UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box: |

| |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

FIRST NBC BANK HOLDING COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| | |

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| ¨ | Fee paid previously by written preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amounts Previously Paid: |

| | | |

| | 2) | Form Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date FIled: |

| | | |

October 17, 2016

Dear Shareholder:

You are cordially invited to attend the 2016 annual meeting of the shareholders of First NBC Bank Holding Company. The meeting will be held on Thursday, November 17, 2016, at 11:00 a.m., local time, at the Renaissance New Orleans Pere Marquette Hotel, located at 817 Common Street, New Orleans, Louisiana 70112 in the 2nd floor ballroom.

Information about the annual meeting, including the items to be considered and acted upon by the shareholders, is presented in the following notice of annual meeting and proxy statement. Following the formal business of the annual meeting, management will report on our operations during 2015, comment on our outlook for 2016 and take questions from shareholders in attendance.

We hope that you will attend the 2016 annual meeting. However, whether or not you plan to attend, please complete, sign, date and return the enclosed proxy card, or register your vote by proxy over the Internet or by telephone, as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. Returning your proxy will NOT deprive you of your right to attend the meeting, to change or revoke your vote, or to vote your shares in person at the meeting. You will find the procedures to follow if you wish to revoke your proxy or otherwise change your vote on page 3 of this proxy statement. Your vote is very important.

We look forward to seeing you at the meeting.

|

| | |

| | Ashton J. Ryan, Jr. |

| | President and |

| | Chief Executive Officer |

210 Baronne Street New Orleans, Louisiana 70112 (504) 671-3800 Fax (504) 671-3481

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OF FIRST NBC BANK HOLDING COMPANY

To Be Held on November 17, 2016

The 2016 annual meeting of shareholders of First NBC Bank Holding Company will be held on Thursday, November 17, 2016, at 11:00 a.m., local time, at the Renaissance New Orleans Pere Marquette Hotel, located at 817 Common Street, New Orleans, Louisiana 70112 in the 2nd floor ballroom for the following purposes:

| |

| 1. | To elect directors; and |

| |

| 2. | To transact such other business that may properly come before the meeting or any adjournment or postponement of the meeting. |

Our Board of Directors has fixed the close of business on October 7, 2016 as the record date for the determination of the shareholders entitled to notice of to attend, and to vote at, the meeting. Information about the annual meeting, including the items to be considered and acted upon by the shareholders, is presented in the following proxy statement related to the annual meeting. We have also enclosed a copy of our 2015 Form 10-K.

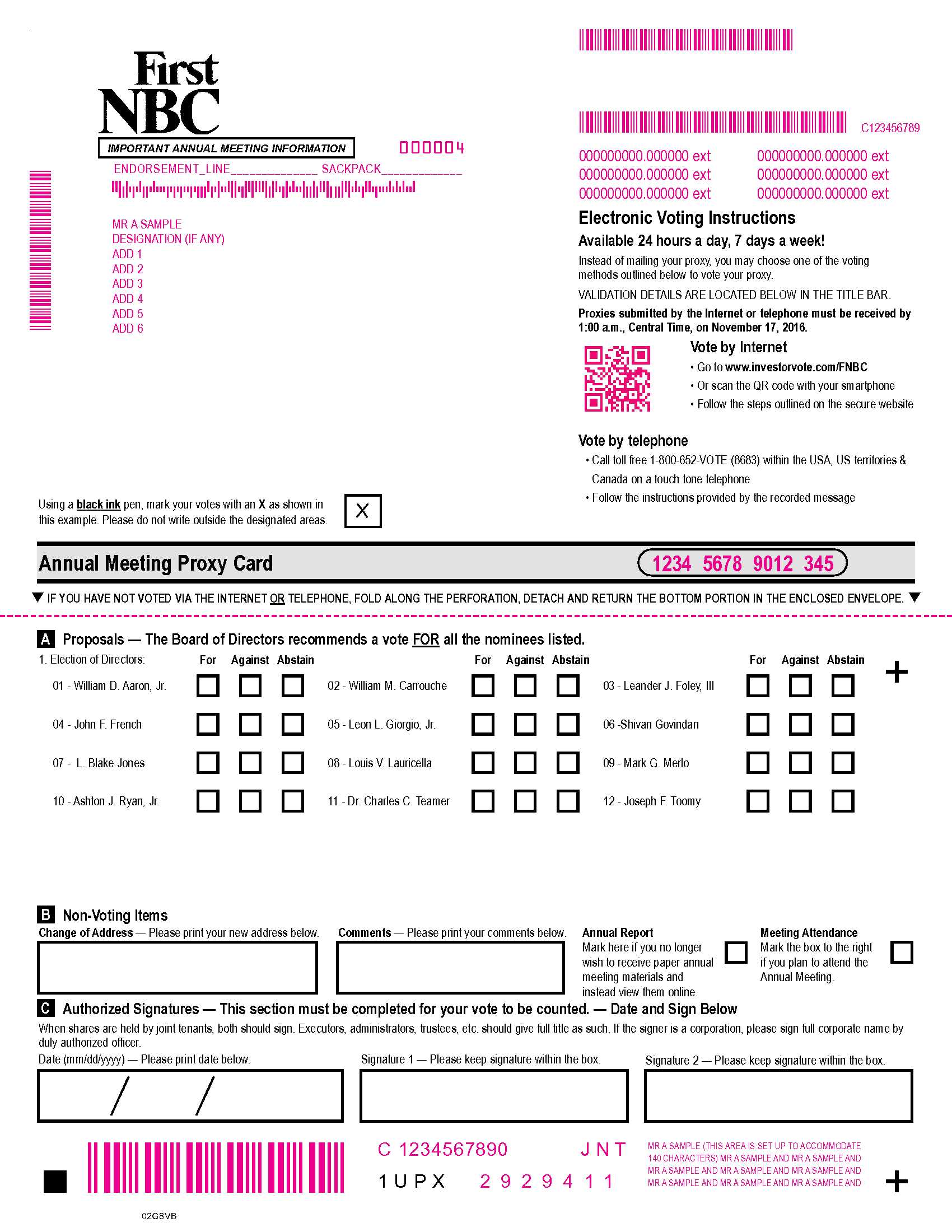

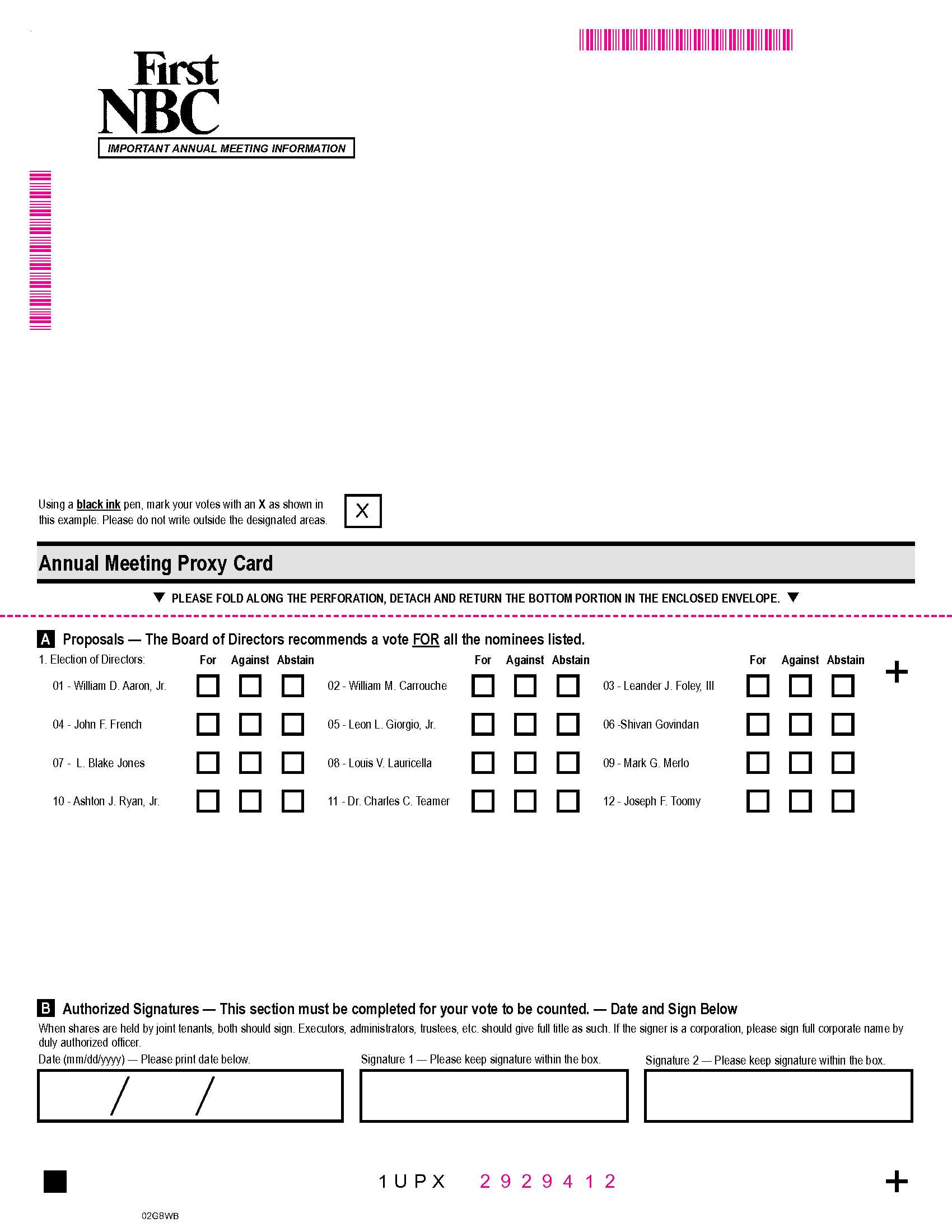

Your vote is important. Whether or not you expect to attend the meeting in person, please complete, sign, date and return the enclosed proxy card, or register your vote by proxy over the Internet or by telephone, as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. If you hold your shares in street name through a brokerage firm, telephone or Internet voting will be available to you only if offered by your bank or broker, which will provide you with instructions on how to vote the shares held in your account. You may revoke your proxy at any time prior to its use at the meeting. |

