PRELIMINARY ECONOMIC ASSESSMENT

FOR THE CERRO MORO GOLD-SILVER PROJECT,

SANTA CRUZ PROVINCE, ARGENTINA

Technical Report NI 43-101

Submitted by

Carlos Guzmán, Mining Eng, Registered Member of the Chilean Mining Commission

Bill Gosling, BSc Eng, MBA, FAusIMM

David (Ted) Coupland, BSc, DipGeoSc CFSG ASIA, MAusIMM (CP)

Anthony Sanford, BSc, MBA, SACNASP Pr.Sci.Nat.

Krishna Sinha, PhD, P. Eng Utah

Michael Gabora, BSc, MSc, P. Geo Ontario

Effective Date:

March 30, 2012

CERTIFICATE OF QUALIFIED PERSON

I,Carlos Guzmán,Mining Engineer do hereby certify that:

| 1. | I am Principal and Project Director with the firm NCL Ingenieria y Construccion Ltda, Santiago, Chile. My address is General del Canto 235, Providencia, Santiago, Chile. |

| 2. | This certificate applies to the technical report titled “Preliminary Economic Assessment for the Cerro Moro Gold-Silver Project, Santa Cruz Province, Argentina” dated effective March 30, 2012 (the “Technical Report”) with respect to the Cerro Moro Gold-Silver Project in Santa Cruz Province, Argentina (the “Property”). |

| 3. | I am a practicing mining engineer and a member of the Australasian Institute of Mining and Metallurgy (AusIMM, No. 229036); and a Registered Member of the Chilean Mining Commission. |

| 4. | I am a graduate of the Universidad de Chile and hold a Mining Engineer title (1965). |

| 5. | I have practiced my profession continuously since 1995. |

| 6. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 7. | I most recently personally inspected the Property in November, 2010, for two days. |

| 8. | I am responsible for the preparation of sections 1.1, 1.2, 1.6, 1.9, 1.10, 1.11 (except for 1.11.4 and 1.11.8), 1.12, 1.14, 1.15, 1.16, 1.17, 2, 3, 16 (except for 16.3), 18 (except for 18.1.8 and 18.4), 21.1.2, 21.2.2, 21.2.3, 22, 25, 26 and 27 of the Technical Report. |

| 9. | I am independent of Extorre Gold Mines Limited as described in section 1.5 of NI 43-101. |

| 10. | I have had prior involvement with the Property, namely, I am a “qualified person” responsible for the preparation of portions of the technical report titled “Cerro Moro Gold-Silver Project, Second Preliminary Economic Assessment, Technical Report NI 43-101”, dated August 2, 2011. |

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that instrument. |

| 12. | At the effective date of the Technical Report, to the best of the my knowledge, information and belief, the sections of the Technical Report for which I am responsible contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 30th day of March, 2012.

CERTIFICATE OF QUALIFIED PERSON

I,Bill Gosling, do hereby certify that:

| 1. | I am a Senior Process Engineer. My address is 179 Great Eastern Highway, Belmont, Western Australia. |

| 2. | This certificate applies to the technical report titled “Preliminary Economic Assessment for the Cerro Moro Gold-Silver Project, Santa Cruz Province, Argentina” dated effective March 30, 2012 (the “Technical Report”) with respect to the Cerro Moro Gold-Silver Project in Santa Cruz Province, Argentina (the “Property”). |

| 3. | I possess a Bachelor of Engineering (Extractive Metallurgy) from the Western Australian Institute of Technology and a Masters in Business Administration from LaTrobe University. |

| 4. | I am a member in good standing of Australasian Institute of Mining and Metallurgy (AusIMM) Fellow Grade and Society for Mining, Metallurgy and Exploration (SME) Member Grade. |

| 5. | I have worked as process engineer and manager in the mining industry in Australia for 26 years in both base metal flotation and precious metal extraction operations. For the last six years I have been involved in the design, construction and commissioning of process plants throughout Australia. |

| 6. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 7. | I have not personally inspected the Property. |

| 8. | I am responsible for the preparation of sections 1.7, 1.8, 13, 17, 21.1.1 and 21.2.1 of the Technical Report. |

| 9. | I am independent of Extorre Gold Mines Limited as described in section 1.5 of NI 43-101. |

| 10. | I have had prior involvement with the Property, namely, I am a “qualified person” responsible for the preparation of portions of the technical report titled “Cerro Moro Gold-Silver Project, Second Preliminary Economic Assessment, Technical Report NI 43-101”, dated August 2, 2011. |

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that instrument. |

| 12. | At the effective date of the Technical Report, to the best of the my knowledge, information and belief, the sections of the Technical Report for which I am responsible contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

| Dated this 30th day of March, 2012. |

| |

| /s/ Bill Gosling |

| Bill Gosling,BEng(Extractive Metallurgy), MBA |

| |

| Senior Process Engineer |

| |

| GR Engineering Service |

CERTIFICATE OF QUALIFIED PERSON

I,David (Ted) Coupland, BSc DipGeoSc CFSG ASIA MAusIMM (CP) MMICA, do hereby certify that:

| 13. | I am a Director and Principal Geostatistician of Cube Consulting Pty Ltd. My address is Level 4, 1111 Hay Street, West Perth 6005. |

| 14. | This certificate applies to the technical report titled “Preliminary Economic Assessment for the Cerro Moro Gold-Silver Project, Santa Cruz Province, Argentina”” dated effective March 30, 2012 (the “Technical Report”) with respect to the Cerro Moro gold-silver project in Santa Cruz Province, Argentina (the “Property”). |

| 15. | I graduated with a Bachelor of Science Degree (Geology) from the University of New England, Australia in 1987. In addition, I have obtained a Post Graduate Diploma in Mineral Economics from Macquarie University, Australia in 1995 and a Post Graduate Diploma in Applied Finance and Investment from the Securities Institute of Australia in 1997. I have completed a Post Graduate Specialisation in Geostatistics (CFSG) from the Paris School of Mines, Fontainebleau, France in 2007. |

| 16. | I am a current Member of the Australian Institute of Mining and Metallurgy (AusIMM No. 109925). I am a holder of AusIMM Chartered Professional (CP) accreditation in the discipline of Geology. I am also a member of the Mineral Industry Consultants Association (MICA). |

| 17. | I have worked as a geologist continuously for 24 years since my graduation from University. I specialize in mineral resource estimation and mine geology. |

| 18. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 19. | I most recently personally inspected the Property September 17 - 19, 2011. |

| 20. | I am responsible for the preparation of sections 1.3, 1.4, 1.5, 4, 6, 7, 8, 9, 10, 11, 12, 14, 15, 19, 23, 24, 25.1 and 26.1 of the Technical Report. |

| 21. | I am independent of Extorre Gold Mines Limited as described in section 1.5 of NI 43-101. |

| 22. | I have had prior involvement with the Property, namely, I am a “qualified person” responsible for the preparation of all or portions of four previous technical reports: |

“Independent Technical Report (NI 43 101) Update Report on the Cerro Moro Project, Santa Cruz Province, Argentina”, dated December 31, 2009;

“Independent Technical Report (NI 43 101), Resource Estimation for the Cerro Moro Project, Santa Cruz Province, Argentina”, dated May 31, 2010;

“Cerro Moro Project - Preliminary Economic Assessment Technical Report NI 43 101”, dated December 2, 2010;

“Cerro Moro Gold-Silver Project, Second Preliminary Economic Assessment, Technical Report NI 43-101”, dated August 2, 2011; and

“Independent Technical Report (NI 43-101), Resource Estimation for the Cerro Moro Project, Santa Cruz Province, Argentina, December 16th 2011”, dated December 16, 2011.

| 23. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that instrument. |

| 24. | At the effective date of the Technical Report, to the best of the my knowledge, information and belief, the sections of the Technical Report for which I am responsible contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 30th day of March, 2012.

| /s/ David (Ted) Coupland | |

| David (Ted) Coupland | |

CERTIFICATE OF QUALIFIED PERSON

I,Anthony M. Sanford, BSc. (Hons.), MBA (Mineral Resources Management), Pr.Sci.Nat., do hereby certify that:

| 1. | I am employed as the Environmental Services Manager with Ausenco Vector in Lima, Peru. My address is Calle Esquilache 371, Piso 6, San Isidro, Lima, Peru. |

| 2. | This certificate applies to the technical report titled “Preliminary Economic Assessment for the Cerro Moro Gold-Silver Project, Santa Cruz Province, Argentina” dated effective March 30, 2012 (the “Technical Report”) with respect to the Cerro Moro Gold-Silver Project in Santa Cruz Province, Argentina (the “Property”). |

| 3. | I graduated from the University of Dundee, Scotland, Centre for Energy, Petroleum and Mineral Law and Policy (MBA, Mineral Resources Management) in 1998, the University of Natal, Durban, South Africa (B.Sc (Hons.)., Geology) in 1985 and B.Sc. (Geology & Applied Geology) in 1984. |

| 4. | I am a professional natural scientist registered with the South African Council for Natural Scientific Professions (#400089/93). |

| 5. | I am a Registered Member of the Geological Society of South Africa (GSSA; Member # 37218). |

| 6. | I have practiced my profession for nearly 28 years since completing my honours degree in 1984 in the fields of geology, and environmental and social science related to the exploration, construction, operation, and closure phases of mine development. I have been directly involved in environmental and social issues related to both open pit and underground mining including heap leaching and mine waste/tailings disposal, and on the development of regulatory permits including ESIAs and mine closure plans, the last 12 years of which have been in South America. |

| 7. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 8. | I most recently personally inspected the Property on March 7 and 8, 2012. |

| 9. | I am responsible for the preparation of sections 1.13. Sewerage content of section 1.11.4, section 5 and section 20 of the Technical Report. |

| 10. | I am independent of Extorre Gold Mines Limited as described in section 1.5 of NI 43-101. |

| 11. | I have had prior involvement with the Property. |

| 12. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that instrument. |

| 13. | At the effective date of the Technical Report, to the best of the my knowledge, information and belief, the sections of the Technical Report for which I am responsible contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 30th day of March, 2012.

| /s/ Anthony M. Sanford | |

| Anthony M. Sanford | |

CERTIFICATE OF QUALIFIED PERSON

I,Krishna P. Sinha, Ph.D., P.E, S.E.,do hereby certify that:

| 1. | I am employed as the Corporate Technical Director with Ausenco Vector. My address is 851 Northcrest Drive, Salt Lake City, UT 84103, USA. |

| 2. | This certificate applies to the technical report titled “Preliminary Economic Assessment for the Cerro Moro Gold-Silver Project, Santa Cruz Province, Argentina” dated effective March 30, 2012 (the “Technical Report”) with respect to the Cerro Moro Gold-Silver Project in Santa Cruz Province, Argentina (the “Property”). |

| 3. | I graduated from the University of Minnesota, Department of Civil & Mineral Engineering (Ph.D. Geological Engineering) in 1979, the University of Roorkee, India (M.E., Civil Engineering – Soil Mechanics & Foundation Eng.) in 1967, and Bihar Institute of Technology, Sindri, India, (B.Sc. Engineering, Civil) in 1964. |

| 4. | I am a professional engineer registered in the State of Utah (#272545). |

| 5. | I am a Registered Member of the Society for Mining, Metallurgy, and Exploration (SME; Member # 4038056RM) |

| 6. | I have practiced my profession for nearly 40 years since obtaining my undergraduate degree in 1964 in the fields of geotechnical engineering and energy resources related to drilling, exploration, production, stimulation and development. In the mining and other energy sector, I have been directly involved in and have worked on issues related to both open pit and underground mining including heap leaching and mine waste/tailings disposal. |

| 7. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 8. | I most recently personally inspected the Property on February 22nd and 23rd, 2012. |

| 9. | I am responsible for the preparation of sections 1.11.8 and 18.4 of the Technical Report. |

| 10. | I am independent of Extorre Gold Mines Limited as described in section 1.5 of NI 43-101. |

| 11. | I have had prior involvement with the Property. |

| 12. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that instrument. |

| 13. | At the effective date of the Technical Report, to the best of the my knowledge, information and belief, the sections of the Technical Report for which I am responsible contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

| Dated this 30th day of March, 2012. |  |

| /s/ Krishna P. Sinha |

| Krishna P. Sinha |

CERTIFICATE OF QUALIFIED PERSON

I,Michael Gabora, do hereby certify that:

| 14. | I am employed as a Senior Hydrogeologist with Ausenco Vector. My address is 5613 DTC Parkway, Suite 300, Greenwood Village, Colorado 80111, USA. |

| 15. | This certificate applies to the technical report titled “Preliminary Economic Assessment for the Cerro Moro Gold-Silver Project, Santa Cruz Province, Argentina” dated effective March 30, 2012 (the “Technical Report”) with respect to the Cerro Moro gold-silver project in Santa Cruz Province, Argentina (the “Property”). |

| 16. | I graduated with a degree in Bachelor of Science in Earth and Planetary Sciences from the University of New Mexico in 1998. In addition, I have obtained a Master of Water Resources from the University of New Mexico in 2003. |

| 17. | I am a professional geologist registered in Ontario, Canada #0969. My relevant experience includes having worked as a hydrogeologist in mining hydrology, dewatering, and groundwater flow modeling. |

| 18. | I have worked as a hydrogeologist for a total of 11 years since my graduation with a BSc from university. |

| 19. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 20. | I most recently personally inspected the Property on January 10 and January 11, 2012. |

| 21. | I am responsible for the preparation of sections 16.3 and 18.1.8 of the Technical Report. |

| 22. | I am independent of Extorre Gold Mines Limited as described in section 1.5 of NI 43-101. |

| 23. | I have not had prior involvement with the Property. |

| 24. | I have read NI 43-101 and the section of the Technical Report for which I am responsible has been prepared in compliance with that instrument. |

| 25. | At the effective date of the Technical Report, to the best of the my knowledge, information and belief, the section of the Technical Report for which I am responsible contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 30th day of March, 2012.

| /s/ Michael Gabora | |

| Michael Gabora | |

TABLE OF CONTENTS

| 1. | SUMMARY | 29 |

| 2. | INTRODUCTION | 56 |

| 3. | RELIANCE ON OTHER EXPERTS | 58 |

| 4. | PROPERTY DESCRIPTION AND LOCATION | 59 |

| 5. | ACCESS, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 66 |

| 6. | HISTORY | 68 |

| 7. | GEOLOGICAL SETTING AND MINERALIZATION | 71 |

| 8. | DEPOSIT TYPES | 90 |

| 9. | EXPLORATION | 92 |

| 10. | DRILLING | 100 |

| 11. | SAMPLE PREPARATION, ANALYSIS AND SECURITY | 117 |

| 12. | DATA VERIFICATION | 125 |

| 13. | MINERAL PROCESSING AND METALLURGICAL TESTING | 135 |

| 14. | MINERAL RESOURCE ESTIMATES | 161 |

| 15. | MINERAL RESERVE ESTIMATES | 194 |

| 16. | MINING METHODS | 195 |

| 17. | RECOVERY METHODS | 232 |

| 18. | PROJECT INFRASTRUCTURE | 244 |

| 19. | MARKET STUDIES AND CONTRACTS | 259 |

| 20. | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 262 |

| 21. | CAPITAL AND OPERATING COSTS | 276 |

| 22. | ECONOMIC ANALYSIS | 304 |

| 23. | ADJACENT PROPERTIES | 317 |

| 24. | OTHER RELEVANT DATA AND INFORMATION | 322 |

| 25. | INTERPRETATION AND CONCLUSIONS | 329 |

| 26. | RECOMMENDATIONS | 333 |

| 27. | REFERENCES | 336 |

TABLE OF CONTENTS

| 1. | SUMMARY | 29 |

| 1.1 | Introduction | 29 |

| 1.2 | Property and Location | 29 |

| 1.3 | Geology and Mineralization | 31 |

| 1.4 | Exploration | 32 |

| 1.5 | Mineral Resource Estimation | 32 |

| 1.6 | Preliminary Mining Studies | 34 |

| 1.7 | Metallurgical Testwork Summary | 37 |

| 1.8 | Mineral Processing and Recovery Methods | 37 |

| 1.9 | Mine Geotechnical | 38 |

| 1.10 | Plant Site Geotechnical | 38 |

| 1.11 | Site Infrastructure | 39 |

| 1.11.1 | Power Supply | 39 |

| 1.11.2 | Site Access Roads | 40 |

| 1.11.3 | Communications Link | 40 |

| 1.11.4 | Water Supply and Sewerage Treatment | 40 |

| 1.11.5 | Mine Infrastructure | 41 |

| 1.11.6 | Cerro Moro Administration | 41 |

| 1.11.7 | Accommodation Camps | 41 |

| 1.11.8 | Tailings Storage Facility | 42 |

| 1.12 | Project Implementation | 42 |

| 1.13 | Environmental Permits | 42 |

| 1.14 | Capital and Operating Cost Estimates | 44 |

| 1.15 | Economic Analysis | 50 |

| 1.16 | Conclusions | 52 |

| 1.16.1 | Mineral Resource | 52 |

| 1.16.2 | Risks and Uncertainties | 52 |

| 1.16.3 | Mining Studies | 52 |

| 1.16.4 | Metallurgical Processing | 53 |

| 1.16.5 | Preliminary Economic Assessment Results | 54 |

| 1.17 | Recommendations | 54 |

| 2. | Introduction and terms of reference | 56 |

| 2.1 | Introduction | 56 |

| 2.2 | Qualified Persons | 56 |

| 2.3 | Frequently Used Acronyms, Abbreviations, Definitions, and Units of Measure | 57 |

