UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

State Bank Financial Corporation

(Name of Registrant as Specified In Its Charter)

_____________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

__________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

__________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

__________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

__________________________________________________________________________________

(5) Total fee paid:

__________________________________________________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

______________________________________

(2) Form, Schedule or Registration Statement No.:

______________________________________

(3) Filing Party:

______________________________________

(4) Date Filed:

______________________________________

STATE BANK FINANCIAL CORPORATION

3399 Peachtree Road NE

Suite 1900

Atlanta, Georgia 30326

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 25, 2017

Dear Shareholder,

I cordially invite you to attend the annual meeting of shareholders of State Bank Financial Corporation, the holding company of State Bank and Trust Company, to be held on Thursday, May 25, 2017 at 1:00 p.m. EDT at our headquarters located at 3399 Peachtree Road NE, Suite 1900, Atlanta, Georgia 30326, for the following purposes:

| |

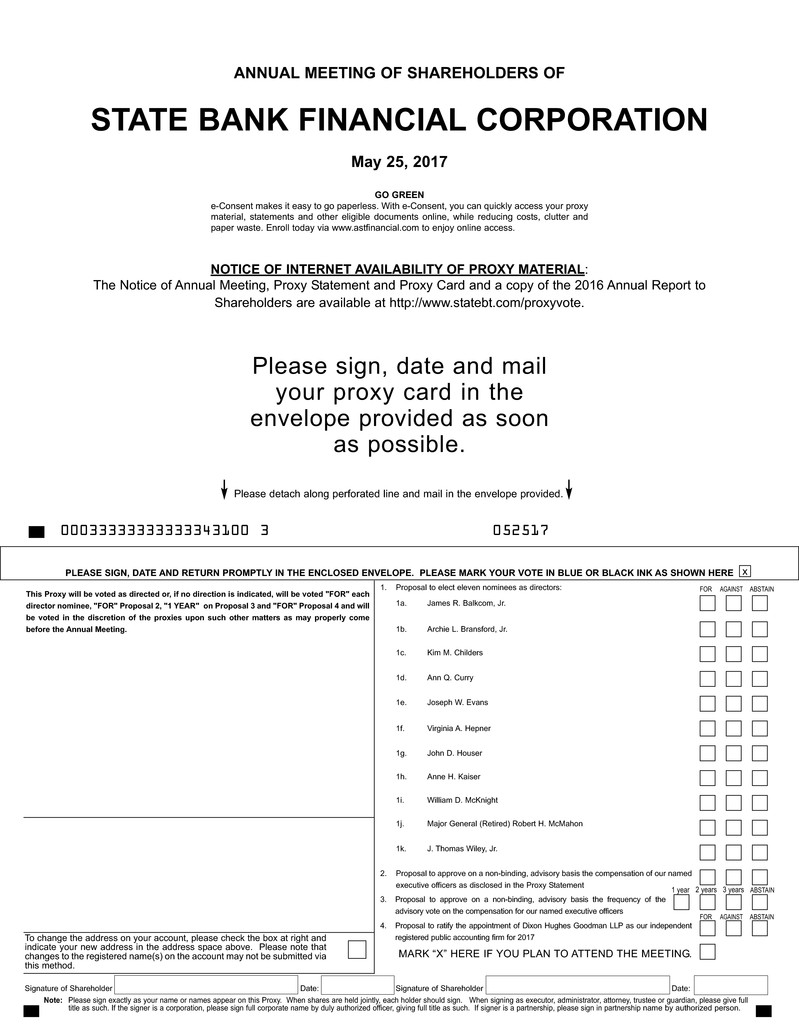

| 1) | to elect 11 directors to our board of directors to serve a one-year term; |

| |

| 2) | to conduct an advisory vote on the compensation of our named executive officers; |

| |

| 3) | to conduct an advisory vote on the frequency of the advisory vote on the compensation of our named executive officers; |

| |

| 4) | to ratify the appointment of Dixon Hughes Goodman LLP as our independent registered public accounting firm for 2017; and |

| |

| 5) | to transact such other business as may properly come before the annual meeting or any adjournment of the meeting. |

The board of directors set the close of business on April 7, 2017 as the record date to determine the shareholders who are entitled to vote at the annual meeting. Under rules of the Securities and Exchange Commission, we are providing access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials on the Internet.

Although we would like each shareholder to attend the annual meeting, I realize that for some of you this is not possible. Whether or not you plan to attend the annual meeting, we encourage you to vote as soon as possible by signing, dating and mailing your proxy card in the enclosed postage-paid envelope. For specific instructions on voting, please refer to the instructions on the enclosed proxy card.

Important Notice Regarding Availability of Proxy Materials for the Annual Meeting: Our 2017 proxy statement, proxy card and 2016 Annual Report to Shareholders are available free of charge online at http://www.statebt.com/proxyvote.

Your vote is important, and I appreciate the time and consideration that I am sure you will give it.

On behalf of the board of directors,

Joseph W. Evans

Chairman and Chief Executive Officer

April 13, 2017

PROXY SUMMARY

Unless the context indicates otherwise, all references to the “Company”, “we,” “us” and “our” in this proxy statement refer to State Bank Financial Corporation and our wholly-owned subsidiary bank, State Bank and Trust Company (“State Bank”).

2017 Annual Meeting of Shareholders

|

| | |

| Date: | May 25, 2017 |

| Time: | 1:00 p.m. EDT |

| Place: | 3399 Peachtree Road NE Suite 1900 Atlanta, Georgia 30326 |

| Record Date: | April 7, 2017 |

| Voting: | Common shareholders as of the record date are entitled to vote. Shareholders of record can vote by: |

| | Mail: | Vote by filling out the proxy card and sending it back in the postage-paid envelope provided. |

| | In Person: | You may vote in person at the annual meeting. |

See Voting Procedures and Related Matters beginning on page 61 for more information about how to vote your shares.

Proposals That Require Your Vote |

| | | | | |

| | | | Board Recommendation | | More Information |

| Proposal 1 | Election of 11 directors | | FOR each nominee | | |

| Proposal 2 | Advisory vote on the compensation of our named executive officers | | FOR | | |

| Proposal 3 | Advisory vote on the frequency of the advisory vote on the compensation of our named executive officers | | EVERY YEAR | | |

| Proposal 4 | Ratification of the appointment of our independent registered public accounting firm for 2017 | | FOR | | |

PROPOSAL 1 - ELECTION OF DIRECTORS

Nominees for Election as Directors

Our bylaws provide for a board of directors consisting of not fewer than five nor more than 25 individuals, with the exact number to be fixed by the board of directors. Our board has fixed the number of directors constituting the entire board at 11 directors, and the board currently consists of 11 directors. All of the current members of the board of directors have been nominated for re-election.

If elected, all nominees will serve a one-year term, expiring at the 2018 annual meeting of shareholders or until their respective successors are duly elected and qualified. Each nominee has agreed to serve if elected. If any named nominee is unable to serve, proxies will be voted for the remaining named nominees.