| | |

| | By Order of the Board of Directors |

| | |

|

| | |

| | Ashton J. Ryan, Jr. |

| | President and Chief Executive Officer |

| | |

|

| |

| New Orleans, Louisiana | |

| October 17, 2016 | |

|

|

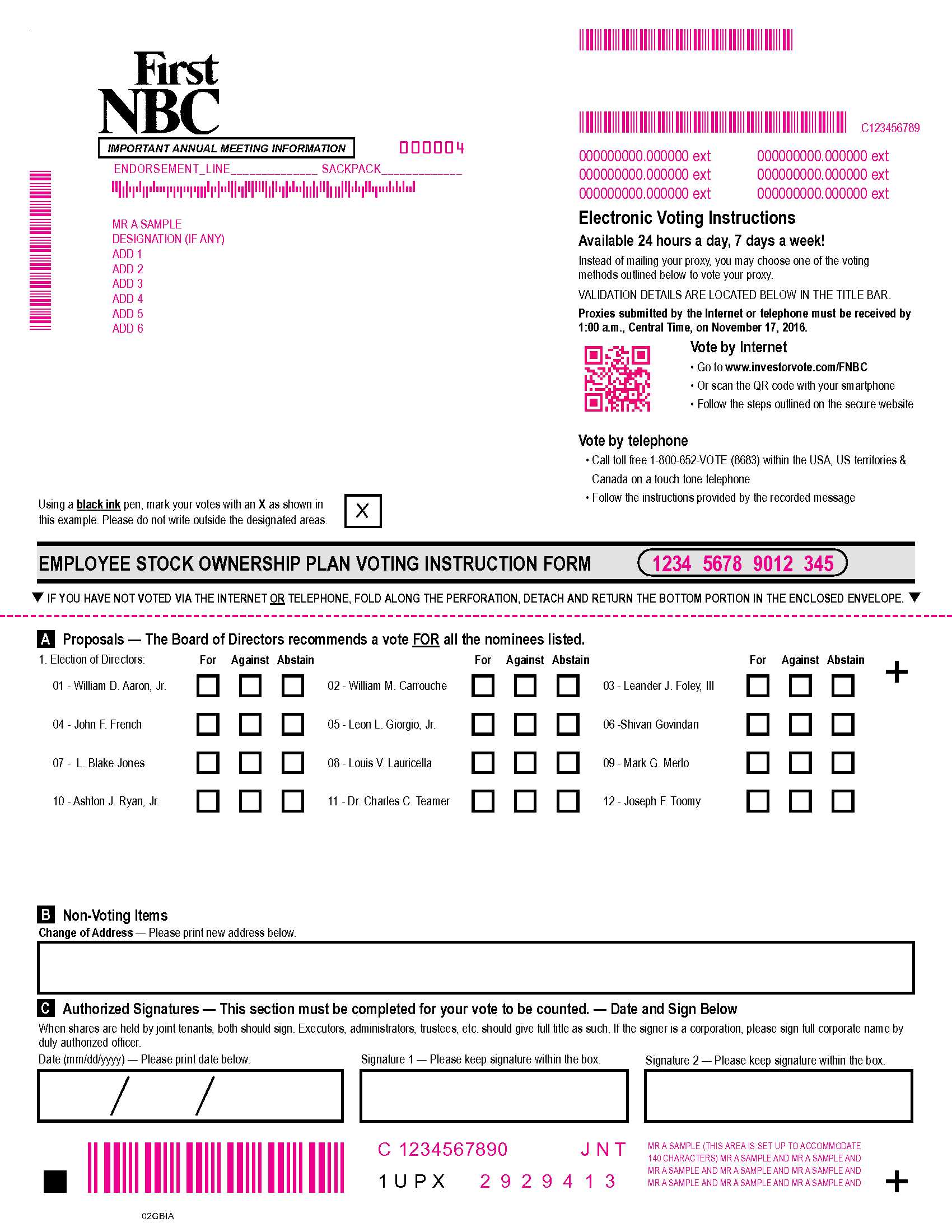

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 17, 2016 |

| This proxy statement, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 is available free of charge on the following website: www.firstnbcbank.com. |

|

| | |

TABLE OF CONTENTS |

| | Page |

|

| ABOUT THE ANNUAL MEETING | 1 |

|

| | |

| ELECTION OF DIRECTORS | 5 |

|

| General | 5 |

|

| Information Regarding Director Nominees | 5 |

|

| | |

| INDEPENDENT PUBLIC ACCOUNTANTS | 9 |

|

| Ernst & Young Fees | 9 |

|

| Audit Committee Pre-Approval Policies and Procedures | 9 |

|

| Report of the Audit Committee of the Board of Directors | 10 |

|

| | |

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | 11 |

|

| Board Independence | 11 |

|

| Leadership Structure | 11 |

|

| Compensation Committee Interlocks and Insider Participation | 11 |

|

| Shareholder Communications with Our Board of Directors | 12 |

|

| Director Qualifications | 12 |

|

| Board Meetings | 13 |

|

| Board Committees | 13 |

|

| Information Regarding Executive Officers | 15 |

|

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 17 |

|

| | |

| COMPENSATION INFORMATION | 20 |

|

| Summary Compensation Table | 20 |

|

| All Other Compensation | 20 |

|

| Stock Incentive Plan | 21 |

|

| Outstanding Equity Awards at Fiscal Year-End | 22 |

|

| 401(k) Retirement Plan | 22 |

|

| Deferred Compensation Plan | 23 |

|

| Employee Stock Ownership Plan | 23 |

|

| Director Compensation | 23 |

|

| | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 24 |

|

| | |

| SHAREHOLDER PROPOSALS AND NOMINATIONS | 26 |

|

| | |

| COST OF ANNUAL MEETING AND PROXY SOLICITATION | 26 |

|

| | |

| HOUSEHOLDING | 26 |

|

| | |

| SECTION 16(A) BENEFICIAL OWNERSHIP COMPLIANCE | 27 |

|

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 17, 2016

We are providing these proxy materials in connection with our 2016 annual meeting of shareholders. This proxy statement and the accompanying proxy card are being first mailed or electronically transmitted to our shareholders on or about October 17, 2016. You may also view our proxy statement electronically on our website (www.firstnbcbank.com) under the Investor Relations page. This proxy statement contains important information for you to consider regarding the matters to be presented at the meeting. Please read it carefully.

When we refer in this proxy statement to “we,” “our,” and “us,” we are referring to First NBC Bank Holding Company, unless the context indicates otherwise. When we refer to “you” and “your,” we are referring to the shareholder reading this proxy statement.