| 3. | RELIANCE ON OTHER EXPERTS | 58 |

| 3.1 | Qualified Persons | 58 |

| 3.2 | Other Independent Expert Persons | 58 |

| 4. | PROPERTY DESCRIPTION AND LOCATION | 59 |

| 4.1 | Location | 59 |

| 4.2 | Land Area | 60 |

| 4.3 | Company Ownership and Agreements | 60 |

| 4.4 | Title Agreements and Ownership | 61 |

| 4.4.1 | Estelar - CVSA Option Agreement | 62 |

| 4.4.2 | Estelar - Fomicruz Agreement | 63 |

| 4.4.3 | History of Cerro Moro Acquisition | 64 |

| 4.5 | Environmental Liabilities and Permitting | 65 |

| 5. | Access, Climate, Local Resources, Infrastructure and Physiography | 66 |

| 5.1 | Access | 66 |

| 5.2 | Climate | 66 |

| 5.3 | Local Resources and Infrastructure | 66 |

| 5.4 | Physiography | 66 |

| 6. | History | 68 |

| 6.1 | Cerro Moro History | 68 |

| 6.2 | Recent Exploration at Cerro Morro | 69 |

| 6.3 | Mining History | 70 |

| 7. | Geology | 71 |

| 7.1 | Regional Geology | 71 |

| 7.2 | Local Geology | 73 |

| 7.3 | Deposit Geology and Mineralization | 79 |

| 7.3.1 | Escondida | 80 |

| 7.3.2 | Gabriela | 81 |

| 7.3.3 | Esperanza | 81 |

| 7.3.4 | Loma Escondida | 82 |

| 7.3.5 | Silvia | 82 |

| 7.3.6 | Nini | 82 |

| 7.3.7 | Moro | 83 |

| 7.3.8 | Patricia | 83 |

| 7.3.9 | Deborah | 83 |

| 7.3.10 | Michelle | 83 |

| 7.3.11 | Carla | 84 |

| 7.3.12 | Natalia | 84 |

| 7.3.13 | Mosquito | 84 |

| 7.3.14 | Susy | 84 |

| 7.3.15 | Cassius | 84 |

| 7.3.16 | Carolene | 85 |

| 7.3.17 | Florencia | 85 |

| 7.3.18 | Virginia | 85 |

| 7.3.19 | Laura | 85 |

| 7.3.20 | Dora | 85 |

| 7.3.21 | Tres Lomas | 86 |

| 7.3.22 | Maria | 86 |

| 7.3.23 | Carlita | 86 |

| 7.3.24 | Lala | 86 |

| 7.3.25 | FMD | 86 |

| 7.3.26 | Romina | 87 |

| 7.3.27 | Ornella | 87 |

| 7.3.28 | Deborah Termination Structure | 87 |

| 7.3.29 | Lourdes | 87 |

| 7.3.30 | Lucia | 87 |

| 7.3.31 | Gabriela South-East Extension | 88 |

| 7.3.32 | Conceptual Targets | 88 |

| 7.3.33 | Agostina | 88 |

| 7.3.34 | Belen | 88 |

| 7.3.35 | Deborah Parallel | 89 |

| 8. | DEPOSIT TYPES | 90 |

| 9. | EXPLORATION | 92 |

| 9.1 | Introduction | 92 |

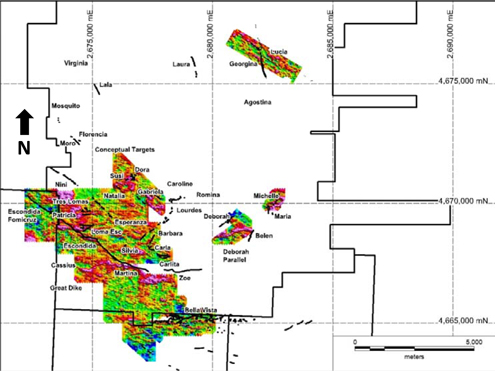

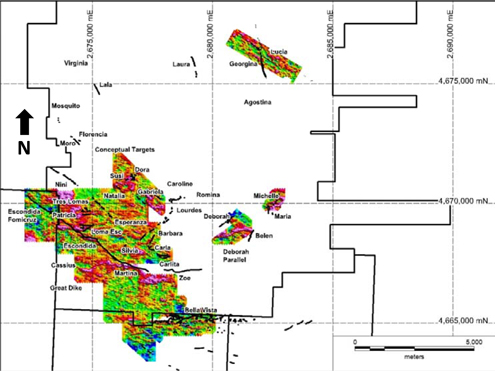

| 9.2 | Geophysics | 95 |

| 9.2.1 | Ground Magnetic Surveys | 95 |

| 9.2.2 | Gradient Array IP Surveys | 97 |

| 9.2.3 | CSAMT Surveys | 98 |

| 9.2.4 | Representivity of Exploration Programs | 98 |

| 10. | Drilling | 100 |

| 10.1 | Interpretation of Drilling Results | 103 |

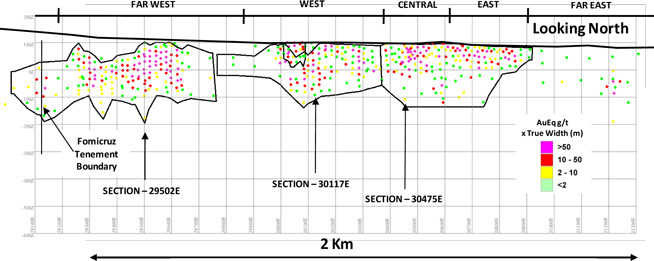

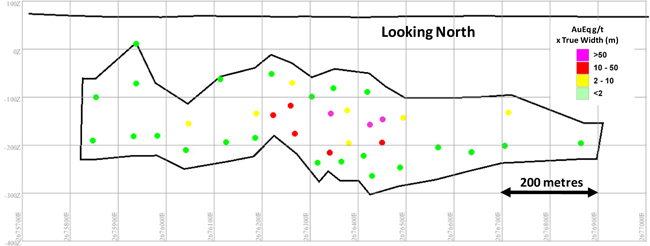

| 10.1.1 | Escondida | 103 |

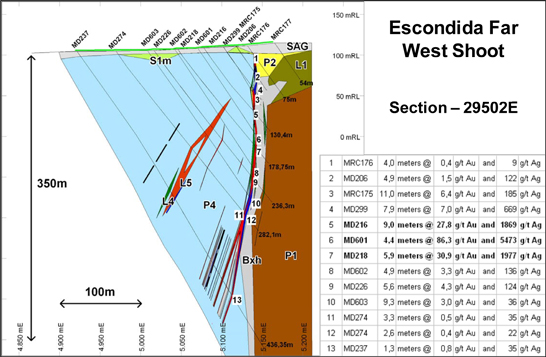

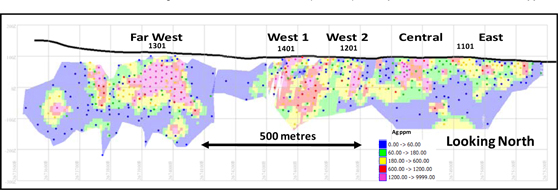

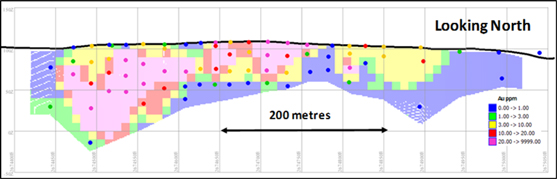

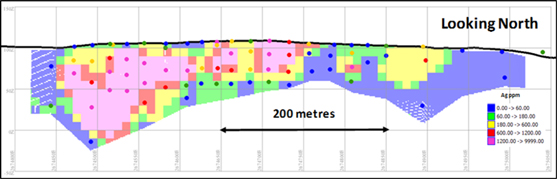

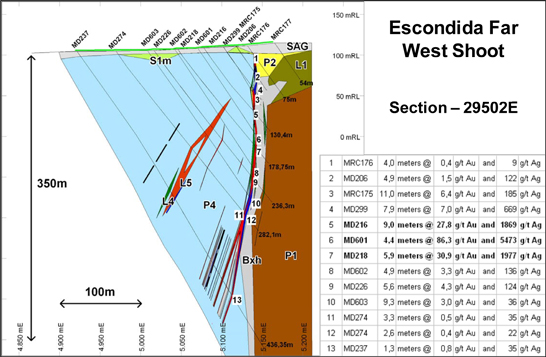

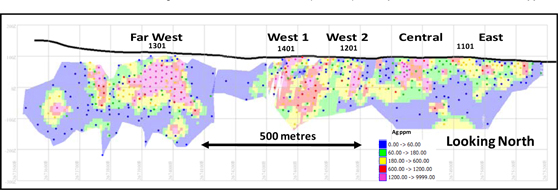

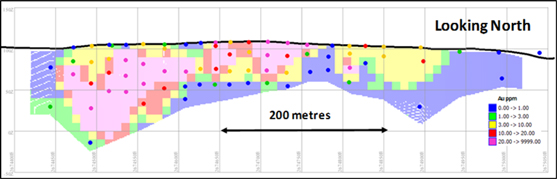

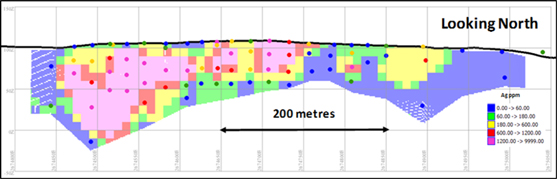

| 10.1.1.1 | Escondida Far West | 104 |

| 10.1.1.2 | Escondida West, Central and East | 104 |

| 10.1.1.3 | Escondida Far East | 104 |

| 10.1.1.4 | Martina | 105 |

| 10.1.1.5 | Zoe | 105 |

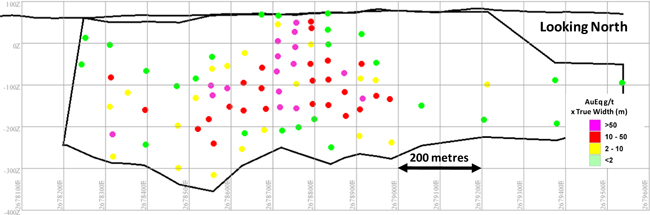

| 10.1.2 | Gabriela | 105 |

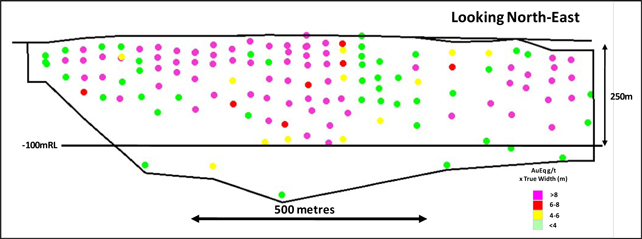

| 10.1.3 | Loma Escondida | 112 |

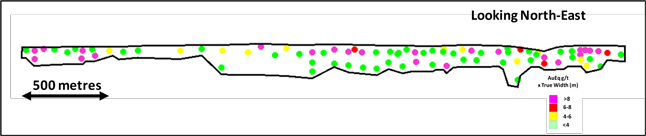

| 10.1.4 | Nini-Esperanza | 112 |

| 10.1.5 | Carla | 112 |

| 11. | SAMPLE PREPARATION, ANALYSES AND SECURITY | 117 |

| 11.1 | Previous Sampling | 117 |

| 11.2 | Sample Procedures and Protocols | 117 |

| 11.2.1 | Surface Sampling | 117 |

| 11.2.2 | Diamond Drilling | 117 |

| 11.2.3 | RC Percussion Drilling | 118 |

| 11.3 | Density Determination | 119 |

| 11.4 | Sample Preparation and Analysis | 119 |

| 11.4.1 | ACME On-site Sample Preparation Facility | 120 |

| 11.4.2 | ACME Procedures | 120 |

| 11.4.3 | ALS Chemex Procedures | 121 |

| 11.4.4 | Representivity of Metallurgical Sampling | 122 |

| 11.5 | Quality Control | 123 |

| 11.6 | Security | 124 |

| 11.7 | Authors Statement | 124 |

| 12. | Data Verification | 125 |

| 12.1 | QAQC Mincorp | 125 |

| 12.2 | QAQC Exeter / Extorre | 125 |

| 12.2.1 | Geochemical Standards | 125 |

| 12.2.2 | RC Percussion Duplicate Samples | 127 |

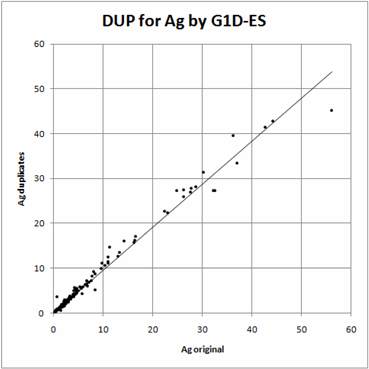

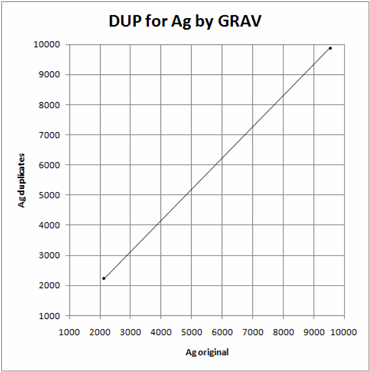

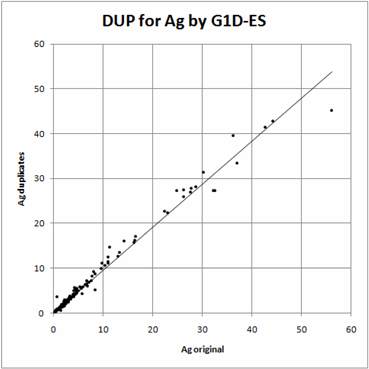

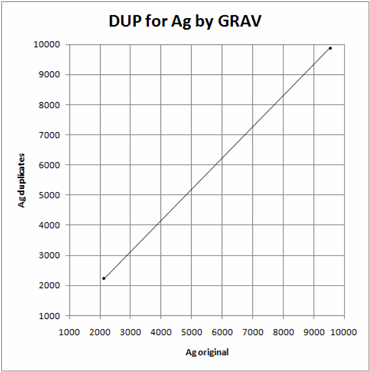

| 12.2.3 | Diamond Drilling Duplicate Samples | 127 |

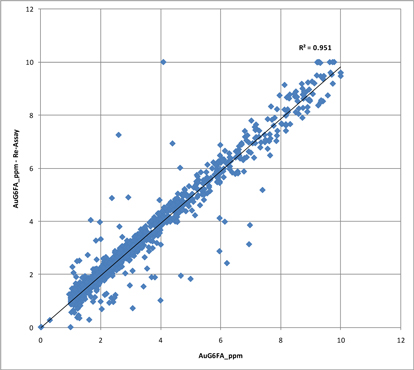

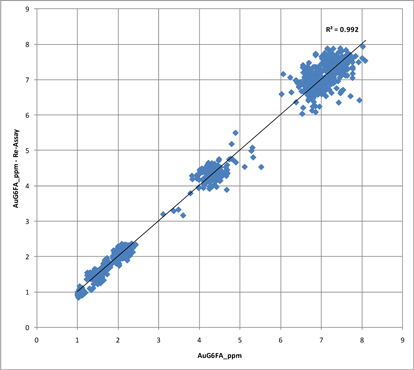

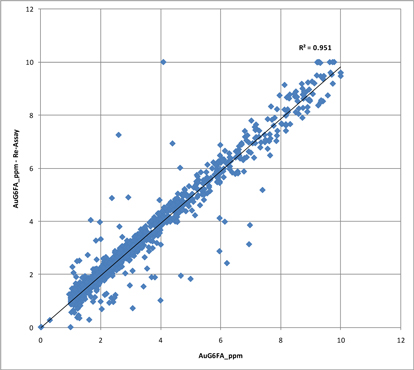

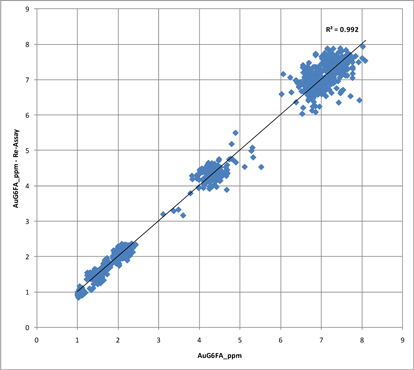

| 12.2.4 | Check Assaying of Samples Greater than 1ppm Au | 129 |

| 12.2.5 | Blanks | 131 |

| 12.2.6 | Twinned Holes | 131 |

| 12.2.7 | Database | 131 |

| 12.3 | Data Verification by Cube | 131 |

| 12.3.1 | Drill Hole Collar Location | 131 |

| 12.3.2 | Database Validation | 132 |

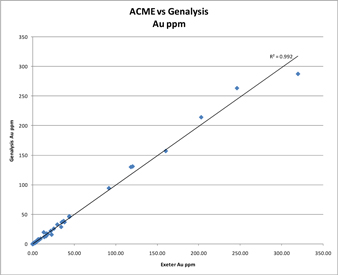

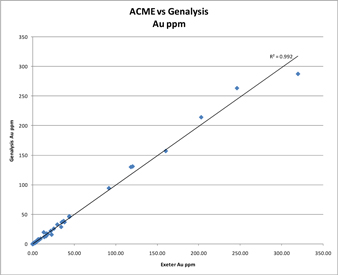

| 12.3.3 | Independent Laboratory Checks | 132 |

| 12.3.4 | Independent Sampling | 134 |

| 12.4 | Author’s Statement | 134 |

| 13. | Mineral Processing and Metallurgical Testing | 135 |

| 13.1 | Introduction | 135 |

| 13.2 | Representivity of Metallurgical Sampling | 136 |

| 13.3 | Testwork Samples | 136 |

| 13.4 | Testwork Water | 137 |

| 13.5 | Testwork Analyses | 137 |

| 13.6 | Mineralization | 137 |

| 13.7 | Comminution | 146 |

| 13.8 | Gravity Concentration | 146 |

| 13.9 | Flotation | 147 |

| 13.10 | Flotation and Gravity Concentrate Treatment | 148 |

| 13.11 | Leaching | 149 |

| 13.12 | Merrill Crowe | 155 |

| 13.13 | Thickening and Filtration | 156 |

| 13.14 | Cyanide Destruction | 160 |

| 13.15 | Metallurgical Recoveries | 160 |

| 14. | Mineral Resource Estimate | 161 |

| 14.1 | Summary | 161 |

| 14.2 | Coordinate Systems | 164 |

| 14.3 | Drilling Database | 164 |

| 14.4 | Resource Estimation | 165 |

| 14.4.1 | Data Types | 165 |

| 14.4.1.1 | Escondida | 165 |

| 14.4.1.2 | Loma Escondida | 165 |

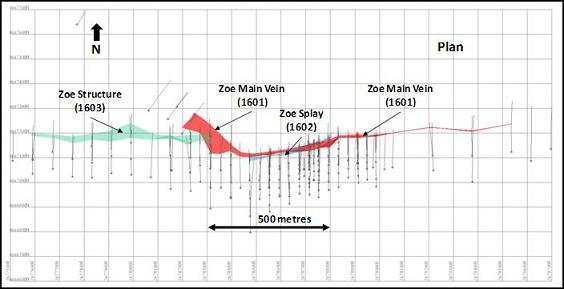

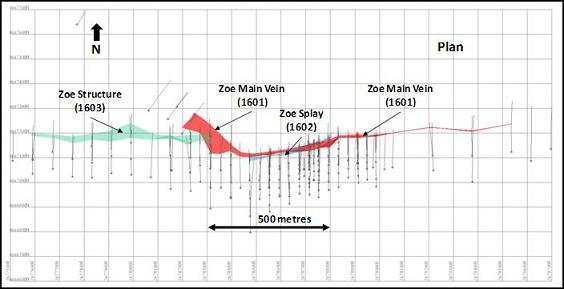

| 14.4.1.3 | Zoe | 166 |

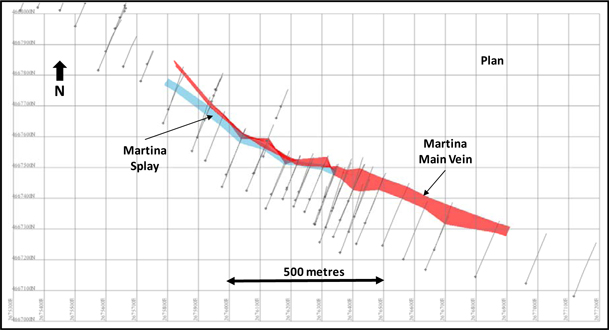

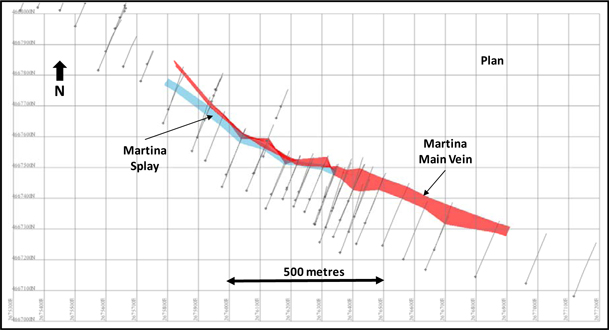

| 14.4.1.4 | Martina | 166 |

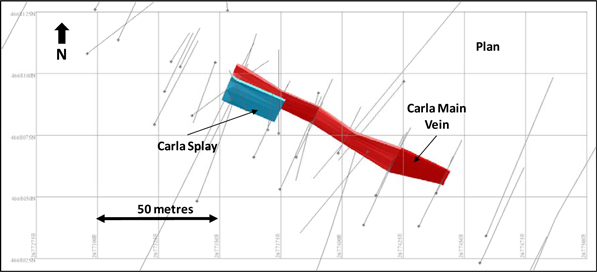

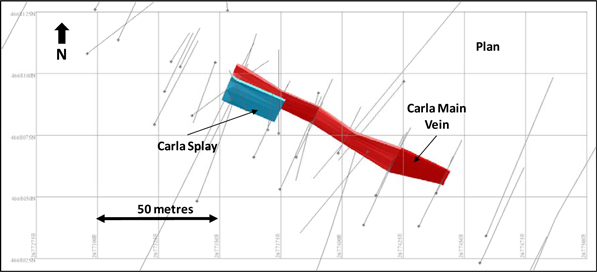

| 14.4.1.5 | Carla | 166 |

| 14.4.1.6 | Gabriela | 166 |

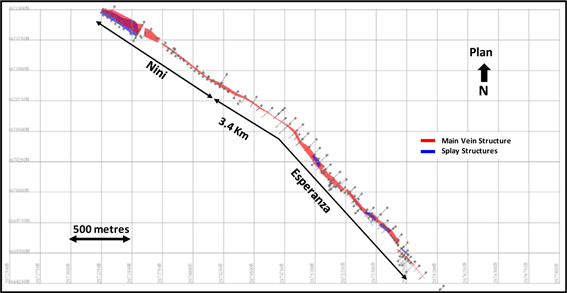

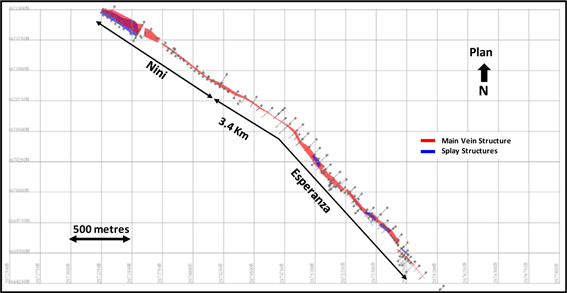

| 14.4.1.7 | Nini-Esperanza} | 166 |

| 14.4.1.8 | Deborah | 166 |

| 14.4.2 | Domaining and Volume Modelling | 166 |

| 14.4.2.1 | Escondida and Loma Escondida | 171 |

| 14.4.2.2 | Zoe | 172 |

| 14.4.2.3 | Martina | 172 |

| 14.4.2.4 | Carla | 173 |

| 14.4.2.5 | Gabriela | 174 |

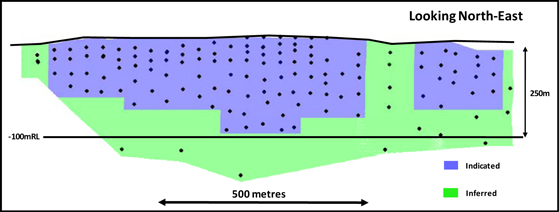

| 14.4.2.6 | Nini-Esperanza | 174 |

| 14.4.2.7 | Deborah | 175 |

| 14.4.3 | Database Coding and Compositing | 175 |

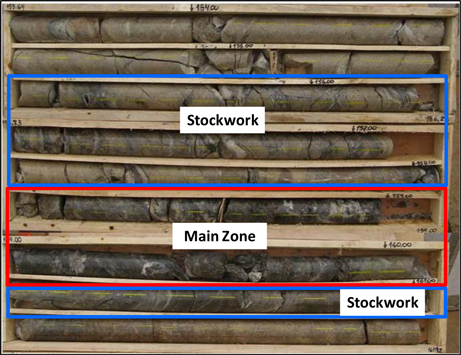

| 14.4.3.1 | Main Zone (MZ+HGZ) | 175 |

| 14.4.3.2 | Stockwork | 175 |

| 14.4.4 | Descriptive Statistics and High Grade Capping | 176 |

| 14.4.5 | Variography | 178 |

| 14.4.5.1 | Main Zone (MZ+HGZ) | 178 |

| 14.4.5.2 | Stockwork | 179 |

| 14.4.6 | Grade Estimation | 179 |

| 14.4.6.1 | Main Zone (MZ+HGZ) | 179 |

| 14.4.6.2 | Stockwork | 179 |

| 14.4.7 | 3D Block Model Definition | 180 |

| 14.4.8 | Bulk Density | 182 |

| 14.4.9 | Oxidation | 183 |

| 14.4.10 | Model Validation | 183 |

| 14.4.11 | Final Model | 188 |

| 14.5 | Resource Classification | 188 |

