CHINACACHE INTERNATIONAL HOLDINGS LTD.

6/F, Block A, Galaxy Plaza

No. 10 Jiuxianqiao Road Middle, Chaoyang District

Beijing, 100015

People’s Republic of China

January 14, 2012

VIA EDGAR

Mark Shuman, Legal Branch Chief

Gabriel Eckstein, Staff Attorney

Kathleen Collins, Accounting Branch Chief

Megan Akst, Staff Accountant

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: ChinaCache International Holdings Ltd. (the “Company”)

Form 20-F for the Fiscal Year Ended December 31, 2011 (the “2011 Form 20-F”)

Filed April 24, 2012 (File No. 001-34873)

Dear Mr. Shuman, Mr. Eckstein, Ms. Collins and Ms. Akst:

This letter sets forth the Company’s responses to the comments contained in the letter dated December 14, 2012 from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) regarding the Company’s 2011 Form 20-F. The Staff’s comments are repeated below and are followed by the Company’s responses thereto. All capitalized terms used but not defined in this letter shall have the meanings ascribed to such terms in the 2011 Form 20-F.

Form 20-F for the Fiscal Year Ended December 31, 2011 General

1. We are aware of a news report that you have signed an agreement to provide solutions to improve customer utilization of the website of Hainan Airlines Company Limited, a carrier that enables its customers to fly to and from Khartoum International Airport in Sudan. In addition, you state on page 39 that you have deployed service nodes in the Middle East, a region that includes Syria and Iran. Sudan, Syria, and Iran are designated by the U.S. Department of State as state sponsors of terrorism, and are subject to U.S. economic sanctions and export controls. Your Form 20-F does not include disclosure regarding contacts with Sudan, Syria, or Iran. Please describe to us the nature and extent of your past, current, and anticipated contacts with Sudan, Syria, and Iran, if any, whether through direct or indirect arrangements. Your response should describe any products, equipment, components, technology, software, or services you have provided into Sudan, Syria, and Iran, directly or indirectly, and any agreements, arrangements, or other contacts you have had with the governments of Sudan, Syria, and Iran or entities they control.

The Company respectfully advises the Staff that, in the past, present and anticipated future, none of the Company’s clients have been, are, or will be based in Sudan, Syria or Iran. The Company has not directly provided any products, equipment, components, technology, software, or services into Sudan, Syria, or Iran, and does not have any agreements, arrangements, or other contacts with the governments of Sudan, Syria, or Iran or entities they control. However, the Company’s business involves providing content delivery network (“CDN”) services to improve the performance of its clients’ websites and online services. It is possible that the clients’ websites and online services may be used in connection with any commercial relationships those clients or their end-users may have in Sudan, Syria or Iran, but such use of third-party websites and online services is beyond the Company’s control.

In November 2012, the Company entered into an agreement to provide CDN services to improve customer utilization of the website of Hainan Airlines Company Limited (“Hainan Airlines”). The CDN services which the Company provides to Hainan Airlines to support its website are generally the same kind of services which the Company provides to its other clients. Under the agreement with Hainan Airlines, the Company will provide solutions to Hainan Airlines’ official website to improve speed, reliability and security for customers who access the website to purchase tickets, search and check-in for flights, request live customer support and manage their accounts.

The Company respectfully advises the Staff that its service nodes in the Middle East referred to on page 39 of the 2011 Form 20-F, whereby the Company enables its clients in China to distribute Internet services and applications to end-users in the Middle East and vice versa, are located in Doha, Qatar. These service nodes located in Doha are established pursuant to a cooperation arrangement between Qatar Telecom (Qtel) Q.S.C. (“Qatar Telecom”) and ChinaCache North America, Inc. (“ChinaCache North America”), a wholly-owned subsidiary of the Company, to deliver services to Middle East users. Under this cooperation arrangement, Qatar Telecom provides facility, power and bandwidth, and ChinaCache North America provides servers and equipment.

2

Item 4. Information on the Company, page 31

2. In the transcript for the 2011 fourth quarter conference call, you refer to seasonality as a reason for changes in operating expenses. In future filings, please include a discussion of seasonality in your business. Refer to Item 4 section B.3 of Form 20-F.

The Staff’s comment is noted, and the Company respectfully advises the Staff that it will include a discussion of seasonality in its business, if any, in future filings of the Company’s annual report on Form 20-F.

B. Business Overview, page 32

3. In the first paragraph of this section, you refer to 2009 data from iResearch. Please tell us the basis for your belief that the 2009 data provides investors with meaningful and reliable information on your market share and leading market position at the time the Form 20-F was filed.

The Company respectfully advises the Staff that, at the time of the filing of the 2011 Form 20-F, the Company did not have access to any publicly available industry data which was more recent than the 2009 data from iResearch concerning the Company’s market share in the CDN industry, which the Company refers to as the “Internet content and application delivery services industry” in its SEC filings. According to the 2009 data from iResearch, the Company had a sizable lead in the CDN industry, accounting for 53% market share in terms of revenues in 2009, with the closest competitor, ChinaNetCenter (Chinese name: 网宿), accounting for 27% of the market share. The Company has included as Exhibit I to this response letter the relevant page of the iResearch report containing the market share of the Company and ChinaNetCenter.

From 2009 to 2011, the Company’s revenues (substantially all of which were derived from the sale of its content and application delivery services) increased from RMB260.0 million to RMB618.4 million, representing a 137.8% increase during this two-year period. This growth rate was higher than the projected CDN industry overall growth rate, according to the same iResearch report. According to the 2009 data from iResearch, the CDN industry in China in terms of revenues was projected to grow by 128.7% from 2009 to 2011. Due to (1) the Company’s sizable lead position in the CDN industry as of the end of 2009 and (2) the fact that the Company’s growth rate in content and application delivery services revenues exceeded the projected industry growth rate during the same two-year period, the Company believes it continues to be the leading provider of Internet content and application delivery services in China.

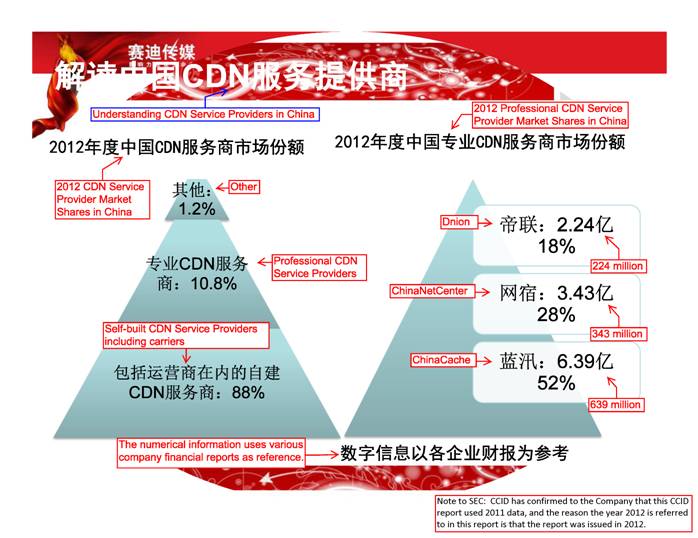

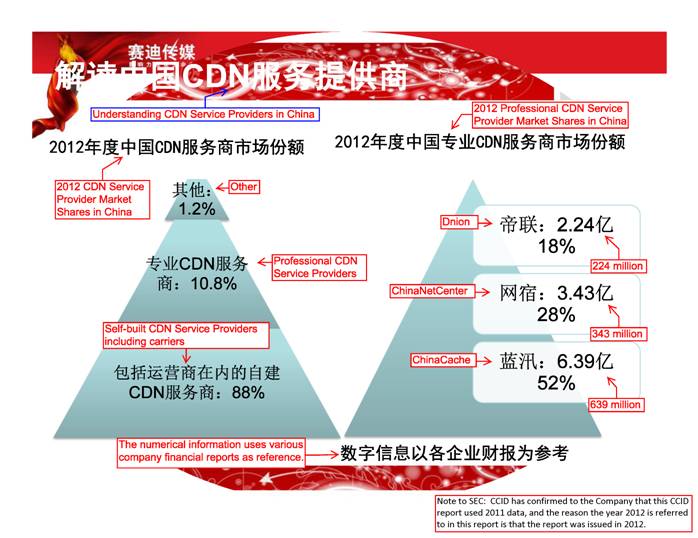

The Company respectfully advises the Staff that in September 2012, Beijing CCID Media Investments Co., Ltd. released a report (the “CCID Report”) providing market share information for 2011 in the CDN industry in China based on CDN revenues in 2011 as disclosed in quarterly earnings releases provided by companies in the CDN industry. According to the CCID Report, and consistent with 2009 iResearch statistics and the Company’s forward-looking implied claims, the Company continued to be the leading provider of CDN services as of the end of 2011, with a 52% market share, and the second largest company, ChinaNetCenter, had a 28% market share. The Company has included as Exhibit II to this response letter the relevant page of the CCID Report containing this market share information.

