Filed Pursuant to Rule 424(h)

Registration No. 333-206413

The information in this prospectus is not complete and may be changed. The securities offered hereby may not be sold, nor may offers to buy be accepted, prior to the time a final prospectus is completed. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 17, 2018

Ally Master Owner Trust

Issuing Entity (CIK 0001499357)

$500,000,000(1) Class A Asset Backed Notes, Series 2018-2

Ally Wholesale Enterprises LLC Depositor (CIK 0001492632)

Ally Bank Sponsor (CIK 0001601846)

Ally Financial Inc. Servicer (CIK 0000040729)

| | | | | | |

You should consider carefully the risk factors beginning on page 13 in this prospectus. The offered notes represent obligations of the issuing entity only and do not represent obligations of or interests in, and are not guaranteed by, Ally Bank, Ally Wholesale Enterprises LLC, Ally Financial Inc. or any of their affiliates. Neither the notes nor the receivables are insured or guaranteed by any governmental entity. | | | | | | Offered Notes |

| | | | | | Series 2018-2 Class A Notes |

| | | | Principal Balance | | $500,000,000(1) |

| | | | Interest Rate | | % |

| | | | Initial Scheduled Distribution Date | | June 15, 2018 |

| | | | Expected Maturity Date | | May 2021 distribution date |

| | | | Legal Maturity Date | | May 2023 distribution date |

| | | | Distribution Frequency | | Monthly |

| | | | Price to Public | | % |

| | | | Underwriting Discount | | % |

| | | | Proceeds to Depositor | | % |

| (1) | The aggregate principal amount of Series 2018-2 Class A notes being offered under this prospectus and of each other class of Series 2018-2 notes being issued by the trust in connection therewith may be increased or decreased, pro rata, at or before the time of pricing. In such event, any dollar amounts specified in this prospectus with respect to the Series 2018-2 that are calculated based on the principal amount of the Series 2018-2 notes will similarly be increased or decreased, pro rata. |

As described in “Credit Risk Retention,” the depositor or another wholly-owned affiliate of the sponsor will retain the Series 2018-2 Class E notes and the Certificate Interest related to the Series 2018-2.

The assets of the issuing entity consist primarily of a revolving pool of wholesale automotive receivables generated under a portfolio of dealer floorplan financing agreements.

Credit Enhancement and Liquidity

| | • | | Reserve fund, with an initial deposit of approximately $3,333,333 (or 0.50% of the initial principal balance of the Series 2018-2 notes). |

| | • | | Series 2018-2 Class E asset backed notes with an initial principal balance of $83,332,667 will be issued by the trust. The Series 2018-2 Class E notes are not being offered under this prospectus. |

| | • | | Series 2018-2 Class D asset backed notes with an initial principal balance of $20,000,000 will be issued by the trust. The Series 2018-2 Class D notes are not being offered under this prospectus. |

| | • | | Series 2018-2 Class C asset backed notes with an initial principal balance of $26,667,000 will be issued by the trust. The Series 2018-2 Class C notes are not being offered under this prospectus. |

| | • | | Series 2018-2 Class B asset backed notes with an initial principal balance of $36,667,000 will be issued by the trust. The Series 2018-2 Class B notes are not being offered under this prospectus. |

| | • | | The Series 2018-2 Class E notes are subordinated to all the other classes of Series 2018-2 notes. |

| | • | | The Series 2018-2 Class D notes are subordinated to the Series 2018-2 Class A notes, the Series 2018-2 Class B notes and the Series 2018-2 Class C notes. |

| | • | | The Series 2018-2 Class C notes are subordinated to the Series 2018-2 Class A notes and the Series 2018-2 Class B notes. |

| | • | | The Series 2018-2 Class B notes are subordinated to the Series 2018-2 Class A notes. |

| | • | | Excess interest on the receivables. |

| | • | | Overcollateralization with respect to the offered notes. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Underwriters for the Series 2018-2 Class A Notes:

| | | | |

| Citigroup | | Deutsche Bank Securities | | RBC Capital Markets |

The date of this prospectus is May , 2018

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS PROSPECTUS

You should rely only on the information provided in this prospectus and any pricing supplement hereto, including the information incorporated by reference in this prospectus. We have not authorized anyone to provide you with other or different information. We are not offering the notes in any state where the offer is not permitted.

This prospectus provides information regarding the pool of receivables held by the issuing entity and the terms of your notes.

You can find definitions of the capitalized terms used in this prospectus in the “Glossary of Terms,” which appears at the end of this prospectus.

The term “Ally Bank,” when used in connection with Ally Bank’s capacity as acquirer of the receivables or seller of the receivables to the depositor, includes any successors or assigns of Ally Bank in such capacity permitted pursuant to the transaction documents.

The term “Ally Financial,” when used in connection with Ally Financial Inc.’s capacity as servicer of the receivables, includes any successors or assigns of Ally Financial Inc. in such capacity permitted pursuant to the transaction documents.

Ally Wholesale Enterprises LLC has met the registration requirements of General Instruction I.A.1 of Form SF-3 by filing no later than the date of the filing of the final prospectus, and determining that each of its affiliated depositors and issuing entities have timely filed, or have cured by filing at least 90 days prior to the date hereof:

| | • | | the CEO certification described in “The Depositor—CEO Certification”; and |

| | • | | the transaction documents containing the provisions described in “Asset Representations Review,” “The Pool of Accounts—Dispute Resolution” and “The Transfer and Servicing Agreements—Investor Communications.” |

v

FORWARD LOOKING STATEMENTS

Your prospectus, including information included or incorporated by reference in this prospectus, may contain certain forward-looking statements.

