Exhibit 99.1

January 18, 2017 2017 Investor Day

2 Safe harbor statement – reconciliation of non - GAAP measures This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements are based on current expectations and are indicated by words or phrases such as “anticipate, “estimate,” “expect,” “p roject,” “plan,” “we believe,” “will,” “would” and similar words or phrases, and involve known and unknown risks, uncertainties and other factors whi ch may cause actual results, performance or achievements to be materially different from the future results, performance or achievements expresse d i n or implied by such forward - looking statements. Detailed information concerning the Company’s risks and uncertainties are readily available in our Annual Report on Form 10 - K for the Fiscal Year Ended July 30, 2016 (“Fiscal 2016 10 - K”). We undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Where indicated, certain financial information herein has been presented on a non - GAAP basis. This basis adjusts for non - recurr ing items such as (i) acquisition and integration expenses, (ii) restructuring and other related charges incurred under the Company's Change for Gr owt h initiative, (iii) the impact of a 53rd week included in our Fiscal 2016 financial results and (iv) non - cash charges associated with the purchase accou nting adjustments of ANN's assets and liabilities to fair market value, primarily reflecting inventory expense, depreciation and amortization expe nse , and lease - related adjustments. Management believes that these items are not indicative of the Company’s underlying financial performance. In add ition, we present the financial performance measure of earnings before interest, taxes, depreciation and amortization (“EBITDA”), which has als o b een adjusted for these non - recurring items (“Adjusted EBITDA”). Many investors also use non - GAAP measures as a common basis for comparing the pe rformance of different companies. A general limitation of non - GAAP measures is that they are not prepared in accordance with U.S. generally a ccepted accounting principles and may not be comparable to similarly titled measures of other companies due to differences in methods of calcula tio n and excluded items. These non - GAAP measures should be considered in addition to, not as a substitute for, the Company’s Operating income (loss) and Net income (loss) per common share, as well as other measures of financial performance and liquidity reported in accordance with U.S. generally ac cepted accounting principles. Reference should be made to our year - end fiscal 2016 and Q1 fiscal 2017 earnings releases filed in our Current Reports on Form 8 - K dated September 19, 2016 and December 1, 2016, respectively, for a reconciliation of non - GAAP adjusted financial measures to the most directly comparable GAAP financial measures . Additionally, a reconciliation of the projected non - GAAP measures, which are forward - looking, to the most directly comparable GA AP financial measures, is not provided because the Company is unable to provide such reconciliation without unreasonable effort. The inabi lit y to provide a reconciliation is due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the peri ods in which the non - GAAP adjustments may be recognized. These GAAP measures may include the impact of such items as restructuring charges, acquisition an d integration related expenses, asset impairments and the tax effect of all such items. As previously stated, the Company has historically exc luded these items from non - GAAP financial measures. The Company currently expects to continue to exclude these items in future disclosures of non - GAAP financial measures and may also exclude other items that may arise (collectively, “non - GAAP adjustments”). The decisions and events that typically lead to the recognition of items that result in non - GAAP adjustments, such as actions under the Company's Change for Growth program, or acquisition and integration expenses, are inherently unpredictable as to if or when they may occur. For the same reasons, the Company is unable to addres s t he probable significance of the unavailable information, which could be material to future results.

3 Agenda Welcome / introduction David Jaffe, CEO, ascena Brand Services / ‘Change for Growth’ Brian Lynch, COO, ascena Financial outlook Robb Giammatteo, CFO, ascena BREAK Premium Fashion segment Gary Muto, Segment CEO Ann Taylor, LOFT, and Lou & Grey Value Fashion segment George Goldfarb, Segment CEO maurices and dressbarn Plus Fashion segment Scott Glaser, Segment CFO Lane Bryant and Catherines Kids Fashion segment Lece Lohr, Segment President Justice Q&A Corporate / Segment Leaders

David Jaffe Chief Executive Officer

Investment highlights • Largest specialty apparel retailer focused exclusively on women and girls • Diversified portfolio of brands, customers, and real estate • Efficient, scalable shared services platform • Positioned to navigate dramatic industry change • Strong cash flow and liquidity 5

$ 15,472 $ 12,480 $ 7,002 $ 3,618 $ 3,529 $ 3,403 $ 2,489 $ 2,441 $ 2,279 $ 2,259 $ 1,763 $ 1,481 $ 1,027 $ 934 $ 391 $ 385 Gap L Brands ascena American Eagle Outfitters Urban Outfitters Abercrombie & Fitch Chico's J. Crew Express Lululemon Children's Place Aéropostale Buckle New York & Company Christopher & Banks Bebe Stores 6 Largest specialty apparel retailer focused exclusively on women and girls… LTM Net Sales ($ millions) (a) (a) Public company filings – latest reported quarter as of 1/2/2017

7 …built on a history of successful acquisitions of Brands with significant heritage Founded 1931 Founded 1962 Founded 1987 : Under Limited Too banner 2009: dressbarn acquires Justice 2005: dressbarn acquires maurices 2011: ascena Retail Group, Inc. becomes the successor reporting company to The Dress Barn, Inc. 2012: ascena acquires Charming Shoppes, Inc. 2015: ascena acquires ANN INC. Founded 1900 Founded 1954 1998: First Ann Taylor LOFT store opens Founded 1960 1960s 1980s 2000 2005 2010 2015 1900 2014: First Lou & Grey store opens

8 Well - diversified brand portfolio covering multiple customer segments…

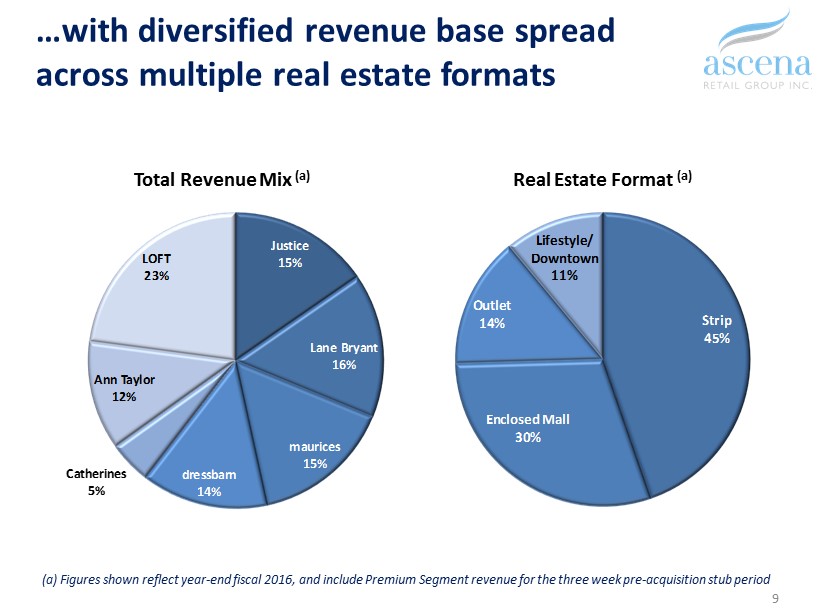

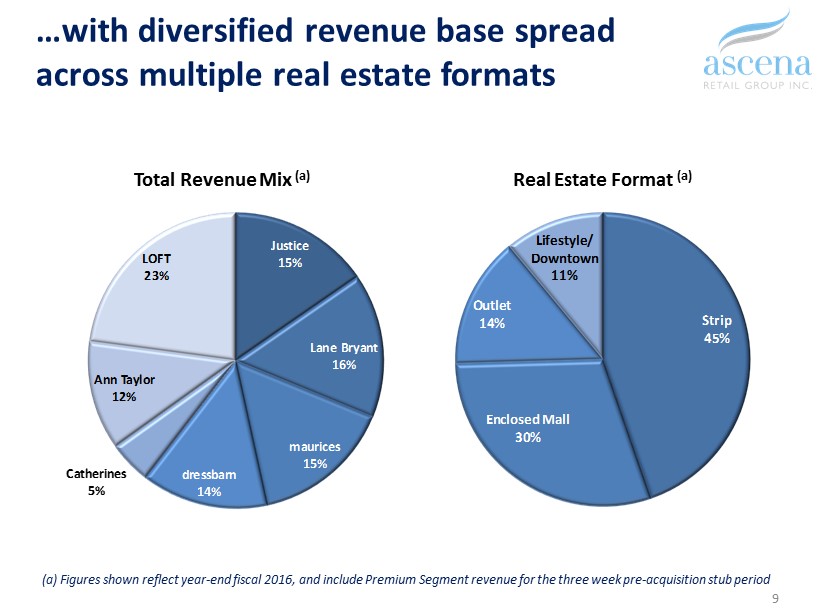

9 …with diversified revenue base spread across multiple real estate formats (a) Figures shown reflect year - end fiscal 2016, and include Premium Segment revenue for the three week pre - acquisition stub period Total Revenue Mix (a) Justice 15% Lane Bryant 16% maurices 15% dressbarn 14% Catherines 5% Ann Taylor 12% LOFT 23% Real Estate Format (a) Strip 45% Enclosed Mall 30% Outlet 14% Lifestyle/ Downtown 11%

Scalable shared services platform – $300+ million investment (FY13 – FY16) • Efficient distribution and fulfillment network • Omni - channel platform • Global sourcing capability • Consolidated corporate functions 10

Operating Environment

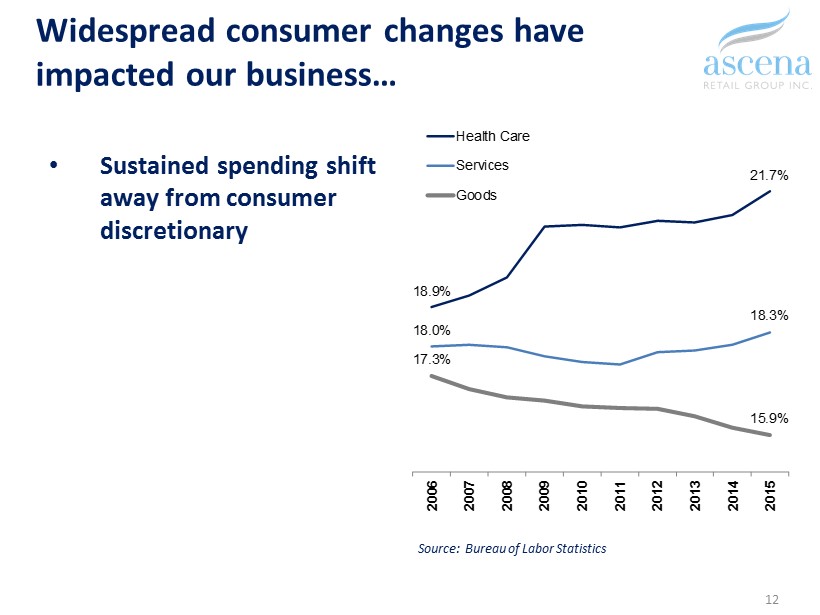

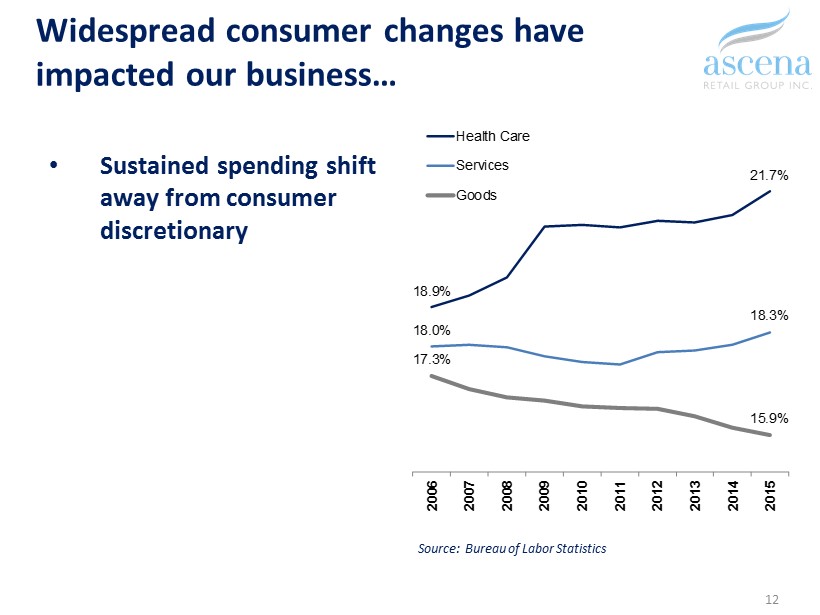

Widespread consumer changes have impacted our business… • Sustained spending shift away from consumer discretionary 12 Source: Bureau of Labor Statistics 18.9% 21.7% 18.0% 18.3% 17.3% 15.9% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Health Care Services Goods

