Table of Contents

Filed Pursuant to Rule 424(b)(5)

| | Registration No. 333-204830 |

| PROSPECTUS SUPPLEMENT | | |

| (To Prospectus dated June 19, 2015) | | |

2,646,091 Shares

Common Stock

______________

We are offering 2,646,091 shares of our common stock, par value $0.001 per share, directly to investors in this offering at a price of $6.875 per share. In a concurrent private placement, we are selling to each such investor warrants to purchase the number of shares of our common stock purchased by such investor in this offering. The warrants and the shares of our common stock issuable upon the exercise of the warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder.

Our common stock is listed on The NASDAQ Capital Market under the symbol “PLXP.” The consolidated closing bid price and the last reported sale price of our common stock on June 8,2017were $6.75 per share and $6.95 per share, respectively.

The warrants will be exercisable six months and one day after the date of issuance of the shares of our common stock offered hereunder, and will remain exercisable until the 10th anniversary of the date of issuance. The exercise price for the warrants initially will be $7.50, subject to certain adjustments.

The warrants are not registered and are not and will not be listed for trading on The NASDAQ Capital Market, or any other securities exchange or nationally recognized trading system. There is no market through which the warrants may be sold, and purchasers may not be able to resell the warrants purchased in the private placement conducted concurrently with this offering. This may affect the pricing of the warrants in the secondary market, the transparency and availability of trading prices, and the liquidity of the warrants.

By means of this prospectus supplement, we are offering $18,191,869 of securities pursuant to General Instruction I.B.6 of Form S-3. As of April 19, 2017, the aggregate market value of our outstanding common stock held by non-affiliates, or the public float, was approximately $56.0 million based on 5,229,661 shares of common stock held by non-affiliates and a per share price of $10.70, which was the closing price of our common stock on April 19, 2017. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our securities in a primary public offering with a value in excess of one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12-calendar months prior to and including the date of this prospectus supplement.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus supplement and future filings.

Investing in our common stock involves risks. See “Risk Factors” beginning on page S-11 of this prospectus supplement, on page6 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

We have engaged Raymond James & Associates, Inc. and Janney Montgomery Scott LLC as our placement agents in connection with this offering. The placement agents have no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the placement agent fees set forth in the table below, which assumes that we sell all of the common shares we are offering pursuant to this prospectus supplement and all of the warrants we are offering in the concurrent private placement. See “Plan of Distribution” beginning on page S-93 of this prospectus supplement for more information regarding these arrangements.

| | | Per Share | | | Total | |

Public offering price | | $ | 6.875 | | | $ | 18,191,869 | |

Placement agent fees (1) | | $ | 0.4125 | | | $ | 1,091,512 | |

Proceeds to us, before expenses (2) | | $ | 6.4625 | | | $ | 17,100,357 | |

__________________

| (1) | For additional information about the expenses for which we have agreed to reimburse the placement agents in connection with this offering, see “Plan of Distribution” beginning on page S-93 of this prospectus supplement. |

| | | |

| | (2) | The amount of the offering proceeds to us presented in this table does not give effect to any exercise of the warrants being issued in the concurrent private placement. |

Certain of our directors and management team have agreed to purchase an aggregate of $525,000 of our shares of common stock and warrants in this offering and the concurrent private placement.

The placement agents expect to deliver the shares of common stock on or about June 14, 2017, subject to the satisfaction of certain conditions.

Lead Placement Agent

RAYMOND JAMES | Co-Lead Placement Agent JANNEY MONTGOMERY SCOTT |

|

The date of this prospectus supplement is June 9, 2017 |

PROSPECTUSSUPPLEMENT

PROSPECTUS

ABOUTTHIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the terms of the offering of the securities offered hereby and also adds to and updates the information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering and some of which may have been supplemented or superseded by information in this prospectus supplement or documents incorporated or deemed to be incorporated by reference in this prospectus supplement that we filed with the SEC subsequent to the date of the prospectus. To the extent that there is any conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference herein or therein, on the other hand, you should rely on the information in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectuses we may provide to you in connection with this offering. We have not, and the placement agents have not, authorized any other person to provide you with any information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and any free writing prospectuses we may provide to you in connection with this offering is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates. You should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement outside the United States. Furthermore, you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

Aspertec™ and PLxGuard™ are trademarks of PLx. All other trademarks used in this prospectus supplement are the property of their respective owners. Use or display by us of other parties’ trademarks, trade names or service marks is not intended to and does not imply a relationship with, or endorsement or sponsorship by us of, the trademark, trade name or service mark owner.

The industry and market data contained or incorporated by reference in this prospectus supplement are based either on our management’s own estimates or on independent industry publications, reports by market research firms or other published independent sources. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness, as industry and market data are subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. Accordingly, you should be aware that the industry and market data contained or incorporated by reference in this prospectus supplement, and estimates and beliefs based on such data, may not be reliable. Unless otherwise indicated, all information contained or incorporated by reference in this prospectus supplement concerning our industry in general or any segment thereof, including information regarding our general expectations and market opportunity, is based on management’s estimates using internal data, data from industry related publications, consumer research and marketing studies and other externally obtained data.

CAUTIONARYSTATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents we have filed with the SEC that are incorporated by reference into this prospectus supplement and the accompanying prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

| | ● | our expected uses of the net proceeds to us from this offering; |

| | ● | our ability to bring both Aspertec 81 mg and Aspertec 325 mg to market-readiness; |

| | ● | our ability to maintain regulatory approval of Aspertec 325 mg or obtain and maintain regulatory approval of Aspertec 81 mg and any future product candidates; |

| | ● | the benefits of the use of Aspertec 325 mg and Aspertec 81 mg; |

| | ● | the projected dollar amounts of future sales of established and novel gastrointestinal(GI)-safer technologies for non-steroidal anti-inflammatory drugs (NSAIDs) and other analgesics; |

| | ● | our ability to successfully commercialize our Aspertec products, or any future product candidates; |

| | ● | the rate and degree of market acceptance of our Aspertec products or any future product candidates; |

| | ● | our expectations regarding government and third-party payor coverage and reimbursement; |

| | ● | our ability to scale up manufacturing of our Aspertec products to commercial scale; |

| | ● | our ability to successfully build a specialty sales force and commercial infrastructure or collaborate with a firm that has these capabilities; |

| | ● | our ability to compete with companies currently producing GI-safer technologies for NSAIDs and other analgesics; |

| | ● | our reliance on third parties to conduct our clinical studies; |

| | ● | our reliance on third-party contract manufacturers to manufacture and supply our product candidates for us; |

| | ● | our reliance on our collaboration partners’ performance over which we do not have control; |

| | ● | our ability to retain and recruit key personnel, including development of a sales and marketing function; |

| | ● | our ability to obtain and maintain intellectual property protection for our Aspertec products or any future product candidates; |

| | ● | the actual receipt and timing of any milestone payments or royalties from our collaborators; |

| | ● | our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional financing; |

| | ● | our expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”); |

| | ● | our ability to identify, develop, acquire and in-license new products and product candidates; |

| | ● | our ability to successfully establish and successfully maintain appropriate collaborations and derive significant revenue from those collaborations; |

| | ● | our financial performance; and |

| | ● | developments and projections relating to our competitors or our industry. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus supplement and the accompanying prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus supplement to conform these statements to actual results or to changes in our expectations.

