UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| | Filed by the Registrant | [X ] |

| | Filed by a Party other than the Registrant | [ ] |

Check the appropriate box:

| | [ ] | Preliminary Proxy Statement |

| | [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | [X] | Definitive Proxy Statement |

| | [ ] | Definitive Additional Materials |

| | [ ] | Soliciting Material under Rule 14a-12 |

Pinnacle Capital Management Funds Trust

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | Payment of Filing Fee (Check the appropriate box): | |

| | | | |

| | [X] | No fee required | |

| | [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4)and 0-11 |

| | | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | | |

| | | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | | |

| | | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | | | |

| | (4) | Proposed maximum aggregate value of transaction: | |

| | | | |

| | | | |

| | (5) | Total fee paid: | |

| | | | |

| | | | |

| | | | |

| | [ ] | Fee paid previously with preliminary materials | |

| | [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | (1) | Amount Previously Paid: |

| | | | |

| | | | |

| | (2) | Form, Schedule or Registration Statement No: |

| | | | |

| | | | |

| | (3) | Filing Party: | |

| | | | |

| | | | |

| | (4) | Date Filed: | |

| | | | |

| | | | |

PINNACLE CAPITAL MANANGEMENT

FUNDS TRUST

1789 Growth and Income Fund

Class P Shares (PSEPX)

Class C Shares (PSECX)

July 11, 2019

Important Voting Information Inside

Please vote immediately!

You can vote through the Internet, by telephone, or by mail.

Details on voting can be found on your proxy card.

| | TO VOTE BY TELEPHONE: | | TO VOTE BY INTERNET: |

| • | Read the Proxy Statement and have the enclosed proxy card at hand | • | Read the Proxy Statement and have the enclosed proxy card at hand |

| • | Call the toll-free number that appears on the enclosed proxy card and follow the simple instructions | • | Go to the website found on the enclosed card and follow the simple instructions |

PROXY

STATEMENT

Pinnacle Capital Management

Funds Trust

Important Voting Information Inside!

TABLE OF CONTENTS

| Letter from the President | 3 |

| Notice of Special Meeting of Shareholders | 4 |

| Questions and Answers | 6 |

| Information About the Meeting | 7 |

| Proposal 1: Election of Trustees | 9 |

| Additional Information | 15 |

| Investment Adviser and Other Service Providers | 17 |

| Other Business | 19 |

| Appendix A: Charter for Nominating and Corporate Governance Committee | 20 |

Please Vote Immediately!

You can vote through the Internet, by telephone, or by mail.

Details on voting can be found on your proxy card.

LETTER FROM THE PRESIDENT

Pinnacle Capital Management Funds Trust

100 Limestone Plaza

Fayetteville, New York 13066

July 11, 2019

Dear Shareholder,

I am writing to inform you of an upcoming Special Meeting of Shareholders of Pinnacle Capital Management Funds Trust (the “Trust”), consisting of the1789 Growth and Income Fund, a series of the Trust, to be held on August 13, 2019. At the meeting, you are being asked to vote on an important proposal affecting the Trust.

I am sure you, like most people, lead a busy life and are tempted to put this proxy aside for another day. Please don’t. When shareholders do not return their proxies, additional expenses are incurred to pay for follow-up mailings and telephone calls. PLEASE TAKE A FEW MINUTES TO REVIEW THIS PROXY STATEMENT AND VOTE YOUR SHARES TODAY.

The Board of Trustees recommends a vote “FOR” each of the Nominees being proposed for election to the Board of Trustees. If you have any questions regarding the issue to be voted on or need assistance in completing your proxy card, please contact Okapi Partners, our proxy solicitor, toll-free at 1-877-869-0171.

I appreciate your consideration of this important proposal. Thank you for investing with Pinnacle Capital Management Funds Trust and for your continued support.

Sincerely,

Cortland H. Schroder

President and Principal Executive Officer

Pinnacle Capital Management Funds Trust

1789 Growth and Income Fund

Class P Shares (PSEPX)

Class C Shares (PSECX)

100 Limestone Plaza

Fayetteville, New York 13066

1-877-869-0171

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on August 13, 2019

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders of Pinnacle Capital Management Funds Trust, a Delaware statutory trust (the “Trust”), will be held at the offices of Ultimus Fund Solutions, LLC, the Trust’s transfer agent, located at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246, on August 13, 2019, at 10:30 a.m., Eastern time. This meeting is being held so that shareholders can vote on proposals to:

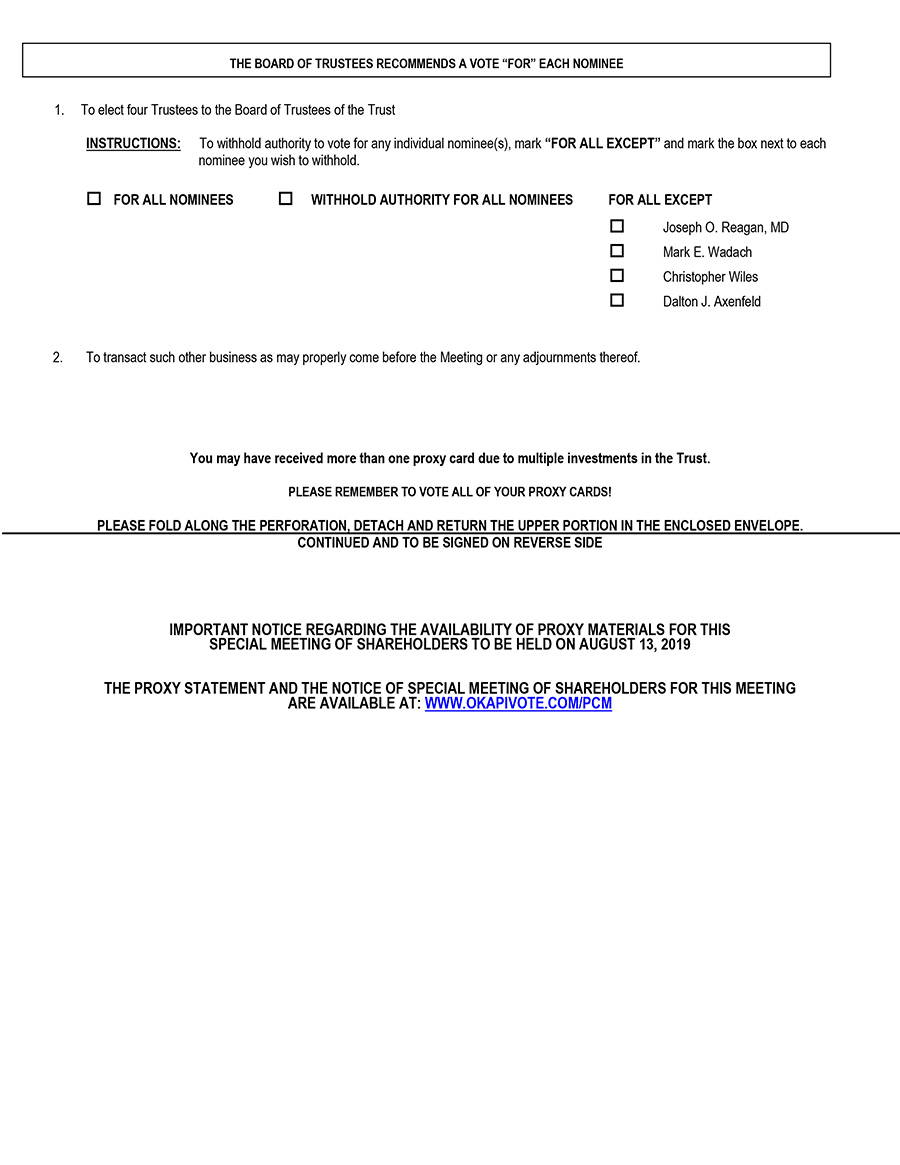

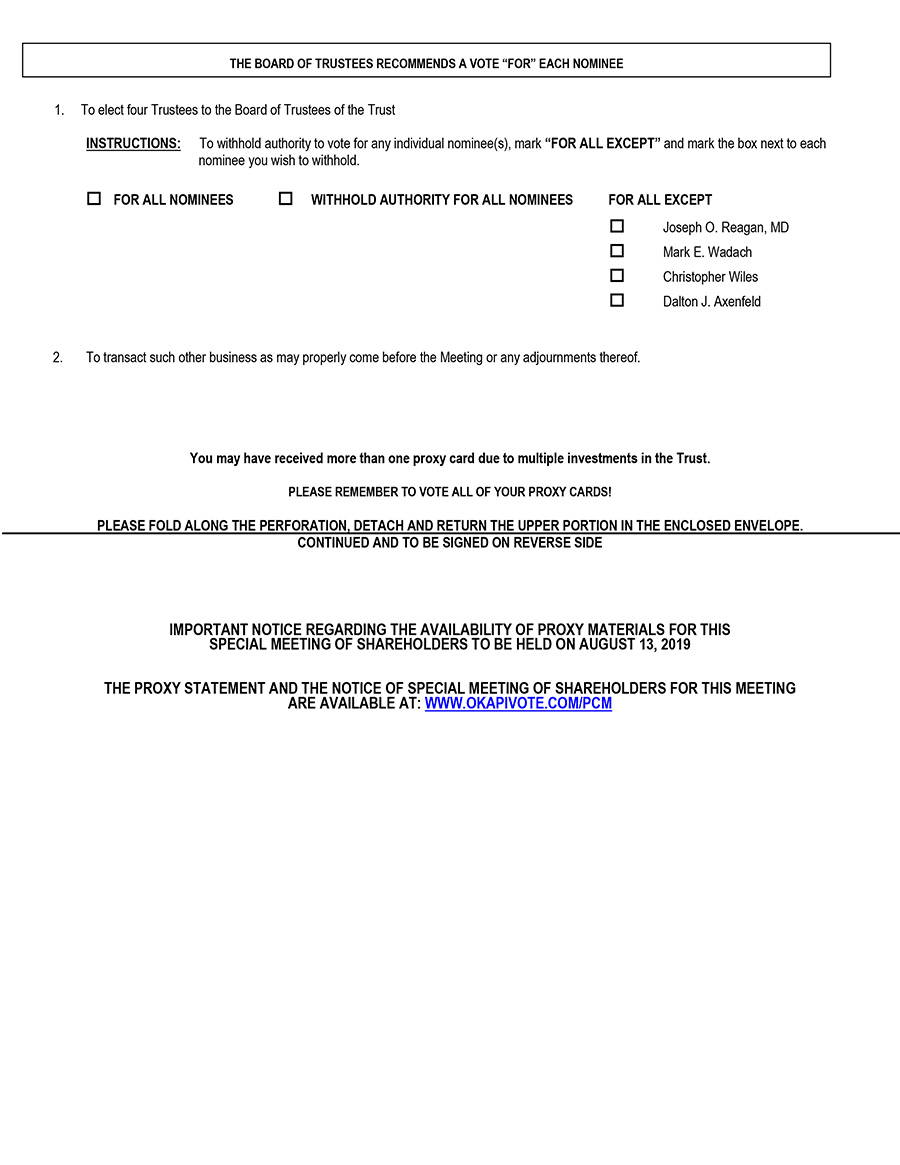

| 1. | Elect four (4) Trustees for the Trust; and |

| 2. | Transact such other business as may properly come before the meeting or any adjournment thereof. |

This is a notice and proxy statement for the Special Shareholders’ Meeting. Shareholders of record as of the close of business on July 3, 2019 are the only persons entitled to notice of and to vote at the meeting and any adjournments thereof. Your attention is directed to the attached proxy statement.

