4th Quarter 2017 Earnings Presentation Tom Wiley, Vice Chairman and CEO Sheila Ray, EVP and CFO and COO David Black, EVP and CCO Joe Evans, Chairman January 25, 2018 State Bank Financial Corporation

2 Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements, which are based on certain assumptions and describe our future plans, strategies, and expectations, can generally be identified by the use of the words “will,” “expect,” “should,” “anticipate,” “may,” and “project,” as well as similar expressions. These forward-looking statements include, but are not limited to, statements regarding our focus on improving efficiency, including expected cost savings and the timing thereof related to the AloStar Bank of Commerce (“AloStar”) acquisition, our ability to achieve our target burden and target efficiency ratios, and other statements about expected developments or events, our future financial performance, and the execution of our strategic goals. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions (“risk factors”) that are difficult to predict with regard to timing, extent, likelihood and degree. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. Pro forma financial information is not a guarantee of future results and is presented for informational purposes only. We undertake no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events or otherwise. Risk factors include, without limitation, the following: • negative reactions to our recent or future acquisitions of each bank’s customers, employees, and counterparties or difficulties related to the transition of services; • the integration of AloStar’s business into ours and the conversion of AloStar’s operating systems and procedures may take longer than anticipated or may be more costly than anticipated or have unanticipated adverse results related to AloStar’s or our existing businesses; • the anticipated benefits of the AloStar acquisition, including anticipated cost savings and strategic gains, may be significantly harder or take longer than expected or may not be achieved in the entirety or at all as a result of unexpected factors or events; • our ability to achieve anticipated results from the transactions with AloStar will depend on the state of the economic and financial markets going forward; • economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a reduction in demand for credit and a decline in real estate values; • a general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results; • risk associated with income taxes including the potential for adverse adjustments and the inability to fully realize deferred tax benefits; • increased cybersecurity risk, including potential network breaches, business disruptions, or financial losses; • restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • competitive pressures among depository and other financial institutions may increase significantly; • changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; • other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; • our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry; • adverse changes may occur in the bond and equity markets; • war or terrorist activities may cause deterioration in the economy or cause instability in credit markets; and • economic, governmental, or other factors may prevent the projected population, residential, and commercial growth in the markets in which we operate. In addition, risk factors include, but are not limited to, the risk factors described in Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently ended fiscal year. These and other risk factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a forward- looking statement.

3 2017 Highlights Completed the all cash acquisition of AloStar Bank of Commerce on September 30, 2017, adding $908mm in assets at the time of acquisition Successfully integrated The National Bank of Georgia and S Bank acquisitions in the first quarter Record full year 2017 pre-tax earnings of $87.6mm Increased interest income excluding accretion 43% year over year Benefiting from the AloStar acquisition, organic and PNCI loans grew $703mm, or 26%, year over year, with C&I increasing from 13.7% of the loan portfolio to 28.6% and CRE decreasing from 57.1% to 47.9% Deposit growth of $158mm, including $103mm, or 10.4%, growth in noninterest-bearing deposits, excluding acquisitions