Forward-looking statements include statements using the words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,” “intend,” “evaluate,” “pursue,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of these words, or similar expressions which are intended to identify these forward-looking statements. All statements herein, other than statements of historical fact, including statements about future events and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results.

The forward-looking statements made in this prospectus speak only as of the date stated on the cover of this prospectus. The issuing entity and the depositor undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

NOTICES TO RESIDENTS OF THE UNITED KINGDOM

THIS PROSPECTUS MAY ONLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED IN THE UNITED KINGDOM TO PERSONS AUTHORIZED TO CARRY ON A REGULATED ACTIVITY UNDER THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (“FSMA”) OR TO PERSONS OTHERWISE HAVING PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFYING AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19 (INVESTMENT PROFESSIONALS) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED (THE “ORDER”), OR TO PERSONS FALLING WITHIN ARTICLE 49(2)(A)-(D) (HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.) OF THE ORDER OR TO ANY OTHER PERSON TO WHOM THIS PROSPECTUS MAY OTHERWISE LAWFULLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED.

NEITHER THIS PROSPECTUS NOR THE NOTES ARE OR WILL BE AVAILABLE TO OTHER CATEGORIES OF PERSONS IN THE UNITED KINGDOM AND NO ONE IN THE UNITED KINGDOM FALLING OUTSIDE SUCH CATEGORIES IS ENTITLED TO RELY ON, AND THEY MUST NOT ACT ON, ANY INFORMATION IN THIS PROSPECTUS. THE COMMUNICATION OF THIS PROSPECTUS TO ANY PERSON IN THE UNITED KINGDOM OTHER THAN PERSONS IN THE CATEGORIES STATED ABOVE IS UNAUTHORIZED AND MAY CONTRAVENE THE FSMA.

NOTICES TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSES OF THE PROSPECTUS DIRECTIVE (DEFINED BELOW). THIS PROSPECTUS HAS BEEN PREPARED ON THE BASIS THAT ANY OFFER OF THE NOTES IN ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA WHICH HAS IMPLEMENTED THE PROSPECTUS DIRECTIVE (EACH, A “RELEVANT MEMBER STATE”) WILL BE MADE ONLY TO A PERSON OR LEGAL ENTITY QUALIFYING AS A QUALIFIED INVESTOR (AS DEFINED IN THE PROSPECTUS DIRECTIVE (AS DEFINED BELOW)). ACCORDINGLY ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN THAT RELEVANT MEMBER STATE OF NOTES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED IN THIS PROSPECTUS MAY ONLY DO SO TO ONE OR MORE QUALIFIED INVESTORS. NONE OF THE ISSUING ENTITY, THE DEPOSITOR NOR THE UNDERWRITERS HAS AUTHORIZED, NOR DO THEY AUTHORIZE, THE MAKING OF ANY OFFER OF NOTES TO ANY PERSON OR LEGAL ENTITY OTHER THAN A QUALIFIED INVESTOR. THE EXPRESSION “PROSPECTUS DIRECTIVE” MEANS DIRECTIVE

vi

2003/71/EC (AS AMENDED, INCLUDING BY DIRECTIVE 2010/73/EU), AND INCLUDES ANY RELEVANT IMPLEMENTING MEASURE IN THE RELEVANT MEMBER STATE.

THE NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY RETAIL INVESTOR IN THE EUROPEAN ECONOMIC AREA. FOR THESE PURPOSES, A RETAIL INVESTOR MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (AS AMENDED, “MIFID II”); OR (II) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE 2002/92/EC (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN THE PROSPECTUS DIRECTIVE. CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (THE “PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO RETAIL INVESTORS IN THE EUROPEAN ECONOMIC AREA HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY RETAIL INVESTOR IN THE EUROPEAN ECONOMIC AREA MAY BE UNLAWFUL UNDER THE PRIIPS REGULATION.

