UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 333-192373

Sabine Pass Liquefaction, LLC

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 27-3235920 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| None | None | None |

Securities registered pursuant to Section 12(g) of the Act: None

The registrant meets the conditions set forth in General Instructions I(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Note: As of January 1, 2022, the registrant is a voluntary filer not subject to the filing requirements of Sections 13 or 15(d) of the Securities Exchange Act of 1934. However, the registrant has filed all reports required pursuant to Sections 13 or 15(d) during the preceding 12 months as if the registrant was subject to such filing requirements.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates: Not applicable

Indicate the number of shares outstanding of the issuer’s classes of common stock, as of the latest practicable date: Not applicable

Documents incorporated by reference: None

SABINE PASS LIQUEFACTION, LLC

TABLE OF CONTENTS

As used in this annual report, the terms listed below have the following meanings:

Common Industry and Other Terms

| | | | | | | | |

| Bcf | | billion cubic feet |

| Bcf/d | | billion cubic feet per day |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| FERC | | Federal Energy Regulatory Commission |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| LIBOR | | London Interbank Offered Rate |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| mtpa | | million tonnes per annum |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

| TUA | | terminal use agreement |

Entity Abbreviations

| | | | | | | | |

| Cheniere | | Cheniere Energy, Inc. |

| | |

| Cheniere Investments | | Cheniere Energy Investments, LLC |

| Cheniere Marketing | | Cheniere Marketing, LLC and subsidiaries |

| CQP | | Cheniere Energy Partners, L.P. |

| Cheniere Terminals | | Cheniere LNG Terminals, LLC |

| CTPL | | Cheniere Creole Trail Pipeline, L.P. |

| SPLNG | | Sabine Pass LNG, L.P. |

Unless the context requires otherwise, references to “SPL,” the “Company,” “we,” “us” and “our” refer to Sabine Pass Liquefaction, LLC.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

•statements that we expect to commence or complete construction of our natural gas liquefaction project, or any expansions or portions thereof, by certain dates, or at all;

•statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products;

•statements regarding any financing transactions or arrangements, or our ability to enter into such transactions;

•statements regarding our future sources of liquidity and cash requirements;

•statements relating to the construction of our Trains, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto;

•statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total natural gas liquefaction or storage capacities that are, or may become, subject to contracts;

•statements regarding counterparties to our commercial contracts, construction contracts and other contracts;

•statements regarding our planned development and construction of additional Trains, including the financing of such Trains;

•statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities;

•statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change;

•statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions;

•statements regarding the COVID-19 pandemic and its impact on our business and operating results, including any customers not taking delivery of LNG cargoes, the ongoing creditworthiness of our contractual counterparties, any disruptions in our operations or construction of our Trains and the health and safety of Cheniere’s employees, and on our customers, the global economy and the demand for LNG;

•any other statements that relate to non-historical or future information; and

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “achieve,” “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intend,” “plan,” “potential,” “predict,” “project,” “pursue,” “target,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this annual report and in the other reports and other information that we file with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

PART I

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

General

We are a Delaware limited liability company formed by Cheniere Energy Partners, L.P. (“CQP”). We provide clean, secure and affordable LNG to integrated energy companies, utilities and energy trading companies around the world. We aspire to conduct our business in a safe and responsible manner, delivering a reliable, competitive and integrated source of LNG to our customers.

LNG is natural gas (methane) in liquid form. The LNG we produce is shipped all over the world, turned back into natural gas (called “regasification”) and then transported via pipeline to homes and businesses and used as an energy source that is essential for heating, cooking and other industrial uses. Natural gas is a cleaner-burning, abundant and affordable source of energy. When LNG is converted back to natural gas, it can be used instead of coal, which reduces the amount of pollution traditionally produced from burning fossil fuels, like sulfur dioxide and particulate matter that enters the air we breathe. Additionally, compared to coal, it produces significantly fewer carbon emissions. By liquefying natural gas, we are able to reduce its volume by 600 times so that we can load it onto special LNG carriers designed to keep the LNG cold and in liquid form for efficient transport overseas.

The natural gas liquefaction and export facility at Sabine Pass, Louisiana (the “Sabine Pass LNG terminal”), one of the largest LNG production facilities in the world, has six operational Trains, with Train 6 which achieved substantial completion on February 4, 2022, for a total production capacity of approximately 30 mtpa of LNG (the “Liquefaction Project”). The Sabine Pass LNG terminal is located in Cameron Parish, Louisiana, adjacent to the existing regasification facilities owned and operated by Sabine Pass LNG, L.P. (“SPLNG”).

Our customer arrangements provide us with significant, stable and long-term cash flows. As further discussed below, we contract our anticipated production capacity under SPAs, in which our customers are generally required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes, We have contracted approximately 75% of the total production capacity from the Liquefaction Project through long-term SPAs, with approximately 16 years of weighted average remaining life as of December 31, 2021, which includes volumes contracted under SPAs in which the customers are required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes. For further discussion of the contracted future cash flows under our revenue arrangements, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.

We remain focused on operational excellence and customer satisfaction. Increasing demand for LNG has allowed us to expand our liquefaction infrastructure in a financially disciplined manner. We have increased available liquefaction capacity at our Liquefaction Project as a result of debottlenecking and other optimization projects. We hold a significant land position at the Sabine Pass LNG terminal, which provides opportunity for further liquefaction capacity expansion. Further development of the Sabine Pass LNG terminal will require, among other things, acceptable commercial and financing arrangements before we can make a final investment decision (“FID”).

Additionally, we are committed to the responsible and proactive management of our most important environmental, social and governance (“ESG”) impacts, risks and opportunities. Cheniere published its 2020 Corporate Responsibility (“CR”) report, which details our strategy and progress on ESG issues, as well as our efforts on integrating climate considerations into our business strategy and taking a leadership position on increased environmental transparency, including conducting a climate scenario analysis and our plan to provide LNG customers with Cargo Emission Tags. In August 2021, Cheniere also announced a peer-reviewed LNG life cycle assessment study which allows for improved greenhouse gas emissions assessment, which was published in the American Chemical Society Sustainable Chemistry & Engineering Journal. Cheniere’s CR report is available at cheniere.com/IMPACT. Information on our website, including the CR report, is not incorporated by reference into this Annual Report on Form 10-K.

Our Business Strategy

Our primary business strategy is to develop, construct and operate assets supported by long-term, fixed fee contracts. We plan to implement our strategy by:

•safely, efficiently and reliably operating and maintaining our assets, including our Trains;

•procuring natural gas to our facility;

•commencing commercial delivery for our long-term SPA customers, of which we have initiated for seven of eight third party long-term SPA customers as of December 31, 2021;

•maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows;

•optimizing the Liquefaction Project by leveraging existing infrastructure;

•maintaining a prudent and cost-effective capital structure; and

•strategically identifying actionable environmental solutions.

