[GS letterhead]

VIA EDGAR AND OVERNIGHT MAIL

Securities and Exchange Commission

Staff Attorney I Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attn: John R Lucas

Re: Jintai Mining Group, Inc.

Registration Statement on Form S-1

File No. 333-168803

Filed August 12, 2010

Dear Mr. Lucas:

We are counsel to Jintai Mining Group, Inc. (the “Company” or “our client”). On behalf of our client, we respond as follows to the comments by the staff of the Division of the Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “SEC”) dated September 10, 2010, relating to the above-captioned registration statement. The Company amended the Registration Statement in response to the SEC's comments. Captions and section headings herein will correspond to those set forth in Amendment No. 1 to the Registration Statement on Form S-1 (“Registration Statement”), a copy of which has been marked with the changes from the initial filing, and is enclosed herein. Please note that for the Staff’s convenience, we have recited each of the Staff’s comments in the order in which they appeared in the comment letter and provided the Company’s response to each comment immediately thereafter.

General

| Comment: | 1. Please provide complete responses, and where disclosure has changed, indicate precisely where in the marked version of the amendment you provide we will find your responsive changes. |

| Response: | The Company has provided complete responses and provided a marked version of the Registration Statement. The Company’s responses to the comments below indicate where in the Registration Statement the Staff’s comments have been addressed. |

| Comment | 2. To the extent comments on one section apply to similar disclosure elsewhere, please make corresponding revisions to all affected disclosure. Further, please provide updated disclosure with each amendment. This will minimize the need for us to repeat similar comments. |

| Response: | Responses to the Staff’s comment have been incorporated in all sections affected by such comments. Moreover, the Company has updated all disclosures in the Registration Statement. |

| Comment | 3. Please monitor the need to update your financial statements in accordance with Item 8-03 of Regulation S-X. We note that you have included two prospectuses in this registration statement: one for the public offering by the company and another for the resale offering by the selling stockholders. With a view towards disclosure, please tell us if you intend to use both prospectuses concurrently in the same format as filed, with the resale offering prospectus showing only the pages that differ from the public offering prospectus. If so, please advise us as to how you will inform investors whether they will be investing in the public offering by the company, in which case the company would receive the proceeds, or in the resale offering. |

| Response: | The Company intends to use both prospectuses currently in the same format as filed on August 12, 2010, with the resale offering prospectus showing on the pages that differ from the public offering prospectus. The registration statement has also been revised to state that investors who receive the public offering prospectus from the Company or underwriter will all be investing in the public offering. The purpose of the alternative prospectus in connection with the resale offering is that the selling stockholders, whose shares are being registered in the resale offering prospectus, will be responsible for delivering the alternative prospectus in connection with any sales made by such selling stockholders. |

| Comment | 4. Please note that prior to declaring this registration statement effective, we will need to receive confirmation from FINRA that they have approved the underwriter compensation scheme. Please ensure that they contact us prior to your requesting acceleration of effectiveness. |

| Response: | On behalf of the Company, we hereby undertake to inform the Staff of FINRA’s approval of the underwriter’s compensation scheme when received. |

| Comment | 5. Please fill in all blank spaces, except those specifically allowed by Rule 430A, as soon as possible. |

| Response: | The Registration Statement has been revised in response to such comment. |

Prospectus Cover Page

| Comment | 9. We note that you intend to apply for listing on the NYSE Amex. Please provide us with an update of your activities in this regard. |

| Response: | The Company will submit the application for listing to the NYSE Amex promptly following the filing of the Registration Statement. |

| Comment | 10. You state in the opening sentence that you are offering 6 million shares of common stock. However, in the third sentence you state you will offer 6 million shares “[I]f the offering price of the shares $5.00." This suggests that the number of shares to be offered will depend on the offering price. Please revise or advise. |

| Response: | The Registration Statement has been revised to clarify that the Company is offering 6,000,000 shares at a price per share of between $4 and $6. Please see the cover page of the Prospectus. |

The Company, page 1

| Comment | 7. We note your disclosure that for the fiscal year ended March 31, 2010, you generated $35.02 million in revenue with approximately 30% pre-tax margins. However, your pre-tax margin divided by total revenues appears to be in excess of 43% for the fiscal year ended March 31, 2010. Please clarify how you calculated this pre-tax margin and revise if necessary throughout your filing. |

| Response: | The Company has removed the references to its pre-tax margin on the first page of the Registration Statement. A discussion of the Company’s financial operations is included in the MD&A section of the Registration Statement beginning on page 38 of the Registration Statement. |

Corporate Structure, page 1

| Comment | 11. You state that Jintai HK is a holding company that controls, through Xiangguang, your operating entity, Huanjiang Jintai, through a series of variable interest contractual arrangements. This statement appears to conflict with the statements you make elsewhere that the variable interest contractual arrangements are not yet effective because Xiangguang has not yet received its business license. Please revise throughout your filing as applicable. |

| Response: | The Company has amended the Registration Statement to indicate that the VIE agreements between Xiangguang and Huanjiang Jintai were signed on August 25, 2010 and that Xiangguang obtained its business license on August 24, 2010. Please see page 55 of the Registration Statement. |

Summary Financial and Operating Data, page 5

| Comment | 12. Please tell us how your presentation complies with Item 301 of Regulation S-K. In this regard, we believe that, as a smaller reporting company, if you choose to respond to an item, you should fully comply with those item requirements. As part of your response, please tell us why you appear to have presented duplicative information on page 33. In addition, please tell us where to find the pro forma basic and diluted net loss per common share you refer to on page 33. |

| Response: | The Registration Statement has been revised to exclude the Selected Financial Data. Moreover, the Registration Statement has been revised to indicate that the pro forma basic net income per common share was $0.12 for the three months ended September 30, 2010, and $0.10 for the same period of 2009. The pro forma basic net income per common share was $0.29 for the six months ended September 30, 2010, and $0.17 for the same period of 2009. The diluted net income per common share was the same as the pro forma numbers. |

Risk Factors, page 6

| Comment | 13. Many of your risk factors contain language that attempts to mitigate the risks described. For example, we note your statements on page 6 that "we are taking appropriate measures to ensure that our Ore Mine is safe" and at page 7 that "we have established stringent rules relating to the storage, handling and use of such dangerous materials." Similar statements occur throughout your risk factors section. Please revise to remove any such qualifications. You may discuss any relevant mitigating and qualifying factors in another appropriate section of your registration statement, such as management's discussion and analysis. |

| Response: | In response to this comment, the Company has deleted the mitigating language in the relevant risk factors discussions. Please see pages 11 to 31 of the Registration Statement. |

Risks Relating to our Business Operations, page 6

| Comment | 14. Please add a risk factor addressing, to the extent true, that your management has no experience managing or operating a public company. |

| Response: | The Company has added a risk factor to state that none of the Company’s management team, other than the Chief Operating Officer of the Company, Danny T.N. Ho, has any experience managing or operating a public company. Please see page 15 of the Registration Statement. |

Mining operations are highly susceptible to hazardous weather conditions, page 6

| Comment | 15. We note your disclosure that 5 of the 9 access portals to your ore mine are inaccessible or unusable. This appears to conflict with your disclosure at page 9 that only 2 portals are accessible. Please clarify or revise. |

| Response: | The Company has modified the disclosure throughout the Registration Statement to reflect the fact that as of the date hereof, all nine (9) portals are fully accessible and in production. In this regard, please note that the change was due to the fact that when the original registration statement was filed on August 12, 2010, four (4) portals were then inaccessible due to the rainy season then being experienced in China. The Company has made reference to this in the Risk Factors. Please see page 11 of the Registration Statement. |