vii

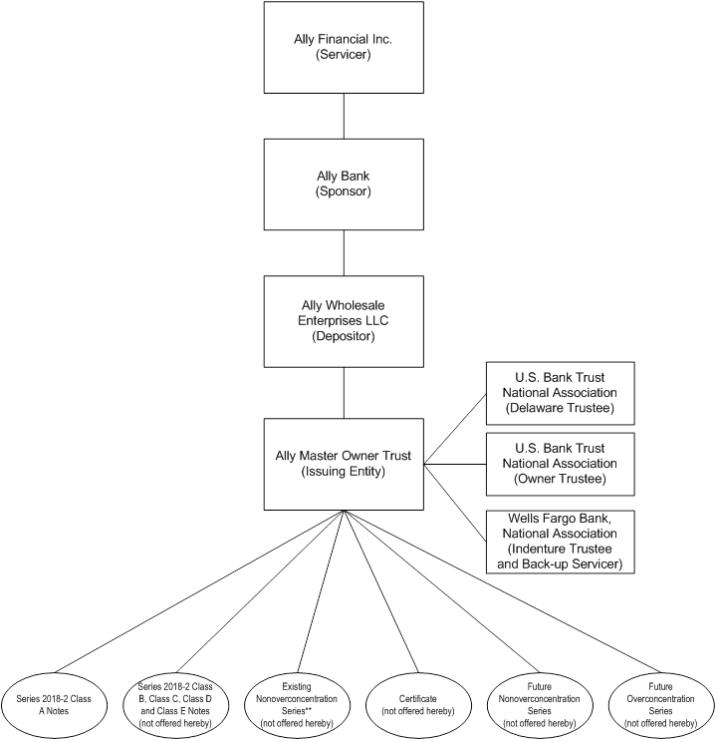

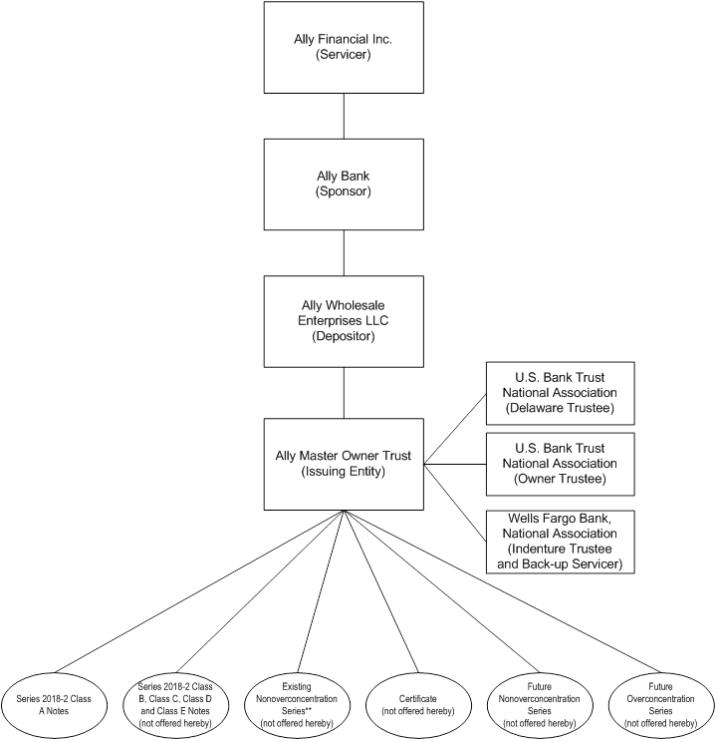

SUMMARY OF TRANSACTION PARTIES

| * | This chart provides only a simplified overview of the relations among the key parties to the transaction. Refer to this prospectus for a further description. |

| ** | For information regarding the existing series of notes issued by the issuing entity, see Annex A to this prospectus. |

viii

SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that you need to consider in making your investment decision. To understand the material terms of this offering of the offered notes, carefully read this entire prospectus.

Transaction Overview

The issuing entity is a master owner trust that owns a revolving pool of receivables that arise in connection with the purchase and financing by motor vehicle dealers of their new and used car, light and medium duty truck and van inventory. The issuing entity will issue the Series 2018-2 notes, which are backed by this revolving pool of receivables, to the depositor on the closing date. The depositor will sell the offered notes to the underwriters who will then sell them to you.

The Parties

Sponsor

Ally Bank, a Utah state chartered bank.

Issuing Entity

Ally Master Owner Trust, a Delaware statutory trust formed by the depositor, will be the issuing entity of the offered notes. In this prospectus, we also refer to the issuing entity as the “trust.”

Depositor

Ally Wholesale Enterprises LLC, a wholly-owned subsidiary of Ally Bank, is the depositor to the trust.

Servicer

Ally Financial Inc. (formerly GMAC Inc.), or “Ally Financial,” is the servicer for the trust.

Indenture Trustee and Back-up Servicer

Wells Fargo Bank, National Association.

Owner Trustee and Delaware Trustee

U.S. Bank Trust National Association.

Asset Representations Reviewer

Clayton Fixed Income Services LLC.

Closing Date

The “closing date” will be on or about May 30, 2018.

Securities

On the closing date, the trust will issue the following securities:

| | • | | $500,000,000 aggregate principal balance of Class A fixed rate asset backed notes, Series 2018-2, which we refer to as the “Series 2018-2 Class A notes” or the “offered notes.” |

| | • | | $36,667,000 Class B fixed rate asset backed notes, Series 2018-2, which we refer to as the “Series 2018-2 Class B notes.” |

| | • | | $26,667,000 Class C fixed rate asset backed notes, Series 2018-2, which we refer to as the “Series 2018-2 Class C notes.” |

1

| | • | | $20,000,000 Class D fixed rate asset backed notes, Series 2018-2, which we refer to as the “Series 2018-2 Class D notes.” We refer to the Series 2018-2 Class A notes, the Series 2018-2 Class B notes, the Series 2018-2 Class C notes and the Series 2018-2 Class D notes, collectively, as the “Series 2018-2 investor notes.” |

| | • | | $83,332,667 Class E asset backed equity notes, Series 2018-2, which we refer to as the “Series 2018-2 Class E notes.” We refer to the Series 2018-2 investor notes and the Series 2018-2 Class E notes, collectively, as the “Series 2018-2 notes” or as “your notes” and we refer to the Series 2018-2 notes and all other series of notes issued by the trust as the “notes.” |

The aggregate principal amount of Series 2018-2 Class A notes being offered under this prospectus and of each other class of Series 2018-2 notes being issued by the trust in connection therewith may be increased or decreased, pro rata, at or before the time of pricing. In such event, any dollar amounts specified in this prospectus with respect to the Series 2018-2 that are calculated based on the principal amount of the Series 2018-2 notes will similarly be increased or decreased, pro rata.