Proxy materials for the shareholder meeting are enclosed and are also available atwww.okapivote.com/PCM.

In addition to voting by mail you may also vote either by telephone or through the Internet as follows:

| | TO VOTE BY TELEPHONE: | | TO VOTE BY INTERNET: |

| • | Read the Proxy Statement and have the enclosed proxy card at hand | • | Read the Proxy Statement and have the enclosed proxy card at hand |

| • | Call the toll-free number that appears on the enclosed proxy card and follow the simple instructions | • | Go to the website found on the enclosed proxy card and follow the simple instructions |

We encourage you to vote by telephone or through the Internet using the control number that appears on the enclosed proxy card. Use of telephone or Internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote.

We appreciate your participation and prompt response to this matter and thank you for your continued support. If you have any questions after considering the enclosed materials, please call Okapi Partners, our proxy solicitor, toll-free at 1-877-869-0171.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT YOU CAST YOUR VOTE “FOR” THE PROPOSAL.

| July 11, 2019 | BY ORDER OF THE BOARD OF TRUSTEES |

| | |

| |  |

| | Benjamin V. Mollozzi |

| | Assistant Secretary |

Please vote by telephone or through the Internet by following the instructions on your proxy card, thus avoiding unnecessary expense and delay. You may also execute the enclosed proxy and return it promptly in the enclosed envelope. No postage is required if mailed in the United States. The proxy is revocable and will not affect your right to vote in person if you attend the Meeting.

QUESTIONS AND ANSWERS

While we encourage you to carefully read the entire text of the Proxy Statement, for your convenience we have provided answers to some of the most frequently asked questions and a brief summary of the proposal to be voted on by shareholders.

Q: What is happening? Why did I get this package of materials?

A: Pinnacle Capital Management Funds Trust (the “Trust”) is conducting a special meeting of shareholders (the “Special Meeting” or “Meeting”), scheduled to be held at 10:30 a.m., Eastern Time, on August 13, 2019. According to our records, you are a shareholder of record of the 1789 Growth and Income Fund, the sole series of the Trust, as of July 3, 2019, the record date for this Meeting.

Q: Why am I being asked to elect Trustees?

A: The Trust is required to hold a shareholder meeting for the purpose of electing Trustees to ensure that at least two-thirds of the members of the Board have been elected by the shareholders of the Trust as required by the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Board has considered the qualifications of each of the nominees, including those nominees that currently serve as Trustees, and determined that each is qualified to serve on the Board.

Q: Why might I receive more than one Proxy Card?

A: If you own shares that are registered in different accounts, you may receive a separate proxy card for the shares held in each named account and should vote each proxy card received.

Q: How does the Board of Trustees recommend that I vote?

A: After careful consideration of the proposal, the Board of Trustees unanimously recommends that you vote FOR the proposal. Information on the qualifications of the nominees is set forth in the accompanying Proxy Statement.

Q: What will happen if there are not enough votes to hold the Meeting?

A: It is important that shareholders vote by telephone or Internet or complete and return signed proxy cards promptly, but no later than August 12, 2019, to ensure there is a quorum for the Meeting. You may be contacted by a representative of the Trust or a proxy solicitor if we do not hear from you. If we have not received sufficient votes to have a quorum at the Meeting or have not received enough votes to approve the proposal, we may adjourn the Meeting to a later date so we can continue to seek more votes.

Q: Who should I call for additional information about the Proxy Statement?

A: If you have any questions regarding the Proxy Statement or completing and returning your proxy card, you can call Okapi Partners, our proxy solicitation firm, toll-free at 1-877-869-0171.

INFORMATION ABOUT THE MEETING

This proxy statement is being provided to you on behalf of the Board of Trustees in connection with the Special Meeting of Shareholders to be held on Tuesday, August 13, 2019 at 10:30 a.m., Eastern time. The Special Meeting will be held at the offices of the Trust’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. In this proxy statement, Pinnacle Capital Management Funds Trust will be referred to as the “Trust.” The shares of the Trust entitled to vote at the Meeting are issued in a sole series of the Trust. Currently, the one series issued is the – 1789 Growth and Income Fund, (which will be referred to as the “Fund”).

This notice of Special Meeting and proxy statement are first being mailed to shareholders on or around July 17, 2019. Supplementary solicitations may be made by representatives of the Trust by mail, telephone, e-mail, facsimile or other electronic means.

Costs of Proxy and Proxy Solicitation Services. All costs associated with the Special Meeting, including the expenses of preparing, printing and mailing this proxy statement and the solicitation and tabulation of proxies, will be borne by Pinnacle Capital Management, LLC, the investment adviser to the Trust (the “Adviser”). The Trust has retained Okapi Partners to assist with the distribution, tabulation and solicitation of proxies. The estimated costs of such services by Okapi Partners is $8,750. Banks, brokerage houses, nominees and other fiduciaries will be requested to forward this proxy statement to the beneficial owners of shares of the Fund and obtain authorization for executing proxies. The Adviser may reimburse brokers, banks and other fiduciaries for postage and reasonable expenses incurred in the forwarding of proxy materials to the beneficial owners. Supplementary proxy solicitation services may include any additional solicitation made by letter, Internet, telephone or telecopy. Expenses incurred in connection with the Special Meeting will be paid for by the Adviser and not the Fund.

by voting immediately, you can help avoid the considerable expense of any additional solicitation of proxies

Voting Your Proxy. If you vote your proxy now, you may revoke it before the Special Meeting using any of the voting procedures described on your proxy card or by attending the Special Meeting and voting in person. Unless revoked, proxies that have been returned by shareholders without instructions will be voted in favor of all proposals. In instances where choices are specified on the proxy, those proxies will be voted as the shareholder has instructed.