"The actual output at our Ore Mine exceeds the annual capacity allowed...," page 8

| Comment | 16. We note that you may be required to make payments for additional mining licenses or payment of fines. Please tell us how you have considered ASC 450-20-25-1 through 5 with respect to the production at your Ore Mine. |

| Response: | Upon further discussion with PRC counsel, it has been determined that the PRC government has not imposed a fine on Huanjiang Jintai’s mining operations due to the fact that a mine’s output exceeds the annual capacity permitted, and further, the PRC government currently has not issued any definitive rule or interpretation regarding whether the excessive output of zinc lead ores like the one Huanjiang Jintai conducted shall be subject to any judicial or administrative discipline such as suspension or revocation of the mining license. As such, this risk factor has been modified to state that the Company is not facing fines or other penalties at this time but no assurance can be given as to possible future governmental actions. Since the likelihood of a future loss or additional liability is remote. The disclosure in the financial statements is not required. |

Risks Related to Our Corporate Structure, page 10

| Comment | 17. We note that Huanjiang Jintai may terminate the consulting agreement (Exhibit 10.1) under Section 7.2.5 if "circumstances arise which materially and adversely affect the performance or the objectives" of the agreement. Please provide related risk factor disclosure. |

| Response: | The Company has revised the Registration Statement to include the risk factor requested. Please see page 18 of the Registration Statement. |

We conduct our business through Huanjiang Jintai by means of contractual. page 10

| Comment | 18. It appears that you have inadvertently duplicated your disclosure in this section. Please revise or advise. |

Response: The Company has deleted the duplicative sections in response to this comment.

"Failure to abide by certain requirements with regard to transfer of certain state-owned assets...," page 15

| Comment | 19. We note your disclosure that "Shaoguan Jinteng Mining Co., Ltd. ("Shaoguan Jinteng") and Guangxi Zhuang Autonomous Region General Bureau for Geology & Mineral Exploration ("Guangxi General Bureau") formed Huanjiang Jintai on November 27, 2003, each holding 70% and 30%, respectively, of the shares of Huanjiang Jintai" Please tell and disclose which operating entities were owned by Shaoguan Jinteng and Guangxi General Bureau on November 27, 2003, and describe the nature and terms under which these entities were assigned ownership. |

| Response: | Shaoguan Jinteng Mining Co., Ltd. ("Shaoguan Jinteng") and General Institutes of Geology & Mineral Prospecting & Exploitation Guangxi Zhuang Autonomous Region ("Guangxi General Institutes") formed Huanjiang Jintai under the laws of the PRC on November 27, 2003, and Guangxi General Institutes entered into an Equity Transfer Agreement with Mr. Kuizhong Cai and transferred its equity ownership in Huanjiang Jintai to Kuizhong Cai on November 8, 2007. The relevant risk factor with regard to the equity transfer has been amended as PRC counsel has confirmed that the equity transfer by Guangxi General Institutes was approved and validated by the PRC government. |

| Comment | 20. We further note your disclosure that "in 2007, Guangxi General Bureau transferred its shares of Huanjiang Jintai to Kuizhong Cai." Please tell us and disclose the nature and terms under which Guangxi General Bureau transferred its shares of Huanjiang Jintai to Kuizhong Cai, and clarify if the state still owns any of the equity interests or underlying land, plant, property, or equipment associated with the mines. |

| Response: | Guangxi Bureau of Geology & Mineral Prospecting & Exploitation, the governmental agency authorized by the Guangxi People’s Government with the power to dispose and manage state-owned assets on behalf of the State, had approved that the transfer by Guangxi General Institutes of its 30% equity interest in Huanjiang Jintai to Kuizhong Cai. All approval and assessment procedures of equity transfer were followed and the change in the registration of shareholder title in the local AIC from Guangxi General Institutes to Kuizhong Cai was completed. At this time, neither Guangxi General Bureau, nor any other state entity, owns any equity interest in Huanjiang Jintai. |

Use of Proceeds, page 26

| Comment | 21. Your disclosure that you intend to hold in trust $1.5 million to pay the expenses related to being a public company appears to conflict with your subsequent disclosure that you have undertaken to place in trust 5% of the net proceeds of this offering for such purposes. Please revise. In addition, please file the agreement in which such undertaking was made by the company, as it does not appear to be in the VIE agreements filed on EDGAR. |

| Response: | $1,000,000 of the net proceeds from the public offering will be held in an escrow account to pay for the expenses related to being a public company. Please see page 33 of the Registration Statement for the clarified disclosure. This undertaking will be set forth as part of the underwriting agreement. |

| Comment | 22. Further, please clarify the specific expenses covered by this provision. |

| Response: | The funds to be held in the escrow account will be used to cover legal costs associated with the filing of the Registration Statement, costs related to engaging a transfer agent, an auditing firm and an investor relationship firm, costs associated with the purchase of directors’ and officers’ insurance, as well as costs to cover all other necessary costs and expenses related to being a public company, including those related to periodic filings that the Company will be required to make. |

| Comment | 23. It is not clear whether the proceeds of this offering will be sufficient to cover fully the projects set forth in the three bullet items. If they will not, provide the disclosure required by Instruction 3 to Item 504 of Regulation S-K. |

| Response: | The Company has modified the relevant disclosure to clearly state that management believes that the proceeds of the offering will be sufficient to cover fully the projects set forth in the three bullet items in the Use of Proceeds section. |

Dividend Policy, page 28

| Comment | 24. Please provide a page reference in this section to your extensive risk factor disclosure regarding possible limitations on the payment of dividends. |

| Response: | The Company has added the page reference referring to the relevant risk factor. Please see page 34 of the Registration Statement. |

Management's Discussion and Analysis, page 35

| Comment | 25. We note your financial results fluctuated dramatically from fiscal 2009 to fiscal 2010. However, your disclosure does not adequately discuss the key factors and trends that caused these changes. For example, we note that your revenues increased 47%, but your cost of goods sold increased only 20%. While you suggest in your discussion of gross profit margin that this is due to a change in products sold, you should provide enhanced disclosure of the reasons for these changes across reporting periods. |

| Response: | In response to this comment, the Company has revised the Registration Statement to provide enhanced disclosure of the reasons for the significant increase of revenue and the relatively smaller increase of the cost of goods sold in fiscal year 2010 compared to fiscal year 2009. Please see pages 41 to 42 of the Registration Statement. |

| Comment | 26. Please address whether your decision to discontinue the sale of the products that you traditionally manufacture (e.g. zinc calcine, zinc dust, etc.) and to focus on the sale of your tailings is a short-term decision or whether it reflects a change in business strategy. We note that you do not discuss the sale of tailings anywhere else in your disclosure, although your disclosure here suggests that this is the primary factor in your increased financial performance in 2010. |

| Response: | The Registration Statement has been modified to clarify that the sale of tailings which began in the later half of fiscal year ended March 31, 2009 and in the fiscal year ended March 31, 2010 is a part of the Company’s sales strategy during the periods of financial turmoil. Since the economic situation has gradually improved and the zinc and lead price have risen to an acceptable level in 2010, the Company resumed sales of traditional products in April 2010. Please see page 42 of the Registration Statement. |

| Comment | 27. We note your statement, "[W]e imported raw ores and primarily focused on the sale of our tailings as a main revenue driver." This suggests that in 2010 you processed imported ore rather than ore from your mine. Please clarify. |

| Response: | The Registration Statement has been modified to clarify that in the year 2010, the Company processed both purchased ore and ore from the Company’s own mine. Please see page 42 of the Registration Statement. |