Our Business

Liquefaction Facilities

The Liquefaction Project is one of the largest LNG production facilities in the world. We operate six Trains, including Train 6 which achieved substantial completion on February 4, 2022, and two marine berths, and are constructing a third marine berth. We have a lump sum turnkey contract with Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) for the EPC of Train 6. The following table summarizes the project completion and construction status of Train 6 of the Liquefaction Project as of December 31, 2021:

| | | | | | | | | | | |

| | Train 6 |

| Overall project completion percentage | | 99.5% |

| Completion percentage of: | | |

| Engineering | | 100.0% |

| Procurement | | 100.0% |

| Subcontract work | | 99.6% |

| Construction | | 98.8% |

| Date of substantial completion | | February 4, 2022 |

SPLNG has received authorization from the FERC for the construction of the third marine berth.

The following summarizes the volumes of natural gas for which we have received approvals from FERC to site, construct and operate the Liquefaction Project and the orders we have received from the DOE authorizing the export of domestically produced LNG by vessel from the Sabine Pass LNG terminal through December 31, 2050:

| | | | | | | | | | | | | | | | | | | | | | | |

| FERC Approved Volume | | DOE Approved Volume |

| (in Bcf/yr) | | (in mtpa) | | (in Bcf/yr) | | (in mtpa) |

| FTA countries | 1,661.94 | | 33 | | 1,661.94 | | 33 |

| Non-FTA countries | 1,661.94 | | 33 | | 1,509.3 (1) | | 30 |

(1)The authorization for an additional 152.64 Bcf/yr (approximately 3 mtpa) of natural gas is currently pending.

Natural Gas Supply, Transportation and Storage

We have secured natural gas feedstock for the Sabine Pass LNG terminal through long-term natural gas supply agreements. Additionally, to ensure that we are able to transport natural gas feedstock to the Sabine Pass LNG terminal and manage inventory levels, it has entered into transportation precedent and other agreements to secure firm pipeline transportation and storage capacity from third-parties.

Terminal Use Agreements

Customers

The following table shows customers with revenues of 10% or greater of total revenues from external customers:

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Percentage of Total Revenues from External Customers |

| | | | Year Ended December 31, |

| | | | | | 2021 | | 2020 | | 2019 |

| BG Gulf Coast LNG, LLC | | | | | | 25% | | 25% | | 29% |

| GAIL (India) Limited | | | | | | 18% | | 19% | | 21% |

| Korea Gas Corporation | | | | | | 17% | | 18% | | 21% |

| Naturgy LNG GOM, Limited | | | | | | 16% | | 16% | | 19% |

| Total | | | | | | 10% | | * | | * |

* Less than 10%

All of the above customers contribute to our LNG revenues through SPA contracts.

Governmental Regulation

The Liquefaction Project is subject to extensive regulation under federal, state and local statutes, rules, regulations and laws. These laws require that we engage in consultations with appropriate federal and state agencies and that we obtain and maintain applicable permits and other authorizations. These rigorous regulatory requirements increase the cost of construction and operation, and failure to comply with such laws could result in substantial penalties and/or loss of necessary authorizations.

Federal Energy Regulatory Commission

The design, construction, operation, maintenance and expansion of the Liquefaction Project are highly regulated activities subject to the jurisdiction of the FERC pursuant to the Natural Gas Act of 1938, as amended (the “NGA”). Under the NGA, the FERC’s jurisdiction generally extends to the sale for resale of natural gas in interstate commerce and to the construction, operation, maintenance and expansion of liquefaction facilities.

The FERC issued its final Order Granting Section 3 Authority (“Order”) in April 2012 approving our application for an order under Section 3 of the NGA authorizing the siting, construction and operation of Trains 1 through 4 of the Liquefaction Project (and related facilities). Subsequently, in May 2012, the FERC issued written approval to commence site preparation work for Trains 1 through 4. In October 2012, we applied to amend the FERC approval to reflect certain modifications to the Liquefaction Project, and in August 2013, the FERC issued an Order approving the modifications. In October 2013, we applied to further amend the FERC approval, requesting authorization to increase the total permitted LNG production capacity of Trains 1 through 4 from the then authorized 803 Bcf/yr to 1,006 Bcf/yr so as to more accurately reflect the estimated maximum LNG production capacity of Trains 1 through 4. In February 2014, the FERC issued an order approving the October 2013

application (the “February 2014 Order”). A party to the proceeding requested a rehearing of the February 2014 Order, and in September 2014, the FERC issued an order denying the rehearing request (the “FERC Order Denying Rehearing”). The party petitioned the U.S. Court of Appeals for the District of Columbia Circuit to review the February 2014 Order and the FERC Order Denying Rehearing. The court denied the petition in June 2016. In September 2013, we filed an application with the FERC for authorization to add Trains 5 and 6 to the Liquefaction Project, which was granted by the FERC in an Order issued in April 2015 and an Order denying rehearing issued in June 2015. These Orders are not subject to appellate court review. In October of 2018, we applied to the FERC for authorization to add a third marine berth to the Liquefaction Project, which FERC approved in February of 2020. FERC issued written approval to commence site preparation work for the third berth in June 2020.

On September 27, 2019, we filed a request with the FERC pursuant to Section 3 of the NGA, requesting authorization to increase the total LNG production capacity of the terminal from currently authorized levels to an amount which reflects more accurately the capacity of the facility based on enhancements during the engineering, design and construction process, as well as operational experience to date. The requested authorizations do not involve construction of new facilities. Corresponding applications for authorization to export the incremental volumes were also submitted to the DOE. The DOE issued Orders granting authorization to export LNG to FTA countries in April 2020. The DOE authorization for export to non-FTA countries is still pending. In October 2021, the FERC issued its Orders Amending Authorization under Section 3 of the NGA.

On February 18, 2022, FERC updated its 1999 Policy Statement on certification of new interstate natural gas facilities and the framework for FERC’s decision-making process, which would now include, among other things, reasonably foreseeable greenhouse gas emissions that may be attributable to the project and the project’s impact on environmental justice communities. These FERC changes are the first revision in more than 20 years to FERC’s policy for the certification of new interstate natural gas pipeline projects under Section 7 of the NGA. The updated Policy Statement has more limited applicability to LNG projects regulated under Section 3 of the Natural Gas Act. While the impact on our future projects and expansions is not known at this time, we do not expect it to have a material adverse effect on our operations.

All of our FERC construction, operation, reporting, accounting and other regulated activities are subject to audit by the FERC, which may conduct routine or special inspections and issue data requests designed to ensure compliance with FERC rules, regulations, policies and procedures. The FERC’s jurisdiction under the NGA allows it to impose civil and criminal penalties for any violations of the NGA and any rules, regulations or orders of the FERC up to approximately $1.3 million per day per violation, including any conduct that violates the NGA’s prohibition against market manipulation.

