EXHIBIT 99.1

ANNUAL INFORMATION FORM

For the year ended December 31, 2011

Dated as of March 30, 2012

P.O. Box 41, Axa Place

Suite 1660, 999 West Hastings Street

Vancouver, B. C. V6C 2W2 Canada

Phone: (604) 681-9512

Fax: (604) 688-9532

TABLE OF CONTENTS

Page

| PRELIMINARY NOTES | 1 |

| Date of Information | 1 |

| Documents Incorporated by Reference | 1 |

| Currency | 1 |

| Conversion Table | 2 |

| Cautionary Statements Regarding Forward Looking Statements | 2 |

| Cautionary Note to United States Investors Regarding Mineral Reserve and Resource Estimates | 4 |

| Mineral Application Process in Argentina | 4 |

| CORPORATE STRUCTURE | 7 |

| Name, Address and Incorporation | 7 |

| Intercorporate Relationships | 8 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 8 |

| 2011 | 8 |

| 2010 | 9 |

| Subsequent Events | 10 |

| DESCRIPTION OF THE BUSINESS | 10 |

| General | 10 |

| Specialized Skills | 10 |

| Competitive Conditions | 11 |

| Business Cycles | 11 |

| Environmental Protection Requirements | 11 |

| Employees | 11 |

| Foreign Operations | 11 |

| Social or Environmental Policies | 11 |

| RISK FACTORS | 12 |

| CERRO MORO - PRINCIPAL PROJECT | 23 |

| Acquisition Terms | 23 |

| Summary | 23 |

| Introduction | 23 |

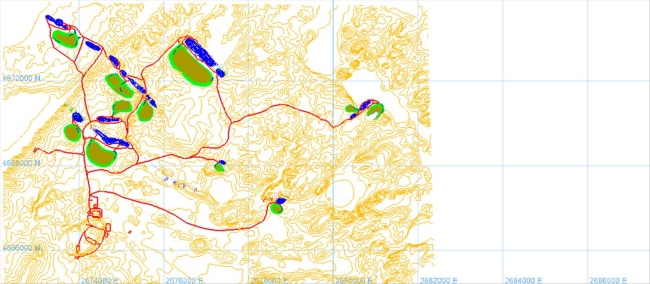

| Property Location | 24 |

| Geology and Mineralization | 25 |

| Exploration | 26 |

| Mineral Resource Estimation | 27 |

| Preliminary Mining Studies | 28 |

| Metallurgical Testwork Summary | 32 |

| Mineral Processing and Recovery Methods | 33 |

| Site Infrastructure | 33 |

| Environmental | 35 |

| Capital and Operating Cost Estimates | 36 |

| Economic Analysis | 41 |

| Conclusions | 42 |

| OTHER NON MATERIAL PROPERTIES | 45 |

| DIVIDENDS AND DISTRIBUTIONS | 46 |

| DESCRIPTION OF CAPITAL STRUCTURE | 46 |

| MARKET FOR SECURITIES | 46 |

| DIRECTORS AND EXECUTIVE OFFICERS | 48 |

| Name, Address and Occupation | 48 |

| CONFLICTS OF INTEREST | 50 |

| LEGAL PROCEEDINGS | 50 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 50 |

| TRANSFER AGENT | 51 |

| MATERIAL CONTRACTS | 51 |

| INTEREST OF EXPERTS | 51 |

| AUDIT COMMITTEE | 52 |

| Audit Fees, Audit-Related Tax and All Other Fees | 52 |

| ADDITIONAL INFORMATION | 53 |

EXTORRE GOLD MINES LIMITED

PRELIMINARY NOTES

Date of Information

In this Annual Information Form (the “AIF”), unless the content otherwise requires, references to “our”, “us”, “it”, “its”, “the Company” or “Extorre” mean Extorre Gold Mines Limited and its subsidiaries. All the information contained in this AIF is as at December 31, 2011, the last day of the Company’s most recently completed financial year, unless otherwise indicated.

Documents Incorporated by Reference

Certain sections of the technical report entitled “Preliminary Economic Assessment For The Cerro Moro Gold-Silver Project, Santa Cruz Province, Argentina” (the “PEA”) is incorporated by reference into this AIF, a copy of which can be obtained online from SEDAR at www.sedar.com. See “Cerro Moro – Principal Project”. The PEA has an effective date of March 30, 2012 and was co-authored by Carlos Guzmán, Mining Eng, Registered Member of the Chilean Mining Commission, Bill Gosling, BSc Eng, MBA, FAusIMM, David (Ted) Coupland, BSc, DipGeoSc CFSG ASIA, MAusIMM (CP), Anthony Sanford, BSc, MBA, SACNASP Pr.Sci.Nat., Krishna Sinha, P. Eng Utah and Michael Gabora, P. Geo Ontario.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this AIF to the extent that a statement contained in this AIF or in any subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not constitute a part of this AIF, except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Currency

All dollar amounts referenced in this AIF are expressed in Canadian dollars, unless otherwise indicated.

The following table sets forth the rate of exchange for the Canadian dollar expressed in United States dollars in effect at the end of the periods indicated, the average of exchange rates in effect on the last day of each month during such periods, and the high and low exchange rates during such periods based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars.

Canadian Dollars to U.S. Dollars | Year Ended December 31 |

| 2011 | 2010 | 2009 |

| Rate at end of period | $0.9833 | $1.0054 | $0.9555 |

| Average rate for period | $1.0151 | $0.9671 | $0.8833 |

| High for period | $1.0583 | $1.0054 | $0.9716 |

| Low for period | $0.9430 | $0.9278 | $0.7692 |

The noon rate of exchange on March 30, 2012 as reported by the Bank of Canada for the conversion of Canadian dollars into United States dollars was Canadian $1.00 equals US$ 1.0009.