Summary information about each of the director nominees is provided below. Each director is currently a director of the Company and State Bank. |

| | | | | | |

| Name | | Age | | Director Since | | Primary Occupation |

| James R. Balkcom, Jr. | | 72 | | 2010 | | Chairman of the Board of TMG Gases, Inc., a gas supply chain management company |

| Archie L. Bransford, Jr. | | 64 | | 2010 | | President of Bransford & Associates, LLC, a bank regulatory consulting group |

| Kim M. Childers | | 58 | | 2010 | | Executive Risk Officer of the Company and State Bank and Vice Chairman of the Boards of Directors of the Company and State Bank |

| Ann Q. Curry | | 73 | | 2013 | | Chair and Chief Client Strategist of Coxe Curry & Associates, a fundraising consulting firm |

| Joseph W. Evans | | 67 | | 2010 | | Chief Executive Officer of the Company and Chairman of the Boards of Directors of the Company and State Bank |

| Virginia A. Hepner | | 59 | | 2010 | | President and Chief Executive Officer of The Woodruff Arts Center, a visual and performing arts center |

| John D. Houser | | 68 | | 2012 | | Former President and Chief Executive Officer of Southern Trust Corporation (Retired), a commercial insurance firm |

| Anne H. Kaiser | | 60 | | 2016 | | Vice President, Community and Economic Development of Georgia Power Company, a regional utility that supplies electric power and energy services to Georgia residents and businesses |

| William D. McKnight | | 59 | | 2015 | | President and Chief Executive Officer of McKnight Construction Company, a construction company that provides construction services throughout the Southeast |

| Major General (Ret.) Robert H. McMahon | | 60 | | 2012 | | President of Fickling Management Services, a property management and leasing firm |

| J. Thomas Wiley, Jr. | | 64 | | 2010 | | Chief Executive Officer of State Bank, President of the Company and Vice Chairman of the Boards of Directors of the Company and State Bank |

Voting for Directors

Each share of our common stock entitles the holder to one vote on all matters voted on at the meeting. Provided a quorum is present, directors will be elected by the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the annual meeting. Shareholders do not have cumulative voting rights. If you hold your shares in street name and do not complete and return voting instructions to your broker or other nominee, this will have the same effect as a vote “AGAINST” the election of our director nominees. Abstentions will also have the same effect as a vote “AGAINST” the election of our director nominees. All of our nominees are currently serving as directors. If a nominee does not receive the required vote for re-election, the

director will continue to serve on the board as a “holdover” director until his or her death, written resignation, retirement, disqualification or removal, or his or her successor is elected.

Biographical Information for Each Nominee for Director

James R. Balkcom, Jr. is Chairman of the Board of TMG Gases, Inc., a gas supply chain management company. Mr. Balkcom also serves as an operating partner with Council Ventures, Inc., a position he has held since 2001. He served as Chairman of the Board of Advisors for Talent Quest, a leadership consultancy, from 2004 through 2010 and as Chairman of the Board of iKobo, Inc., a provider of online money transfer services, from 2006 until 2009. Mr. Balkcom also served as a director of EndoChoice, Inc. from 2009 until 2016 and as a director of Reach Health, Inc. from 2010 until 2014. He served as Chairman of the Board of Commerce South Bank, Inc. from 2001 until 2004 and as a director and Chairman of the compensation committee of Century South Banks, Inc. from 1997 until 2001. He was also a director and Chairman of the audit committee of DataPath, Inc. from 2007 until 2009. Mr. Balkcom served as Chief Executive Officer of Techsonic Industries, Inc. from 1977 until 1994. He serves as a Civilian Aide to the Secretary of the Army for Georgia and has served on the executive committee of the USO Council of Georgia since 2000. Mr. Balkcom also serves on the advisory board of the Shepherd Center Foundation, Inc. Mr. Balkcom holds a bachelor’s degree in engineering from the United States Military Academy at West Point and a master’s degree in business administration from Harvard Business School.

Mr. Balkcom’s extensive experience in corporate governance and finance, together with his management experience as a senior executive with several companies, make him well qualified to be a member of our board.

Archie L. Bransford, Jr. is the President of Bransford & Associates, LLC, a bank regulatory consulting group that consults with banks on risk management and regulatory matters, a position he has held since 2004. Prior to forming the consulting group, Mr. Bransford retired from the Office of the Comptroller of the Currency as the Deputy Comptroller for the agency’s Southern District, where he was responsible for the regulatory activity of approximately 700 banks. Mr. Bransford was a member of the board of directors of Banuestra Financial Corporation, a private financial services company, from 2006 until 2008. Mr. Bransford holds a bachelor’s degree in business administration from the University of Detroit.

Mr. Bransford’s depth of knowledge and valuable experience with bank regulatory matters make him well qualified to be a member of our board.

Kim M. Childers is the Executive Risk Officer of the Company and State Bank, a position he has held since July 2012 and has been a Vice Chairman of the board of the Company since 2010 and a Vice Chairman of the board of State Bank since 2009. Mr. Childers previously served as our Chief Credit Officer from 2009 until July 2012 and as our President from 2009 until December 2012. Mr. Childers previously held senior positions with Flag Bank and RBC Centura Bank, including Executive Vice President and Chief Credit Officer of Flag Bank from 2002 until 2007 and as Director-Georgia Risk Management of RBC Centura Bank from 2006 until 2007. Before joining Flag Bank in 2002, Mr. Childers was employed with Century South Banks, Inc., the holding company of 12 banks located in Georgia, Tennessee, Alabama and North Carolina, acting in a number of capacities, including Regional Chief Executive Officer for the North Georgia Region (which included eight charters and $600 million in assets), Chief Credit Officer and Senior Vice President/Credit Administration. Mr. Childers also serves as a managing principal of Bankers’ Capital Group, LLC, an investment company that primarily buys and sells notes. Mr. Childers holds a bachelor’s degree in agricultural economics from the University of Georgia.

Mr. Childers’ depth of knowledge and years of experience in banking make him well qualified to be a member of our board. His extensive personal understanding of the markets we serve is also a valuable asset to our board.

Ann Q. Curry is the Chair and Chief Client Strategist of Coxe Curry & Associates, a fundraising consulting firm serving nonprofit organizations in greater Atlanta and throughout Georgia, a position she has held since 2015. Ms. Curry previously served as the President of Coxe Curry & Associates from 1992 until 2014. Ms. Curry has held leadership roles both locally and nationally with the League of Women Voters, and she was a five-year member of

the Board of Research Atlanta and its first woman president. She is a graduate of Leadership Atlanta and Leadership Georgia and a member of the YWCA Academy of Women Achievers. Ms. Curry serves on the CDC Foundation’s Advisory Board, on the Nominating Committee of United Way, on the Advisory Board of the Georgia Conservancy and is a member of the Atlanta Rotary Club. She is a graduate of Duke University, a past chair of the Duke University Women’s Studies Council and a six-year member of the Board of Visitors for Trinity College at Duke. She also currently serves on the advisory board for Duke University Libraries.

Ms. Curry’s extensive experience in business management, as well as her depth of knowledge of the market areas we serve, make her well qualified to be a member of our board.

Joseph W. Evans is the Chief Executive Officer of the Company and Chairman of the Board, positions he has held since 2010. Mr. Evans also served as the Chief Executive Officer of State Bank from July 2009 until January 1, 2015. He is the former Chairman, President and Chief Executive Officer of Flag Financial Corporation which was acquired by RBC Centura Bank in 2006. Mr. Evans previously served as President and Chief Executive Officer of Bank Corporation of Georgia which was acquired by Century South Banks, Inc. in 1997 and later served as President and Chief Executive Officer of Century South Banks, Inc., which was acquired by BB&T in 2001. Currently, Mr. Evans is also a managing principal of Bankers’ Capital Group, LLC, an investment company that primarily buys and sells notes. Mr. Evans serves on the boards of directors of Southern Trust Insurance Company and the Metro Atlanta Chamber. He is Vice President of the Buckhead Coalition, a trustee of the Foundation of the Methodist Home of the South Georgia Conference, Inc. in Macon, Georgia, where he chairs its investment committee, a member of the Board of Councilors of the Carter Center and the Chair of the Finance Committee of the Mt. Zion United Methodist Church. Mr. Evans serves on the Board of Trustees of the Georgia Tech Foundation as Treasurer, Chairman of the Finance Committee and as a member of the Executive Committee. He also serves on the Executive Committee of the advisory board of the Scheller College of Business at Georgia Tech, having previously served as chairman. He is the former Chairman of the Board of Trustees of the Georgia Tech Alumni Association and previously served as a director of the Alliance Theater at The Woodruff Arts Center. Mr. Evans holds a bachelor’s degree in industrial management from Georgia Tech.

Mr. Evans’ depth of knowledge and years of experience in banking make him well qualified to be a member of our board. His ties to our market area also provide him with personal contacts and an awareness of the social environment within which we operate.

