Q2 FY17 Earnings Release Supplemental Material March 6, 2017

Safe Harbor Statement 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on current expectations and are indicated by words or phrases such as “anticipate, “estimate,” “expect,” “project,” “plan,” “we believe,” “will,” “would” and similar words or phrases, and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from the future results, performance or achievements expressed in or implied by such forward-looking statements. Detailed information concerning those risks and uncertainties are readily available in the Company’s filings with the U.S. Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward- looking statements, whether as a result of new information, future events or otherwise. Where indicated, certain financial information herein has been presented on a non-GAAP basis. This basis adjusts for non-recurring items that management believes are not indicative of the Company’s underlying operating performance. These measures may not be directly comparable to similar measures used by other companies and should not be considered a substitute for performance measures in accordance with GAAP such as operating income and net income. Additionally, a reconciliation of the projected non-GAAP EPS, which are forward-looking non-GAAP financial measures, to the most directly comparable GAAP financial measures, is not provided because the Company is unable to provide such reconciliation without unreasonable effort. The inability to provide a reconciliation is due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. These GAAP measures may include the impact of such items as restructuring charges, acquisition and integration related expenses, asset impairments and the tax effect of all such items. As previously stated, the Company has historically excluded these items from non-GAAP financial measures. The Company currently expects to continue to exclude these items in future disclosures of non-GAAP financial measures and may also exclude other items that may arise (collectively, “non-GAAP adjustments”). The decisions and events that typically lead to the recognition of non-GAAP adjustments, such as actions under the Company's Change for Growth program, or acquisition and integration expenses, are inherently unpredictable as to if or when they may occur. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. Reference should be made to today’s earnings release for the nature of such adjustments and for a reconciliation of such non-GAAP measures to the Company’s financial results prepared in accordance with GAAP.

Q2 FY17 Earnings Highlights 3 (a) Non-GAAP figures are adjusted to exclude restructuring and acquisition and integration expenses, along with the impact of non-cash purchase accounting entries related to write up of ANN’s assets and liabilities to fair market value Q2 FY17 Q2 FY16 Q2 FY17 Q2 FY16 Comp Sales (4%) (5%) Gross Margin 54.1% 52.6% 54.1% 53.8% BD&O 18.3% 17.9% 18.3% 18.0% SG&A 30.8% 29.8% 30.7% 29.7% EPS ($0.18) ($0.12) ($0.07) $0.01 GAAP Non-GAAP (a)