Conversion Table

For ease of reference in this AIF, the following conversion factors from metric measurements into imperial equivalents are provided:

| To Convert from Metric | To Imperial | Multiply by |

| | | |

| Hectares (ha) | Acres | 2.471 |

| Metres (m) | Feet (ft) | 3.281 |

| Kilometres (km) | Miles | 0.621 |

| Tonnes | Tons (2000 pounds) | 1.102 |

| Grams/tonne (g/t) | Ounces/ton (troy/ton) | 0.029 |

| | | |

Cautionary Statements Regarding Forward Looking Statements

This AIF contains “forward looking information” and “forward-looking statements” (together, “forward-looking statements”) within the meaning of securities legislation in Canada and the United States Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Statements concerning mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. While the Company has based these forward-looking statements on its expectations about future events as at the date that such statements were prepared, the statements are not a guarantee of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors and assumptions include, amongst others, the effects of general economic conditions, changing foreign exchange rates and actions by government authorities, uncertainties associated with negotiations and misjudgements in the course of preparing forward-looking statements. In addition, there are also known and unknown risk factors which may cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| | ● | risks related to the Company’s lack of operating history; |

| | ● | risks related to the Company’s lack of revenues from operations and its continued ability to fund ongoing and planned exploration and possible future mining operations; |

| | ● | risks related to the Company’s history of losses, which may continue to occur in the future; |

| | ● | risks related to the on-going credit crisis centered in the United States and Europe and the Company’s ability to raise money in the future to fund its operations; |

| | ● | risks related to its ability to successfully establish mining operations or profitably produce precious or other metals; |

| | ● | risks related to differences between US and Canadian practices for reporting mineral resources and reserves; |

| | ● | risks related to the speculative nature of resource exploitation; |

| | | risks related to the effect of foreign exchange regulations on operations in Argentina; |

| | | risks related to the absence of mineral reserves; |

| | | risks related to uninsured risks; |

| | | risks related to shortages of equipment and supplies; |

| | | uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that any possible future development activities will result in profitable mining operations; |

| | | risks related to mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated; |

| | | changes in the market price of gold and silver, and other minerals which in the past has fluctuated widely and which could affect the profitability of possible future operations and financial condition; |

| | | risks related to currency fluctuations; |

| | | risks related to the inherently dangerous activity of mining, including conditions or events beyond the Company’s control; |

| | | risks related to the Company’s primary property being located in Argentina, including political, economic, and regulatory instability; |

| | | uncertainty in the Company’s ability to obtain and maintain certain permits necessary for current and anticipated operations; |

| | | risks related to the Company being subject to environmental laws and regulations which may increase the costs of doing business and/or restrict operations; |

| | | risks related to land reclamation requirements which may be burdensome; |

| | | risks over the uncertainty in the Company’s ability to attract and maintain qualified management to meet the needs of anticipated growth and risks relating to its ability to manage growth effectively; |

| | | risks related to the Company’s held mineral properties being subject to prior unregistered agreements, transfers, or claims and other defects in title; |

| | | risks related to increased competition that could adversely affect the Company’s ability to attract necessary capital funding or acquire suitable producing properties for mineral exploration in the future; |

| | | risks related to officers and directors becoming associated with other natural resource companies which may give rise to conflicts of interests; |

| | | the volatility of the Company’s common share price and volume; |

| | | tax consequences to United States shareholders; and |

| | | risks relating to potential claims by indigenous people over the Company’s mineral properties. |

The above list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in

this AIF. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

Cautionary Note to United States Investors Regarding Mineral Reserve and Resource Estimates

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (“CIM Standards”). These definitions differ from the definitions in the United States Securities and Exchange Commission’s (the “SEC”) Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and environmental authorizations must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101 and the CIM Standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in limited cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this AIF and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by US companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Mineral Application Process in Argentina

The laws, procedures and terminology regarding mineral title in Argentina differ considerably from those in Canada and the United States. According to Argentine Political State Organisation, the minerals are owned by the provinces where they are located, which grant the exploration permits and mine concessions to the applicants. However, the Argentinean Federal Government is entitled to enact the National Mining Code, which is applicable to the whole country, while the provinces have the power to regulate the

procedural aspects of the Mining Code through each Provincial Mining Procedure Code and to organize the concession and enforcement authorities.

In general, a similar concept applies to the environmental aspects related to mining activities. Although the Mining Code includes a chapter that regulates the main aspects of environmental regulations, provinces are the enforcement authorities. Furthermore, in application of Section 121 and Section 41 of the Argentine Constitution, many provinces have also enacted additional environmental laws, which directly or indirectly are applicable to mining activities.

The Mining Code

The rights, obligations, and procedures for the acquisition, exploration, exploitation, and use of mineral substances in Argentina are regulated by the Mining Code. The Mining Code establishes three classes of minerals, two of which are: (i) the main metalliferous substances such as gold, silver, copper, and lead whose ownership is vested in the provincial government, which in turn grants exploitation concessions to private companies; and (ii) the other metalliferous substances, which include earthy minerals and industrial minerals that belong to the land owner. Except for minerals contained in this last category, mineral rights in Argentina are separate rights from surface ownership rights. Creek bed and placer deposits, as well as abandoned tailings and mine waste rock deposits, are included in the latter mineral class.

Description of “Exploration” and “Mining” Permits

There is no actual ground staking of mineral claims for securing mineral rights in Argentina. Mineral rights are acquired by application to the government for concessions to seek, own and sell minerals located within a specified parcel of land. Generally, all persons or entities qualified to acquire and possess real estate can obtain mineral rights. The levels of mineral rights and titles are described below:

Cateo

A cateo is an exploration concession which does not permit mining but gives the owner a preferential right to a mining concession for exploitation of minerals discovered in the same area. Cateos are measured in 500 hectare unit areas. A cateo cannot exceed 20 units (10,000 hectares). No person may hold more than 20 permits or 400 units in a single province. The term of a cateo is based on its area: 150 days for the first unit (500 hectares) and an additional 50 days for each unit thereafter. After a period of 300 days, 50% of the area over four units (2,000 hectares) must be relinquished. At 700 days, 50% of the area remaining must be relinquished. Extensions may be granted to allow for bad weather, difficult access, or similar issues. Cateos are identified by a file number or dossier number.