Only the offered notes are offered hereby. The Series 2018-2 Class B notes, the Series 2018-2 Class C notes, the Series 2018-2 Class D notes and the Series 2018-2 Class E notes are not being offered under this prospectus. The Series 2018-2 Class B notes, the Series 2018-2 Class C notes, and the Series 2018-2 Class D notes and the Series 2018-2 Class E notes initially will be retained by the depositor or sold in one or more private placements. The depositor will retain the right to sell all or a portion of any retained notes at any time upon satisfaction of the conditions set forth in the Series 2018-2 Indenture Supplement. The depositor or a wholly-owned affiliate of the sponsor will retain the Series 2018-2 Class E notes and the Certificate Interest related to the Series 2018-2 as described in “Credit Risk Retention.”

On the Initial Closing Date, the trust issued a certificate which represents the Certificate Interest in the trust and which we refer to as the “certificates.” The “Certificate Interest” is the interest in the trust assets not allocated to any series of notes. The amount of the Certificate Interest, called the “Certificate Amount,” will fluctuate based on the principal amount of receivables held by the trust and on the amount of notes outstanding. The depositor will retain the right to sell all or a portion of the certificates or the Certificate Interest. The certificates are currently held by the depositor and are not being offered under this prospectus. The certificates will not provide subordination for the Series 2018-2 notes. We refer to the notes and the certificates, collectively, as the “securities.”

The trust has issued other series of notes that are also secured by the assets of the trust. Annex A summarizes certain characteristics of each outstanding series of notes that has been issued by the trust.

Under certain conditions as described in the prospectus under “The Notes—New Issuances,” the trust may, from time to time, at the direction of the sponsor, issue additional series of notes. Noteholder approval is not required for these additional issuances. There is no requirement to give noteholders notice of such events; however, noteholders will be notified of additional issuances in the Form 10-D filed with respect to a calendar month in which additional securities are issued. See “The Transfer and Servicing Agreements—Reports to Noteholders.”

The offered notes will be available for purchase in denominations of $1,000 and integral multiples of $1,000 thereof in book-entry form only. The offered notes will be registered in the name of the nominee for The Depository Trust Company. You may hold your offered notes through the book-entry systems of DTC in the United States or Clearstream or Euroclear in Europe.

Payments on the Notes

Interest

The trust will pay interest on the Series 2018-2 Class A notes at a rate equal to % per annum, on the Series 2018-2 Class B notes at a rate equal to % per annum, on the Series 2018-2 Class C notes at a rate equal to % per annum, and on the Series 2018-2 Class D notes at a rate equal to % per annum. No interest will be payable in respect of the Series 2018-2 Class E notes.

Interest on the Series 2018-2 Class A notes, the Series 2018-2 Class B notes, the Series 2018-2 Class C notes and the Series 2018-2 Class D notes will be payable based on a fixed rate, and we refer to the Series 2018-2 Class A notes, the Series 2018-2 Class B notes, the Series 2018-2 Class C notes and the Series 2018-2 Class D notes as the “Series 2018-2 fixed rate notes.”

The trust will pay interest on the Series 2018-2 fixed rate notes on each Distribution Date based on a 360-day year consisting of twelve 30-day months. Interest on the outstanding principal balance of each class of Series 2018-2 investor notes will accrue from and including the closing date, or from and including the most recent Distribution Date, to but excluding the current Distribution Date.

The trust will pay interest on the Series 2018-2 investor notes monthly on the 15th day of each calendar month or, if that day is not a Business Day, the next Business Day, commencing June 15, 2018. We refer to these dates as the “Distribution Dates.”

2

The payment of interest on each class of Series 2018-2 investor notes is subordinate to the payment of interest on each class of Series 2018-2 investor notes with a prior alphabetical designation, and no interest will be paid on a class of Series 2018-2 investor notes until all interest due and payable on each class with a prior alphabetical designation has been paid.

In certain circumstances, Principal Collections may be reallocated to make interest payments on the Series 2018-2 investor notes to the extent described in this prospectus.

Principal Payments

We expect that the trust will pay the entire principal balance of each class of the Series 2018-2 notes on the “Series 2018-2 Expected Maturity Date,” which is the Distribution Date in May 2021.

All unpaid principal on each class of the Series 2018-2 notes will be due on the “Series 2018-2 Legal Maturity Date,” which is the Distribution Date in May 2023. If the trust fails to pay any class of the Series 2018-2 notes in full on the Series 2018-2 Legal Maturity Date, an Event of Default will occur for the Series 2018-2 notes.

The payment of principal on each class of Series 2018-2 notes is subordinate to the payment of principal on each class of Series 2018-2 notes with a prior alphabetical designation, and no principal will be paid on a class of Series 2018-2 notes until all principal due and payable on each class of Series 2018-2 notes with a prior alphabetical designation has been paid.

Collections and Allocations

Collections on the receivables will be allocated to the various interests in the trust, including the Series 2018-2 notes, in various steps and based on the relative percentages of those interests.

After receipt by the servicer of collections on the receivables, the servicer will allocate those collections between Interest Collections or Principal Collections. The servicer will then further allocate Interest Collections between the Overconcentration Interest in the trust and the Nonoverconcentration Interest in the trust. Similarly, the servicer will further allocate Principal Collections between the Overconcentration Interest in the trust and the Nonoverconcentration Interest in the trust.

The servicer will then allocate Overconcentration Principal Collections and Overconcentration Interest Collections among each outstanding Overconcentration Series of notes issued by the trust, the Certificate Interest and, under certain circumstances, outstanding Nonoverconcentration Series of notes issued by the trust. These allocated collections will be deposited by the servicer up to specified amounts into the collection account for the trust.

