State Bank Financial Corporation 1st Quarter 2016 Earnings Presentation Joe Evans, Chairman and CEO Tom Wiley, Vice Chairman and President Sheila Ray, EVP and Chief Financial Officer David Black, EVP and Chief Credit Officer April 28, 2016

2 Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “will,” “expect,” “should,” “anticipate,” “may,” and “project,” as well as similar expressions. These forward-looking statements include, but are not limited to, statements related to our expected revenue trends, including the impact of expanding our SBA lending team, statements regarding our proposed acquisition of NBG Bancorp (“NBG”) and its subsidiary, including expected costs to be incurred and costs savings to be realized in connection with the transaction, the expected impact of the transaction on our future financial performance (including anticipated accretion to earnings per share, the tangible book value earn-back period and pro forma TCE ratio), the assumed purchase accounting adjustments, loan marks and other key transaction assumptions, statements regarding our net noninterest expense target, and other statements about expected developments or events, our future financial performance, and the execution of our strategic goals. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions (“risk factor”) that are difficult to predict with regard to timing, extent, likelihood and degree. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. We undertake no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events or otherwise. Risk factors including, without limitation, the following: • completion of the transaction with NBG is dependent on, among other things, receipt of regulatory approvals and NBG shareholder approval, the timing of which cannot be predicted and which may not be received at all; • the impact of the completion of the transaction with NBG on our financial statements will be affected by the timing of the transaction; • the transaction may be more expensive to complete and the anticipate benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events; • the integration of NBG’s business and operations into ours may be more costly than anticipated or have unanticipated adverse results related to NBG’s or our existing businesses; • our ability to achieve anticipated results from the transaction with NBG will depend on the state of the economic and financial markets going forward; • our failure to integrate our new SBA lending team as expected and their inability to transition their current clients to our platform; • general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a reduction in demand for credit and a decline in real estate values; • a general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results; • restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • competitive pressures among depository and other financial institutions may increase significantly; • changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; • other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; • our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry; • adverse changes may occur in the bond and equity markets; • war or terrorist activities may cause deterioration in the economy or cause instability in credit markets; and • economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate. In addition, risk factors include, but are not limited to, the risk factors described in Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently ended fiscal year. These and other risk factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a forward- looking statement.

3 Additional Information About the Merger and Where to Find It In connection with the proposed merger transaction, State Bank Financial will file a registration statement on Form S-4 with the SEC to register State Bank Financial’s shares that will be issued to NBG Bancorp, Inc.’s shareholders in connection with the transaction. The registration statement will include a proxy statement of NBG Bancorp, Inc. and a prospectus of State Bank Financial, as well as other relevant documents concerning the proposed transaction. The registration statement and the proxy statement/prospectus to be filed with the SEC related to the proposed transaction will contain important information about State Bank Financial, NBG Bancorp, Inc. and the proposed transaction and related matters. WE URGE SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT AND PROXY/PROSPECTUS WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT AND PROXY/PROSPECTUS) BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Security holders may obtain free copies of these documents and other documents filed with the SEC on the SEC’s website at http://www.sec.gov. Security holders may also obtain free copies of the documents filed with the SEC by State Bank Financial at its website at https://www.statebt.com (which website is not incorporated herein by reference) or by contacting Jeremy Lucas by telephone at 404.239.8626. State Bank Financial and their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of NBG Bancorp, Inc. in connection with the proposed merger. Information regarding these persons who may, under the rules of the SEC, be considered participants in the solicitation of shareholders in connection with the proposed merger will be provided in the proxy statement/prospectus described above when it is filed with the SEC. Additional information regarding State Bank Financial’s directors and executive officers is included in State Bank Financial’s definitive proxy statement for 2016, which was filed with the SEC on April 15, 2016. You can obtain free copies of this document from State Bank Financial using the contact information above.

