Filed by Seawell Limited. Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Allis-Chalmers Energy Inc.

Commission File No. of Subject Company: 001-02199

This filing relates to the proposed merger of Wellco Sub Company, a wholly owned subsidiary of Seawell Limited, with Allis-Chalmers Energy Inc., pursuant to the terms of an Agreement and Plan of Merger, dated as of August 12, 2010, by and among Seawell Limited, Wellco Sub Company and Allis-Chalmers Energy Inc..

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as "will," "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "target," "forecast," and other words and terms of similar meaning. These forward-looking statements involve a number of risks and uncertainties. Seawell and Allis-Chalmers caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving Seawell and Allis-Chalmers, including future financial and operating results, Seawell's and Allis-Chalmers' plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in Allis-Chalmers’ filings with the Securities and Exchange Commission. These include risks and uncertainties relating to: the ability to obtain the requisite Allis-Chalmers stockholder approval; the risk that Allis-Chalmers or Seawell may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the timing to consummate the proposed m erger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; general worldwide economic conditions and related uncertainties; and the effect of changes in governmental regulations. Neither Seawell nor Allis-Chalmers undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The publication or distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Seawell, Allis-Chalmers and their respective affiliates disclaim any responsibility or liability for the violation of such restrictions by any person. In connection with the proposed merger between Seawell and Allis-Chalmers, Seawell will file with the SEC a Registration Statement on Form F-4 that will include a proxy statement of Allis-Chalmers that also constitutes a prospectus of Seawel l. Seawell and Allis-Chalmers will mail the proxy statement/prospectus to the Allis-Chalmers stockholders. Seawell and Allis-Chalmers urge investors and stockholders to read the proxy statement / prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC's website (www.sec.gov). You may also obtain these documents, free of charge, from Seawell's website (www.seawellcorp.com) under the tab "Investors.” You may also obtain these documents, free of charge, from Allis-Chalmers' website (www.alchenergy.com) under the tab "For Investors" and then under the heading "SEC Filings."

Participants In The Merger Solicitation

Seawell, Allis-Chalmers, and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Allis-Chalmers stockholders in favor of the merger and related matters. Information regarding the persons, who may, under the rules of the SEC, is deemed participants in the solicitation of Allis-Chalmers stockholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about Allis-Chalmers' executive officers and directors in its definitive proxy statement filed with the SEC on April 30, 2010. Additional information about Seawell's executive officers and directors and Allis-Chalmers' executive officers and directors can be found in the above-refere nced Registration Statement on Form F-4 when it becomes available. You can obtain free copies of these documents from Seawell and Allis-Chalmers using the contact information above.

Page 1

Seawell to

Acquire

Allis-Chalmers

Page 2

Forward-looking statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-

looking statements are typically identified by words or phrases such as "will," "anticipate," "estimate," "expect," "project," "intend," "plan,"

"believe," "target," "forecast," and other words and terms of similar meaning. These forward-looking statements involve a number of risks and

uncertainties. Seawell and Allis-Chalmers caution readers that any forward-looking statement is not a guarantee of future performance and that

actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not

limited to, statements about the benefits of the proposed merger involving Seawell and Allis-Chalmers, including future financial and operating

results, Seawell's and Allis-Chalmers' plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and

other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by such

forward-looking statements are set forth in Allis-Chalmers’ filings with the Securities and Exchange Commission. These include risks and

uncertainties relating to: the ability to obtain the requisite Allis-Chalmers stockholder approval; the risk that Allis-Chalmers or Seawell may be

unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay

the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that a condition to closing of the

merger may not be satisfied; the timing to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the

risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected;

disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of

management time on merger-related issues; general worldwide economic conditions and related uncertainties; and the effect of changes in

governmental regulations. Neither Seawell nor Allis-Chalmers undertakes any obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise.

Additional Information and where to find it

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

The publication or distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come

into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law,

Seawell, Allis-Chalmers and their respective affiliates disclaim any responsibility or liability for the violation of such restrictions by any person. In

connection with the proposed merger between Seawell and Allis-Chalmers, Seawell will file with the SEC a Registration Statement on Form F-4 that

will include a proxy statement of Allis-Chalmers that also constitutes a prospectus of Seawell. Seawell and Allis-Chalmers will mail the proxy

statement/prospectus to the Allis-Chalmers stockholders. Seawell and Allis-Chalmers urge investors and stockholders to read the proxy statement

/ prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain

important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC's website

(www.sec.gov). You may also obtain these documents, free of charge, from Seawell's website (www.seawellcorp.com) under the tab "Investors.”

