UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: April 30, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-54045

BULLION MONARCH MINING, INC.

(Exact Name of Registrant as specified in its Charter)

| |

Utah | 20-1885668 |

(State or other Jurisdiction of Incorporation or organization) | (I.R.S. Employer Identification No.) |

20 North Main Street

Suite 202

St. George, Utah 84770

(Address of Principal Executive Offices)

(801) 426-8111

(Registrant’s Telephone Number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company:

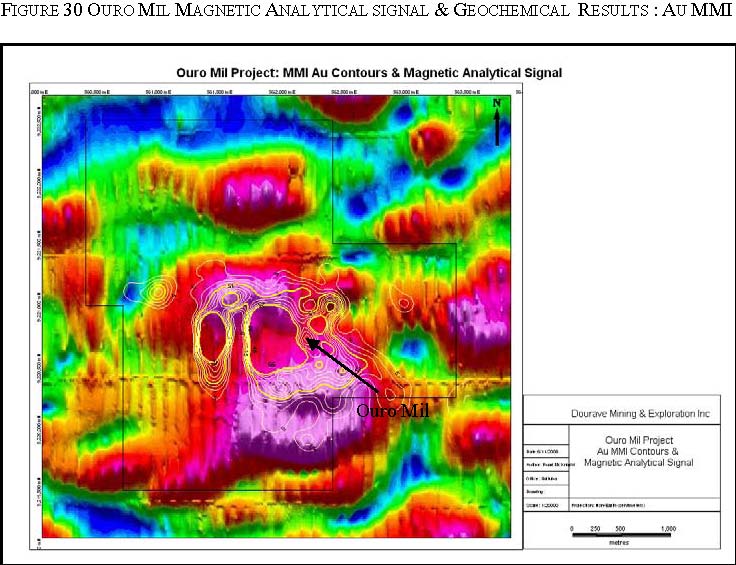

| |

| |

Large accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common stock of the Registrant held by non-affiliates was approximately $24,137,562, based on 24,381,376 shares held by non-affiliates and the closing price of $0.99 per share for the Registrant’s common stock on the OTCQB on October 29, 2010.

As of July 15, 2011, the Registrant had 43,504,093 shares of common stock outstanding; however, a portion of these shares are subject to cancellation if not exchanged under the reorganization with our predecessor, Bullion Monarch Company, by September 26, 2011, as discussed under the caption “PREFATORY NOTE” below inserted before the commencement of our discussion in Part I of this Annual Report. According to the court and fairness hearing approved plan, holders of un-exchanged rights of “old” Bullion Monarch Company had five (5) years to exchange their rights in “old” Bullion Monarch Company. To avoid the loss of these rights, which were owned or acquired prior to September 26, 2006, they must be exchanged for an equal amount of “new” Bullion Monarch Mining Inc. shares, prior to September 26, 2011.

Documents Incorporated by Reference

Part II and Part III incorporates information by reference from the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the solicitation of proxies for the Registrant’s 2011 Annual Meeting of Shareholders.

PREFATORY NOTE

See the “PREFATORY NOTE” below prior to the commencement of Part I, Item 1.

1

TABLE OF CONTENTS

PART I

4

ITEM 1. BUSINESS 4

ITEM 1A. RISK FACTORS 13

ITEM 2: PROPERTIES 17

ITEM 3: LEGAL PROCEEDINGS 38

ITEM 4: (RESERVED AND REMOVED) 39

PART II 39

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES 39

ITEM 6. SELECTED FINANCIAL DATA. 40

ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 40

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK 40

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 44

ITEM 9: CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE 70

ITEM 9A: CONTROLS AND PROCEDURES

PART III 71

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE 71

ITEM 11: EXECUTIVE COMPENSATION 71

ITEM 12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS 71

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTORS INDEPENDENCE 71

ITEM 14: PRINCIPAL ACCOUNTING FEES AND SERVICES 71

PART IV 72

ITEM 15: EXHIBITS, FINANCIAL STATEMENT SCHEDULES 72

77

SIGNATURES 73

2

FORWARD-LOOKING STATEMENTS

Statements made in this Annual Report about us that are not purely historical are forward-looking statements with respect to our goals, plan objectives, intentions, expectations, financial condition, results of operations, future performance and business, including, without limitation, statements preceded by, followed by or that include the words “may,” “would,” “could,” “should,” “expects,” “projects,” “anticipates,” “believes,” “estimates,” “plans,” “intends,” “targets” or similar expressions.

Forward-looking statements involve inherent risks and uncertainties. Important factors, many of which are beyond our control, could cause actual results to differ materially from those set forth in the forward-looking statements, including but not limited to the following: general economic or industry conditions, nationally and internationally; increases or decreases in the prices of metals; changes in the interest rate environment, legislation or regulatory requirements; conditions of the securities markets; our ability to raise capital when required; changes in accounting principles, policies or guidelines; financial or political instability; acts of war or terrorism; and other economic, competitive, governmental, regulatory and technical factors affecting our operations, products, services and prices, among others.

Accordingly, results actually achieved may differ materially from expected results in these statements. Forward-looking statements speak only as of the date they are made. We do not undertake, and specifically disclaim, any obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

PREFATORY NOTE

In 1999, Bullion Monarch Company was administratively dissolved by the State of Utah for failing to file its annual reports with the Department of Commerce for the State of Utah. Bullion Monarch Company subsequently organized Bullion Monarch Mining, Inc., and completed a court approved reorganization, effective March 31, 2005, whereby shareholders of the dissolved Bullion Monarch Company exchanged rights in that company for a like number of shares in the newly organized Bullion Monarch Mining, Inc. equal to the shares previously owned in Bullion Monarch Company, following a fairness hearing conducted by the Utah Division of Securities on September 27, 2006. Shares issued by Bullion Monarch Mining, Inc. since inception, will continue to be its shares held by its shareholders; and Bullion Monarch Company rights holders who have not exchanged rights for shares of Bullion Monarch Mining, Inc. under the reorganization will continue to have the same rights of exchange each had under the reorganization with Bullion Monarch Company, subject to the five year exchange limitation provided for in the reorganization or to the close of business on September 26, 2011.

3

PART I

ITEM 1. BUSINESS

Corporate Structure

Bullion Monarch Mining, Inc. (“Bullion Monarch” or the “Company”) is a gold-focused exploration and royalty company with additional interests in bauxite and oil-shale technology. The Company is focused on creating new royalties or participating interests through a continuous review of exploration opportunities.

Bullion Monarch has three material subsidiaries, Dourave Mining and Exploration Inc. (“Dourave Canada”), Dourave Mineracao E Exploracao Mineral Ltda (“Dourave Brazil”) and collectively with Dourave Canada, “Dourave”), and EnShale, Inc. (“EnShale”).

Dourave Canada is a wholly owned subsidiary of Bullion Monarch and through Dourave Canada, Bullion Monarch holds 99.99% of Dourave Brazil. Dourave Canada is federally incorporated under the laws of Canada as 6854893 Canada Inc. in November 2007 and changed its name to Dourave Mining and Exploration Inc. in December 2007. The registered office of Dourave Canada is c/o Peterson Law Professional Corporation Suite 806, 390 Bay Street, Toronto, Ontario M5H 2Y2.

Dourave Brazil was incorporated under the laws of Brazil in September 2007. The registered office of Dourave Brazil is c/o Avenida Alcindo Cacela, 1264 Bairro – Nazarel, Belem, Para Brazil.

Bullion Monarch holds an 80% ownership interest in EnShale. EnShale was incorporated under the laws of Wyoming in July 2000 under the name International Energy Resource Development, Inc. and subsequently changed its name to EnShale, Inc. in September 2005. The registered office of EnShale is 20 N. Main St., Suite 202, St. George, UT 84770.

4

The following sets out the corporate structure of the Company with respect to its material subsidiaries and Company’s projects and properties:

| | |

Bullion Monarch Mining, Inc. (Utah) · North Pipeline · La Reyna · Ophir |

100% | |

80% |

Dourave Mining and Exploration Inc. (Canada) | | EnShale Inc. (Wyoming) |

| | |

99.99%(1) | | |

Dourave Mineracao E Exploracao Mineral Ltda (Brazil)

· Bom Jesus Project · Niquelândia Project · Bom Jardim · Ouro Mil · Caldieras · Pontal do Paranaita | | |

Note: (1) Brazilian nationals own a fraction (less than 1/100th of one percent) of Dourave Brazil.

General

The Company completed its most successful year ever, ending its fiscal year at April 30, 2011 with record revenue of $6.2 million and record earnings of $0.05 per share. The revenue was derived primarily from its Carlin Trend Royalty, a royalty claim block located in the renowned Carlin Trend in Northeastern Nevada, on which the Company holds a 1% GSR royalty. The Carlin Trend Royalty project is the Company’s flagship royalty property and includes portions of the following: the Leeville Mine, the East Ore Mine, the North Lantern Mine, the Turf Deposit and Four Corners Deposit. The majority (approximately 99.5%) of revenue that the Company currently earns is derived from combined production at the Leeville Mine and East Ore Mine (collectively, the “Leeville Mine Property”), which is discussed in more detail later.

