As filed with the Securities and Exchange Commission on July 12, 2013

Registration No. 333-169535

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 7

to

Form S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

Cole Real Estate Income Strategy (Daily NAV), Inc.

(Exact Name of Registrant as Specified in its Governing Instruments)

2325 East Camelback Road

Suite 1100

Phoenix, AZ 85016

(602) 778-8700

(Address, Including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

D. Kirk McAllaster, Jr.

Cole Real Estate Income Strategy (Daily NAV), Inc.

Executive Vice President, Chief Financial Officer and Treasurer

2325 East Camelback Road

Suite 1100

Phoenix, AZ 85016

(602) 778-8700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Ettore A. Santucci

Goodwin Procter LLP

Exchange Place

53 State Street

Boston, MA 02109

(617) 570-1000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

| | | | | | |

Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer þ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

This Post-Effective Amendment No. 7 consists of the following:

| | 1. | The Registrant’s final prospectus dated May 1, 2013. |

| | 2. | Supplement No. 5 dated July 12, 2013 to the Registrant’s prospectus dated May 1, 2013, included herewith, which supersedes and replaces all prior supplements to the prospectus dated May 1, 2013, and which will be delivered as an unattached document along with the prospectus dated May 1, 2013. |

| | 3. | Part II, included herewith. |

| | 4. | Signatures, included herewith. |

PROSPECTUS

Cole Real Estate Income Strategy (Daily NAV), Inc.

Maximum Offering of $4,000,000,000 — Minimum Offering of $10,000,000

Cole Real Estate Income Strategy (Daily NAV), Inc. is a newly organized corporation formed to invest primarily in single-tenant necessity commercial properties, which are leased to creditworthy tenants under long-term net leases. By utilizing this conservative and disciplined investment approach, we expect to generate a relatively predictable and stable current stream of income for investors, along with the potential for long-term capital appreciation in the value of our real estate. We intend to qualify as a real estate investment trust, or REIT, for federal income tax purposes, and we are externally managed by our advisor, Cole Real Estate Income Strategy (Daily NAV) Advisors, LLC, an affiliate of our sponsor, Cole Real Estate Investments. Our advisor has engaged a sub-advisor to assist in selecting and managing the component of our portfolio consisting of liquid assets.

We intend to offer shares of our common stock on a continuous basis and for an indefinite period of time, by filing a new registration statement before the end of each prior offering, subject to regulatory approval. We are initially offering up to $4,000,000,000 in shares of common stock, consisting of up to $3,500,000,000 in shares in our primary offering and up to $500,000,000 in shares pursuant to our distribution reinvestment plan. The per share purchase price will vary from day-to-day and, on each day, will equal the sum of our net asset value, or NAV, divided by the number of shares of our common stock outstanding as of the end of business on such day (NAV per share). On April 11, 2013, our NAV per share was $16.31. Our fund accountant calculates our NAV per share reflecting several components, including (1) estimated values of each of our commercial real estate assets, related liabilities and notes receivable secured by real estate based upon individual appraisal reports provided periodically by an independent valuation expert, (2) the price of liquid assets for which third party market quotes are available, (3) accruals of our daily distributions and (4) estimated accruals of our operating revenues and expenses. Although we do not intend to list our common stock for trading on a stock exchange or other trading market, we have adopted a redemption plan designed to provide our stockholders with limited liquidity on a daily basis for their investment in our shares.

We intend to distribute our shares principally through registered investment advisors and broker/dealers that charge their clients a fee for their services (typically referred to as wrap or fee based accounts). We received funds equal to the minimum offering amount of $10,000,000 on December 6, 2011, and broke escrow and accepted the investor’s subscription for shares of our common stock in this offering on December 7, 2011.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a significant decline in, or a complete loss of, the value of your investment. See “Risk Factors” beginning on page 30 for risks to consider before buying our shares, including:

| • | | We are a “blind pool.” As of the date of this prospectus, we have acquired 14 real estate properties and we have not identified all of the specific properties that we may purchase with future offering proceeds and have a limited operating history. |

| • | | There is no public market for our shares of common stock, and our charter does not require us to effect a liquidity event at any point in time in the future. |

| • | | Our redemption plan will provide stockholders with the opportunity to redeem their shares on a daily basis, but redemptions will be subject to available liquidity and other potential restrictions. |

| • | | We may pay distributions and fund redemptions from sources other than cash flow from operations, including borrowings, proceeds from this offering or asset sales, and we have no limits on the amounts we may pay from such other sources. |

| • | | The valuation methodologies used by our independent valuation expert in arriving at the estimates of value of each of our commercial real estate assets, related liabilities and notes receivable secured by real estate (one of the components of our NAV) set forth in individual appraisal reports, each of which are prepared in accordance with valuation guidelines reviewed by the advisor and approved by our board of directors, involve subjective judgments and estimates. These estimated values are then reflected by our fund accountant in the calculation of our NAV. As a result, our NAV may not accurately reflect the actual prices at which our commercial real estate assets, related liabilities and notes receivable secured by real estate could be liquidated on any given day. |

| • | | There are substantial conflicts of interest between us and our advisor and its affiliates, including our payment of substantial fees to our advisor and its affiliates. |

| • | | This is a “best efforts” offering. If we are not able to raise a substantial amount of capital in the near term, we may have difficulties investing in properties and our ability to achieve our investment objectives could be adversely affected. |

| • | | We may suffer from delays in identifying suitable investments, which may adversely impact our results of operations and the value of your investment. |

| • | | If we fail to qualify as a REIT for federal income tax purposes and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease. |

Neither the Securities and Exchange Commission, any state securities commission, nor the Attorney General of the State of New York has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The use of forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence which may flow from an investment in this program is not permitted.

| | | | | | | | | | | | |

| | | Per Share | | | Total Minimum | | | Total Maximum(1) | |

Public Offering Price(2) | | $ | 15.00 | | | $ | 10,000,000 | | | $ | 4,000,000,000 | |

First Year Underwriting Compensation(3) | | $ | 0.15 | | | $ | 100,000 | | | $ | 20,000,000 | |

Proceeds to Us, Before Expenses | | $ | 14.85 | | | $ | 9,900,000 | | | $ | 3,980,000,000 | |

| | | | | | | | | | | | |

| (1) | Includes shares of common stock being offered under our distribution reinvestment plan. |

| (2) | The price per share shown is based on our original sales price per share which was determined by our board of directors. The total price per share in this offering is equal the daily NAV per share, which varies from day-to-day. |

| (3) | Investors will not pay upfront selling commissions in connection with the purchase of our shares of common stock. We will pay our dealer manager an asset-based dealer manager fee that is payable in arrears on a monthly basis and accrues daily in an amount equal to 1/365th of 0.55% of our NAV for such day. At our dealer manager’s discretion it may reallow a portion of the dealer manager fee equal to an amount up to 1/365th of 0.20% of our NAV to participating broker dealers. During our first year after the escrow period, we may use up to 1% of our offering proceeds (not to exceed $2,000,000,000, in total, of offering proceeds and excluding shares issued under our distribution reinvestment plan) along with our cash flows from operations, to pay for the costs of distribution and other underwriting compensation. The total amount that will be paid over time for the asset-based dealer manager fee and other underwriting compensation depends on the average length of time for which shares remain outstanding, the term over which such amount is measured, and the performance of the Company’s investments. During the indefinite life of the Company, such amount in the aggregate from all sources could reach, but will never exceed, 10% of the aggregate amount of gross proceeds received by the Company from our primary offering (i.e., excluding proceeds from sales pursuant to our distribution reinvestment plan). See “Use of Proceeds,” and “Compensation.” |

The dealer manager of this offering, Cole Capital Corporation, a member firm of the Financial Industry Regulatory Authority, Inc., or FINRA, is an affiliate of our advisor and will offer the shares on a best efforts basis.

