Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

BLRX similar filings

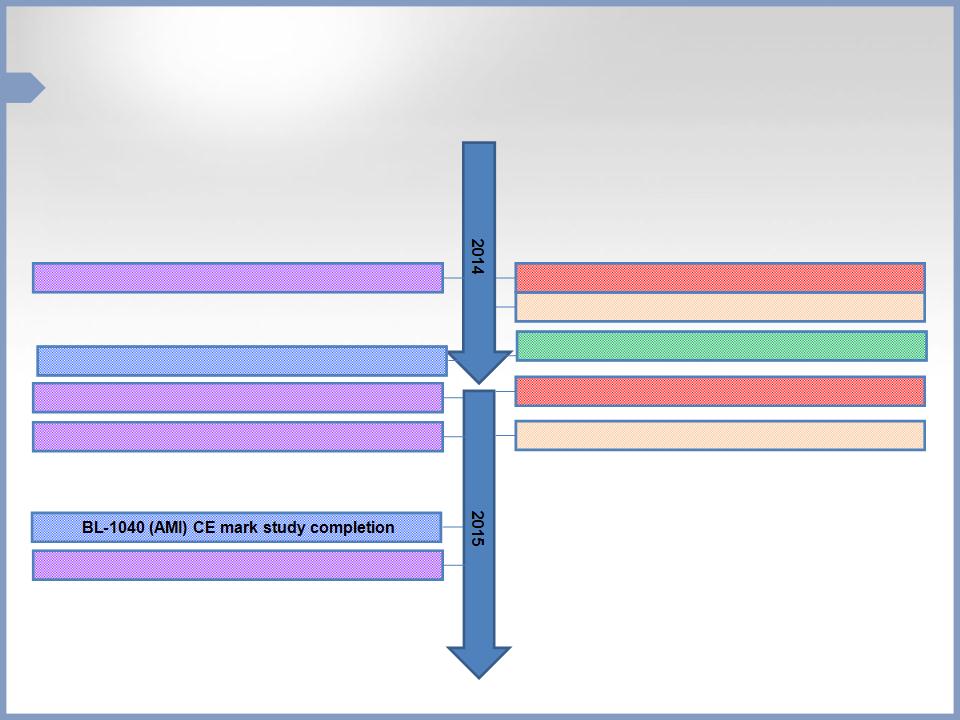

- 3 Sep 14 Current report (foreign)

- 21 Aug 14 BioLineRx Receives Notice of Allowance for US Patent on BL-7010

- 14 Aug 14 2014 Annual General Meeting of Shareholders

- 6 Aug 14 Second Quarter 2014 Earnings Presentation

- 16 Jul 14 BioLineRx Announces Results from

- 23 Jun 14 Current report (foreign)

- 16 Jun 14 BioLineRx Receives Approval to Commence

Filing view

External links