Several other material governmental and regulatory approvals and permits will be required throughout the life of the Liquefaction Project. In addition, our FERC orders require us to comply with certain ongoing conditions, reporting obligations and maintain other regulatory agency approvals throughout the life of the Liquefaction Project. For example, throughout the life of our liquefaction facility, we are subject to regular reporting requirements to the FERC, the Department of Transportation’s (“DOT”) Pipeline and Hazardous Materials Safety Administration (“PHMSA”) and applicable federal and state regulatory agencies regarding the operation and maintenance of our facility. To date, we have been able to obtain and maintain required approvals as needed, and the need for these approvals and reporting obligations have not materially affected our construction or operations.

DOE Export Licenses

The DOE has authorized the export of domestically produced LNG by vessel from the “Sabine Pass LNG terminal as discussed in Liquefaction Facilities. Although it is not expected to occur, the loss of an export authorization could be a force majeure event under our SPAs.

Under Section 3 of the NGA applications for exports of natural gas to FTA countries, which allow for national treatment for trade in natural gas, are “deemed to be consistent with the public interest” and shall be granted by the DOE without “modification or delay.” FTA countries currently recognized by the DOE for exports of LNG include Australia, Bahrain, Canada, Chile, Colombia, Dominican Republic, El Salvador, Guatemala, Honduras, Jordan, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, Republic of Korea and Singapore. FTAs with Israel and Costa Rica do not require national treatment for trade in natural gas. Applications for export of LNG to non-FTA countries are considered by the DOE in a notice and comment proceeding whereby the public and other interveners are provided the opportunity to comment and may assert that such authorization would not be consistent with the public interest.

Other Governmental Permits, Approvals and Authorizations

Construction and operation of the Liquefaction Project requires additional permits, orders, approvals and consultations to be issued by various federal and state agencies, including the DOT, U.S. Army Corps of Engineers (“USACE”), U.S. Department of Commerce, National Marine Fisheries Service, U.S. Department of the Interior, U.S. Fish and Wildlife Service, the U.S. Environmental Protection Agency (the “EPA”), U.S. Department of Homeland Security and the Louisiana Department of Environmental Quality (“LDEQ”).

The USACE issues its permits under the authority of the Clean Water Act (“CWA”) (Section 404) and the Rivers and Harbors Act (Section 10). The EPA administers the Clean Air Act (“CAA”), and has delegated authority to the LDEQ to issue the Title V Operating Permit (the “Title V Permit”) and the Prevention of Significant Deterioration Permit (the “PSD Permit”). These two permits are issued by the LDEQ for the Liquefaction Project.

Commodity Futures Trading Commission (“CFTC”)

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) amended the Commodity Exchange Act to provide for federal regulation of the over-the-counter derivatives market and entities, such as us, that participate in those markets. The CFTC has enacted a number of regulations pursuant to the Dodd-Frank Act, including the speculative position limit rules which became effective on March 15, 2021 and have a phased-in compliance date that began on January 1, 2022. Given the recent enactment of the speculative position limit rules, as well as the impact of other rules and regulations under the Dodd-Frank Act, the impact of such rules and regulations on our business continues to be uncertain.

As required by the Dodd-Frank Act, the CFTC and federal banking regulators also adopted rules requiring Swap Dealers (as defined in the Dodd-Frank Act), including those that are regulated financial institutions, to collect initial and/or variation margin with respect to uncleared swaps from their counterparties that are financial end users, registered swap dealers or major swap participants. These rules do not require collection of margin from non-financial-entity end users who qualify for the end user exception from the mandatory clearing requirement or from non-financial end users or certain other counterparties in certain instances. We qualify as a non-financial-entity end user with respect to the swaps that we enter into to hedge our commercial risks.

Pursuant to the Dodd-Frank Act, the CFTC adopted additional anti-manipulation and anti-disruptive trading practices regulations that prohibit, among other things, manipulative, deceptive or fraudulent schemes or material misrepresentation in the futures, options, swaps and cash markets. In addition, separate from the Dodd-Frank Act, our use of futures and options on commodities is subject to the Commodity Exchange Act and CFTC regulations, as well as the rules of futures exchanges on which any of these instruments are executed. Should we violate any of these laws and regulations, we could be subject to a CFTC or an exchange enforcement action and material penalties, possibly resulting in changes in the rates we can charge.

Environmental Regulation

The Liquefaction Project is subject to various federal, state and local laws and regulations relating to the protection of the environment and natural resources. These environmental laws and regulations require significant expenditures for compliance, can affect the cost and output of operations and may impose substantial penalties for non-compliance and substantial liabilities for pollution. Many of these laws and regulations, such as those noted below, restrict or prohibit impacts to the environment or the types, quantities and concentration of substances that can be released into the environment and can lead to substantial administrative, civil and criminal fines and penalties for non-compliance.

Clean Air Act

The Liquefaction Project is subject to the federal CAA and comparable state and local laws. We may be required to incur certain capital expenditures over the next several years for air pollution control equipment in connection with maintaining or obtaining permits and approvals addressing air emission-related issues. We do not believe, however, that our operations, or the construction and operations of the Liquefaction Project, will be materially and adversely affected by any such requirements.

In 2009, the EPA promulgated and finalized the Mandatory Greenhouse Gas Reporting Rule requiring annual reporting of greenhouse gas (“GHG”) emissions from stationary sources in a variety of industries. In 2010, the EPA expanded the rule to include reporting obligations for LNG terminals. In addition, the EPA has defined GHG emissions thresholds that would

subject GHG emissions from new and modified industrial sources to regulation if the source is subject to PSD Permit requirements due to its emissions of non-GHG criteria pollutants. While the EPA subsequently took a number of additional actions primarily relating to GHG emissions from the electric power generation and the oil and gas exploration and production industries, those rules were largely stayed or repealed during the Trump Administration including by amendments adopted by the EPA on February 23, 2018 and additional amendments to new source performance standards for the oil and gas industry on September 14 and 15, 2020. On November 15, 2021, the EPA proposed new regulations to reduce methane emissions from both new and existing sources within the Crude Oil and Natural Gas source category. The proposed regulations if finalized, would result in more stringent requirements for new sources, expand the types of new sources covered, and for the first time, establish emissions guidelines for existing sources in the Crude Oil and Natural Gas source category. We are supportive of regulations reducing GHG emissions over time.

From time to time, Congress has considered proposed legislation directed at reducing GHG emissions. In addition, many states have already taken regulatory action to monitor and/or reduce emissions of GHGs, primarily through the development of GHG emission inventories or regional GHG cap and trade programs. It is not possible at this time to predict how future regulations or legislation may address GHG emissions and impact our business. However, future regulations and laws could result in increased compliance costs, the imposition of taxes or fees related to GHG emissions or additional operating restrictions and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Coastal Zone Management Act (“CZMA”)

The siting and construction of the Liquefaction Project within the coastal zone is subject to the requirements of the CZMA. The CZMA is administered by the states (in Louisiana, by the Department of Natural Resources, and in Texas, by the General Land Office). This program is implemented to ensure that impacts to coastal areas are consistent with the intent of the CZMA to manage the coastal areas.