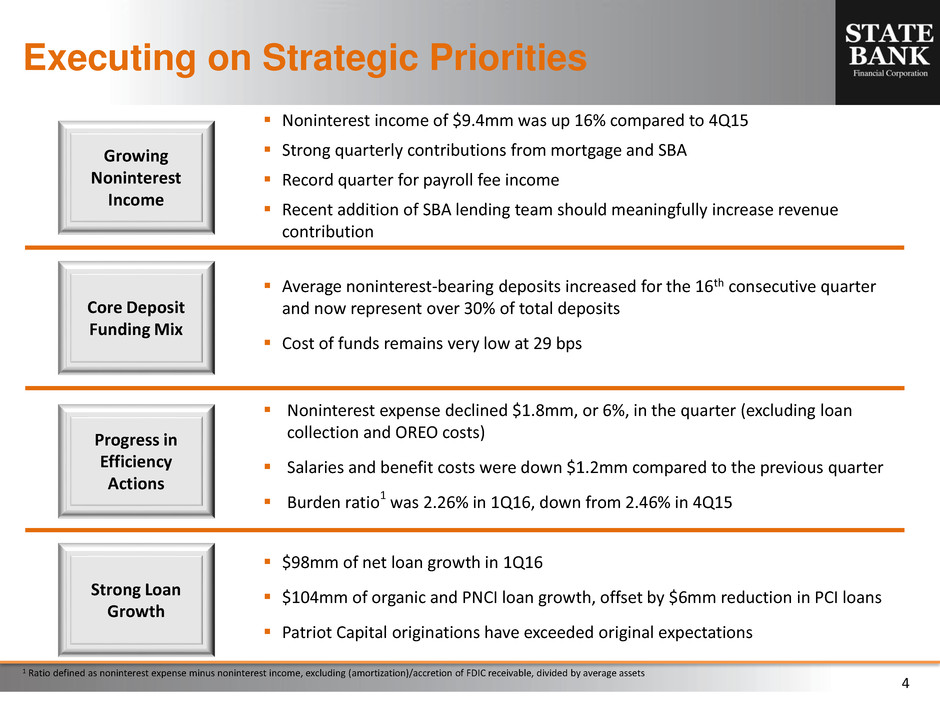

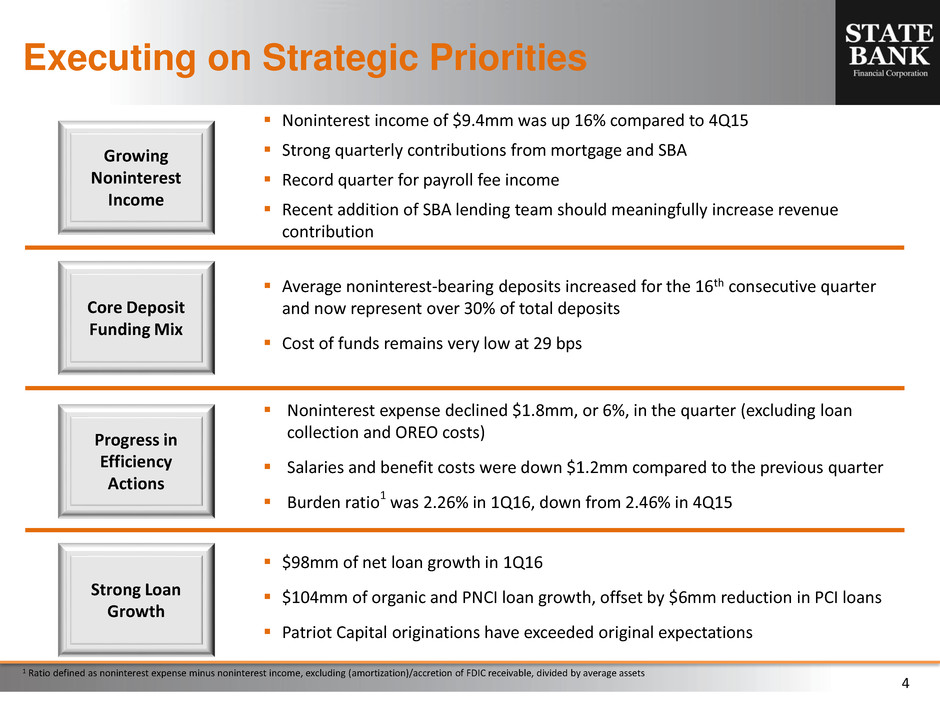

4 Executing on Strategic Priorities Growing Noninterest Income Core Deposit Funding Mix Progress in Efficiency Actions Noninterest income of $9.4mm was up 16% compared to 4Q15 Strong quarterly contributions from mortgage and SBA Record quarter for payroll fee income Recent addition of SBA lending team should meaningfully increase revenue contribution Average noninterest-bearing deposits increased for the 16th consecutive quarter and now represent over 30% of total deposits Cost of funds remains very low at 29 bps Noninterest expense declined $1.8mm, or 6%, in the quarter (excluding loan collection and OREO costs) Salaries and benefit costs were down $1.2mm compared to the previous quarter Burden ratio1 was 2.26% in 1Q16, down from 2.46% in 4Q15 Strong Loan Growth $98mm of net loan growth in 1Q16 $104mm of organic and PNCI loan growth, offset by $6mm reduction in PCI loans Patriot Capital originations have exceeded original expectations 1 Ratio defined as noninterest expense minus noninterest income, excluding (amortization)/accretion of FDIC receivable, divided by average assets