You should read this prospectus supplement and the accompanying prospectus and the documents that we reference in this prospectus supplement and the accompanying prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus are a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

PROSPECTUSSUPPLEMENT SUMMARY

This summary highlights certain information about us, thisoffering,and information appearing elsewhere in this prospectus supplement or the accompanying prospectus and in the documents we incorporate by reference.This summary is not complete and does not contain all of the information that you should consider before investing in our securities.The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements and notes thereto appearing elsewhere in this prospectus supplement or incorporated herein by reference.Before you decide to invest in our securities, to fully understand this offering and its consequences to you, you should carefully read the entire prospectus supplement, including the matters set forth under the caption“Risk Factors” beginning on pageS-11 of this prospectus supplement and page6 of the accompanying prospectus, and the consolidated financial statements and related notes included or incorporated by reference in this prospectus supplement, the accompanying prospectus and the other documents incorporated by reference herein and therein.

On April19, 2017,Dipexium Acquisition Corp.,a Delaware corporation (“Merger Sub”) anda wholly-owned subsidiary of Dipexium Pharmaceuticals, Inc., a Delaware corporation (“Dipexium”),merged with and into PLx Pharma Inc., a privately-held Delaware corporation (“Old PLx”),pursuant to the terms of that certain Agreementand Plan of Merger and Reorganizationdated as ofDecember 22, 2016 (the“Merger Agreement”) by and among Dipexium, Merger Sub and Old PLx (the“Merger”).As part of the Merger, Dipexium was re-named PLx Pharma Inc.(“New PLx”)and Old PLx was re-namedPLx Opco Inc.Following completion of the Merger, Old PLx became a wholly-owned subsidiary ofNewPLx. Since the completion of the Merger, the business we have conducted has been primarily the business of Old PLx. Unless the context requires otherwise, references in this Prospectus Supplement to “we”, “us”, “our”, the “Company”, and “PLx” refer to New PLx and its subsidiaries.

References in this prospectussupplement to“pro forma” or“on a pro forma basis” shall mean that the results for the stated period or other information have been adjusted to reflect the consummation of the Merger.Unless otherwise provided, all per share amounts and other data with respect to our common stock in this prospectus supplement give effect to a 1-for-8 reverse stock split effected by Dipexium in April 2017. Unless otherwise indicated, discussions of historical results reflect the results of Old PLx prior to the completion of the Merger and do not include the results of Dipexium prior to the completion of the Merger.

Overview

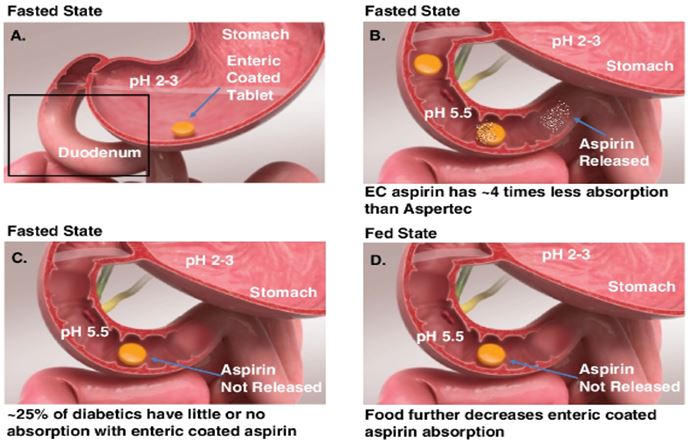

We are a late-stage specialty pharmaceutical company initially focused on developing our clinically validated and patent-protected PLxGuard delivery system to provide safer and more effective aspirin products. Our PLxGuard delivery system works by releasing active pharmaceutical ingredients into the duodenum, the first part of the small intestine immediately below the stomach, rather than in the stomach itself. We believe this improves the absorption of many drugs currently on the market or in development, and reduces acute gastrointestinal (GI) side effects — including erosions, ulcers and bleeding — associated with aspirin and ibuprofen, and potentially other drugs.

Our U.S. Food and Drug Administration, or FDA, approved lead product, Aspertec 325 mg, is a novel formulation of aspirin that uses the PLxGuard delivery system that is intended to significantly reduce acute GI side effects while providing superior antiplatelet effectiveness for cardiovascular disease prevention as compared with the current standard of care, enteric coated aspirin. Aspertec 325 mg (formerly PL2200 Aspirin 325 mg) was originally approved under the drug name aspirin, and the proprietary name ‘Aspertec’ was granted subsequent to the FDA approval. A companion 81 mg dose of the same novel formulation — Aspertec 81 mg — is in late-stage development and will be the subject of a supplemental New Drug Application, or sNDA, leveraging the already approved status of Aspertec 325 mg.

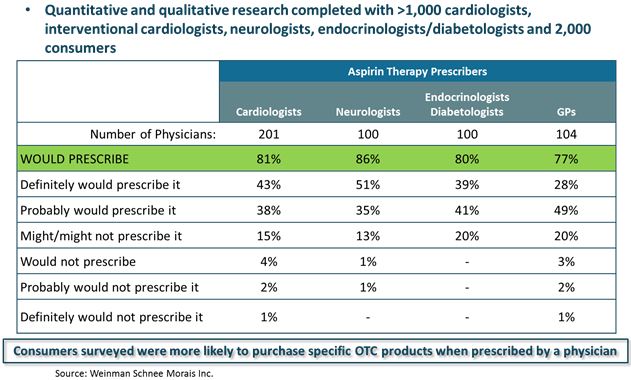

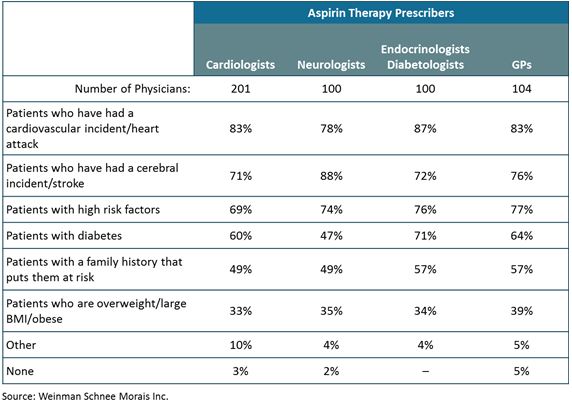

Our commercialization strategy will target both the over-the-counter, or OTC, and prescription markets, taking advantage of the existing OTC distribution channels for aspirin while leveraging the FDA approval of Aspertec 325 mg and expected approval for Aspertec 81 mg for OTC and prescription use when recommended by physicians for cardiovascular disease treatment and prevention. Given our clinical demonstration of better antiplatelet efficacy (as compared with enteric coated aspirin) and better acute GI safety, we intend to use a physician-directed sales force to inform physicians — and, by extension, consumers — about our product’s clinical results in an effort to command both greater market share and a higher price for our superior aspirin product. Our product pipeline also includes other oral nonsteroidal anti-inflammatory drugs, or NSAIDs, using the PLxGuard delivery system that may be developed, including a clinical-stage, GI-safer ibuprofen — PL1200 Ibuprofen 200 mg — for pain and inflammation.