The Company has ongoing exploration efforts for gold and bauxite in Brazil through Dourave Brazil. The Company has four primary exploration and development projects in Brazil; Bom Jesus, Bom Jardim and Ouro Mil, which are gold-focused, and Niquelândia, which is a bauxite property. The Company also has interests in various mineral assets in North and South America which are presently at the exploration stage and which are not currently producing any ore or income.

The Company has been developing a process, through EnShale, to extract oil from oil shale ore in an economically viable manner. Bullion Monarch is currently working to monetize its substantial oil-shale assets through the development of EnShale.

Bullion Monarch’s royalty portfolio generates high-margin free cash flow with lower exposure to operating and capital costs than operating companies. Bullion Monarch’s portfolio also provides for direct

5

leverage to commodity prices and the exploration potential of world-class ore deposits and mineral exploration trends where they have existing royalty interests. Bullion Monarch management believes that a diverse portfolio of royalty interests provides our shareholders with a higher risk-adjusted return through the commodity cycle than direct operating interests in mining properties.

In June 2011, Bullion Monarch determined to terminate exploration activities on the La Reyna property. A year earlier, in June 2010, the Company entered into a binding term sheet (“Chihuahua Term Sheet”) relating to mining rights of a property located in Chihuahua, Mexico. The agreement required that Bullion Monarch make a $50,000 exploration right payment on execution of the agreement and a $100,000 payment for the right to conduct exploration activities on the subject property until November 30, 2010. Bullion Monarch had the option of continuing exploration activities by making additional payments of $100,000 for each six month interval, through May 31, 2012, at which time our payment requirements were to increase for each successive period. These payments were to be applied toward a $5,000,000 total purchase price on the subject property. Several months after making the second payment of $100,000, the Company contacted the landowner with whom the agreement was made, and informed them that due to an unacceptable level of risk related to physical employee security, as well as regional political instability in strategic areas of Chihuahua Mexico, Bullion Monarch had decided to discontinue option payments and cease exploration on the property.

In May 2011, the Company decided to postpone its planned Canadian market offering ten million shares due to unfavorable market conditions. The offering was planned to coincide with and assist in the listing of Bullion Monarch shares on a Canadian stock exchange. The Company plans to review market conditions in the fall of 2011 to determine if it will proceed with an offering or listing of its shares at that time.

On April 1, 2011 the Company executed a revised stock purchase agreement with certain shareholders of Dourave Canada holding approximately 81.37% of the outstanding capital shares of Dourave and executed separate purchase agreements (collectively and together with the revised stock purchase agreement described above, the “Purchase Agreements”) with the holders of all remaining outstanding capital shares of Dourave, resulting in the Company owning 100% of the outstanding shares of Dourave Canada and by virtue of that ownership position, a 99.99% ownership stake in Dourave Brazil. The closing of the purchase of the shares under the Dourave Purchase Agreements was effective April 1, 2011. The Company issued an aggregate of 5,000,000 shares of the Company’s common stock and warrants to purchase up to 2,500,000 shares of its common stock at an exercise price equal to $1.20 per share and also assumed the obligation to issue up to 281,410 shares of the Company’s common stock under outstanding warrants to purchase capital shares of Dourave at an exercise price equal to 4.78 per share as total consideration for all of the capital shares of Dourave acquired pursuant to the Purchase Agreements. The Purchase Agreements contain customary representations and warranties regarding Dourave Canada and its business and the selling shareholders’ ownership of the capital shares of Dourave Canada being sold to the Company. The Purchase Agreements also contain customary covenants and indemnity obligations of the parties.

The Purchase Agreements are dated as of February 7, 2011 as a result of the Company’s offer made on such date to purchase the Dourave shares for an aggregate consideration equal to $3,220,000, which was based on the value as of such date of the Company common stock and warrants to purchase common stock to be issued in consideration for the capital shares of Dourave, as set forth in the Purchase Agreements. The Purchase Agreements contain customary representations and warranties regarding Dourave Canada and its business and the selling shareholders’ ownership of the capital shares of Dourave Canada being sold to the Company. The Purchase Agreements also contain customary covenants and indemnity obligations of the parties.

In the acquisition, Bullion Monarch acquired six highly prospective properties controlled by Dourave. In addition Bullion Monarch retained, as employees, Sergio Aquino and Ruari McKnight who each have years of experience in the Brazilian mining industry. Bullion Monarch believes that the synergy

6

created with the acquisition of Dourave will help it progress much faster in its goal to establish a self-funded natural resource company focused on exploring for and developing world class gold opportunities.

On April 5, 2011, the Company announced the acquisition of the Niquelândia bauxite project by Dourave Brazil. This exploration project is substantial in scope and requires Bullion Monarch to allocate significant resources to adequately explore the area. An exploration budget of $1.5 million USD is estimated to be invested in the first year of the project. Development of the project will be supported by excellent infrastructure, with asphalt and all weather road access, close proximity to the major cites of Brasilia and Goiania, availability of cheap hydroelectric power from the Serra da Mesa hydroelectric plant and the proposed extensions of existing rail access (Ferrovia 354) to nearby Urucu and possibly Niquelandia in the future.

EnShale

EnShale was established to profit from the rising demand for liquid petroleum when an opportunity to purchase a patented technology for commercial oil shale production was acquired by Bullion Monarch.

Combined with the Company’s interest in oil shale extraction technology, in December 2005, Bullion Monarch leased mineral rights from the State of Utah on approximately 4,650 acres of state owned land in Eastern Utah referenced herein as the SITLA Oil Shale Leases, which are presently held by EnShale. The leased parcels are designated by the State of Utah to have oil shale beds containing varying amounts of oil. Our total initial purchase price for the acreage, comprising five separate leases, was $9,669. Each lease is for a term of 10 years and requires a production royalty on the basis of 5% of the market price of the products produced from the leased properties.

EnShale engaged Utah Fabrication to design, develop and construct a demonstration plant to test technology it developed for the potential commercial production of oil from oil shale on an economically beneficial basis. Bullion Monarch has been funding EnShale through the demonstration plant and testing phases. In 2008, EnShale contracted with the Idaho National Laboratory, a Division of the U. S. Department of Energy for an engineering analysis to be done of our oil shale extraction process utilizing ASPEN modeling. The results of the modeling indicated that our process could be capable of producing oil from shale in an economically feasible manner.

In June of 2008, EnShale commenced construction on a pre-production demonstration plant to extract oil from oil shale using its patent pending extraction process. In June 2008, Bullion Monarch increased ownership to 80% of EnShale by exchanging all of its oil shale mineral leases on Utah State Institutional Trust Land in Eastern Utah’s Uintah County (the “SITLA Oil Shale Leases”). EnShale purchased a five acre parcel of industrial real property in Vernal, Utah that is strategically located for planned EnShale operations and has all required utilities readily available. Fabrication of EnShale’s testing and demonstration plant was completed in May of 2009 and transported to the EnShale industrial property located in Vernal, Utah.

EnShale is presently in the process of reviewing funding options, including debt and equity financing, to take the plant to the commercial production phase if results from our demonstration plant show commercial viability of the process. Management believes that EnShale has accomplished a major breakthrough in the development of technology for the commercial processing and extraction of oil from oil shale.

In February 2011, Bullion Monarch announced that EnShale had received a notice of allowability by the United States Patent and Trademark Office for a patent on its oil shale processing technology. EnShale has also applied for patents in the foreign countries of Australia, Canada, Brazil, Estonia, and China.

EnShale completed an enclosure to contain the oil-shale demonstration plant allowing process and product testing to happen unimpeded by weather. Testing is currently ongoing and will continue at the EnShale

7

plant until sufficient optimized data exists to complete an independent feasibility study focused on building a larger capacity commercial processing facility.

EnShale Ownership and Demonstration and Testing Plant Status

Research and Development Costs During the Last Two Fiscal Years

Bullion Monarch expended $ 468,360 and $451,733 during the fiscal years ended April 30, 2011 and 2010, respectively, on research and development related to the process of extracting oil from oil shale.

8

EnShale Ownership

Stock Ownership of EnShale, Inc.

| | | |

Title Of Class | Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

Common Stock | Bullion Monarch Mining, Inc. (1) | 32,000,000 | 80.0% |

Common Stock | R. Don Morris (2) | 1,680,000 | 4.2% |

Common Stock | James A. Morris (2) | 400,000 | 1.0% |

Common Stock | Robert D. Morris (2) | 1,200,000 | 3.0% |

Common Stock | Peter F. Passaro (2) | 400,000 | 1.0% |

Common Stock | Wayne E. Pearce (2) | 1,400,000 | 3.5% |

Common Stock | Rex L. Franson (2) | 1,720,000 | 4.3% |

Common Stock | Merrill C. Fisher (2) | 1,200,000 | 3.0% |

Total | | 40,000,000 | 100% |

(1)

12,000,000 shares acquired in exchange for License Agreement acquired for $400,000 on January 10, 2006, or approximately $0.033 per share; and 20,000,000 shares acquired for the transfer of rights owned in its SITLA Oil Shale Leases on Utah State Institutional Trust Land in Eastern Utah’s Uintah County. Bullion acquired the five oil shale mineral leases exchanged for these shares from the State of Utah, on December 1, 2005, and transferred them to EnShale in June, 2008. The SITLA Oil Leases were acquired for an aggregate of $9,669, which was the required minimum bid. See the heading “Other Properties” below in this Item I, and Part I, Item 3, for additional information about these leases.

