UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811- 22441

John Hancock Hedged Equity & Income Fund

(Exact name of registrant as specified in charter)

200 Berkeley Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

200 Berkeley Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant's telephone number, including area code:617-663-4497

| Date of fiscal year end: | December 31 |

| | |

| | |

| Date of reporting period: | December 31, 2019 |

ITEM 1. REPORTS TO STOCKHOLDERS.

John Hancock

Hedged Equity & Income Fund

Ticker: HEQ

Annual report 12/31/19

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund's shareholder reports such as this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the transfer agent or from your financial intermediary. Instead, the reports will be made available on our website, and you will be notified by mail each time a report is posted and be provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling the transfer agent, Computershare, at 800-852-0218, by going to "Communication Preferences" at computershare.com/investor, or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform the transfer agent or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

Managed distribution plan

The fund has adopted a managed distribution plan (Plan). Under the Plan, the fund makes quarterly distributions of an amount equal to $0.376 per share, which will be paid quarterly until further notice. The fund may make additional distributions: (i) for purposes of not incurring federal income tax at the fund level of investment company taxable income and net capital gain, if any, not included in such regular distributions; and (ii) for purposes of not incurring federal excise tax on ordinary income and capital gain net income, if any, not included in such regular distributions.

The Plan provides that the Board of Trustees of the fund may amend the terms of the Plan or terminate the Plan at any time without prior notice to the fund's shareholders. The Plan is subject to periodic review by the fund's Board of Trustees.

You should not draw any conclusions about the fund's investment performance from the amount of the fund's distributions or from the terms of the fund's Plan. The fund's total return at NAV is presented in the Financial highlights section.

With each distribution that does not consist solely of net income, the fund will issue a notice to shareholders and an accompanying press release that will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the fund's investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. The fund may, at times, distribute more than its net investment income and net realized capital gains; therefore, a portion of your distribution may result in a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the fund is paid back to you. A return of capital does not necessarily reflect the fund's investment performance and should not be confused with yield or income.

A message to shareholders

Dear shareholder,

Global financial markets delivered robust returns during the 12 months ended December 31, 2019. Stocks were particularly strong in the United States, where they delivered double-digit returns across most economic sectors. Investors benefited from a combination of low inflation, accommodative central bank policy, healthy fundamentals, and corporate buybacks of stock. Investors in non-U.S. equities also saw strong gains, fueled in part by similarly supportive monetary policy and some signs of strength in developing markets.

After such a strong year of returns—in a historically long bull market—investors are prudent to consider the risks to future gains. Growth has slowed in the United States, with some negative data in manufacturing reflecting concerns over international trade and wavering business confidence. Indeed, trade disputes and other geopolitical tensions may continue to create uncertainty among businesses and skepticism among investors. Your financial advisor can helpposition your portfolio so that it's sufficiently diversified to meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management, I'd like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Hedged Equity & Income Fund

Table of contents

| | | |

| 2 | | Your fund at a glance |

| 5 | | Manager's discussion of fund performance |

| 7 | | Fund's investments |

| 34 | | Financial statements |

| 37 | | Financial highlights |

| 38 | | Notes to financial statements |

| 49 | | Report of independent registered public accounting firm |

| 50 | | Tax information |

| 51 | | Additional information |

| 54 | | Trustees and Officers |

| 58 | | More information |

ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND 1

INVESTMENT OBJECTIVE

The fund seeks to provide total return with a focus on current income and gains and also consisting of long-term capital appreciation.

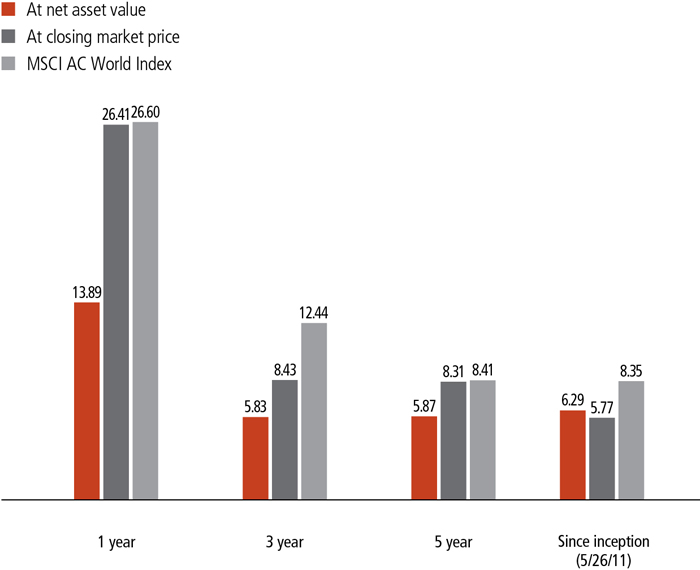

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/19 (%)

The MSCI All Country (AC) World Index is a free float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets.

It is not possible to invest directly in an index. Index figures do not reflect expenses and sales charges, which would result in lower returns.

The performance data contained within this material represents past performance, which does not guarantee future results.

Investment returns and principal value will fluctuate and a shareholder may sustain losses. Further, the fund's performance at net asset value (NAV) is different from the fund's performance at closing market price because the closing market price is subject to the dynamics of secondary market trading. Market risk may be increased when shares are purchased at a premium to NAV or sold at a discount to NAV. Current month-end performance may be higher or lower than the performance cited. The fund's most recent performance can be found at jhinvestment.com or by calling 800-852-0218.

ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND 2

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

Easing economic policy and trade tensions boosted equities

Global stocks delivered positive returns, spurred by accommodative economic policy from global central banks and progress in trade negotiations between the United States and China.

The fund's stock selection hurt relative results

The fund had a positive return but underperformed its comparative index, the MSCI All Country World Index, owing primarily to stock selection and sector allocation within its equity strategy.

Options and hedging strategies also detracted from performance

The fund's equity option overlay and beta hedge strategy also detracted from relative results, while its high-yield fixed-income exposure had a positive absolute contribution.

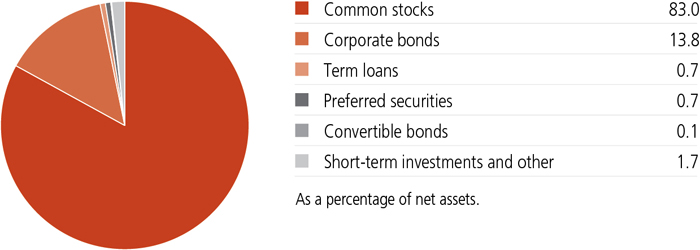

PORTFOLIO COMPOSITION AS OF 12/31/19 (%)

ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND 3

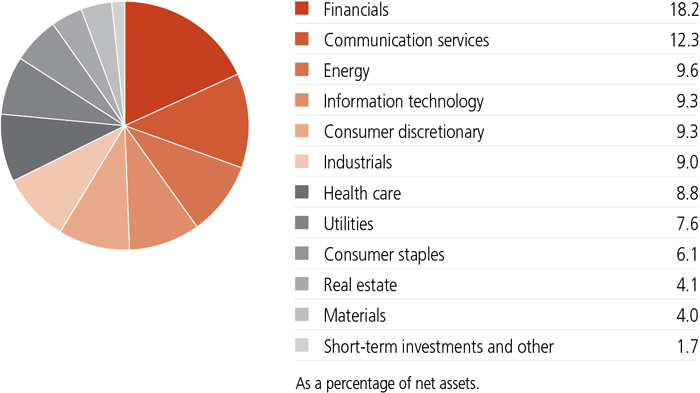

SECTOR COMPOSITION AS OF 12/31/19 (%)

A note about risks

As is the case with all exchange-listed closed-end funds, shares of this fund may trade at a discount or a premium to the fund's net asset value (NAV). An investment in the fund is subject to investment and market risks, including the possible loss of the entire principal invested. There is no guarantee prior distribution levels will be maintained, and distributions may include a substantial return of capital. A return of capital is the return of all or a portion of a shareholder's investment in the fund. For the fiscal year ended December 31,2019, the fund's aggregate distributions included a return of capital of $0.83 per share, or 55% of aggregate distributions, which could impact the tax treatment of a subsequent sale of fund shares. See the Financial highlights and notes to the financial statements for details of the return of capital and risks associated with distributions made by the fund. The fund's prospectus includes additional information regarding returns of capital and the risks associated with distributions made by the fund, including potential tax implications. Fixed-income investments are subject to interest-rate risk; their value will normally decline as interest rates rise. An issuer of securities held by the fund may default, have its credit rating downgraded, or otherwise perform poorly, which may affect fund performance. Derivatives transactions, including hedging and other strategic transactions, may increase a fund's volatility and could produce disproportionate losses, potentially more than the fund's principal investment. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Investments in higher-yielding, lower-rated securities include a higher risk of default. The primary risks associated with the use of futures contracts and options are imperfect correlation, unanticipated market movement, and counterparty risk. Cybersecurity incidents may allow an unauthorized party to gain access to fund assets, customer data, or proprietary information, or cause a fund or its service providers to suffer data corruption or lose operational functionality. Similar incidents affecting issuers of a fund's securities may negatively impact performance.

ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND 4

Manager's discussion of fund performance

What factors drove global equities' strong results during the 12 months ended December 31, 2019?

Volatility led by macro themes, accommodative economic policy, and the state of trade negotiations between the United States and China drove markets during the period. Stocks rose in the first quarter, due to productive trade talks and dovish rhetoric and policy actions by the major central banks. They continued to move higher in the second quarter, overcoming escalating trade tensions and Brexit uncertainty. Interest-rate cuts from the U.S. Federal Reserve and a sweeping stimulus package from the European Central Bank boosted equities in a volatile third quarter and set the stage for a strong finish to the year. Waning recession fears, forecasts for improving global growth in 2020, and an easing of trade tensions in the fourth quarter helped to bolster risk appetite.

What trends led to the fund's underperformance?

Weak security selection—particularly in the communication services, consumer discretionary, and financials sectors—drove the fund's underperformance of its benchmark, the MSCI All Country World Index. Sector allocation also detracted from relative performance, particularly an underweight allocation to the information technology sector and overweight allocations to the energy and utilities sectors.

| | | | | |

TOP 10 HOLDINGS

AS OF 12/31/19 (%) | | COUNTRY COMPOSITION

AS OF 12/31/19 (%) |

| TOTAL SA | 1.2 | | United States | 41.3 |

| Verizon Communications, Inc. | 1.0 | | Japan | 10.2 |

| Philip Morris International, Inc. | 1.0 | | United Kingdom | 7.0 |

| Pfizer, Inc. | 1.0 | | France | 6.2 |

| UBS Group AG | 1.0 | | Canada | 5.3 |

| Mitsubishi UFJ Financial Group, Inc. | 1.0 | | Netherlands | 4.0 |

| Bank of America Corp. | 1.0 | | Switzerland | 3.3 |

Taiwan Semiconductor

Manufacturing Company, Ltd. | 0.9 | | Germany | 2.2 |

| AXA SA | 0.9 | | Australia | 1.8 |

| TC Energy Corp. | 0.9 | | China | 1.5 |

| TOTAL | 9.9 | | Other countries | 17.2 |

| | | | TOTAL | 100.0 |

| As a percentage of net assets. | | As a percentage of net assets. |

| Cash and cash equivalents are not included. | | |

ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND 5

The fund's options and beta hedge strategies, which are designed to generate extra income and reduce equity exposure through selling the MSCI EAFE Index, FTSE Index, and STOXX 50 Index, also detracted from performance, while its global high-yield fixed-income exposure contributed to results over the year. The top relative detractors included underweight exposures to Apple, Inc. and Microsoft Corp. The top relative contributors were wireless and communications chipmaker QUALCOMM, Inc. and Zurich Insurance Group AG. We sold Zurich during the period.

