SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP

A DELAWARE LIMITED LIABILITY PARTNERSHIP

世達國際律師事務所

30/F, TOWER 2

| CHINA WORLD TRADE CENTER | FIRM/AFFILIATE OFFICES |

| NO. 1, JIAN GUO MEN WAI AVENUE |

|

| BEIJING 100004 CHINA | BOSTON |

|

| CHICAGO |

| TEL: (86-10) 6535-5500 | HOUSTON |

| FAX: (86-10) 6535-5577 | LOS ANGELES |

| www.skadden.com | NEW YORK |

| | PALO ALTO |

| | SAN FRANCISCO |

| November 12, 2010 | WASHINGTON, D.C. |

| | WILMINGTON |

| |

|

| | BRUSSELS |

| | FRANKFURT |

| | HONG KONG |

| | LONDON |

| | MOSCOW |

| | MUNICH |

| | PARIS |

| | SÃO PAULO |

| | SHANGHAI |

| | SINGAPORE |

| | SYDNEY |

| | TOKYO |

| | TORONTO |

| | VIENNA |

VIA EDGAR AND HAND DELIVERY

Mr. Larry Spirgel, Assistant Director

Ms. Celeste Murphy, Legal Branch Chief

Mr. John Zitko, Staff Attorney

Ms. Cicely LaMothe, Branch Chief

Mr. Wilson Lee, Staff Accountant

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

RE: SYSWIN Inc.

Amendment No. 1 to Registration Statement on Form F-1

Dear Mr. Spirgel, Ms. Murphy, Mr. Zitko, Ms. LaMothe and Mr. Lee:

On behalf of our client, SYSWIN Inc., a foreign private issuer organized under the laws of the Cayman Islands (the “Company”), we enclose five courtesy copies of the Company’s first amendment (“Amendment No. 1”) to the registration statement on Form F-1, which was filed on EDGAR with the Securities and Exchange Commission (the “Commission”) on November 10, 2010. Courtesy copies of Amendment No. 1, enclosed herewith, have been marked to show changes to the registration statement originally filed on EDGAR with the Commission on November 4, 2010 (the “Registration Statement”).

Set forth below are the Company’s responses to the comments contained in the letter dated November 10, 2010 from the staff of the Commission (the “Staff”). The comments are repeated below and followed by the Company’s responses. We have included page numbers to refer to the location in Amendment No. 1 where the language addressing a particular comment appears.

In addition to revising disclosure in response to the Staff’s comments, the Company has, among other things, updated portions of Amendment No. 1 to include the estimated range of the initial public offering price and other required information.

The Company has commenced its roadshow and expects to, on or around November 18, 2010, file the request that the effectiveness of the Registration Statement be accelerated to, and that the Registration Statement become effective on, as early as November 22, 2010. The Company would very much appreciate the Staff’s support and assistance in working towards this timetable.

* * *

General

1. We note the legal opinion provided by Jingtian & Gongcheng (Exhibit 99.2) which, though not explicit, appears to imply that Syswin Xing Ye’s activities are not to be considered real estate agency and consultancy services. However, we also note the disclosure throughout your prospectus indicating that you “conduct [y]our real estate sales agency and consultancy businesses through Syswin Xing Ye and its subsidiaries.” (page 93)

For example, on page 126 (“Regulations on Urban Real Estate Sales Agency and Consultancy Services - General Principles on Urban Real Estate Intermediary Services”) you state:

“According to the Urban Real Estate Law and the Intermediary Services Administration provisions, the urban real estate intermediary services agencies are categorized as real estate consultancy agencies, real estate appraisal agencies and real estate brokerage agencies. Accordingly, our operating entities engaged in real estate sales agency and consultancy services are subject to the laws and regulations governing real estate brokerage agencies and real estate consultancy agencies, respectively, and shall obtain business licenses from the State Administration for Industry and Commerce, or SAIC, or its local branches before commencing their real estate sales agency and consultancy businesses in China.”

Likewise, on page 95, you disclose that:

“Syswin Xing Ye and its subsidiaries, other than Qingdao Syswin and Shanxi Syswin, have obtained all necessary licenses and permits from the PRC government to engage in real estate sales agency and consultancy services businesses.”

Moreover, we note your assertion to be “the largest primary real estate service provider in Beijing and Northern China,” contained on page one of your prospectus as well as your proposed front cover for the prospectus.

Please file a revised legal opinion to address explicitly whether Syswin Xing Ye engages in real estate sales agency and consultancy services, revise your prospectus to disclose the scope of Xing Ye’s business as set forth in its business license, reconcile the implied assertion in the opinion that Xing Ye does not engage in real estate agency and consultancy services with the disclosure contained throughout your prospectus indicating otherwise, and clarify why, if Xing Ye is not engaged in such services, it has “obtained all necessary licenses and permits from the PRC government to engage in real estate sales agency and consultancy services businesses.” We may have further comment.

2

In response to the Staff’s comment, the Company’s PRC counsel, Jingtian & Gongcheng Attorneys At Law (“Jingtian”), has revised its legal opinion to clarify that Syswin Xing Ye (the consolidated entity of the Company) does engage in real estate sales agency and consultancy services. Its opinion was never intended to imply that Syswin Xing Ye does not engage in such services and the Company apologizes for any confusion regarding this point. As disclosed on pages 4, 93 and other places elsewhere in Amendment No. 1, the Company conducts substantially all of its operations in China through contractual arrangements with Syswin Xing Ye, and, therefore, the Company relies significantly upon Syswin Xing Ye’s ability to provide these services. Syswin Xing Ye’s scope of business, as prescribed in its business license, includes real estate sales agency services and real estate consultancy (including planning consultancy). Syswin Xing Ye’s business license and its English translation are included as Annex I to this response letter.

It is Syswin Zhi Di (the PRC subsidiary of the Company) that is restricted from engaging in real estate sales agency and consultancy services. And for that reason, Syswin Zhi Di relies on contractual arrangements with Syswin Xing Ye in order for the Company to conduct its core business. As stated on page 2 of Amendment No. 1: “Due to restrictions under PRC law on foreign investment in primary real estate sales agency and consultancy businesses, we operate our business primarily through our consolidated entity and its subsidiaries in China. We do not hold equity interests in our consolidated entity. However, through a series of contractual arrangements with such consolidated entity and its shareholders, we, among other things, effectively exercise control over, and derive substantially all of the economic benefits from, such consolidated entity.” Restrictions on foreign investment in this industry are further described on page 131 of Amendment No. 1.

Jingtian has also confirmed in its opinion that Syswin Xing Ye has obtained all the permits, licenses, certificates required by PRC laws in order to engage in real estate agency and consultancy services. A revised version of Jingtian’s opinion, which has been amended to remove any statements that could imply that Syswin Xing Ye does not engage in real estate sales agency and consultancy services, has been attached hereto as Annex II to this response letter.

2. We note your disclosure and the legal opinion provided by Jingtian & Gongcheng (Exhibit 99.2) asserting that the services provided by Zhi Di to Xing Ye are not real estate sales agency and consultancy services under PRC Laws and do not require a license or permit for such. However, the basis for such opinion is not clear. Please file a revised legal opinion to address directly why, in light of Xing Ye’s status (as addressed in the preceding comment) “the consultancy services provided by Syswin Zhi Di to Syswin Xing Ye shall not be deemed as real estate consultancy service nor sales agency service under PRC Laws.”

As discussed in the Company’s response to Comment No. 1 above, it is Syswin Xing Ye (the consolidated entity of the Company) that provides the real estate sales agency and consultancy services, not Syswin Zhi Di (the PRC subsidiary of the Company). The business of Syswin Zhi Di is limited to providing technology consulting services, marketing consulting services and general management services to Syswin Xing Ye. Syswin Zhi Di is not licensed to, and does not engage in real estate sales agency and consultancy services.