Record Date and Outstanding Shares. The Board of Trustees has fixed the close of business on July 3, 2019 (the “Record Date”) as the record date for the determination of shareholders entitled to notice of and to vote at the Special Meeting and any adjournment(s) thereof. Shareholders of record as of the Record Date will be entitled to one vote for each share held and a proportionate vote for fractional shares held. No shares have cumulative voting rights. As of the Record Date, the total number of issued and outstanding shares of beneficial interest of the Trust is 1,875,816.1700. Below is a table reflecting the Fund’s outstanding shares as of the Record Date.

| Fund | Shares Outstanding |

| 1789 Growth and Income Fund | 1,875,816.1700 |

Shareholder Vote Required.The vote of a plurality of the Trust’s shares represented at the Meeting is required for the election of Trustees (Proposal 1 below). If Proposal 1 does not receive enough “FOR” votes by the date of the Meeting to constitute approval, the named proxies may propose adjourning the Special Meeting to allow the gathering of more proxy votes.

Quorum. A quorum is the number of shares legally required to be at a meeting in order to conduct business. The presence, in person or by proxy, of one-third of the outstanding shares of the Trust is necessary to constitute a quorum at the Special Meeting. Proxies properly executed and marked with a negative vote or an abstention will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes are not received to approve the proposal, the persons named as proxies may propose one or more adjournments of the meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares represented at the Meeting in person or by proxy. If a quorum is not present, the persons named as proxies will vote those proxies received that voted in favor of the proposal in favor of an adjournment, and will vote those proxies for which they are required to vote “AGAINST” the proposal against any such adjournment.

Abstentions and “broker non-votes” are counted for purposes of determining whether a quorum is present but do not represent votes cast with respect to the proposal. “Broker non-votes” are shares held by a broker or nominee for which an executed proxy is received by the Trust, but are not voted as to one or more proposals because instructions have not been received from the beneficial owners or persons entitled to vote, and the broker or nominee does not have discretionary voting power. Notwithstanding the foregoing, “broker non-votes” will be excluded from the denominator of the calculation of the number of votes required to approve any proposal to adjourn the Meeting. Accordingly, abstentions and “broker non-votes” effectively will be a vote against the proposal and will have no effect on a vote for adjournment.

Trustee Votes. The Trustees intend to vote all of their shares held in the Fund in favor of the proposal described herein. As of the Record Date, the incumbent Trustees, Trustee nominees and officers of the Trust, as a group, owned of record or beneficially 0.23% of the outstanding shares of the Fund.

PROPOSAL 1:

ELECTION OF TRUSTEES

Four individuals are being proposed for election to the Board of Trustees (the “Nominees”). Except for Dalton J. Axenfeld and Christopher Wiles, all Nominees are currently Trustees and have served in that capacity for the length of time indicated in the table below. At the Special Meeting, the shareholders of the Trust will be asked to elect the Nominees to serve on the Board of Trustees of the Trust. It is intended that the enclosed Proxy will be voted “FOR” the election of the four Nominees named below as Trustees, unless such authority has been withheld in the Proxy.

Shareholders are being asked to elect the four Nominees to serve on the Board of Trustees of the Trust to ensure that at least two-thirds of the members of the Board have been elected by the shareholders of the Trust as required by the Investment Company Act. Currently, the Board consists of two Trustees, one of which has been elected by shareholders and one who has not been elected by shareholders. The Board recently had a Trustee resign, causing the Trust to no longer meet the requirement that two-thirds of all Trustees be elected by shareholders. To ensure continued compliance with the forgoing requirements of the Investment Company Act, shareholders are being asked at the Special Meeting to elect the four Nominees. Each Nominee has indicated a willingness to serve as a member of the Board of Trustees if elected. If any of the Nominees should not be available for election, the persons named as proxies (or their substitutes) may vote for other persons in their discretion. However, management has no reason to believe that any Nominee will be unavailable for election. On June 19, 2019, the Independent Trustees met to review pertinent information on the nomination of Dalton J. Axenfeld and Christopher Wiles to serve on the Board. After considering Mr. Axenfeld and Mr. Wiles’ background and experience, the Independent Trustees determined to nominate Mr. Axenfeld and Mr. Wiles for election, each as a Trustee. The Board of Trustees recommends that Dalton J. Axenfeld and Christopher Wiles be elected to serve as a Trustee of the Trust. If elected, Mr. Axenfeld will be an interested Trustee and Mr. Wiles will be an independent Trustee.

The Board of Trustees Generally

The Trustees serve for an indefinite term, subject to death, resignation, removal or retirement. The Trustees have not adopted a retirement policy. Subject to the Investment Company Act and applicable Delaware law, the Trustees may fill vacancies in or reduce the number of Board members, and may elect and remove such officers and appoint and terminate such agents as they consider appropriate.

The Board of Trustees oversees the management of the Trust and meets at least quarterly to review reports about the Trust’s operations. The Board of Trustees provides broad supervision over the affairs of the Trust. The Board of Trustees, in turn, elects the officers of the Trust to actively supervise the Fund’s day-to-day operations. The Trustees may appoint from their own number and establish and terminate one or more committees consisting of two or more Trustees who may exercise the powers and authority of the Board to the extent that the Trustees determine. The Trustees may, in general, delegate such authority as they consider desirable to any officer of the Trust, to any committee of the Board and to any agent or employee of the Trust. During the most recent fiscal year ended October 31, 2018, the Board of Trustees held four meetings. Each Trustee attended each Board meeting (that occurred during his term in office) during the October 31, 2018 fiscal year.