How was the fund positioned at the end of the period?

The fund's largest overweights were in utilities and energy, while the largest underweights were in information technology and healthcare. From a regional perspective, the strategy ended the period most overweight in Europe and most underweight in North America. Macro challenges created a volatile backdrop for the market in 2019 and we expect this to persist into the new year. We note an unusual lack of consensus across the industry around the macroeconomic outlook, which leads to a wide range of potential outcomes. As a result, we believe that a multistrategy factor-based approach to capital allocation can help manage risk amid uncertainty and reduce excess drawdown in the event of market shocks.

Can you tell us about a manager change?

Effective February 21, 2019, Roberto J. Isch, CFA, joined the management team.

MANAGED BY

| | |

| Gregg R. Thomas, CFA

On the fund since 2011

Investing since 1993 |

| Roberto J. Isch, CFA

On the fund since 2019

Investing since 2006 |

The views expressed in this report are exclusively those of Gregg R. Thomas, CFA, Wellington Management Company LLP, and are subject to change. They are not meant as investment advice. Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund's investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND 6

AS OF 12-31-19

| | | | | Shares | Value |

| Common stocks 83.0% | | | | | $150,670,783 |

| (Cost $155,227,272) | | | | | |

| Communication services 9.8% | | | 17,741,599 |

| Diversified telecommunication services 5.0% | | | |

| AT&T, Inc. | | | 11,966 | 467,631 |

| BCE, Inc. | | | 14,303 | 662,638 |

| BT Group PLC | | | 452,313 | 1,152,579 |

| CenturyLink, Inc. | | | 23,227 | 306,829 |

| China Telecom Corp., Ltd., H Shares | | | 406,016 | 167,274 |

| China Unicom Hong Kong, Ltd. | | | 211,210 | 198,880 |

| Hellenic Telecommunications Organization SA | | | 69,772 | 1,116,815 |

| Koninklijke KPN NV | | | 386,641 | 1,144,216 |

| KT Corp. | | | 6,755 | 157,623 |

| Magyar Telekom Telecommunications PLC | | | 51,006 | 77,153 |

| O2 Czech Republic AS | | | 76,525 | 789,789 |

| Orange SA | | | 42,664 | 626,999 |

| Proximus SADP | | | 2,820 | 80,804 |

| Spark New Zealand, Ltd. | | | 31,799 | 92,726 |

| Telefonica Deutschland Holding AG | | | 62,932 | 182,560 |

| Verizon Communications, Inc. | | | 30,135 | 1,850,289 |

| Entertainment 0.3% | | | |

| Avex, Inc. | | | 5,800 | 66,809 |

| DeNA Company, Ltd. | | | 5,020 | 80,908 |

| Konami Holdings Corp. | | | 967 | 39,736 |

| NHN Corp. (A) | | | 480 | 27,635 |

| Nintendo Company, Ltd. | | | 137 | 54,795 |

| The Walt Disney Company | | | 1,665 | 240,809 |

| Interactive media and services 0.9% | | | |

| Alphabet, Inc., Class A (A) | | | 520 | 696,483 |

| Baidu, Inc., ADR (A) | | | 312 | 39,437 |

| Facebook, Inc., Class A (A) | | | 2,088 | 428,562 |

| Gree, Inc. | | | 24,510 | 110,743 |

| InterActiveCorp (A) | | | 258 | 64,270 |

| Kakaku.com, Inc. | | | 1,591 | 40,623 |

| SINA Corp. (A) | | | 528 | 21,083 |

| Z Holdings Corp. | | | 44,445 | 187,652 |

| Media 1.4% | | | |

| Comcast Corp., Class A | | | 33,408 | 1,502,358 |

| Criteo SA, ADR (A) | | | 4,152 | 71,954 |

| Eutelsat Communications SA | | | 3,861 | 62,910 |

| Fuji Media Holdings, Inc. | | | 4,275 | 60,698 |

| Gendai Agency, Inc. | | | 1,360 | 5,254 |

| 7 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

| Communication services (continued) | | | |

| Media (continued) | | | |

| Metropole Television SA | | | 5,260 | $99,187 |

| Nippon Television Holdings, Inc. | | | 8,170 | 108,998 |

| RTL Group SA | | | 4,867 | 239,806 |

| SES SA | | | 5,030 | 70,700 |

| Telenet Group Holding NV | | | 2,803 | 126,003 |

| Television Francaise 1 | | | 13,880 | 115,694 |

| TV Asahi Holdings Corp. | | | 5,240 | 96,755 |

| Zee Entertainment Enterprises, Ltd. | | | 18,725 | 76,575 |

| Wireless telecommunication services 2.2% | | | |

| China Mobile, Ltd. | | | 83,601 | 706,416 |

| Intouch Holdings PCL | | | 30,935 | 59,065 |

| KDDI Corp. | | | 34,900 | 1,041,288 |

| Millicom International Cellular SA | | | 25,514 | 1,225,281 |

| Mobile TeleSystems PJSC, ADR | | | 22,955 | 232,993 |

| MTN Group, Ltd. | | | 11,145 | 65,701 |

| NTT DOCOMO, Inc. | | | 3,126 | 87,078 |

| Orange Belgium SA | | | 3,779 | 87,768 |

| Softbank Corp. | | | 16,427 | 220,281 |

| VEON, Ltd. | | | 45,662 | 115,525 |

| Vodafone Group PLC | | | 45,824 | 88,961 |

| Consumer discretionary 6.9% | | | 12,428,280 |

| Auto components 1.0% | | | |

| Aisan Industry Company, Ltd. | | | 2,680 | 19,309 |

| Bridgestone Corp. | | | 5,711 | 212,164 |

| Exedy Corp. | | | 4,455 | 100,779 |

| Fuyao Glass Industry Group Company, Ltd., H Shares (B) | | | 56,585 | 173,262 |

| NOK Corp. | | | 8,965 | 133,720 |

| Sumitomo Riko Company, Ltd. | | | 6,080 | 54,849 |

| Tachi-S Company, Ltd. | | | 4,340 | 56,544 |

| The Yokohama Rubber Company, Ltd. | | | 33,746 | 654,501 |

| Tokai Rika Company, Ltd. | | | 5,890 | 114,780 |

| Toyoda Gosei Company, Ltd. | | | 5,125 | 127,968 |

| Toyota Boshoku Corp. | | | 2,480 | 39,821 |

| Unipres Corp. | | | 7,000 | 98,227 |

| Automobiles 1.8% | | | |

| Daimler AG | | | 5,655 | 312,633 |

| Dongfeng Motor Group Company, Ltd., H Shares | | | 177,960 | 167,422 |

| Ford Motor Company | | | 26,073 | 242,479 |

| Honda Motor Company, Ltd. | | | 12,800 | 362,260 |

| Isuzu Motors, Ltd. | | | 78,600 | 929,112 |

| Kia Motors Corp. (A) | | | 18,498 | 706,448 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 8 |