PLxGuardTM Delivery System

Our PLxGuard delivery system uses surface acting lipids, such as phospholipids and free fatty acids, to modify the physiochemical properties of various drugs to selectively release these drugs to targeted portions of the GI tract. Unlike tablet or capsule polymer coating technologies (e.g., enteric coating), which rely solely on drug release based on pH differences in the GI tract, the PLxGuard delivery system uses the differential in pH and bile acid contents between the stomach and duodenum to target Aspertec’s release. This approach is intended to more reliably release active pharmaceutical ingredients in the duodenum and decrease their exposure to the stomach, which is more susceptible to NSAID-induced bleeding and ulceration. The PLxGuard delivery system is a platform technology that we believe may be useful in improving the absorption of many acid labile, corrosive, and insoluble or impermeable drugs.

We believe our PLxGuard delivery system has the potential to improve many already-approved drugs and drugs in development because it may:

| | ● | enhance the efficacy of the drug using our technology; |

| | ● | improve the GI safety of the drug; |

| | ● | provide new or extended patent protection for an already-approved or development-stage drug: and |

| | ● | utilize the 505(b)(2) New Drug Application, or NDA, regulatory path, which may provide a faster and lower-cost FDA approval route when used with already-approved drugs. |

The PLxGuard delivery system has clinically proven these benefits with our novel formulations using aspirin and has clinical evidence supporting the potential for a GI-safer ibuprofen and preclinical evidence supporting the potential for a GI-safer oral diclofenac and intravenous indomethacin products. Other existing or new drugs in development that may benefit from the PLxGuard delivery system will be evaluated either by us or through collaboration agreements with other companies.

Product Pipeline

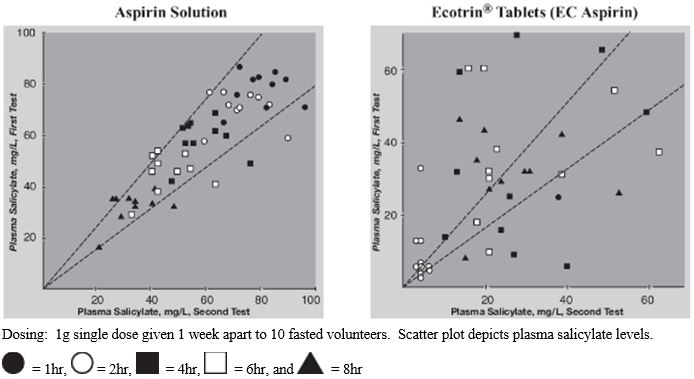

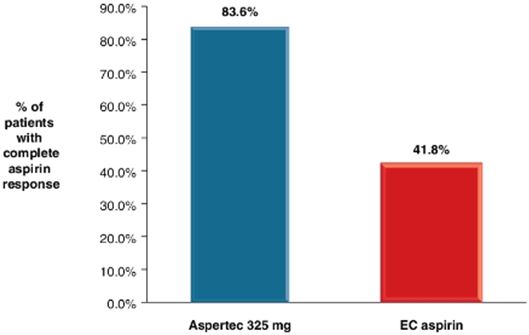

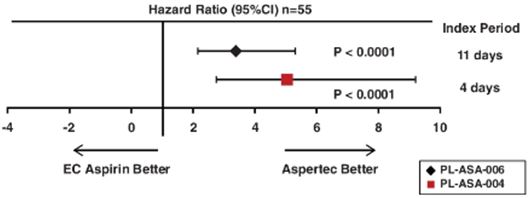

Our lead product, Aspertec 325 mg, has been approved by the FDA for OTC distribution and is the first-ever FDA-approved liquid-fill aspirin capsule. All the clinical trials necessary for product launch have been completed. In clinical trials in diabetic patients at risk for cardiovascular disease, Aspertec 325 mg demonstrated better antiplatelet efficacy compared with enteric coated aspirin, which is the current standard of care for cardiovascular disease prevention and treatment. Aspertec 325 mg delivers faster antiplatelet efficacy than enteric coated aspirin with a median time to 99% inhibition of serum Thromboxane B2 of two hours compared with 48 hours for enteric coated aspirin. Serum Thromboxane B2 is a clinically accepted marker for antiplatelet efficacy, which is sometimes referred to as aspirin response.

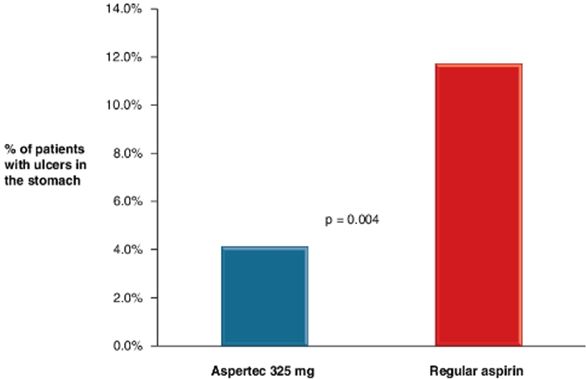

Aspertec 325 mg provides more reliable, predictable and sustained antiplatelet benefits than enteric coated aspirin with a 3 – 5 times greater chance of a complete aspirin antiplatelet effect than enteric coated aspirin. Aspertec 325 mg has demonstrated a statistically significant 65% reduction in the risk of acute ulcers compared with immediate release aspirin in healthy subjects with an age associated risk for cardiovascular disease. This acute GI safety benefit may also be important for acute coronary syndrome, or ACS, patients. Moreover, we believe ACS patients who are also diabetics and suffer from gastroparesis, or a lack of digestive stomach motility, could also benefit from Aspertec due to its more predictable absorption when compared to enteric coated aspirin. The acute GI safety benefit may also be used to differentiate Aspertec 325 mg from products intended for use in conditions associated with pain and inflammation, including other aspirin and NSAID products.

Aspertec 81 mg is our lower-dose companion product for Aspertec 325 mg (the two dose forms are often referred to in this prospectus supplement together as “Aspertec”). This product utilizes exactly the same formulation as the 325 mg product (except delivered in a capsule one quarter the size) and will be the subject of an sNDA, which we expect to submit to the FDA in the last quarter of 2017. We will rely on the clinical results for Aspertec 325 mg for the Aspertec 81 mg sNDA and do not anticipate any additional clinical trials will be required, effectively positioning this product as an end of Phase 3 status. We intend to begin selling both products by the end of 2018.

We believe our technology may be used with other selected NSAIDs, such as ibuprofen. We have used the PLxGuard delivery system to create a lipid-based formulation of ibuprofen, PL1200 Ibuprofen 200 mg, for the OTC market, and PL1100 Ibuprofen 400 mg, for prescription doses of ibuprofen. We have OTC and prescription (Rx) Investigational New Drug applications, or INDs, active with the FDA and have demonstrated bioequivalence with the OTC 200 mg dose ibuprofen to support a 505(b)(2) NDA in fasted-state clinical trials at three different doses, 200 mg, 400 mg and 800 mg. Using the PL1200 capsules at prescription doses, we demonstrated better GI safety in osteoarthritic patients with equivalent analgesic and anti-inflammatory efficacy, when compared with prescription ibuprofen in a six-week endoscopy pilot clinical trial. PL1200 and PL1100 Ibuprofen may be considered as being in Phase 1 in the FDA process and may qualify for the 505(b)(2) NDA path.

The following table summarizes information regarding our product candidates and development program:

The Market

Cardiovascular/Aspirin Market

Aspirin, also known as acetylsalicylic acid, or ASA, is a foundational medicine which is widely used for the treatment and prevention of cardiovascular disease, or CVD—a collective term for chest pain, coronary artery disease, heart attack, heart failure, high blood pressure and stroke—which is the leading cause of death in the United States. Aspirin is widely used to treat patients exhibiting signs and symptoms of heart attack or stroke (collectively referred to as ACS), and is commonly prescribed or recommended by physicians, in addition to other drugs such as cholesterol or blood pressure medications, as the standard of care for treating ACS and preventing recurrent ACS for the duration of a patient’s life.