Board Committees.The Board has established a Nominating and Corporate Governance Committee and an Audit Committee consisting entirely of the Independent Trustees. The members of each committee are Joseph O. Reagan and Mark E. Wadach, and subject to his election as Trustee at the Special Meeting, Christopher Wiles. The Audit Committee oversees (i) the Trust's accounting and financial reporting policies and practices, its internal controls and, as appropriate, the internal controls of certain service providers; and (ii) the quality and objectivity of the Trust’s financial statements and the independent audit thereof. In addition, the Audit Committee acts as a liaison between the Trust’s independent auditors and the full Board and pre-approves the scope of the audit and non-audit services the independent auditors provide to the Trust. The Nominating and Corporate Governance Committee shall make nominations for Trustee membership on the Board of Trustees, including the Independent Trustees. The Committee shall evaluate candidates’ qualifications for Board membership and their independence from the investment adviser to the Trust’s series portfolio and the Trust’s other principal service providers. The Nominating and Corporate Governance Committee will review shareholder recommendations for nominations to fill vacancies on the Board of Trustees if such recommendations are submitted in writing, addressed to the Nominating and Corporate Governance Committee at the Trust’s offices, and meet any minimum qualifications that may be adopted by the Committee. The Nominating and Corporate Governance Committee may adopt, by resolution, policies regarding its procedures for considering candidates for the Board of Trustees, including any recommended by shareholders. A copy of the Trust’s Nominating and Governance Committee charter is available free of charge, upon request directed to the Assistant Secretary of the Trust, and is included herewith as Appendix A. During the most recent fiscal year ended October 31, 2018, the Audit Committee met two times and the Nominating and Governance Committee met zero times.

Information Regarding the Nominees and Officers of the Trust

The following is a list of the Nominees, as well as the executive officers of the Trust. Dalton J. Axenfeld is an “interested person” of the Trust, as defined by the Investment Company Act. The other Nominees are Independent Trustees; that is, they are not considered “interested persons” of the Trust under the Investment Company Act because they are not employees or officers of, and have no financial interest in, the Trust’s affiliates or its service providers.

Independent Trustee Nominees

Name,

Address(1),

and Age | Position(s)

with the

Trust | Length

of

Time

Served | Principal

Occupation(s)

During Past 5 Years | Number

of

Portfolios

in

Fund

Complex

Overseen

by

Trustee | Other

Directorships

Held by

Trustee

During the

Past 5 Years |

Joseph O. Reagan, MD

(born 1951) | Trustee/ Chairman/ Nominee | Indefinite Term; Since 2010 | Adjunct Professor, Cornell University’s Sloan School of Management: 2009 to 2015; Practice Consultant, Community General Hospital’s Anesthesia Group 2008 to present; Professor, New York State Office of Professional Medical Conduct: 2015 to 2016; Anesthesiologist, Anesthesia Group of Onondaga, PC: Retired 2006. | 1 | None |

Mark E. Wadach

(born 1951) | Trustee/ Nominee | Indefinite Term; Since 2014 | Sales Representative for Upstate Utilities Inc. (utilities, telecom and cellular): 2007 to present. | 1 | NYSA Series Trust for its one series. |

Christopher Wiles

(born 1943) | Nominee | ------------ | Retired, New York State Attorney General’s Office, 2014 – 2018. | N/A | None |

Interested Trustee Nominee

Name,

Address,

and Age | Position(s)

with the

Trust | Length

of

Time

Served | Principal

Occupation(s)

During Past 5 Years | Number

of

Portfolios

in

Fund

Complex

Overseen

by

Trustee | Other

Directorships

Held by

Trustee

During the

Past 5 Years |

Dalton J. Axenfeld(2)

(born 1988) | Nominee | ---------- | CFO, Pinnacle Holding Company, LLC 2017 – present, Controller, Pinnacle Holding Company, LLC 2016 – 2017, Senior Auditor, Dannible & McKee, LLP 2011 - 2016 | N/A | None |

| (1) | The address of each Trustee / Nominee is c/o Pinnacle Capital Management Funds Trust, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

| (2) | Dalton J. Axenfeld, is an affiliated person of the Fund’s Adviser, and is an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act. |

Executive Officers

Name,

Address(1),

and Age | Position(s)

with the

Trust | Length of

Time

Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios

in

Fund

Complex

Overseen

by

Trustee | Other

Directorships

Held by

Trustee

During the

Past 5 Years |

Cortland Schroder(2)

(born 1965) | President, Chief Executive Officer, and Secretary | Indefinite Term;

Since 2014 | Chief Marketing Officer, Pinnacle Holding Co., LLC: July 2014 to June 2016; Chief Marketing Officer, Pinnacle Capital Management: March 2014 to June 2016; Vice President, Business Development for Pinnacle Capital Management LLC: June 2016 to Present. | N/A | N/A |

Paul A. Tryon, CFA(2)

(born 1975) | Treasurer and Chief Financial Officer | Indefinite Term; Since 2017 | Principal, Senior Portfolio Manager, Pinnacle Capital Management, LLC, 2016 to present; Director of Investments, Emerson Investment Management, 2011 to 2016. | N/A | N/A |

Kevin R. McClelland(2)

(born 1986) | Chief Compliance Officer | Indefinite Term; Since 2012 (CCO Since June 2013) | Chief Compliance Officer, Pinnacle Capital Management, LLC: June 2013 to present (previously Chief Operating Officer of Pinnacle Capital Management) | N/A | N/A |

Dean S. Dellas(2)

(born 1984) | Vice

President | Indefinite

Term;

Since 2018 | Head Trader, Pinnacle Capital Management, LLC – 2018-Present; Managing Director, Sales & Distribution, Pinnacle Capital Management, LLC – 2017-Present; Financial Advisor/Portfolio Manager, Pinnacle Investments, LLC (Broker Dealer and Registered Investment Advisor) – 2013-Present | N/A | N/A |

| (1) | The address of each Executive Officer is c/o Pinnacle Capital Management Funds Trust, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

| (2) | Cortland Schroder,Paul A. Tryon, Kevin R. McClelland and Dean S. Dellas are considered to be an affiliated person of the Fund’s Adviser, and are an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act. |

Ownership in the Trust’s Adviser or Distributor by the Nominees who are Independent Trustees

As of the Record Date, none of the Trustees or Nominees who are Independent Trustees of the Trust hold any positions, or have any ownership interest in the Adviser, Pinnacle Investments, LLC (the “Distributor”) or any affiliated person of the Trust.