The Company intends to include in its annual report on Form 20-F for the year 2012 the most recent publicly available industry data to support any statement it may make regarding its market share and leading market position.

3

Regulation

Regulations on Value-Added Telecommunications Business and Content and Application Delivery Business, page 42

4. We note that the Cross-Regional VAT license held by Beijing Blue I.T. has an effective term until October 8, 2012. Tell us whether you have renewed this license or tell us the status of any renewal efforts. If you have not yet renewed this license (or if you do not anticipate renewing it), please explain further the impact that the loss of this license will have on the company’s operations and tell us how you considered including a discussion of such impact in the filing.

The Company respectfully advises the Staff that the Cross-Regional VAT license held by Beijing Blue I.T. was renewed on October 17, 2012, and currently has an effective term until October 17, 2017. The Company will disclose the renewal of this license in its annual report on Form 20-F for the year 2012.

The Company has included as Exhibit III to this response letter an English translation of the October 17, 2012 Cross-Regional VAT license held by Beijing Blue I.T.

5. In addition, tell us whether you have renewed (or expect to renew) Beijing Blue I.T.’s ICP license that is set to expire on December 18, 2012. To the extent you do not anticipate renewing this license, please clarify the expected impact that the loss of this license will have on the company’s operations and your consideration to disclose such impact in future filings.

The Company respectfully advises the Staff that the ICP license held by Beijing Blue I.T. was renewed on December 10, 2012, and currently has an effective term until December 10, 2017. The Company will disclose the renewal of this license in its annual report on Form 20-F for the year 2012.

The Company has included as Exhibit IV to this response letter an English translation of the December 10, 2012 ICP license held by Beijing Blue I.T.

4

Item 5. Operating and Financial Review and Prospects

Net Revenues, page 69

6. The third sentence of the first paragraph indicates that total revenues increased in part from an increase in the number of active customers. Please tell us and disclose in future filings the other material factors that affected revenues. In this regard, we note your disclosure on page 54 that you face pricing pressure and are experiencing and will continue to experience price erosion. In your revised disclosure, you should quantify the impact of changes in price and volume on your revenues.

The Company respectfully advises the Staff that, in addition to an increase in the number of the Company’s active customers, the other material factor that affected the increase in the Company’s total revenues from the year ended December 31, 2010 to the year ended December 31, 2011 was an improvement in the composition of the Company’s customer base, which it refers to as its “customer mix.” The following disclosure on Page 54 of the 2011 Form 20-F contains additional information on this material factor which affects the Company’s total revenues from period to period:

“Our overall customer mix improved in 2010 and 2011 as compared to prior years, as the number of our customers that purchase services with higher average selling prices, which we refer to as high-value customers, increased. In 2009, customers from the Internet and software industries contributed a significant portion of our revenues, but such customers generally generated lower average selling prices. In 2010, we significantly increased our sales to high-value mobile Internet, enterprise customers and e-commerce customers. In 2011, sales in mobile Internet significantly increased from 2010 and the contribution of customers from the Internet and software industries decreased from the level in 2010. The improved overall customer mix contributed to our better gross profit margins in 2010 and 2011 as compared with prior years.”

The Company respectfully advises the Staff that although pricing pressures have resulted in a general decline in the average selling prices for the Company’s services in recent years, the improvement in the Company’s overall customer mix in 2010 and 2011 as compared to prior years has resulted in a higher portion of its revenues being generated from sales of services with higher average selling prices, such as sales in mobile Internet. This improvement in the Company’s overall customer mix has mitigated in part the impact of pricing pressures on its total net revenues.

The Company respectfully advises the Staff that, in its annual report on Form 20-F for the year 2012, it will include in its “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Results of Operations” disclosure the effect of changes in its customer mix and average selling prices on the changes in its total net revenues from year to year, and that such future disclosures will quantify the impact of changes in price and volume on the Company’s revenues, to the extent that these impacts are significant.

5

B. Liquidity and Capital Resources, page 74

7. Tell us and consider disclosing whether there are any significant differences between accumulated profits as calculated pursuant to PRC accounting standards and regulations as compared to accumulated profits as presented in your financial statements.

The Company respectfully advises the Staff that it does not prepare consolidated financial statements in accordance with PRC GAAP, because it is not required to do so for any statutory (business or tax) purposes. However, the Company’s PRC subsidiaries, ChinaCache Beijing and Xin Run, and the Company’s variable interest entities (“VIEs”), Beijing Blue I.T. and Beijing Jingtian, through which substantially all of the Company’s operations are operated, are each required to prepare their stand-alone management accounts in accordance with PRC GAAP. Based on the aggregation of these entities’ stand-alone PRC GAAP management accounts without performing additional reconciliation procedures, the Company estimates that the difference between the accumulated profits under U.S. GAAP and PRC GAAP (assuming the Company had to prepare consolidated financial statements in accordance with PRC GAAP) to be approximately RMB2.1 million (approximately US$0.3 million) as of December 31, 2011. This difference relates primarily to the recognition of liabilities for unrecognized tax benefits and the related interest and penalties in accordance with ASC 740 - Income Taxes.

Item 15. Controls and Procedures

Disclosure Controls and Procedures, page 106

8. We note that as of December 31, 2011, your CEO and CFO concluded that your disclosure controls and procedures were “effective to provide reasonable assurance that material information required to be disclosed by [you] in the reports that [you] file with, or submit to, the SEC under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in by the SEC’s rules and regulations.” Please revise to clarify, if true, that your officers concluded your disclosure controls and procedures are also effective to ensure that information required to be disclosed in the reports that you file or submit under the Exchange Act is accumulated and communicated to management, as appropriate, to allow timely decisions regarding required disclosure. In this regard, please note that if your conclusions concerning the effectiveness of your disclosure controls and procedures refer to the definition of disclosure controls and procedures as indicated in Rule 15(e) of the Exchange Act, then you should either (1) provide the entire definition or (2) clearly indicate that the evaluation was made with respect to disclosure controls and procedures as defined in Rule 13a-15(e) of the Exchange Act. Please revise accordingly.

In response to the Staff’s comments, the Company proposes to include the following disclosure under “Item 15. Controls and Procedures—Disclosure Controls and Procedures” in its future Form 20-F filings if the management concludes that the Company’s disclosure controls and procedures were effective as of the end of the period covered by the relevant future 20-F filing:

“Our management, with the participation of our chief executive officer and chief financial officer, has performed an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report, as required by Rule 13a-15(b) under the Exchange Act. Based upon this evaluation, our management, with the participation of our chief executive officer and chief financial officer, has concluded that, as of the end of the period covered by this annual report, our disclosure controls and procedures were effective in ensuring that the information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in by the SEC’s rules and forms, and that the information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.”