The date of this prospectus is May 1, 2013

©Cole Capital Advisors, Inc.

Suitability Standards

An investment in our common stock involves risk and is not suitable for all investors. There is no certainty as to the amount of distributions you may receive, liquidity under our redemption program may not be available at all times and the value of your investment may decline significantly.

In consideration of these factors, we have established minimum suitability standards for initial stockholders and subsequent purchasers of shares from our stockholders. These minimum suitability standards require that a purchaser of shares have, excluding the value of a purchaser’s home, furnishings and automobiles, either:

| | • | | a net worth of at least $250,000; or |

| | • | | a gross annual income of at least $70,000 and a net worth of at least $70,000. |

Certain states have established suitability requirements in addition to the minimum standards described above. Shares will be sold to investors in these states only if they meet the additional suitability standards set forth below:

Alabama: Investors must have a liquid net worth of at least ten times their investment in us and similar programs.

California: Investors must have either (i) a net worth of at least $250,000, or (ii) a gross annual income of at least $75,000 and a net worth of at least $75,000. In addition, the investment must not exceed ten percent (10%) of the net worth of the investor.

Iowa and New Mexico: Investors may not invest, in the aggregate, more than 10% of their liquid net worth in us and all of our affiliates.

Kansas and Massachusetts: It is recommended by the office of the Kansas Securities Commissioner and the Massachusetts Securities Division that investors in Kansas and Massachusetts not invest, in the aggregate, more than 10% of their liquid net worth in this and similar direct participation investments. For these purposes, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

Kentucky, Michigan, Oregon and Pennsylvania: Investors must have a liquid net worth of at least ten times their investment in us.

Maine: Investors must have either (i) a minimum net worth of at least $250,000, or (ii) an annual gross income of at least $70,000 and a minimum net worth of $70,000. In addition, the investment in us (plus any investments in our affiliates) by an investor must not exceed ten percent (10%) of the liquid net worth of the investor.

Nebraska: Investors must have (excluding the value of their home, furnishings and automobiles) either (i) a minimum net worth of $100,000 and an annual income of $70,000, or (ii) a minimum net worth of $350,000. In addition, the investment in us must not exceed 10% of the investor’s net worth.

North Dakota: Investors must have a liquid net worth of at least ten times their investment in us and our affiliates.

Ohio: Investors may not invest in the aggregate more than 10% of their liquid net worth in our shares, our affiliates, and in other non-traded real estate investment programs. “Liquid net worth” means that portion of net worth (total assets exclusive of home, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities.

Tennessee: Investors must have (excluding the value of their home, home furnishings and automobiles) either (i) a minimum net worth of at least $500,000, or (ii) an annual gross income of at least $100,000 and a minimum net worth of at least $100,000.

i

Texas: An investor must have had (excluding the value of the investor’s home, home furnishings and automobiles), during the last tax year, or estimate that the investor will have during the current tax year, (a) a minimum net worth of $100,000 and a minimum annual gross income of $100,000, or (b) a minimum net worth of $500,000.

Because the minimum offering of our common stock is less than $400,000,000, Pennsylvania investors are cautioned to evaluate carefully our ability to accomplish fully our stated objectives and to inquire as to the current dollar volume of our subscription proceeds.

Our sponsor and affiliated dealer manager are responsible for determining if investors meet our minimum suitability standards and state specific suitability standards for investing in our common stock. In making this determination, our sponsor and affiliated dealer manager will rely on participating broker-dealers and/or information provided by investors and their advisors. In addition to the minimum suitability standards described above, each participating broker-dealer, authorized representative or any other person placing shares on our behalf, and our sponsor and affiliated dealer manager, are required to make every reasonable effort to determine that the purchase of shares is a suitable and appropriate investment for each investor.

It shall be the responsibility of your participating broker-dealer, authorized representative or other person placing shares on our behalf to make this determination, based on a review of the information provided by you, including your age, investment objectives, income, net worth, financial situation and other investments held by you, as well as whether you:

| | • | | meet the minimum income and net worth standards established in your state; |

| | • | | can reasonably benefit from an investment in our common stock based on your overall investment objectives and portfolio structure; |

| | • | | are able to bear the economic risk of the investment based on your overall financial situation; and |

| | • | | have an apparent understanding of: |

| | • | | the fundamental risks of an investment in our common stock; |

| | • | | the risk that you may lose your entire investment; |

| | • | | the limited liquidity of our common stock; |

| | • | | the restrictions on transferability of our common stock; |

| | • | | the background and qualifications of our advisor and sub-advisor; and |

| | • | | the tax, including ERISA, consequences of an investment in our common stock. |

Our sponsor, our dealer manager and each participating broker-dealer, authorized representative or other person placing shares on our behalf shall maintain records of the information used to determine that an investment in our shares is suitable and appropriate for a stockholder. The participating broker-dealer shall maintain these records for at least six years.

The income and net worth standards set forth above do not apply to participant-directed purchases under a 401(k) or other defined contribution plan where the authorized plan fiduciary has approved our shares of common stock as an available investment option under such plan. In addition, in the case of sales to fiduciary accounts the suitability standards shall be met by the fiduciary account, by the person who directly or indirectly supplied the funds for the purchase of the shares of our common stock or by the beneficiary of the account.

IMPORTANT NOTE FOR BROKER-DEALERS: This prospectus will be supplemented each month with respect to pricing information (NAV per share) and from time to time with respect to other information. All sales literature used in connection with this offering must be accompanied by (1) the

ii

current prospectus, (2) all prospectus supplements (other than pricing supplements) and (3) the most recent pricing supplement filed through the close of business on the business day immediately preceding delivery or, if delivered after the close of business, then through the close of business on the day such sales literature is delivered.

IMPORTANT NOTE FOR INVESTORS: Please carefully read the information in this prospectus and any accompanying prospectus supplements, which we refer to collectively as the prospectus. You should rely only on the information contained in this prospectus. Neither we, our advisor, our fund accountant or our independent valuation expert has authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell these securities. You should not assume that the information contained in this prospectus or the latest prospectus supplement is accurate as of any date later than the date hereof or thereof, as applicable or such other dates as are stated herein or therein or as of the respective dates of any documents or other information incorporated herein or therein by reference.