(2)

Acquired March 10, 2006, for services rendered of an aggregate value of $264,000 or approximately $0.033 per share.

Executive Officers of the Registrant

The following table sets forth the names of all of the Company’s executive officers.

| | | |

Name | Positions Held | Date of Election or Designation | Date of Termination or Resignation |

R. Don Morris | Chief Executive Officer | 2010 | * |

James A. Morris | President | 2010 | * |

Philip L. Manning | Chief Financial Officer | 2009 | |

Robert Morris III | Secretary | 2008 | * |

Business Experience

R. Don Morris, 67, has served as an officer and director of Bullion Monarch since its incorporation in 2004 and is currently serving as CEO. Prior to the establishment of Bullion Monarch, he was President of Bullion Monarch Company, the Company’s predecessor, for many years. Mr. Morris is the force behind Bullion Monarch. He has over 40 years of experience in the mineral industry from early exploration and development through production. Mr. Morris is best known for his involvement and development of the famous Carlin Trend in Northeast Nevada as President of MM&S Exploration Company, which was acquired by Bullion Monarch Company in 1969. Mr. Morris has worked in the mining industry throughout the world in various executive and management capacities. He has served on various Boards of Directors, including US Copper Corp., Gold Standard of Nevada, Metals Inc., Elko Ready Mix and Arco Aris Minerals. In the early 1990’s, Mr. Morris was invited as a special envoy to study the mineral industry in Russia, Yugoslavia and Bosnia. Mr. Morris has worked throughout North and South America, Europe and Asia. Mr. Morris received a Bachelor’s of Science degree in geology from Brigham Young University in 1966 and completed graduate studies at Colorado School of Mines and McKay School of Mines in Nevada.

9

James Andrew Morris, 43, has served on the Company’s Board of Directors since 2004 and as President since January 2010. He graduated from Brigham Young University with a degree in Business Finance in 1993. He was employed by Merrill Lynch before founding a retail golf franchise, Utah Golf Equipment, LLC, in 1993. He was the owner/operator of this golf business until the time of its sale in 1999. Mr. Morris then began employment with Eagle Home Mortgage, in its Elko, Nevada, Branch. In 2002 he served as President of Zephyr Gold and in 2004 he established M&P Development, a real estate development company, where he directed the planning and construction of three successful residential projects in Elko, Nevada. He has served on the Great Basin College Foundation Board as well as spending much of his time in volunteer work with Spring Creek High School raising funds to build an outdoor track facility. He continues to serve as managing partner of M&P Development and as a board member for Full Circle Recovery Systems Inc. In January 2010, Mr. Morris joined Bullion Monarch on a full-time basis, serving temporarily as CEO of EnShale and currently President of Bullion Monarch.

Robert Morris III, 39, has been the Secretary of Bullion Monarch since 2010. He has a Bachelor’s degree in Business Finance. From 1999 to 2002, Mr. Morris was a Branch Manager for Enterprise Rent-a-Car, where he oversaw all aspects of the local operation, including inventory, customer service personnel and related duties. In 2002, he joined Verilease Finance as its Vice President of Sales. He successfully managed all equipment leasing activities and employees. Mr. Morris is the President of EnShale and serves as corporate Secretary for Bullion.

Philip Manning, 52, has been our Chief Financial Officer since 2009. He has over 20 years of experience in various sectors of the finance industry. He received his Bachelor of Science degree in Business from Brigham Young University and earned an MBA in International Management from the American Graduate School of International Management in 1984. His financial management experience is diverse, beginning with employment at companies such as RCA Corporation in their finance department. In 1984, Mr. Manning joined William Wright Associates, Ltd., an investment advisory firm, where he rose from accountant to Portfolio Manager. While employed there, Mr. Manning was instrumental in establishing a fund to provide mezzanine financing to small companies. In this capacity, he served on boards and advisory boards, advising companies in a variety of industries ranging from high tech start-ups, equestrian equipment manufacturing to manufactured home builders. Beginning in 1990, he spent several years with Merrill Lynch, where he assisted corporate clients with asset management and received recognition from Merrill Lynch for outstanding achievement. In 1995, Mr. Manning began his own business as a consultant. In this role, he worked for business clients, including Bullion Monarch in the late 1990’s. In 1998, he joined Bright Trading, one of the largest proprietary trading firms in the U.S., where he was ultimately appointed Manager of the Draper, Utah Branch Office. As Branch Manager, he was responsible for the hiring, training and supervising of traders, which he engaged in until 2001. Mr. Manning continued trading for his own account and in 2005, commenced consulting for business clients once again. More recently, his consultation business included Bullion Monarch, among other clients. His work with Bullion Monarch was primarily in the Company’s accounting and finance functions. His contributions proved that he would make a valuable addition to the Bullion Monarch management team and led the Company to offer him his current position as CFO.

Competition

The Company competes with mining companies for the acquisition of new mining properties. The Company has limited resources when compared with larger royalty, mining and exploration companies and most companies with which it competes have substantially greater resources, personnel and expertise. The Company’s competitive position in this industry is not considered to be significant. However, the demand for precious metals is such that once a metal is produced it can be sold at an established market price which has made the exploration and production of such mineral resources, while highly speculative, highly lucrative.

Some major competitors in the gold royalty business include: Royal Gold, Silver Wheaton and Franco Nevada. OSEC IDT Corp. and Red Leaf are small companies that compete with EnShale in the development and use of oil shale extraction technology. Exxon Mobil Corp., Chevron Corp. and Royal Dutch Shell are large companies that will be competitors in the extraction of oil from oil shale. The

10

Company’s competitive position in this industry is also not presently considered to be significant; however, that could change if our oil shale extraction process currently being developed and tested proves to be economically and commercially viable.

Dependence on One or a Few Major Customers

The Company has no customers; however, most all of its current revenues received are derived from its 1% royalty interest on our Carlin Trend Royalty claim block and specifically Newmont’s Leeville/East Ore Mine under its 1979 property agreement.

Intellectual Property

Enshale has a U.S. Patent Pending No. USSN 11/974492, filed October 12, 2007, and an International PCT Patent Application, Serial Number PCT/US2008/011656, with a priority date of October 12, 2007, and an international filing date of October 10, 2008, File No. 2682.003PC, regarding EnShale’s oil shale extraction process, and entitled “Petroleum Products From Oil Shale.” The International PCT Patent Application discloses certain improvements in the patent pending process filed initially in the U.S.

.

Regulations on the Business

General Mining and Oil Shale Requirements. All of Bullion Monarch’s United States mining and exploration and development activities and oil shale extraction operations, if its technology proves commercially viable, will be subject to various federal and state laws and regulations governing the protection of the environment, including the Clean Air Act; the Clean Water Act; the Comprehensive Environmental Response, Compensation and Liability Act; the Emergency Planning and Community Right-to-Know Act; the Endangered Species Act; the Federal Land Policy and Management Act; the National Environmental Policy Act; the Resource Conservation and Recovery Act; and related state laws. These laws and regulations are continually changing and are generally becoming more restrictive.

General Mining and Oil Shale Environmental Requirements. Exploration and development operations in mining or oil shale extraction are subject to environmental regulations, which could result in additional costs and operational delays. All phases of the Company’s planned operations are subject to environmental regulation. Environmental legislation is evolving in some countries or jurisdictions in a manner that may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not negatively affect the Company’s projects. Bullion Monarch is currently subject to environmental regulations with respect to its properties.

The Bureau of Land Management requires that mining operations on lands subject to its regulation obtain an approved plan of operations subject to environmental impact evaluation under the National Environmental Policy Act. Any significant modifications to the plan of operations may require the completion of an environmental assessment or Environmental Impact Statement prior to approval. Mining companies must post a bond or other surety to guarantee the cost of post-mining reclamation. These requirements could add significant additional cost and delays to any mining project undertaken by Bullion Monarch.

At the state level, mining operations are also regulated by various regulatory bodies including environmental, safety and various permitting agencies. The Company is required to hold Nevada Reclamation Permits required under NRS 519A.010 through 519A.170. These permits mandate concurrent and post-mining reclamation of mines and require the posting of reclamation bonds sufficient to guarantee the cost of mine reclamation. Other Nevada regulations govern operating and design standards for the construction and operation of any source of air contamination and landfill operations. Any changes to

11

these laws and regulations could have a negative impact on the Company’s financial performance and results of operations by, for example, required changes to operating constraints, technical criteria, fees or surety requirements.

Employees

Bullion Monarch currently has nine employees, seven of which are full-time employees. EnShale has four employees, two of which are full-time employees. Dourave Brazil has thirty employees, eight of which are full-time employees.

12

Additional Information

You may read and copy any materials that the Company files with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may also find all of the reports or registration statements that the Company has filed electronically with the Securities and Exchange Commission at its internet site at www.sec.gov.