Revenues, page 35

| Comment | 28. Your revenue discussions should identify and quantify changes resulting from demand, prices, and other factors. Other factors should be described and, where necessary, quantified. We see that the increase in net revenues for the year ended March 31, 2010 was mainly attributable to an increase in margins. It appears that the impact of changes in prices and quantities of product sold should be quantified. We also have concerns that your discussion of operating results does not consistently explain the "why" behind factors that you cite. In general, your discussion should not only identify and quantify reasons for changes in financial statement line items, but reasons the cited factors exist or arose should also be described. Please apply throughout MD&A where significant. |

| Response: | The Registration Statement has been modified in response to the comment. Please see pages 31-33 of the Registration Statement. |

| Comment | 29. Please include a discussion and analysis of historical cash flows for all periods presented to include cash flows from operations, cash flows from investing activities, and cash flows from financing activities where material changes have occurred. In doing so, please ensure your discussion and analysis of historical cash flows is not merely a recitation of changes evident from the financial statements. For example, you indicate that the decrease in fiscal 2010 cash from operating activities was primarily due to an increase in accounts payable of $13,894,212. Please provide analysis explaining the underlying reasons for the fluctuations in the working capital accounts. See Section IV(B) of SEC Release 33-8350. |

| Response: | The Registration Statement has been modified in response to the comment. Please see pages 43 to 44 of the Registration Statement. |

| Comment | 30. In addition, please clarify how you calculated the $13.9 million increase in accounts payable in fiscal 2010. In this manner, we note that your $8.4 million accounts payable balance as of March 31, 2009 decreased by approximately $7 million to $1.4 million. As part of your response, please clarify your statement that the increase in operating cash flow was mainly due to the re-classification of accounts payable and other receivables recovery. It is unclear to us why a re-classification of accounts payable results in operating cash flow. |

| Response: | The Registration Statement has been modified in response to the comment. Please see pages 43 to 44 of the Registration Statement. |

| Comment | 31. We note your statements that net cash provided by operating activities for the year ended March 31, 2010 was $2 million as compared to $19.8 million used for the year ended March 31, 2009. However, you appear to have generated cash flow from operations in both fiscal years presented. Please revise. |

| Response | The Company has modified the disclosure to state that “Net cash provided by operating activities for the year ended March 31, 2010 was $2 million, as compared to $19.8 million provided for the year ended March 31, 2009”. Please see page 43 of the Registration Statement. |

| Comment | 32. On page 37, you state that as of August 11, 2010, you obtained gross proceeds of $10,000,000 from the issuance of Convertible Notes. This statement appears to contradict with the statement you make in the following sentence that you will obtain the proceeds in the very near future. In addition, you also indicate that you have "obtained aggregate gross proceeds of $20,000,000 from the issuance of the Convertible Notes," which implies you have already received $20,000,000. Please revise here and throughout your registration statement to clearly indicate when the correct amount of the proceeds and when such proceeds were or will be received. |

| Response: | The Company has revised the Registration Statement to state that the Company issued two Convertible Notes in August and November 2010. The Company received from the first Convertible Note proceeds of $10,000,000. Approximately $7 million has been used for tunnel expansion, general exploration on the Shangchao-Gangshan lead ore deposit and the infrastructure construction and site expansion of the Duchuan Smelter. The remaining $3 million washeld in an escrow account established with Guangzhou Kaituo Trading Co. Ltd. and would be released to the Company in December, 2010.The Company expects to receive in December, 2010 the proceeds of $10,000,000 from the Convertible Notes issued in November 2010. Please see page 44 of the Registration Statement. |

Financial Condition, Liquidity and Capital Resources, page 36

| Comment | 33. We note your disclosure here, as well as Exhibits 10.8 through 10.10, regarding the private transactions with Ms. Hu and Mr. Zhong. Please provide us with an update, and revise your disclosure as applicable, regarding whether you have obtained the additional $10 million in proceeds from the sale of the convertible notes. |

| Response: | The Registration Statement has been modified in response to the comment. Please see page 44 of the Registration Statement. |

| Comment | 34. Please revise to disclose that under the convertible note agreements with Ms. Hu and Mr. Zhong, filed as exhibit 10.8, the conversion price will be $4 per share if the IPO is not conducted within 90 days of the date of the agreement, as stated in Section 2.2(b). |

| Response: | The Registration Statement has been modified to state that the convertible notes have been amended to state that the conversion price of the notes shall be equal to the offering price without qualification. Please see page 44 of the Registration Statement. |

| Comment | 35. We note a discrepancy between your disclosure in this section and the text of exhibit 10.10 with regard to the exercise price of the warrants issued to Ms. Hu and Mr. Zhong in the event the offering does not occur within 90 days of the date of issuance. Please revise for consistency. It appears that the exercise price in that case would be $4.40, as you note at page 41. |

| Response: | The Company has revised the relevant disclosure to indicate that the warrants have been amended and now provide for an exercise price of the warrants of 110% of the initial public offering price, without qualification. Please see page 44 of the Registration Statement and the revised warrant has been included as Exhibit 10.14. |

| Comment | 36. Please disclose when the issuances of the convertible notes and warrants occurred and file the executed versions of these agreements |

| Response: | An executed version of the convertible note issued to Liwen Hu is filed as Exhibit 10.8 to the Registration Statement. The convertible note issued to Haibin Zhong, the amendment to the promissory note and warrant issued to Liwen Hu are filed as Exhibit 10.10, Exhibit 10.9, and Exhibit 10.14 to the Registration Statement, respectively. |

| Comment | 37. Your disclosure that you have obtained gross proceeds of $20 million from the sale of convertible conflicts with your disclosure in the preceding sentences that you have only obtained $10 million from such sales as of the prospectus date. |

| Response: | The Company has modified the Registration Statement in response to this comment. Please see page 44 of the Registration Statement. |

| Comment | 38. We note that your planned uses for the $20 million raised through the sales of convertible notes overlaps with your planned uses of funds raised in the public offering. Please clarify whether these amounts are complimentary or alternative. For example and without limitation, you state that you plan to use $2 million of public offering proceeds and $2.5 million of convertible note proceeds to rehabilitate up to four transportation tunnels as well as ventilation, drainage, and slagging shafts. Please clarify whether this means that you intend to spend $4.5 million total on this project. In general, further clarify the breakdown between the planned uses of public offering and private placement funds. |

| Response: | The Company has expanded the disclosure throughout the Registration Statement to clarify the use of proceeds from the sales of convertible notes and from the public offering. The use of proceeds of the two offerings are complementary and not dependent on one another. Please see pages 4 and 33 of the Registration Statement. |

Environmental Considerations, page 37

| Comment | 39. Please provide a brief description of each environmental law to which you are subject, as well as whether or not you are currently in compliance with such laws. |

| Response: | The Registration Statement has been revised to include a brief discussion of the environmental laws which the Company is subject to and have indicated whether the Company is currently in compliance with such environmental laws. Please see pages 75 to 78 of the Registration Statement. |

| Comment | 40. In addition, in an appropriate place in your registration statement, discuss the costs and effects of compliance with existing PRC regulations governing your business. For example only, we note your risk disclosure regarding the facts that: |

| · | Your mining operations have material safety concerns that may cause, among other problems, "massive roof failure, inadequate natural ventilation and high likelihood of flooding." In this regard, we note a Wall Street Journal article dated April 7, 2010, which states that the PRC government has launched a "nationwide crackdown on safety in mines."http://online.wsj.com/article/SB10001424052702303591204575169763719230180. html; |

| | · | You are currently violating your governmentally authorized production amount by ten times the amount you are licensed to produce. Address the affects on your financial position and results of operations in the event you are required to comply with your current mining license. |

| Response: | The Registration Statement has been modified in response to this comment. Please see pages 78 to 80 thereof. |

