Registration No. 333-168803

WASHINGTON, D.C. 20549

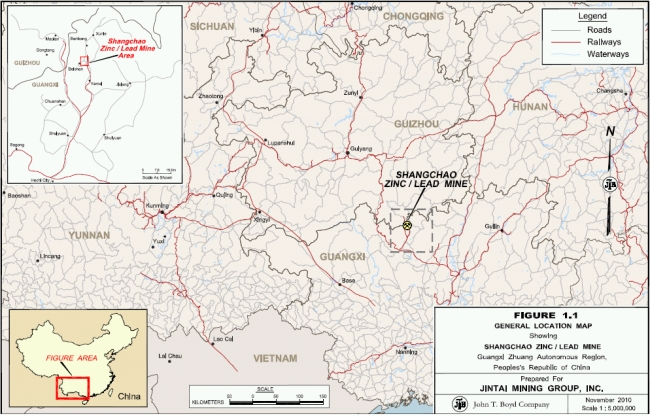

JINTAI MINING GROUP, INC.

No. 48 Qiaodong Road, Sien Town,

National Corporate Research, Ltd.

615 S. Dupont Highway

Approximate date of commencement of proposed sale to the public: As soon as practicable after the

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 (the “Securities Act”) or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

This registration statement contains two forms of prospectus, as set forth below:

The Public Offering Prospectus and the Selling Stockholder Prospectus will be identical in all respects except for the following principal points:

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

JINTAI MINING GROUP, INC.

We are offering 6,000,000 shares of our common stock. We expect the initial public offering price of the shares to be between $4.00 and $6.00 per share. Currently, no public market exists for our common stock. We intend to apply for the listing of the shares on the NYSE Amex Equities under the symbol “JTI”, however no assurance can be given that our application will be approved. If the application is not approved, we will not complete this offering.

Investing in our common stock involves a high degree of risk. Please see the section entitled "Risk Factors" starting on page 6 of this prospectus to read about risks that you should consider carefully before buying shares of our common stock.

(1)Based on the mid-point price for this offering.

(2)Does not include a corporate finance fee equal to 1% of the gross proceeds, or $0.05 per share, payable to the underwriter, Maxim Group, LLC, of which $25,000 has been paid by the Company to the underwriter.

We have granted the underwriter a 45-day option to purchase up to an additional 900,000 shares of our common stock at the public offering price, less the underwriting discount, to cover any over-allotments.

The underwriter expects to deliver the shares against payment in New York, New York, on or about ____, 2011.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This summary contains basic information about us and our securities. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” are forward-looking statements and may involve a number of risks and uncertainties. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

The following summary highlights some of the information in this prospectus. It may not contain all of the information that is important to you. To understand this offering fully, you should read the entire prospectus carefully, including the risk factors and our financial statements and the notes accompanying the financial statements appearing elsewhere in this prospectus.

We will seek to implement numerous strategies to expand the size of our Company and continue efficient operating advantages. Our strategies include:

Based on management’s assessment, we believe that our relationship with local government and provincial government is strong and mutually beneficial. We are not aware of any current problems and are not aware of any reason why this strong relationship would not continue over the foreseeable future.

Failure to abide by certain requirements with regard to the transfer of certain state-owned assets to Huanjiang Jintai’s prior shareholder may cause such transfer to be invalidated and could have a material adverse affect on the transaction.

Future inflation in China may inhibit economic activity and adversely affect our operations.

The Chinese economy has experienced periods of rapid expansion in recent years which has led to high rates of inflation and deflation. This has caused the PRC government to, from time to time, enact various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the PRC government to once again impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China. Any action on the part of the PRC government that seeks to control credit and/or prices may adversely affect our business operations.

A slowdown or other adverse developments in the PRC economy may materially and adversely affect our customers, demand for our products and our business.

We are a holding company and of our operations are entirely conducted in the PRC. In addition, all of our revenues are currently generated from sales in the PRC. Although the PRC economy has grown at a remarkable pace in recent years, we cannot assure you that such growth will continue. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC may materially reduce the demand for our products and have a materially adverse affect on our business.

We may be restricted from freely converting the Renminbi (“RMB”) to other currencies in a timely manner.

At the present time, the RMB is not a freely convertible currency. We receive all of our revenue in RMB, which may need to be converted to other currencies, primarily U.S. dollars, in order to be remitted outside of the PRC. Effective July 1, 1996, foreign currency “current account” transactions by foreign investment enterprises are no longer subject to the approval of State Administration of Foreign Exchange (“SAFE,” formerly, “State Administration of Exchange Control”), but need only a ministerial review, according to the Administration of the Settlement, Sale and Payment of Foreign Exchange Provisions promulgated in 1996 (the “FX regulations”). “Current account” items include international commercial transactions, which occur on a regular basis, such as those relating to trade and provision of services. Distributions to joint venture parties also are considered “current account transactions.” Other non-current account items, known as “capital account” items, remain subject to SAFE approval. Under current regulations, we can obtain foreign currency in exchange for RMB from swap centers authorized by the government. No assurance can be given that foreign currency shortages or changes in currency exchange laws and regulations by the PRC government will not restrict us from freely converting RMB in a timely manner.

Our PRC subsidiary is subject to restrictions on paying dividends and making other payments to us.

We are a holding company incorporated in Delaware and do not have any assets or conduct any business operations other than our investments in our subsidiaries. As a result of our holding company structure, we rely primarily on dividend payments from our subsidiaries. However, PRC regulations currently permit payment of dividends only out of accumulated profits, as determined in accordance with PRC accounting standards and regulations. Our subsidiary in PRC is also required to set aside a portion of their after-tax profits according to PRC accounting standards and regulations to fund certain reserve funds. Further, we may experience difficulties in completing the administrative procedures necessary to obtain any dividends due to us, which could materially affect our financial operations.

Due to various restrictions under PRC laws on the distribution of dividends by our PRC operating companies, we may not be able to pay dividends to our shareholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended and the Wholly-Foreign Owned Enterprise Law Implementing Rules (2001), as amended and the Company Law of the PRC (2006) contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises (“WFOE”) may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, a WFOE is required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes.