| 14.5.1 | Escondida | 188 |

| 14.5.2 | Loma Escondida | 189 |

| 14.5.3 | Zoe | 189 |

| 14.5.4 | Martina | 190 |

| 14.5.5 | Carla | 190 |

| 14.5.6 | Gabriela | 190 |

| 14.5.7 | Nini-Esperanza | 191 |

| 14.5.8 | Deborah | 191 |

| 14.6 | Cerro Moro Resource Reporting | 191 |

| 14.7 | Other Factors and Mineral Resources | 193 |

| 15. | Mineral RESERVES Estimate | 194 |

| 16. | Mining Methods | 195 |

| 16.1 | Preliminary Mining Study | 195 |

| 16.1.1 | Summary | 195 |

| 16.1.2 | Open Pit Mining | 198 |

| 16.1.3 | Underground Mining | 202 |

| 16.1.4 | Dilution | 205 |

| 16.1.5 | Cut-Off Grade | 207 |

| 16.1.6 | Underground Mining Inventory | 207 |

| 16.1.7 | Mine Production Schedule | 211 |

| 16.1.7.1 | Mine Schedule at 1,300 tpd (Option A) | 212 |

| 16.1.7.2 | Mine Schedule at 1,150 tpd (Option B) | 215 |

| 16.1.8 | Mobile Mining Fleet | 219 |

| 16.1.9 | Mine Labour | 223 |

| 16.2 | Geotechnical Studies | 224 |

| 16.3 | Hydrology and Hydrogeology | 229 |

| 17. | RECOVERY Methods | 232 |

| 17.1 | Introduction | 232 |

| 17.2 | Crushing Circuit | 232 |

| 17.3 | Crushed Product Storage and Reclaim | 234 |

| 17.4 | Grinding | 234 |

| 17.5 | Flash Flotation and Gravity Concentration | 234 |

| 17.6 | Flotation | 235 |

| 17.7 | Gravity and Flotation Concentrate Handling | 235 |

| 17.8 | Intensive Leaching | 236 |

| 17.9 | Leaching and CCD | 236 |

| 17.10 | Merrill Crowe | 237 |

| 17.11 | Reagents | 237 |

| 17.12 | Cyanide Destruction | 238 |

| 17.13 | Water Services | 239 |

| 17.14 | Air Services | 240 |

| 17.15 | Electrical | 240 |

| 17.16 | Projected Energy, Water, Process Material Requirements | 243 |

| 18. | PROJECT INFRASTURUCTURE | 244 |

| 18.1 | Cerro Moro Site | 244 |

| 18.1.1 | Water Supply | 244 |

| 18.1.2 | Process Plant Earthworks | 244 |

| 18.1.3 | Run of mine (ROM) Area | 245 |

| 18.1.4 | Roads | 245 |

| 18.1.5 | Site Accommodation | 245 |

| 18.1.6 | Power Supply | 245 |

| 18.1.7 | Fuel Storage | 246 |

| 18.1.8 | Potable Water Supply | 247 |

| 18.1.9 | Sewerage Treatment | 247 |

| 18.1.10 | Vehicle Washdown | 247 |

| 18.1.11 | Heavy Vehicle Workshop | 247 |

| 18.1.12 | Administration Office Complex | 247 |

| 18.1.13 | Stores and Plant Maintenance Workshop | 248 |

| 18.1.14 | Communications | 248 |

| 18.2 | Puerto Deseado Facilities | 248 |

| 18.2.1 | Office Facilities | 248 |

| 18.2.2 | Laboratory | 248 |

| 18.3 | Mining Facilities | 249 |

| 18.3.1 | Magazine | 249 |

| 18.3.2 | Workshop | 249 |

| 18.3.3 | Underground Ventilation | 249 |

| 18.3.4 | Refuge and Escape Shaft | 249 |

| 18.4 | Tailings Storage Facility | 249 |

| 18.4.1 | Introduction | 249 |

| 18.4.2 | Methodology | 250 |

| 18.4.3 | Design Criteria | 250 |

| 18.4.4 | Scheduled Costs | 252 |

| 18.4.5 | Tailing Storage Facilities | 252 |

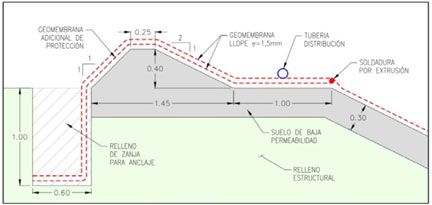

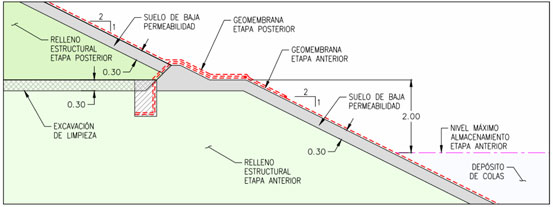

| 18.4.6 | Dams Construction | 253 |

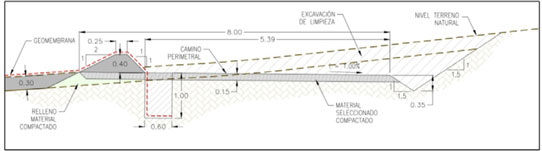

| 18.4.7 | Perimeter Service Roads | 255 |

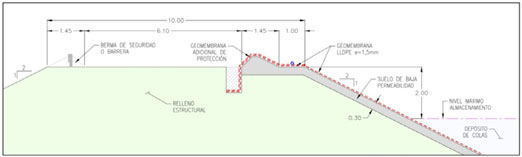

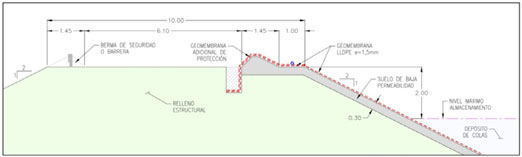

| 18.4.8 | Waterproofing system | 255 |

| 18.4.9 | Surface water diversion system | 255 |

| 18.4.10 | Control and monitoring system | 255 |

| 18.4.11 | Geotechnical Site Investigations | 256 |

| 18.4.12 | 2011 Geotechnical Campaign (Ausenco) | 256 |

| 18.4.13 | Water Table Presence | 257 |

| 18.4.14 | Laboratory Testing | 257 |

| 18.4.15 | Conclusions | 257 |

| 18.4.16 | Recommendations | 258 |

| 19. | Marketing | 259 |

| 19.1 | Introduction | 259 |

| 19.2 | Market Outlook | 259 |

| 19.3 | Gold Demand | 260 |

| 19.4 | Available Refineries | 261 |

| 19.5 | Exchange (LME) | 261 |

| 19.6 | Shipping | 261 |

| 19.7 | Qualified Person's Statement | 261 |

| 20. | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 263 |

| 20.1 | Environmental Studies | 263 |

| 20.1.1 | Main Environmental Findings | 263 |

| 20.2 | Permitting | 270 |

| 20.3 | Environmental Impact | 271 |

| 20.4 | Social and Community Impact | 272 |

| 20.5 | Environmental Management Plan | 273 |

| 20.6 | Community Relations Plan and Social Responsibility | 274 |

| 21. | CAPITAL AND OPERATING COSTs | 276 |

| 21.1 | Capital | 276 |

| 21.1.1 | Process Plant and Infrastructure | 277 |

| 21.1.2 | Process Plant and Infrastructure Sustaining Capital | 283 |

| 21.1.3 | Mining | 283 |

| 21.2 | Operating | 290 |

| 21.2.1 | Process Plant | 290 |

| 21.2.2 | Mining | 298 |

| 21.2.3 | General and Administrative (G&A) Costs | 303 |

| 22. | ECONOMIC ANALYSIS | 304 |

| 22.1 | Taxes and Royalties | 305 |

| 22.2 | Economic Analysis – 1,300 tpd (Option A) | 305 |

| 22.3 | Economic Analysis – 1,150 tpd (Option B) | 306 |

| 22.4 | Sensitivity Analysis | 315 |

| 23. | Adjacent Properties | 317 |

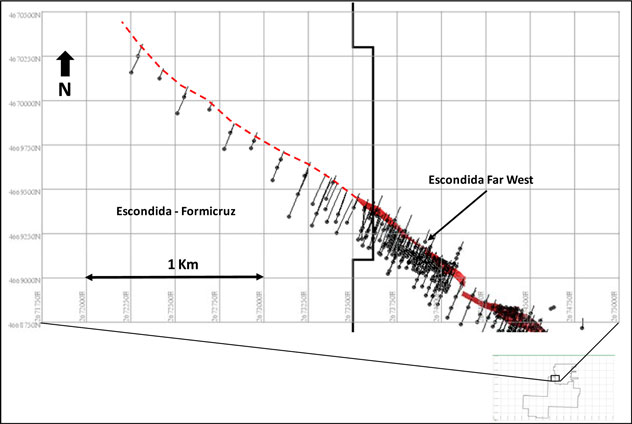

| 23.1 | Escondida-Formicruz Prospect | 319 |

| 23.2 | Bella Vista Prospect | 320 |

| 23.3 | Veta Olvidada Prospect | 321 |

| 23.4 | Union Domes Prospect | 321 |

| 24. | OTHER RELEVANT DATA | 322 |

| 24.1 | Plant Geotechnical | 322 |

| 24.2 | Operations Project Organisation | 322 |

| 24.3 | Project Implementation | 323 |

| 24.3.1 | Mine Management Team | 323 |

| 24.3.2 | EPCM Project Management Team | 324 |

| 24.3.3 | Development Objective | 324 |

| 24.3.4 | EPCM Services | 324 |

| 24.3.5 | Equipment and Materials Supplies | 325 |

| 24.3.6 | Construction Packages | 326 |

| 24.3.7 | Project Duration | 326 |

| 24.3.8 | Critical Path | 327 |

| 24.3.9 | Engineering Design | 327 |

| 24.3.10 | Equipment Procurement | 327 |

| 24.3.11 | Site Construction Activity | 328 |

| 25. | INTERPRETATION AND CONCLUSIONS | 329 |

| 25.1 | Mineral Resource | 329 |

| 25.2 | Risks and Uncertainties | 330 |

| 25.3 | Mining Studies | 330 |

| 25.4 | Metallurgical Processing | 331 |

| 25.5 | Preliminary Economic Assessment Results | 331 |

| 26. | Recommendations | 333 |

| 26.1 | Drilling | 333 |

| 26.2 | Mining | 333 |

| 26.3 | Infrastructure | 334 |

| 26.4 | Metallurgical Testwork | 334 |

| 26.5 | Site Geotechnical | 335 |

| 26.6 | Risk Assessment | 335 |

| 26.7 | Proposed Budget | 335 |

| 27. | References | 336 |

LIST OF FIGURES

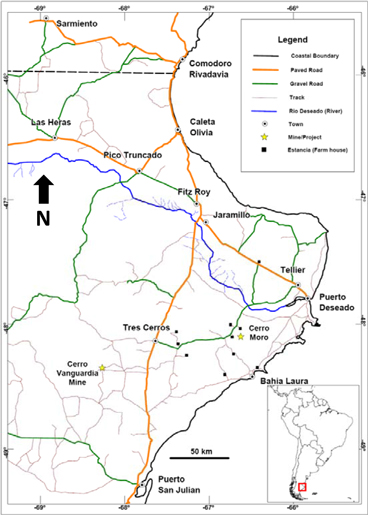

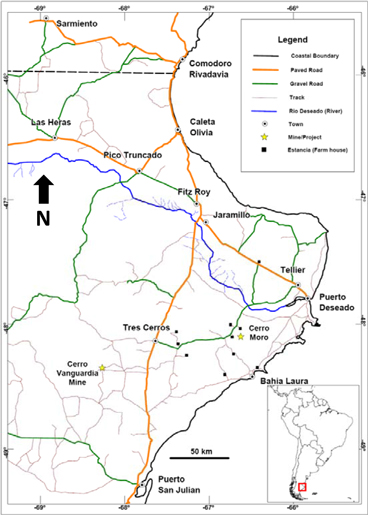

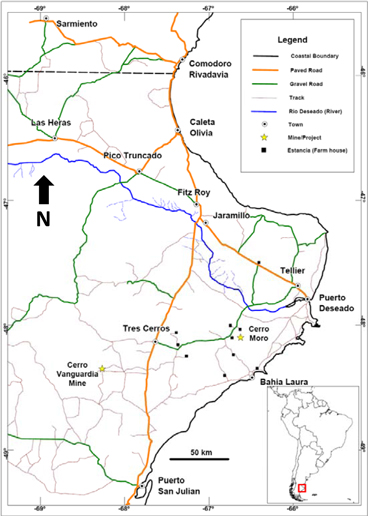

| Figure 1 | Location and Access Map (Source Extorre, 2011) | 30 |

| Figure 2 | Conceptual Mine Development for Cerro Moro (Source: NCL, 2011) | 37 |

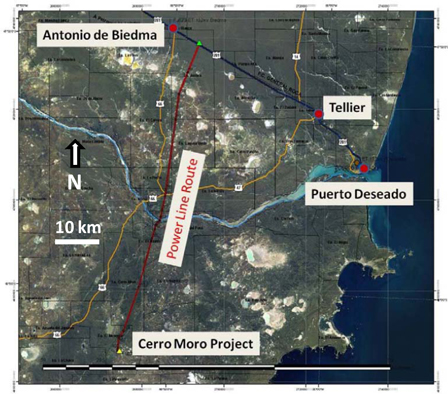

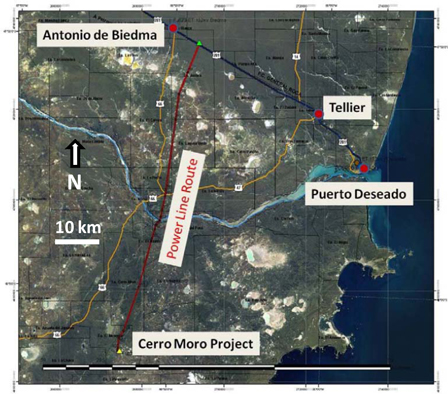

| Figure 3 | Overhead Powerline Route to Cerro Moro (Source: SIEyE, 2012) | 40 |

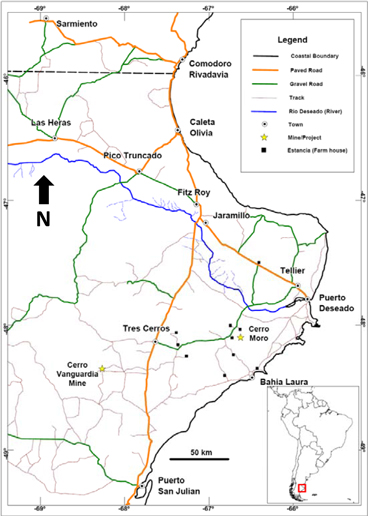

| Figure 4 | Location and Access Map (Source: Extorre, 2011) | 59 |

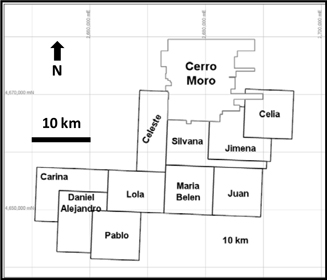

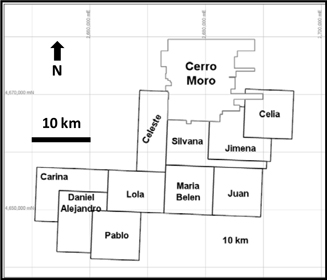

| Figure 5 | Exeter Property Tenement Map (Source: Exeter, 2009a) | 60 |

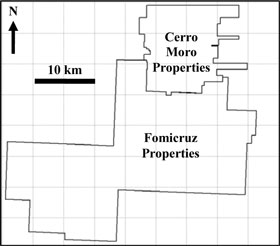

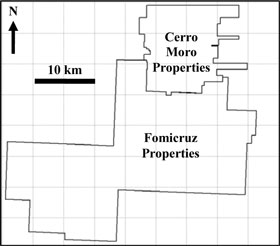

| Figure 6 | Fomicruz Property Tenement Map (Source: Extorre, 2011) | 63 |

| Figure 7 | Regional Geology and Schematic Columnar Section (Source: Extorre, 2011) | 72 |

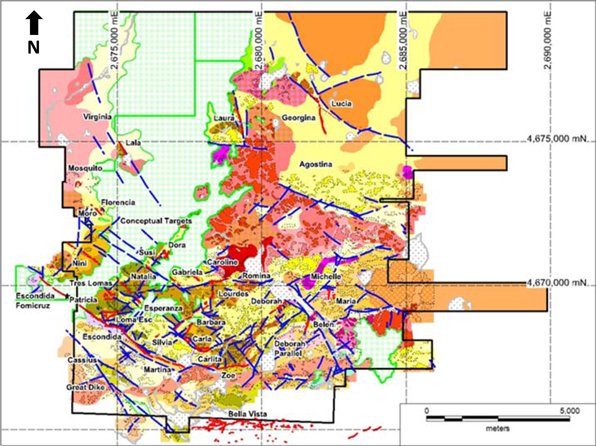

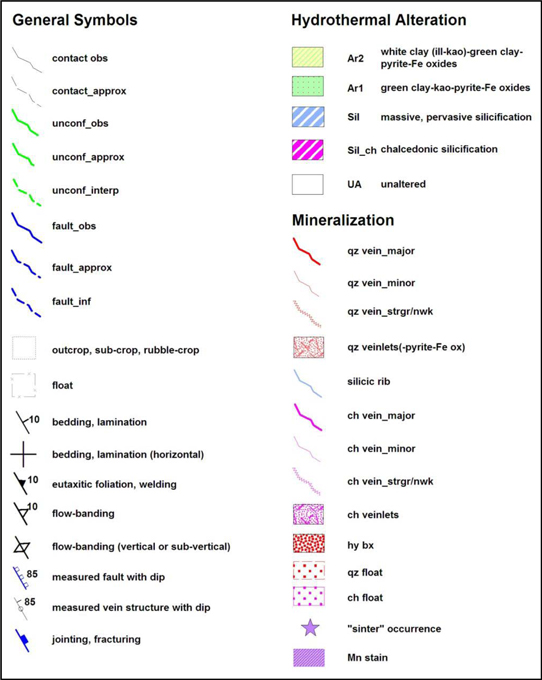

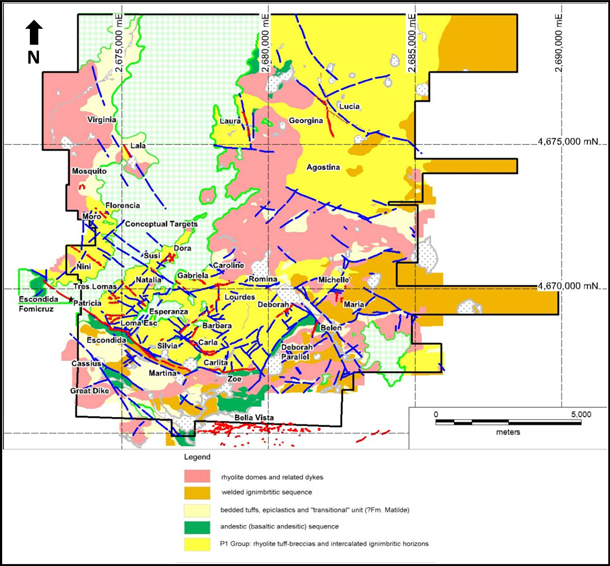

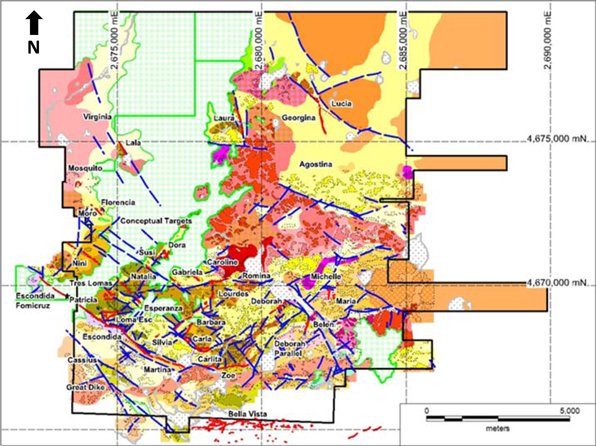

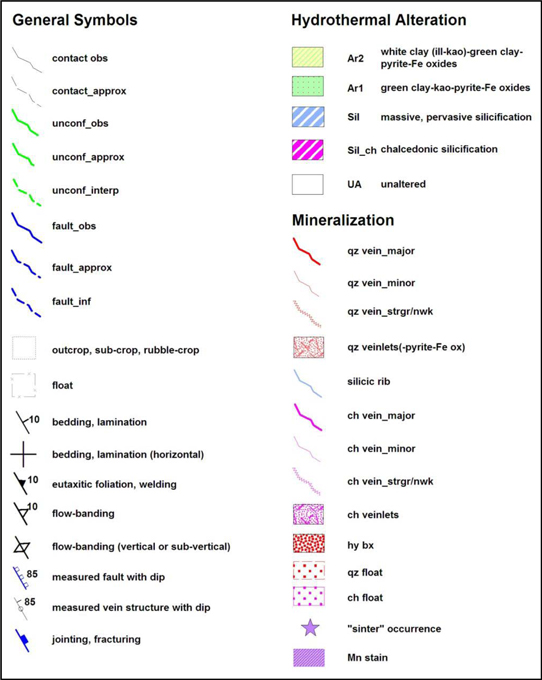

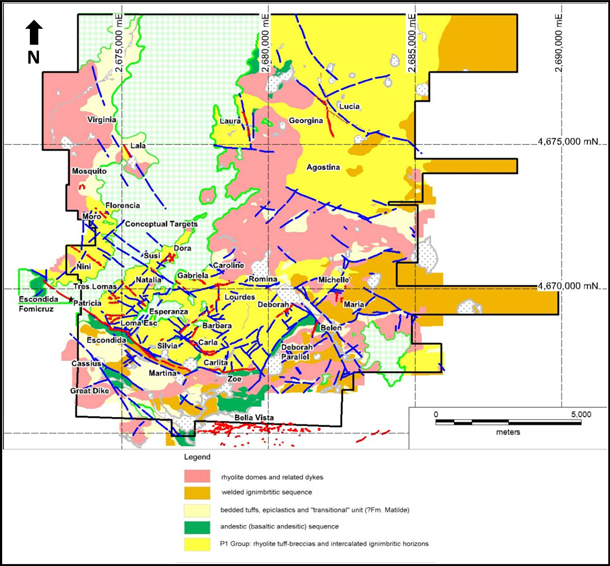

| Figure 8 | Interpreted Geology and Vein Location Map (Source: Extorre, 2011) | 75 |