Critical Accounting Policies, page 37

Contractual Arrangements, page 38

| Comment | 41. We note you disclose on page 38 that "the contractual arrangements between Xiangguang and Huanjiang Jintai are set forth in the following agreements:" However, you do not appear to have provided any additional related disclosure following this sentence. Please revise. |

| Response: | The Company has modified the Registration Statement to insert the text that was inadvertently omitted. Please see pages 54 to 55 of the Registration Statement. |

| Comment | 42. We note your reference to an opinion of PRC counsel regarding the legality of the VIE agreements once Xiangguang receives its business license. Please balance your disclosure by addressing the factors you disclose in the related risk factor on page 10 regarding the possible invalidation of such arrangement by the PRC government. |

| Response: | The Registration Statement has been modified in response to this comment. Please see page 16 of the Registration Statement. |

| Comment | 43. In addition, when you file the opinion of PRC counsel, ensure that it contains a consent to the specific disclosures attributed to such counsel. |

| Response: | The disclosure has been revised in response to this request and PRC counsel has included the requested consent in the revised legal opinion. Please see Exhibit 99.1 to the Registration Statement. |

Foreign Currency Translation, page 38

| Comment | 44. It is not clear in this section, as well as several other sections throughout your registration statement, whether this is a draft version of the prospectus. For example, this section is bracketed and states, "[Jintai, please confirm]." Similar text appears on pages 13 and 14. We urge those people who are legally responsible for the adequacy and accuracy of disclosure in a registration statement to confirm such information prior to filing. |

| Response: | The Company has removed all bracketed texts throughout the Registration Statement and completed the statements. |

Land, plant and equipment, mining right, and exploration right, page 39

| Comment: | 44. We note you intend to depreciate your mining rights over 5 years. Please explain to us in detail by reference to authoritative accounting literature why this is an appropriate methodology to depreciate your mining rights. As part of your response, please address why you believe 5 years is an appropriate timeframe for depreciation given your statements on page 60 that in December 2009 you renewed your mining right through December 2018. |

| Response: | The Registration Statement has been revised to state that the mining rights are being depreciated over 9 years. Please see page 46 of the Registration Statement. |