6

Changes in Internal Control over Financial Reporting, page 107

9. We note that in fiscal 2010, the company identified a material weakness in your internal control over financial reporting related to the lack of adequate resources with the requisite U.S. GAAP and SEC financial accounting and reporting expertise to support the accurate and timely assembly and presentation of your consolidated financial statements and related disclosures. We further note from the disclosures in your current Form 20-F that the company believes you have remediated this material weakness by hiring additional qualified personnel with relevant accounting experience, skills and knowledge in U.S GAAP and SEC rules and regulations. In addition, you hired a director of internal audit with requisite experience in Section 404 of the Sarbanes-Oxley Act and developed an internal audit function. Please explain further the following as it relates to your remediation efforts:

· With regards to your CFO, please explain further how you determined that she is able to review financial statements in accordance with U.S. GAAP and take the ultimate responsibilities related to your financial reporting and effectiveness of your internal control over financial reporting considering she does not appear to have been schooled in accounting and all of her U.S. GAAP work experience appears to have been obtained while working for other registrants domiciled in the PRC;

The Company respectfully advises the Staff that, in assessing the ability of the Company’s current chief financial officer to review financial statements in accordance with U.S. GAAP and take the ultimate responsibilities related to the Company’s financial reporting and effectiveness of its internal control over financial reporting, the Company’s board of directors evaluated both her professional experience and education (a summary of which is set forth on page 81 of the 2011 Form 20-F), and in particular considered the following factors within its hiring assessment:

· Ms. Kazmerzak has an MBA from a U.S. business school, with a concentration in finance, and her coursework while at business school included accounting (including instruction in U.S. GAAP);

7

· Ms. Kazmerzak completed the Chartered Financial Analyst program, a program which includes sections on how to review and analyze financial statements in accordance with U.S. GAAP (as well as IFRS); and

· at the time that the Company was considering Ms. Kazmerzak for the position of its chief financial officer, she was chief financial officer for China Information Technology, Inc., a NASDAQ-listed company, and in such capacity Ms. Kazmerzak:

· had direct recent and relevant experience in analyzing the consolidated financial statements in accordance with U.S. GAAP, and presenting her analysis, conclusions and recommendations to the chief executive officer and audit committee;

· had experience in evaluating the effectiveness of China Information Technology, Inc.’s internal control over financial reporting, including providing the certification by the chief financial officer pursuant to Section 302 of SOX for two separate fiscal years;

· led SEC and NASDAQ compliance efforts; and

· provided training on U.S. GAAP, corporate governance and managerial accounting.

Based on the professional experience and education of Ms. Kazmerzak, as set forth in her biography on page 81 of the 2011 Form 20-F and as set forth above, the Company concluded that Ms. Kazmerzak could review financial statements in accordance with U.S. GAAP and take the ultimate responsibilities related to the Company’s financial reporting and effectiveness of its internal control over financial reporting.

· Explain further the role of both the director of internal audit and the external consultant in the evaluation of the company’s internal control over financial reporting. Provide both the educational background and work experience for the director of internal audit that supports his or her experience in Section 404 of the Sarbanes-Oxley Act. In addition, please provide the name of the external consultant that you hired to perform an assessment of your internal control over financial reporting and describe their qualifications. Also, tell us how many hours they spent last year performing these services for you and the total amount of fees paid to this firm.

The Company respectfully advises the Staff that the director of internal audit has the following responsibilities in the evaluation of the Company’s internal control over financial reporting:

· establishing a Sarbanes-Oxley Act (“SOX”) project management office, led by the Company’s chief executive officer and chief financial officer, and establishing a SOX compliance team;

· determining the Company’s SOX compliance efforts and work plans with the assistance of the Company’s external SOX consultant, and ensuring the Company’s SOX compliance efforts and work plans are reviewed and approved by the Company’s SOX project management office;

8

· overseeing the implementation of the SOX compliance work plans;

· performing an enterprise-wide risk assessment and identifying and designing controls to address the identified business, operating and financial risks that impact the Company’s financial reporting and related disclosure;

· leading the SOX compliance team in testing the controls, documenting the controls and testing work performed and overseeing remediation measures;

· discussing control issues, remediation plans and status with the persons having the ultimate responsibility over such controls being tested, and periodically assessing the progress of the implementation of the remediation plans; and

· providing timely and relevant SOX-related training to the Company’s staff.

The Company respectfully advises the Staff that the prior professional experience of the director of internal audit was obtained while working at Deloitte Touche Tohmatsu CPA Ltd. (“Deloitte”) for almost six years, where she provided internal control advisory, SOX readiness advisory, risk management and internal audit services to a number of U.S.-listed audit and non-audit clients. During her time at Deloitte, she received various Section 404 related trainings and obtained deep experiences, which included leading a number of Section 404 readiness and internal control assessment projects for various U.S. public companies. The director of internal audit also previously worked at a company which has three subsidiaries listed in the PRC, including Hong Kong, and while working at this company she led a number of audit projects and oversaw the implementation of responses and remediation efforts to audit findings. The Company’s director of internal audit received her bachelor’s degree in accounting and master’s degree in management from a college in China. The director of internal audit is also a Certified Internal Auditor.

The Company respectfully advises the Staff that it has engaged PricewaterhouseCoopers Consultants (Shenzhen) Limited (“PwC”) to provide assistance, training and technical advice to the Company and its internal audit team in carrying out the enterprise-wide assessment of controls, evaluation of the design and operating effectiveness of controls, documentation of controls and testing work, and advising and following-up on remediation by process owners with respect to the Company’s internal control over financial reporting for year 2011 to comply with SOX Section 404. PwC also provides risk management and internal control advisory services (including Section 404 advisory) to a number of public companies operating throughout China. The PwC team members have qualifications such as U.S. CPA, ACCA, ISACA, CIA, ANIA and CISA, and are also experienced in U.S. GAAP and the preparation of consolidated financial statements, and have experience working on many Section 404 advisory and audit projects.

9

The Company respectfully advises the Staff that the Company paid a total amount of RMB902,161.40 (US$143,344) in fees to PwC for SOX advisory services in regard to fiscal year 2011, and the total amount of hours incurred by PwC for the foregoing services was approximately 1,700 hours.

· As it relates to the audit committee financial experts that you identify on page 108, please describe further their qualifications, including the extent of their knowledge of U.S. GAAP and internal control over financial reporting; and

The Company respectfully sets forth the following information which, along with the descriptions of Ms. Kathleen Chien’s and Ms. Bin Laurence’s professional experience and education contained on pages 80 and 81 of the 2011 Form 20-F, summarizes the qualifications of Ms. Chien and Ms. Laurence to be audit committee financial experts:

· Each of Ms. Chien’s and Ms. Laurence’s present and prior work experience as chief financial officers of U.S.-listed/SEC-reporting companies, which report their financial statements in accordance with U.S. GAAP has given them experience as principal financial officers of companies which report their financial statements in accordance with U.S. GAAP. Ms. Chien is chief operating officer and acting chief financial officer of 51job, Inc., a NASDAQ-listed company which had a market capitalization of approximately US$1.36 billion as of December 26, 2012 and total revenues of RMB1,370 million (US$217.7 million) in 2011. Previously, Ms. Chien was 51job, Inc.’s chief financial officer from 2004 to March 2009. Ms. Laurence has served as the chief financial officer of E-House (China) Holdings Limited (“E-House”), a NYSE-listed company, since April 2012, and was chief financial officer of E-House’s subsidiary, China Real Estate Information Corporation (“CRIC”), which had been a NASDAQ-listed company prior to its acquisition by E-House in 2012, from August 2009 to April 2012. E-House had a market capitalization of US$492.2 million as of December 26, 2012 and total revenues of approximately US$401.6 million in 2011.

· As chief financial officers of U.S.-listed/SEC-reporting companies reporting their financial statements in accordance with U.S. GAAP, each of Ms. Chien and Ms. Laurence has a solid understanding of generally accepted accounting principles and considerable experience analyzing financial statements and a broad range of accounting issues that are generally comparable to the breadth and complexity of issues that have been and can reasonably be expected to be raised in the Company’s financial statements. Such U.S. GAAP accounting issues include, but are not limited to, those relating to: the use of a variable interest entity corporate structure, and the contractual arrangements relating thereto; share-based compensation; revenue recognition; and business combinations.

· Each of Ms. Chien and Ms. Laurence has actively supervised the accounting teams of the companies at which they serve and has served as chief financial officer, and has experience overseeing and assessing the performance of public accountants with respect to the preparation, auditing and evaluation of their respective companies’ financial statements.

10

· In their work as chief financial officers, each of Ms. Chien and Ms. Laurence has significant experience with evaluating the effectiveness of internal controls and procedures over financial reporting. As the current acting chief financial officer or previous chief financial officer of 51job, Inc. Ms. Chien has provided the certification by the chief financial officer pursuant to Section 302 of SOX for seven separate fiscal years. In her previous position as chief financial officer of CRIC, Ms. Laurence provided the certification by the chief financial officer pursuant to Section 302 of SOX for two separate fiscal years. In addition, in her present position as chief financial officer of E-House, Ms. Laurence has provided the certification by the chief financial officer pursuant to Section 302 of SOX for one fiscal year.