Virginia A. Hepner is the President and Chief Executive Officer of The Woodruff Arts Center, a position she has held since 2012. The Woodruff Arts Center is one of the largest arts centers in the world, home to the Tony Award-winning Alliance Theater, the Grammy Award-winning Atlanta Symphony Orchestra and the High Museum of Art. Before joining The Woodruff Arts Center, Ms. Hepner was a business consultant with DMI, Inc., an entertainment and music marketing company, from 2011 until 2012. She serves on the board of directors of Oxford Industries, Inc., a publicly traded lifestyle brands retailer. Ms. Hepner has over 25 years of corporate banking experience with Wachovia Bank and its predecessors, serving in North Carolina, Chicago and Atlanta. She joined Wachovia Bank in 1979 and, until her retirement in 2005, she held numerous positions in corporate banking and capital markets, including Atlanta Commercial Banking Manager, Manager of the Foreign Exchange and Derivatives Group, and Executive Vice President and Manager of the U.S. Corporate Client Group. Ms. Hepner was formerly a director of Chexar Corporation (now named Ingo Money, Inc.), a private financial technology company. She is also active in many not-for-profit and civic organizations and presently serves as a board member of the Metro Atlanta Chamber, Midtown Alliance and the Atlanta Convention and Visitors Bureau. Ms. Hepner holds a bachelor’s degree in finance from the Wharton School of the University of Pennsylvania.

Ms. Hepner’s depth of knowledge and years of experience in corporate banking make her well qualified to be a member of our board.

John D. Houser served as the President and Chief Executive Officer of Southern Trust Corporation from 2007 until his retirement in August 2016. Mr. Houser served as director, President and Chief Executive Officer of Southern Trust Insurance Company from 2007 until January 2016 and as a member of Southern Specialty Underwriters, LLC from 2009 until 2015. He served as a director of Flag Financial Corporation from 2004 until

2006 and as Managing Partner of Miller Ray Houser & Stewart, a Certified Public Accounting firm in Atlanta, from 1998 until 2007. Mr. Houser served as an officer in the United States Navy from 1970 until 1973. Mr. Houser served as member of the Georgia Underwriting Association from 2008 until 2016 and as its Chairman from 2012 until 2016. He also served as a director of the Georgia Association of Property and Casualty Insurance Companies from 2008 until 2015. He previously served on the Board of Trustees of the United Way of Middle Georgia from 2010 until 2016 and currently serves on the board of the Community Foundation of Central Georgia. Mr. Houser received a bachelor’s degree in Industrial Management from Georgia Tech in 1970 and a master’s of public accountancy from Georgia State University in 1975.

Mr. Houser’s depth of knowledge and years of experience in finance and accounting make him well qualified to be a member of our board.

Anne H. Kaiser is the Vice President of Community and Economic Development for Georgia Power Company, a position she has held since 2015, leading the company’s efforts to recruit new industry to Georgia and help existing industries grow. Ms. Kaiser previously served as Vice President, Northwest Region for Georgia Power Company from 2008 until 2015 with responsibility for 15 counties and more than 170,000 customers. Ms. Kaiser joined Georgia Power Company in 1998 and has held a variety of positions, including Vice President of Corporate Services, assistant to the President and Chief Executive Officer and Vice President of Sales. Before joining Georgia Power Company, Ms. Kaiser held senior marketing management positions at the accounting and consulting firm KPMG, the Westminster Schools of Atlanta and Alston & Bird LLP, an international law firm headquartered in Atlanta. Ms. Kaiser serves on the boards of Berry College, where she chairs the Finance Committee, and Georgia Children’s Cabinet. In addition, she serves as chair of the REACH Foundation, co-chair of the Alliance Theatre board, vice chair of the Technical College System of Georgia board and is on the advisory board of the Georgia Department of Economic Development. Ms. Kaiser holds a bachelor’s degree in public relations from the University of Georgia. She is also a graduate of the Advanced Marketing Program at Harvard Business School and the National Association of Corporate Directors’ College.

Ms. Kaiser’s experience in dealing with complex business problems, as well as her substantial community involvement in the market areas we serve, make her well qualified to be a member of our board.

William D. McKnight is the President and Chief Executive Officer of McKnight Construction Company, a general contracting firm that operates in the Southeast, a position he has held since 1979. Mr. McKnight is also the President of Will McKnight Construction Company, a position he has held since 1999. Mr. McKnight previously served as a director of Georgia-Carolina Bancshares, Inc. ("Georgia-Carolina Bancshares") until it merged with the Company on January 1, 2015. He served as Chairman of the Board of Directors of First Bank of Georgia, which we acquired in our acquisition of Georgia-Carolina Bancshares, from May 2010 until July 2015, when First Bank of Georgia was merged into State Bank. Mr. McKnight currently serves on the boards of the Georgia Ports Authority, the Jasper Ports Authority and the Georgia Health Sciences Foundation. He has previously served on the boards of Associated General Contractors of America, the Augusta Ballet and the Tuttle-Newton Home. He is a graduate of Georgia Tech.

Mr. McKnight’s extensive experience in business management, as well as his in-depth knowledge of the Augusta market, makes him well qualified to be a member of our board.

Major General (Retired) Robert H. McMahon is the President of Fickling Management Services, a property management and leasing firm, since November 2015. Major General (Ret.) McMahon previously served as Director of C-17 Field Operations at Boeing from May 2014 until August 2015 and as President and Chief Executive Officer of the 21st Century Partnership in Warner Robins, Georgia, from 2012 until May 2014. Major General (Ret.) McMahon served as Commander, Warner Robins Air Logistics Center, Air Force Material Command, Robins Air Force Base, in Warner Robins, Georgia from 2010 until he retired in 2012. The Warner Robins Air Logistics Center was one of three Air Force air logistics centers and the largest single-site industrial complex in the State of Georgia. Before that, from 2008 until 2010, he served as Director of Logistics, Deputy Chief of Staff for Logistics, Installations and Mission Support, with the U.S. Air Force, in Washington, D.C. Major General (Retired) McMahon served as a director of NORDAM from 2012 to 2014. He entered active duty after graduation from the

U.S. Air Force Academy in 1978 with a bachelor’s of science in International Affairs and later earned a master’s of science in maintenance management from the Air Force Institute of Technology.

Major General (Ret.) McMahon’s depth of knowledge and years of experience in finance and government relations, together with his management experience as a senior officer with the United States Air Force, make him well qualified to be a member of our board.

J. Thomas Wiley, Jr. has served as Chief Executive Officer of State Bank since January 2015, as President of the Company since January 2013 and as a director of the Company and State Bank since 2010 (and as Vice Chairman of the boards of directors of the Company and State Bank since 2013). Mr. Wiley also served as President of State Bank from January 2013 until July 2015. Mr. Wiley also served as a director of First Bank of Georgia, which we acquired in our acquisition of Georgia-Carolina Bancshares from January 2015 until July 2015, when First Bank of Georgia was merged into State Bank. Mr. Wiley is the former President and Chief Executive Officer of Coastal Bankshares, Inc. and its subsidiary bank, The Coastal Bank, where he served from 2007 until November 2012. Mr. Wiley also served as Chairman of the Board of Directors of Coastal Bankshares and The Coastal Bank from 2007 until March 2014. Before joining Coastal Bankshares, Mr. Wiley served as the Vice Chairman/director and Chief Banking Officer of Flag Financial Corporation from 2002 until 2006 and as President and Chief Executive Officer of Flag Bank from 2002 until 2006. Mr. Wiley is also a managing principal of Bankers’ Capital Group, LLC, an investment company that primarily buys and sells notes. Mr. Wiley serves on the board of governors of the Georgia Chamber of Commerce, the board of trustees of the Atlanta Police Foundation and is a former chairman of the Georgia Bankers Association. Mr. Wiley is a graduate of the Leadership Georgia Foundation Class of 2001. Mr. Wiley also serves as Co-Chairman of the Valdosta State University Capital Campaign. Mr. Wiley earned his bachelor’s degree in business administration from Valdosta State University and is a graduate of the School of Banking of the South, Louisiana State University.

Mr. Wiley’s depth of knowledge and years of experience in banking make him well qualified to be a member of our board.

The board of directors recommends a vote FOR each of the above nominees.