Widespread consumer changes have impacted our business… • Sustained spending shift away from consumer discretionary • Increasing market fragmentation / Amazon effect 13 Source: Deloitte Development LLC, Deloitte Retail Volatility Index, 2016 22.8 33.5 45.9 55.6 78.2 112.2 2010 2011 2012 2013 2014 2015 Third Party Amazon Direct CAGR ~54% CAGR ~30% Estimated Amazon Total Gross Merchandise Value ($B)

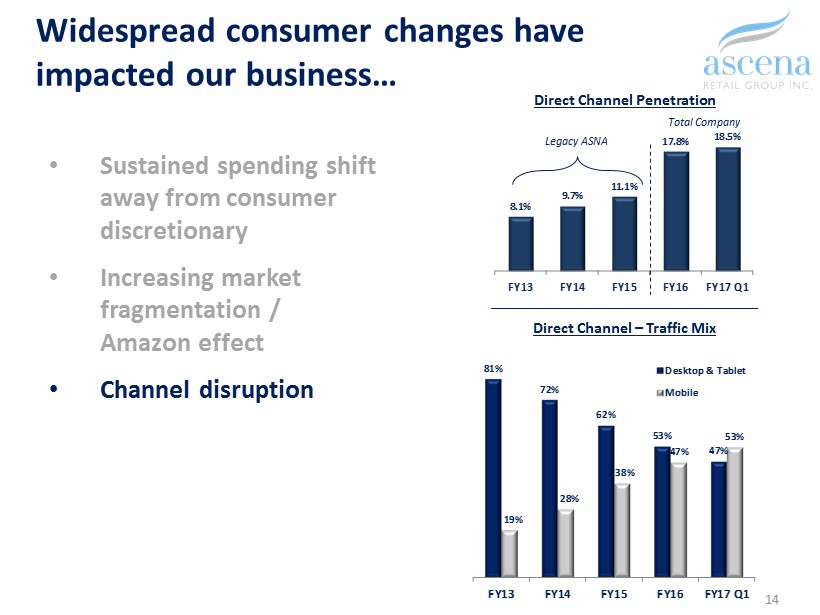

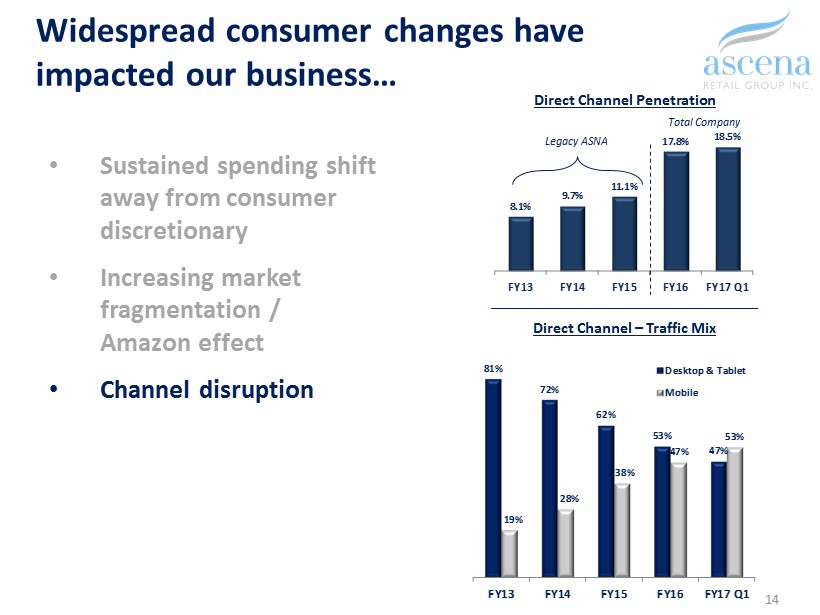

Widespread consumer changes have impacted our business… • Sustained spending shift away from consumer discretionary • Increasing market fragmentation / Amazon effect • Channel disruption 14 81% 72% 62% 53% 47% 19% 28% 38% 47% 53% FY13 FY14 FY15 FY16 FY17 Q1 Desktop & Tablet Mobile Direct Channel – Traffic Mix 8.1% 9.7% 11.1% 17.8% 18.5% FY13 FY14 FY15 FY16 FY17 Q1 Direct Channel Penetration Legacy ASNA Total Company

Widespread consumer changes have impacted our business… • Sustained spending shift away from consumer discretionary • Increasing market fragmentation / Amazon effect • Channel disruption • Increasing importance of price and buy - now / wear - now on purchase intent 15 3.3% 7.3% 15.2% 0.0% 6.0% 9.0% Specialty Off-Price Fast Fashion 2010-2015 2015 - 2018 (E) Source: Goldman Sachs Research, September 2016 (CAGR) (CAGR)

…and we have responded to mitigate these challenges • Leverage our existing supply chain network 16

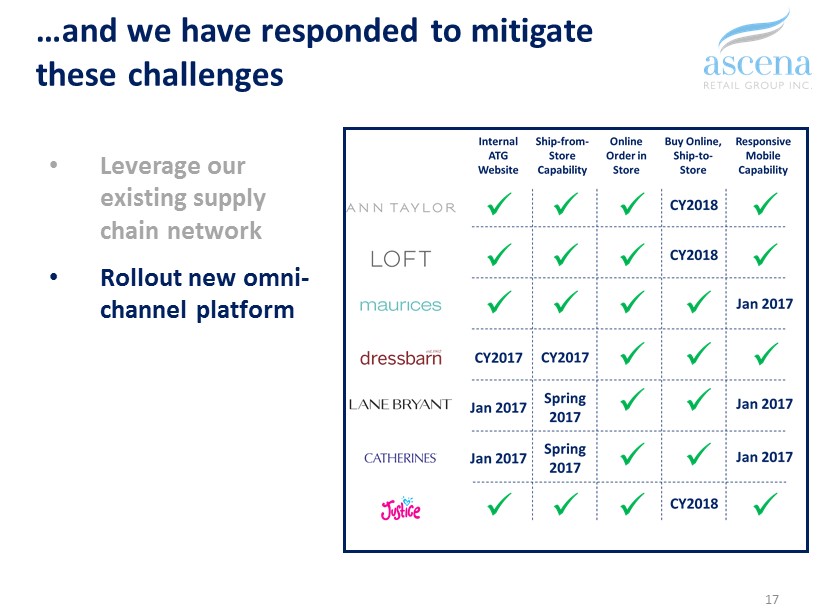

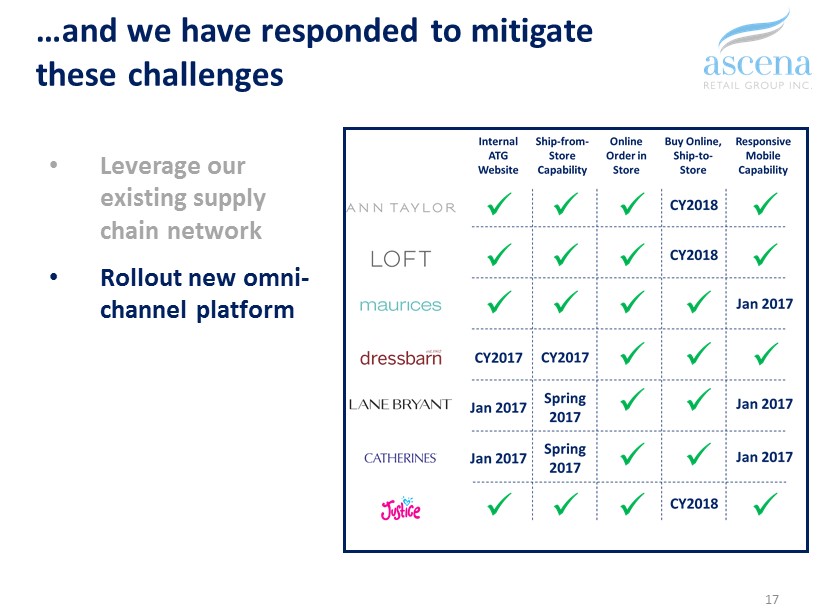

…and we have responded to mitigate these challenges • Leverage our existing supply chain network • Rollout new omni - channel platform 17

…and we have responded to mitigate these challenges • Leverage our existing supply chain network • Rollout new omni - channel platform • Restructured our operating model 18

• Unique, in - store experiences • Seamless omni experience • Brand differentiation • Pricing architecture • Assortment strategy • Speed / sourcing Our segment leaders continue to execute brand strategies to serve our customers… Fashion Execution Customer Experience 19

…while we are transforming our business to address structural challenges 20 Capabilities Operating Efficiencies • Operating model • Non - merchandise spend • Store fleet productivity • Planning and allocation • CRM / segmentation • Advanced analytics

In closing… • Our scale, diversification, and platform capabilities differentiate our competitive position • Focused enterprise transformation initiatives grounded in support of our customers • We are responding decisively to structural challenges to our business model 21

Brian Lynch Chief Operating Officer

ONE $ 7 BILLION OUR GOAL IS TO EVOLVE FROM SEVEN $ 1 BILLION COMPANIES INTO POWERHOUSE 23

AS A $7 BILLION POWERHOUSE WE HAVE THE COMBINED STRENGTH, EXPERTISE AND SCALE TO EXCEED OUR CUSTOMERS’ EXPECTATIONS AND BECOME A LEADER IN SPECIALTY RETAIL . 24

WE MUST BE GREAT . WE MUST BE EXCEPTIONAL AT DELIVERING SERVICES AND SOLUTIONS TO OUR BRANDS AND CUSTOMERS THAT ARE BETTER, FASTER AND MORE COST EFFICIENT . 25

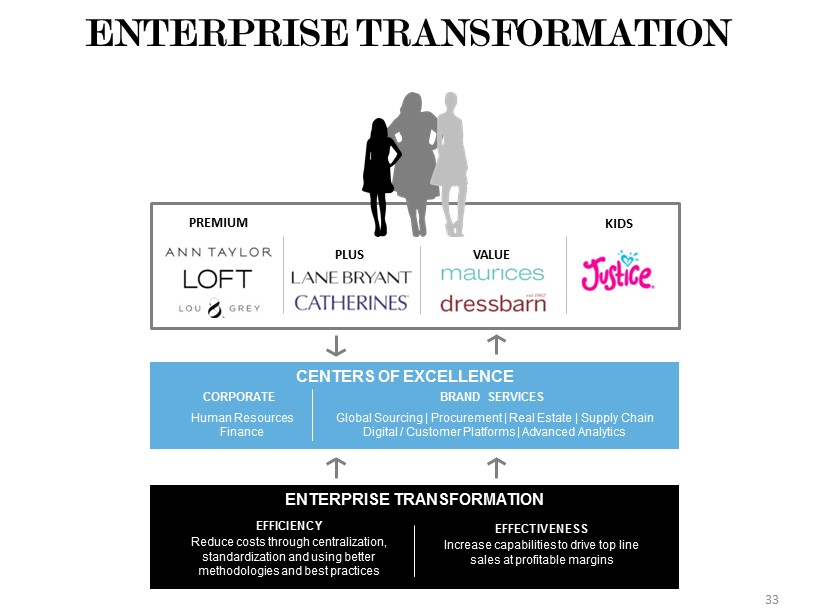

CENTERS OF EXCELLENCE BRAND SERVICES Procurement | Global Sourcing | Real Estate | Digital / Customer Platforms | Supply Chain | Advanced Analytics CORPORATE Human Resources | Finance PREMIUM PLUS VALUE KIDS ENTERPRISE TRANSFORMATION LEVERAGING CENTERS OF EXCELLENCE

PROCUREMENT 27 CENTER OF EXCELLENCE WE WILL HAVE THE… STRONGEST EXPERTISE IN CONTRACT NEGOTIATIONS BROADEST UNDERSTANDING OF INDUSTRY RESOURCES MOST COMPREHENSIVE CONTROLS AND POLICIES

GLOBAL SOURCING 28 CENTER OF EXCELLENCE WE WILL HAVE THE… STRONGEST EXPERTISE IN MATERIALS DEEPEST UNDERSTANDING OF COUNTRY MANAGEMENT BROADEST AND DEEPEST RELATIONSHIPS WITH MANUFACTURING PARTNERS BEST LEVERAGE FOR PURCHASING BEST PROCESS AND SYSTEMS TO MAXIMIZE SPEED AND EFFICIENCY

REAL ESTATE CENTER OF EXCELLENCE WE WILL HAVE THE… STRONGEST LEVERAGE TO NEGOTIATE WITH OUR LANDLORDS BEST EXPERTISE IN MARKET AND GEOGRAPHY STRONGEST ECONOMY OF SCALE WITH DEVELOPMENT AND CAPITAL COSTS BEST ANALYTICS TO OPTIMIZE FLEET 29

WE WILL HAVE THE… TOP TIER OMNICHANNEL FULFILLMENT DEEPEST CRM KNOWLEDGE GREATEST CUSTOMER EXPERIENCE DIGITAL / CUSTOMER PLATFORMS CENTER OF EXCELLENCE 30

