SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 10-K

____________________________

X. ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

. TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM _______________ to _______________

RARUS MINERALS INC.

(Exact name of small business issuer as specified in its charter)

Commission File #333-168925

Nevada

(State or other jurisdiction of incorporation or organization)

27-2015109

(IRS Employer Identification Number)

2850 W. Horizon Ridge Parkway

Suite 200

Henderson, NV 89052

(Address of principal executive offices)

Phone: (702) 430-4610

Fax: (702) 430-4501

(Issuer’s telephone number)

Copy of all Communications to:

Parsons, Burnett, Bjordahl, Hume, LLP

1850 Skyline Tower

10900 NE 4th St.

Bellevue, WA 98004

(425) 451-8036; (425) 451-8568 (fax)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes . No X.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes . No X.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes X. No .

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X. No .

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | . | Accelerated filer | . |

Non-accelerated filer | .(Do not check if a smaller reporting company) | Smaller reporting company | X. |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes . No X.

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2011 was $NIL based upon the price ($NIL) at which the common stock was last sold as of the last business day of the most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws.

As of September 27, 2011, there were 434,750,000 shares of the registrant’s $0.001 par value common stock issued and outstanding.

Documents incorporated by reference: None

ii

Table of Contents

| | | |

PART I |

ITEM 1. | Description of Business | 1 |

ITEM 1A. | Risk Factors | 7 |

ITEM 1B. | Unresolved Staff Comments | 12 |

ITEM 2. | Properties | 12 |

ITEM 3. | Legal Proceedings | 20 |

ITEM 4. | [Removed and Reserved] | 20 |

|

PART II |

ITEM 5. | Market for Company’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities | 20 |

ITEM 6. | Selected Financial Data | 21 |

ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 22 |

ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 25 |

ITEM 8. | Financial Statements and Supplementary Data: | 26 |

| | Report of Independent Registered Public Accounting Firm | 27 |

| | Balance Sheets at June 30, 2011 and June 30, 2010 | 28 |

| | Statements of Operations for the years ended June 30, 2011 and June 30, 2010 and the Exploration Stage Period of June 23, 2010 to June 30, 2011 | 29 |

| | Statement of Stockholders’ Equity | 30 |

| | Statements of Cash Flows for the years ended June 30, 2011 and June 30, 2010 and the Exploration Stage Period of June 23, 2010 to June 30, 2011 | 31 |

| | Supplemental Disclosure of Non-cash Investing and Financing Activities for the years ended June 30, 2011 and June 30, 2010 and the Exploration Stage Period of June 23, 2010 to June 30, 2011 | 32 |

| | Notes to Financial Statements | 33 |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 39 |

ITEM 9A. | Controls and Procedures | 39 |

ITEM 9B. | Other Information | 40 |

|

PART III |

ITEM 10. | Directors, Executive Officers and Corporate Governance | 40 |

ITEM 11. | Executive Compensation | 43 |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 44 |

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 44 |

ITEM 14. | Principal Accounting Fees and Services | 45 |

|

PART IV |

ITEM 15. | Exhibits, Financial Statements Schedules | 46 |

| | |

SIGNATURES | 47 |

iii

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

·

The availability and adequacy of our cash flow to meet our requirements;

·

Economic, competitive, demographic, business and other conditions in our local and regional markets;

·

Changes or developments in laws, regulations or taxes in our industry;

·

Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities;

·

Competition in our industry;

·

The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business;

·

Changes in our business strategy, capital improvements or development plans;

·

The availability of additional capital to support capital improvements and development; and

·

Other risks identified in this report and in our other filings with the Securities and Exchange Commission (the 'SEC').

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context, references in this report to “Company”, “RARS”, “we”, “us” and “our” are references to Rarus Minerals Inc. All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

iv

PART I

ITEM 1. BUSINESS

History of the Company

The Company was incorporated on June 23, 2010 in the State of Nevada under the name HotelPlace, Inc. The original business plan of the Company was to provide Internet search and advertising services that facilitate access to hotel and travel information on the Internet relevant to key geographic locations. The Company has since abandoned its original business plan and restructured its business to focus on the acquisition, exploration and development of rare earth mineral properties.

We decided to enter the mining business because we were seeking out viable options to create value for our shareholders. After conducting independent research on the feasibility of discovering and exploiting commercially recoverable amounts of rare earth minerals, we determined that staking and exploring potential mineral claims could be a sound long term investment strategy that could potentially lead to lucrative business opportunities. On June 24, 2011, the Company filed a Certificate of Amendment to its Articles of Incorporation with the Nevada Secretary of State changing its corporate name to Rarus Minerals Inc. to reflect the change in the Company’s business direction.

On June 24, 2011, the Company entered into an Option to Purchase Pilot Peak Property (the “Option Agreement") with two individuals (together, the “Optionor”), pursuant to which the Company has the exclusive option (the “Option”) to purchase a 100% interest in Optionor’s rights to those certain lode mining claims, consisting of approximately 2,600 acres, known as the Pilot Peak Property, situated in San Bernardino County, California (hereinafter referred to as the “Claims”). To fully exercise the Option and receive an undivided 100% right, title and interest in and to the Claims, the Company must: (1) pay an aggregate sum of $910,000 to Optionor; (2) incur an aggregate of at least $950,000 of expenditures on or with respect to the Claims; and (3) issue to Optionor an aggregate of ten million five hundred thousand (10,500,000) restricted shares of common stock of the Company. As of September 27, 2011, the Company has taken the following actions to perfect the Option: (1) made initial cash payments totaling $33,000 and issued 9,750,000 restricted common shares to Optionor; (2) incurred expenditures totaling $52,460 on or with respect to the Claims; and (3) commenced the initial exploration work on the Claims.

Description of Business

We are now an exploration stage corporation engaged in the search of rare earth mineral deposits or reserves, which are not in the development or production stage. We seek to become a vertically integrated rare earth elements producer in Southwestern North America and throughout the entire world. Currently, our premier focus is on the State of California and more specifically, the area of the Mojave Desert. We are considered an exploration or exploratory stage company because we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of rare earth metals, if any, and their extent. A rare earth mineral is a mineral which contains one or more rare earth elements as major metal constituents.

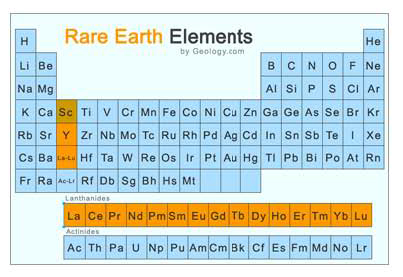

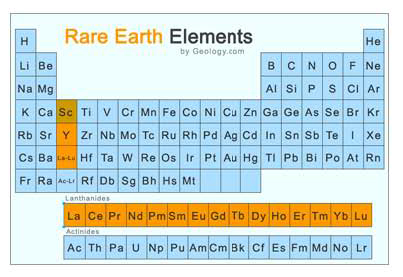

Rare earth metals are a collection of seventeen (17) chemical elements in the periodic table, namely scandium, yttrium and the fifteen (15) lanthanides (see below table). They are commonly used for high tech applications, alternative energy technologies, and defense technologies. For example, rare earth metals are used in wind power generation, fuel cells, rechargeable batteries, hydrogen storage, radar deflection, stealth detection, night vision and permanent magnets used in electric and electric-hybrid vehicles. Generally, rare earth metals cannot be replaced by an alternative, making them virtually essential to our technological world. Deposits of rare earth metals in high concentrations are relatively rare.

1

Because we are an exploration stage company, there is no assurance that commercially viable rare earth mineral deposits exist on the property underlying our Claims, and a great deal of further exploration will be required before a final evaluation is made as to the economic viability of our Claims. To date, we have no known reserves of any type of mineral on our Claims and we have not discovered economically viable mineral deposits on the Claims, and there is no assurance that we will discover such deposits. However, our Claims have demonstrated promising surface results.

Exploration for minerals is a speculative venture involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercially exploitable reserves of valuable rare earth minerals. The probability of a mineral claim ever having commercially exploitable reserves is extremely remote, and in all probability our mineral Claims may not contain any reserves. If we are unable to find reserves of valuable rare earth minerals or if we cannot remove the minerals because we either do not have the capital to do so, or because it is not economically feasible to do so, then we will cease operations and potential investors will lose their investment in the Company.

If we discontinue exploration of our currently staked Claims, we may seek to acquire other natural resource exploration properties. Any such acquisition(s) will involve due diligence costs in addition to the acquisition costs. We will also have an ongoing obligation to maintain our periodic filings with the appropriate regulatory authorities, which will involve legal and accounting costs. In the event that our available capital is insufficient to acquire an alternative resource property and sustain minimum operations, we will need to secure additional funding or else we will be compelled to discontinue our business.

If commercially marketable quantities of rare earth mineral deposits exist on the property underlying our Claims and sufficient funds are available, we will evaluate the technical and financial risks of mineral extraction, including an evaluation of the economically recoverable portion of the deposits, market rates for minerals, engineering concerns, infrastructure costs, finance and equity requirements, safety concerns, regulatory requirements and an analysis of the Claims from initial excavation all the way through to reclamation. After we conduct this analysis and determine that a given mineral deposit is worth recovering, we will begin the development process. Development will require us to obtain a processing plant and other necessary equipment including equipment to extract, transport and store the minerals.

We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish its plan of operations described herein and eventually attain profitable operations.

We anticipate that any additional funding that we require will be in the form of equity financing from the sale of our common stock. However, there is no assurance that we will be able to raise sufficient funding from the sale of our common stock. The risky nature of this enterprise and lack of tangible assets places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until such time as an economically viable mine can be demonstrated. We do not have any arrangements in place for any future equity financing. If we are unable to secure additional funding, we will cease or suspend operations. We have no plans, arrangements or contingencies in place in the event that we cease operations.