Director Compensation

Our bylaws permit our directors to receive compensation as determined by the board of directors. We do not pay our “inside” employee-directors any additional compensation for their service as directors. Our non-employee director compensation package includes both cash and equity award components.

In February 2016, the Independent Directors Committee performed a review of our non-employee director compensation package, with the assistance of Matthews, Young & Associates, Inc. (“Matthews, Young”), who served as our independent compensation adviser from 2010 until September 2016, to ensure our directors continued to be fairly compensated compared to peer organizations. The peer group included 40 publicly-traded financial institutions in the eastern region of the United States of comparable size to the Company.

As a result of that review, the Independent Directors Committee approved an increase in the number of shares of restricted stock granted annually to each of our non-employee directors from 1,000 shares to 1,200 shares in order to more closely align the equity component of our director compensation with the peer group analyzed. Our annual cash retainers and board meeting fees described below were not changed.

Our director restricted stock grants vest in full on the date of the next annual meeting of shareholders following the date of grant, unless the director’s service as a member of the board of directors ceases for any reason before the vesting date, other than as a result of death or permanent disability. If the director’s service ceases due to death or permanent disability, the number of shares of restricted stock that vest will be determined by dividing the total number of shares of restricted stock by 12 and multiplying that result by the number of months served as director between the date of grant and the date of the next annual meeting of shareholders.

Under the cash component of our director compensation package, our non-employee directors receive:

•a cash retainer of $40,000 (which is prorated and payable quarterly);

| |

| • | an additional cash retainer of $10,000 to the chairs of each of the Audit Committee, Independent Directors Committee and Risk Committee (which is prorated and payable quarterly); |

•a fee of $1,000 per board meeting (if attended in person) or $500 (if attended by phone); and

| |

| • | a fee of $500 per meeting of the Audit Committee, the Independent Directors Committee, the Risk Committee and the Executive Committee. |

In addition, from time to time, our non-employee directors may perform services for us in their capacity as directors that are beyond the services intended to be covered by the annual retainers and per meeting fees described above, and we will pay our directors additional compensation for such services. We also reimburse our non-employee directors for reasonable expenses incurred in connection with serving as a director.

The following table provides the compensation paid to our non-employee directors for the year ended December 31, 2016.

Director Compensation for 2016

|

| | | | | | | | | | |

Name | | Fees Earned or Paid in Cash ($) | |

Stock Awards ($)(1) | | All Other Compensation ($) | |

Total ($) |

| James R. Balkcom, Jr. | | 65,000(2) | | 26,088 |

| | 644(3) |

| | 91,732 |

| Archie L. Bransford, Jr. | | 65,038(4) | | 26,088 |

| | 644(3) |

| | 91,770 |

| Ann Q. Curry | | 52,000 | | 26,088 |

| | 644(3) |

| | 78,732 |

| Virginia A. Hepner | | 56,000 | | 26,088 |

| | 644(3) |

| | 82,732 |

| John D. Houser | | 88,000(5) | | 26,088 |

| | 644(3) |

| | 114,732 |

Anne Kaiser(6) | | 15,087 | | — |

| | — |

| | 15,087 |

| William D. McKnight | | 52,500 | | 26,088 |

| | 644(3) |

| | 79,232 |

| Major General (Ret.) McMahon | | 57,000 | | 26,088 |

| | 644(3) |

| | 83,732 |

| |

| (1) | The amounts in the Stock Awards column are the aggregate grant date fair values computed in accordance with FASB ASC Topic 718. Assumptions made in the valuation of awards can be found in Note 17 of the Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. |

| |

| (2) | As chair of the Independent Directors Committee, Mr. Balkcom received a cash retainer of $10,000 in 2016. |

| |

| (3) | This amount reflects cash dividends related to unvested restricted stock. |

| |

| (4) | As chair of the Risk Committee, Mr. Bransford received a cash retainer of $9,038 in 2016. Mr. Bransford was appointed as chair of the Risk Committee in February 2016, and his cash retainer was prorated accordingly. |

| |

| (5) | As chair of the Audit Committee, Mr. Houser received a cash retainer of $10,000 in 2016. In addition, Mr. Houser received additional director fees of $10,000 for services he performed for us in his capacity as a director that were outside the scope of services intended to be covered by our annual retainers and per meeting fees. |

| |

| (6) | Ms. Kaiser was appointed as a director in September 2016. |

The table below shows the aggregate number of shares of restricted stock held by non-employee directors as of December 31, 2016.

|

| | | |

Name | | Restricted Stock (in shares)(1) |

| James R. Balkcom, Jr. | | 1,200 |

|

| Archie L. Bransford, Jr. | | 1,200 |

|

| Ann Q. Curry | | 1,200 |

|

| Virginia A. Hepner | | 1,200 |

|

| John D. Houser | | 1,200 |

|

| Anne H. Kaiser | | — |

|

| William D. McKnight | | 1,200 |

|

| Major General (Ret.) McMahon | | 1,200 |

|

| |

| (1) | The shares of restricted stock were granted under our 2011 Omnibus Equity Compensation Plan (the “Equity Plan”) and vest in full on May 25, 2017, the date of our annual meeting of shareholders. |

Biographical Information for Executive Officers

Our executive officers are:

|

| | |

| Name | | Position |

| Joseph W. Evans | | Chief Executive Officer of the Company and Chairman of the Boards of Directors of the Company and State Bank |

| Kim M. Childers | | Executive Risk Officer of the Company and State Bank and Vice Chairman of the Boards of Directors of the Company and State Bank |

| J. Thomas Wiley, Jr. | | Chief Executive Officer of State Bank, President of the Company and Vice Chairman of the Boards of Directors of the Company and State Bank |

| Sheila E. Ray | | Chief Financial Officer, Corporate Secretary and Executive Vice President of the Company and State Bank |

| David F. Black | | Chief Credit Officer and Executive Vice President of State Bank |

| Remer Y. Brinson III | | President of State Bank and Executive Vice President of the Company |

| David C. Brown | | Corporate Development Officer and Executive Vice President of the Company and State Bank |

| David W. Cline | | Chief Information Officer and Executive Vice President of the Company and Chief Operating Officer and Executive Vice President of State Bank |

| Steven G. Deaton | | Enterprise Risk Officer and Executive Vice President of the Company and State Bank |

| Michael R. Fitzgerald | | Chief Talent Officer and Executive Vice President of State Bank |

| Bradford L. Watkins | | Managing Director of the Commercial Finance Group and Executive Vice President of State Bank |

Because each of Mr. Evans, Mr. Childers and Mr. Wiley also serves on our board of directors, we have provided biographical information for them above with our other directors. Biographical information for each of Ms. Ray, Mr. Black, Mr. Brinson, Mr. Brown, Mr. Cline, Mr. Deaton, Mr. Fitzgerald and Mr. Watkins is provided below:

Sheila E. Ray, age 58, serves as Chief Financial Officer of the Company and State Bank, a position she has held since January 2015. Ms. Ray also serves as the Corporate Secretary of the Company and State Bank, a position she has held since December 2015. Ms. Ray joined the Company and State Bank in October 2014 as Executive Vice President – Finance. She also served as the Chief Financial Officer of our former subsidiary bank, First Bank of

Georgia, concurrent with her service as Chief Financial Officer of the Company, from January 2015 until July 2015, when it was merged into State Bank. Before that, she served as Chief Financial Officer of Atlanta Bancorporation, Inc. and Bank of Atlanta from 2006 until each was merged into the Company and State Bank, respectively, on October 1, 2014. She also served on the board of directors of Bank of Atlanta, a position she held from 2010 until 2014. Before that, Ms. Ray served as Chief Operating Officer and Chief Financial Officer of Eagle Bancshares, Inc., and its subsidiary unitary thrift, Tucker Federal Bank, from 1997 until it was acquired by RBC Centura Bank in 2002. In 2003, she left RBC Centura Bank to work as an independent consultant, providing financial analysis and strategic planning to a variety of community banks. Ms. Ray also previously served in various leadership roles at First National Bancorp and its subsidiary bank First National Bank of Gainesville from 1988 until 1996, including the Director of Information Processing and Administrative Support and Director of Internal Audit. Ms. Ray served in various leadership roles within internal audit at Wachovia Corporation from 1981 until 1988, including Vice President and Deputy Auditor. Ms. Ray is a Certified Public Accountant, a member of the Board of Trustees at Toccoa Falls College and a member of the board of directors for the Care and Counseling Center of Georgia. Ms. Ray holds a bachelor’s of business administration in accounting from the University of Georgia.