| | | | | Shares | Value |

| Consumer discretionary (continued) | | | |

| Automobiles (continued) | | | |

| Mitsubishi Motors Corp. | | | 19,220 | $80,114 |

| Nissan Motor Company, Ltd. | | | 51,587 | 298,933 |

| Renault SA | | | 3,197 | 151,817 |

| Diversified consumer services 0.2% | | | |

| Allstar Co-Invest LLC (A)(C)(D) | | | 236,300 | 92,157 |

| Benesse Holdings, Inc. | | | 2,000 | 52,569 |

| H&R Block, Inc. | | | 6,366 | 149,474 |

| Hotels, restaurants and leisure 0.6% | | | |

| Carnival Corp. | | | 2,036 | 103,490 |

| Chipotle Mexican Grill, Inc. (A) | | | 81 | 67,806 |

| Las Vegas Sands Corp. | | | 4,717 | 325,662 |

| OPAP SA | | | 19,480 | 253,445 |

| Starbucks Corp. | | | 2,537 | 223,053 |

| Yum! Brands, Inc. | | | 1,193 | 120,171 |

| Household durables 1.6% | | | |

| Funai Electric Company, Ltd. (A) | | | 9,123 | 58,912 |

| Newell Brands, Inc. | | | 36,051 | 692,900 |

| Nikon Corp. | | | 8,835 | 108,049 |

| Persimmon PLC | | | 2,823 | 100,835 |

| Sekisui House, Ltd. | | | 31,769 | 678,422 |

| Taylor Wimpey PLC | | | 177,647 | 455,499 |

| Woongjin Coway Company, Ltd. | | | 9,803 | 788,110 |

| Internet and direct marketing retail 0.5% | | | |

| Alibaba Group Holding, Ltd., ADR (A) | | | 789 | 167,347 |

| Amazon.com, Inc. (A) | | | 376 | 694,788 |

| Qliro Group AB (A) | | | 22,910 | 17,099 |

| Leisure products 0.0% | | | |

| Sankyo Company, Ltd. | | | 2,060 | 68,418 |

| Multiline retail 0.2% | | | |

| Kohl's Corp. | | | 1,766 | 89,978 |

| Macy's, Inc. | | | 5,936 | 100,912 |

| Marks & Spencer Group PLC | | | 34,043 | 96,528 |

| Specialty retail 0.8% | | | |

| CECONOMY AG (A) | | | 13,941 | 84,277 |

| Halfords Group PLC | | | 23,425 | 52,700 |

| Kingfisher PLC | | | 50,663 | 145,845 |

| L Brands, Inc. | | | 2,418 | 43,814 |

| Nishimatsuya Chain Company, Ltd. | | | 7,660 | 65,772 |

| Shimamura Company, Ltd. | | | 1,650 | 125,439 |

| The Gap, Inc. | | | 4,109 | 72,647 |

| The Home Depot, Inc. | | | 3,983 | 869,808 |

| Xebio Holdings Company, Ltd. | | | 7,025 | 84,830 |

| 9 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

| Consumer discretionary (continued) | | | |

| Textiles, apparel and luxury goods 0.2% | | | |

| 361 Degrees International, Ltd. | | | 199,300 | $36,342 |

| Daphne International Holdings, Ltd. (A) | | | 272,250 | 5,068 |

| Geox SpA | | | 18,989 | 25,183 |

| Pandora A/S | | | 1,108 | 48,185 |

| Sanyo Shokai, Ltd. | | | 3,660 | 46,334 |

| Tapestry, Inc. | | | 6,647 | 179,270 |

| Consumer staples 5.4% | | | 9,862,371 |

| Beverages 0.2% | | | |

| Anadolu Efes Biracilik Ve Malt Sanayii AS | | | 14,420 | 55,952 |

| Coca-Cola Icecek AS | | | 9,312 | 60,514 |

| PepsiCo, Inc. | | | 1,917 | 261,996 |

| Food and staples retailing 0.2% | | | |

| Cawachi, Ltd. | | | 2,270 | 45,993 |

| Costco Wholesale Corp. | | | 328 | 96,406 |

| J Sainsbury PLC | | | 60,930 | 185,791 |

| METRO AG | | | 2,917 | 46,938 |

| Food products 1.7% | | | |

| General Mills, Inc. | | | 4,133 | 221,363 |

| Kellogg Company | | | 19,844 | 1,372,411 |

| Nestle SA | | | 6,096 | 659,985 |

| Perusahaan Perkebunan London Sumatra Indonesia Tbk PT | | | 311,600 | 33,322 |

| The Hershey Company | | | 483 | 70,991 |

| The Kraft Heinz Company | | | 15,546 | 499,493 |

| Tyson Foods, Inc., Class A | | | 1,229 | 111,888 |

| Wens Foodstuffs Group Company, Ltd., Class A | | | 10,300 | 49,715 |

| Household products 0.4% | | | |

| Colgate-Palmolive Company | | | 2,039 | 140,365 |

| Kimberly-Clark Corp. | | | 1,482 | 203,849 |

| The Clorox Company | | | 654 | 100,415 |

| The Procter & Gamble Company | | | 2,744 | 342,726 |

| Personal products 0.4% | | | |

| The Estee Lauder Companies, Inc., Class A | | | 428 | 88,399 |

| Unilever NV | | | 11,575 | 664,297 |

| Tobacco 2.5% | | | |

| Altria Group, Inc. | | | 8,783 | 438,360 |

| British American Tobacco PLC | | | 22,878 | 972,362 |

| Imperial Brands PLC | | | 42,489 | 1,051,190 |

| Japan Tobacco, Inc. | | | 11,642 | 259,576 |

| Philip Morris International, Inc. | | | 21,484 | 1,828,074 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 10 |

| | | | | Shares | Value |

| Energy 7.6% | | | $13,814,259 |

| Energy equipment and services 0.1% | | | |

| Fugro NV (A) | | | 5,786 | 65,234 |

| Helmerich & Payne, Inc. | | | 1,205 | 54,743 |

| Saipem SpA (A) | | | 23,508 | 114,971 |

| The Drilling Company of 1972 A/S (A) | | | 308 | 20,337 |

| Trican Well Service, Ltd. (A) | | | 28,240 | 24,792 |

| Oil, gas and consumable fuels 7.5% | | | |

| Advantage Oil & Gas, Ltd. (A) | | | 30,548 | 64,693 |

| Aker BP ASA | | | 5,127 | 168,270 |

| ARC Resources, Ltd. | | | 8,373 | 52,744 |

| BP PLC | | | 55,388 | 348,435 |

| Cameco Corp. | | | 6,237 | 55,427 |

| Chevron Corp. | | | 2,234 | 269,219 |

| Coal India, Ltd. | | | 96,323 | 285,705 |

| Enbridge, Inc. | | | 40,173 | 1,597,268 |

| Encana Corp. | | | 27,227 | 127,481 |

| Eni SpA | | | 22,859 | 355,028 |

| Equinor ASA | | | 6,363 | 126,893 |

| Exxon Mobil Corp. | | | 15,502 | 1,081,730 |

| Galp Energia SGPS SA | | | 87,469 | 1,468,434 |

| Gazprom PJSC, ADR | | | 18,593 | 152,834 |

| Inpex Corp. | | | 18,740 | 194,141 |

| Inter Pipeline, Ltd. | | | 4,768 | 82,762 |

| Japan Petroleum Exploration Company, Ltd. | | | 1,865 | 50,224 |

| Kinder Morgan, Inc. | | | 16,930 | 358,408 |

| LUKOIL PJSC, ADR | | | 758 | 74,822 |

| LUKOIL PJSC, ADR (London Stock Exchange) | | | 905 | 90,144 |

| Lundin Petroleum AB | | | 22,550 | 765,673 |

| Painted Pony Energy, Ltd. (A) | | | 20,525 | 12,013 |

| Royal Dutch Shell PLC, A Shares | | | 1,190 | 35,241 |

| Royal Dutch Shell PLC, B Shares | | | 38,328 | 1,137,715 |

| Surgutneftegas PJSC, ADR (London Stock Exchange) | | | 19,435 | 157,328 |

| Targa Resources Corp. | | | 6,356 | 259,515 |

| TC Energy Corp. | | | 30,537 | 1,626,382 |

| The Williams Companies, Inc. | | | 10,675 | 253,211 |

| TOTAL SA | | | 38,922 | 2,159,803 |

| Tourmaline Oil Corp. | | | 4,826 | 56,564 |

| YPF SA, ADR | | | 5,706 | 66,075 |

| Financials 16.4% | | | 29,779,862 |

| Banks 10.0% | | | |

| ABN AMRO Bank NV (B) | | | 88,379 | 1,610,824 |

| AIB Group PLC | | | 24,563 | 85,809 |

| Allahabad Bank (A) | | | 30,492 | 8,099 |

| 11 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

| Financials (continued) | | | |

| Banks (continued) | | | |

| Aozora Bank, Ltd. | | | 4,963 | $131,116 |

| Bank of America Corp. | | | 48,981 | 1,725,111 |

| Bank of Ireland Group PLC | | | 29,239 | 160,920 |

| Bank Polska Kasa Opieki SA | | | 3,343 | 88,467 |

| BNP Paribas SA | | | 5,298 | 314,903 |

| BPER Banca | | | 20,124 | 101,255 |

| CaixaBank SA | | | 68,889 | 216,935 |

| Canara Bank (A) | | | 23,669 | 73,425 |

| China Construction Bank Corp., H Shares | | | 1,123,000 | 973,688 |

| CIMB Group Holdings BHD | | | 66,200 | 83,380 |

| Dah Sing Financial Holdings, Ltd. | | | 16,100 | 63,464 |

| Danske Bank A/S | | | 1,778 | 28,765 |

| DGB Financial Group, Inc. (A) | | | 11,871 | 72,978 |

| DNB ASA | | | 3,758 | 70,323 |

| HSBC Holdings PLC | | | 55,892 | 437,547 |

| ING Groep NV | | | 98,784 | 1,187,621 |

| Kasikornbank PCL, NVDR | | | 21,900 | 110,248 |

| KB Financial Group, Inc. | | | 4,029 | 165,987 |

| Lloyds Banking Group PLC | | | 263,224 | 218,060 |

| Mitsubishi UFJ Financial Group, Inc. | | | 319,549 | 1,727,589 |

| Mizuho Financial Group, Inc. | | | 103,045 | 158,732 |

| Moneta Money Bank AS (B) | | | 83,746 | 314,228 |

| National Australia Bank, Ltd. | | | 5,783 | 100,070 |

| Nordea Bank ABP (Stockholm Stock Exchange) | | | 101,504 | 821,186 |

| People's United Financial, Inc. | | | 12,407 | 209,678 |

| Raiffeisen Bank International AG | | | 1,643 | 41,123 |

| Resona Holdings, Inc. | | | 167,995 | 732,211 |

| Royal Bank of Canada | | | 13,154 | 1,040,833 |

| Sberbank of Russia PJSC, ADR | | | 6,040 | 99,056 |

| Shinhan Financial Group Company, Ltd. | | | 3,843 | 144,085 |

| Skandinaviska Enskilda Banken AB, A Shares | | | 15,609 | 146,722 |

| Societe Generale SA | | | 14,717 | 513,593 |

| Standard Chartered PLC | | | 154,797 | 1,458,666 |

| Sumitomo Mitsui Financial Group, Inc. | | | 7,900 | 291,789 |

| Sumitomo Mitsui Trust Holdings, Inc. | | | 4,360 | 172,355 |

| The Bank of Nova Scotia | | | 26,193 | 1,479,540 |

| The Tochigi Bank, Ltd. | | | 14,670 | 31,515 |

| Unicaja Banco SA (B) | | | 89,456 | 97,119 |

| UniCredit SpA | | | 18,946 | 276,933 |

| Wells Fargo & Company | | | 5,679 | 305,530 |

| Westpac Banking Corp. | | | 4,334 | 74,011 |

| Capital markets 1.8% | | | |

| CME Group, Inc. | | | 1,080 | 216,778 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 12 |