Furthermore, if our consolidated subsidiary in China incurs debt on its own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our consolidated subsidiary are unable to receive all of the revenues from our operations due to these contractual or dividend arrangements, we may be unable to pay dividends to our shareholders. In addition, under current PRC law, we must retain a reserve equal to 10 percent of net income after taxes each year, with the total amount of the reserve not to exceed 50 percent of registered capital. Accordingly, this reserve will not be available to be distributed as dividends to our shareholders. We presently do not intend to pay dividends in the foreseeable future. Our management intends to follow a policy of retaining all of our earnings to finance the development and execution of our strategy and the expansion of our business.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of foreign currency out of the PRC. We receive all of our revenues in RMB, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our subsidiaries’ ability to remit sufficient foreign currency to pay dividends due to us, or otherwise satisfy foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where RMB is to be converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

Fluctuations in the exchange rate could have an adverse effect upon our business and reported financial results.

We conduct our business in RMB, thus our functional currency is the RMB, while our reporting currency is the U.S. dollar. The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, the political situation as well as economic policies and conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging its currency to the U.S. currency. Under that policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximate 21% appreciation of the RMB against the U.S. dollar between 2005 and 2008. However, the PRC government decided to repeg the RMB to U.S. dollars in response to the financial crisis in 2008. On June 19, 2010, China ended the pegging of the RMB to the U.S. dollar, allowing for a greater flexibility of its exchange rate. There remains significant international pressure on the significant appreciation of the RMB against the U.S. dollar. To the extent any of our future revenues are denominated in currencies other than the U.S. dollar, we would be subject to increased risks relating to foreign currency exchange rate fluctuations which could have a material adverse affect on our financial condition and operating results since operating results are reported in United States dollars and significant changes in the exchange rate could materially impact our reported earnings.

Changes in PRC State Administration of Foreign Exchange (“SAFE”) Regulations regarding offshore financing activities by PRC residents may increase the administrative burden we face and create regulatory uncertainties that could adversely affect the implementation of our acquisition strategy.

In 2005, SAFE promulgated regulations which require registrations with, and approval from, SAFE on direct or indirect offshore investment activities by PRC legal person resident and/or natural person resident. The SAFE regulations require that if an offshore company formed by or controlled by PRC legal person resident and/or natural person resident, whether directly or indirectly, intends to acquire a PRC company, such acquisition shall be subject to strict examination and registration with SAFE. Without such registration, the PRC entity cannot remit any of its profits out of the PRC, whether as dividends or otherwise. As such, the failure by our shareholders who are PRC residents to make any required applications, filings or registrations pursuant to such SAFE regulations may prevent us from being able to distribute profits and could expose us, as well as our PRC resident shareholders to liability under PRC law.

If we make equity compensation grants to persons who are PRC citizens, they may be required to register with SAFE. We may also face regulatory uncertainties that could restrict our ability to adopt equity compensation plans for our directors and employees and other parties under PRC laws.

On April 6, 2007, SAFE issued the “Operating Procedures for Administration of Domestic Individuals Participating in the Employee Stock Ownership Plan or Stock Option Plan of An Overseas Listed Company, also known as “Circular 78”. It is not clear whether Circular 78 covers all forms of equity compensation plans or only those which provide for the granting of stock options. For any plans which are so covered and are adopted by a non-PRC listed company, such as our company, after April 6, 2007, Circular 78 requires all participants who are PRC citizens to register with and obtain approvals from SAFE prior to their participation in the plan. In addition, Circular 78 also requires PRC citizens to register with SAFE and make the necessary applications and filings if they participated in an overseas listed company’s covered equity compensation plan prior to April 6, 2007. We believe that the registration and approval requirements contemplated in Circular 78 will be burdensome and time consuming.

We intend to adopt an employee stock option plan and we may adopt other equity incentive plan and make stock option grants under these plans to our officers, directors and employees, some of whom are PRC citizens and may be required to register with SAFE. If it is determined that any of our equity compensation plans are subject to Circular 78, failure to comply with such provisions may subject us and participants of our equity incentive plan who are PRC citizens to fines and legal sanctions and prevent us from being able to grant equity compensation to our PRC employees. In that case, our ability to compensate our employees and directors through equity compensation would be hindered and our business operations may be adversely affected.

As all of our operations and personnel are in the PRC, we may have difficulty establishing adequate western style management, legal and financial controls.

The PRC historically has been deficient in western style management and financial reporting concepts and practices, as well as in modern banking, and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, and especially given that we expect to be a publicly listed company in U.S. and subject to regulation as such, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet western standards. We may have difficulty establishing adequate management, legal and financial controls in the PRC. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act and other applicable laws, rules and regulations. This may result in significant deficiencies or material weaknesses in our internal controls which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our business and the public announcement of such deficiencies could adversely impact our stock price.

Because our principal assets are located outside of the United States and most of our directors and officers reside outside of the United States, it may be difficult for an investor to enforce any right founded on U.S. Federal Securities Laws against us and/or our officers and directors, or to enforce a judgment rendered by a United States court against us or our officers and directors.

Our operation and principle assets are located in the PRC, and most of our officers and directors are non-residents of the United States. Therefore, it may be difficult to effect service of process on such persons in the United States, and it may be difficult to enforce any judgments rendered against us or our officers and/or directors. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in China in the event that you believe that your rights have been infringed under the securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the PRC may render you unable to enforce a judgment against our assets or the assets of our directors and officers. As a result of all of the above, our shareholders may have more difficulty in protecting their interests through actions against our management, directors or major shareholders compared to shareholders of a corporation doing business entirely within the United States.

Because our assets are located overseas, shareholders may not receive distributions that they would otherwise be entitled to if we were declared bankrupt or insolvent.

Because all of our assets are located in the PRC, they may be outside of the jurisdiction of U.S. courts to administer if we become subject of an insolvency or bankruptcy proceeding. As a result, if we declared bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were to be located within the U.S., under U.S. Bankruptcy laws.

New labor laws in the PRC may adversely affect our results of operations.

On January 1, 2008, the PRC government promulgated the Labor Contract Law of the PRC, or the New Labor Contract Law. The New Labor Contract Law imposes greater liabilities on employers and significantly impacts the cost of an employer’s decision to reduce its workforce. Further, it requires certain terminations to be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost effective manner, thus materially and adversely affecting our financial condition and results of operations.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Certain of our customers are PRC government entities and our dealings with them are likely to be considered to be with government officials for these purposes. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. We could suffer severe penalties if our employees or other agents were found to have engaged in such practices

Our bank accounts are not insured or protected against loss.