The 325 mg dose is generally prescribed:

| | ● | in an acute setting for the treatment of ACS; |

| | ● | following an interventional procedure (such as placement of a stent); and |

| | ● | for preventing heart attack or stroke during the high-risk period following an event or intervention. |

Eventually, most patients move to the 81 mg dose for secondary prevention applications and for high-risk primary prevention, as they are typically directed to take aspirin every day for the rest of their life. The 81 mg aspirin dose is the most prevalent, representing approximately 70% to 80% of aspirin sales in the United States, followed by the 325 mg dose and then several other dose forms including powdered and effervescent aspirin products. In the United States, the primary use for aspirin is for the prevention and treatment of cardiovascular disease as evidenced by the predominance of the 81 mg dose.

Aspirin is also used for pain relief and fever reduction and is the most common NSAID available. The most widely used dose for pain is 325 mg. A GI-safer Aspertec 325 mg may be able to capture market share from other aspirin and NSAID products in the large pain and inflammation market.

The leading aspirin brand reported global annual sales in 2016 exceeding $1 billion. Branded OTC aspirin products include Bayer®, Ecotrin® and St. Joseph®, and there are numerous private label or store brands.Because of the known GI toxicity issues associated with immediate release or regular aspirin, enteric coated aspirin has evolved to become the leading aspirin dose form, representing over 90% of U.S. aspirin sales in 2013. This success is largely based on early clinical studies suggesting that enteric coated aspirin showed a reduction in superficial gastric lesions as compared with regular aspirin. However, when measured using contemporary clinical procedures, enteric coated aspirin has not continued to demonstrate such reductions. These deficiencies create a significant opportunity for the demonstrated efficacy of Aspertec.

Pain & Inflammation/Ibuprofen

The U.S. OTC analgesic market was over $4 billion in annual sales in 2016 (Consumer Healthcare Products Association). The leading OTC NSAID brands in the United States represented greater than $1 billion in annual sales in 2016 with one leading OTC ibuprofen brand generating more than $750 million in worldwide sales in 2016 (Evaluate). This class of OTC drugs is one of the most widely used drugs worldwide. Increasing concerns over liver toxicity associated with acetaminophen products, coupled with known ibuprofen analgesic superiority over acetaminophen, indicate there is a substantial global opportunity for a GI safer ibuprofen product. While we do not believe our technology will work with the entire NSAID class, it is possible that our technology may be successfully applied to other NSAIDs beyond aspirin and ibuprofen. For example, we have preclinical data suggesting that diclofenac — a leading NSAID for pain and inflammation outside the United States — is a viable product candidate.

Our Key Competitive Strengths

| | ● | Our lead product,Aspertec 325 mg, has been approved by the FDA under the 505(b)(2) NDA process. We intend to leverage clinical studies and market research to launch Aspertec 325 mg on a commercial scale using a combined prescription and OTC strategy that takes advantage of the existing OTC distribution channels for aspirin while leveraging the FDA approval of Aspertec 325 mg for prescription and recommendation by physicians for cardiovascular disease treatment and prevention. We will be seeking approval of the companion Aspertec 81 mg dose via an sNDA, which we intend to file in the last quarter of 2017, that should benefit from the prior approval of Aspertec 325 mg. |

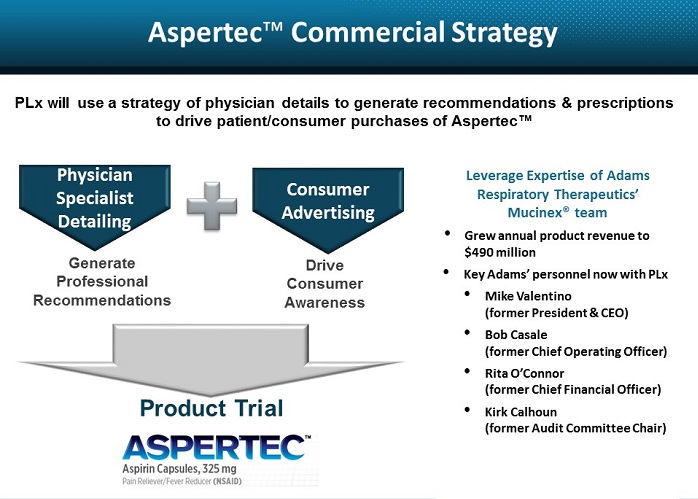

| | ● | Our management team has extensive experience in development and commercialization of OTC products. Mr. Valentino, our Executive Chairman of the Board, brings over 30 years of experience in the healthcare industry. Mr. Valentino successfully built Adams Respiratory Therapeutics into a fully integrated specialty pharmaceutical company with more than $490 million in annual revenue and leading OTC brands such as Mucinex® and Delsym®. In December 2007, Adams Respiratory Therapeutics sold to Reckitt Benckiser for approximately $2.3 billion. Ms. Giordano, our President and Chief Executive Officer, has over 20 years in the life science industry and has successfully developed commercialization plans for several new product launches across various therapeutic areas, specifically building physician directed sales teams, including with one of the most successful products in the cardiology sector, Lipitor. |

| | ● | Aspertec 325 mg has demonstrated clinically superior antiplatelet efficacy in diabetic patients when compared to enteric coated aspirin, the current standard of care for cardiovascular disease prevention. Aspertec 325 mg delivers faster and more reliable, predictable and sustained antiplatelet benefits than enteric coated aspirin as clinically demonstrated in diabetic patients at risk for cardiovascular disease with a median time to 99% inhibition of serum Thromboxane B2 (an accepted clinical marker of anti-platelet efficacy) of two hours compared with 48 hours and with a 3 – 5 times greater chance of a complete aspirin antiplatelet effect than enteric coated aspirin. |

| | ● | Aspertec 325 mg has demonstrated clinically superior GI safety when compared to regular aspirin. Aspertec 325 mg has demonstrated a statistically significant 65% reduction in the risk of acute ulcers compared with regular aspirin in healthy subjects with an age associated risk for cardiovascular disease. Based on physician market research, we believe that our clinical data supporting superior acute GI safety as compared to regular aspirin is important for physicians who are having difficulty keeping high-risk patients on sustained aspirin use due to lack of tolerability. |

| | ● | Our PLxGuard delivery system is a platform technology that may improve GI safety and efficacy when applied to already approved drugs. Our PLxGuard delivery system is a platform technology that we believe could improve the GI safety of selected NSAIDs that meet specific criteria. The U.S. analgesic market was over $4 billion in annual sales in 2016 (Consumer Healthcare Products Association). The leading NSAID brands in the United States represented greater than $1 billion annual sales in 2016 (Statista Inc.) with one leading OTC ibuprofen brand generating more than $750 million in worldwide sales in 2016 (Evaluate). We intend to explore new development opportunities and utilize the 505(b)(2) NDA regulatory pathway to decrease the time and costs associated with obtaining FDA approval for new products. |

| | ● | Our PLxGuard delivery system may lower development risk and costs by leveraging the 505(b)(2) NDA pathway. A 505(b)(2) NDA is permitted to rely on the FDA’s prior conclusions regarding the safety and effectiveness of a previously approved drug, or to rely in part on data in the public domain. Reliance on the FDA's prior findings or data collected by others may expedite the development program for our product candidates by potentially decreasing the amount of clinical data that we would need to generate to submit an NDA. As the FDA has previously approved Aspertec 325 mg pursuant to a 505(b)(2) NDA, we believe that there is a strong likelihood that our future products would similarly qualify. The factors related to this qualification are expected to reduce the time and costs associated with clinical trials when compared to a traditional NDA for a new chemical entity. We also believe the strategy of targeting drugs with proven safety and efficacy provides a better prospect of clinical success of our proprietary development portfolio as compared to de novo drug development. We believe that the average time to market and cost of clinical trials for our products could be less than that required to develop a new drug. |

| | ● | Our issued patents and patent applications in the United States and worldwide may protect us from generic competition and enable a higher price point than current aspirin products. We believe our patent portfolio provides strong protection of our delivery platform, drug formulations and manufacturing processes with 44 issued patents and additional pending applications with expirations ranging from December 19, 2021 through September 29, 2032. |