The internet address for the Company’s website is www.bullionmm.com. The internet address provided in this Annual Report on Form 10-K is not intended to function as a hyperlink and the information on the Company’s website is not and should not be considered part of this report and is not incorporated by reference in this document. The Company makes available on its website its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and amendments to such reports and proxy statements (the “SEC Reports”) filed with or furnished to the Securities and Exchange Commission (“SEC”) pursuant to federal securities laws, as soon as reasonably practicable after each SEC Report is filed with or furnished to the SEC. In addition, copies of the SEC Reports are available, without charge, upon written request to the Company’s Chief Financial Officer.

ITEM 1A. RISK FACTORS

As a smaller reporting company, we are not required to provide risk factors. However, we have included the following risk factors.

The ownership of shares of our common stock is highly speculative and involves a high degree of risk. Therefore, you should consider all of the risk factors discussed below, as well as the other information contained in this Annual Report and other reports filed by us with the Securities and Exchange Commission prior to considering any investment in us.

Risks Related To Bullion

Future financial results may fluctuate significantly. As a result of our limited operations, we cannot predict future revenues or operating results. Management, however, does expect future revenues and operating results to fluctuate due to a combination of factors, including the costs of production, world prices for minerals and oil and other factors. If we have a shortfall in revenues in relation to our expenses, or if our expenses increase before our revenues do, then our business for a particular period would be materially adversely affected. Because of all of these factors and the other risks discussed in this section, management believes that our quarterly and annual revenues, expenses and operating results likely will vary significantly in the future.

Additional financing requirements. We may be required to seek additional financing to fund operations and carry out our business plan. There can be no assurance that such financing will be available on acceptable terms, or at all. We do not have any arrangements with any bank or financial institution to secure additional financing, and there can be no assurance that any such arrangement, if required or otherwise sought, would be available on terms deemed to be commercially acceptable and in our best interests.

Bullion will not be successful unless it recovers precious metals or oil from oil shale and sells them in U.S. or world markets. Our success and possible growth will depend on our ability, or the ability of those companies which we are in contract with, to recover precious metals or oil, process them and successfully sell them on U.S. and world markets. The success of this process is dependent on the spot market prices paid in relation to the costs of production. We may not always be able to produce at a profit because we can maintain a level of control only over our costs and have no ability to control the world spot market prices.

The cost of acquisition, exploration, and development activities are substantial and there is no assurance that the returns from mining activities or oil shale development will justify commercial operations. We cannot be certain that our acquisition, exploration and development activities will be

13

commercially successful. Substantial expenditures are required to acquire existing mineral and oil shale properties, to establish reserves through drilling and analysis, to develop metallurgical processes to extract metal from the ore or oil from the shale in the case of new properties and to develop the mining and processing facilities and infrastructure at any site chosen for mining or oil shale production. There can be no assurance that any mineral reserves, mineralized material or oil from oil shale acquired or discovered will be in sufficient quantities or adequate grade to justify commercial operations or that the funds required for development can be obtained on a timely basis.

The price of gold, other minerals and oil is known to fluctuate on a regular basis and the downturn in price could negatively impact our operations and cash flow. The price of gold, other minerals and oil is subject to fluctuations, which could adversely affect the realizable value of our assets and potential future results of operations and cash flow.

Mining and oil shale activities are inherently hazardous and any exposure may exceed Bullion’s insurance limits or may not be insurable. Mining and oil shale exploration, development and operating activities are inherently hazardous. Mineral exploration involves many risks that even a combination of experience, knowledge, and careful evaluation may not be able to overcome. Operations in which we have direct or indirect interests will be subject to all the hazards and risks normally incidental to exploration, development and production of gold and other metals, any of which could result in work stoppages, damage to property and possible environmental damage. The nature of these risks is such that liabilities might exceed any liability insurance policy limits. It is also possible that the liabilities and hazards might not be insurable, or we could elect not to insure us against such liabilities due to high premium costs or other reasons, in which event, we could incur significant costs that could have a material adverse effect on our financial condition.

Since reserve calculations are only estimates, any material change may negatively affect the economic viability of our properties. Reserve calculations are estimates only, subject to uncertainty due to factors including metal and oil prices and recoverability of metal and oil in the mining and mineral recovery process. There is a degree of uncertainty attributable to the calculation of reserves and corresponding grades dedicated to future production. Until reserves are actually mined and processed, the quantity of ore or oil and grades must be considered as an estimate only. In addition, the quantity of reserves and ore or oil may vary depending on metal or oil prices. Any material change in the quantity of reserves, mineralization, grade or stripping ratio may negatively affect the economic viability of our properties. In addition, there can be no assurance that gold recoveries, other metal or oil recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Bullion’s operations are subject to strict environmental regulations that may result in added costs of operations and operational delays. Exploration and development operations are subject to environmental regulations, which could result in additional costs and operational delays. All phases of our planned operations are subject to environmental regulation. Environmental legislation is evolving in some countries or jurisdictions in a manner that may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not negatively affect our projects. We are currently subject to environmental regulations with respect to all of our properties.

Bullion is subject to federal laws that require environmental assessments and bond/surety postings that add significant costs to our operations and delays in our projects. The Bureau of Land Management requires that mining operations on lands subject to its regulation obtain an approved plan of operations subject to environmental impact evaluation under the National Environmental Policy Act. Any significant modifications to the plan of operations may require the completion of an environmental assessment or Environmental Impact Statement prior to approval. Mining companies must post a bond or other surety to guarantee the cost of post-mining reclamation. These requirements could add significant additional cost and delays to any mining project undertaken by us.

14

Changes in state laws, which are already strict and costly, can negatively affect our operations by becoming stricter and costlier. At the state level, mining operations are also regulated by various regulatory bodies including environmental, safety, and various permitting agencies. Nevada state law requires projects to hold Nevada Water Pollution Control Permits, which dictate operating controls and closure and post-closure requirements directed at protecting surface and ground water. In addition, we are required to hold Nevada Reclamation Permits required under NRS 519A.010 through 519A.170. These permits mandate concurrent and post-mining reclamation of mines and require the posting of reclamation bonds sufficient to guarantee the cost of mine reclamation. Other Nevada regulations govern operating and design standards for the construction and operation of any source of air contamination and landfill operations. Any changes to these laws and regulations could have a negative impact on our financial performance and results of operations by, for example, required changes to operating constraints, technical criteria, fees or surety requirements.

Title claims against Bullion’s mining properties could require it to compensate parties, if successful, and divert management’s time from operations. There may be challenges to our title in the mineral properties in which we hold a material interest. If there are title defects with respect to any of our properties, we might be required to compensate other persons or perhaps reduce our interest in the affected property. Also, in any such case, the investigation and resolution of title issues would divert management’s time from ongoing exploration and development programs.

The requirements of being a public company may strain our resources and distract management. As a public company, we are subject to the reporting requirements of the Exchange Act and the Sarbanes-Oxley Act. These requirements may place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls for financial reporting. We currently do not have an internal audit group. We have established an Audit Committee and are in the process of adopting an Audit Committee Charter. To maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight will be required. This may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, we will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge, and management cannot assure you that we will be able to do so in a timely or cost effective fashion.

Bullion does not intend to pay cash dividends on its common stock in the near term and, consequently, your only opportunity to achieve a return on your investment is if the price of our stock appreciates. We do not plan to declare cash dividends on shares of our common stock in the foreseeable future. Consequently, your only opportunity to achieve a return on your investment in us will be if the market price of our common stock appreciates and you sell your shares at a profit. There is no guarantee that the price of our common stock that will prevail in the market after this offering will ever exceed the price that you pay.

Bullion’s business depends on a limited number of key personnel, and the loss of any of these personnel could negatively affect us. Our officers are important to our success. If they become unable or unwilling to continue in their present positions, our business and financial results could be materially negatively affected.

No established market for common stock. Although our common stock is quoted on the OTCQB Bulletin Board under the trading symbol “BULM,” there is currently no “established trading market” for our shares, and there can be no assurance that such a market will ever develop or be maintained. Any market price for shares of our common stock is likely to be very volatile, and numerous factors beyond our control may have a significant adverse effect. In addition, the stock markets generally have experienced, and continue to experience, extreme price and volume fluctuations which have affected the market price of many small capital companies and which have often been unrelated to the operating performance of these companies. These broad market fluctuations, as well as general economic and political conditions, may

15

adversely affect the market price of our common stock in any market that may develop. Sales of “restricted securities” under Rule 144 may also have an adverse effect on any market that may develop.

Shares eligible for public sale in the future could decrease the price of Bullion’s common shares and reduce our future ability to raise capital. All shares issued in the Fairness Hearing are freely transferable and will not be “restricted securities.” If there is ever an established trading market in our common stock, of which there can be no assurance, sales of substantial amounts of our common stock in the public market could decrease the prevailing market price of our common stock and our ability to raise equity capital in the future.