IMPORTANT NOTE ABOUT THIS PROSPECTUS: The term “sponsor” refers to Cole Real Estate Investments, our sponsor; the terms “advisor” and “Cole Advisors” refers to Cole Real Estate Income Strategy (Daily NAV) Advisors, LLC, our advisor and an affiliate of our sponsor; and the term “sub-advisor” refers to BlackRock Investment Management, LLC, the sub-advisor to our advisor. In this prospectus, the term “operating partnership” refers to Cole Real Estate Income Strategy (Daily NAV) Operating Partnership, LP of which Cole Real Estate Income Strategy (Daily NAV), Inc. is the sole general partner. The words “we,” “us,” and “our” refer to Cole Real Estate Income Strategy (Daily NAV), Inc. and our operating partnership, taken together, unless the context requires otherwise.

iii

TABLE OF CONTENTS

iv

Questions and Answers About This Offering

Set forth below are some questions (and accompanying answers) we anticipate investors interested in this offering may have. They are not a substitute for disclosures elsewhere in this prospectus and the latest prospectus supplement furnished to you. You are strongly encouraged to read the “Prospectus Summary,” the “Risk Factors” and the remainder of this prospectus in their entirety for more detailed information about this offering before deciding to purchase shares of our common stock.

| Q: | What is a real estate investment trust, or REIT? |

| A: | In general, a REIT is a company that: |

| | • | | combines the capital of many investors to acquire or provide financing for the acquisition of real estate; |

| | • | | typically offers the benefit of a diversified real estate portfolio under professional management; |

| | • | | must distribute to investors at least 90% of its annual REIT taxable income; and |

| | • | | is able to qualify as a REIT for U.S. federal income tax purposes and is therefore generally not subject to federal corporate income taxes on its net income that it currently distributes to its stockholders, which substantially eliminates the “double taxation” (i.e., taxation at both the corporate and stockholder levels) that generally results from investments in a corporation. |

We expect to qualify as a REIT beginning with our taxable year ended December 31, 2012. We will also use the so-called UPREIT (Umbrella Partnership Real Estate Investment Trust) structure, where a REIT holds all or substantially all of its assets through a partnership the REIT controls as a general partner. We chose this structure principally because it may be attractive to sellers of real estate who wish to defer taxable gain by exchanging their asset for limited partnership interests.

| Q: | Why should I consider an investment in real estate? |

| A: | Our goal is to provide a professionally managed, diversified portfolio of institutional quality commercial real estate to investors who generally have had very limited access to such investments in the past. Allocating some portion of your portfolio to a direct investment in institutional quality commercial real estate may provide you with: |

| | • | | a reasonably predictable and stable level of current income from the investment; |

| | • | | diversification of your portfolio, by investing in an asset class that historically has not been correlated with the stock market generally; and |

| | • | | the opportunity for capital appreciation. |

| Q: | What is your investment strategy, and what types of properties do you intend to acquire? |

| A: | Under our investment strategy, we intend to invest primarily in single-tenant, necessity commercial properties, which are leased to creditworthy tenants, under long-term net leases. Our commercial properties will consist primarily of properties in the retail, office and industrial sectors that meet our investment criteria. Once all of the offering proceeds are invested, our property sector allocations will broadly reflect the composition of the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index (NPI) with the exception of multi-family and lodging, which will be excluded from our investment universe. The NPI is managed by the NCREIF and is a widely followed benchmark among institutional investors. NCREIF is a not-for-profit trade association that serves its membership, and the academic and investment community’s need for improved commercial real estate data, performance measurement, investment analysis, information standards, education, and peer group interaction. The NPI comprises performance data from retail, office, industrial, multi-family and lodging (hotel) properties. Since our strategy will focus on |

1

| | income producing real estate with long term leases, we will not invest in multi-family or lodging properties that have short duration leases and have historically had volatile performance. The actual percentage of our portfolio that is invested in retail, office and industrial property categories may fluctuate due to market conditions and investment opportunities. |

We believe that our investment approach will allow us to achieve a relatively predictable and stable stream of income for investors in our common stock, along with the potential for long-term appreciation in the value of our real estate assets. For over three decades, our sponsor has developed and utilized this investment approach in acquiring and managing real estate assets primarily in the retail sector. We believe that our sponsor’s experience in the single-tenant, necessity retail sector will provide us with a competitive advantage as we invest across multiple property sectors to create a diversified real estate portfolio. In addition, our sponsor has built an organization of over 300 employees, who are experienced in the various aspects of acquiring, financing, managing and disposing of retail, office, and industrial real estate, and we believe that our access to these resources also will provide us with an advantage.

| Q: | What are “necessity commercial” properties? |

| A: | We use the term necessity commercial properties to describe retail properties for companies that provide consumers with products that are important to, and part of, their everyday lives, and to describe office and industrial properties that are essential to the business operations of a corporate tenant. |

Examples of necessity retail properties include pharmacies, home improvement stores, national superstores, restaurants and regional retailers that provide products considered necessities to that region. Historically, the retail sector of commercial real estate has been able to withstand most market cycles better than other sectors, due to the long-term resilience of consumer spending. By focusing our retail investment strategy on necessity retailers subject to long-term net leases, our objective is to provide our stockholders with a relatively stable stream of current income, while avoiding a significant decline in the value of our real estate portfolio.

Necessity office and industrial properties are essential to the business operations of a corporate tenant, typically due to one or more of the following factors:

| | • | | difficulty of replacement or prohibitive cost to relocate; |

| | • | | sole or major location for its distribution or office operations; |

| | • | | proximity to its distribution, manufacturing, research facilities or customer base; |

| | • | | lower labor, transportation and/or operating costs; |

| | • | | more stable labor force; |

| | • | | optimal access to transportation networks that enable efficient distribution; and/or |

| | • | | significant amount of tenant-funded capital improvements, such as customized computer systems and information technology infrastructure, racking and sorting systems, and cooling or refrigeration systems. |

For example, distribution facilities, warehouses, manufacturing plants and corporate or regional headquarters are often considered to be necessity office and industrial properties. We believe that necessity office and industrial properties provide a relatively greater level of stability than other office and industrial property types because necessity properties typically involve long-term leases and experience relatively low tenant turnover. We also believe that, as a result of recent and ongoing business developments, such as the role of the internet in the distribution of products, globalization of importing and exporting products and consolidation of businesses requiring office buildings to accommodate a single-tenant, there is, and we expect there will continue to be, increasing demand by commercial tenants for necessity office and industrial properties.

2

| Q: | What is the experience of your sponsor and advisor in managing commercial real estate? |