We maintain our cash with various banks and trust companies located in China. Our cash accounts are not insured or otherwise protected. Should any bank or trust company holding our cash deposits become insolvent, or if we are otherwise unable to withdraw funds, we would lose the cash on deposit with that particular bank or trust company.

Under the PRC Enterprise Income Tax Law, we may be classified as a “resident enterprise” of the PRC. Such classification could result in PRC tax consequences to us and our non-PRC resident enterprise shareholders.

On March 16, 2007, the National People’s Congress approved and promulgated a new tax law, the PRC Enterprise Income Tax Law, or “EIT Law”, which took effect on January 1, 2008. Under the EIT Law, enterprises are classified as resident enterprises and non-resident enterprises. An enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define “de facto management bodies” as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise; however, it remains unclear whether the PRC tax authorities would deem our managing body as being located within China. Due to the short history of the EIT Law and lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of a foreign (non-PRC) company on a case-by-case basis.

If the PRC tax authorities determine we are a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25 percent on our worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, under the EIT Law and its implementing rules, dividends paid between “qualified resident enterprises” are exempt from enterprise income tax. As a result, if we are treated as a “qualified resident enterprise,” all dividends that we receive from Xianguang (assuming such dividends are considered sourced within the PRC) should be exempt from PRC tax. If we are treated as a “non-resident enterprise” under the EIT Law, then dividends that we receive from Xianguang (assuming such dividends are considered sourced within the PRC) may be subject to a 10 percent PRC withholding tax. Any such tax on dividends could materially reduce the amount of dividends, if any, we could pay to our shareholders.

Finally, the new “resident enterprise” classification could result in a situation in which a 10 percent PRC tax is imposed on dividends we pay to our institutional, but not individual, investors that are not tax residents of the PRC (“non-resident investors”) and gains derived by them from transferring our common stock, if such income is considered PRC-sourced income by the relevant PRC tax authorities. In such event, we may be required to withhold a 10 percent PRC tax on any dividends paid to our non-resident investors. Our non-resident investors also may be responsible for paying PRC tax at a rate of 10 percent on any gain realized from the sale or transfer of our common stock in certain circumstances. We would not, however, have an obligation to withhold PRC tax with respect to such gain under the PRC tax laws.

PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds from this offering to make loans our PRC subsidiary and Huanjiang Jintai or additional capital contributions to our PRC subsidiary.

In utilizing the proceeds from this offering, we may make loans to our PRC subsidiary and Huanjiang Jintai, or we may make additional capital contributions to our PRC subsidiary. Both loans and additional capital contributions are subject to PRC regulations, including registration and approval requirements. If we lend money to our PRC subsidiary or Huanjiang Jintai, such a loan must be approved by the relevant government authorities and registered with SAFE or its local counterpart. If we finance our PRC subsidiary through additional capital contributions, the amount of these capital contributions must be approved by MOFCOM or its local counterparts.

In addition, on August 29, 2008, SAFE promulgated Circular 142, a notice regulating the conversion by a foreign-invested company of foreign currency into RMB by restricting how the converted RMB may be used. Circular 142 requires that RMB converted from the foreign currency-denominated capital of a foreign-invested company may only be used for purposes within the business scope approved by the applicable governmental authority and may not be used for equity investments within the PRC unless specifically provided for otherwise in its business scope. In addition, SAFE strengthened its oversight over the flow and use of RMB funds converted from the foreign currency-denominated capital of a foreign-invested company. The use of such RMB fund may not be changed without approval from SAFE or its local counterparts, and may not be used to repay RMB loans if the proceeds of such loans have not yet been used. Violations of Circular 142 may result in severe penalties, including substantial fines as set forth in the Foreign Exchange Administration Regulations.

We cannot assure you that we will be able to obtain the required government registrations or approvals on a timely basis, if at all, with respect to future loans made to our PRC subsidiary and Huanjiang Jintai or additional capital contributions made by us to our PRC operating subsidiary. If we fail to receive such registrations or approvals, our ability to use the proceeds from this offering and to fund our operations in China would be negatively affected, which would adversely and materially affect our liquidity and our ability to expand our business.

Our Chairman of the Board and President and his affiliates control us through their stock ownership and their interests may differ from other shareholders.

Mr. Kuizhong Cai, our President and Chairman of our Board of Directors, Mr. Yuan Lin, our Chief Executive Officer, Mr. Zhiming Jiang and Mr. Weiheng Cai will beneficially own approximately an aggregate of 76.2% of our issued and outstanding common stock after the sale of the shares offered pursuant to this offering and the conversion of the Convertible Notes. As a result, they have the ability to influence the outcome of shareholder votes on various matters, including the election of directors, as well as extraordinary corporate transactions such as business combinations. The interest of these individuals may differ from those of minority shareholders and no assurance can be given that such directors will act in our best interest or those of the minority shareholders.

The elimination of monetary liability against our directors, officers and employees under our certificate of incorporation and the existence of indemnification of our directors, officers and employees under Delaware law may result in substantial expenditures by us and may discourage lawsuits against our directors, officers and employees.

Our certificate of incorporation contains provisions which eliminate the liability of our directors for monetary damages to us and our stockholders to the maximum extent permitted under the corporate laws of Delaware. We may also provide contractual indemnification obligations under agreements with our directors, officers and employees. These indemnification obligations could result in our incurring substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees, which we may be unable to recoup. These provisions and resultant costs may also discourage us from bringing a lawsuit against directors, officers and employees for breach of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors, officers and employees even though such actions, if successful, might otherwise benefit us and our shareholders.

Because of our cash requirements as well as potential government restrictions, we may be unable to pay dividends.

The payment of dividends to our shareholders would require payment of dividends to us by our PRC subsidiary and controlled company. This, in turn, would require a conversion of RMB into US dollars and repatriation of funds to the United States. Although our subsidiary, Xiangguang, is classified as a wholly-owned foreign enterprise under PRC law and is thus permitted to declare dividends and repatriate our funds to the Delaware parent company in the United States, any change in this status or the regulations permitting such repatriation could prevent it from doing so. Any inability to repatriate funds to us as the Delaware parent company would in turn prevent payments of dividends to our shareholders.

We will incur increased costs as a public company which may affect our profitability.