Cateos are awarded by the following process:

| | (i) | an application is made in respect of a designated area, describing a minimum work program and an estimation of the investment to be made and a schedule for exploration; |

| | (ii) | approval is granted by the province and a formal placement on the official map or graphic register is made provided the requested area is not superseded by a previous mining right; |

| | (iii) | publication of the claim is made in the provincial official bulletin so as to notify third parties of the claim; and |

| | (iv) | upon expiry of a period following publication in the official bulletin, the cateo is awarded. |

The length of this process varies depending on the province, and often takes up to two years. Applications are processed on a first-come, first-served, basis. During the application period, the first applicant has rights to any mineral discoveries made by third parties in the area of the cateo without its prior consent.

Until August 1995, a “canon fee”, or tax, of AR$400 per unit was payable upon the awarding of a cateo. An amendment to this law requires that a canon fee be paid upon application for the cateo. The canon fee for the cateo is paid once for the whole duration of the exploration permit.

Mina

Minas (Manifestos de Descubrimiento) are mining concessions which permit mining on a commercial basis. Although the previous granting of a cateo is not a pre-condition for the granting of a mina, the most common way to acquire a mina would be by discovering a mine as a consequence of an exploration process under the awarding of a cateo. The area of a mina is measured in claims (“pertenencias”). Each mina may consist of one or more claim (pertenencias). “Vein mineral claim (pertenencias)” are 6 hectares and “Disseminated mineral claim (pertenencias)” are 100 hectares (relating to disseminated deposits of metals rather than discrete veins). The mining law determines the number of claim (pertenencias) allowed to cover the geologic extent of the mineral deposit in question according to the applicant category (company or person). Once granted, minas have an indefinite term assuming the requirements of law and exploration development or mining is in progress.

To convert an exploration concession, or cateo, to a mining concession, or mina, a declaration of manifestation of discovery must be made wherein a point within a cateo must be nominated as a discovery point. The manifestation of discovery is used as a basis for location of the claims (pertenencias). Manifestations of discovery do not have a definite area until pertenencias are measured. Within a period following designation of a manifestation of discovery, the claimant may do further exploration, if necessary, to determine the size and shape of the ore body.

Following a publication and opposition period and approval by the province, a formal survey of the pertenencias, together forming the mina, is completed. A surveyed mina provides the highest degree of mineral rights in Argentina.

The application to the mining authority must include official cartographic coordinates of the mine location and of the reconnaissance area, and a sample of the mineral discovered. The reconnaissance area, which may be as much as twice the surface area projection of the mine, is intended to allow for the geological extent of the ore body and for site layout and development. Excess area is released once the survey plans are approved by the mining authority.

Once the application for a mine has been submitted, the holder of the mining concession may commence the mining operation. Any person opposed to the mine operation, whether a holder of an overlapping cateo, a land owner disputing the existence of the ore deposit or the class of the economic mineral, or a partner in the discovery who claims to have been neglected, must register his opposition to the operation with the mining authority.

New mining concessions may also be awarded for mines that were abandoned or for which their original mining concessions were declared to have expired. In such cases, the first person claiming an interest in the property will have priority. A new mining concession will be awarded for the mine in the condition left by the previous holder.

The titleholder of a mine must fulfill three conditions as part of its mining concession in order to maintain its title to the mining concession in good standing: (i) payment of mining canons; (ii) provision of minimum investment; and (iii) continuous mining activity (if the mine is shut down for more than four years, the mining authority may demand the mine to be reactivated and a new investment plan be submitted).

Mining canons are paid to the state (national or provincial) under which the mining concession is registered, and are paid in equal instalments twice yearly. The canon is set by national law according to the category of the mine. In general, the canon due per year is AR$80 per 6 hectare pertenencia for common ore bodies held by the mining concession, or AR$800 per 100 hectares pertenencia for disseminated ore bodies. Failure to comply with this obligation for fourteen months results in the cancellation of the mining right. However, the titleholder can recover the mining right during 45 days after being notified by the mining authority, by paying the due canon plus 20% charge as a fine. The discoverer of the mine is exempt from paying canons for three years from the date on which formal title was awarded to the mine.

The holder of the mining concession must also commit to investing in the fixed assets of the property to a minimum of at least 300 times the value of the annual mining canon, over a period of five years. In the first two years, 20% of the total required investment must be made in each year. For the final three years, the remaining 60% of the total required investment may be distributed in any other manner to the discretion of the concessionaire. The mining concession expires if the minimum required investment schedule is not met. If the exploration or exploitation works at the mine are suspended for more than four years in a row, the mining authority can require the holder of the concession to prepare and undertake a plan to activate or reactivate work. Failure to file such reactivation plan within six months results in the cancellation of the mining right. Such work must be completed on the property within a maximum period of five years.

Environmental Regulation

Argentina’s Mining Code contains environmental provisions which are administered by each Province. Operators are liable for environmental damage. Before initiating operations, mining companies must prepare and submit an environmental impact report to the Provincial regulators. This report outlines the proposed operations and methods and what measures will be taken to minimize the impact on the environment. Updates which detail the status of operations and results are required. If the regulators determine the protection measures to be inadequate or insufficient, additional environmental protection measures may be required, and violators may be forced to cease operations and rectify any damage.

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated on December 21, 2009 under the Canada Business Corporations Act as 7300492 Canada Inc. and changed its name to Extorre Gold Mines Limited on February 5, 2010.

On March 24, 2010, pursuant to a Plan of Arrangement (the “Arrangement”) conducted by Exeter Resource Corporation (“Exeter”) under the Business Corporations Act (British Columbia), Exeter transferred its wholly owned subsidiaries, Estelar Resources Limited (“Estelar”) and Cognito Limited (��Cognito”) together with cash and working capital balances of approximately $25 million to Extorre. Estelar and Cognito hold the former Argentine assets of Exeter, which included interests in a number of precious and base metal projects, the Cerro Moro property (“Cerro Moro” or the “Cerro Moro Project” or the “Project”), the Don Sixto property, the Estelar properties and the MRP properties.