ABOUT THE ANNUAL MEETING

| |

| Q: | Who is soliciting my vote? |

| |

| A: | Our Board of Directors is soliciting your vote for the 2016 annual meeting. |

| |

| A: | A proxy is a legal designation of another person, the proxy, to vote on your behalf. By completing and returning the enclosed proxy card, or registering your proxy vote by telephone or over the Internet, you are giving the named proxies, who were appointed by our Board, the authority to vote your shares in the manner that you indicate on your proxy card or by phone or Internet. |

| |

| Q: | What does it mean if I receive more than one proxy card? |

| |

| A: | It generally means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy cards you receive. |

| |

| Q: | Who is entitled to vote at the annual meeting? |

| |

| A: | You are entitled to receive notice of and to vote at the 2016 annual meeting if you owned shares of our common stock at the close of business on October 7, 2016, the record date for the meeting. |

| |

| Q. | How many votes can be cast by all shareholders? |

| |

| A. | As of October 7, 2016, there were 19,230,911 shares of common stock outstanding and entitled to vote. Each share of our common stock is entitled to one vote on each matter presented. |

| |

| Q: | How many votes must be present to hold the annual meeting? |

| |

| A: | A majority of our issued and outstanding shares as of the record date, or 9,615,456 shares, must be present at the annual meeting in order to conduct business. This is called a “quorum.” Your shares will be counted as present at the annual meeting if you are present and vote in person at the annual meeting or a proxy card has been properly submitted by you or on your behalf. |

| |

| Q: | What is the difference between a “shareholder of record” and a “street name” holder? |

| |

| A: | These terms describe how your shares are held. If your shares are registered directly in your name with our stock records, you are considered the “shareholder of record” with respect to those shares, and these proxy materials are being sent directly to you by us. If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or nominee, who is considered the shareholder of record with respect to those shares. |

| |

| Q. | How do I vote my shares? |

| |

| A. | If you are a “shareholder of record,” you have several choices. You can vote your proxy: |

| |

| • | by returning the enclosed proxy card in the enclosed postage pre-paid envelope; |

Please refer to the specific instructions set forth on the enclosed proxy card. You may also vote your shares in person at the meeting. We encourage you to attend the meeting, and voting by proxy will not affect your right to attend the meeting and vote in person. However, to ensure that your shares are voted in accordance with your wishes and that a quorum is present at the meeting so that we can transact business, we urge you to register your vote by proxy as promptly as possible. Your prompt response will help reduce proxy solicitation costs. For security reasons, our electronic voting system has been designed to authenticate your identity as a shareholder. If you hold your shares in “street name,” your broker, bank, trustee or nominee will provide you with materials and instructions for voting your shares.

| |

| Q. | What if I fail to vote for some of the matters listed on my proxy card? |

| |

| A. | If you vote by proxy, your proxy will be voted in accordance with your instructions. However, if you return a signed proxy without indicating your vote on one or more proposals, your proxy will be voted in accordance with the recommendations of the Board as to those proposals for which no vote is indicated. |

| |

| Q: | Can I vote in person at the meeting? |

| |

| A: | If you are a “shareholder of record,” you may vote your shares in person at the meeting. If you hold your shares in “street name,” you must obtain a proxy from your broker, bank, trustee or nominee, giving you the right to vote the shares at the meeting. |

| |

| Q: | Will my broker vote my shares for me if I do not return my voting instructions to my broker? |

| |

| A: | Brokers do not have the authority to vote shares held in brokerage accounts in connection with the election of directors or certain other non-routine items, unless they have received instructions from their clients. Accordingly, if your shares are held in a brokerage account and you fail to instruct your broker how to vote your shares, your shares will not be voted in the election of directors. |

| |

| Q: | What are my choices when voting? |

| |

| A: | Election of Directors (Item One). You may vote “FOR” or “AGAINST,” or you may “ABSTAIN” from voting, with respect to each director nominee. |

| |

| Q: | How does the Board of Directors recommend that I vote my shares? |

| |

| A: | The Board of Directors recommends a vote “FOR” the election of each of the 12 director nominees |

| |

| Q: | Do I have the right to cumulate my votes in the election of directors? |

| |

| A. | No. Our articles of incorporation do not provide for cumulative voting rights. |

| |

| Q: | How are abstentions and broker non-votes treated? |

| |

| A: | If you abstain from voting with respect to any director nominee or proposal, your shares will not be voted with respect to the nominee or proposal. However, your shares will be counted for purposes of determining whether there is a quorum. |

A broker “non-vote” occurs when the beneficial owner of shares held in a brokerage account fails to instruct his or her broker as to how to vote the shares on a particular proposal for which the broker does not have discretionary voting power. Broker “non-votes” are counted as present for purposes of determining whether there is a quorum. However, they are not included as a vote in favor of or against the proposal.

Because directors are elected by plurality, abstentions and broker “non-votes” will have no effect on any of the matters to be considered at the meeting.

| |

| Q: | Can I change my vote or revoke my proxy after I have mailed in my proxy card or voted by telephone or over the Internet? |

| |

| A: | You may change your vote or revoke your proxy by doing one of the following: |

| |

| • | by delivering a written notice of revocation to our Corporate Secretary that is actually received prior to the meeting, stating that you revoke your proxy; |

| |

| • | by delivering a later-dated proxy (including a telephone or Internet vote) that is received prior to the meeting in accordance with the instructions included on the proxy card; or |

| |

| • | by attending the meeting and voting your shares in person. |

| |

| Q: | What vote is required to approve each item? |

| |

| A: | A nominee will be elected to the Board of Directors if the nominee receives a plurality of the votes cast, which means that the 12 director nominees receiving the highest number of votes will be elected to the Board of Directors. However, because the election of directors is uncontested, meaning there are as many nominees as there are positions on the Board of Directors to be filled, a nominee who is elected but receives more votes against than for election will serve as a director for a term of 90 days or until an individual is selected by the Board of Directors to fill the office held by such director, whichever is earlier. |

| |

| Q: | Who will count the votes? |

| |

| A: | Computershare, Inc., our inspector, will tabulate the votes at the meeting. |

| |

| Q: | What do I need to bring to the annual meeting and when should I arrive? |

| |

| A: | If you plan to vote shares held in the name of a bank, broker or other holder of record, a brokerage statement, letter, or proxy from your bank or broker is an example of proof of ownership and will need to be presented. Any holder of a proxy from a shareholder must present the proxy card, properly executed, to be admitted. Shareholders and proxy holders may also be required to present a form of photo identification, such as a driver’s license. |

Seating at the annual meeting may be limited. In order to ensure that you are seated by the commencement of the annual meeting at 11:00 a.m. on November 17, 2016, we recommend you arrive early.

If you have any further questions about voting your shares or attending the meeting, please call William Roohi at (504) 671-3870.

| |

| Q: | How can I receive future shareholder communications electronically? |

| |

| A: | If you received your annual meeting materials by mail, we encourage you to conserve natural resources, and help us reduce printing and mailing costs, by electing to receive your shareholder communications by e-mail. Your choice will remain in effect until you notify us otherwise. Electronic delivery can also help reduce the number of bulky documents in your personal files and eliminate duplicate mailings. To sign up for future electronic delivery, you may do one of the following: |

| |

| • | Request future electronic delivery when you vote via the Internet; or |

| |

| • | Notify William Roohi by mail at the address on the first page of this proxy statement, by telephone at (504) 671-3870, or by email at broohi@firstnbcbank.com. |

| |

| Q: | Could other matters be decided at the annual meeting? |

| |

| A: | We are not aware of any other matters that will be considered at the annual meeting. If any other matters arise at the annual meeting that are properly presented at the meeting, the proxies will be voted at the discretion of the proxy holders. |

| |

| Q: | What happens if the meeting is postponed or adjourned? |

| |

| A: | Your proxy will still be good and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted. |

| |

| Q: | Where can I find the voting results of the annual meeting? |

Preliminary voting results will be announced at the annual meeting. Final voting results will be tallied by the inspector of election after the vote at the annual meeting. We will publish the final voting results in a Current Report on Form 8-K, which we are required to file with the Securities and Exchange Commission within four business days following the annual meeting.

ELECTION OF DIRECTORS

General

At the annual meeting, our shareholders will be asked to elect 12 persons to serve as directors until the 2017 annual meeting of shareholders or until their successors are elected and qualified. Our Board of Directors has nominated the following 12 individuals to serve in these positions: William D. Aaron, Jr., William M. Carrouche, Leander J. Foley, III, John F. French, Leon L. Giorgio, Jr., Shivan Govindan, L. Blake Jones, Louis V. Lauricella, Mark G. Merlo, Ashton J. Ryan, Jr., Dr. Charles C. Teamer and Joseph F. Toomy.

We have entered into an agreement with Castle Creek Capital Partners IV, L.P. that permits it to appoint one representative to our Board of Directors, and one nonvoting observer to the Board of Directors of First NBC Bank, for so long as Castle Creek Capital Partners IV, L.P. and its affiliates own at least 81,632 shares of our common stock. Mark G. Merlo currently serves on our Board of Directors as the representative of Castle Creek Capital Partners IV, L.P.

Each of the nominees was approved by our Board of Directors upon the recommendation of the Nominating and Governance Committee. In addition, each of the nominees has previously served as a director of First NBC Bank Holding Company or First NBC Bank and has agreed to serve as a director, if elected, for an additional term. If any of the nominees should become unable to serve as a director, our Board of Directors may designate a substitute nominee. In that case, the persons named on the proxy card as proxies may vote for the substitute nominee or nominees recommended by our Board of Directors. We have no reason to believe that any of the 12 nominees for election named above will be unable to serve.