“Penny stock” rules may make buying or selling Bullion common stock difficult. We anticipate that the trading price for our common stock will be at $5.00 or less per share in the near future. Securities that trade for $5.00 or less are subject to the “penny stock” rules. The Securities and Exchange Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. These rules require that any broker-dealer who recommends our common stock to persons other than prior customers and “accredited investors,” must, prior to the sale, make a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the transaction. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and the current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market price and liquidity of our common stock. Broker-dealers who sell penny stocks to certain types of investors are required to comply with the Securities and Exchange Commission’s regulations concerning the transfer of penny stocks. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

We may not address successfully the problems encountered in connection with any potential future acquisitions. We expect to continue to consider opportunities to acquire or make investments in properties or companies that hold properties that we believe could enhance our capabilities, complement our current resources or expand the breadth of our property holdings. We have little experience in acquiring other businesses. Potential and completed acquisitions and investments involve numerous risks and if we fail to properly evaluate and execute acquisitions and strategic investments, our management team may be distracted from our day-to-day operations, our business may be disrupted and our operating results may suffer. In addition, if we finance acquisitions by issuing equity or convertible debt securities, our stockholders would be diluted.

Our disclosure controls and procedures may not prevent or detect all acts of fraud. Our disclosure controls and procedures are designed to reasonably assure that information required to be disclosed in reports filed or submitted under the Securities Exchange Act is accumulated and communicated to management and is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Our management expects that our disclosure controls and procedures and internal controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations in all control systems, they cannot provide absolute assurance that all control issues and instances of fraud, if any, within our company have been prevented or detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by an unauthorized override of the controls. The design of any systems of controls also is based in part upon certain assumptions about the likelihood of future events, and we cannot assure that any design will succeed in achieving its stated goals under all potential future conditions. Accordingly, because of the inherent limitations in a cost effective control system, misstatements due to error or fraud may occur and not be detected.

16

There are numerous risks associated with our international operations, any number of which could harm our business. We have offices and operations outside of the United States, including Canada and Brazil. The geographical distances between our operations create a number of logistical and communications challenges. These challenges include managing operations across multiple time zones, directing the our exploration efforts across long distances, coordinating procurement of services necessary for our operations to multiple locations, and coordinating the activities and decisions of the employees and management team, which are based in different countries.

In addition, there are other risks inherent in international operations, which could result in disruption or termination of supply of our products available for sale. These risks include:

• unexpected changes in regulatory requirements, taxes, trade laws and tariffs;

• political instability and the potential reversal of current favorable policies encouraging foreign investment or foreign trade by host countries;

• differences in labor laws, labor unrest and difficulties in staffing and managing international operations;

• longer payment cycles;

• fluctuations in currency exchange rates;

• potential adverse tax consequences;

• limitations on imports or exports of components or assembled products, or other travel restrictions;

• differing intellectual property rights and protections;

• delays from doing business with customs brokers and governmental agencies; and

• higher costs of operations.

These factors could materially and adversely affect our business, operating results, and financial condition.

ITEM 2: PROPERTIES

Real Properties and Facilities

Office Building: We own a 1,850 square foot office building, purchased in August 2005, for $175,000. This building is currently used as office space. The building is located at 299 East 950 South, Orem, Utah.

Business Building: On May 22, 2008, we acquired certain real property in the Vernal, Utah, area, for use by our majority-owned subsidiary, EnShale, as office facilities. The property was purchased for $317,900 and is comprised of approximately 2,000 square feet of finished interior, with an additional 1,500 available to be finished.

Industrial Property: On March 11, 2009 we purchased an industrial parcel of real property in Vernal, Utah, which is strategically located for our planned EnShale operations and has all utilities readily available. This property is used for our oil shale demonstration and testing plant. We purchased 5.01 acres at a total price of $140,000.

17

Royalty Properties

Carlin Trend Royalty

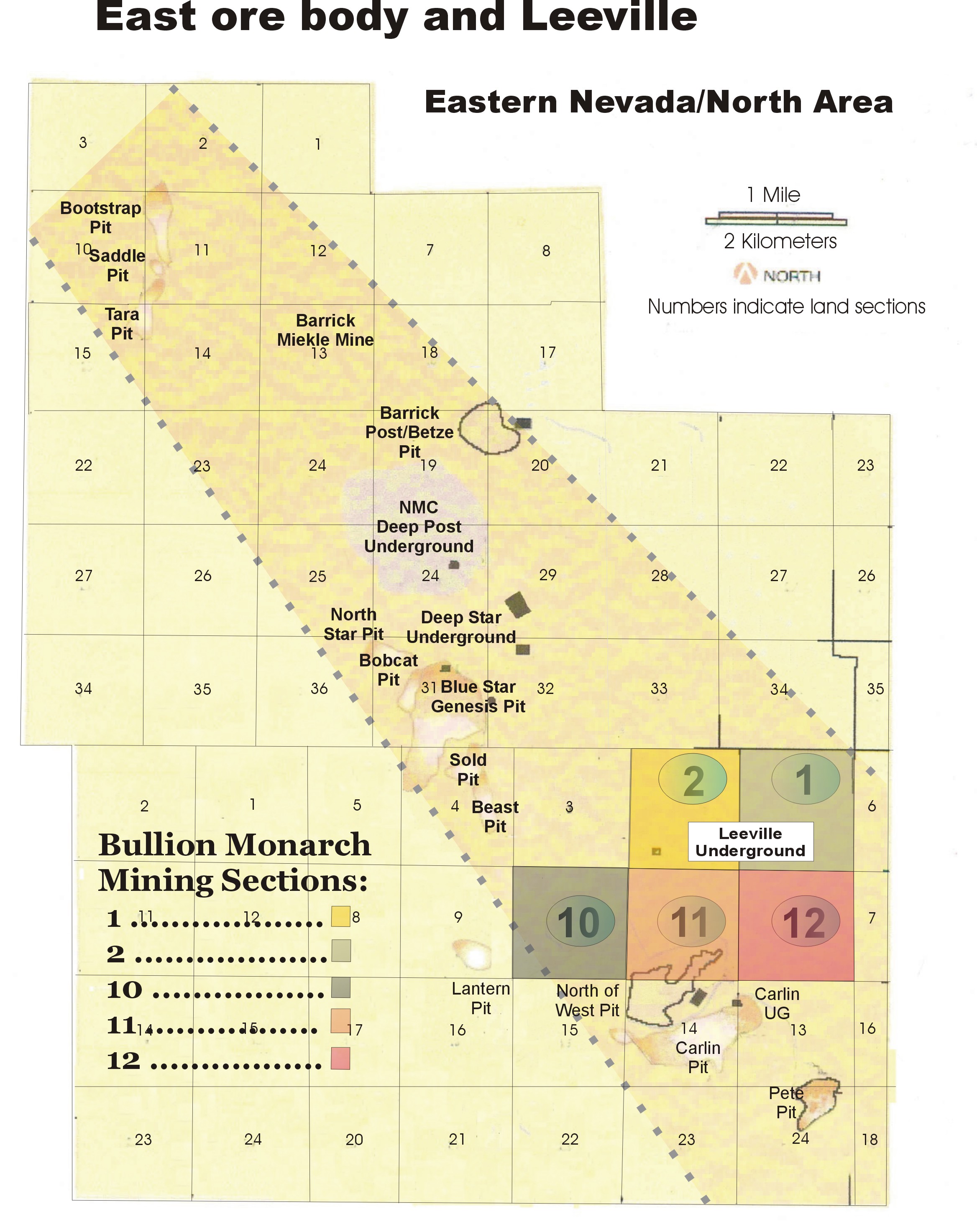

Leeville Mine: This property is located in Eureka County, Nevada, Sections 1, 2, 10, 11, and 12 of Township 35 North, Range 50 East, Mount Diablo Meridian, Lynn Mining District and is accessed via improved paved roads. The property is currently being mined by Newmont, and we receive a continuing 1% gross smelter return royalty. The Leeville claims are owned by Newmont, and we retain a royalty interest. The total claim responsibility for these claims lies with Newmont. Reserve estimates on this property, according to data published by Newmont are 2.9 million ounces.

Bullion Monarch Mining has claimed that this 1% royalty as defined in the May 10, 1979, Leeville/East Ore Mine Agreement also applies to an area of interest that contains the Sections and Townships listed below approximately encompassing the area eight (8) miles in a northerly direction, eight (8) miles in a southerly direction, eight (8) miles in an easterly direction and eight (8) miles in a westerly direction from Section 10, Township 35 North, Range 50 East, M.D.B. & M., Eureka County, Nevada. See Part I, Item 3, regarding our litigation with Newmont and Barrick Gold Strike. We believe the following accurately describes this area of interest, more or less.

