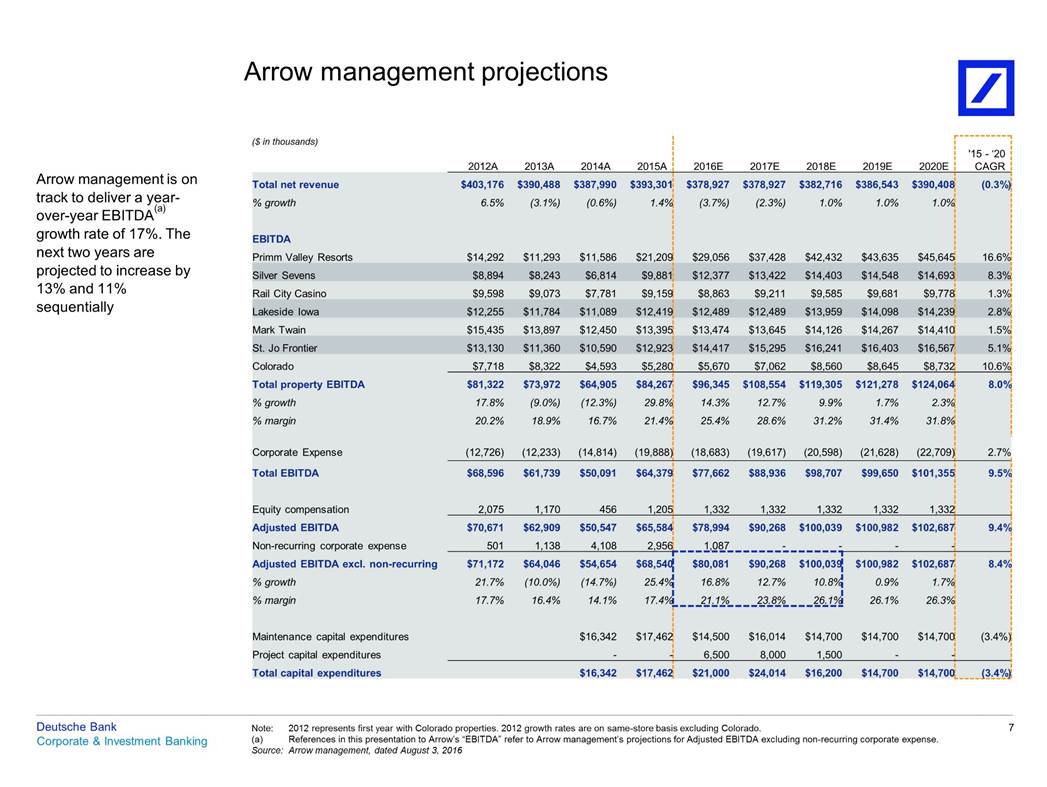

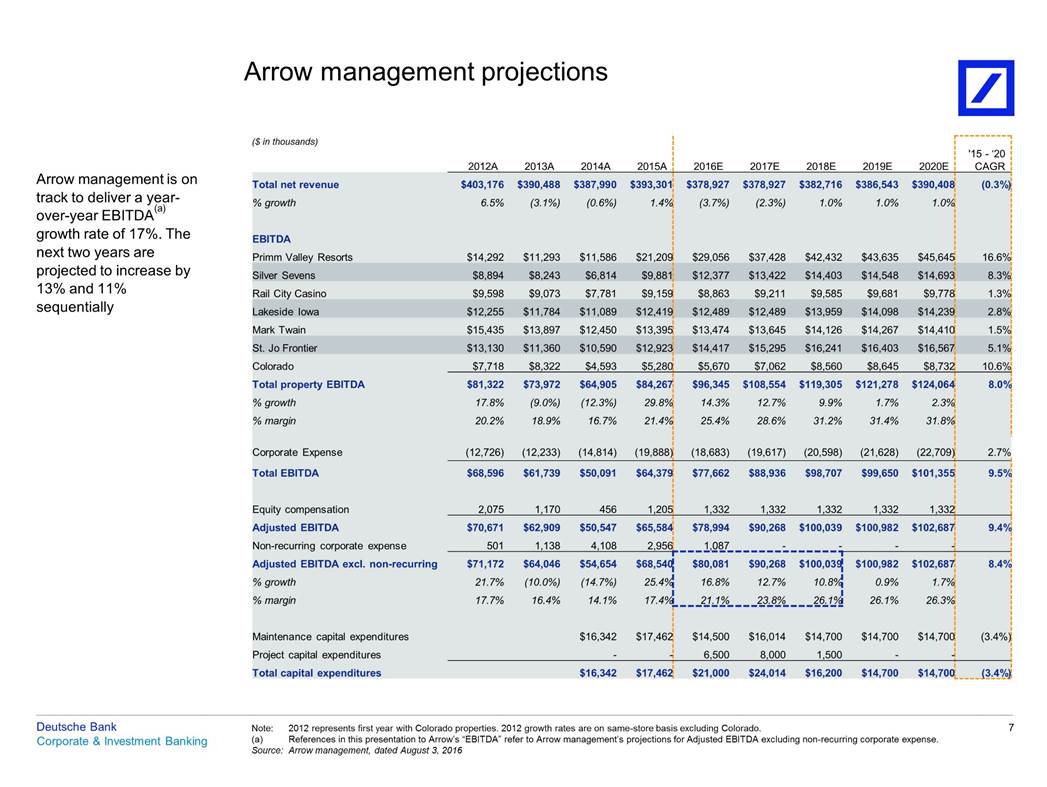

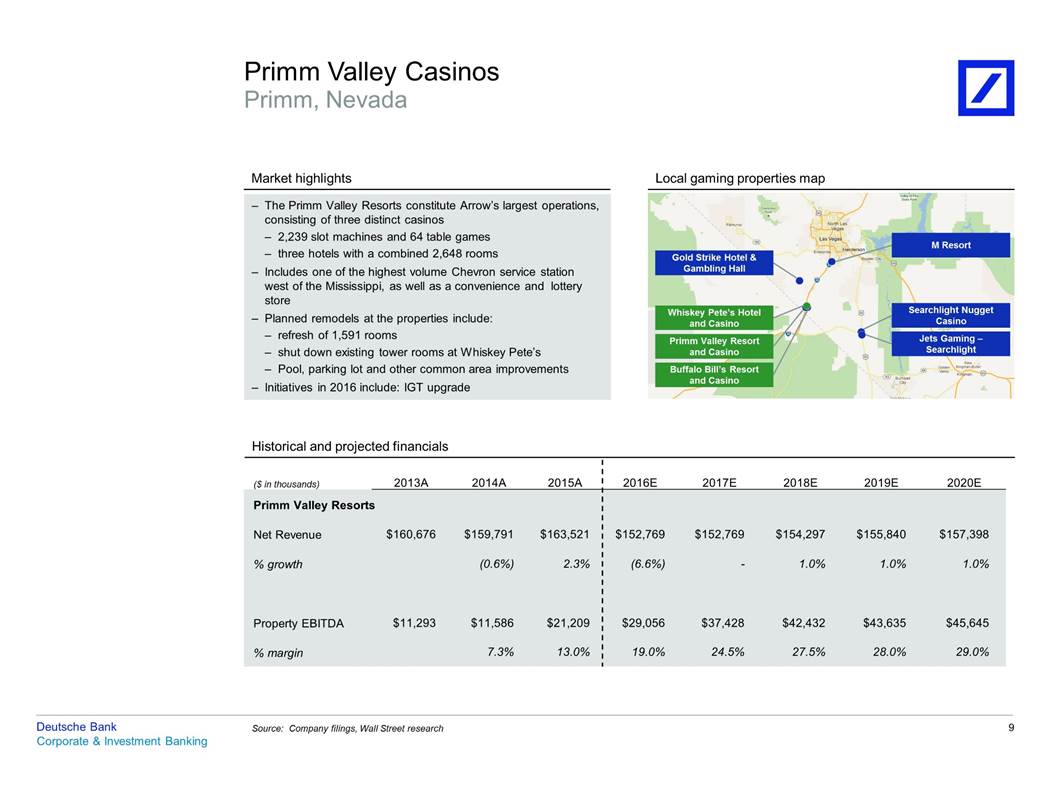

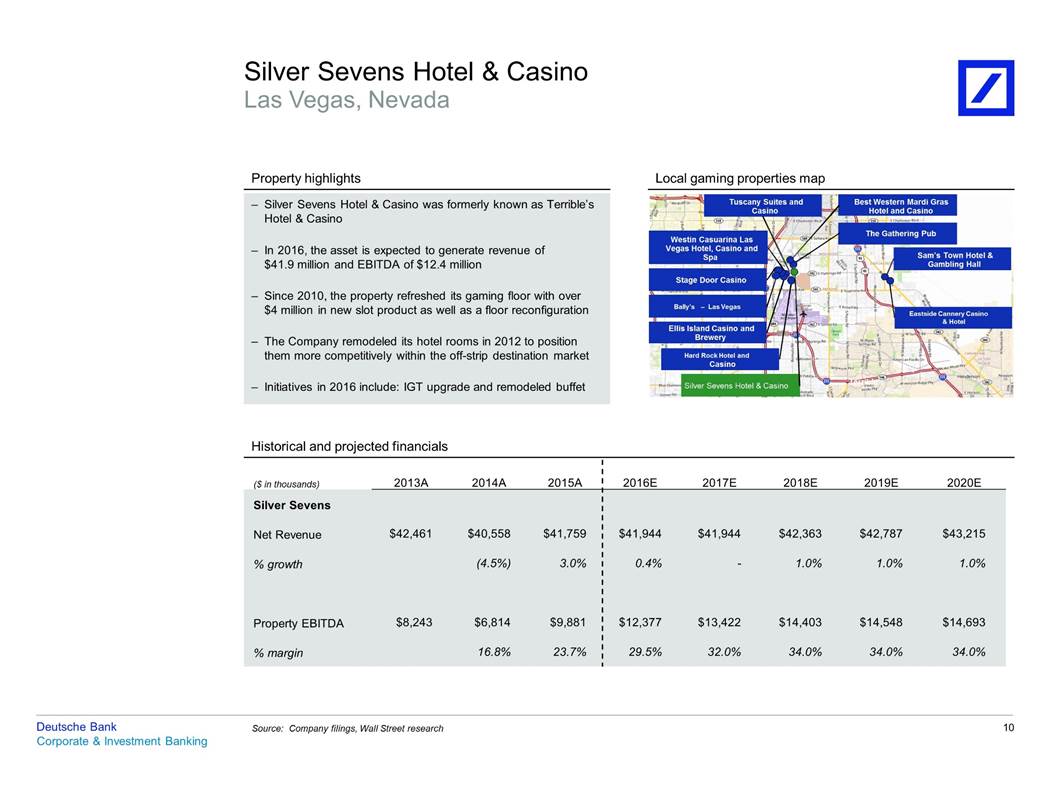

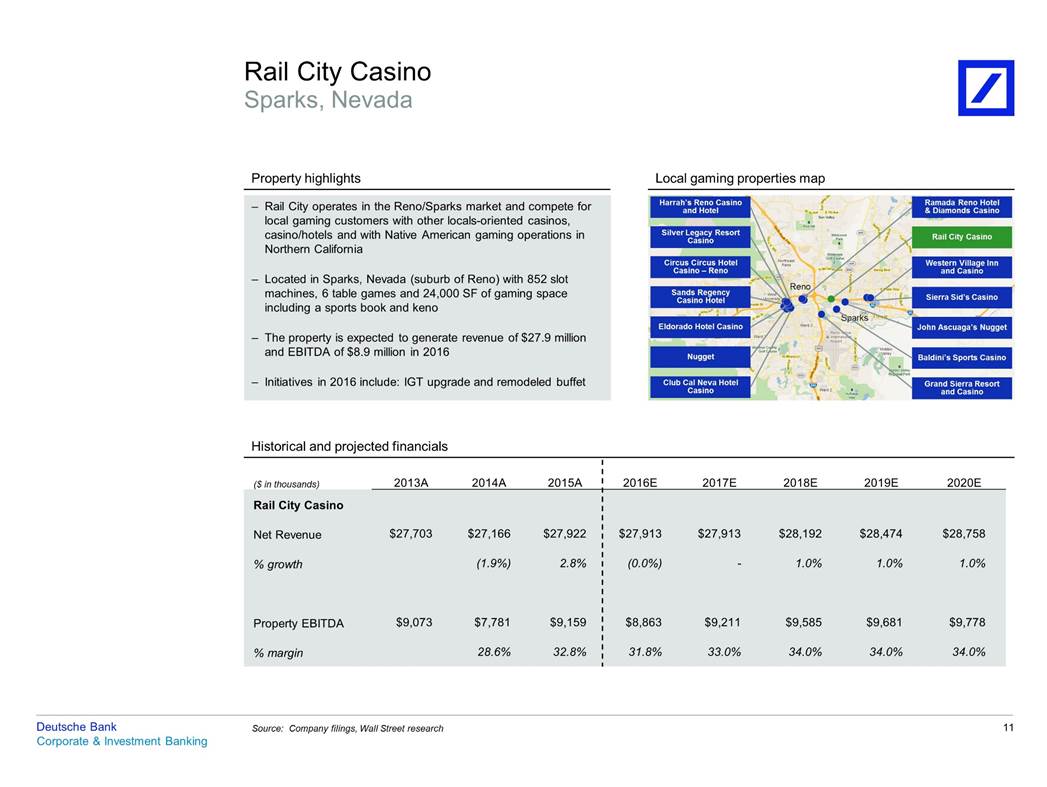

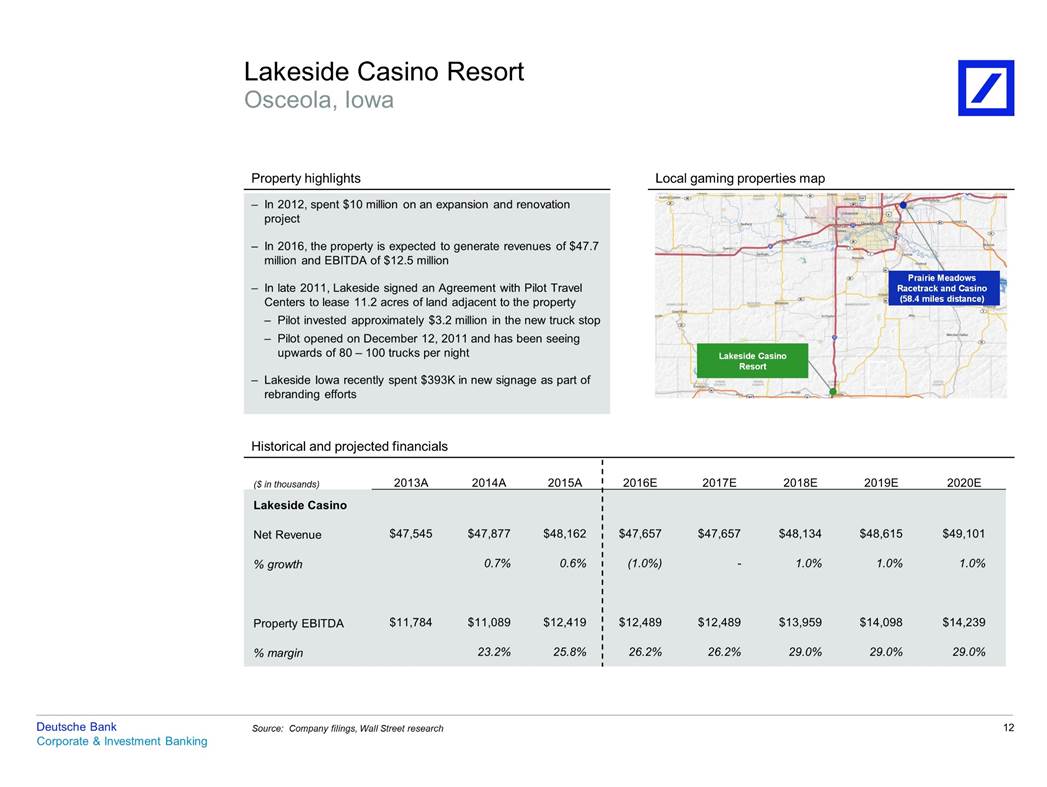

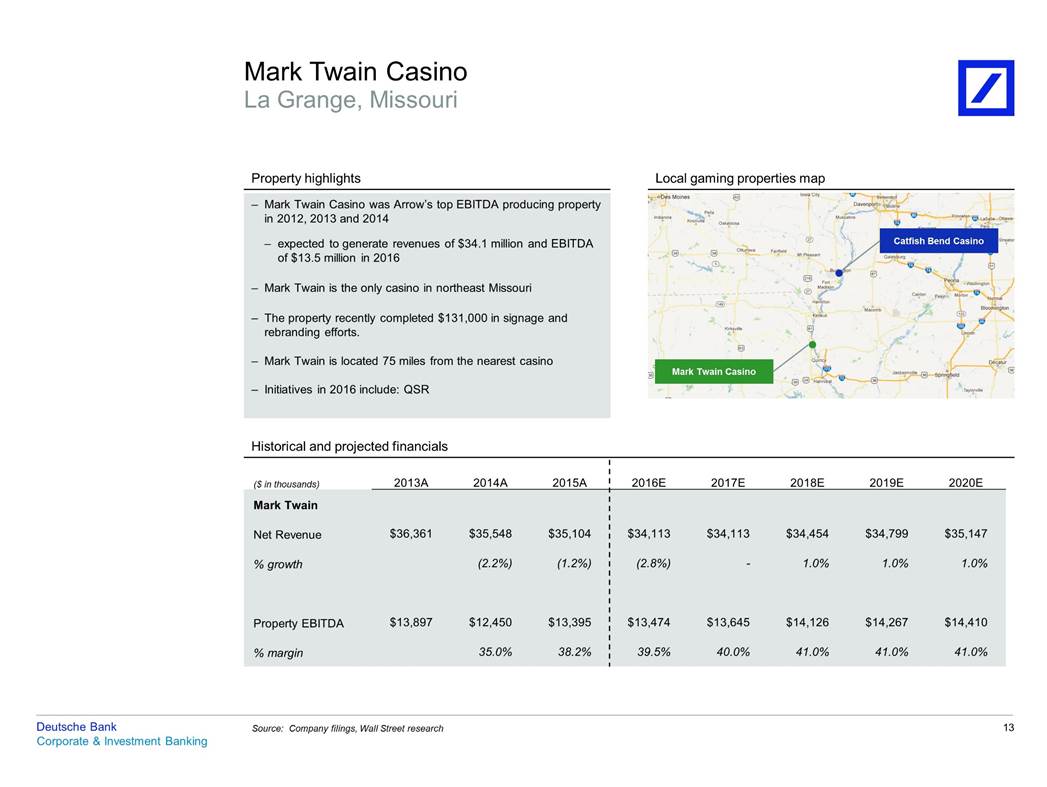

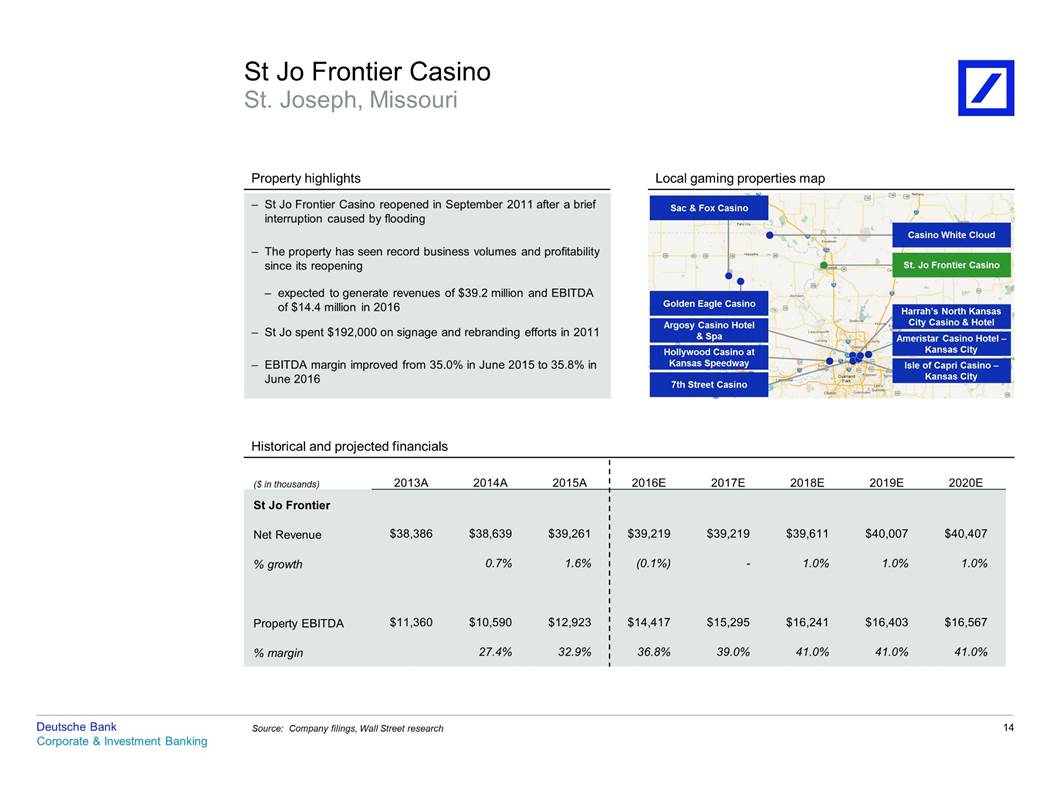

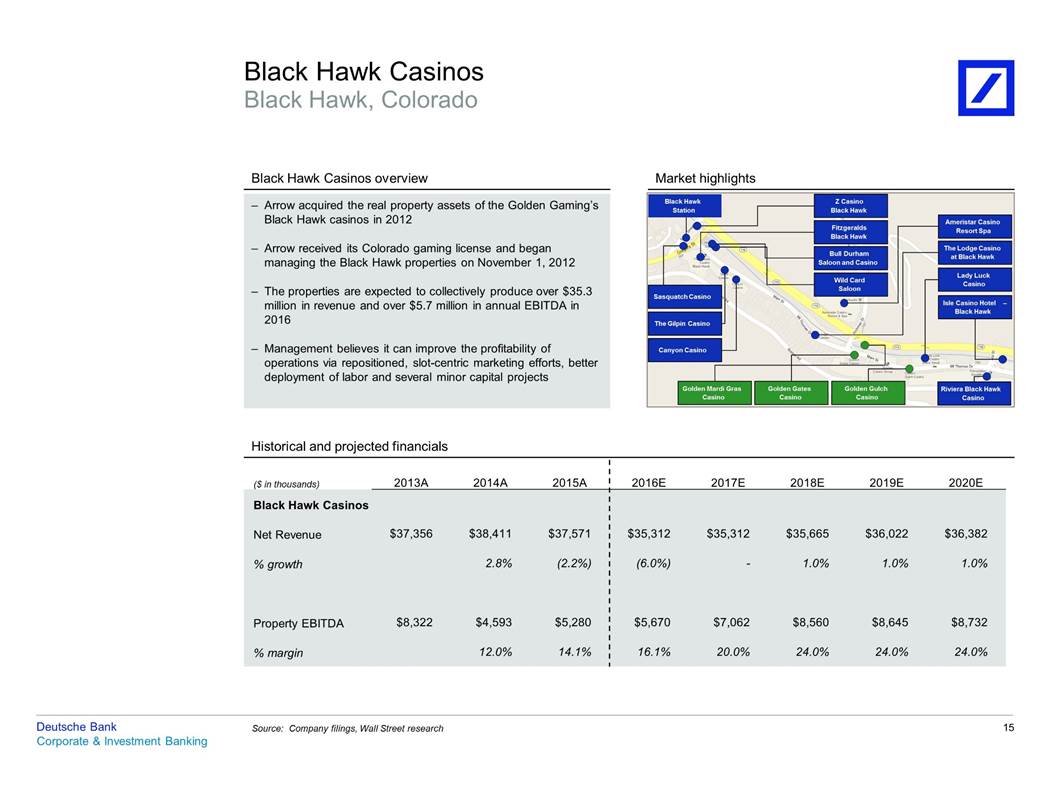