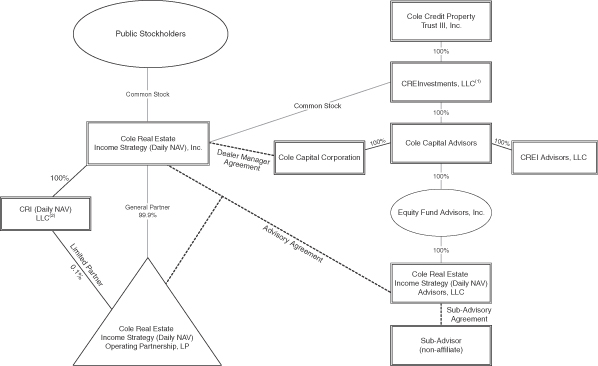

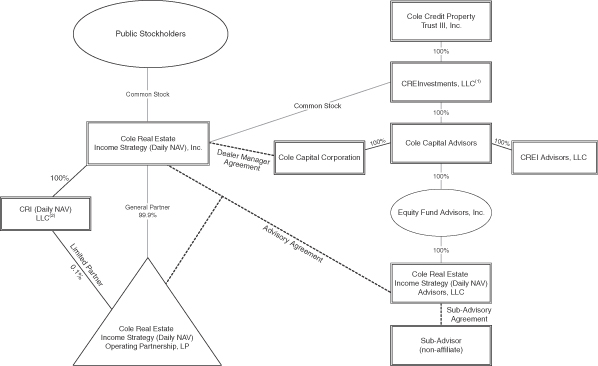

| A: | References to our sponsor throughout this prospectus refer to a group of affiliated entities that, prior to April 5, 2013, were directly or indirectly controlled by Christopher H. Cole. On April 5, 2013, Cole Credit Property Trust III, Inc. (“Cole Credit Property Trust III”) acquired our sponsor pursuant to a transaction whereby Cole Holdings Corporation merged with and into CREInvestments, LLC (“CREI”), a wholly-owned subsidiary of Cole Credit Property Trust III. Prior to the merger, Cole Holdings was wholly owned by Mr. Christopher H. Cole, our chairman of the board, chief executive officer and president. Cole Holdings Corporation was also an affiliate of our sponsor, the parent company and indirect owner of Cole Real Estate Income Strategy (Daily NAV) Advisors, LLC, our advisor, and the indirect owner of Cole Capital Corporation, our dealer manager. As a result of the merger, our advisor and dealer manager are now wholly-owned by CREI. Also in connection with the merger, the property management services previously performed for us by Cole Realty Advisors, Inc. (“Cole Realty Advisors”) have been assigned to CREI Advisors, LLC (“CREI Advisors”), a wholly-owned subsidiary of CREI. Despite the indirect change in control of our advisor and dealer manager, and the assignment of these property management services to CREI Advisors, we expect that the advisory, dealer manager and property management services we receive will continue without any changes in personnel or service procedures. |

From January 1, 2003 to December 31, 2012, our sponsor and its affiliates sponsored 66 prior programs, including 61 privately offered programs and five publicly offered REITs, which are comprised of Cole Credit Property Trust II, Inc. (“Credit Property Trust II”), Cole Credit Property Trust III, Cole Corporate Income Trust, Inc. (“Cole Corporate Income Trust”), Credit Property Trust IV, Inc. (“Credit Property Trust IV”) and this program, Cole Real Estate Income Strategy (Daily NAV), Inc. (“Cole Income NAV Strategy”). These prior programs had raised approximately $8.1 billion from over 155,000 investors and had purchased 2,090 properties located in 47 states and the U.S. Virgin Islands at an acquisition cost of $12.5 billion as of December 31, 2012. Our program, Credit Property Trust IV and Cole Corporate Income Trust are each currently raising capital pursuant to their respective initial public offerings of shares of their common stock.

For over three decades, our sponsor has developed and utilized a conservative investment approach that focuses on single-tenant commercial properties, which are leased to name-brand creditworthy tenants, subject to long-term “net” leases. While our sponsor has used this investment strategy primarily in the retail sector, our sponsor has also used the same investment strategy (single-tenant commercial properties subject to long-term net leases with creditworthy tenants) in the office and industrial sector. We expect that our sponsor’s prior experience in applying this conservative and disciplined investment strategy in both the retail and corporate sectors will provide us with a competitive advantage, as our advisor, an affiliate of our sponsor, acquires and manages, on our behalf, a portfolio of necessity retail properties. In addition, our sponsor has built an organization of over 350 employees, who are experienced in the various aspects of acquiring, financing and managing commercial real estate, and we believe that our access to these resources will also provide us with a competitive advantage. A summary of the real estate programs managed over the last ten years by our sponsor, including adverse business and other developments, is set forth in the section of this prospectus captioned “Prior Performance Summary.”

Our advisor is Cole Real Estate Income Strategy (Daily NAV) Advisors, LLC, an affiliate of our sponsor that was formed solely for the purpose of managing our company. The chief executive officer and president of our advisor, and other key personnel of our advisor, have been associated with Cole Real Estate Investments for several years. For additional information about the key personnel of our advisor, see the section of this prospectus captioned “Management — The Advisor.”

| Q: | What is a perpetual-life, publicly offered, non-exchange traded REIT? |

| A: | A non-exchange traded REIT is a REIT whose shares are not listed for trading on a stock exchange or other securities market. A public non-exchange traded REIT is registered with the Securities and Exchange Commission (“SEC”) and is required to file with the SEC financial statements and other reports. |

3

We use the term “perpetual-life” non-exchange traded REIT to describe an investment vehicle of indefinite duration focused principally on acquiring a portfolio of commercial real estate, where the shares of common stock are continuously available for purchase and redemption on a daily basis at a price equal to net asset value per share (“NAV per share”).

Non-exchange traded REITs have traditionally had a finite life with a specified date by which there would be some type of liquidity event for the benefit of all stockholders. In our perpetual-life structure, the investor or his financial advisor will determine when to purchase or liquidate an investment in shares of our common stock and our charter does not require us to effect a liquidity event at any point-in-time in the future. As of the date of this prospectus, we are aware of four perpetual-life, publicly offered, non-exchange traded REIT with an effective registration statement.

| Q: | How is an investment in shares of your common stock different from investing in shares of a listed REIT? |

| A: | Investing in REITs whose shares are listed for trading on a national securities exchange is one alternative for investing in commercial real estate. Shares of listed REITs, however, generally fluctuate in price with the stock market as a whole; that is, there is a relatively close relationship or correlation between changes in the price of listed REIT shares and changes in the value of the stock market generally. This close correlation suggests that the value of shares of listed REITs may be based on a variety of factors beyond the value of the listed REITs’ underlying real estate investments, such as the supply of available shares (number of sellers) and the demand for shares (number of buyers), as well as changes in investors’ short- or long-term financial market expectations in general. By comparison, the change in price of a direct investment in commercial real estate, as measured by actual transactions, historically has not been closely correlated, or in direct alignment, with the average value of the stock market generally. |

Our objective is to offer an alternative for investing in commercial real estate, where the value of your investment will be based on our NAV. Our NAV will reflect several components, one of which will be the estimated values of each of our commercial real estate assets, related liabilities and notes receivable secured by real estate contained within individual appraisal reports provided to our fund accountant by our independent valuation expert. These estimates of the values of our commercial real estate properties, which are based on information provided by our advisor, who also reviews them, will not fluctuate depending on the number of shares available for purchase in a trading market or on the number of investors looking to sell shares in a trading market. Although our advisor will periodically review and provide input on the estimates of value, our independent valuation expert will be free to accept or reject such input in its discretion. Our shares will be offered for sale on a continuous basis by the Company and redemptions will be based on the NAV per share calculated by our fund accountant, regardless of the volume of redemption requests. Because of these valuation guidelines applicable to our NAV, we expect that changes in the value of our shares will be more closely correlated, or aligned, with changes in prices of direct investments in real estate, as compared to changes in trading prices for the common stock of listed REITs. Since direct investments in real estate are not highly correlated with stock market prices generally, we expect that an investment in our shares will provide a measure of diversification to an investor’s portfolio that otherwise largely consists of stocks traded on a stock exchange.

In addition, on average, a direct investment in real estate, as measured by actual transactions, has historically exhibited significantly less volatility, or changes in value, than an investment in listed REITs. Again, since the NAV of our shares will be based on an estimate of the value of the real estate that we own, we expect that an investment in our shares will fluctuate in value, over time, less than an investment in a listed REIT.

Investors should bear in mind that investing in our shares differs from investing in listed REITs in significant ways. An investment in our shares has limited liquidity and our redemption program may be limited, modified or suspended. In contrast, an investment in a listed REIT is a liquid investment, as shares can be sold on an exchange at any time. Investing in our shares also differs from investing directly in real estate, including the expenses related to this offering and other fees and expenses that are payable.