Prior to this offering, Huanjiang Jintai operated as a private company in China. As a public company, we, and consequently, Huanjiang Jintai, will incur significant legal, accounting and other expenses that it did not incur as a private company. We will be subject to the SEC’s rules and regulations relating to public disclosure. SEC disclosures generally involve a substantial expenditure of financial resources. In addition, the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, required changes in corporate governance practices of public companies. We expect that compliance with these rules and regulations will significantly increase our legal and financial compliance costs and some activities will be more time-consuming and costly. For example, we will be required to maintain independent board committees and adopt policies regarding internal controls and disclosure controls and procedures. Management may need to increase compensation for senior executive officers, engage senior financial officers who are able to adopt financial reporting and control procedures, allocate a budget for an investor and public relations program, and increase our financial and accounting staff in order to meet the demands and financial reporting requirements as a public reporting company. Such additional personnel, public relations, reporting and compliance costs may negatively impact our financial results.

Generally, we have not paid any cash dividends to our shareholders and no cash dividends will be paid in the foreseeable future.

We do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. Even if the funds are legally available for distribution, we may nevertheless decide or may be unable to pay any dividends. At the present time, we intend to retain all earnings for our operations.

We may need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our shareholders.

We believe that our current cash and cash equivalents, anticipated cash flow from operations and the net proceeds from this offering will be sufficient to meet our anticipated cash needs for the next twelve (12) months. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If our resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain additional credit. The sale of additional equity securities could result in additional dilution to our shareholders. Incurring indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

The potential sale, either pursuant to this registration statement or Rule 144, of a significant number of our shares may decrease the market price of our common stock and encourage short sales by third parties.

Actual sales, or the prospect of sales by our shareholders pursuant to this prospectus or under Rule 144, may have a negative effect on the market price of the shares of our common stock. We may also register certain shares of our common stock in the future or those reserved for issuance under our stock option plans. Once such shares are registered, they can be freely sold in the public market upon exercise of the options. At any given time, if any of our shareholders either individually or in the aggregate cause a large number of securities to be sold in the public market, or if the market perceives that these holders intend to sell a large number of securities, such sales or anticipated sales could result in a substantial reduction in the trading price of shares of our common stock and could also impede our ability to raise future capital.

The presence of short sellers in our common stock may further depress the price of our common stock. If a significant number of shares of our common stock are sold, the market price of our common stock may decline. Furthermore, the sale or potential sale of the offered securities pursuant to a prospectus and the depressive effect of such sales or potential sales could make it difficult for us to raise funds from other sources.

The market price for our stock may be volatile.

The market price for our stock may be volatile and subject to wide fluctuations in response to factors including the following:

Our operating results may fall below the expectations of our investors and that of securities analysts. In this event, the market price of our common stock would likely be materially adversely affected and the value of your investment may decline. In addition, the securities market has from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our stock.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock may be characterized by significant price volatility, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources.

Our common stock may be thinly traded and you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

We intend to apply to have our common stock listed on the NYSE Amex Equities. Our common stock may be “thinly-traded”, meaning that the number of persons interested in purchasing our common stock at or near bid prices at any given time may be relatively small or non-existent. This situation may be attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and might be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broad or active public trading market for our common stock will develop or be sustained.

Our management will have broad discretion over the use of the net proceeds from this offering and may not obtain a favorable return on the use of these proceeds.

Our management will have broad discretion in determining how to apply the net proceeds from this offering and may spend the proceeds in a manner that our stockholders may not deem desirable. We currently intend to use the net proceeds that we will receive from this offering to improve our existing mine, explore certain exploration properties, construction of mining machinery and for certain expenses. We cannot assure you that these uses or any other use of the net proceeds of this offering will yield favorable returns or results. See “Use of Proceeds”.

Provisions in our Certificate of Incorporation and By-laws and Delaware law might discourage, delay or prevent a change of control of our company or changes in our management and, therefore, depress the trading price of our common stock.

Provisions of our certificate of incorporation and by-laws and Delaware law may discourage, delay or prevent a merger, acquisition or other change in control that stockholders may consider favorable, including transactions in which you might otherwise receive a premium for your shares of our common stock. These provisions may also prevent or frustrate attempts by our stockholders to replace or remove our management. These provisions include:

In addition, we are subject to Section 203 of the Delaware General Corporation Law, which generally prohibits a Delaware corporation from engaging in any of a broad range of business combinations with an interested stockholder for a period of three years following the date on which the stockholder became an interested stockholder, unless such transactions are approved by our board of directors. The existence of the foregoing provisions and anti-takeover measures could limit the price that investors might be willing to pay in the future for shares of our common stock. They could also deter potential acquirers of our company, thereby reducing the likelihood that you could receive a premium for your common stock in an acquisition.

This prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business” contains forward-looking statements. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations and financial position, business strategy and plans and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

Assuming the sale of all 6,000,000 shares offered herein at a public offering price of $5.000 per share, the midpoint of the range set forth on the cover of this prospectus, our net proceeds after deducting the estimated underwriting discounts and commissions and estimated offering expenses, will be approximately $26,000,000.

We have also undertaken that $1,000,000 raised in this offering shall be placed in escrow for a period of twelve (12) months to be released solely as payment for expenses related to us being a public company such as legal costs associated with the filing of the registration statement, costs related to engaging a transfer agent, an auditing firm and an investor relationship firm, the purchase of directors and officer’s insurance, as well as to cover all other necessary costs and expenses related to being a public company, including costs related to periodic filings that we will be required to make. Our management and officers will not be entitled to procure funds from the escrow account for any other purpose.

If we receive any additional net proceeds from the exercise of the over-allotment option, we anticipate that such additional funds would be used for mergers and acquisitions with companies that we deem will contribute to our growth as a company, and which are in line with our long term strategies. At the present time, we have no agreements in place to acquire any companies.

The allocation of the net proceeds of the offering set forth above represents our estimates based upon our current plans and assumptions regarding industry and general economic conditions and our future revenues and expenditures.

At this time, it is anticipated that the net proceeds from the offering will be sufficient to fully cover the costs to be incurred for the above-mentioned projects. Investors are cautioned, however, that expenditures may vary substantially from these estimates. Investors will be relying on the judgment of our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations, business developments and related rates of growth. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes.

From time to time, we evaluate these and other factors and we anticipate continuing to make such evaluations to determine if the existing allocation of resources, including the proceeds of this offering, are being optimized. Pending such uses, we intend to invest the net proceeds of this offering in direct and guaranteed obligations of the United States, interest-bearing, investment-grade instruments or certificates of deposit.