Clean Water Act

The Liquefaction Project is subject to the federal CWA and analogous state and local laws. The CWA imposes strict controls on the discharge of pollutants into the navigable waters of the United States, including discharges of wastewater and storm water runoff and fill/discharges into waters of the United States. Permits must be obtained prior to discharging pollutants into state and federal waters. The CWA is administered by the EPA, the USACE and by the states (in Louisiana, by the LDEQ). The CWA regulatory programs, including the Section 404 dredge and fill permitting program and Section 401 water quality certification program carried out by the states, are frequently the subject of shifting agency interpretations and legal challenges, which at times can result in permitting delays.

Resource Conservation and Recovery Act (“RCRA”)

The federal RCRA and comparable state statutes govern the generation, handling and disposal of solid and hazardous wastes and require corrective action for releases into the environment. When such wastes are generated in connection with the operations of our facilities, we are subject to regulatory requirements affecting the handling, transportation, treatment, storage and disposal of such wastes.

Protection of Species, Habitats and Wetlands

Various federal and state statutes, such as the Endangered Species Act, the Migratory Bird Treaty Act, the CWA and the Oil Pollution Act, prohibit certain activities that may adversely affect endangered or threatened animal, fish and plant species and/or their designated habitats, wetlands, or other natural resources. If the Liquefaction Project may adversely affect a protected species or its habitat, we may be required to develop and follow a plan to avoid those impacts. In that case, siting, construction or operation may be delayed or restricted and cause us to incur increased costs.

It is not possible at this time to predict how future regulations or legislation may address protection of species, habitats and wetlands and impact our business. However, we do not believe that our operations, or the construction and operations of our Liquefaction Project, will be materially and adversely affected by such regulatory actions.

Market Factors and Competition

Market Factors

Our ability to enter into additional long-term SPAs to underpin the development of additional Trains, sale of LNG by Cheniere Marketing, or development of new projects is subject to market factors. These factors include changes in worldwide supply and demand for natural gas, LNG and substitute products, the relative prices for natural gas, crude oil and substitute products in North America and international markets, the rate of fuel switching for power generation from coal, nuclear or oil to natural gas, economic growth in developing countries and other related factors such as the effects of the COVID-19 pandemic. In addition, Cheniere’s ability to obtain additional funding to execute its business strategy is subject to the investment community’s appetite for investment in LNG and natural gas infrastructure and Cheniere’s ability to access capital markets.

We expect that global demand for natural gas and LNG will continue to increase as nations seek more abundant, reliable and environmentally cleaner fuel alternatives to oil and coal. Players around the globe have shown commitments to environmental goals consistent with many policy initiatives that we believe are constructive for LNG demand and infrastructure growth. Currently, significant amounts of money are being invested across Europe and Asia in natural gas projects under construction, and more continues to be earmarked to planned projects globally. Some examples include India’s commitment to invest over $60 billion to usher a gas-based economy, around $100 billion earmarked for Europe’s gas infrastructure buildout, and China’s hundreds of billions all along the natural gas value chain. We highlight regasification capacity, which will not only expand existing import capacities in rapidly growing markets like China and India, but also add new import markets all over the globe, raising the total number of import markets to approximately 60 by 2030 from 43 in 2020 and just 15 markets as recently as 2005.

As a result of these dynamics, global demand for natural gas is projected by the International Energy Agency to grow by approximately 20 trillion cubic feet (“Tcf”) between 2020 and 2030 and 33 Tcf between 2020 and 2040. LNG’s share is seen growing from about 11% in 2020 to about 12% of the global gas market in 2030 and 14% in 2040. Wood Mackenzie Limited (“WoodMac”) forecasts that global demand for LNG will increase by approximately 57%, from 366.6 mtpa, or 17.6 Tcf, in 2020, to 576.5 mtpa, or 27.7 Tcf, in 2030 and to 734.5 mtpa or 35.3 Tcf in 2040. WoodMac also forecasts LNG production from existing operational facilities and new facilities already under construction will be able to supply the market with approximately 517 mtpa in 2030, declining to 456 mtpa in 2040. This could result in a market need for construction of an additional approximately 60 mtpa of LNG production by 2030 and about 279 mtpa by 2040. As a cleaner burning fuel with far lower emissions than coal or liquid fuels in power generation, we expect gas and LNG to play a central role in balancing grids and contributing to a low carbon energy system globally. We believe the capital and operating costs of the uncommitted capacity of our Liquefaction Projects is competitive with new proposed projects globally and we are well-positioned to capture a portion of this incremental market need.

Our LNG business has limited exposure to oil price movements as we have contracted a significant portion of our LNG production capacity under long-term sale and purchase agreements. These agreements contain fixed fees that are required to be paid even if the customers elect to cancel or suspend delivery of LNG cargoes. We have contracted approximately 75% of the total production capacity from the Liquefaction Project, with approximately 16 years of weighted average remaining life as of December 31, 2021, which includes volumes contracted under SPAs in which the customers are required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes.

Competition

When we need to replace any existing SPA or enter into new SPAs, we will compete on the basis of price per contracted volume of LNG with other natural gas liquefaction projects throughout the world, including our affiliate Corpus Christi Liquefaction, LLC (“CCL”), which operates three Trains at a natural gas liquefaction facility near Corpus Christi, Texas. Revenues associated with any incremental volumes of the Liquefaction Project, including those under the Cheniere Marketing SPA, will also be subject to market-based price competition. Many of the companies with which we compete are major energy corporations with longer operating histories, more development experience, greater name recognition, greater financial, technical and marketing resources and greater access to LNG markets than us.

Employees

We have no employees. We have contracts with subsidiaries of Cheniere and CQP for operations, maintenance and management services. As of January 31, 2022, Cheniere and its subsidiaries had 1,550 full-time employees, including 513 employees who directly supported the Liquefaction Project. See Note 12—Related Party Transactions of our Notes to Financial Statements for a discussion of the services agreements pursuant to which general and administrative services are provided to us.

Available Information

Our principal executive offices are located at 700 Milam Street, Suite 1900, Houston, Texas 77002, and our telephone number is (713) 375-5000. Our internet address is www.cheniere.com. We provide public access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the SEC under the Exchange Act. These reports may be accessed free of charge through our internet website. We make our website content available for informational purposes only. The website should not be relied upon for investment purposes and is not incorporated by reference into this Form 10-K. The SEC maintains an internet site (www.sec.gov) that contains reports and other information regarding issuers.