The Claims

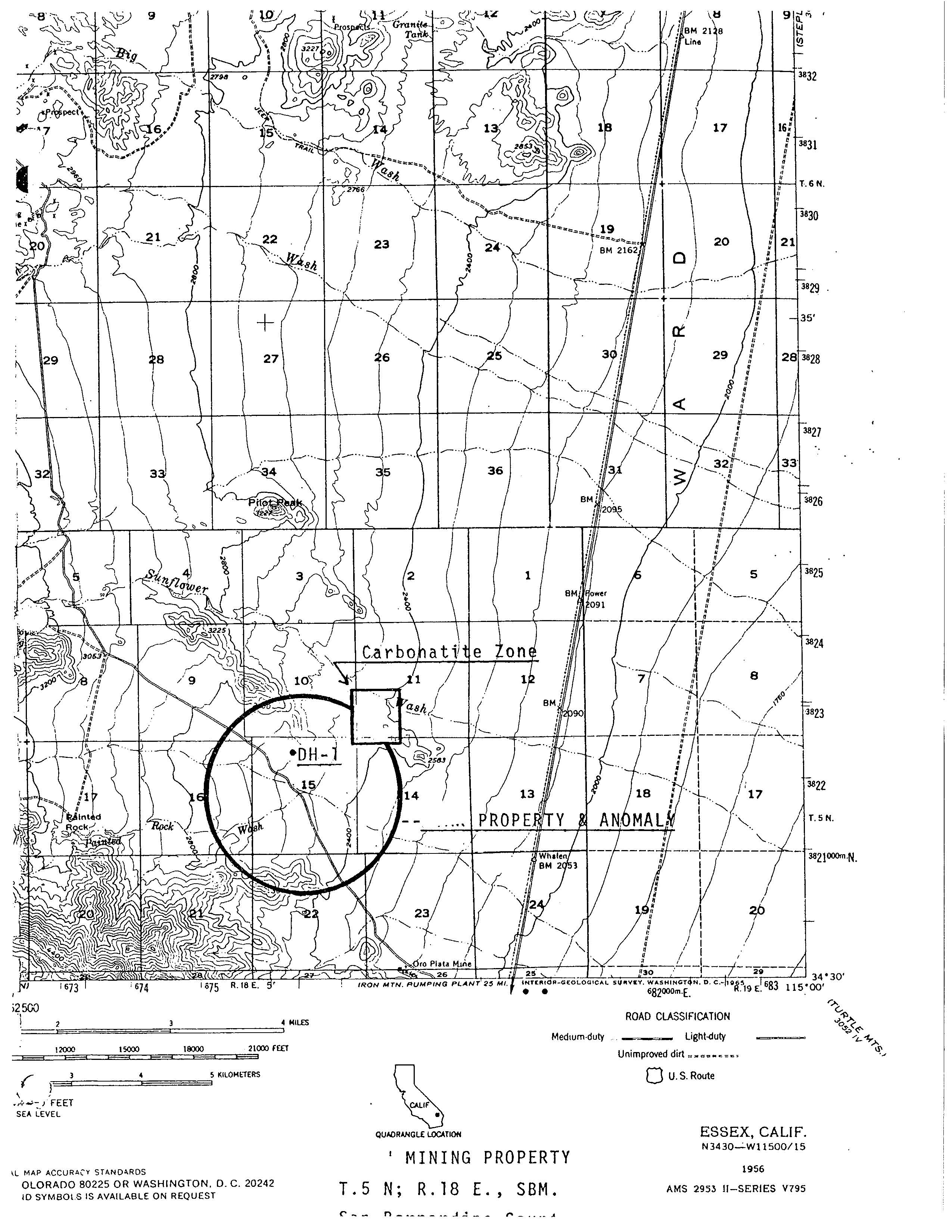

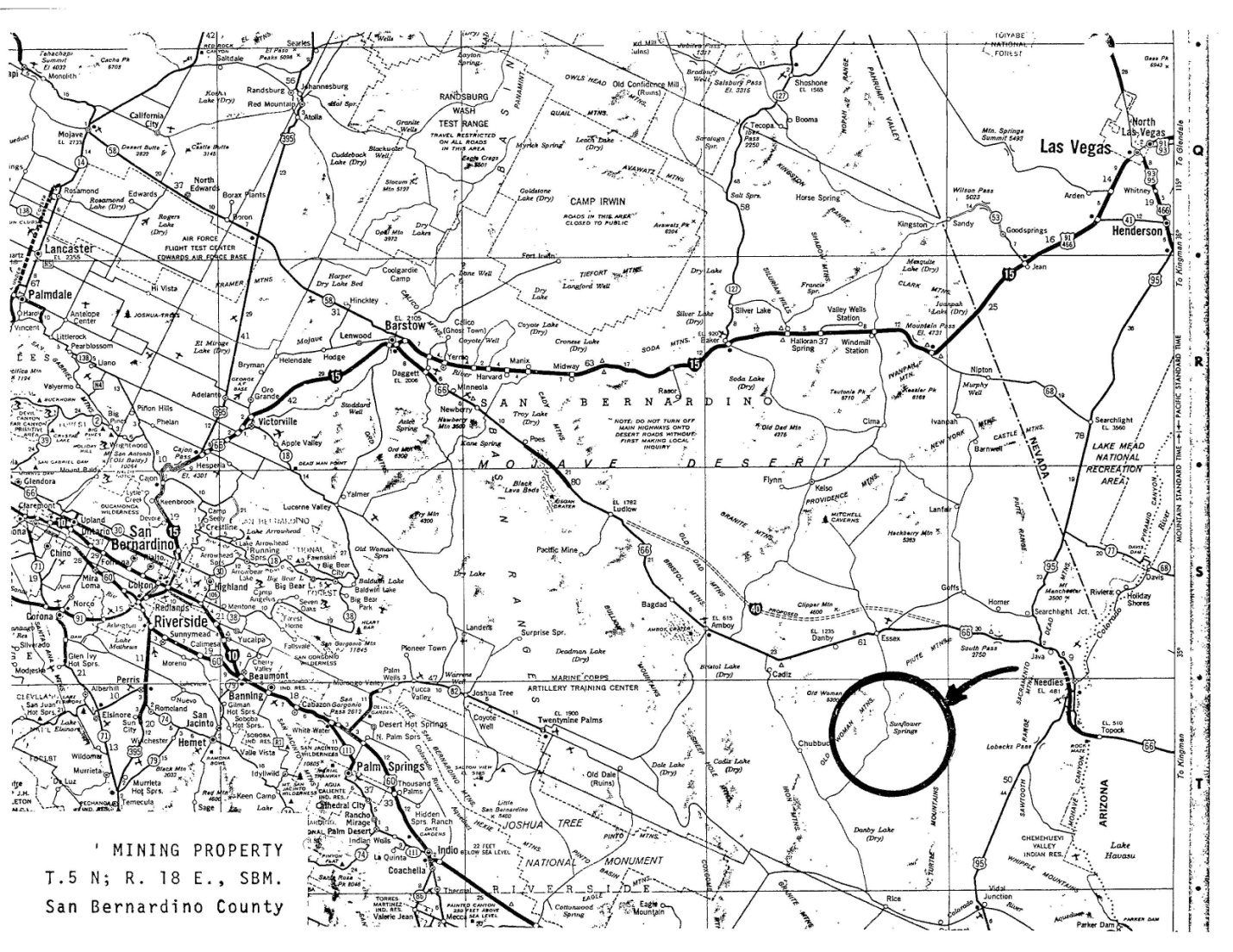

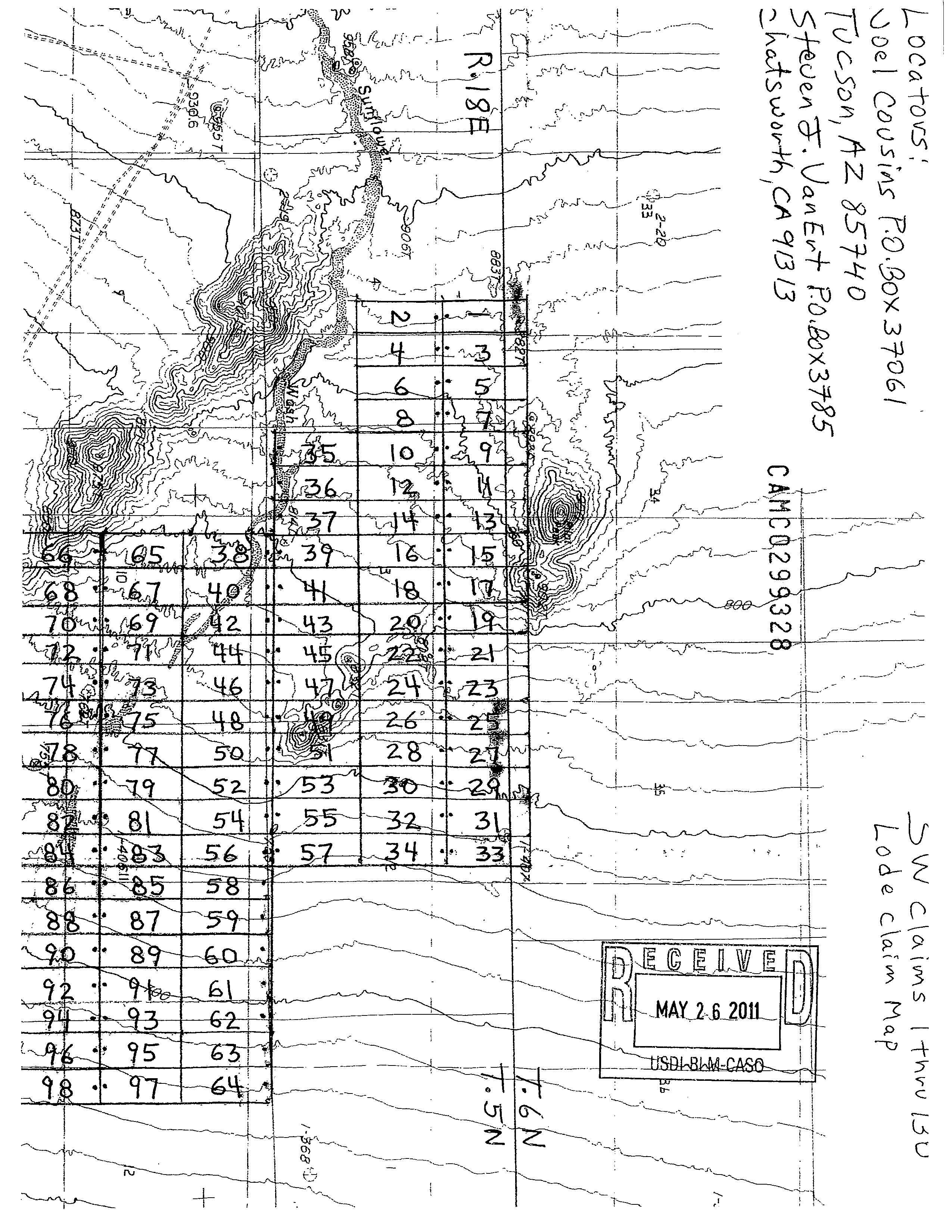

Our Claims consist of an aggregate of 134 lode mining claims located in an area of the Mojave Desert in Township 5N, Range 18E, Sections 2, 3, 4, 10, 11, 12, 14 and 15 and Township 6N, Range 18E, Sections 34 and 35, San Bernardino Base & Meridian, San Bernardino County, California.

Generally, the United States owns mineral rights in the United States and these are administered by the U.S. Bureau of Land Management (“BLM”) and its associated state offices. The BLM allows certain land to be claimed and “staked”, thereby granting rights to enter, explore and exploit the land in accordance with local, state, and federal regulations.