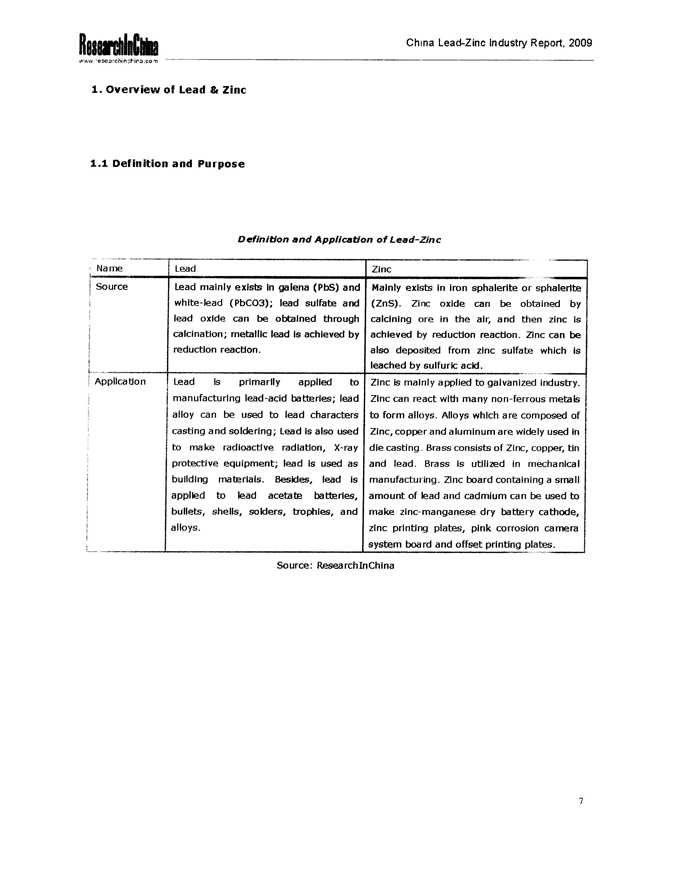

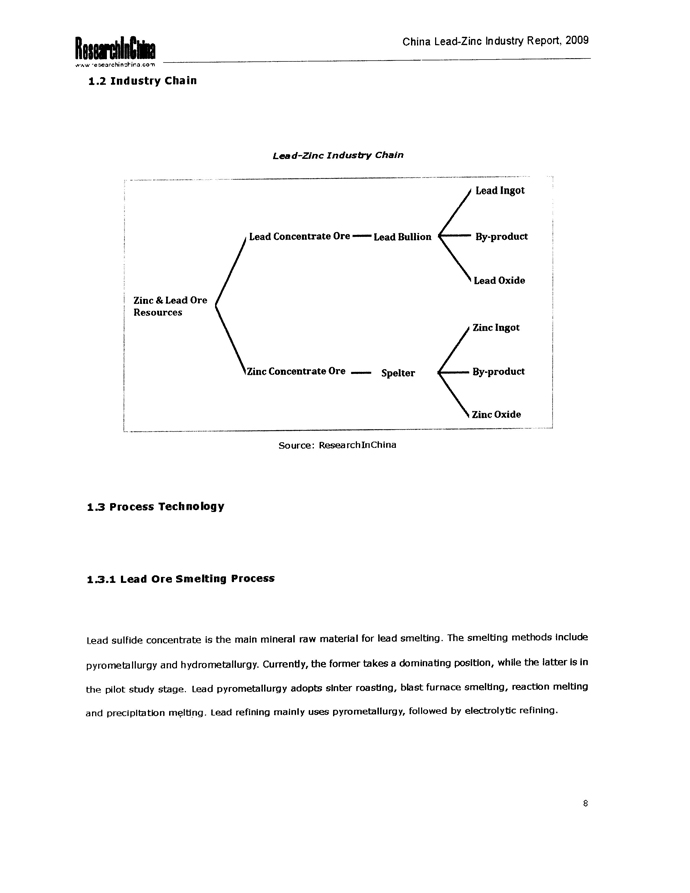

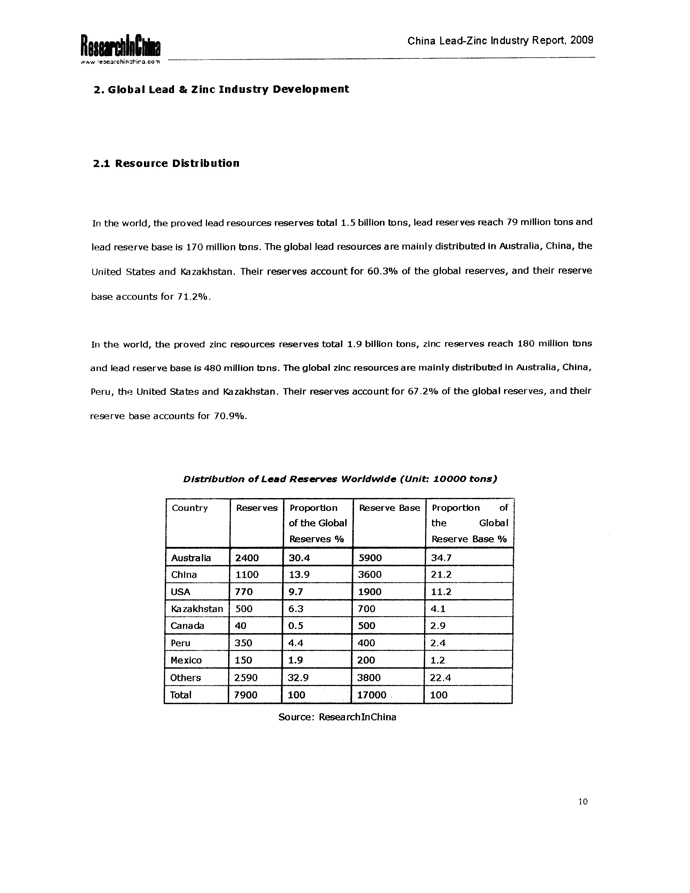

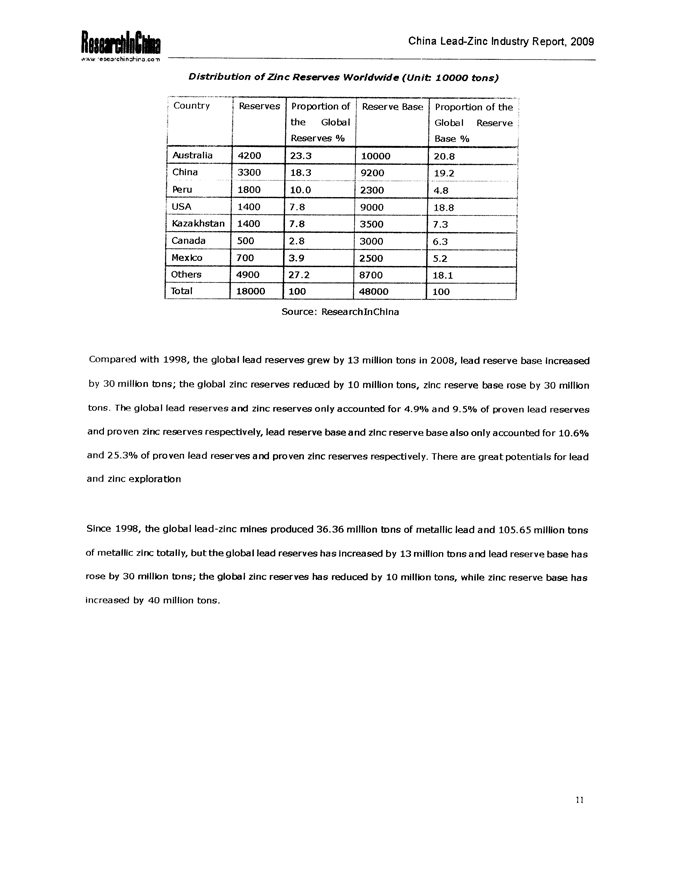

Industry Overview, page 42

| Comment | 46. Please provide us supplementally with the Research in China report that you reference in this section. Please note that you should remove any references for which you cannot provide independently verifiable support. |

| Response: | The Research in China report has been included as Exhibit A to this response. All references for which the Company cannot provide independently verifiable support have also been removed and/or appropriately qualified by stating that such assumption is based on management’s belief. |

Overview of Zinc Industry, page 42

| Comment: | 47. As you disclose that you have no reserves, it does not appear that this information regarding worldwide reserves is relevant to your company except to suggest that your properties contain reserves because China accounts for a high proportion of total world reserves. Please clarify how this is relevant or remove it. |

| Response: | The Registration Statement has been revised to state that the Company does have zinc reserves as its reserve report has now been completed. As such, the Overview of Zinc Industry section has been retained. |

Production and Demand of Zinc and Lead in China, page 48

| Comment: | 48. Your statement that the increase in production of zinc and lead in China is attributed to the increase in demand for such products conflicts with your disclosure at page 45 that production continued to increase in China despite the reduction in overall demand experienced in 2008. Please revise or advise. |

| Response: | The Registration Statement has been modified in response to this comment to state that the demand for zinc and lead in China increased while the demand worldwide has decreased. Please see page 52 of the Registration Statement. |

Our Mining and Processing Operations, page 49

| Comment | 49. With respect to your mining license, disclose the limitations on total output and provide a cross reference to the relevant risk factor on page 8. |

| Response: | The Company has disclosed the limitations on total output on page 12 of the Registration Statement and has added a cross reference to the relevant risk factor on page 12 thereof. |

Ore Mine Operations, page 49

| Comment | 50. In light of your risk factor on page 7 discussing the risks posed by your use of rudimentary mining methods and "low levels of mechanization," please revise to discuss in greater detail the process by which you extract ore from your mine. |

| Response: | The Company has described the extraction process in greater detail. Please see page 57 to 64 of the Registration Statement. |

Our Exploration Activities in the Exploration Rights Properties, page 54

| Comment | 51. Please disclose whether there are any minimum expenditures or other commitments required to renew your exploration licenses. |

| Response: | The Registration Statement has been modified in response to this comment to state the minimum expenditure requirements to renew our exploration license. Please see page 81 of the Registration Statement. |

Our Products, page 54

| Comment | 52. Your disclosure here appears to be inconsistent with your disclosure in Management's Discussion and Analysis. Specifically, it appears that your 2010 sales were primarily tailings and not the products you list in this section. Please advise. |

Response: | The Registration Statement has been modified in response to this comment. Please see page 42 of the Registration Statement. |

Long-Term Business Strategy, page 55

| Comment | 53. You state that you plan to increase ore production through the improvement and upgrading of up to four mine tunnels. However, it appears from your other disclosure that there are other material obstacles to such a goal, including the use of rudimentary mining methods and the hazardous conditions in your mine. Please address whether your long-term plan includes any remediation of these and any other material obstacles to increasing ore production. |

| Response: | The Registration Statement has been modified in response to this comment. Please see page 70 of the Registration Statement. |

Raw Material and Power Supply, page 56

| Comment | 54. Your statement that the ore mine provides all the zinc and lead ore used in the production and manufacturing of all your products conflicts with your disclosure at page 35 that in 2010 you processed imported ore. Clarify or revise. |

| Response: | The Registration Statement has been modified to state that the Company processed imported ore from other mines that do not have their own processing facilities. Please see page 42 of the Registration Statement. |

Comment 55. Clarify the term "Evergreen" in your discussion of power supply contracts.

| Response: | The Company has removed the relevant discussion on our power supply contracts. |

| Comment | 56. Provide your basis for your belief that you have a cost advantage in most of your long-term power supply contracts, or revise. |

| Response: | The Company has deleted such statement from the Registration Statement. |

Our Major Customers, page 57

| Comment | 57. Update this information to reflect the most current information, such as the information for fiscal year 2010, some of which you provide in a risk factor on page 9. |

| Response: | The Registration Statement has been modified in response to this comment. Please see page 71 of the Registration Statement. |

| Comment | 58. We note your disclosure at page 9 that Huanjiang Mao Nan Autonomous County Nanping Concentrator Co. Ltd. accounted for 29% of your total revenue in 2010 and 57% in 2009. Please explain why this customer does not appear in any of your tables in this section, or revise. |

| Response: | The Company has modified the disclosure in the table located in the section of the Registration Statement titled “Our Major Customers” to state that Huanjiang Mao Nan Autonomous County Nanping Concentrator Co. Ltd accounted for 57% of the Company’s total revenue in the 2010 fiscal year and 29% in the 2009 fiscal year. Please see page 71 of the Registration Statement. |

| Comment | 59. In addition, please disclose whether you have any agreements with your major customers that require them to purchase, or you to sell, specified amounts of products. If so, please file these agreements as material contracts. |

| Response: | There is no agreement with any of the Company’s major customers that require the customer to purchase or the Company to sell specified amounts of products. Please see page 71 of the Registration Statement. |