The following table sets forth certain information regarding our directors:

|

| | | | | | | | |

| Name | | Age | | Position with First NBC

Bank Holding Company (HC) | | Position with

First NBC Bank | | HC Director Since |

| William D. Aaron, Jr. | | 65 | | Director | | Director | | 2014 |

| William M. Carrouche | | 75 | | Director | | Director | | 2007 |

| Leander J. Foley, III | | 66 | | Director | | None | | 2009 |

| John F. French | | 51 | | Director | | Director | | 2007 |

| Leon L. Giorgio, Jr. | | 65 | | Vice Chairman | | Vice Chairman | | 2007 |

| Shivan Govindan | | 41 | | Chairman | | Director | | 2007 |

| L. Blake Jones | | 65 | | Director | | Director | | 2007 |

| Louis V. Lauricella | | 60 | | Director | | None | | 2007 |

| Mark G. Merlo | | 52 | | Director | | None | | 2011 |

| Ashton J. Ryan, Jr. | | 66 | | President & Chief Executive Officer | | President & Chief Executive Officer | | 2007 |

| Dr. Charles C. Teamer | | 80 | | Director | | Director | | 2009 |

| Joseph F. Toomy | | 65 | | Director | | Director | | 2007 |

Information Regarding Director Nominees

A brief description of the background of each of our directors is set forth below. No director has a family relationship with any other executive officer or director.

William D. Aaron, Jr. Mr. Aaron is the Managing Shareholder of Aaron & Gianna, PLC A Professional Law Corporation based in New Orleans. Prior to joining the predecessor to his current law firm in January 2000, he served as a partner at Phelps Dunbar, LLP. Mr. Aaron has more than 38 years of legal experience practicing in the public and private sectors and is licensed to practice law in Louisiana, Texas and the District of Columbia. His public sector experience includes service as City Attorney for the City of New Orleans, Assistant District Counsel for the U. S. Small Business Administration, and Special Prosecutor with the Orleans Parish District Attorney’s Office. He currently serves as Chairman of the Jefferson Business Council and is a former Board Chairman for the New Orleans Chamber of Commerce. He remains actively involved with the New Orleans Chamber of Commerce,

where he serves as Co-chair of the Legislative Affairs Committee and as a member of the Chairman’s Council. Mr. Aaron is a member of the Boards of Directors of the Pontchartrain Park Community Development Corporation and Laureate Academy Charter School. He is a former Director of several organizations including Greater New Orleans, Inc. the New Orleans Museum of Art, the New Orleans Neighborhood Development Collaborative, Volunteers of America and CrimeStoppers. Mr. Aaron joined the holding company board in 2014, and has served as a director of First NBC Bank since its inception. Mr. Aaron is a graduate of Duke University, B.A. 1972, and Loyola University School of Law, J.D. 1977. Mr. Aaron’s extensive legal experience, as well as his long-term relationships with the New Orleans business and civic community make him a valuable member of our Board of Directors.

William M. Carrouche. Mr. Carrouche retired in 2013 after serving as President of the Fire Fighters’ Pension & Relief Fund for the City of New Orleans since 1975. He also served as a Fire Deputy Chief of the New Orleans Fire Department for 36 years. Mr. Carrouche served as Vice President and Board Member of the New Orleans Fire Federal Credit Union for over 20 years. Mr. Carrouche’s extensive relationships within the New Orleans business and civic community, as well as his business experience, make him a valuable member of our Board of Directors.

Leander J. Foley, III. Since 2002, Mr. Foley has served as Managing Director of Capitol Hill Partners (formerly Foley, Maldonado & O’Toole), a consulting firm that advises clients in matters before the United States Congress and the Executive Branch in various policy areas, including banking and financial services, community and economic development, asset building, rural and agricultural programs and small business development. Mr. Foley serves on the boards of directors of One United Bank, Alluvion Securities and the Cotton Exchange, LLC. Mr. Foley also served as a director of Dryades Bancshares, Inc. and Dryades Savings Bank, FSB until its acquisition by First NBC Bank in 2010. Mr. Foley is a graduate of Georgetown University, B.A., 1970. Mr. Foley’s extensive experience as a director for numerous financial services companies, including two banking organizations, one broker-dealer and one registered investment advisor, as well as his long-standing knowledge of and relationships in the New Orleans business community, add significant value to our Board of Directors.

John F. French. Since 1992, Mr. French has served as President of JAB - New Orleans, Inc., a Jos. A. Bank Clothiers franchise. He operates 12 Jos. A. Bank retail clothing locations across the country. Mr. French also serves as Managing Member of Penthouse Apartment Management, LLC, and as a director and principal of Biltmore Property Group, LLC and its affiliate The Columbus Group, Inc., which develop, own and operate community-oriented shopping centers and mixed use destinations. In addition to his business activities, he serves on the Boards of Directors of the Audubon Nature Institute and the Fenner French Foundation. Mr. French is a graduate of the University of the South, B.A., 1986, and the Freeman School of Business at Tulane University, M.B.A., 1992. He is also licensed by the State of Louisiana as a real estate broker. Mr. French’s extensive commercial real estate experience, his experience overseeing the successful growth of a local retail business into a national competitor, as well as his long-standing relationships in the local business and civic community, enable him to provide valuable insights to our Board of Directors.

Leon L Giorgio, Jr. Mr. Giorgio serves as Chairman, Chief Executive Officer, and President of Select Properties, Ltd.; Select Properties, Ltd. Realty; and their associated companies, which were co-founded by Mr. Giorgio in 1982 and which specialize in commercial real estate acquisitions, development, management, rehabilitation, investments, brokerage and design. A licensed real estate broker in the States of Louisiana and Mississippi, he heads an IREM Accredited Management Organization. Additionally, Select is General Partner/Managing Member of several real estate limited partnerships and limited liability companies which are actively engaged in commercial real estate and Mellow Mushroom restaurants in New Orleans, Covington and Lafayette. In addition to his own business activities, Mr. Giorgio represents Jefferson Parish on the Regional Planning Commission and served as co-chair of Jefferson Parish Envision 2020, which developed and is implementing a comprehensive 20-year land use plan. He currently serves on the Boards of Director of numerous civic and business organizations, including The Louisiana Community and Technical College System Foundation, Delgado Community College Foundation and the Jefferson Chamber of Commerce. He also serves on the University of New Orleans President’s Council. Mr. Giorgio is a graduate of the University of Southern Mississippi, B.S., 1972. Mr. Giorgio’s extensive experience in real estate and finance in the New Orleans metropolitan area and in the State of Louisiana, together with his long-standing relationships within the New Orleans business and civic communities, make him well qualified to serve on our Board of Directors. Mr. Giorgio became our Vice Chairman in 2016.

Shivan Govindan. Mr. Govindan is Managing Member of Pilgrims and Indians Capital, LLC, and has been since 2016. Pilgrims & Indians Capital, LLC makes private equity and other investments in U.S. community banks

and other financial services companies. From May 2015 until 2016, he had been a Managing Member and Chief Investment Officer of Celeridem Capital Management, LLC. Celeridem Management, LLC made investments in financial technology companies. From 2004 to 2014, Mr. Govindan held various positions at Resource America, Inc., including President of Resource Financial Institutions Group, Inc., from 2005 to 2014, and Managing Director of Trapeza Capital Management, LLC from 2005 to 2014. From 2000 to 2004 he served as Principal of Beehive Ventures, LLC, and served as Director of Corporate Development for portfolio company CFM Partners, Inc, from 2002-2003. From 1998 to 2000, Mr. Govindan was Director of Corporate Development at IQ Financial Systems, Inc. Mr. Govindan began his career at Bankers Trust as an Analyst from 1995-1996, and as Associate from 1996 to 1998. He also serves on the boards of directors of Colorado National Bancorp, Bridge Entertainment, Inc., an online market research company, and Symbiont.io, Inc., a leading block chain startup. Mr. Govindan is a graduate of University of Pennsylvania, B.A., 1995. Mr. Govindan’s extensive experience with respect to capital acquisition and capital markets, risk management, financial analysis, and oversight within the banking industry, as well as his experience and oversight overseeing the growth of early stage portfolio companies, bring significant value to our Board of Directors. Mr. Govindan has served as our Chairman since 2016 after serving as Vice Chairman from 2013 to 2016.

L. Blake Jones. Since 1974, Mr. Jones has been a partner with Scheuermann & Jones, a Louisiana-based law firm that practices throughout much of the United States. He currently serves as the firm’s managing partner. In addition, he serves on the board of directors of Helix BioMedix, Inc., a public company focused on the biomedical industry, where he is a member of the audit committee and governance committee. He also serves on the national board of directors for the not-for-profit St. Jude’s Ranch for Children, where he is a member of the audit committee. Among other client’s, he has represented the Orleans Assessor’s Office, and currently is counsel to the City of New Orleans Department of Finance. He is a developer and investor in hotel, apartment, and commercial properties in the New Orleans area with specific reference to Tax credit and finance matters. Mr. Jones is a graduate of Louisiana State University, B.A., 1968, and Tulane Law School, J.D., 1972. Mr. Jones’ extensive legal experience, his service on the boards of other companies, including his public company experience, and his relationships within the New Orleans community, including past Chairman of Family Services of Greater New Orleans, make him a valued member of our Board of Directors.