The head office of the Company is located at Suite 1660-999 West Hastings Street, Vancouver, British Columbia, V6C 2W2. The address for service and the registered and records office of the Company is located at Suite 2300, 550 Burrard Street, Vancouver, British Columbia V6C 2B5.

Intercorporate Relationships

As of the effective date of this AIF, the Company has two wholly-owned subsidiaries: Estelar and Cognito. Estelar and Cognito are incorporated in the British Virgin Islands and are registered to conduct the Company’s business in Argentina.

GENERAL DEVELOPMENT OF THE BUSINESS

The Company is engaged in the business of acquisition, exploration and development of mineral properties located in Argentina; its business development over the last two years is described in the following paragraphs. Unless otherwise noted in this AIF, Eric Roth, President and Chief Executive Officer of the Company and a Fellow of the AusIMM, a qualified person under NI 43-101, is responsible for the preparation of scientific or technical information in this AIF.

2011

During the first quarter, the Company continued to explore at the Cerro Moro Project with four drill rigs. The exploration drilling at Cerro Moro was focused on both the evaluation of new exploration targets as well as infill drilling on the Escondida and Gabriela veins. Initial drill programs were also completed on the Union Dome and Falcon targets, which lie within the Bahia Laura (Fomicruz Joint Venture) and Santa Cruz Regional tenements, respectively. The Company also listed on the NYSE Amex stock exchange under the trading symbol “XG”.

During the second quarter, Extorre announced the discovery of high grade gold-silver mineralization in the Zoe sector at Cerro Moro. Concurrent with the discovery of Zoe, an accelerated drill program was initiated with the arrival of two additional drill rigs. An updated mineral resource estimate for the Cerro Moro Project, which included the results of drilling completed up until February, 2011 (and therefore excluding Zoe), was prepared in April, 2011. The updated mineral resource statement included an indicated category resource of 927,000 ounces gold equivalent* and inferred category resource of 396,000 gold ounces equivalent. In May 2011, Extorre received approval from Santa Cruz Provincial authorities for the Environmental Impact Assessment (“EIA”) that had been submitted in September, 2010, for the development of a 750 tonne per day mining operation at Cerro Moro. Discovery drilling on the Santa Cruz Regional tenements led to the discovery of the Renaldo prospect on the Puntudo property, which is located 200 kilometres west of Cerro Moro. In June 2011, mine development-related studies continued at Cerro Moro, including additional metallurgical testwork,

On July 12, 2011, the Company completed a bought deal equity financing in which it sold 2,400,000 common shares at a price of $10.50 per share to raise gross proceeds of $25.2 million. The Company paid the underwriters a cash fee in an amount equal to six percent (6.0%) of the gross proceeds received from the offering and also issued 120,000 broker warrants which are exercisable to acquire up to 120,000 common shares of the Company at an exercise price of $11.15 per common share for a period of 12 months from closing.

* The gold equivalent ounces are calculated by dividing the total silver ounces by 50 and adding this value to the total gold ounces.

Extorre continued to release positive drill results from Zoe that extended the zone of high-grade mineralization. Drilling and assaying continued to be undertaken at an accelerated rate with six drill rigs operating at Cerro Moro. Mineral resource definition drilling was nearly completed in preparation for an updated mineral resource estimate in the fourth quarter. The Company also released positive initial drill results from the Puntudo property.

Early in the fourth quarter, the Company received final assays from the Zoe discovery for incorporation in an updated mineral resource estimate. On October 13, 2011, Extorre announced the appointment of key development personnel Trevor Mulroney (Chief Operating Officer) and Alberto Carlocchia (Country Manager – Argentina). On October 26, 2011, the Argentine government announced new foreign currency transfer regulations that created uncertainty in the market. Extorre responded publically to these new regulations on October 26, 2011. On November 3, 2011 Extorre announced an updated mineral resource estimate for Cerro Moro undertaken by Cube Consulting Pty. Ltd. (“Cube”) which incorporated maiden contributions from the Martina, Carla, Nini & Zoe veins. The updated mineral resource statement included an indicated mineral resource category of 1.35 million ounces gold equivalent*, and an inferred mineral resource category of 1.05 million ounces gold equivalent*. Further positive assays were released from the Zoe vein near year end. Concurrent with the release of the updated mineral resource statement, the number of drill rigs at Cerro Moro was reduced from 6 to 4. By year-end, a total of 73,900 m of drilling in 389 drill holes had been completed on the central portion of the Cerro Moro tenements.

2010

During the first quarter Exeter and Extorre announced that they had completed the Arrangement.

During the second quarter, the Company released an updated mineral resource estimate and technical report dated May 31, 2010 prepared by an independent qualified person for the Cerro Moro Project.

Ongoing drilling and engineering studies on the Cerro Moro Project continued through the second quarter.

Due to a significant assay backlog, with some 4,000 sample results awaited, Extorre entered into a contract for the installation and management of a dedicated on-site sample preparation facility at Cerro Moro, to be managed by an independent, accredited geochemical contractor.

During the third quarter the Company presented its EIA for the proposed Cerro Moro mine development to the Santa Cruz Provincial authorities. Separately, an addendum to the existing exploration permits requesting permission for the construction of a decline at Escondida Far West was prepared and submitted to the Santa Cruz Minister of Mines.

On August 3, 2010 the Company reported a new high grade gold zone on the Martina zone at the Cerro Moro Project and results from the Escondida Far West and Carla zones where drilling defined high grade mineralization.

Drilling, assaying and engineering studies continued on an accelerated basis including undertaking a preliminary economic assessment for Cerro Morro. Consequently, the Company’s staff continued increasing.

* The gold equivalent ounces are calculated by dividing the total silver ounces by 50 and adding this value to the total gold ounces.

On September 28, 2010, the Company completed a bought deal equity financing in which it sold 9,100,000 common shares at a price of $4.45 per share to raise gross proceeds of $40.5 million. The Company paid the underwriters a cash fee in an amount equal to six percent (6.0%) of the gross proceeds received from the offering and also issued 455,000 broker warrants which are exercisable to acquire up to 455,000 common shares of the Company at an exercise price of $5.00 per common share for a period of 12 months from closing.