David F. Black, age 41, serves as Chief Credit Officer and Executive Vice President of State Bank, positions he has held since September 2013. Mr. Black previously served as Chief Credit Officer of the Company from September 2013 until February 2015. Mr. Black joined State Bank in 2011 as Senior Vice President of Finance. Previously, Mr. Black served as Director of Corporate Strategy at First Horizon National Corporation in Memphis, Tennessee from July 2009 until August 2011. Mr. Black held various leadership roles in Finance and Corporate Development at Wachovia Corporation and Wells Fargo & Company (following Wells Fargo & Company’s purchase of Wachovia Corporation in 2008) in Winston-Salem and Charlotte, North Carolina between June 2000 and July 2009, and he started his banking career with SunTrust Bank in Atlanta. Mr. Black holds both a bachelor’s of business administration in finance and a master’s degree in business administration from the Terry College of Business at the University of Georgia.

Remer Y. Brinson III, age 56, serves as Executive Vice President of the Company, a position he has held since January 2015, and as President of State Bank since July 2015. Mr. Brinson served as the President and Chief Executive Officer of Georgia-Carolina Bancshares from May 2008 until January 2015, when it was merged with the Company, and he served as a director of Georgia-Carolina Bancshares from May 2004 until January 2015. Mr. Brinson also previously served as President and Chief Executive Officer of our former subsidiary bank, First Bank of Georgia, from October 1999 until it was merged into State Bank in July 2015. Mr. Brinson served as President and Chief Executive Officer of Citizens Bank and Trust until its acquisition by Allied Bank of Georgia. From 1994 to 1999, he was Senior Vice President of Allied Bank of Georgia and Regions Bank. From 1982 to 1994, Mr. Brinson served First Union Bank and its predecessor, Georgia-Railroad Bank and Trust, in various capacities, including Senior Vice President, Corporate Banking. Mr. Brinson has served as Chairman of the board of directors of the Georgia Bankers Association, Augusta Tomorrow, The Episcopal Day School and The Augusta Country Club. Mr. Brinson currently serves on the boards of directors of the Georgia Bankers Insurance Trust, The Richmond County Development Authority and Tuttle-Newton Home. Mr. Brinson holds a bachelor’s of business administration in finance from the University of Georgia.

David C. Brown, age 51, serves as Corporate Development Officer and Executive Vice President of the Company and State Bank, positions he has held since December 2013, with respect to the Company, and since March 2016, with respect to State Bank. Before joining the Company, Mr. Brown served as Managing Principal of Sagus Partners, LLC from January 2008 until December 2013. Mr. Brown holds a bachelor’s of arts in philosophy from Vanderbilt University and a master’s degree in business administration from the University of Georgia.

David W. Cline, age 56, serves as Chief Information Officer and Executive Vice President of the Company, positions he has held since January 2010. Mr. Cline also serves as the Chief Operating Officer and Executive Vice President of State Bank, positions he has held since January 2015. Mr. Cline previously served as Chief Information Officer and Executive Vice President of State Bank from August 2009 until December 2014. Before joining State Bank in August 2009, Mr. Cline was a Director of Technical Operations with AT&T Business Field Services, serving the AT&T and BellSouth family of companies in technical management roles from 1988 until retiring in 2009. Mr. Cline holds a bachelor’s of science degree from Virginia Polytechnic Institute and State University.

Steven G. Deaton, age 54, serves as Enterprise Risk Officer and Executive Vice President of the Company and State Bank, positions he has held since August 2012. Mr. Deaton previously served as Atlanta Regional President/Chief Banking Officer and Executive Vice President of State Bank from August 2009 until July 2012. Before joining State Bank, Mr. Deaton served as Executive Vice President/Atlanta Regional President of Flag Bank from 2005 until 2006 and served as President of Business Banking for Georgia for RBC Centura Bank from 2006 until 2007 (following RBC Centura Bank’s acquisition of Flag Bank). Mr. Deaton joined Flag Bank after it acquired First Capital Bank, successor of Chattahoochee National Bank, where he served as Chief Operating Officer, Chief Credit Officer and Senior Lender. Before that, Mr. Deaton held various senior management positions at Bank South and SouthTrust Bank from 1985 until 2000, including Georgia Commercial Banking Manager, Georgia Credit Administrator and Director of the Management Training Program. Mr. Deaton holds a bachelor’s of science in business administration from the University of North Carolina at Chapel Hill.

Michael R. Fitzgerald, age 58, serves as Chief Talent Officer and Executive Vice President of State Bank, positions he has held since August 2015. Mr. Fitzgerald previously served as State Bank’s Chief Revenue and Chief Deposit Officer from 2012 until 2015 and as State Bank’s Senior Deposit Officer from 2011 until 2012. Before joining State Bank, he served as President of FitzgeraldMSI, a consulting company for banks, from 2002 until 2010. Mr. Fitzgerald previously served as President and Chief Operating Officer of NetBank, Vice President of Mellon Bank and President of directbanking.com, the online banking division of Salem Bank of Boston. Mr. Fitzgerald holds an economics degree from the University of Massachusetts.

Bradford L. Watkins, age 50, serves as Managing Director of the Commercial Finance Group and Executive Vice President of State Bank, positions he has held since 2015 and 2011, respectively. In his role, he has responsibility for Commercial Real Estate Finance, Homebuilder Finance, Government Guaranteed (SBA) Lending, Wholesale Lending and Specialty Finance. Mr. Watkins previously served as Director of Real Estate Banking of State Bank from 2011 until 2015 and as Atlanta Regional Credit Officer of State Bank from 2009 until 2011. Before joining State Bank, he served as Senior Vice President of Cornerstone Bank between 2007 and 2009. Before that, he served as the Regional President for Atlanta and later for Real Estate Finance at Flag Bank from 2002 until 2006. He began his career in 1988 at Wachovia Bank, where he served in various capacities in Retail Banking and Corporate Finance. Mr. Watkins holds a bachelor’s degree in history from Washington & Lee University and a master’s of business administration in finance from Georgia State University. He also has completed the Executive Development Program at the Wharton School at the University of Pennsylvania.

CORPORATE GOVERNANCE

Introduction

We are committed to providing effective corporate governance over the business operations and corporate structure of the Company for the benefit of our shareholders. Our board of directors has adopted a set of Corporate Governance Principles that, together with our articles of incorporation, bylaws and the charters of our board committees, provide a framework for the governance of the Company. The Independent Directors Committee reviews and assesses the adequacy of our Corporate Governance Principles on an annual basis and oversees our compliance with such principles.

