Exhibit 99.1

EXTORRE GOLD MINES LIMITED

#1660 – 999 West Hastings Street

Vancouver, BC V6C 2W2

| | |

ANNUAL | | Notice of Annual Meeting of Shareholders |

| |

MEETING | | Management Information Circular |

| |

Place: | | Suite 1660 – 999 West Hastings Street Vancouver, British Columbia |

| |

Time: | | 10:00 a.m. (Vancouver Time) |

| |

Date: | | Monday, June 25, 2012 |

EXTORRE GOLD MINES LIMITED

| | |

CORPORATE DATA | | Head Office Extorre Gold Mines Limited #1660 – 999 West Hastings Street Vancouver, British Columbia V6C 2W2 |

| |

| | Directors and Officers Trevor Mulroney – President & Chief Executive Officer Bryce Roxburgh – Co-Chairman & Director Yale Simpson – Co-Chairman & Director Eric Roth – Director Ignacio Celorrio – Director James D. R. Strauss – Director Robert Reynolds – Director George Lawton – Director Darcy Daubaras – Chief Financial Officer Cecil Bond – Vice President Finance Louis G. Montpellier – Senior Vice-President & Corporate Secretary Rob Grey – Vice President, Corporate Communications Marina Trasolini – Vice President, Corporate Development |

| |

| | Registrar and Transfer Agent Computershare Investor Services Inc. 3rd Floor, 510 Burrard Street Vancouver, British Columbia Canada V6C 3B9 |

| |

| | Legal Counsel Gowling Lafleur Henderson LLP Suite 2300, 550 Burrard Street Vancouver, British Columbia Canada V6C 2B5 |

| |

| | Auditor PricewaterhouseCoopers LLP Chartered Accountants 250 Howe Street, Suite 700 Vancouver, British Columbia Canada V6C 3S7 |

| |

| | Listing Toronto Stock Exchange, Symbol “XG” NYSE MKT LLC, Symbol “XG” |

- 2 -

EXTORRE GOLD MINES LIMITED

#1660 - 999 West Hastings Street

Vancouver, BC V6C 2W2

(604) 681-9512

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting (the “Meeting”) of the shareholders (“Shareholders”) of Extorre Gold Mines Limited (hereinafter called the “Company”) will be held in the Company’s offices at Suite 1660 – 999 West Hastings Street, Vancouver, British Columbia, on Monday, June 25, 2012 at the hour of 10:00 a.m. (local time), for the following purposes:

| 1. | To receive the audited consolidated financial statements of the Company for the fiscal year ended December 31, 2011 (with comparative statements relating to the preceding fiscal period) together with the report of the auditors therein; |

| 2. | To elect six (6) directors for the ensuing year; |

| 3. | To appoint PricewaterhouseCoopers LLP as the Company’s auditor for the ensuing year and to authorize the directors to fix their remuneration; |

| 4. | To pass an ordinary resolution to ratify and approve a shareholder rights plan, as more particularly described in the accompanying information circular; and |

| 5. | To transact such further or other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

Accompanying this Notice is the Company’s Information Circular dated May 14, 2012, a form of Proxy and a Financial Statement Request Form. The accompanying Information Circular provides information relating to the matters to be addressed at the Meeting, and is incorporated into this Notice.

Registered Shareholders

Every registered holder of common shares (“Common Shares”) at the close of business on May 14, 2012 is entitled to receive notice of, and to vote such Common Shares at the Meeting.

Registered Shareholders who are unable to attend the Meeting in person and who wish to ensure that their Common Shares will be voted at the Meeting are requested to complete, sign and deliver the enclosed form of Proxy c/o Proxy Dept., Computershare Investor Services Inc. (“Computershare”), 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1. In order to be valid and acted upon at the Meeting, forms of Proxy must be returned to the aforesaid address not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time set for the holding of the Meeting or any adjournment(s) thereof. Further instructions with respect to the voting by Proxy are provided in the form of Proxy and in the Information Circular accompanying this Notice.

Non Registered Shareholders

Shareholders may beneficially own Common Shares that are registered in the name of a broker, another intermediary or an agent of that broker or intermediary (“Non Registered Shareholders”). Without specific instructions, intermediaries are prohibited from voting shares for their clients.If you are a Non Registered Shareholder, it is vital that the voting instruction form provided to you by Computershare, your broker, intermediary or its agent is returned according to the instructions provided in or with such form, sufficiently in advance of the deadline specified, to ensure that they are able to provide voting instructions on your behalf.

DATED at Vancouver, British Columbia, this 14th day of May, 2012.

BY ORDER OF THE BOARD

(signed) “Yale Simpson”

Yale Simpson

Co-Chairman and Director

EXTORRE GOLD MINES LIMITED

#1660 - 999 West Hastings Street

Vancouver, BC V6C 2W2

INFORMATION CIRCULAR

(Containing Information as at May 14, 2012 unless indicated otherwise)

SOLICITATION OF PROXIES

This information circular (the “Information Circular”) is furnished in connection with the solicitation of proxies by the management of Extorre Gold Mines Limited (the “Company”) for use at the Annual Meeting of shareholders (the “Shareholders”) of the Company (and any adjournment thereof) to be held on Monday, June 25, 2012 (the “Meeting”) at the time and place and for the purposes set forth in the accompanying Notice of Meeting. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the directors, officers and regular employees of the Company at nominal cost. All costs of solicitation by management will be borne by the Company.

The contents and the sending of this Information Circular have been approved by the directors of the Company.

APPOINTMENT OF PROXYHOLDER

The individuals named (“Management’s Nominees”) in the accompanying form of proxy (the “Proxy”) are directors and/or officers of the Company.A SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON (WHO NEED NOT BE A SHAREHOLDER) TO REPRESENT HIM AT THE MEETING HAS THE RIGHT TO DO SO, EITHER BY STRIKING OUT THE NAMES OF THOSE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY AND INSERTING THE DESIRED PERSON’S NAME IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY OR BY COMPLETING ANOTHER FORM OF PROXY. A Proxy will not be valid unless the completed form of Proxy is received by COMPUTERSHARE INVESTOR SERVICES INC. (the “Transfer Agent” or “Computershare”), Proxy Department, 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting, or any adjournment thereof. Proxies delivered after that time will not be accepted.

REVOCATION OF PROXIES

A Shareholder who has given a Proxy may revoke it by an instrument in writing executed by the Shareholder or by his attorney authorized in writing or, where the Shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered either to the registered office of the Company, at Suite 2300 – 550 Burrard Street, Vancouver, British Columbia, V6C 2B5 (Attention: Cyndi Laval), at any time up to and including the last business day preceding the day of the Meeting, with the Chairman of the Meeting on the day of the Meeting or if adjourned, any reconvening thereof, or in any other manner provided by law. A revocation of a Proxy does not affect any matter on which a vote has been taken prior to the revocation.

REGISTERED SHAREHOLDERS

Registered Shareholders may wish to vote by proxy whether or not they are able to attend the Meeting in person. Registered Shareholders electing to submit a Proxy may do so by:

| | (a) | completing, dating and signing the enclosed form of Proxy and returning it to the Company’s Transfer Agent, by mail or by hand to the 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1; |

| | (b) | using a touch-tone phone to transmit voting choices to the toll-free number indicated in the Proxy. Registered Shareholders must follow the instructions of the voice response system and refer to the enclosed Proxy form for the holder’s account number and the Proxy control number; or |

| | (c) | using the Internet through the website of the Company’s Transfer Agent atwww.investorvote.com. Registered Shareholders must follow the instructions that appear on the screen and refer to the enclosed Proxy form for the holder’s account number and the Proxy control number; |

in all cases ensuring that the proxy is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

INFORMATION FOR NON-REGISTERED SHAREHOLDERS

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most Shareholders of the Company are “non-registered” Shareholders because the Common Shares (as defined herein) they own are not registered in their names but are instead registered in the names of a brokerage firm, bank or other intermediary or in the name of a clearing agency. Shareholders who do not hold their Common Shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only registered Shareholders may vote at the Meeting. If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those Common Shares will not be registered in such Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which company acts as nominee for many Canadian brokerage firms). Common Shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted (for or against resolutions) at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting Common Shares for the brokers’ clients.Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of Proxy provided by the Company to the registered Shareholders. However, its purpose is limited to instructing the registered Shareholder (i.e. the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically prepares a machine-readable voting instruction form, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the forms to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting.A Beneficial Shareholder who receives a Broadridge voting instruction form cannot use that form to vote Common Shares directly at the Meeting. The voting instruction form must be returned to Broadridge (or instructions respecting the voting of Common Shares must be communicated to Broadridge) well in advance of the Meeting in order to have the Common Shares voted.