Arrow management projections ($ in thousands) Arrow management is on track to deliver a year-Total net revenue % growth (a) over-year EBITDA growth rate of 17%. The next two years are projected to increase by 13% and 11% sequentially EBITDA Primm Valley Resorts Deutsche Bank Corporate & Investment Banking 7 Note:2012 represents first year with Colorado properties. 2012 growth rates are on same-store basis excluding Colorado. (a) References in this presentation to Arrow’s “EBITDA” refer to Arrow management’s projections for Adjusted EBITDA excluding non-recurring corporate expense. Source: Arrow management, dated August 3, 2016 2012A2013A2014A2015A2016E2017E2018E2019E2020E '15 - ‘20 CAGR $403,176 $390,488 $387,990 $393,301 6.5%(3.1%)(0.6%)1.4% $14,292$11,293$11,586$21,209 $378,927 $378,927 $382,716 $386,543 $390,408 (3.7%)(2.3%)1.0%1.0%1.0% $29,056$37,428$42,432$43,635$45,645 (0.3%) 16.6% Silver Sevens$8,894$8,243$6,814$9,881 $12,377$13,422$14,403$14,548$14,693 8.3% Rail City Casino$9,598$9,073$7,781$9,159 $8,863$9,211$9,585$9,681$9,778 1.3% Lakeside Iowa$12,255$11,784$11,089$12,419 $12,489$12,489$13,959$14,098$14,239 2.8% Mark Twain$15,435$13,897$12,450$13,395 $13,474$13,645$14,126$14,267$14,410 1.5% St. Jo