Qualifications of Trustees / Nominees

The Nominating and Corporate Governance Committee reviews the experience, qualifications, attributes and skills of potential candidates for nomination or election by the Board. In evaluating a candidate for nomination or election as a Trustee, the Nominating and Corporate Governance Committee takes into account the contribution that the candidate would be expected to make to the diverse mix of experience, qualifications, attributes and skills that the Nominating and Corporate Governance Committee believes contribute to good governance for the Trust. The Board has concluded, based on each Trustee’s / Nominee’s experience, qualifications, attributes or skills on an individual basis and in combination with the other Trustees / Nominees, that each Trustee / Nominee is qualified and should serve as such. In determining that a particular Trustee / Nominee is qualified to serve as a Trustee, the Board considered a variety of criteria, none of which, in isolation, was controlling.

| Joseph O. Reagan, MD |

| Joseph O. Reagan, MD is a retired Anesthesiologist with over 30 years of business and investment experience as a practicing physician, partner of the Anesthesia Group of Onondaga, PC, and spent 14 years as Chairman of the Anesthesia Department at St. Joseph’s Hospital Health Center. Dr. Reagan was an Adjunct Professor at Cornell University’s Sloan School of Management and is a Practice Consultant for Community General Hospital Anesthesia Group. Dr. Reagan earned degrees from Hamilton College, University of Guadalajara School of Medicine, and the State University of New York. Dr. Reagan has served as Chairman and a Trustee of the Trust since 2010. The Board concluded that Dr. Reagan is suitable to serve as a Trustee because of his professional experience and his academic background. |

| Mark E. Wadach |

| Mr. Mark E. Wadach has over 25 years of business experience in sales and marketing and has served as a trustee of another investment company since 1997. Mr. Wadach was a member of the Syracuse University basketball team during undergraduate school where he earned a Bachelor of Science Degree in Business Management. Mr. Wadach has served as a Trustee of the Trust since 2014. The Board concluded that Mr. Wadach is suitable to serve as a Trustee because of his business experience, academic background and his service and experience on other board. |

| Christopher Wiles |

| Mr. Christopher Wiles worked for the New York State Attorney's Office from 2001 until 2018. Prior to the New York State Attorney General's office, Mr. Wiles worked in a law partnership practice where he concentrated in real estate, trusts and estates, and commercial matters. He is a Board member and a past President of the Volunteer Lawyers project of Onondaga County and is presently President of the Syracuse Parks Conservancy. Mr. Wiles holds a degree in history from Princeton University and a J.D. degree from Cornell Law School where he has also taught clinical courses related to his work with the Attorney General's office. The Board concluded that Mr. Wiles is suitable to serve as a Trustee because of his business and legal experience, his academic background and his professional experience as a practicing attorney for more than 45 years. |

| Dalton J. Axenfeld |

| Mr. Dalton J. Axenfeld is the Chief Financial Officer for Pinnacle Holding Company, LLC. and oversees all financial reporting and accounting for the various companies. Mr. Dalton joined Pinnacle Holding Company, LLC as the Controller in 2016 after spending 5 years in public accounting as a Senior Auditor where he gained valuable experience working for a nationally recognized firm. Mr. Dalton is a Certified Public Accountant (CPA) in the state of New York, a member of the New York State Society of CPAs (NYSSCPA), and the American Institute of CPAs (AICPA). He also attended Ithaca College where he obtained his MBA, and Le Moyne College where he received his B.S. in Accounting. The Board concluded that Mr. Dalton is suitable to serve as a Trustee because of his business and accounting experience and his academic and professional background. |

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES.

ADDITIONAL INFORMATION

Audit Committee Financial Expert.The Board of Trustees has determined that the Trust does not have an audit committee financial expert serving on the Audit Committee.

Nominee Ownership of Shares of the Trust as of the Record Date.The following table shows the dollar range of beneficial ownership of shares of the Fund and, on an aggregate basis the dollar range of ownership of shares of all Funds within the Trust, held by each Trustee / Nominee as of the Record Date. Currently there is only one Fund in the Trust.

| Name of Trustee or Nominee | Name of Fund | Dollar Range of

Fund Shares

Owned by

Trustee/Nominee | Aggregate Dollar Range of

Shares of All Funds in Trust

Overseen by Trustee/Nominee |

| Interested Trustee/Nominee | | | |

| Dalton J. Axenfeld | 1789 Growth and Income Fund | None | None |

| Independent Trustees/Nominees: | | | |

| Joseph O. Reagan, MD | 1789 Growth and Income Fund | $10,001 - $50,000 | $10,001 - $50,000 |