Township 34 North, Range 49 East Sections 1-5, 8-17, and 20-24

Township 35 North, Range 49 East Sections 1-5, 8-17, and 32-36

Township 36 North, Range 49 East Sections 1-5, 8-17, 20-29 and 32-36

Township 37 North, Range 49 East Sections 32-36

Township 34 North, Range 50 East Sections 1-24

Township 35 North, Range 50 East Sections All

Township 36 North, Range 50 East Sections All

Township 37 North, Range 50 East Sections 31-36

Township 34 North, Range 51 East Sections 3-10 and 15-22

Township 35 North, Range 51 East Sections 3-10, 15-22 and 27-34

Township 36 North, Range 51 East Sections 3-10, 15-22 and 27-34

Township 37 North, Range 51 East Sections 31-34

East Ore Body Mine: This property is located in Eureka County, Nevada, Sections 1, 2, 10, 11, and 12 of Township 35 North, Range 50 East, Mount Diablo Meridian, Lynn Mining District and is accessed via improved paved roads. The property is currently being mined by Newmont, and we are receiving a continuing 1% gross smelter return royalty. The East Ore Body Mine claims are owned by Newmont, and we retain a royalty interest. The total claim responsibility for these claims lies with Newmont. Reserve estimates on this property, if any, are not available to us. We have claimed that this 1% royalty as defined in the May 10th 1979 Leeville/East Ore Mine Agreement also applies to an area of interest that contains the Sections and Townships listed below approximately encompassing the area eight (8) miles in a northerly direction, eight (8) miles in a southerly direction, eight (8) miles in an easterly direction and eight (8) miles in a westerly direction from Section 10, Township 35 North, Range 50 East, M.D.B. & M., Eureka County, Nevada. See Part I, Item 3, regarding our litigation with Newmont and Barrick Gold Strike. We believe the following accurately describes this area of interest, more or less.

Township 34 North, Range 49 East Sections 1-5, 8-17, and 20-24

Township 35 North, Range 49 East Sections 1-5, 8-17, and 32-36

Township 36 North, Range 49 East Sections 1-5, 8-17, 20-29 and 32-36

Township 37 North, Range 49 East Sections 32-36

Township 34 North, Range 50 East Sections 1-24

Township 35 North, Range 50 East Sections All

Township 36 North, Range 50 East Sections All

Township 37 North, Range 50 East Sections 31-36

Township 34 North, Range 51 East Sections 3-10 and 15-22

Township 35 North, Range 51 East Sections 3-10, 15-22 and 27-34

Township 36 North, Range 51 East Sections 3-10, 15-22 and 27-34

Township 37 North, Range 51 East Sections 31-34

18

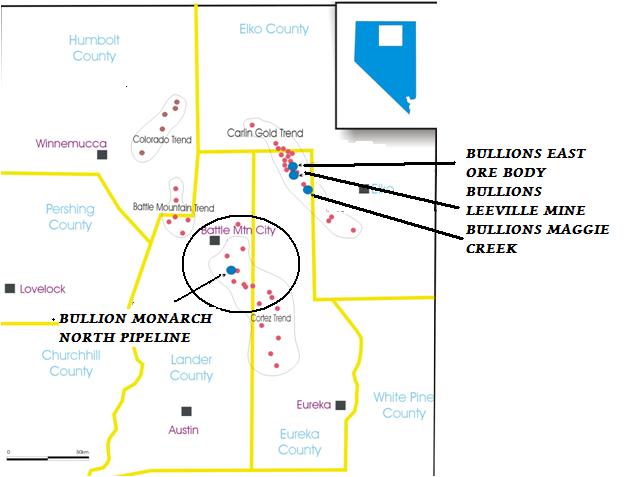

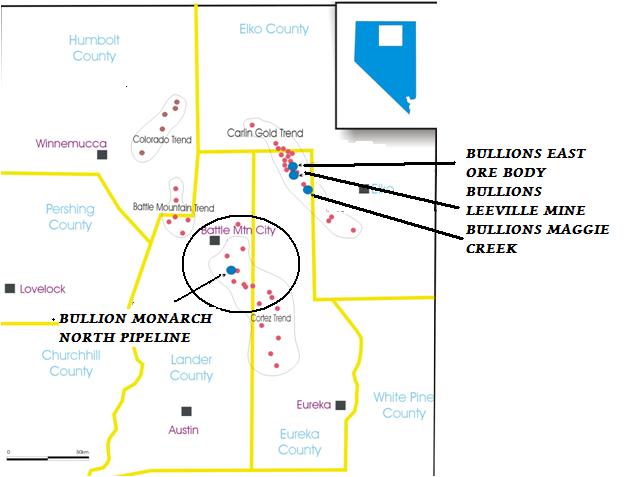

Nevada map with the Leeville Mine, East Ore Body Mine, North Pipeline property and Maggie Creek property locations

19

Locations of the Leeville Mine, East Ore Mine, North Pipeline property and Maggie Creek property in Central Nevada

20

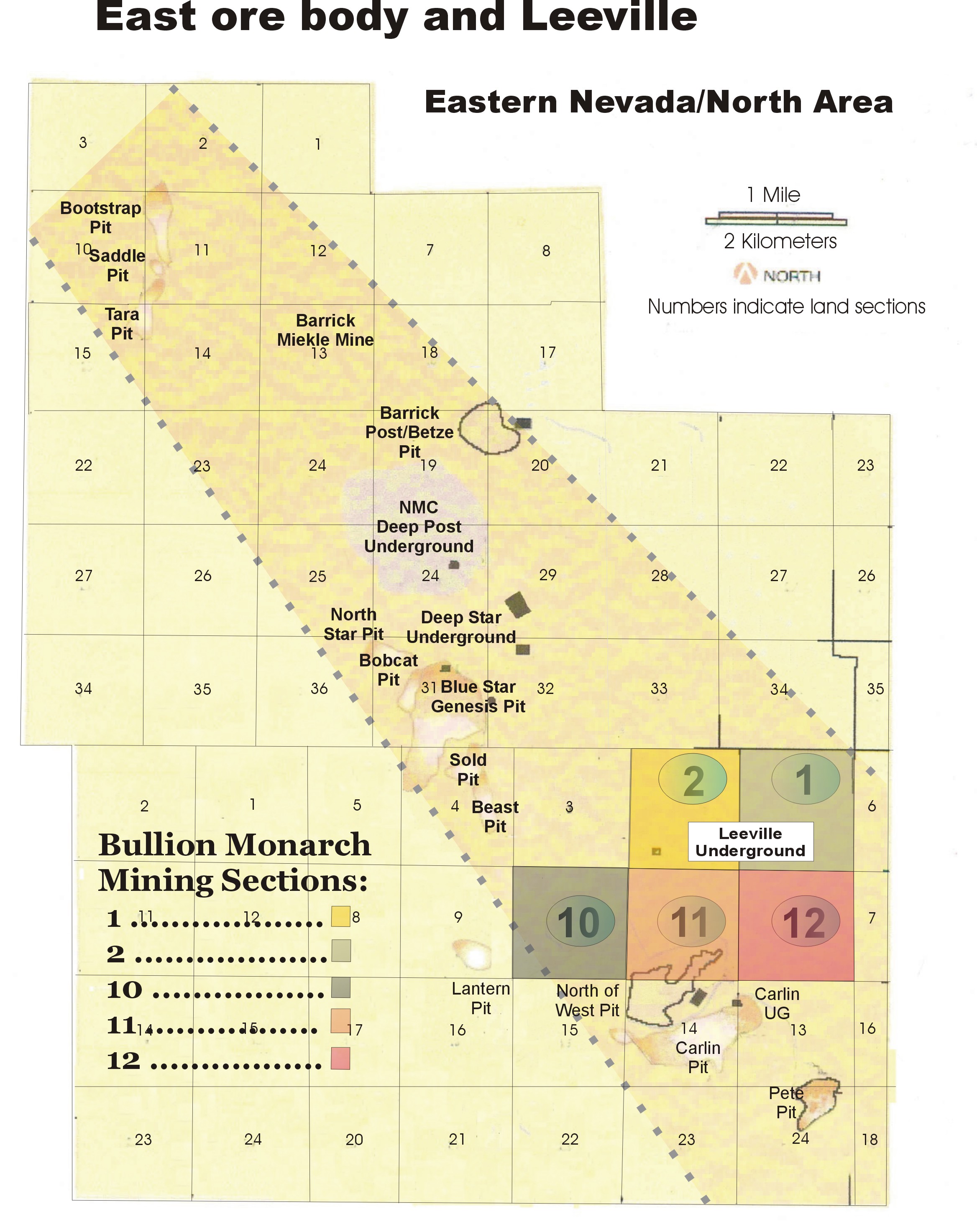

Location of Leeville Mine, East Ore Body Mine

21

Leeville Mine, East Ore Body Mine BLM map

22

North Pipeline: This property is located in Lander County, Nevada, Township 29 North, Range 47 East, Mount Diablo Meridian, Section 9, more particularly described as the E ½; E ½ of the NW ¼ of Section 9, Township 29, Range 47, and is accessed via improved paved roads. We have a royalty agreement with Nevada Rae Gold, Inc. on our North Pipeline property, pursuant to a contract entered into in September of 2003 for the mining rights of the surface gravel. The contract calls for a guaranteed annual advanced royalty of $20,000 minimum per year. The production royalty is $0.50 per yard of ore processed or 4% of net profits, whichever is greater. We have retained all rights to the hard rock minerals in the North Pipeline Property.

North Pipeline is a real property interest and not a mining claim of any kind, patented or unpatented. We purchased this property according to the laws of the State of Nevada. We hold the surface and underground mineral rights to this real property, and pay annual taxes to Lander County, Nevada, presently in the amount of approximately $258.