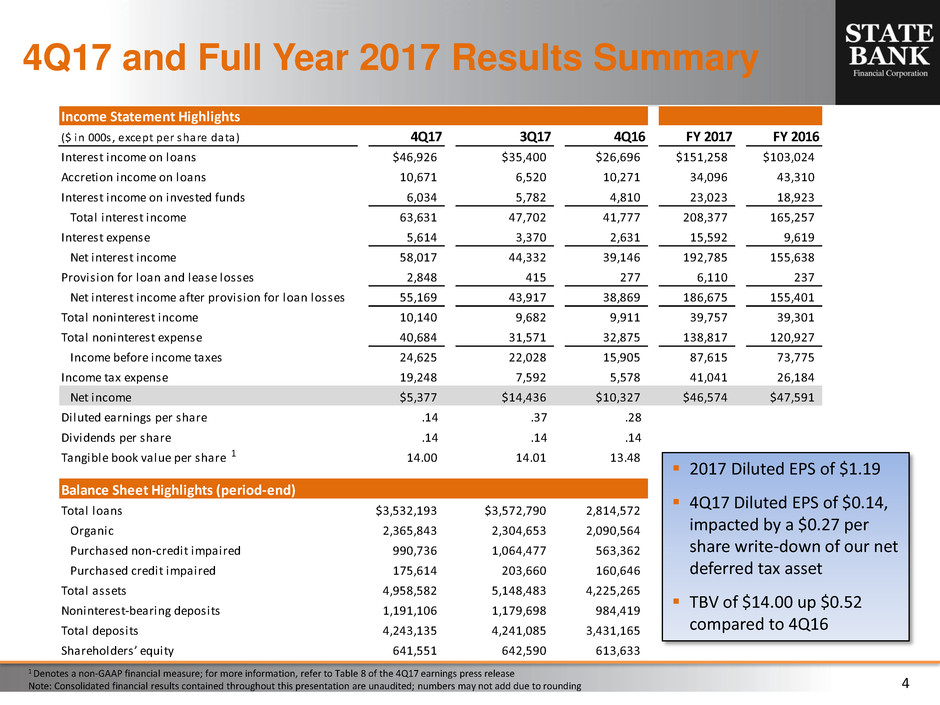

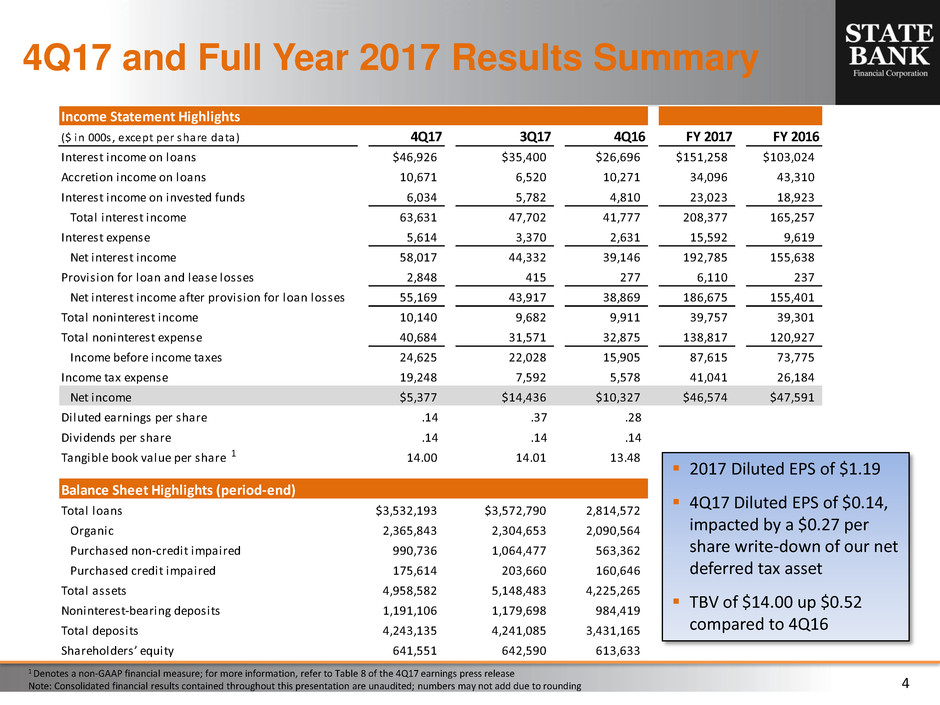

4 4Q17 and Full Year 2017 Results Summary 1 Denotes a non-GAAP financial measure; for more information, refer to Table 8 of the 4Q17 earnings press release Note: Consolidated financial results contained throughout this presentation are unaudited; numbers may not add due to rounding Income Statement Highlights ($ in 000s , except per share data) 4Q17 3Q17 4Q16 FY 2017 FY 2016 Interest income on loans $46,926 $35,400 $26,696 $151,258 $103,024 Accretion income on loans 10,671 6,520 10,271 34,096 43,310 Interest income on invested funds 6,034 5,782 4,810 23,023 18,923 Total interest income 63,631 47,702 41,777 208,377 165,257 Interest expense 5,614 3,370 2,631 15,592 9,619 Net interest income 58,017 44,332 39,146 192,785 155,638 Provision for loan and lease losses 2,848 415 277 6,110 237 Net interest income after provision for loan losses 55,169 43,917 38,869 186,675 155,401 Total noninterest income 10,140 9,682 9,911 39,757 39,301 Total noninterest expense 40,684 31,571 32,875 138,817 120,927 Income before income taxes 24,625 22,028 15,905 87,615 73,775 Income tax expense 19,248 7,592 5,578 41,041 26,184 Net income $5,377 $14,436 $10,327 $46,574 $47,591 Diluted earnings per share .14 .37 .28 Dividends per share .14 .14 .14 Tangible book value per share 14.00 14.01 13.48 Balance Sheet Highlights (period-end) Total loans $3,532,193 $3,572,790 2,814,572 Organic 2,365,843 2,304,653 2,090,564 P rchased non-credit impaired 990,736 1,064,477 563,362 Purchased credit impaired 175,614 203,660 160,646 Total assets 4,958,582 5,148,483 4,225,265 Noninterest-bearing deposits 1,191,106 1,179,698 984,419 Total deposits 4,243,135 4,241,085 3,431,165 Shareholders’ equity 641,551 642,590 613,633 1 2017 Diluted EPS of $1.19 4Q17 Diluted EPS of $0.14, impacted by a $0.27 per share write-down of our net deferred tax asset TBV of $14.00 up $0.52 compared to 4Q16

5 Notable Impacts in 4Q17 ($ in mm) Income Before Income Taxes Effective Tax Rate Tax Expense Net Income Diluted EPS 4Q17 Reported Results (GAAP) $24,625 78.2% $19,248 $5,377 $0.14 Deferred Tax Asset Revaluation ($8,106) $8,106 $0.21 Merger Tax Election ($2,545) $2,545 $0.07 Merger Expenses $2,588 $998 $1,590 $0.04 Investment Portfolio Restructuring Loss $1,481 $570 $911 $0.02 Loan Recovery Income ($5,919) ($2,281) ($3,638) ($0.09) Adjusted 4Q17 Results (Non-GAAP) $22,775 34.6% $7,884 $14,891 $0.38 Estimated “pro forma” impact to 2017 results had the Tax Cut and Jobs Act been effective January 1, 2017 ¹ ($2,703) Adjusted 4Q17 results after Tax Cut and Jobs Act $22,775 22.8% $5,181 $17,594 $0.45 ¹ Inclusive of entertainment and other expenses which were previously deductible