In response to Staff’s question on the basis for the opinion that the services provided by Syswin Zhi Di to Syswin Xing Ye are not real estate sales agency and consultancy services, the Company respectfully refers the Staff to the analysis included in the revised legal opinion of Jingtian, attached hereto as Annex II and reproduced below:

We are of the opinion that (i) all of the services provided by Syswin Zhi Di to Syswin Xing Ye under Article 1 of the Service Agreement are not, and shall not be deemed to

3

be, real estate sales agency and consultancy services under PRC Laws; and (ii) all services provided by Syswin Zhi Di to Syswin Xing Ye as described in Article 1 of the Service Agreement fall within Syswin Zhi Di’s business scope as prescribed in its business license and are in compliance with PRC Laws. Our opinion is rendered based on the following analysis:

1) Pursuant to the Provisions on the Administration of Urban Real Estate Intermediary Services, or the Intermediary Services Administration Provisions, promulgated by the Ministry of Construction, or MOC, as amended on August 15, 2001, real estate sales agency and consultancy services refer to those sales agency and consultancy services provided to parties in a real estate transaction. Neither the Intermediary Services Administration Provisions nor its implementation rules provide a definition of the term “parties in a real estate transaction.” As a result, in interpreting such term, we have referred to (i) the Rules on Real Estate Agency Practice, an industry guideline released on November 1, 2006 by the Association of China Real Estate Appraisers and Real Estate Brokers, the national industry association in real estate services business in China and (ii) our verbal consultation with local real estate regulatory authorities, including Beijing Committee of Construction and Urban-rural Housing and its counterpart in Mentougou District in Beijing, the local regulatory authority administering relevant laws and regulations in Beijing, where Syswin Xing Ye is incorporated. According to the industry guideline and based on our verbal consultation, the term “parties in a real estate transaction” refers solely to property purchasers, and the property developers in primary property transactions or property sellers in secondary property transactions, as applicable.

Because Syswin Xing Ye is a real estate sales agency and consultancy service provider and is not a property purchaser or a property seller involved in a real estate transaction, Syswin Zhi Di, solely by virtue of providing consulting services to Syswin Xing Ye, as a matter of PRC Law, shall not be deemed to engage in real estate sales agency or consultancy services. In other words, Syswin Zhi Di functions like a typical information technology, marketing and general management consulting firm providing consulting services to Syswin Xing Ye.

2) In addition, based on the Legislation Law of the PRC, local regulatory authorities may adopt implementation rules with more stringent standards comparing to the rules or regulations promulgated by a regulatory body with higher level of authority. The local real estate regulatory authority in Beijing (where both Syswin Zhi Di and Syswin Xing Ye were incorporated and conduct their operations) has issued the implementation rules based on Intermediary Services Administration Provisions, which defines the scope of real estate sales agency and consultancy services to be those sales agency and consultancy services provided in relation to a specific real estate transaction or project. Syswin Zhi Di provides consulting services to Syswin Xing Ye on the general administrative and operational aspects. Such consulting services provided do not relate to any specific real estate transaction or project. As a result, the consulting services provided by Syswin Zhi Di to Syswin Xing Ye are not, and shall not be deemed to be, real estate sales agency or consultancy services.

3. We note the disclosure that your board and shareholders approved resolutions on November 3, 2010 in order to effect a 12,500-for-one split of the Company’s share capital and designate 2.5 billion preferred shares in preparation for your intended initial public offering. We also note the disclosure that your board member and Chief Executive Officer, Liangsheng Chen, who currently owns 78.29% of your outstanding ordinary shares, agreed to sell $16 million worth of shares to entities controlled by Sino-Ocean Land Holdings Limited and to SouFun Holdings Limited, at a price per share

4

equal to the initial public offering price, on October 28, 2010 and November 4, 2010. Please revise your prospectus to disclose why the board determined to effect the specific forward split in the ratio it did and designate 2.5 billion preferred shares. Revise to disclose whether (and, if so, how) the board considered Mr. Chen’s October 28, 2010 agreement and whether it knew of Mr. Chen’s impending November 4, 2010 agreement (and, if so, how it considered such agreement).

In response to the Staff’s comment regarding the share split, the Company has revised the disclosure on page 94 to disclose that, the 12,500-for-1 share split was effected “in contemplation of this offering,” and in particular, “the share split ratio and the number of authorized ordinary shares after the share split were determined based on a number of factors, including the customary ratio of ordinary shares to one ADS, our expected market capitalization upon completion of the offering, and the customary price range of ADSs.” Revised disclosure on page 94 also further clarified that prior to the share split, the Company had 5 million authorized (issued and unissued) ordinary shares, with 12,390 shares issued. After the share split, the Company had 62.5 billion authorized (issued and unissued) ordinary shares, with 154,870,000 shares issued.

In addition, in response to the Staff’s comment regarding the designated preferred shares, the Company has revised the disclosure on page 94 to disclose that, its board of directors authorized the preferred shares, “effective upon the declaration of effectiveness of the registration statement” by the Commission, so as to “increase its flexibility in implementing anti-takeover defense mechanisms such as the adoption of a rights plan.” The Company has also included the cross-reference to the risk factor that “Our amended and restated articles of association contain anti-takeover provisions that could have a material adverse effect on the rights of holders of our ordinary shares and ADSs” in the Risk Factors section. The Company supplementally advises the Staff that the aggregate number of authorized preferred shares (2.5 billion) represents 4% of its aggregate number of authorized preferred and ordinary shares (62.5 billion) and it believes that such recapitalization results in a reasonable share capital structure to enable its board to take appropriate corporate actions against any unsolicited takeover activities, subject to its duties, fiduciary or otherwise, under the Cayman Islands laws.

In response to the Staff’s comment regarding Mr. Chen’s proposed sale of shares concurrent with the closing of the proposed public offering, the Company has revised the disclosure on page 94 to disclose that its “board of directors was informed of these transactions in the early stages of the negotiation processes. The board subsequently approved these transactions as it believed that these transactions would be beneficial to [the] company in light of the potential business cooperation between [the] company and the investors.” The Company respectfully advises the Staff that, as also disclosed on page 94, “based on an initial public offering price of US$10.25 per ADS, being the mid-point of the estimated initial public offering price range shown on the front cover of this prospectus and as a result of these investments, Sino-Ocean Land Holdings Limited and SouFun Holdings Limited are expected to own 2.02% and 1.01%, respectively, of [its]ordinary shares immediately upon the closing of this offering.”

4. In light of Mr. Chen’s 78.29% control of Syswin, please revise your prospectus to affirmatively disclose all material terms of the October 28 and November 4, 2010 agreements.

In response to the Staff’s comment, the Company has revised the disclosure on pages 93 and 94 to include disclosure regarding all material terms the agreements, including the purchase price, aggregate purchase consideration, closing conditions (which are generally beyond any party’s control) as well as the lock-up arrangements. The Company is not a party to any of these purchase agreements.

5

To assist the Staff in its review, the Company has included the relevant purchase agreements as Annex III to this response letter.

5. Please revise your prospectus to disclose how the number of authorized ordinary shares was established.

In response to the Staff’s comments, the Company respectfully advises the Staff that, as disclosed on page 94, the number of authorized ordinary shares was established through a 12,500-for-1 share split effected on November 3, 2010, and a recapitalization by redesignating 4% of its authorized ordinary shares as authorized preferred shares, effective upon the declaration of effectiveness of the registration statement by the Commission.

The table below sets forth information regarding such share split and recapitalization:

| | Authorized Share Capital | | Issued Shares | |

| | Ordinary

Shares | | Preferred

Shares | | Total | | Ordinary

Shares | |

Since the Company’s incorporation in December 5, 2007 through November 3, 2010 (Pre-Share Split) | | 5,000,000 | | 0 | | 5,000,000 | | 12,470 | |

Since November 3, 2010 through the effectiveness of the registration statement (Post-Share Split, Pre-Recapitalization) | | 62,500,000,000 | | 0 | | 62,500,000,000 | | 154,870,000 | |

Upon the effectiveness of the registration statement (Post-Recapitalization) | | 60,000,000,000 | | 2,500,000,000 | | 62,500,000,000 | | 193,275,000 | |

In addition, as disclosed on page 94, the purpose of the share split is to facilitate the proposed initial public offering, and in particular, “the share split ratio and the number of authorized ordinary shares after the share split were determined based on a number of factors, including the customary ratio of ordinary shares to one ADS, our expected market capitalization upon completion of the offering, and the customary price range of ADSs.” The purpose of the redesignated preferred shares is to “increase its flexibility in implementing anti-takeover defense mechanisms such as the adoption of a rights plan.”

