November 19, 2021

Wei Lu

Staff Accountant

U.S. Securities and Exchange Commission

Office of Energy & Transportation

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Re: Spirit Airlines, Inc.

Form 10-K for Fiscal Year Ended December 31, 2020

Filed February 10, 2021

Form 8-K filed October 27, 2021

File No. 001-35186

Dear Wei Lu:

This letter is in response to your comment letter, dated November 5, 2021, to Spirit Airlines, Inc. (the “Company”). The comment of the staff of the U.S. Securities and Exchange Commission (the “Staff”) is set forth in bold italicized text below, and the response of the Company is set forth in plain text immediately following the comment.

Form 8-K filed October 27, 2021

Exhibit 99.1

Forward Looking Guidance, page 3

1.Please revise to include a quantitative reconciliation of your forward looking non-GAAP guidance measures to the most directly comparable GAAP measures, or include a statement that such reconciliation is not practicable without unreasonable effort. Refer to guidance in Item 10(e)(1)(i)(B) of Regulation S-K and Question 102.10 of the Compliance and Disclosure Interpretations on Non-GAAP Financial Measures (“C&DIs”).

The Company will add disclosure substantially similar to the following to its future earnings release or other filings with forward-looking non-GAAP guidance measures:

“Adjusted operating expenses and Adjusted EDITDA Margin are non-GAAP financial measures, which are provided on a forward-looking basis. The Company does not provide a reconciliation of non-GAAP forward-looking measures on a forward-looking basis where the Company believes such reconciliation would imply a degree of precision and certainty that could be confusing to investors and is unable to reasonably predict certain items included in/excluded from the GAAP financial measures without unreasonable efforts. This is due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred and are out of the Company’s control or cannot be reasonably predicted. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Non-GAAP forward-looking measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

Non GAAP Financial Measures, page 10

2.We note your presentation of various non-GAAP financial measures. Expand your disclosure to further explain why management believes the presentation of each individual non-GAAP financial measure provides useful information to investors. Refer to Item 10(e)(1)(i)(c) of Regulation S-K.

The Company will expand its disclosure regarding non-GAAP financial measures in its future earnings releases as follows:

“The Company evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (“GAAP”) and non-GAAP financial measures, including Adjusted operating expenses, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted operating income (loss), Adjusted operating margin, Adjusted pre-tax income (loss), Adjusted pre-tax margin, Adjusted net income (loss), Adjusted diluted earnings (loss) per share and Adjusted CASM. These non-GAAP financial measures are provided as supplemental information to the financial information presented in this press release that is calculated and presented in accordance with GAAP and these non-GAAP financial measures are presented because management believes that they supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods.

Because the non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered superior to and are not intended to be considered in isolation or as a substitute for the related GAAP financial measures presented in the press release and may not be the same as or comparable to similarly titled measures presented by other companies due to possible differences in the method of calculation and in the items being adjusted. We encourage investors to review our financial statements and other filings with the Securities and Exchange Commission in their entirety and not to rely on any single financial measure.

The Company does not provide a reconciliation of forward-looking measures on a forward-looking basis where the Company believes such reconciliation would imply a degree of precision and certainty that could be confusing to investors and is unable to reasonably predict certain items included in/excluded from the non-GAAP financial measures without unreasonable efforts. This is due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred and are out of the Company’s control or cannot be reasonably predicted. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Non-GAAP forward-looking measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

The information below provides an explanation of certain adjustments reflected in the non-GAAP financial measures and shows a reconciliation of non-GAAP financial measures reported in this press release (other than forward-looking non-GAAP financial measures) to the most directly comparable GAAP financial measures. Within the financial tables presented, certain columns and rows may not add due to the use of rounded numbers. Per unit amounts presented are calculated from the underlying amounts.

The Company believes that adjusting for special charges (credits), gains and losses on disposal of assets, supplemental rent adjustments related to the modification of

aircraft or engine leases, costs associated with accelerated asset retirements, benefits associated with Federal excise tax recovery efforts, non-operating special items including losses on debt extinguishment, and discrete tax benefits associated with the CARES Act is useful to investors because these items are not indicative of the Company’s ongoing performance and the adjustments are similar to those made by our peers and allow for enhanced comparability to other airlines.