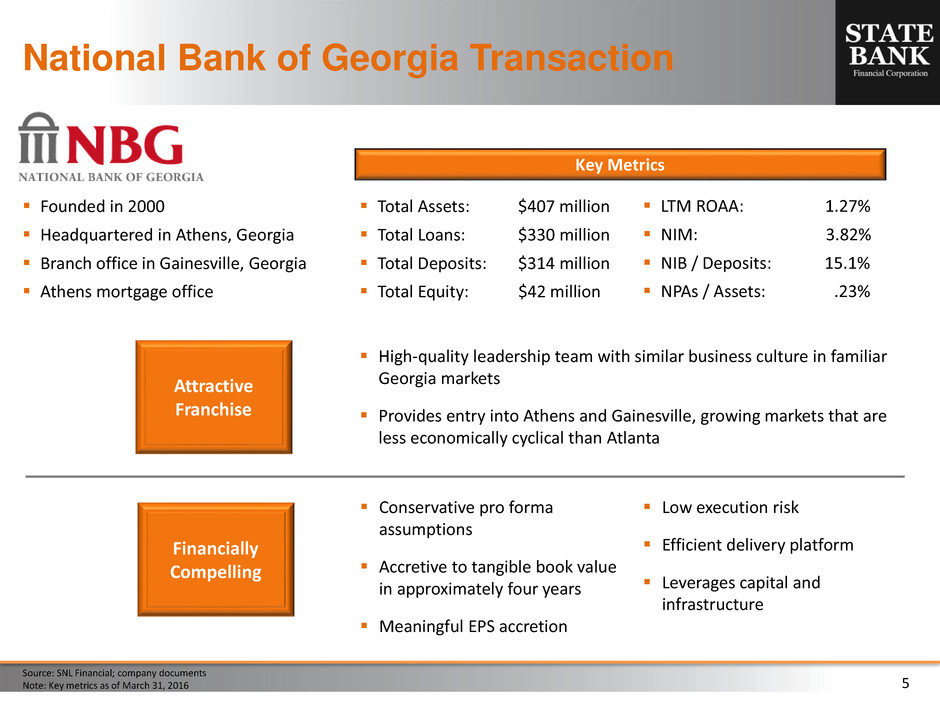

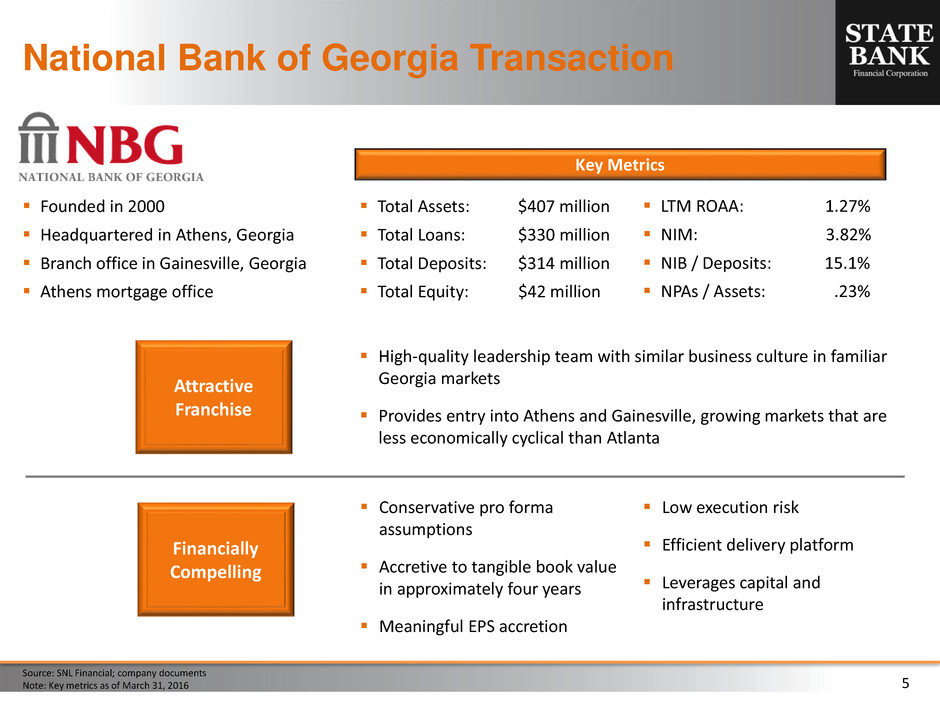

5 National Bank of Georgia Transaction Source: SNL Financial; company documents Note: Key metrics as of March 31, 2016 Founded in 2000 Headquartered in Athens, Georgia Branch office in Gainesville, Georgia Athens mortgage office Total Assets: $407 million Total Loans: $330 million Total Deposits: $314 million Total Equity: $42 million LTM ROAA: 1.27% NIM: 3.82% NIB / Deposits: 15.1% NPAs / Assets: .23% Key Metrics Financially Compelling Conservative pro forma assumptions Accretive to tangible book value in approximately four years Meaningful EPS accretion Attractive Franchise High-quality leadership team with similar business culture in familiar Georgia markets Provides entry into Athens and Gainesville, growing markets that are less economically cyclical than Atlanta Low execution risk Efficient delivery platform Leverages capital and infrastructure