4

| Q: | How is an investment in shares of your common stock different from investing in shares of a traditional non-exchange traded REIT? |

| A: | Generally, an investment in shares of our common stock differs from a traditional non-exchange traded REIT because: |

| | • | | The per share purchase and redemption price of our common stock is based on our NAV as calculated by our fund accountant, State Street Bank and Trust Company, and may vary from day to day. Traditional non-exchange traded REITs sell shares at a fixed price throughout the offering period and typically value their common stock at least every eighteen months, thereafter. Daily pricing of our shares at NAV per share will enable investors to calculate a reasonable estimate of the total return on their investments as of any given time. |

| | • | | Contrary to traditional non-exchange traded REITs, which typically limit redemptions to 5% or less of the weighted average number of shares outstanding during the trailing twelve-month period, the goal of our redemption plan is to provide significantly greater liquidity to our stockholders by allowing for net redemptions per quarter of at least 5% of the prior quarter-end’s NAV and by maintaining a liquid reserve available to fund redemptions. There are circumstances under which our redemption program may be limited, modified or suspended. |

| | • | | Most traditional non-exchange traded REITs typically provide for a two to five year offering period and a single liquidity event, such as a listing on a national exchange or liquidation, within 10 years of the end of the offering period. In contrast, we are a perpetual-life entity with no defined life and we will continuously offer shares for purchase and allow redemptions. This will provide our stockholders with greater flexibility in determining when they want to make or liquidate their investment. |

| | • | | Finally, by targeting investors in wrap or fee based accounts, where the investor pays a fee for the investment services provided by his investment advisor or broker-dealer, we will avoid paying up-front selling commissions. We expect that our costs of distribution will be significantly lower than those of a traditional non-exchange traded REIT, resulting in a greater percentage of investors’ capital being available for investing in real estate and real estate-related investments. |

| Q: | What is the purchase price for shares of your common stock? |

| A: | The per share purchase price varies from day-to-day and, on each business day, is equal to our NAV divided by the number of shares outstanding as of the close of business on such day. After the close of business (the close of the New York Stock Exchange; generally, 4:00 p.m. Eastern Time), on each day that the New York Stock Exchange is open (a business day), we update our website, www.colecapital.com, which identifies the NAV per share for that day. Any purchase orders that we receive prior to the close of business on any business day will be executed at a price equal to our NAV per share for that day, as calculated after the close of business on that day. Purchase orders that we receive after the close of business are executed at a price equal to our NAV per share as calculated after the close of business on the next business day. Purchase orders placed on a day that is not a business day, and purchase orders pursuant to our systematic investment program that would otherwise occur on a day that is not a business day, will be executed as if they were received prior to the close of business on the immediately following business day. See “Share Purchases and Redemptions — Buying Shares” for more details. |

| Q: | How will your NAV per share be calculated? |

| A: | Our NAV per share is calculated daily as of the close of business by our fund accountant using a process that reflects (1) estimated values of each of our commercial real estate assets, related liabilities and notes receivable secured by real estate provided periodically by our independent valuation expert in individual appraisal reports, as they may be updated upon certain material events described below, (2) the price of liquid assets for which third party market quotes are available, (3) accruals of our daily distributions, and (4) estimates of daily accruals, on a net basis, of our operating revenues, expenses, debt service costs and fees. Our advisor reviews estimated values of commercial real estate assets, related liabilities and notes receivable secured by real estate provided in individual appraisal reports and if a material event in respect of |

5

| | such asset or liability occurs between scheduled quarterly valuations that our advisor believes may materially affect the value thereof, our advisor will inform the independent valuation expert so that, if appropriate, the independent valuation expert can issue an update to its individual appraisal report to adjust the most recent valuations to account for the estimated impact. |

We have engaged CBRE, Inc. (formerly known as CB Richard Ellis, Inc.), which has expertise in appraising commercial real estate, to act as our independent valuation expert. CBRE provides our fund accountant with periodic estimates of the values of our commercial real estate assets, related liabilities and notes receivable secured by real estate, all or substantially all of which will be held in our operating partnership. Our assets will consist primarily of a portfolio of commercial real estate as well as notes receivable or marketable securities where the underlying collateral will typically be commercial real estate or security interests therein. We will also invest in liquid assets and hold cash and cash equivalents, which will not be valued by our independent valuation expert. Our commercial real estate-related liabilities to be valued by CBRE will consist primarily of mortgage loans secured by our commercial real estate. Our other liabilities will be estimated by our advisor for use by our fund accountant in determining NAV and will include accrued operating expenses, accrued dealer manager and advisory fees and accrued distributions to stockholders.

Upon purchase, each real estate asset is initially carried at its purchase price, plus related acquisition costs. On a quarterly basis thereafter, our independent valuation expert will value each of our commercial real estate properties and real estate assets, such that each of these investments will be valued at least once per quarter beginning with the quarter following the first full calendar quarter after we acquire the asset. Based on all information deemed relevant, our independent valuation expert will analyze the cash flow from, and other characteristics of, each commercial real estate property in our portfolio. The independent valuation expert will consider, as appropriate, valuation methodologies, opinions and judgments in compliance with the Uniform Standards of Professional Appraisal Practice and the requirements of the Code of Professional Ethics and Standards of Professional Ethics and Standards of Professional Appraisal Practice of the Appraisal Institute. See “Valuation Policies — Valuation — Valuation of Commercial Real Estate Properties and Secured Loans.”

Between quarterly valuations, our advisor will monitor our commercial real estate assets, related liabilities and notes receivable secured by real estate to determine whether a material event has occurred that our advisor believes may have a material impact on the most recent estimated values thereof as set forth in the relevant appraisal report provided by our independent valuation expert. If, in the opinion of our independent valuation expert, the event identified by our advisor, or in some circumstances an event that becomes known to the independent valuation expert through other means, is likely to have a material impact on previously provided estimated values of the affected commercial real estate assets, related liabilities and notes receivable secured by real estate, the independent valuation expert will recommend valuation adjustments that the fund accountant will then incorporate into our NAV. Any such adjustments will be estimates of the market impact of specific events based on assumptions and judgments that may or may not prove to be correct, and may also be based on limited information, as full and complete information may not be readily available. In addition to providing estimated values of our commercial real estate asset portfolio, our independent valuation expert will also provide, on a quarterly basis beginning with the quarter following the first full calendar quarter after we acquire any notes receivable, an estimate of the value of our notes receivable, primarily relying on a discounted cash flow analysis, and an estimate of the value of our mortgages, primarily by comparing the terms of our mortgages to the terms of mortgages on comparable properties, as seen in the market generally. These quarterly valuations may also be adjusted, between quarters, as described above. Liquid assets and assets that are traded with reasonable frequency will be valued by third party pricing institutions on a daily basis, assuming market quotes are available. Our advisor will periodically review and provide input on the estimated value provided by the independent valuation expert set forth in an individual appraisal report for each such asset, but the independent valuation expert will be free to accept or reject such input in its discretion. The board of directors, including a majority of the independent directors, has adopted our valuation guidelines, will be responsible for ensuring that the independent valuation expert discharges its responsibilities in accordance with our valuation guidelines, and will periodically receive and review such information about the valuation of our assets and liabilities as it deems necessary to exercise its oversight responsibility.