Proposed Artwork Provided Supplementally

6. We note your reference to “specialized and differentiated expertise in client service.” Please revise to provide context for such statements to explain how the company’s expertise is specialized and differentiated and indicate whether this is a determination made by the company or by a third party or remove such general statement.

The Company acknowledges the Staff’s comment and has decided not to include any artwork for the inside front cover and inside back cover of the prospectus.

7. We note your assertion of being “a leading brand in primary real estate agency services in China” and “the largest primary real estate service provider in Beijing and Northern China.” Please remove such statements in light of the legal opinion attached as Exhibit 99.2, which states that you are not engaged in such services.

The Company acknowledges the Staff’s comment and has decided not to include any artwork for the inside front cover and inside back cover of the prospectus. The Company respectfully advises the Staff that, as stated in its response to Comments 1 and 2, the Company engages in real estate sales agency and consultancy businesses, through Syswin Xing Ye and its subsidiaries, which are its consolidated entities.

8. Please advise as to the relevance of the inset map, which does not contain geographical names but appears to contain at least one dot not reflected on the larger map.

The Company acknowledges the Staff’s comment and has decided not to include any artwork for the inside front cover and inside back cover of the prospectus.

6

9. Please revise to explain the reference to “Syswin Brokerage,” as you disclose in your prospectus that you transferred your brokerage business to entities controlled by Mr. Chen in August 2010.

The Company acknowledges the Staff’s comment and has decided not to include any artwork for the inside front cover and inside back cover of the prospectus. In addition, the Company has included a revised company logo without reference to the term “brokerage” to avoid any confusion in this regard.

Financial Statements and Notes

Consolidated Statements of Operations, page F-5

10. We have considered your response to comment eight. Please revise to disclose cash dividends per share in the notes to the financial statements instead of on the face of the Consolidated Statements of Operations.

In response to the Staff’s comment, the Company has revised the disclosure on page F-41 to disclose cash dividends per share in the notes to the financial statements instead of on the face of Consolidated Statements of Operations on page F-5.

* * *

If you need additional copies or have any questions regarding Amendment No. 1, please contact the undersigned by phone at +8610-6535-5599 (work) or +86-135-0138-5907 (mobile) or via e-mail at peter.huang@skadden.com.

| Very truly yours, |

| |

| /s/ Peter Huang_ |

| |

| Peter Huang |

Enclosures

cc: Liangsheng Chen, Chief Executive Officer, SYSWIN Inc.

Kai Li, Chief Financial Officer, SYSWIN Inc.

Xiaoling Hu, Managing Director, CDH Investments

Laura Butler, Partner, PricewaterhouseCoopers Zhong Tian CPAs Limited Company

Alan Seem, Partner, Shearman & Sterling LLP

7

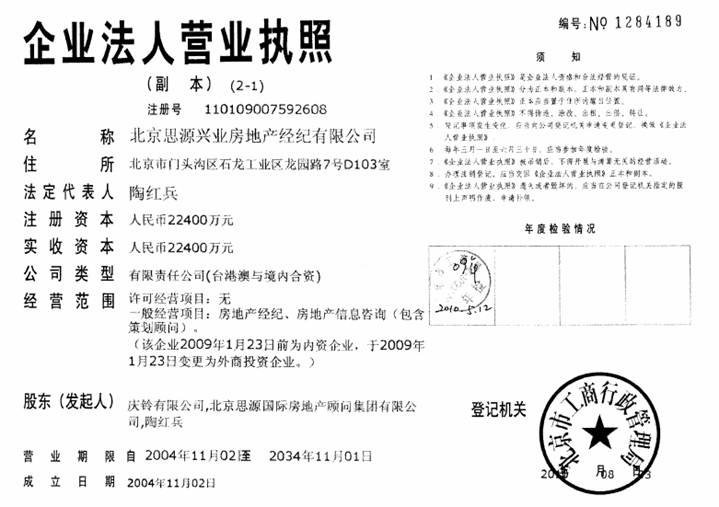

ANNEX I

(In Response to Staff’s Comment 1)

Business License

Serial Number: No. 1284189

(Copy) (2-1)

Registration Number: 110109007592608

Company: Beijing Syswin Xing Ye Real Estate Brokerage Company, Limited | | Annual Check: 2009 |

Registered Address: Rm. D103, 7 Longyuan Road, Shilong Industrial District, Mentougou District, Beijing |

Legal Representative: TAO Hongbing |

Registered Capital: RMB 224 millions |

Paid Capital: RMB 224 millions |

Company Type: Limited Liability Company |

Business Scope: Real estate sales agency services, real estate consultancy (including planning consultancy services) |

Investors: Qingling Company Limited, Beijing Syswin International Real Estate Consulting Group Co., Ltd, Tao Hongbing |

Term of Operation: 2 November 2004 to 1 November 2034 |

Date of Establishment: 2 November 2004 | Registration Agency: Administration for Industry and Commerce of Beijing |

Annex II

(In Response to Staff’s Comments 1 and 2)

November 12, 2010

SYSWIN Inc.

9/F, Syswin Building

No. 316, Nan Hu Zhong Yuan

Chaoyang District

Beijing 100102

The People’s Republic of China

Re: SYSWIN Inc.

We have acted as the People’s Republic of China (the “PRC”, for the purpose of this legal opinion, not including Hong Kong Special Administrative Region, Macau Special Administrative Region and Taiwan) legal advisers to SYSWIN Inc. (the “Company”) in connection with its initial public offering (the “Offering”) and listing of American depositary shares, representing the Company’s ordinary shares (“ADSs”) on the New York Stock Exchange (the “NYSE”).

We are qualified lawyers in the PRC and are authorized by the Ministry of Justice of the PRC to issue legal opinions in relation to the above matters in accordance with the published and publicly available laws and regulations of the PRC, and such qualification and authorization have not been revoked, suspended, restricted or limited in any manner whatsoever.

For the purpose of rendering this Legal Opinion (this “Opinion”), we have examined copies of the documents provided to us by the Company. In such examination, we have assumed that:

1

(a) all documents submitted to us as copies are identical to their originals;

(b) all signatures, seals and chops on such documents are genuine;

(c) all parties in relation to any of the documents aforesaid or to any other documents as referred to in this legal opinion have the requisite power and authority to enter into, and have duly executed and delivered the documents and performed their obligations hereunder; and

(d) all facts and documents which may affect our opinions herein have been disclosed to us, and there has not been or will not be any omission in respect of such disclosure.

This Opinion is rendered on the basis of the PRC laws, administrative regulations, rules, and supreme court’s judicial interpretations effective as of the date hereof (the “PRC Laws”) and there is no assurance that any of such laws, regulations, rules and interpretations will not be changed, amended or replaced in the immediate future or in the longer term. Any such changes, amendments thereto or replacements thereof may become effective immediately on promulgation or publication.

We do not purport to be experts on or generally familiar with or qualified to express legal opinions based on the laws of any jurisdiction other than the PRC. Accordingly, we express or imply no opinion on the laws of any jurisdiction other than the PRC.