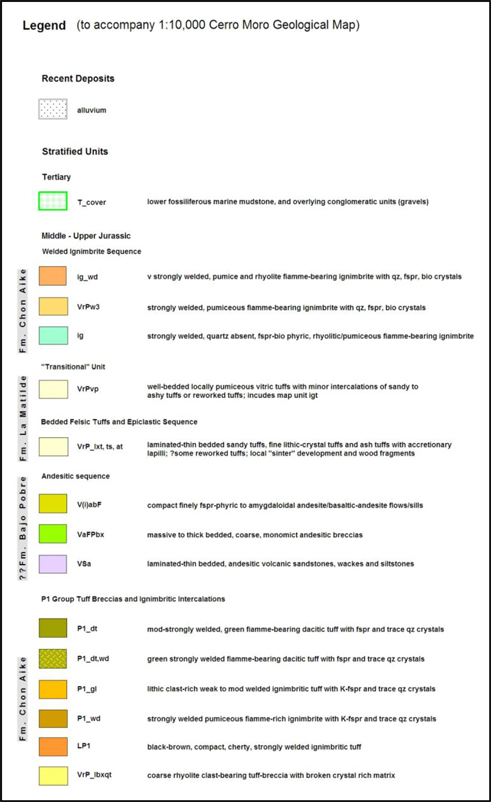

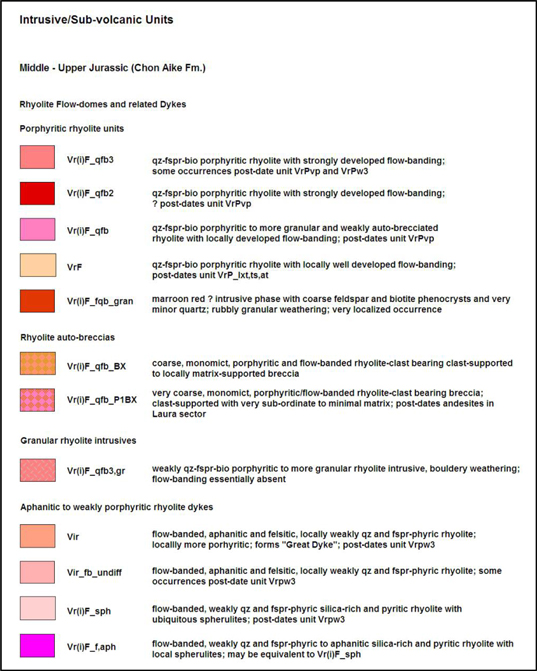

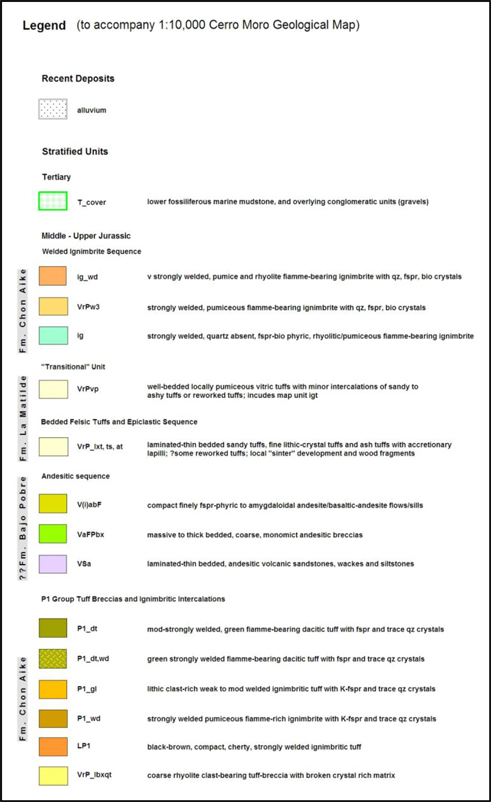

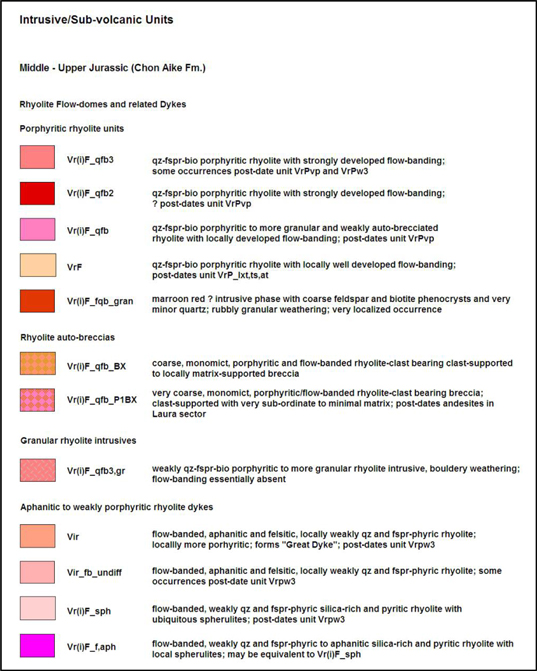

| Figure 9 | Legend for Figure 8 (Part 1 of 3) | 76 |

| Figure 10 | Legend for Figure 8 (Part 2 of 3) | 77 |

| Figure 11 | Legend for Figure 8 (Part 3 of 3) | 78 |

| Figure 12 | Geological Summary Map (Source: Extorre, 2011) | 79 |

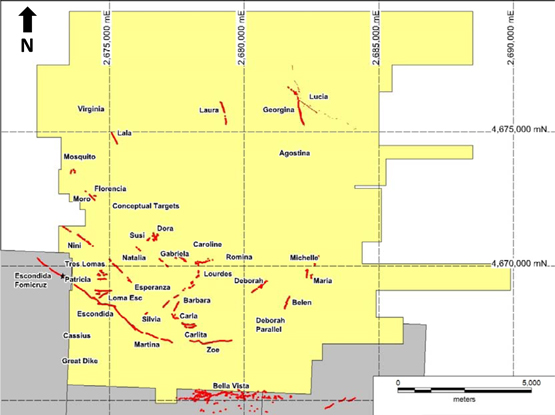

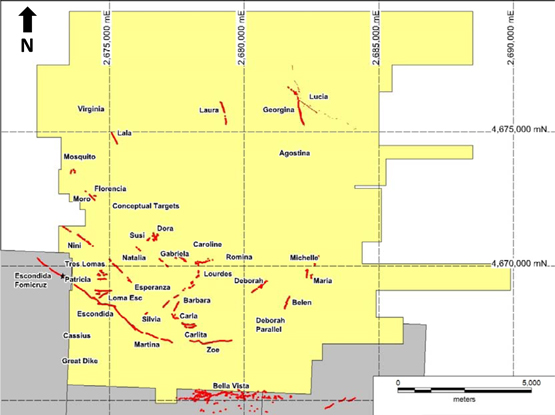

| Figure 13 | Cerro Moro Prospect Locations (Source: Extorre, 2011) | 80 |

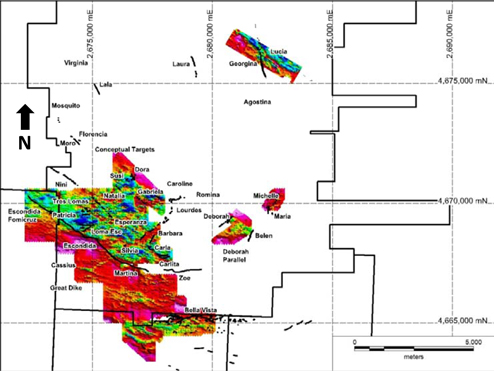

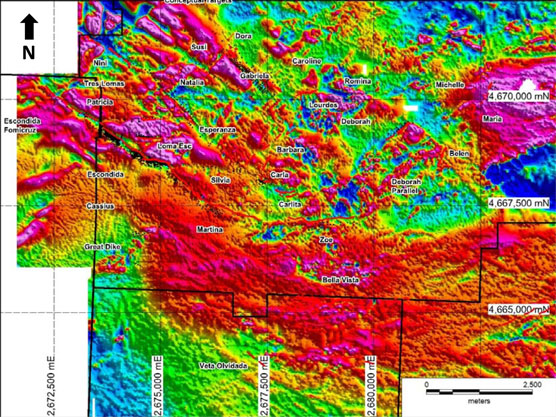

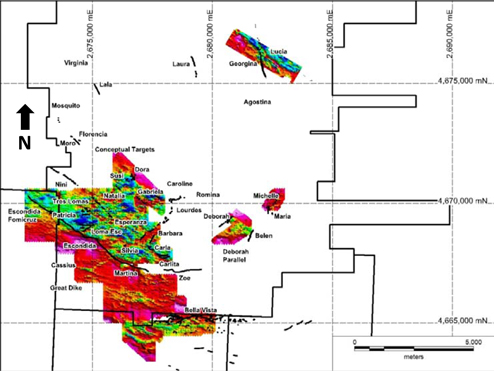

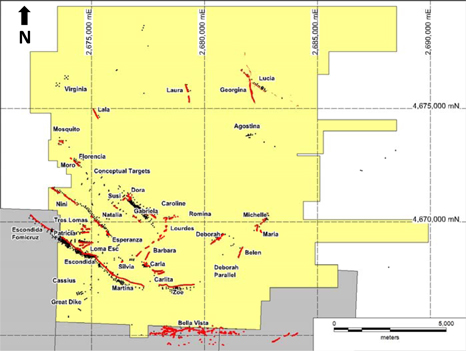

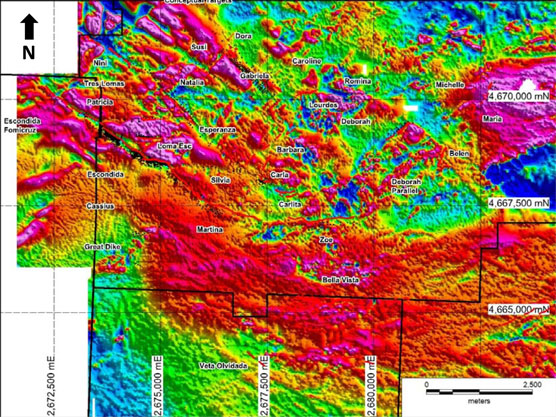

| Figure 14 | Cerro Moro Ground Magnetics – Reduced to Pole (RTP) Image (Source: Extorre 2010) | 96 |

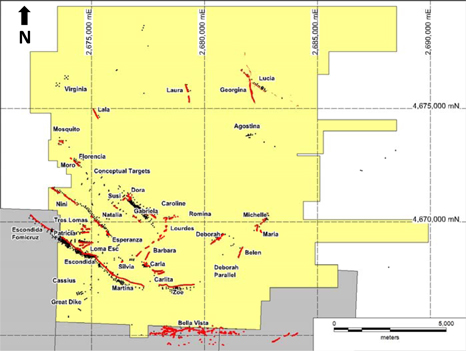

| Figure 15 | Escondida to Bellavista – Chargeability Data (Source: Extorre 2010) | 97 |

| Figure 16 | Escondida to Bellavista – Resistivity Data (Source: Extorre 2010) | 98 |

| Figure 17 | Drill Collars and Prospects Location Map (Source: Extorre 2011) | 102 |

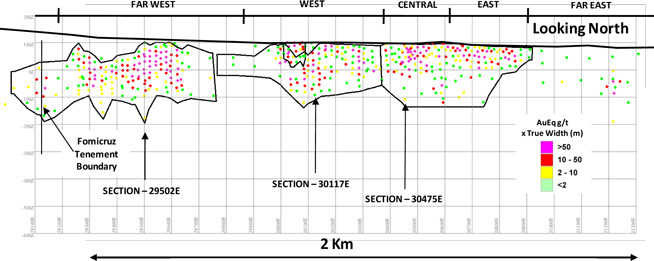

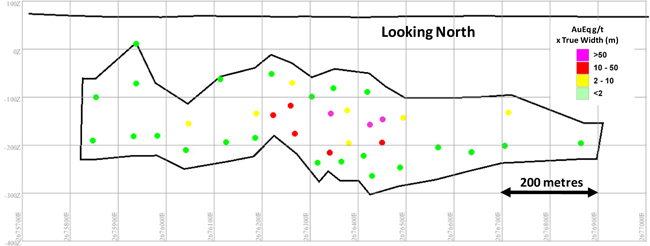

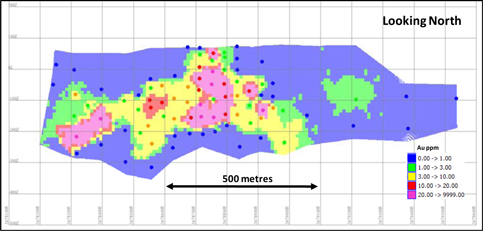

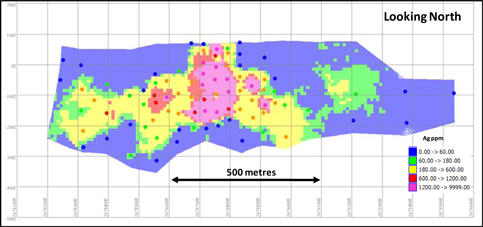

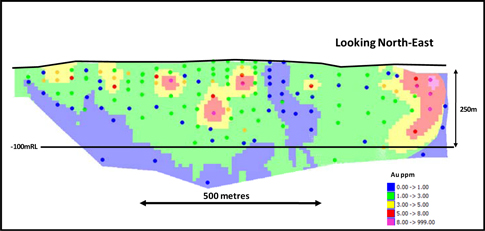

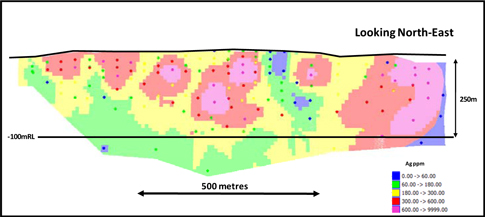

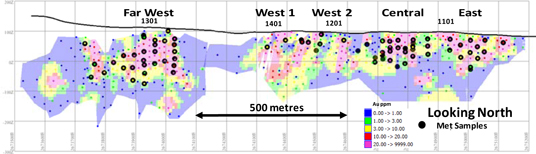

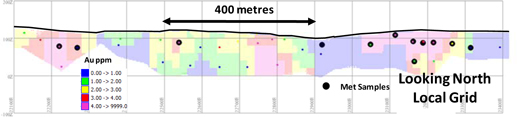

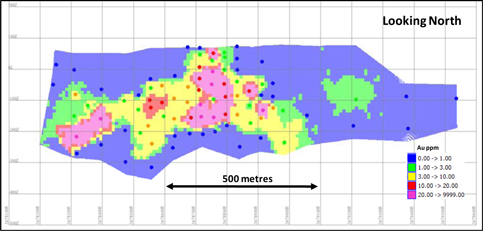

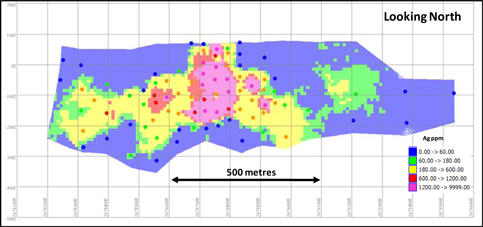

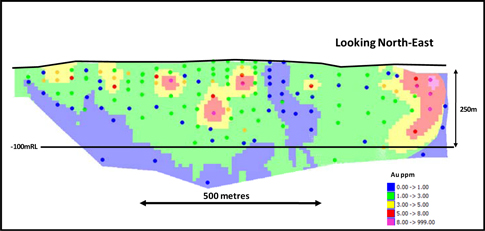

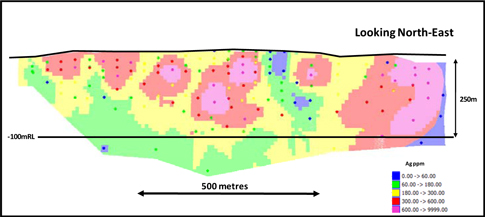

| Figure 18 | Escondida Total Project Longitudinal Projection - Octoberl 2011 Drilling (Local Grid) | 106 |

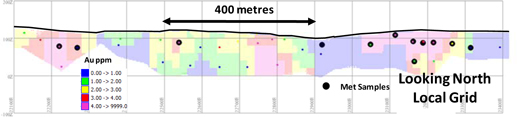

| Figure 19 | Escondida Far West Shoot - Schematic Cross-Section 29502E (Local Grid) | 107 |

| Figure 20 | Escondida West Shoot - Schematic Cross-Section 30117E (Local Grid) | 108 |

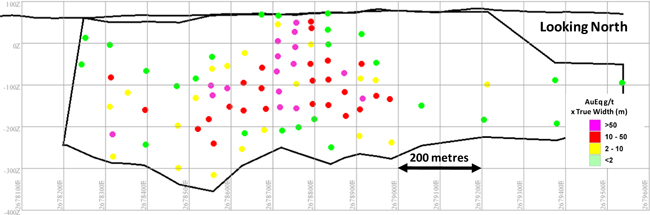

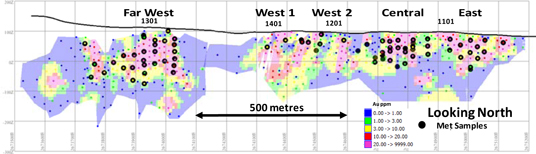

| Figure 21 | Escondida Central Shoot - Schematic Cross-Section 30475E (Local Grid) | 109 |

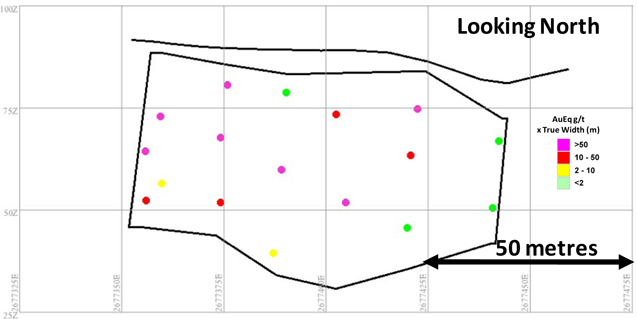

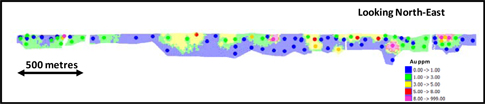

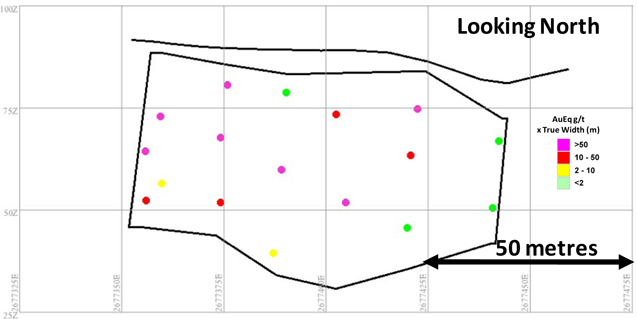

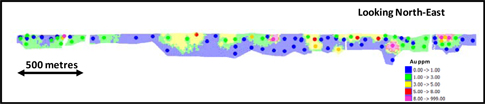

| Figure 22 | Martina Project - October 2011 Drilling - Vertical Section - AuEq*TW ppm | 110 |

| Figure 23 | Zoe Project - October 2011 Drilling - Vertical Section - AuEq*TW ppm | 111 |