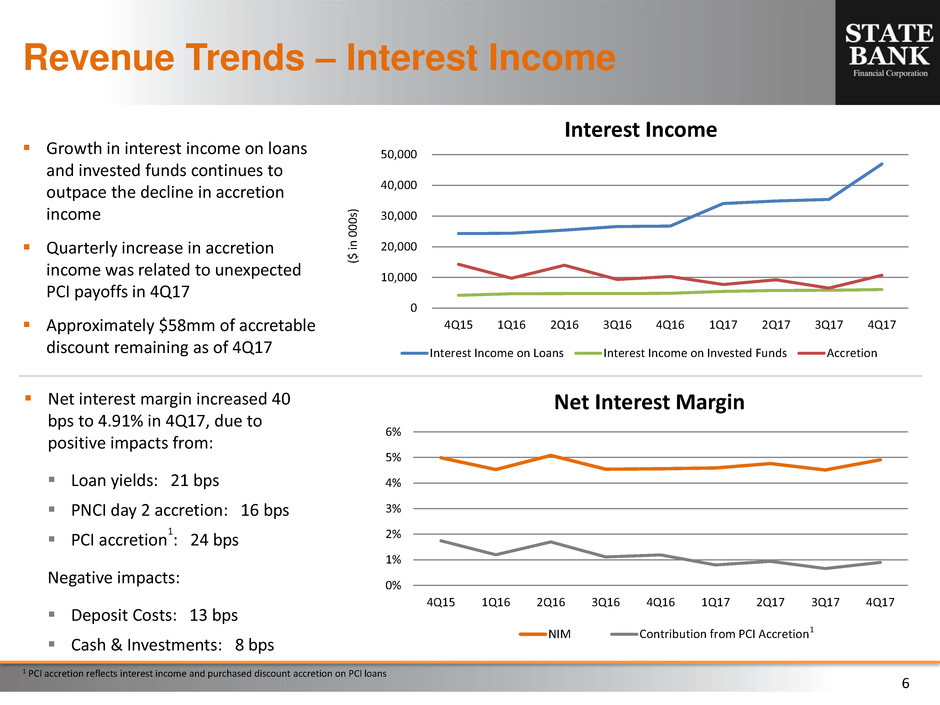

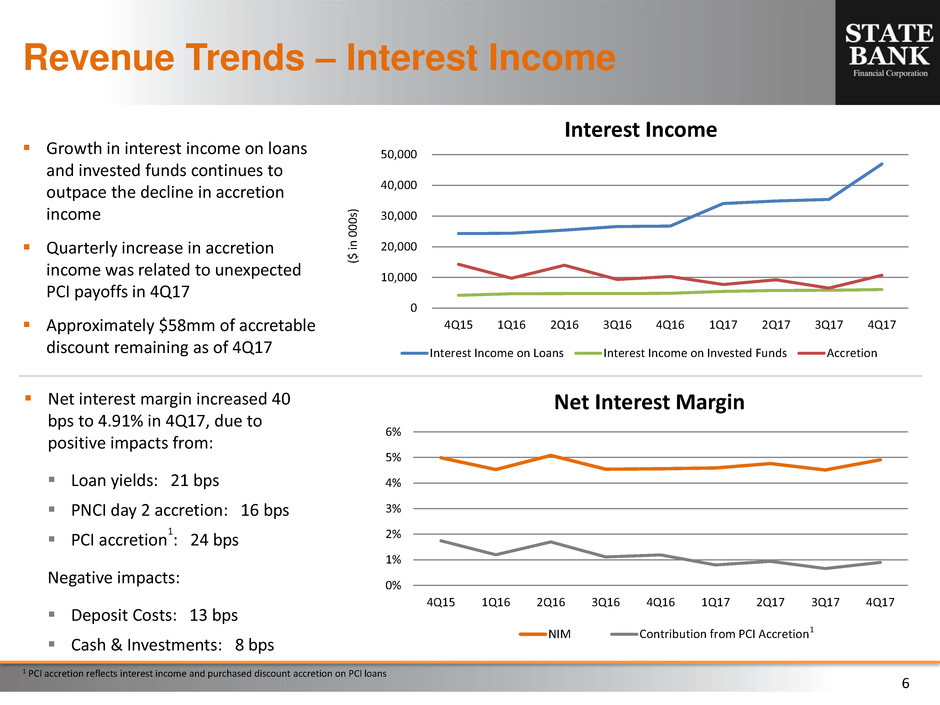

6 Revenue Trends – Interest Income Growth in interest income on loans and invested funds continues to outpace the decline in accretion income Quarterly increase in accretion income was related to unexpected PCI payoffs in 4Q17 Approximately $58mm of accretable discount remaining as of 4Q17 ($ i n 000 s) Net interest margin increased 40 bps to 4.91% in 4Q17, due to positive impacts from: Loan yields: 21 bps PNCI day 2 accretion: 16 bps PCI accretion 1 : 24 bps Negative impacts: Deposit Costs: 13 bps Cash & Investments: 8 bps 1 1 PCI accretion reflects interest income and purchased discount accretion on PCI loans 0 10,000 20,000 30,000 40,000 50,000 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 Interest Income Interest Income on Loans Interest Income on Invested Funds Accretion 0% 1% 2% 3% 4% 5% 6% 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 Net Interest Margin NIM Contribution from PCI Accretion

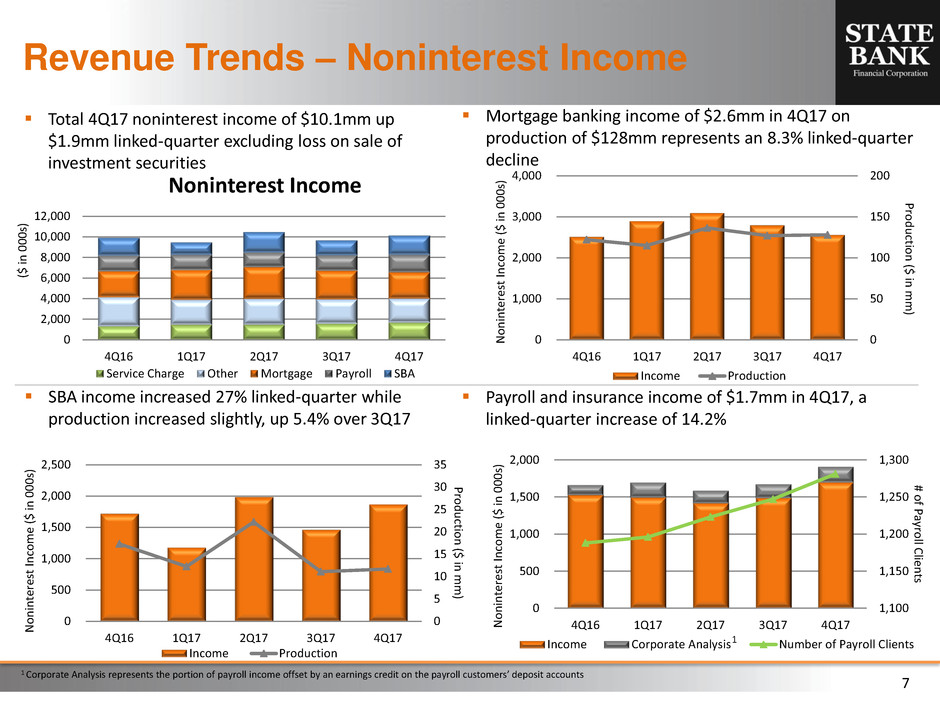

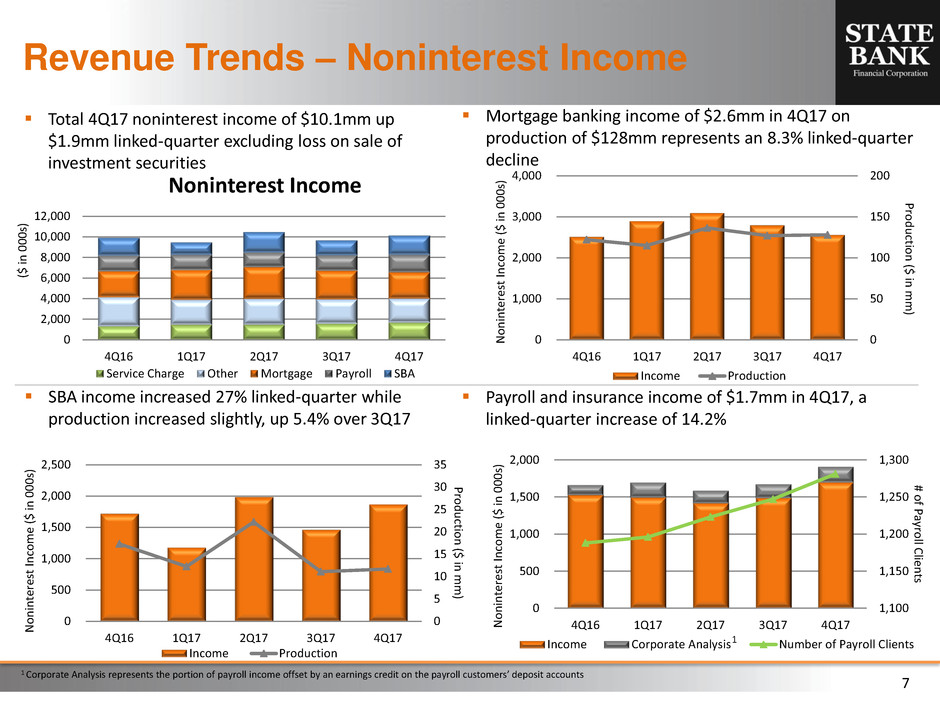

7 SBA income increased 27% linked-quarter while production increased slightly, up 5.4% over 3Q17 Payroll and insurance income of $1.7mm in 4Q17, a linked-quarter increase of 14.2% Revenue Trends – Noninterest Income Mortgage banking income of $2.6mm in 4Q17 on production of $128mm represents an 8.3% linked-quarter decline Total 4Q17 noninterest income of $10.1mm up $1.9mm linked-quarter excluding loss on sale of investment securities ($ i n 000 s) 1 1 Corporate Analysis represents the portion of payroll income offset by an earnings credit on the payroll customers’ deposit accounts 0 2,000 4,000 6,000 8,000 10,000 12,000 4Q16 1Q17 2Q17 3Q17 4Q17 Noninterest Income Service Charge Other Mortgage Payroll SBA 0 5 10 15 20 25 30 35 0 500 1,000 1,500 2,000 2,500 4Q16 1Q17 2Q17 3Q17 4Q17 Pr o d u cti o n ($ in mm ) N o n in ter es t In com e ($ i n 000 s) Income Production 1,100 1,150 1,200 1,250 1,300 0 500 1,000 1,500 2,000 4Q16 1Q17 2Q17 3Q17 4Q17 # o f P ayro ll C lien ts N o n in ter es t In com e ($ i n 000 s) Income Corporate Analysis Number of Payroll Clients 0 50 100 150 200 0 1,000 2,000 3,000 4,000 4Q16 1Q17 2Q17 3Q17 4Q17 Pr o d u cti o n ($ in m m ) N o n in ter es t In com e ($ i n 000 s) Income Production