This Information Circular and accompanying materials are being sent to both registered Shareholders and Beneficial Shareholders. Beneficial Shareholders fall into two categories – those who object to their identity being known to the issuers of securities which they own (“Objecting Beneficial Owners”, or “OBO’s”) and those who do not object to their identity being made known to the issuers of the securities they own (“Non-Objecting Beneficial Owners”, or “NOBO’s”). Subject to the provision of National Instrument 54-101 –Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) issuers may request and obtain a list of their NOBO’s from intermediaries via their transfer agents. Pursuant to NI 54-101, issuers may obtain and use the NOBO list for distribution of Proxy-related materials directly (not via Broadridge) to such NOBO’s. If you are a Beneficial Shareholder, and the Company or its agent has sent these materials directly to you, your name, address and information about your holdings of Common Shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding the Common Shares on your behalf.

- 2 -

The Company has decided to take advantage of the provisions of NI 54-101 that permit it to deliver Proxy-related materials directly to its NOBO’s. By choosing to send these materials to you directly, the Company (and not the intermediary holding Common Shares on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. As a result if you are a NOBO of the Company, you can expect to receive a scannable Voting Instruction Form (“VIF”) from the Transfer Agent. Please complete and return the VIF to the Transfer Agent in the envelope provided. In addition, telephone voting and internet voting instructions can be found on the VIF. The Transfer Agent will tabulate the results of the VIF’s received from the Company’s NOBO’s and will provide appropriate instructions at the Meeting with respect to the shares represented by the VIF’s they receive.

The Company’s OBO’s can expect to be contacted by Broadridge or their brokers or their broker’s agents as set out above.

Although Beneficial Shareholders may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of his broker, a Beneficial Shareholder may attend the Meeting as proxyholder for the registered Shareholder and vote the Common Shares in that capacity.Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as proxyholder for the registered Shareholder should enter their own names in the blank space on the Proxy provided to them and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker.

All references to Shareholders in this Information Circular and the accompanying form of Proxy and Notice of Meeting are to Shareholders of record unless specifically stated otherwise.

VOTING OF PROXIES

The Common Shares represented by a properly executed Proxy in favour of the proposed Management Nominees as proxyholders in the accompanying form of Proxy will:

| | (a) | be voted or withheld from voting in accordance with the instructions of the person appointing the proxyholder on any ballot that may be taken; and |

| | (b) | where a choice with respect to any matter to be acted upon has been specified in the form of Proxy, be voted in accordance with the specification made in such Proxy. |

ON A POLL SUCH SHARES WILL BE VOTEDIN FAVOUR OF EACH MATTER FOR WHICH NO CHOICE HAS BEEN SPECIFIED, OR WHERE BOTH CHOICES HAVE BEEN SPECIFIED, BY THE SHAREHOLDER.

The enclosed form of Proxy when properly completed and delivered and not revoked confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. If any amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the enclosed form of Proxy to vote in accordance with their best judgment on such matters or business. At the time of the printing of this Information Circular, the management of the Company knows of no such amendment, variation or other matter that may be presented to the Meeting.

In order to approve a motion proposed at the Meeting a majority of greater than 50% of the votes cast will be required (an “ordinary resolution”) unless the motion requires a “special resolution” in which case a majority of not less than 66 2/3% of the votes cast will be required.

- 3 -

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No person who has been a director or executive officer of the Company at any time since the beginning of the last financial year, nor any proposed nominee for election as a director of the Company, nor any associate or affiliate of any of the foregoing, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon other than the election of directors or the appointment of auditors.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

| | |

Authorized Capital: | | an unlimited number of common shares without par value (“Common Shares”)an unlimited number of preferred shares |

| |

Issued and Outstanding: | | 96,919,339 (1) Common Shares Nil preferred shares |

Only Shareholders of record at the close of business on May 14, 2012 (the“Record Date”) who either personally attend the Meeting or who have completed and delivered a form of Proxy in the manner and subject to the provisions described above shall be entitled to vote or to have their Common Shares voted at the Meeting.

On a show of hands, every individual who is present and is entitled to vote as a Shareholder or as a representative of one or more corporate Shareholders will have one vote, and on a poll every Shareholder present in person or represented by a Proxy and every person who is a representative of one or more corporate Shareholders, will have one vote for each Common Share registered in that Shareholder’s name on the list of Shareholders as at the Record Date, which is available for inspection during normal business hours at Computershare and will be available at the Meeting.Shareholders represented by Proxy holders are not entitled to vote on a show of hands.

To the knowledge of the directors and executive officers of the Company, no person or company beneficially owns, directly or indirectly or exercises control or direction over Common Shares carrying 10% or more of the voting rights attached to all outstanding Common Shares of the Company.

ELECTION OF DIRECTORS

The board of directors (the “Board”) presently consists of seven (7) directors and it is intended to elect six (6) directors for the ensuing year.

According to its Articles, the Company may have a minimum of one (1) and a maximum of twelve (12) directors. The term of office of each of the present directors expires at the Meeting. The persons named below will be presented for election at the Meeting as Management’s nominees and the persons proposed by Management as proxyholders in the accompanying form of Proxy intend to vote for the election of these nominees. Management does not contemplate that any of these nominees will be unable to serve as a director. Each director elected will hold office until the next annual meeting of the Company or until his successor is elected or appointed, unless his office is earlier vacated in accordance with the By-laws of the Company or the provisions of theCanada Business Corporations Act(the “CBCA”).

The following table and notes thereto sets out the name of each person proposed to be nominated by Management for election as a director (a “proposed director”), the province or state and country in which he is ordinarily resident, all offices of the Company now held by him, his principal occupation, the period of time for which he has been a director of the Company, and the number of Common Shares of the Company beneficially owned by him, directly or indirectly, or over which he exercises control or direction, as at the date hereof.

- 4 -

| | | | | | | | |

Name, Position, Province or State and Country of Residence(1) | | Principal Occupation During Past Five Years(1) | | Director Since | | Number of

Common Shares

beneficially

owned or

controlled or

directed, directly

or indirectly(2) | |

Bryce G. Roxburgh Makati, Philippines Co-Chairman and Director | | President & CEO, Exeter Resource Corporation (“Exeter”), since September 2003; Chairman of Rugby Mining Limited since January 2007. | | March 11, 2010 | | | 4,667,250 | (6) |

| | | |

Yale R. Simpson British Columbia, Canada Co-Chairman and Director | | Chairman of Exeter since September 2003; President of Canaust Resource Consultants Ltd. (“Canaust”) since 1992. | | March 11, 2010 | | | 1,433,250 | |

| | | |

Robert G. Reynolds(3)(4)(5) N.S.W., Australia Director | | Chartered Accountant; Chairman of Alacer Gold Corp. from March, 2002 to August, 2011. | | March 11, 2010 | | | 125,000 | |

| | | |

Ignacio Celorrio Buenos Aires, Argentina Director | | Lawyer with Quevedo Abogados since November 2007; President of Malbex San Juan S.A. since 2009, Minera Cielo Azul S.A. and Inversiones Mineras Australes S.A. since 2007. | | March 11, 2010 | | | 25,000 | |

| | | |

James D.R. Strauss(3)(4)(5) London, United Kingdom Director | | Director of Strauss Partners Ltd. since November 2010; Partner of Strauss Partners LLP from April 2010 to November 2010; prior, Mr. Strauss has worked as a stockbroker in the City of London for 26 years specialising in the corporate resource arena including BMO Capital Markets as Managing Director of UK. | | September 8, 2010 | | | Nil | |

| | | |

George W. Lawton(3)(4)(5) British Columbia, Canada Director | | Chartered Accountant and Chief Financial Officer of EastCoal Inc. since April, 2012 and Chief Financial Officer of Aegis Mobility Inc. from August 2010 to December, 2011. | | September 8, 2010 | | | Nil | |