Louis V. Lauricella. Since 1988, Mr. Lauricella has served as Managing Member and Director of Development for Lauricella Land Company, L.L.C., a commercial real estate development firm, and President of Lauricella & Associates, a real estate brokerage and consulting firm, each based in New Orleans. Since joining Lauricella Land Company, he has overseen the development of more than 2.0 million square feet of commercial space and secured financing of over $200 million for Lauricella projects. Mr. Lauricella serves as Chairman of the New Orleans Recreation Development (NORD) Foundation, on the NORD Commission and as Chairman of the Lauricella Land Company Foundation. He also serves on the Boards of GNO, Inc., the Jefferson Business Council and the Jefferson Community Foundation. Mr. Lauricella served as a director of First Bank & Trust (New Orleans) from 1994 to 2005. Mr. Lauricella is a graduate of Harvard College, B.A.,1978, and Tulane University, M.B.A. and J.D., 1984. Mr. Lauricella's extensive financing structures, his experience as a bank director, and his active involvement in many local professional and charitable organizations, enable him to provide valuable insight to our Board of Directors.

Mark G. Merlo. Since 1996, Mr. Merlo has worked at Castle Creek Capital, LLC, and is currently a Managing Principal of this private equity fund management company headquartered in Rancho Santa Fe, California. Mr. Merlo has over 21 years of experience in private equity investments and mergers and acquisitions in the financial services industry. Prior to joining Castle Creek, Mr. Merlo spent 11 years working at various bank and thrifts managing their investment portfolios, hedging interest rate risk and treasury operations. Mr. Merlo also serves as a director of Business Bancshares, Inc., its subsidiary Business Bank of St. Louis and Carlile Holdings, Inc. He has previously served on the boards of three other community banks. Mr. Merlo is a graduate of University of Missouri, Columbia, B.S., 1984. Mr. Merlo’s extensive prior experience as a director of numerous banking organizations, including his experience as a director of a publicly-traded banking organization, as well as his extensive experience with capital acquisition and management in the banking industry, add significant value to our Board of Directors.

Ashton J. Ryan, Jr. Mr. Ryan has served as President and Chief Executive Officer since its inception in 2006 and First NBC Bank Holding Company since its formation in 2007. From 1998 to 2005, Mr. Ryan served as President of First Trust Corporation and Chief Executive Officer and President of First Bank & Trust (New Orleans). From 1991 to 1998, he was President of First National Bank of Commerce, the lead bank of First Commerce

Corporation, until First Commerce Corporation’s acquisition by Bank One in 1998. Mr. Ryan also served as senior executive vice-president in charge of all customer contact functions at First Commerce Corporation from 1992 to 1998. From 1971 to 1981, Mr. Ryan was a staff auditor, and from 1981 to 1991 a partner, at Arthur Andersen & Co. Mr. Ryan served on the board of directors of Stewart Enterprises, a NASDAQ-listed company, until its sale in December 2013. He also serves on the boards of directors of GNO, Inc., Louisiana Cancer Research Consortium, Early Childhood and Family Learning Center, Gulf Coast Housing Partnership, Junior Achievement, Delgado Community College Foundation, UNO Foundation, East Jefferson General Hospital and the Urban League of New Orleans and was an adjunct professor at the A.B. Freeman School of Business at Tulane University for 30 years. Mr. Ryan is a graduate of Tulane University, B.S., 1969, and M.B.A., 1971. Mr. Ryan’s extensive business and banking experience, as well as his long-standing business and banking relationships in the community, make him exceptionally well qualified to serve on our Board of Directors.

Dr. Charles C. Teamer. Dr. Teamer previously served as Chairman of Dryades Savings Bank, FSB, a position he held from its inception in 1993 through its acquisition by First NBC Bank in 2010. Mr. Teamer was employed for more than 30 years with Dillard University, where he served in numerous capacities, including Vice President of Fiscal Affairs. He has also served as a member of the Board of Supervisors of the University of Louisiana System, the Board of Trustees of Tulane University and the Business and Higher Education Council at the University of New Orleans. Dr. Teamer has also held leadership positions in numerous New Orleans-based civic and community organizations. He has served as the Chairman of the boards of the Urban League of Greater New Orleans, the Board of Commissioners of the Port of New Orleans, the United Way, the Metropolitan Area Committee, the Greater New Orleans Foundation and the World Trade Center. He has also served on the boards of the Entergy-New Orleans, Alton Oschner Medical Foundation, the Audubon Institute, the Audubon Zoo Commission, the Southern Education Foundation, the New Orleans Center for Creative Arts, the Common Fund, the Children’s Hospital and the Boy Scouts of America. Dr. Teamer is a graduate of Clark Atlanta University, B.S., 1954. Dr. Teamer’s broad experience in leadership positions in local business, public and civic organizations, his long-standing relationships within the New Orleans community and his extensive experience as a bank director, enable him to provide significant contributions to our Board of Directors.

Joseph F. Toomy. Since 2000, Mr. Toomy has been an independent insurance broker based in Gretna, Louisiana. He served from 1981 to 2000 in numerous capacities with Delgado Community College in New Orleans, including as Vice Chancellor of Administrative Affairs. Mr. Toomy is a member of the Algiers Development District, a special taxing district and local redevelopment authority within the City of N.O. Mr. Toomy is Chairman of G-REDI, a redevelopment agency for the City of Gretna. Mr. Toomy is also a member of the Board of PACE (Program for the All Inclusive Care of the Elderly) Greater New Orleans, a non-profit corporation affiliated with the Archdiocese of New Orleans. From 1984 to 2008, he served as the District 85 member of the Louisiana House of Representatives. He is also a former Chairman of the Board of Commissioners of the Port of New Orleans. Mr. Toomy is a graduate of Tulane University, B.A., 1971, and M.B.A., 1973. Mr. Toomy’s long-standing business and personal relationships in the New Orleans metropolitan area, his extensive business and governmental sector experience, and long-time involvement in local civic organizations, make him a valued member of on our Board of Directors.

|

| | | | |

Our Board of Directors recommends that shareholders vote “FOR” the election of the 12 persons nominated by the Board to serve as directors. |

INDEPENDENT PUBLIC ACCOUNTANTS

Ernst & Young, LLP served as our independent registered public accounting firm for 2015. Representatives from that firm will be present at the annual meeting to answer appropriate questions and to make a statement if they desire. We have not yet selected our independent public accountants for 2016, although Ernst & Young, LLP has notified the Audit Committee that it is declining to stand for reappointment for 2016 as described below. The Audit Committee has commenced a process to select an independent registered public accounting firm for 2016 and expects to engage a firm after the date of this proxy statement, but prior to the annual meeting.

As previously disclosed, on August 30, 2016, Ernst & Young notified the Audit Committee that it was declining to stand for re-appointment as the independent auditors of our financial statements for the year ending December 31, 2016, and the effectiveness of our internal control over financial reporting as of December 31, 2016. The reports of Ernst & Young with respect to our consolidated financial statements for the years ended December 31, 2015 and 2014 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. During the fiscal years ended December 31, 2015 and 2014, and in the subsequent interim period through August 30, 2016, there were no disagreements with Ernst & Young on any matters of accounting principles or practices, financial statement disclosure, or auditing scope and procedures which, if not resolved to the satisfaction of Ernst & Young, would have caused Ernst & Young to make reference to the subject matter in its report. During the fiscal years ended December 31, 2015 and 2014, and in the subsequent interim period through August 30, 2016, there also were no reportable events as that term is described in Item 304(a)(1)(v) of Regulation S-K of the rules and regulations of the SEC, except that Ernst & Young’s report with respect to our internal control over financial reporting as of December 31, 2015 contained an adverse opinion on the effectiveness of our internal control over financial reporting as a consequence of the identified material weaknesses disclosed in greater detail in Item 9A of our Annual Report on Form 10-K for the year ended December 31, 2015.

Fees

The following table presents fees for professional services rendered by Ernst & Young for 2015 and 2014: |

| | | | | | | |

| | 2015 | | 2014 |

| Audit Fees | $ | 5,027,309 |

| | $ | 1,636,649 |

|

| Audit-related Fees | — |

| | 73,200 |

|

| Tax Fees | 222,450 |

| | 134,000 |

|

| All other fees | 1,500 |

| | 3,100 |

|

As defined by the Securities and Exchange Commission, (i) “audit fees” are fees for professional services rendered by the independent registered public accounting firm for the audit of our annual financial statements and review of financial statements included in our Form 10-Q, or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years; (ii) “audit-related fees” are fees for assurance and related services by our principal accountant that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “audit fees;” (iii) “tax fees” are fees for professional services rendered by our principal accountant for tax compliance, tax advice, and tax planning; and (iv) “all other fees” are fees for products and services provided by our principal accountant, other than the services reported under “audit fees,” “audit-related fees,” and “tax fees.”

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee selects and oversees our independent auditor. In addition, it is required to pre-approve the audit and non-audit services performed by our independent auditor to ensure that they do not impair the auditor’s independence. Federal securities regulations specify the types of non-audit services that an independent auditor may not provide to us and establish the Audit Committee’s responsibility for administration of the engagement of our independent auditors. During 2015, the Audit Committee pre-approved all services provided to us by our independent auditor.