6

Our fund accountant calculates our daily NAV at the end of each business day based on the net valuation of our operating partnership’s principal assets and liabilities, based primarily on the individual estimated values provided by the independent valuation expert as described above, together with the other components of NAV described elsewhere in this prospectus. First, the fund accountant will subtract from the net value of the operating partnership the other partnership liabilities, including estimates of accrued fees and expenses attributable to the offering, and estimates of accrued operating revenues, fees and expenses. Our fund accountant will take the resulting amount and multiply that amount by our percentage ownership interest in the operating partnership. Initially, the only limited partner is our wholly-owned subsidiary, CRI (Daily NAV), LLC, which holds a 0.1% interest. Our fund accountant will then add any assets held directly by the REIT, which should be limited to cash and cash equivalents, and subtract an estimate of any accrued liabilities of the REIT, which should be limited to certain legal, accounting and administrative costs. The result of this calculation will be our NAV as of the end of any business day.

Our NAV per share is determined by dividing our NAV on such day by the number of shares of our common stock outstanding as of the end of such day, prior to giving effect to any share purchases or redemptions to be effected on such day. See “Valuation Policies — Calculation of Our NAV Per Share” for more details about how our NAV is calculated.

| Q: | Does our independent valuation expert calculate or is it responsible for the NAV? |

| A: | Our NAV per share is calculated by our fund accountant. While our independent valuation expert will periodically provide estimated values of each of our commercial real estate assets, related liabilities and notes receivable secured by real estate based upon individual appraisal reports, our independent valuation expert is not responsible for and does not prepare our daily NAV per share. |

| Q: | How exact is the calculation of the daily NAV per share? |

| A: | Our goal is to provide a reasonable estimate of the market value of our shares. Our assets will consist principally of commercial real estate assets, the valuation of which by our independent valuation expert is subject to a number of judgments and assumptions that may not prove to be accurate. The use of different judgments or assumptions would likely result in different estimates of the value of our real estate assets. The daily calculation of our NAV per share by the fund accountant may not reflect the precise amount that might be paid for your shares in a market transaction. On any given day, our published NAV per share may not fully reflect certain material events to the extent that they are not known or their financial impact on our portfolio is not immediately quantifiable. Any resulting potential disparity in our NAV per share may be in favor of either stockholders who redeem their shares, or stockholders who buy new shares, or existing stockholders. See “Valuation Policies — Calculation of Our NAV Per Share.” |

| Q: | Will I have the opportunity to redeem my shares of common stock? |

| A: | While you should view your investment in our shares as a long-term investment with limited liquidity, we have adopted a redemption plan whereby, on any business day, stockholders may request that we redeem all or any portion of their shares. The redemption price per share on any business day will be equal NAV per share, determined as described above. Subject to limited exceptions, shares redeemed within 365 days of the date of purchase will be subject to a short-term trading fee equal to 2% of the aggregate NAV per share of such shares redeemed. See “Share Purchases and Redemptions — Redemption Plan.” |

| Q: | Will there be any limits on my ability to redeem my shares? |

| A: | Yes. While we designed our redemption plan to allow stockholders to request redemptions on any business day, of all or any portion of their shares, our ability to fulfill redemption requests is subject to a number of limitations. The vast majority of our assets will consist of commercial properties, which cannot generally be readily liquidated without impacting our ability to realize full value upon their disposition. However, to fund |

7

| | our redemption plan, we will maintain a number of sources of liquidity including (i) cash, cash equivalents, other liquid investments and liquid securities and (ii) in the discretion of our advisor, a line of credit. |

In order to maintain a reasonable level of liquidity, our investment guidelines provide that we will target the following aggregate allocation to the above sources of liquidity: (1) 10% of our NAV up to $1 billion and (2) 5% of our NAV in excess of $1 billion. In addition, we may also fund redemptions from any available source of funds, including operating cash flows, borrowings, proceeds from this offering and/or the sale of our assets. Despite these sources of liquidity, we may not always have sufficient liquid resources to satisfy redemption requests and you may not always be able to redeem your shares.

Under ordinary circumstances the total amount of net redemptions during a calendar quarter is limited to five percent of our total net assets on the last business day of the preceding quarter. Redemption requests will be satisfied on a first-come, first-served basis. If net redemptions do not reach the five percent limit in a calendar quarter, the unused portion will be carried over to the next quarter, except that the maximum amount of net redemptions during any quarter can never exceed ten percent of our total net assets on the last business day of the preceding quarter. If net redemptions in a calendar quarter reach the five percent limit (plus any carried over amount), then after pro-rating redemptions for that day we will be unable to process any redemption requests for the rest of the calendar quarter. We will begin accepting redemption requests again on the first business day of the next calendar quarter, but will apply the five percent quarterly limitation on redemptions on a per-stockholder basis, instead of a first-come, first-served basis. Therefore, at any time during that quarter each stockholder will be able to redeem up to five percent of the stockholder’s investment in our shares on the last business day of the preceding quarter, plus any new investment by the stockholder in our shares during that quarter (subject to applicable short-term trading fees). The per-stockholder limit will remain in effect for the following quarter if total net redemptions are more than two and one-half percent of our net assets on the last business day of the preceding quarter. Further, to protect our operations and our non-redeeming stockholders, to prevent an undue burden on our liquidity or to preserve our status as a REIT, our board of directors may limit, or suspend our redemption program. See “Share Purchases and Redemptions — Redemption Plan — Redemption Limitations.”

| Q: | How do you intend to distribute your shares? |

| A: | We intend to distribute our shares of common stock principally through registered investment advisers and broker-dealers that are paid a fee by their clients for the services provided — typically referred to as wrap or fee based accounts. As a result, we expect that our costs of distribution will be less than the total expenses of a traditional finite-life non-exchange traded REIT. |

| Q: | Will I be charged upfront selling commissions? |

| A: | No. Investors will not pay upfront selling commissions as part of the price per share of our common stock purchased in our primary offering or issued under our distribution reinvestment plan. |

We pay our dealer manager an asset-based dealer manager fee that is payable in arrears on a monthly basis and accrues daily in an amount equal to 1/365th of 0.55% of our NAV for such day. At our dealer manager’s discretion it may reallow a portion of the dealer manager fee equal to an amount up to 1/365th of 0.20% of our NAV to participating broker dealers. See “Plan of Distribution.” We will pay the dealer manager fee until the date at which, in the aggregate, underwriting compensation from all sources, including the dealer manager fee and other underwriting compensation paid by us and our advisor and its affiliates, equals 10% of the gross proceeds from our primary offering (i.e., excluding proceeds from sales pursuant to our distribution reinvestment plan).