The following table summarizes some of the corporate governance practices we follow.

|

| |

| Highlights of Our Corporate Governance Practices |

| Director Attendance | We expect each director to attend all meetings of the board and of each committee of which the director is a member. |

| Focus on Strategic Planning | The board and management focus on our corporate strategy, holding annual off-site meetings to conduct strategic planning. |

| Board Independence | 8 of our 11 directors are independent. |

|

| |

| Highlights of Our Corporate Governance Practices |

| Board Committees | We have four board committees —Audit; Independent Directors; Risk; and Executive Committee. |

| Our Audit, Independent Directors and Risk Committees consist entirely of independent directors. |

| Director Qualifications | Our board is comprised of directors with diverse backgrounds, business experience and abilities necessary to allow the board to fulfill its responsibilities. |

| Independent Lead Director | Our independent directors elect an independent lead director. |

| The lead director regularly presides over executive sessions without management present. |

| Succession Planning | The Independent Directors Committee identifies and develops leaders through its oversight of succession planning for the Chief Executive Officer, senior executives and other officers. |

| Board Effectiveness | The board and its committees perform an annual self-evaluation to assess and improve the board’s effectiveness. |

| Mandatory Director Retirement Policy | The board adopted a policy in which directors are required to retire on the date of the next annual meeting of shareholders after reaching age 75. |

| Board Oversight of Risk | Our board oversees the Company’s general risk management strategy and advises management on the development and execution of the Company’s strategy. |

| Our Audit Committee oversees risk management processes related to internal controls, financial reporting and audit functions. |

| Our Risk Committee reviews and monitors our risk appetite and risk profile and articulates the types and tolerance of risk that the Company will assume in pursuit of its corporate objectives. |

| The Independent Directors Committee oversees risk related to our compensation and incentive plans, in addition to risk associated with the Company’s corporate governance principles. |

| Code of Ethics | The Company maintains a robust Code of Ethics policy providing expectations and guidelines to ensure all employees and directors act in a responsible manner. |

| Board Communications | We have a process through which all shareholders may communicate with our Board. |

| Related Person Transactions | Our Audit Committee reviews all related person transactions. |

Director Attendance

The directors meet to review our operations and discuss our business plans and strategies for the future. The full board of directors met eleven times in 2016. During 2016, each director attended at least 75% of the aggregate of the total number of board meetings and the total number of meetings held by the committees of the board on which he or she served. We expect each director to attend our annual meeting of shareholders, although we recognize that conflicts may occasionally arise that will prevent a director from attending an annual meeting. All of our directors attended the 2016 annual meeting.

Director Independence

Our board of directors has determined that each of James R. Balkcom, Jr., Archie L. Bransford, Jr., Ann Q. Curry, Virginia A. Hepner, John D. Houser, Anne H. Kaiser, William D. McKnight and Major General (Ret.) Robert H. McMahon is an “independent” director, based on the independence criteria in the corporate governance listing standards of The NASDAQ Capital Market. Our shares of common stock were listed and began trading on The NASDAQ Capital Market on April 14, 2011.

In determining that Mr. Balkcom is independent, the board took into account a charitable contribution made by State Bank to the Shepherd Center Foundation, Inc. for which Mr. Balkcom serves as a member of its advisory

board. The Shepherd Center Foundation, Inc. supports Shepherd Center, a private, not-for-profit hospital in Atlanta, Georgia specializing in medical treatment, research and rehabilitation for people with spinal cord injury and brain injury.

In determining that Ms. Hepner is independent, the board took into account, among other things, charitable contributions made by State Bank to The Woodruff Arts Center and the Alliance Theater, a division of The Woodruff Arts Center. Ms. Hepner serves as President and Chief Executive Officer of The Woodruff Arts Center.

In determining that Mr. Houser is independent, the board took into account, among other things, that Mr. Houser, until January 2016, served as President of Southern Trust Corporation, which owns Southern Trust Insurance Company (“Southern Trust”), and that Southern Trust paid State Bank’s insurance division for commissions owed to State Bank. Neither the Company nor State Bank paid any fees to Southern Trust for any accounting, consulting, legal, investment banking or financial advisory services. The board also took into account charitable contributions paid by State Bank to United Way of Middle Georgia and the Community Foundation of Central Georgia for which Mr. Houser served on the board of directors.

In determining that Ms. Kaiser is independent, the board took into account, among other things, a charitable contribution paid by State Bank to the Georgia Chamber of Commerce, for which Ms. Kaiser serves on the board of governors.

Mr. Evans, Mr. Childers and Mr. Wiley are considered inside directors because of their employment as our executive officers.

There are no family relationships between any of our directors and executive officers.

Committees of the Board of Directors

Our board committees are currently composed as follows (M — member; C — chairman): |

| | | | | | | | |

| Name | | Audit Committee | | Independent Directors Committee | | Risk Committee | | Executive Committee |

| James R. Balkcom, Jr. | | | | C | | M | | M |

| Archie L. Bransford, Jr. | | | | M | | C | | M |

| Ann Q. Curry | | | | M | | M | | |

| Joseph W. Evans | | | | | | | | C |

| Virginia A. Hepner | | M | | M | | | | |

| John D. Houser | | C | | M | | | | M |

| Anne H. Kaiser | | | | M | | M | | |

| William D. McKnight | | M | | M | | | | |

| Robert H. McMahon | | M | | M | | | | |

| J. Thomas Wiley, Jr. | | | | | | | | M |

In 2010, the board of directors established an Audit Committee, a Compensation Committee and a Nominating Committee. In January 2011, for administrative purposes, the board of directors combined the functions of the Compensation Committee and the Nominating Committee into one committee, the Independent Directors Committee. The board of directors also established the Risk Committee in March 2013, which previously operated as a committee of State Bank, and established the Executive Committee in November 2013.

Audit Committee. Our Audit Committee is composed of Mr. Houser (Chairman), Ms. Hepner, Mr. McKnight and Major General (Ret.) McMahon. The board has determined that each of Ms. Hepner and Mr. Houser is an “audit committee financial expert” for purposes of the rules and regulations of the SEC. The board has determined that each member of the committee is “independent” under SEC Rule 10A-3 and under The NASDAQ Capital Market listing standards. The Audit Committee met twelve times in 2016. The Audit Committee operates under a written charter that is available on our website, www.statebt.com, in the “Governance Documents” section under “Investors.”

To review our annual Audit Committee report, please see “Proposal 4 – Ratification of Appointment of Independent Registered Public Accounting Firm–Report of the Audit Committee.”

Independent Directors Committee. As noted above, we have combined the functions of our Nominating Committee and our Compensation Committee into one committee, the Independent Directors Committee. Our Independent Directors Committee performs the dual roles of overseeing (a) our corporate governance matters and the nomination of director candidates to the board of directors and (b) our compensation and personnel policies. Our Independent Directors Committee is composed of Mr. Balkcom (Chairman), Mr. Bransford, Ms. Curry, Ms. Hepner (Vice Chair), Mr. Houser, Ms. Kaiser, Mr. McKnight and Major General (Ret.) McMahon. The Independent Directors Committee charter is available on our website, www.statebt.com, in the “Governance Documents” section under “Investors.”

In its compensation role, the Independent Directors Committee has authority to establish the salaries and incentive compensation for our named executive officers. The committee also has the authority, among other things:

| |

| • | to annually determine and approve corporate goals and objectives relevant to the compensation of our Chief Executive Officer; |

| |

| • | to review and approve annual base salary, annual incentive levels, any special or supplemental benefits and perquisites for our executive officers; |

| |

| • | to review and approve employment agreements, new hire awards or payments, severance and change in control or similar termination agreements for our executive officers; |

| |

| • | to oversee and administer our equity-based compensation, including the review and grant of equity awards to all eligible employees, and to fulfill such duties and responsibilities as described in those plans; |

| |

| • | to review, approve and recommend to the board, as appropriate, any new compensation and incentive plans, policies or programs; |

| |

| • | to oversee, monitor and assess the Company’s compensation and incentive plans, policies and programs; and |

| |

| • | to oversee the Company’s management development and succession plans for executive officers. |

In addition, the Independent Directors Committee annually reviews, evaluates and establishes levels of director compensation. For purpose of performance reviews, the committee evaluates the performance of our Chief Executive Officer, and our Chief Executive Officer evaluates the performance of our other named executive officers and discusses the results of such evaluations with the committee.

Under the Independent Directors Committee charter, the committee may delegate to one or more of our officers, who are also directors, the power to designate the officers and employees of the Company or State Bank who will receive awards under the Company’s equity-based incentive plan and to determine the terms of such awards in accordance with such plan. Notwithstanding that authority, no officer may be delegated the power to designate himself or herself as a recipient of restricted shares, options or warrants, or to grant restricted shares,

options or warrants to any person who is subject to reporting obligations under Section 16 of the Securities Exchange Act of 1934. Acting under this authority, the Independent Directors Committee delegated to Mr. Evans, our Chairman and Chief Executive Officer, the authority to issue equity incentive grants to any eligible employee, not to exceed 25,000 shares per employee per year. The Independent Directors Committee reviews a report of all grants authorized by Mr. Evans on at least a quarterly basis. The Independent Directors Committee must review and approve in advance all equity incentive grants to any individual exceeding 25,000 shares per year.