A $1.00 increase (decrease) in the assumed initial public offering price of $5.00 per share, the midpoint of the range set forth on the cover of this prospectus, would increase (decrease) the net proceeds to us from this offering by approximately $5.6 million, assuming the number of shares offered by us as listed on the cover page of this prospectus remains the same.

our receipt of estimated net proceeds from the sale of 6,000,000 shares of common stock (excluding the 900,000 shares of common stock which the underwriter has the option to purchase to cover over-allotments, if any) in this offering at an offering price of $5.00 per share, and after deducting estimated underwriting discounts and commissions and estimated offering expenses; and

the conversion of the Convertible Notes sold to Ms. Liwen Hu and Mr. Haibin Zhong, the Selling Stockholders, at $5.00 per share, the midpoint of the range set forth on the cover of this prospectus.

You should read this table in conjunction with the sections of this prospectus entitled “Use of Proceeds”, “Summary Financial and Operating Data”, “Management’s Discussion and Analysis of Financial Condition and “Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

As of September 30, 2010, there were four holders of record of our common stock.

If you invest in our securities, your investment will be diluted immediately to the extent of the difference between the initial public offering price per share of common stock you pay in this offering, and the pro forma net tangible book value per share of common stock immediately after this offering.

Pro forma net tangible book value represents the amount of our total tangible assets reduced by our total liabilities after giving effect to the sale of 6,000,000 shares of common stock at an assumed price of $5.00 per share, the midpoint of the range set forth on the cover of this prospectus, in this offering. Tangible assets equal our total assets less goodwill and intangible assets. Pro forma net tangible book value per share represents our pro forma net tangible book value divided by the number of shares of common stock outstanding after giving effect to the issuance of 4,000,000 shares issuable upon conversion of the Convertible Notes. Net tangible book value per share represents the amount of our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of September 30, 2010. As of September 30, 2010, our pro forma net tangible book value was $93.72 million and our pro forma net tangible book value per share was $2.23.

Dilution in net tangible book value per share to new investors represents the difference between the amount per share paid by purchasers of shares in this offering and the net tangible book value per share of common stock immediately after completion of this offering.

After giving effect to the sale of all the shares being sold pursuant to this offering at the offering price of $5.00 per share (the mid-point of the price range for this offering) and after deducting underwriting discount and commission estimated offering expenses payable by us in the amount of $400,000, our net tangible book value would be approximately $93.72 million, or $2.23 per share of common stock. This represents an immediate increase in net tangible book value of $0.85 per share of common stock to existing stockholders and an immediate dilution in net tangible book value of $2.77 per share to new investors purchasing the shares in this offering.

The information above is as of September 30, 2010 and excludes the exercise of the Selling Stockholders’ Warrants issued by us to the Selling Stockholders in August and November 2010.

Our adjusted pro forma net tangible book value after the offering, and the dilution to new investors in the offering, will change from the amounts shown above if the underwriter’s over-allotment option is exercised.

A $1.00 increase (decrease) in the assumed initial public offering price would increase (decrease) our adjusted pro forma net tangible book value per share after this offering by approximately $0.14, and dilution per share to new investors by approximately $0.86, after deducting the underwriting discount and estimated offering expenses payable by us.

Our business is primarily conducted in China and all of our revenues are received and denominated in RMB. Capital accounts of our consolidated financial statements are translated into United States dollars from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of the balance sheet date. Income and expenditures are translated at the average exchange rate of the period. RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into United States dollars at the rates used in translation.

The following management’s discussion and analysis should be read in conjunction with our consolidated financial statements and the notes thereto and the other financial information appearing elsewhere in this item. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “may”, “will”, “could”, “expect”, “anticipate”, “intend”, “believe”, “estimate”, “plan”, “predict”, and similar terms or terminology, or the negative of such terms or other comparable terminology. Although we believe the expectations expressed in these forward-looking statements are based on reasonable assumptions within the bounds of our knowledge of our business, our actual results could differ materially from those discussed in these statements. Factors that could contribute to such differences include, but are not limited to, those discussed in the “Risk Factors” section of this Prospectus. We undertake no obligation to update publicly any forward-looking statements for any reason even if new information becomes available or other events occur in the future.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States. See “Exchange Rate Information” section for information concerning the exchanges rates at which Renminbi (“RMB”) were translated into U.S. Dollars (“USD”) at various pertinent dates and for pertinent periods.

We were incorporated under the laws of the State of Delaware on June 14, 2010. Our operations are based in Guangxi Province, China. We are a vertically-integrated mining and refined zinc and lead mineral producer with exploration, mining, leaching, smelting and further processing operations.

SIX MONTHS ENDED SEPTEMBER 30, 2010 COMPARED WITH SIX MONTHS ENDED SEPTEMBER 30, 2009

For the six months ended September 30, 2010, gross profit was $13.42 million, representing an increase of approximately $6.54 million or 95.2%, as compared to $6.88 million for the same period of 2009.

General and administrative expenses increased by approximately 280% or $1.27 million to $ 1.72 million for the six months ended September 30, 2010 from $0.45 million for the same period in 2009. The increase in general and administrative expenses was primarily due to expenses related to our efforts in becoming a publicly reporting company, such as legal costs associated with the filing of the registration statement covering the shares sold under this prospectus, costs related to engaging an auditing firm and costs related to the production of the necessary mining report.

The accompanying financial statements are presented in U.S. Dollars. Our functional currency is the RMB of the PRC. The financial statements are translated into U.S. Dollars from RMB at period-end exchange rates for assets and liabilities, and weighted average exchange rates for revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. For the six months ended September 30, 2010, we recognized a foreign currency translation gain of $735,008 as compared to $58,946 for the same period in 2009.

Net income for the six months ended September 30, 2010 was $9.21 million, an increase of 69.8% or $3.79 million compared to $5.42 million for the same period in 2009. Such increase was due mainly to an increase in our revenue and gross profit, which were direct results of the rebound of non-ferrous metal market prices in 2010, the strong recovery of refined zinc and lead prices and low cost of goods sold.

Cost of goods sold in 2010 and 2009 was $18.43 million and $15.27 million respectively. The cost of goods sold during fiscal year 2010 showed an increase of $3.16 million, or 20.7%.

General and administrative expenses increased by approximately 13.2% or $0.15 million to $ 1.26 million in 2010 from $1.11 million in 2009. The increase in general and administrative expenses was primarily due to an increase in employee salaries, paid bonuses, benefits and administrative costs.