· As chief financial officers of SEC-reporting companies, each of Ms. Chien and Ms. Laurence has experience overseeing the preparation of, and reviewing, consolidated financial statements that must be included in Forms 20-F, 6-K and other forms required to be filed with the SEC for the companies for which each serves as chief financial officer.

· We would like to understand more about the background of any others (aside from the CFO and director of internal audit) who are primarily responsible for preparing and supervising the preparation of your financial statements and evaluating the effectiveness of your internal control over financial reporting and their knowledge of U.S. GAAP and SEC rules and regulations. Do not identify people by name, but for each person, please tell us:

· what role he or she takes in preparing your financial statements and evaluating the effectiveness of your internal control;

The Company respectfully advises the Staff that, in addition to the Company’s chief financial officer and director of internal audit, the Company’s finance and accounting team includes a financial controller, a finance director and a reporting manager who are also responsible for preparing and supervising the preparation of the Company’s consolidated financial statements.

The reporting manager reviews the financial statements prepared by each of the Company’s subsidiaries and consolidated affiliated entities in China based on PRC GAAP, prepares accounts adjustments and financial statements for each company and consolidated affiliated entity based on US GAAP, and prepares accounts consolidations and reconciliations as well as the consolidated financial statements. As part of its continuous effort to further improve the Company’s financial reporting process and strengthen its accounting and finance department, the financial controller was hired in the third quarter of 2012. In 2011, prior to the financial controller being hired, the reporting manager’s work as described above was first reviewed by the financial director and then the chief financial officer. Beginning with the conclusion of quarterly accounts for the fourth quarter of 2012, the reporting manager’s work will be preliminarily reviewed by the finance director, then submitted to the financial controller for a second review, and then submitted to the chief financial officer for final review.

11

The Company respectfully advises the Staff that in addition to the Company’s chief executive officer and chief financial officer, the Company’s financial controller, finance director and reporting manager are also involved in the preparation of the Company’s financial statements and financial disclosures. In addition to the Company’s chief executive officer and chief financial officer, the director of internal audit and the internal audit team, supported by the Company’s external SOX consultant, are responsible for evaluating the effectiveness of the Company’s internal control over financial reporting.

· what relevant education and ongoing training he or she has had relating to U.S. GAAP;

· whether he or she holds and maintains any professional designations such as Certified Public Accountant (U.S.) or Certified Management Accountant; and

· about his or her professional experience, including experience in preparing and/or auditing financial statements prepared in accordance with U.S. GAAP and evaluating effectiveness of internal control over financial reporting.

In regards to the Staff’s comments set forth in the three bullet points above, the Company respectfully directs the Staff to the summary background information on the financial controller, finance director and reporting manager below.

Financial Controller. The financial controller’s prior professional experience includes: serving as a group finance manager with overall finance control function in China for Jebsen & Co. (China) Ltd., with responsibilities including, among others: (1) having overall responsibility for the accounting function at the company; (2) responsibility for the year-end audit in accordance with PRC GAAP and Hong Kong IFRS and tax filing; and (3) formulating policies and procedures for internal control. Prior to working at Jebsen & Co. (China) Ltd., the financial controller worked as a financial director (regional control/BU finance) at 51job.com, a U.S. GAAP NASDAQ-listed company. The financial controller’s responsibilities while at 51job.com included, among other things, assessing internal control risks and identifying internal control weaknesses, working with the financial reporting team, revising workflows and operating procedures to meet the requirements of SOX 404, and assisting the financial reporting team with the preparation of consolidated financial statements in accordance with U.S. GAAP. Earlier in her career, the financial controller was a senior accountant at KPMG Peat Marwick Huazhen, where her work centered on PRC accounting-related services.

12

The financial controller received a bachelor’s degree in finance and accounting from Hebei Finance & Economics University and an MBA from Mt-Eliza Business School — University of Queensland (Beijing). The financial controller is a member of the Chinese Institute of Certified Public Accountants and is a Certified Appraiser in China. The financial controller has attended various trainings in recent years relating to U.S. GAAP and SEC compliance, including: conferences in 2012 organized by the Center for Professional Education Inc. relating to accounting and reporting updates for U.S.-listed companies, and a U.S. GAAP update conference in 2011 organized by Deloitte.

Finance Director. Prior to working at the Company, the finance director was a K-12 business unit finance manager at a NYSE-listed company that reports its financial statements in accordance with U.S. GAAP. The finance director’s responsibilities at that company included, among other things: overall responsibility of accounting work for K-12 schools with a team consisting of 20 accountants; converting financial statements compiled based on PRC GAAP to US GAAP for U.S. reporting purposes, and coordinating and supervising external auditors to complete audit work for schools. The finance director’s prior work experience also includes being a senior accountant in the audit department at Deloitte. In his almost three years of work experience at Deloitte, the finance director led teams to complete audit work under US GAAP, including initial public offering audits and regular post-IPO audits, and he also performed SOX 404 testing. Earlier in his career, he also worked in the audit department of PricewaterhouseCoopers and Arthur Andersen.

The finance director received a bachelor’s degree (accounting major) from Zhongnan University of Finance and Economics and an MBA from Schulich School of Business at York University in Toronto, Canada. He is a member of the Association of Chartered Certified Accountants and the Chinese Institute of Certified Public Accountants. The finance director has attended various trainings in recent years relating to U.S. GAAP and SEC compliance, including: conferences in 2012 organized by the Center for Professional Education Inc. relating to accounting and reporting updates for U.S.-listed companies, a U.S. GAAP update conferences in 2011 co-sponsored by PwC and a U.S. GAAP update conference in 2011 organized by Deloitte.

Reporting Manager. Prior to joining the Company, the reporting manager worked for almost six years at Deloitte, where she attained the position of senior auditor. At Deloitte, the reporting manager’s engagements included providing audit services to pre-IPO and NASDAQ-listed companies, including conducting audits in accordance with U.S. GAAP, and doing internal control consultations. The reporting manager received a bachelor’s degree in international economics and trade at Liaoning University and a master’s degree in economics at the University of Birmingham. The reporting manager has attended many U.S. GAAP trainings, including many U.S. GAAP updates and SEC regulation updates provided each year by Deloitte. The reporting manager is a Certified Internal Auditor.

The Company respectfully advises the Staff that it requires the reporting manager to attend various U.S. GAAP trainings at least on a quarterly basis, the financial controller and the finance director to attend various U.S. GAAP trainings at least on a biannual basis, and the director of internal audit to attend various U.S. GAAP trainings at least on an annual basis, and for all such persons to share the U.S. GAAP and SEC regulation updates internally with the rest of the finance team from time to time.

The Company respectfully advises the Staff that the board and the senior management have been conducting periodic reviews and evaluations of the work performance of core members of the Company’s finance team, as applicable. These reviews and evaluations are designed to ensure that the finance staff under review has the knowledge and competencies required to perform the tasks within the scope of his or her job, and that he or she is making efforts to improve the relevant skill set, knowledge and teamwork spirit necessary to meet with the requirements of the Company’s expansion and anticipated growth.

13

Item 18. Financial Statements

Notes to Consolidated Financial Statements

Note 1. Organization, page F-12

10. We note from your disclosures on page 51 that in the opinion of your PRC counsel, each of the contracts under the contractual arrangements among your PRC subsidiary, PRC consolidated VIE and their shareholders governed by PRC law are valid, binding and enforceable and will not result in any violation of PRC laws or regulation currently. If you consider this enforceability conclusion to be a significant consolidation judgment and/or assumption please revise the disclosures in the footnotes to your audited financial statement to indicate as such. See ASC 810-10-50-2AA.

The Company respectfully advises the Staff that it has disclosed the opinion of its PRC counsel concerning the validity, enforceability and non-violation of current PRC laws and regulations as a significant consolidation judgment on page F-16 of the Company’s consolidated financial statements, which are included in the 2011 Form 20-F. In addition, the Company has also disclosed the risk of substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations which might have an impact on the Company’s current organizational and operational structure.