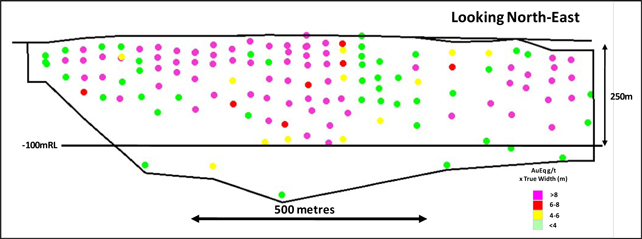

| Figure 24 | Gabiela Project - October 2011 Drilling - Vertical Section - AuEq*TW ppm | 113 |

| Figure 25 | Loma Escondida Project - October 2011 Drilling - Vertical Section - AuEq*TW ppm | 114 |

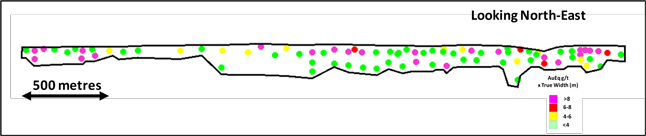

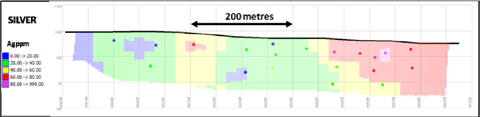

| Figure 26 | Nini Esperanza Project - October 2011 Drilling - Vertical Section - AuEq*TW ppm | 115 |

| Figure 27 | Carla Project - October 2011 Drilling - Vertical Section - AuEq*TW ppm | 116 |

| Figure 28 | Escondida –Metallurgical Sampling Locations | 122 |

| Figure 29 | Loma Escondida – Metallurgical Sampling Locations | 123 |

| Figure 30 | Gabriela – Metallurgical Sampling Locations | 123 |

| Figure 31 | Esperanza – Metallurgical Sampling Locations | 123 |

| Figure 32 | Diamond Duplicate Samples vs Original Sample – Au ppm | 127 |

| Figure 33 | Diamond Duplicate Samples vs Original Sample – Ag ppm by Code G1D-ES | 128 |

| Figure 34 | Diamond Duplicate Samples vs Original Sample – Ag ppm by Code 8TD | 128 |

| Figure 35 | Diamond Duplicate Samples vs Original Sample – Ag ppm by Code G6 GRAV | 129 |

| Figure 36 | ACME Re-assays of diamond samples greater than 1 Au ppm | 130 |

| Figure 37 | ACME Re-assays of geochemical standards greater than 1 Au ppm | 130 |

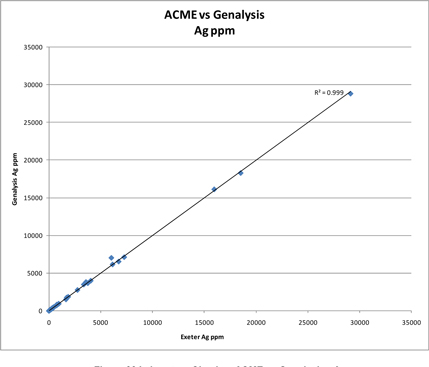

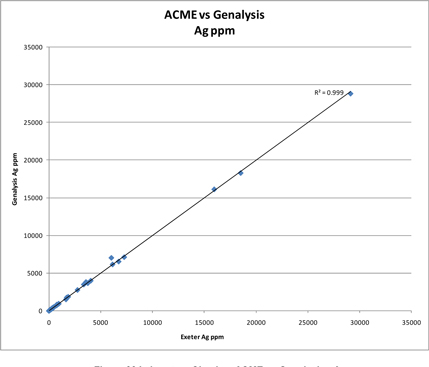

| Figure 38 | Laboratory Checks - ACME vs Genalysis - Au ppm | 133 |

| Figure 39 | Laboratory Checks - ACME vs Genalysis - Ag ppm | 133 |

| Figure 40 | Zoe Drillhole MD1351 Showing Independent Sampling Interval | 134 |

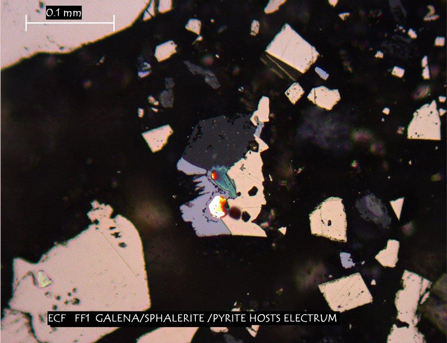

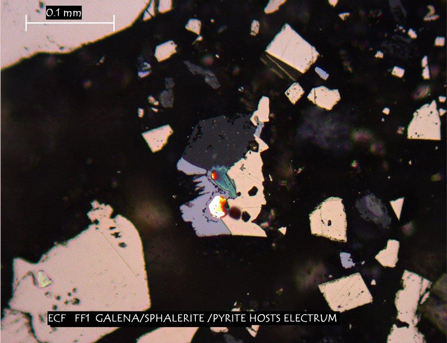

| Figure 41 | 20 µm electrum(white) at galena/pyrite contact, also sphalerite | 139 |

| Figure 42 | 50 µm argentian gold within coarse pyrite also containing galena | 140 |

| Figure 43 | Electrum of 6 µm in chalcopyrite enclosed by 100 micron acanthite | 140 |

| Figure 44 | Two electrums (63% silver) 5 and 10 µm in pyrite, composite with sphalerite and jalpaite, also titanium oxide. | 141 |

| Figure 45 | Zoned electrum from 5 to 100 µm composite with acanthite, sphalerite and chalcopyrite. | 142 |

| Figure 46 | Electrum of 10 µm in acanthite in sphalerite | 142 |

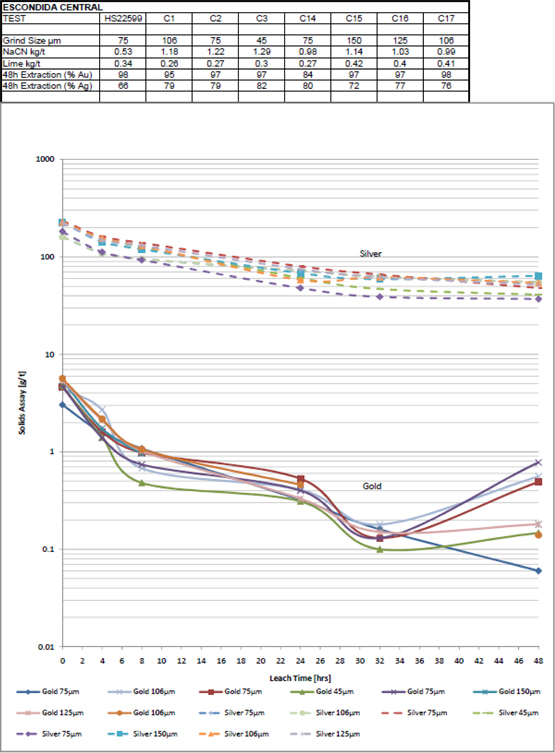

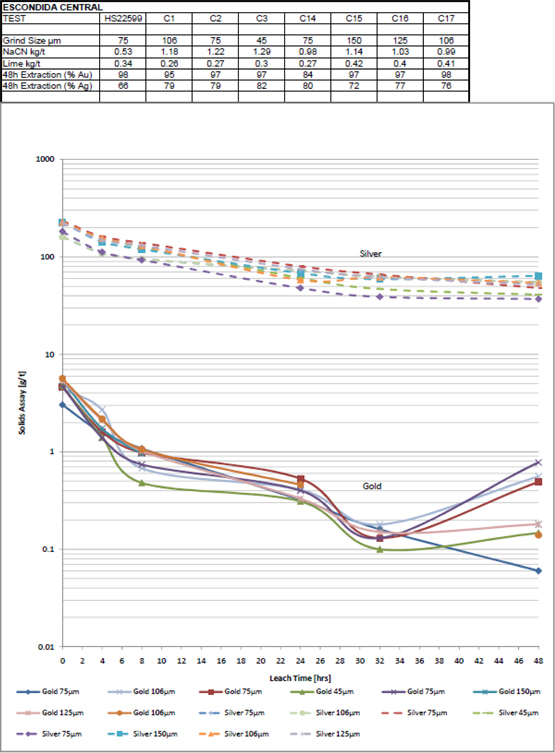

| Figure 47 | Effect of Primary Grind Size on Flotation-Gravity Tail Leach – Escondida Central | 152 |

| Figure 48 | Effect of Primary Grind Size on Gravity Tail Leach – Escondida Central | 153 |

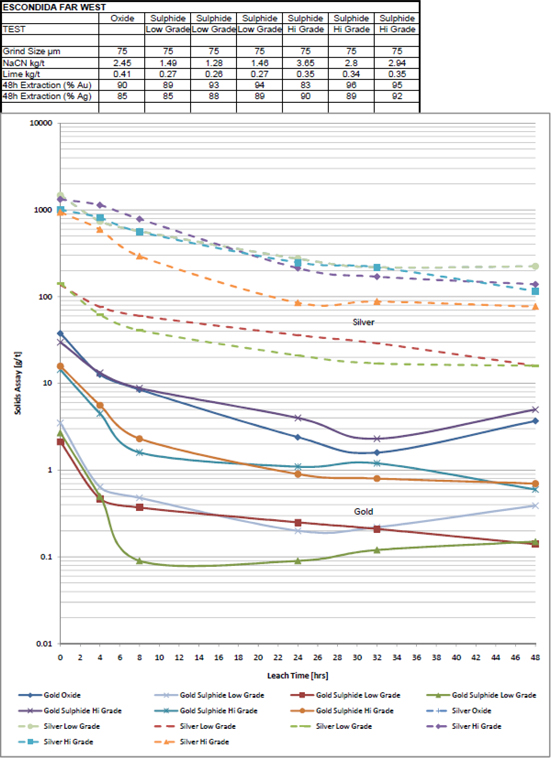

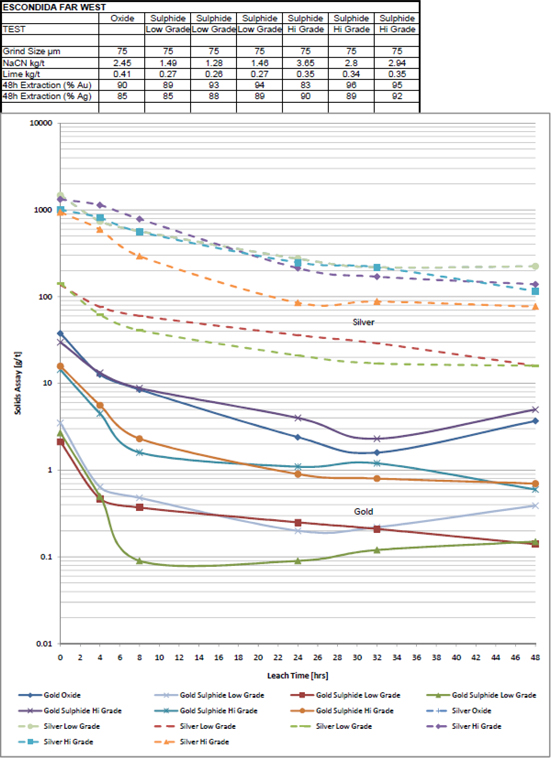

| Figure 49 | Effect of Primary Grind Size on Flotation - Gravity Tail Leach – Escondida Far West | 154 |

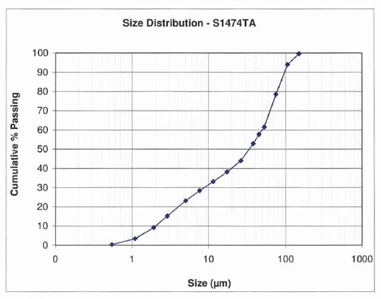

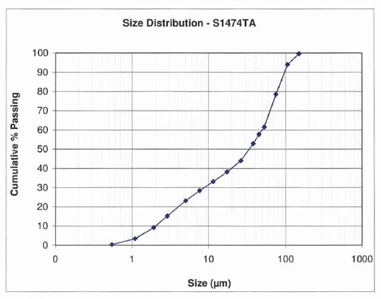

| Figure 50 | Leach Tailing Particle Size Distribution | 157 |

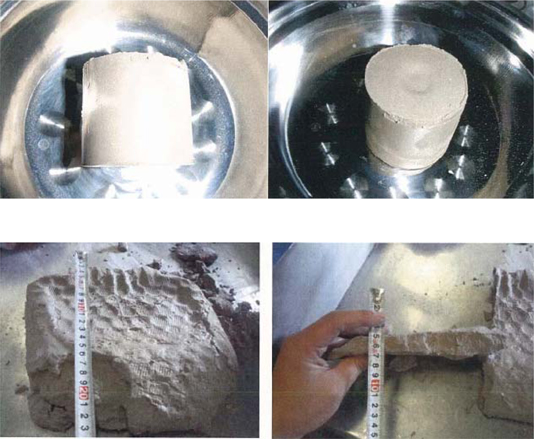

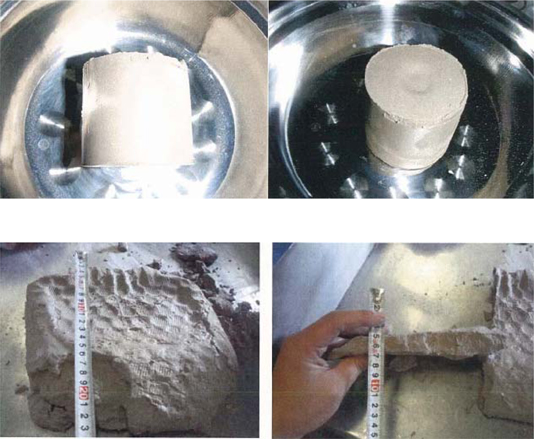

| Figure 51 | Filter cakes from tests showing plasticine nature. | 158 |

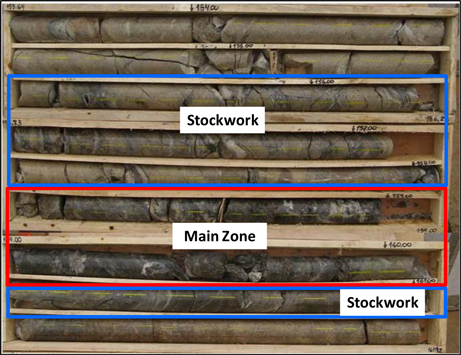

| Figure 52 | Escondida Drillhole MD633 Showing Styles of Mineralization | 167 |

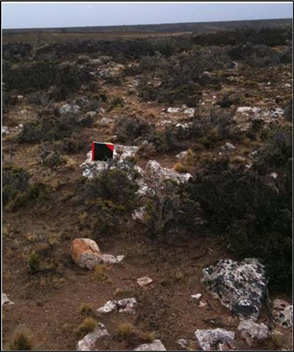

| Figure 53 | Escondida Central – Quartz Float and Sub-Outcrop | 168 |

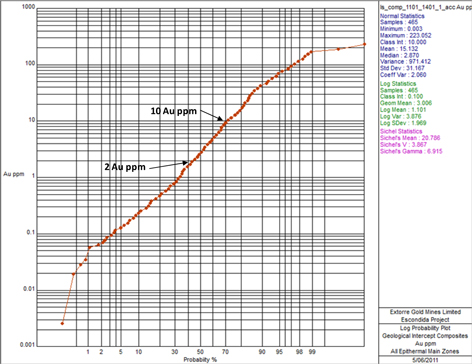

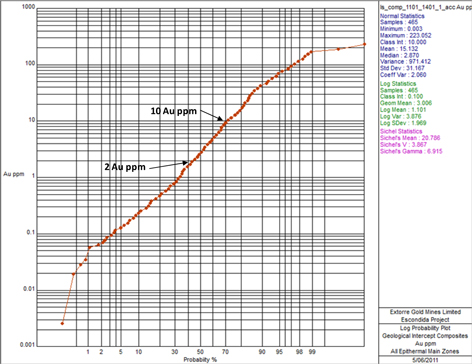

| Figure 54 | Escondida Main Zones - Gold Indicator Thresholds – Log-Probability Plot | 169 |

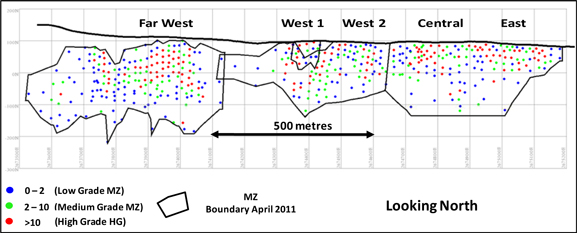

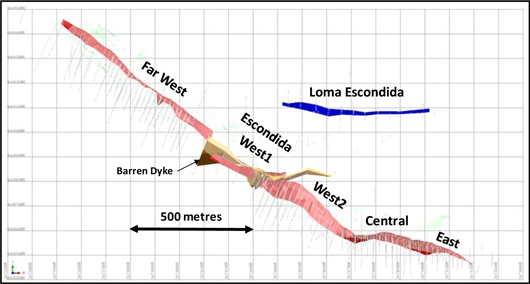

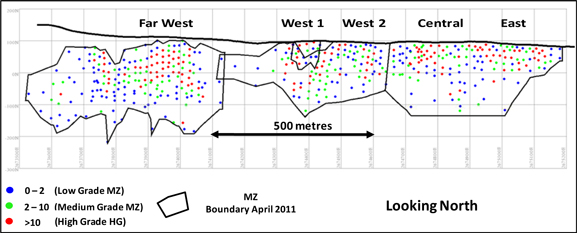

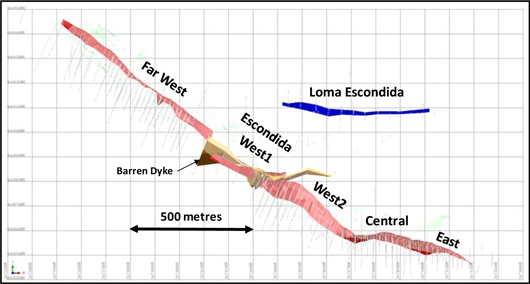

| Figure 55 | Escondida Main Zones – Geological Composites – Au ppm – Indicators - Long Section | 170 |