Report of the Audit Committee of the Board of Directors

The Audit Committee’s general role is to assist the Board of Directors in overseeing the financial reporting process and related matters of First NBC Bank Holding Company and its consolidated subsidiaries, or First NBC. Each member of the committee is “independent” as that term is defined by the Nasdaq Stock Market rules.

The Audit Committee has reviewed and discussed with management and Ernst & Young LLP, First NBC’s independent registered public accounting firm, the audited financial statements of First NBC to be included in its Annual Report on Form 10-K for the year ended December 31, 2015.

The Audit Committee reviewed with the independent auditor, which is responsible for expressing an opinion on the conformity of those audited consolidated financial statements and related schedules with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of First NBC’s accounting principles and such other matters as are required to be discussed with the Audit Committee by the standards of the Public Company Accounting Oversight Board, including Auditing Standard No. 16, Communications With Audit Committees, the rules of the Securities and Exchange Commission, and other applicable regulations. In addition, the Audit Committee discussed with the independent auditor the firm’s independence from First NBC’s management and First NBC, including the matters in the letter from the firm required by Public Company Accounting Oversight Board Rule 3526, Communication with Audit Committees Concerning Independence, and considered the compatibility of non-audit services with the independent auditor’s independence.

It is not the duty of the Audit Committee to plan or conduct audits or to determine that First NBC’s financial statements are complete and accurate and in accordance with generally accepted accounting principles; that is the responsibility of management and Ernst & Young LLP. In giving its recommendation to the Board of Directors, the Audit Committee has relied on (1) management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles and (2) the reports of Ernst & Young LLP with respect to those financial statements.

Based on the review and discussion referenced above, the Audit Committee recommends to the Board of Directors that the audited financial statements be included in First NBC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission.

|

| | | | |

| Submitted by the Audit Committee of the Board of Directors |

| Joseph F. Toomy (Chairman) |

| Shivan Govindan |

| L. Blake Jones |

| Leander J. Foley, III |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

We are committed to having sound corporate governance principles, which are essential to running our business efficiently and maintaining our integrity in the marketplace. Our Board of Directors has adopted Corporate Governance Guidelines, which set forth the framework within which our Board, assisted by Board committees, directs the affairs of our organization. The Guidelines address, among other things, the composition and functions of the Board, director independence, compensation of directors, management succession and review, Board committees and selection of new directors. In addition, our Board of Directors has adopted a Code of Conduct that applies to all of our directors, officers and employees, as well as a separate Code of Ethics for Principal Executive and Senior Financial Officers, including our Chief Executive Officer and Chief Financial Officer. Our Corporate Governance Guidelines, as well the Code of Conduct and Code of Ethics, are available on our website at www.firstnbcbank.com. Any amendments to the Code of Ethics, or any waivers of its requirements, will be disclosed on our website, as well as any other means required by the Nasdaq Stock Market rules.

Board Independence

Under the rules of the Nasdaq Stock Market, independent directors must comprise a majority of our Board of Directors. The rules of the Nasdaq Stock Market, as well as those of the Securities and Exchange Commission, also impose several other requirements with respect to the independence of our directors. Our Board of Directors has evaluated the independence of its members based upon the rules of the Nasdaq Stock Market and the Securities and Exchange Commission. Applying these standards, our Board of Directors has affirmatively determined that, with the exception of Chief Executive Officer Ashton J. Ryan, Jr., William D. Aaron, Jr., and Dr. Charles C. Teamer, each of our current directors is an independent director, as defined under the applicable rules. The Board determined that Messrs. Ryan and Teamer do not qualify as independent directors because each is an employee of First NBC Bank, and the law firm of which Mr. Aaron is a partner is providing general counsel-related services on an interim basis to both First NBC Bank and us.

Leadership Structure

Our Board of Directors meets quarterly, and more often as necessary, and the Board of Directors of First NBC Bank meets monthly, and more often as necessary. We are currently led by an independent Chairman of the Board, separate from our Chief Executive Officer. The Board believes that it is important to maintain flexibility in its leadership structure and has had in place different leadership structures since inception, depending on the organization’s needs at the time. At this time, the Board believes that an independent Chairman is in the best interests of our organization and shareholders by providing strong independent leadership at the Board level. We also believe that independent leadership and oversight are enhanced through a Board of Directors composed of a significant majority of independent directors and wholly-independent Audit, Compensation and Nominating and Governance Committees.

Prior to the separation of the Chairman and Chief Executive Officer positions, our Board of Directors has promoted independent leadership at the Board level through the appointment of a lead independent director. Having an independent Chairman or a lead independent director enables non-management directors to raise issues and concerns for Board consideration without immediately involving management. An independent Chairman or lead independent director also serves as a liaison between the Board and senior management. While the Board has determined that the current structure, with an independent Chairman separate from the Chief Executive Officer, is the most appropriate structure at this time, our Corporate Governance Guidelines ensure that, at all times, there will be an independent director in a Board leadership position, either as an independent Chairman of the Board or as lead independent director.

Compensation Committee Interlocks and Insider Participation

During 2015, none of the members of our Compensation Committee was or had been an officer or employee of First NBC Bank Holding Company or First NBC Bank. In addition, none of our executive officers serves or has served as a member of the Board of Directors, compensation committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Shareholder Communications with Our Board of Directors

Our Board of Directors has established a process for shareholders to communicate with the Board of Directors or with individual directors or groups of directors, including the independent directors as a group. Shareholders who wish to communicate with our Board of Directors or with individual directors or groups of directors should direct written correspondence to our Corporate Secretary at our principal executive offices located at 210 Baronne Street, New Orleans, Louisiana 70112. Any such communication should specify the applicable addressee or addressees to be contacted as well as the general topic of the communication. Communications may be confidential or anonymous. We will initially receive and process communications before forwarding them to the addressee. Communications may also be referred to other departments within our organization. We generally will not forward to the directors a communication that we determine to be primarily commercial in nature or related to an improper or irrelevant topic, or that requests general information about us.

Director Qualifications

Our Board of Directors considers all qualified candidates identified by members of the Board of Directors, by senior management and by shareholders. The Nominating and Governance Committee recommends nominees for election to the Board. The Board of Directors has determined this practice of selecting directors to be appropriate as a means of ensuring diversity of viewpoints, background, experience and demographics on the Board of Directors. The Nominating and Governance Committee reviews each candidate’s biographical information and assesses each candidate’s independence, skills and expertise, based on the variety of factors, including the following criteria:

| |

| • | Demonstrated ability and sound judgment that usually will be based on broad experience; |

| |

| • | Personal qualities and characteristics, accomplishments and reputation in the business community, professional integrity, educational background, business experience and related experience; |

| |

| • | Willingness to objectively appraise management performance; |

| |

| • | Giving due consideration to potential conflicts of interest, current knowledge and contacts in the communities in which we conduct business and in our industry or other industries relevant to our business; |

| |

| • | Ability and willingness to commit adequate time to Board and committee matters including attendance at Board meetings, committee meetings, and annual shareholders meetings; |

| |

| • | Commitment to serve on the Board over a period of several years to develop knowledge about our principal operations; |

| |

| • | Fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of our organization and the interests of our shareholders; and |

| |

| • | Diversity of viewpoints, background, experience and demographics. |

We do not have a formal policy regarding the consideration of diversity in identifying director nominees, but our Board of Directors strives to nominate directors with a variety of complementary skills so that, as a group, our Board of Directors will possess the appropriate talent, skills and expertise to oversee our businesses.

We believe that it is appropriate that our Board of Directors be comprised of a majority of independent directors and that at least one audit committee financial expert serve on the Audit Committee. Based on its assessment of each candidate’s independence, skills and qualifications and the criteria discussed above, the Nominating and Governance Committee makes recommendations regarding director nominees to the Board. The Nominating and Governance Committee follows the same process and uses the same criteria for evaluating candidates proposed by shareholders, members of the Board of Directors and members of senior management.

Board Meetings

Our Board of Directors held 7 scheduled meetings in 2015. Information regarding meetings of the various committees is described below. All directors attended at least 75% of the Board and committee meetings on which they served during 2015. Directors are encouraged to attend annual meetings of our shareholders, although we have no formal policy on director attendance at annual meetings.

Board Committees

Our Board of Directors has established standing committees in connection with the discharge of its responsibilities. These committees include the Audit Committee, the Compensation Committee, the Nominating and Governance Committee and the Merger and Acquisition Committee. Our Board of Directors also may establish such other committees as it deems appropriate, in accordance with applicable law and regulations and our corporate governance documents.

Audit Committee. The Audit Committee assists the Board of Directors in fulfilling its responsibilities for general oversight of the integrity of our financial statements, compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, the performance of our internal audit function and independent auditors, and risk assessment and risk management. Among other things, the Audit Committee:

| |

| • | annually reviews the Audit Committee charter and the committee’s performance; |

| |

| • | appoints, evaluates and determines the compensation of our independent auditors; |

| |

| • | reviews and approves the scope of the annual audit, the audit fee and the financial statements; |

| |

| • | reviews disclosure controls and procedures, internal controls, internal audit function, and corporate policies with respect to financial information; |

| |

| • | oversees investigations into complaints concerning financial matters, if any; and |

| |

| • | reviews other risks that may have a significant impact on our financial statements. |

The Audit Committee works closely with management as well as our independent auditors. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding to engage, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The Audit Committee is composed solely of members who satisfy the applicable independence and other requirements of the Securities and Exchange Commission and the Nasdaq Stock Market for Audit Committees. In addition, we have determined that at least one member of the Audit Committee qualifies as an “audit committee financial expert.” The Audit Committee has adopted a written charter, which is available on our website. The members of the Audit Committee are Shivan Govindan, L. Blake Jones, Joseph F. Toomy and Leander J. Foley, III. The committee held 10 meetings in 2015.