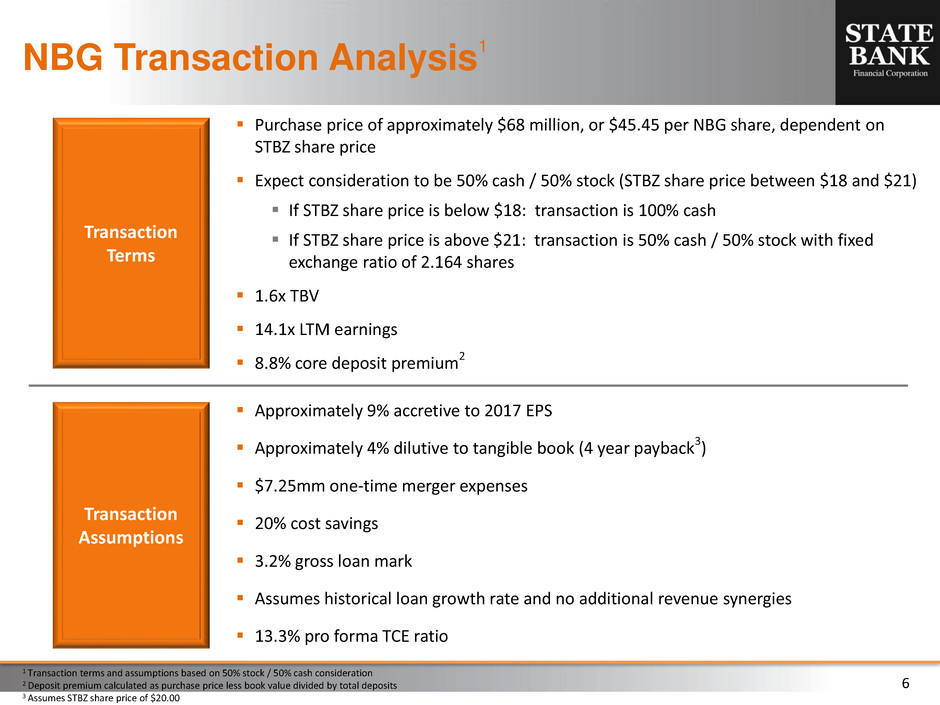

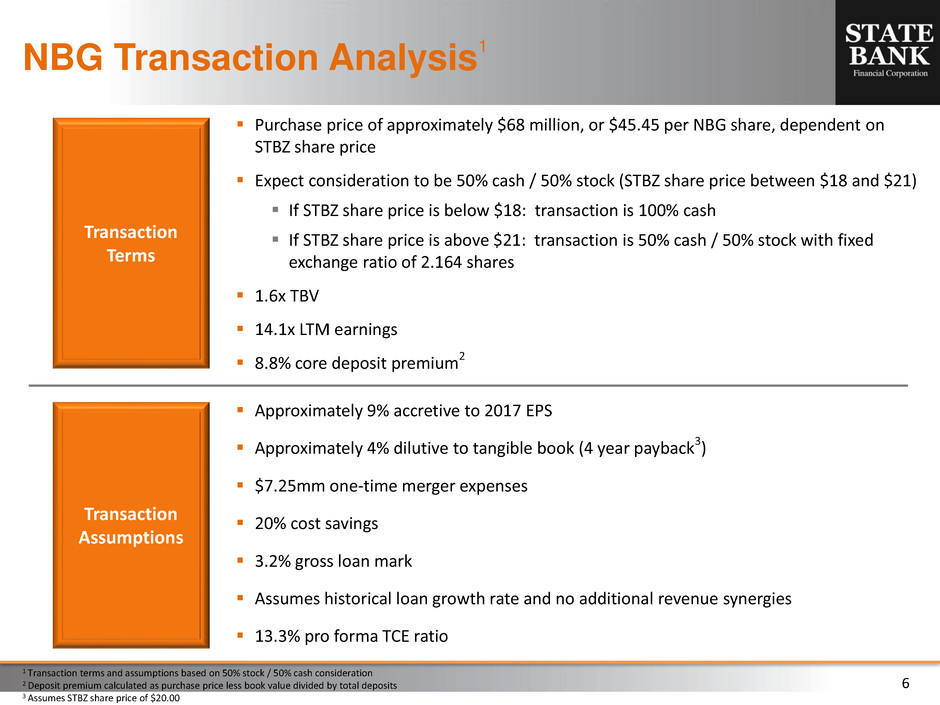

6 NBG Transaction Analysis 1 1 Transaction terms and assumptions based on 50% stock / 50% cash consideration 2 Deposit premium calculated as purchase price less book value divided by total deposits 3 Assumes STBZ share price of $20.00 Transaction Assumptions Approximately 9% accretive to 2017 EPS Approximately 4% dilutive to tangible book (4 year payback3) $7.25mm one-time merger expenses 20% cost savings 3.2% gross loan mark Assumes historical loan growth rate and no additional revenue synergies 13.3% pro forma TCE ratio Transaction Terms Purchase price of approximately $68 million, or $45.45 per NBG share, dependent on STBZ share price Expect consideration to be 50% cash / 50% stock (STBZ share price between $18 and $21) If STBZ share price is below $18: transaction is 100% cash If STBZ share price is above $21: transaction is 50% cash / 50% stock with fixed exchange ratio of 2.164 shares 1.6x TBV 14.1x LTM earnings 8.8% core deposit premium2