| | | | | Shares | Value |

| Financials (continued) | | | |

| Capital markets (continued) | | | |

| GAM Holding AG (A) | | | 11,057 | $32,068 |

| Ichiyoshi Securities Company, Ltd. | | | 5,910 | 34,716 |

| IGM Financial, Inc. | | | 6,245 | 179,287 |

| Intercontinental Exchange, Inc. | | | 2,029 | 187,784 |

| Julius Baer Group, Ltd. (A) | | | 3,922 | 202,190 |

| MarketAxess Holdings, Inc. | | | 209 | 79,234 |

| Natixis SA | | | 70,272 | 313,028 |

| Nomura Holdings, Inc. | | | 30,900 | 159,005 |

| UBS Group AG (A) | | | 139,953 | 1,766,121 |

| Uranium Participation Corp. (A) | | | 12,333 | 38,750 |

| Consumer finance 0.0% | | | |

| Provident Financial PLC | | | 8,472 | 51,363 |

| Diversified financial services 0.0% | | | |

| G-Resources Group, Ltd. (A) | | | 2,076,450 | 15,451 |

| Insurance 3.2% | | | |

| Admiral Group PLC | | | 3,458 | 105,671 |

| Ageas | | | 2,872 | 169,829 |

| American Financial Group, Inc. | | | 4 | 439 |

| Assicurazioni Generali SpA | | | 13,126 | 270,984 |

| AXA SA | | | 58,058 | 1,640,501 |

| Dai-ichi Life Holdings, Inc. | | | 10,145 | 167,192 |

| Direct Line Insurance Group PLC | | | 64,748 | 267,898 |

| Fidelity National Financial, Inc. | | | 3,899 | 176,820 |

| Legal & General Group PLC | | | 22,181 | 89,102 |

| Orange Life Insurance, Ltd. (B) | | | 4,080 | 99,561 |

| Power Corp. of Canada | | | 26,927 | 693,626 |

| Powszechny Zaklad Ubezpieczen SA | | | 22,356 | 236,112 |

| Sampo OYJ, A Shares | | | 7,729 | 337,472 |

| Shin Kong Financial Holding Company, Ltd. (A) | | | 225,563 | 77,954 |

| T&D Holdings, Inc. | | | 21,365 | 270,176 |

| Tokio Marine Holdings, Inc. | | | 19,800 | 1,108,578 |

| Tongyang Life Insurance Company, Ltd. (A) | | | 10,877 | 37,547 |

| Mortgage real estate investment trusts 1.3% | | | |

| AGNC Investment Corp. | | | 78,245 | 1,383,372 |

| Annaly Capital Management, Inc. | | | 113,838 | 1,072,354 |

| Thrifts and mortgage finance 0.1% | | | |

| New York Community Bancorp, Inc. | | | 11,099 | 133,410 |

| Health care 7.4% | | | 13,468,899 |

| Biotechnology 1.0% | | | |

| AbbVie, Inc. | | | 13,368 | 1,183,603 |

| Amgen, Inc. | | | 671 | 161,758 |

| 13 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

| Health care (continued) | | | |

| Biotechnology (continued) | | | |

| Gilead Sciences, Inc. | | | 6,343 | $412,168 |

| Health care equipment and supplies 1.0% | | | |

| Abbott Laboratories | | | 4,437 | 385,398 |

| Hoya Corp. | | | 1,237 | 118,086 |

| Koninklijke Philips NV | | | 15,319 | 748,849 |

| Medtronic PLC | | | 2,218 | 251,632 |

| ResMed, Inc. | | | 1,538 | 238,344 |

| Stryker Corp. | | | 178 | 37,369 |

| Health care providers and services 0.6% | | | |

| Anthem, Inc. | | | 150 | 45,305 |

| Cardinal Health, Inc. | | | 2,141 | 108,292 |

| CVS Health Corp. | | | 9,319 | 692,309 |

| UnitedHealth Group, Inc. | | | 933 | 274,283 |

| Health care technology 0.0% | | | |

| AGFA-Gevaert NV (A) | | | 10,540 | 54,591 |

| Life sciences tools and services 0.0% | | | |

| CMIC Holdings Company, Ltd. | | | 1,390 | 23,522 |

| Pharmaceuticals 4.8% | | | |

| AstraZeneca PLC | | | 14,138 | 1,415,100 |

| Bristol-Myers Squibb Company | | | 17,853 | 1,145,984 |

| Chugai Pharmaceutical Company, Ltd. | | | 635 | 58,480 |

| Daiichi Sankyo Company, Ltd. | | | 880 | 58,119 |

| Eisai Company, Ltd. | | | 1,090 | 81,560 |

| Eli Lilly & Company | | | 590 | 77,544 |

| Johnson & Johnson | | | 4,865 | 709,658 |

| Merck & Company, Inc. | | | 12,661 | 1,151,518 |

| Novartis AG | | | 16,403 | 1,553,193 |

| Pfizer, Inc. | | | 45,846 | 1,796,246 |

| Roche Holding AG | | | 688 | 223,602 |

| Takeda Pharmaceutical Company, Ltd. | | | 10,690 | 422,813 |

| Zoetis, Inc. | | | 299 | 39,573 |

| Industrials 7.5% | | | 13,603,110 |

| Aerospace and defense 1.0% | | | |

| L3Harris Technologies, Inc. | | | 292 | 57,778 |

| Lockheed Martin Corp. | | | 1,731 | 674,017 |

| Northrop Grumman Corp. | | | 308 | 105,943 |

| The Boeing Company | | | 2,960 | 964,250 |

| Air freight and logistics 0.2% | | | |

| bpost SA | | | 5,808 | 67,150 |

| CTT-Correios de Portugal SA | | | 11,333 | 40,679 |

| PostNL NV | | | 40,636 | 91,950 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 14 |

| | | | | Shares | Value |

| Industrials (continued) | | | |

| Air freight and logistics (continued) | | | |

| United Parcel Service, Inc., Class B | | | 981 | $114,836 |

| Airlines 0.2% | | | |

| ANA Holdings, Inc. | | | 2,437 | 81,356 |

| Deutsche Lufthansa AG | | | 5,993 | 110,096 |

| SAS AB (A) | | | 62,699 | 101,995 |

| Building products 0.2% | | | |

| Cie de Saint-Gobain | | | 7,529 | 308,432 |

| Commercial services and supplies 0.3% | | | |

| Babcock International Group PLC | | | 15,722 | 131,199 |

| Republic Services, Inc. | | | 2,303 | 206,418 |

| Serco Group PLC (A) | | | 9,812 | 21,065 |

| Toppan Forms Company, Ltd. | | | 6,140 | 68,747 |

| Waste Management, Inc. | | | 1,592 | 181,424 |

| Construction and engineering 1.2% | | | |

| China Machinery Engineering Corp., H Shares | | | 133,870 | 53,950 |

| Chiyoda Corp. (A) | | | 9,025 | 23,344 |

| Implenia AG | | | 2,070 | 83,965 |

| JGC Holdings Corp. | | | 9,845 | 156,693 |

| Raubex Group, Ltd. | | | 29,671 | 50,861 |

| Shanghai Construction Group Company, Ltd., Class A | | | 695,600 | 353,783 |

| Toyo Engineering Corp. (A) | | | 6,610 | 42,975 |

| Vinci SA | | | 13,094 | 1,458,325 |

| Electrical equipment 1.0% | | | |

| ABB, Ltd. | | | 24,858 | 599,653 |

| Cosel Company, Ltd. | | | 4,340 | 46,670 |

| Emerson Electric Company | | | 13,135 | 1,001,675 |

| Ushio, Inc. | | | 2,555 | 37,886 |

| Zumtobel Group AG (A) | | | 6,494 | 66,165 |

| Industrial conglomerates 0.5% | | | |

| 3M Company | | | 1,331 | 234,815 |

| Siemens AG | | | 5,313 | 693,833 |

| Machinery 0.6% | | | |

| Hisaka Works, Ltd. | | | 4,580 | 42,244 |

| Mitsubishi Heavy Industries, Ltd. | | | 3,565 | 138,239 |

| Nabtesco Corp. | | | 22,400 | 660,060 |

| The Japan Steel Works, Ltd. | | | 4,980 | 97,278 |

| THK Company, Ltd. | | | 3,310 | 88,868 |

| Toshiba Machine Company, Ltd. | | | 1,883 | 50,733 |

| Marine 0.2% | | | |

| A.P. Moller - Maersk A/S, Series B | | | 140 | 201,996 |

| D/S Norden A/S | | | 6,238 | 99,895 |

| 15 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

| Industrials (continued) | | | |

| Marine (continued) | | | |

| Kuehne + Nagel International AG | | | 287 | $48,407 |

| Pacific Basin Shipping, Ltd. | | | 422,330 | 88,953 |

| Professional services 0.2% | | | |

| Adecco Group AG | | | 3,981 | 251,688 |

| Hays PLC | | | 36,234 | 87,144 |

| Pagegroup PLC | | | 9,785 | 67,820 |

| SThree PLC | | | 10,597 | 53,104 |

| Road and rail 0.4% | | | |

| BTS Group Holdings PCL | | | 1,545,026 | 680,088 |

| The Go-Ahead Group PLC | | | 1,404 | 41,142 |

| Trading companies and distributors 0.7% | | | |

| Rexel SA | | | 14,498 | 192,833 |

| SIG PLC | | | 30,506 | 49,742 |

| Triton International, Ltd. | | | 24,997 | 1,004,879 |

| Transportation infrastructure 0.8% | | | |

| Hamburger Hafen und Logistik AG | | | 1,500 | 41,132 |

| Sydney Airport | | | 111,892 | 679,824 |

| Transurban Group | | | 67,365 | 705,113 |

| Information technology 8.3% | | | 15,145,530 |

| Communications equipment 1.1% | | | |

| Cisco Systems, Inc. | | | 25,688 | 1,231,996 |

| Motorola Solutions, Inc. | | | 997 | 160,657 |

| Nokia OYJ (A) | | | 151,229 | 559,376 |

| Electronic equipment, instruments and components 0.3% | | | |

| Citizen Watch Company, Ltd. | | | 23,385 | 127,357 |

| Enplas Corp. | | | 1,710 | 56,065 |

| Foxconn Technology Company, Ltd. | | | 45,320 | 100,195 |

| Innolux Corp. | | | 355,860 | 99,092 |

| Nichicon Corp. | | | 11,310 | 117,443 |

| Nippon Chemi-Con Corp. | | | 4,760 | 90,709 |

| IT services 1.4% | | | |

| Broadridge Financial Solutions, Inc. | | | 1,397 | 172,585 |

| Fidelity National Information Services, Inc. | | | 1,213 | 168,716 |

| Fujitsu, Ltd. | | | 1,144 | 107,600 |

| IBM Corp. | | | 2,894 | 387,912 |

| Infosys, Ltd. | | | 5,420 | 55,880 |

| Itochu Techno-Solutions Corp. | | | 1,953 | 55,001 |

| Jack Henry & Associates, Inc. | | | 545 | 79,390 |

| Leidos Holdings, Inc. | | | 1,307 | 127,942 |

| Mastercard, Inc., Class A | | | 1,040 | 310,534 |

| Nomura Research Institute, Ltd. | | | 4,006 | 85,672 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 16 |