WE WILL HAVE TOP TIER… COST PER UNIT DELIVERY TO STORES COST PER ORDER FULFILLED CLICK TO DELIVERY TIME SUPPLY CHAIN CENTER OF EXCELLENCE 31

WE WILL HAVE… DEEP EXPERTISE IN INTERPRETING CUSTOMER BEHAVIORS AND FINANCIAL AND OPERATIONAL OPPORTUNITIES ABILITY TO TRANSFORM PREDICTIONS INTO VALUABLE ACTIONS USING THE BEST PRESCRIPTIVE ANALYTICS TOOLS • MARKDOWN OPTIMIZATION • ADVANCED DEMAND FORECASTING ADVANCED ANALYTICS CENTER OF EXCELLENCE 32

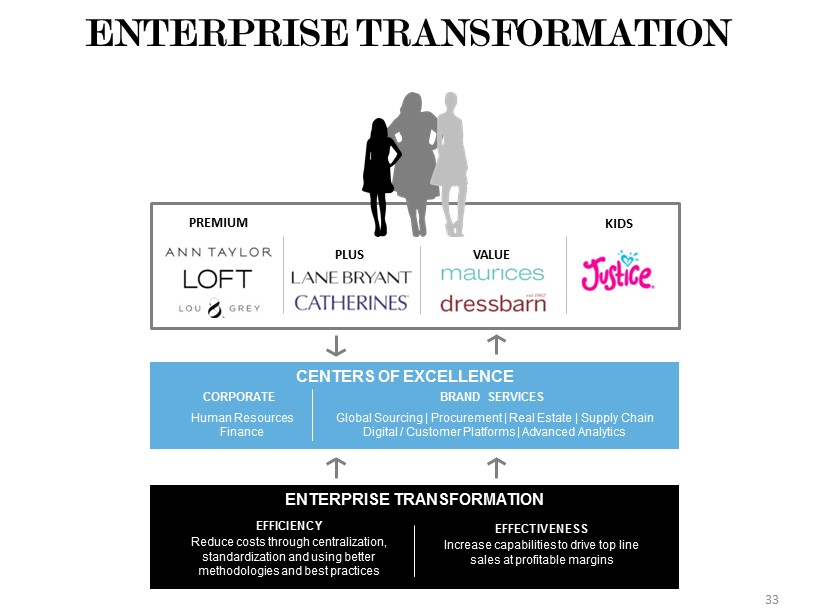

ENTERPRISE TRANSFORMATION EFFECTIVENESS Increase capabilities to drive top line sales at profitable margins BRAND SERVICES Global Sourcing | Procurement | Real Estate | Supply Chain Digital / Customer Platforms | Advanced Analytics CORPORATE Human Resources Finance CENTERS OF EXCELLENCE EFFICIENCY Reduce costs through centralization, standardization and using better methodologies and best practices ENTERPRISE TRANSFORMATION PREMIUM PLUS VALUE KIDS 33

Robb Giammatteo Chief Financial Officer

Key financial drivers Initiative - driven benefits • ANN deal synergies • Change for Growth enterprise transformation • Omni - channel platform • Internal product sourcing • Margin enhancement Macro - driven risk • Store traffic trends • Customer price elasticity 35

36 ANN deal synergies / cost savings – tracking to original expectations $150M deal synergies $85M cost savings ($M) FY15(A) FY16(A) FY17(E) FY18(E) Total Supply Chain / Capability 0 35 36 71 Non-Merch Procurement 9 25 10 44 Public Company Elimination 18 9 8 35 Product Cost Savings 0 0 25 25 50 SG&A Optimization 7 28 0 0 35 Total 7 55 94 79 235

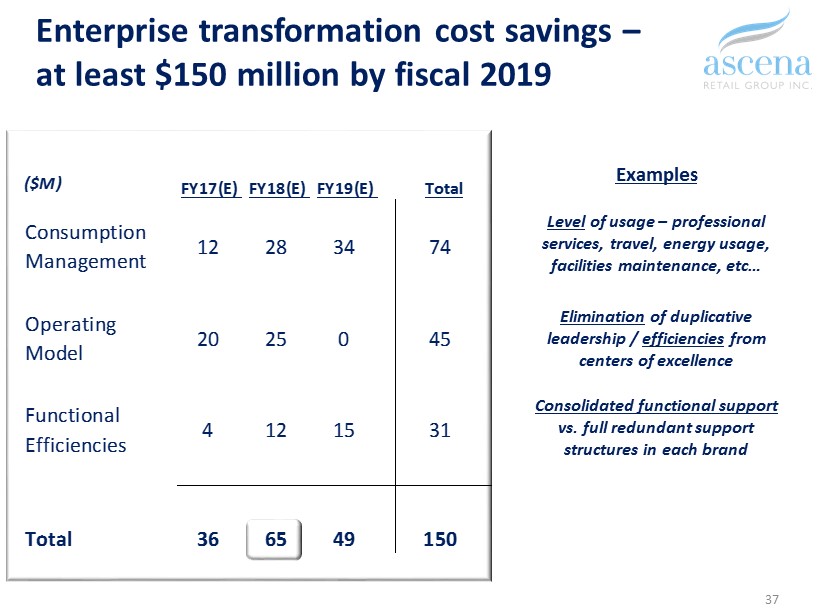

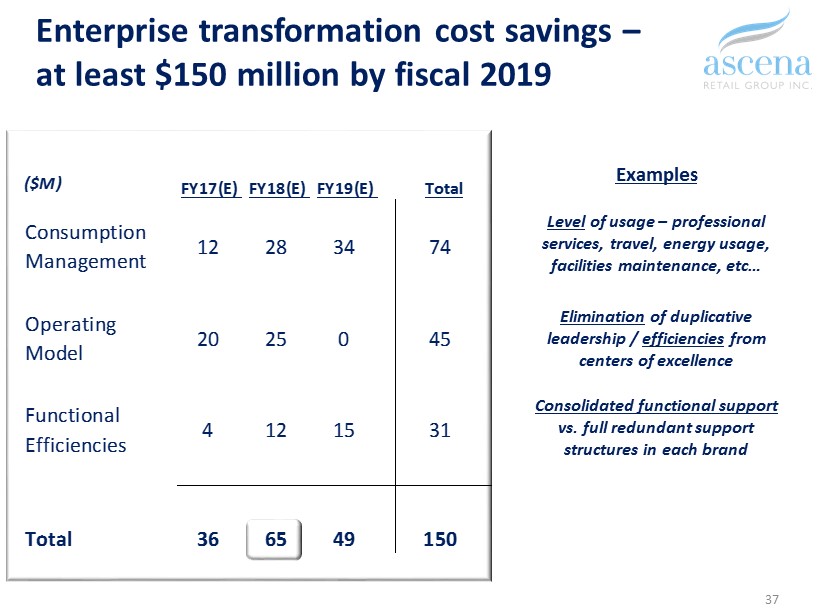

Enterprise transformation cost savings – at least $150 million by fiscal 2019 37 ($M) FY17(E) FY18(E) FY19(E) Total Consumption Management 12 28 34 74 Operating Model 20 25 0 45 Functional Efficiencies 4 12 15 31 Total 36 65 49 150 Examples Level of usage – professional services, travel, energy usage, facilities maintenance, etc… Elimination of duplicative leadership / efficiencies from centers of excellence Consolidated functional support vs. full redundant support structures in each brand

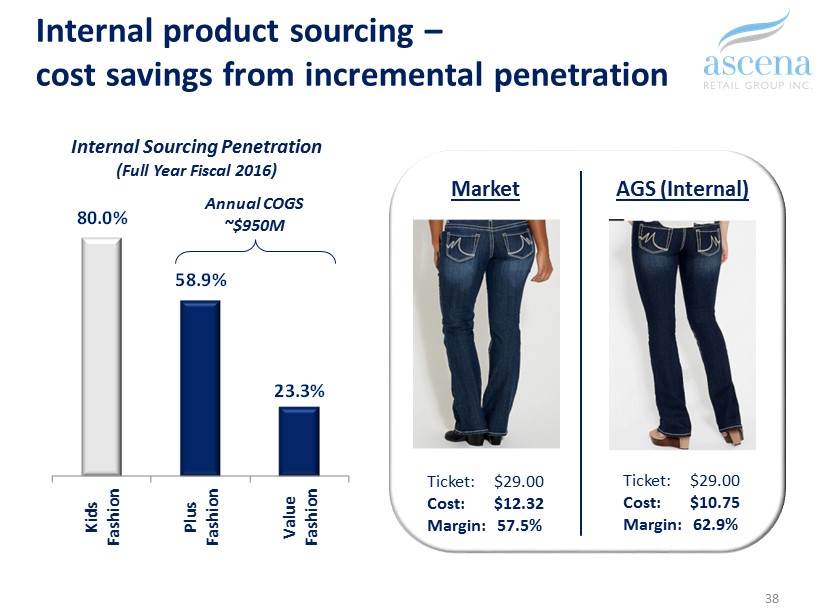

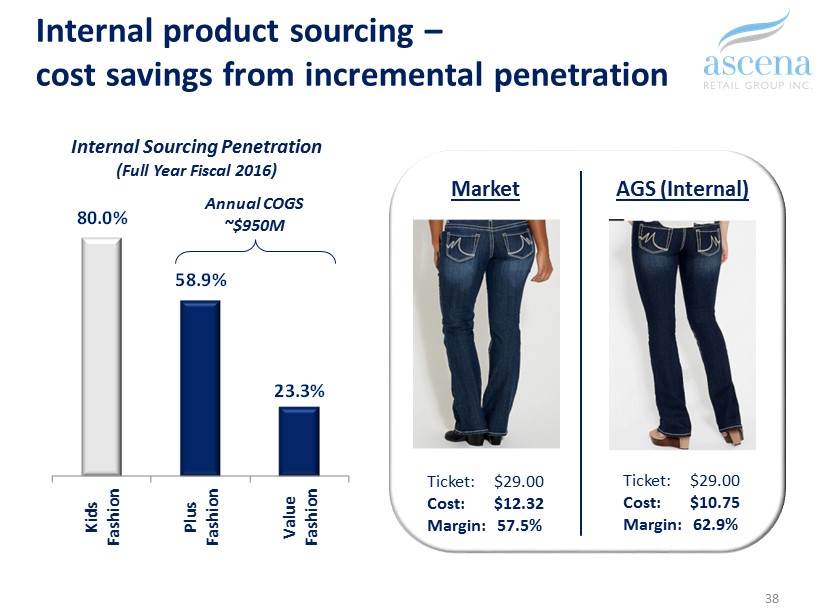

38 Internal product sourcing – cost savings from incremental penetration Internal Sourcing Penetration (Full Year Fiscal 2016) 80.0% 58.9% 23.3% Kids Fashion Plus Fashion Value Fashion Annual COGS ~$950M Market Ticket: $29.00 Cost : $12.32 Margin: 57.5% AGS (Internal) Ticket: $29.00 Cost: $ 10.75 Margin: 62.9%

Omni - channel platform – shadow demand opportunity • Facilitate multi - channel behavior • Realize shadow demand (25%+ run rate lift) • Tune ship - from - store parameters to flow through profit 39 Platform Rollout Cadence

570 79 65 20 20 85 669 89 580 FY17 (E) Adj. EBITDA ANN Deal Synergies / Cost Savings Change for Growth Internal Sourcing Omni- Channel Inflation FY18 (E) Adj. EBITDA (Flat Baseline) Baseline Comp Risk FY18 (E) Adj. EBITDA (Trend-Risk) 40 Controllable initiatives represent significant EBITDA growth off FY17 base… non - GAAP ($M)

(5.9%) (6.8%) (9.0%) (5.8%) (5.3%) (3.3%) (4.3%) (4.3%) (2.7%) (2.5%) (6.5%) (9.2%) (8.3%) FY14 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY15 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY16 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY17 Q1 41 …but store traffic and customer price sensitivity pose risk that may offset company initiatives Historical ASNA Store Traffic Change (a) Average (5.7%) (a) Figures shown reflect legacy ascena performance, excluding Justice, to provide comparable base through FY16 Justice selling strategy change

7.5% 6.5% 7.2% 4.1% 4.0% 4.8% 5.2% 4.7% 1.7% 2.6% 0.6% 2.6% 1.6% FY14 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY15 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY16 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY17 Q1 42 …but store traffic and customer price sensitivity pose risk that may offset company initiatives Historical ASNA Store Return on Visit (ROV) Change (a) Average 4.1% (a) ‘Return on Visit’ defined as product of conversion rate and average dollar sale; figures shown reflect legacy ascena performance, excluding Justice, to provide comparable base through Justice FY16 selling strategy change