However, in response to the Staff’s comment, the Company proposes to revise its disclosure in “Note 1 — Organization” on page F-16 in future filings of its Form 20-F to reflect the following amendments:

“Legal compliance

Assessing the legal validity and compliance of these above noted arrangements are a precursor to the Company’s ability to consolidate the results of operations and financial condition of its VIEs. In the opinion of the Company’s management and PRC counsel, (i) the ownership structure of the Company and the VIEs are in compliance with existing PRC laws and regulations; (ii) the contractual arrangements with the VIEs and its shareholder are valid and binding, and will not result in any violation of PRC laws or regulations currently in effect; and (iii) the Company’s business operations are in compliance with existing PRC laws and regulations in all material respects.

14

However, there is significant consolidation judgment due to the existence of substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Accordingly, the Company cannot be assured that PRC regulatory authorities will not ultimately take a contrary view to its opinion. If the current ownership structure of the Company and its contractual arrangements with its VIEs is found to be in violation of any existing or future PRC laws and regulations, the Company may be required to restructure its ownership structure and operations in the PRC. To the extent that changes to and new PRC laws and regulations prohibit the Company’s VIE arrangements from also complying with the principles of consolidation, then the Company would no longer be able to consolidate and therefore would have to deconsolidate the financial position and results of operations of its VIEs. In the opinion of management, the likelihood of loss and deconsolidation in respect of the Company’s current ownership structure or the contractual arrangements with its VIEs is remote based on current facts and circumstances.”

11. We note your discussion regarding the various VIE agreements beginning on page F-14. Revise your disclosures here to include the terms of each of these agreements along with a discussion of which party or parties have renewal rights. Also, revise to clarify how you considered each of these agreements in concluding that you are the primary beneficiary of the VIEs and specifically address the agreements from which you obtain effective control over the VIEs and those that provide you the ability to receive substantially all of the economic benefits of the VIEs. We refer you to ASC 810-10-50- 2(AA).

In response to the Staff’s comments No. 11 and 12, the Company proposes to revise the disclosure in “Note 1. Organization” relating to its VIEs in future filings of its Form 20-F as set forth below. For the convenience of the Staff, the revisions to the disclosure are underlined.

“Note 1. Organization

The following is a summary of the various VIE agreements:

Exclusive option agreement

Pursuant to the exclusive option agreement amongst the Company and the Nominee Shareholders of Beijing Blue IT, the Nominee Shareholders irrevocably granted the Company or its designated party, an exclusive option to purchase all or part of the equity interests held by the Nominee Shareholders in Beijing Blue IT, when and to the extent permitted under PRC law, at an amount equal to either a) the outstanding loan amount pursuant to the loan agreement owed by the Nominee Shareholders or b) the lowest permissible purchase price as set by PRC law. Such consideration, if in excess of the outstanding loan amount, when received by the Nominee Shareholders upon the exercise of the exclusive option is required to be remitted in full to ChinaCache Beijing. Beijing Blue IT cannot declare any profit distributions or grant loans in any form without the prior written consent of the Company. The Nominee Shareholders must remit in full any funds received from Beijing Blue IT to ChinaCache Beijing, in the event any distributions are made by the VIEs pursuant to any written consents of the Company. This agreement is valid for ten years and expires on September 23, 2015. Such agreement can be renewed for an additional ten years at the sole discretion of the Company, and the times of such renewals are unlimited.

15

Similar exclusive option agreements were signed by ChinaCache Beijing with the VIEs, Shanghai JNet (Note 4(b)) and Beijing Jingtian, respectively.

Exclusive business cooperation agreement

Pursuant to the exclusive business cooperation agreement between ChinaCache Beijing and the VIEs, ChinaCache Beijing is to provide exclusive business support, technical and consulting services including technical services, business consultations, intellectual property licenses, equipment or property leasing, marketing consultancy, system integration, product research and development and system maintenance in return for fees based on of a percentage of the VIEs’ profit before tax, which is adjustable at the sole discretion of ChinaCache Beijing. This agreement is valid for ten years and expires on September 23, 2015. Prior to this agreement’s and subsequent agreements’ expiration dates, ChinaCache Beijing can at its sole discretion renew at a term of its choice through written confirmation.

ChinaCache Beijing also agreed to provide unlimited financial support to Shanghai JNet (Note 4(b)) and Beijing Jingtian for their operations and agree to forego the right to seek repayment in the event Shanghai JNet and Beijing Jingtian are unable to repay such funding.

Exclusive technical support and service agreement/Exclusive technical consultation and training agreement/Equipment leasing agreement

Pursuant to these agreements between ChinaCache Beijing and Beijing Blue IT, ChinaCache Beijing is to provide research and development, technical support, consulting, training and equipment leasing services in return for fees, which is adjustable at the sole discretion of ChinaCache Beijing. The original term of each of these three agreements was five years running from September 23, 2005, and each of the agreements was renewed in September 2010 for a five year term which expires on September 23, 2015. The term of the equipment leasing agreement can be extended solely by ChinaCache Beijing by written notice prior to the expiration of the term, and the extended term shall be determined by ChinaCache Beijing.

The exclusive business cooperation agreement, exclusive technical support and service agreement, exclusive technical consultation and training agreement, and equipment leasing agreement are collectively referred to as “Service Agreements”.

16

Loan agreement

The Company provided a loan facility of RMB10,000,000 to the Nominee Shareholders of Beijing Blue IT for the purpose of providing capital to Beijing Blue IT to develop its business. In addition, the Company also agreed to provide unlimited financial support to Beijing Blue IT for its operations and agree to forego the right to seek repayment in the event Beijing Blue IT is unable to repay such funding. The loan agreement between the Company and the Nominee Shareholders of Beijing Blue IT is valid for ten years and expires on September 23, 2015. Such agreement can be extended upon mutual written consent of the Company and the Nominee Shareholders of Beijing Blue IT.

ChinaCache Beijing also provided a loan of RMB100,000 to the Nominee Shareholders of Beijing Jingtian for their investment in the registered share capital. The loan agreement between ChinaCache Beijing and the Nominee Shareholders of Beijing Jingtian is valid for ten years and expires on July 31, 2018. Such agreement can be extended upon mutual written consent of ChinaCache Beijing and the Nominee Shareholders of Beijing Jingtian.

Power of attorney agreement

The Nominee Shareholders entered into the power of attorney agreement whereby they granted an irrevocable proxy of the voting rights underlying their respective equity interests in the VIEs to ChinaCache Beijing, which includes, but are not limited to, all the shareholders’ rights and voting rights empowered to the Nominee Shareholders by the company law and the Company’s Article of Association. This agreement remains continuously valid, as long as the Nominee Shareholders continue to be the shareholders of the VIEs.

Share pledge agreement

Pursuant to the share pledge agreement between ChinaCache Beijing and the Nominee Shareholders, the Nominee Shareholders have pledged all their equity interests in the VIEs to guarantee the performance of the VIEs’ obligations under the exclusive business cooperation agreements.

If the VIEs breach their respective contractual obligations under the business cooperation agreements, ChinaCache Beijing, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The Nominee Shareholders agreed not to transfer, sell, pledge, dispose of or otherwise create any new encumbrance on their equity interests in the VIEs without the prior written consent of ChinaCache Beijing. This agreement is continuously valid until all payments due under the above VIE agreements have been fulfilled by the VIEs.”

Despite the lack of technical majority ownership, there exists a parent-subsidiary relationship between the Company and the VIEs through the irrevocable power of attorney agreement, whereby the Nominee Shareholders effectively assigned all of their voting rights underlying their equity interest in the VIEs to ChinaCache Beijing. The Company demonstrates its ability and intention to continue to exercise the ability to absorb substantially all of the expected losses directly through the loan agreement for Beijing Blue IT and through ChinaCache Beijing using the business cooperation agreements for Shanghai JNet (Note 4(b)) and Beijing Jingtian. In addition, the Company also demonstrates its ability to receive substantially all of the profits of the VIEs through ChinaCache Beijing. Thus, the Company is also considered the primary beneficiary of the VIEs either directly or through ChinaCache Beijing. As a result of the above, the Company consolidates the VIEs under by Accounting Standards Codification (“ASC”) Subtopic 810-10 (“ASC 810-10”) “Consolidation: Overall.”