ITEM 1A. RISK FACTORS

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates or expectations contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

The risk factors in this report are grouped into the following categories:

Risks Relating to Our Financial Matters

Our existing level of cash resources and significant debt could cause us to have inadequate liquidity and could materially and adversely affect our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

As of December 31, 2021, we had no cash and cash equivalents, $98 million of restricted cash and cash equivalents, $805 million of available commitments under the our $1.2 billion Working Capital Revolving Credit and Letter of Credit Reimbursement Agreement (the “2020 Working Capital Facility”) and $13.1 billion of total debt outstanding (before unamortized premium, discount and debt issuance costs). We incur, and will incur, significant interest expense relating to the assets at the Liquefaction Project. Our ability to refinance our indebtedness will depend on our ability to access additional project financing as well as the debt and equity capital markets. A variety of factors beyond our control could impact the availability or cost of capital, including domestic or international economic conditions, increases in key benchmark interest rates and/or credit spreads, the adoption of new or amended banking or capital market laws or regulations and the repricing of market risks and volatility in capital and financial markets. Our financing costs could increase or future borrowings may be unavailable to us or unsuccessful, which could cause us to be unable to pay or refinance our indebtedness or to fund our other liquidity needs. We also rely on borrowings under our credit facilities to fund our capital expenditures. If any of the lenders in the syndicates backing these facilities was unable to perform on its commitments, we may need to seek replacement financing, which may not be available as needed, or may be available in more limited amounts or on more expensive or otherwise unfavorable terms.

Our ability to generate cash is substantially dependent upon the performance by customers under long-term contracts that we have entered into, and we could be materially and adversely affected if any significant customer fails to perform its contractual obligations for any reason.

Our future results and liquidity are substantially dependent upon performance by our customers to make payments under long-term contracts. As of December 31, 2021, we had SPAs with terms of 10 or more years with a total of eight different third party customers.

While substantially all of our long-term third party customer arrangements are executed with a creditworthy parent company or secured by a parent company guarantee or other form of collateral, we are nonetheless exposed to credit risk in the event of a customer default that requires us to seek recourse.

Additionally, our long-term SPAs entitle the customer to terminate their contractual obligations upon the occurrence of certain events which include, but are not limited to: (1) if we fail to make available specified scheduled cargo quantities; (2) delays in the commencement of commercial operations; and (3) under the majority of our SPAs upon the occurrence of certain events of force majeure.

Although we have not had a history of material customer default or termination events, the occurrence of such events are largely outside of our control and may expose us to unrecoverable losses. We may not be able to replace these customer arrangements on desirable terms, or at all, if they are terminated. As a result, our business, contracts, financial condition, operating results, cash flow, liquidity and prospects could be materially and adversely affected.

Risks Relating to Our Operations and Industry

Catastrophic weather events or other disasters could result in an interruption of our operations, a delay in the completion of our Liquefaction Project, damage to our Liquefaction Project and increased insurance costs, all of which could adversely affect us.

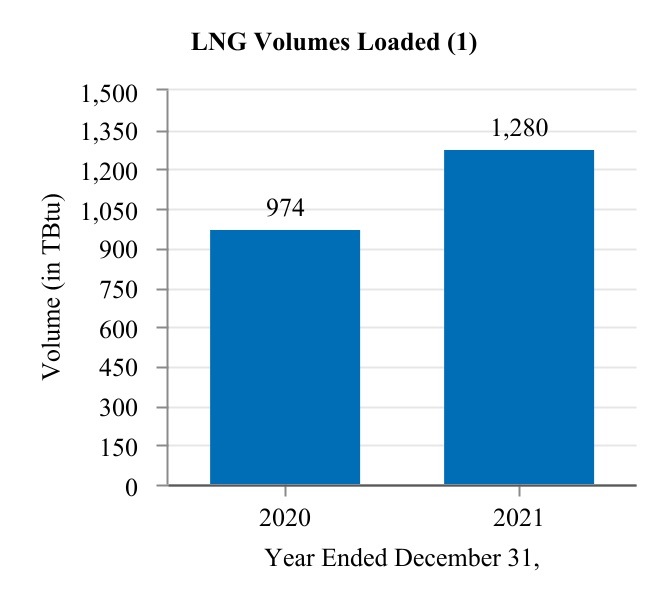

Hurricanes Katrina and Rita in 2005, Hurricane Ike in 2008, Hurricane Harvey in 2017, Hurricanes Laura and Delta in 2020 and Winter Storm Uri in 2021 caused interruptions or temporary suspension in construction or operations at our Liquefaction Project or caused minor damage to our Liquefaction Project. In August 2020, we entered into an arrangement with our affiliate to provide the ability, in limited circumstances, to potentially fulfill commitments to LNG buyers from the other facility in the event operational conditions impact operations at the Sabine Pass LNG terminal or at our affiliate’s terminal. During the year ended December 31, 2021, eight TBtu was loaded at affiliate facilities pursuant to this agreement. Future storms and related storm activity and collateral effects, or other disasters such as explosions, fires, floods or accidents, could result in damage to, or interruption of operations at, the Sabine Pass LNG terminal or related infrastructure, as well as delays or cost increases in the construction and the development of our other facilities and increase our insurance premiums. The U.S. Global Change Research Program has reported that the U.S.’s energy and transportation systems are expected to be increasingly disrupted by climate change and extreme weather events. An increase in frequency and severity of extreme weather events such as storms, floods, fires and rising sea levels could have an adverse effect on our operations.

Disruptions to the third party supply of natural gas to our facilities could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We depend upon third party pipelines and other facilities that provide gas delivery options to our Liquefaction Project. If the construction of new or modified pipeline connections is not completed on schedule or any pipeline connection were to become unavailable for current or future volumes of natural gas due to repairs, damage to the facility, lack of capacity, failure to replace contracted firm pipeline transportation capacity on economic terms, or any other reason, our ability to receive natural gas volumes to produce LNG or to continue shipping natural gas from producing regions or to end markets could be adversely impacted. Any significant disruption to our natural gas supply could result in a substantial reduction in our revenues under our long-term SPAs or other customer arrangements, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We may not be able to purchase or receive physical delivery of sufficient natural gas to satisfy our delivery obligations under the SPAs, which could have a material adverse effect on us.

Under the SPAs with our customers, we are required to make available to them a specified amount of LNG at specified times. However, we may not be able to purchase or receive physical delivery of sufficient quantities of natural gas to satisfy those obligations, which may provide affected SPA customers with the right to terminate their SPAs. Our failure to purchase or receive physical delivery of sufficient quantities of natural gas could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We are subject to significant construction and operating hazards and uninsured risks, one or more of which may create significant liabilities and losses for us.