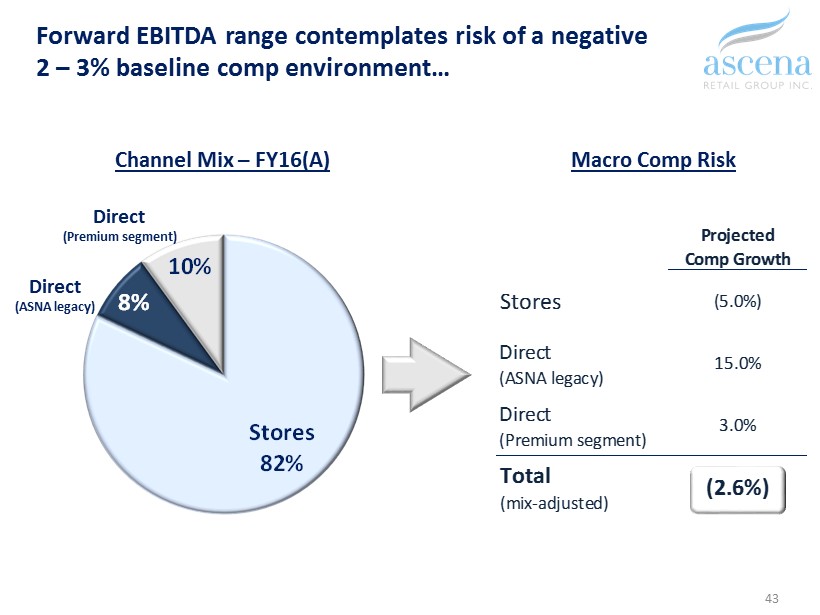

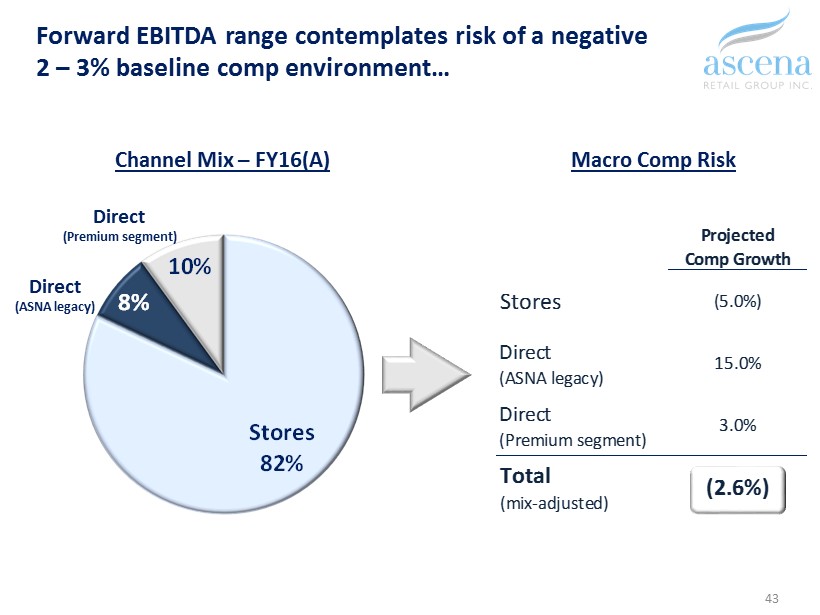

Projected Comp Growth Stores (5.0%) Direct (ASNA legacy) 15.0% Direct (Premium segment) 3.0% Total (mix-adjusted) (2.6%) 43 Forward EBITDA range contemplates risk of a negative 2 – 3% baseline comp environment… Stores 82% 8% 10% Channel Mix – FY16(A) Macro Comp Risk Direct (ASNA legacy) Direct (Premium segment)

…that is partially offset with expected continued improvement in gross margin rate • Reduced promotional activity • Inventory management • Markdown optimization • Credit economics 44 Gross Margin Rate 55.1% 55.5% 55.6% 58.5% 58.7% FY13 FY14 FY15 FY16 FY17(E) Legacy ASNA Legacy ASNA excl. Justice Note: Figures shown exclude the impact of non - cash amortization of inventory - related purchase accounting adjustments ($19.9M in FY13 and $126.9M in FY16)

45 Projected FY18 EBITDA range non - GAAP ($M) 570 79 65 20 20 85 669 89 580 FY17 (E) Adj. EBITDA ANN Deal Synergies / Cost Savings Change for Growth Internal Sourcing Omni- Channel Inflation FY18 (E) Adj. EBITDA (Flat Baseline) Baseline Comp Risk FY18 (E) Adj. EBITDA (Trend-Risk) Comp: (2.6%) GM%: +20bp

46 Normalizing capital expenditures… ($M) 291 478 313 367 235 - 260 200 - 250 FY13 FY14 FY15 FY16 FY17(E) Steady State Target Legacy ASNA only (5 brands) Total Company (8 brands)

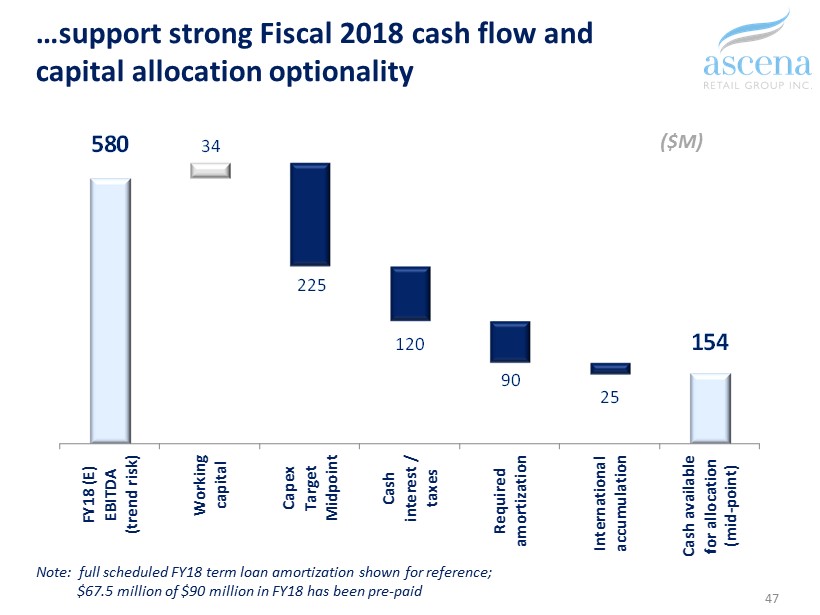

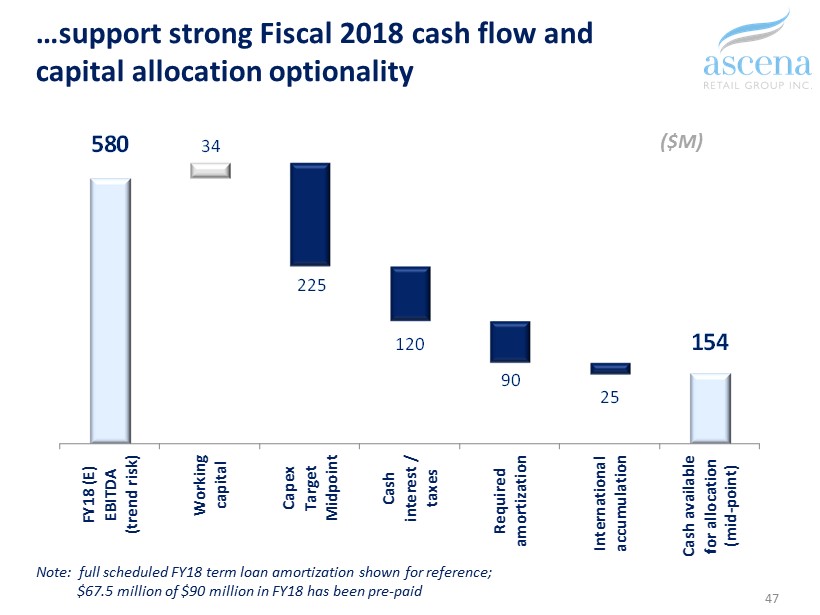

580 34 225 120 90 25 154 FY18 (E) EBITDA (trend risk) Working capital Capex Target Midpoint Cash interest / taxes Required amortization International accumulation Cash available for allocation (mid-point) 47 …support strong Fiscal 2018 cash flow and capital allocation optionality ($M) Note: full scheduled FY18 term loan amortization shown for reference; $67.5 million of $90 million in FY18 has been pre - paid

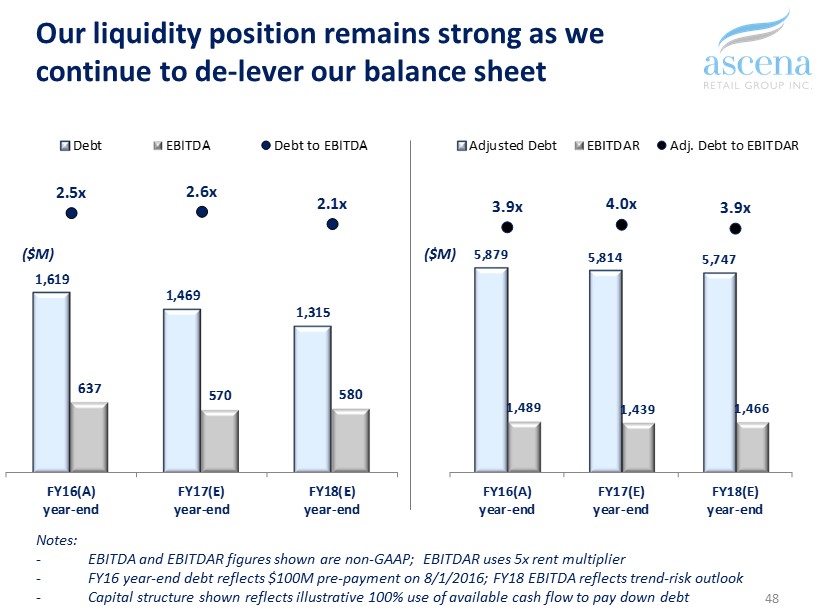

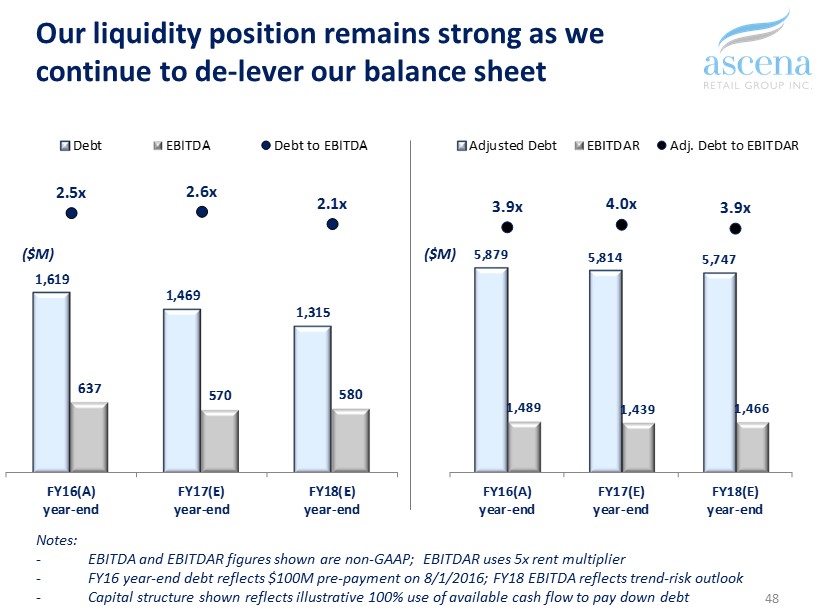

1,619 1,469 1,315 637 570 580 2.5x 2.6x 2.1x FY16(A) year-end FY17(E) year-end FY18(E) year-end Debt EBITDA Debt to EBITDA 48 Our liquidity position remains strong as we continue to de - lever our balance sheet 5,879 5,814 5,747 1,489 1,439 1,466 3.9x 4.0x 3.9x FY16(A) year-end FY17(E) year-end FY18(E) year-end Adjusted Debt EBITDAR Adj. Debt to EBITDAR ($M) ($M) Notes: - EBITDA and EBITDAR figures shown are non - GAAP; EBITDAR uses 5x rent multiplier - FY16 year - end debt reflects $100M pre - payment on 8/1/2016; FY18 EBITDA reflects trend - risk outlook - Capital structure shown reflects illustrative 100% use of available cash flow to pay down debt