Exploration activities continued at Cerro Moro with four drill rigs active on site. Drilling activities were primarily focused on i) the discovery of new mineral resources and ii) infill drilling on the Loma Escondida and Gabriela veins.

On October 19, 2010, the Company released the results of the preliminary economic assessment on the Cerro Moro Project. Drill activities were initiated on the Verde and Falcon (Calandria) properties. These properties form part of the CVSA agreement that was originally signed in December 2003 (see “Cerro Moro Principal Project”).

Subsequent Events

On March 30, 2012, the Company filed the PEA on SEDAR at www.sedar.com.

On March 16, 2012, the Company closed a bought deal private placement financing and sold 3,530,000 common shares of the Company at a price of $7.10 per share for gross proceeds of $25.1 million. The underwriter received a cash commission of 5% of the gross proceeds raised. The common shares issued with respect to the financing are subject to a four month hold period.

DESCRIPTION OF THE BUSINESS

General

The Company is a mineral resource exploration company. The Company’s principal property is the Cerro Moro property in Southern Argentina.

The Company is in the exploration stage of its corporate development; it owns no producing properties and, consequently has no current operating income or cash flow from the properties it holds, nor has it had any income from operations in the past three financial years. As a consequence, operations of the Company are primarily funded by equity subscriptions.

The progress on and results of work programs on the Company’s principal property is set out in the Principal Project section of this AIF. At this time, based on the exploration results to-date, the Company cannot project significant mineral production from any of its existing properties.

Specialized Skills

The Company’s business requires specialized skills and knowledge in the areas of geology, drilling, planning, implementation of exploration programs, and compliance. To date, the Company has been able to locate and retain such professionals in Canada and Argentina, and believes it will be able to continue to do so.

Competitive Conditions

The Company operates in a very competitive industry, and competes with other companies, many of which have greater technical and financial facilities for the acquisition and development of mineral properties, as well as for the recruitment and retention of qualified employees and consultants.

Business Cycles

Late in 2008 the credit crisis in the United States sent many economies, including the Canadian economy, into a recession. Since then, some markets have recovered and others have worsened (most notably some member States of the European Economic Union) and the commodity markets have remained volatile. The gold market, late in 2010, made significant gains in terms of US dollars but remained volatile throughout 2011 and suffered declines through the latter part of the year.

In addition to commodity price cycles and recessionary periods, exploration activity may also be affected by political developments and seasonal and irregular weather conditions in Argentina.

Environmental Protection Requirements

The Company’s operations are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, and the use of cyanide which would result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and their directors, officers, contractors and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the viability or profitability of operations.

Employees

As of December 31, 2011, and the date hereof, the Company has two employees in Canada, and approximately 123 employees in Argentina. The Company relies on and engages consultants on a contract basis to provide services, management and personnel who assist the Company to carry on its administrative or exploration activities in Canada and Argentina.

Foreign Operations

Mineral exploration and mining activities in Argentina may be affected in varying degrees by political instability and government regulations relating to the mining industry. Any changes in regulations or shifts in political conditions may adversely affect the Company’s business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, foreign exchange controls, income taxes, expropriation of property, environmental legislation and mine safety.

Social or Environmental Policies

In March 2010, the Company adopted its “Environment and Corporate Social Responsibility Principles and Policies” which sets out the principles that all directors, management and employees are required to

adhere to while conducting Company business. The principles are (i) environmental stewardship, which sets the objective of minimizing negative impacts on the environment; (ii) the commitment to conduct due diligence before undertaking material activities on the ground to ensure proper management of issues surrounding these activities; (iii) a commitment to engage host communities and other affected and interested parties by including all parties and providing clear and accurate information; (iv) contribute to community development; (v) upholding Human Rights; (vi) safeguarding the health and safety of workers and local populations by implementing sound health and safety policies; (vii) a commitment to accurate and transparent reporting; and (viii) the commitment to ethical business practices.

RISK FACTORS

Properties in which the Company has or is acquiring an interest, are all currently at the exploration stage. The activities of the Company are speculative due to the high risk nature of its business which is the acquisition, financing, exploration and development of mining properties. The following risk factors, which are not exhaustive, could materially affect the Company’s business, financial condition or results of operations and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. These risks include but are not limited to the following:

Risks Associated with Our Operations and Mineral Exploration

We operate in the resource industry, which is highly speculative, and has certain inherent exploration risks which could have a negative effect on our operations.

Resource exploration is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by us may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors such as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. Any one or a combination of these factors may result in the Company not receiving an adequate return on our investment capital.

We have no declared mineral reserves and no economic reserves may exist on our properties, which could have a negative effect on our operations and valuation.

Despite exploration work on our mineral claims, no mineral reserves have been established on any of our mineral properties. We may expend substantial funds in exploring some of our properties only to abandon them and lose our entire expenditure on the properties if no commercial or economic quantities of minerals are found. Even if commercial quantities of minerals are discovered, the exploration properties might not be brought into a state of commercial production. Finding mineral deposits is dependent on a number of factors, including the technical skill of exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent on a number of factors, some of which are the particular attributes of the deposit, such as content of the deposit including harmful substances, size, grade and proximity to infrastructure, as well as metal prices and the availability of power and water in sufficient supply to permit development. Most of these factors are beyond the control of the entity conducting such mineral exploration. We are an exploration and development stage company with no history of pre-tax profit and no income from our operations. There can be no assurance that our operations will be profitable in the future. There is no certainty that the expenditures to be made by us in the exploration and development of our properties will result in discoveries of mineralized material in

commercial quantities. Most exploration projects do not result in the discovery of commercially mineable deposits and no assurance can be given that any particular level of recovery of mineral reserves will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) mineral deposit which can be legally and economically exploited. There can be no assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production. If we are unsuccessful in our exploration and development efforts, we may be forced to acquire additional projects or cease operations.

Preliminary economic assessment results are based on many factors that are subject to uncertainty and risks.