Notes:

| (1) | The information as to the province or state, as applicable, country of residence and principal occupation, not being within the knowledge of the Company, has been furnished by the respective directors individually. |

| (2) | The information as to Common Shares beneficially owned or over which a director exercises control or direction, not being within the knowledge of the Company, has been furnished by the respective directors individually. |

| (3) | Member of the Audit Committee. George Lawton is Chair. |

| (4) | Member of the Compensation Committee. Robert Reynolds is Chair. |

| (5) | Member of the Nominating and Corporate Governance Committee. James Strauss is Chair. |

| (6) | Of these Common Shares, 2,958,000 are registered in the name of Rowen Company Ltd. (“Rowen”), a private company controlled by Mr. Roxburgh. |

- 5 -

AUDIT COMMITTEE

Under National Instrument 52-110 –Audit Committees (“NI 52-110”), companies are required to provide disclosure with respect to their audit committee, including the text of the audit committee’s charter, the composition of the audit committee and the fees paid to the external auditor. This information is provided in the Company’s annual information form dated March 30, 2012 (the “AIF”) with respect to the fiscal year ended December 31, 2011. The AIF is available for review by the public on the SEDAR website located atwww.sedar.com “Company Profiles – Extorre Gold Mines Limited” and may also be obtained free of charge by sending a written request to the Company at the Company’s head office located at #1660-999 West Hastings Street, Vancouver, British Columbia, V6C 2W2.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Discussion and Analysis

The Company does not have a formal compensation program. However, the administration of the Company’s compensation mechanisms is handled by the compensation committee (the “Compensation Committee”) of the Board of the Company. The general mandate of the Compensation Committee is to examine matters relating to the compensation of the directors and executive officers of the Company with respect to (i) general compensation goals and guidelines and the criteria by which bonuses and stock compensation awards are determined; (ii) amendments to any equity compensation plans adopted by the Board and changes in the number of shares reserved for issuance thereunder; and (iii) other plans that are proposed for adoption or adopted by the Company for the provision of compensation. In accordance with the mandate, the Compensation Committee meets to discuss and determine the recommendations that it will make to the Board regarding management compensation, without reference to formal objectives, criteria or analysis. The general objectives of the Company’s compensation strategy are to (a) compensate Management in a manner that encourages and rewards a high level of performance and outstanding results with a view to increasing long-term Shareholder value; (b) align Management’s interests with the long-term interests of Shareholders; (c) provide a compensation package that is commensurate with other junior mineral exploration companies to enable the Company to attract and retain talent; and (d) ensure that the total compensation package is designed in a manner that takes into account the constraints that the Company is under by virtue of the fact that it is a junior mineral exploration company without a history of earnings.

As at December 31, 2011, the Compensation Committee was composed of George Lawton, Robert G. Reynolds and James Strauss, all of whom were independent directors, applying the definition set out in section 1.4 of NI 52-110.

The Compensation Committee considers and evaluates executive compensation levels on an annual basis against available information for “peer group” companies, which are principally comprised of “junior mineral exploration” companies, to ensure that the Company’s executive compensation levels are within the range of comparable norms. In selecting peer group companies, the Compensation Committee primarily looks for public companies that are comparable in terms of business and size. In 2011, no review of cash compensation was performed as executive compensation levels were reviewed when the existing contracts, with two year terms, for the Company’s executives were put in place effective September 1, 2010.

Currently, the principal components of the Company’s executive compensation packages are base remuneration, long-term incentive in the form of stock options, and a discretionary annual incentive cash bonus. The Company targets base remuneration, bonuses, and option based awards towards the upper range relative to peer companies for similarly experienced executives performing similar duties. Generally, awards are made within this range, although compensation is awarded above or below in cases of exceptional or poor corporate and/or individual performance or other individual factors relating to a Named Executive Officer (as defined below). The Company benchmarks against upper compensation because benchmarking allows the Company to attract and retain executives, provides an incentive for executives to strive for better than average performance to earn better than average compensation and helps the Company to manage the overall cost of management compensation.

While the Compensation Committee believes that it is important to use benchmarking data to assist it in determining appropriate ranges for executive compensation, it also considers other factors when awarding executive compensation such as the overall financial strength of the Company, its exploration successes, and equity financing success.

- 6 -

Base salary is used to provide the Named Executive Officers a set amount of money during the year with the expectation that each Named Executive Officer will perform his responsibilities to the best of his ability and in the best interests of the Company.

The granting of incentive stock options provides a link between management compensation and the Company’s share price. It also rewards management for achieving results that improve Company performance and thereby increase Shareholder value. Stock options are generally awarded to executive officers at the commencement of employment and periodically thereafter. In making a determination as to whether a grant of long-term incentive stock options is appropriate, and if so, the number of options that should be granted, consideration is given to: the number and terms of outstanding incentive stock options held by the Named Executive Officer; current and expected future performance of the Named Executive Officer; the potential dilution to Shareholders and the cost to the Company; general industry standards; and the limits imposed by the terms of the Company’s stock option plan (the “Plan”) and the Toronto Stock Exchange (the “TSX”). The Company considers the granting of incentive stock options to be a particularly important element of compensation as it allows the Company to reward each Named Executive Officer’s efforts to increase value for Shareholders without requiring the Company to use cash from its treasury. The terms and conditions of the Company’s stock option grants, including vesting provisions and exercise prices, are governed by the terms of the Plan, which are described under “Incentive Plan Awards” below.

Finally, the Compensation Committee will consider whether it is appropriate and in the best interests of the Company to award a discretionary cash bonus to the Named Executive Officers and if so, in what amount. A cash bonus may be awarded to reward extraordinary performance that has led to increased value for Shareholders through property acquisitions or divestitures, the formation of new strategic or joint venture relationships and/or capital raising efforts. Demonstrations of extraordinary personal commitment to the Company’s interests, the community and the industry may also be rewarded through a cash bonus.

- 7 -

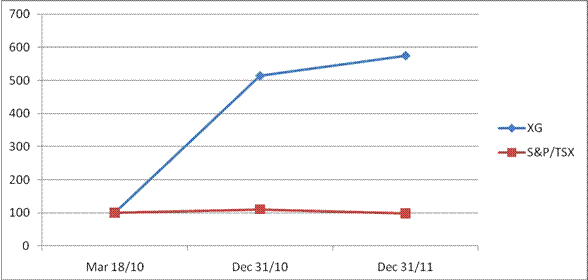

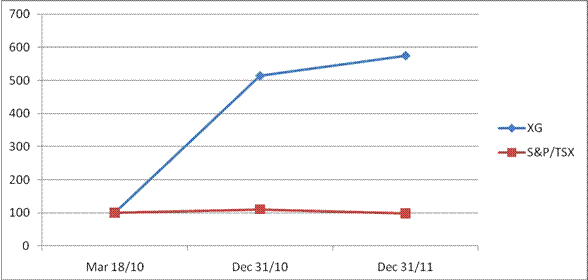

Performance Graph

The following graph compares the year-end investment value of the total cumulative Shareholder return for $100 invested in Common Shares of the Company against the cumulative total return of the S&P/TSX Composite Index since the date of public trading on the TSX (being March 18, 2010) for the two fiscal years ended December 31, 2010 and 2011.