| Mark E. Wadach | 1789 Growth and Income Fund | None | None |

| Christopher Wiles | 1789 Growth and Income Fund | None | None |

Independent Trustee Compensation. Interested Trustees of the Trust do not receive any compensation from the Trust for serving as a Trustee of the Trust. If Mr. Axenfeld is elected as a Trustee, he will not receive any compensation from the Trust for his services as he would be considered an Interested Trustee. Effective December 19, 2018, each Independent Trustee receives from the Trust a fee of $500 for attendance at each in-person meeting of the Board of Trustees and $300 for attendance at each telephonic meeting of the Board of Trustees. Prior to December 19, 2018, each Independent Trustee received from the Trust a fee of $250 for attendance at each in-person meeting of the Board of Trustees and $150 for attendance at each telephonic meeting of the Board of Trustees. The following table shows the compensation paid to each Trustee/Nominee during the Trust’s fiscal year ended October 31, 2018:

| | Aggregate Compensation

From The

Fund | Pension or

Retirement

Benefits

Accrued | Estimated

Retirement

Benefits

Accrued | Aggregate

Compensation

From the

Trust |

| Dalton J. Axenfeld * | None | None | None | None |

| Christopher Wiles** | None | None | None | None |

| Mark E. Wadach | $1,000 | None | None | $1,000 |

| Joseph O. Reagan, MD | $1,000 | None | None | $1,000 |

| * | Dalton J. Axenfeld is a Trustee Nominee and if elected, he would be considered an “Interested Trustee” of the Trust. |

| ** | Christopher Wiles is an Independent Trustee Nominee. |

INVESTMENT ADVISER AND OTHER SERVICE PROVIDERS

Investment Adviser. Pinnacle Capital Management, LLC (the “Adviser”), 100 Limestone Plaza, Fayetteville, New York 13066, is the investment adviser to the Fund. The Adviser is responsible for managing the Fund’s investment portfolio and oversees the daily business operations of the Fund.

Administrator. Ultimus Fund Solutions, LLC (“Ultimus”) provides the Fund with administration, fund accounting and transfer agent and shareholder services. The mailing address of Ultimus is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Principal Underwriter. Pinnacle Investments, LLC, (the “Distributor”) is the Fund’s principal underwriter. The Distributor is a subsidiary of Pinnacle Holding Company, LLC. The Distributor’s mailing address is 507 Plum Street, Suite 120, Syracuse, NY 13204.

Annual and Semiannual Reports.The Trust will furnish, without charge, a copy of the Fund’s most recent annual and semiannual reports upon request. To request these documents, please call us at 1-888-229-9448 or write to the Trust at 1789 Growth and Income Fund c/o Ultimus Fund Solutions, LLC P.O. Box 46707, Cincinnati, Ohio 45246-0707. The annual and semiannual reports are also available on the Fund’s website at https://www.pcm-advisors.com/offerings/1789-growth-income-fund/.

Independent Registered Public Accounting Firm. The Board of Trustees, including a majority of the Independent Trustees, has selected Cohen & Company, Ltd. (“Cohen”) as the Trust’s independent registered public accounting firm. Cohen is located at 1350 Euclid Avenue, Suite 800, Cleveland, Ohio 44115. Representatives of Cohen are not expected to be present at the Meeting although they will have an opportunity to attend and to make a statement, if they desire to do so. If representatives of Cohen are present at the Meeting, they will be available to respond to appropriate questions from shareholders.

The Board of Trustees has not adopted policies and procedures with regard to the pre-approval of services provided by Cohen. Audit, audit-related and tax compliance services provided to the Trust on an annual basis require specific pre-approval by the Board. During the last two fiscal years, all of the services provided to the Trust were pre-approved by the Audit Committee.

Fees Billed by Cohen to the Trust During the Previous Two Fiscal Years

| • | Audit Fees. The aggregate fees billed for professional services rendered by Cohen for the audit of the annual financial statements of the Trust or for services that are normally provided by Cohen in connection with statutory and regulatory filings or engagements were $14,500 with respect to the fiscal year ended October 31, 2017 and $14,500 with respect to the fiscal year ended October 31, 2018. |

| • | Audit-Related Fees. No fees were billed to the Trust in either of the last two fiscal years for assurance and related services by Cohen that are reasonably related to the performance of the audit of the Trust’s financial statements and are not reported as “Audit Fees” in the preceding paragraph. |

| • | Tax Fees.The aggregate fees billed for professional services rendered by Cohen to the Trust for tax compliance, tax advice and tax planning were $2,500 with respect to the fiscal year ended October 31, 2017 and $2,500 with respect to the fiscal year ended October 31, 2018. The services comprising these fees are tax consulting and the preparation of the Trust’s federal income and excise tax returns. |

| • | All Other Fees. No fees were billed to the Trust in either of the last two fiscal years for products and services provided by Cohen, other than the services reported above. |

| • | Non-Audit Fees Paid by the Adviser. The aggregate non-audit fees billed by Cohen to the Trust’s Adviser were $11,500 with respect to the fiscal year ended October 31, 2017 and $11,500 with respect to the fiscal year ended October 31, 2018. |

The percentage of hours expended by Cohen on the audit of the Trust’s financial statements for the last completed fiscal year that were attributed to work performed by individuals other than Cohen full time, permanent employees was less than fifty percent.

Principal Shareholders of the Fund. As of the Record Date, there were no shareholders known by the Trust to own of record or beneficially more than 5% of the outstanding shares of the Fund.

Shareholder Proposals.As a Delaware statutory trust, the Trust does not intend to, and is not required to hold annual meetings of shareholders, except under certain limited circumstances. The Board of Trustees does not believe a formal process for shareholders to send communications to the Board of Trustees is appropriate due to the infrequency of shareholder communications to the Board of Trustees. The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the SEC, shareholder proposals may, under certain conditions, be included in the Trust's proxy statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust's proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Annual meetings of shareholders of the Trust are not required as long as there is no particular requirement under the Investment Company Act or state law, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Benjamin V. Mollozzi, Assistant Secretary of the Trust, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Communicating with the Board.Shareholders may communicate with the Board of Trustees, or, if applicable, specified individual Trustees, by writing to Pinnacle Capital Management Funds Trust, 100 Limestone Plaza Fayetteville, NY, 13066.