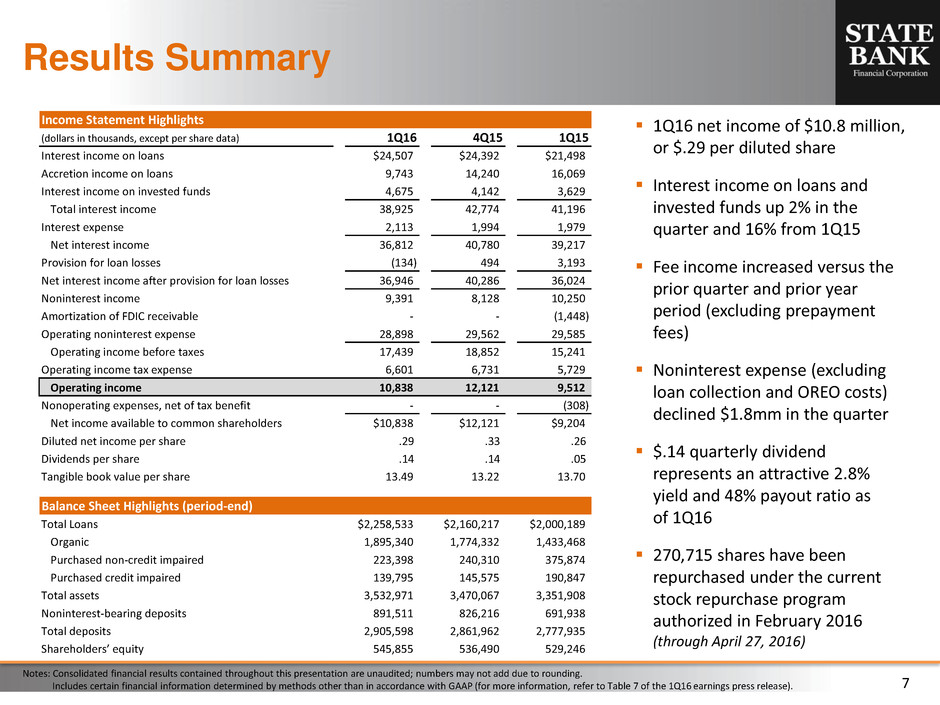

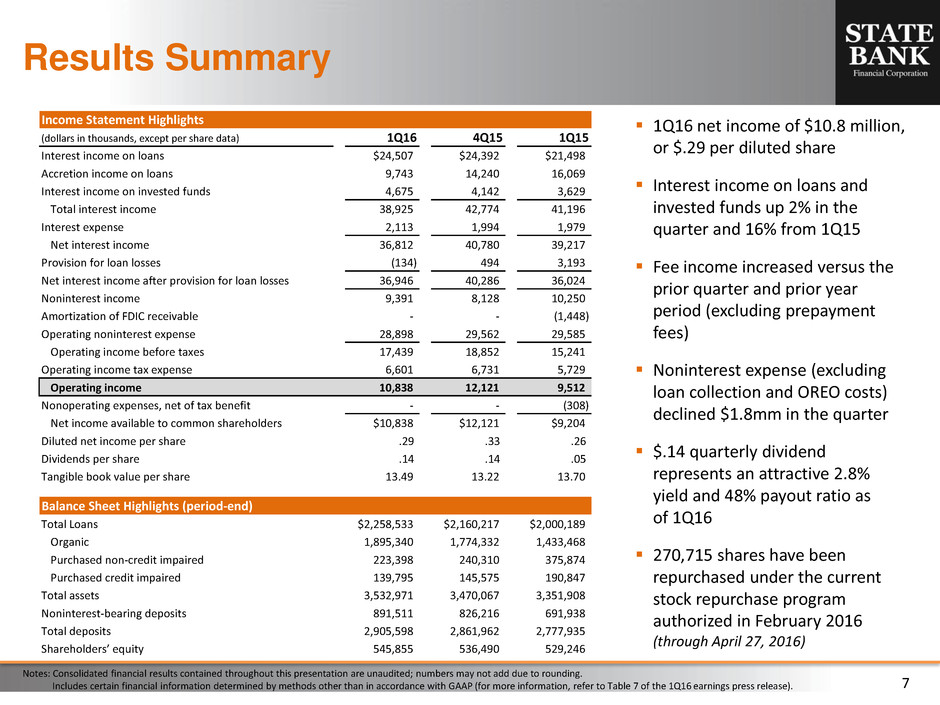

7 Results Summary Notes: Consolidated financial results contained throughout this presentation are unaudited; numbers may not add due to rounding. Includes certain financial information determined by methods other than in accordance with GAAP (for more information, refer to Table 7 of the 1Q16 earnings press release). 1Q16 net income of $10.8 million, or $.29 per diluted share Interest income on loans and invested funds up 2% in the quarter and 16% from 1Q15 Fee income increased versus the prior quarter and prior year period (excluding prepayment fees) Noninterest expense (excluding loan collection and OREO costs) declined $1.8mm in the quarter $.14 quarterly dividend represents an attractive 2.8% yield and 48% payout ratio as of 1Q16 270,715 shares have been repurchased under the current stock repurchase program authorized in February 2016 (through April 27, 2016) Income Statement Highlights (dollars in thousands, except per share data) 1Q16 4Q15 1Q15 Interest income on loans $24,507 $24,392 $21,498 Accretion income on loans 9,743 14,240 16,069 Interest income on invested funds 4,675 4,142 3,629 Total interest income 38,925 42,774 41,196 Interest expense 2,113 1,994 1,979 Net interest income 36,812 40,780 39,217 Provision for loan losses (134) 494 3,193 Net interest income after provision for loan losses 36,946 40,286 36,024 Noninterest income 9,391 8,128 10,250 Amortization of FDIC receivable - - (1,448) Operating noninterest expense 28,898 29,562 29,585 Operating income before taxes 17,439 18,852 15,241 Operating income tax expense 6,601 6,731 5,729 Operating income 10,838 12,121 9,512 Nonoperating expenses, net of tax benefit - - (308) Net income available to common shareholders $10,838 $12,121 $9,204 Diluted net income per share .29 .33 .26 Dividends per share .14 .14 .05 Tangible book value per share 13.49 13.22 13.70 Balance Sheet Highlights (period-end) Total Loans $2,258,533 $2,160,217 $2,000,189 Organic 1,895,340 1,774,332 1,433,468 Purchased non-credit impaired 223,398 240,310 375,874 Purchased credit impaired 139,795 145,575 190,847 Total assets 3,532,971 3,470,067 3,351,908 Noninterest-bearing depo its 891,511 826,216 691,938 Total deposits 2,905,598 2,861,962 2,777,935 Shareholders’ equity 545,855 536,490 529,246

8 20,000 22,000 24,000 26,000 28,000 30,000 1Q15 2Q15 3Q15 4Q15 1Q16 Interest Income 1 Continue to replace accretion income with interest income from organic and purchased non-credit impaired portfolios Total interest income (excluding accretion) of $29.0mm in 1Q16, is up $4.0mm, or 16%, from 1Q15 ($ i n t h o u sa n d s) Revenue Trends ($ i n t h o u sa n d s) First quarter 2016 mortgage production of $117mm, leading to a 13% year-over-year increase in fee income to $3.0mm SBA team production of $20.5mm in 1Q16, leading to total SBA income of $1.5mm, a 34% year-over-year increase Record quarter for payroll fee income, which increased 15% year-over-year to $1.3mm as number of clients increased 9% year-over-year 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 1Q15 2Q15 3Q15 4Q15 1Q16 Noninterest Income Key Initiatives Mortgage SBA Payroll 1 Excludes accretion income on loans