The Independent Directors Committee has the authority under its charter to appoint, select, obtain advice from, retain, terminate and approve the fees and other retention terms of advisors (including compensation consultants). From 2010 until September 2016, the Independent Directors Committee engaged Matthews, Young as an independent advisor to assist the committee in determining and evaluating director and executive compensation. In September 2016, the committee concluded its relationship with Matthews, Young and engaged Meridian Compensation Partners, LLC (“Meridian”) to serve as its independent advisor to assist with the review and establishment of our compensation programs and practices. The Independent Directors Committee assessed the independence of each of Matthews, Young and Meridian, taking into consideration all factors specified in The NASDAQ Capital Market listing standards. Based on this assessment, the committee determined that neither the engagement of Matthews, Young nor Meridian raised a conflict of interest.

Risk Committee. Our Risk Committee is composed of Mr. Bransford (Chairman), Mr. Balkcom, Ms. Curry and Ms. Kaiser. Ms. Kaiser joined the Risk Committee in November 2016. The board has appointed the Risk Committee to assist in the fulfillment of its oversight responsibilities, specifically as it relates to (a) communicating with management and monitoring our risk appetite and risk profile regarding credit risk, risk related to information technology and cyber security, operational risk, regulatory/compliance risk, liquidity and market risk, strategic risk and capital and earnings risk; and (b) approving our risk management framework and reviewing its effectiveness.

Executive Committee. Our Executive Committee is composed of our Chairman (Mr. Evans), Mr. Wiley and the Chairs of the Audit Committee (Mr. Houser), the Independent Directors Committee (Mr. Balkcom) and the Risk Committee (Mr. Bransford). The Executive Committee was appointed to exercise the powers and authority of the board, with certain limitations more fully provided in its charter, during the intervals between meetings of the board, when, based on the business needs of the Company, it is desirable for board-level actions to be considered but the convening of a special board meeting is not warranted as determined by the Chairman of the board. The Executive Committee reports any actions or recommendations to the board at the next regularly scheduled meeting. It is the general intention that all substantive matters in the ordinary course of business be brought before the full board for action, but the board recognizes the need for flexibility to act on substantive matters where action may be necessary between board meetings.

Nominations of Directors

The Independent Directors Committee serves to identify, screen, recruit and nominate candidates to the board of directors. The committee’s charter requires the committee to review potential candidates for the board, including any nominees submitted by shareholders in accordance with our bylaws. The committee evaluated each nominee recommended for election as a director in these proxy materials. In evaluating candidates proposed by shareholders, the committee will follow the same process and apply the same criteria as it does for candidates identified by the committee or the board of directors.

For a shareholder to nominate a director candidate, the shareholder must comply with the advance notice provisions and other requirements of our bylaws. Each notice must state:

| |

| • | the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; |

| |

| • | a representation that the shareholder is a holder of record of stock of the Company entitled to vote at the annual meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

| |

| • | a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the shareholder is making the nomination or nominations; and |

| |

| • | such other information regarding each nominee proposed by the shareholder as would be required to be included in a proxy statement filed under the proxy rules of the SEC relating to the election of directors. |

The notice must be accompanied by the sworn or certified statement of the shareholder that the nominee has consented to being nominated and that the shareholder believes the nominee will stand for election and will serve if elected.

When considering a potential candidate for nomination, the Independent Directors Committee will consider the skills and background that the Company requires and that the person possesses, the diversity of the board and the ability of the person to devote the necessary time to serve as a director. The Independent Directors Committee has established the following minimum qualifications for service on our board of directors:

| |

| • | the highest ethics, integrity and values; |

| |

| • | an outstanding personal and professional reputation; |

| |

| • | professional experience that adds to the mix of the board as a whole; |

| |

| • | the ability to exercise sound, independent business judgment; |

| |

| • | freedom from conflicts of interest; |

| |

| • | demonstrated leadership skills; |

| |

| • | the willingness and ability to devote the time necessary to perform the duties and responsibilities of a director; and |

| |

| • | relevant expertise and experience and the ability to offer advice and guidance to our Chief Executive Officer based on that expertise and experience. |

In considering whether to recommend any particular candidate for inclusion in the board’s slate of recommended director nominees, the committee also considers the following criteria, among others:

| |

| • | whether the candidate possesses the qualities described above; |

| |

| • | whether the candidate has significant contacts in our markets and the ability to generate additional business for State Bank; |

| |

| • | whether the candidate qualifies as an independent director under our guidelines; |

| |

| • | the candidate’s management experience in complex organizations and experience with complex business problems; |

| |

| • | the likelihood of obtaining regulatory approval of the candidate, if required; |

| |

| • | whether the candidate would qualify under our guidelines for membership on the Audit Committee or the Independent Directors Committee, including whether a potential director nominee qualifies as an "audit committee financial expert" as that term is defined by the SEC or as an “independent” director under the listing standards of The NASDAQ Capital Market; |

| |

| • | the extent to which the candidate contributes to the diversity of the board in terms of background, specialized experience, age, gender and race; |

| |

| • | the candidate’s other commitments, such as employment and other board positions; and |

| |

| • | whether the candidate complies with any minimum qualifications or restrictions set forth in our bylaws. |

The committee does not assign specific weights to particular criteria, and no particular criterion is a prerequisite for each prospective nominee. Although we have no formal policy regarding diversity, we believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the board of directors to fulfill its responsibilities.

Board Leadership Structure

Our governance framework provides our board of directors with flexibility to determine the appropriate board leadership structure for the Company. We recognize that different board leadership structures may be appropriate for our Company depending on a number of different factors and, therefore, we reexamine our corporate governance policies and leadership structure from time to time to ensure that they continue to meet our needs. We believe this flexibility is important to allow our board of directors to determine the appropriate structure based on our specific needs at any given time.

Under our current leadership structure, the roles of the Chairman of the board of directors and Chief Executive Officer are combined, the board of directors has appointed a lead independent director and our audit, independent directors and risk committees consist entirely of independent directors.

Mr. Evans, one of our founders, has served in the dual roles of Chief Executive Officer and Chairman since the Company’s formation in 2010 (and also served in these dual roles at State Bank before our holding company reorganization in 2010), and the board believes that having Mr. Evans serve in these combined roles provides certain synergies and efficiencies that have successfully served our business and our shareholders. Under Mr. Evans’ leadership, we have successfully executed our growth strategy through 12 Federal Deposit Insurance Corporation (“FDIC”) assisted acquisitions and four non-assisted acquisitions, while also achieving strong organic loan and deposit growth. Mr. Evans has extensive experience in banking, as well as an in-depth knowledge of our organization, our shareholders and our markets. As a result, he is able to promote the development of our corporate strategies by facilitating effective and efficient information flow between management and the board. The board also believes that when the combined role of Chairman and Chief Executive Officer is coupled with a lead independent director appointed by the board, the interests of shareholders are served by providing a balance between the development of corporate strategies and independent oversight of management.

The Independent Directors Committee has elected, and the full board has approved, Mr. Balkcom as our lead independent director. Mr. Balkcom has served in this role since 2011. In this role, he calls and presides over executive sessions of the independent directors, without management present, as he deems necessary.

Other Governance Policies and Practices

Management Succession Plan. As noted above, in accordance with our Independent Directors Committee charter, the Independent Directors Committee reviews, in conjunction with the Chief Executive Officer, the Chief Executive Officer’s mission and objectives and considers succession plans for the Chief Executive Officer and other senior executives, officers and business unit managers. The Independent Directors Committee has developed a management succession plan to minimize the risk to our business from an unplanned departure of our Chief Executive Officer or other members of our senior management and to help ensure the continuity of senior management.