CUMULATIVE TOTAL SHAREHOLDER RETURNS

EXTORRE GOLD MINES LIMITED (XG) VS S&P/TSX COMPOSITE INDEX

| | | | | | | | | | | | |

| | | 18-Mar-2010 | | | 31-Dec-2010 | | | 31-Dec-2011 | |

Extorre – XG | | | 100 | | | | 514 | | | | 575 | |

S&P/TSX | | | 100 | | | | 111 | | | | 99 | |

SUMMARY COMPENSATION TABLE

For the purposes of this Information Circular, a “Named Executive Officer”, or “NEO”, means each of the following individuals:

| 1. | a chief executive officer (“CEO”) of the Company; |

| 2. | a chief financial officer (“CFO”) of the Company; |

| 3. | each of the Company’s three most highly compensated executive officers of the Company including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 as determined in accordance with subsection 1.3(6) of Form 51-102F6, for the financial year ended December 31, 2011; and |

| 4. | each individual who would be a NEO under paragraph 3 but for the fact that the individual was neither an executive officer of the Company or its subsidiaries, nor acting in a similar capacity at December 31, 2011. |

- 8 -

Summary Compensation Table

During the financial year ended December 31, 2011, the Company had five (5) Named Executive Officers: Eric Roth, the former President and Chief Executive Officer, Darcy Daubaras, Chief Financial Officer, Cecil Bond, Vice President Finance, Louis Montpellier, Senior Vice-President, and Corporate Secretary and Trevor Mulroney, former Chief Operating Officer. The following table sets forth all direct and indirect compensation for, or in connection with, services provided to the Company for the three most recently completed financial years ending December 31, 2011, 2010, and 2009 in respect of the NEOs of the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and

principal

position | | Year(1) | | | Salary

($)(2) | | | Share-

based

awards

($) | | | Option-

based

awards

($)(3)(10) | | | Non-equity incentive

plan compensation($) | | | Pension

value

($) | | | All other

compensa-

tion

($) | | | Total

compensa-

tion

($)(2) | |

| | | | | | Annual

incentive

plans(4) | | | Long-term

incentive

plans(5) | | | | |

Eric Roth, (former President & CEO) | |

| 2011

2010

2009 |

| |

| 300,000

245,775 Nil | (6)

(6) | |

| Nil

Nil Nil |

| |

| Nil

1,723,448 Nil |

| |

| 75,000

Nil Nil |

| |

| Nil

Nil Nil |

| |

| Nil

Nil Nil |

| |

| Nil

Nil Nil |

| |

| 375,000

1,969,223 Nil |

|

Darcy Daubaras, CFO | |

| 2011

2010

2009 |

| |

| 100,000

60,000 Nil | (7)

(7) | |

| Nil

Nil Nil |

| |

| Nil

234,394 Nil |

| |

| 15,000

Nil Nil |

| |

| Nil

Nil Nil |

| |

| Nil

Nil Nil |

| |

| Nil

Nil Nil |

| |

| 115,000

294,394 Nil |

|

Cecil R. Bond, VP Finance | |

| 2011

2010

2009 |

| |

| 200,000

66,668 Nil | (8)

(8) | |

| Nil

Nil Nil |

| |

| Nil

664,670 Nil |

| |

| 100,000

Nil Nil |

| |

| Nil

Nil Nil |

| |

| Nil

Nil Nil |

| |

| Nil

Nil Nil |

| |

| 300,000

731,338 Nil |

|

Louis G. Montpellier, Senior VP & Corporate Secretary | |

| 2011

2010

2009 |

| |

| 200,000

66,668 N/A | (9)

(9) | |

| Nil

Nil N/A |

| |

| Nil

593,930 N/A |

| |

| 100,000

Nil N/A |

| |

| Nil

Nil N/A |

| |

| Nil

Nil N/A |

| |

| Nil

Nil N/A |

| |

| 300,000

660,598 N/A |

|

Trevor Mulroney, Chief Operating Officer | | | 2011 | | | | 119,000 | (11) | | | Nil | | | | 941,780 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | 1,060,780 | |

Notes:

| (1) | Financial years ended December 31. The Company was incorporated on December 21, 2009. All compensation is reflected from March 11, 2010, the date of completion of the Arrangement, as herein defined. |

| (2) | All amounts shown were paid in Canadian currency, the reporting currency of the Company, except for those payments made to Trevor Mulroney, which were made in US dollars. |

| (3) | The Company used the Black-Scholes option pricing model for determining the fair value of stock options issued at grant date based on the following assumptions: expected annual volatility 90% (2010 – 90%); risk-free interest rate 1.05% (2010 – 1.05%—2.20%); expected life 3 years (2010 – 3 - 3.5 years); expected dividend yield 0.0% (2010 – 0.0%). These values do not represent actual amounts received by the NEOs as the gain, if any, will depend on the market value of the shares on the date that the option is exercised. |

| (4) | The Company does not currently have a formal annual incentive plan or long term incentive plan for any of its executive officers, including its Named Executive Officers, but may award discretionary bonus payments from time to time. |

| (5) | The Company does not have any pension, retirement or deferred compensation plans, including defined contribution plans. |

| (6) | During the financial year ended December 31, 2011, Mr. Roth’s services were provided pursuant to a consulting agreement dated January 18, 2010, as described below (theRoth Consulting Agreement”). Mr. Roth resigned as CEO and President on April 16, 2012. |

| (7) | Mr. Daubaras’ services are provided pursuant to an employment agreement dated September 1, 2010, as described below (the “Daubaras Employment Agreement”). |

| (8) | Mr. Bond’s services are provided pursuant to a consulting agreement dated September 1, 2010 as described below (the “Bond Consulting Agreement”). This amount was paid to 667060 BC Ltd. (“667060”), a company controlled by Mr. Bond, for management fees. |

| (9) | Mr. Montpellier’s services are provided pursuant to a consulting agreement dated September 1, 2010, as described below (the “Montpellier Consulting Agreement”). This amount was paid to Patrocinium Services Corporation (“Patrocinium”), a company wholly-owned by Mr. Montpellier for consulting fees. |

- 9 -

| (10) | Also see “Outstanding Option - Based Awards” for details of options granted by Exeter to the NEOs and assumed by the Company on completion of the Arrangement (see “Interests of Informed Persons in Material Transactions” for a description of the Arrangement). |

| (11) | Mr. Mulroney’s services are provided pursuant to a consulting agreement dated September 22, 2011 (the “Mulroney Consulting Agreement”). This amount was paid to Pact Mining Pty. Ltd. (“Pact”), a company controlled by Mr. Mulroney. Mr. Mulroney was appointed President and Chief Executive Officer of the Company on April 16, 2012. |

Consulting/Employment Agreements

The Company entered into consulting agreements dated as of and effective from September 1, 2010 with certain individuals (including certain NEOs), namely, Messrs. Roxburgh, Bond, Simpson, and Montpellier, and the companies through which their services are provided.

The Company entered into the Roth Consulting Agreement on January 18, 2010, with Eric Roth (“Roth”) pursuant to which Roth provided his services as President and Chief Executive Officer of the Company. Pursuant to the Roth Consulting Agreement, the Company paid Roth a monthly consulting fee of $25,000 for Roth’s services, and reimbursed Roth for any reasonable travelling and other direct expenses incurred by Roth in connection with the services. Roth was also eligible for an additional annual payment (the “Annual Bonus”) based on performance in each fiscal year to be paid in accordance with terms approved by the Board in each such year. The Roth Consulting Agreement had a term of two years, and upon expiry, was eligible for an automatic renewal for a further two years unless the Company gave 90 days’ notice otherwise. Mr. Roth resigned as President and CEO on April 16, 2012.

The Company entered into the Daubaras Employment Agreement with Darcy Daubaras (“Daubaras”) on September 1, 2010 pursuant to which Daubaras provides the services of Chief Financial Officer of the Company. The Company pays Daubaras an annual salary of $100,000 and reimburses Daubaras for any reasonable travelling and other direct expenses incurred by Daubaras in connection with the services. Daubaras is also eligible for an Annual Bonus based on performance in each fiscal year to be paid in accordance with terms approved by the Board in each such year.