You may also obtain these documents, free of charge, from Allis-Chalmers' website (www.alchenergy.com) under the tab "For Investors" and then

under the heading "SEC Filings."

Participants in the merger solicitation

Seawell, Allis-Chalmers, and their respective directors, executive officers and certain other members of management and employees may be

soliciting proxies from Allis-Chalmers stockholders in favor of the merger and related matters. Information regarding the persons, who may, under

the rules of the SEC, is deemed participants in the solicitation of Allis-Chalmers stockholders in connection with the proposed merger will be set

forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about Allis-Chalmers' executive officers and

directors in its definitive proxy statement filed with the SEC on April 30, 2010. Additional information about Seawell's executive officers and

directors and Allis-Chalmers' executive officers and directors can be found in the above-referenced Registration Statement on Form F-4 when it

becomes available. You can obtain free copies of these documents from Seawell and Allis-Chalmers using the contact information above.

Disclaimer

Page 3

Table of contents

Section 1

Aim and strategic rationale

Section 2

Transaction details and governance

Section 3

Allis-Chalmers in short

Page 4

Section 1

Aim and strategic rationale

Page 5

Building a first-class oilfield service company

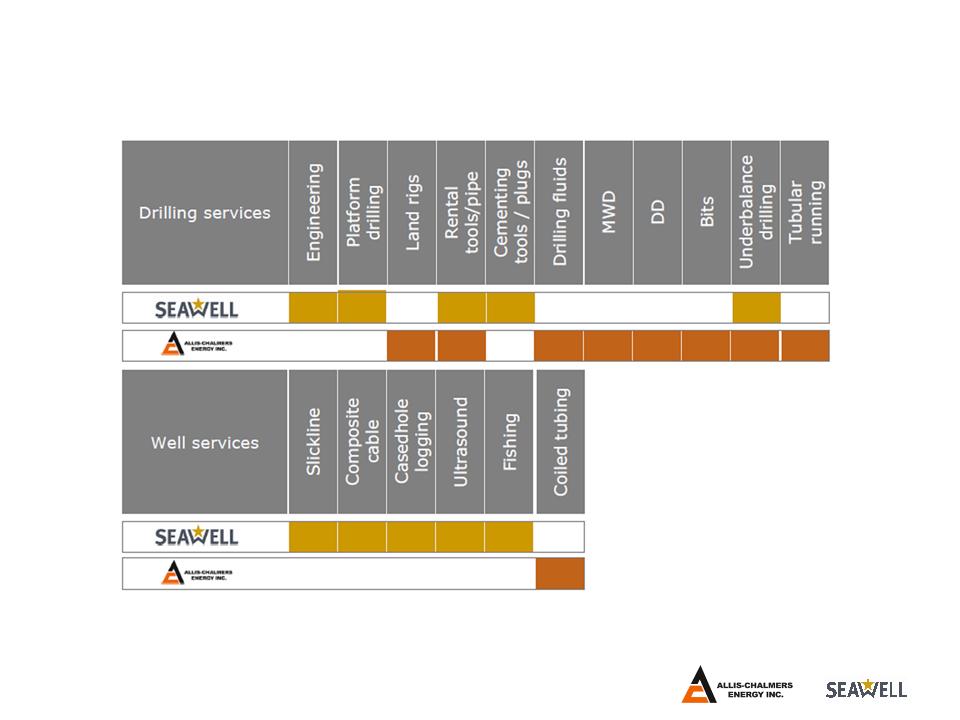

• Our service segments will be:

– Drilling services

– Engineering services

– well services

– Oilfield rentals

• Focused on enhanced oil recovery

• Global footprint to leverage and distribute key technologies

• Significant presence in drilling services

• Leadership in drilling services & technology

• Strong owner base to capitalise on growth opportunities

• Experienced management team that can execute strategy

• Ability to acquire, integrate and grow oilfield technology companies

Page 6

Why the acquisition makes sense

• Highly complimentary

– No product or services overlap

– Similar business focus, very experienced drilling personnel

– No geographical overlap

• Significant cross-selling synergies

– Bring Allis-Chalmers Energy competence to the North Sea

– Bring Seawell leading-edge technology to Americas

– Build a platform for integration of future acquisitions and in-house

development of unique technologies

• Critical size, strong owners, global footprint

• Will combine Seawell’s premium services offering, North Sea

competence and technology with Allis-Chalmers’ drilling and oil

service competencies, quality asset base and operational gearing

Page 7

The Well Company

Combining strengths

• 6,500 employees in 30+ countries

• USD 1.3 billion revenues in 2010, USD 195

million in EBITDA1

• Leading oilfield service company in North Sea

• Major onshore player in the Americas

• 30+ years experience in drilling and servicing

production wells

• A compelling range of cutting-edge downhole

technologies

Page 8

Global footprint

• Complimentary services in common geographies

• Next step would be to develop full presence in Middle East and Far East

• Global footprint to distribute technologies and grow unique offering

Page 9

Combined company could deliver fully integrated projects

Highly complimentary service & product

offering

Page 10

Well positioned to capitalise on the demand

for enhanced oil recovery (EOR) services

Combined strengths for EOR

• Global service footprint

• Strength in advanced drilling techniques and services

• No. 1 platform driller globally

• First class drilling assets

• Well intervention technologies and services

• Strong suite of downhole technologies

Page 11

1Source Annual reports.

2Seawell’s revenue is converted to USD based on NOK/USD of 6.29 (average 2009).

3Revenues based on fiscal year ending 31 March, 2010.

2

3

Top 10 leading oil service companies1

Page 12

Section 2

Transaction details and governance

Page 13

Transaction details

• Seawell to acquire Allis-Chalmers

for a combination of shares and

cash

• Terms

– 1.15 Seawell shares offered for

each Allis-Chalmers share

– Cash alternative at USD 4.25 per

share, capped at maximum of

35% of outstanding shares in Allis

-Chalmers

• Transaction valued at approx.

USD 890million (including

assumed debt)

• Listing of Seawell on OSE or LSE

Page 14

Notes:

Notes:

Company’s new 9 member Board would have 7 nationalities on 4 continents

Company’s new 9 member Board would have 7 nationalities on 4 continents

Registered Bermuda company

Registered Bermuda company

Agreed to be listed at closing on Oslo or London Stock Exchange

Agreed to be listed at closing on Oslo or London Stock Exchange

Governance

Proposed Board of Directors

• Chairman - Saad Bargach

• Vice Chairman - Tor Olav Trøim

• John Reynolds

• Alejandro P. Bulgheroni

• Gianni Dell'Orto

• Cecilie Fredriksen

• Alf C. Thorkildsen

• Kate Blankenship

• Jørgen P. Rasmussen

Executive Management

• CEO & President - Jørgen Peter

Rasmussen (51), Danish

• COO and EVP - Thorleif Egeli

(46), Norwegian

• Senior advisor to the Board -

Munawar H. Hidayatallah (age),

nationality

Page *

Section 3

Allis-Chalmers Energy in short

Page 16

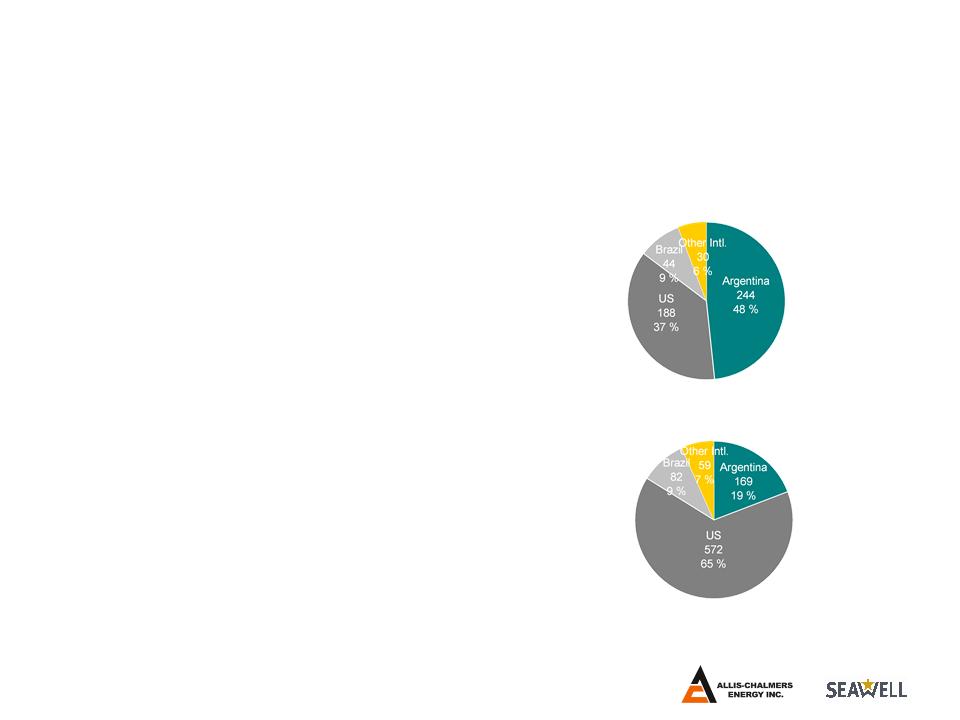

1Source: 2009 annual report. Numbers in pies: USDm, relative share of total.

2Source: 2009 annual report. Defined as long-lived assets. Total assets of USD 1080.6m

2009 revenues by geography

Assets per 31.12.20092

Introduction to Allis-Chalmers

• Provider of services and equipment to

oil and natural gas E&P companies

• Operations in US, Argentina, Brazil,

Bolivia and Mexico

• Employs approximately 3,300 skilled

and experienced people

• Three business segments

– Oilfield services

– Drilling and Completion

– Rental Services

• Listed on NYSE

• Largest shareholder is Lime Rock

Partners

Key figures1

Page 17

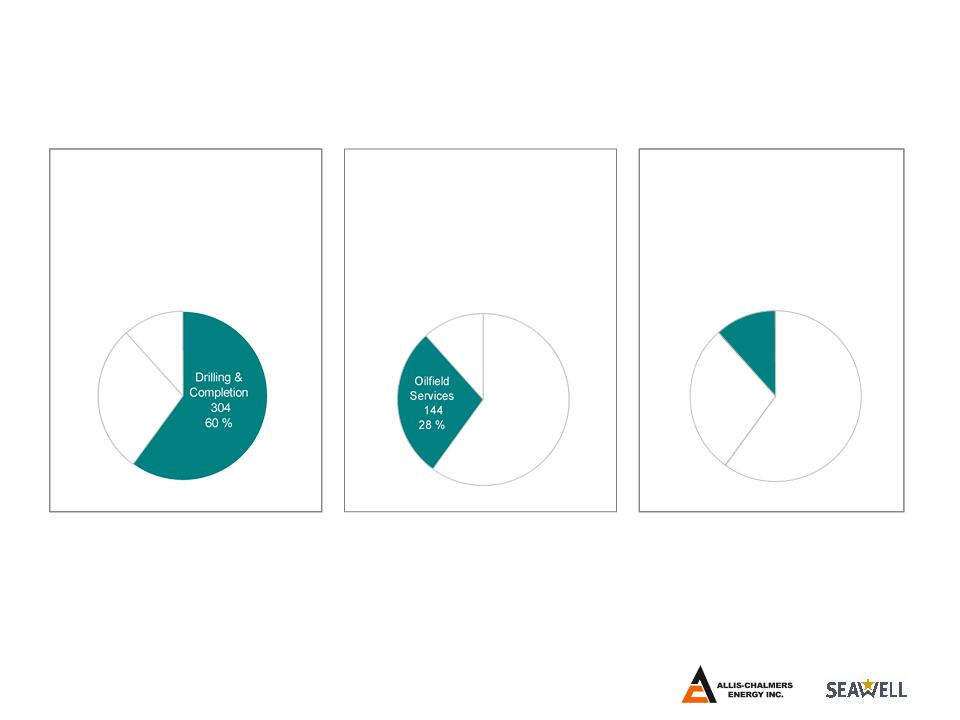

Oilfield services

• Directional drilling

• Casing and tubulars

• Underbalanced drilling

• Production services

Notes:

2009 revenues by segments USDm, relative share of total)

Source - annual report

Rental

Tools

59

12 %

Allis-Chalmers Business Segments

Drilling & completion

• Drilling

• Completion

• Workover

• Other related services

Tool rentals

• Premium drill pipe

• BOPs

• Other specialised

equipment

Page 18

Allis-Chalmers Land Rigs

• 30 drilling rigs / 48 service rigs:

– Argentina: 17d / 47s

– Brazil 8d / 1s

– Bolivia 3d

– USA 2d+2d

• Key clients

– Pan America

– Petrobras