The accompanying financial statements are presented in U.S. Dollars. Our functional currency is the RMB of the PRC. The financial statements are translated into U.S. Dollars from RMB at period-end exchange rates for assets and liabilities, and weighted average exchange rates for revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. For the fiscal year ended March 31, 2010, we recognized a foreign currency translation gain of $34,697.

Net income for the year ended March 31, 2010 was $12.79 million, an increase of 96.5% or $6.28 million compared to $6.51 million for 2009. Such increase was mainly due to our increased overall profit margin resulting from a shift in our sales strategy from the sale of refined zinc products to the sale of tailings in the fiscal year ended March 31, 2010.

Cash and cash equivalents were $6.36 million as of March 31, 2010, an increase of $2.18 million as compared to the balance of $4.18 million as of March 31, 2009. The increase in cash position was mainly due to a reduction in investment spending. Net income in 2010 increased and investments have decreased. As a result, the overall effect on cash and cash equivalents has increased by approximately $2.18 million as compared to the balance in 2009. There was a $16.75 million reduction in investment spending compared to 2009 when $17.1 million was spent on plants, properties and equipments purchases. On the other hand, there was a decrease in operating cash flow compared to 2009 mainly due to accounting error. We re-classified certain amounts representing accounts payable, and other payable due to related party which simultaneously decreased the operating cash flow and increased the cash provided in financing activities.

Net cash provided by operating activities for the year ended March 31, 2010 was $2.05 million, as compared to $19.80 million provided by operating activities for the year ended March 31, 2009. The decrease in net cash provided by operating activities was mainly due to an aggregate increase of approximately $1.52 million in accounts receivable, other receivables, amounts paid in advance and deposits in 2010. Accounts payable has also decreased by $6.95 million compared to 2009. The overall effect was a decrease in the net cash in operating activities.

The main driver for the significant inflow of cash from operating activities in 2009 was due to our business strategy. We undertook several investment projects, such as the construction projects at the mine, which required a large amount of capital for investment expenditures. Therefore, we negotiated better payment terms with suppliers on our procurement activities. During this fiscal 2009, it engendered a large increase in accounts payable of $7.94 million. As a result, the cash outflow decreased accordingly, which coupled with the increases in cash flow from operating activities; meanwhile, we collected other accounts receivable with an amount of $7.76 million from 2008, which also contributed to the increase in cash flow from operations. In 2010, we settled most of our accounts payable as we had available funds collected from our clients. As a result, we had an overall decrease in cash flow from operation in 2010.

Net cash provided by financing activities for the year ended March 31, 2010 was $.44 million compared to $.82 million for the same period in 2009. The decrease was mainly due to a repayment of loans. Due to the large investment expenditures required by the construction projects mentioned above in 2009, we could not rely solely on its self-generated capital to satisfy all these expenditures. In this case, we used moderate financing to support its operating activities, which resulted in an increase in the cash flow from financing. As a result of major investments made in 2009, there were relatively less investment expenditures needed on fixed assets and construction in progress in 2010. Hence, we could use part of our revenues generated from operating activities to repay financing amount owed, resulting in a decrease in the cash flow from financing.

We generated a net operating profit of approximately $15.06 million and $7.16 million during the years ended March 31, 2010 and 2009, respectively.

In August and November 2010, the Selling Stockholders, Ms. Liwen Hu and Mr. Haibin Zhong, purchased an aggregate of $20,000,000 in Convertible Notes from us bearing an interest rate of 3% per annum and were issued an aggregate of 800,000 warrants to purchase shares of our common stock (“Selling Stockholders’ Warrants”). The Convertible Notes automatically convert into common stock upon the effectiveness of this registration statement at the public offering price.

Based on the terms of the Convertible Notes (as amended) upon the effectiveness of this registration statement, the Convertible Notes shall automatically be converted into fully paid and non-assessable shares of our common stock at a conversion price equal to the offering price for the common stock offered herein. The Warrants issued to the Selling Stockholders provided that they are exercisable at a purchase price equal to 110% of the offering price and further provided that in the event that the offering does not occur within ninety (90) days from the date of issuance of the Selling Stockholders’ Warrants, the exercise price shall be four dollars ($4.00) per share. However, on November 26, 2010, the parties agreed to revise the terms of the Warrants to state that they are exercisable at 110% of the offering price of our common stock, without qualification.

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated financial statements requires us to make estimates, judgments and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and the related disclosure of contingent assets and liabilities. We base our estimates on historical experience and on various other assumptions that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

An accounting policy is considered to be critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time the estimates are made, and if different estimates that reasonably could have been used, or changes in the accounting estimates that are reasonably likely to occur, could materially impact the financial statements.

We believe that the following critical accounting policies reflect the significant estimates and assumptions which are used in the preparation of the consolidated financial statements and affect our financial condition and results of operations.

The reporting currency of the Company is the United States dollar (“U.S. dollars”). Transactions denominated in currencies other than the U.S. dollar are calculated at the average rate for the period. Monetary assets and liabilities denominated in currencies other than U.S. dollar are translated into the U.S. dollar at the rates of exchange ruling at the balance sheet date. The resulting exchange differences are recorded in other comprehensive income. The Company maintains its books and records in its local currency, the Renminbi Yuan (“RMB”), which is our functional currency as being the primary currency of the economic environment in which its operations are conducted. In general, the Company translates the assets and liabilities into U.S. dollars using the applicable exchange rates prevailing at the balance sheet date, and the statement of operations is translated at average exchange rates during the reporting period. Adjustments resulting from the translation of the financial statements are recorded as accumulated other comprehensive income.

In preparing these financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets and revenues and expenses during the year reported. Actual results may differ from these estimates. On an ongoing basis, management reviews estimates. Changes in facts and circumstances may alter such estimates and affect results of operations and financial position in future periods.

In accordance with ASC 930-330, ore access costs during the development of a mine, before production begins, are recapitalized as a part of the depreciable cost of building, developing and constructing a mine. These capitalized costs are amortized over the productive life of the mine using the units of production method. The productive phase of a mine is deemed to have begun when saleable minerals are extracted (produced) from an ore body, regardless of the level of production. The production phase does not commence with the removal of de minimis saleable mineral material that occurs in conjunction with the removal of overburden or waste material for purposes of obtaining access to an ore body. The costs incurred in the production phase of a mine are variable production costs included in the costs of the inventory produced (extracted) during the period that the stripping costs are incurred.