Maggie Creek: This property is located in Eureka County, Nevada, seven miles north of Carlin, Nevada on unpatented claims located in sections 12 and 14, township 33 North, Range 51 East, Mount Diablo Meridian, Lynn Mining District. This property is accessed via improved paved roads. This property is not currently in operation, but adjacent to this property is Newmont’s Gold Quarry mine, which is a producing gold mine. Our interest in this property is future three-percent (3%) royalty income from operations performed by others mining this property. Since we have only a royalty interest in this property, we do not have the right to conduct mining operations. The total claim responsibility for these claims lies with Newmont. Reserve estimates on this property, if any, are not available to us.

Golden Ibex Property: This property consists of 13 patented mining claims located approximately 10 miles west of Sumpter and 40 miles southeast of Baker City in Southeastern Oregon, in the heart of the Blue Mountain Gold belt, which has been long known for precious metal production. The Company currently owns a 1% NSR royalty interest and a 2.4% equity position in Golden Ibex. Golden Ibex has committed US$500,000 to exploration in the first year. Bullion is not currently collecting any royalties on the Golden Ibex Property.

Exploration Properties

Niquelandia: The Niquelandia bauxite project is located at 14° 27' 0” South, 48° 27' 0” West, just north of the town of Niquelandia in the state of Goiás, Brazil. The town of Niquelandia has a population of about 40,000 and is located approximately 200 km northwest of Brasilia, the federal capital of Brazil. The city changed its name to Niquelândia in 1943 after a world class nickel deposit was discovered by a prospector looking for gold in the region. It the largest municipality in the state and is an important producer of minerals. Other mining towns of Tupiracaba, Indaianopolis, and Barro Alto are in the area. Access to the Niquelândia Project area is readily available on asphalt state road GO 237. State road GO 538 is a well maintained improved dirt road that runs along the western portion of the Project to Indaianopolis. State road BR 414 runs east of the Project.

The Niquelândia Project is comprised of 9 mineral exploration permits totalling approximately 16,488.3 hectares. The permits are shown to have been published on June 1, 2010. Under Brazilian law, once the permit has been published the holder has three years to complete exploration upon which the license can be renewed for up to three more years, for a total of six years, at the discretion of the Departamento Nacional de Prodacao Mineral (“DNPM”) as long as work is done on the property and the taxes are paid. After six years, a permit holder either gives up the property or obtains a mining license.

Bauxite mineralization is the primary focus for the Niquelândia Project’s exploration permits. However surrounding this area are numerous published permits for: nickel exploration to the north and southwest; and gold to the west and the southeast; and aluminum due east (by Companhia Brasileira de Aluminio). The property comprises the western portion of a prominent local teardrop-shaped topographic feature. Nickel laterite deposits are located along the eastern portion of this topographic high.

23

Niquelandia - General Location Map

The Niquelândia Project is comprised of 9 mineral leases totalling 16,488.3 hectares. A third party has recently transferred all exploration rights for the Niquelândia bauxite property to Dourave Brazil. By agreement, and registered with DNPM as of February 16, 2011, Dourave Brazil has obtained the right to explore on and eventually purchase the property. Niquelândia Project infrastructure is uncommonly good. The proximity to paved roads and electrical power is excellent. An airport, with a paved, lighted runway over 5,000 feet long (that is well maintained but not legal for night flight), is located to the southeast of the property. Cell phone, internet and telephone access are available. A ready workforce is available. Mine equipment, repair and support are available locally.

The Niquelândia complex, a large layered intrusion occurring in Central Goiás, Brazil, consists of an upper and lower layered sequence, separated by a high T shear zone containing abundant crustal xenoliths and lenses. The upper sequence is bordered by the volcano-sedimentary Proterozoic Indaianopolis sequence, and the lower sequence is in tectonic contact with the terrains of the Archean basement.

24

The area of interest covered by the Niquelândia Project is predominately within what has been called the Serra dos Borges Unit (“SBU”), which has an estimated thickness of 4-6 km and consists of interlayered “gabbroic” rocks (gabbro, gabbronorite, olivine gabbro) and “anorthositic” rocks (anorthosite leucotroctolite, leucogabbro, leucogabbronorite). Although invariably interlayered, the “gabbroic” rocks predominate at the base of the unit, whereas the “anorthositic” rocks predominate at the top.

Analysis and mapping of surface geological features, including locations of gabbro and anorthosite, has been undertaken to a limited extent.

Dourave geologists have mapped three separate target exploration zones:

·

Southern Zone

·

Central Zone

·

Northern Zone

The total area of the three target zones is 63 km2. The southern zone has an area of 15.5 km2. The central zone has an area of 33.2 km2. The northern zone has an area of 14.2 km2.

Surface sampling has been performed in several locations. The following section details the sample locations and assay results.

25

Figure B

Verified Bauxite Occurrences

Lateritic weathering of the upper sequence anorthosites is abundant throughout the property. The anorthosites are course-grain and display varying amounts of mafic minerals (pyroxene and olivine) within the plagioclase matrix. These variations affect the texture of the anorthosite and can be classified as spotted, mottled or banded anorthosite. The highest grades of aluminum oxide (~60%) appear to be associated with weathered pure anorthosite, with a “crust” of bauxite forming around a pure anorthosite core. These weathered anorthosites range from cobble to boulder in size and are usually present within lateritic clay matrices.

Extensive bauxite profiles were also observed as unconsolidated clay matrix. It is possible that these bauxite-clay profiles are a result of more frequent weathering due to persistent drainage or runoff. It is possible that higher grade, weathered pure anorthosite will be found below these bauxite clays. Massive muscovite mica deposits were also observed at two locations in the central/southern zone. These massive aluminum phyllosilicate mica deposits are thought by Bullion’s geologist to be most likely a result of feldspathic alteration.

A two stage exploration program is to be instituted. Given the large size of the concession and the widespread nature of the deposit, a campaign of relatively short drill holes spaced on a regular grid as currently envisioned by Dourave has merit. A detailed ground mapping campaign identifying locations of gabbro intrusions and other unmineralized zones should first be undertaken in order to define locations where drilling will not pay dividends. Bikerman recognizes that some mapping of these areas has been performed, but more detail is desirable.

Metallurgical analysis of the different classes or textures of bauxite mineralization should be undertaken in order to determine the differences in composition, characteristics and processability of the

aluminum oxide. The differences between the spotted, banded, or mottled textures, as well as degree of oxidation and/or alternation, have on grade, processability, and profitability.

26

Phase I

• Detailed mapping

• Geophysical analysis

• Metallurgical sampling, testing and characterization

• Wide space drilling in areas of known mineralization

Phase II

• Definition drilling on a regularized pattern in prioritized locations

• Metallurgical analysis

• Resource calculation

Reserve modeling will be performed based upon the results of phase I and II. This will involve the assessment of minability and processability of the mineralization and economic viability of the Niquelândia Project. As such a total exploration budget of $1.5 million is recommended. Phase I work is estimated to cost $575,000 and phase II is estimated to cost $925,000.