Section I. Definitions

Unless otherwise expressly prescribed in this Opinion, the following capitalized terms shall have the meanings ascribed to them below:

“AOA” | | refers to articles of association of a company. |

2

“Equity Interest Pledge Agreements” | | refers to the equity interest pledge agreements entered into between Syswin Zhi Di and each of Syswin Xing Ye’s Shareholders on August 4, 2010. |

| | |

“Service Agreement” | | refers to the Exclusive Technical Consultation and Service Agreement entered between Syswin Xing Ye and Syswin Zhi Di on August 4, 2010. |

| | |

“SYSWIN Hong Kong” | | refers to SYSWIN Limited, a company incorporated under the laws of the Hong Kong Special Administrative Region, the 100% equity interest of which is directly owned by the Company. |

| | |

“Syswin Zhi Di” | | refers to Beijing Syswin Zhi Di Technology Limited, a wholly foreign owned enterprise (“WFOE”) incorporated under the PRC Laws, the 100% equity interest of which is directly owned by SYSWIN Hong Kong. |

| | |

“Syswin Xing Ye” | | refers to Beijing Syswin Xing Ye Real Estate Brokerage Company Limited, a domestic company incorporated under the PRC Laws with its shareholders being Beijing Syswin International Real Estate Consulting Company Limited, Mr. Hongbing Tao and Qingling Company Limited (collectively referred to as “Syswin Xing Ye’s shareholders). |

| | |

“Syswin Xing Ye’s Subsidiaries” | | refers to Syswin Xing Ye’s wholly-owned subsidiary companies, all of which are incorporated under the PRC Laws and a list of which is included as Annex I to this Opinion. |

3

“PRC Subsidiaries” | | refers to Syswin Zhi Di, Syswin Xing Ye and Syswin Xing Ye’s Subsidiaries. |

| | |

“Group Companies” | | refers to the Company, SYSWIN Hong Kong, Syswin Zhi Di, Syswin Xing Ye and Syswin Xing Ye’s Subsidiaries. |

| | |

“Government Agency” | | refers to any competent government authorities, courts, arbitration commissions, or regulatory bodies of the PRC. |

| | |

“Governmental Authorization” | | refers to any approval, consent, permit, authorization, filing, registration, exemption, waiver, endorsement, annual inspection, qualification and license required by the applicable PRC Laws to be obtained from any Government Agency. |

| | |

“Registration Statement” | | refers to the Form F-1 registration statement under the United States Securities Act of 1933, as amended, filed with the Securities and Exchange Commission (the “SEC”) for registration of the offer and sale of the Company’s ordinary shares. |

| | |

“Prospectus” | | refers to the prospectus, including all amendments or supplements thereto, that forms part of the Registration Statement. |

Section II. Opinions

Based on the foregoing, we are of the opinion on the date hereof that:

4

1. Corporate Structure. The entering into, and the consummation of, the transactions contemplated under the contractual arrangements described in the Registration Statement and the Prospectus under “Our Corporate Structure” constitute legal, valid and binding obligations of all the parties therein, enforceable against all the parties therein, and will not contravene, result in a breach or violation of, or constitute a default under, any of the terms and provisions of the PRC Subsidiaries’ respective AOAs or business licenses, constitutive documents and Governmental Authorizations; all necessary steps for the transactions contemplated thereunder have been taken, and all consents required from any of the PRC Subsidiaries and each of their respective shareholders have been obtained and are in full force and effect; except as disclosed in the Registration Statement and the Prospectus, all Governmental Authorizations and all necessary steps required under applicable PRC Laws for the transactions contemplated thereunder have been obtained, made and taken, and are in full force and effect. Because the Company and its subsidiaries exercise control over Syswin Xing Ye through contractual arrangements without any direct investment therein, the restrictions imposed by the PRC Laws on foreign investment in businesses involved in primary real estate agency and consultancy services are not applicable to the Company, SYSWIN Hong Kong or Syswin Zhi Di.

2. M&A Rules. On August 8, 2006, six PRC regulatory agencies, including the Ministry of Commerce, or MOFCOM, the State-Owned Assets Supervision and Administration Commission, or SASAC, the State Administration of Taxation, or SAT, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or the CSRC, and the State Administration of Foreign Exchange, or SAFE, jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, which came into effect on September 8, 2006 and was amended on June 22, 2009. The M&A Rules prescribe, among other things, the procedures and formalities for mergers and acquisitions of domestic enterprises in China by foreign investor(s) by either purchasing the equities or assets of, or stock swaps with,

5

the target PRC enterprise. Following the adoption of the M&A Rules, on September 21, 2006, the CSRC published on its official website procedures regarding its approval of overseas listings by special purpose vehicles as defined under the M&A Rules.

We are of the opinion that the Company is not required by the M&A Rules to apply to the relevant Government Agencies, including the CSRC, for approval of the listing and trading of the Company’s ADSs on a US stock exchange because (1) Syswin Zhi Di was established as an foreign-invested enterprise by direct investment and not through a “merger with or acquisition of the equity or assets of any PRC domestic enterprise” as such term is defined under the M&A Rules; (2) neither the Company nor any of its subsidiaries holds any equity interests in Syswin Xing Ye or any of Syswin Xing Ye’s Subsidiaries; and (3) neither the M&A Rules themselves, nor the administrative practices under the M&A Rules made public as of the date of the Prospectus, clearly indicate the application of the M&A Rules in connection with the issue, listing and sale of the Company’s ADSs. However, we cannot exclude the possibility that the CSRC or other relevant PRC authorities might further clarify or interpret the M&A Rules in writing or orally to require their approvals or consents be obtained for the Offering.

3. Equity Pledge. The Equity Interest Pledge Agreements were entered into between Syswin Zhi Di and each of Syswin Xing Ye’s Shareholders on August 4, 2010. According to the Provisions on Change of the Equity Interests of the Investors of Foreign-Invested Enterprises, there is no time limit for Syswin Xing Ye to obtain approval for these pledges from the Government Agency that approved Syswin Xing Ye’s establishment. Syswin Xing Ye obtained such approval on September 15, 2010 and the process for its obtaining of such approval complies with the PRC Laws.

After obtaining the above equity pledge approval, Syswin Xing Ye filed registration documents with the Government Agency in charge of equity pledge registration and

6

completed such equity pledge registration on October 12, 2010. Syswin Xing Ye’s completion of equity pledge registration complies with the PRC Laws.

4. Syswin Xing Ye’s Business. Syswin Xing Ye is a PRC company that provides real estate sales agency and consultancy services in China and it has obtained all the Governmental Authorizations required to provide such services. Syswin Xing Ye’s provision of the above-mentioned services complies in all respects with the PRC Laws and Syswin Xing Ye’s AOA, and the above-mentioned services fall within Syswin Xing Ye’s business scope as prescribed in its business license, which includes real estate sales agency services and real estate consultancy (including planning consultancy services).

5. Syswin Zhi Di’s Services provided to Syswin Xing Ye. We are of the opinion that (i) all of the services provided by Syswin Zhi Di to Syswin Xing Ye under Article 1 of the Service Agreement are not, and shall not be deemed to be, real estate sales agency and consultancy services under PRC Laws; and (ii) all services provided by Syswin Zhi Di to Syswin Xing Ye as described in Article 1 of the Service Agreement fall within Syswin Zhi Di’s business scope as prescribed in its business license and are in compliance with PRC Laws. Our opinion is rendered based on the following analysis:

1) Pursuant to the Provisions on the Administration of Urban Real Estate Intermediary Services, or the Intermediary Services Administration Provisions, promulgated by the Ministry of Construction, or MOC, as amended on August 15, 2001, real estate sales agency and consultancy services refer to those sales agency and consultancy services provided to parties in a real estate transaction. Neither the Intermediary Services Administration Provisions nor its implementation rules provide a definition of the term “parties in a real estate transaction.” As a result, in interpreting such term, we have referred to (i) the Rules on Real Estate Agency Practice, an industry guideline released on November 1, 2006 by the Association of China Real Estate Appraisers and Real

7

Estate Brokers, the national industry association in real estate services business in China and (ii) our verbal consultation with local real estate regulatory authorities, including Beijing Committee of Construction and Urban-rural Housing and its counterpart in Mentougou District in Beijing, the local regulatory authority administering relevant laws and regulations in Beijing, where Syswin Xing Ye is incorporated. According to the industry guideline and based on our verbal consultation, the term “parties in a real estate transaction” refers solely to property purchasers, and the property developers in primary property transactions or property sellers in secondary property transactions, as applicable.

Because Syswin Xing Ye is a real estate sales agency and consultancy service provider and is not a property purchaser or a property seller involved in a real estate transaction, Syswin Zhi Di, solely by virtue of providing consulting services to Syswin Xing Ye, as a matter of PRC Law, shall not be deemed to engage in real estate sales agency or consultancy services. In other words, Syswin Zhi Di functions like a typical information technology, marketing and general management consulting firm providing consulting services to Syswin Xing Ye.