The construction and operation of the Liquefaction Project is, and will be, subject to the inherent risks associated with this type of operation, including explosions, breakdowns or failures of equipment, operational errors by vessel or tug operators, pollution, release of toxic substances, fires, hurricanes and adverse weather conditions and other hazards, each of which could result in significant delays in commencement or interruptions of operations and/or in damage to or destruction of our facilities or damage to persons and property. In addition, our operations and the facilities and vessels of third parties on which our operations are dependent face possible risks associated with acts of aggression or terrorism.

We do not, nor do we intend to, maintain insurance against all of these risks and losses. We may not be able to maintain desired or required insurance in the future at rates that we consider reasonable. The occurrence of a significant event not fully insured or indemnified against could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Cyclical or other changes in the demand for and price of LNG and natural gas may adversely affect our LNG business and the performance of our customers and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

Our LNG business and the development of domestic LNG facilities and projects generally is based on assumptions about the future availability and price of natural gas and LNG, and the prospects for international natural gas and LNG markets. Natural gas and LNG prices have been, and are likely to continue to be, volatile and subject to wide fluctuations in response to one or more of the following factors:

•competitive liquefaction capacity in North America;

•insufficient or oversupply of natural gas liquefaction or receiving capacity worldwide;

•insufficient LNG tanker capacity;

•weather conditions, including temperature volatility resulting from climate change, and extreme weather events may lead to unexpected distortion in the balance of international LNG supply and demand. For example, LNG procurement in Japan rose dramatically in 2011 and several years thereafter following a tsunami that caused extensive destruction to its nuclear power infrastructure;

•reduced demand and lower prices for natural gas;

•increased natural gas production deliverable by pipelines, which could suppress demand for LNG;

•decreased oil and natural gas exploration activities which may decrease the production of natural gas, including as a result of any potential ban on production of natural gas through hydraulic fracturing;

•cost improvements that allow competitors to provide natural gas liquefaction capabilities at reduced prices;

•changes in supplies of, and prices for, alternative energy sources such as coal, oil, nuclear, hydroelectric, wind and solar energy, which may reduce the demand for natural gas;

•changes in regulatory, tax or other governmental policies regarding imported or exported LNG, natural gas or alternative energy sources, which may reduce the demand for imported or exported LNG and/or natural gas;

•political conditions in natural gas producing regions;

•sudden decreases in demand for LNG as a result of natural disasters or public health crises, including the occurrence of a pandemic, and other catastrophic events;

•adverse relative demand for LNG compared to other markets, which may decrease LNG exports from North America; and

•cyclical trends in general business and economic conditions that cause changes in the demand for natural gas.

Adverse trends or developments affecting any of these factors could result in decreases in the price of LNG and/or natural gas, which could materially and adversely affect the performance of our customers, and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

Failure of exported LNG to be a competitive source of energy for international markets could adversely affect our customers and could materially and adversely affect our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Operations of the Liquefaction Project are dependent upon the ability of our SPA customers to deliver LNG supplies from the United States, which is primarily dependent upon LNG being a competitive source of energy internationally. The success of our business plan is dependent, in part, on the extent to which LNG can, for significant periods and in significant volumes, be supplied from North America and delivered to international markets at a lower cost than the cost of alternative energy sources. Through the use of improved exploration technologies, additional sources of natural gas may be discovered outside the United States, which could increase the available supply of natural gas outside the United States and could result in natural gas in those markets being available at a lower cost than LNG exported to those markets.

Political instability in foreign countries that import natural gas, or strained relations between such countries and the United States, may also impede the willingness or ability of LNG purchasers or suppliers and merchants in such countries to import LNG from the United States. Furthermore, some foreign suppliers of LNG may have economic or other reasons to obtain their LNG from non-U.S. markets or from our competitors’ liquefaction facilities in the United States.

In addition to natural gas, LNG also competes with other sources of energy, including coal, oil, nuclear, hydroelectric, wind and solar energy. LNG from the Liquefaction Project also competes with other sources of LNG, including LNG that is priced to indices other than Henry Hub. Some of these sources of energy may be available at a lower cost than LNG from the Liquefaction Project in certain markets. The cost of LNG supplies from the United States, including the Liquefaction Project, may also be impacted by an increase in natural gas prices in the United States.

As a result of these and other factors, LNG may not be a competitive source of energy internationally. The failure of LNG to be a competitive supply alternative to local natural gas, oil and other alternative energy sources in markets accessible to our customers could adversely affect the ability of our customers to deliver LNG from the United States or from the Liquefaction Project on a commercial basis. Any significant impediment to the ability to deliver LNG from the United States generally, or from the Liquefaction Project specifically, could have a material adverse effect on our customers and on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We face competition based upon the international market price for LNG.

Our Liquefaction Project is subject to the risk of LNG price competition at times when we need to replace any existing SPA, whether due to natural expiration, default or otherwise, or enter into new SPAs. Factors relating to competition may prevent us from entering into a new or replacement SPA on economically comparable terms as existing SPAs, or at all. Such an event could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects. Factors which may negatively affect potential demand for LNG from our Liquefaction Project are diverse and include, among others:

•increases in worldwide LNG production capacity and availability of LNG for market supply;

•increases in demand for LNG but at levels below those required to maintain current price equilibrium with respect to supply;

•increases in the cost to supply natural gas feedstock to our Liquefaction Project;

•decreases in the cost of competing sources of natural gas or alternate fuels such as coal, heavy fuel oil and diesel;

•decreases in the price of non-U.S. LNG, including decreases in price as a result of contracts indexed to lower oil prices;

•increases in capacity and utilization of nuclear power and related facilities; and

•displacement of LNG by pipeline natural gas or alternate fuels in locations where access to these energy sources is not currently available.

A cyber attack involving our business, operational control systems or related infrastructure, or that of third party pipelines which supply the Liquefaction Project, could negatively impact our operations, result in data security breaches, impede the processing of transactions or delay financial or compliance reporting. These impacts could materially and adversely affect our business, contracts, financial condition, operating results, cash flow and liquidity.

The LNG industry is increasingly dependent on business and operational control technologies to conduct daily operations. We rely on control systems, technologies and networks to run our business and to control and manage our liquefaction and shipping operations. Cyber attacks on businesses have escalated in recent years, including as a result of geopolitical tensions, and use of the internet, cloud services, mobile communication systems and other public networks exposes our business and that of other third-parties with whom we do business to potential cyber attacks, including third party pipelines which supply natural gas to our Liquefaction Project. For example, in 2021 Colonial Pipeline suffered a ransomware attack that led to the complete shutdown of its pipeline system for six days. Should multiple of the third party pipelines which supply our Liquefaction Project suffer similar concurrent attacks, the Liquefaction Project may not be able to obtain sufficient natural gas to operate at full capacity, or at all. A cyber attack involving our business or operational control, systems or related infrastructure, or that of third party pipelines with which we do business, could negatively impact our operations, result in data security breaches, impede the processing of transactions or delay financial or compliance reporting. These impacts could materially and adversely affect our business, contracts, financial condition, operating results, cash flow and liquidity.