Preliminary economic assessments are used to estimate the economic viability of a deposit. The economic assessment results of the preliminary economic assessment are preliminary and do not reflect the same level of certainty as a definitive feasibility study. Generally accepted levels of confidence are plus or minus 35-40% for a preliminary economic assessment. The level reflects the level of confidence that exists at the time the study is completed. While a preliminary economic assessment is based on the best information available to us, we cannot be certain that actual costs will not significantly exceed the estimated cost. While we incorporate what we believe is an appropriate contingency factor in cost estimates to account for this uncertainty, there can be no assurance that the contingency factor is adequate. Many factors are involved in the determination of the economic viability of a mineral deposit, including the achievement of satisfactory mineral reserve estimates, the level of estimated metallurgical recoveries, capital and operating cost estimates and estimates of future metal prices. Resource estimates are based on the assay results of many intervals from many drill holes and the interpolation of those results between holes. Mineral reserve estimates may be materially affected by metallurgical, environmental, permitting, legal title, socio-economic factors, marketing, political and other factors. There is no certainty that metallurgical recoveries obtained in bench scale or pilot plant scale tests will be achieved in commercial operations. Capital and operating cost estimates are based upon many factors, including anticipated tonnage and grades of ore to be mined and processed, the configuration of the orebody, ground and mining conditions, expected recovery rates of the metals from the ore and anticipated environmental and regulatory compliance costs. Each of these factors involves uncertainties, and as a result, we cannot give any assurance that our preliminary economic assessment results will not be subject to change and revisions. If a mine is developed, actual operating results may differ from those anticipated in a feasibility study, pre-feasibility study or preliminary economic assessment.

We conduct mineral exploration in foreign countries which have special risks which could have a negative effect on our operations and valuation.

Our exploration and development operations are located in Argentina. Foreign countries can experience economic instability associated with unfavourable exchange rates, high unemployment, inflation and foreign debt. These factors could pose serious potential problems associated with our ability to raise additional capital which will be required to explore and/or develop any of our mineral properties. For example, official government estimates of inflation in Argentina for 2011 are around 14%, however, unofficial estimates place this figure at closer to 25 - 30%. Inflation of this magnitude would impact the cost of carrying out our business plans in Argentina. Developing economies have additional risks, including: foreign exchange controls, changes to or invalidation of government mining laws and regulations; expropriation or revocation of land or property rights; changes in foreign ownership rights; changes in foreign taxation rates; corruption; uncertain political climate; terrorist actions or war; and lack of a stable economic climate. For example, on June 20, 2007, legislation was passed by the Provincial government, in Mendoza, Argentina, prohibiting the use of chemicals typically used in the extraction of gold and other metals in the province, affecting all mining companies that use such extraction techniques, and effectively putting our Don Sixto project on hold. As a result of these regulations, the Company has

written off its investment in Don Sixto. On February 28, 2011 the Argentine President enacted Decree 207/2011 which regulates Law 26,639 (the Law on Minimum Standards for the Protection of Glaciers and the Peri-glacial Environment). Decree 207/2011 has only regulated 4 out of the 17 sections of Law 26,639. The general outlines established by the Decree establish the specific objectives of the National Glacier Inventory, define the Strategic Environmental Evaluation as the systematic process of study of the environmental impact of the policies, plans or programs and their alternatives, including the preparation of a written report and the evaluation conclusions as well as their use in the public decision proceedings and appoints the Environment and Sustainable Development Secretariat of Chief Ministry as the application authority of Law 26,639. In addition, indigenous and community organizations can impact government mining regulations resulting in additional uncertainty. The presence or persistence of any of these conditions could have a negative effect on our operations and could lead to us being unable to exploit, or losing outright, our rights. This would have a negative impact on the Company and the value of our securities.

On October 26, 2011 the Federal Government of Argentina announced that future export revenues derived from mining operations must be repatriated to Argentina and converted to Argentine currency prior to being distributed either locally or back overseas. The distribution of earnings back overseas would require the Argentine currency to be reconverted to foreign currency for repatriation. This overturns the benefits provided in 2002 and 2003-04 to all Argentine oil and mining companies, respectively, that exempted them from the currency repatriation laws that apply to all other primary producers in the country. A preliminary analysis of the new decree by Extorre legal counsel in Buenos Aires indicates that this does not change the current regulations that allow, subject to the Argentinean central bank rules, the unlimited purchase and transfer of foreign currency to offshore destinations in consideration for debt repayment facilities or approved and budgeted dividend payments.

Argentina’s economy has a history of instability and future instability and uncertainty could negatively affect our ability to operate in the country.

Since 1995, Argentina’s economy has suffered periods of instability, which include high inflation, capital flight, default on international debts and high government budget deficits. Results of these problems included domestic disturbances and riots, government resignations and instability in the currency and banking system. Official government estimates of inflation in Argentina in 2011 are 14%, however, unofficial estimates place this figure at closer to 25 - 30%. Such disorder in the future, including significant increases in the rate of inflation, could make it difficult or impossible for us to operate effectively in the country and require us to reduce or suspend our operations in Argentina.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mineral exploration and, if warranted, development operations. The Argentine Government has introduced measures requiring local sourcing of equipment and supplies wherever possible. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out its operations and therefore limit or increase the cost of production.

Mining and resource exploration is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on its business and plans.

Mining and mineral exploration involves various types of risks and hazards, including:

| | | metallurgical and other processing problems; |

| | | unusual or unexpected geological formations; |

| | | personal injury, flooding, fire, explosions, cave-ins, landslides and rock-bursts; |

| | | inability to obtain suitable or adequate machinery, equipment, or labour; |

| | | fluctuations in exploration, development and production costs; |

| | | unanticipated variations in grade; |

| | | mechanical equipment failure; and |

| | | periodic interruptions due to inclement or hazardous weather conditions. |

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, may be prohibitively expensive. We may suffer a material adverse effect on our business if we incur losses related to any significant events that are not covered by our insurance policies.