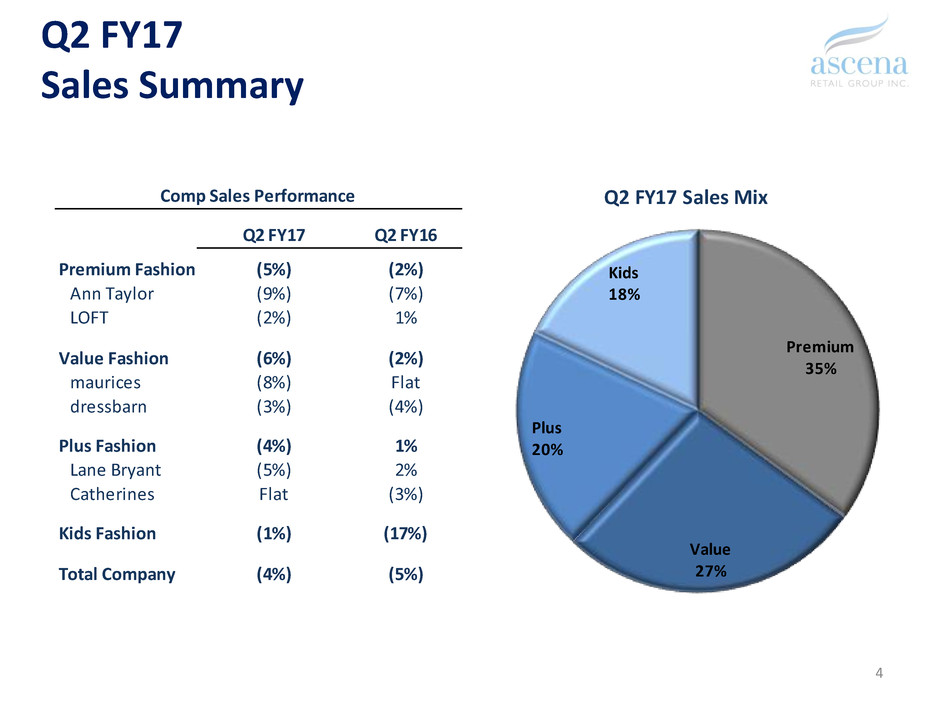

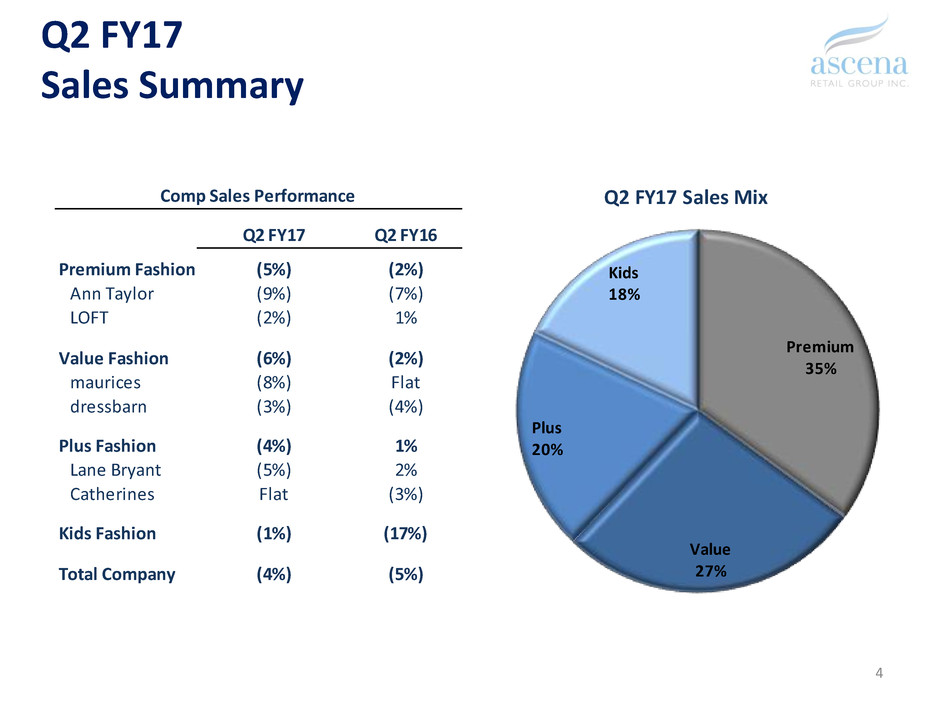

Q2 FY17 Sales Summary 4 Q2 FY17 Q2 FY16 Premium Fashion (5%) (2%) Ann Taylor (9%) (7%) LOFT (2%) 1% Value Fashion (6%) (2%) maurices (8%) Flat dressbarn (3%) (4%) Plus Fashion (4%) 1% Lane Bryant (5%) 2% Catherines Flat (3%) Kids Fashion (1%) (17%) Total Company (4%) (5%) Comp Sales Performance Premium 35% Value 27% Plus 20% Kids 18% Q2 FY17 Sales Mix

Q2 FY17 End-of-Period Segment Inventory 5 (a) Inventory figures for the Value, Plus, and Kids Fashion segments reflect differences of intercompany in-transit allocation from the Kids Fashion segment (importer of record) to the Value and Plus Fashion segments (~$11M and ~$15M, respectively) in the prior year (b) Adjusted inventory at Value and Plus Fashion segments reflects the impact of earlier shipments out of Asia due to the timing of the Chinese New Year; excluding receipt timing, adjusted inventory was up 4.4% and 2.1% at the Value and Plus Fashion segments, respectively, and down 0.6% for total company (8.3%) 17.6% 16.1% (24.5%) 2.5% Premium Fashion Value Fashion Plus Fashion Kids Fashion Total Company Reported (8.3%) 11.1% 6.1% 1.5% 2.5% Premium Fashion Value Fashion (b) Plus Fashion (b) Kids Fashion Total Company Adjusted (a)