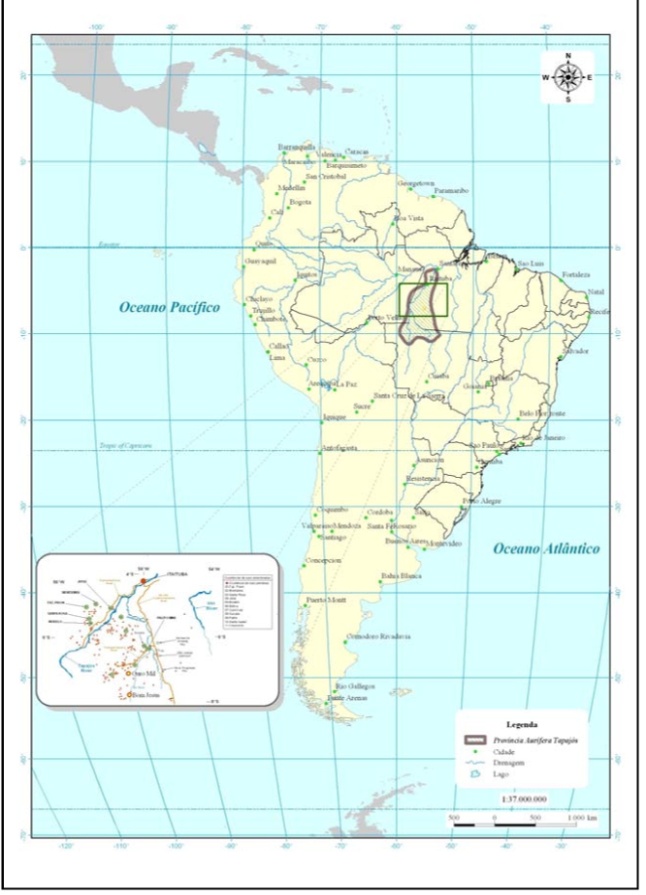

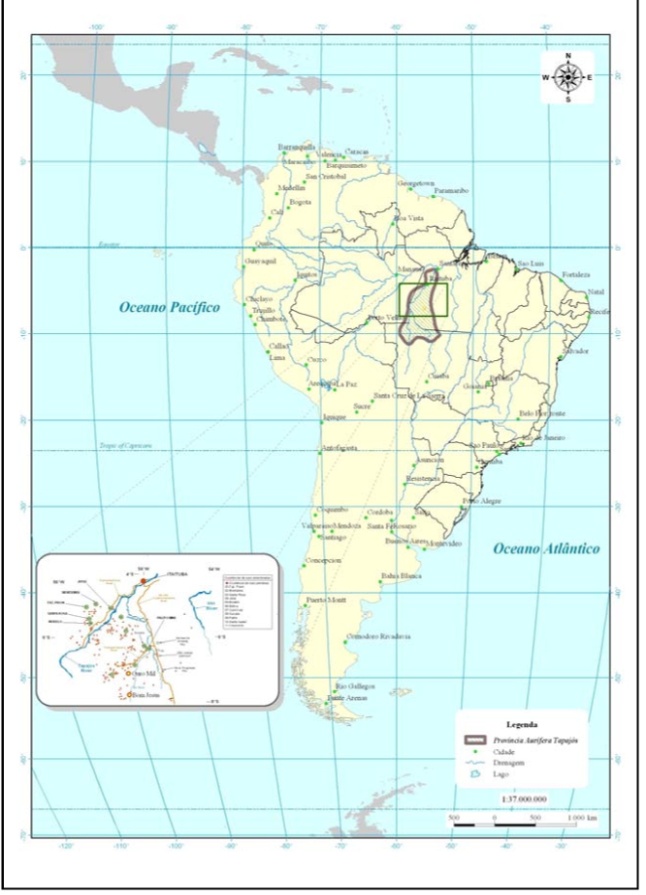

Bom Jesus: The Bom Jesus Project covers 9,150 hectares and includes 262 PLG’s (prospectors’ leases) and 2 overlying exploration leases. The exploration leases are both from 2008: DNPM# 850.652 is registered to Solange Moreira de Aguilar; and DNPM # 850.653 is 5,217.8 hectares and registered to Valmir Clamaco de Aguilar (Valmir). Operating license permit #4353/2010 for DNPM # 850.653 is in force and valid until May 23, 2013. Bullion holds the rights to the Bom Jesus Project through its wholly owned subsidiary Dourave Canada, which in turn owns 99.99% of the shares of Dourave Brazil.This 9,150 hectares gold project lies within the Tapajós gold province, which encompasses an area of about 100,000 km2 in southwest Para region of Brazil. It is accessible by air or river transportation year round

As with many properties in the Tapajós Region, the Bom Jesus Project is serviced primarily by air by both single-engine airplane with a flight time of either 1 Hr 40 Min from Itaituba or 30min from Novo Progresso (on the BR163 Santarem- Cuiaba Highway). The airstrip at the Bom Jesus Project is in good condition. The runway had been recently graded by heavy machinery and requires little or no work beyond grading after heavy rains.

Dourave Brazil has entered into a lease/purchase & sale agreement dated September 24, 2007 with the registered owners of the Bom Jesus Project. Under the terms of the lease/purchase agreement, rights of exploration of the mining area (called a garimpo) are ceded to Dourave. In exchange, Dourave initially agreed to lease payments of US$5,000 per month. Dourave and the registered owners amended the terms of the lease/purchase agreement to provide for the lease payments to be paid on the closing of the purchase of the property by Dourave.

If the Company discovers an “exploitable resource” on the property and commences to “exploit its resources”, the vendors shall transfer the relevant property to the Company upon receipt from the Company of $7 million, to be paid as follows:

a.

$1 million upon the submission of an feasibility study to the Departamento Nacional de Prodacao Mineral (“DNPM”);

b.

$1 million upon the approval of the feasibility study by the DNPM;

c.

$1 million within ten days following publication of a mining concession on the Bom Jesus or Bom Jardim property by the regulatory authorities in the Brazilian Government Official Daily Gazette;

d.

$1 million within ten days following issuance of an environmental permit by the appropriate licensing authority;

e.

$1 million within 180 days following the payment described in item (c) above;

f.

$1 million within 60 days following the payment described in item (d) above; and

$1 million within 60 days following the payment described in item (e) above.

The Bom Jesus Project is situated about 120 meters above sea level. Locally the elevation is somewhat rolling, forming hills and valleys. There are some ridges of land on the Bom Jesus Project which are up to 50 meters above the surrounding drainages. The vegetation is composed of dense forest, with

27

localized areas occupied by farmers and the timber industry. In the case of the Bom Jesus Project, there is little activity in the surrounding areas and the garimpo is essentially isolated from outside interference. The property lies within the Amazon basin and vegetation is typical of that found in a tropical jungle environment. The principle areas not covered by jungle have been worked by the garimpeiros, and the drainages are filled by either tailings or swamps, although there is some cleared land used for the cultivation of crops. The lowest parts of these workings are now flooded. There are manydrainages.

Bom Jesus - General Location Map

The relatively flat topography could adequately site a plant and tailings and waste impoundments.

The Tapajós Province is situated in Central Amazon and is a part of the large Amazon Craton. In the North, it is bounded by the Amazon Basin near the town of Itaituba, and in the South by the Cachimbo Graben. The main rock units of the Province are attributed to events that took place during the Archaean, Proterozoic, and Phanerozoic. Tropical latosoils are developed over most areas at Cuiú, with thicker development on plateaus. The latosoil is 2 to 5 meters thick, brick red to ochre in color, and usually displays a well-developed “stone line” or ferricrete horizon, several meters below surface, just above the transition to saprolite.

Dourave has completed its initial phase of exploration on the Bom Jesus property, which included: geochemical and geophysical exploration and a 2212.05 meter diamond drilling program spread over various drilling locations on the property. Its focus was to determine the source of coincident geochemical, geophysical and geological anomalies and the potential for an economic gold and polymetallic resource. The Company began an additional stream sediment sampling program on the Bom Jesus Project in November 2010.

Early rock and channel sampling returned bonanza grades. Highlights from vein samples include:

| | |

Sampling Location | Gold (g/t) | Silver (g/t) |

BJ-R-05 | 128 | 18 |

BJ-R-10 | 1.97 | |

BJ-R-13 | 424 | 33 |

BJ-R-23 | 2.42 | 12 |

BJ-R-28 | 2.16 | |

BJ-R-32 | 1.36 | |

BJ-R-38 | 387 | 47 |

BJ-R-47 | 41.3 | 11 |

BJ-R-51 | 2.20 | |

BJ-R-2 (over 0.3m) | 83.9 | 12 |

Analytical and geochemical results from a recent stream sediment sampling program exceeded expectations and established a large anomaly to the west and southwest of previous exploration efforts. Traditionally any values between 50 and 100 ppb gold would be considered anomalous. Several results were returned with over 3000 ppb gold (3 grams of gold per ton), the highest being over 20,000 ppb gold (20 grams of gold per ton).The presence of significant gold-in-soil anomalies verified by recent stream sediment survey results at the Bom Jesus Project has extended the existing gold anomaly to over six km.

The figure below provides an overview of the results of the stream sediment survey:

In order to cover both the central gold and base metal prospective drill targets within the Bom Jesus Project’s mineralized system, as well as the nearby geophysical targets indicated in the previous aeromagnetic surveys, an IP geophysical survey was designed to cover the known targets highlighted in previous surveys.

All diamond drill holes in the 2010 drilling campaign intersected pervasive pottassic alteration with multiple zones of sericitic, propylitic alteration with varying degrees of disseminated sulphides. The presence of this alteration indicates that the Bom Jesus Project area is within a large alteration system,

29

The figure below is a map of the Bom Jesus drill hole locations.

Best results were returned from holes FBJ-15 & FBJ-16 with multiple lower grade intersections encountered in holes FBJ-09, FBJ-11 & FBJ-13. As per the previous drilling program anomalous gold values are often associated with anomalous varying degrees of Ag, Cu, Pb and Zn. Preliminary data suggests that the Bom Jesus Project is within a large, pervasive alteration system with up to 5 different phases of alteration. Current studies utilizing thin and polished sections will help define which of these alteration phases is related to gold and base metal mineralization and the subsequent exploration program will be adapted accordingly. Samples have been taken both from surface outcrops and diamond drilling core to allow the preparation of a three-dimensional model of the alteration and mineralization system.

30

The figure below shows Bom Jesus Drill Holes FBJ 09, 11, 13, 15 and 16.

The history of mining on the Bom Jesus Project from near surface deposits shows the potential profitability from near surface exploration on the surrounding grounds. He also notes that the impressive high grade surface samples recently discovered to the southwest gives reason to believe that near- surface high-grade structures maybe found in the vicinity.

Bom Jardim: This property is located in Para region of Brazil. Recent geophysical surveys confirm the prospective geology and show indications of strong hydrothermal alternation in the project area is considered an advanced exploration project as it has been in small scale production by Mineracao Bom Jardim Ltda. for several years and has had considerable exploration mapping and sampling completed under the direction of a qualified professional geologist to produce a resource base. The Bom Jardim project area covers 22,075.53 and includes 4 exploration leases. The Bom Jardim project is located approximately 175 km southwest of Itaituba. The principal drainages are the Edson and Joel Creeks, which are tributaries to the Bom Jardim Creek which flows into the Tapajos River. The area is accessible by air, land or water.