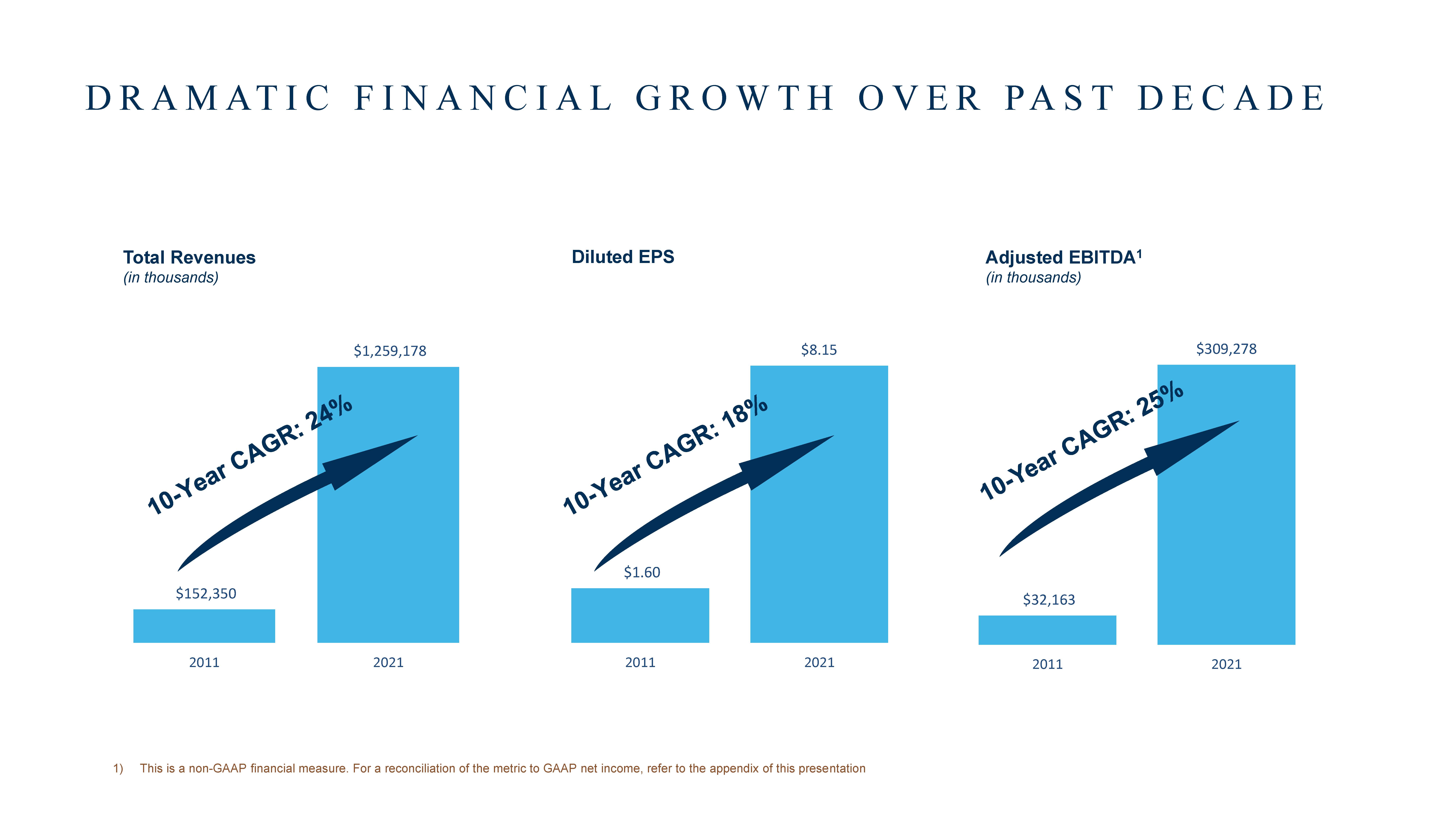

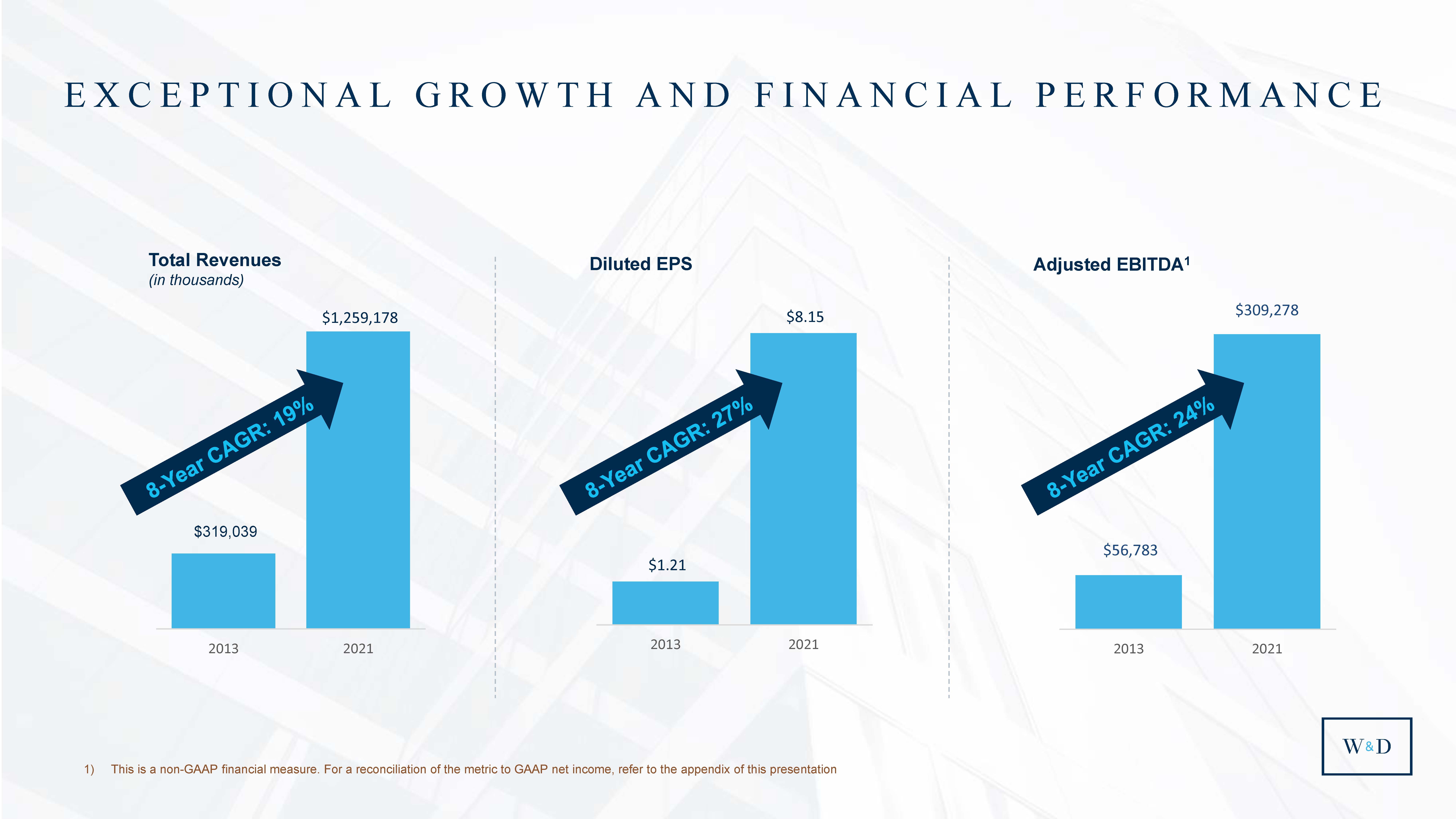

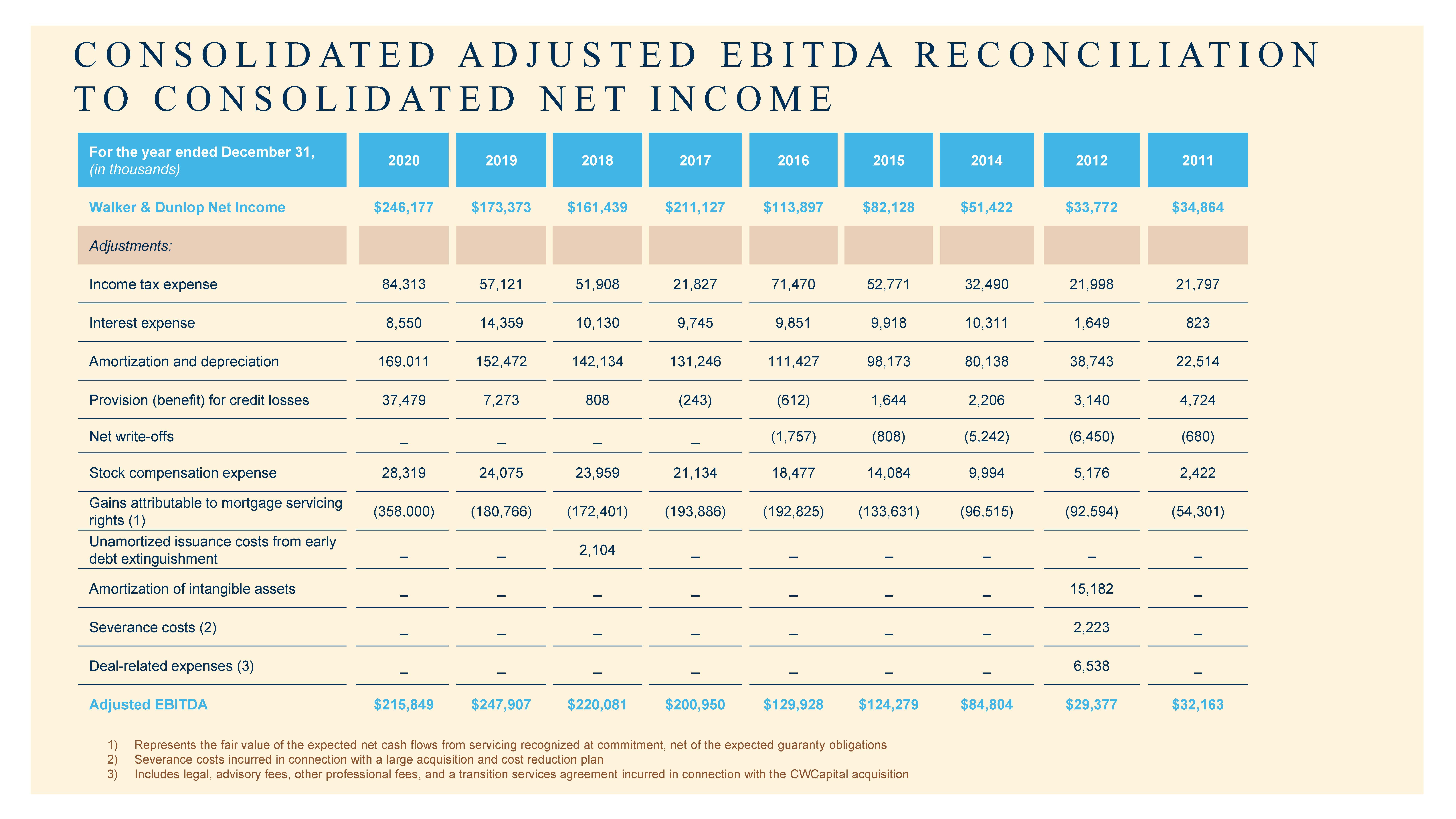

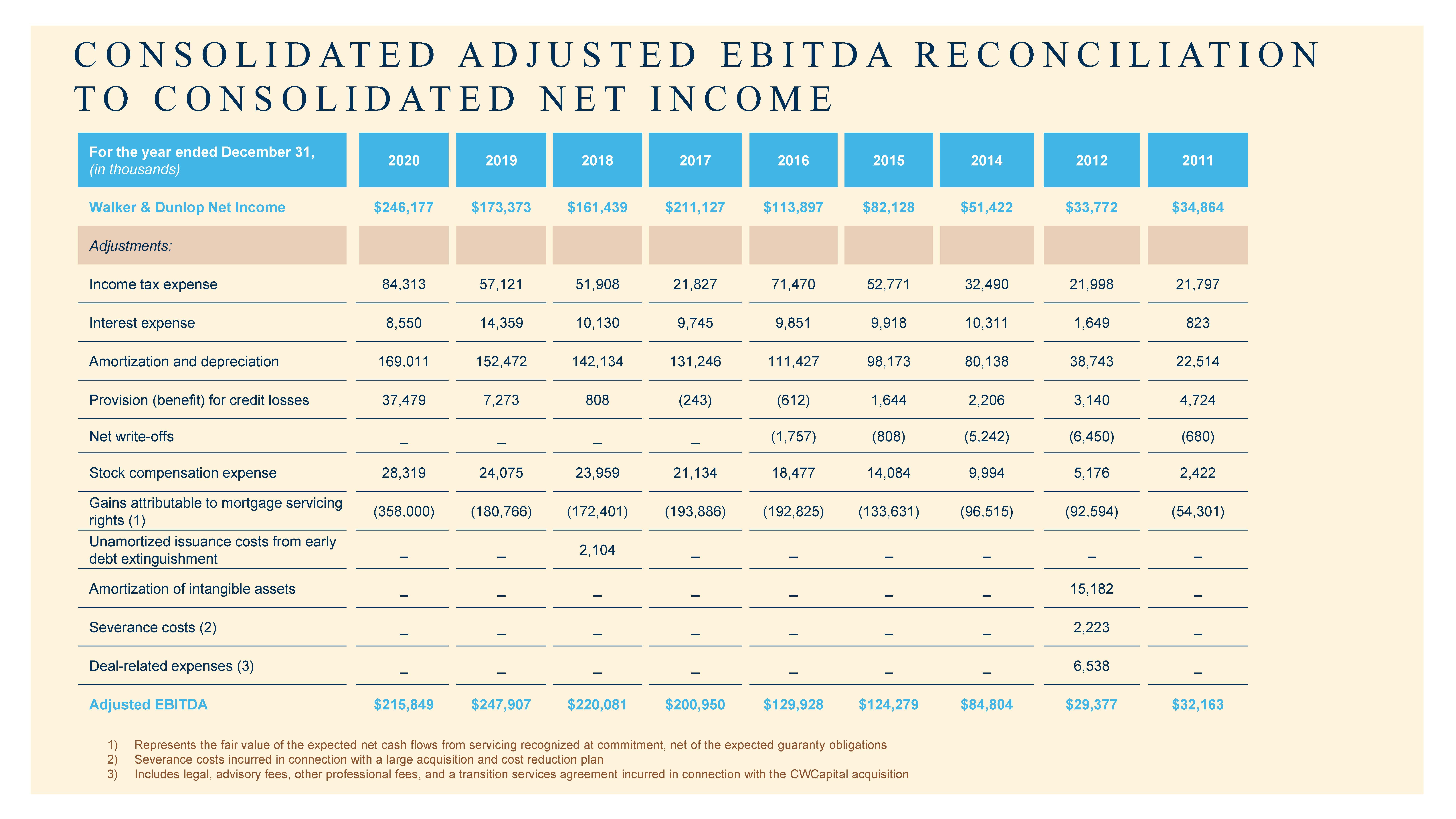

| CONSOLIDATED ADJUSTED EBITDA RECONCILIATION TO CONSOLIDATED NET INCOME For the year ended December 31, (in thousands) 2020 2019 2018 2017 2016 2015 2014 2012 2011 Walker & Dunlop Net Income $246,177 $173,373 $161,439 $211,127 $113,897 $82,128 $51,422 $33,772 $34,864 Adjustments: Income tax expense 84,313 57,121 51,908 21,827 71,470 52,771 32,490 21,998 21,797 Interest expense 8,550 14,359 10,130 9,745 9,851 9,918 10,311 1,649 823 Amortization and depreciation 169,011 152,472 142,134 131,246 111,427 98,173 80,138 38,743 22,514 Provision (benefit) for credit losses 37,479 7,273 808 (243) (612) 1,644 2,206 3,140 4,724 Net write-offs _ _ _ _ (1,757) (808) (5,242) (6,450) (680) Stock compensation expense 28,319 24,075 23,959 21,134 18,477 14,084 9,994 5,176 2,422 Gains attributable to mortgage servicing rights (1) (358,000) (180,766) (172,401) (193,886) (192,825) (133,631) (96,515) (92,594) (54,301) Unamortized issuance costs from early debt extinguishment _ _ 2,104 _ _ _ _ _ _ Amortization of intangible assets _ _ _ _ _ _ _ 15,182 _ Severance costs (2) _ _ _ _ _ _ _ 2,223 _ Deal-related expenses (3) _ _ _ _ _ _ _ 6,538 _ Adjusted EBITDA $215,849 $247,907 $220,081 $200,950 $129,928 $124,279 $84,804 $29,377 $32,163 1) Represents the fair value of the expected net cash flows from servicing recognized at commitment, net of the expected guaranty obligations 2) Severance costs incurred in connection with a large acquisition and cost reduction plan 3) Includes legal, advisory fees, other professional fees, and a transition services agreement incurred in connection with the CWCapital acquisition |