The Company entered into a consulting agreement on September 1, 2010 (the “Roxburgh Consulting Agreement”) with Rowen of Hong Kong, a company controlled by Bryce Roxburgh (“Roxburgh”). Pursuant to the Roxburgh Consulting Agreement, Rowen provides the services of Roxburgh to the Company, and provides for Roxburgh to serve as a director of the Company and to hold the office of Co-Chairman of the Company at the pleasure of the Board. The Company pays Rowen a monthly consulting fee of $11,667 for Roxburgh’s services and reimburses Roxburgh for any reasonable travelling and other direct expenses incurred by Rowen in connection with the services. Roxburgh is also eligible for an Annual Bonus based on performance in each fiscal year to be paid in accordance with terms approved by the Board in each such year.

The Company entered into a consulting agreement on September 1, 2010 (the “Simpson Consulting Agreement”) with Canaust, of Vancouver, British Columbia and Yale Simpson (“Simpson”). Pursuant to the Simpson Consulting Agreement, Canaust provides the services of Yale Simpson to the Company, and provides for Simpson to serve as a director of the Company and to hold the office of Co-Chairman at the pleasure of the Board. Canaust is controlled by Simpson. The Company pays Canaust a monthly consulting fee of $14,583 for Simpson’s services and reimburses Simpson for any reasonable travelling and other direct expenses incurred by Simpson in connection with the services. Simpson is also eligible for an Annual Bonus based on performance in each fiscal year to be paid in accordance with terms approved by the Board in each such year.

The Company entered into the Bond Consulting Agreement on September 1, 2010 with 667060, of Vancouver, British Columbia and Cecil Bond (“Bond”). Pursuant to the Bond Consulting Agreement, 667060 provides the services of Bond to the Company, and provides for Bond to serve as Vice President Finance of the Company at the pleasure of the Board. 667060 is controlled by Bond. The Company pays 667060 a monthly consulting fee of $16,667 for Bond’s services and reimburses Bond for any reasonable travelling and other direct expenses incurred by Bond in connection with the services. Bond is also eligible for an Annual Bonus based on performance in each fiscal year to be paid in accordance with terms approved by the Board in each such year.

- 10 -

The Company entered into the Montpellier Consulting Agreement on September 1, 2010 with Patrocinium of Vancouver, British Columbia, and Louis Montpellier (��Montpellier”). Pursuant to the Montpellier Consulting Agreement, Patrocinium provides the services of Montpellier to the Company, and provides for Montpellier to serve as an executive officer of the Company at the pleasure of the Board. Patrocinium is controlled by Montpellier. The Company pays Patrocinium a monthly consulting fee of $16,667 for Montpellier’s services and reimbursement of any reasonable travelling and other direct expenses incurred by Montpellier in connection with the services. Montpellier is also eligible for an Annual Bonus based on performance in each fiscal year to be paid in accordance with terms approved by the Board in each such year.

The Company entered into the Mulroney Consulting Agreement dated September 22, 2011 with Pact pursuant to which Pact provided the services of Trevor Mulroney (“Mulroney”) to the Company, to serve as Chief Operating Officer of the Company at the pleasure of the Board. Pact is controlled by Mulroney. The Company pays Pact a monthly consulting fee of US$35,000 for Mulroney’s services and reimbursement of any reasonable travelling and other direct expenses incurred by Mulroney in connection with the services. On April 16, 2012, the parties agreed to amend the Mulroney Consulting Agreement to provide for Mulroney to change his role from Chief Operating Officer to President and Chief Executive Officer of the Company in consideration for a monthly consulting fee of US$35,000 and the reimbursement of reasonable travelling and other expenses.

See “Termination and Change of Control Benefits” below.

INCENTIVE PLAN AWARDS

Outstanding Option-Based Awards

The following table sets forth for the NEOs, the incentive stock options (option-based awards), pursuant to the Plan, outstanding as at December 31, 2011. As at December 31, 2011, 5,077,500 of these option-based awards have vested.

| | | | | | | | | | | | | | |

| | | Option-based Awards | |

Name | | Number of

securities

underlying

unexercised

options

(#) | | | Option

exercise price

($) | | | Option expiration

date | | Value of unexercised

in-the-money options

($)(1) | |

Eric Roth | |

| 50,000

800,000 50,000 112,500 | (2)

(2) | | $

$

$

$ | 1.06

1.45

4.60

6.80 |

| | September 28, 2014

February 1, 2015

September 3, 2015

December 16, 2015 | | | 5,416,125 | |

Darcy Daubaras | |

| 132,900

20,000

56,250 | (2)

| | $

$

$ | 0.38

2.04

6.80 |

| | November 7, 2013

March 26, 2015

December 16, 2015 | | | 1,101,098 | |

Cecil R. Bond | |

| 50,000

100,000 400,000 150,000 60,000 65,000 112,500 | (2)

(2) (2) (2) | | $

$ $ $ $ $ $ | 0.60

0.60 0.60 1.45 2.04 4.60 6.80 |

| | June 27, 2012

November 13, 2012February 27, 2014 February 1, 2015 March 26, 2015 September 3, 2015 December 16, 2015 | | | 5,325,475 | |

Louis G. Montpellier | |

| 200,000

500,000

65,000

112,500 |

| | $

$

$

$ | 0.60

1.45

4.60

6.80 |

| | January 23, 2013

February 1, 2015 September 3, 2015 December 16, 2015 | | | 4,698,575 | |

Trevor Mulroney | | | 200,000 | | | $ | 8.89 | | | October 13, 2016 | | | Nil | |

- 11 -

| (1) | In-the-money options are those where the market value of the underlying securities as at the most recent financial year end exceeds the option exercise price. This amount is calculated as the difference between the market value of the Common Shares underlying the options on December 31, 2011, being the last trading day of the Company’s Common Shares for the financial year, which was $7.53, and the exercise price of the option. Except for 100,000 options exercised by Mr. Simpson at an exercise price of $0.63, 132,900 options exercised by Mr. Daubaras at an exercise price of $0.38, 200,000 options exercised by Mr. Montpellier at an exercise price of $0.60 and 300,000 options exercised by Mr. Bond at an exercise price of $0.60 subsequent to the year end, these options have not been and may never be, exercised and actual gains, if any, on exercise will depend on the market value of the underlying securities on the date of exercise. |

| (2) | These options were originally granted by Exeter, and were assumed by the Company in connection with the Arrangement, as hereinafter defined. These options have the same expiry date as the original Exeter options and the exercise price was determined on the basis of the relative volume weighted average trading price of Exeter and the Company during the first five trading days after the completion of the Arrangement, being 21%, applied to the original option price. |

Subsequent to the year ended December 31, 2011, no stock options have been granted to the NEOs.

Incentive Plan Awards – Value Vested or Earning During The Year

The following table sets forth for the NEOs, the value vested during the financial year ended on December 31, 2011 for options awarded under the Plan, as well as the value earned under non-equity incentive plans for the same period.

| | | | | | | | | | | | |

Name | | Option-based awards-

Value vested during

the year

($)(1) | | | Share-based awards -

Value vested during

the year

($) | | | Non-equity incentive

plan compensation -

Value earned during

the year

($) | |

Eric Roth | | | 1,247,282 | | | | Nil | | | | N/A | |

Darcy Daubaras | | | 123,287 | | | | Nil | | | | N/A | |

Cecil R. Bond | | | 709,769 | | | | Nil | | | | N/A | |

Louis G. Montpellier | | | 4,524,919 | | | | Nil | | | | N/A | |

Trevor Mulroney | | | Nil | | | | Nil | | | | N/A | |

| (1) | Value vested during the year is calculated by subtracting the market price of the Company’s Common Shares on the date the option vested (being the closing price of the Company’s Common Shares on the TSX on the last trading day prior to the vesting date) from the exercise price of the option. |

- 12 -

TERMINATION AND CHANGE OF CONTROL BENEFITS

Termination and Change of Control Benefits

Other than as set forth below, as at the financial year ended December 31, 2011, the Company did not have any contract, agreement, plan or arrangement that provides for payments to a Named Executive Officer at, following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement, a change in control of the Company or a change in the NEO’s responsibilities.