Our Strategy

Our goal is to become a leading specialty pharmaceutical company, commercializing both the Aspertec 325 mg and Aspertec 81 mg dose forms and developing additional branded products using our PLxGuard technology. The key elements of our strategy are to:

Successfully commercialize Aspertec 325 mg. Prior to launch, we will need to finalize labeling with the FDA, scale up our commercial production capabilities, and conduct three validation manufacturing runs required to satisfy FDA pre-launch requirements. We intend to hire, train and deploy initially a 45-person sales force growing to 125 persons to support a national launch to appropriate healthcare providers. This will provide a technical focus on Aspertec 325 mg and 81 mg products based upon our compelling clinical results to enhance the value of these products. We intend to begin selling both products by the end of 2018.

Obtain FDA approval for Aspertec 81 mg and prepare it for commercial launch. This will include, in addition to the efforts described above, submission of an sNDA seeking approval to launch Aspertec 81 mg simultaneously with the already-approved 325 mg strength. Once our Aspertec 81 mg product becomes available as the result of planned manufacturing activities, we expect to conduct a clinical crossover trial of Aspertec 81 mg comparing pharmacokinetic and pharmacodynamic endpoints with 81 mg enteric coated aspirin. The trial would be intended for commercial purposes and is not otherwise required in connection with any near-term regulatory filings or approvals. We intend to begin selling both products by the end of 2018.

Initiate a market launch strategy targeting physicians who desire reliable and predictable antiplatelet efficacy for their highest risk cardiovascular patients. Our market launch strategy will focus on targeting physicians who are seeking reliable and predictable antiplatelet efficacy for their highest risk cardiovascular patients. This strategy is designed to drive product sales professionally with a technical sales approach. We anticipate taking advantage of aspirin’s unique OTC and prescription approval by using a sales force to call on physicians to inform them of the clinically validated attributes of Aspertec. This physician sales effort will be designed to create interest in Aspertec among healthcare professionals and to influence their recommendations and prescriptions of Aspertec over other aspirin products.

Move beyond aspirin to leverage our PLxGuard delivery systemin new products. While we are currently focused on Aspertec, there is a pipeline of additional opportunities that can be exploited. We are developing novel formulations that combine already-approved selected NSAIDs that meet our specific criteria with our proprietary PLxGuard technology to make safer and more effective new products. In addition to Aspertec, we have clinical data for a GI-safer OTC ibuprofen product, PL1200 Ibuprofen 200 mg, and preclinical data for a GI-safer diclofenac and a GI-safer intravenous indomethacin. We believe that the PLxGuard technology may also prove a novel drug delivery platform for corrosive, acid labile and insoluble and impermeable drugs providing delivery along the GI tract. We believe that by focusing initially on commercializing Aspertec we can demonstrate the viability of our PLxGuard delivery system as a versatile platform technology.

Hire additional senior management and key personnel to support the formulation and execution of successful product launches. Though we will continue to evaluate other market launch options, including co-promotion in the United States with one or more existing firms, we currently expect to launch Aspertec in the United States using our own sales and marketing team. This will require additional hiring of both management and sales personnel.

Seek strategic partners to commercialize Aspertec and other products in global markets. We have licensed the rights to commercialize Aspertec in the People’s Republic of China (including Macao and Hong Kong), along with an option for commercialization in Cambodia, Indonesia, Laos, Malaysia, Myanmar, Papua New Guinea, Philippines, Singapore, Taiwan, Thailand and Vietnam. We will continue to seek partners in other global markets.

Recent Developments

On May 10, 2017, we announced that we had been awarded a $1.9 million grant by the National Cancer Institute (NCI) of the National Institutes of Health (NIH) in support of our novel formulation of aspirin for chemoprevention of colorectal cancer. Further research of our novel phosphatidylcholine (PC)-associated aspirin (Aspirin-PC) for the prevention of colorectal cancer and potentially other cancers is supported by two recently published studies in peer-reviewed journals of the American Association for Cancer Research (AACR).

On May 12, 2017, we entered into a non-binding term sheet with Silicon Valley Bank regarding a potential $15 million debt financing. The financing would (a) be contingent upon completion of this offering and a minimum threshold of available cash on hand upon completion of this offering, (b) provide for $7.5 million at closing with the remaining $7.5 million subject to the achievement of certain milestones, (c) have a maximum term of 42 months, with interest-only payments being made during the first 18 months, (d) be secured by a first-lien security interest on all of our assets, and (e) include a requirement that upon each $7.5 million tranche funding we grant Silicon Valley Bank a warrant exercisable for ten years from the date of issuance for the purchase of shares of our common stock equal to 5% of the amount committed by Silicon Valley Bank divided by an exercise price equal to the lower of the average price per share over the preceding 10 trading days or the price per share on the day prior to funding. The terms of the financing remain subject to negotiation and definitive documentation, and we will continue to evaluate our liquidity options going forward.

Risks Associated With Our Business

Our business is subject to numerous risks and uncertainties related to our status as a development-stage company, our financial condition and need for additional capital, the commercialization of Aspertec, development of other product candidates, our reliance on third parties, our intellectual property and government regulation. These risks include those highlighted in the section entitled “Risk Factors” immediately following this prospectus supplement summary, including the following:

| | ● | We have not yet generated significant revenues, have a limited operating history, have incurred net losses in each year since our inception and anticipate that we will continue to incur significant losses for the foreseeable future, and if we are unable to achieve and sustain profitability, the market value of our common stock will likely decline. |

| | ● | We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or terminate our operations or commercialization efforts. |

| | ● | We are substantially dependent on the success of our lead product candidate, Aspertec. If we are unable to successfully commercialize Aspertec or experience significant delays in doing so, our business could be materially harmed. |

| | ● | Even though Aspertec 325 mg has already obtained regulatory approval, it may never achieve market acceptance necessary for commercial success and the market opportunity may be smaller than we estimate. |

| | ● | Our ability to market Aspertec for long-term use may be hampered by lack of trial results demonstrating long-term GI-safety benefits. |

| | ● | We currently have no sales and marketing staff or distribution organization. If we are unable to develop a sales and marketing and distribution capability on our own or through third parties, we will not be successful in commercializing our future products. |

| | ● | We face substantial competition and our competitors may discover, develop or commercialize products faster or more successfully than us. |

| | ● | Our business will be highly dependent on professional and public reputation and perception, which may change, leading to volatile levels of sales. |

| | ● | We may not be able to protect our intellectual property rights throughout the world. |

| | ● | The regulatory approval process is expensive, time consuming and uncertain and may prevent us from obtaining, or cause delays in obtaining, approvals for the commercialization of the 81 mg dose form of Aspertec or future product candidates, which will materially impair our ability to generate revenue. |

Corporate Information

Dipexium was originally organized as a limited liability company under Delaware law in January 2010. In March 2014, Dipexium converted from a Delaware limited liability company to a Delaware corporation. Dipexium’s common stock previously traded on The NASDAQ Capital Market under the symbol “DPRX.” In connection with the Merger, our common stock began trading on The NASDAQ Capital Market under the symbol “PLXP” on April 20, 2017.