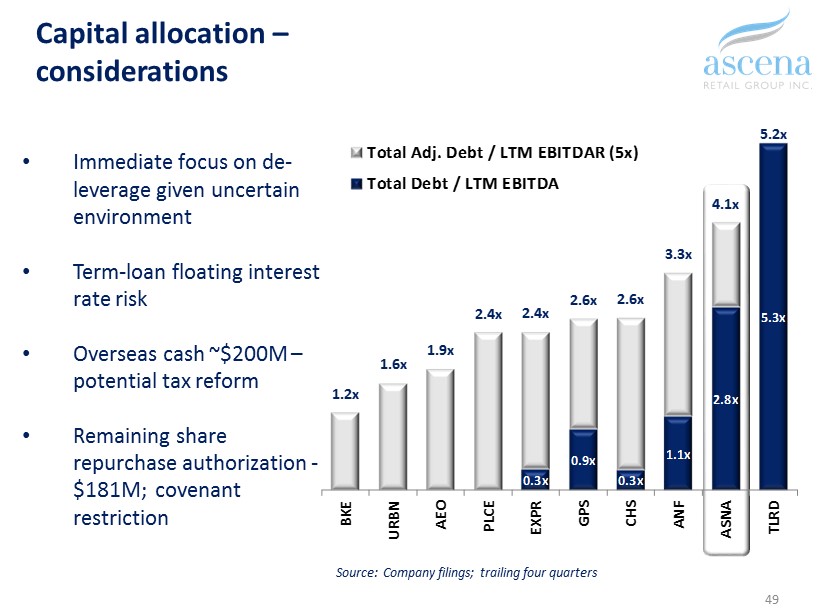

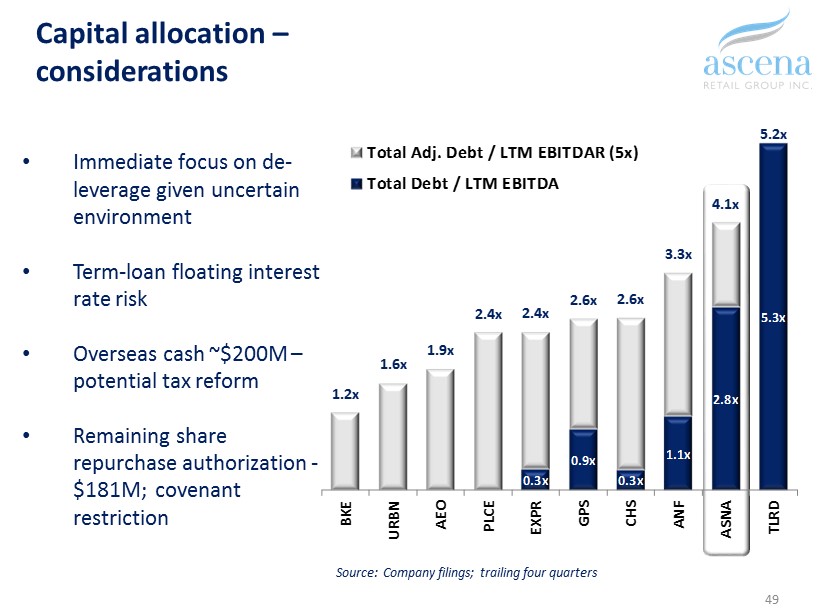

Capital allocation – considerations • Immediate focus on de - leverage given uncertain environment • Term - loan floating interest rate risk • Overseas cash ~$200M – potential tax reform • Remaining share repurchase authorization - $181M; covenant restriction 49 0.3x 0.9x 0.3x 1.1x 2.8x 5.3x 1.2x 1.6x 1.9x 2.4x 2.4x 2.6x 2.6x 3.3x 4.1x 5.2x BKE URBN AEO PLCE EXPR GPS CHS ANF ASNA TLRD Total Adj. Debt / LTM EBITDAR (5x) Total Debt / LTM EBITDA Source: Company filings; trailing four quarters

50 BREAK

Premium Fashion Segment Gary Muto President and CEO

Strong brands with deep relevance 52

Client - focused strategic priorities • Deepen client understanding and engagement • Continue to evolve our omnichannel platform • Accelerate product development timeline • Build on brand equities by adjusting assortment, pricing and positioning 53 Client Experience Product

Enhancing client understanding and engagement • Advanced behavioral client segmentation • Targeted marketing communication and product recommendations • Elevated digital experience through personalization and search engine optimization • ‘ Mobile First’ lens to product and client contact strategies 54 54

Industry leading omnichannel platform 55 OMNICHANNEL: If we have it and she wants it, she gets it Existing capabilities • Ship from store • “Endless aisle” iPad app • Cross channel returns • Online find in store • Upgraded order management platform • Fit prediction technology • Optimized adaptive mobile sites • Optimized store detail pages Upcoming capabilities • Buy online pickup in store • Ship to store pilot • Alternative payments allowing 1 - click checkout • Enhanced site reviews • Personalization • Clienteling app

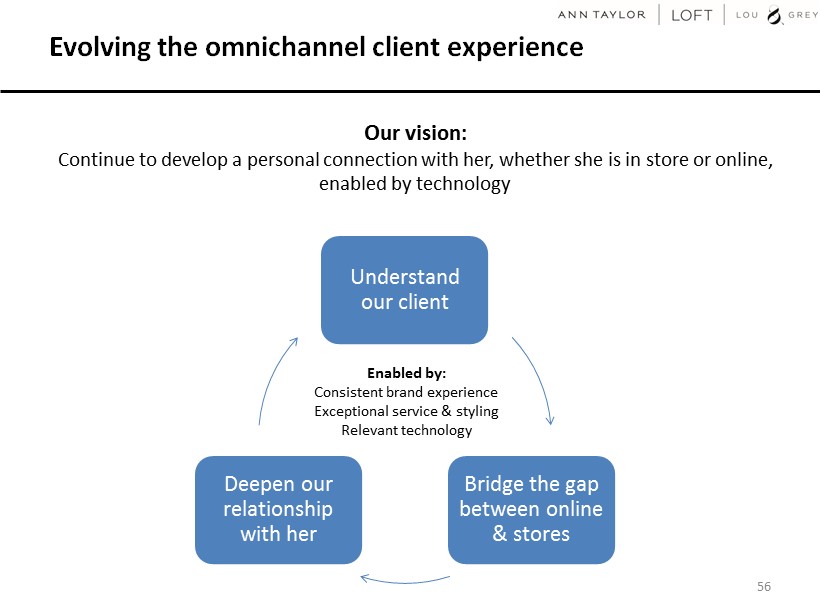

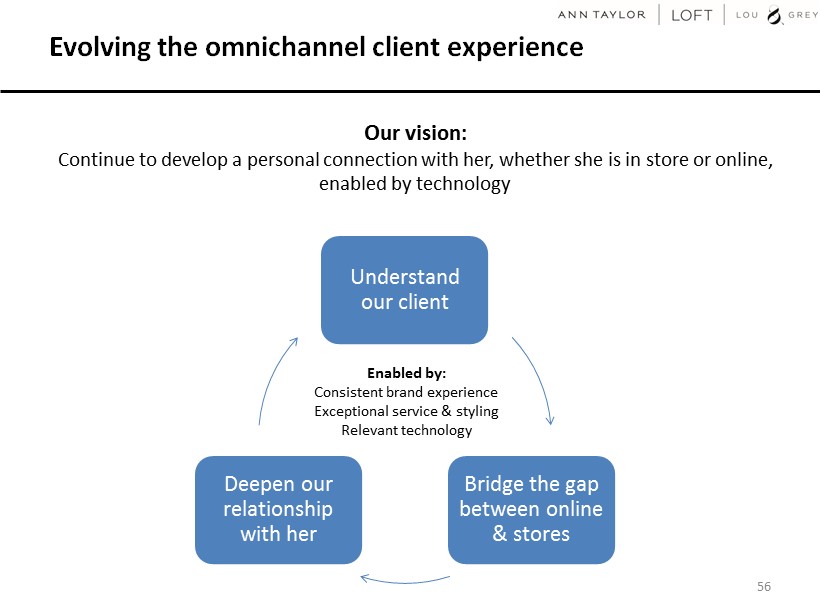

Evolving the omnichannel client experience 56 Our vision: Continue to develop a personal connection with her, whether she is in store or online, enabled by technology Understand our client Bridge the gap between online & stores Deepen our relationship with her Enabled by: Consistent brand experience Exceptional service & styling Relevant technology

Accelerating product development timeline 57 Evolve from a traditional specialty pipeline to one that enables speed and agility while maintaining product storytelling and outfitting <3 months 6 - 9 months 9+ months Chase 10% Fast 20% Foundational 70%

Ann Taylor – We give women the inspiration and confidence to move effortlessly between work life and life’s work 58 • Modernize and evolve wear - to - work definition • Opportunity to invite more women into the brand • Deliver versatile assortment • Increase penetration of fashion and novelty • Sharpen pricing architecture 58

59

LOFT – A loved + trusted style resource for women who live casual, full lives and want a versatile wardrobe that works for all of it • Focus on versatility and easy outfitting • Deliver new fashion more frequently • Use color, pattern and novelty to deliver an optimistic product experience • Maintain value proposition with compelling and competitive product and pricing 60

61

Lou & Grey – Clothes that are comfortably stylish and stylishly comfortable 62 • Continue to evolve as a feminine fashion brand that offers casual sophistication – Provide client soft, covetable innovative fabrics in easy silhouettes – Curate brand partnerships to enhance our unique client experience • Expand freestanding stores opportunistically • Build brand awareness to attract new and valuable clients 62

Lou & Grey – Photo Collage 63 63

Our evolution • Robust client insights enabled by advanced analytics • Seamless in store and online experience servicing all her needs • Deepened client engagement driving loyalty • Agile pipeline and improved assortment to deliver the product she wants, at the right price, anytime, anywhere 64

Value Fashion Segment George Goldfarb President and CEO

VALUE FASHION SEGMENT Brands that deliver a broad fashion offering across age, size & distinct lifestyles Her hometown f ashion d estination Inspiring her to look and feel beautiful 66

VALUE FASHION SEGMENT Priorities to leverage the segment model & deliver unique fashion and experience • Embrace unified segment structure • Leverage hybrid sourcing model: speed, innovation and margin • Develop seamless omni experience • Re - establish differentiated brand price / fashion market position • Execute brand customer experience initiatives 67

VALUE FASHION SEGMENT Embrace unified segment structure • Unified leadership team • Leverage similarities • Cost structure opportunities • Leverage unique brand capabilities 68

VALUE FASHION SEGMENT LEAD TIME BENEFIT % SPRING PENETRATION 6 - 9 months Innovation & Margin maurices: 40% dressbarn: 40% 4 - 6 months Speed & Innovation maurices: 40% dressbarn: 50 % 2 - 3 months Speed maurices: 20% dressbarn: 10% Hybrid sourcing model: Delivering speed, innovation, & margin Chase Market Direct 69

VALUE FASHION SEGMENT Seamless omni experience evolves the customer relationship • New ascena eComm Platform ; integrated partners/programs • Mobile first • S hip - from - store capability, adding full inventory visibility • Private label credit card / loyalty program integration • Cross channel customer attribution 70

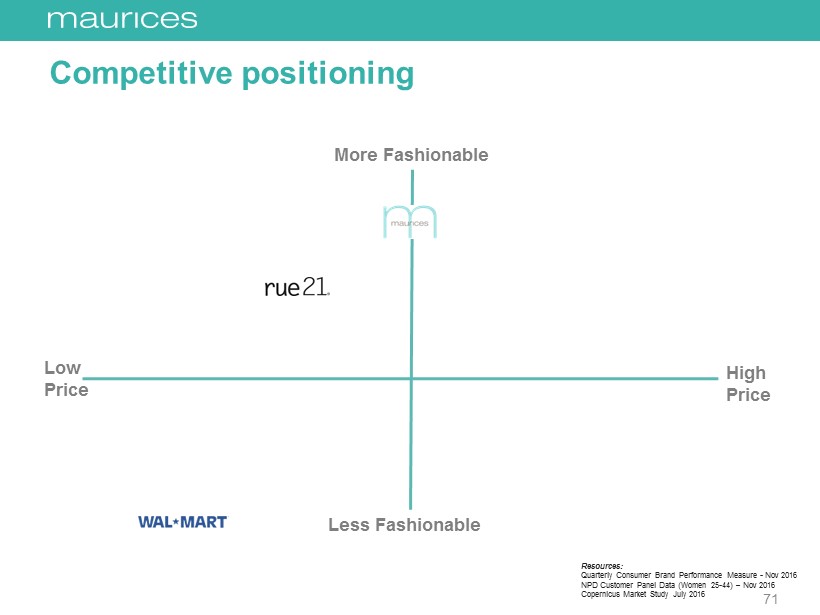

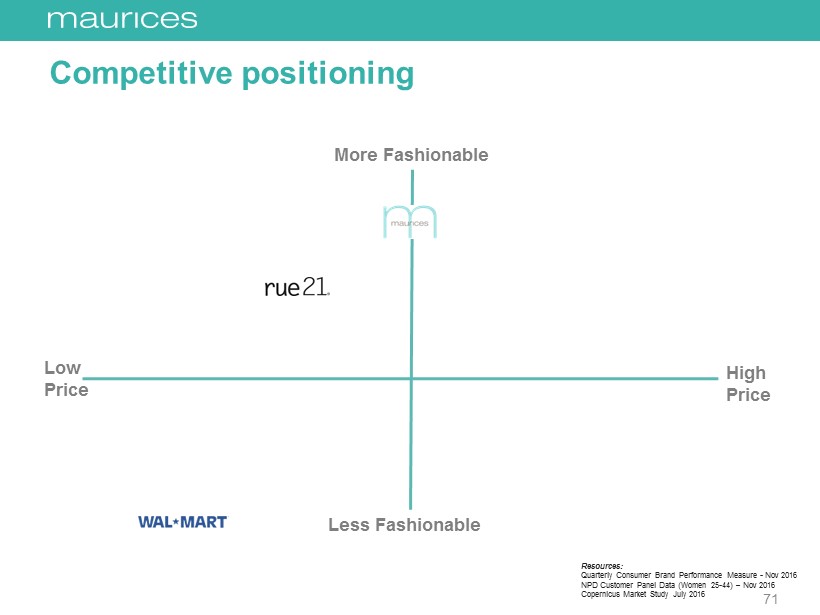

High Price Low Price More Fashionable Less Fashionable Resources: Quarterly Consumer Brand Performance Measure - Nov 2016 NPD Customer Panel Data (Women 25 - 44) – Nov 2016 Copernicus Market Study July 2016 Competitive positioning 71