Compensation Committee. The Compensation Committee is responsible for discharging the Board’s responsibilities relating to compensation of the executives and directors. Among other things, the Committee:

| |

| • | evaluates human resources and compensation strategies; |

| |

| • | reviews and approves objectives relevant to executive officer compensation; |

| |

| • | evaluates performance and determines the compensation of the Chief Executive Officer in accordance with those objectives; |

| |

| • | approves any changes to non-equity based benefit plans involving a material financial commitment; |

| |

| • | recommends to the Board of Directors compensation for directors; and |

| |

| • | evaluates performance in relation to the Compensation Committee charter. |

The Compensation Committee is composed solely of members who satisfy the applicable independence requirements of the Securities and Exchange Commission and the Nasdaq Stock Market. The Compensation Committee has adopted a written charter, a copy of which is available on our website. The members of the Compensation Committee are William M. Carrouche, John F. French and Leon L. Giorgio. The committee held 5 meetings in 2015.

The Compensation Committee works throughout the year in its formal meetings, discussions with consultants, interaction with management and review of compensation-related materials developed for it. The Compensation Committee works closely with executive management, primarily our Chief Executive Officer, in assessing the appropriate compensation approach and levels. The Compensation Committee is empowered to advise management and make recommendations to the Board of Directors with respect to the compensation and other employment benefits of executive officers and key employees. The Compensation Committee establishes objectives for our Chief Executive Officer and sets the Chief Executive Officer’s compensation based, in part, on the evaluation of peer group data. The Compensation Committee also administers our long-term compensation plans and our incentive bonus programs for executive officers and key employees.

The Compensation Committee regularly reviews our compensation programs to ensure that remuneration levels and incentive opportunities are competitive and reflect performance. Factors taken into account in assessing the compensation of individual officers include our overall performance, the officer’s performance and contribution, experience, strategic impact, external equity and market value, internal equity and fairness, and retention priority. There are no material differences in compensation policies for our executive officers, as all relate primarily to performance and contribution in achieving consolidated results. In the case of our executive officers other than our Chief Executive Officer, our Chief Executive Officer makes recommendations to the Compensation Committee about each of their individual compensation levels. The Compensation Committee may delegate the specific allocation of certain salary increase or annual incentive awards to the Chief Executive Officer to determine the allocation for other executives.

The Compensation Committee regularly uses salary surveys and peer group information when evaluating compensation strategy. In 2015, the Compensation Committee engaged McLagan Consulting, a compensation consulting firm and division of Aon Hewitt, to provide salary surveys, peer group information and other advice with respect to executive compensation matters. McLagan Consulting reported to and acted at the direction of the Compensation Committee. During 2015, it assisted the Compensation Committee in reviewing the compensation program for management, provided data relating to our industry and a representative peer group for comparison (but not specifically benchmarking) purposes, and advised the Compensation Committee on best practices for executive compensation, including advising on salaries, bonuses and equity-based awards with respect to our executive officers. Our management provided input to McLagan Consulting, but did not have the authority to direct or oversee its activities with respect to our executive compensation programs. The Compensation Committee believes that McLagan Consulting is able to provide independent, objective compensation advice to the Compensation Committee. Other than providing the advice and services to the Compensation Committee, McLagan Consulting, an Aon Hewitt Company, provided no other material services to us, and the Compensation Committee is not aware of any conflict of interest that existed that would have prevented McLagan Consulting from being so independently engaged.

Nominating and Governance Committee. The Nominating and Governance Committee is responsible, among other things, for:

| |

| • | identifying individuals qualified to be directors consistent with the criteria approved the Board of Directors and recommending director nominees to the full Board of Directors; |

| |

| • | ensuring that the independent committees of the Board of Directors have the benefit of qualified “independent” directors; |

| |

| • | overseeing management continuity planning; |

| |

| • | leading the Board of Directors in its annual performance review; and |

| |

| • | taking a leadership role in shaping the corporate governance of our organization. |

The Nominating and Governance Committee is composed solely of members who satisfy the applicable independence requirements of the Securities and Exchange Commission and the Nasdaq Stock Market. The Nominating and Governance Committee has adopted a written charter, a copy of which is available on our website. The members of the Nominating and Governance Committee are William M. Carrouche, John F. French, Leon L. Giorgio, Shivan Govindan, L. Blake Jones, Louis V. Lauricella, Mark G. Merlo and Joseph F. Toomy. The committee held one meeting in 2015.

Merger and Acquisition Committee. The Merger and Acquisition Committee meets on an as-needed basis to evaluate acquisition opportunities and make recommendations to the Board of Directors on all such opportunities. In connection with the evaluation of potential acquisitions, the Committee may conduct feasibility studies, if appropriate. The Committee also oversees the due diligence process undertaken by management in the context of potential transactions. The members of the Merger and Acquisition Committee are John F. French, Shivan Govindan, Ashton J. Ryan, Jr. and Joseph F. Toomy. The committee held no meetings in 2015.

Information Regarding Executive Officers

A brief description of the background of each of our executive officers is set forth below. No executive officer has a family relationship with any other executive officer or director.

Ashton J. Ryan, Jr. For biographical information regarding Mr. Ryan, see the section titled “Item One - Election of Directors - Information Regarding Director Nominees” elsewhere in this proxy statement.

William J. Burnell. Mr. Burnell, age 66, has served First NBC Bank as Chief Credit Officer since its inception in 2006. He has also served in the same capacity with First NBC Bank Holding Company since its inception in 2007. Mr. Burnell was President and Executive Director of Business Resource Capital Specialty Business from 2000 to 2006 and was a Practice Manager for Oracle Corporation from 1999 to 2000. Before that, he was Credit Review Manager at First National Bank of Commerce for 19 years, prior to its acquisition by Bank One in 1998. He is a graduate of the University of Alabama, B.S., 1971.

Marsha S. Crowle. Ms. Crowle, age 55, has served First NBC Bank as Chief Compliance Officer since its inception in 2006. She has also served in the same capacity with First NBC Bank Holding Company since its inception in 2007. Prior to her employment with First NBC Bank, Ms. Crowle was a Senior Vice President and Chief Compliance Officer for First Bank & Trust (New Orleans) from 1996 to 2006 and served as Compliance Officer while employed by Delta Bank from 1981 to 1996.

George L. Jourdan. Mr. Jourdan, age 72, has served First NBC Bank as Executive Vice President and Chief Operations Officer since its inception in 2006. He has also served in the same capacity for First NBC Bank Holding Company since its inception in 2007. Prior to his employment with First NBC Bank, he served as Project Manager at Science Applications International from 2001 to 2005 and Senior Vice President of Information Technology for First Commerce Corporation for over 30 years. Mr. Jourdan is a graduate of Louisiana State University, Baton Rouge, B.S., 1967.

Albert J. Richard, III. Mr. Richard, age 69, has served First NBC Bank and First NBC Bank Holding Company as Chief Financial Officer since September 2016 after serving as Chief Accounting Officer for approximately ten months. Prior to joining First NBC, he worked in public accounting for 46 years, most recently with Postlethwaite & Netterville, the largest public accounting firm based in Louisiana, where he served for 16 years. During his tenure with the firm, he served as a Managing Director of the New Orleans, Louisiana office, and his principal responsibilities included serving as the Audit Engagement Director for a diverse group of clients, including banks and other financial institutions. His prior financial audit experience includes work with KPMG and Deloitte, where he also served in leadership capacities. Mr. Richard is a member of the American Institute of Certified Public Accounts and the Society of Louisiana Certified Public Accountants, where he received a lifetime achievement award. He also serves as a member of the Jefferson Business Council.

William M. Roohi. Mr. Roohi, age 51, has served First NBC Bank as Senior Vice President and Director of Human Resources since its inception in 2006. He has also served as Senior Vice President and Director of Human

Resources at First NBC Bank Holding Company since its inception in 2007. Before joining First NBC Bank, Mr. Roohi had 20 years of banking experience, serving in various capacities with First Bank & Trust (New Orleans), IBERIABANK Corporation, Hibernia Corporation, Bank One Corporation and First Commerce Corporation. He is a graduate of Spring Hill College, B.S. 1987, and holds a Senior Professional of Human Resources (SPHR) designation.