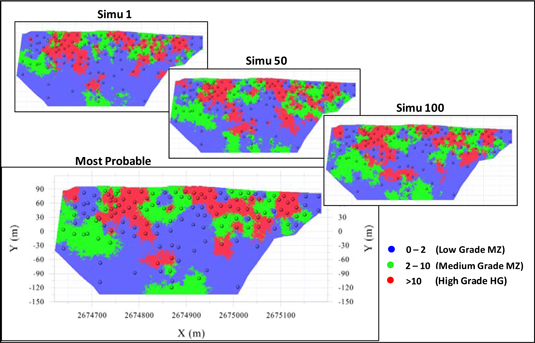

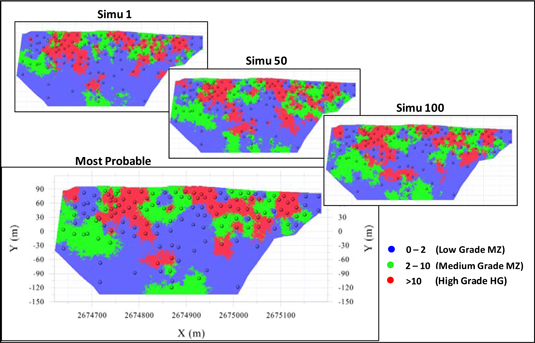

| Figure 56 | Escondida Central-East Zone – HGZ Indicator Probability Map | 170 |

| Figure 57 | Escondida Central-East Zone – Simulated Domains | 171 |

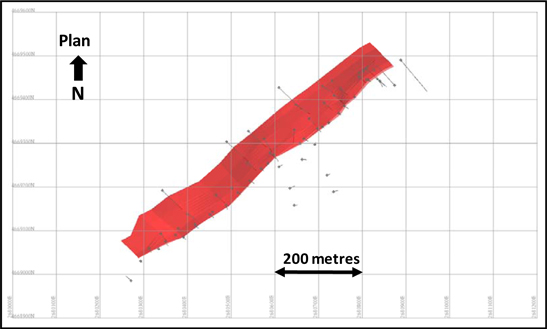

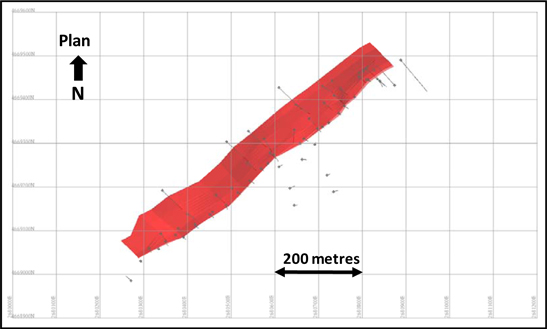

| Figure 58 | Escondida and Loma Escondida Main Epithermal Vein Zones – Plan View (Source: Cube, 2011) | 172 |

| Figure 59 | Zoe Vein Structures – Plan View (Source: Cube, 2011) | 172 |

| Figure 60 | Martina Vein Structures – Plan View (Source: Cube, 2011) | 173 |

| Figure 61 | Carla Vein Structures – Plan View (Source: Cube, 2011) | 173 |

| Figure 62 | Gabriela Main Epithermal Vein Zone – Plan View (Source: Cube, 2011) | 174 |

| Figure 63 | Nini-Esperanza Vein Structures – Plan View (Source: Cube, 2011) | 174 |

| Figure 64 | Deborah Main Epithermal Vein Zone – Plan View (Source: Cube, 2011) | 175 |

| Figure 65 | Escondida Main Zones (MZ+HGZ) – Composites vs Model Grades – Au ppm | 184 |

| Figure 66 | Escondida Main Zones (MZ+HGZ) – Composites vs Model Grades – Ag ppm | 184 |

| Figure 67 | Loma Escondida Main Zone (MZ+HGZ) – Composites vs Model Grades – Au ppm | 184 |

| Figure 68 | Loma Escondida Main Zone (MZ+HGZ) – Composites vs Model Grades – Ag ppm | 184 |

| Figure 69 | Zoe Main Vein– Composites vs Model Grades – Au ppm | 185 |

| Figure 70 | Zoe Main Vein– Composites vs Model Grades – Ag ppm | 185 |

| Figure 71 | Martina Main Vein– Composites vs Model Grades – Au ppm | 185 |

| Figure 72 | Martina Main Vein– Composites vs Model Grades – Ag ppm | 186 |

| Figure 73 | Carla Main Vein– Composites vs Model Grades – Au ppm | 186 |

| Figure 74 | Carla Main Vein– Composites vs Model Grades – Ag ppm | 186 |

| Figure 75 | Gabriela Main Zone – Composites vs Model Grades – Au ppm | 187 |

| Figure 76 | Gabriela Main Zone – Composites vs Model Grades – Ag ppm | 187 |

| Figure 77 | Nini-Esperanza Main Vein– Composites vs Model Grades – Au ppm | 187 |

| Figure 78 | Nini-Esperanza Main Vein– Composites vs Model Grades – Ag ppm | 187 |

| Figure 79 | Deborah Main Zone – Composites vs Model Grades – Au ppm | 188 |

| Figure 80 | Deborah Main Zone – Composites vs Model Grades – Ag ppm | 188 |

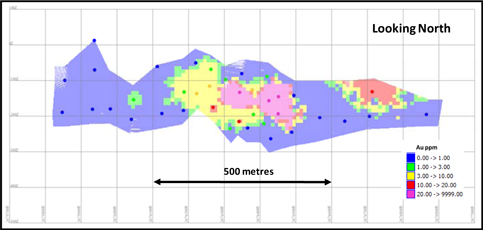

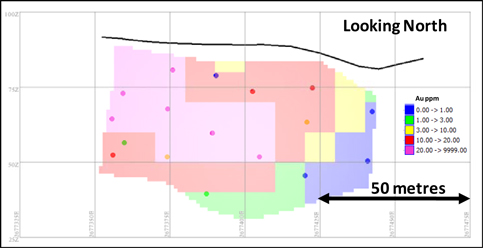

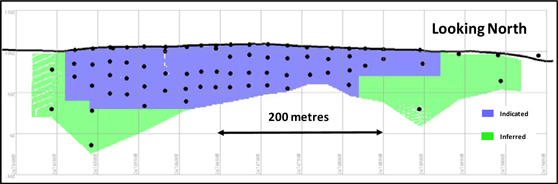

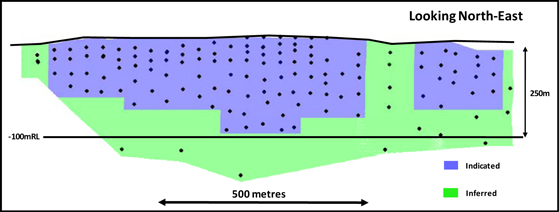

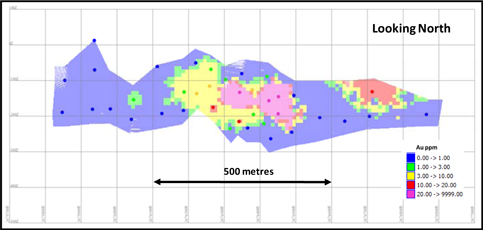

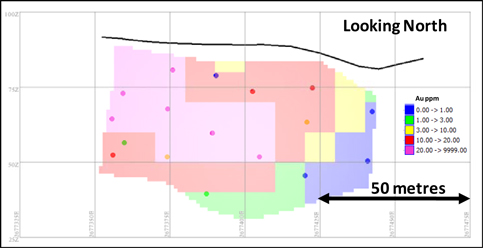

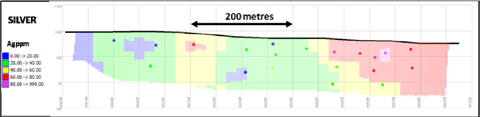

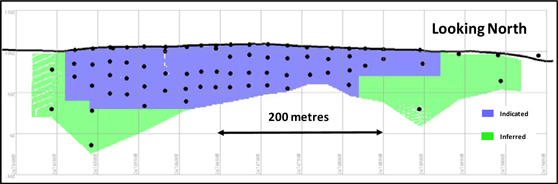

| Figure 81 | Escondida Main Zones – Resource Classification | 189 |

| Figure 82 | Loma Escondida Main Zone – Resource Classification | 189 |

| | |

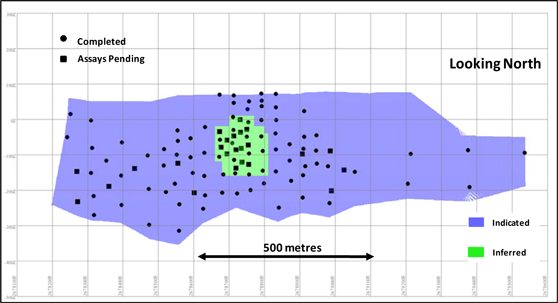

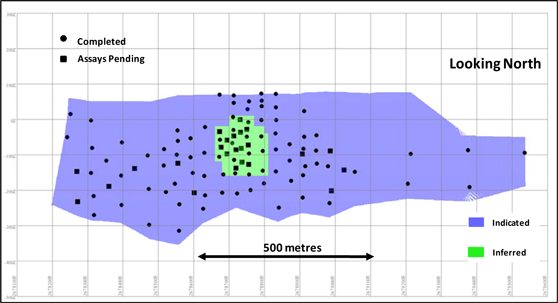

| Figure 83 | Zoe Main Vein – Resource Classification | 190 |

| Figure 84 | Gabriela Main Zone – Resource Classification | 191 |

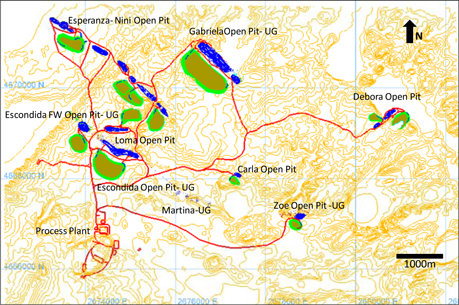

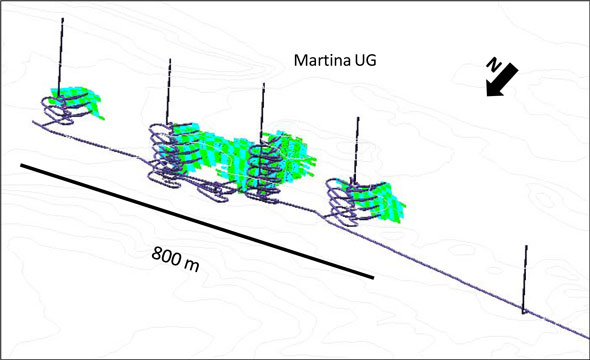

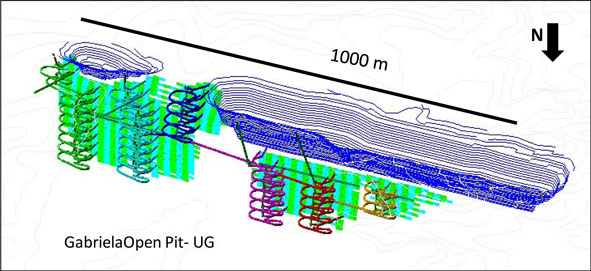

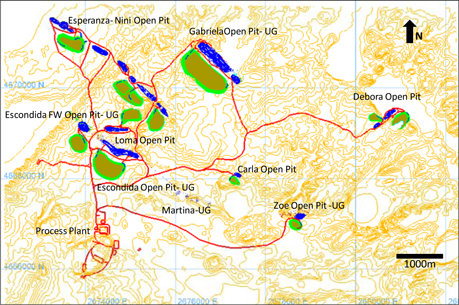

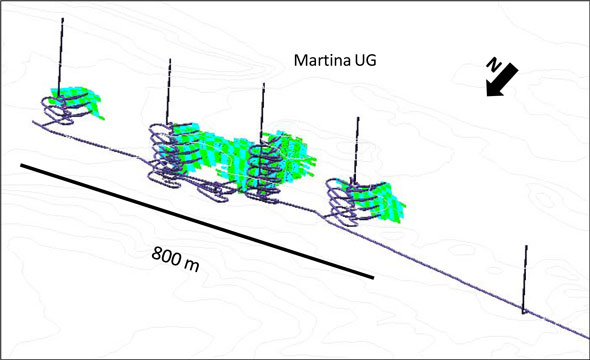

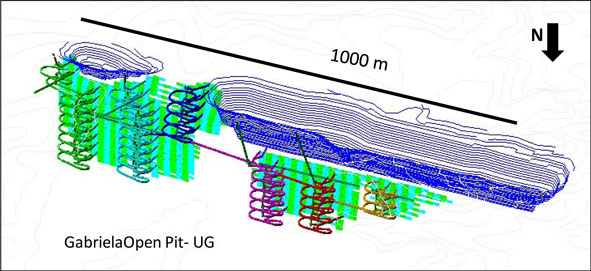

| Figure 85 | Conceptual Mine Development for Cerro Moro (Source: NCL, 2011) | 196 |

| Figure 86 | Conceptual Mine Development for Escondida (Source: NCL, 2011) | 197 |