17

12. Please describe further the terms of the Exclusive Business Cooperation Agreement between ChinaCache and Beijing Blue IT and tell us how such terms grant ChinaCache the ability to receive substantially all of the economic benefits and incur substantially all the losses of Beijing Blue IT. In this regard, pursuant to Section 2 of Exhibit 10.13 (as filed with your Form F-1 on September 9, 2010), the service fees under this Agreement shall be determined and paid based on methods set forth in separate agreements to be entered into between ChinaCache and Beijing Blue IT. Tell us if you entered into any separate agreements and if so, provide the terms of such agreements and explain further how they support your conclusions to consolidate this entity. In addition, tell us your consideration to file such agreements pursuant to Item 4 in the Instructions to Exhibits of Form 20-F.

The Company respectfully advises the Staff that the Exclusive Business Cooperation Agreement, dated September 23, 2005 (the “Business Cooperation Agreement”), between ChinaCache Beijing and Beijing Blue I.T., is a framework agreement, and under Section 2 of the Business Cooperation Agreement, ChinaCache Beijing and Beijing Blue I.T. agreed that the service fees under the Business Cooperation Agreement shall be determined and paid based on the methods set forth in separate agreements to be entered between ChinaCache Beijing and Beijing Blue I.T. Pursuant to Section 2 of the Business Cooperation Agreement, ChinaCache Beijing and Beijing Blue I.T. entered into the following separate agreements under which service fees are paid by Beijing Blue I.T. to ChinaCache Beijing: (1) Exclusive Technical Consultation and Training Agreement, dated September 23, 2005 (the “Technical Consultation and Training Agreement”), between ChinaCache Beijing and Beijing Blue I.T.; and (2) Exclusive Technical Support and Service Agreement, dated September 23, 2005 (the “Technical Support and Service Agreement”), between ChinaCache Beijing and Beijing Blue I.T. The Business Cooperation Agreement, Technical Consultation and Training Agreement and Technical Support and Service Agreement were filed as exhibits 4.17, 4.18 and 4.19 to the 2011 Form 20-F, and a summary of the terms of each of these agreements is set forth on pages 50 and 51 of the 2011 Form 20-F.

18

Under Section 3.1 of the Technical Consultation and Training Agreement, Beijing Blue I.T. agreed to pay service fees to ChinaCache Beijing in accordance with the appendix to that agreement, and under Section 2.1 of the Technical Support and Service Agreement, Beijing Blue I.T. agreed to pay service fees to ChinaCache Beijing in accordance with the appendix to that agreement. Each year, ChinaCache Beijing and Beijing Blue I.T. sign a written confirmation in the form of the appendix to the Technical Consultation and Training Agreement and sign a written confirmation in the form of the appendix to the Technical Support and Service Agreement, and in each of these written confirmations ChinaCache Beijing and Beijing Blue I.T. agree on the service fees to be paid under these two agreements for the current fiscal year, as well as the calculation of such fees for that year. The fees paid under the Technical Consultation and Training Agreement and Technical Support and Service Agreement, as set forth in the respective written confirmations, include an annual fixed amount and a variable quarterly amount which is determined based on all of the following factors:

· the number of ChinaCache Beijing’s employees who provided the services pursuant to the Business Cooperation Agreement to Beijing Blue I.T. during the quarter (the “Quarterly Services”) and the qualifications of the employees;

· the number of hours ChinaCache Beijing’s employees spent to provide the Quarterly Services;

· operating expenses incurred by ChinaCache Beijing to provide the Quarterly Services;

· nature and value of the Quarterly Services; and

· Beijing Blue I.T.’s operating revenue for the quarter.

The above-mentioned contractual arrangements provide ChinaCache Beijing with the ability to receive substantially all of the economic benefits of Beijing Blue I.T. The Company’s obligation to incur substantially all of the losses of Beijing Blue I.T. result from the loan agreements, dated September 23, 2005 (the “Loan Agreements”), between the Company and the shareholders of Beijing Blue I.T., and the supplementary agreements to loan agreements, dated May 10, 2010 (the “Supplementary Agreements to Loan Agreements”), between the Company and the shareholders of Beijing Blue I.T. Pursuant to the Loan Agreements, the Company provided an interest-free loan facility of RMB10.0 million to the nominee shareholders of Beijing Blue I.T. for the purpose of providing capital to Beijing Blue I.T. to develop its business. In addition, under the Supplementary Agreements to Loan Agreements, the Company agreed to provide unlimited financial support to the shareholders of Beijing Blue I.T. for Beijing Blue I.T.’s operations. The Loan Agreements and Supplementary Agreements to Loan Agreements were filed as exhibits 4.13 and 4.14, respectively, to the 2011 Form 20-F, and a summary of the terms of these agreements is set forth on page 49 of the 2011 Form 20-F.

19

The Company respectfully advises the Staff that its ability to consolidate Beijing Blue I.T., as disclosed in the revised disclosure provided in response to the Staff’s comment No. 11 above, is supported by: (1) ChinaCache Beijing’s ability to receive substantially all of the economic benefits of Beijing Blue I.T. pursuant to the Business Cooperation Agreement, Technical Consultation and Training Agreement and Technical Support and Service Agreement , and (2) the Company’s obligation to incur substantially all of the losses of Beijing Blue I.T. as a result of the Loan Agreements and the Supplementary Agreements to Loan Agreements.

13. We note that in May 2010, ChinaCache Beijing assigned the power of attorney agreements to ChinaCache Beijing’s shareholders. Please tell us why ChinaCache Beijing reassigned their power of attorney. Also, please provide the names of ChinaCache’s shareholders and their percentage ownership.

The Company respectfully advises the Staff that the business reason for the change in the organizational structure, such that the Company replaced ChinaCache Beijing as the primary beneficiary of the VIEs, is that the Company’s board of directors are in a position to make decisions with respect to the VIEs in a manner that is more aligned with the Company’s business goals as compared to the executive officers of ChinaCache Beijing. Moreover, from a fiduciary duty perspective, the Company believes it is preferable for the powers of attorney to be ultimately exercised by the Company’s board of directors, who directly have fiduciary duties to the Company’s shareholders, than for the powers of attorney to be exercised by the executive officers of ChinaCache Beijing.

The Company respectfully advises the Staff that ChinaCache Network (Hong Kong) Limited (“ChinaCache HK”) owns 100% of the equity interest of ChinaCache Beijing, and the Company owns 100% of the equity interest of ChinaCache HK. The shareholding information, as of April 13, 2012, of the Company’s directors, executive officers and principal shareholders is set forth on page 88 of the 2011 Form 20-F.

Note 4. Consolidation (Deconsolidation) of Shanghai JNet

Post-Acquisition Settlement Consideration, page F-33

14. Provide us with the calculations that support the post-acquisition settlement consideration reported in fiscal 2010 and the change in the fair value of such consideration as recorded in fiscal 2011. Please ensure that your response includes the assumed dollar amount of Shanghai JNet’s pre-tax income used in your calculations and tell us how such assumptions compare to the actual amount of pre-tax income recognized by Shanghai JNet.

The Company respectfully advises the Staff that the calculations which support the post-acquisition settlement consideration for 2010 and 2011 were performed on a quarterly basis based on the actual pre-tax income and discount rate for the quarter and the estimated pretax income for future periods. The summarized computation of post-acquisition settlement consideration was derived on an annual basis for 2010 and 2011:

20

| | 2010 | |

Actual pre-tax income for 2010 (RMB’000) | | 7,686 | |

Estimated pre-tax income for 2011 (RMB’000) | | 6,908 | * |

Estimated pre-tax income for 2012 (RMB’000) | | 6,491 | * |

| | | |

Total pre-tax cashflows (RMB’000) | | 21,085 | |

Discount rate | | 17 | %** |

| | | |

Fair value of post-acquisition settlement consideration (RMB’000) | | 18,840 | (a) |

| | 2011 | |

Actual pre-tax income for 2010 (RMB’000) | | 7,686 | |

Actual pre-tax income for 2011 (RMB’000) | | 9,788 | |

Estimated pre-tax income for 2012 (RMB’000) | | 9,472 | * |

| | | |

Total pre-tax cashflows (RMB’000) | | 26,946 | |

Discount rate | | 16 | %** |

| | | |

Fair value of post-acquisition settlement consideration (RMB’000) | | 25,998 | (b) |

| | | |

Change in fair value of the post-acquisition settlement consideration in 2011 (RMB’000) | | 7,158 | (a)-(b) |

Change in fair value of the post-acquisition settlement consideration in 2011 (USD’000) | | 1,137 | |

* The estimated pre-tax income was derived from historical actual operating results coupled with management’s best estimate of future performance, which included significant estimates and judgments surrounding current and future economic market and industry conditions, technological advancements, current customer retention and new customer growth, revenue growth, average selling prices and the speed with which the Company can introduce new products to their current and new customers.