2) In addition, based on the Legislation Law of the PRC, local regulatory authorities may adopt implementation rules with more stringent standards comparing to the rules or regulations promulgated by a regulatory body with higher level of authority. The local real estate regulatory authority in Beijing (where both Syswin Zhi Di and Syswin Xing Ye were incorporated and conduct their operations) has issued the implementation rules based on Intermediary Services Administration Provisions, which defines the scope of real estate sales agency and consultancy services to be those sales agency and consultancy services provided in relation to a specific real estate transaction or project. Syswin Zhi Di provides consulting services to Syswin Xing Ye on the

8

general administrative and operational aspects. Such consulting services provided do not relate to any specific real estate transaction or project. As a result, the consulting services provided by Syswin Zhi Di to Syswin Xing Ye are not, and shall not be deemed to be, real estate sales agency or consultancy services.

This Opinion is rendered solely to you for the Offering and the listing of the Company’s ADSs and may not be used for any other purpose. It may not be disclosed to and/or relied upon by anyone else or used for any other purpose without our prior written consent, except for (i) submission to the New York Stock Exchange, and (ii) incorporation in the Registration Statement and the Prospectus, which shall be prepared and publicly disclosed for the consummation of the Offering and the listing of the Company’s ADSs. We hereby consent to the reference to our name under the headings “Risk Factors”, “Regulations”, “Legal Matters” and “Enforceability of Civil Liabilities” and elsewhere in the Registration Statement and Prospectus. In giving such consent, we do not thereby admit that we come within the category of persons whose consent is required under Section 7 of the United States Securities Act of 1933, as amended, or the rules and regulations of the SEC thereunder.

Yours faithfully,

/s/ Jingtian & Gongcheng Attorneys at Law

Jingtian & Gongcheng Attorneys at Law

9

Annex I

List of Syswin Xing Ye’s Subsidiaries

Beijing Syswin Zhi Di Real Estate Consulting Company Limited

Tianjin Syswin Real Estate Brokerage Company Limited

Hohhot Syswin Real Estate Brokerage Company Limited

Guiyang Syswin Real Estate Brokerage Company Limited

Yantai Syswin Real Estate Brokerage Company Limited

Qingdao Syswin Xing Ye Real Estate Brokerage Company Limited

Jinan Syswin Real Estate Brokerage Company Limited

Chongqing Syswin Real Estate Brokerage Company Limited

Shenyang Syswin Real Estate Brokerage Company Limited

Yinchuan Syswin Xing Ye Real Estate Brokerage Company Limited

Chengdu Syswin Real Estate Brokerage Company Limited

Dalian Syswin Real Estate Brokerage Company Limited

Suzhou Syswin Real Estate Brokerage Company Limited

Shanxi Syswin Xing Ye Real Estate Brokerage Company Limited

Beijing Syswin Jia Ye Real Estate Brokerage Company Limited

Nanjing Syswin Xing Ye Real Estate Brokerage Company Limited

Hangzhou Syswin Real Estate Brokerage Company Limited

Shanghai Syswin Real Estate Brokerage Company Limited

10

Annex III

(In Response to Staff’s Comment 4)

SHARES PURCHASE AGREEMENT

THIS SHARES PURCHASE AGREEMENT (this “Agreement”) is made as of October 28, 2010, by and among:

(1) SOL Investment Fund Limited, an exempted company incorporated in the Cayman Islands (the “Investor”);

(2) Each of the selling shareholders listed on Schedule I hereto (each a “Selling Shareholder” and collectively, the “Selling Shareholders”).

The parties listed above are collectively referred to herein as the “Parties” and individually as a “Party.”

RECITALS

(A) SYSWIN Inc., a company incorporated in the Cayman Islands (the “Company”) desires to engage in a public offering (the “Public Offering”) by the Company of American Depositary Shares (“ADS”), each representing such number of ordinary shares of the Company (“Ordinary Shares”); and

(B) at the Closing (as defined below) and subject to terms and the conditions of this Agreement, the Investor wishes to purchase certain number of Ordinary Shares from each of the Selling Shareholders.

WITNESSETH

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual promises hereinafter set forth, the parties hereto agree as follows:

1. Purchase and Sale.

1.1 Upon the terms and subject to the conditions of this Agreement, the Investor hereby agrees to purchase, and each of the Selling Shareholders hereby agrees to sell and deliver to the Investor, severally but not jointly, at the Closing, the Ordinary Shares (the “Secondary Shares”) at the Offer Price Per Share (as defined below). The total consideration payable by the Purchaser shall be US$6,000,000 (the “Purchase Price”). The total number of the Secondary Shares that the Purchaser may purchase shall be calculated by dividing (i) the Purchase Price by

1

(ii) the Offer Price Per Share. The consideration payable by the purchaser to each Selling Shareholder is set forth opposite the name of such Selling Shareholder on Schedule I hereto.

1.2 The “Offer Price Per Share” means the “public offering price per ADS” set forth on the cover of the Company’s final prospectus (the “Final Prospectus”) filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) under the U.S. Securities Act of 1933, as amended (the “Securities Act”) in connection with the Public Offering divided by the number of Ordinary Shares represented by one ADS as set forth in the Final Prospectus.

2. Closing.

2.1 Subject to Section 6, the closing (the “Closing”) of the sale and purchase of the Secondary Shares pursuant to Section 1 shall take place upon and concurrently with the closing of the Public Offering at the same offices for the closing of the Public Offering or at such other time and place as the Selling Shareholders holding a majority of the Secondary Shares may agree. The date and time of the Closing are referred to herein as the “Closing Date.”

2.2 At the Closing, the Investor shall pay and deliver the total purchase price to each of the Selling Shareholders in U.S. dollars by wire transfer, or by such other method mutually agreeable to the parties, of immediately available funds to such bank account designated in writing by such Selling Shareholder and each Selling Shareholder shall cause the Company to deliver one or more duly executed share certificates in original form, registered in the name of the Investor, together with a certified true copy of the register of the members of the Company, evidencing the Secondary Shares being transferred to the Investor. For the avoidance of doubt, the failure by one or more Selling Shareholders to perform their respective obligations or to fulfill or waive any condition precedent to the Closing hereunder shall not affect the ability of any other Selling Shareholder to consummate or not to consummate the transactions contemplated hereunder in accordance with this Agreement.

3. Representations and Warranties of the Selling Shareholders.

Each of the Selling Shareholders hereby severally but not jointly represents and warrants to, and agrees with the Investor that:

3.1 Such Selling Shareholder, if an entity, has been duly organized and is validly existing as a limited liability company in good standing in its jurisdiction of formation.

3.2 This Agreement has been duly authorized, executed and delivered by each of the Selling Shareholders and constitutes valid, legal and binding obligations of such Selling Shareholders, enforceable against the Selling Shareholders in accordance with its terms, except (i)

2

as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

3.3 Neither the execution of this Agreement, nor the performance by each of the Selling Shareholders of its respective obligations under this Agreement (A) violates or will violate such Selling Shareholders’ organizational documents, as applicable, (B) conflicts with or results in a breach of any agreement of such Selling Shareholders or to which such Selling Shareholders or any of its respective assets are bound or will be bound.

3.4 Subject to the accuracy of the representations and warranties of the Investor in Section 4 hereof, no consent or approval of, or filing with, any governmental authority or other person is required for the execution, delivery and performance by the Selling Shareholders or consummation of the transaction contemplated by this Agreement, other than those have been duly obtained and are in full force and effect or will be duly obtained prior to the Closing.

3.5 Such Selling Shareholder has good and valid title to the Secondary Shares to be sold by such Selling Shareholder hereunder. Each of the Secondary Shares, when sold in accordance with the terms of this Agreement will have been fully paid and non-assessable, will be free from any mortgage, charge, pledge, lien, option, restriction, right of first refusal, right of pre-emption, third party right or interest, other encumbrance or security interest of any kind or another type of preferential arrangement.