In addition, our advisor or its affiliates, pay on our behalf all other costs incurred in connection with our organization and the offering of our shares (excluding the dealer manager fee), including (i) our legal, accounting, printing, mailing and filing fees, charges of our escrow agent, and broker/dealer due diligence expenses; (ii) costs incurred in connection with preparing supplemental sales materials, holding educational

8

conferences and attending retail seminars conducted by broker-dealers; and (iii) reimbursements for our dealer manager’s wholesaling costs, and other marketing and organization costs including payments made to participating broker-dealers. We reimburse our advisor for these costs. Reimbursement payments are made in monthly installments, but the aggregate monthly amount reimbursed can never exceed 0.75% of the aggregate gross offering proceeds from this offering, including shares issued in connection with the distribution reinvestment plan. If the sum of the total unreimbursed amount of such organization and offering costs, plus new costs incurred since the last reimbursement payment, exceeds the reimbursement limit described above for the applicable monthly installment, the excess will be eligible for reimbursement in subsequent months (subject to the 0.75% limit), calculated on an accumulated basis, until our advisor has been reimbursed in full.

| Q: | What other fees and expenses will you pay to our advisor or any of its affiliates? |

| A: | We pay our advisor a monthly advisory fee that will be payable in arrears on a monthly basis and accrue daily in an amount equal to 1/365th of 0.90% of the NAV per share for each day. We will also pay our advisor a performance fee calculated on the basis of our total return to stockholders, payable annually in arrears, such that for any calendar year in which our total return on stockholders’ capital exceeds 6% per annum, our advisor will be entitled to 25% of the excess total return but not to exceed 10% of the aggregate total return for such year. In the event the NAV per share decreases below $15.00 (“Base NAV”) the performance-based fee will not be calculated on any increase in NAV up to Base NAV. We will not pay advisory fees to the sub-advisor, as those fees will be paid by our advisor. |

Although we will not pay our advisor any acquisition, financing or other similar fees in connection with making investments, we reimburse our advisor for out-of-pocket expenses in connection with the acquisition and financing of commercial real estate properties, real estate-related assets and other investments.

Additionally, we reimburse our advisor for out-of-pocket operating expenses in connection with providing services to us, including reasonable salaries and wages, benefits and overhead of all employees directly involved in the performance of services to us other than our executive officers. The expense reimbursements that we pay to our advisor include expenses incurred by the sub-advisor on our behalf.

The payment of fees and expenses will reduce the cash available for investment and distribution and will directly impact our daily NAV. See “Compensation” for more details regarding the fees that will be paid to our advisor and its affiliates.

| Q: | Will you invest in anything other than commercial properties? |

| A: | Yes. Our portfolio also may include other income-producing real estate, as well as real estate-related investments such as mortgage, mezzanine, bridge and other loans and liquid securities. Although this is our current target portfolio, we may make adjustments to our target portfolio based on real estate market conditions and investment opportunities. We will not forego a high quality investment because it does not precisely fit our presently expected portfolio composition. Thus, to the extent that our advisor presents us with high quality investment opportunities that allow us to meet the REIT requirements under the Internal Revenue Code of 1986, as amended (the “Code”), and that result in an overall real estate portfolio that is consistent with our investment objectives, our portfolio composition may vary from time to time. Our goal is to assemble a portfolio that is diversified by investment type, investment size and investment risk, which generates a relatively predictable and stable stream of income for investors and the potential for long-term capital appreciation in the value of our real estate assets. See the section of this prospectus captioned “Investment Objectives, Strategy and Policies — Acquisition and Investment Policies” for a more detailed discussion of all of the types of investments we may make. |

| Q: | Generally, what will be the terms of your leases? |

| A: | We will seek to secure leases from creditworthy tenants, before or at the time we acquire a property. We expect that many of our leases will be triple net or double net leases, which means that the tenant will be |

9

| | primarily responsible for the cost of repairs, maintenance, property taxes, utilities, insurance and other operating costs. This helps ensure the predictability and stability of our expenses and, we believe, will result in greater predictability and stability of our cash distributions to stockholders. We intend to enter into leases that have terms of ten or more years, may include renewal options and may also include rental increases over the term of the lease. A number of our leases, however, may have a shorter term. In addition, we expect that a number of our leases will be guaranteed by the corporate parent of the tenant, ensuring that, unless the parent company goes into bankruptcy, the rent on the property will be paid, even if the individual store is closed for any reason. |

| Q: | How will you determine whether tenants are creditworthy? |

| A: | Our advisor and its affiliates have a well-established underwriting process to determine the creditworthiness of our potential tenants. The underwriting process includes analyzing the financial data and other information about the tenant, such as income statements, balance sheets, net worth, cash flow, business plans, data provided by industry credit rating services, and/or other information our advisor may deem relevant. In addition, we may obtain guarantees of leases by the corporate parent of the tenant, in which case our advisor will analyze the creditworthiness of the guarantor. In some instances, especially in sale-leaseback situations, where we are acquiring a property from a company and simultaneously leasing it back to such company under a long-term lease, we expect that we will meet with the senior management of the company to discuss the company’s business plan and strategy. |

| A: | Yes, we intend to use leverage. Our targeted leverage, after we have acquired a substantial portfolio, is 50% of the greater of cost (before deducting depreciation or other non cash reserves) or market value of our gross assets. During the period when we are acquiring our initial portfolio, we may employ greater leverage in order to build quickly a diversified portfolio of assets. Please see “Investment Objectives, Strategy and Policies” for more details. |

| Q: | How often will I receive distributions? |

| A: | We expect that our board of directors will declare distributions with a daily record date, and pay distributions monthly in arrears. Any distributions we make are at the discretion of our board of directors, and are based on, among other factors, our present and reasonably projected future cash flow. We also expect that the board of directors will set the rate of distributions at a level that will be reasonably consistent and sustainable over time. In addition, the board of directors’ discretion as to the payment of distributions is limited by the REIT distribution requirements, which generally require that we make aggregate annual distributions to our stockholders of at least 90% of our REIT taxable income. See “Description of Capital Stock — Distributions” and “Material U.S. Federal Income Tax Considerations.” |

Any distributions that we make will directly impact our NAV, by reducing the amount of our assets. Our goal is to provide a reasonably predictable and stable level of current income, through monthly distributions, while at the same time maintaining a fair level of consistency in our NAV. Over the course of your investment, your distributions plus the change in NAV per share (either positive or negative) will produce your total return.

| Q: | What will be the source of your distributions? |

| A: | We may pay distributions from sources other than cash flow from operations, including from the proceeds of this offering, from borrowings or from the sale of properties or other investments, among others, and we have no limit on the amounts we may pay from such sources. We expect that our cash flow from operations available for distribution will be lower in the initial stages of this offering until we have raised significant capital and made substantial investments. As a result, we expect that during the early stages of our |

10

| | operations, and from time to time thereafter, we may pay distributions from sources other than cash flows from operations. Contrary to traditional non-exchange traded REITs, however, whose shares are typically sold and, on a limited basis, redeemed at, a fixed price that is not necessarily intended to reflect the current value of the shares, our common stock will be sold and redeemed on a daily basis at NAV per share. As a result, distributions that represent a return of capital or exceed our operating cash flow will be reflected in our daily calculation of NAV. |

| Q: | Will the distributions I receive be taxable as ordinary income? |

| A: | Unless your investment is held in a qualified tax-exempt account or we designate certain distributions as capital gain dividends, distributions that you receive generally will be taxed as ordinary income to the extent they are from current or accumulated earnings and profits. The portion of your distribution in excess of current and accumulated earnings and profits is considered a return of capital for tax purposes and will reduce the tax basis of your investment, rather than result in current tax, until your basis is reduced to zero. This, in effect, defers a portion of your tax until you redeem or sell your shares. Return of capital distributions made to you in excess of your tax basis in our stock will be treated as sales proceeds from the sale of our stock. Distributions we designate as capital gain dividends will generally be taxable at long-term capital gains rates. However, because each investor’s tax considerations are different, we recommend that you consult with your tax advisor. You also should review the section of this prospectus entitled “Material U.S. Federal Income Tax Considerations.” |