Similarly, the servicer will then allocate Nonoverconcentration Principal Collections and Nonoverconcentration Interest Collections among each outstanding Nonoverconcentration Series of notes issued by the trust, the Certificate Interest and, under certain circumstances, outstanding Overconcentration Series of notes issued by the trust. These allocated collections will be deposited by the servicer up to specified amounts into the collection account for the trust.

The allocations of Nonoverconcentration Interest Collections, Nonoverconcentration Principal Collections and defaulted receivables allocated to the Nonoverconcentration Interest to your series of notes will be based on varying percentages applicable to your series as described in this prospectus.

Trust assets allocated to the Nonoverconcentration Interest of the trust will be available to make payments on your series of notes, while trust assets allocated to Overconcentration Interest in the trust will not, except in very limited circumstances and to the extent specified in this prospectus, be available to make payments on your series of notes. For a discussion of the allocations of trust assets and collections between the Nonoverconcentration Interest and the Overconcentration Interest, see “The Notes—Overconcentration Interest and Nonoverconcentration Interest.”

Losses on the receivables also will be allocated to the various interests in the trust, including the Series 2018-2 notes, in a similar manner. The amount of principal receivables that are written off as uncollectible is referred to as the “Aggregate Dealer Defaulted Amount”.

The servicer will allocate Interest Collections and the Aggregate Dealer Defaulted Amount each month and Principal Collections each day among:

| | • | | other outstanding series of notes that the trust has issued; and |

3

The amounts allocated to your series will be determined based generally on the size of your series’ Net Invested Amount, compared with the Nonoverconcentration Pool Balance of the trust, which is the portion of the principal receivables not allocated to the Overconcentration Interest in the trust. The Net Invested Amount of the Series 2018-2 notes on the closing date will be $666,666,667, the sum of the aggregate principal amounts of all of the issued Series 2018-2 notes. If the Net Invested Amount of your series declines, amounts allocated and available to make required distributions for your series will be reduced.

For a more detailed description of the allocation calculations and the events that may lead to these reductions, you should read “The Notes—Series Percentages,” “The Notes—Series Defaulted Amount and Reallocated Principal Collections” and “The Notes—Overconcentration Interest and Nonoverconcentration Interest.”

Groups

Your series will be included in the group of series of notes issued by the trust referred to as “Excess Interest Sharing Group One” and in the group of series of notes issued by the trust referred to as “Principal Sharing Group One.” As part of these groups, your series will be entitled in certain situations to share in Excess Interest Collections and Shared Principal Collections that are allocable to other series of notes in the same group.

For a more detailed description of these groups, you should read “The Notes—Groups.”

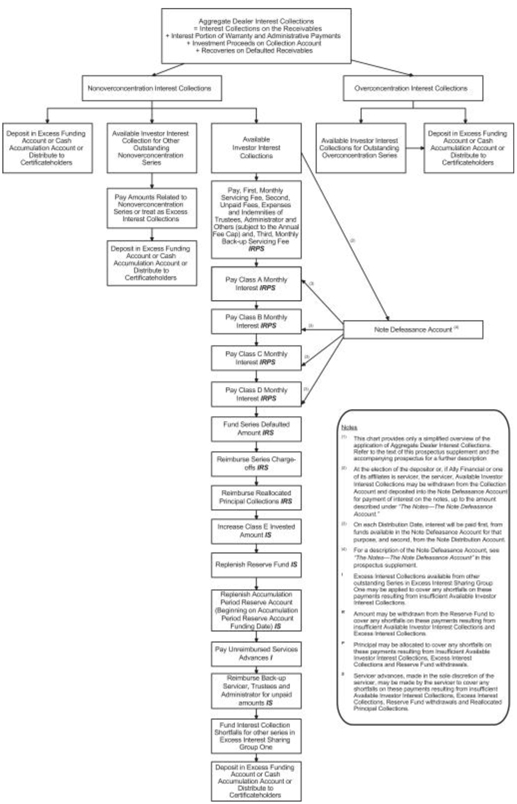

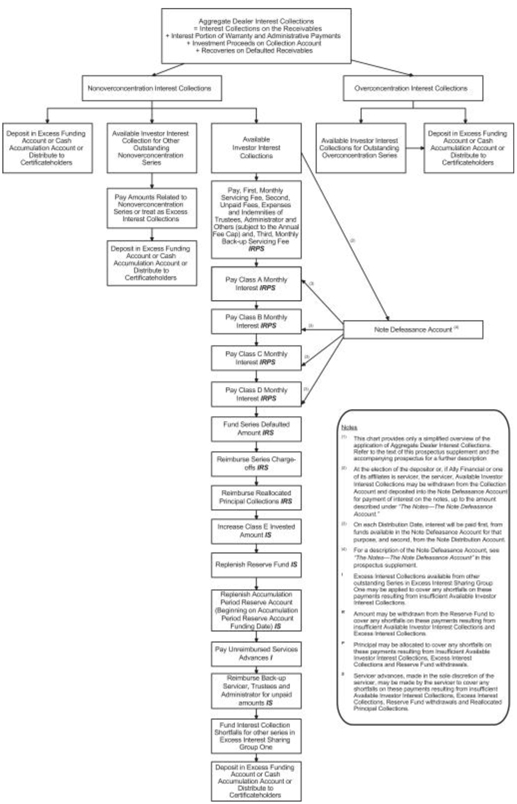

Application of Collections

Interest Collections

On each Distribution Date, Available Series Interest Collections on deposit in the Collection Account and, solely with respect to the allocations described below in clauses (2) through (5), the Note Defeasance Account (other than investment earnings), will be applied in the following order of priority:

| | (1) | first, an amount equal to the Monthly Servicing Fee for that Distribution Date, together with any Monthly Servicing Fees previously due but not paid to the servicer on prior Distribution Dates, will be distributed to the servicer (unless such amount has been netted against deposits into the Collection Account in accordance with the Indenture); second, pro rata, an amount equal to the accrued and unpaid fees, expenses and indemnities owed to the indenture trustee, the owner trustee, the administrator, the asset representations reviewer, and any other fees or expenses of the trust payable by the servicer or the administrator (to the extent not paid by the servicer or the administrator) shall be distributed to the indenture trustee, the owner trustee, the administrator, the asset representations reviewer or the person to whom such payment is owed, as applicable, provided that the amount distributed pursuant to this clause second shall not exceed the Annual Fee Cap in any calendar year; and third, an amount equal to the Monthly Back-up Servicing Fee for that Distribution Date, together with any Monthly Back-up Servicing Fees previously due but not paid to the back-up servicer on prior Distribution Dates, will be distributed to the back-up servicer; |

| | (2) | an amount equal to the Class A Monthly Interest for that Distribution Date, together with any Class A Monthly Interest previously due but not paid to the Series 2018-2 Class A noteholders on prior Distribution Dates, will be paid to the Series 2018-2 Class A noteholders, pro rata based on the amounts owing to them, first from funds available in the Note Defeasance Account and, second, to the extent those funds are not sufficient, from funds available in the Collection Account; |

| | (3) | an amount equal to the Class B Monthly Interest for that Distribution Date, together with any Class B Monthly Interest previously due but not paid to the Series 2018-2 Class B noteholders on prior Distribution Dates, will be paid to the Series 2018-2 Class B noteholders, pro rata based on the amounts owing to them, first from funds available in the Note Defeasance Account and, second, to the extent those funds are not sufficient, from funds available in the Collection Account; |

| | (4) | an amount equal to the Class C Monthly Interest for that Distribution Date, together with any Class C Monthly Interest previously due but not paid to the Series 2018-2 Class C noteholders on prior Distribution Dates, will be paid to the Series 2018-2 Class C noteholders, pro rata based on the amounts owing to them, first from funds available in the Note Defeasance Account and, second, to the extent those funds are not sufficient, from funds available in the Collection Account; |

| | (5) | an amount equal to the Class D Monthly Interest for that Distribution Date, together with any Class D Monthly Interest previously due but not paid to the Series 2018-2 Class D noteholders on prior Distribution Dates, will be paid to the Series 2018-2 Class D noteholders, pro rata based on the amounts owing to them, first from funds available in the Note Defeasance Account and, second, to the extent those funds are not sufficient, from funds available in the Collection Account; |

4

| | (6) | an amount equal to the Series Defaulted Amount will be treated as Additional Available Series Principal Collections for that Distribution Date; |

| | (7) | an amount equal to the sum of Series Charge-Offs that have not been previously reimbursed will be treated as Additional Available Series Principal Collections for that Distribution Date; |

| | (8) | an amount equal to the sum of Reallocated Principal Collections that have not been previously reimbursed will be treated as Additional Available Series Principal Collections for that Distribution Date; |

| | (9) | an amount necessary to cause the Class E Invested Amount to not be less than the Required Class E Invested Amount will be treated as Additional Available Series Principal Collections for that Distribution Date; |

| | (10) | an amount required to fund the Reserve Fund up to the Reserve Fund Required Amount; |

| | (11) | the amount required to repay the servicer for all outstanding servicer advances made in respect of the Series 2018-2 notes will be paid to the servicer (unless such amount has been netted against deposits into the Collection Account in accordance with the Indenture); |

| | (12) | pro rata, the amounts required to pay any remaining fees, expenses, indemnities or other amounts required to be paid pursuant to the first bullet point, clause second above but not paid as a result of the proviso thereto, the amount required to reimburse the back-up servicer for all unpaid Servicer Termination Costs in excess of the amounts reimbursed by funds from the Servicer Termination Costs Reserve Account and, the amount required to reimburse the back-up servicer for all unpaid amounts due to the back-up servicer pursuant to the Back-up Servicing Agreement will be distributed to the applicable person; |

| | (13) | an amount equal to the Interest Collections Shortfalls for other outstanding series of notes in Excess Interest Sharing Group One will be treated as Excess Interest Collections available from your series and applied to cover the Interest Collections Shortfalls for other outstanding series of notes in Excess Interest Sharing Group One; |

| | (14) | all remaining amounts to the holders of the Certificate Interest (unless such amount has been netted against deposits into the Collection Account in accordance with the Indenture), but only to the extent that the remaining amount is not otherwise required to be deposited into the Excess Funding Account or the Cash Collateral Account pursuant to the Indenture. |

As a result of these allocations and the allocations described in “—Principal Collections” below, the Class E notes and the Certificate Interest related to the Series 2018-2 meet the risk retention requirements of an eligible horizontal residual interest. For a more detailed description of these applications, you should read “The Notes—Application of Collections—Application of Interest Collections.”