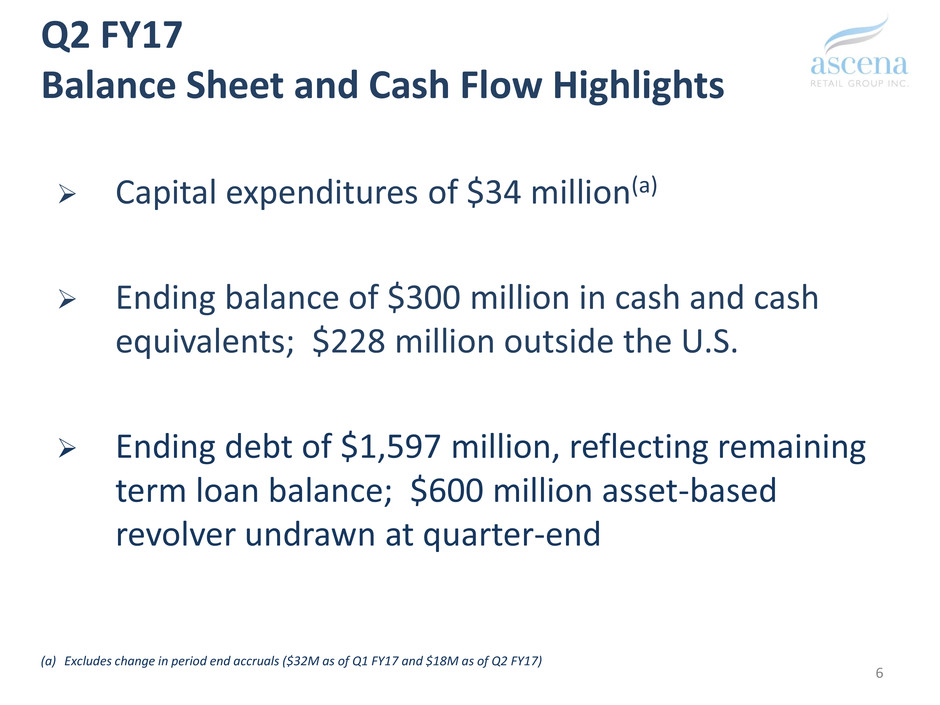

Q2 FY17 Balance Sheet and Cash Flow Highlights Capital expenditures of $34 million(a) Ending balance of $300 million in cash and cash equivalents; $228 million outside the U.S. Ending debt of $1,597 million, reflecting remaining term loan balance; $600 million asset-based revolver undrawn at quarter-end 6 (a) Excludes change in period end accruals ($32M as of Q1 FY17 and $18M as of Q2 FY17)

Real Estate Summary 7 Quarter Ended January 23, 2016 Store Locations Store Locations Store Locations End of Q1 End of Q2 End of Q2 Premium Fashion 1,023 1 (18) 1,006 1,027 Ann Taylor 340 0 (12) 328 346 LOFT 683 1 (6) 678 681 Value Fashion 1,815 9 (17) 1,807 1,797 maurices 1,006 7 (1) 1,012 976 dressbarn 809 2 (16) 795 821 Plus Fashion 1,146 3 (10) 1,139 1,139 L ne Bryant 776 3 (9) 770 763 Catherines 370 0 (1) 369 376 Kids Fashion 936 0 (10) 926 955 Total Company 4,920 13 (55) 4,878 4,918 Quarter Ended January 28, 2017 Store Locations Opened Store Locations Closed

(a) Included ~$3M in deal cost amortization, consistent with guidance Q2 Results vs. 1/10/17 Guide - Non-GAAP Basis 8 Actual Guidance Total Company Sales $1.749B ~$1.75B Gross Margin 54.1% 54.1 – 54.3% Operating Income $3M ($14) to ($4)M Interest expense (a) $25M ~$25M Effective tax rate 37% 40% Diluted share count 195M 196M EPS ($0.07) ($0.11) to ($0.08)