| Q: | May I reinvest my cash distributions in additional shares? |

| A: | Yes. We have adopted a distribution reinvestment plan whereby investors may elect to have their cash distributions automatically reinvested in additional shares of our common stock. The purchase price for shares purchased under our distribution reinvestment plan is equal to our NAV per share on the date that the distribution is payable, after giving effect to the distribution. Because the dealer manager fee is calculated based on NAV, it reduces NAV with respect to all shares of our common stock, including shares issued under our distribution reinvestment plan. See “Description of Capital Stock — Distribution Reinvestment Plan” for more information regarding reinvestment of distributions you may receive from us. |

| Q: | Do you expect to acquire properties and loans in transactions with your advisor or its affiliates? |

| A: | From time to time our advisor may direct certain of its affiliates to acquire properties that would be suitable investments for us or may create special purpose entities to acquire properties for the specific purpose of selling the properties to us at a later time. Subsequently, we may acquire such properties from such affiliates, but any and all acquisitions from affiliates of our advisor must be approved by a majority of our directors, including a majority of independent directors, not otherwise interested in such transactions as being fair and reasonable to us. In addition, either our purchase price in any such transaction will be limited to the cost of the property to the affiliate, including acquisition-related expenses, or a majority of our independent directors must determine that there is substantial justification for any amount above such cost and that the difference is reasonable. Further, our charter provides that in no event will the purchase price of any asset acquired from an affiliate exceed its current appraised value as determined by an independent appraiser. |

From time to time, we may borrow funds from affiliates of our advisor, including our sponsor, as bridge financing to enable us to acquire a property when offering proceeds alone are insufficient to do so and third party financing has not been arranged or is insufficient. Any and all such transactions must be approved by a majority of our directors, including a majority of our independent directors not otherwise interested in such transaction, as fair, competitive and commercially reasonable, and no less favorable to us than comparable loans between unaffiliated parties. Our advisor or its affiliates may pay costs on our behalf, pending our reimbursement, or we may defer payment of fees to our advisor or its affiliates, but neither of these transactions would be considered a loan.

11

| Q: | Will you acquire properties in joint ventures, including joint ventures with affiliates? |

| A: | It is possible that we may acquire properties through one or more joint ventures in order to increase our purchasing power and diversify our portfolio of properties in terms of geographic region, property type and tenant industry group. Increased portfolio diversification reduces the risk to investors as compared to a program with less diversified investments. Our joint ventures may be with affiliates of our advisor or with non-affiliated third parties. Any joint venture with an affiliate of our advisor must be approved by a majority of our directors, including a majority of our independent directors, not otherwise interested in such transaction, as being fair and reasonable to us and on substantially the same terms and conditions as those received by other joint ventures and the cost of our investment must be supported by a current appraisal of the asset. Generally, we will only enter into a joint venture in which we will approve major decisions of the joint venture. If we do enter into joint ventures, we may assume liabilities related to joint ventures that exceed the percentage of our investment in the joint venture. |

| Q: | For whom is an investment in your shares appropriate? |

| A: | An investment in our shares may be appropriate for you if you: |

| | • | | meet the minimum suitability standards mentioned above under “Suitability Standards;” |

| | • | | seek to diversify your portfolio by allocating a portion of your portfolio to a direct, long-term investment in commercial real estate that is non-correlated to the stock market; |

| | • | | seek to receive current income through our payment of distributions; |

| | • | | wish to obtain the benefits of potential long-term capital appreciation; and |

| | • | | are able to hold your investment in our shares as a long-term investment, as our redemption program may not always be available to redeem your shares. |

| Q: | Are there any risks involved in buying our shares? |

| A: | Investing in our common stock involves a high degree of risk. If we are unable to effectively manage the impact of these risks, we may not meet our investment objectives, and therefore, you should purchase these securities only if you can afford a complete loss of your investment. Some of the more significant risks relating to this offering and an investment in our shares include: |

| | • | | We are a “blind pool.” As of April 11, 2013, we have acquired 14 real estate properties and we have not identified all of the specific assets to be purchased with the net proceeds from this offering and have a limited operating history. |

| | • | | The valuation methodologies used by our independent valuation expert in arriving at the estimates of value of each of our commercial real estate assets, related liabilities and notes receivable secured by real estate (one of the components of our NAV) are set forth in individual appraisal reports prepared in accordance with valuation guidelines approved by our board of directors and involve subjective judgments and estimates. These individual appraisal reports are periodically reviewed by our advisor. These estimated values are then reflected by our fund accountant in the calculation of our NAV. As a result, our NAV may not accurately reflect the actual prices at which our commercial real estate assets, notes receivable secured by real estate or related real estate liabilities could be liquidated on any given day. |

| | • | | There is no public market for our shares of common stock, and our charter does not require us to effect a liquidity event at any point in time in the future. |

| | • | | Our redemption plan will provide stockholders with the opportunity to redeem their shares on a daily basis, but redemptions will be subject to available liquidity and other potential restrictions. |

12

| | • | | We may pay distributions, and fund redemptions, from sources other than cash flow from operations, including borrowings, proceeds from this offering or asset sales, and we have no limits on the amounts we may pay from such other sources. Payments of distributions from sources other than cash flow from operations may reduce the amount of capital we ultimately invest in real estate, which may negatively impact the value of your investment and directly impact our daily NAV per share. |

| | • | | There are substantial conflicts of interest between us and our advisor and its affiliates, including our payment of substantial fees to our advisor and its affiliates. |

| | • | | This is a “best efforts” offering. If we are not able to raise a substantial amount of capital in the near term, we may have difficulties investing in properties and our ability to achieve our investment objectives could be adversely affected. |

| | • | | We may suffer from delays in identifying suitable investments, which may adversely impact the value of your investment. |

| | • | | If we fail to qualify as a REIT for federal income tax purposes and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease. |

| A: | You can buy shares pursuant to this prospectus by working with your financial advisor to (1) complete the required documentation and (2) pay for the shares at the time your purchase order is settled. Please see “Share Purchases and Redemptions — Buying Shares” for more information about how to purchase shares. |

| Q: | May I make an investment through my IRA or other tax-deferred retirement account? |

| A: | Yes. You may make an investment through your IRA or other tax-deferred retirement account. In making these investment decisions, you should consider, at a minimum, (1) whether the investment is in accordance with the documents and instruments governing your IRA, plan or other retirement account, (2) whether the investment would constitute a prohibited transaction under applicable law, (3) whether the investment satisfies the fiduciary requirements associated with your IRA, plan or other retirement account, (4) whether the investment will generate unrelated business taxable income (“UBTI”) to your IRA, plan or other retirement account, and (5) whether there is sufficient liquidity for such investment under your IRA, plan or other retirement account. You should note that an investment in shares of our common stock will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Code. |

| Q: | Is there any minimum investment required? |

| A: | Subject to limited exceptions, the minimum initial investment in shares of our common stock is $2,500. |

| Q: | What is the term or expected life of this offering? |

| A: | We have registered $3,500,000,000 in shares of our common stock to be sold in our primary offering and up to $500,000,000 in shares to be sold pursuant to our distribution reinvestment plan. It is our intent, however, to conduct a continuous offering for an indefinite period of time, by filing for additional offerings of our shares, subject to regulatory approval and continued compliance with the rules and regulations of the SEC and applicable state laws. |