In order to locate and stake a mining claim in the state of California, you must take the following steps: (1) put up a conspicuous structure at the place of discovery (“discovery monument”), distinctly mark the claim’s boundaries on the ground and post a notice of location at such site; (2) file a copy of the signed notice of location form and pay, per claim, a maintenance fee of $140, a service charge of $15 and a location fee of $34 to the California BLM within 90 days from the date of location of the claim; and (3) file the same notice of location form with the respective county recorder’s office. The notice of location form must contain the following information: (i) the date of location of the claim/site, (ii) a description of the discovery monument, (iii) the name of the claim/site, (iv) the legal description of the claim/site (metes and bounds or legal subdivision), and (v) the names and addresses of all locators.

2

From March 1, 2011 to March 3, 2011, the Optionor staked the Claims by filing a notice of location form for each individual Claim with the California BLM office and recording the forms with the Recorder’s Office for the County of San Bernardino. The notice of location forms for the Claims were recorded in San Bernardino County on May 25, 2011. By taking the foregoing steps, the Optionor acquired the rights to enter, explore and exploit the Claims until September 1, 2011, such rights which were passed to the Company through execution of the Pilot Peak Agreement on June 24, 2011. To maintain the Claims, the Company paid a total annual fee of $18,760 to the BLM on August 30, 2011, which covers all of the Claims. This same fee must be paid to the BLM each calendar year and is due by September 1st each year.

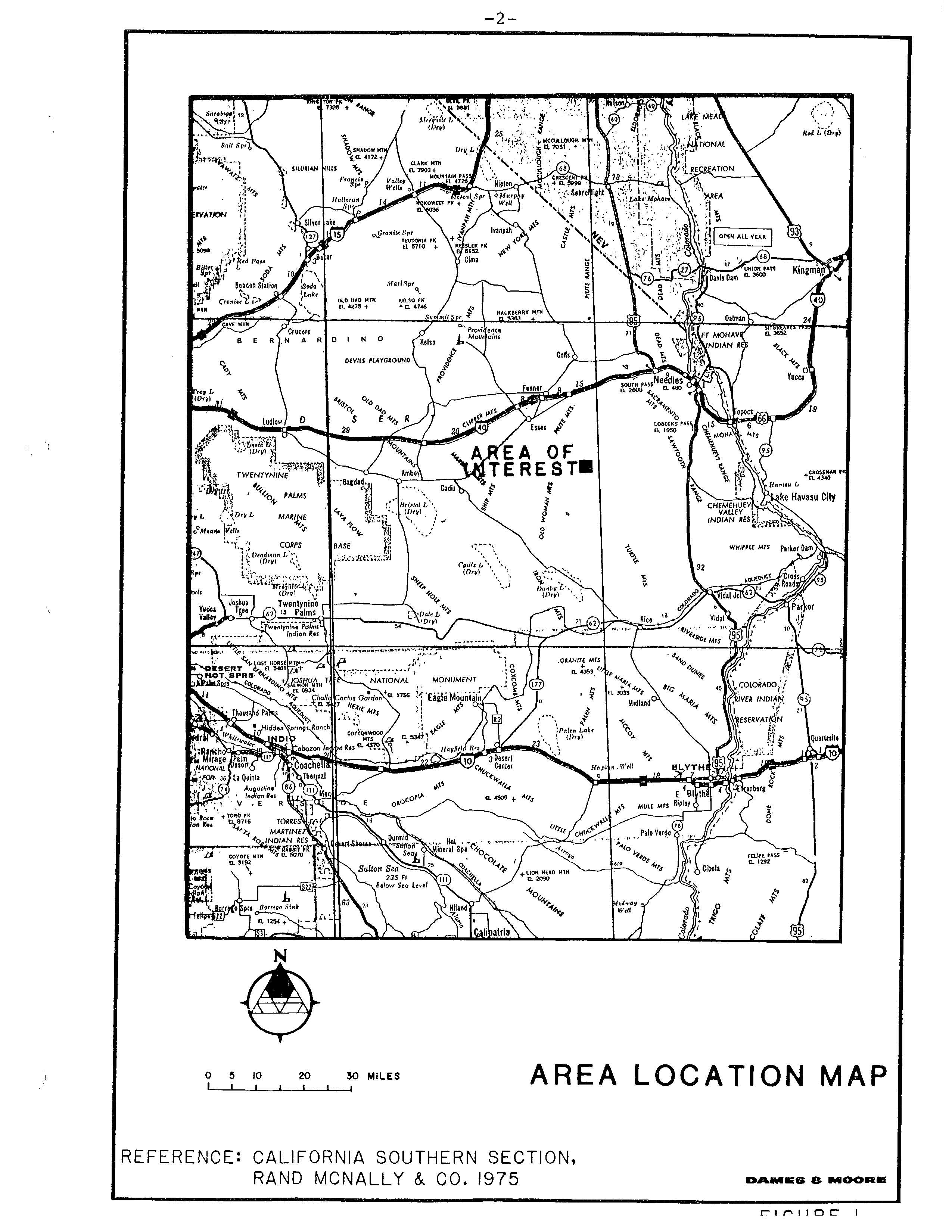

Location and General Geology of the Land

Our Claims are located in the Mojave Desert on the eastern flank of the Old Woman Mountains in Township 5N, Range 18E, Sections 2, 3, 4, 10, 11, 12, 14 and 15 and Township 6N, Range 18E, Sections 34 and 35, San Bernardino Base & Meridian, San Bernardino County, California, approximately 16 miles southeast of Essex, California. The Claims are staked in a north-south direction and each Claim is approximately 1,500 feet in length by 600 feet in width constituting approximately 20 acres of land. Collectively, the Claims total approximately 2,686 acres of land. The property is accessible by approximately 20 miles of dirt road adjacent to a paved highway.

The terrain is gentle to moderate. The area is generally covered with a thin alluvial fan, with bedrock cropping out in the higher elevations. The alluvial surface trends up from a low of approximately 2,100 feet above mean sea level in the southeastern portion of the area, to a high of approximately 2,800 feet in the northwestern portion. The highest elevations on the property, approximately 2,900 feet, are located on the slopes of Pilot Peak at the northwestern edge of the study area.

The geology and mineralization of the area in which the Claims are located is composed of rare earth-bearing allanite gneisses of Precambrian age which are exposed along northwest trending fault zones displaying associated carbonate veins, lamprophyre dikes and biotite augen gneiss. Intrusive rocks related to mineralization and composed of dikes, sills and masses of syenite/carbonatite make up the core of a series of low hills which also align northwest of the Claims. Observation suggests intrusives exposed are evidence of a large complex mostly obscured by shallow cover. Ground magnetic traverses have been effective in tracing major rock types and mineralized faults into adjacent areas of alluvial cover.

There are large alluvial-covered areas between the syenite/carbonatite complex and the allanite gneiss zones which may indicate potential targets for exploration of rare earth deposits. These include the alluvium covered, northwest trending topographic linears which may indicate mineralized structures along a projected trace of the syenite/carbonatite mass. Potential areas of interest also appear to exist along the trend of mineralization seen on previous wide-spaced drilling at the Claim sites. Preliminary geological research may indicate potential for deposits of lanthanum, cerium, praseodymium, neodymium and yttrium.

Observation, several geologic reports, and one preliminary engineering study evidence that previous exploration work has been done at the Claims. Currently, there are no improvements, buildings, houses, or infrastructure of any kind within the Claims’ boundaries. There are no plants, equipment, surface or subsurface improvements, or facilities on the land on which the Claims are located. Our Claims are without known mineral reserves and our plan of exploration is exploratory in nature.

Climate

The climate of the area in which our Claims are located is characterized by desert conditions with very hot summers and mild winters. Temperatures are fairly mild in the early spring, late fall, and winter, generally anywhere between 30 – 80°F. Summer temperatures are extremely hot, commonly averaging over 115°F and can reach well over 120°F.

Plan of Operation

We plan to implement the following initial exploration program consisting of three phases. We plan to conduct mineral exploration activities on the Claims to assess whether the Claims contain mineral reserves capable of commercial extraction. Our exploration program is designed to explore for commercially viable deposits of rare earth metals, niobium and phosphate. To date, we have not identified any commercially exploitable reserves of these or other minerals on the Claims.

3

We plan to commence the first phase (Phase I) of the exploration program on the Claims during the third to fourth calendar quarter of 2011. Phase I work will consist of retaining consultant(s) to conduct exploration activities on the Claims, including: geological mapping, geological prospecting, assaying and information review. Geological mapping involves plotting previous exploration data relating to a property area on a map in order to determine the best property locations to conduct subsequent exploration work. Geological prospecting involves analyzing rocks on the property surface in order to discover indications of potential mineralization. All samples gathered will be sent to a laboratory where they are crushed and analyzed for mineral content. Assaying is the chemical analysis of a substance to determine its components. We expect Phase I to take approximately 60 days to complete and an additional month for the consulting geologist to receive the lab results from these activities and prepare an analytic report. We have estimated the cost of Phase I to be approximately $66,000.

If Phase I proves successful in identifying mineral deposits and we have sufficient funds to continue, we intend to proceed with the second phase (Phase II) of the program as soon as practicable upon completion of Phase I. In Phase II, we will retain a consultant(s) to begin trenching, surveying localized soils, and detailed sampling of historic zones. Trenching is the process of turning over land to uncover underlying material. Soil surveying is the systematic examination, description, classification, and mapping of soils in an area. The objective of sampling in mineral processing is to estimate grades and contents of sample soils, rocks, and other discovered materials. The estimated cost of Phase II is between $37,000 and $59,500, depending on the level of our activities during this phase and the funds available. It will take approximately 50 days to complete Phase II and an additional month for the consulting geologist to receive the lab results from these activities and prepare an analytic report. We expect to commence work on Phase II between the fourth calendar quarter of 2011 and first calendar quarter of 2012, subject to the availability of funds.

After all surveys and initial samples have been collected and positive results have been obtained from such activities, we expect to begin the third phase (Phase III) of the program around the second calendar quarter of 2012, assuming we have adequate funds to continue our operations. Phase III will consist of retaining a consultant(s) to conduct core sampling and analysis. Core sampling is the process of drilling holes to a depth of up to 100 feet in order to extract a sample of earth. We anticipate that it will take between one to three months to drill 16-32 holes to a depth of 100 feet each. Our estimated costs for this drilling program is approximately $79,000.

As part of Phase IIII, after core sampling, the consultant(s) will analyze the samples collected from the core drilling. The total estimated cost for analyzing the core samples is $3,500, and we estimate this process will take approximately 30 days. The core samples will be tested to determine if mineralized material is located on the Claims. We intend to take our core samples to analytical chemists, geochemists and registered assayers located in San Bernardino County, California. We have not selected any of the foregoing persons as of the date of this Report. Based upon the tests of the core samples, we will determine if we will terminate operations, proceed with additional exploration of the Claims, or develop the Claims. If we do not find mineralized material or we cannot remove mineralized material, either because we do not have the funds or because it is not economically feasible to proceed, we will cease operations.