The figures for our resources are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, resource estimates presented in this AIF and in our filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineral resources and grades of mineralization on our properties.

Estimates can be imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

| | | these estimates will be accurate; |

| | | resource or other mineralization estimates will be accurate; or |

| | | this mineralization can be mined or processed profitably. |

Any material changes in mineral resource estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

Because we have not completed feasibility studies on our properties and have not commenced actual production, mineralization estimates, including resource estimates, for our properties may require adjustments or downward revisions. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our estimates and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The resource estimates contained in this AIF have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold, silver or other commodities may render portions of our mineralization and resource estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability determinations we reach. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on its share price and the value of our properties.

Land reclamation requirements for our properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

| | | control dispersion of potentially deleterious effluents; |

| | | treat ground and surface water to drinking water standards; and |

| | | reasonably re-establish pre-disturbance land forms and vegetation. |

In order to carry out reclamation obligations imposed on us in connection with its potential development activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our long-term viability and future profitability depend, in large part, upon the market price of gold, silver and other metals and minerals. The market price of gold, silver and other metals is volatile and is impacted by numerous factors beyond our control, including:

| | | expectations with respect to the rate of inflation; |

| | | the relative strength of the US dollar and certain other currencies; |

| | | global or regional political or economic conditions; |

| | | supply and demand for jewellery and industrial products containing metals; |

| | | sales by central banks and other holders, speculators and producers of gold, silver and other metals in response to any of the above factors; and |

| | | any executive order curtailing the production or sale of gold or silver. |

We cannot predict the effect of these factors on metal prices. A decrease in the market price of gold, silver, and other metals could affect the commercial viability of our properties and our anticipated development of such properties in the future. Lower gold prices could also adversely affect our ability to finance exploration and development of our properties.

Fluctuations in the availability and costs of labour could negatively affect our operations and financial condition.

Employees at our various projects may be a mix of union and non-union workers. At the present time a sufficient supply of qualified workers is available for our current operations at our projects. The continuation of such supply depends upon a number of factors, including principally, the demand occasioned by other competing companies. There can be no assurance that we will continue to be able to retain or attract qualified employees. There is a risk that increased labour costs and labour litigation risks could have a material adverse effect on our operating costs.

Our operations contain significant uninsured risks which could negatively impact future profitability as we maintain no insurance against our operations.

Our exploration and development of our mineral properties contains certain risks, including unexpected or unusual operating conditions including rock bursts, cave-ins, flooding, fire and earthquakes. It is not always possible to insure against these risks. Should events such as these arise, they could reduce or eliminate our assets and shareholder equity as well as result in increased costs and a decline in the value of our securities. We expect to maintain only general liability and director and officer insurance but no insurance against our properties or operations. We may decide to take out this insurance in the future if it is available at economically viable rates.

We have not surveyed any of our properties, have no guarantee of clear title to our mineral properties and we could lose title and ownership of our properties which would have a negative effect on our operations and valuation.

Only a preliminary legal survey of the boundaries of some of our properties has been done and, therefore, in accordance with the laws of the jurisdictions in which these properties are situated, their existence and area could be in doubt. If title is disputed, we will have to defend our ownership through the courts. In the event of an adverse judgment, we would lose our property rights.

The natural resource industry is highly competitive, which could restrict our growth.

We compete with other exploration resource companies which have similar operations, and many competitors have operations, financial resources and industry experience greater than ours. This may place us at a disadvantage in acquiring, exploring and developing properties. These other companies could outbid us for potential projects or produce minerals at lower costs which would have a negative effect on our operations.

Mineral operations are subject to market forces outside of our control which could negatively impact our operations.

The marketability of minerals is affected by numerous factors beyond our control including market fluctuations, foreign exchange controls, government regulations relating to prices, taxes, royalties, allowable production, imports, exports and supply and demand. One or more of these risk elements could have an impact on the costs of our operations and if significant enough, reduce the profitability of our operations and threaten our continuation.

We are subject to substantial environmental and permitting requirements which could cause a restriction, suspension or abandonment of our operations.

Our current and anticipated future operations require permits from various governmental authorities and such operations are and will be governed by laws and regulations governing various elements of the mining industry. Our exploration activities in Argentina are subject to various Federal, Provincial and local laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal and toxic substances. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require us to obtain permits from various governmental agencies.

Exploration generally requires one form of permit while development and production operations require additional permits. There can be no assurance that all permits which we may require for future exploration or possible future development will be obtainable at all or on reasonable terms. In addition,

future changes in applicable laws or regulations could result in changes in legal requirements or in the terms of existing permits applicable to us or our properties. This could have a negative effect on our exploration activities or our ability to develop our properties.

We are also subject to environmental regulations which require us to minimize impacts upon air, water, soils, vegetation and wildlife, as well as historical and cultural resources, if present. In Argentina, prior to conducting operations, miners must submit an environmental impact assessment to the provincial government, describing the proposed operation and the methods to be used to prevent environmental damage. The Company submitted this report for the potential development of a 750 tonnes per mining mine at Cerro Moro to the provincial authorities in Argentina in September 2010 and received approval of the report in May 2011. Additional approvals for revisions or updates to the environmental impact assessment are still required for proposed development at Cerro Moro. Approval must be received from the applicable bureau and/or department, which will also conduct ongoing monitoring of operations before exploration can begin. In addition, landowners must consent to any access and work within their property. While to date we have been able to secure necessary access agreements from landowners in areas where our properties are located, if in the future a landowner believes that our activities are producing environmental damage, the landowner could apply to the courts seeking damages or requesting an injunction or suspension of our activities.

On June 20, 2007, legislation was passed by the Provincial government, in Mendoza Argentina, prohibiting the use of chemicals typically used in the extraction of gold and other metals in the province. The legislation effectively puts our Don Sixto project on hold, unless the government amends the law or our lawsuit to have the law declared unconstitutional is successful.

As we are presently at the exploration and development stage, the disturbance of the environment is limited and the costs of complying with environmental regulations are minimal. However, if operations result in negative effects upon the environment, government agencies will likely require us to provide remedial actions to correct the negative effects.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or other remedial actions.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain, and would be particular to the geographic circumstances in areas in which it operates. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing

temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

We depend upon key management employees, the absence of which would have a negative effect on our operations.