Outbreaks of infectious diseases, such as the outbreak of COVID-19, at our facilities could adversely affect our operations.

Our facilities at the Liquefaction Project are critical infrastructure and have continued to operate during the COVID-19 pandemic through our implementation of workplace controls and pandemic risk reduction measures. While the COVID-19 pandemic, including the Delta and Omicron variants, has had no adverse impact on our on-going operations during this time, the risk of future variants is unknown. While we believe we can continue to mitigate any significant adverse impact to our employees and operations at our critical facilities related to the virus in its current form, the outbreak of a more potent variant in the future at one or more of our facilities could adversely affect our operations.

We are entirely dependent on Cheniere and CQP, including employees of Cheniere and its subsidiaries, for key personnel, and the unavailability of skilled workers or failure to attract and retain qualified personnel could adversely affect us. In addition, changes in our key personnel could affect our business results.

As of January 31, 2022, Cheniere and its subsidiaries had 1,550 full-time employees, including 513 employees who directly supported the Liquefaction Project. We have contracted with subsidiaries of Cheniere and CQP to provide the personnel necessary for the operation, maintenance and management of the Liquefaction Project. We depend on Cheniere’s subsidiaries hiring and retaining personnel sufficient to provide support for the Liquefaction Project. Cheniere competes with other liquefaction projects in the United States and globally, other energy companies and other employers to attract and retain qualified personnel with the technical skills and experience required to construct and operate our facilities and to provide our customers with the highest quality service. We also compete with any other project Cheniere is developing, including its liquefaction project at Corpus Christi, Texas, for the time and expertise of Cheniere’s personnel. Further, we and Cheniere face competition for these highly skilled employees in the immediate vicinity of the Liquefaction Project and more generally from the Gulf Coast hydrocarbon processing and construction industries.

Our executive officers are officers and employees of Cheniere and its affiliates. We do not maintain key person life insurance policies on any personnel, and we do not have any employment contracts or other agreements with key personnel binding them to provide services for any particular term. The loss of the services of any of these individuals could have a material adverse effect on our business. In addition, our future success will depend in part on our ability to engage, and Cheniere’s ability to attract and retain, additional qualified personnel.

A shortage in the labor pool of skilled workers, remoteness of our site locations, or other general inflationary pressures, changes in applicable laws and regulations or labor disputes could make it more difficult to attract and retain qualified personnel and could require an increase in the wage and benefits packages that are offered, thereby increasing our operating costs. Any increase in our operating costs could materially and adversely affect our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We have numerous contractual and commercial relationships, and conflicts of interest, with Cheniere and its affiliates, including Cheniere Marketing.

We have agreements to compensate and to reimburse expenses of affiliates of Cheniere. In addition, we have a TUA with SPLNG under which SPLNG derives economic benefits, we have entered into a transportation agreement with CTPL to transport natural gas to the Liquefaction Project and we have also executed agreements with Cheniere Marketing to sell: (1) at Cheniere Marketing’s option, any LNG produced by us in excess of that required for other customers at a price of 115% of Henry Hub plus $3.00 per MMBtu of LNG and (2) up to 306 cargoes to be delivered between 2022 and 2027 at a weighted average price of $1.95 plus 115% of Henry Hub. All of these agreements involve conflicts of interest between us, on the one hand, and Cheniere and its other affiliates, on the other hand. In addition, Cheniere is currently operating three Trains at a natural gas liquefaction facility near Corpus Christi, Texas and CCL has entered into fixed price SPAs with third-parties for the sale of LNG from this natural gas liquefaction facility, and may continue to enter into with respect to any future expansion of the Liquefaction Project.

We expect that there will be additional agreements or arrangements with Cheniere and its affiliates, including future SPAs, transportation, interconnection, marketing and gas balancing arrangements with one or more Cheniere-affiliated entities as well as other agreements and arrangements that cannot now be anticipated. In those circumstances where additional contracts with Cheniere and its affiliates may be necessary or desirable, additional conflicts of interest will be involved.

We are dependent on Cheniere and its affiliates to provide services to us. If Cheniere or its affiliates are unable or unwilling to perform according to the negotiated terms and timetable of their respective agreement for any reason or terminate their agreement, we would be required to engage a substitute service provider. This could result in a significant interference with operations and increased costs.

Risks Relating to Regulations

Failure to obtain and maintain approvals and permits from governmental and regulatory agencies with respect to the design, construction and operation of the Liquefaction Project and the export of LNG could impede operations and construction and could have a material adverse effect on us.

The design, construction and operation of the Liquefaction Project and the export of LNG are highly regulated activities. Approvals of the FERC and DOE under Section 3 of the NGA, as well as several other material governmental and regulatory approvals and permits, including several under the CAA and the CWA, are required in order to construct and operate an LNG facility and export LNG. To date, the FERC has issued orders under Section 3 of the NGA authorizing the siting, construction and operation of the six Trains and related facilities of the Liquefaction Project. To date, the DOE has also issued orders under Section 4 of the NGA authorizing us to export domestically produced LNG.

Authorizations obtained from the FERC, DOE and other federal and state regulatory agencies contain ongoing conditions that we must comply with. Failure to comply with such conditions, or our inability to obtain and maintain existing or newly imposed approvals and permits, filings, which may arise due to factors outside of our control such as a U.S. government disruption or shutdown, political opposition or local community resistance to the siting of LNG facilities due to safety, environmental or security concerns, could impede the operation and construction of our infrastructure. There is no assurance that we will obtain and maintain these governmental permits, approvals and authorizations, or that we will be able to obtain them on a timely basis. Any impediment could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Existing and future environmental and similar laws and governmental regulations could result in increased compliance costs or additional operating costs or construction costs and restrictions.

Our business is and will be subject to extensive federal, state and local laws, rules and regulations applicable to our construction and operation activities relating to, among other things, air quality, water quality, waste management, natural resources, and health and safety. Many of these laws and regulations, such as the CAA, the Oil Pollution Act, the CWA and the RCRA, and analogous state laws and regulations, restrict or prohibit the types, quantities and concentration of substances that can be released into the environment in connection with the construction and operation of our facilities, and require us to maintain permits and provide governmental authorities with access to our facilities for inspection and reports related to our compliance. In addition, certain laws and regulations authorize regulators having jurisdiction over the construction and operation of our terminal, including the PHMSA, to issue compliance orders, which may restrict or limit operations or increase compliance or operating costs. Violation of these laws and regulations could lead to substantial liabilities, compliance orders, fines and penalties or to capital expenditures that could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects. Federal and state laws impose liability, without regard to fault or the lawfulness of the original conduct, for the release of certain types or quantities of hazardous substances into the environment. As the owner and operator of our facilities, we could be liable for the costs of cleaning up hazardous substances released into the environment at or from our facilities and for resulting damage to natural resources.