High Price Low Price More Fashionable Less Fashionable Resources: Quarterly Consumer Brand Performance Measure - Nov 2016 NPD Customer Panel Data (Women 25 - 44) – Nov 2016 Copernicus Market Study July 2016 Competitive positioning 72

High Price Low Price More Fashionable Less Fashionable Resources: Quarterly Consumer Brand Performance Measure - Nov 2016 NPD Customer Panel Data (Women 25 - 44) – Nov 2016 Copernicus Market Study July 2016 Competitive positioning 73

Casual 41% Career / Dressy 38% Athleisure 21% TY Differentiated price / fashion position Three distinct lifestyles Assortment expansion ▪ Plus ▪ Athleisure / Active Revised pricing strategy ▪ Online exclusives ▪ Emerging (test, third party) 20% of assortment Casual 55% Career / Dressy 30% Athleisure 15% LY 74

Unique customer experience • Hometown relationships • Style expertise & service • Engagement – Loyalty – Social – Connected selling 9 75

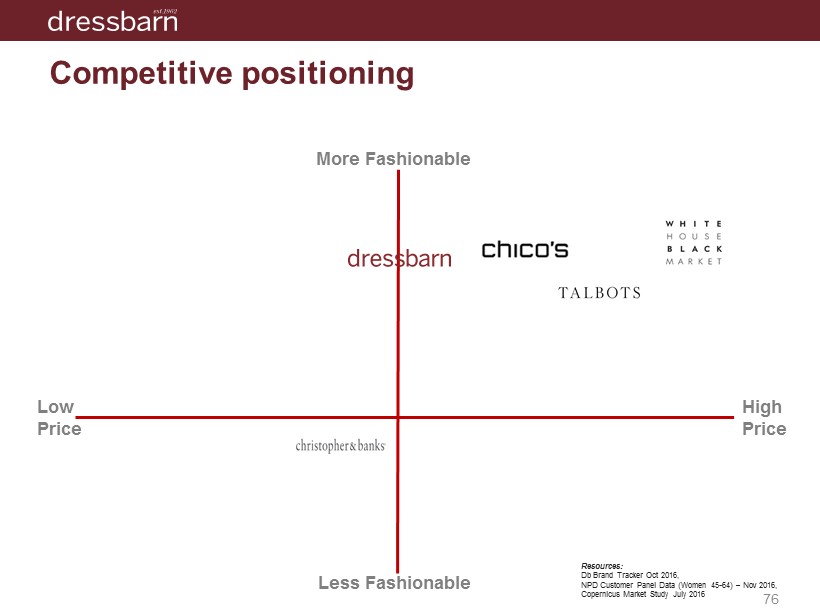

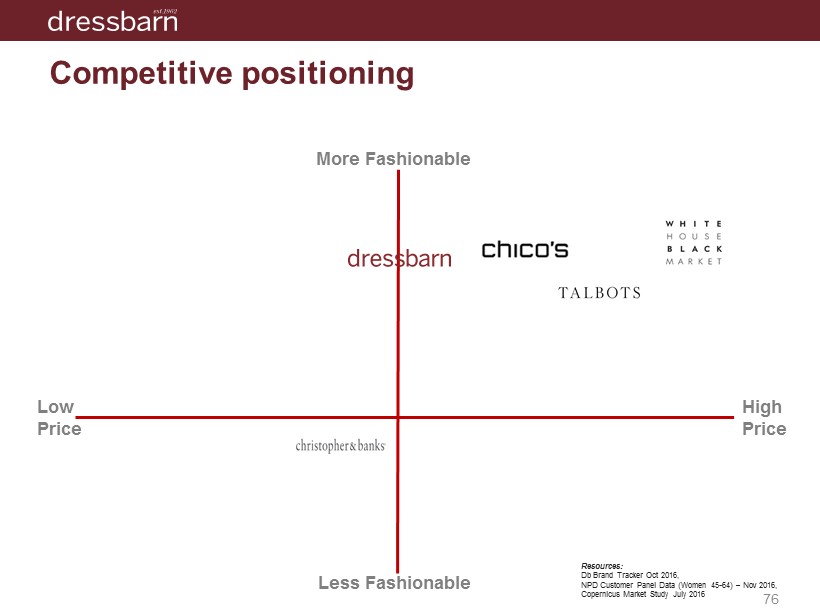

C ompetitive positioning More Fashionable High Price Low Price Less Fashionable Resources: Db Brand Tracker Oct 2016, NPD Customer Panel Data (Women 45 - 64 ) – Nov 2016, Copernicus Market Study July 2016 76

Competitive positioning More Fashionable High Price Low Price Less Fashionable Resources: Db Brand Tracker Oct 2016, NPD Customer Panel Data (Women 45 - 64 ) – Nov 2016, Copernicus Market Study July 2016 77

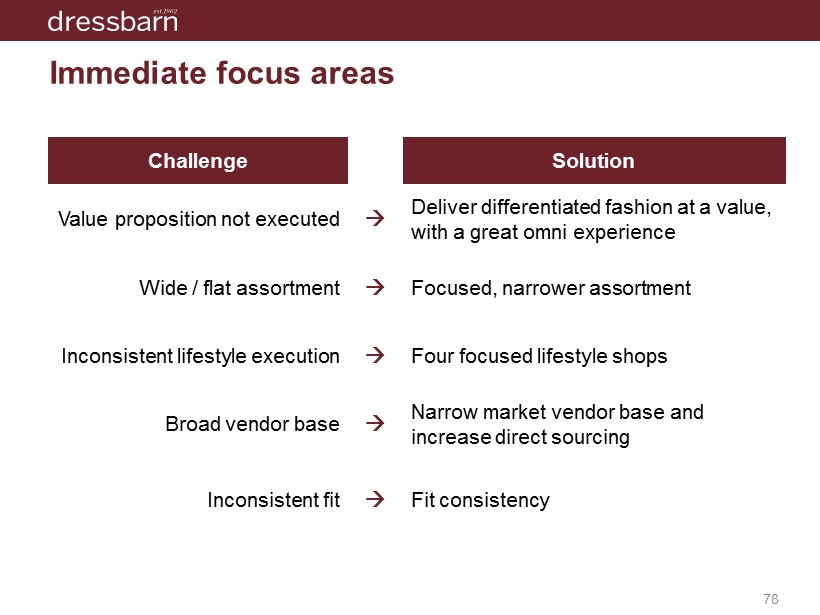

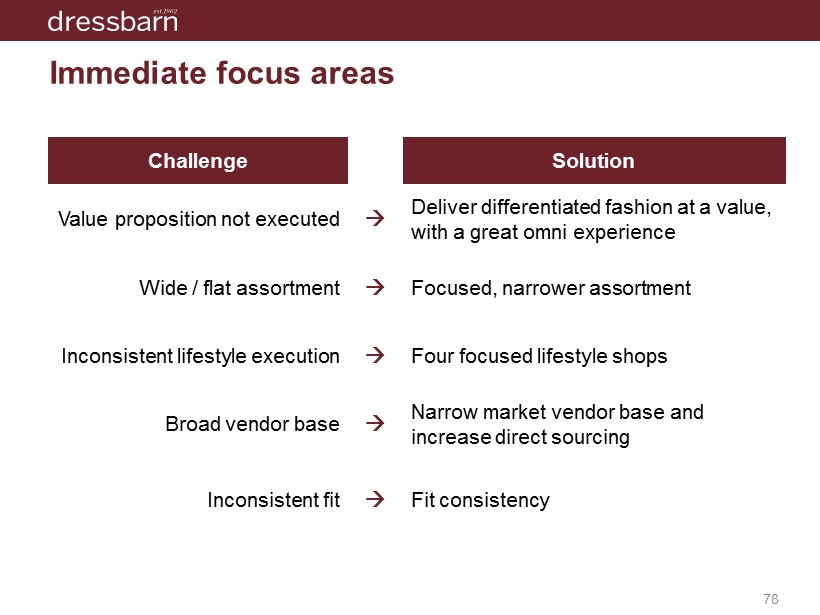

Immediate focus areas 11 Challenge Solution Value proposition not executed ; Deliver differentiated fashion at a value, with a great omni experience Wide / flat assortment ; Focused, narrower assortment Inconsistent lifestyle execution ; Four focused lifestyle shops Broad vendor base ; Narrow market vendor base and increase direct sourcing Inconsistent fit ; Fit consistency 78

Differentiated fashion position • Execute product assortment to support lifestyle strategy • Focused fashion assortment with reduced choice count • Continue integration of design capabilities, teams, and infrastructure 79

Differentiated customer experience Rollout SMART store concept this Spring • Narrow and focused assortment • Elevate fashion and execute to the fashion pyramid • Offer lifestyle solutions for all facets of her life • Support selling strategy BEFORE AFTER 80

Differentiated customer experience B uild assortments that are balanced between what she expects and what will surprise her. core essentials 25 % (LY 38%) fashion drivers 60% (LY 55 %) trends 15% (LY 7%) 81

Differentiated customer experience • Enhance digital experience through showcasing lifestyles online • Create and deliver on the t rusted stylist role: the inspiration • Leverage segment engagement tools and capabilities • More consistent fit 82

VALUE FASHION SEGMENT Key takeaways • Embrace unified segment structure • Leverage hybrid sourcing model: speed, innovation and margin • Develop seamless omni experience • Re - establish differentiated brand price / fashion market position • Execute brand customer experience initiatives 83

Plus Fashion Segment Scott Glaser SVP – Chief Financial Officer

Purpose - driven brands 85

Purpose - driven brands 86

Purpose - driven brands 87

Purpose - driven brands 88

Purpose - driven brands 89

Purpose - driven brands “Change is not impossible. There are aesthetically worthy retail successes in this market. When helping women who are size 14 and up, my go - to retailer is Lane Bryant … ” Changing the Conversation 90

Compelling market $40 - $50B market, growing 4% annually Bridge sizes are a huge opportunity, extended sizes growing rapidly and ‘ ownable ’ Distorted growth in active, intimates, petites Est. $ Billions 2015 2020 CAGR Plus per NPD $20 $24 3.9% Add'l Bridge Sizes $12 $15 3.8% Size 12 $12 $14 4.2% TRUE OPPORTUNITY $44 $53 3.9% 91

Compelling market $40 - $50B market, growing 4% annually Bridge sizes are a huge opportunity, extended sizes growing rapidly and ‘ ownable ’ Distorted growth in active, intimates, petites 92

Segment model benefits • Shared leadership, complementary strategies • Trend, color, fabric development • Sourcing coordination & product cost leverage • Intimate apparel design & product development • CRM, research, marketing operations • Support functions: HR, finance, procurement, operations 93

Priorities: Customer Experience Seamless omni - experience • Mobile & ecom re - platform • Distributed order management launch Brand differentiation • Purpose - driven brands • Breadth of assortment, fits • Credit and loyalty programs Unique in - store experiences • Lane Style Studio 94

Highly differentiated service that engages and affirms Personalized, appointment - based shopping that maximizes value Dedicated store/fitting room space, clienteling tools Lane Style Studio 95 95

Lane Style Studio “I couldn’t believe it! I was able to walk out with $800 in beautiful new clothes and accessories… I have become an online buyer, have a Lane Bryant credit card, and enjoy receiving your e - mails… This was a milestone in my evolution as a shopper and I applaud you for making it so…” - Seana 96

Assortment opportunities • Livi active, athleisure • Fit equity, size 12 & petites • Cacique, intimates Speed • Optimized vendor base + western hemisphere • Concept to market acceleration Pricing strategy & effectiveness • Opening price point value • Promotion rationalization • Product cost improvements Priorities: Fashion Execution 97