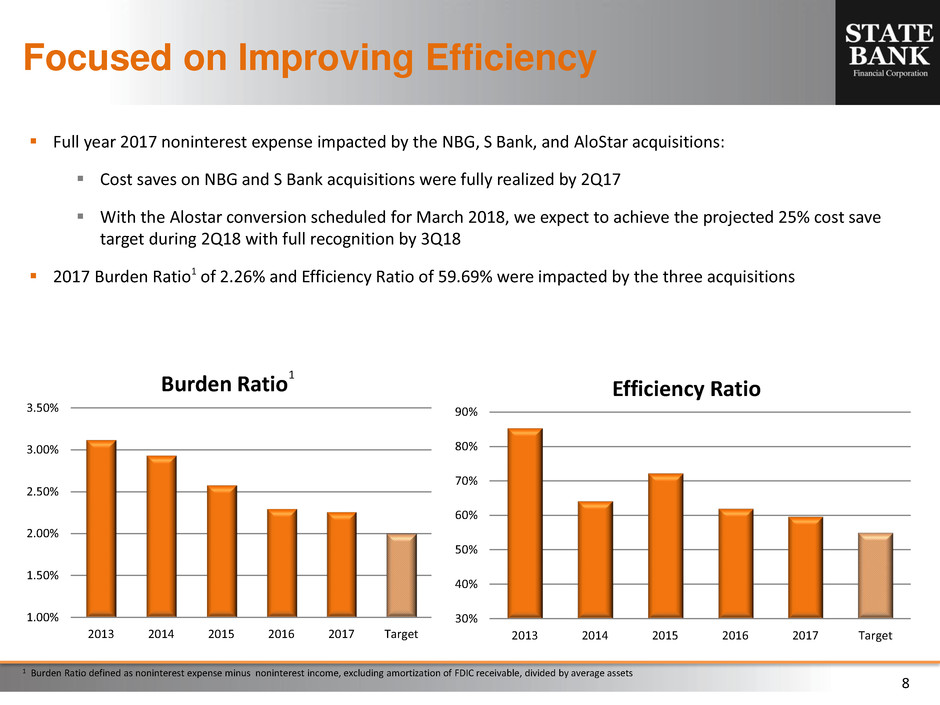

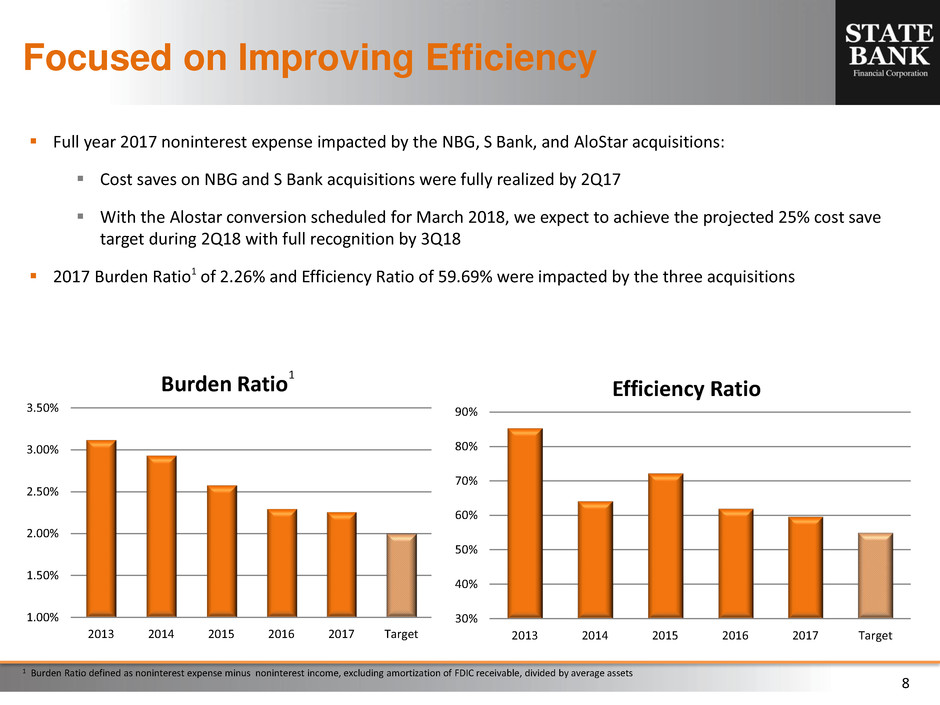

8 Focused on Improving Efficiency Full year 2017 noninterest expense impacted by the NBG, S Bank, and AloStar acquisitions: Cost saves on NBG and S Bank acquisitions were fully realized by 2Q17 With the Alostar conversion scheduled for March 2018, we expect to achieve the projected 25% cost save target during 2Q18 with full recognition by 3Q18 2017 Burden Ratio1 of 2.26% and Efficiency Ratio of 59.69% were impacted by the three acquisitions 1 Burden Ratio defined as noninterest expense minus noninterest income, excluding amortization of FDIC receivable, divided by average assets 30% 40% 50% 60% 70% 80% 90% 2013 2014 2015 2016 2017 Target Efficiency Ratio 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2013 2014 2015 2016 2017 Target Burden Ratio 1