Frontier$13,130$11,360$10,590$12,923 $14,417$15,295$16,241$16,403$16,567 5.1% Colorado Total property EBITDA % growth % margin Corporate Expense Total EBITDA Equity compensation Adjusted EBITDA Non-recurring corporate expense Adjusted EBITDA excl. non-recurring % growth % margin Maintenance capital expenditures $7,718$8,322$4,593$5,280 $5,670$7,062$8,560$8,645$8,732 10.6% $81,322$73,972$64,905$84,267 17.8%(9.0%)(12.3%)29.8% 20.2%18.9%16.7%21.4% (12,726)(12,233)(14,814)(19,888) $96,345 $108,554 $119,305 $121,278 $124,064 14.3%12.7%9.9%1.7%2.3% 25.4%28.6%31.2%31.4%31.8% (18,683)(19,617)(20,598)(21,628)(22,709) 8.0% 2.7% $68,596$61,739$50,091$64,379 2,0751,1704561,205 $77,662$88,936$98,707$99,650 $101,355 1,3321,3321,3321,3321,332 9.5% $70,671$62,909$50,547$65,584 5011,1384,1082,956 $78,994$90,268 $100,039 $100,982 $102,687 1,087----9.4% $71,172$64,046$54,654$68,540 21.7%(10.0%)(14.7%)25.4% 17.7%16.4%14.1%17.4% $16,342$17,462 $80,081$90,268 $100,039 16.8%12.7%10.8% 21.1%23.8%26.1% $100,982 $102,687 0.9%1.7% 26.1%26.3% 8.4% (3.4%) $14,500$16,014$14,700$14,700$14,700 Project capital expenditures Total capital expenditures --6,5008,0001,500--$16,342$17,462 $21,000$24,014$16,200$14,700$14,700 (3.4%)