Total maximum expenditures for the exploration of our Claims over the next 12 months are expected to range from approximately $143,500 to $208,000. If Phase I proves to be successful and sufficient funds are available after completion of such Phase, we will continue with Phase II and so on until funds are no longer available. In the event we have enough money to begin but not to complete one of the Phases, we will cease operations until we raise more money. If we cannot or do not raise sufficient money to complete one or more Phases, or if our exploration activities are not successful, we will discontinue exploration of our Claims and any funds spent on exploration will likely be lost.

Quality Assurance/Quality Control

The data obtained from our exploration program will consist of survey data, sampling data, and assay results. Quality Assurance / Quality Control (QA/QC) protocols will be in place at the mining site and at the laboratory to test the sampling and analysis procedures.

The Company will utilize statistical methodologies to calculate mineral reserves based on interpolation between and projection beyond sample points. Interpolation and projection are limited by certain factors including geologic boundaries, economic considerations and constraints to safe mining practices. Sample points will consist of variably spaced drill core intervals obtained from drill sites located on the surface and in underground development workings. Results from all sample points within the mineral reserve area will be evaluated and applied in determining the mineral reserves.

4

Samples will be sent to a laboratory for analyses. The samples will be under a strict monitoring and tracking system from log-in to completion. Samples will be logged-in immediately upon receipt and carefully checked for any special handling that may be needed. All analytical procedures, sample handling, and preservation techniques used will strictly adhere to those approved by the Environmental Protection Agency (“EPA”), where applicable. To test assay accuracy and reproducibility, pulps from core samples will be submitted and then resubmitted for analysis and compared. To test for sample errors or cross-contamination, blank core (waste core) samples will be submitted with the mineralized samples and compared. Reference samples from the EPA or from private sources will also be tested with every set of samples to provide an additional measure of accuracy.

The QA/QC protocols will be practiced on both resource development and production samples. The data will be entered into a 3-dimensional modeling software package and analyzed to produce a 3-dimensional solid block model of the resource. The assay values will be further analyzed by a geostatistical modeling technique to establish a grade distribution within the 3-dimensional block model. Dilution will then be applied to the model and a diluted tonnage and grade will be calculated for each block. Mineral and waste tons, contained ounces and grade will then be calculated and summed for all blocks. A percent mineable factor based on historic geologic unit values will be applied and the final proven reserve tons and grade will be calculated.

The Company will review its methodology for calculating mineral reserves on an annual and as-needed basis. Conversion, an indicator of the success in upgrading probable mineral reserves to proven mineral reserves, will be evaluated as part of the reserve process. The review will examine the effect of new geologic information, changes implemented or planned in mining practices and mine economics on factors used for the estimation of probable mineral reserves. The review will include an evaluation of the Company’s rate of conversion of probable reserves to proven reserves.

Government Regulation

Exploration activities are subject to various federal, state, foreign and local laws and regulations, which govern prospecting, mineral exploration, drilling, mining, production, mineral extraction, transportation of minerals, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and several other matters. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations promulgated by the State of California and the United States Federal Government. Currently, there are no costs associated with our compliance with such regulations and laws. There is presently no need for any government approval of our business or our anticipated mineral products.

Environmental Regulations

Our exploration activities are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our exploration activities are conducted in material compliance with applicable environmental laws and regulations. Changes to current local, state or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating costs. Although we are unable to predict what additional legislation and the associated costs of such legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain exploration activities uneconomic.

The Industry

Rare earth elements are moderately abundant in the earth’s crust, some even more abundant than copper, lead, gold, and platinum. While more abundant than many other minerals, rare earth elements are not concentrated enough to make them easily exploitable economically. The United States was once self-reliant in domestically produced rare earth elements, but over the past 15 years has become 100% reliant on imports, primarily from China, the current global leader in supplying rare earth elements. There is no rare earth mineral production in the United States.

5

Rare Earth Elements: World Production and Reserves – 2009

| | | | | | |

Country | Mine Production (metric tons) | % of total | Reserves (million metric tons) | % of total | Reserve Base (million metric tons)(1) | % of total |

| | | | | | |

United States | none | - | 13.0 | 13 | 14.0 | 9.3 |

China | 120,000 | 97 | 36.0 | 36 | 89.0 | 59.3 |

Russia (and other former Soviet Union Countries) | - | - | 19.0 | 19 | 21.0 | 14 |

Australia | - | - | 5.4 | 5 | 5.8 | 3.9 |

India | 2,700 | 2 | 3.1 | 3 | 1.3 | 1 |

Brazil | 650 | - | small | - | - | - |

Malaysia | 380 | - | small | - | - | - |

Other | 270 | 1 | 22.0 | 24 | 23 | 12.5 |

| | | | | | |

Total | 124,000 | 100.0% | 99.0 | 100.0% | 154 | 100.0% |

Source: U.S. Department of the Interior, Mineral Commodity Summaries, USGS, 2010.

NOTES:

(1)Reserve Base is defined by the USGS to include reserves (both economic and marginally economic) plus some sub-economic resources (i.e. those that may have potential for becoming economic reserves).

World demand for rare earth elements is estimated at 134,000 tons per year, with global production around 124,000 tons annually. The difference is covered by previously mined above ground stocks. World demand is projected to rise to 180,000 tons annually by 2012, while it is unlikely that new mine output will close the gap in the short term. By 2014, global demand for rare earth elements may exceed 200,000 tons per year. China’s output may reach 160,000 tons per year (up from 130,000 tons in 2008) in 2014, and an additional capacity shortfall of 40,000 tons per year may occur. Further, new mining projects could easily take 10 years to reach production. In the long run, however, the United States Geological Survey (“USGS”) expects that global reserves and undiscovered resources are large enough to meet the demand.

While world demand for rare earth elements continues to climb, U.S. demand is also projected to rise, according to USGS Commodity Specialist Jim Hedrick. For example, the demand for permanent magnets, used in electric and electric-hybrid vehicles, is expected to grow by 10%-16% per year through 2012. Demand for rare earth elements in auto catalysts and petroleum cracking catalysts is expected to increase between 6% and 8% each year over the same period. Demand increases are also expected for rare earth elements in flat panel displays, hybrid vehicle engines, and defense and medical applications.

Access to a reliable supply to meet current and projected demand is an issue of concern. In 2009, China produced 97% of the world’s rare earth elements and continues to restrict exports of the material through quotas and export tariffs. China has plans to reduce mine output, eliminate illegal operations, and restrict rare earth element exports even further. There are some immediate supply concerns with lower rare earth export quotas in China. China has cut its exports of rare earth elements from about 50,000 metric tons in 2009 to 30,000 metric tons in 2010. According to a Bloomberg news report, a July 2010 announcement by China’s Ministry of Commerce would cut exports of rare earth elements by 72%, to about 8,000 metric tons, for the second half of 2010.

While limited production and processing capacity for rare earth elements currently exists elsewhere in the world, additional capacity is expected to be developed in the United States, Australia, and Canada within two to five years, according to some experts. Chinese producers are also seeking to expand their production capacity in areas around the world, particularly in Australia. There are only a few exploration companies that develop the resource, and because of long lead times needed from discovery to refined elements, supply constraints are likely in the short term.

The supply chain for rare earth elements generally consist of mining, separation, refining, alloying, and manufacturing (devices and component parts). A major issue for rare earth element development in the United States is the lack of refining, alloying, and fabricating capacity that could process any future rare earth production. Many people in the industry believe that it is not enough to develop rare earth element mining operations alone without building the value-added refining, metal production, and alloying capacity that would be needed to manufacture component parts for end-use products, which suggests that vertically integrated companies may be more desirable.

Source of Information: Humphries, Marc. Congressional Research Service. Rare Earth Elements: The Global Supply Chain. September 30, 2010. Retrieved July 15, 2011 from and publicly available at: http://www.fas.org/sgp/crs/natsec/R41347.pdf.

6

Competition

Our business is focused on the development of rare earth metals in which few, if any, mining companies in the United States are currently engaged. Thus, we will not face strong competition in southern California or elsewhere in the United States for rare earth metals. Further, there is no competition for the exploration or extraction of minerals from our Claims as we currently have the exclusive right to explore and exploit the Claims.

However, we will compete with other mineral resource exploration companies for the acquisition of new mineral properties, available resources and equipment, financing and more. Many of the mineral resource exploration companies with whom we will compete will likely have more experience in the industry and greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend more on acquiring mineral properties of merit and exploring and developing their mineral properties. In addition, they may be able to afford to hire consultants with greater geological expertise in the field. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who finance these kinds of exploration activities. This competition could adversely impact our ability to find financing for further exploration and development of our mineral properties.

We believe that we will be competitive in the mining industry because we are one of very few, if any, public companies seeking to develop a rare earth element deposit outside of China. The Company’s market timing for rare earth element mining and processing is excellent, as the world’s fossil fuels are decreasing and the demand for rare earth elements is increasing. Additionally, we are seeking to become a vertically integrated producer of rare earth elements, with a “mine-to-market” strategy. Thus, we will not limit our company to the mining of rare earth elements, but will also engage in refining, alloying and manufacturing the metals into marketable products. We believe that this will set us apart from our competitors.

Customers

If the Company is able to develop commercial operations, process rare earth minerals that we extract from our Claims, and ultimately manufacture products from these minerals, we anticipate that we will sell our products throughout the United States and eventually throughout the world, given the ever-increasing demand for these types of products and the variety of uses for these products in high tech applications, alternative energy technologies, and defense technologies.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts

We presently do not utilize patents, licenses, franchises, concessions, royalty agreements or labor contracts in connection with our business.

Employees

We have no employees, other than Manfred Ruf, our sole officer and director. We believe that until such time that we commence our exploration program, we will not have any employees. Once we commence our exploration activities, we anticipate that we will frequently engage consultants to assist the Company in completing projects and carrying out the phases of our exploration program. We believe that the use of consultants will be instrumental to keeping our projects on a timeframe and on budget.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site,www.sec.gov.

Reports to security holders

We are not currently required to deliver an annual report to our security holders and do not expect to do so for the foreseeable future.

7

ITEM 1A. RISK FACTORS

The following risk factors should be considered in connection with an evaluation of the business of our business:

In addition to other information in this current report, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements. Additional risks and uncertainties not presently known to us, or that we currently consider to be immaterial, may also impact our business, operating results, liquidity and financial condition. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, the trading price of our securities could decline, and you may lose all or part of your investment.

Risks Associated With Mining

Mineral exploration and development activities are speculative in nature

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by our company may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection, the combination of which factors may result in our company not receiving an adequate return of investment capital.