Board and Committee Self-Evaluations. The board conducts annual self-evaluations to determine whether the board and its committees are functioning effectively. The Independent Directors Committee oversees this annual review process and, through its Chairman, discusses the input with the full board. In addition, each board committee reviews annually the qualifications and effectiveness of that committee and its members. The Company, the board and each of the board committees will continue to monitor corporate governance developments and will continue to evaluate committee charters, duties and responsibilities.

Mandatory Director Retirement Policy. The Company maintains a policy requiring a director to retire from the board upon attaining the age of 75, effective as of the next annual meeting of shareholders. The Company adopted this policy to promote board diversity and encourage the addition of directors with varied perspectives, skills and strengths.

Board’s Role in Risk Oversight

Our Audit Committee is primarily responsible for overseeing our risk management processes as it relates to management, financial statements and audit functions on behalf of the full board. Specifically, the Audit Committee focuses on financial reporting risk and internal controls, oversight of the internal audit process and legal compliance, regulatory compliance, review of insurance programs, policies and procedures as they relate to our conflicts of interest and complaints regarding accounting and audit matters. The Audit Committee receives reports from management at least quarterly regarding our assessment of risks and the adequacy and effectiveness of internal control systems and operational risk (including compliance and legal risk that may have a significant effect on the financial statements of the Company). The Audit Committee also receives reports from management addressing the most serious risks impacting the day-to-day operations of the Company and State Bank. Our Director of Internal Audit reports to the Audit Committee and meets with the committee, at least annually, in executive sessions to discuss any potential risk or control issues involving management. The Audit Committee reports regularly to the full board, which also considers our entire risk profile.

In addition to the risk management oversight functions provided by the Audit Committee, the Independent Directors Committee and the Risk Committee also perform functions related to oversight of risk management processes on behalf of the full board. Both the Independent Directors Committee and the Risk Committee regularly report to the full board.

The Risk Committee is responsible for overseeing risk management processes and controls related to credit risk, operational risk, risks related to compliance and regulatory matters, liquidity and market risks, strategic risk, capital and earning risks, and risks related to information technology and cyber security. The Risk Committee also reviews the establishment of risk levels for those identified risks and monitors the Company’s performance within such risk levels. Our Director of Internal Loan Review reports to the Risk Committee and meets with the Risk Committee no less frequently than quarterly. In addition, the Risk Committee reviews policies related to risk management governance.

In its compensation role, the Independent Directors Committee reviews our compensation and incentive plans, policies and programs made available to our named executive officers and to all other employees and directors. In its nomination and corporate governance role, the Independent Directors Committee manages risks associated with the independence of the members of the board and the Company’s compliance with its corporate governance principles.

The full board focuses on the most significant risks facing the Company and the Company’s general risk management strategy and also ensures that risks we undertake are consistent with board policy. In addition, the full board regularly considers strategic, market and reputational risk. While the board of directors oversees our risk management, management is responsible for the day-to-day risk management processes. We believe this division of responsibility is the most effective approach for addressing the risks facing the Company and that our board leadership structure supports this approach.

Code of Ethics

We expect all of our employees to conduct themselves honestly and ethically. Our board of directors has adopted a Code of Ethics that applies to all employees of the Company and State Bank, including officers and directors. The Code of Ethics is intended to provide guidance to assure compliance with law and promote ethical behavior. The Code of Ethics is available on our website, www.statebt.com, in the “Governance Documents” section under “Investors.” If we amend or waive any of the provisions of our Code of Ethics applicable to our principal executive officer, principal financial officer, controller or persons performing similar functions that relate to any element of the definition of “Code of Ethics” enumerated in Item 406(b) of Regulation S-K under the Securities Exchange Act of 1934, we intend to disclose these actions on our website, www.statebt.com in the “Governance Documents” section under “Investors.”

Communications with the Board of Directors

The board of directors has established a process for shareholders to send communications to the board of directors. Shareholders may communicate with the board as a group or individually by writing to: Corporate Secretary, State Bank Financial Corporation, 3399 Peachtree Road NE, Suite 1900, Atlanta, Georgia 30326. The board has instructed the Corporate Secretary to forward all such communications promptly to the board.

Certain Relationships and Related Person Transactions

Our Code of Ethics sets forth the guidelines for reviewing all related person transactions for potential conflicts of interest. Under the Code of Ethics, our Audit Committee (or another independent body of the board) is responsible for reviewing, approving and ratifying all related person transactions. The Audit Committee Charter also sets forth the committee’s requirement to review and approve such transactions. Pursuant to the terms of the Audit Committee Charter, the Audit Committee has delegated to the Chair of the Audit Committee, or the Chair’s designee, the authority to approve a related person transaction, and the decision of the Chair or the Chair’s designee is to be presented to, and reviewed by, the Audit Committee. For purposes of this review, related person transactions include all transactions that are required to be disclosed under applicable SEC regulations.

The spouse of David W. Cline, the Company’s Chief Information Officer and State Bank’s Chief Operating Officer, is an employee of State Bank. During 2016, Mr. Cline’s spouse received compensation in the amount of $186,725, which included base salary, an annual incentive payment, the granting of 781 shares of restricted stock, cash dividends related to restricted stock grants and 401(k) matching contributions.

A son-in-law of one of our directors had loans outstanding with State Bank in 2016. These loans were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing for comparable loan transactions with other customers of State Bank not related to State Bank and did not include more than the normal risk of collectability associated with State Bank’s other banking transactions or other unfavorable features. The loans made to the son-in-law of one of our directors were made in accordance with our policy guidelines and were not disclosed as nonaccrual, past due, restructured or potential problems as of the date of this proxy statement.

In addition, State Bank is subject to the provisions of Section 23A of the Federal Reserve Act, which limits the amount of loans or extensions of credit to, or investments in, or certain other transactions with, affiliates and the amount of advances to third parties collateralized by the securities or obligations of affiliates. State Bank is also subject to the provisions of Section 23B of the Federal Reserve Act, which, among other things, prohibits an institution from engaging in certain transactions with certain affiliates unless the transactions are on terms substantially the same, or at least as favorable to such institution or its subsidiaries, as those prevailing at the time for comparable transactions with nonaffiliated companies.

Compensation Committee Interlocks and Insider Participation

None of the members of the Independent Directors Committee was an officer or employee, or former officer or employee, of the Company or State Bank during 2016. In addition, none of these individuals had any relationship requiring disclosure under Certain Relationships and Related Person Transactions, except as otherwise described above.

During 2016, none of our executive officers served on the board or compensation committee (or other committee serving an equivalent function) of any other entity (as defined in Item 407(e)(4) of Regulation S-K under the Securities Exchange Act of 1934) whose executive officers served on our board or Independent Directors Committee, except Mr. Evans, our Chairman and Chief Executive Officer. Mr. Evans serves on the board of directors of Southern Trust Insurance Company. Mr. Houser, a member of our board, served as the Chief Executive Officer and President of Southern Trust Insurance Company until January 2016.

PRINCIPAL AND MANAGEMENT SHAREHOLDERS

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table shows the owners of more than 5% of our outstanding common stock as of April 7, 2017, the record date.

|

| | | | | | | |

| Name and Address | | Number of Shares Owned | | Right to Acquire | | Percentage of Beneficial Ownership(1) |

| | | | | | | |

The Vanguard Group(2) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | | 2,706,846 | | — | | 6.95 | % |

Franklin Mutual Advisers, LLC(3) 101 John F. Kennedy Parkway Short Hills, New Jersey 07078 | | 2,235,360 | | — | | 5.74 | % |

BlackRock, Inc.(4) 55 East 52nd Street New York, New York 10055 | | 2,076,259 | | — | | 5.33 | % |

| |

| (1) | The percentage of beneficial ownership is based on 38,939,203 shares outstanding on April 7, 2017. |

| |

| (2) | This information is based solely on the Schedule 13G/A filed on February 10, 2017 by The Vanguard Group, which reported sole voting power over 42,934 shares, shared voting power over 6,800 shares, shared dispositive power over 47,688 shares and sole dispositive power over 2,659,158 shares. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 40,888 shares as a result of serving as an investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 8,846 shares as a result of serving as an investment manager of Australian investment offerings. |

| |