Competitive Advantage, page 59

Comment 60. Please provide the basis for your beliefs that:

| | · | you own one of the highest quality zinc-lead mines in the region; |

| | · | you are the lowest cost producer; |

| | · | you have good relationships with local government agencies. |

| Response: | The Registration has been revised in response to this comment. Please see pages 72 to 73 thereof. |

Our History and Corporate Structure, page 62 Corporate Overview, page 62

| Comment | 61. Please clarify whether Huanjiang Jinteng Mining Co., Ltd., the company listed in the organizational chart as owning 76.67% of Huanjiang Jintai Mining Co. Limited, is the same company as Huanjiang Jinteng Mining LLC, which is the name listed in Note 13 on page F-16. If so, please revise for consistency. |

| Response: | The Financial Statements have been modified to indicate that these are the same entity. Please see page 53 of the Registration Statement. |

| Comment | 62. Please revise your organizational chart to reflect Mr. Kuizhong Cai's 95% ownership of Huangjian Jinteng Mining Co. Ltd. |

| Response: | The Company has updated the organization chart in the Registration Statement to reflect the transfer of equity interest from Shaoguan Jinteng Mining Co. Ltd to Huanjiang Jinteng Mining Co., Ltd and the correct equity percentage of Mr. Kuizhong Cai in Huanjiang Jinteng Mining Co., Ltd. Please see page 53 of the Registration Statement. |

| Comment | 63. You indicate that Xiangguang will receive a fee from Huanjiang Jintai equal to Huanjiang Jintai's net income for the quarter. However, you do not address any economic benefits going to Huanjiang Jinteng Mining Co. Limited. or Shaoguan Jinteng Mining Co. Ltd. Please expand your disclosure to address this. |

| Response: | The Registration Statement has been modified in response to this comment. Please see page 55 of the Registration Statement. |

| Comment | 64. In this regard, your disclosure speaks as if this structure is already in place. However, it is our understanding that Xiangguang does not yet have all necessary permits and approvals in place. Please advise or revise. Also, tell us whether the effectiveness of the registration statement and commencement of the offering is conditioned upon having obtained those permits and approvals. |

| Response: | Xiangguang obtained its business license on August 24, 2010 and has all the necessary permits and approvals. Please see page 55 of the Registration Statement. |

| Comment | 65. Explain the nature of the "intellectual property rights" that Xiangguang will own. |

| Response: | The Company has deleted this section from the Registration Statement as it does not have any intellectual property rights. |

Directors and Executive Officers, page 68

| Comment | 66. For each of your directors, briefly discuss the specific experience, qualifications, attributes, or skills that led to the conclusion that the person should serve as a director at this time. See Item 401(e) of Regulation S-K. |

| Response: | The Registration Statement has been modified in response to this request. Please see pages 88 to 91 of the Registration Statement. |

Executive Compensation, page 72

| Comment | 67. Please ensure that all compensation information is included in the appropriate tables. In this regard, we note the statement in your disclosure, "[Jintai, please provide the information requested in the below charts]." In addition, please revise the total column of the summary compensation table to reflect the total amount of compensation awarded. |

| Response: | The Registration Statement has been modified in response to this request. Please see page 93 of the Registration Statement. |

| Comment | 68. Please fill in the Outstanding Equity Awards table, or if no awards are outstanding, remove it. |

| Response: | The Company has deleted the Outstanding Equity Awards table from the Registration Statement as no awards have been given to date. |

Financial Statements, page F-1

General

| Comment | 69. We note your disclosure on page 6 that you have not obtained a comprehensive geological survey report indicating the resources or reserves contained in the Ore Mine and the Exploration Rights Properties. As such, no assurance can be given as to the amount of zinc and lead reserves contained in the Ore Mine or in the Exploration Rights Properties. Since you have not established reserves, it does not appear that your planned principal operations have commenced. As such, please identify each of your financial statements as those of an exploration stage entity and revise the presentation of your financial statements to include: |

| | · | A balance sheet that reports cumulative net earnings/loss with a descriptive caption such as earnings accumulated during the exploration stage; and |

| | · | A separate column showing cumulative amounts from the entity's inception on the statements of operations, stockholders' equity, and cash flows. |

| Response: | Based on the reserve report provided by JT Boyd and the fact that the Company has been extracting ore for several years, the Company’s management does not believe it is an exploratory stage entity. As such, the financial statements for the Company were not revised to state that the Company is an exploratory stage company. |

Jintai Mining_Co., Ltd., Financial Statement Index, page F-1

| Comment | 70. We note you have presented the financial statements of an entity named Jintai Mining Co., Ltd. for the fiscal years ended March 31, 2010 and 2009. Please clarify the following: |

| | · | Confirm that the entity presented is Jintai Mining Co., Ltd., as depicted in the chart of your corporate structure on page 62, and explain to us in detail why you believe you have presented the appropriate entity's financial statements in your registration statement. |

| | · | Tell us the subsidiaries of Jintai Mining Co., Ltd. that are included in your financial statements. |

| | · | Explain why Note 13 on page F-16 appears to be describing the capital structure of Huangjiang Jintai Mining Co., Ltd. |

| | · | If the entity presented is Jintai Mining Co., Ltd. and you have consolidated Huangjiang Jintai Mining Co., Ltd., tell us in detail by referring to the appropriate US GAAP accounting literature why you believe it is appropriate to consolidate Huangjiang Jintai Mining Co., Ltd. in the financial statements of Jintai Mining Co., Ltd. at March 31, 2010 and 2009 in light of your disclosures on page 38 that Xiangguang Corporate Management Limited has not yet received its business license and your VIE agreements will not be effective until such license is received. |

| Response: | The Registration Statement has been modified in response to this request. Please see page F-6 of the Registration Statement. |

Report of Independent Registered Public Accounting Finn, page F-2

| Comment | 71. Please have your auditor revise their audit report to identify the city and State where they issued their report, as required by Item 2-02(a)(3) of Regulation S-X. In light of the fact that your operations are located in China, if your auditors are located in the United States, please explain to us in sufficient detail the steps taken by your auditors to complete their audit of your business activities, including the associated assets and liabilities. As part of your response, tell us whether or not another auditing firm was involved in the audit of your operations, and, if so, tell us the name of the firm, the nature of the procedures they performed, and how your auditors considered AU Section 543. |

| Response: | The audit report has been modified to indicate the city and state where the report was issued, in response to this comment. In conducting its audit, representatives from Lake Associates CPA's, including partners and employees, travelled to China to personally inspect and audit the Company's books and records. The Firms staff includes Mandarin and English Staff members. No other auditing firm was engaged in relation to the audit of the Company's financial statements. |

Balance Sheets as of March 31, 2010 and March 31, 2009, page F-3 Statements of Cash Flows, page F-6

| Comment | 72. Please clarify the nature of the amounts designated as foreign currency translation adjustment. In doing so, confirm that the amounts are consistent with ASC 830-230-45-1 and revise the description to match the example provided in ASC 830-230-55-1.73.We note your supplemental disclosure of cash flow information for the year ended March 31, 2010 indicates that you paid income taxes of $2.3 million which is the identical amount you recorded as the tax provision. Please clarify how you calculated this amount given that you included an adjustment to reconcile net income to net cash provided by operating activities of $0.2 million for the year ended March 31, 2010. |

| Response: | The Registration Statement has been modified in response to this request. Please see the notes to the financial statements beginning on page F-6 of the Registration Statement. |

| Comment | 73. We note your supplemental disclosure of cash flow information for the year ended March 31, 2010 indicates that you paid income taxes of $2.3 million which is the identical amount you recorded as the tax provision. Please clarify how you calculated this amount given that you included an adjustment to reconcile net income to net cash provided by operating activities of $0.2 million for the year ended March 31, 2010. |

| Response: | The Registration Statement has been modified in response to this request. Please see the notes to the financial statements beginning on page F-6 of the Registration Statement and our response to comment no. 72. |