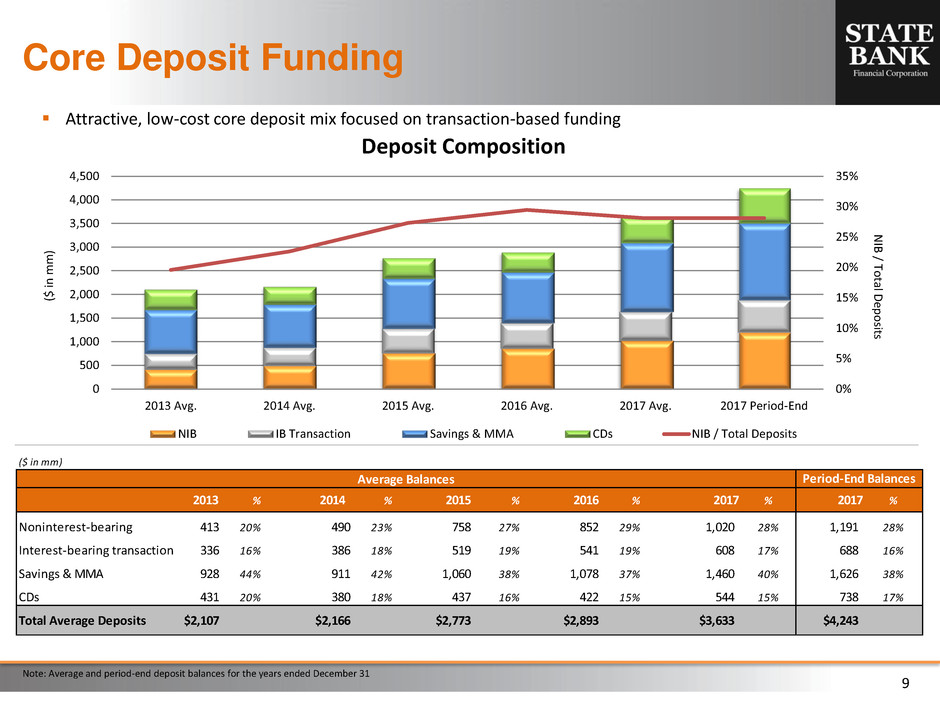

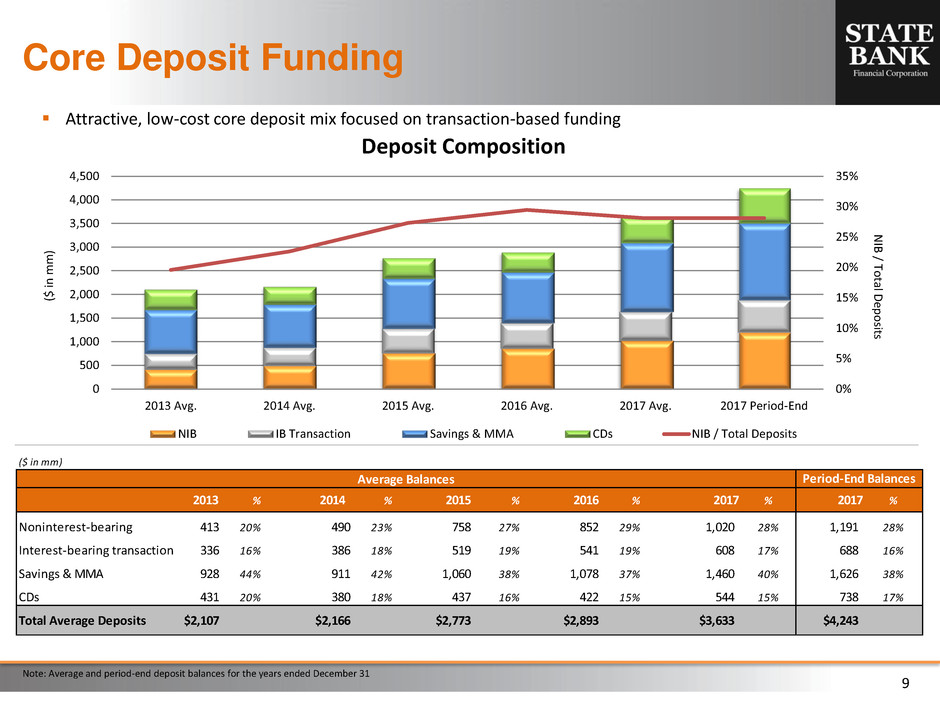

9 Core Deposit Funding ($ i n m m ) N IB / Tot al D ep o sit s Attractive, low-cost core deposit mix focused on transaction-based funding 1 Note: Average and period-end deposit balances for the years ended December 31 ($ in mm) 2013 % 2014 % 2015 % 2016 % 2017 % 2017 % Noninterest-bearing 413 20% 490 23% 758 27% 852 29% 1,020 28% 1,191 28% Interest-bearing transaction 336 16% 386 18% 519 19% 541 19% 608 17% 688 16% Savings & MMA 928 44% 911 42% 1,060 38% 1,078 37% 1,460 40% 1,626 38% CDs 431 20% 380 18% 437 16% 422 15% 544 15% 738 17% Total Average Deposits $2,107 $2,166 $2,773 $2,893 $3,633 $4,243 Average Balances Period-End Balances 0% 5% 10% 15% 20% 25% 30% 35% 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2013 Avg. 2014 Avg. 2015 Avg. 2016 Avg. 2017 Avg. 2017 Period-End Deposit Composition NIB IB Transaction Savings & MMA CDs NIB / Total Deposits