Mary Beth Verdigets. Ms. Verdigets, age 49, has served First NBC Bank as Executive Vice President and Treasurer since 2016, after serving as Chief Financial Officer for First NBC Bank and First NBC Bank Holding Company from 2011 to 2016, Chief Asset/Liability Management Officer from 2008 to 2011, and as Chief Accounting Officer from 2006 to 2008. Before joining First NBC Bank, she served as Vice President and Manager of Financial Planning at First Bank and Trust from 2000 to 2006, as a financial analyst at Whitney National Bank from 1999 to 2000, and in various accounting related positions for First Commerce Corporation from 1993 to 1999. Ms. Verdigets is a graduate of Tulane University, B.S., 1989, and is a certified public accountant.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information regarding the beneficial ownership of our common stock for:

| |

| • | each person known to us to be the beneficial owner of more than five percent of our common stock; |

| |

| • | each of our directors, director nominees and executive officers; and |

| |

| • | all directors and executive officers, as a group. |

We have determined beneficial ownership in accordance with the rules of the Securities and Exchange Commission. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the tables below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

The number of shares beneficially owned by each of the persons known to us to be the beneficial owner of more than five percent of our common stock is based on beneficial ownership information contained in reports filed by each such person with the Securities and Exchange Commission. The number of shares beneficially owned by our directors, director nominees and executive officers is based on beneficial ownership information as of September 30, 2016. The table below calculates the percentage of beneficial ownership based on 19,230,911 shares of common stock outstanding as of September 30, 2016, except as follows. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock subject to options or warrants held by that person that are currently exercisable or exercisable within sixty days of September 30, 2016. However, we did not deem these shares outstanding for the purpose of computing the percentage ownership of any other person. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

|

| | | | |

| | Number of Shares | | Percent of Class |

| Name of Beneficial Owner | | | |

| Greater than 5% shareholders | | | |

Castle Creek Capital Partners IV, L.P. (1) | 2,205,382 |

| | 11.47% |

FMR LLC (2) | 1,710,009 |

| | 8.89% |

| BlackRock, Inc. (3) | 1,403,152 |

| | 7.30% |

| Numeric Investors, LLC (4) | 1,091,851 |

| | 5.68% |

| Directors and Executive Officers | | | |

| William D. Aaron, Jr.(5) | 42,199 |

| | * |

| William J. Burnell (6) | 59,997 |

| | * |

| William M. Carrouche (7) | 8,112 |

| | * |

| Marsha S. Crowle (8) | 57,602 |

| | * |

| Leander J. Foley, III (9) | 112,184 |

| | * |

| John F. French (10) | 149,477 |

| | * |

| Leon L. Giorgio, Jr. (11) | 77,577 |

| | * |

| Shivan Govindan | 11,130 |

| | * |

| L. Blake Jones (12) | 136,077 |

| | * |

| George Jourdan (13) | 34,151 |

| | * |

| Louis V. Lauricella (14) | 211,183 |

| | 1.10% |

| Mark G. Merlo (15) | — |

| | * |

| Albert J, Richard, III | 2,035 |

| | * |

|

| | | | |

| William M. Roohi (16) | 24,822 |

| | * |

| Ashton J. Ryan, Jr. (17) | 474,746 |

| | 2.47% |

| Dr. Charles C. Teamer (18) | 61,175 |

| | * |

| Joseph F. Toomy (19) | 107,577 |

| | * |

| Mary Beth Verdigets (20) | 41,106 |

| | * |

| All directors and executive officers, as a group (18 persons) | 1,611,150 |

| | 8.38% |

(1) Based on the Schedule 13G filed with the SEC on November 9, 2015, Castle Creek Capital Partners IV, LP, Castle Creek Capital IV, LLC and John M. Eggemeyer III may be deemed to be the beneficial owner of the reported shares. Mr. Eggemeyer is a managing principal of Castle Creek Capital IV, LLC, the sole general partner of Castle Creek Capital Partners IV, LP. Castle Creek Capital IV, LLC and Mr. Eggemeyer each disclaim beneficial ownership of the reported shares, except to the extent of their respective pecuniary interests in Castle Creek Capital Partners IV, LP. The business address for Castle Creek Partners Capital IV, LP, Castle Creek Capital IV, LLC and John M. Eggemeyer III is 6051 El Tordo, Rancho Santa Fe, California 92067.

(2) Based on the Schedule 13G filed with the SEC on February 12, 2016, FMR LLC, and Abigail P. Johnson reported shared voting and dispositive power over all shares beneficially owned. Their address is c/o FMR LLC, 245 Summer Street, Boston, Massachusetts 02210.

(3) Based on the Schedule 13G filed with the SEC on January 22, 2016, BlackRock, Inc. reported shared voting or dispositive power over all shares beneficially owned. Its address is c/o BlackRock, Inc., 55 East 52nd Street, New York, New York, 10055

(4) Based on the Schedule 13G filed with the SEC on August 16, 2016, Numeric Investors, LLC and Man Group PLC reported shared voting and dispositive power over all shares beneficially owned. The address of Numeric Investors, LLC is 470 Atlantic Avenue, 6th Floor, Boston, Massachusetts 02210, and the address of Man Group, PLC is Riverbank House, 2 Swan Lake, London EC4R 3AD, United Kingdom.

| |

| (5) | Includes options to purchase 6,400 shares of common stock. |

| |

| (6) | Includes options to purchase 49,772 shares of common stock and 747 shares of common stock allocated to Mr. Burnell’s account in the ESOP. |

| |

| (7) | Includes options to purchase 16,000 shares of common stock. |

| |

| (8) | Includes options to purchase 49,772 shares of common stock and 773 shares of common stock allocated to Ms. Crowle’s account in the ESOP. |

| |

| (9) | Includes warrants to purchase 23,602 shares and options to purchase 9,600 shares of common stock. |

| |

| (10) | Includes 54,696 shares held of record by Penthouse Apartment Management, L.L.C. and 58,696 shares held of record by The Columbus Group, Inc., entities over which Mr. French exercises control, and options to purchase 16,000 shares of common stock. The number of shares as beneficially owned includes 122,712 shares pledged as collateral. |

| |

| (11) | Includes 22,500 shares held of record by Select Properties, Ltd., 10,000 shares held of record by J.K. Lee, Inc. and 15,000 shares held of record by 2121 Limited Partnership, over all of which Mr. Giorgio has beneficial ownership, and options to purchase 16,000 shares of common stock. |

| |

| (12) | Includes options to purchase 16,000 shares of common stock. |

| |

| (13) | Includes options to purchase 19,266 shares of common stock and 764 shares of common stock allocated to Mr. Jourdan’s account in the ESOP. |

| |

| (14) | Includes 200,000 shares held of record by Elmwood Banking Investment, L.L.C., a wholly-owned subsidiary of Lauricella Land Company, L.L.C., an entity for which Mr. Lauricella serves as managing member, and options to purchase 9,600 shares of common stock. |

| |

| (15) | Does not include any shares of common stock held by Castle Creek Capital Partners IV, L.P., which are described in note 1 to this table, for which Mr. Merlo disclaims beneficial ownership. |

| |

| (16) | Includes options to purchase 16,796 shares of common stock and 604 shares of common stock allocated to Mr. Roohi’s account in the ESOP. |

| |

| (17) | Includes 829 shares of common stock allocated to Mr. Ryan’s account in the ESOP and 435,000 shares of common stock pledged as collateral to secure outstanding debt obligations. |

| |

| (18) | Includes warrants to purchase 12,918 shares of common stock, options to purchase 16,000 shares of common stock, and 237 shares of common stock allocated to Dr. Teamer’s account in the ESOP. |

| |

| (19) | Includes options to purchase 16,000 shares of common stock. |

| |

| (20) | Includes options to purchase 34,204 shares of common stock and 619 shares of common stock allocated to Ms. Verdigets’ account in the ESOP. |

COMPENSATION INFORMATION

The following section provides information regarding compensation for:

| |

| • | Ashton J. Ryan, Jr., President and Chief Executive Officer; |

| |

| • | William J. Burnell, Senior Executive Vice President and Chief Credit Officer; and |

| |

| • | Marsha S. Crowle, Senior Executive Vice President and Chief Compliance Officer |

We have not entered into employment agreements with any of our executive officers or employees, each of whom serves at the pleasure of our Board of Directors and is an “at will” employee.

Summary Compensation Table

The following table provides information regarding the compensation of our named executive officers for the years ended December 31, 2015 and 2014. All cash compensation paid to each of our named executive officers was paid by First NBC Bank, where each serves in the same capacity. The summary compensation table represents compensation prior to the recent restatements of our financial information. The Compensation Committee is presently reviewing compensation in light of the restatements.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary | | Bonus | | Non-Equity Incentive Plan(1) | | Option Awards(2)(3) | | Stock Awards(2)(3) | | All Other Compensation | | Total |

| Ashton J. Ryan, Jr. | | 2015 | | $ | 520,834 |

| | $ | — |

| | $ | 577,500 |

| | $ | 46,876 |

| | $ | 140,616 |

| | $ | 327,029 |

| | $ | 1,612,855 |

|

| President and Chief Executive Officer | | 2014 | | 491,667 |

| | — |

| | 550,000 |