** Discount rates were determined through the assessment of the Company’s specific and industry specific risks.

Deconsolidation of JNet, page F-24

15. Supplementally explain the business reason(s) behind the December 26, 2011 termination of the contractual arrangements between the company and Shanghai JNet that led to the deconsolidation and “effective” disposal of Shanghai JNet back to the sellers.

The Company supplementally advises the Staff that the primary business reason for the termination of the contractual arrangements between the Company and Shanghai JNet that led to the deconsolidation and “effective” disposal of Shanghai JNet back to the sellers was mainly attributable to both the costs of the post-acquisition settlement consideration incurred by the Company and the efforts expended by the Company with respect to the integration of Shanghai JNet’s operations and personnel with the Company’s overall operations, which outweighed the benefit of Shanghai JNet’s deteriorating percentage contribution of revenue to the Company (as disclosed on page 59 of the 2011 Form 20-F, Shanghai JNet had contributed 4.6%, 2.0% and 1.6% of the Company’s total net revenues in 2009, 2010 and 2011, respectively).

21

Note 25. Discontinued Operation, page F-71

16. Tell us how you determined that the classification of “post-acquisition settlement consideration” in continuing operations is appropriate considering you have classified the financial results of Shanghai JNet as discontinued operations for all periods presented. Please cite the authoritative literature you relied upon.

The Company respectfully advises the Staff that the Company has incurred the post-acquisition settlement consideration obligation as a cost of doing its business based on the agreed terms of the Shanghai JNet acquisition. The Company did consider the reclassification of these amounts within discontinued operations but concluded that the post-acquisition settlement consideration was not a part of the continuing results of operations of Shanghai JNet in accordance with ASC 205-20-45-1, and thus has not classified these amounts as a component of discontinued operations.

Item 19. Exhibits, page 110

17. You state in the fourth full paragraph on page 50 that irrevocable powers of attorney granting voting powers in Beijing Jingtian to ChinaCache Beijing’s shareholders were re-signed. You also state in the first and second full paragraphs on page 51 that agreements referenced in those paragraphs have been extended for five years. Please include these revisions as exhibits or tell us why you do not believe that they are required to be filed.

The Company respectfully advises the Staff that on May 10, 2010, the board of directors and the shareholders of ChinaCache Beijing each approved resolutions whereby, among other things, all shareholder rights that ChinaCache Beijing has in Beijing Blue I.T. pursuant to the irrevocable powers of attorney executed by the shareholders of Beijing Blue I.T. on September 23, 2005, and all shareholder rights that ChinaCache Beijing has in Beijing Jingtian pursuant to the irrevocable powers of attorney executed by the shareholders of Beijing Jingtian on July 31, 2008, were re-assigned to ChinaCache Beijing’s shareholders or a party designated by ChinaCache Beijing’s shareholders, for the business reason discussed in the response to SEC comment No. 13. English language translations of these board and shareholder resolutions of ChinaCache Beijing are attached to this response letter as Exhibit V. Accordingly, there were no new powers of attorney executed in connection with the May 10, 2010 board and shareholder resolutions of ChinaCache Beijing.

22

The Company respectfully advises the Staff that, when the terms of the Technical Support and Service Agreement, Technical Consultation and Training Agreement and the Equipment Leasing Agreement, dated September 23, 2005 (the “Equipment Leasing Agreement”), between ChinaCache Beijing and Beijing Blue I.T., were extended, new agreements were not entered into, but rather the terms of these three agreements were extended by means of a written confirmation. The Company has included a copy of this written confirmation as Exhibit VI to this response letter. The Company respectfully advises the Staff that in its future Form 20-F filings, it will include as exhibits to its Form 20-F the Technical Support and Service Agreement, Technical Consultation and Training Agreement, Equipment Leasing Agreement and the written confirmation concerning the extension of the terms of each of these agreements.

* * *

23

The Company hereby acknowledges that:

· the Company is responsible for the adequacy and accuracy of the disclosure in the filing;

· Staff comments or changes to disclosure in response to Staff comments do not foreclose the SEC from taking any action with respect to the filing; and

· the Company may not assert Staff comments as a defense in any proceeding initiated by the SEC or any person under the federal securities laws of the United States.

If you have any additional questions or comments regarding the 2011 Form 20-F, please contact the Company’s U.S. counsel, Z. Julie Gao of Skadden, Arps, Slate, Meagher & Flom LLP, at +852 3740-4850.

| Very truly yours, |

| |

| /s/ Song Wang |

| Song Wang |

| Chairman and Chief Executive Officer |

cc:

Z. Julie Gao, Esq., Skadden, Arps, Slate, Meagher & Flom LLP

John Qian, Partner, Ernst & Young Hua Ming LLP

24

Exhibit I

Extracted Page from 2009 iResearch Report

I-1

Exhibit II

Extracted Page from the CCID Report

II-1

Exhibit III

English Translation of Current Cross-Regional VAT License Held by Beijing Blue I.T.

The People’s Republic of China

Value Added Telecommunication Services Operation License

Operation License No.: B1-20070275

In accordance with the Regulation on Telecommunications of the People’s Republic of China and relevant state regulations, the company is approved to conduct value added telecommunication services specified in this license (both the body of the text and the appendix) after examination. It is hereby to issue this license for trans-regional operation of value added telecommunication services.

Name of the Company: Beijing Blue I.T. Technologies Co., Ltd.

Legal Representative: KOU Xiaohong

Registered Capital: RMB 10,000,000

Registered Address: No. Jia 8, Ta Yuan Lang Qiu Yuan, Haidian District, Beijing

Business Type: (see appendix)

Business Coverage Scope: (see appendix)

(Service Items)

Signature: | |

Approved by: (Seal) | |

| |

Miao Wei | |

| |

Date of Issue: October 17, 2012 | |

| |

Date of Expiration: October 17, 2017 | |

III-1

Operation License No.: B1-20070275

The People’s Republic of China

Value Added Telecommunication Services Operation License

(Appendix)

I. The business type that Beijing Blue I.T. Technologies Co., Ltd. is approved to conduct:

Domestic Internet Protocol Virtual Private Network Services and Internet Data Centre Services under Category I Value-added Telecommunication Services (including internet data contents acceleration and express (CDN) services)

II. The business coverage scope that Beijing Blue I.T. Technologies Co., Ltd. is approved to have:

1. Internet Protocol Virtual Private Network Services

Beijing and Shanghai (two municipalities); Nanjing, Wuhan, Guangzhou, Shenzhen, Chengdu and Xi’an (six cities)

2. Internet Data Centre Services (including internet data contents acceleration and express (CDN) services):

Beijing, Shanghai, Tianjin and Chongqing (four municipalities); Shijiazhuang, Langfang, Tangshan, Handan, Taiyuan, Datong, Hohhot, Tongliao, Shenyang, Dalian, Anshan, Changchun, Jilin, Yanbian Korean Autonomous Prefecture, Harbin, Daqing, Jiamusi, Mudanjiang, Nanjing, Yangzhou, Xuzhou, Suzhou, Wuxi, Changzhou, Hangzhou, Ningbo, Wenzhou, Shaoxing, Hefei, Wuhu, Fuzhou, Quanzhou, Xiamen, Nanchang, Jiujiang, Jinan, Qingdao, Liaocheng, Weihai, Zhengzhou, Luoyang, Nanyang, Wuhan, Jingzhou, Jingmen, Changsha, Hengyang, Zhuzhou, Guangzhou, Shenzhen, Shantou, Dongguan, Zhanjiang, Foshan, Nanning, Guilin, Haikou, Chengdu, Mianyang, Neijiang, Guiyang, Zunyi, Kunming, Yuxi, Dali Bai Autonomous Prefecture, Lijiang, Xi’an, Weinan, Xining, Haixi Mongol and Tibetan Autonomous Prefecture, Lanzhou, Tianshui, Yinchuan, Shizuishan, Urumchi (75 cities)

III-2

Operation License No.: B1-20070275

The People’s Republic of China

Value Added Telecommunication Services Operation License

(Appendix)

Shareholding structure and contribution percentage of Beijing Blue I.T. Technologies Co., Ltd.:

Name of the Shareholder | | ID (Registration No. of the

Legal Person) | | Contribution Percentage | |

WANG Song | | 110102196402071516 | | 55 | % |

KOU Xiaohong | | 110106196111241242 | | 45 | % |

III-3

Operation License No.: 2-4-1-2002001 has been changed to B1-20060088

Record of Annual Inspection on Telecommunication Services Operation License

In accordance with the Measures for the Administration of Permits for Operation of Telecommunication Business, the license issuing authority shall implement annual inspection system to operation licenses. License issuing authority shall, while conducting annual inspections to operation licenses, comprehensive review the materials submitted by the telecommunication service operators and conduct necessary inspections to operating parties, operation acts, construction of telecommunication infrastructures, telecommunication charges and service quality. The license issuing authority shall affix the official seal hereunder if annual inspection is qualified.