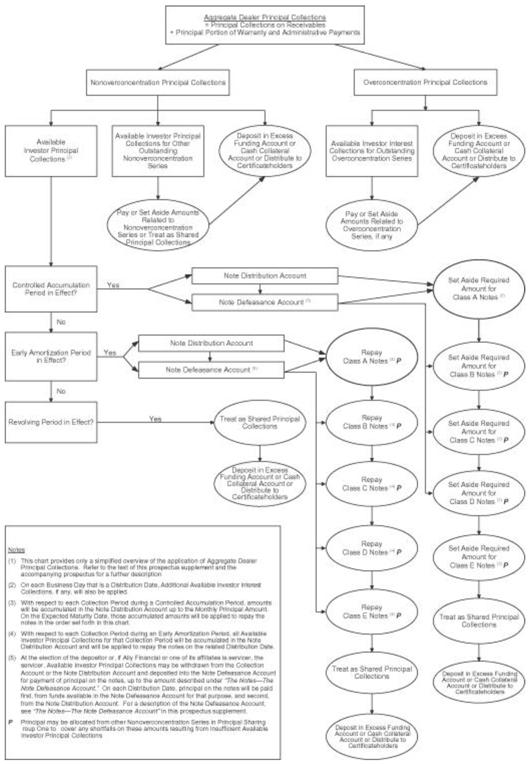

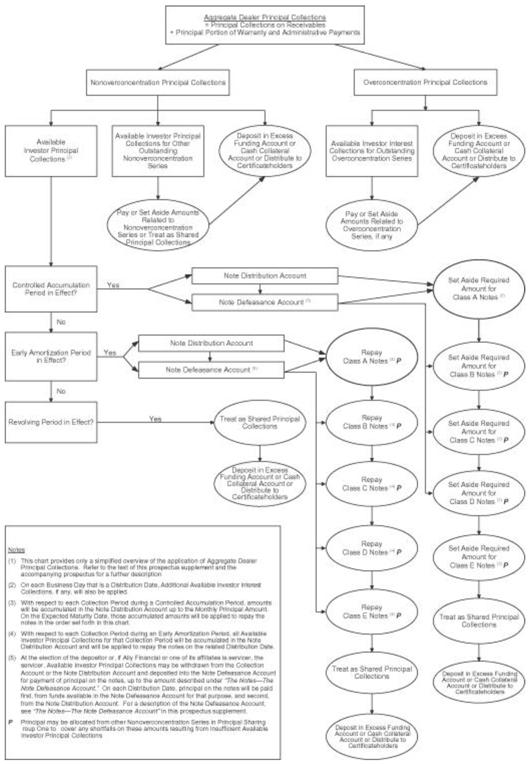

Principal Collections

The order of priority for the application of Available Series Principal Collections on each Distribution Date will depend on whether your series is in the Revolving Period, the Controlled Accumulation Period or the Early Amortization Period.

| | • | | Revolving Period. The “Revolving Period” for your series begins on the closing date and ends on the day preceding the date on which the Controlled Accumulation Period or the Early Amortization Period begins. During the Revolving Period, no principal will be paid to you or accumulated in the Note Distribution Account or the Note Defeasance Account for your series. Instead, Principal Collections allocated to your series will be treated as Shared Principal Collections and made available to make required principal distributions and deposits for other series of notes in Principal Sharing Group One or paid to the holders of the Certificate Interest to the extent not required to be deposited into the Excess Funding Account or the Cash Collateral Account. |

| | • | | Controlled Accumulation Period. The Controlled Accumulation Period for your series is scheduled to begin on the first day of the November 2020 Collection Period, but may begin at a later date. On each Business Day during the Controlled Accumulation Period, Principal Collections allocated to your series will be deposited into the Note Distribution Account or, at the election of the depositor or the servicer, the Note Defeasance Account, up to the Controlled Deposit Amount for the related Collection Period. Any Principal Collections allocated to your series in excess of the Controlled Deposit Amount will be treated as Shared Principal Collections and will be made available to make required principal distributions and deposits for other series of notes in Principal Sharing Group One or paid to the holders of the Certificate Interest to the extent not required to be deposited into the Excess Funding Account or the Cash Collateral Account. During the Controlled Accumulation Period for the Series 2018-2 notes, the trust may also be setting aside or distributing Principal Collections for the repayment of other series of notes. |

| | • | | On the Series 2018-2 Expected Maturity Date, the amounts on deposit in the Note Distribution Account and the Note Defeasance Account and any amounts constituting Additional Available Series Principal Collections for that |

5

| | Distribution Date will be paid first to the Series 2018-2 Class A noteholders, pro rata on the basis of the amount owing to them, second to the Series 2018-2 Class B noteholders, pro rata on the basis of the amount owing to them, third to the Series 2018-2 Class C noteholders, pro rata on the basis of the amount owing to them, fourth to the Series 2018-2 Class D noteholders, pro rata on the basis of the amount owing to them, and fifth to the Series 2018-2 Class E noteholders, pro rata on the basis of the amount owing to them, in each case, until the respective principal balance has been paid in full. It is possible that the trust will not repay the entire principal balance of each class of the Series 2018-2 notes on or before the Series 2018-2 Expected Maturity Date. If Principal Collections are slower than anticipated during the Controlled Accumulation Period, then there may not be sufficient funds to repay the principal balance of each class of the Series 2018-2 notes in full on the Series 2018-2 Expected Maturity Date. In that case, on each subsequent Distribution Date, Principal Collections and other available funds allocated to your series will be paid first to the Series 2018-2 Class A noteholders, pro rata on the basis of the amount owing to them, second to the Series 2018-2 Class B noteholders, pro rata on the basis of the amount owing to them, third to the Series 2018-2 Class C noteholders, pro rata on the basis of the amount owing to them, fourth to the Series 2018-2 Class D noteholders, pro rata on the basis of the amount owing to them, and fifth to the Series 2018-2 Class E noteholders, pro rata on the basis of the amount owing to them, in each case, until the respective principal balance has been paid in full. |