The consulting agreements with each of Rowen, 667060, Canaust and Patrocinium have a term of two years, and upon expiry, will automatically be extended for a further two years unless the Company gives notice 180 days before expiry that it will not extend the agreement. Each of Rowen, 667060, Canaust, or Patrocinium, as applicable, may terminate the consulting agreements prior to the expiry of the term by giving 30 days’ written notice to the Company. The consulting agreements with each of Rowen, 667060, Canaust and Patrocinium contain the following provisions:

| | • | the Company may terminate the agreement prior to the expiry of the term by giving notice to Rowen, 667060, Canaust, or Patrocinium, as applicable, whereupon the Company will pay Rowen, 667060, Canaust, or Patrocinium, as applicable, a lump sum equal to 24 times the monthly consulting fee under the agreement plus an amount equivalent to the highest Annual Bonus paid in any one of the immediately preceding two years. If no such Annual Bonus has been paid then the deemed Annual Bonus will be fifty (50) per cent of the annual fee paid to Rowen, 667060, Canaust, or Patrocinium, as applicable; |

| | • | where termination notice is delivered by either Rowen, 667060, Canaust, Patrocinium or the Company, as applicable, within the 90-day period following a Change of Control, as hereinafter defined, except where such Change of Control occurs only as a result of the Company completing a financing in the ordinary course of business, then the Company will pay Rowen, 667060, Canuast and Patrocinium, as applicable, a lump sum amount equal to 30 months’ consulting fee plus 2 times the Annual Bonus or deemed Annual Bonus, and all stock options granted to Roxburgh, Bond, Simpson, and Montpellier, as applicable, will vest immediately and Roxburgh, Bond, Simpson, and Montpellier, as applicable, shall be entitled to exercise the stock options at any time during the lesser of the remaining term of the stock options or 185 days; |

| | • | the Company may respectively terminate each consulting agreement without notice upon the occurrence of any of the following events: |

| | (a) | the consultant’s respective conviction of a crime (indictable level or penalized by incarceration or a lesser crime related to the provision of the services), or any act involving money or other property of the Company and its subsidiaries that would constitute a crime in the jurisdiction involved; or |

| | (b) | Rowen, 667060, Canaust, or Patrocinium respectively is dissolved, liquidated or formally wound up; or |

- 13 -

Pursuant to the Daubaras Employment Agreement between the Company and Daubaras, where termination notice is delivered by either Daubaras or the Company within the 90-day period following a Change of Control, as hereinafter defined, except where such Change of Control occurs only as a result of the Company completing a financing in the ordinary course of business, then the Company will pay Daubaras, a lump sum amount equal to 12 months’ salary at the rate being paid at the time of termination, and all the stock options held by Daubaras will vest immediately. Such severance amount shall remain the same for the first year of the employment agreement and following the first anniversary of the employment agreement the lump sum severance will increase to:

| | (a) | 14 months’ salary up to the second anniversary of the employment agreement; |

| | (b) | 16 months’ salary following the second anniversary of the employment agreement up to the third anniversary of the Daubaras Employment Agreement; and |

| | (c) | thereafter 18 months’ salary. |

The Daubaras Employment Agreement has an indefinite term, and may be terminated by Daubaras, as applicable, upon 30 days’ written notice to the Company. The Company may terminate the agreement by giving notice to Daubaras, whereupon the Company will pay Daubaras a lump sum equal to 6 months’ salary at the rate being paid at the time of termination. Pursuant to the employment agreement with Daubaras, the Company may terminate the agreement without notice upon the occurrence of any of the following events:

| | (a) | Daubaras’ conviction of a crime (indictable level or penalized by incarceration or a lesser crime related to the provision of the services), or any act involving money or other property of the Company and its subsidiaries that would constitute a crime in the jurisdiction involved; or |

| | (b) | for just cause that would in law permit the Company to, without notice, terminate the employment of Daubaras; |

whereupon Daubaras shall not be entitled to a severance payment but shall be entitled to receive the full amount of the instalments falling due in respect of Daubaras’ annual salary through to the date of the notice of termination plus an amount of any accrued holiday pay, and the amount, if any, of any awards previously made to Daubaras, as applicable which have not been paid.

The Mulroney Consulting Agreement has a term of 12 months and may be terminated by Pact upon 30 days’ written notice to the Company. The Company may terminate the agreement by giving notice to Pact, whereupon the Company will pay to Pact a lump sum equal to three times the monthly fee or the remainder of the term whichever is longer. Pursuant to the Mulroney Consulting Agreement, the Company may terminate the agreement without notice upon the occurrence of any of the following events:

| | (a) | Pact’s or Mulroney’s conviction of a crime (indictable level or penalized by incarceration or a lesser crime related to the provision of the services), or any act involving money or other property of the Company and its subsidiaries that would constitute a crime in the jurisdiction involved; or |

| | (b) | If Pact is dissolved, liquidated or formally wound up; or |

whereupon Pact or Mulroney shall not be entitled to a severance payment but shall be entitled to receive the full amount of the instalments falling due in respect of Pact or Mulroney’s fees and expenses owing through to the date of the notice of termination and all stock options will terminate.

“Change of Control” is defined in the consulting agreements with Rowen, 667060, Canaust and Patrocinium and the Daubaras Employment Agreement as:

| | (i) | the sale, transfer or disposition of the majority of the Company’s assets in liquidation or dissolution of the Company; or |

| | (ii) | the Company amalgamates, merges or enters into a plan of arrangement with another company at arm’s length to the Company and its affiliates, other than an amalgamation, merger or plan of arrangement that would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving or resulting entity) more than 50% of the combined voting power of the surviving or resulting entity outstanding immediately after such amalgamation, merger or plan of arrangement; or |

- 14 -

| | (iii) | any Person or combination of Persons at arm’s length to the Company and its affiliates acquires or becomes the beneficial owner of, directly or indirectly, more than 20% of the voting securities of the Company, whether through the acquisition of previously issued and outstanding voting securities, or of voting securities that have not been previously issued, or any combination thereof, or any other transaction having a similar effect, and such Person or combination of Persons exercise(s) the voting power attached to such securities in a manner that causes the incumbent directors to cease to constitute a majority of the Board; or |

| | (iv) | any Person or combination of Persons at arm’s length to the Company and its affiliates acquires or becomes the beneficial owner of, directly or indirectly, more than 50% of the voting securities of the Company, whether through the acquisition of previously issued and outstanding voting securities, or of voting securities that have not been previously issued, or any combination thereof, or any other transaction having a similar effect; or |

| | (v) | the removal, by extraordinary resolution of the shareholders of the Company, of more than 51 % of the then Incumbent Directors of the Company, or the election of a majority of directors to the Board who were not nominees of the incumbent Board at the time immediately preceding such election. |

“Incumbent Director” means any member of the Board who was a member of the Board prior to the occurrence of the transaction, transactions or elections giving rise to a Change of Control and any successor to an Incumbent Director who was recommended or elected or appointed to succeed an Incumbent Director by the affirmative vote of a majority of the Incumbent Directors then on the Board.

“Person” means any individual, partnership, limited partnership, joint venture, syndicate, sole proprietorship, company or corporation with or without share capital, unincorporated association, trust, trustee, executor, administrator or other legal personal representative, regulatory body or agency, government or governmental agency or entity however designated or constituted.