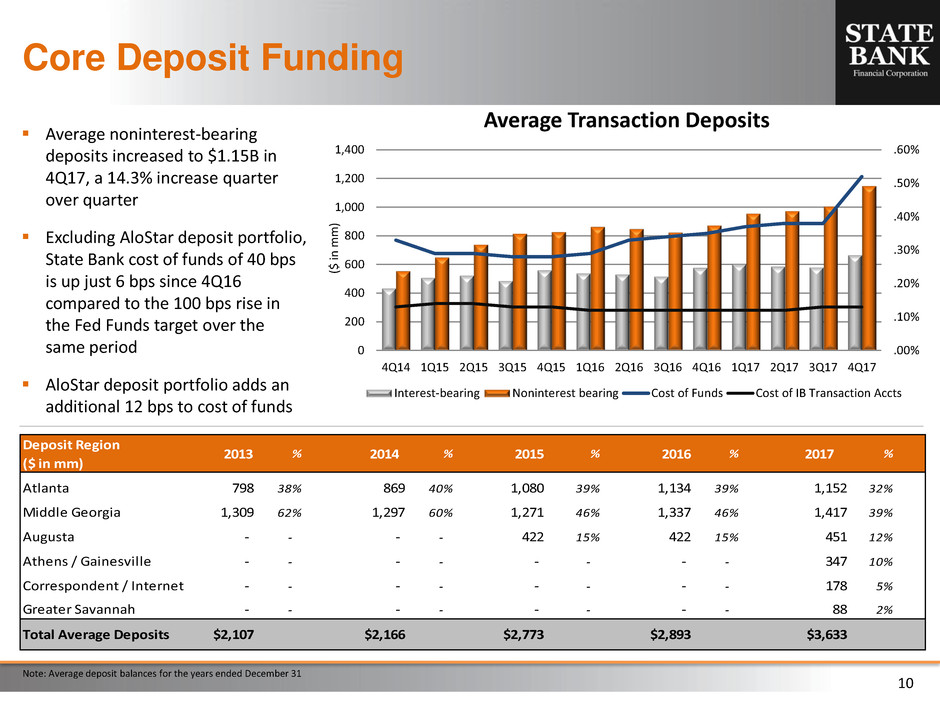

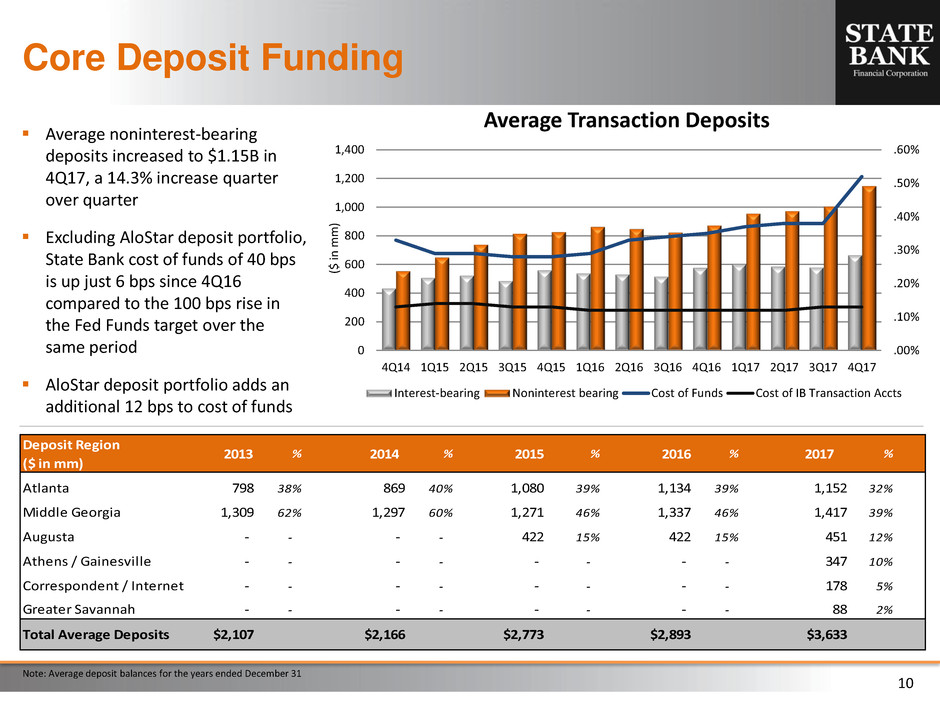

10 Core Deposit Funding Average noninterest-bearing deposits increased to $1.15B in 4Q17, a 14.3% increase quarter over quarter Excluding AloStar deposit portfolio, State Bank cost of funds of 40 bps is up just 6 bps since 4Q16 compared to the 100 bps rise in the Fed Funds target over the same period AloStar deposit portfolio adds an additional 12 bps to cost of funds ($ i n m m ) .00% .10% .20% .30% .40% .50% .60% 0 200 400 600 800 1,000 1,200 1,400 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 Average Transaction Deposits Interest-bearing Noninterest bearing Cost of Funds Cost of IB Transaction Accts Deposit Region ($ in m) 2013 % 2014 % 2015 % 2016 % 2017 % Atlanta 798 38% 869 40% 1,080 39% 1,134 39% 1,152 32% Middle Georgia 1,309 62% 1,297 60% 1,271 46% 1,337 46% 1,417 39% August - - - - 422 15% 422 15% 451 12% Athens / Gainesville - - - - - - - - - - 347 10% Correspondent / Internet - - - - - - - - 178 5% Greater Savannah - - - - - - - - - - 88 2% Total Average Deposits $2,107 $2,166 $2,773 $2,893 $3,633 Note: Average deposit balances for the years ended December 31

11 Loan Portfolio To ta l L o an s ($ in m m ) 1 New loan fundings include new loans funded and net loan advances on existing commitments 1 New loan originations and fundings in excess of $508mm in 4Q17 is a 20% increase over previous quarter and total originations for 2017 increased 8% over 2016 Diversification in the organic and PNCI loan portfolio continues to improve as C&I increased to 28.6% of the portfolio, compared to 27.4% in 3Q17 and 13.7% in 4Q16 N ew Lo an Fu n d in gs ($ i n m m ) Loan Composition (period-end) ($ in mm) 2013 2014 2015 2016 2017 Construction, land & land development $251 $313 $501 $551 $438 Other commercial real estate 550 636 736 964 1,168 Total commercial real estate 802 949 1,236 1,516 1,607 Residential real estate 67 135 210 289 293 Owner-occupied real estate 175 212 281 372 379 C&I and Leases 71 123 267 435 1,012 Consumer 9 9 21 42 67 Total Organic & PNCI Loans 1,123 1,428 2,015 2,654 3,357 PCI Loans 257 206 146 161 176 Total Loans $1,381 $1,635 $2,160 $2,815 $3,532 0 100 200 300 400 500 600 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 Total Loan Portfolio Organic PNCI PCI New Loan Fundings