3.6 No “directed selling efforts” (as defined in Rule 902 of Regulation S under the Securities Act) have been made by any of the Selling Shareholders, any of its affiliates or any person acting on its behalf with respect to any Secondary Shares that are not registered under the Securities Act; and none of such persons has taken any actions that would result in the sale of the Secondary Shares to the Investor under this Agreement requiring registration under the Securities Act.

4. Representations and Warranties of the Investor.

The Investor hereby represents and warrants to each of the Selling Shareholders that:

4.1 The Investor has been duly organized and is validly existing as a corporation in good standing in the jurisdiction of its incorporation.

4.2 This Agreement has been duly executed and delivered by the Investor and constitutes the legal, valid and binding obligation of the Investor, enforceable against it in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency,

3

reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

4.3 Neither the execution of this Agreement, nor the performance by the Investor of its obligations under this Agreement (A) violates or will violate the Investor’s organizational documents, (B) conflicts with or results in a breach of any agreement of the Investor or to which the Investor or any of its respective assets are bound or will be bound.

4.4 The Investor is an “Accredited Investor” as defined in Rule 501 of Regulation D under the Securities Act. The Investor has sufficient knowledge and experience in financial and business matters so as to be capable of evaluating the merits and risks of its investment in the Secondary Shares. The Investor is capable of bearing the economic risks of such investment, including a complete loss of its investment. The Secondary Shares purchased hereunder, and to be received by the Investor will be acquired for investment purposes for the Investor’s own account, not as a nominee or agent, and not with a view to the resale or distribution, and the Investor does not have any present intention of selling, granting any participation in, or otherwise distributing the same. The Investor does not have any direct or indirect arrangement, or understanding with any other persons to distribute, or regarding the distribution of the Secondary Shares in violation of the Securities Act or any other applicable state securities law. The Investor understands that the Secondary Shares have not been qualified or registered under the Securities Act or laws of any other jurisdiction and therefore may be viewed as restricted securities under any or all of such other applicable securities laws.

4.5 The Investor is not a “U.S. person” as defined in Rule 902 of Regulation S under the Securities Act. The Investor has been advised and acknowledges that in selling the Secondary Shares to the Investor pursuant hereto, the Selling Shareholders are relying upon the exemption from registration provided by Regulation S under the Securities Act.

5. Restrictive Legend.

Each certificate representing the Secondary Shares shall be endorsed with the following legend (in addition to any legend required under applicable state securities laws):

THIS SECURITY HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (AS AMENDED, THE “ACT”) OR UNDER THE SECURITIES LAWS OF ANY STATE. THIS SECURITY MAY NOT BE TRANSFERRED, SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED: (A) IN THE ABSENCE OF (1) AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT, (2) AN EXEMPTION OR QUALIFICATION UNDER APPLICABLE SECURITIES LAWS OR (3) DELIVERY TO THE COMPANY OF AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED; AND (B)

4

WITHIN THE UNITED STATES OR TO ANY U.S. PERSON, AS EACH OF THOSE TERMS IS DEFINED IN REGULATION S UNDER THE ACT, DURING THE 40 DAYS FOLLOWING CLOSING OF THE PURCHASE. ANY ATTEMPT TO TRANSFER, SELL, PLEDGE OR HYPOTHECATE THIS SECURITY IN VIOLATION OF THESE RESTRICTIONS SHALL BE VOID.

6. Conditions Precedent to Closing.

6.1 Conditions to Investor’s Obligations. The obligations of the Investor to purchase the Secondary Shares from the Selling Shareholders are subject to the satisfaction, or the waiver by the Investor, on or prior to the Closing Date, of the following conditions:

(i) successful completion of the Public Offering and the listing of the ADSs on the New York Stock Exchange;

(ii) the representations and warranties of the Selling Shareholders contained herein shall be true and complete when made and shall be true and complete on and as of the Closing Date with the same effect as though such representations and warranties had been made on and as of the Closing Date, except in either case for those representations and warranties that address matters only as of a particular date, which representations will have been true and complete as of such particular date; and

(iii) the Selling Shareholders shall have performed in all material respects all of their covenants and agreements required to be performed by them under this Agreement on or prior to the Closing.

6.2 Conditions to the Selling Shareholders’ Obligations. The obligations of each of the Selling Shareholders to sell the Secondary Shares to the Investor pursuant to this Agreement are subject to the satisfaction, or the waiver of such Selling Shareholder at or prior to the Closing Date, of the following conditions:

(i) successful completion of the Public Offering and the listing of the ADSs on the New York Stock Exchange;

(ii) the representations and warranties of the Investor contained herein shall be true and complete when made and shall be true and complete on and as of the Closing Date with the same effect as though such representations and warranties had been made on and as of the Closing Date, except in either case for those representations and warranties that address matters only as of a particular date, which representations will have been true and complete as of such particular date; and

5

(iii) the Investor shall have performed and complied with all agreements required by this Agreement to be performed or complied with by the Investor on or prior to the Closing Date.

7. Indemnity.

For a period of six months commencing the Closing Date, each of the Selling Shareholders shall severally but not jointly, and the Investor (each an “Indemnifying Party”) shall, indemnify and hold each other and their respective directors, officers and agents (collectively, the “Indemnified Party”) harmless from and against any losses, claims, damages, liabilities, judgments, fines, obligations, expenses and liabilities of any kind or nature whatsoever, including but not limited to any investigative, legal and other expenses incurred in connection with, and any amounts paid in settlement of, any pending or threatened legal action or proceeding, and (ii) any taxes or levies that may be payable by such person by reason of the indemnification of any indemnifiable loss hereunder (collectively, “Losses”) resulting from or arising out of: (i) the breach of any representation or warranty of such Indemnifying Party contained in this Agreement or in any schedule or exhibit hereto; or (ii) the violation or nonperformance, partial or total, of any covenant or agreement of such Indemnifying Party contained in this Agreement for reasons other than gross negligence or willful misconduct of such Indemnified Party. In calculating the amount of any Losses of an Indemnified Party hereunder, there shall be subtracted the amount of any insurance proceeds and third-party payments received by the Indemnified Party with respect to such Losses, if any. Notwithstanding the foregoing, the Indemnifying Party shall have no liability (for indemnification or otherwise) with respect to any Losses in excess of the aggregate total purchase price (and with respect to each Selling Shareholder, its proportionate share of such total purchase price).

8. Lock-Up.

Each Party agrees that it shall enter into a lock-up agreement (the “Lock-up Agreement”) with the underwriters in the Public Offering substantially in the form attached hereto as Exhibit A. The Investor agrees that it shall not seek any waiver from the underwriters to waive any restrictions set forth in the Lock-up Agreement without the prior written consent of each of the Selling Shareholders. Each Selling Shareholder agrees that it shall not seek any waiver from the underwriters to waive any restrictions set forth in the Lock-up Agreement without the prior written consent of the Investor.

9. Amendment and Termination.

9.1 This Agreement may not be amended or varied without the prior written consent of the Parties hereto.

6

9.2 In the event that the Closing shall not have occurred by June 30, 2011, this Agreement shall be terminated unless the Parties mutually agree by June 30, 2011 to renegotiate.

9.3 Upon termination, except this Section 9.3 and Section 10 (Miscellaneous), this Agreement shall be of no more force and effect.

10. Miscellaneous.

10.1 (i) Unless otherwise notified by the relevant parties, all notices delivered hereunder shall be in writing and may be delivered by hand or given by facsimile to the related addresses listed beneath each party’s signature hereto.

(ii) Any notice delivered by hand shall be deemed to have been received when physically received by the person referred to in this Section 10.1 (including receipt by facsimile).

10.2 This Agreement constitutes the entire understanding and agreement between the Parties hereto with respect to the matters covered hereby, and all prior agreements and understandings, oral or in writing, if any, between the Parties with respect to the matters covered hereby are merged and superseded by this Agreement.

10.3 Each Party hereto acknowledges that the terms and conditions of this Agreement, and all schedules, exhibits, restatements and amendments hereto and thereto, including their existence, shall be considered confidential information and shall not be disclosed by it to any third party without the prior written consent of the other Parties, unless such disclosure is required by applicable laws, regulations or securities exchange rules.