Substantial expenditures are required to establish ore reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities and grades to justify commercial operations or that funds required for development can be obtained on a timely basis. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

Despite exploration work on our mineral properties, we have not established that any of them contain any mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7, which can be viewed atwww.sec.gov/divisions/corpfin/forms/industry.htm#secguide7,as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is extremely remote; in all probability our mineral resource property does not contain any 'reserve' and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop our properties into producing mines and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

8

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

If we establish the existence of a mineral resource on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, either from the sale of our mineral resource properties or from the extraction and sale of rare earth, precious and/or base metals. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of rare earth, precious and base metals, and therefore the economic viability of any of our exploration properties and projects, cannot accurately be predicted.

9

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

In identifying and acquiring mineral resource properties, we compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

Risks Related To Our Company

We have a limited operating history on which to base an evaluation of our business and prospects.

We have been in the business of exploring mineral resource properties since June 24, 2011 (the date of acquisition of the Pilot Peak Property) and we have not yet located any mineral reserves. As a result, we have never had any revenues from our operations. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. We have no way to evaluate the likelihood of whether our mineral properties contain any mineral reserve or, if they do that we will be able to build or operate a mine successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties. We therefore expect to continue to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from mining operations and any dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

Our activities will be subject to environmental and other industry regulations which could have an adverse effect on our financial condition

Our company's activities are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation generally provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailing disposal areas, which would result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations could have an adverse effect on the financial condition of our company.

The operations of our company will include exploration and development activities and potentially commencement of production on our properties, which requires permits from various federal, state and local governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

10

The fact that we have not earned any operating revenues since our incorporation raises substantial doubt about our ability to continue to explore our mineral properties as a going concern.

We have not generated any revenue from operations since our incorporation and we anticipate that we will continue to incur operating expenses without revenues unless and until we are able to identify a mineral resource in a commercially exploitable quantity on one or more of our mineral properties and we build and operate a mine. At June 30, 2011, we had cash in the amount of $1,325 and a net working capital deficiency of $(70,004). We incurred a net loss of $(39,609) for the twelve month period ended June 30, 2011 and a net loss of $(46,409) since inception on June 23, 2010. We may have to raise additional funds to meet our currently budgeted operating requirements for the next 12 months. As we cannot assure a lender that we will be able to successfully explore and develop our mineral properties, we will probably find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity securities and shareholder loans, but there can be no assurance that we will continue to be able to do so. If we cannot raise the money that we need to continue exploration of our mineral properties, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail.

These circumstances have lead our independent registered public accounting firm, in their report included in this Form 10-K, to comment about our company’s ability to continue as a going concern. Management has plans to seek additional capital through private placements and/or public offerings of its capital stock and debt offerings. These conditions raise substantial doubt about our company’s ability to continue as a going concern. Although there are no assurances that management’s plans will be realized, management believes that our company will be able to continue operations in the future. Our consolidated financial statements do not include any adjustments relating to the recoverability and potential classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event our company cannot continue in existence. We continue to experience net operating losses.

We currently rely on certain key individuals and the loss of one of these key individuals could have an adverse effect on the Company

Our success depends to a certain degree upon certain key members of our management. These individuals are a significant factor in the our growth and success. The loss of the service of members of management and our board could have a material adverse effect on our company. In particular, the success of our company is highly dependent upon the efforts of our President & CEO, the loss of whose services would have a material adverse effect on the success and development of our company. Additionally, we do not anticipate having key man insurance in place in respect of our directors and senior officers in the foreseeable future.

We require substantial funds merely to determine whether commercial precious metal deposits exist on our properties

Any potential development and production of our exploration properties depends upon the results of exploration programs and/or feasibility studies and the recommendations of duly qualified engineers and geologists. Such programs require substantial additional funds. Any decision to further expand our operations on these exploration properties is anticipated to involve consideration and evaluation of several significant factors including, but not limited to:

·

Costs of bringing each property into production, including exploration work, preparation of production feasibility studies, and construction of production facilities;

·

Availability and costs of financing;

·

Ongoing costs of production;

·

Market prices for the precious metals to be produced;

·

Environmental compliance regulations and restraints; and

·

Political climate and/or governmental regulation and control.

Risks Associated with Our Common Stock

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the Over-The-Counter Bulletin Board service of the Financial Industry Regulatory Authority. Trading in stock quoted on the Over-The-Counter Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the Over-The-Counter Bulletin Board is not a stock exchange, and trading of securities on the Over-The-Counter Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like NASDAQ, or a stock exchange like Amex. Accordingly, shareholders may have difficulty reselling any of their shares.

11

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations and FINRA’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority ’ requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our principal executive office is located at 2850 W. Horizon Ridge Parkway, Suite 200, Henderson, Nevada, USA 89052, which we rent for $199 per month on a month to month basis. This is currently sufficient to meet our needs, however, once we expand our business to a significant degree, we will have to find larger office facilities. We do not currently own any real estate.

Pilot Peak Property

On June 24, 2011, the Company entered into an Option to Purchase Pilot Peak Property (the “Option Agreement") with two individuals (together, the “Optionor”), pursuant to which the Company acquired the exclusive option (the “Option”) to purchase a 100% interest in Optionor’s rights to certain lode mining claims, consisting of approximately 2,600 acres, situated in San Bernardino County, California (the “Pilot Peak Property”).

To fully exercise the Option and receive an undivided 100% right, title and interest in and to the Pilot Peak Property, the Company must: (1) pay an aggregate sum of $910,000 to Optionor (the “Cash Payments”); (2) incur an aggregate of at least $950,000 of expenditures on or with respect to the Pilot Peak Property (the “Expenditures”); and (3) issue to Optionor an aggregate of ten million five hundred thousand (10,500,000) restricted shares of common stock of the Company (the “Stock Issuances”). The Cash Payments, Expenditures and Stock Issuances are herein collectively referred to as the “Option Price” and shall be paid as follows:

12

Cash Payments: The Company shall pay the Cash Payments to Optionor in the following amounts and by the dates described below:

i.

$33,000 prior to or upon execution of the Option Agreement (the “Execution Date”) (such payments which have been made);

ii.

$52,000 on or before November 1, 2011;

iii.

$25,000 on or before March 1, 2012;

iv.

$75,000 on or before one year from the Execution Date;

v.

$75,000 on or before November 1, 2012;

vi.

$100,000 on or before two years from the Execution Date;

vii.

$100,000 on or before November 1, 2013;

viii.

$100,000 on or before three years from the Execution Date;

ix.

$100,000 on or before November 1, 2014;

x.

$125,000 on or before four years from the Execution Date; and

xii.

$125,000 on or before November 1, 2015.

Expenditures: The Company shall incur Expenditures on or with respect to the Pilot Peak Property in the following amounts and by the dates described below:

i.

$150,000 within 12 months following the Execution Date;

ii.

$200,000 on or before 24 months following the Execution Date;

iii.

$300,000 on or before 36 months following the Execution Date; and

iv.

$300,000 on or before 48 months following the Execution Date.

Stock Issuances: The Company shall issue shares of its common restricted stock to Optionor in the following amounts and by the dates described below:

i.

9,750,000 restricted common shares on or before the Execution Date, (which were valued at a fair value estimate of $4,875 and have been issued);

ii.

250,000 restricted common shares on or before November 1, 2011;

iii.

250,000 restricted common shares on or before November 1, 2012; and

iv.

250,000 restricted common shares on or before November 1, 2013.

Upon satisfaction of the foregoing terms and conditions, the Company will have fully exercised the Option and will have acquired an undivided 100% right, title and interest in and to the Pilot Peak Property, subject to certain royalties reserved to Optionor per the terms of the Option Agreement, and in and to any resulting mineral permits or leases. If the Company fails to deliver or pay the Option Price within the time periods set forth above, the Option and the Option Agreement shall terminate 30 days after Optionor provides written notice to the Company of such failure, during which time the Company may deliver or pay the consideration overdue and therefore maintain the Option in good standing.

Location and General Geology of the Land

Our Claims are located in the Mojave Desert on the eastern flank of the Old Woman Mountains in Township 5N, Range 18E, Sections 2, 3, 4, 10, 11, 12, 14 and 15 and Township 6N, Range 18E, Sections 34 and 35, San Bernardino Base & Meridian, San Bernardino County, California, approximately 16 miles southeast of Essex, California. The Claims are staked in a north-south direction and each Claim is approximately 1,500 feet in length by 600 feet in width constituting approximately 20 acres of land. Collectively, the Claims total approximately 2,686 acres of land. The property is accessible by approximately 20 miles of dirt road adjacent to a paved highway.

The terrain is gentle to moderate. The area is generally covered with a thin alluvial fan, with bedrock cropping out in the higher elevations. The alluvial surface trends up from a low of approximately 2,100 feet above mean sea level in the southeastern portion of the area, to a high of approximately 2,800 feet in the northwestern portion. The highest elevations on the property, approximately 2,900 feet, are located on the slopes of Pilot Peak at the northwestern edge of the study area.

The geology and mineralization of the area in which the Claims are located is composed of rare earth-bearing allanite gneisses of Precambrian age which are exposed along northwest trending fault zones displaying associated carbonate veins, lamprophyre dikes and biotite augen gneiss. Intrusive rocks related to mineralization and composed of dikes, sills and masses of syenite/carbonatite make up the core of a series of low hills which also align northwest of the Claims. Observation suggests intrusives exposed are evidence of a large complex mostly obscured by shallow cover. Ground magnetic traverses have been effective in tracing major rock types and mineralized faults into adjacent areas of alluvial cover.

13

There are large alluvial-covered areas between the syenite/carbonatite complex and the allanite gneiss zones which may indicate potential targets for exploration of rare earth deposits. These include the alluvium covered, northwest trending topographic linears which may indicate mineralized structures along a projected trace of the syenite/carbonatite mass. Potential areas of interest also appear to exist along the trend of mineralization seen on previous wide-spaced drilling at the Claim sites. Preliminary geological research may indicate potential for deposits of lanthanum, cerium, praseodymium, neodymium and yttrium.

Observation, several geologic reports and one preliminary engineering study evidence that previous exploration work has been done at the Claims. Currently, there are no improvements, buildings, houses, or infrastructure of any kind within the Claims’ boundaries. There are no plants, equipment, surface or subsurface improvements, or facilities on the land on which the Claims are located. Our Claims are without known mineral reserves and our plan of exploration is exploratory in nature.