Our principal executive offices are located at 8285 El Rio Street, Suite 130, Houston, Texas, 77054, and our telephone number is (713) 842-1249. Our website address iswww.plxpharma.com. The information contained on our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus supplement or the accompanying prospectus or in deciding whether to purchase our common stock.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of exemptions from some of the reporting requirements that are otherwise applicable to public companies. These exceptions include:

| | ● | being permitted to present only two years of audited financial statements and only two years of related disclosure in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2016; |

| | ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; |

| | ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| | ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the earlier of (i) December 31, 2019, (ii) the last day of the fiscal year (a) in which we have total annual gross revenue of at least $1.0 billion or (b) in which we are deemed to be a large accelerated filer, which means the market value of our equity securities that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (iii) the date on which we have issued more than $1.0 billion of non-convertible debt in any three-year period.

We have elected to take advantage of certain of the reduced disclosure obligations, and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different from what you might receive from other public reporting companies in which you hold equity interests. In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards, and at the same time, as other public companies that are not emerging growth companies.

THEOFFERING

Common stock offered by us in this offering | 2,646,091 shares |

| | |

Common stock outstanding beforethis offering | 6,037,824 shares |

| | |

Common stock to be outstanding immediately after this offering | 8,683,915 shares |

| | |

Use of proceeds | We intend to use these net proceeds to: advance Aspertec 325 mg to market-readiness; obtain supplemental regulatory approval of Aspertec 81 mg; fund the technology transfer and the commercial scale validation and manufacturing necessary to support both efforts; expand our management team; fund a PK/PD clinical study (for marketing purposes only) comparing Aspertec 81mg to enteric coated aspirin; and to fund working capital, capital expenditures and other general corporate purposes, which may include the acquisition or licensing of other products, businesses or technologies. See “Use of Proceeds” for additional information. |

| | |

Risk factors | See “Risk Factors” beginning on page S-11 of this prospectus supplement and page 6 of the accompanying prospectus, the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, and the other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| | |

| Concurrent Private Placement | In a concurrent private placement, we are selling to the purchasers of shares of our common stock in this offering warrants to purchase the number of shares of our common stock purchased by such investors in this offering, or up to 2,646,091 warrants. We will receive gross proceeds from the concurrent private placement transaction only to the extent such warrants are exercised for cash. The warrants will be exercisable six months and one day after the issuance date at an exercise price of $7.50 per share and will expire on the 10th anniversary of the issuance date. The warrants and the shares of our common stock issuable upon the exercise of the warrants are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. See "Private Placement Transaction." |

| | |

NASDAQ symbol | “PLXP” |

| | |

The number of shares of common stock to be outstanding after this offering is based on 1,391,218 shares of Dipexium common stock outstanding as of March 31, 2017, and excludes the following:

| | ● | 266,668 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2017, at a weighted average exercise price of $73.12 per share under Dipexium’s 2013 Equity Incentive Plan (the “2013 Plan”); and |

| | ● | 978 shares of our common stock, subject to increase on an annual basis, reserved for future issuance under the 2013 Plan as of March 31, 2017. |

On a pro forma basis, the number of shares of our common stock to be outstanding after this offering is based on 6,025,349 shares of our common stock outstanding as of March 31, 2017, and excludes the following:

| | ● | 691,386 shares of our common stock issuable upon the exercise of stock options outstanding as of March 31, 2017, at a weighted average exercise price of $12.44 per share under Old PLx’s 2015 Omnibus Incentive Plan (the “2015 Plan”); |

| | ● | 450,580 shares of our common stock reserved for future issuance under the 2015 Plan as of March 31, 2017; |

| ● | 266,668 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2017, at a weighted average exercise price of $73.12 per share under the 2013 Plan; |

| | | |

| ● | 978 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2017, at a weighted average exercise price of $73.12 per share under the 2013 Plan; and |

| | | |

| ● | 2,646,091 shares of common stock issuable upon exercise of warrants issued to investors in the concurrent private placement. |

The shares of common stock issuable upon the exercise of the warrants issued to investors in the concurrent private placement and the exercise price of such warrants are subject to anti-dilution adjustments in certain circumstances. See “Dilution” for more information about these possible anti-dilution adjustments.

RISKFACTORS

Investing in our common stock involves a high degree of risk.Before deciding to invest in our common stock, you should carefully consider each of the following risk factors and all other information set forth in this prospectus supplement,theaccompanying prospectus, the documents incorporated herein and therein by reference and any related free writing prospectus.The following risks and the risks described elsewhere in this prospectussupplement and the accompanying prospectus (and any documents incorporated herein by reference), including in the section entitled“Management’s discussion and analysis of financial condition and results of operations,” could materially harm our business, financial condition, operating results, cash flow and prospects.If that occurs, the trading price of our common stock could decline, and you may lose all or part of your investment.

Please also read carefully the section entitled “Cautionary Statement Concerning Forward-Looking Statements” included in this prospectus supplement.

Risks Related to Our Business and Capital Requirements

We have not yet generated significant revenues, have a limited operating history, have incurred net losses in each year since our inception and anticipate that we will continue to incur significant losses for the foreseeable future, and if we are unable to achieve and sustain profitability, the market value of our common stock will likely decline.

We have not generated any revenue from the sale of products, have generated minimal revenue from licensing activities, and have incurred losses in each year since we commenced operations. Old PLx’s net loss for the year ended December 31, 2016 was $4.9 million. Similarly, Dipexium incurred a net loss of $21.3 million for the year ended December 31, 2016. As of March 31, 2017, we had an accumulated deficit of approximately $52.7 million on a pro forma basis.

We expect to continue to incur significant expenses and increasing operating losses for the foreseeable future as we continue the development and commercialization of Aspertec and our other product candidates. Our expenses will also increase substantially if and when we:

| | ● | discover and develop additional product candidates; |

| | ● | establish a sales, marketing and distribution infrastructure to commercialize Aspertec and any other product candidates for which we may obtain marketing approval; |

| | ● | establish a manufacturing and supply chain sufficient for commercial quantities of Aspertec and any other product candidates for which we may obtain marketing approval; |

| | ● | maintain, expand and protect our intellectual property portfolio; |

| | ● | hire additional clinical, scientific and commercial personnel; |

| | ● | add operational, financial and management information systems and personnel, including personnel to support our product development and planned future commercialization efforts, as well as to support our obligations as a publicly reporting company; and |

| | ● | acquire or in-license other product candidates and technologies. |

Even if we do generate revenues, we may never achieve profitability, and even if we do achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on our stockholders’ equity and working capital. If we are unable to achieve and sustain profitability, the market value of our common stock will likely decline. Because of the numerous risks and uncertainties associated with developing biopharmaceutical products, we are unable to predict the extent of any future losses or when, if ever, we will become profitable.

We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or terminate our operations or commercialization efforts.