| | | | | Shares | Value |

| Information technology (continued) | | | |

| IT services (continued) | | | |

| Obic Company, Ltd. | | | 407 | $54,823 |

| Sabre Corp. | | | 6,802 | 152,637 |

| Sopra Steria Group | | | 190 | 30,687 |

| Tata Consultancy Services, Ltd. | | | 178 | 5,398 |

| The Western Union Company | | | 4,873 | 130,499 |

| TravelSky Technology, Ltd., H Shares | | | 18,000 | 43,942 |

| Visa, Inc., Class A | | | 2,934 | 551,299 |

| Semiconductors and semiconductor equipment 2.8% | | | |

| Advanced Micro Devices, Inc. (A) | | | 1,794 | 82,273 |

| Applied Materials, Inc. | | | 2,082 | 127,085 |

| ASML Holding NV | | | 334 | 98,883 |

| Broadcom, Inc. | | | 839 | 265,141 |

| Disco Corp. | | | 183 | 42,973 |

| Intel Corp. | | | 3,038 | 181,824 |

| KLA Corp. | | | 1,171 | 208,637 |

| Lam Research Corp. | | | 466 | 136,258 |

| Maxim Integrated Products, Inc. | | | 1,450 | 89,190 |

| Microchip Technology, Inc. | | | 947 | 99,170 |

| Miraial Company, Ltd. | | | 1,900 | 24,155 |

| NVIDIA Corp. | | | 941 | 221,417 |

| QUALCOMM, Inc. | | | 1,628 | 143,638 |

| Skyworks Solutions, Inc. | | | 473 | 57,176 |

| STMicroelectronics NV | | | 4,953 | 133,635 |

| Taiwan Semiconductor Manufacturing Company, Ltd. | | | 151,000 | 1,671,241 |

| Texas Instruments, Inc. | | | 9,108 | 1,168,465 |

| Tokyo Electron, Ltd. | | | 784 | 171,171 |

| Tokyo Seimitsu Company, Ltd. | | | 2,975 | 115,513 |

| Software 0.9% | | | |

| Intuit, Inc. | | | 459 | 120,226 |

| Microsoft Corp. | | | 8,304 | 1,309,541 |

| Oracle Corp. | | | 2,505 | 132,715 |

| Trend Micro, Inc. | | | 2,500 | 127,924 |

| Technology hardware, storage and peripherals 1.8% | | | |

| Acer, Inc. | | | 155,770 | 92,843 |

| Apple, Inc. | | | 4,812 | 1,413,044 |

| Canon, Inc. | | | 14,443 | 395,283 |

| Compal Electronics, Inc. | | | 235,585 | 148,385 |

| HP, Inc. | | | 8,328 | 171,140 |

| Maxell Holdings, Ltd. | | | 4,680 | 63,235 |

| Melco Holdings, Inc. | | | 736 | 20,910 |

| NetApp, Inc. | | | 861 | 53,597 |

| Quadient | | | 4,047 | 98,061 |

| 17 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

| Information technology (continued) | | | |

| Technology hardware, storage and peripherals (continued) | | | |

| Samsung Electronics Company, Ltd. | | | 2,241 | $107,987 |

| Seagate Technology PLC | | | 13,267 | 789,387 |

| Materials 2.8% | | | 5,014,073 |

| Chemicals 0.5% | | | |

| China BlueChemical, Ltd., H Shares | | | 246,420 | 60,712 |

| Dow, Inc. | | | 3,536 | 193,525 |

| EMS-Chemie Holding AG | | | 101 | 66,401 |

| JSR Corp. | | | 10,110 | 184,938 |

| LyondellBasell Industries NV, Class A | | | 2,840 | 268,323 |

| Nitto Denko Corp. | | | 2,170 | 122,014 |

| Construction materials 0.2% | | | |

| Imerys SA | | | 1,836 | 77,934 |

| LafargeHolcim, Ltd. (A) | | | 4,320 | 239,663 |

| Vicat SA | | | 1,710 | 77,389 |

| Containers and packaging 0.2% | | | |

| Amcor PLC | | | 16,185 | 175,445 |

| AMVIG Holdings, Ltd. | | | 75,690 | 19,032 |

| International Paper Company | | | 2,450 | 112,823 |

| Nampak, Ltd. (A) | | | 93,285 | 45,519 |

| Metals and mining 1.9% | | | |

| Alumina, Ltd. | | | 68,097 | 109,991 |

| Anglo American PLC | | | 6,950 | 199,659 |

| Barrick Gold Corp. | | | 10,716 | 199,045 |

| Centerra Gold, Inc. (A) | | | 11,469 | 91,236 |

| Chubu Steel Plate Company, Ltd. | | | 2,010 | 13,403 |

| CST Group, Ltd. (A) | | | 1,440,000 | 4,430 |

| Eldorado Gold Corp. (A) | | | 7,668 | 61,574 |

| Eregli Demir ve Celik Fabrikalari TAS | | | 161,626 | 245,463 |

| Fortescue Metals Group, Ltd. | | | 15,613 | 117,696 |

| Gold Fields, Ltd. | | | 15,096 | 103,040 |

| Harmony Gold Mining Company, Ltd., ADR (A) | | | 22,634 | 82,161 |

| Hitachi Metals, Ltd. | | | 2,010 | 29,587 |

| IAMGOLD Corp. (A) | | | 8,320 | 31,034 |

| Impala Platinum Holdings, Ltd. (A) | | | 6,607 | 67,506 |

| Kinross Gold Corp. (A) | | | 19,925 | 94,445 |

| Kyoei Steel, Ltd. | | | 5,610 | 109,320 |

| Magnitogorsk Iron & Steel Works PJSC, GDR | | | 21,639 | 187,693 |

| MMC Norilsk Nickel PJSC, ADR | | | 4,470 | 136,290 |

| Nakayama Steel Works, Ltd. | | | 8,690 | 43,347 |

| Neturen Company, Ltd. | | | 2,890 | 23,614 |

| Norsk Hydro ASA | | | 44,838 | 166,735 |

| Northern Dynasty Minerals, Ltd. (A) | | | 4,162 | 1,795 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 18 |

| | | | | Shares | Value |

| Materials (continued) | | | |

| Metals and mining (continued) | | | |

| Pacific Metals Company, Ltd. | | | 2,350 | $54,836 |

| Petra Diamonds, Ltd. (A) | | | 88,495 | 10,420 |

| Resolute Mining, Ltd. (A) | | | 48,845 | 42,982 |

| Salzgitter AG | | | 5,037 | 111,184 |

| SEMAFO, Inc. (A) | | | 29,144 | 60,597 |

| Severstal PJSC, GDR | | | 45,494 | 688,488 |

| Tokyo Steel Manufacturing Company, Ltd. | | | 13,140 | 94,958 |

| Western Areas, Ltd. | | | 37,581 | 80,033 |

| Yamato Kogyo Company, Ltd. | | | 4,305 | 107,793 |

| Real estate 3.8% | | | 6,964,376 |

| Equity real estate investment trusts 2.9% | | | |

| American Tower Corp. | | | 341 | 78,369 |

| Crown Castle International Corp. | | | 925 | 131,489 |

| Equity Residential | | | 828 | 67,002 |

| Extra Space Storage, Inc. | | | 1,862 | 196,664 |

| Fortress REIT, Ltd., Class B | | | 721,287 | 412,235 |

| Growthpoint Properties, Ltd. | | | 94,610 | 149,456 |

| Healthpeak Properties, Inc. | | | 4,097 | 141,224 |

| Host Hotels & Resorts, Inc. | | | 8,050 | 149,328 |

| Iron Mountain, Inc. | | | 10,366 | 330,364 |

| Japan Prime Realty Investment Corp. | | | 155 | 681,516 |

| Land Securities Group PLC | | | 7,652 | 100,444 |

| Nippon Building Fund, Inc. | | | 91 | 667,053 |

| Public Storage | | | 928 | 197,627 |

| Redefine Properties, Ltd. | | | 358,084 | 193,331 |

| Simon Property Group, Inc. | | | 2,087 | 310,880 |

| Sun Communities, Inc. | | | 98 | 14,710 |

| The British Land Company PLC | | | 11,319 | 95,846 |

| The GPT Group | | | 165,648 | 652,495 |

| The Macerich Company | | | 6,561 | 176,622 |

| Ventas, Inc. | | | 1,675 | 96,715 |

| VEREIT, Inc. | | | 3,974 | 36,720 |

| Welltower, Inc. | | | 1,528 | 124,960 |

| WP Carey, Inc. | | | 4,733 | 378,829 |

| Real estate management and development 0.9% | | | |

| Mitsubishi Estate Company, Ltd. | | | 7,540 | 144,277 |

| Nexity SA | | | 28,575 | 1,436,220 |

| Utilities 7.1% | | | 12,848,424 |

| Electric utilities 2.9% | | | |

| Alliant Energy Corp. | | | 1,329 | 72,723 |

| American Electric Power Company, Inc. | | | 2,069 | 195,541 |

| 19 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

| Utilities (continued) | | | |

| Electric utilities (continued) | | | |

| Duke Energy Corp. | | | 3,176 | $289,683 |

| Edison International | | | 16,664 | 1,256,632 |

| Enel SpA | | | 104,119 | 827,103 |

| Entergy Corp. | | | 1,221 | 146,276 |

| Evergy, Inc. | | | 1,248 | 81,232 |

| Eversource Energy | | | 1,691 | 143,853 |

| FirstEnergy Corp. | | | 1,433 | 69,644 |

| Iberdrola SA | | | 139,680 | 1,439,482 |

| NextEra Energy, Inc. | | | 1,027 | 248,698 |

| OGE Energy Corp. | | | 2,285 | 101,614 |

| Pinnacle West Capital Corp. | | | 478 | 42,987 |

| PPL Corp. | | | 7,690 | 275,917 |

| The Southern Company | | | 302 | 19,237 |

| Xcel Energy, Inc. | | | 1,483 | 94,156 |

| Gas utilities 0.4% | | | |

| AltaGas, Ltd. | | | 6,672 | 101,630 |

| APA Group | | | 90,623 | 705,449 |

| Independent power and renewable electricity producers 0.3% | | | |

| China Longyuan Power Group Corp., Ltd., H Shares | | | 755,995 | 478,084 |

| NTPC, Ltd. | | | 8,984 | 14,982 |

| Ratch Group PCL | | | 17,559 | 40,302 |

| Multi-utilities 2.6% | | | |

| CenterPoint Energy, Inc. | | | 6,016 | 164,056 |

| Centrica PLC | | | 127,676 | 150,938 |

| CMS Energy Corp. | | | 728 | 45,748 |

| Consolidated Edison, Inc. | | | 821 | 74,276 |

| Dominion Energy, Inc. | | | 14,092 | 1,167,099 |

| DTE Energy Company | | | 649 | 84,286 |

| E.ON SE | | | 110,962 | 1,185,837 |

| Engie SA | | | 11,172 | 180,968 |

| National Grid PLC | | | 93,699 | 1,170,972 |

| Public Service Enterprise Group, Inc. | | | 712 | 42,044 |

| RWE AG | | | 2,567 | 78,658 |

| Sempra Energy | | | 810 | 122,699 |

| WEC Energy Group, Inc. | | | 1,895 | 174,776 |

| Water utilities 0.9% | | | |

| Guangdong Investment, Ltd. | | | 372,000 | 778,060 |

|

| United Utilities Group PLC | | | 62,553 | 782,782 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 20 |