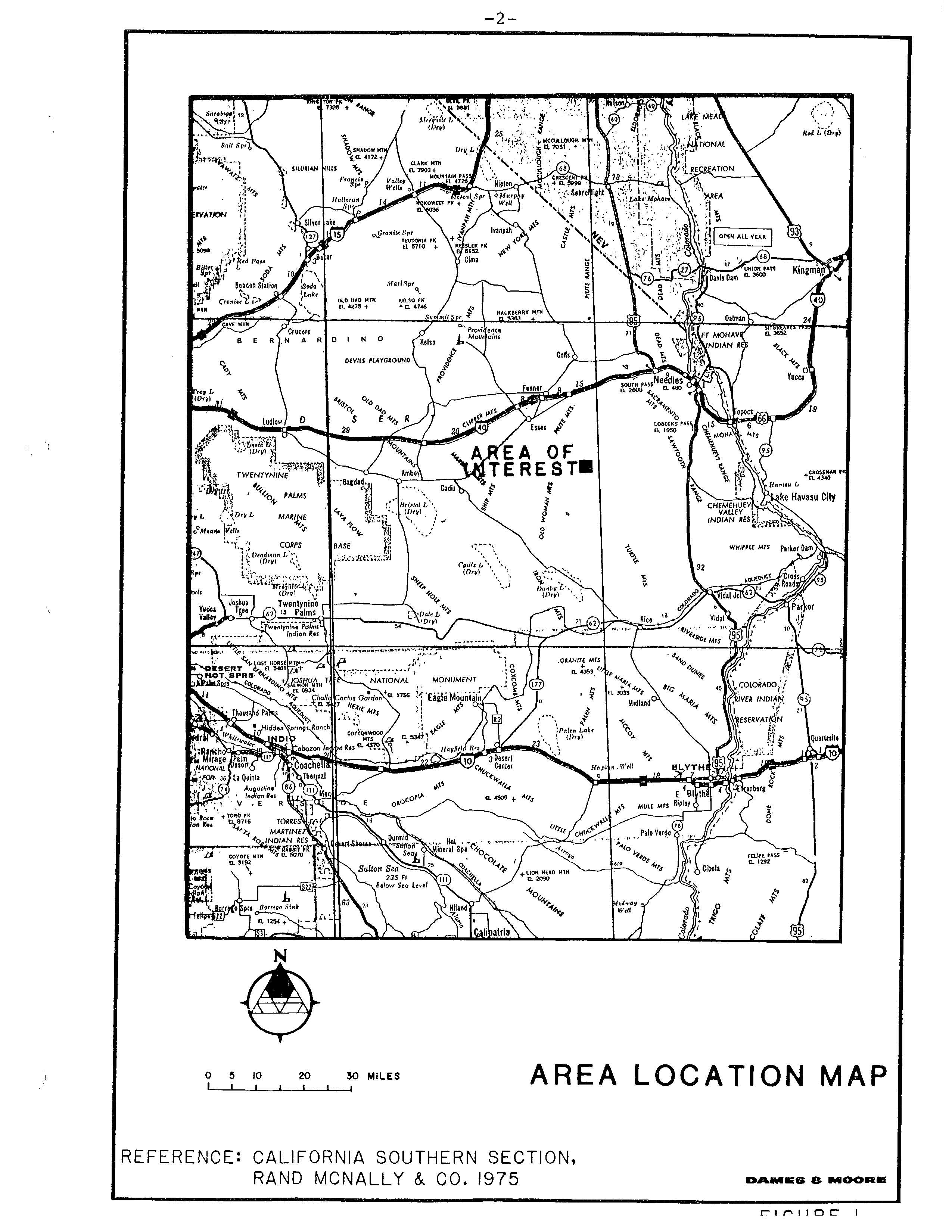

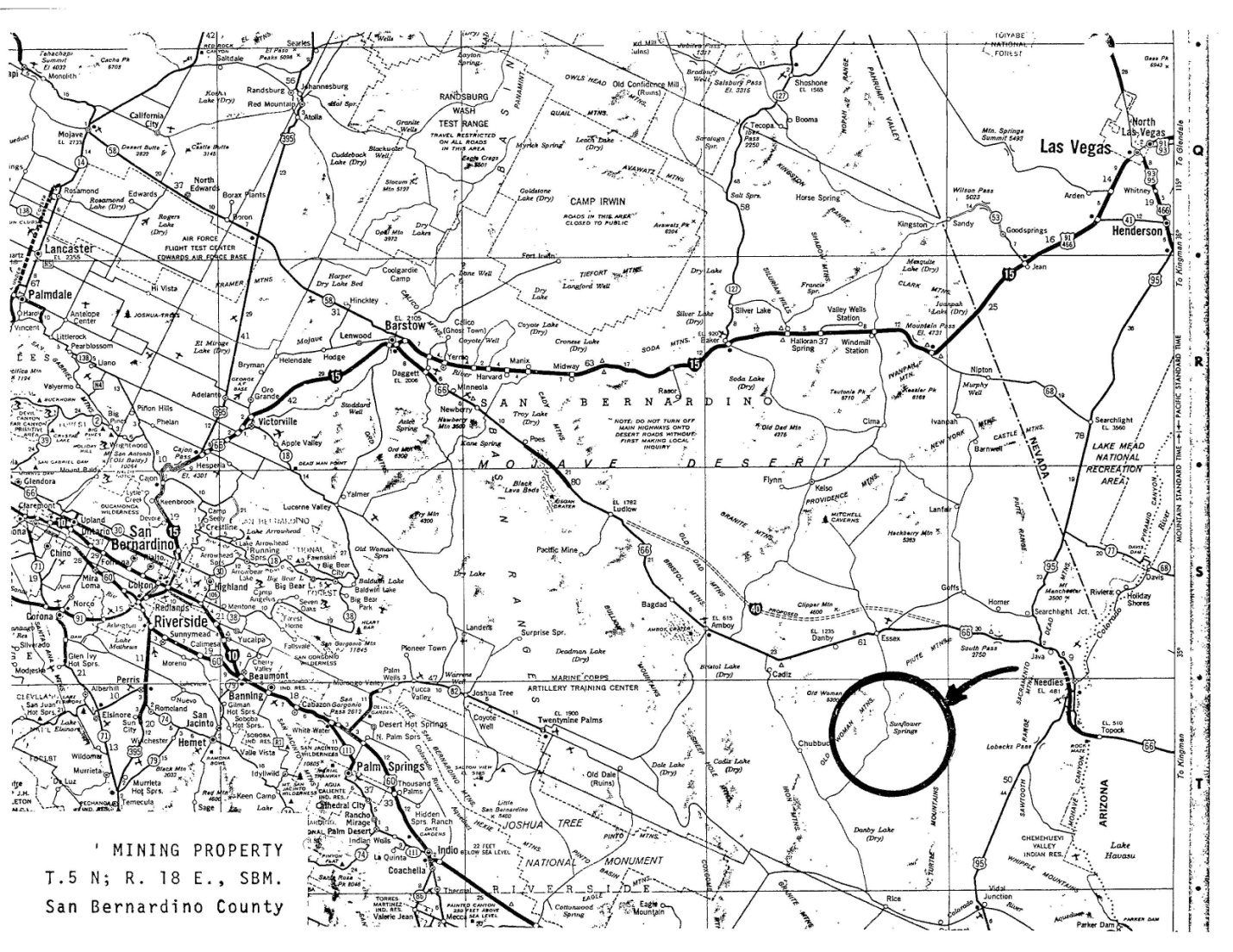

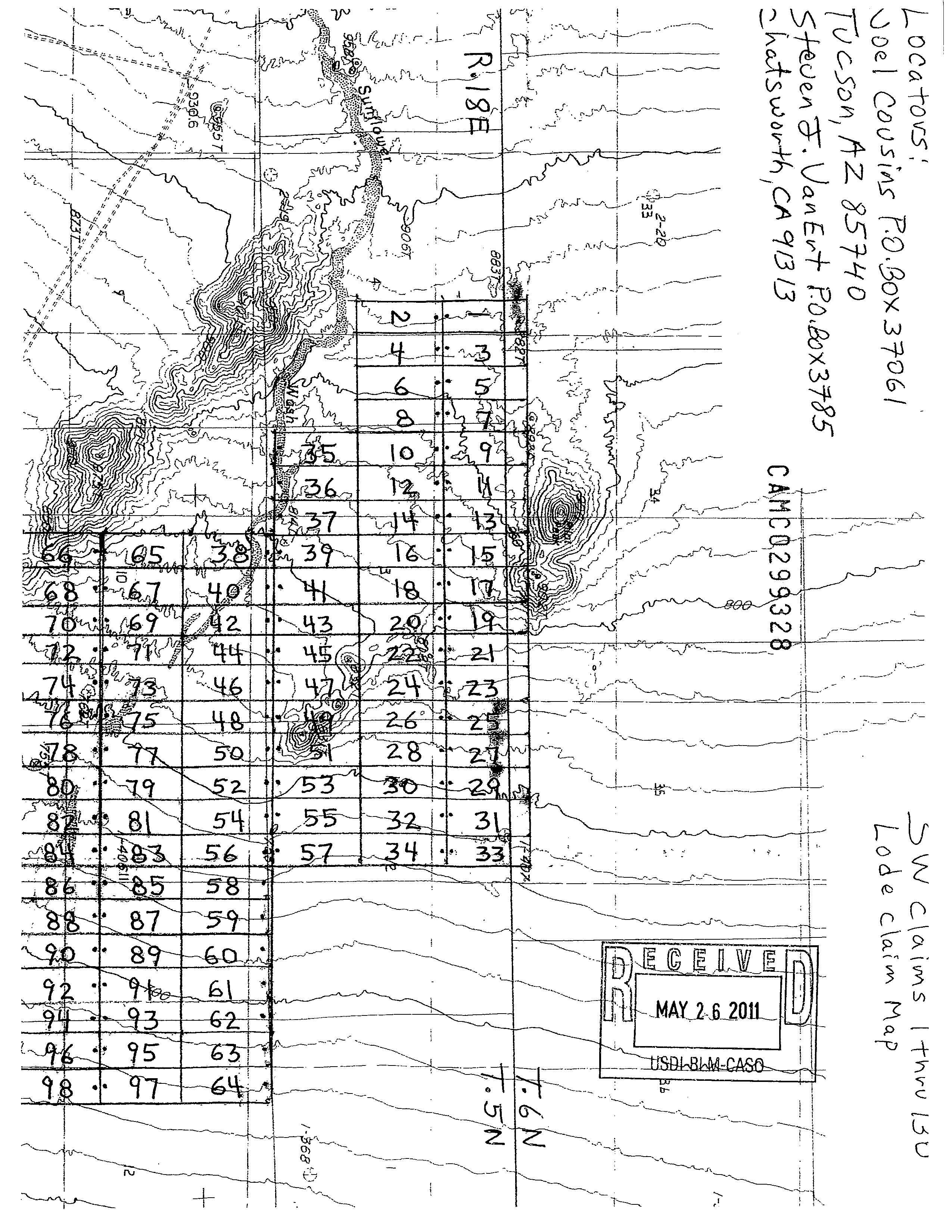