Ore access costs related to expansion of a mining asset of proven and probable reserves are variable production costs that are included in the costs of the inventory produced during the period that the costs are incurred.

Mining right, plant, machinery and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

Expenditure for maintenance and repairs is expensed as incurred.

Costs related to mine infrastructure such as roads, buildings and mills, and smelters utilized in processing ore and concentrate are capitalized and depreciated over the estimated useful life

Cost incurred for the performance of surface reconnaissance, drilling and sampling costs as well as preparation of feasibility and engineering studies are expensed as incurred.

Exploration rights are permits to explore the ore capacity underground but without the actual mining right.

Application fees and other expenses related to exploration activities are expensed when occurred

In accordance with guidance issued by the FASB, long-lived assets and certain identifiable intangible assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of assets to estimated discounted net cash flows expected to be generated by the assets. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets.

The FASB issued ASU No. 2010-12 through No. 2010-21. These ASUs, except for No. 2010-13, entail technical corrections to existing guidance or affect guidance related to specialized industries or entities and therefore have minimal, if any, impact on the Company.

In May 2009, the FASB issued a new accounting standard (FASB ASC 855-10) on subsequent events, which establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. This accounting standard establishes: 1) the period after the balance sheet date during which management of a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements; 2) the circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements; and 3) the disclosures that an entity should make about events or transactions that occurred after the balance sheet date. This accounting standard also requires disclosure of the date through which an entity has evaluated subsequent events. The adoption of this statement is not expected to have a material impact on our consolidated financial position or results of operation.

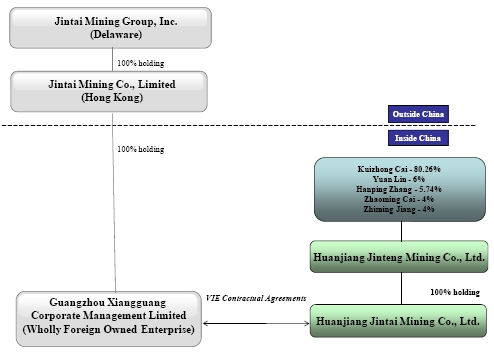

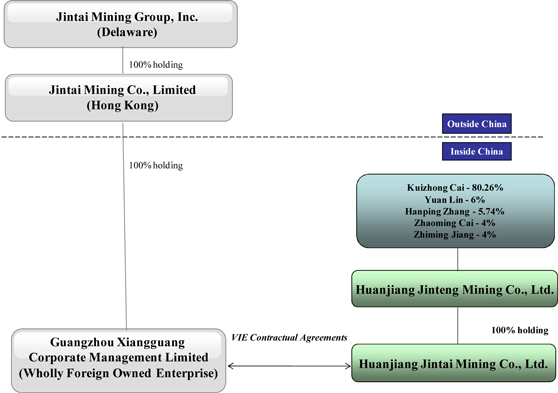

On April 28, 2010, Jintai Mining Co., Limited, a Hong Kong Limited Company, was created which owns Xiangguan, the VIE beneficiary of the operating entity. The operating entity is controlled by Xiangguan through the VIE contractual arrangements.

On June 14, 2010, Jintai Mining Group, Inc. was formed and incorporated in the State of Delaware. Jintai Mining Group, Inc. is the holding company of Jintai HK and is the SEC reporting entity.

On August 3, 2010, Jintai Mining Group, Inc. issued 32,000,000 shares of Common Stock, valued at $3,200 with par value $0.0001 per share, to Jintai Mining Co., Limited.

On August 31, 2010, we entered into a Subscription Agreement (the “Agreement”) with an individual investor. The individual investor, Liwen Hu, purchased a Convertible Note bearing an interest rate of 3% per annum from us. The Convertible Note is automatically convertible into shares of our Common Stock at a conversion rate equal to the offering price for our common stock in the initial public offering, provided that in the event that we do not conduct the initial public offering of its common stock within ninety (90) days from the date thereof, the holder may opt to convert the outstanding principal and unpaid interest on the Convertible Note at a conversion price of $4.00 per share. In connection with the issuance of the Convertible Note we issued the investor an aggregate of 400,000 warrants to purchase common stock. On November 26, 2010, we and Ms. Hu agreed to amend the Convertible Note and the warrant to state that such Convertible Note shall have a conversion price equal to the price of our common stock in the initial public offering and that the warrants shall be exercisable at 110% of the offering price of our common stock in the initial public offering, without qualification.

On November 26, 2010, we entered into a Subscription Agreement (the “Agreement”) with an individual investor. The individual investor, Mr. Haibin Zhong, purchased a Convertible Note bearing an interest rate of 3% per annum from us. The Convertible Note is automatically convertible into shares of our Common Stock at a per share price equal to the price of our common stock in the initial public offering. In connection with the issuance of the Convertible Note we issued the investor an aggregate of 400,000 warrants to purchase common stock, exercisable at 110% of the initial public offering price of our common stock.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

We have not had any changes in or disagreements with accountants on accounting and financial disclosure.

INDUSTRY OVERVIEW

Industry Data

Market and industry data and other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources, as well as on a study conducted for us by John T. Boyd Company, Mining and Geological Consultants, who we refer to in this prospectus as JT Boyd. The most recent government data available regarding the mining industry in the PRC are for the year 2009. Although we believe that the information provided to us by JT Boyd is accurate, we have not independently verified the information and cannot guarantee its accuracy or completeness.

Unless otherwise indicated, the market and industry statistical data that we use in the discussion of the zinc and lead industry contained in the sections of this prospectus entitled “Prospectus Summary”, “Risk Factors”, “Overview of Our Industry” and “Business” have been taken from a report issued by ResearchInChina. We believe that the information and data taken from such report is accurate in all material respects and we have relied upon such for purposes of this prospectus and have not independently verified this data from other third-party sources.

General

Zinc is commonly mined as a co-product with lead, and both of these metals have core markets that are growing steadily. With regards to zinc, its main use is for galvanizing, or the process of coating iron, steel or aluminum with a thin zinc layer as zinc’s electropositive nature gives these metals added protection against corrosion. Zinc’s by-products, such as zinc calcine, zinc dust and sand, are also used in the manufacturing of a wide variety of industrial products, including zinc oxide and steel.