Qualified in the annual inspection for year 2002 | | Qualified in the annual inspection for year 2004 |

| | |

Approved by: (Seal) | | Approved by: (Seal) |

| | |

April 1, 2003 | | June 20, 2005 |

| | |

Qualified in the annual inspection for year 2005 | | Qualified in the annual inspection for year 2006 |

| | |

Approved by: (Seal) | | Approved by: (Seal) |

| | |

June 22, 2006 | | August 15, 2007 |

| | |

Qualified in the annual inspection for year 2007 | | |

| | |

Approved by: (Seal) | | |

| | |

April 7, 2008 | | |

III-4

Operation License No.: B1-20070275

Record of Annual Inspection on Telecommunication Services Operation License

In accordance with the Measures for the Administration of Permits for Operation of Telecommunication Business, the license issuing authority shall implement annual inspection system to operation licenses. License issuing authority shall, while conducting annual inspections to operation licenses, comprehensive review the materials submitted by the telecommunication service operators and conduct necessary inspections to operating parties, operation acts, construction of telecommunication infrastructures, telecommunication charges and service quality. The license issuing authority shall affix the official seal hereunder if annual inspection is qualified.

Qualified in the annual inspection for year 2008 | | Qualified in the annual inspection for year 2009 |

| | |

Approved by: (Seal) | | Approved by: (Seal) |

| | |

May 6, 2009 | | May 21, 2010 |

| | |

Qualified in the annual inspection for year 2010 | | Qualified in the annual inspection for year 2011 |

| | |

Approved by: (Seal) | | Approved by: (Seal) |

| | |

May 23, 2011 | | April 25, 2012 |

| | |

Qualified in the annual inspection for year | | |

| | |

Approved by: (Seal) | | |

| | |

MM/DD/YY | | |

III-5

Exhibit IV

English Translation of Current ICP License Held by Beijing Blue I.T.

The People’s Republic of China

Telecommunication and Information Services Operation License

Operation License No.: Jing ICP License 020384

In accordance with relevant state regulations, the company is approved to conduct the telecommunication services specified in this license after examination. It is hereby to issue this license.

Name of the Company: Beijing Blue I.T. Technologies Co., Ltd.

Legal Representative: KOU Xiaohong

Registered Address: No. Jia 8, Ta Yuan Lang Qiu Yuan, Haidian District, Beijing

Business Type: Information services business under Category II Value added Telecommunication Services (limited to internet information services)

Service Items: (see appendix)

Website Name: (see appendix)

Website Address: (see appendix)

The term of validity of this license is from December 10, 2012 to December 10, 2017.

(Annual inspection is required to this license, otherwise the license is invalid.)

IV-1

Special Provisions

1. The telecommunication services operation license is a statutory certificate for a telecommunication services operator to operate telecommunication services. The telecommunication services operation license shall not be forged, altered, falsely used, rented, sold or transferred. If the telecommunication services operator changes the company name, registered address or legal representative, the operators shall conduct the change procedure with the original license issuing authority within 30 days after the change.

2. Conducting the change of business scope (added the item of “internet information services”) shall go to competent administrative department for industry and commerce with the operation license, relevant charging standard shall be recorded with the competent price bureau in Beijing.

3. The operation license number shall be indicated in a significant place on the homepage of the website. Establishment of new websites in Beijing shall be applied to competent telecommunication authority.

4. Strictly comply with the Regulation on Telecommunications of the People’s Republic of China (Decree No. 291 of State Council), Regulation on Internet Information Service of the People’s Republic of China (Decree No. 292 of State Council), Measures for the Administration of Permits for Operation of Telecommunication Business (Order No. 5 of Ministry of Industry and Information Technology) and other relevant regulations. Do the management of network information security well. Accept the management, supervision and inspection by telecommunication authority and authorities in the industries of news, publication, education, medical and health care, medicine and medical instrument. Observe the relevant laws and regulations on advertisement and intellectual property protection, and operate in accordance with applicable laws.

5. Annual inspection to the operation unit engaging in internet information services shall be conducted from January 1st to March 3rd each year. The operation license will be invalid if not taking annual inspection or the result is unqualified, so that the operation unit will be prohibited to continue to engage in this business.

Qualification Record of Annual Inspection

Qualified in the annual inspection for year 2011 | | Qualified in the annual inspection for year | | Qualified in the annual inspection for year |

| | | | |

(Seal) March 31, 2012 | | (Seal) MM/DD/YY | | (Seal) MM/DD/YY |

| | | | |

Qualified in the annual inspection for year | | Qualified in the annual inspection for year | | Qualified in the annual inspection for year |

| | | | |

(Seal) MM/DD/YY | | (Seal) MM/DD/YY | | (Seal) MM/DD/YY |

IV-2

The People’s Republic of China

Telecommunication and Information Services Operation License

(Appendix)

Beijing Blue I.T. Technologies Co., Ltd.

Jing ICP License 020384

No. | | Website Name | | Domain Name | | Service Items |

1 | | Cache | | chinacache.com | | Internet information services, excluding news, publication, education, medical and health care, medicine and medical instrument, and bulletin board services. |

| | | | | | |

2 | | Cache Virtualization | | cc-cps.com | | Internet information services, excluding news, publication, education, medical and health care, medicine and medical instrument, and bulletin board services. |

(Seal)

IV-3

Exhibit V

English Language Translation of Board and Shareholder Resolutions of

ChinaCache Beijing, dated May 10, 2010

ChinaCache Network Technology (Beijing) Limited

Board Resolution

We, the undersigned, being all of the existing directors of ChinaCache Network Technology (Beijing) Limited (the “Company”), in accordance with relevant provisions of the Articles of Association of the Company and through full discussion, DO HEREBY CONSENT in writing to the adoption of the following resolution on May 10, 2010:

WHEREAS, Xiaohong Kou and Song Wang, as the shareholders of Beijing Blue I.T. Technologies Co., Ltd., issued their Power of Attorney to the Company respectively on September 23, 2005, and authorized the Company to exercise their shareholders’ right in Beijing Blue I.T. Technologies Co., Ltd.. Yong Sha, Huiling Ying, Hao Yin, Xiurong Mei and Yongkai Mei, as the shareholders of Shanghai JNet Telecom Co., Ltd., issued their Power of Attorney to the Company respectively in 2008 or 2010, and authorized the Company to exercise their shareholders’ right in Shanghai JNet Telecom Co., Ltd.. Xinxin Zheng and Huiling Ying, as the shareholders of Beijing Jingtian Technology Co., Ltd., issued their Power of Attorney to the Company respectively on July 31, 2008, and authorized the Company to exercise their shareholders’ right in Beijing Jingtian Technology Co., Ltd..

NOW THEREFORE, BE IT RESOLVED THAT pursuant to the PRC laws any decision and execution conducted by the shareholder of the Company or individual designated by the shareholder of the Company (including but not limited to the Company’s legal representative) with respect to the rights which are authorized by the shareholders of Beijing Blue I.T. Technologies Co., Ltd., Shanghai JNet Telecom Co., Ltd., and Beijing Jingtian Technology Co., Ltd. under the Power of Attorney, shall be deemed as decisions and executions of the Company.

V-1