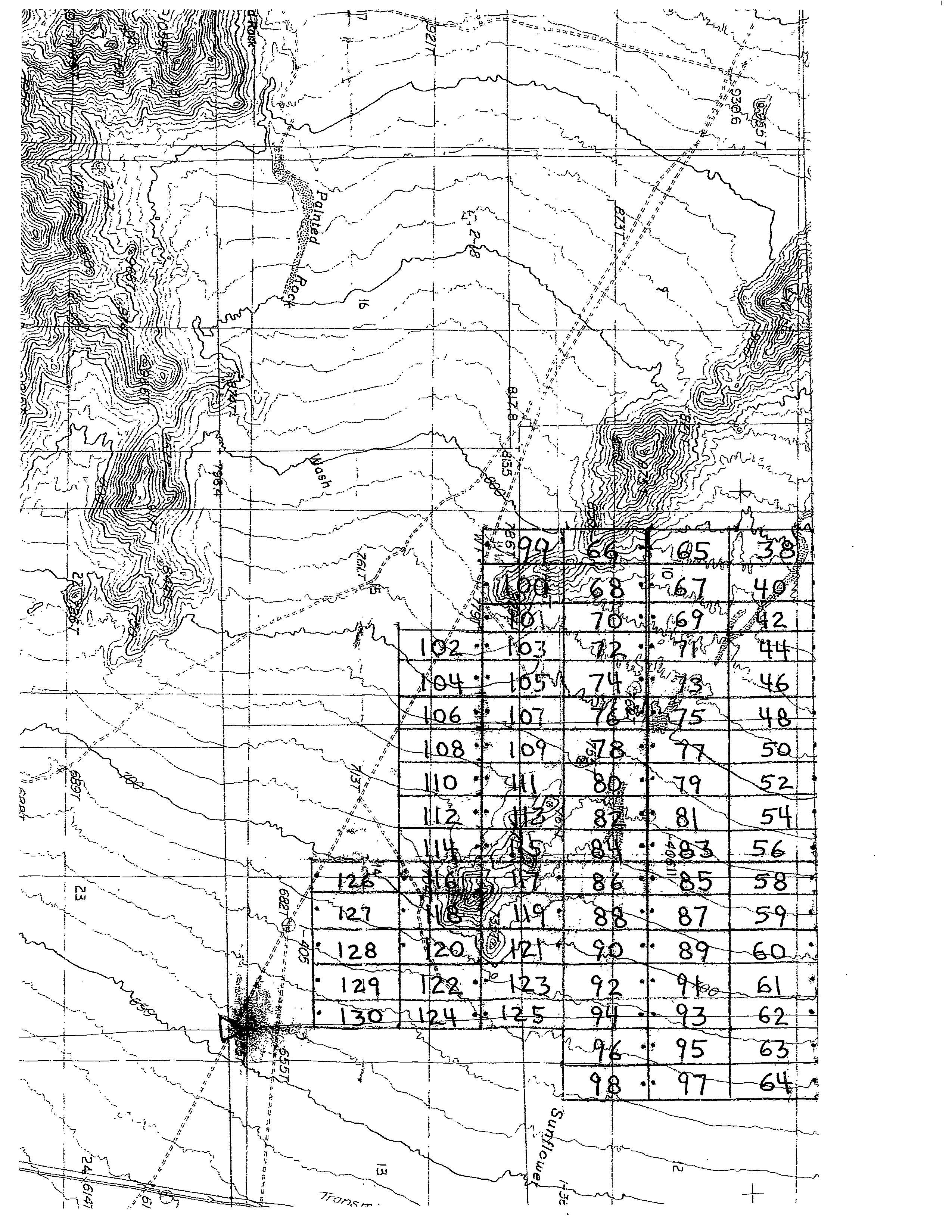

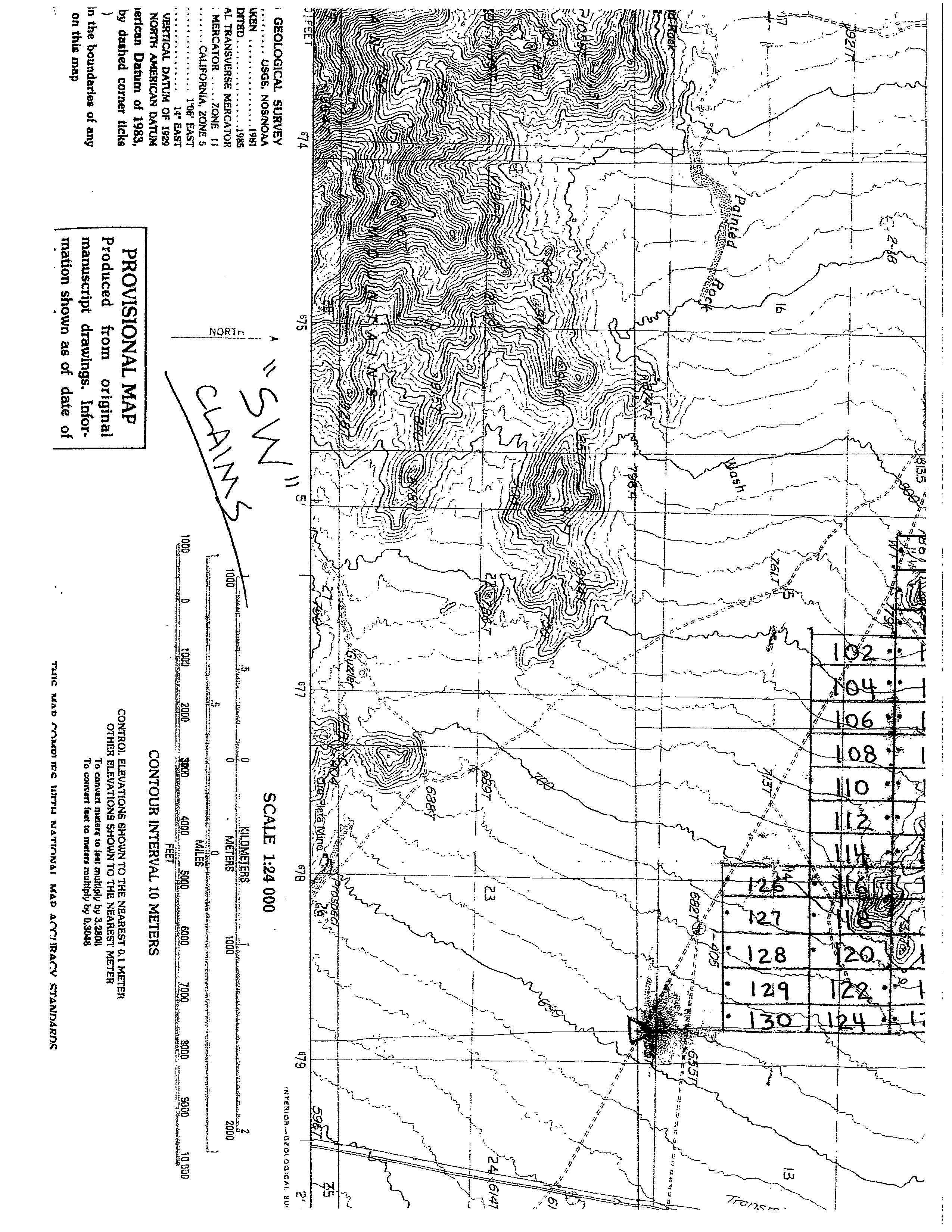

The following maps show the location of our Claims within San Bernardino County:

14

15

16

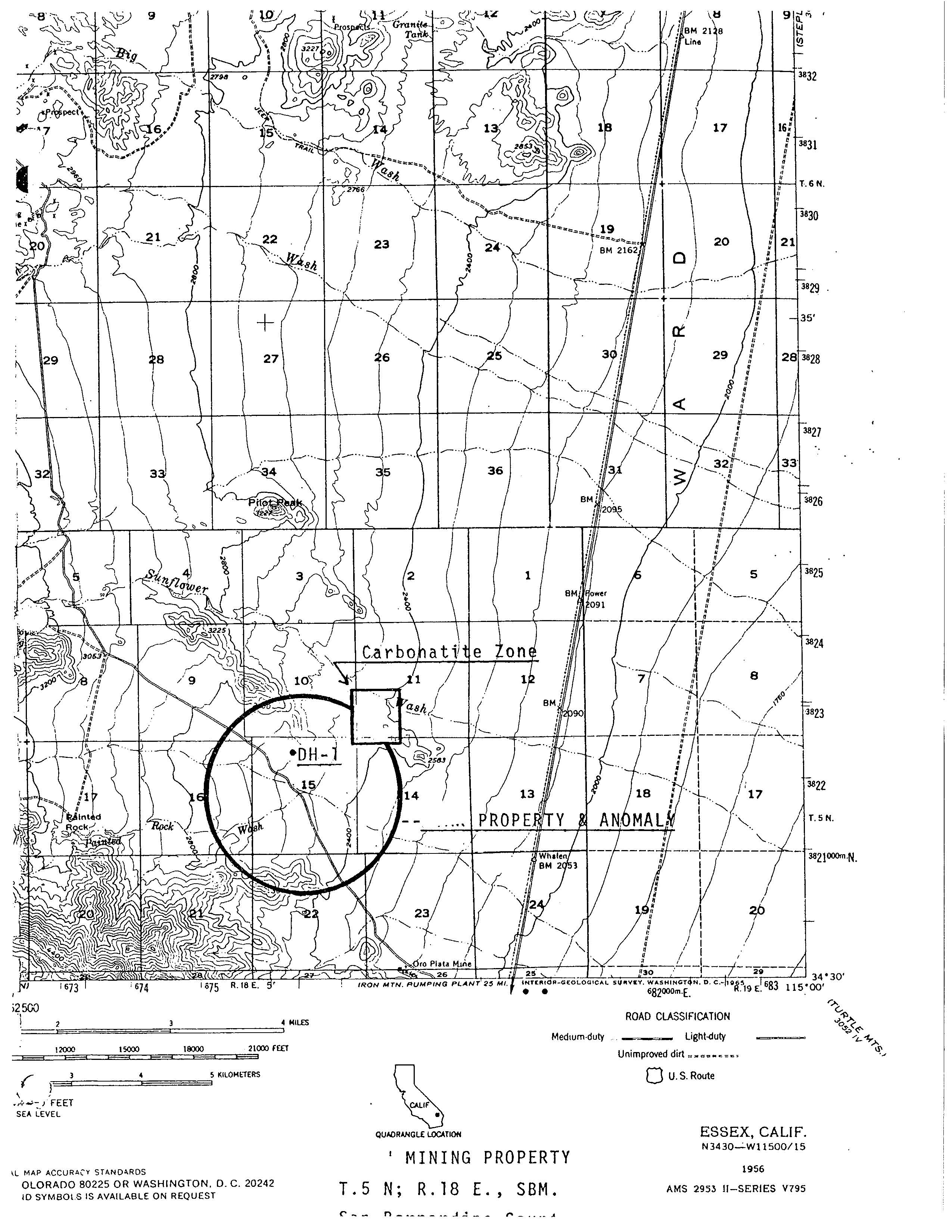

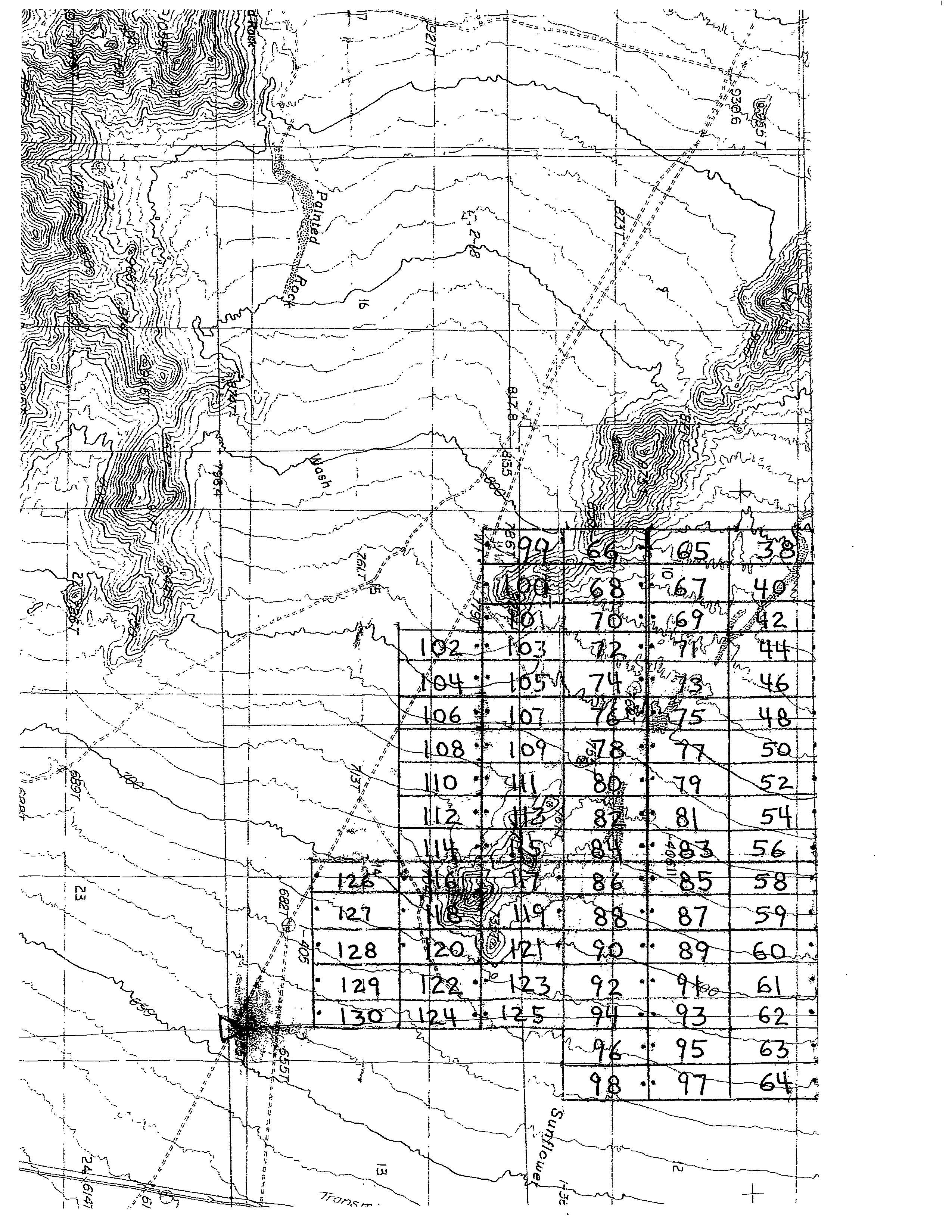

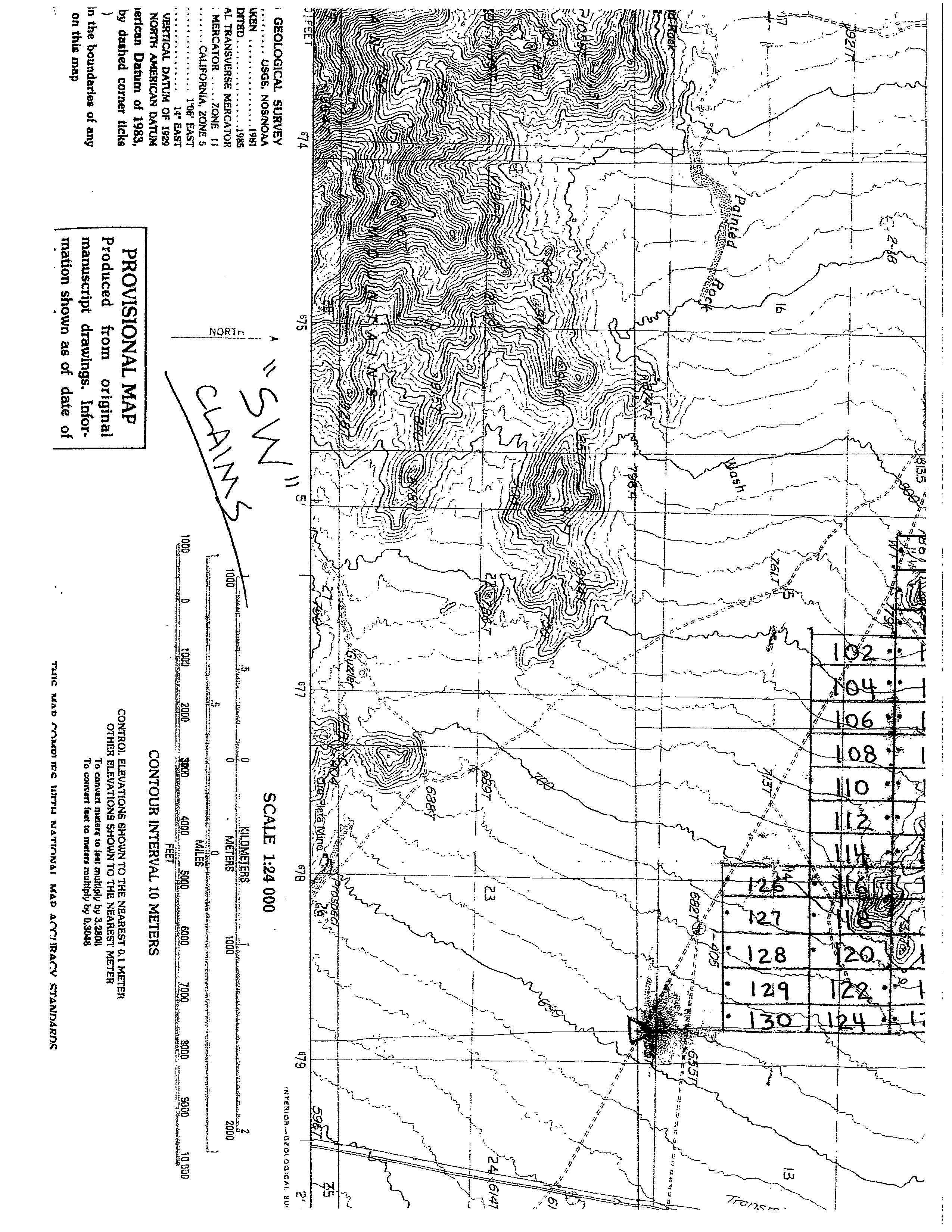

The following maps depict the specific coordinates of these 134 lode mining claims located in Township 5N, Range 18E, Sections 2, 3, 4, 10, 11, 12, 14 and 15 and Township 6N, Range 18E, Sections 34 and 35, San Bernardino Base & Meridian, San Bernardino County, California:

17

18

Climate

The climate of the area in which our Claims are located is characterized by desert conditions with very hot summers and mild winters. Temperatures are fairly mild in the early spring, late fall, and winter, generally anywhere between 30 – 80°F. Summer temperatures are extremely hot, commonly averaging over 115°F and can reach well over 120°F.

19

ITEM 3. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. [REMOVED AND RESERVED]

PART II

ITEM 5. MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is currently quoted on the OTC Bulletin Board. Our common stock has been quoted on the OTC Bulletin Board since April 15, 2011 under the symbol “HTPC.OB.” On August 5, 2011, our symbol was changed to “RARS.OB” to reflect the Company’s name change. Because we are quoted on the OTC Bulletin Board, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

The following table sets forth the high and low bid prices for our Common Stock per quarter as reported by the OTCBB since we began trading April 15, 2011 based on our fiscal year end of June 30, 2011. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

| | | | |

| First Quarter (July 1, 2010 – Sept 30, 2010) | Second Quarter (Oct 1, 2010 – Dec 31, 2010) | Third Quarter (Jan 1, 2011 – March 31, 2011) | Fourth Quarter (April 1, 2011 – June 30, 2011) |

High | --- | --- | --- | --- |

Low | --- | --- | --- | --- |

Close | --- | --- | --- | --- |

Shareholders ofRecord

As of September 27, 2011, an aggregate of 434,750,000 shares (post 50-for-1 forward split) of our common stock were issued and outstanding and were owned by 15 shareholders of record.

Recent Sales of Unregistered Securities

On February 23, 2011, the Company issued 100,000,000 shares (as adjusted for the 50-for-1 forward split) of its common stock to nineteen (19) accredited investors who purchased their shares under a registration statement filed on Form S-1 with the Securities Exchange Commission ('SEC'). The nineteen (19) individual investors paid $0.0002 per share (as adjusted for the 50-for-1 forward split) for aggregate proceeds of $20,000.

On July 12, 2011, the Company issued 9,750,000 restricted shares of its common stock (as adjusted for the 50-for-1 forward split) to the two individuals who form the Optionor of the Pilot Peak Property, as fulfillment of the initial stock payment required by the Pilot Peak Property Agreement. These shares were valued at a fair value estimate of $0.0005 per share, for aggregate deemed proceeds of $4,875.

Re-Purchase of Equity Securities

None.

20

Dividends

There are no restrictions that would limit the Company from paying dividends. We have not paid any cash or stock dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

ITEM 6. SELECTED FINANCIAL DATA(1)

| | |

| Fiscal 2011 | Fiscal 2010 |

| $ | $ |

Operating Revenue: | | |

Quarter I –Three Months to September 30th | – | n/a |

Quarter II – Three Months to December 31st | – | n/a |

Quarter III – Three Months to March 31st | – | n/a |

Full Year – Twelve Months to June 30th | – | – |

| | |

Net Income/(Loss): | | |

Quarter I –Three Months to September 30th | (1,410) | n/a |