If a severance payment triggering event had occurred on December 31, 2011, the severance payments that would be payable to each of the Named Executive Officers and Rowen, 667060, Canaust, Patrocinium and Pact would have been approximately as follows:

| | | | | | | | |

Name | | Termination by the Company for

any reason other than cause and

unrelated to “Change of Control”

of the Company (estimated)

($) | | | Termination by the Company

without cause after a “Change of

Control” of the Company

(estimated)

($) | |

Roth (Eric Roth) | | | Nil | | | | Nil | |

Rowen (Bryce G. Roxburgh) | | | 405,000 | | | | 600,000 | |

667060 (Cecil R. Bond) | | | 500,000 | | | | 700,000 | |

Canaust (Yale R. Simpson) | | | 425,000 | | | | 587,500 | |

Patrocinium (Louis G. Montpellier) | | | 500,000 | | | | 700,000 | |

Darcy Daubaras | | | 50,000 | | | | 116,667 | |

Pact (Trevor Mulroney) | | | 315,000 | | | | 315,000 | |

Total | | | 2,195,000 | | | | 3,019,167 | |

- 15 -

DIRECTOR COMPENSATION

During 2011 directors were not compensated for their services, other than through the granting of incentive stock options. Effective January 1 2012, non-executive directors will receive fees totaling $50,000 per annum payable quarterly. The granting of incentive stock options provides a link between director compensation and the Company’s share price. Stock options are generally awarded to directors when they are first elected by the shareholders or appointed by the Board and periodically thereafter. In making a determination as to whether a grant of long term incentive stock options is appropriate, and if so, the number of options that should be granted, consideration is given to: the number and terms of outstanding incentive stock options held by the director; current and expected future contribution of the director; the potential dilution to shareholders and the cost to the Company; general industry standards; and the limits imposed by the terms of the Plan and the TSX. The Company considers the granting of incentive stock options to be a particularly important element of compensation as it allows the Company to reward each director’s efforts to increase value for shareholders without requiring the Company to use cash from its treasury.

Director Compensation Table

The following table sets forth all amounts of compensation provided to the directors for the Company’s most recently completed financial year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees

Earned

($) | | | Share-

based

awards

($) | | | Option-

based

awards

($)(1)(2) | | | Non-equity

incentive

plan

compensation

($) | | | Pension

value

($) | | | All other

compensation

($) | | | Total

($) | |

Bryce G. Roxburgh(3) | | | 140,000 | | | | Nil | | | | Nil | | | | 125,000 | | | | Nil | | | | Nil | | | | 265,000 | |

Yale R. Simpson(3) | | | 175,000 | | | | Nil | | | | Nil | | | | 75,000 | | | | Nil | | | | Nil | | | | 250,000 | |

Robert Reynolds | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | N/A | | | | Nil | | | | Nil | |

Ignacio Celorrio | | | 125,000 | (4) | | | Nil | | | | Nil | | | | Nil | | | | N/A | | | | Nil | | | | 125,000 | |

James Strauss | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | N/A | | | | Nil | | | | Nil | |

George Lawton | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | N/A | | | | Nil | | | | Nil | |

| (1) | Figures represent the grant date fair value of the options. The Company used the Black-Scholes option pricing model for determining the fair value of stock options issued at grant date based on the following assumptions: expected annual volatility 90%; risk-free interest rate 1.05%; expected life 3 years; expected dividend yield 0.0%. These amounts do not represent actual amounts received by the directors as any gain, if any, will depend on the market value of the shares on the date that the option is exercised. |

| (2) | Also see “Outstanding Option-Based Awards” for details of options granted by Exeter to the directors and assumed by the Company on completion of the Arrangement, as defined herein. |

| (3) | See “Consulting/Employment Agreements and “Termination and Change of Control Benefits” for further particulars. |

| (4) | Commencing April 1, 2011, Mr. Celorrio was paid a retainer of $12,500 per month. |

- 16 -

Outstanding Option-Based Awards

The following table sets forth for each director all awards outstanding at the end of the most recently completed financial year, including awards granted before the most recently completed financial year. As at December 31, 2011 a portion of these option-based awards have vested.

| | | | | | | | | | | | | | |

| | | Option-based Awards | |

Name | | Number of securities

underlying

unexercised options

(#) | | | Option exercise

price ($) | | | Option expiration

date | | Value of unexercised

in-the-money options

($)(1) | |

Bryce G. Roxburgh | |

| 100,000

150,000 400,000 250,000 65,000 150,000 180,000

112,500 | (2)

(2) (2) (2)

| | $

$ $ US$ $ $ $ $ | 0.60

0.60 0.60 0.62 2.04 2.98 4.60 6.80 |

| | June 27, 2012

November 13, 2012

February 27, 2014

July 17, 2014

March 26, 2015

June 24, 2015

September 3, 2015

December 16, 2015 | | | 7,880,875 | |

Yale R. Simpson | |

| 100,000

100,000 150,000 400,000 65,000 135,000 180,000 112,500 | (2)

(2) (2) (2) | | $

$ $ $ $ $ $ $ | 0.63

0.60 0.60 0.60 2.04 2.98 4.60 6.80 |

| | February 3, 2012

June 27, 2012 November 13, 2012 February 27, 2014 March 26, 2015 June 24, 2015 September 3, 2015 December 16, 2015 | | | 6,775,125 | |

Robert Reynolds | |

| 200,000

50,000 25,000 65,000 56,250 | (2)

(2) | | $

$ $ $ $ | 0.60

0.60 2.04 4.60 6.80 |

| | June 27, 2012

November 13, 2012 March 26, 2015 September 3, 2015 December 16, 2015 | | | 2,101,263 | |

Ignacio Celorrio | |

| 25,000

100,000 50,000 56,250 | (2)

(2) | | $

$ $ $ | 1.06

1.45 4.60 6.80 |

| | September 28, 2014

February 1, 2015 September 3, 2015 December 16, 2015 | | | 957,313 | |

James Strauss | |

| 270,000

56,250 | (3)

| | $

$ | 5.06

6.80 |

| | September 8, 2015

December 16, 2015 | | | 707,963 | |

George Lawton | |

| 150,000

56,250 | (3)

| | $

$ | 5.06

6.80 |

| | September 8, 2015

December 16, 2015 | | | 391,031 | |

| (1) | Value is calculated based on the difference between the exercise price of the option and the closing price of the Company’s Common Shares on the TSX on December 31, 2011, being the last trading day of the Company’s Common Shares for the financial year, which was $7.53. |

| (2) | These options were originally granted by Exeter, and were assumed by the Company in connection with the Arrangement, as hereinafter defined. These options have the same expiry date as the original Exeter options and the exercise price was determined on the basis of the relative volume weighted average trading price of Exeter and the Company during the first five trading days after the completion of the Arrangement, being 21%, applied to the original option price. |

| (3) | These options vest as to 75,000 six months from the date of appointment as a director on September 8, 2010 and an additional 75,000 each six months thereafter, with all such options having vested on that date which is two years from the date of appointment as a director, subject to such director continuing as such for the duration of such period and the other terms of the Plan. |

- 17 -

Incentive Plan Awards – Value Vested or Earned During The Year

The following table sets forth, for each director, other than those who are also NEOs of the Company, the value of all incentive plan awards vested during the year ended December 31, 2011.

| | | | | | | | | | | | |

Name (a) | | Option-based awards-

Value vested during

the year

($)(1)

(b) | | | Share-based awards -

Value vested during

the year

($)

(c) | | | Non-equity incentive

plan compensation -

Value earned during

the year

($)

(d) | |

Bryce G. Roxburgh | | | 1,471,600 | | | | Nil | | | | N/A | |

Yale R. Simpson | | | 1,404,250 | | | | Nil | | | | N/A | |

Robert Reynolds | | | 304,181 | | | | Nil | | | | N/A | |

Ignacio Celorrio | | | 861,641 | | | | Nil | | | | N/A | |

James Strauss | | | 530,482 | | | | Nil | | | | N/A | |

George Lawton | | | 530,482 | | | | Nil | | | | N/A | |

| (1) | Value vested during the year is calculated by subtracting the market price of the Company’s Common Shares on the date the option vested (being the closing price of the Company’s Common Shares on the TSX on the last trading day prior to the vesting date) from the exercise price of the option. |

A description of the significant terms of the Plan is found under the heading “Equity Compensation Plan Information”.