10.4 Neither this Agreement nor any of the rights, interests or obligations under this Agreement shall be assigned, in whole or in part, by operation of law or otherwise by any of the parties without the prior written consent of the other parties. Subject to the preceding sentence, this Agreement shall be binding upon, inure to the benefit of, and be enforceable by, the parties and their respective successors and assigns.

10.5 This Agreement shall be governed by and construed under the laws of the State of New York, without giving effect to the principles of conflicts of law thereof.

10.6 Any dispute arising out of or relating to this Agreement, including any question regarding its existence, validity or termination (“Dispute”) shall be referred to and finally resolved by arbitration at the Hong Kong International Arbitration Centre in accordance with the UNCITRAL Arbitration Rules. There shall be three arbitrators. The language to be used in the arbitration proceedings shall be English. Each of the parties hereto irrevocably waives any

7

immunity to jurisdiction to which it may be entitled or become entitled (including without limitation sovereign immunity, immunity to pre-award attachment, post-award attachment or otherwise) in any arbitration proceedings and/or enforcement proceedings against it arising out of or based on this Agreement or the transactions contemplated hereby.

10.7 This Agreement may be executed in counterparts, each of which shall constitute an original and which together shall constitute one and the same instrument.

10.8 The parties acknowledge that money damages will not be a sufficient remedy for breach of this Agreement and that the parties hereto may obtain specific performance or other injunctive relief, without the necessity of posting a bond or security therefor.

10.9 The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement.

10.10 If one or more provisions of this Agreement are held to be unenforceable under applicable law, such provision shall be excluded from this Agreement and the remainder of this Agreement shall be interpreted as if such provision were excluded and shall be enforceable in accordance with its terms.

10.11 Each party shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as any other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

[Signature page to follow]

8

IN WITNESS WHEREOF, each of the parties has duly executed this Agreement as of the date first set forth above.

| | BRILLIANT STRATEGY LIMITED |

| | |

| | |

| | By: | /s/ Liangsheng Chen |

| | | Name: | Liangsheng Chen |

| | | Title: | Sole Director |

| | |

| | |

| | Address: Syswin Building, No. 316 Nan Hu

Zhong Yuan, Chaoyang District, Beijing 100102 |

[signature page to the share purchase agreement]

S-1

IN WITNESS WHEREOF, each of the parties has duly executed this Agreement as of the date first set forth above.

| | SOL INVESTMENT FUND LIMITED |

| | |

| | C/O SOMERLEY ASSET MANAGEMENT LIMITED |

| | |

| | |

| | By: | /s/ Jamie Cheung |

| | | Name: Jamie Cheung |

| | | Title: Investment Manager |

| | |

| | |

| | Registered address: |

| | |

| | |

| | P.O. Box 2681 |

| | Cricket Square, Hutchins Drive |

| | Grand Cayman KY1-1111 |

| | Cayman Islands |

| | Correspondence address: |

| | c/o Somerley Asset Management limited |

| | 10/F, The Hong Kong Club Building |

| | 3A Chater Road, Central, Hong Kong |

[signature page to the share purchase agreement]

S-2

Schedule I

Selling Shareholder

Names of Selling Shareholders | | Purchase Price

payable | |

| | | |

BRILLIANT STRATEGY LIMITED | | US$ | 6,000,000 | |

| | | | |

Total | | US$ | 6,000,000 | |

Exhibit A

Form of Lock-up Agreement

Morgan Stanley & Co. International plc

25 Cabot Square, Canary Wharf

London, E14 4QA

United Kingdom

As representative of the several Underwriters

named in the Underwriting Agreement

Ladies and Gentlemen:

The undersigned understands that you propose to enter into an Underwriting Agreement (the “Underwriting Agreement”) with SYSWIN Inc., an exempted company with limited liability incorporated under the laws of the Cayman Islands (the “Company”), providing for the public offering (the “Public Offering”) by the several Underwriters, including you (the “Underwriters”), of American depositary shares (the “ADSs”), each representing such number of Ordinary shares of the Company (the “Ordinary Shares”).

To induce the Underwriters that may participate in the Public Offering to continue their efforts in connection with the Public Offering, the undersigned hereby agrees that, without your prior written consent on behalf of the Underwriters, it will not, during the period commencing on the date hereof and ending 180 days after the date of the final prospectus relating to the Public Offering (the “Prospectus”), (1) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any Ordinary Shares, ADSs or any securities convertible into or exercisable or exchangeable for Ordinary Shares or ADSs or (2) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Ordinary Shares or ADSs, whether any such transaction described in clause (1) or (2) above is to be settled by delivery of Ordinary Shares,

ADSs or such other securities, in cash or otherwise or (3) publicly disclose the intention to make any such offer, pledge, sale or disposition, or enter into any such transaction, swap, hedge or other arrangement. The foregoing sentence shall not apply to (a) transactions relating to Ordinary Shares, ADSs or other securities acquired in open market transactions after the completion of the Public Offering, provided that no filing under Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shall be required or shall be voluntarily made in connection with subsequent sales of Ordinary Shares, ADSs or other securities acquired in such open market transactions, (b) transfers of Ordinary Shares or ADSs as a bona fide gift, or (c) distribution of Ordinary Shares or ADSs to limited partners or shareholders of the undersigned; provided that in the case of any transfer or distribution pursuant to clause (b) or (c), (i) each donee or distributee shall sign and deliver a lock-up letter substantially in the form of this letter and (ii) no filing under Section 16(a) of the Exchange Act, reporting a reduction in beneficial ownership of Ordinary Shares or ADSs, shall be required or shall be voluntarily made in respect of the transfer or distribution during the restricted period referred to in the foregoing sentence. In addition, the undersigned agrees that, without your prior written consent on behalf of the Underwriters, it will not, during the period commencing on the date hereof and ending 180 days after the date of the Prospectus, make any demand for or exercise any right with respect to, the registration of any Ordinary Shares, ADSs or any security convertible into or exercisable or exchangeable for Ordinary Shares or ADSs. The undersigned also agrees and consents to the entry of stop transfer instructions with the Company’s transfer agent, registrar and depositary against the transfer of the undersigned’s Ordinary Shares or ADSs except in compliance with the foregoing restrictions.

If:

(1) during the last 17 days of the restricted period the Company issues an earnings release or material news or a material event relating to the Company occurs; or

(2) prior to the expiration of the restricted period, the Company announces that it will release earnings results during the 16-day period beginning on the last day of the restricted period;

the restrictions imposed by this agreement shall continue to apply until the expiration of the 18-day period beginning on the issuance of the earnings release or the occurrence of the material news or material event.

The undersigned shall not engage in any transaction that may be restricted by this agreement during the 34-day period beginning on the last day of the initial restricted period unless the undersigned requests and receives prior written confirmation from the Company or you that the restrictions imposed by this agreement have expired.

The undersigned understands that the Company and the Underwriters are relying upon this agreement in proceeding toward consummation of the Public Offering. The undersigned

further understands that this agreement is irrevocable and shall be binding upon the undersigned’s heirs, legal representatives, successors and assigns.

Whether or not the Public Offering actually occurs depends on a number of factors, including market conditions. Any Public Offering will only be made pursuant to an Underwriting Agreement, the terms of which are subject to negotiation between the Company and the Underwriters.

| Very truly yours, |

| |

| |

| |

| (Name) |

| |

| |

| (Address) |

SHARES PURCHASE AGREEMENT

THIS SHARES PURCHASE AGREEMENT (this “Agreement”) is made as of October 28, 2010, by and among:

(1) Kee Shing International Limited, a limited company incorporated in Hong Kong (the “Investor”);

(2) Each of the selling shareholders listed on Schedule I hereto (each a “Selling Shareholder” and collectively, the “Selling Shareholders”).

The parties listed above are collectively referred to herein as the “Parties” and individually as a “Party.”

RECITALS

(A) SYSWIN Inc., a company incorporated in the Cayman Islands (the “Company”) desires to engage in a public offering (the “Public Offering”) by the Company of American Depositary Shares (“ADS”), each representing such number of ordinary shares of the Company (“Ordinary Shares”); and

(B) at the Closing (as defined below) and subject to terms and the conditions of this Agreement, the Investor wishes to purchase certain number of Ordinary Shares from each of the Selling Shareholders.