Fit / size opportunities PETITES • 20 % of the plus market • $60 - 70M incremental opportunity SIZE SHIFT / SIZE 12 • LB standards competitively misaligned • 12 is the single highest - volume apparel size in the market • Competitors now start at 10 / 12 EXTENDED SIZES • $1B+ market • Ownable - minimal competition 98

Cacique intimates 99

BRAS • FGH cups • Expanded band sizes PANTIES • Bridge size expansion • Matchback ratio to bras OTHER • Private - label shapewear • Swimwear equity • Underpenetrated sleepwear Cacique intimates – product opportunity 100

• High regard - low awareness • Current customer penetration • Coattail effect on total store • Omnichannel initiatives • Cross - segment growth Cacique intimates – customer growth 101

Summary 102 • Unique, purpose - driven brands positioned to compete effectively in an increasingly digital marketplace • Emerging omnichannel capabilities and synergies • Operating margin growth levers throughout the P&L 102

Kids Fashion Segment Lece Lohr President

104

More Fashionable Less Fashionable Low Price High Price Competitive Positioning 106

Stabilizing Customer File • Reflects strategic execution • New - to - file and total file growth over last two quarters • Double digit growth for new - to - file, multi - channel buyers and direct - only buyers during Holiday 107

Exclusively focused on the Tween girl (and Mom!) OUR GIRL – Ages 6 - 12 – Average age: ~9 years, and in fourth grade – 1 - 2 siblings – Highly connected, Digital native – A ctive and creative – A Justice Brand fanatic! OUR PURCHASER – 70% Moms – Average age: ~37 years – Average household income: $91k – 2 - 3 kids – Priority purchase decisions: age appropriate, quality, fit – Health and self - esteem of her daughter is of high value 108

Strategies for Growth Customer Experience • ‘Live Justice’ Brand Platform • Magical moments in an omni - environment • Fun, in - store experience • Enhanced Social engagement • Value - added offers Fashion Execution • Exclusive, on - trend product • Broaden customer reach • Competitive pricing architecture 109

Customer Experience 110

‘Live Justice’ Brand Platform 111

Magic Moments in an Omni - Environment 112

Fun In - Store Experience 113

Enhanced Social Engagement Social Engagement – Brand fanatics share their love of Justice Product – Partner with influencers – Compelling storytellers Girls with Heart – Brand Ambassadors 114

Enhanced Social Engagement ‘Live Justice’ App 115

Value Added Offers 116

Fashion Execution 117

Exclusive, On - Trend Product • Fashion designed exclusively for her by us ‘with love’ • Embracing and celebrating ‘firsts’ • Covering all her lifestyle needs. • “Every Girl Every Day” • Supporting what makes her unique and special 118

Broaden Customer Reach • Expanded plus - size assortment in all apparel categories • Educate customers and sales associates on plus - size fit • Utilize order in store to broaden customer reach • Leverage digital marketing channels 119

Competitive Pricing Architecture • Continuous competitive analysis on offerings and pricing • Reduced price on key ‘Style Buy’ programs • Introduced patterns in key programs that command higher price • Eliminate all f ashion Style Buys 120

121

Management Team Q&A

Supplemental Material

Q2 and Full Year Fiscal 2017 Guide – non - GAAP basis 124 Q2 FY17 Full Year FY17 Net sales: ~$1.75B $6.775 to $6.825B Comparable sales: Down 4.5% Down 4% to Down 3% Gross margin: 54.1 – 54.3% 58.5 – 58.7% Depreciation and amortization ~$88M ~$350M Operating income: ($14) to ($4)M $215 to $230M Interest expense (a) : ~$ 25M $95 to $100M Effective tax rate: 40% 41% Diluted share count: 196M 196M EPS ($0.11) to ($0.08) $0.37 to $0.42 (a) Inclusive of non - cash interest of approximately $3 and $12 million (Q2 and full year, respectively) related to the amortization of the term loan original issue discount and debt issuance costs

a scena store fleet detail 125 End of Fiscal 2016 Premium Segment Value Segment Plus Segment Kids Segment Ann Taylor LOFT Lou & Grey maurices dressbarn Lane Bryant Catherines Justice ascena Store Count 340 672 10 993 809 772 373 937 4,906 Real Estate Mix Strips 3 53 0 568 600 383 362 209 2,178 Enclosed Malls 126 218 4 349 52 190 6 518 1,463 A - Malls 92 105 4 97 0 25 2 340 665 B - Malls 31 95 0 151 52 157 4 165 655 C - Malls 3 18 0 101 0 8 0 13 143 Outlets 123 142 0 56 157 115 2 113 708 Lifestyle / Downtown 88 259 6 20 0 84 3 97 557 Average S.F. per Store Gross 5,399 5,814 2,237 5,124 7,839 5,524 4,161 4,165 5,486 Selling 4,197 4,442 1,669 4,283 6,115 4,260 3,289 3,276 4,324

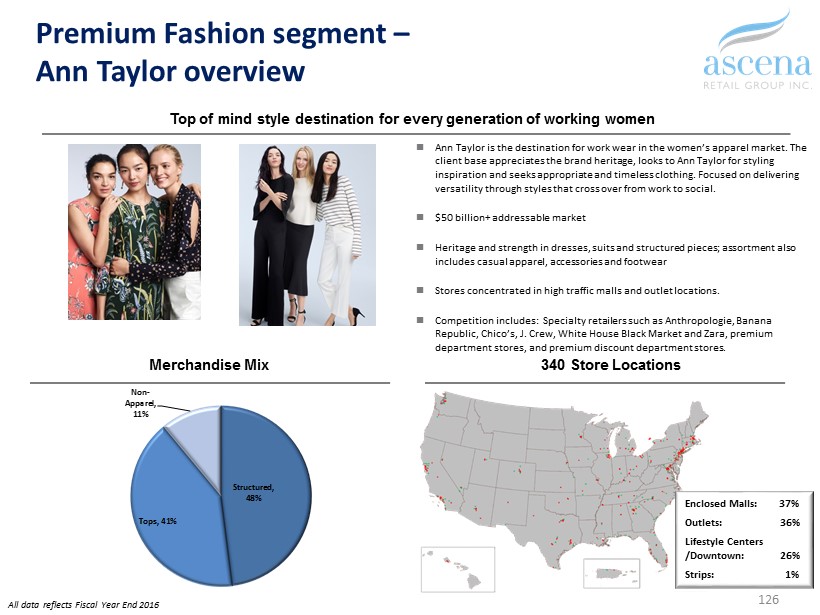

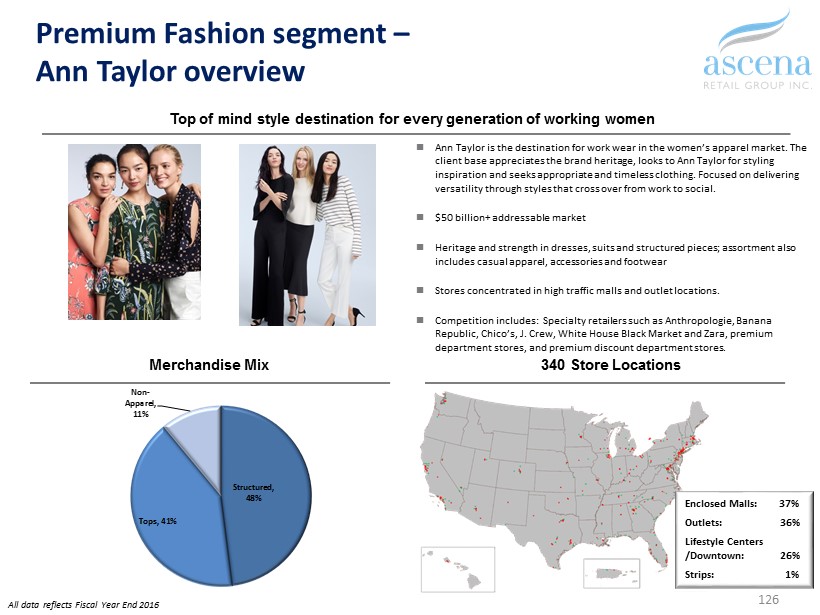

Premium Fashion segment – Ann Taylor overview 126 Top of mind style destination for every generation of working women Merchandise Mix 340 Store Locations Enclosed Malls: 37% Outlets: 36% Lifestyle Centers / Downtown: 26 % Strips : 1 % All data reflects Fiscal Year End 2016 ; Ann Taylor is the destination for work wear in the women’s apparel market. The client base appreciates the brand heritage, looks to Ann Taylor for styling inspiration and seeks appropriate and timeless clothing. Focused on delivering versatility through styles that cross over from work to social. ; $50 billion+ addressable market ; Heritage and strength in dresses, suits and structured pieces; assortment also includes casual apparel, accessories and footwear ; Stores concentrated in high traffic malls and outlet locations. ; Competition includes: Specialty retailers such as Anthropologie, Banana Republic, Chico’s, J . Crew, White House Black Market and Zara, premium department stores, and premium discount department stores. Structured, 48% Tops, 41% Non - Apparel, 11%

Premium Fashion segment – LOFT overview 127 Feminine , versatile fashion for everyday dressing Merchandise Mix 672 Store Locations Tops, 51% Separates, 41% Non - Apparel, 8% ; Offers modern, feminine and versatile fashion at surprising prices in an engaging shopping environment. ; LOFT has broad appeal across consumer segments, ages and end use in a $50 billion+ addressable market ; Products include women’s casual everyday and weekend apparel, loungewear, accessories, and wear to work apparel . ; Stores throughout the country but close to 50% of locations in the East . Very small exposure to Canada . ; Competition includes: Specialty retailers such as Express , Gap, Forever 21, H&M , The Limited, discount stores, TJ Maxx, and department stores. Lifestyle Centers /Downtown: 39% Enclosed Malls: 32% Outlets: 21% Strips : 8 % All data reflects Fiscal Year End 2016

Tops, 51% Bottoms, 21% Dresses, 20% Jackets, 5% Active, 2% 3rd Party & Other, 1% Premium Fashion segment – Lou & Grey overview 128 Casual, easy, effortless style Merchandise Mix 10 Store Locations ; Offers a fusion of activewear and streetwear, appealing to a younger, more fashion - conscious set of clients. ; $30 billion+ addressable market. ; Product assortment includes core loungewear, an expanded fashion offering in select stores, and third party non - apparel in standalone stores. ; Stores planned to achieve diversity in geography , location type and client demographics. Lifestyle Centers /Downtown: 60% Enclosed Malls: 40% All data reflects Fiscal Year End 2016