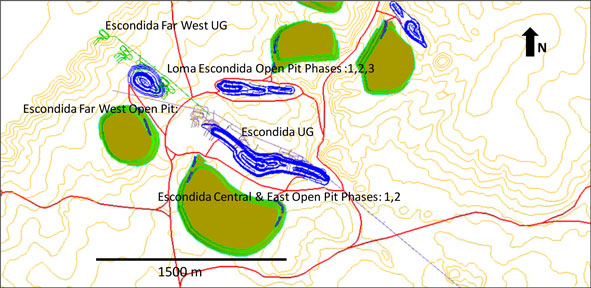

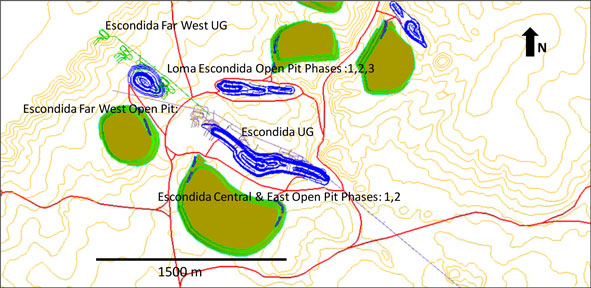

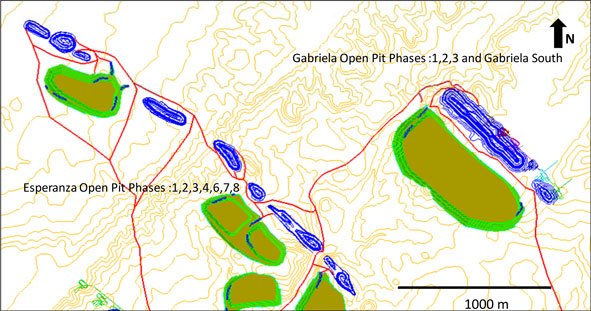

| Figure 87 | Escondida Open Pits (Source: NCL, 2011) | 200 |

| Figure 88 | Gabriela Open Pits (Source: NCL, 2011) | 201 |

| Figure 89 | Nini-Esperanza Open Pits (Source: NCL, 2011) | 201 |

| Figure 90 | Deborah Open Pits (Source: NCL, 2011) | 202 |

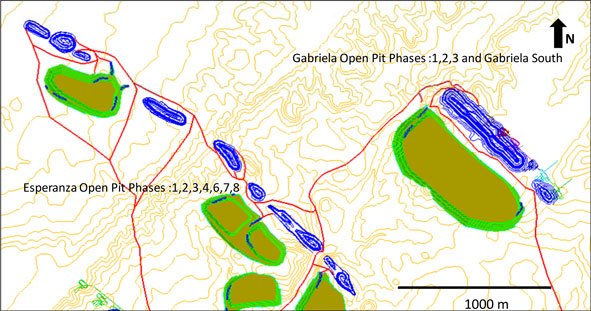

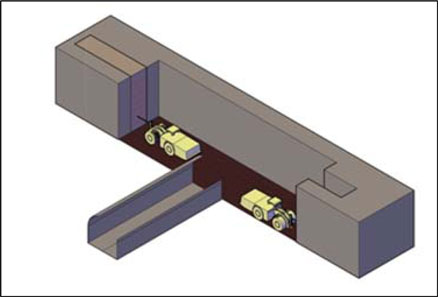

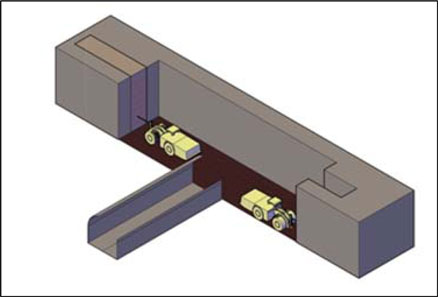

| Figure 91 | Mining Method – Bench & Fill (Source: NCL, 2011) | 204 |

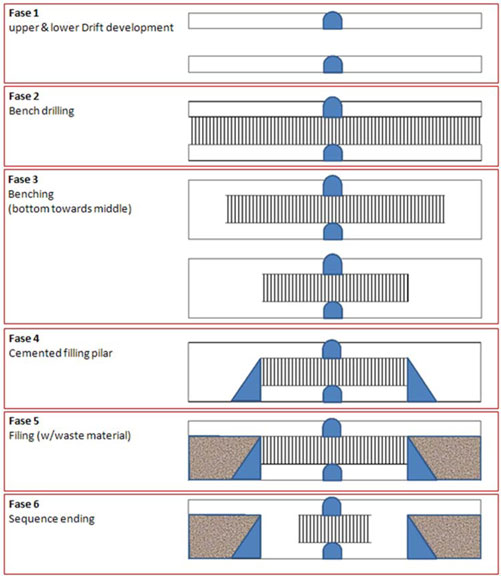

| Figure 92 | Bench & Fill – Split Blasting (Source: NCL, 2011) | 204 |

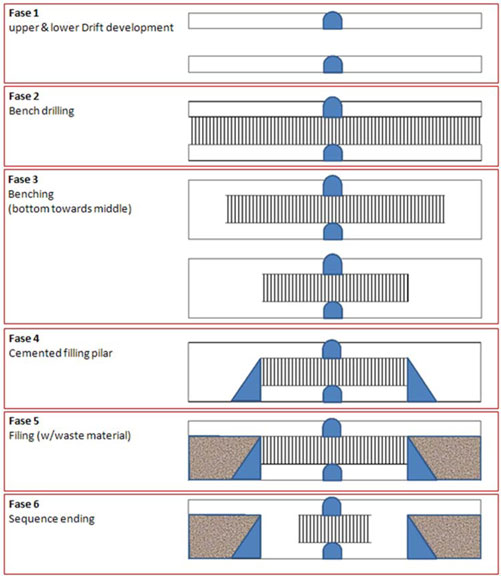

| Figure 93 | Bench & Fill - Sequence (Source: NCL, 2011) | 205 |

| Figure 94 | Underground Dilution Estimation (Source: NCL, 2011) | 206 |

| Figure 95 | Escondida West Mine Resources – Vertical Section | 208 |

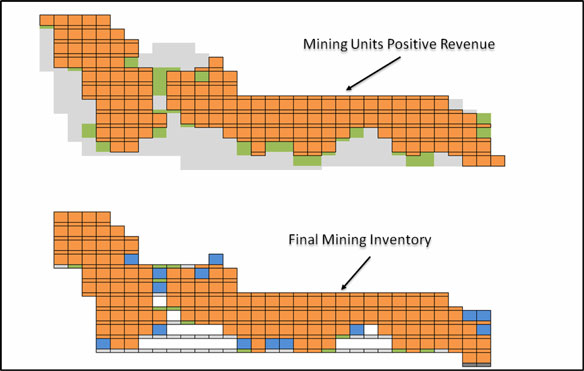

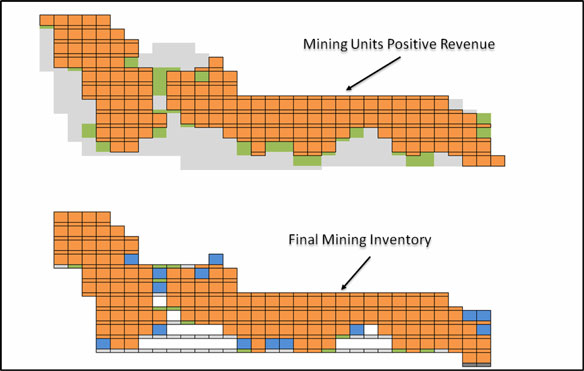

| Figure 96 | Positive and Negative Mining Units (Source: NCL, 2011) | 208 |

| Figure 97 | Escondida Schematic Underground Layout (Source: NCL, 2011) | 209 |

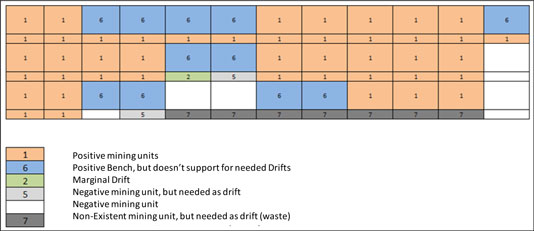

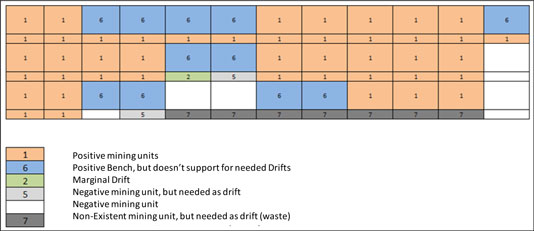

| Figure 98 | Zoe Schematic Underground Layout (Source: NCL, 2011) | 210 |

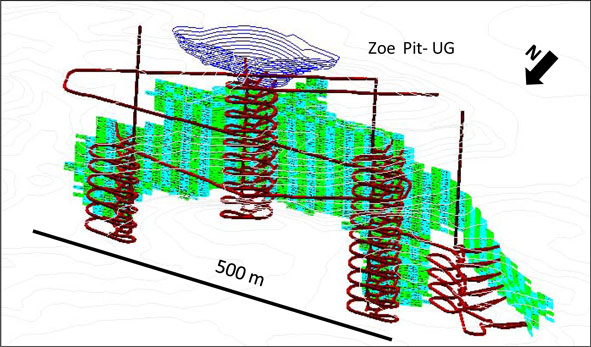

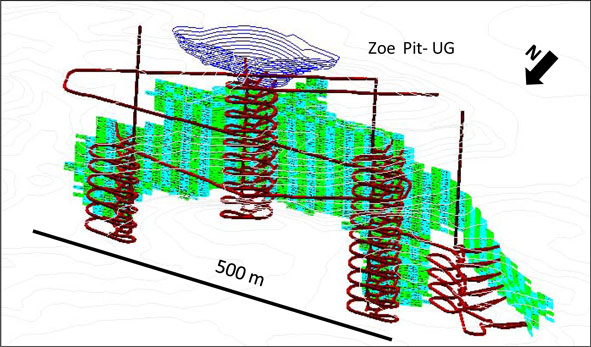

| Figure 99 | Martina Schematic Underground Layout (Source: NCL, 2011) | 210 |

| Figure 100 | Gabriela Schematic Underground Layout (Source: NCL, 2011) | 211 |

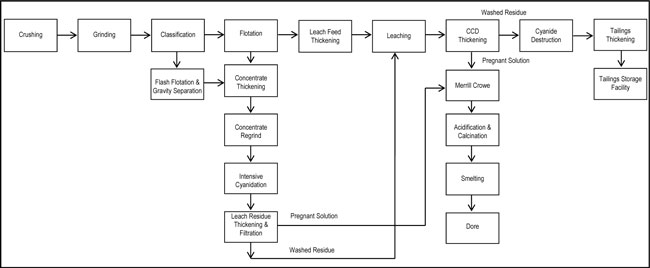

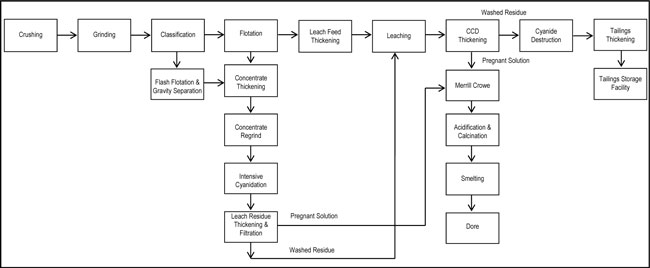

| Figure 101 | Overall Flowsheet (Source: GRES, 2011) | 233 |

| Figure 102 | Proposed power line route for the Project | 246 |

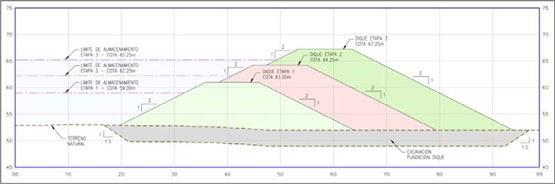

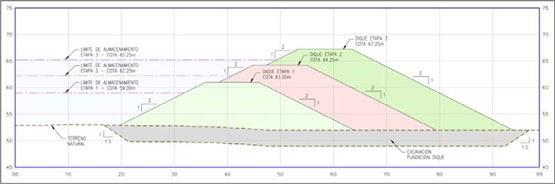

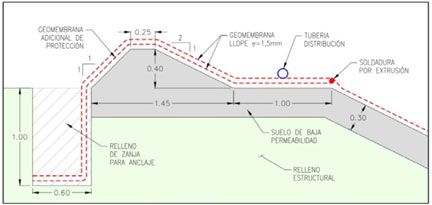

| Figure 103 | Construction stages | 253 |

| Figure 104 | Dam crest diagram | 254 |

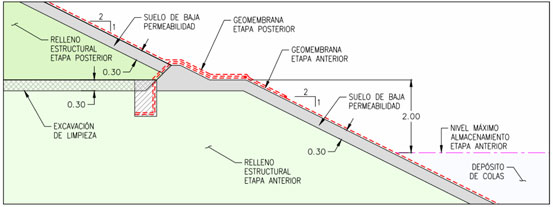

| Figure 105 | Geomembrane anchoring detail | 254 |

| Figure 106 | Transition between stages | 254 |

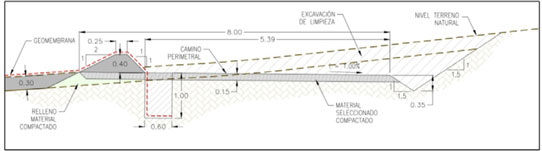

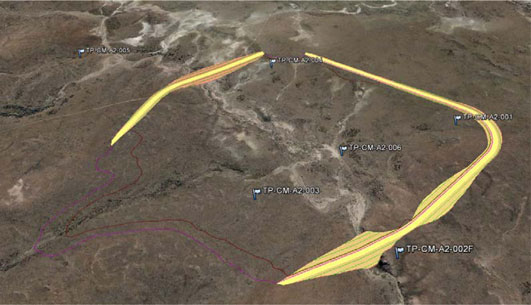

| Figure 107 | Perimeter road | 255 |

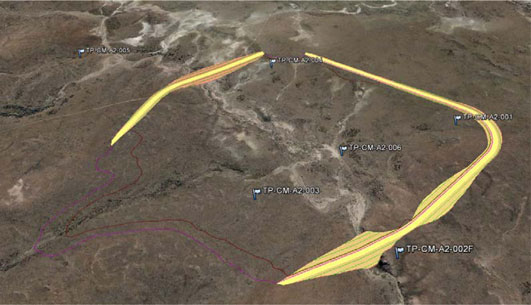

| Figure 108 | Location of the test pits | 256 |

| Figure 109 | Tailings Storage Facility conceptual view | 258 |

| Figure 110 | Gold Spot Price – January 29, 2011 to January 31, 2012 (Source: www.kitco.com) | 260 |

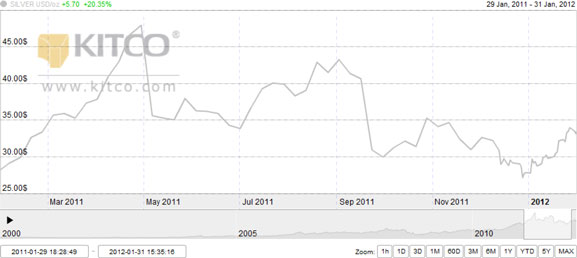

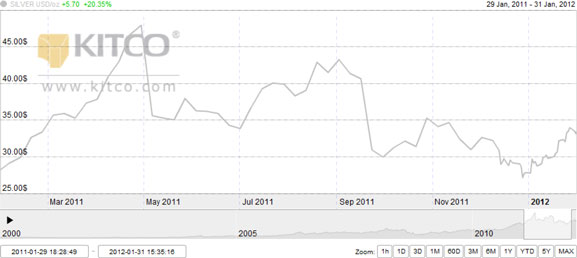

| Figure 111 | Silver Spot Price – January 29, 2011 to January 31, 2012 (Source: www.kitco.com) | 260 |

| Figure 112 | Fomicruz Properties Location (Source: Exeter, 2009a) | 317 |

| Figure 113 | Drilling Completed at Escondida (Fomicruz Extension), Bella Vista, and Veta Olvidada with Ground Magnetic Data (RTP) (Source:Extorre, 2011) | 319 |

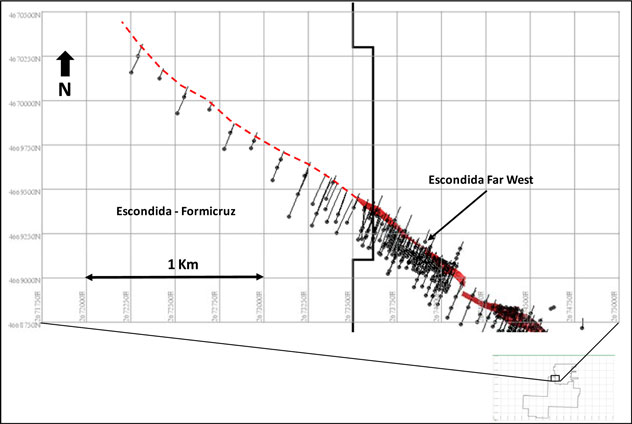

| Figure 114 | Escondida-Fomicruz Prospect – Drill Hole Locations (Source: Cube 2011) | 320 |

LIST OF TABLES

| Table 1 | Summary of Exploration Work undertaken by Extorre - Jan 2011 to Jan 2012 | 32 |

| Table 2 | Cerro Moro Indicated Mineral Resources above 1 ppm Gold Equivalent | 33 |

| Table 3 | Cerro Moro Inferred Mineral Resources above 1 ppm Gold Equivalent | 33 |

| Table 4 | Mine Schedule Summary for 1,300 tpd (Option A) | 35 |

| Table 5 | Mine Schedule Summary for 1,150 tpd (Option B) | 36 |

| Table 6 | Schedule of the filing of the Environmental Impact Assessment (EIA) | 43 |

| Table 7 | Mine, Process Plant and Infrastructure CAPEX Summary (1,300 tpd Option A) | 44 |

| Table 8 | Mine, Process Plant and Infrastructure CAPEX Summary (1,150 tpd, Option B) | 45 |

| Table 9 | Process Plant Total Capex and Operating Cost Summary – 1,300 tpd Option A | 46 |

| Table 10 | Process Plant Total Capex and Operating Cost Summary – 1,150 tpd Option B | 47 |

| Table 11 | Mining CAPEX and OPEX Summary – 1,300 tpd Option A | 48 |

| Table 12 | Mining CAPEX and OPEX Summary – 1,150 tpd Option B | 49 |

| Table 13 | Economical Evaluation Results Summary (1,300 tpd) | 50 |

| Table 14 | Economical Evaluation Results Summary (1,150 tpd) | 51 |

| Table 15 | Economical Evaluation Results Summary (1,300 tpd & 1,150 tpd) | 54 |

| Table 16 | Technical Report Responsibility Matrix | 57 |

| Table 17 | Frequently used acronyms and abbreviations | 57 |

| Table 18 | Cerro Moro Tenements (Source Extorre, 2011) | 62 |

| Table 19 | Schedule of the filing of the Environmental Impact Assessments (EIAs) | 65 |

| Table 20 | Summary of Exploration Work undertaken by Exeter Prior to 2009 | 92 |

| Table 21 | Summary of Exploration Work undertaken between January, 2009 and December, 2010 | 94 |

| Table 22 | Summary of Exploration Work undertaken by Extorre to January 31, 2012 | 95 |

| Table 23 | Drilling Details for Cerro Moro at January 31, 2012 | 102 |

| Table 24 | Zoe Drillhole MD1351 Independent Sampling Results | 134 |

| Table 25 | Summary of flash flotation & gravity concentrate mineralogy findings (Escondida & Gabriela) | 144 |

| Table 26 | Liberation and composite details for Acanthite (Ag2S) in leach tailing (Escondida) | 145 |

| Table 27 | Test work results showing overall extractions for gold and silver using the flash flotation, gravity and cyanide leach flow sheet | 150 |

| Table 28 | Test work results showing overall extractions for gold and silver using the flash flotation, gravity and flotation flow sheet | 151 |

| Table 29 | Test work results showing overall extractions for gold and silver using the flash flotation, gravity, flotation and cyanide leach flow sheet | 151 |

| Table 30 | Critical Design Data for Merrill Crowe Circuit | 156 |

| Table 31 | Summary of Initial Thickening Test Work | 157 |

| Table 32 | Summary of Initial Filtration Test Work | 157 |

| Table 33 | Summary of Cyanide Destruction Test Work | 160 |

| Table 34 | Cerro Moro Indicated Mineral Resources above 1 ppm Gold Equivalent | 164 |

| Table 35 | Cerro Moro Inferred Mineral Resources above 1 ppm Gold Equivalent | 164 |

| Table 36 | Database - Numerical Equivalent Values for Below Detection Values | 165 |

| Table 37 | Escondida Main Zones - Summary Statistics – Geological Composites | 176 |

| Table 38 | Loma Escondida Main Zone - Summary Statistics – Geological Composites | 177 |

| Table 39 | Zoe Main Zone - Summary Statistics – Geological Composites | 177 |

| Table 40 | Martina Main Zone - Summary Statistics – Geological Composites | 177 |

| Table 41 | Carla Main Zone - Summary Statistics – Geological Composites | 177 |

| Table 42 | Gabriela Main Zone - Summary Statistics – Geological Composites | 177 |

| Table 43 | Nini-Esperanza Main Zone - Summary Statistics – Geological Composites | 178 |

| Table 44 | Deborah Main Zone - Summary Statistics – Geological Composites | 178 |

| Table 45 | Main Zones – Estimation Parameters | 179 |

| Table 46 | Stockwork Zones – Estimation Parameters | 180 |

| Table 47 | Escondida and Loma Escondida 3D Block Model Definition | 180 |

| Table 48 | Zoe 3D Block Model Definition | 180 |

| Table 49 | Martina 3D Block Model Definition | 181 |

| Table 50 | Carla 3D Block Model Definition | 181 |

| Table 51 | Gabriela 3D Block Model Definition | 181 |

| Table 52 | Nini-Esperanza 3D Block Model Definition | 181 |

| Table 53 | Deborah 3D Block Model Definition | 181 |

| Table 54 | Block Model Attribute Names | 182 |

| Table 55 | List of Domain Codes | 182 |

| Table 56 | Density Values | 183 |

| Table 57 | Cerro Moro Main Zones - De-Clustered Composite vs Model Grade | 183 |

| Table 58 | Cerro Moro Indicated Mineral Resources above 1 ppm Gold Equivalent | 191 |

| Table 59 | Cerro Moro Inferred Mineral Resources above 1 ppm Gold Equivalent | 192 |

| Table 60 | Mineral Inventory Summary by Sector | 198 |

| Table 61 | Pit Optimization Parameters | 199 |

| Table 62 | Pit Optimization Results | 199 |

| Table 63 | Final Pits Summary | 200 |

| Table 64 | Dilution Criteria | 206 |

| Table 65 | Underground Mining Inventory Summary | 209 |

| Table 66 | General Mining Sequence (1,300 tpd) | 212 |

| Table 67 | Mine Production Schedule (1,300 tpd) | 213 |

| Table 68 | Mine Plan and Plant Feed at 1,300tpd | 215 |

| Table 69 | General Mining Sequence (1,150 tpd) | 216 |

| Table 70 | Mine Production Schedule (1,150 tpd) | 217 |

| Table 71 | Mine Plan and Plant Feed at 1,150tpd | 219 |

| Table 72 | Open Pit Mining Equipment Requirement | 220 |

| Table 73 | Underground Mining Equipment Requirement | 222 |

| Table 74 | Open Pit Operators | 223 |

| Table 75 | Open Pit Maintenance | 223 |

| Table 76 | Underground Operators & Maintenance | 223 |

| Table 77 | Indirect Personnel | 224 |

| Table 78 | Final design angles for the pits at Cerro Moro | 225 |

| Table 79 | Maximum length of the open stope for the different mines of the Project | 227 |

| Table 80 | Details of reagent systems | 238 |

| Table 81 | Projected Energy, Water and Material Requirements | 243 |

| Table 82 | TSF Design Criteria | 251 |

| Table 83 | TSF Scheduled Costs | 252 |

| Table 84 | Forecast Annual Production | 259 |

| Table 85 | Main findings of the ABA test work program | 264 |

| Table 86 | Schedule of the filing of the Environmental Impact Assessment (EIA) | 271 |

| Table 87 | Overall Capital Costs (1,300 tpd option) | 276 |

| Table 88 | Overall Capital Costs (1,150 tpd option) | 277 |

| Table 89 | Capital Cost Summary by Discipline (1,300 tpd Option) | 279 |

| Table 90 | Capital Cost Summary by Discipline (1,150 tpd Option) | 280 |

| Table 91 | Capital Cost Summary by Area (1,300 tpd Option) | 281 |

| Table 92 | Capital Cost Summary by Area (1,150 tpd Option) | 282 |

| Table 93 | Open Pit Capital Cost (1,300 tpd option) | 284 |

| Table 94 | Open Pit Capital Cost (1,150 tpd option) | 285 |

| Table 95 | Underground Capital Cost Summary (MUS$) – 1,300 tpd option | 286 |

| Table 96 | Development Capital Cost – 1,300 tpd option | 286 |

| Table 97 | Underground Equipment Capital Cost – 1,300 tpd option | 287 |

| Table 98 | Underground Infrastructure and Services Capital Cost – 1,300 tpd option | 288 |

| Table 99 | Underground Capital Cost Summary (MUS$) – 1,150 tpd option | 288 |

| Table 100 | Development Capital Cost – 1,150 tpd option | 289 |

| Table 101 | Underground Equipment Capital Cost – 1,150 tpd option | 289 |

| Table 102 | Underground Infrastructure and Services Capital Cost – 1,150 tpd option | 290 |

| Table 103 | Operating Cost Estimate by Cost Centre (1,300 tpd option) | 291 |

| Table 104 | Operating Cost Estimate by Cost Area (1,300 tpd option) | 292 |

| Table 105 | Operating Cost Estimate by Cost Centre (1,150 tpd option) | 293 |

| Table 106 | Operating Cost Estimate by Cost Centre (1,150 tpd option) | 294 |

| Table 107 | Labour Cost Estimate Breakdown. | 295 |

| Table 108 | Power Cost Estimate Breakdown. | 296 |

| Table 109 | Reagents and Grinding Media Cost Estimate Input Breakdown | 297 |

| Table 110 | Linings Cost Estimate Breakdown. | 298 |

| Table 111 | Open Pit Operating Cost (US$) – 1,300 tpd option | 299 |

| Table 112 | Open Pit Operating Cost (US$/t ROM) – 1,300 tpd option | 299 |

| Table 113 | Underground Mine Operating Cost (US$) – 1,300 tpd option | 300 |

| Table 114 | Underground Mine Operating Cost (US$/t) – 1,300 tpd option | 300 |

| Table 115 | Open Pit Operating Cost (US$) – 1,150 tpd option | 301 |

| Table 116 | Open Pit Operating Cost (US$/t ROM) – 1,150 tpd option | 301 |

| Table 117 | Underground Mine Operating Cost (US$) – 1,150 tpd option | 302 |

| Table 118 | Underground Mine Operating Cost (US$/t) – 1,150 tpd option | 302 |

| Table 119 | Economical Model General Parameters | 303 |

| Table 120 | Economical Evaluation Results Summary (1,300 tpd) | 305 |

| Table 121 | Economical Evaluation Results Summary (1,150 tpd) | 306 |

| Table 122 | Cash Flow Economical Model for 1,300 tpd option | 307 |

| Table 123 | Cash Flow Economical Model for 1,150 tpd option | 311 |

| Table 124 | Sensitivity – Gold Price and Discount Rate (1,300 tpd option) | 315 |

| Table 125 | Sensitivity – Gold Price and Operating Cost (1,300 tpd option) | 315 |

| Table 126 | Sensitivity – Gold Price and Capital Cost (1,300 tpd option) | 315 |

| Table 127 | Sensitivity – Gold Price and Discount Rate (1,150 tpd option) | 316 |

| Table 128 | Sensitivity – Gold Price and Operating Cost (1,150 tpd option) | 316 |

| Table 129 | Sensitivity – Gold Price and Capital Cost (1,150 tpd option) | 316 |

| Table 130 | Drilling Completed in Fomicruz Properties (Source: Extorre, 2011) | 319 |

| Table 131 | Economical Evaluation Results Summary (1,300 tpd) | 332 |

| Table 132 | Economical Evaluation Results Summary (1,150 tpd) | 332 |

This technical report describes the Cerro Moro Gold-Silver Project (the “Project” or “Cerro Moro”), which is located in the Deseado Department, Santa Cruz Province, Argentina. The Project is held by Extorre Gold Mines Limited (“Extorre”) through its local subsidiary Estelar Resources Ltd (“Estelar”).

Cerro Moro consists of a series of low- to immediate-sulfidation epithermal-style veins with locally high grade gold-silver mineralization, especially in the Escondida zone. To date, National Instrument 43-101 Standards for Disclosure of Mineral Projects (“NI 43-101”) compliant mineral resources have been delineated in a total of 8 sectors (Escondida, Loma Escondida, Zoe, Martina, Carla, Esperanza-Nini, Gabriela, and Deborah) all of which are located within the central portion of the Cerro Moro tenements. This technical report considers the potential development options for the Project and is based upon the November, 2011, NI 43-101-compliant mineral resource estimate as prepared by Cube Consulting Pty Ltd.

Extraction of the mineral inventory at Cerro Moro could potentially be achieved using a combination of open pit and underground (bench-and-fill) mining techniques. Treatment of the mineral inventory is proposed through a processing plant that includes a standard crushing / milling circuit, flotation and gravity recovery stages, and a Merrill Crowe (zinc cementation) circuit for the recovery of precious metals from leach solutions. Throughput rates of 1,300 tonnes per day (Option A) and 1,150 tonnes per day (Option B) are considered and compared. Metallurgical testwork completed to date has indicated very high recoveries of both gold (95%) and silver (93%) from Cerro Moro mineralization. The projected precious metal production over the life of the Project is 848,000 ounces of gold and 47.2 million ounces of silver, with economic modelling (using the base case metal price assumptions of $US 1,320 / ounce for gold and $US 26 / ounce for silver) indicating that gold is expected to contribute approximately 48% of the projected future revenue stream for Cerro Moro and silver the remaining 52%.

NCL Ingeniería y Construcción Ltda. (“NCL”) was responsible for the compilation of information and preparation of the overall study. Significant contributions were also received from Cube Consulting Pty Ltd. (“Cube”; Geology and Mineral Resource Estimates), GR Engineering Services Ltd. (“GRES”; Metallurgy and Process Plant Design), and Ausenco Vector (“Ausenco”; Environmental, Hydrology, and Tailings Storage Facility).

The Cerro Moro Project comprises eighteen tenements covering an area of approximately 177 square kilometers. Sixteen of these tenements are mining claims (Manifestaciones de Descubrimiento), with the remaining two being exploration claims (Cateos de Exploracion). The Cerro Moro concessions are currently held 100% by Estelar, and are subject to a 2% NSR payable to Cerro Vanguardia SA on any future metal production. Provincial mining entity Fomicruz also possesses the right to receive a 5% participating interest in the Project once all permits required to begin production are received.

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 29 |

The Project is located 70 km (90 km by road) southwest of the port city of Puerto Deseado, Santa Cruz Province, southern Argentina (Figure 1). The Project area is geographically centred at approximately 48° 01’ 55” south latitude and 66° 33’ 45” west longitude. Access to the Project is via 20 km of paved road (Provincial Highway 281) from Puerto Deseado to the locality of Tellier, followed by 70 km of all-weather gravel road (Provincial Route 47) to the Project turnoff. The Project area is characterized by low altitudes (70 m to 150 m above mean sea level), flat to undulating relief, and a cool, dry climate typical of the Patagonian pampa (plains).