DISCLOSURE OF CORPORATE GOVERNANCE PRACTICE

National Instrument 58-101,Disclosure of Corporate Governance Practices(“NI 58-101”) requires reporting issuers to disclose the corporate governance practices, on an annual basis, that they have adopted. The Company’s approach to corporate governance is provided in Schedule “A”.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

At no time during the Company’s last completed financial year or as of May 14, 2012 was any director, executive officer, employee, proposed management nominee for election as a director of the Company, nor any associate of any such director, executive officer, or proposed management nominee of the Company, or any former director, executive officer or employee of the Company or any of its subsidiaries, indebted to the Company or any of its subsidiaries, or indebted to another entity where such indebtedness was the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or any of its subsidiaries.

- 18 -

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Equity Compensation Plan Information

The following table provides information regarding compensation plans under which securities of the Company are authorized for issuance to directors, officers, employees and consultants in effect as of the end of the Company’s most recently completed fiscal year end:

Equity Compensation Plan Information

| | | | | | | | | | | | |

Plan Category | | Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

(a) | | | Weighted-Average Exercise

Price of Outstanding

Options, Warrants and

Rights

(b) | | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (a))

(c) | |

Equity Compensation Plans Approved By Securityholders | | | 10,343,213 | (1) | | $ | 3.13 | | | | 3,541,827 | |

Equity Compensation Plans Not Approved By Securityholders | | | Nil | | | | N/A | | | | N/A | |

Total | | | 10,343,213 | | | $ | 3.13 | | | | 3,541,827 | |

| (1) | This number represents 5,061,313 options granted by the Company, as well as 5,281,900 options exercisable for Common Shares which obligations were assumed by the Company in connection with the Arrangement. Pursuant to the Arrangement, on March 11, 2010, the Shareholders of Exeter approved the Plan. |

The Company has adopted the Plan which provides for equity participation in the Company by eligible directors, officers, employees and consultants through the acquisition of Common Shares pursuant to the grant of options to purchase Common Shares. The purpose of the Plan is to attract and retain superior directors, officers, employees, consultants and other person or companies engaged to provide ongoing services to the Company as an incentive for such persons to put forth maximum effort for the continued success and growth of the Company and in connection with these goals, to encourage their participation in the performance of the Company.

The aggregate maximum number of Common Shares available for issuance from treasury under the Plan and all of the Company’s other security based compensation arrangements at any given time is 15% of the issued and outstanding Common Shares as at the date of grant of an option, subject to certain adjustments. As a “rolling” plan, the Plan contains an “evergreen” feature whereby any options which has been granted under the Plan and which have been exercised or which have been cancelled, repurchased, expired or terminated in accordance with the terms of the Plan will automatically “reload” and be available for future grants under the Plan. The TSX requires that plans containing an “evergreen” feature be submitted to Shareholders for ratification every three years. The Plan was instituted and approved by Exeter Shareholders prior to the completion of the Arrangement. The Plan will next require re-approval at the Company’s 2013 annual meeting.

The Plan provides that stock options may be granted only to eligible persons, being directors, officers, employees and consultants of the Company and any of its affiliates, and to consultant companies.

The Plan may be terminated by the Board at any time, but such termination will not alter the terms or conditions of any option awarded prior to the date of such termination. Any stock option outstanding when the Plan is terminated will remain in effect until it is exercised or expires or is otherwise terminated in accordance with the provisions of the Plan.

The Plan provides that other terms and conditions may be attached to a particular stock option, and any vesting schedule as determined by the Board. Such vesting, terms and conditions to be referred to in a schedule attached to the option certificate.

The Plan provides that it is solely within the discretion of the Board to determine who should receive stock options and in what amounts. The Board may issue a majority of the options to insiders of the Company. However, unless the Company has received disinterested Shareholder approval, in no case will the number of Common Shares reserved for issuance and issuable within a one-year period to insiders, and issuable to insiders at any time, under the Plan, or when combined with all of the Company’s other security-based compensation arrangements, exceed 10% of issued and outstanding Common Shares.

- 19 -

Options awarded under the Plan will be for a term not to exceed ten years from their award date. Unless the Company otherwise decides, in the event an option holder ceases to be a director, officer, consultant or employee of the Company other than by reason of death, his or her option will expire on the earlier of the expiry date stated in the option certificate (the “Fixed Expiry Date”) and the 90th day following termination of his or her relationship with the Company. Notwithstanding the foregoing, an option will expire immediately in the event a relationship with a director, officer, employee or consultant is terminated for cause (as such term is defined in the Plan). In the event of the death of an option holder, his or her option will expire six months after the date of death or on the Fixed Expiry Date, whichever is earlier. In the event of a change of control of the Company, the Board may, in its sole discretion, deal with outstanding options in the manner it deems fair and reasonable in light of the circumstances.

Except in respect of options that were granted pursuant to the Arrangement, as hereinafter defined, the minimum exercise price of any options issued under the Plan will be the last daily closing price per Common Share on the TSX on the trading day immediately preceding the grant date.

The price at which an option holder may purchase a Common Share upon the exercise of an option will be as set forth in the option certificate issued in respect of such option and in any event will not be less than the market price of the Company’s Common Shares as of the date of the award of the stock option (the “Award Date”). The market price of the Company’s Common Shares for a particular Award Date would typically be the closing trading price of the Company’s Common Shares on the last trading day immediately preceding the Award Date and if there was no sale on the TSX on such date, then the last sale prior thereto, or otherwise in accordance with the terms of the Plan.

Options may not be assigned or transferred with the exception of assignments to a personal representative of a participant: (i) where they are unable to manage their own affairs; or (ii) on the death of the participant.

Under the terms of the Plan, if an option expires during a period in which a trading black-out period is imposed by the Company to restrict trades in the Company’s securities, the option will expire ten business days after the black-out period is lifted by the Company.

The Board may, subject to the approval of any regulatory authority, and the approval of Shareholders where required by such regulatory authority, amend the Plan or any option at any time. Subject to the policies of the TSX, the Board may, at any time, without obtaining the approval of the Shareholders, amend the Plan or any option granted thereunder, in the following circumstances:

| | (a) | amendments of a “housekeeping nature including, but not limited to, of a clerical grammatical or typographical nature; |

| | (b) | to correct any defect, supply any information or reconcile any inconsistency in the Plan in such manner and to such extent as shall be deemed necessary or advisable to carry out the purposes of the Plan; |

| | (c) | a change to the vesting provisions of the any option or the Plan; |

| | (d) | amendments to reflect any changes in requirements of any regulator or stock exchange to which the Company is subject; |

| | (e) | a change to the termination provisions of an option which does not result in an extension beyond the original term of the option; |

| | (f) | in the case of any option, the substitutions and/or adjustments contemplated under the adjustment provisions of the Plan; |

| | (g) | the addition of a cashless exercise feature, payable in cash or securities of the Company; and |

| | (h) | a change to the class of eligible persons that may participate under the Plan, |

- 20 -

provided that, in the case of any option, no such amendment may, without the consent of the participant, materially decrease the rights or benefit accruing to such participant or materially increase the obligations of such participant. Specific disinterested Shareholder approval is required for any reduction in the exercise price of an option or any extension of the term of an option for an optionee who is an insider at the time of the proposed amendment.

Subject to any required action by the Shareholders and any necessary approval of the regulatory authorities, the exercise price and the number of Common Shares which are subject to an option may be adjusted from time to time for share dividends, in the event of arrangement, amalgamation, or other similar procedure or otherwise, or a share recapitalization, subdivision or consolidation, and any other change that the board in its sole discretion, determines equitable requires and adjustment to be made.

There are no stock appreciation rights (“SAR”) associated with options granted under the Plan and there is no provision under the Plan to transform stock options into stock appreciation rights.