Notes to Financial Statements, page F-7 General

| Comment | 74. Please disclose any related parties to include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. If such relationships exist, please describe the nature of any such transactions between related parties. |

| Response: | All related party transactions have been disclosed. Please see page Q-23 of the Registration Statement. |

| Comment | 75. We note your risk factor on page 7 which indicates that your mining activities are subject to extensive environmental regulations. Please tell us and disclose if you have asset retirement and environmental obligations as referenced in ASC 410. In doing so, please tell us the types of reclamation and remediation activities that you are expected to perform over the lives of your mines. |

| Response: | The Registration Statement has been modified in response to this request. Please see page F-8 of the Registration Statement. |

Note 2 Summary of Significant Accounting Policies, page F-7

| Comment | 76. Please include your basis for consolidation as specified in ASC 235-10-50-4(a). In doing so, please include a brief description of the contractual agreements that provide you economic interest in the consolidated operating company. |

| Response: | The Registration Statement has been modified in response to this request. Please see page F-6 of the Registration Statement. |

Cash Equivalents, F-7

| Comment | 77. We note that your cash equivalents include cash on hand. Please disclose the amount of cash on hand for all periods presented and specify the conditions in which such cash is held. |

| Response: | The Registration Statement has been modified in response to this request. Please see page F-6 of the Registration Statement. |

Inventory, page F-7

| Comment | 78. We note your disclosure that your inventory consists of finished goods. Please disclose and tell us how you account for work in progress including stockpiled ore; ore at the mill; and ore on the leach pad. Also expand upon your disclosure to include the types of costs that are capitalized as a component of inventory. In doing so, please tell us if inventory includes amortization of development costs, depreciation of mine infrastructure, and stripping costs. |

| Response: | The Registration Statement has been modified in response to this request. Please see page F-7 of the Registration Statement. |

Accounts Receivable, page F-8

| Comment | 79. We note your disclosure that receivables that are due within one year are classified as noncurrent which seems to imply that you do not expect payment for at least an additional year. Please clarify if this is true. In doing so, please tell us your basis for recording a 10% allowance if payment is not expected within the next twelve months. Similar concerns apply to the other categories of receivables you disclose are due during various time periods. |

| Response: | Accounts receivable are divided into “current receivables” and “non-current receivables”. Current receivables include amounts that are expected to be collected within the next twelve months, while non-current receivables consist of those that the Company anticipates collecting within 36 months. |

Expenditure for Maintenance and Repairs is expensed as Incurred, page F-9

| Comment | 80. Please tell us and disclose how you account for the following costs associated with your mining activities: |

| | · | removal of overburden and other mine waste materials to access minerals; |

| | · | constructing mine infrastructure such as roads, administrative buildings, and mills and smelters utilized in proCessing ore and concentrate; |

| | · | expanding the existing ore mine; |

| | · | performing surface reconnaissance; |

| | · | drilling and sampling; and |

| | · | preparing feasibility and engineering studies. |

In doing so, please provide the relevant citations under US GAAP

| Response: | The Registration Statement has been modified in response to this request. Please see page F-8 of the Registration Statement. |

Foreign Currency Translation, page F-9

| Comment | 81. We note your disclosure that your functional currency is the RMB and your reporting currency is the US dollar. We further note that monetary assets and liabilities denominated in a currency other than the US dollar are translated at the balance sheet rate and the exchange differences are recorded in other expenses. However the translation of monetary assets and liabilities denominated in RMB and held by a RMB functional entity would generally not impact the statements of operations. Please clarify that this disclosure is consistent with ASC 830-20-35-1 through 2 and revise or advise. |

| Response: | The Registration Statement has been modified in response to this request. Please see page F-9 of the Registration Statement. |

Note 3 Short-term Investment Receivable, page F-11

| Comment | 82. Please clarify the nature and terms of your short-term investment receivable. |

| Response: | The Registration Statement has been modified in response to this request to state that the short term investment was refunded in the first quarter of 2010. Please see page F-11 of the Registration Statement. |

Note 5 Other Receivables, page F-12

| Comment | 83. Please tell us and disclose the nature and terms of the employee advances, including to whom such advances have been made. In doing so, please clarify if these advances are available to all employees. |

| Response: | The Registration Statement has been modified to indicate that employee advances are available only to sales and procurement personnel. Please see page F-12 of the Registration Statement. |

Note 7 Land, Plant, and Equipment, Mining Right and. Exploration Right, page F-13

| Comment | 84. We note you present a single line item for "Land, plant, and equipment." Please tell us how you have considered ASC 360-10-50-1(b). As part of your response, please also describe to us what is included in your "Construction in progress" balance. |

| Response: | The Registration Statement has been modified in response to this request. Please see page F-13 of the Registration Statement. |

Note 12 Income Taxes, page F-15

| Comment | 85. We note your disclosure which indicates that there are no temporary differences between financial statement carrying amounts and the tax bases of existing assets and liabilities. For each jurisdiction in which you operate, please tell us the amount you reported as taxable income (as filed with the taxing authorities) as well as the amount of financial accounting income before income taxes for each of the two years ended March 31, 2010. |

| Response: | The Registration Statement has been modified in response to this request to state that all taxable income is related to the Company’s operations in China. Please see page F-14 of the Registration Statement. |

| Comment | 86. We further note your disclosure under "Land, plant and equipment, mining right, and exploration right" on page F-8, which indicates that such assets are depreciated on a straight line basis over the expected useful lives of the assets for book purposes. Please tell us the method of depreciation used for tax purposes and clarify why you have not recorded any deferred tax assets or liabilities to the extent that the deprecation timeframe differs. |

| Response: | The Registration Statement has been modified in response to this request to state that the straight-line depreciation method is the preferred depreciation method under the tax laws of the PRC and as such, there is no difference in timing and no deferred tax assets or liabilities recorded. Please see page F-13 of the Registration Statement. |

Note 13 Capital Transaction, page F-16

| Comment | 87. You indicate that in December 2009, you executed simultaneous capital transactions resulting in various changes to your ownership. Please explain to us why such transactions do not appear on your statements of stockholders' equity. |

| Response: | The Registration Statement has been modified in response to this request to state that the transaction was between outside shareholders and as such, there was no impact on the statement of stockholder’s equity. Please see page F-16 of the Registration Statement. |

Note 16 Segment Information, page F-18

| Comment | 88. We note that you determined that the company did not have any separately reportable operating segments as of March 31, 2010 and 2009. However, we note your disclosure on page 1 which specifies that you are a vertically integrated company engaged in the exploration, mining, leaching, smelting and other processing operations of zinc and lead. We note from page 61 that a majority of your employees appear to be engaged in smelting and processing activities. Please clarify if you process minerals, concentrated ore for third parties and tell us whether or not your exploration, mining, leaching, smelting and other processing operations of zinc and lead represent separate operating segments as defined in ASC 280-10-50-1. If you do not believe these activities represent separate operating segments, please tell us in detail why not. If you believe these activities represent separate operating segments and meet the criteria discussed in ASC 28040-50-11 for aggregation of all of these operating segments into one reportable segment, provide us with the analysis you performed in reaching this conclusion. If after reassessing the criteria in ASC 280, you believe that your operating segments represent separate reportable segments, revise your financial statements and related disclosures accordingly. |

| Response: | ASC 280-10-50 states three characteristics of an operating segment. The Company believes that it does not meet characteristic (b) which states that the company’s “operating results are regularly reviewed by the public entity’s chief operating decision maker, to make decisions about resource to be allocated to the segment and assess performance.” |

The chief decision maker in the Company does not receive segregated information regarding exploration, mining and smelting. All key decisions presently are on the entity as a whole. Further, the accounting systems used by the Company are very basic and records are not adequate to provide a segment reporting analysis that the SEC discusses. Further, there is no cost benefit to the Company for the additional reporting.