Lead, being a metal that is soft, pliable and highly resistant to corrosion, is most commonly used in the manufacturing of pewter, a malleable metal alloy, traditionally 85-99% tin, with the remainder consisting of copper, antimony, bismuth and lead. In addition, lead is commonly used in the manufacturing of batteries and petrol.

Overview of Zinc Industry

Based on a report issued by ResearchInChina issued in 2009, the proven zinc resources and reserves worldwide are approximately 1.9 billion tons, most of which is found in Australia, China, Peru, the United States and Kazakhstan. Together, these five countries account for 67.2% of the total global zinc reserves, and their collective reserves account for 70.9% of the global reserves.

| Global Distribution of Zinc Reserves (Unit:10000 tons) | |

| Country | | Reserves | | | Proportion to the Global Reserves Percentage | | | Reserve | | | Proportion to the Global Reserves Base Percentage | |

| Australia | | | 4200 | | | | 23.3 | % | | | 10000 | | | | 20.8 | % |

| China | | | 3300 | | | | 18.3 | % | | | 9200 | | | | 19.2 | % |

| Peru | | | 1800 | | | | 10.0 | % | | | 2300 | | | | 4.8 | % |

| United States | | | 1400 | | | | 7.8 | % | | | 9000 | | | | 18.8 | % |

| Kazakhstan | | | 1400 | | | | 7.8 | % | | | 3500 | | | | 7.3 | % |

| Canada | | | 500 | | | | 2.8 | % | | | 3000 | | | | 6.3 | % |

| Mexico | | | 700 | | | | 3.9 | % | | | 2500 | | | | 5.2 | % |

| Others | | | 4900 | | | | 27.2 | % | | | 8700 | | | | 18.1 | % |

| TOTAL | | | 18000 | | | | 100 | % | | | 48000 | | | | 100 | % |

Global zinc reserves decreased by 10 million tons from 1998 to 2008, while zinc reserves rose by 30 million tons. Between 1998 to 2008, zinc-lead mines throughout the world produced 36.36 million tons of metallic lead and 105.65 million tons of metallic zinc.

China’s Zinc and Lead Reserves

Due to its vast zinc and lead resources, a significant number of zinc and lead mines and processing plants have developed in China. While zinc-lead resources may be found throughout the country, a majority of these resources are concentrated within the western and middle areas of China. In 2008, it was reported by ResearchInChina that there were 27 provinces and areas within China wherein zinc-lead ores were explored. However, only 6 of the 27 provinces contained zinc and lead reserves of more than 8 million tons: (i) Yunnan Province- 26.63 million tons; (ii) Inner Mongolia - 16.10 million tons; (iii) Gansu Province - 11.2 million tons (iv) Guangdong Province- 10.8 million tons; (v) Hunan Province - 8.9 million tons; and (vi) Guangxi Province - 8.8 million tons. Based on these figures, the 6 provinces accounted for 82.4 million tons of zinc and lead reserves, or 64% of China’s total reserves of 129.6 million tons.

China’s Zinc and Lead Production

Location of Mines and Processing Plants

Further, a study of the locations of zinc-lead mines within China show that there are five main locations for mining, dressing and smelting and production bases within the country, namely, (i) Northeast; (ii) Hunan; (iii) Guangdong and Guangxi; (iv) Yunnan and Sichuan; and (v) Northwest. In total, the mines and production plants located in these areas have collectively produced more than 95% of the nation’s total zinc production and 85% of its total lead production in 2008.

Five Lead-Zinc Production Bases

| | | | | |

| | | | | |

| | | Available reserves | | |

| | | (10,000 tons) | | |

| Production base | | Lead | | | Zinc | | Main mine and plants |

| | | | | | | | |

| Northeast | | | 31.7 | | | | 95.2 | | Huludao Zinc Plant (Liaoning Province), Qingchengzi Lead-Zinc mine (Liaoning Province), Bajiazi lead-zinc deposit (Liaoning Province), Chaihe Lead-Zinc mine (Liaoning Province), Huanren Copper-Zinc mine (Liaoning Province), Hongtoushan Copper-Zinc Deposit (Liaoning Province), Xilin Lead-Zinc mine (Heilongjiang Province), Tianbaoshan Lead-Zinc mine (Sichuan Province) |

| | | | | | | | | | |

| Hunan | | | 246.75 | | | | 641.84 | | Shuikoushan Mining Administration, Taolin Lead-Zinc Mine, Huangshaping Lead-Zinc Deposit, Dongpo Lead-Zinc Deposit and Zhuzhou Smelt Factory |

| | | | | | | | | | |

| Guangdong & Guangxi | | | 594.19 | | | | 1361.93 | | Fankou Lead-zinc Deposit, Shaoguan Smelting Plant, Bingcun Lead-Zinc Deposit, Changhua Lead-Zinc Deposit, Dajianshan Lead-Zinc Deposit (Lianping County, Guangdong Province), Siding Lead-Zinc Mine (Guanxi Province), Daxin Lead-Zinc Mine (Guangxi Province), Heshan Lead-Zinc Mine (Guangxi Province), Liuzhou Zinc Products Factory, Dachang Mining Administration |

| | | | | | | | | | |

| Yunnan & Sichuan | | | 609.71 | | | | 2053.20 | | Huize Lead-Zinc Mine (Yunnan), Lancang Laochang Lead-Zinc Mine (Yunnan), Kunming Smelt Factory, Jijie Smelt Factory of Gejiu City, Yunnan, Huidong Lead-Zinc Mine, Kuili Lead-Zinc Mine |

| | | | | | | | | | |

| Northwest | | | 621.48 | | | | 1382.57 | | Baiyin Non-ferrous Metal Co., Ltd (Gansu Province), Erlihe Lead-Zinc deposit (Shaanxi Province), Xitieshan Mining Administration of Qinghai |

China’s Zinc Production

The production of zinc ore and refined zinc within China accounts for one-third of the world’s total production. In 2007, China produced approximately 3,748,600 tons of refined zinc and 2,604,000 tons of zinc ore.

While the 2008 global financial crisis had the effect of reducing the overall demand for zinc and its by-products worldwide, China still increased its overall production to 3,910,000 tons of refined zinc and 3,126,600 tons of zinc ore during the year 2008. Such level of production continues to be consistent from year-to-year and it is estimated that between January and October of 2009, China produced approximately 3,520,000 tons of refined zinc. However, due to the declining price in zinc internationally, the production of zinc ore decreased to 2,440,000 tons between January to October 2009.

China’s Lead Production