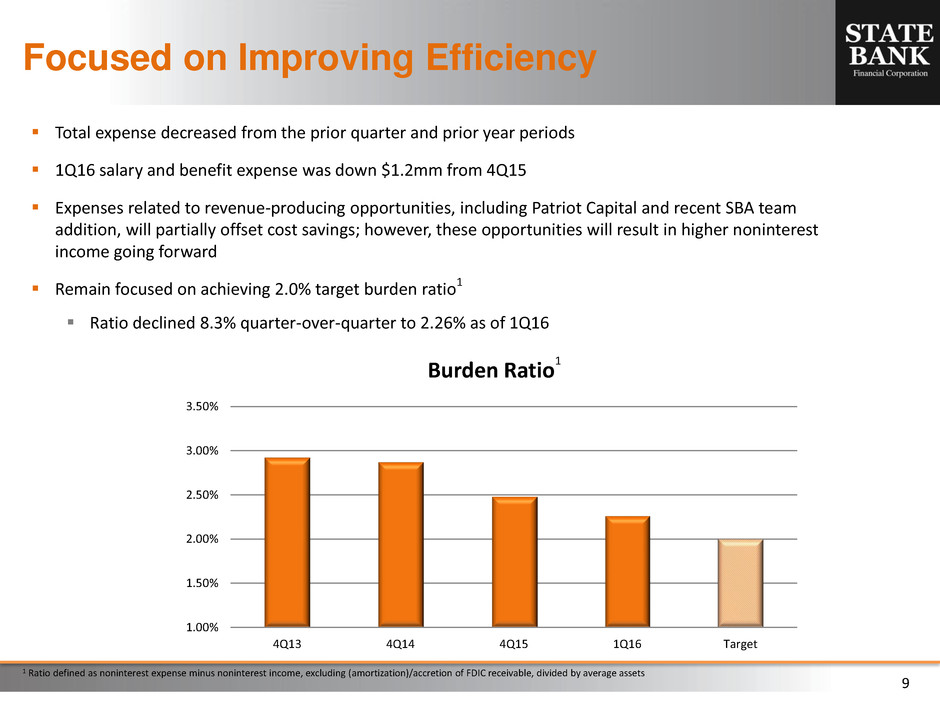

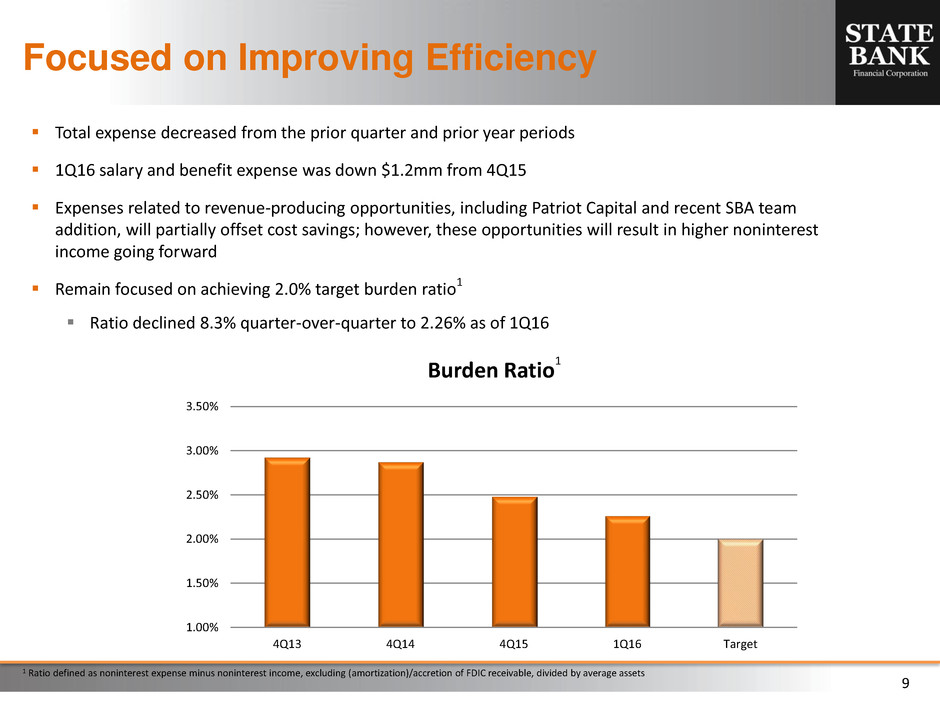

9 Focused on Improving Efficiency Total expense decreased from the prior quarter and prior year periods 1Q16 salary and benefit expense was down $1.2mm from 4Q15 Expenses related to revenue-producing opportunities, including Patriot Capital and recent SBA team addition, will partially offset cost savings; however, these opportunities will result in higher noninterest income going forward Remain focused on achieving 2.0% target burden ratio1 Ratio declined 8.3% quarter-over-quarter to 2.26% as of 1Q16 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4Q13 4Q14 4Q15 1Q16 Target Burden Ratio 1 1 Ratio defined as noninterest expense minus noninterest income, excluding (amortization)/accretion of FDIC receivable, divided by average assets

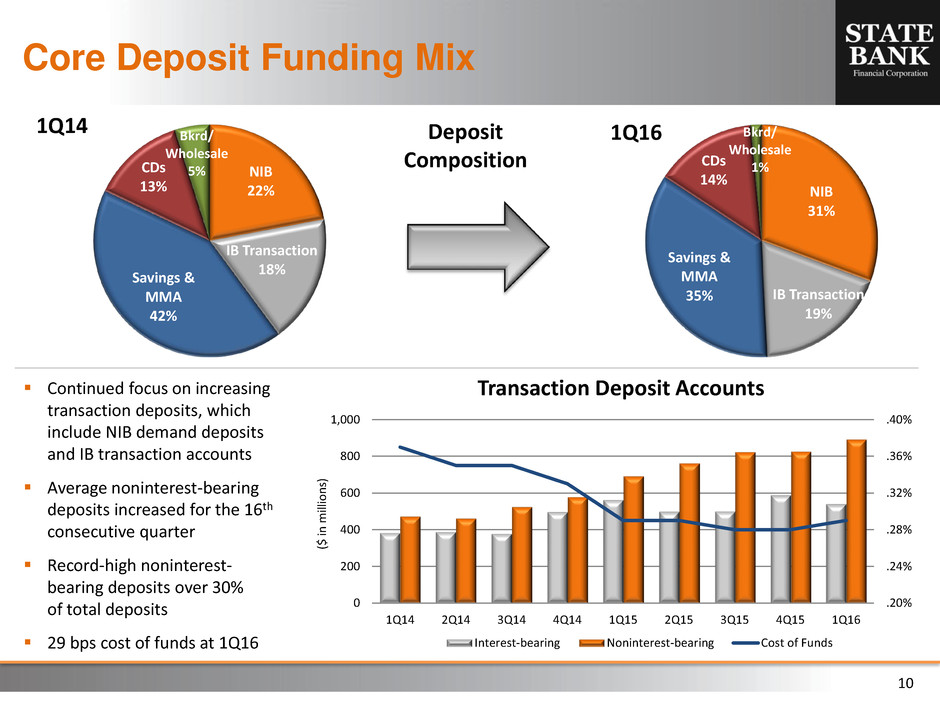

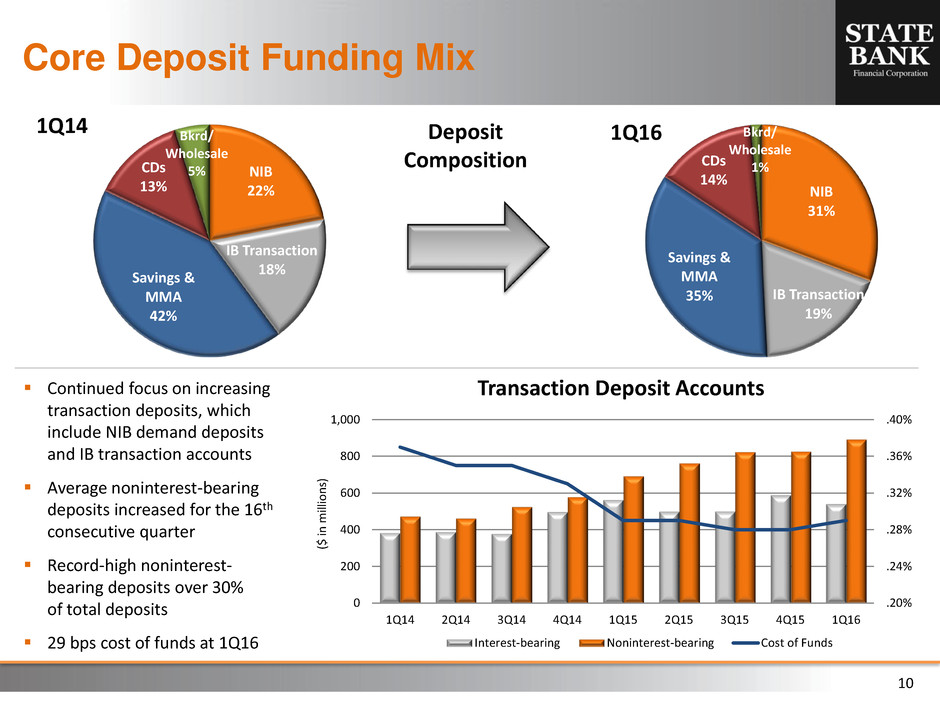

10 Core Deposit Funding Mix Continued focus on increasing transaction deposits, which include NIB demand deposits and IB transaction accounts Average noninterest-bearing deposits increased for the 16th consecutive quarter Record-high noninterest- bearing deposits over 30% of total deposits 29 bps cost of funds at 1Q16 ($ i n mi llio n s) Deposit Composition .20% .24% .28% .32% .36% .40% 0 200 400 600 800 1,000 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Transaction Deposit Accounts Interest-bearing Noninterest-bearing Cost of Funds NIB 31% IB Transaction 19% Savings & MMA 35% CDs 14% Bkrd/ Wholesale 1% 1Q16 NIB 22% IB Transaction 18% Savings & MMA 42% CDs 13% Bkrd/ Wholesale 5% 1Q14