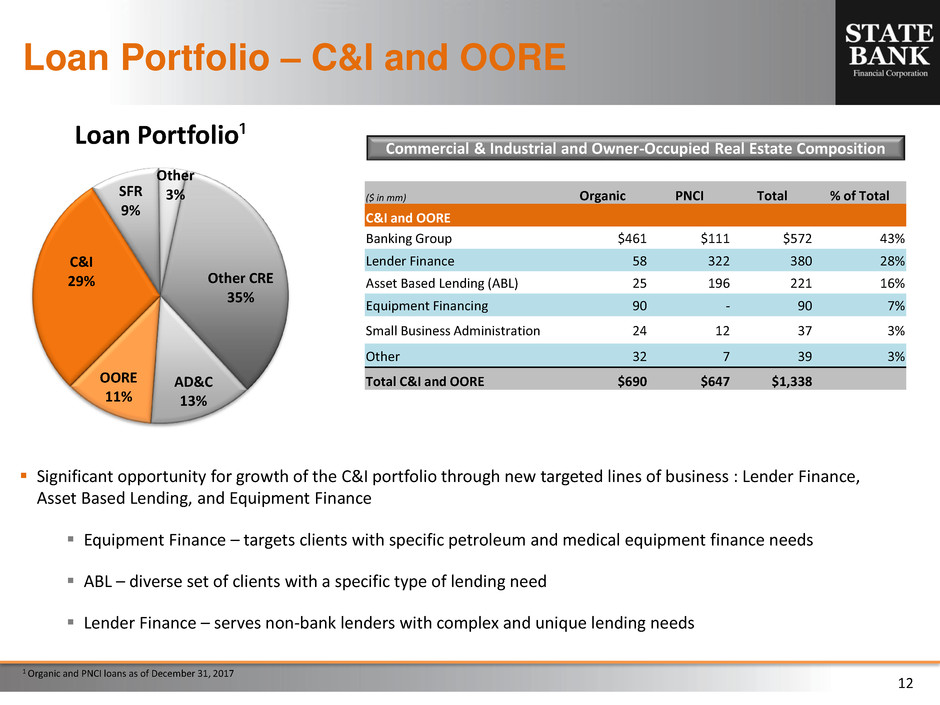

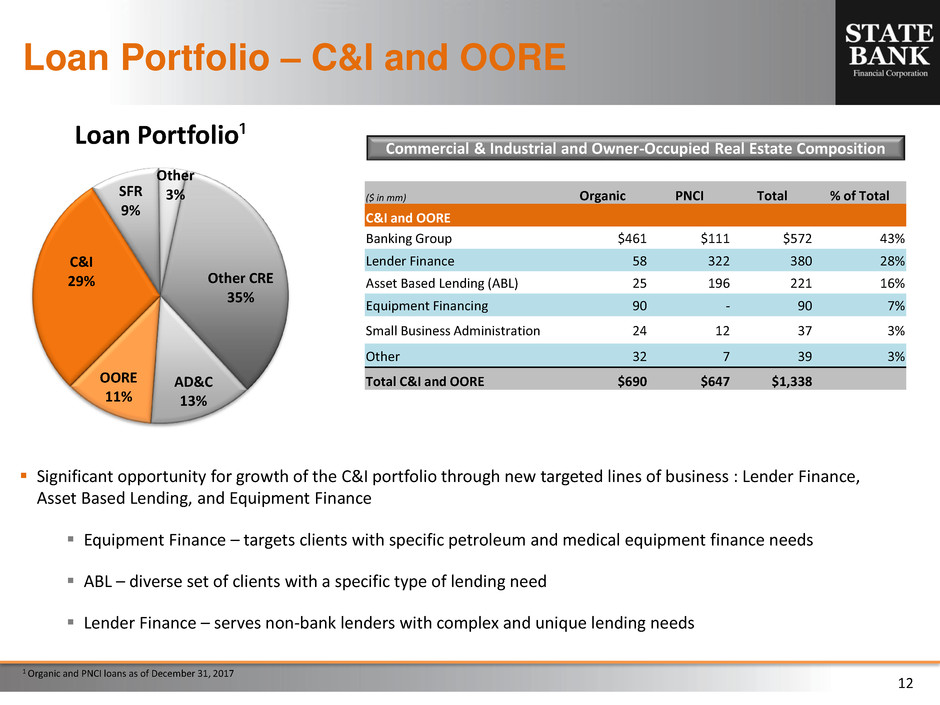

12 Loan Portfolio – C&I and OORE Commercial & Industrial and Owner-Occupied Real Estate Composition 1 Organic and PNCI loans as of December 31, 2017 Significant opportunity for growth of the C&I portfolio through new targeted lines of business : Lender Finance, Asset Based Lending, and Equipment Finance Equipment Finance – targets clients with specific petroleum and medical equipment finance needs ABL – diverse set of clients with a specific type of lending need Lender Finance – serves non-bank lenders with complex and unique lending needs Other CRE 35% AD&C 13% OORE 11% C&I 29% SFR 9% Other 3% Loan Portfolio¹ ($ in mm) Organic PNCI Total % of Total C&I and OORE Banking Group $461 $111 $572 43% Lender Finance 58 322 380 28% Asset Based Lending (ABL) 25 196 221 16% Equipment Financing 90 - 90 7% Small Business Administration 24 12 37 3% Other 32 7 39 3% Total C&I and OORE $690 $647 $1,338