Management believes that based on its present operations, segment reporting would presently add no value for the Company’s shareholders and/or investors since segment reporting would require extensive upgrades in the Company’s current accounting systems. Further, the Company believes that segment reporting based on geographic location would not apply since the Company operates a single mine located in China.

Exhibits, page 11-6

| Comment | 89. Please file all remaining exhibits as soon as practicable, including the underwriting and lock-up agreements. We note that your exhibit list contains astrices next to several exhibits, apparently to indicate that you will file the marked exhibits in subsequent amendments. However, no explanation is provided. |

| Response: | The Company will file all available exhibits to the Registration Statement and add an explanation as to those to be filed with subsequent amendments. |

| Comment | 90. We note that you have filed unsigned, draft versions of the vast majority of your exhibits. Please file the executed versions with your next amendment. |

| Response: | All executed versions of the various agreements have been included as exhibits to the Registration Statement. |

| Comment | 91. With respect to the material contracts constituting the "VIE agreements," please confirm that the Chinese characters included in these documents are translations of the English text. To the extent that they differ materially, provide an English translation. |

| Response: | The Company hereby confirms the Chinese characters included in these documents are true and correct translations of the English text. |

Engineering Comments General, page 1

| Comment | 92. We note your statement that you are a vertically integrated mining company operating a mine at Shangchao, Huanjiang County, Guangxi Province, PRC, and that this mine does not have reserves. Without reserves, the only stage permissible for your company is that of the exploration state. Please amend your filing to reflect this status. In doing so, please revise the presentation of your financial statements and footnotes to clearly identify your activities as being in the exploration stage until such time as your have reserves as defined in the Guide. |

| | · | Please revise your disclosure to ensure that investors understand that you are in the exploration stage. |

| | · | Please remove the terms "develop," "development" or "production" throughout the document, and replace them, as needed, with the terms "explore" or "exploration." This includes the using of the terms in the Financial Statement headnotes and footnotes see Instruction 1 to paragraph (a), Industry Guide 7.Remove all references in the document that use the term "mining" or "mining operations," or any term that can imply mineral production, such as "operations." In particular, substitute the term "mineral exploration" for "mining operations." |

| | · | Under SEC Industry Guide 7, the terms "ores" or "orebody" are treated the same as the term "reserve." Remove these terms from the document. |

You should indicate that you are an exploration stage company and that there is no assurance that a commercially viable mineral deposit exists on any of your properties, and that further exploration will be required before a final evaluation as to the economic and legal feasibility is determined. See Industry Guide 7(a)(4).

| Response: | Please refer to page 2-3 of the JT Boyd Report which is exhibit 99.2 to the Registration Statement. The Company does have reserves, as stated in the report and accordingly, the Company has retained the references. |

Overview of Zinc Industry, page 42

| Comment | 93. Please note that the common definition for the term reserve base includes the aggregate of sub-economic and/or uneconomic materials with economic ore. To avoid confusion with reserves as proscribed by Industry Guide 7, please remove the term reserve base from your filing. |

| Response: | The term “reserve base” has been deleted from the Registration Statement. |

Ore Mine Operations, page 49

| Comment | 94. Please disclose your annual materials mined and processed as required by Regulation S-K, Instructions to Item 102, Part 3. This would include your mine site tonnage and grades, the tonnage and grades of your concentrates, and your salable product quantities processed by your smelter. Please list your average unit price received for each of your salable products. |

| Response: | The Registration Statement has been modified in response to this request. Please see page 46-47 of the Registration Statement. |

Applicable Government Regulation, page 59

| Comment | 95. We note you conform to PRC safety and environmental regulations. Please provide a short summary of the permits and/or operational plans required for your properties. Please disclose your performance history along with your objectives for promoting improvements in those areas. In an appropriate section of your filing, please include a discussion of your safety performance referencing capital expenditures, your safety programs, and statistical measures, such as your total reportable injuries, lost-time injuries and fatal injuries that your organization utilizes to monitor performance. |

| Response: | The Registration Statement has been modified in response to this request. Please see page 73 to 78 of the Registration Statement. |

Description of Property, page 62

| Comment | 96. Please improve the legibility of the charts and tables you present on pages 64. |

| Response: | All charts and tables have been replaced in response to this comment. |

| Comment | 97. Your maps should also show the location and access to each material property, as required by Instruction 3(b) to Item 102 of Regulation S-K. We believe the guidance in 3(b) of Rule 102 of Regulation S-K would generally require maps and drawings to comply with the following features: A legend or explanation showing, by means of pattern or symbol, every pattern or symbol used on the map or drawing. A graphical bar scale should be included. Additional representations of scale such as "one inch equals one mile" may be utilized provided the original scale of the map has not been altered. |

| | · | An index map showing where the property is situated in relationship to the state or province, etc., in which it was located. |

| | · | A title of the map or drawing, and the date on which it was drawn. |

| | · | In the event interpretive data is submitted in conjunction with any map, the identity of the geologist or engineer that prepared such data. |

Any drawing should be simple enough or of sufficiently large scale to clearly show all features on the drawing.

Response: All requested maps have been included in the Registration Statement.

Current Mining Operation, page 65

| Comment | 98. Please disclose a brief description of the rock formations and mineralization of existing or potential economic significance on your property as required under paragraph (b) of Industry Guide 7 for all your material properties. In addition to your mine description, you should describe in more detail, your concentrating, and smelting facilities. You may refer to Industry Guide 7, available on our website at the following address: www.sec.gov/about/fonnstindustryguides.pdf |

| Response: | The Registration Statement has been modified in response to this request. Please see page 86 of the Registration Statement. |

| Comment | 99. On a related point, it appears you should also expand your disclosure concerning the exploration plans for the properties to address the following points. |

| | · | Disclose a brief geological justification for each of the exploration projects written in non-technical language. |

Give a breakdown of the exploration timetable and budget, including estimated amounts that will be required for each exploration activity, such as geophysics, geochemistry, surface sampling, drilling, etc. for each prospect.

| | · | If there is a phased program planned, briefly outline all phases. |

| | · | If there are no current detailed plans to conduct exploration on the property, disclose this prominently. |

| | · | Disclose how the exploration program will be funded. |

| | · | Identify who will be conducting any proposed exploration work, and discuss what their qualifications are. |

| Response: | In response to this comment, the Registration Statement has been revised to include a presentation of the exploration program for the Company’s Shangchao Mine and exploration right properties. Please see page 66 of the Registration Statement. |

| Comment | 100. Please disclose whether you have a geologist or mining engineer's report for each of your material properties. |

| Response: | The Registration Statement has been modified to state that J.T. Boyd has provided a resource report for the Company’s mining properties. |

| Comment | 101. Supplementally provide a description of the adequacy of your current tailings containment facilities. Also describe your plans for any additions or expansions of tailings containment facilities, and what effect, if any, the addition will have on your expected mining rate. |

| Response: | Attached as Exhibit B hereof is a description of the Company’s current tailing containment facilities. Such Exhibit further describes the Company’s plans for any additions or expansions of its tailing containment facilities. |

We trust that the foregoing is responsive to the Staff’s comments. Please do not hesitate to call me at (212) 752-9700 if you have any further questions.

| | Very truly yours, | |

| | | |

| | /s/ Arthur Marcus, Esq. | |

| | Arthur Marcus, Esq. | |