| | | | | Shares | Value |

|

| Preferred securities 0.7% | | | | | $1,225,749 |

| (Cost $1,029,136) | | | | | |

| Consumer discretionary 0.6% | | | | | 1,064,108 |

| Automobiles 0.6% | | | |

| Volkswagen AG | | 5,406 | 1,064,108 |

| Information technology 0.1% | | | | | 106,454 |

| Technology hardware, storage and peripherals 0.1% | | | |

| Samsung Electronics Company, Ltd. | | 2,719 | 106,454 |

| Utilities 0.0% | | | | | 55,187 |

| Electric utilities 0.0% | | | |

|

| Cia Paranaense de Energia, B Shares | | 3,200 | 55,187 |

| Exchange-traded funds 0.0% | | | | | $96,555 |

| (Cost $96,566) | | | | | |

| iShares Core MSCI EAFE ETF | | | | 1,480 | 96,555 |

|

| | Rate (%) | Maturity date | | Par value^ | Value |

| Corporate bonds 13.8% | | | $24,983,718 |

| (Cost $24,269,272) | | | | | |

| Communication services 2.5% | | | 4,544,325 |

| Diversified telecommunication services 0.8% | | | |

| Altice France SA (B) | 3.375 | 01-15-28 | EUR | 100,000 | 115,537 |

| Altice France SA | 5.875 | 02-01-27 | EUR | 165,000 | 208,216 |

| CenturyLink, Inc. | 5.625 | 04-01-25 | | 20,000 | 21,251 |

| CenturyLink, Inc. | 7.500 | 04-01-24 | | 30,000 | 33,825 |

| Embarq Corp. | 7.995 | 06-01-36 | | 100,000 | 105,750 |

| Frontier Communications Corp. | 6.875 | 01-15-25 | | 40,000 | 19,400 |

| Frontier Communications Corp. (B) | 8.500 | 04-01-26 | | 85,000 | 86,063 |

| Frontier Communications Corp. | 10.500 | 09-15-22 | | 40,000 | 19,500 |

| Intelsat Jackson Holdings SA | 5.500 | 08-01-23 | | 125,000 | 107,380 |

| Intelsat Jackson Holdings SA (B) | 8.500 | 10-15-24 | | 160,000 | 145,733 |

| Telecom Argentina SA (B) | 6.500 | 06-15-21 | | 151,000 | 146,470 |

| Telecom Italia Capital SA | 7.200 | 07-18-36 | | 90,000 | 106,632 |

| Telecom Italia SpA (B) | 5.303 | 05-30-24 | | 200,000 | 215,000 |

| Ziggo BV (B) | 5.500 | 01-15-27 | | 170,000 | 180,625 |

| Media 1.3% | | | |

| Altice Financing SA (B) | 7.500 | 05-15-26 | | 210,000 | 225,750 |

| Altice Luxembourg SA (B) | 7.625 | 02-15-25 | | 200,000 | 208,000 |

| Altice Luxembourg SA | 8.000 | 05-15-27 | EUR | 100,000 | 125,630 |

| CCO Holdings LLC (B) | 5.750 | 02-15-26 | | 105,000 | 110,777 |

| CSC Holdings LLC (B) | 6.500 | 02-01-29 | | 390,000 | 434,850 |

| DISH DBS Corp. | 5.000 | 03-15-23 | | 175,000 | 179,524 |

| DISH DBS Corp. | 5.875 | 07-15-22 | | 50,000 | 53,000 |

| 21 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | | | |

| Media (continued) | | | |

| DISH DBS Corp. | 5.875 | 11-15-24 | | 30,000 | $30,656 |

| DISH DBS Corp. | 7.750 | 07-01-26 | | 30,000 | 31,782 |

| Gray Television, Inc. (B) | 5.125 | 10-15-24 | | 130,000 | 134,875 |

| Gray Television, Inc. (B) | 5.875 | 07-15-26 | | 50,000 | 53,188 |

| iHeartCommunications, Inc. (B) | 5.250 | 08-15-27 | | 65,000 | 68,010 |

| Nexstar Broadcasting, Inc. (B) | 5.625 | 07-15-27 | | 180,000 | 189,684 |

| Scripps Escrow, Inc. (B) | 5.875 | 07-15-27 | | 100,000 | 104,750 |

| Sinclair Television Group, Inc. (B) | 5.625 | 08-01-24 | | 100,000 | 102,875 |

| Sirius XM Radio, Inc. (B) | 5.500 | 07-01-29 | | 100,000 | 108,124 |

| WMG Acquisition Corp. | 3.625 | 10-15-26 | EUR | 100,000 | 118,620 |

| WMG Acquisition Corp. (B) | 5.500 | 04-15-26 | | 85,000 | 89,463 |

| Wireless telecommunication services 0.4% | | | |

| Sprint Capital Corp. | 8.750 | 03-15-32 | | 60,000 | 72,825 |

| Sprint Corp. | 7.125 | 06-15-24 | | 50,000 | 53,938 |

| Sprint Corp. | 7.250 | 09-15-21 | | 215,000 | 227,363 |

| Sprint Corp. | 7.875 | 09-15-23 | | 100,000 | 110,333 |

| Turkcell Iletisim Hizmetleri AS | 5.800 | 04-11-28 | | 200,000 | 198,926 |

| Consumer discretionary 1.7% | | | 3,057,312 |

| Auto components 0.2% | | | |

| Adient Global Holdings, Ltd. | 3.500 | 08-15-24 | EUR | 100,000 | 106,000 |

| Adient US LLC (B) | 7.000 | 05-15-26 | | 20,000 | 21,800 |

| American Axle & Manufacturing, Inc. | 6.250 | 04-01-25 | | 15,000 | 15,619 |

| American Axle & Manufacturing, Inc. | 6.500 | 04-01-27 | | 35,000 | 36,313 |

| Panther BF Aggregator 2 LP (B) | 8.500 | 05-15-27 | | 115,000 | 122,188 |

| Distributors 0.1% | | | |

| LKQ European Holdings BV | 3.625 | 04-01-26 | EUR | 100,000 | 118,081 |

| Diversified consumer services 0.1% | | | |

| La Financiere Atalian SASU | 4.000 | 05-15-24 | EUR | 100,000 | 89,998 |

| La Financiere Atalian SASU (B) | 4.000 | 05-15-24 | EUR | 100,000 | 89,998 |

| Service Corp. International | 4.625 | 12-15-27 | | 35,000 | 36,488 |

| Service Corp. International | 5.125 | 06-01-29 | | 25,000 | 26,563 |

| Hotels, restaurants and leisure 0.9% | | | |

| Boyd Gaming Corp. (B) | 4.750 | 12-01-27 | | 25,000 | 25,969 |

| Boyd Gaming Corp. | 6.375 | 04-01-26 | | 85,000 | 91,455 |

| Caesars Resort Collection LLC (B) | 5.250 | 10-15-25 | | 120,000 | 124,050 |

| Eldorado Resorts, Inc. | 6.000 | 04-01-25 | | 130,000 | 136,825 |

| Golden Entertainment, Inc. (B) | 7.625 | 04-15-26 | | 70,000 | 75,425 |

| Hilton Domestic Operating Company, Inc. | 4.250 | 09-01-24 | | 152,000 | 154,850 |

| Jacobs Entertainment, Inc. (B) | 7.875 | 02-01-24 | | 165,000 | 174,900 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 22 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer discretionary (continued) | | | |

| Hotels, restaurants and leisure (continued) | | | |

| KFC Holding Company/Pizza Hut Holdings LLC/Taco Bell of America LLC (B) | 4.750 | 06-01-27 | | 60,000 | $63,150 |

| KFC Holding Company/Pizza Hut Holdings LLC/Taco Bell of America LLC (B) | 5.250 | 06-01-26 | | 60,000 | 63,300 |

| New Red Finance, Inc. (B) | 5.000 | 10-15-25 | | 320,000 | 330,400 |

| Penn National Gaming, Inc. (B) | 5.625 | 01-15-27 | | 186,000 | 196,566 |

| Sugarhouse HSP Gaming Prop Mezz LP (B) | 5.875 | 05-15-25 | | 110,000 | 109,725 |

| Wynn Las Vegas LLC (B) | 5.500 | 03-01-25 | | 120,000 | 128,550 |

| Yum! Brands, Inc. (B) | 4.750 | 01-15-30 | | 30,000 | 31,425 |

| Household durables 0.2% | | | |

| KB Home | 4.800 | 11-15-29 | | 30,000 | 30,600 |

| M/I Homes, Inc. | 5.625 | 08-01-25 | | 40,000 | 41,900 |

| M/I Homes, Inc. | 6.750 | 01-15-21 | | 165,000 | 165,206 |

| Taylor Morrison Communities, Inc. (B) | 5.750 | 01-15-28 | | 140,000 | 152,600 |

| Leisure products 0.1% | | | |

| Jack Ohio Finance LLC (B) | 6.750 | 11-15-21 | | 13,000 | 13,260 |

| Mattel, Inc. (B) | 5.875 | 12-15-27 | | 40,000 | 42,150 |

| Mattel, Inc. (B) | 6.750 | 12-31-25 | | 140,000 | 150,472 |

| Specialty retail 0.1% | | | |

| Lithia Motors, Inc. (B) | 4.625 | 12-15-27 | | 65,000 | 66,811 |

| Party City Holdings, Inc. (B) | 6.625 | 08-01-26 | | 35,000 | 24,675 |

| Consumer staples 0.7% | | | 1,220,647 |

| Food and staples retailing 0.0% | | | |

| Performance Food Group, Inc. (B) | 5.500 | 10-15-27 | | 45,000 | 48,094 |

| Food products 0.5% | | | |

| B&G Foods, Inc. | 5.250 | 09-15-27 | | 55,000 | 55,550 |

| MARB BondCo PLC (B) | 7.000 | 03-15-24 | | 200,000 | 208,500 |

| Post Holdings, Inc. (B) | 5.000 | 08-15-26 | | 190,000 | 200,688 |

| Post Holdings, Inc. (B) | 5.625 | 01-15-28 | | 70,000 | 75,425 |

| Post Holdings, Inc. (B) | 5.750 | 03-01-27 | | 100,000 | 107,250 |

| TreeHouse Foods, Inc. | 4.875 | 03-15-22 | | 190,000 | 190,713 |

| Household products 0.1% | | | |

| Diamond BC BV | 5.625 | 08-15-25 | EUR | 200,000 | 220,302 |

| Personal products 0.1% | | | |

| Prestige Brands, Inc. (B) | 5.125 | 01-15-28 | | 50,000 | 52,375 |

| Revlon Consumer Products Corp. | 6.250 | 08-01-24 | | 130,000 | 61,750 |

| 23 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Energy 2.0% | | | $3,574,520 |

| Energy equipment and services 0.2% | | | |

| Tervita Corp. (B) | 7.625 | 12-01-21 | | 229,000 | 230,431 |

| Transocean, Inc. | 6.800 | 03-15-38 | | 110,000 | 78,100 |

| Oil, gas and consumable fuels 1.8% | | | |

| California Resources Corp. (B) | 8.000 | 12-15-22 | | 15,000 | 6,450 |

| Centennial Resource Production LLC (B) | 5.375 | 01-15-26 | | 65,000 | 63,863 |

| Cheniere Energy Partners LP (B) | 4.500 | 10-01-29 | | 71,000 | 72,960 |

| Chesapeake Energy Corp. (B) | 11.500 | 01-01-25 | | 197,000 | 186,165 |

| DCP Midstream Operating LP | 5.375 | 07-15-25 | | 120,000 | 130,500 |

| Energen Corp. | 4.625 | 09-01-21 | | 105,000 | 107,466 |

| Energy Transfer Operating LP | 4.250 | 03-15-23 | | 110,000 | 114,830 |

| Foresight Energy LLC (B) | 11.500 | 04-01-23 | | 170,000 | 5,950 |

| Jagged Peak Energy LLC | 5.875 | 05-01-26 | | 85,000 | 87,761 |

| Laredo Petroleum, Inc. | 5.625 | 01-15-22 | | 55,000 | 53,350 |

| Laredo Petroleum, Inc. | 6.250 | 03-15-23 | | 65,000 | 60,938 |

| Matador Resources Company | 5.875 | 09-15-26 | | 105,000 | 105,263 |

| MEG Energy Corp. (B) | 6.500 | 01-15-25 | | 80,000 | 83,208 |

| MEG Energy Corp. (B) | 7.000 | 03-31-24 | | 95,000 | 95,594 |

| Noble Holding International, Ltd. (B) | 7.875 | 02-01-26 | | 40,000 | 29,000 |

| Petrobras Global Finance BV | 5.093 | 01-15-30 | | 80,000 | 85,721 |

| Petrobras Global Finance BV | 5.750 | 02-01-29 | | 430,000 | 485,040 |

| Petrobras Global Finance BV | 7.375 | 01-17-27 | | 60,000 | 73,200 |

| QEP Resources, Inc. | 5.250 | 05-01-23 | | 105,000 | 103,950 |

| QEP Resources, Inc. | 5.375 | 10-01-22 | | 15,000 | 15,075 |

| QEP Resources, Inc. | 5.625 | 03-01-26 | | 87,000 | 84,847 |

| SM Energy Company | 5.000 | 01-15-24 | | 100,000 | 95,250 |

| SM Energy Company | 5.625 | 06-01-25 | | 50,000 | 47,459 |

| SM Energy Company | 6.125 | 11-15-22 | | 5,000 | 5,050 |

| SM Energy Company | 6.625 | 01-15-27 | | 85,000 | 83,543 |

| State Oil Company of the Azerbaijan Republic | 4.750 | 03-13-23 | | 200,000 | 209,894 |