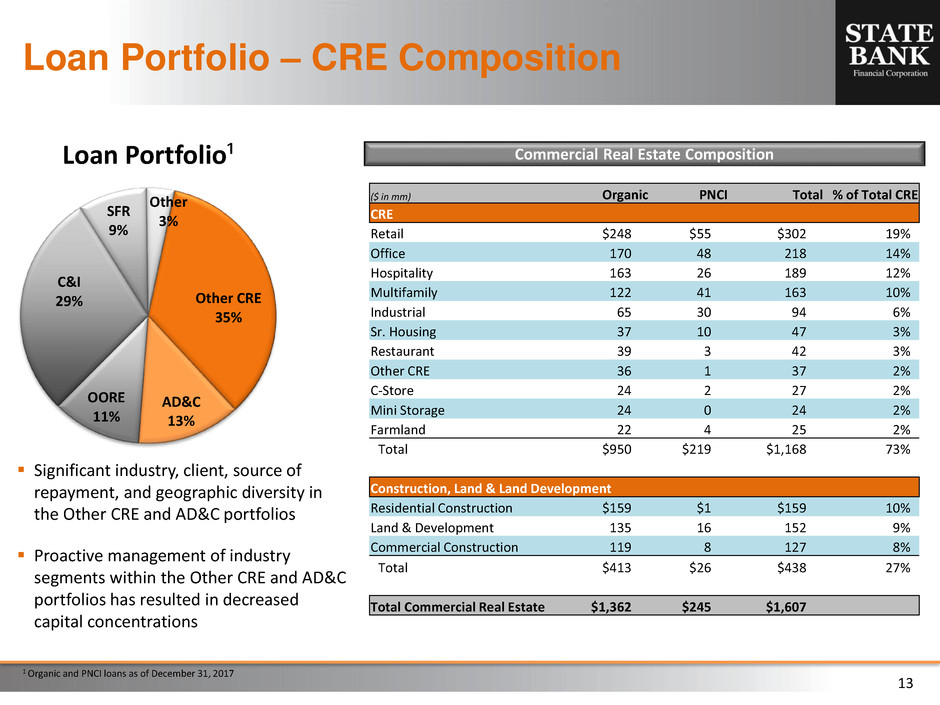

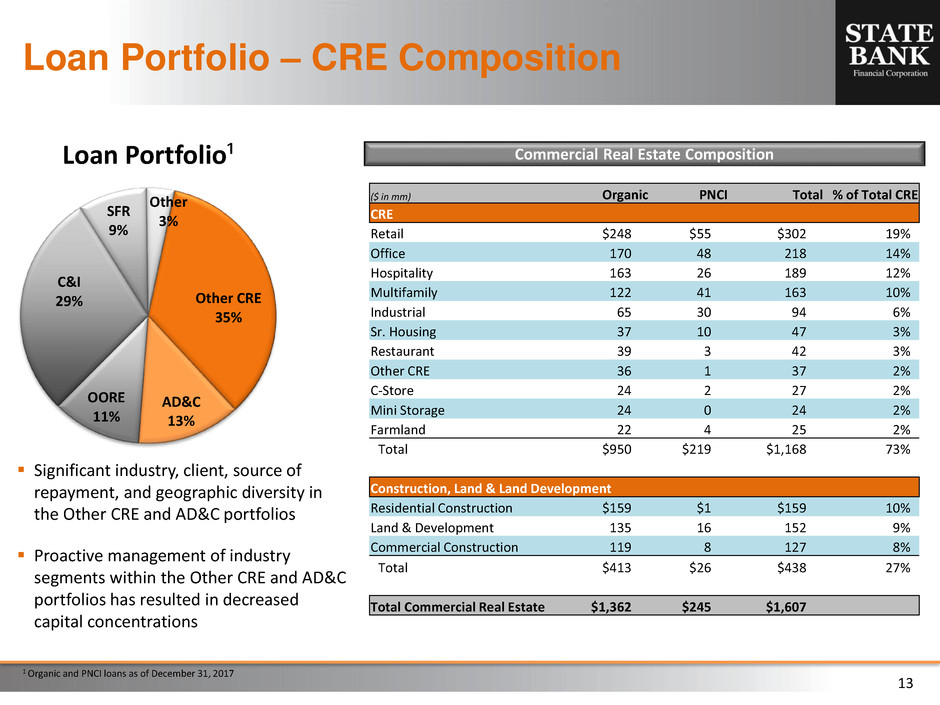

13 Loan Portfolio – CRE Composition 1 Organic and PNCI loans as of December 31, 2017 Commercial Real Estate Composition Significant industry, client, source of repayment, and geographic diversity in the Other CRE and AD&C portfolios Proactive management of industry segments within the Other CRE and AD&C portfolios has resulted in decreased capital concentrations Other CRE 35% AD&C 13% OORE 11% C&I 29% SFR 9% Other 3% Loan Portfolio¹ ($ in mm) Organic PNCI Total % of Total CRE CRE Retail $248 $55 $302 19% Office 170 48 218 14% Hospitality 163 26 189 12% Multifamily 122 41 163 10% Industrial 65 30 94 6% Sr. Housing 37 10 47 3% Restaurant 39 3 42 3% Other CRE 36 1 37 2% C-Store 24 2 27 2% Mini Storage 24 0 24 2% Farmland 22 4 25 2% Total $950 $219 $1,168 73% Construction, Land & Land Development Residential Construction $159 $1 $159 10% Land & Development 135 16 152 9% Commercial Construction 119 8 127 8% Total $413 $26 $438 27% Total Commercial Real Estate $1,362 $245 $1,607

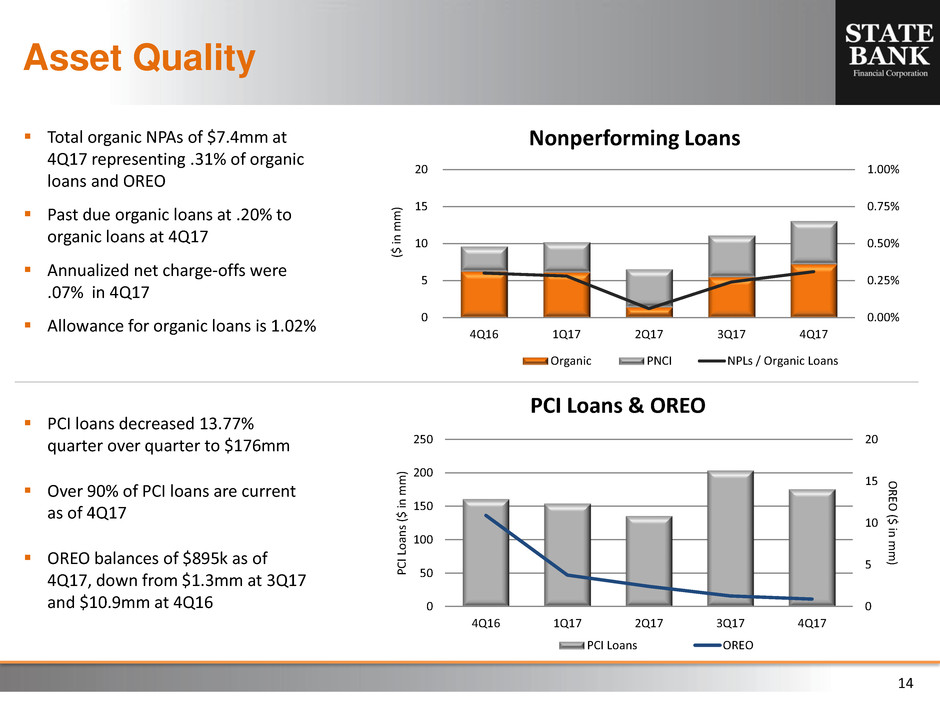

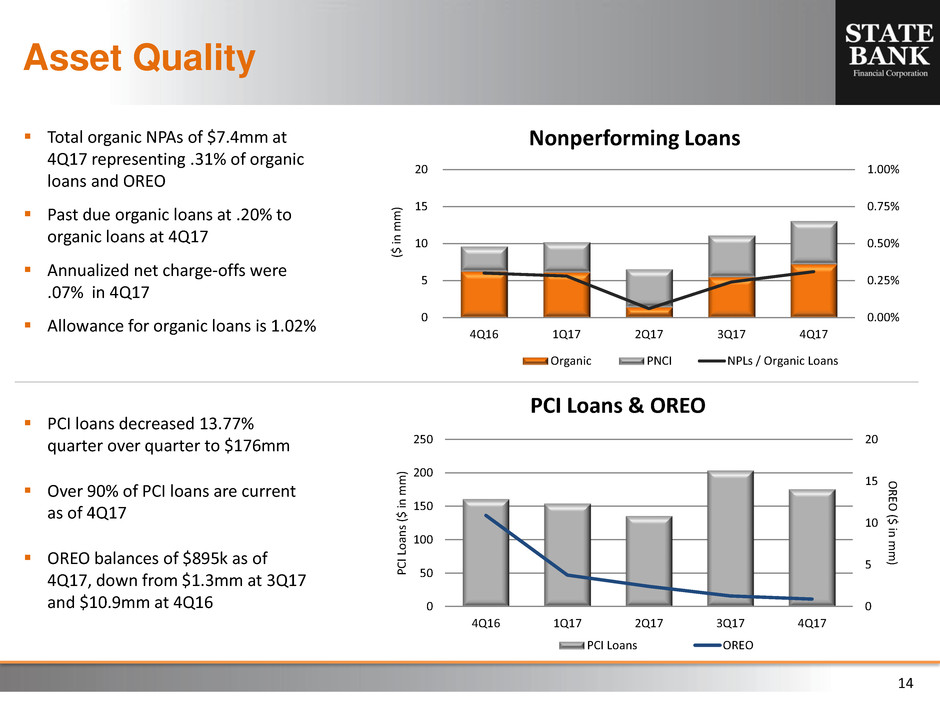

14 PCI loans decreased 13.77% quarter over quarter to $176mm Over 90% of PCI loans are current as of 4Q17 OREO balances of $895k as of 4Q17, down from $1.3mm at 3Q17 and $10.9mm at 4Q16 Asset Quality ($ i n m m ) Total organic NPAs of $7.4mm at 4Q17 representing .31% of organic loans and OREO Past due organic loans at .20% to organic loans at 4Q17 Annualized net charge-offs were .07% in 4Q17 Allowance for organic loans is 1.02% 0.00% 0.25% 0.50% 0.75% 1.00% 0 5 10 15 20 4Q16 1Q17 2Q17 3Q17 4Q17 Nonperforming Loans Organic PNCI NPLs / Organic Loans 0 5 10 15 20 0 50 100 150 200 250 4Q16 1Q17 2Q17 3Q17 4Q17 OR EO ($ i n m m ) PCI Lo an s ($ in m m ) PCI Loans & OREO PCI Loans OREO