WITNESSETH

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual promises hereinafter set forth, the parties hereto agree as follows:

1. Purchase and Sale.

1.1 Upon the terms and subject to the conditions of this Agreement, the Investor hereby agrees to purchase, and each of the Selling Shareholders hereby agrees to sell and deliver to the Investor, severally but not jointly, at the Closing, the Ordinary Shares (the “Secondary Shares”) at the Offer Price Per Share (as defined below). The total consideration payable by the Purchaser shall be US$4,000,000 (the “Purchase Price”). The total number of the Secondary Shares that the Purchaser may purchase shall be calculated by dividing (i) the Purchase Price by

1

(ii) the Offer Price Per Share. The consideration payable by the purchaser to each Selling Shareholder is set forth opposite the name of such Selling Shareholder on Schedule I hereto.

1.2 The “Offer Price Per Share” means the “public offering price per ADS” set forth on the cover of the Company’s final prospectus (the “Final Prospectus”) filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) under the U.S. Securities Act of 1933, as amended (the “Securities Act”) in connection with the Public Offering divided by the number of Ordinary Shares represented by one ADS as set forth in the Final Prospectus.

2. Closing.

2.1 Subject to Section 6, the closing (the “Closing”) of the sale and purchase of the Secondary Shares pursuant to Section 1 shall take place upon and concurrently with the closing of the Public Offering at the same offices for the closing of the Public Offering or at such other time and place as the Selling Shareholders holding a majority of the Secondary Shares may agree. The date and time of the Closing are referred to herein as the “Closing Date.”

2.2 At the Closing, the Investor shall pay and deliver the total purchase price to each of the Selling Shareholders in U.S. dollars by wire transfer, or by such other method mutually agreeable to the parties, of immediately available funds to such bank account designated in writing by such Selling Shareholder and each Selling Shareholder shall cause the Company to deliver one or more duly executed share certificates in original form, registered in the name of the Investor, together with a certified true copy of the register of the members of the Company, evidencing the Secondary Shares being transferred to the Investor. For the avoidance of doubt, the failure by one or more Selling Shareholders to perform their respective obligations or to fulfill or waive any condition precedent to the Closing hereunder shall not affect the ability of any other Selling Shareholder to consummate or not to consummate the transactions contemplated hereunder in accordance with this Agreement.

3. Representations and Warranties of the Selling Shareholders.

Each of the Selling Shareholders hereby severally but not jointly represents and warrants to, and agrees with the Investor that:

3.1 Such Selling Shareholder, if an entity, has been duly organized and is validly existing as a limited liability company in good standing in its jurisdiction of formation.

3.2 This Agreement has been duly authorized, executed and delivered by each of the Selling Shareholders and constitutes valid, legal and binding obligations of such Selling Shareholders, enforceable against the Selling Shareholders in accordance with its terms, except (i)

2

as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

3.3 Neither the execution of this Agreement, nor the performance by each of the Selling Shareholders of its respective obligations under this Agreement (A) violates or will violate such Selling Shareholders’ organizational documents, as applicable, (B) conflicts with or results in a breach of any agreement of such Selling Shareholders or to which such Selling Shareholders or any of its respective assets are bound or will be bound.

3.4 Subject to the accuracy of the representations and warranties of the Investor in Section 4 hereof, no consent or approval of, or filing with, any governmental authority or other person is required for the execution, delivery and performance by the Selling Shareholders or consummation of the transaction contemplated by this Agreement, other than those have been duly obtained and are in full force and effect or will be duly obtained prior to the Closing.

3.5 Such Selling Shareholder has good and valid title to the Secondary Shares to be sold by such Selling Shareholder hereunder. Each of the Secondary Shares, when sold in accordance with the terms of this Agreement will have been fully paid and non-assessable, will be free from any mortgage, charge, pledge, lien, option, restriction, right of first refusal, right of pre-emption, third party right or interest, other encumbrance or security interest of any kind or another type of preferential arrangement.

3.6 No “directed selling efforts” (as defined in Rule 902 of Regulation S under the Securities Act) have been made by any of the Selling Shareholders, any of its affiliates or any person acting on its behalf with respect to any Secondary Shares that are not registered under the Securities Act; and none of such persons has taken any actions that would result in the sale of the Secondary Shares to the Investor under this Agreement requiring registration under the Securities Act.

4. Representations and Warranties of the Investor.

The Investor hereby represents and warrants to each of the Selling Shareholders that:

4.1 The Investor has been duly organized and is validly existing as a corporation in good standing in the jurisdiction of its incorporation.

4.2 This Agreement has been duly executed and delivered by the Investor and constitutes the legal, valid and binding obligation of the Investor, enforceable against it in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency,

3

reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

4.3 Neither the execution of this Agreement, nor the performance by the Investor of its obligations under this Agreement (A) violates or will violate the Investor’s organizational documents, (B) conflicts with or results in a breach of any agreement of the Investor or to which the Investor or any of its respective assets are bound or will be bound.

4.4 The Investor is an “Accredited Investor” as defined in Rule 501 of Regulation D under the Securities Act. The Investor has sufficient knowledge and experience in financial and business matters so as to be capable of evaluating the merits and risks of its investment in the Secondary Shares. The Investor is capable of bearing the economic risks of such investment, including a complete loss of its investment. The Secondary Shares purchased hereunder, and to be received by the Investor will be acquired for investment purposes for the Investor’s own account, not as a nominee or agent, and not with a view to the resale or distribution, and the Investor does not have any present intention of selling, granting any participation in, or otherwise distributing the same. The Investor does not have any direct or indirect arrangement, or understanding with any other persons to distribute, or regarding the distribution of the Secondary Shares in violation of the Securities Act or any other applicable state securities law. The Investor understands that the Secondary Shares have not been qualified or registered under the Securities Act or laws of any other jurisdiction and therefore may be viewed as restricted securities under any or all of such other applicable securities laws.

4.5 The Investor is not a “U.S. person” as defined in Rule 902 of Regulation S under the Securities Act. The Investor has been advised and acknowledges that in selling the Secondary Shares to the Investor pursuant hereto, the Selling Shareholders are relying upon the exemption from registration provided by Regulation S under the Securities Act.

5. Restrictive Legend.

Each certificate representing the Secondary Shares shall be endorsed with the following legend (in addition to any legend required under applicable state securities laws):

THIS SECURITY HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (AS AMENDED, THE “ACT”) OR UNDER THE SECURITIES LAWS OF ANY STATE. THIS SECURITY MAY NOT BE TRANSFERRED, SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED: (A) IN THE ABSENCE OF (1) AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT, (2) AN EXEMPTION OR QUALIFICATION UNDER APPLICABLE SECURITIES LAWS OR (3) DELIVERY TO THE COMPANY OF AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED; AND (B)

4

WITHIN THE UNITED STATES OR TO ANY U.S. PERSON, AS EACH OF THOSE TERMS IS DEFINED IN REGULATION S UNDER THE ACT, DURING THE 40 DAYS FOLLOWING CLOSING OF THE PURCHASE. ANY ATTEMPT TO TRANSFER, SELL, PLEDGE OR HYPOTHECATE THIS SECURITY IN VIOLATION OF THESE RESTRICTIONS SHALL BE VOID.

6. Conditions Precedent to Closing.

6.1 Conditions to Investor’s Obligations. The obligations of the Investor to purchase the Secondary Shares from the Selling Shareholders are subject to the satisfaction, or the waiver by the Investor, on or prior to the Closing Date, of the following conditions:

(i) successful completion of the Public Offering and the listing of the ADSs on the New York Stock Exchange;

(ii) the representations and warranties of the Selling Shareholders contained herein shall be true and complete when made and shall be true and complete on and as of the Closing Date with the same effect as though such representations and warranties had been made on and as of the Closing Date, except in either case for those representations and warranties that address matters only as of a particular date, which representations will have been true and complete as of such particular date; and

(iii) the Selling Shareholders shall have performed in all material respects all of their covenants and agreements required to be performed by them under this Agreement on or prior to the Closing.