, if necessary, by an amendment to the registration statement or incorporated by reference to a Current Report on Form 8-K in connection with the offering of securities registered hereunder ** Previously filed