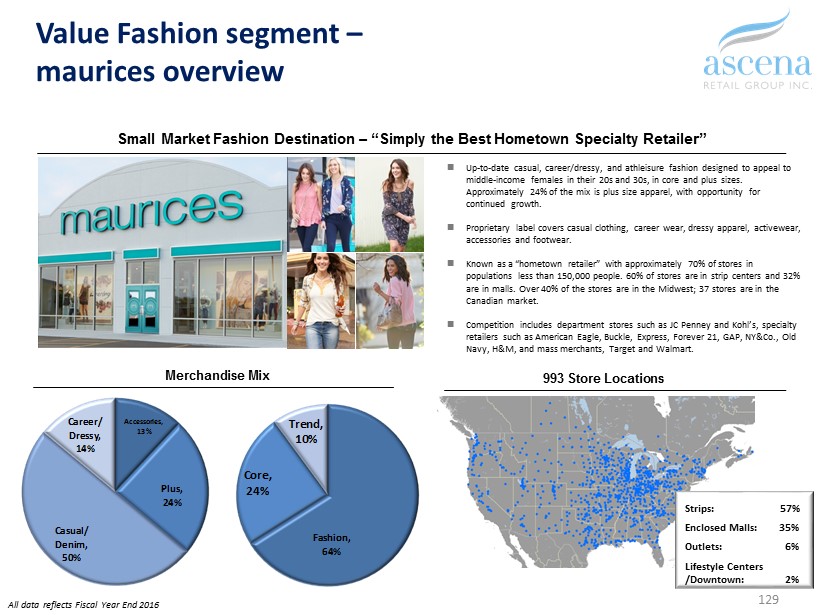

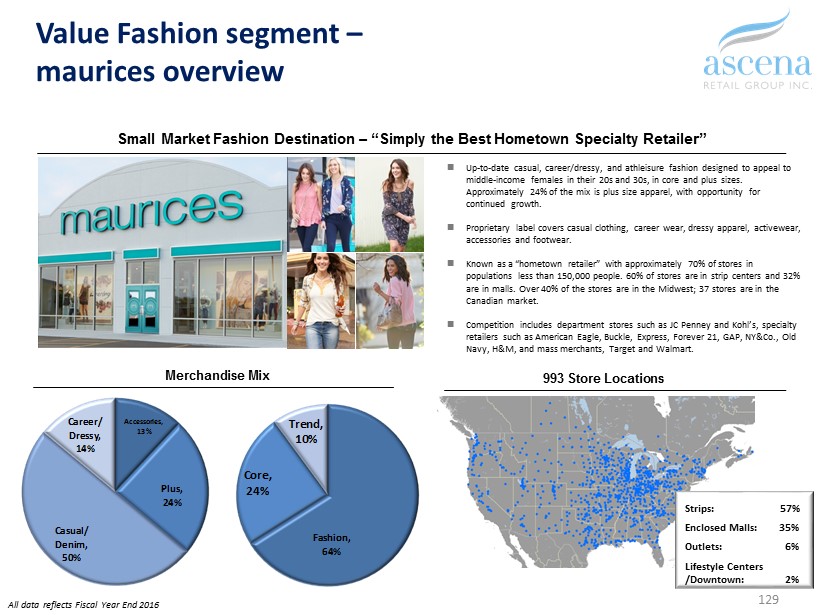

Value Fashion segment – maurices overview 129 993 Store Locations Merchandise Mix Small Market Fashion Destination – “Simply the Best Hometown Specialty Retailer” All data reflects Fiscal Year End 2016 ; Up - to - date casual, career/dressy, and athleisure fashion designed to appeal to middle - income females in their 20s and 30s, in core and plus sizes. Approximately 24% of the mix is plus size apparel, with opportunity for continued growth. ; Proprietary label covers casual clothing, career wear, dressy apparel, activewear , accessories and footwear. ; Known as a “hometown retailer” with approximately 70% of stores in populations less than 150,000 people. 60 % of stores are in strip centers and 32% are in malls. Over 40% of the stores are in the Midwest ; 37 stores are in the Canadian market. ; Competition includes department stores such as JC Penney and Kohl’s, specialty retailers such as American Eagle , Buckle , Express, Forever 21, GAP, NY&Co ., Old Navy, H&M, and mass merchants, Target and Walmart . Strips: 57% Enclosed Malls: 35% Outlets: 6% Lifestyle Centers /Downtown: 2% Accessories, 13% Plus, 24% Casual/ Denim, 50% Career/ Dressy, 14% Fashion, 64% Core, 24% Trend, 10%

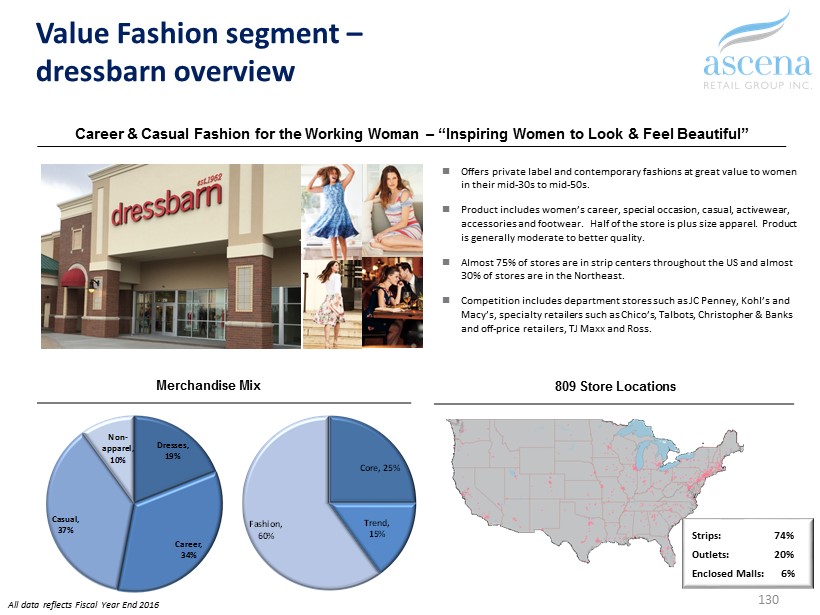

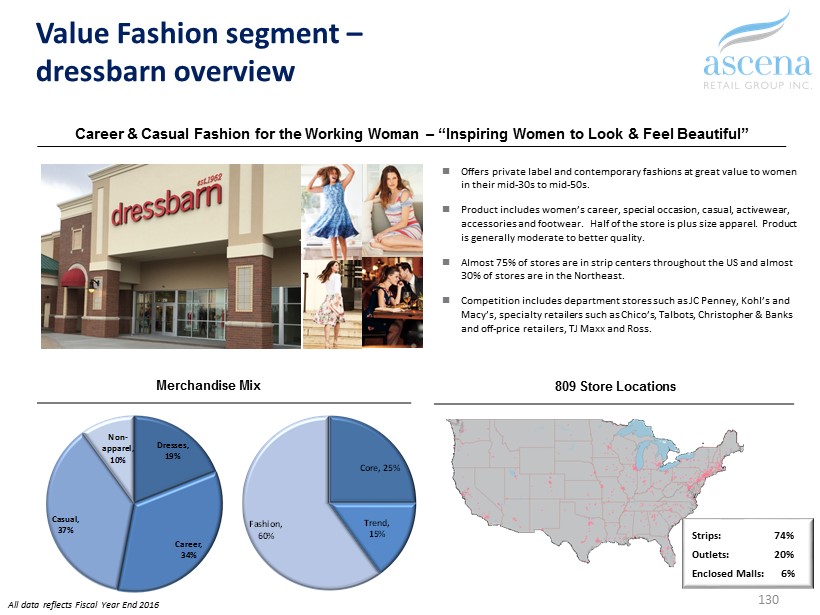

Value Fashion segment – dressbarn overview 130 Career & Casual Fashion for the Working Woman – “Inspiring Women to Look & Feel Beautiful” Merchandise Mix 809 Store Locations Dresses, 19% Career, 34% Casual, 37% Non - apparel, 10% Strips: 74% Outlets: 20% Enclosed Malls: 6% All data reflects Fiscal Year End 2016 ; Offers private label and contemporary fashions at great value to women in their mid - 30s to mid - 50s. ; Product includes women’s career, special occasion, casual, activewear, accessories and footwear. Half of the store is plus size apparel. Product is generally moderate to better quality. ; Almost 75% of stores are in strip centers throughout the US and almost 30% of stores are in the Northeast. ; Competition includes department stores such as JC Penney, Kohl’s and Macy’s, specialty retailers such as Chico’s, Talbots , Christopher & Banks and off - price retailers, TJ Maxx and Ross . Core, 25% Trend, 15% Fashion, 60%

Fashion, 62% Core, 31% Accessories, 7% Plus Fashion segment – Lane Bryant overview 131 On - trend plus - size apparel and intimates – “All women deserve great fashion ” ; Most widely recognized brand name in plus - size fashion. ; Caters to middle - income, female customers aged 25 to 45 in sizes 12 – 28 through private labels Lane Bryant, Cacique, and Livi Active as well as select third - party collaborations. ; Products include intimate apparel, wear - to - work, casual sportswear, activewear, accessories, select footwear and social occasion apparel. ; Stores concentrated in strip and high - traffic malls across the United States. ; Competition includes plus retailers such as avenue, Ashley Stewart, and Torrid, online plus retailer Eloquii, specialty retailers Catherines, dressbarn, maurices, and Old Navy, off price retailer TJ Maxx, and department stores such as JC Penney, Kohl’s, and Macy’s. Merchandise Mix 772 Store Locations Casual, 32% Wear to Work, 19% Accessories, 7% Intimates, 35% Emerging, 7% Strips: 49% Enclosed Malls: 25% Outlets: 15% Lifestyle Centers /Downtown: 11% All data reflects Fiscal Year End 2016

Dresses, 19% Career, 34% Casual, 37% Non - apparel, 10% Plus Fashion segment – Catherines overview 132 Merchandise Mix Classic plus and extended - size apparel and intimates for every occasion – “We fit you beautifully” ; Carries plus - size apparel for all occasions for customers generally 45 years or older. ; Known for offering full range of plus sizes (16 - 34 and 0X - 5X ) and particularly known for extended sizes (28 - 34 and 4X - 5X). ; Products include casual and wear - to - work apparel, intimate apparel, footwear and accessories. ; Retail stores primarily located in strip shopping centers with the highest concentration in the Southeast at ~25%. ; Competition includes department stores such as Macy’s, Dillard’s, and Kohl’s, specialty retailers such as Chico’s, dressbarn, Old Navy, Talbots, plus retailers, Lane Bryant and avenue, off - price retailers TJ Maxx and Ross, mass merchants, Target, Kmart and Walmart. 373 Store Locations Updated, 47% Fashion, 16% Core, 37% Strips: 97% Enclosed Malls: 1% Lifestyle Centers /Downtown: 1% Outlet: 1% All data reflects Fiscal Year End 2016

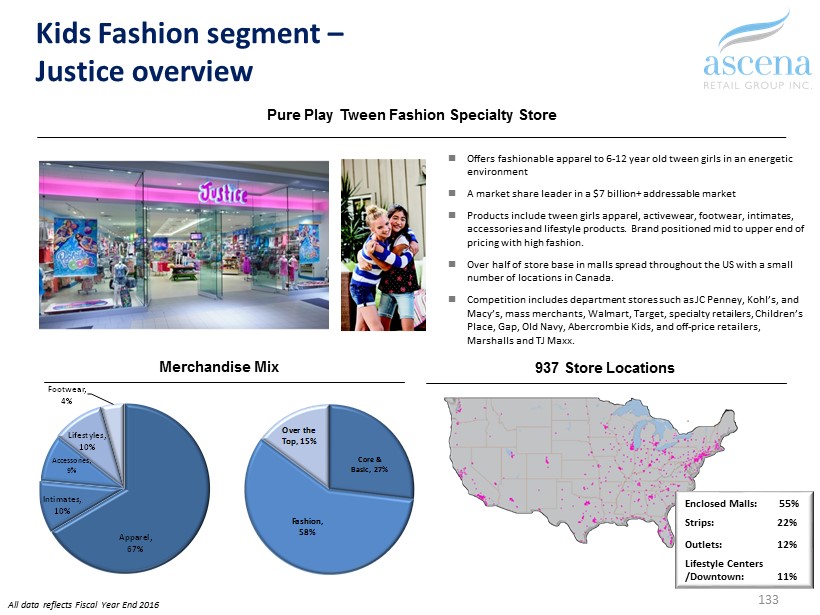

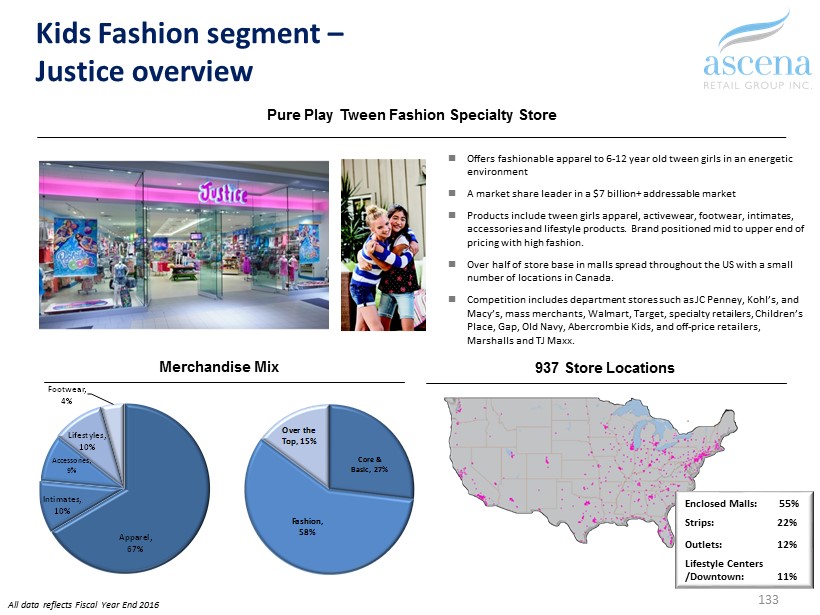

Core & Basic, 27% Fashion, 58% Over the Top, 15% All data reflects Fiscal Year End 2016 Kids Fashion segment – Justice overview 133 Pure Play Tween Fashion Specialty Store Merchandise Mix 937 Store Locations ; Offers fashionable apparel to 6 - 12 year old tween girls in an energetic environment ; A market share leader in a $7 billion+ addressable market ; Products include tween girls apparel, activewear, footwear, intimates, accessories and lifestyle products. Brand positioned mid to upper end of pricing with high fashion. ; Over half of store base in malls spread throughout the US with a small number of locations in Canada. ; Competition includes department stores such as JC Penney, Kohl’s, and Macy’s, mass merchants, Walmart, Target, specialty retailers, Children’s Place, Gap, Old Navy, Abercrombie Kids, and off - price retailers, Marshalls and TJ Maxx. Apparel, 67% Intimates, 10% Accessories, 9% Lifestyles, 10% Footwear, 4% Enclosed Malls: 55% Strips: 22% Outlets: 12% Lifestyle Centers / Downtown: 11%