Figure 1 Location and Access Map (Source Extorre, 2011)

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 30 |

| 1.3 | Geology and Mineralization |

The polymetallic gold-silver mineralization at Cerro Moro is of the low- to intermediate-sulphidation epithermal vein type. Individual prospects vary from simple, single veins to complex vein systems with spur and cymoid loop structures. Limited quartz stockwork veinlets are also present peripheral to the main veins.

The mineralization is hosted in sub-volcanic and volcanic rocks, which are interpreted to belong to the Jurassic age Chon Aike and La Matilde Formations. In general, the Project area is composed of many structural blocks produced by a conjugate set of north-west and north-east faults. Both fault directions contain mineralized quartz veins. In the eastern and central part of the Project, north-easterly trending faults control the mineralization at the Deborah, Belen, Maria, Michelle, Barbara and Ana prospects. In the central and western part of the Project, north-westerly trending structures are the dominant control to the mineralization at the Escondida, Carla, Esperanza, Nini, Gabriela, Carolene, Lucia, Dora, Moro, Florencia, Natalia, Tres Lomas and Lala prospects. The Escondida Structure has a much larger segment of east west strike in the area of the recently discovered Zoe Shoot. Several secondary east-west structures occur between the primary north-west structures, and these control the mineralization at the Patricia, Loma Escondida and Carlita prospects. The width of the veins varies generally from 1 to 5 m, but veins may locally attain widths of up to 10 m. The strike length of individual veins is variable, generally between 200 m and 1 kilometre. The Escondida structure has been defined by drilling for more than 8 km, and remains open along strike and also at depth.

Improved geological, structural and mineralization models developed over the past two years have led to the discovery of numerous high-grade gold-silver polymetallic veins at Cerro Moro. These base metal anomalous Au-Ag veins tend to be recessive and are represented on the surface by either very poorly outcropping quartz vein material or none at all. Extensive cover of Tertiary marine sediments and Quaternary gravels also hinder the location or extensions of some of the veins and targets. Detailed ground magnetic survey data, coupled with IP and resistivity data, has highlighted potential targets that are initially tested via trenching and/or scout drilling, as in the case of the Escondida prospect.

Presently structures in northwest-southeast and east-west orientation are the preferred exploration targets, the latter orientation being interpreted to be due to tensional, pull apart structures resulting from minor strike-slip movement of the larger north-west structures.

The discontinuous mineralized shoots within the larger structures appear to be locally controlled by changes in strike, which are thought to have produced dilational flexures and jogs allowing for greater fluid flow. Changes in wall-rock lithology, along the structures, may be an important factor in controlling the local strike direction of the structures. It has also been noted that the brittle, felsic units have a tendency to produce stronger stockwork style development around the main structures than the intermediate units.

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 31 |

Exploration activities at the Project typically include a combination of geological mapping, geochemical sampling, geophysical surveys, and drilling. The exploration works completed since December 2010 include infill drilling and exploration drilling, Table 1 chronologically summarizes all exploration work undertaken since 1st January 2011 up until 31st January 2012.

| Date | | Extorre Exploration Works |

| Jan 2011 | | Complete infill drilling Martina, Loma Escondida, Gabriela with the aim to convert Inferred resource category mineralization to higher confidence categories. Exploration drilling to extend Lucia, Gabriela Loma Escondida and Esperanza. Scout drilling at Carolene |

| Feb 2011 to end March 2011 | | Exploration drilling to extend Gabriela, Esperanza- Nini, Escondida far west, Michelle, Loma Escondida. Scout drilling Agostina Gabriela NW, Belen and Zoe (discovery of Zoe) Regional drilling Union domes |

| April 2011 to end May 2011 | | Infill drilling at Carla and Gabriela SE. Exploration drilling at Zoe, Tres Lomas and Gabriela. Scout drilling Agostina, Deborah parallel, Loma Escondida and Zoe extensions |

| June 2011 to Jan 2012 | | Infill drilling at Zoe, Carla, and Gabriela. Exploration drilling at Zoe, Tres Lomas, Esperanza, Escondida, Loma Escondida and Gabriela. Scout drilling Carlita, Lala, Deborah parallel, Deborah Termination Structure, Mosquito, Alejandra, Romina, Lechuzo and Belen. |

Table 1 Summary of Exploration Work undertaken by Extorre - Jan 2011 to Jan 2012

| 1.5 | Mineral Resource Estimation |

This technical report includes mineral resources that are not mineral reserves and therefore do not have demonstrated economic viability.

The November 2011 mineral resource estimate for the Project is the third undertaken by Cube Consulting (“Cube”) of Perth, and supersedes a previous estimate that was announced on August 4, 2011. The mineral resource estimates were prepared by Mr. Ted Coupland, MAusIMM (CP), Director and Principal Geostatistician of Cube. Mineral resources have been classified and reported in accordance with the CIM guidelines (CIM 2011) and NI 43-101. Mr. Ted Coupland is ‘independent’ and a ‘qualified person’ as defined by NI 43-101.

Updated mineral resource estimates were compiled for the Gabriela and Esperanza prospects and maiden mineral resource estimates were compiled for the Zoe, Martina, Carla and Nini prospects. No changes have been made to the existing Escondida, Loma Escondida and Deborah mineral resource estimates.

All drilling data available as of October 10, 2011 was used for the November 2011 mineral resource estimation. Additional drilling data received subsequent to this date including geological logging and core photography was used to validate the geological interpretations where possible.

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 32 |

Cube has classified a substantial proportion of the Cerro Moro mineral resources as “Indicated” where drill spacing is sufficient to demonstrate acceptable confidence in the geometry, continuity and grade of the mineralized zones. Surrounding areas have been classified as Inferred where drill spacing is wider or where unresolved geological complexity exists.

A summary of the Cerro Moro Indicated and Inferred mineral resources above a cut-off of 1 ppm gold equivalent are shown in Table 2 and Table 3 respectively.

| Zone | | Tonnes | | | Gold (ppm) | | | Silver (ppm) | | | Gold Equivalent

Grade* (ppm) | | | Gold

(ounces) | | | Silver (ounces) | | | Gold Equivalent

Ounces** | |

| Escondida | | | 620,000 | | | | 18.8 | | | | 829.2 | | | | 35.4 | | | | 374,000 | | | | 16,530,000 | | | | 705,000 | |

| Loma Esc | | | 44,000 | | | | 18.4 | | | | 919.5 | | | | 36.8 | | | | 26,000 | | | | 1,297,000 | | | | 52,000 | |

| Gabriela | | | 1,642,000 | | | | 1.5 | | | | 226.1 | | | | 6.0 | | | | 79,000 | | | | 11,936,000 | | | | 318,000 | |

| Zoe | | | 105,000 | | | | 27.2 | | | | 2,614.5 | | | | 79.5 | | | | 91,000 | | | | 8,798,000 | | | | 267,000 | |

| Carla | | | 15,000 | | | | 16.0 | | | | 701.2 | | | | 30.0 | | | | 7,000 | | | | 327,000 | | | | 14,000 | |

| Total | | | 2,425,000 | | | | 7.4 | | | | 498.8 | | | | 17.4 | | | | 578,000 | | | | 38,888,000 | | | | 1,356,000 | |

Table 2 Cerro Moro Indicated Mineral Resources above 1 ppm Gold Equivalent

| Zone | | Tonnes | | | Gold (ppm) | | | Silver (ppm) | | | Gold Equivalent

Grade* (ppm) | | | Gold

(ounces) | | | Silver (ounces) | | | Gold Equivalent

Ounces** | |

| Escondida | | | 508,000 | | | | 4.3 | | | | 164.8 | | | | 7.6 | | | | 70,000 | | | | 2,689,000 | | | | 123,000 | |

| Loma Esc | | | 13,000 | | | | 9.7 | | | | 595.4 | | | | 21.6 | | | | 4,000 | | | | 256,000 | | | | 9,000 | |

| Zoe | | | 1,248,000 | | | | 4.1 | | | | 280.3 | | | | 9.8 | | | | 167,000 | | | | 11,250,000 | | | | 391,000 | |

| Martina | | | 293,000 | | | | 13.0 | | | | 60.3 | | | | 14.2 | | | | 123,000 | | | | 568,000 | | | | 134,000 | |

| Carla | | | 2,000 | | | | 9.5 | | | | 390.4 | | | | 17.3 | | | | 1,000 | | | | 29,000 | | | | 1,000 | |

| Gabriela | | | 331,000 | | | | 1.3 | | | | 219.7 | | | | 5.7 | | | | 14,000 | | | | 2,336,000 | | | | 61,000 | |

| Esperanza-Nini | | | 1,773,000 | | | | 1.8 | | | | 144.3 | | | | 4.7 | | | | 105,000 | | | | 8,226,000 | | | | 270,000 | |

| Deborah | | | 578,000 | | | | 2.4 | | | | 48.1 | | | | 3.4 | | | | 45,000 | | | | 894,000 | | | | 62,000 | |

| Total | | | 4,747,000 | | | | 3.5 | | | | 172.0 | | | | 6.9 | | | | 528,0000 | | | | 26,249,000 | | | | 1,053,000 | |

Table 3 Cerro Moro Inferred Mineral Resources above 1 ppm Gold Equivalent

*Gold equivalent values have been calculated by Extorre on the basis of the following parameters:

| — | Long term gold price US$1,320/Oz |

| — | Long term silver price US$26/Oz |

| — | Metallurgical recovery gold 100% |

| — | Metallurgical recovery silver 100% |

The gold equivalent grade is calculated by dividing the silver grade (ppm) by 50 (approximate ratio of gold/silver US$ value) and adding it to the gold grade (ppm).

**The gold equivalent ounces are calculated by dividing the total silver ounces by 50 and adding this value to the total gold ounces.

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 33 |

| 1.6 | Preliminary Mining Studies |

This study is based on Cube’s November, 2011, mineral resource statement for Cerro Moro which includes both Indicated and Inferred Category Mineral Resources.

The reader is cautioned that the mining study is a preliminary assessment and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the preliminary assessment will be realized. No Mineral Reserves have been estimated.

The mining study utilizes a combination of open pit and underground mining methods. The pit underground interface is determined by optimising the net value of the (mined) mineralization after mining costs have been considered. A number of different production scenarios were considered, ranging from 1,000 tpd to 1,500 tpd. However, above 1,300 tpd it becomes progressively more difficult to sustain a consistent output with the current resource. This is due to the low tonnes per metre and very high development rates associated with narrow vein mining. Both 1,300 tpd (Option A) and 1,150 tpd (Option B) are considered sustainable with the current resource and mining methods. The 1,300 tpd option is the preferred option for a higher gold-silver production profile.

The open pits will be mined by a conventional (owner-operated) method, using backhoe excavators, front end loaders and 50t mining trucks, together with the usual auxiliary support fleet such as graders bulldozers etc to produce a total material flow of between 3.5 and 7.3 million tonnes per year for the 1,300 tpd option, and between 2.8 and 7.3 million tonnes per year for the 1,150 tpd option.

The average open pit operating cost is estimated to be US$2.46 per tonne of mined material for the 1,300 tpd option and US$2.39 per tonne for the 1,150 tpd option.

In addition to the open pit study, a portion of the underground mineral resources directly below the open pits were considered to be mined using a bench and fill system. The mining analysis carried out indicate a total of 2.3 million tonnes at 7.55 g/t Au and 425.8 g/t Ag can be considered as underground mine resources.

Underground mining at Cerro Moro will be a modified Bench and Fill method that utilizes a primary decline, spiral ramps and cross cuts to access the mineralized horizon. Mining levels are spaced 12 m apart with 8 m high stope benches. The mineralized veins are drilled using hydraulic DTH equipment and the blasted mineral is removed using remote-controlled LHD’s. The mined-out stopes are backfilled with waste from development or the surface waste dumps.

The higher grade material at Cerro Moro comprises most of the indicated resources while the material estimated to have lower grades is mostly in the inferred category. The mining plan maximizes the use of the higher grade material in the early years of the Project, leaving the lower grade (inferred material) to make up the final years of production.

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 34 |

| | Year -1 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Total |

| Combined Open Pit / Underground Mine Plan | Escondida | kt | 27 100 | 232 340 | 252 881 | 177 348 | 143 688 | 76 804 | 17 362 | | | | 927 523 |

| | Au g/t | 19.6 | 14.9 | 12.1 | 13.9 | 13.3 | 12.9 | 10.6 | | | | 13.6 |

| | Ag g/t | 1202.4 | 613.4 | 453.9 | 719.6 | 588.5 | 430.8 | 342.5 | | | | 583.4 |

| Zoe | kt | | 29 800 | 120 200 | 142 800 | 132 075 | 204 525 | 96 602 | 88 700 | 52 800 | 2 870 | 870 372 |

| | Au g/t | | 9.7 | 7.4 | 7.3 | 8.4 | 7.4 | 9.9 | 9.1 | 4.9 | 6.3 | 7.9 |

| | Ag g/t | | 914.4 | 648.2 | 475.9 | 580.8 | 626.6 | 685.6 | 737.5 | 286.2 | 159.5 | 603.4 |

| Gabriela | kt | | | 79 796 | 200 271 | 135 200 | 144 144 | 141 144 | 185 475 | 153 215 | 86 338 | 1125 584 |

| | Au g/t | | | 2.0 | 2.4 | 2.2 | 2.0 | 1.5 | 2.1 | 2.2 | 1.4 | 2.0 |

| | Ag g/t | | | 272.0 | 368.2 | 354.5 | 321.8 | 242.1 | 303.7 | 326.2 | 206.3 | 309.2 |

| Esperanza | kt | | 127 066 | | | | 70 717 | 136 867 | 103 466 | 134 602 | 44 635 | 617 353 |

| | Au g/t | | 1.5 | | | | 3.0 | 2.7 | 3.4 | 3.4 | 4.7 | 2.9 |

| | Ag g/t | | 132.7 | | | | 202.3 | 223.6 | 262.5 | 230.9 | 196.6 | 208.6 |

| Carla | kt | | | | | | | | | | 13 649 | 13 649 |

| | Au g/t | | | | | | | | | | 17.4 | 17.4 |

| | Ag g/t | | | | | | | | | | 762.3 | 762.3 |

| Martina | kt | | | | 45 300 | 95 600 | 85 500 | 53 500 | 8 300 | 1 661 | | 289 861 |

| | Au g/t | | | | 9.0 | 14.1 | 12.3 | 10.0 | 7.3 | 7.0 | | 11.8 |

| | Ag g/t | | | | 52.6 | 61.5 | 48.7 | 41.3 | 36.2 | 34.1 | | 51.7 |

| Deborah | kt | | | | | | | | | 1 543 | 189 392 | 190 935 |

| | Au g/t | | | | | | | | | 2.6 | 3.0 | 3.0 |

| | Ag g/t | | | | | | | | | 60.1 | 68.5 | 68.5 |

| TOTAL | kt | 27 100 | 389 206 | 452 877 | 565 719 | 506 564 | 581 689 | 445 476 | 385 941 | 343 822 | 336 883 | 4 035 278 |

| | Au g/t | 19.6 | 10.1 | 9.1 | 7.8 | 9.2 | 7.0 | 5.1 | 4.1 | 3.1 | 3.4 | 6.9 |

| | Ag g/t | 1202.4 | 479.5 | 473.4 | 480.3 | 424.6 | 388.7 | 312.4 | 386.6 | 280.2 | 149.7 | 391.9 |

Table 4 Mine Schedule Summary for 1,300 tpd (Option A)

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 35 |

| | Year -1 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Total |

| Combined Open Pit / Underground Mine Plan | Escondida | ktonnes | 27 264 | 212 452 | 296 289 | 229 674 | 118 574 | 33 500 | 9 770 | | | | 927 523 |

| Au g/t | 19.5 | 16.1 | 13.9 | 13.3 | 8.6 | 11.3 | 7.6 | | | | 13.6 |

| Ag g/t | 1196.2 | 915.9 | 528.9 | 426.0 | 338.6 | 454.8 | 406.8 | | | | 583.4 |

| Esperanza Nini | ktonnes | | | | | 28 804 | 168 979 | 136 867 | 103 466 | 134 603 | 44 635 | 617 353 |

| Au g/t | | | | | 1.6 | 2.1 | 2.7 | 3.4 | 3.4 | 4.7 | 2.9 |

| Ag g/t | | | | | 150.5 | 158.8 | 223.6 | 262.5 | 230.9 | 196.6 | 208.6 |

| Zoe | ktonnes | | | 13 400 | 104 900 | 142 675 | 194 425 | 143 002 | 112 200 | 85 100 | 74 670 | 870 372 |

| Au g/t | | | 9.6 | 8.5 | 6.3 | 8.3 | 7.5 | 9.6 | 9.5 | 5.1 | 7.9 |

| Ag g/t | | | 991.5 | 725.8 | 462.0 | 687.2 | 539.9 | 633.6 | 750.8 | 322.4 | 603.4 |

| Martina | ktonnes | | | | 45 300 | 95 600 | 85 500 | 53 500 | 8 300 | 1 661 | | 289 861 |

| Au g/t | | | | 9.0 | 14.1 | 12.3 | 10.0 | 7.3 | 7.0 | | 11.8 |

| Ag g/t | | | | 52.6 | 61.5 | 48.7 | 41.3 | 36.2 | 34.1 | | 51.7 |

| Gabriela | ktonnes | | | 15 800 | 129 596 | 218 171 | 195 844 | 141 144 | 185 475 | 153 215 | 86 338 | 1125 584 |

| Au g/t | | | 2.6 | 2.0 | 2.4 | 2.0 | 1.5 | 2.1 | 2.2 | 1.4 | 2.0 |

| Ag g/t | | | 401.3 | 288.7 | 376.2 | 326.3 | 242.1 | 303.7 | 326.2 | 206.3 | 309.2 |

| Deborah | ktonnes | | | | | | | | | 1 543 | 189 392 | 190 935 |

| Au g/t | | | | | | | | | 2.6 | 3.0 | 3.0 |

| Ag g/t | | | | | | | | | 60.1 | 68.5 | 68.5 |

| Carla | ktonnes | | | | | | | | | | 13 649 | 13 649 |

| Au g/t | | | | | | | | | | 17.4 | 17.4 |

| Ag g/t | | | | | | | | | | 762.3 | 762.3 |

| TOTAL | ktonnes | 27 264 | 212 452 | 325 489 | 509 470 | 603 824 | 678 248 | 484 284 | 409 441 | 376 122 | 408 683 | 4 035 278 |

| Au g/t | 19.5 | 16.1 | 13.2 | 9.0 | 6.4 | 5.6 | 4.7 | 4.6 | 4.3 | 3.7 | 6.9 |

| Ag g/t | 1196.2 | 915.9 | 541.7 | 419.6 | 328.5 | 359.4 | 305.9 | 378.3 | 385.8 | 181.2 | 391.9 |

Table 5 Mine Schedule Summary for 1,150 tpd (Option B)

A general layout for the Project is shown in Figure 2

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 36 |

Figure 2 Conceptual Mine Development for Cerro Moro (Source: NCL, 2011)

| 1.7 | Metallurgical Testwork Summary |

Metallurgical test work has demonstrated that the various mineralized zones are readily amenable to cyanidation. Given the high silver to gold ratio (~60:1) a Merrill Crowe circuit was selected for precious metal recovery from solution rather than a carbon adsorption and elution circuit.

Filtration of the leached residue resulted in low filtration rates due to ultrafine clay particles in the mineralization. The mineral inventory is however amenable to thickening and counter current decantation thickening has been selected to wash the leach residue.

The Inco cyanide destruction process proved successful in reducing the weak acid dissociable (“WAD”) cyanide in the process tailings to below 8 ppm. The expected metallurgical recoveries for the mineralization are 95% for gold and 93% for silver, further testwork has been recommended to confirm recoveries for any new potential mineralized zones.

| 1.8 | Mineral Processing and Recovery Methods |

The process design targeted simplicity consistent with maximising recovery of the precious metals and the utilization of well established and proven technologies.

The comminution circuit design involves a three stage crushing circuit followed by a single stage closed circuit ball mill. Classifier overflow from the grinding circuit reports to a conventional flotation circuit to enhance recovery of gold and silver minerals for the subsequent concentrate regrind and leaching stages. The flotation tailings are to be thickened prior to being leached in a five stage leach circuit with a nominal residence time of 48 hours.

Extorre Gold Mines Limited

Cerro Moro Gold – Silver Project

Preliminary Economic Assessment | Page 37 |

The leach residue is to be washed in a 5 stage counter current decantation (“CCD”) thickening circuit with precious metals recovered from the pregnant solution by a conventional Merrill Crowe circuit. The washed residue from the CCD thickening circuit is to undergo cyanide destruction prior to thickening and tailings disposal.

Flash flotation, centrifugal gravity and conventional flotation have been incorporated in the design to recover precious metals into a concentrate that is to be re-ground prior to intensive cyanidation leaching on a continuous basis. The leached concentrate is to be filtered and washed and the resulting pregnant solution fed to the Merrill Crowe circuit for precious metal recovery. The washed filter cake is to be repulped and returned to main leaching circuit to maximise the extraction of precious metals.