| Sunoco LP | 5.500 | 02-15-26 | | 35,000 | 36,313 |

| Sunoco LP | 5.875 | 03-15-28 | | 20,000 | 21,236 |

| Sunoco LP | 6.000 | 04-15-27 | | 50,000 | 53,375 |

| Tallgrass Energy Partners LP (B) | 4.750 | 10-01-23 | | 110,000 | 109,725 |

| Targa Resources Partners LP (B) | 6.500 | 07-15-27 | | 215,000 | 235,425 |

| Vine Oil & Gas LP (B) | 8.750 | 04-15-23 | | 105,000 | 51,450 |

| WPX Energy, Inc. | 5.250 | 09-15-24 | | 125,000 | 132,813 |

| WPX Energy, Inc. | 5.750 | 06-01-26 | | 30,000 | 32,025 |

| WPX Energy, Inc. | 8.250 | 08-01-23 | | 40,000 | 46,000 |

| YPF SA | 7.000 | 12-15-47 | | 70,000 | 55,300 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 24 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Financials 1.6% | | | $2,907,216 |

| Banks 0.7% | | | |

| Abanca Corp. Bancaria SA (4.625% to 4-7-25, then 5 Year Euro Swap Rate + 5.014%) | 4.625 | 04-07-30 | EUR | 100,000 | 118,764 |

| Banco de Sabadell SA (6.500% to 5-18-22, then 5 Year Euro Swap Rate + 6.414%) (E) | 6.500 | 05-18-22 | EUR | 200,000 | 234,435 |

| Credit Agricole SA (8.125% to 12-23-25, then 5 Year U.S. Swap Rate + 6.185%) (B)(E) | 8.125 | 12-23-25 | | 250,000 | 303,019 |

| Freedom Mortgage Corp. (B) | 8.125 | 11-15-24 | | 160,000 | 157,203 |

| Turkiye Is Bankasi AS | 6.125 | 04-25-24 | | 200,000 | 199,491 |

| UniCredit SpA (5.861% to 6-19-27, then 5 Year U.S. ISDAFIX + 3.703%) (B) | 5.861 | 06-19-32 | | 200,000 | 208,496 |

| Capital markets 0.2% | | | |

| Credit Suisse Group AG (6.250% to 12-18-24, then 5 Year U.S. Swap Rate + 3.455%) (E) | 6.250 | 12-18-24 | | 200,000 | 217,550 |

| MSCI, Inc. (B) | 4.000 | 11-15-29 | | 145,000 | 146,994 |

| Consumer finance 0.4% | | | |

| Credit Acceptance Corp. (B) | 5.125 | 12-31-24 | | 75,000 | 77,885 |

| Credit Acceptance Corp. (B) | 6.625 | 03-15-26 | | 70,000 | 75,688 |

| DAE Funding LLC (B) | 4.500 | 08-01-22 | | 35,000 | 35,525 |

| DAE Funding LLC (B) | 5.000 | 08-01-24 | | 140,000 | 146,992 |

| goeasy, Ltd. (B) | 5.375 | 12-01-24 | | 95,000 | 96,741 |

| Navient Corp. | 5.500 | 01-25-23 | | 21,000 | 22,418 |

| Navient Corp. | 6.500 | 06-15-22 | | 80,000 | 86,700 |

| Springleaf Finance Corp. | 6.125 | 05-15-22 | | 120,000 | 128,850 |

| Springleaf Finance Corp. | 6.125 | 03-15-24 | | 5,000 | 5,475 |

| Springleaf Finance Corp. | 8.250 | 12-15-20 | | 155,000 | 162,634 |

| Insurance 0.3% | | | |

| Acrisure LLC (B) | 7.000 | 11-15-25 | | 125,000 | 120,625 |

| Acrisure LLC (B) | 8.125 | 02-15-24 | | 115,000 | 125,063 |

| Acrisure LLC (B) | 10.125 | 08-01-26 | | 75,000 | 80,813 |

| Genworth Holdings, Inc. | 4.800 | 02-15-24 | | 5,000 | 4,887 |

| Genworth Holdings, Inc. | 4.900 | 08-15-23 | | 100,000 | 99,000 |

| Genworth Holdings, Inc. | 7.200 | 02-15-21 | | 30,000 | 30,900 |

| Genworth Holdings, Inc. | 7.625 | 09-24-21 | | 20,000 | 21,068 |

| Health care 1.4% | | | 2,493,052 |

| Health care equipment and supplies 0.2% | | | |

| Constantin Investissement 3 SASU | 5.375 | 04-15-25 | EUR | 100,000 | 115,698 |

| Core & Main Holdings LP (8.625% Cash or 9.375% PIK) (B) | 8.625 | 09-15-24 | | 85,000 | 88,400 |

| Hill-Rom Holdings, Inc. (B) | 4.375 | 09-15-27 | | 80,000 | 82,300 |

| 25 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Health care (continued) | | | |

| Health care providers and services 0.4% | | | |

| Centene Corp. (B) | 4.250 | 12-15-27 | | 30,000 | $30,863 |

| Centene Corp. (B) | 4.625 | 12-15-29 | | 30,000 | 31,616 |

| Community Health Systems, Inc. (B) | 8.125 | 06-30-24 | | 50,000 | 41,000 |

| HCA Healthcare, Inc. | 6.250 | 02-15-21 | | 240,000 | 250,200 |

| HCA, Inc. | 5.375 | 09-01-26 | | 60,000 | 66,825 |

| HCA, Inc. | 5.625 | 09-01-28 | | 10,000 | 11,396 |

| HCA, Inc. | 5.875 | 02-01-29 | | 5,000 | 5,781 |

| HCA, Inc. | 7.500 | 11-15-95 | | 65,000 | 75,725 |

| West Street Merger Sub, Inc. (B) | 6.375 | 09-01-25 | | 140,000 | 139,650 |

| Life sciences tools and services 0.1% | | | |

| Avantor, Inc. (B) | 6.000 | 10-01-24 | | 200,000 | 213,246 |

| Charles River Laboratories International, Inc. (B) | 4.250 | 05-01-28 | | 25,000 | 25,469 |

| Pharmaceuticals 0.7% | | | |

| Bausch Health Companies, Inc. | 4.500 | 05-15-23 | EUR | 130,000 | 147,644 |

| Bausch Health Companies, Inc. (B) | 5.000 | 01-30-28 | | 135,000 | 138,563 |

| Bausch Health Companies, Inc. (B) | 5.500 | 03-01-23 | | 13,000 | 13,065 |

| Bausch Health Companies, Inc. (B) | 5.875 | 05-15-23 | | 108,000 | 108,945 |

| Bausch Health Companies, Inc. (B) | 6.125 | 04-15-25 | | 95,000 | 98,157 |

| Catalent Pharma Solutions, Inc. (B) | 4.875 | 01-15-26 | | 30,000 | 31,050 |

| Catalent Pharma Solutions, Inc. (B) | 5.000 | 07-15-27 | | 20,000 | 20,950 |

| Endo Finance LLC (B) | 5.375 | 01-15-23 | | 185,000 | 124,721 |

| IQVIA, Inc. (B) | 2.250 | 01-15-28 | EUR | 100,000 | 115,813 |

| Teva Pharmaceutical Finance Netherlands II BV | 1.250 | 03-31-23 | EUR | 100,000 | 104,245 |

| Teva Pharmaceutical Finance Netherlands III BV | 2.800 | 07-21-23 | | 225,000 | 208,688 |

| Teva Pharmaceutical Finance Netherlands III BV | 6.750 | 03-01-28 | | 200,000 | 203,042 |

| Industrials 1.2% | | | 2,102,252 |

| Aerospace and defense 0.4% | | | |

| Avolon Holdings Funding, Ltd. (B) | 3.950 | 07-01-24 | | 50,000 | 52,105 |

| Avolon Holdings Funding, Ltd. (B) | 5.250 | 05-15-24 | | 80,000 | 87,326 |

| Bombardier, Inc. (B) | 6.125 | 01-15-23 | | 130,000 | 133,315 |

| Bombardier, Inc. (B) | 7.875 | 04-15-27 | | 105,000 | 108,019 |

| TransDigm, Inc. (B) | 5.500 | 11-15-27 | | 100,000 | 101,123 |

| TransDigm, Inc. (B) | 6.250 | 03-15-26 | | 200,000 | 216,522 |

| Building products 0.1% | | | |

| Advanced Drainage Systems, Inc. (B) | 5.000 | 09-30-27 | | 25,000 | 25,781 |

| Standard Industries, Inc. (B) | 5.375 | 11-15-24 | | 55,000 | 56,513 |

| Commercial services and supplies 0.3% | | | |

| APX Group, Inc. | 7.625 | 09-01-23 | | 155,000 | 145,700 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 26 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Industrials (continued) | | | |

| Commercial services and supplies (continued) | | | |

| APX Group, Inc. | 7.875 | 12-01-22 | | 85,000 | $85,744 |

| Clean Harbors, Inc. (B) | 4.875 | 07-15-27 | | 104,000 | 109,460 |

| Clean Harbors, Inc. (B) | 5.125 | 07-15-29 | | 40,000 | 42,904 |

| IAA, Inc. (B) | 5.500 | 06-15-27 | | 55,000 | 58,438 |

| Stericycle, Inc. (B) | 5.375 | 07-15-24 | | 90,000 | 94,500 |

| Construction and engineering 0.0% | | | |

| Brand Industrial Services, Inc. (B) | 8.500 | 07-15-25 | | 60,000 | 61,500 |

| Electrical equipment 0.1% | | | |

| Sensata Technologies BV (B) | 5.000 | 10-01-25 | | 100,000 | 108,625 |

| Sensata Technologies BV (B) | 5.625 | 11-01-24 | | 80,000 | 89,000 |

| Trading companies and distributors 0.3% | | | |

| Beacon Roofing Supply, Inc. (B) | 4.500 | 11-15-26 | | 15,000 | 15,450 |

| Beacon Roofing Supply, Inc. (B) | 4.875 | 11-01-25 | | 90,000 | 90,450 |

| Herc Holdings, Inc. (B) | 5.500 | 07-15-27 | | 140,000 | 147,350 |

| United Rentals North America, Inc. | 4.625 | 10-15-25 | | 50,000 | 51,405 |

| United Rentals North America, Inc. | 4.875 | 01-15-28 | | 135,000 | 140,566 |

| United Rentals North America, Inc. | 5.875 | 09-15-26 | | 75,000 | 80,456 |

| Information technology 0.7% | | | 1,287,216 |

| IT services 0.1% | | | |

| Cardtronics, Inc. (B) | 5.500 | 05-01-25 | | 10,000 | 10,375 |

| Tempo Acquisition LLC (B) | 6.750 | 06-01-25 | | 240,000 | 247,800 |

| Semiconductors and semiconductor equipment 0.3% | | | |

| Entegris, Inc. (B) | 4.625 | 02-10-26 | | 145,000 | 150,075 |

| Micron Technology, Inc. | 4.640 | 02-06-24 | | 35,000 | 37,956 |

| Micron Technology, Inc. | 4.975 | 02-06-26 | | 90,000 | 99,833 |

| Qorvo, Inc. (B) | 4.375 | 10-15-29 | | 85,000 | 89,038 |

| Qorvo, Inc. | 5.500 | 07-15-26 | | 150,000 | 159,750 |

| Software 0.2% | | | |

| CDK Global, Inc. (B) | 5.250 | 05-15-29 | | 60,000 | 64,350 |

| Infor US, Inc. | 6.500 | 05-15-22 | | 50,000 | 50,750 |

| SS&C Technologies, Inc. (B) | 5.500 | 09-30-27 | | 150,000 | 160,125 |

| Technology hardware, storage and peripherals 0.1% | | | |

| Western Digital Corp. | 4.750 | 02-15-26 | | 35,000 | 36,488 |

| Xerox Corp. | 4.125 | 03-15-23 | | 140,000 | 145,075 |

| Xerox Corp. | 4.800 | 03-01-35 | | 10,000 | 9,226 |

| Xerox Corp. | 6.750 | 12-15-39 | | 25,000 | 26,375 |

| Materials 1.2% | | | 2,244,919 |

| Chemicals 0.1% | | | |

| CF Industries, Inc. | 4.950 | 06-01-43 | | 10,000 | 10,425 |

| CF Industries, Inc. | 5.150 | 03-15-34 | | 70,000 | 78,225 |

| 27 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Materials (continued) | | | |