As of March 31, 2017, on a pro forma basis, we had working capital of approximately $10.2 million and cash and cash equivalents of approximately $12.8 million. We anticipate that we will need to raise substantial additional financing in the future to fund our operations.

We may obtain additional financing through public or private equity offerings, debt financings (including related-party financings), a credit facility or strategic collaborations. Additional financing may not be available to us when we need it or it may not be available to us on favorable terms, if at all. Our failure to raise capital as and when needed could have a negative impact on our financial condition and our ability to pursue our business strategies. Our future financing requirements will depend on many factors, some of which are beyond our control, including:

| | ● | our ability to enter into additional collaboration, licensing or other arrangements and the terms and timing of such arrangements; |

| | ● | the type, number, costs and results of the product candidate development programs which we are pursuing or may choose to pursue in the future; |

| | ● | the rate of progress and cost of our clinical trials, preclinical studies and other discovery and research and development activities; |

| | ● | the timing of, and costs involved in, seeking and obtaining FDA and other regulatory approvals; |

| | ● | the costs of preparing, filing, prosecuting, maintaining and enforcing any patent claims and other intellectual property rights, including litigation costs and the results of such litigation; |

| | ● | the emergence of competing technologies and other adverse market developments; |

| | ● | the resources we devote to marketing, and, if approved, commercializing our product candidates; |

| | ● | the scope, progress, expansion, and costs of manufacturing our product candidates; |

| | ● | our ability to enter into collaborative agreements to support the development of our product candidates and development efforts; |

| | ● | the amount of funds we receive in this offering; and |

| | ● | the costs associated with being a public company. |

Future capital requirements will also depend on the extent to which we acquire or invest in additional complementary businesses, products and technologies. We currently have no understandings, commitments or agreements relating to any of these types of transactions.

If we are unable to raise additional funds when needed, we may be required to sell or license to others technologies or clinical product candidates or programs that we would prefer to develop and commercialize ourselves. Without additional funding — or, alternatively, a partner willing to collaborate and fund development — we will be unable to continue development of PL1200 Ibuprofen or any other development-stage products in our pipeline.

We are substantially dependent on the success of our lead product candidate, Aspertec. If we are unable to successfully commercialize Aspertec or experience significant delays in doing so, our business could be materially harmed.

Our future success is substantially dependent on our ability to successfully commercialize Aspertec, which will depend on several factors, including the following:

| | ● | establishing commercial manufacturing and supply arrangements; |

| | ● | establishing a commercial infrastructure; |

| | ● | identifying and successfully establishing one or more collaborations to commercialize Aspertec; |

| | ● | acceptance of the product by patients, the medical community and third-party payors; |

| | ● | obtaining market share while competing with more established companies; |

| | ● | a continued acceptable safety and adverse event profile of the product; and |

| | ● | qualifying for, identifying, registering, maintaining, enforcing and defending intellectual property rights and claims covering the product. |

Serious adverse events, undesirable side effects or other unexpected properties of Aspertec or any other product candidate may be identified after approval that could delay, prevent or cause the withdrawal of regulatory approval, limit the commercial potential, or result in significant negative consequences following marketing approval.

Serious adverse events or undesirable side effects caused by, or other unexpected properties of, Aspertec or our other product candidates could cause us, an institutional review board, or regulatory authorities to interrupt, delay or halt our manufacturing and distribution operations and could result in a more restrictive label, the imposition of distribution or use restrictions or the delay or denial of regulatory approval by the FDA or comparable foreign regulatory authorities. If Aspertec or any of our other product candidates are associated with serious adverse events or undesirable side effects or have properties that are unexpected, we may need to abandon their development or limit development to certain uses or subpopulations in which the undesirable side effects or other characteristics are less prevalent, less severe or more acceptable from a risk-benefit perspective. Many compounds that initially showed promise in clinical or earlier stage testing have later been found to cause undesirable or unexpected side effects that prevented further development of the compound.

Undesirable side effects or other unexpected adverse events or properties of Aspertec or any of our other product candidates could arise or become known either during clinical development or, if approved, after the approved product has been marketed. If such an event occurs during development, our trials could be suspended or terminated and the FDA or comparable foreign regulatory authorities could order us to cease further development of, or deny approval of, our other product candidates. If such an event occurs with respect to Aspertec, a number of potentially significant negative consequences may result, including:

| | ● | regulatory authorities may withdraw the approval of such product; |

| | ● | regulatory authorities may require additional warnings on the label or impose distribution or use restrictions; |

| | ● | regulatory authorities may require one or more post-market studies; |

| | ● | we may be required to create a medication guide outlining the risks of such side effects for distribution to patients; |

| | ● | we could be sued and held liable for harm caused to patients; and |

| | ● | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product candidate, or could substantially increase commercialization costs and expenses, which could delay or prevent us from generating revenue from the sale of our products and harm our business and results of operations.

We may not be able to realize the anticipated benefits from combining the businesses of Dipexium and Old PLx.

The Merger involved the integration of two companies that previously have operated independently with principal offices in two distinct locations. Significant management attention and resources have been and will be required to integrate the two companies. The failure to successfully integrate and manage successfully the challenges presented by the integration process may result in the combined organization’s failure to achieve some or all of the anticipated benefits of the Merger.

Potential difficulties that may be encountered in the integration process include the following:

| | ● | using the combined organization’s cash and other assets efficiently to develop the business of the combined organization; |

| | ● | appropriately managing the liabilities of the combined organization; and |

| | ● | potential unknown or currently unquantifiable liabilities associated with the Merger and the operations of the combined organization. |

Delays in the integration process could adversely affect our business, financial results, financial condition and stock price. Even if we are able to integrate the business operations successfully, there can be no assurance that this integration will result in the realization of the full benefits of synergies, innovation and operational efficiencies that may be possible from this integration and that these benefits will be achieved within a reasonable period of time.

Even though Aspertec 325 mg has already obtained regulatory approval, it may never achieve market acceptance by physicians, patients, and others in the medical community necessary for commercial success and the market opportunity may be smaller than we estimate.

Even if we are able to launch Aspertec commercially, it may not achieve market acceptance among physicians, patients, hospitals (including pharmacy directors) and third-party payors and, ultimately, may not be commercially successful. Market acceptance of any product candidate for which we receive approval depends on a number of factors, including:

| | ● | the efficacy and safety of the product candidate as demonstrated in clinical trials; |

| | ● | relative convenience and ease of administration; |

| | ● | the clinical indications for which the product candidate is approved; |

| | ● | the potential and perceived advantages and disadvantages of the product candidates, including cost and clinical benefit relative to alternative treatments; |

| | ● | strength of competitive products; |

| | ● | the effectiveness of our sales and marketing efforts; |

| | ● | the strength of marketing and distribution support; |

| | ● | the willingness of physicians to recommend or prescribe the product; |

| | ● | the willingness of hospital pharmacy directors to purchase our products for their formularies; |

| | ● | our ability to maintain regulatory approvals for Aspertec; |

| | ● | acceptance by physicians, operators of hospitals and treatment facilities and parties responsible for reimbursement of the product; |

| | ● | the availability of adequate coverage and reimbursement by third-party payors and government authorities; |

| | ● | limitations or warnings, including distribution or use restrictions, contained in the product’s approved labeling or an approved risk evaluation and mitigation strategy; |

| | ● | the approval of other new products for the same indications; |

| | ● | the timing of market introduction of the approved product as well as competitive products; and |

| | ● | adverse publicity about the product or favorable publicity about competitive products. |

For example, while we believe that the safety profile and certain efficacy data will allow us to differentiate Aspertec from other aspirin products in the market, we may not be able to make direct comparative claims regarding the safety or efficacy of Aspertec and other aspirin products in our promotional materials for Aspertec. Any failure by Aspertec or any other product candidate that obtains regulatory approval to achieve market acceptance or commercial success would adversely affect our business prospects.