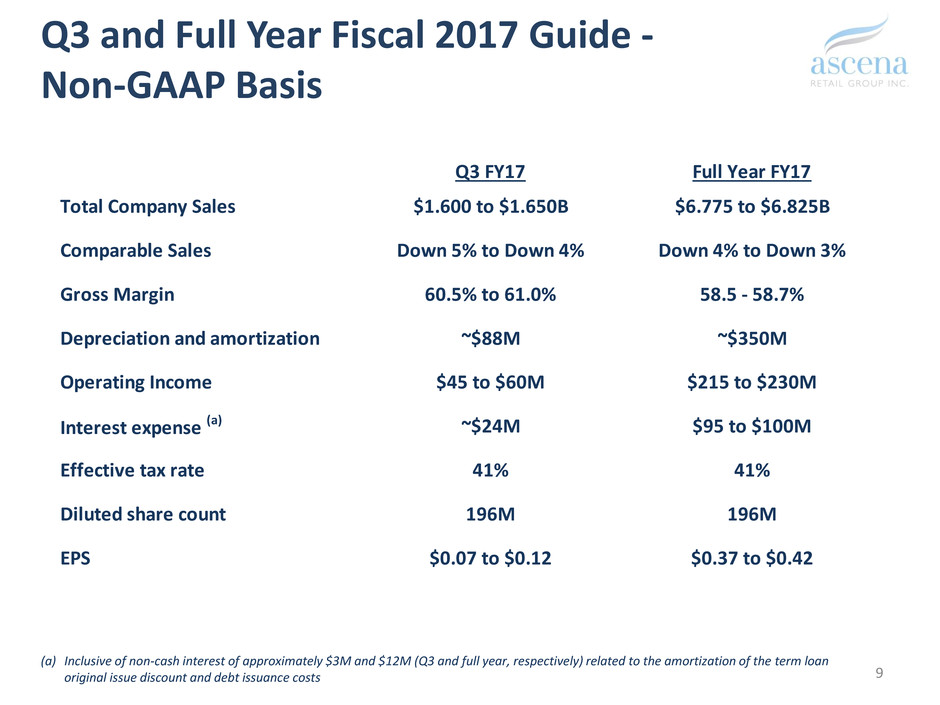

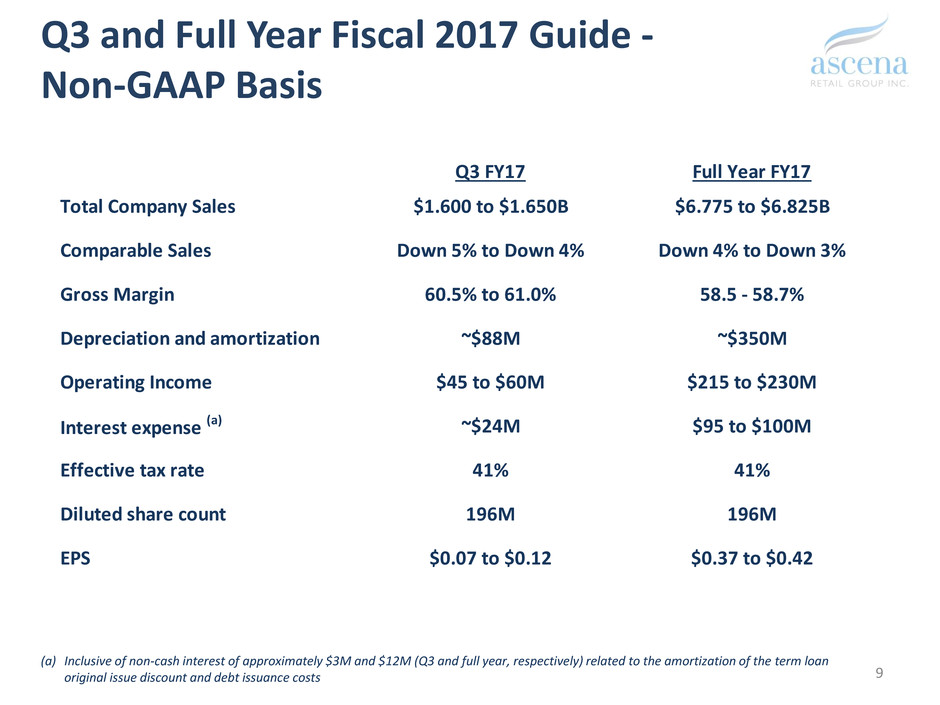

(a) Inclusive of non-cash interest of approximately $3M and $12M (Q3 and full year, respectively) related to the amortization of the term loan original issue discount and debt issuance costs Q3 and Full Year Fiscal 2017 Guide - Non-GAAP Basis 9 Q3 FY17 Full Year FY17 Total Company Sales $1.600 to $1.650B $6.775 to $6.825B Comparable Sales Down 5% to Down 4% Down 4% to Down 3% Gross Margin 60.5% to 61.0% 58.5 - 58.7% Depreciation and amortization ~$88M ~$350M Operating Income $45 to $60M $215 to $230M Interest expense (a) ~$24M $95 to $100M Effective tax rate 41% 41% Diluted share count 196M 196M EPS $0.07 to $0.12 $0.37 to $0.42

Full Year FY17 Guide - Quarterly Comp Sales Progression (5.0%) (4.2%) (4%) - (5%) (0.5%) - (1.5%) (3%) -(4%) (5.1%) (5.3%) ~(6.5%) ~(6%) Q1 (A) Q2 (A) Q3 (E) Q4 (E) Full Year (E) FY17 Actual / Guide Two-year Comp Stack ~(6%) (a) Q4 comp acceleration supported by omni-channel platform rollout, segment initiatives, and easier prior year compares (b) Two-year comp stack excludes Justice FY16 comp progression, due to selling strategy reset implemented in July 2015 10 (a) (b)

Q3 / Q4 detail – y-o-y earnings bridge Y-O-Y Assumptions Comp: (5%) – (4%) Gross margin rate: flat Y-O-Y Assumptions Comp: (1.5%) – (0.5%) Gross margin rate: +60bp 11 Note: ‘Platform savings’ includes ANN synergies / cost savings and Change for Growth transformation savings; guide includes ~$45 million and ~$35 for ANN synergies and Change for Growth transformation savings, respectively, split roughly evenly between Q3 and Q4