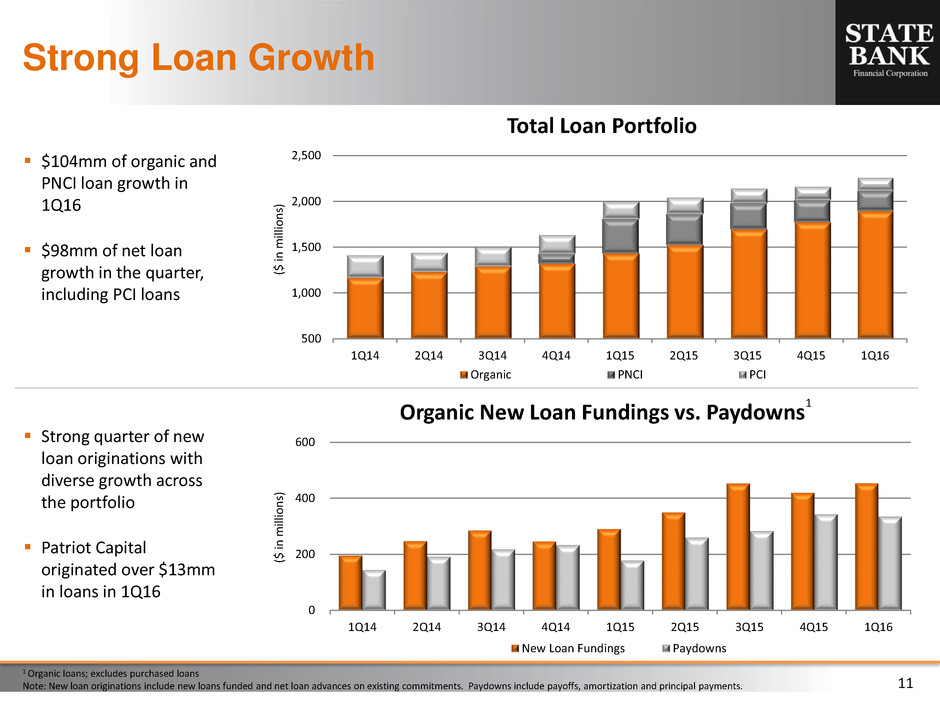

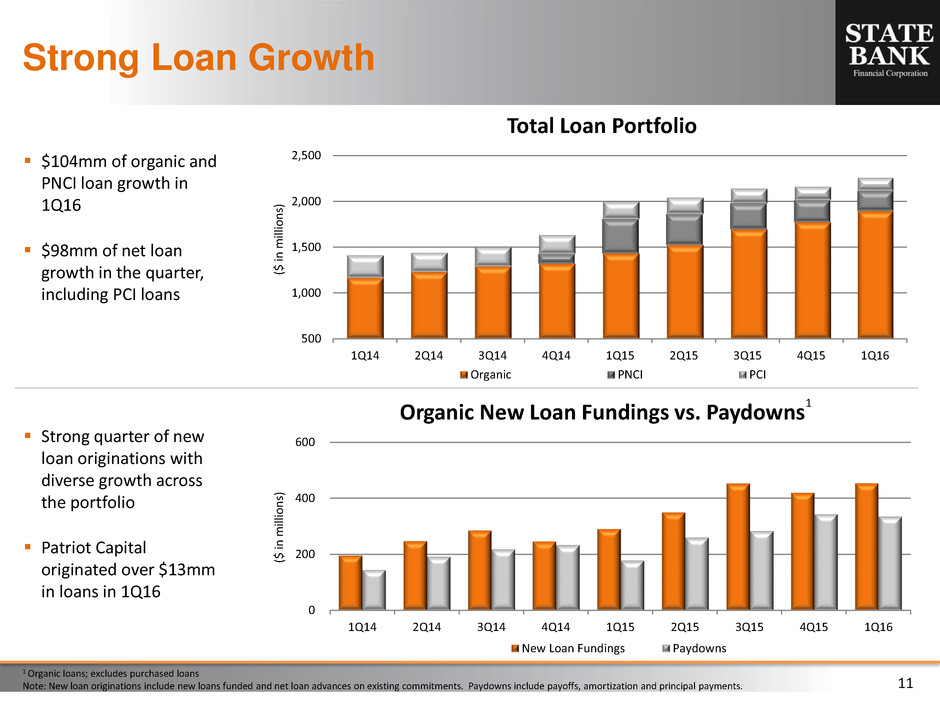

11 Strong Loan Growth ($ i n mi llio n s) ($ i n mi llio n s) 1 Organic loans; excludes purchased loans Note: New loan originations include new loans funded and net loan advances on existing commitments. Paydowns include payoffs, amortization and principal payments. Strong quarter of new loan originations with diverse growth across the portfolio Patriot Capital originated over $13mm in loans in 1Q16 $104mm of organic and PNCI loan growth in 1Q16 $98mm of net loan growth in the quarter, including PCI loans 500 1,000 1,500 2,000 2,500 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Total Loan Portfolio Organic PNCI PCI 0 200 400 600 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Organic New Loan Fundings vs. Paydowns 1 New Loan Fundings Paydowns