We depend on the business and technical expertise of our management and key personnel. It is unlikely that this dependence will decrease in the near term. As our operations expand, additional general management resources will be required. We may not be able to attract and retain additional qualified personnel and this would have a negative effect on our operations. We maintain no “key man” life insurance on any members of our management or directors.

Certain of our officers and directors may have conflicts of interest, which could have a negative effect on our operations.

Certain of our directors and officers are also directors and/or officers and/or shareholders of other natural resource companies. While we are engaged in the business of exploring for and exploiting mineral properties, such associations may give rise to conflicts of interest from time to time. Our directors are required by law to act honestly and in good faith with a view to uphold the best interests of the Company and to disclose any interest that they may have in any project or opportunity of the Company. If a conflict of interest arises at a meeting of our board of directors, any director in a conflict must disclose his interest and abstain from voting on the matter. In determining whether or not we will participate in any project or opportunity, our directors will primarily consider the degree of risk to which we may be exposed and our financial position at the time.

Financing Risks

We have a history of losses and a limited operating history. We will require additional equity financings, which will cause dilution to existing shareholders.

We have limited operating history and have limited financial resources and no operating cash flow. As of the end of December 31, 2011, our historical net loss under International financial reporting standards totalled $163,362,000. Continued exploration efforts will require additional capital to maintain and to expand exploration on our principal exploration properties. Additionally, if we decide to proceed with a feasibility study on any of our primary properties, substantial additional funds will be required to complete the study as well as to complete the acquisition of the projects held under option agreements. Late in fiscal year 2008, resulting from the on-going credit crisis centered in the United States, many economies including that of Canada went into a recession. The US and Canadian economies have shown some signs of recovery but in the meantime the economies and credit ratings of many member States in the European Economic Union have worsened considerably. These developments impacted investor confidence and reduced the availability of risk capital and project financing. If we are unable to obtain sufficient financing in the future, we might have to dramatically slow exploration and development efforts and/or lose control of our projects. If equity financings are required, then such financings could result in significant dilution to existing or prospective shareholders.

We have a lack of cash flow sufficient to sustain operations and do not expect to begin receiving operating revenue in the foreseeable future.

None of our properties have advanced to the commercial production stage and we have no history of earnings or cash flow from operations. Although all persons who will be involved in the management of the Company have had long experience in their respective fields of specialization, we have no operating

history upon which prospective investors can evaluate our performance. We have paid no dividends on our common shares since incorporation and do not anticipate doing so in the foreseeable future. Any future additional equity financing would cause dilution to current shareholders. If we do not have sufficient capital for our operations, management would be forced to reduce or discontinue our activities, which would have a negative effect on the value of our securities.

We operate in Argentina and are subject to currency fluctuations which could have a negative effect on our operating results.

Our operations are located in Argentina which makes us subject to foreign currency fluctuation as our accounts will be maintained in Canadian dollars while certain expenses will be enumerated in US dollars, Australian dollars and the local currency. Such fluctuations may adversely affect our financial position and results. Management may not take any steps to address foreign currency fluctuations that will eliminate all adverse effects and, accordingly, we may suffer losses due to adverse foreign currency fluctuations.

Global financial conditions may adversely impact operations and the value and price of our common shares.

Global financial conditions have been subject to increased volatility and numerous financial institutions have either gone into bankruptcy or have had to be rescued by governmental authorities. Access to public financing has been negatively impacted by both sub-prime mortgages and the liquidity crisis affecting the asset-backed commercial paper market. These factors may impact our ability to obtain equity or debt financing in the future and, if obtained, on terms favourable to us. If these increased levels of volatility and market turmoil continue, our operations could be adversely impacted and the value and the price of our common shares could be adversely affected.

Risks Relating to our Common Shares

The market for our common shares is subject to volume and price volatility which could negatively affect a shareholder’s ability to buy or sell our common shares.

The market for our common shares may be highly volatile for reasons both related to our performance or events pertaining to the industry (i.e. mineral price fluctuation/high production costs/accidents) as well as factors unrelated to us or our industry such as economic recessions and changes to legislation in the countries in which we operate. In particular, market demand for products incorporating minerals in their manufacture fluctuates from one business cycle to the next, resulting in changes in demand for the mineral and an attendant change in the price for the mineral. Since our listing on the Toronto Stock Exchange, the price of our common shares has fluctuated between $2.04 and $14.57 on the TSX and $4.23 and $15.42 on the NYSE Amex. Our common shares can be expected to be subject to volatility in both price and volume arising from market expectations, announcements and press releases regarding our business, and changes in estimates and evaluations by securities analysts or other events or factors. In recent years, the securities markets in the US and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small-capitalization companies such as Extorre, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, our common shares can also be subject to volatility resulting from purely market forces over which we will have no control such as that experienced recently resulting from the on-going credit crisis centered in the United States. Further, despite the existence of a market for trading our common shares in Canada and the United States, our shareholders may be unable to sell significant quantities of our common shares in the public trading markets without a significant reduction in the price of the stock.

The Company could be deemed a passive foreign investment company which could have negative consequences for US investors.

The Company could be classified as a Passive Foreign Investment Company (“PFIC”) under the US tax code. If the Company is declared a PFIC, then owners of the Company’s common shares who are US taxpayers generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund (“QEF”) election or a mark-to-market election with respect to the Company’s common shares. A US taxpayer who makes a QEF election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is classified as a PFIC, whether or not the Company distributes any amounts to its shareholders.

Differences in United States and Canadian reporting of reserves and resources.

The disclosure in this AIF, including the documents incorporated herein by reference, uses terms that comply with reporting standards in Canada. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be used by the Company pursuant to NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of the measured mineral resources, indicated mineral resources, or inferred mineral resources will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility studies or other economic studies, except in rare cases.

Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Further, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits or governmental authorizations must be filed with the appropriate governmental authority.