| Chemicals (continued) | | | |

| CF Industries, Inc. | 5.375 | 03-15-44 | | 20,000 | $21,800 |

| Construction materials 0.0% | | | |

| American Builders & Contractors Supply Company, Inc. (B) | 4.000 | 01-15-28 | | 85,000 | 86,275 |

| Containers and packaging 0.7% | | | |

| ARD Finance SA (5.000% Cash or 5.750% PIK) (B) | 5.000 | 06-30-27 | EUR | 195,000 | 220,413 |

| Ardagh Packaging Finance PLC (B) | 2.125 | 08-15-26 | EUR | 105,000 | 121,731 |

| Ball Corp. | 1.500 | 03-15-27 | EUR | 125,000 | 141,142 |

| Berry Global, Inc. (B) | 1.500 | 01-15-27 | EUR | 106,000 | 119,792 |

| Berry Global, Inc. (B) | 5.625 | 07-15-27 | | 35,000 | 37,538 |

| Berry Global, Inc. | 6.000 | 10-15-22 | | 82,000 | 83,538 |

| Crown European Holdings SA | 2.875 | 02-01-26 | EUR | 225,000 | 273,545 |

| OI European Group BV (B) | 4.000 | 03-15-23 | | 10,000 | 10,075 |

| Owens-Brockway Glass Container, Inc. (B) | 5.875 | 08-15-23 | | 165,000 | 176,138 |

| Reynolds Group Issuer, Inc. (B) | 5.125 | 07-15-23 | | 155,000 | 158,681 |

| Metals and mining 0.3% | | | |

| Constellium SE | 4.250 | 02-15-26 | EUR | 125,000 | 145,821 |

| Novelis Corp. (B) | 5.875 | 09-30-26 | | 55,000 | 58,526 |

| Novelis Corp. (B) | 6.250 | 08-15-24 | | 135,000 | 141,581 |

| Steel Dynamics, Inc. | 4.125 | 09-15-25 | | 25,000 | 25,684 |

| Steel Dynamics, Inc. | 5.125 | 10-01-21 | | 85,000 | 85,051 |

| Paper and forest products 0.1% | | | |

| Flex Acquisition Company, Inc. (B) | 6.875 | 01-15-25 | | 175,000 | 176,313 |

| Norbord, Inc. (B) | 5.750 | 07-15-27 | | 70,000 | 72,625 |

| Real estate 0.3% | | | 568,010 |

| Equity real estate investment trusts 0.3% | | | |

| FelCor Lodging LP | 6.000 | 06-01-25 | | 240,000 | 250,800 |

| Iron Mountain, Inc. (B) | 4.875 | 09-15-29 | | 200,000 | 203,160 |

| VICI Properties LP (B) | 4.250 | 12-01-26 | | 60,000 | 61,800 |

| VICI Properties LP (B) | 4.625 | 12-01-29 | | 50,000 | 52,250 |

| Utilities 0.5% | | | 984,249 |

| Gas utilities 0.2% | | | |

| AmeriGas Partners LP | 5.500 | 05-20-25 | | 32,000 | 34,560 |

| AmeriGas Partners LP | 5.750 | 05-20-27 | | 40,000 | 43,900 |

| AmeriGas Partners LP | 5.875 | 08-20-26 | | 118,000 | 130,095 |

| Ferrellgas LP | 6.500 | 05-01-21 | | 25,000 | 21,625 |

| Ferrellgas LP | 6.750 | 01-15-22 | | 170,000 | 144,500 |

| Ferrellgas LP | 6.750 | 06-15-23 | | 68,000 | 57,460 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 28 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Utilities (continued) | | | |

| Independent power and renewable electricity producers 0.2% | | | |

| Clearway Energy Operating LLC (B) | 4.750 | 03-15-28 | | 65,000 | $65,894 |

| NextEra Energy Operating Partners LP (B) | 4.250 | 07-15-24 | | 70,000 | 72,888 |

| The AES Corp. | 5.125 | 09-01-27 | | 190,000 | 202,825 |

| Water utilities 0.1% | | | |

|

| Aegea Finance Sarl (B) | 5.750 | 10-10-24 | | 200,000 | 210,502 |

| Convertible bonds 0.1% | | | | | $237,921 |

| (Cost $251,343) | | | | | |

| Consumer discretionary 0.0% | | | 57,638 |

| Hotels, restaurants and leisure 0.0% | | | |

| Caesars Entertainment Corp. | 5.000 | 10-01-24 | | 30,000 | 57,638 |

| Information technology 0.1% | | | 180,283 |

| IT services 0.0% | | | |

| Cardtronics, Inc. | 1.000 | 12-01-20 | | 70,000 | 74,510 |

| Technology hardware, storage and peripherals 0.1% | | | |

|

| Western Digital Corp. | 1.500 | 02-01-24 | | 108,000 | 105,773 |

| Term loans (F) 0.7% | | | | | $1,272,275 |

| (Cost $1,262,755) | | | | | |

| Consumer discretionary 0.1% | 183,808 |

| Hotels, restaurants and leisure 0.1% |

| Golden Entertainment, Inc., 2017 1st Lien Term Loan (1 month LIBOR + 3.000%) | 4.800 | 10-21-24 | | 183,350 | 183,808 |

| Financials 0.2% | 373,037 |

| Diversified financial services 0.0% |

| Crown Finance US, Inc., 2018 USD Term Loan (1 month LIBOR + 2.250%) | 4.049 | 02-28-25 | | 81,709 | 81,597 |

| Insurance 0.2% |

| Asurion LLC, 2018 Term Loan B7 (1 month LIBOR + 3.000%) | 4.799 | 11-03-24 | | 192,075 | 193,070 |

| HUB International, Ltd., 2018 Term Loan B (3 month LIBOR + 2.750%) | 4.690 | 04-25-25 | | 98,500 | 98,370 |

| Health care 0.0% | 57,467 |

| Life sciences tools and services 0.0% |

| Syneos Health, Inc., 2018 Term Loan B (1 month LIBOR + 2.000%) | 3.799 | 08-01-24 | | 57,181 | 57,467 |

| 29 | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Industrials 0.3% | $448,520 |

| Commercial services and supplies 0.1% |

| AVSC Holding Corp., 2018 1st Lien Term Loan (1 and 3 month LIBOR + 3.250%) | 5.091 | 03-03-25 | | 98,250 | 97,759 |

| Pitney Bowes, Inc., Term Loan B (G) | TBD | 12-05-26 | | 100,000 | 98,781 |

| Professional services 0.2% |

| The Dun & Bradstreet Corp., Term Loan (1 month LIBOR + 5.000%) | 6.792 | 02-06-26 | | 250,000 | 251,980 |

| Information technology 0.1% | 209,443 |

| IT services 0.1% |

| Blackhawk Network Holdings, Inc., 2018 1st Lien Term Loan (1 month LIBOR + 3.000%) | 4.799 | 06-15-25 | | 98,500 | 98,398 |

| Semiconductors and semiconductor equipment 0.0% |

| Microchip Technology, Inc., 2018 Term Loan B (1 month LIBOR + 2.000%) | 3.800 | 05-29-25 | | 57,489 | 57,777 |

| Software 0.0% |

| SS&C European Holdings Sarl, 2018 Term Loan B4 (1 month LIBOR + 2.250%) | 4.049 | 04-16-25 | | 21,671 | 21,811 |

|

| SS&C Technologies, Inc., 2018 Term Loan B3 (1 month LIBOR + 2.250%) | 4.049 | 04-16-25 | | 31,256 | 31,457 |

| Escrow certificates 0.0% | | | | | $750 |

| (Cost $194) | | | | | |

| Texas Competitive Electric Holdings Company LLC (A)(D) | 11.500 | 10-01-20 | | 500,000 | 750 |

|

| | | | | Par value^ | Value |

| Short-term investments 0.1% | | | | | $100,000 |

| (Cost $100,000) | | | | | |

| Repurchase agreement 0.1% | | | | | 100,000 |

| Goldman Sachs Tri-Party Repurchase Agreement dated 12-31-19 at 1.550% to be repurchased at $100,009 on 1-2-20, collateralized by $94,015 Government National Mortgage Association, 4.500% due 4-20-47 (valued at $102,000) | | | | 100,000 | 100,000 |

|

| Total investments (Cost $182,236,538) 98.4% | | | $178,587,751 |

| Other assets and liabilities, net 1.6% | | | | 2,933,139 |

| Total net assets 100.0% | | | | | $181,520,890 |

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund unless otherwise indicated. |

| ^All par values are denominated in U.S. dollars unless otherwise indicated. |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK HEDGED EQUITY & INCOME FUND | 30 |

| Currency Abbreviations |

| EUR | Euro |

| Security Abbreviations and Legend |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| ISDAFIX | International Swaps and Derivatives Association Fixed Interest Rate Swap Rate |

| LIBOR | London Interbank Offered Rate |

| NVDR | Non-Voting Depositary Receipt |

| PIK | Pay-in-Kind Security - Represents a payment-in-kind which may pay interest in additional par and/or cash. Rates shown are the current rate and most recent payment rate. |

| (A) | Non-income producing security. |

| (B) | These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. |

| (C) | Restricted security as to resale, excluding 144A securities. For more information on this security refer to the Notes to financial statements. |

| (D) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. Refer to Note 2 to the financial statements. |

| (E) | Perpetual bonds have no stated maturity date. Date shown as maturity date is next call date. |

| (F) | Term loans are variable rate obligations. The coupon rate shown represents the rate at period end. |

| (G) | This position represents an unsettled loan commitment at period end. Certain details associated with this purchase are not known prior to the settlement date, including coupon rate, which is disclosed as TBD (To Be Determined). |

The fund had the following country composition as a percentage of net assets on 12-31-19:

| United States | 41.3% |

| Japan | 10.2% |

| United Kingdom | 7.0% |

| France | 6.2% |

| Canada | 5.3% |

| Netherlands | 4.0% |

| Switzerland | 3.3% |

| Germany | 2.2% |

| Australia | 1.8% |