12 Loan Mix Changes Enhancing Diversity Significant industry, client, source of repayment, and geographic diversity in the CRE portfolio Construction, land & land development comprises both commercial and residential construction, which make up 39% and 31%, respectively, of the AD&C portfolio Conversion of commercial construction projects led to the contraction in AD&C and partially contributed to other CRE growth in the quarter Leases and commercial, financial & agricultural loans grew 33% during the quarter 4Q15 Organic PNCI 1Q16 Construction, land & land development $500,685 ($29,433) ($4,639) $466,613 Other c mmercial real estate 735,568 58,278 (4,062) 789,784 Total commercial real estate 1,236,253 28,845 (8,701) 1,256,397 Reside tial real estate 209,666 (120) (3,105) 206,441 Owner-occupied real estate 280,949 2,711 (3,794) 279,866 Commercial, financial & agricultural 195,729 67,679 (901) 262,507 Leases 71,539 21,951 — 93,490 Consumer 20,506 (58) (411) 20,037 Total Organic & PNCI Loans $2,014,642 $121,008 ($16,912) $2,118,738 (Qtr/Qtr D)

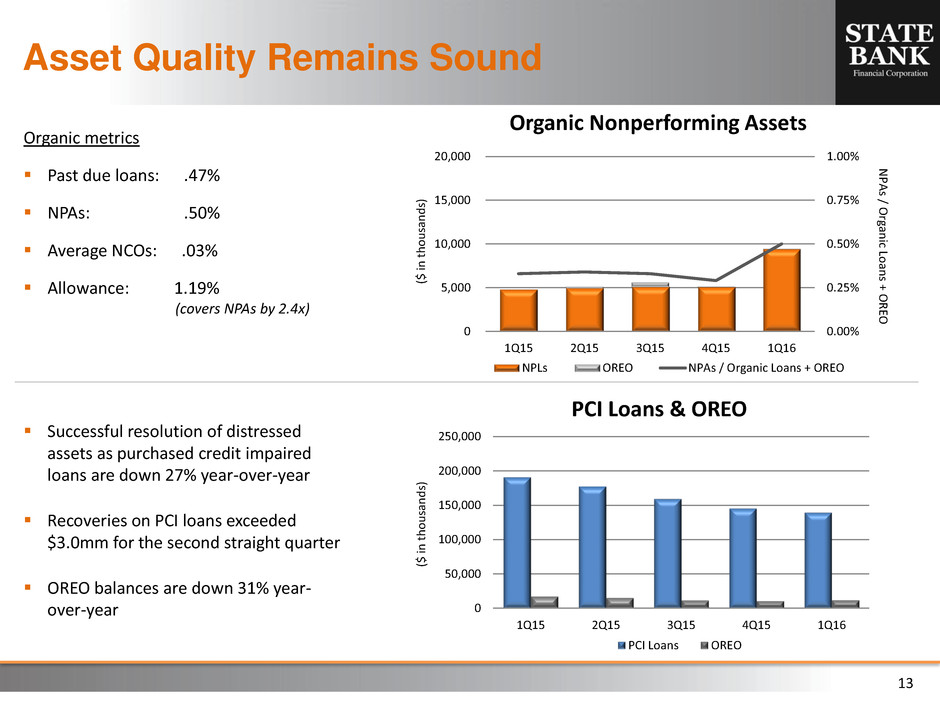

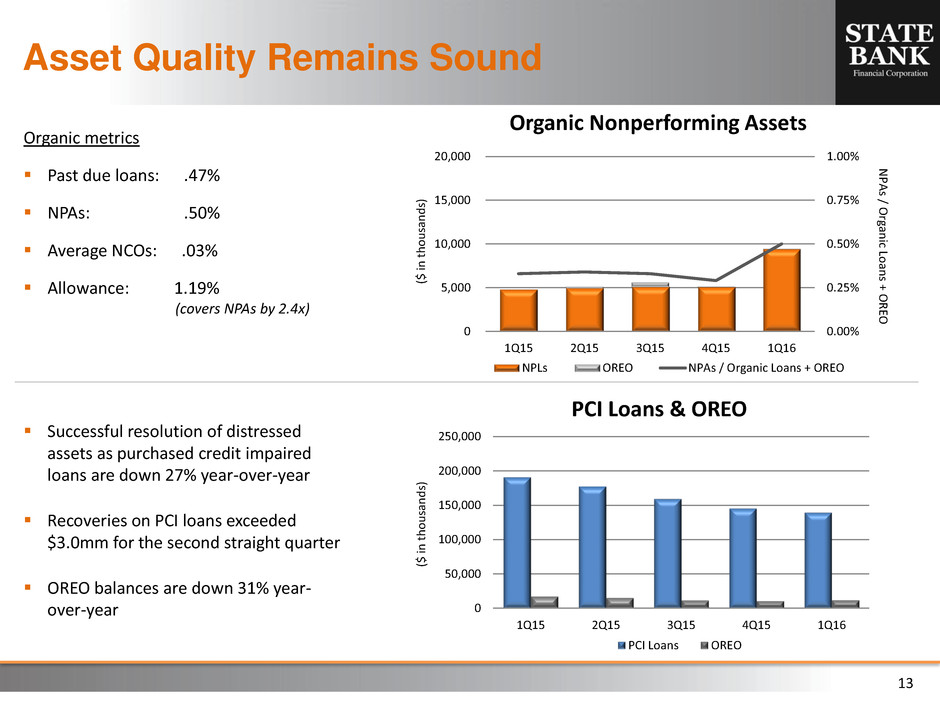

13 ($ i n t h o u sa n d s) Organic metrics Past due loans: .47% NPAs: .50% Average NCOs: .03% Allowance: 1.19% (covers NPAs by 2.4x) N PA s / Orga n ic L o an s + OR EO ($ i n t h o u sa n d s) Successful resolution of distressed assets as purchased credit impaired loans are down 27% year-over-year Recoveries on PCI loans exceeded $3.0mm for the second straight quarter OREO balances are down 31% year- over-year Asset Quality Remains Sound 0.00% 0.25% 0.50% 0.75% 1.00% 0 5,000 10,000 15,000 20,000 1Q15 2Q15 3Q15 4Q15 1Q16 Organic Nonperforming Assets NPLs OREO NPAs / Organic Loans + OREO 0 50,000 100,000 150,000 200,000 250,000 1Q15 2Q15 3Q15 4Q15 1Q16 PCI Loans & OREO PCI Loans OREO