In 2009, the EPA promulgated and finalized the Mandatory Greenhouse Gas Reporting Rule requiring annual reporting of GHG emissions from stationary sources in a variety of industries. In 2010, the EPA expanded the rule to include reporting obligations for LNG terminals. In addition, the EPA has defined GHG emissions thresholds that would subject GHG emissions from new and modified industrial sources to regulation if the source is subject to PSD Permit requirements due to its emissions of non-GHG criteria pollutants. While the EPA subsequently took a number of additional actions primarily relating to GHG emissions from the electric power generation and the oil and gas exploration and production industries, those rules were largely stayed or repealed during the Trump Administration including by amendments adopted by the EPA on February 23, 2018 and additional amendments to new source performance standards for the oil and gas industry on September 14 and 15, 2020. On November 15, 2021, the EPA proposed new regulations to reduce methane emissions from both new and existing sources within the Crude Oil and Natural Gas source category. The proposed regulations, if finalized, would result in more stringent requirements for new sources, expand the types of new sources covered, and for the first time, establish emissions guidelines for existing sources in the Crude Oil and Natural Gas source category. In addition, other federal and state initiatives may be considered in the future to address GHG emissions through, for example, United States treaty commitments, direct regulation, market-based regulations such as a carbon emissions tax or cap-and-trade programs or clean energy standards. Such initiatives could affect the demand for or cost of natural gas, which we consume at our terminals, or could increase compliance costs for our operations. We are supportive of regulations reducing GHG emissions over time.

Other future legislation and regulations, such as those relating to the transportation and security of LNG exported from the Sabine Pass LNG terminal or climate policies of destination countries in relation to their obligations under the Paris Agreement or other national climate change-related policies, could cause additional expenditures, restrictions and delays in our business and to our proposed construction activities, the extent of which cannot be predicted and which may require us to limit substantially, delay or cease operations in some circumstances. Revised, reinterpreted or additional laws and regulations that result in increased compliance costs or additional operating or construction costs and restrictions could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 3. LEGAL PROCEEDINGS

We may in the future be involved as a party to various legal proceedings, which are incidental to the ordinary course of business. We regularly analyze current information and, as necessary, provide accruals for probable liabilities on the eventual disposition of these matters.

LDEQ Matter

Certain of Cheniere’s subsidiaries are in discussions with the LDEQ to resolve self-reported deviations arising from operation of the Sabine Pass LNG terminal and the commissioning of the Liquefaction Project, and relating to certain requirements under its Title V Permit. The matter involves deviations self-reported to LDEQ pursuant to the Title V Permit and covering the time period from January 1, 2012 through March 25, 2016. On April 11, 2016, certain of Cheniere’s subsidiaries received a Consolidated Compliance Order and Notice of Potential Penalty (the “Compliance Order”) from LDEQ covering deviations self-reported during that time period. Certain of Cheniere’s subsidiaries continue to work with LDEQ to resolve the matters identified in the Compliance Order. We do not expect that any ultimate sanction will have a material adverse impact on our financial results.

PHMSA Matter

In February 2018, the PHMSA issued a Corrective Action Order (the “CAO”) to us in connection with a minor LNG leak from one tank and minor vapor release from a second tank at the Sabine Pass LNG terminal. These two tanks have been taken out of operational service while we conduct analysis, repair and remediation. On April 20, 2018, we and PHMSA executed a Consent Agreement and Order (the “Consent Order”) that replaces and supersedes the CAO. On July 9, 2019, PHMSA and FERC issued a joint letter setting out operating conditions required to be met prior to us returning the tanks to service. In July 2021, PHMSA issued a Notice of Probable Violation (“NOPV”) and Proposed Civil Penalty to us alleging violations of federal pipeline safety regulations relating to the 2018 tank incident and proposing civil penalties totaling $2,214,900. On September 16, 2021, PHMSA issued an Amended NOPV that reduced the proposed penalty to $1,458,200. On October 12, 2021, we responded to the Amended NOPV, electing not to contest the alleged violations in the Amended NOPV and electing to pay the proposed reduced penalty. PHMSA notified us in a letter dated November 9, 2021 that the case was considered “closed.” We continue to coordinate with PHMSA and FERC to address the matters relating to the February 2018 leak, including repair approach and related analysis. We do not expect that the Consent Order and related analysis, repair and remediation or resolution of the NOPV will have a material adverse impact on our financial results or operations.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED MEMBER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Not applicable.

ITEM 6. [Reserved]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The following discussion and analysis presents management’s view of our business, financial condition and overall performance and should be read in conjunction with our Financial Statements and the accompanying notes. This information is intended to provide investors with an understanding of our past performance, current financial condition and outlook for the future. Discussion of 2019 items and variance drivers between the year ended December 31, 2020 as compared to December 31, 2019 are not included herein, and can be found in “Management's Discussion and Analysis of Financial Condition and Results of Operations” in our annual report on Form 10-K for the fiscal year ended December 31, 2020.

Our discussion and analysis includes the following subjects:

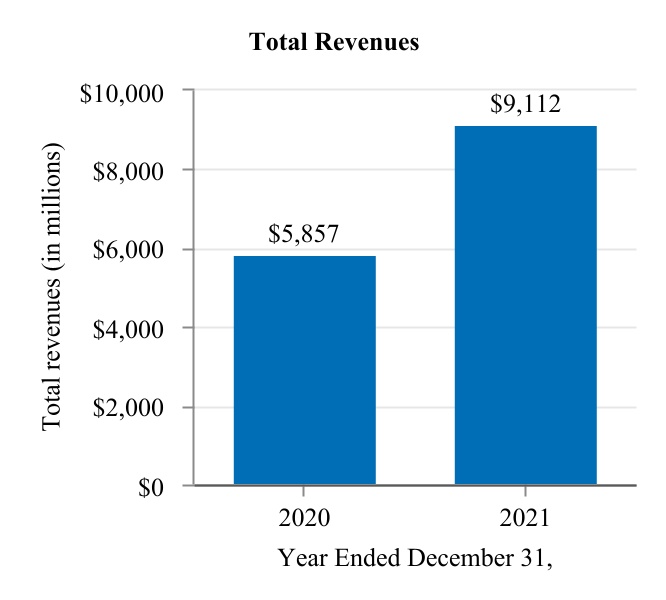

Overview

We are a limited liability company formed by CQP to provide clean, secure and affordable LNG to integrated energy companies, utilities and energy trading companies around the world. We operate a natural gas liquefaction and export facility at Sabine Pass, Louisiana (the “Sabine Pass LNG terminal”) with six operational natural gas liquefaction Trains (the “Liquefaction Project”). For further discussion of our business, see Items 1. and 2. Business and Properties.