Our ability to market Aspertec for long-term use may be hampered by lack of trial results demonstrating long-term GI-safety benefits.

While demonstrating a statistically significant reduction in mucosal damage at 42 days when evaluated using the same clinical endpoints used for early studies involving enteric coated aspirin, Aspertec 325 mg did not demonstrate a reduction in ulcer risk over the course of a 42-day trial when more contemporary clinical endpoints were used. This lack of demonstrated long-term GI benefits could hamper our ability to market Aspertec 325 mg for long-term use.

For many new product candidates, we will rely on third parties to conduct our preclinical studies and all of our clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for or commercialize any of our product candidates.

If we elect to pursue new products, we will rely on medical institutions, clinical investigators, contract laboratories and other third parties, such as contract research organizations, to conduct our preclinical studies and clinical trials on our product candidates in compliance with applicable regulatory requirements. These third parties are not our employees and, except for restrictions imposed by our contracts with such third parties, we have limited ability to control the amount or timing of resources that they devote to our programs. Although we rely on these third parties to conduct our preclinical studies and clinical trials, we remain responsible for ensuring that each of our preclinical studies and clinical trials is conducted in accordance with its investigational plan and protocol and the applicable legal, regulatory, and scientific standards, and our reliance on these third parties does not relieve us of our regulatory responsibilities. The FDA and regulatory authorities in other jurisdictions require us to comply with regulations and standards, commonly referred to as current good clinical practices, or cGCPs, for conducting, monitoring, recording and reporting the results of clinical trials, in order to ensure that the data and results are scientifically credible and accurate and that the trial subjects are adequately informed of the potential risks of participating in clinical trials. If we or any of our third-party contractors fail to comply with applicable cGCPs, the clinical data generated in our clinical trials may be deemed unreliable and the FDA or comparable foreign regulatory authorities may require us to perform additional clinical trials before approving our marketing applications. In addition, we are required to report certain financial interests of our third party investigators if these relationships exceed certain financial thresholds and meet other criteria. Our clinical trials must also generally be conducted with products produced under current good manufacturing practice, or cGMP, regulations. Our failure to comply with these regulations may require us to repeat clinical trials, which would delay the regulatory approval process.

Many of the third parties with whom we contract may also have relationships with other commercial entities, some of which may compete with us. If the third parties conducting our preclinical studies or our clinical trials do not perform their contractual duties or obligations or comply with regulatory requirements we may need to enter into new arrangements with alternative third parties. This could be costly, and our preclinical studies or clinical trials may need to be extended, delayed, terminated or repeated, and we may not be able to obtain regulatory approval in a timely fashion, or at all, for the applicable product candidate, or to commercialize such product candidate being tested in such studies or trials. If any of our relationships with these third parties terminate, we may not be able to enter into arrangements with alternative third party contractors or to do so on commercially reasonable terms. Though we carefully manage our relationships with our contract research organizations, there can be no assurance that we will not encounter similar challenges or delays in the future or that these delays or challenges will not have a material adverse impact on our business, financial condition and prospects.

Clinical trials for future products may be delayed or prevented.

Clinical trials may be delayed or prevented for a broad range of reasons, including:

| | ● | Difficulties obtaining regulatory approval to begin trials; |

| | ● | Delays in reaching agreements on acceptable terms with contract manufacturers and contract research organizations; |

| | ● | Insufficient or inadequate supply or quality of a product candidate or other materials necessary to conduct our clinical trials; |

| | ● | Challenges recruiting and enrolling subjects to participate in clinical trials for a variety of reasons, including size and nature of subject population, proximity of subjects to clinical sites, eligibility criteria for the trial, nature of trial protocol, the availability of approved effective treatments for the relevant disease and competition from other clinical trial programs for similar indications; |

| | ● | Difficulties maintaining contact with subjects after treatment, which results in incomplete data; |

| | ● | Receipt by a competitor of marketing approval for a product targeting an indication that our product targets, such that we are not “first to market” with our product candidate; |

| | ● | Governmental or regulatory delays and changes in regulatory requirements, policy and guidelines; |

| | ● | Inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities; |

| | ● | Unforeseen safety issues, including serious adverse events associated with a product candidate, or lack of effectiveness; and |

| | ● | Lack of adequate funding to continue the clinical trial. |

One or more of these difficulties could result in delayed or cancelled trials and have a significant negative impact on our earnings.

We will rely on third-party contract manufacturing organizations to manufacture and supply Aspertec and other product candidates for us, as well as certain raw materials used in the production thereof. If one of our suppliers or manufacturers fails to perform adequately we may be required to incur significant delays and costs to find new suppliers or manufacturers.

We currently have limited experience in, and we do not own facilities for, manufacturing our product candidates, including Aspertec. We rely upon third-party manufacturing organizations to manufacture and supply our product candidates and certain raw materials used in the production thereof. Some of our key components for the production of Aspertec have a limited number of suppliers.

We will not control the manufacturing process of, and will be completely dependent on, our contract manufacturing partners for compliance with cGMP regulations for manufacture of our drug products. We will be relying on our contract manufacturers to successfully manufacture material that conforms to our specifications and the strict regulatory requirements of the FDA or others. In addition, although we will have no day-to-day control over the ability of our contract manufacturers to maintain adequate quality control, quality assurance and qualified personnel, we are nonetheless responsible for ensuring that our drug products are manufactured in accordance with cGMPs. If the facilities that manufacture our drug products fail to maintain a cGMP compliance status acceptable to the FDA or a comparable foreign regulatory authority, we may need to find alternative manufacturing facilities, which would significantly impact our ability to develop, obtain regulatory approval for or market our product candidates, if approved. The FDA or a comparable foreign regulatory authority could also take enforcement action with regard to the facilities or the drug products.

We do not have commercial supply agreements with our suppliers. In the event that we and our suppliers cannot agree to the terms and conditions for them to provide clinical and commercial supply needs, we would not be able to manufacture our product candidates until a qualified alternative supplier is identified, which could also delay the development of, and impair our ability to commercialize, our product candidates.

Our third-party suppliers may not be able to meet our supply needs or timelines and this may negatively affect our business. The failure of third-party manufacturers or suppliers to perform adequately or the termination of our arrangements with any of them may adversely affect our business.

A key ingredient for our products is currently available from only a single provider.

One key ingredient is currently limited to a single provider, Lipoid GmbH, or Lipoid, who supplies cGMP lecithin and is a leader in supplying high quality lipids to the global pharmaceutical industry. Lipoid developed this particular cGMP lecithin with us over a several year period, and has informed us that we are currently the only buyer of the product. We do not have a long-term contract with Lipoid for the supply of commercial quantities of this product, and there can be no assurances that Lipoid will be able to supply sufficient commercial quantities in compliance with regulatory requirements at an acceptable cost.

We may be subject to costly product liability claims related to our products and product candidates and, if we are unable to obtain adequate insurance or are required to pay for liabilities resulting from a claim excluded from, or beyond the limits of, our insurance coverage, a material liability claim could adversely affect our financial condition.