Operating expenses per available seat mile (“CASM”) is a common metric used in the airline industry to measure an airline’s cost structure and efficiency. We exclude aircraft fuel and related taxes and special items from operating expenses to determine Adjusted CASM ex-fuel. We also believe that excluding fuel costs from certain measures is useful to investors because it provides an additional measure of management’s performance excluding the effects of a significant cost item over which management has limited influence and increases comparability with other airlines that also provide a similar metric.”

3.Expand your disclosure and tell us why you believe Supplemental rent adjustments should be excluded from operating expenses. Refer to Question 100.01 of the C&DIs.

Supplemental rent includes maintenance reserves paid to aircraft lessors in advance of the performance of major maintenance activities that are not probable of being reimbursed and probable and estimable lease return obligations. Supplemental rent adjustments in the Company’s non-GAAP financial measures include changes to supplemental rent amounts triggered by lease modifications (i.e., lease extensions and termination of leases in connection with purchasing aircraft and engines from a lessor). These changes to supplemental rent occur less frequently than planned major maintenance overhaul expenses and supplemental rent amounts that are recorded each period over the lease term, and are not indicative of the Company’s ongoing maintenance activities. The Company believes these adjustments are similar to how other airlines exclude gains and losses associated with the purchase and sale of aircraft and engines from Adjusted net income and helps investors compare us with the Company’s peers.

The Company intends to enhance its disclosure on supplemental rent adjustments in its future earnings releases as described in the response to Comment #2 above.

4.We note your reconciliation of Adjusted Net Income to GAAP Net Income includes an adjustment for Provision (benefit) for income taxes. Expand your disclosure under footnote (5) to explain in greater detail the nature of the adjustments for all periods presented. Additionally, tell us how you considered the tax effect of the special items expense (credit) in arriving at your Adjusted net income (loss). Refer to Question 102.11 of the C&DIs.

The Company will expand the disclosure under footnote (5) in its future earnings releases to be substantially similar to the following:

“In the reconciliation of Adjusted Net Income to GAAP Net Income, the Company determined the Adjusted Provision (Benefit) for Income Taxes by calculating our estimated annual effective tax rate on adjusted pre-tax income and applying it to Adjusted Income (Loss) Before Income Taxes, before giving effect to discrete items. In addition, the third quarter and year-to-date 2020 Adjusted Provision (Benefit) for Income Taxes excludes discrete tax benefits related to CARES Act tax loss carryback provisions in those periods.”

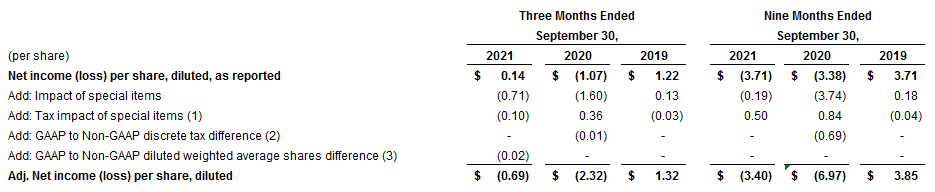

5.Revise to present a reconciliation of Adjusted net income (loss) per share, diluted on a per share basis. Refer to Item 10(e)(1)(i)(B) of Regulation S-K and Question 102.05 of the C&DIs.

The Company will include a reconciliation of Adjusted net income (loss) per share, diluted on a per share basis in its future earnings releases. The reconciliation will be substantially the same as the following, with updates for appropriate periods:

Reconciliation of Adjusted Net Income per Share to GAAP Net Income per Share

(1)Reflects the difference between the Company’s GAAP Provision for Income Taxes and Adjusted Provision for Income Taxes as presented in the Reconciliation of Adjusted Net Income to GAAP Net Income, on a per share basis and before discrete items excluded in the Non-GAAP measure.

(2)Adjustment related to GAAP to Non-GAAP discrete tax differences reflects CARES Act tax loss carryback discrete items in the periods.

(3)Adjustment related to GAAP and Non-GAAP diluted weighted average shares difference, due to the Company being in a Net income position on a GAAP basis versus a Net loss position on a Non-GAAP basis.

* * * * *

If you have any questions regarding this letter, please do not hesitate to call me at (954) 447-8117.

Sincerely,

/s/ Scott Haralson

Scott Haralson

cc: Matthew E. Kaplan, Debevoise & Plimpton LLP

Eric T. Juergens, Debevoise & Plimpton LLP