OTHER BUSINESS

The proxy holders have no present intention of bringing any other matter before the Special Meeting other than those specifically referred to above or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the Special Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

| | By Order of the Board of Trustees |

| | |

| |  |

| | Benjamin V. Mollozzi |

| | Assistant Secretary |

Date: July 11, 2019

Please execute the enclosed proxy and return it promptly in the enclosed envelope, thus avoiding unnecessary expense and delay. No postage is necessary if mailed in the United States. The proxy is revocable and will not affect your right to vote in person if you attend the Meeting.

APPENDIX A

PINNACLE CAPITAL MANAGEMENT FUNDS TRUST

CHARTER FOR THE

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Nominating and Corporate Governance Committee Membership

| 1. | The Nominating and Corporate Governance Committee of Pinnacle Capital Management Funds Trust (the “Trust”) shall be composed entirely of Independent Trustees. |

Board Nominations and Functions

| 1. | The Committee shall make nominations for Trustee membership on the Board of Trustees, including the Independent Trustees. The Committee shall evaluate candidates’ qualifications for Board membership and their independence from the investment advisers to the Trust’s series portfolios and the Trust’s other principal service providers. Persons selected as Independent Trustees must not be “interested person” as that term is defined in the Investment Company Act of 1940, nor shall Independent Trustee have and affiliations or associations that shall preclude them from voting as an Independent Trustee on matters involving approvals and continuations of Rule 12b-1 Plans, Investment Advisory Agreements and such other standards as the Committee shall deem appropriate. The Committee shall also consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence,e.g., business, financial or family relationships with managers or service providers. See Appendix A for Procedures with Respect to Nominees to the Board. |

| 2. | The Committee shall periodically review Board governance procedures and shall recommend any appropriate changes to the full Board of Trustees. |

| 3. | The Committee shall periodically review the composition of the Board of Trustees to determine whether it may be appropriate to add individuals with different backgrounds or skill sets from those already on the Board. |

| 4. | The Committee shall periodically review trustee compensation and shall recommend any appropriate changes to the Independent Trustees as a group. |

Committee Nominations and Functions

| 1. | The Committee shall make nominations for membership on all committees and shall review committee assignments at least annually. |

| 2. | The Committee shall review, as necessary, the responsibilities of any committees of the Board, whether there is a continuing need for each committee, whether there is a need for additional committees of the Board, and whether committees should be combined or reorganized. The Committee shall make recommendations for any such action to the full Board. |

Other Powers and Responsibilities

| 1. | The Committee shall have the resources and authority appropriate to discharge its responsibilities, including authority to retain special counsel and other experts or consultants at the expense of the Trust. |

| 2. | The Committee shall review this Charter at least annually and recommend any changes to the full Board of Trustees. |

APPENDIX A

TO THE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE CHARTER

PINNACLE CAPITAL MANAGEMENT FUNDS TRUST

PROCEDURES WITH RESPECT TO NOMINEES TO THE BOARD

| I. | Identification of Candidates. When a vacancy on the Board of Trustees exists or is anticipated, and such vacancy is to be filled by an Independent Trustee, the Nominating and Corporate Governance Committee shall identify candidates by obtaining referrals from such sources as it may deem appropriate, which may include current Trustees, management of the Trust, counsel and other advisors to the Trustees, and shareholders of the Trust who submit recommendations in accordance with these procedures. In no event shall the Nominating and Corporate Governance Committee consider as a candidate to fill any such vacancy an individual recommended by any investment adviser of any series portfolio of the Trust, unless the Nominating and Corporate Governance Committee has invited management to make such a recommendation. |

| II. | Shareholder Candidates.The Nominating and Corporate Governance Committee shall, when identifying candidates for the position of Independent Trustee, consider any such candidate recommended by a shareholder if such recommendation contains: (i) sufficient background information concerning the candidate, including evidence the candidate is willing to serve as an Independent Trustee if selected for the position; and (ii) is received in a sufficiently timely manner as determined by the Nominating and Corporate Governance Committee in its discretion. Shareholders shall be directed to address any such recommendations in writing to the attention of the Nominating and Corporate Governance Committee, c/o the Secretary of the Trust. The Secretary shall retain copies of any shareholder recommendations which meet the foregoing requirements for a period of not more than 12 months following receipt. The Secretary shall have no obligation to acknowledge receipt of any shareholder recommendations. |

| III. | Evaluation of Candidates. In evaluating a candidate for a position on the Board of Trustees, including any candidate recommended by shareholders of the Trust, the Nominating and Corporate Governance Committee shall consider the following: (i) the candidate’s knowledge in matters relating to the mutual fund industry; (ii) any experience possessed by the candidate as a director or senior officer of public companies; (iii) the candidate’s educational background; (iv) the candidate’s reputation for high ethical standards and professional integrity; (v) any specific financial, technical or other expertise possessed by the candidate, and the extent to which such expertise would complement the Board’s existing mix of skills, core competencies and qualifications; (vi) the candidate’s perceived ability to contribute to the ongoing functions of the Board, including the candidate’s ability and commitment to attend meetings regularly and work collaboratively with other members of the Board; (vii) the candidate’s ability to qualify as an Independent Trustee and any other actual or potential conflicts of interest involving the candidate and the Trust; and (viii) such other factors as the Nominating and Corporate Governance Committee determines to be relevant in light of the existing composition of the Board and any anticipated vacancies. Prior to making a final recommendation to the Board, the Nominating and Corporate Governance Committee shall conduct personal interviews with those candidates it concludes are the most qualified candidates. |