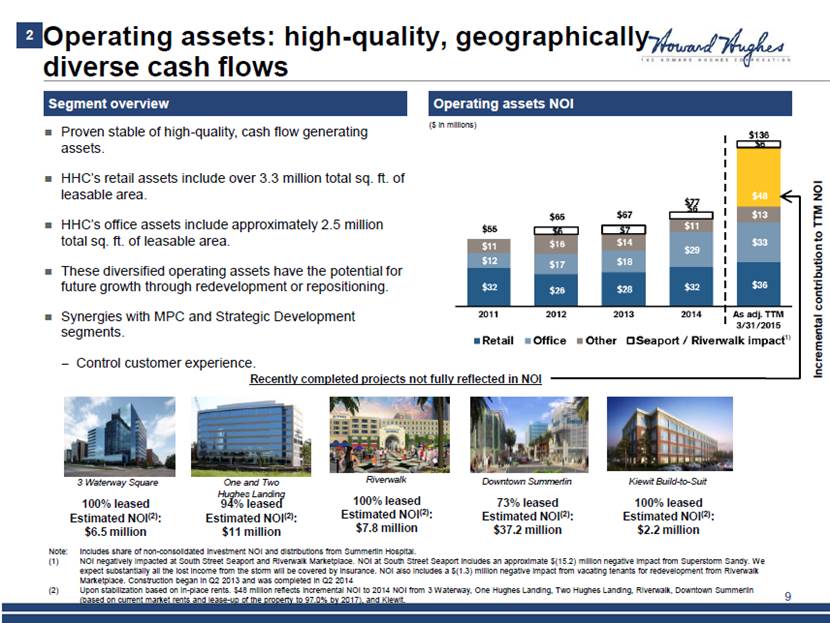

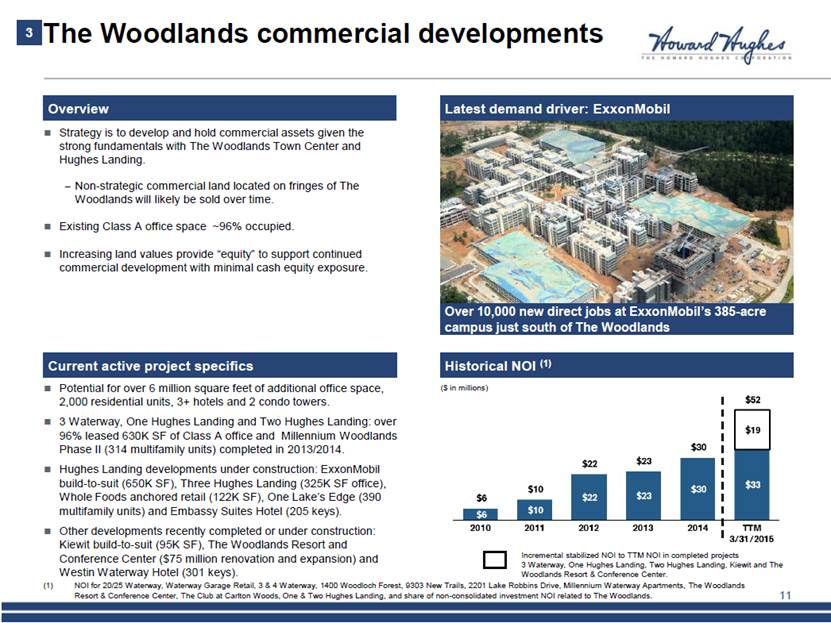

| Financial reconciliations (cont’d) 37 Year ended December 31, Three months ended March 31, Twelve months ended March 31, ($ in thousands) 2011 2012 2013 2014 2014 2015 2015 Reconciliation of total operating assets NOI to total operating assets REP EBT: Total operating assets NOI $ 55,121 $ 59,259 $ 59,569 $ 71,663 $ 16,850 $ 27,167 $ 81,980 Equity method investment NOI (3,894) (2,783) (1,533) (1,488) (55) 182 (1,251) Distribution from Summerlin Hospital (3,894) (2,376) (2,503) (1,649) (1,781) (1,747) (1,615) Total operating assets NOI-consolidated 47,333 - 54,100 - 55,533 68,526 15,014 25,602 79,114 Total Operating Asset Redevelopments - 639 (5,665) 1,234 - - 1,234 Total Operating Asset Dispositions - 1,204 790 77 - - 77 Straight-line lease and incentives amortization 918 (736) 1,759 (763) (436) 1,194 867 Development-related marketing costs - - (3,461) (9,770) (2,079) (2,266) (9,957) Early extinguishment of debt (11,305) - - - - - - Demolition costs - - (2,078) (6,712) (2,494) (117) (4,335) Depreciation and amortization (20,309) (23,318) (31,427) (49,272) (9,010) (18,762) (59,024) Write-off of lease intangibles and other - - (2,884) (2,216) - (154) (2,370) Equity in earnings from real estate affiliates 3,926 3,683 3,893 2,025 1,805 885 1,105 Interest expense, net (12,775) (16,104) (19,011) (16,930) (1,925) (6,485) (21,490) Less: Partners' share of operating assets REP EBT 425 - - - - - - Total operating assets Rep EBT $ 8,213 $ 19,468 $ (2,551) $ (13,801) $ 875 $ (103) $ (14,779) Operating assets NOI-Equity and cost method investments: Millennium Waterway Apartments (Phase I & II) $ 2,571 $ 1,768 $ (74) $ (84) $ - $ (104) $ (188) Summerlin Baseball Club - - (13) (153) (247) (234) (140) Metropolitan - - - - - (508) (508) Woodlands Sarofim #1 1,489 621 1,417 1,516 401 391 1,506 Stewart Title (title company) 1,069 1,876 2,515 2,659 198 391 2,852 Forest View/Timbermill Apartments 1,826 487 - - - - - Total NOI-equity investees $ 6,955 $ 4,752 $ 3,844 $ 3,938 $ 352 $ (64) $ 3,522 Adjustments to NOI (3,862) (1,476) (77) (1,112) (31) (680) (1,761) Equity Method Investments REP EBT $ 3,093 $ 3,276 $ 3,767 $ 2,826 $ 321 $ (744) $ 1,761 Less: Joint venture partner's share of REP EBT (3,061) (1,969) (2,377) (2,450) (297) (118) (2,271) Equity in earnings (loss) from real estate affiliates 32 1,307 1,390 376 24 (862) (510) Distributions from Summerlin Hospital Investment 3,894 2,376 2,503 1,649 1,781 1,747 1,615 Segment equity in earnings (loss) from real estate affiliates $ 3,926 $ 3,683 $ 3,893 $ 2,025 $ 1,805 $ 885 $ 1,105 Company's share of equity method investments NOI: Millennium Waterway Apartments (Phase I & II) $ 2,148 $ 1,477 $ - $ (68) $ - $ (85) $ (153) Summerlin Baseball Club - - (7) (77) (124) (117) (70) Metropolitan - - - - - (254) (254) Woodlands Sarofim #1 298 124 283 303 80 78 301 Stewart Title (title company) 535 938 1,257 1,330 99 196 1,427 Forest View/Timbermill Apartments 913 244 - - - - - Total NOI-equity investees $ 3,894 $ 2,783 $ 1,533 $ 1,488 $ 55 $ (182) $ 1,251 |