| | • | | Early Amortization Period. If an Early Amortization Event occurs, the Early Amortization Period will begin. On each Business Day with respect to the Early Amortization Period, all Available Series Principal Collections up to the amount required to pay the Series 2018-2 notes in full will be deposited into the Note Distribution Account or, at the election of the depositor or the servicer, the Note Defeasance Account. On each Distribution Date related to the Early Amortization Period, those funds deposited into the Note Distribution Account and the Note Defeasance Account, as applicable, and any amounts constituting Additional Available Series Principal Collections for that Distribution Date will be paid first to the Series 2018-2 Class A noteholders, pro rata on the basis of the amount owing to them, second to the Series 2018-2 Class B noteholders, pro rata on the basis of the amount owing to them, third to the Series 2018-2 Class C noteholders, pro rata on the basis of the amount owing to them, fourth to the Series 2018-2 Class D noteholders, pro rata on the basis of the amount owing to them, and fifth to the Series 2018-2 Class E noteholders, in each case, until the respective principal balance has been paid in full. |

As a result of these allocations and the allocations described in “—Interest Collections” above, the Class E notes and the Certificate Interest related to the Series 2018-2 meet the risk retention requirements of an eligible horizontal residual interest. For a more detailed description of these applications, you should read “The Notes—Application of Collections—Application of Principal Collections.”

Early Amortization Events

The Series 2018-2 notes are subject to specified Early Amortization Events described under “The Notes—Early Amortization Events,” which are applicable to the Series 2018-2 notes.

The occurrence of specified Early Amortization Events will cause an Early Amortization Period to begin with respect to the Series 2018-2 notes.

Events of Default

The Series 2018-2 notes are subject to specified Events of Default described under “The Notes—Events of Default,” which are applicable to the Series 2018-2 notes.

Upon the occurrence of a bankruptcy or similar event relating to the trust, the Series 2018-2 notes will be accelerated automatically. Upon any other Event of Default, the indenture trustee may, or shall, at the direction of the holders of a majority of the outstanding principal balance of the Series 2018-2 notes, accelerate the Series 2018-2 notes. If the Series 2018-2 notes are accelerated following an Event of Default, an Early Amortization Period will begin with respect to Series 2018-2.

For a more detailed description of the Events of Default, the application of funds and the rights of noteholders and the indenture trustee following an Event of Default, you should read “The Notes—The Indenture—Events of Default; Rights Upon Event of Default.”

6

Optional Redemption

The servicer (if Ally Financial or an affiliate of Ally Financial is the servicer) will have the option to redeem the Series 2018-2 notes by purchasing the portion of the trust assets allocated to the Series 2018-2 notes at any time after the remaining outstanding principal balance of the Series 2018-2 notes is 10% or less of the initial principal balance of the Series 2018-2 notes.

Defeasance

The depositor may terminate its obligations in respect of the Series 2018-2 notes by depositing with the indenture trustee amounts sufficient to make all remaining scheduled interest and principal payments on the Series 2018-2 notes on the dates scheduled for those payments.

For more information about defeasance, you should read “The Notes—Defeasance.”

Repurchases and Purchases of Receivables

Unless otherwise cured, Ally Bank and the depositor will be required to repurchase any receivable with respect to which a breach of any representation or warranty of the depositor or Ally Bank has a material and adverse effect on the interests of the noteholders. For a description of such repurchase requirements, see “The Transfer and Servicing Agreements.” If the downgrade trigger is met or exceeded for a monthly period and a majority of the Series 2018-2 noteholders vote to direct a review of “programmed” and “no credit” accounts and the related receivables as described under “The Pool of Accounts—Asset Representations Review,” the asset representations reviewer will review all “programmed” and “no credit” accounts and the related receivables to determine if the applicable representations and warranties with respect to the “programmed” and “no credit” accounts and the related receivables were satisfied. For a description of “programmed” and “no credit” accounts, see “The Dealer Floorplan Financing Business—Dealer Status; Realization on Collateral Security.” For a description of the asset representations review process, see “The Pool of Accounts—Asset Representations Review.”

Credit Enhancement and Liquidity

The trust will repay the Series 2018-2 notes and the other securities primarily from Principal Collections and Interest Collections on the receivables. The following will be additional sources of funds available to the trust to pay principal and interest on the Series 2018-2 notes and to make other required payments in certain circumstances:

| | • | | subordination of other series of notes. |

In addition, each class of Series 2018-2 notes with a subsequent alphabetical designation is subordinate to each class of Series 2018-2 notes with a prior alphabetical designation, in each case, to the extent described in this prospectus.

Losses not covered by any credit enhancement or support will be allocated to the securities as described in “The Notes—Credit Enhancement and Other Enhancement—Subordination.”

The series enhancement described above is available only for your series. You are not entitled to any series enhancement available to any other series of notes that the issuing entity has already issued or may issue in the future.

Series 2018-2 Class E Notes

The Series 2018-2 Class E notes are subordinated to the Series 2018-2 investor notes. The initial principal balance of the Series 2018-2 Class E notes will be $83,332,667. The Series 2018-2 Class E notes principal balance is subject to reductions and increases from time to time.

As of any Determination Date, the Class E Invested Amount is required to be equal to or greater than the Required Class E Invested Amount. The Required Class E Invested Amount may increase and decrease from time to time as described below and in the definitions of “Required Class E Invested Amount” and “Subordination Factor” in this prospectus.

If on any Distribution Date, the average monthly payment rate for the three preceding months is less than 25.00% and greater than or equal to 22.50%, then on such Distribution Date, the depositor will be required to either (i) increase the Subordination Factor

7

by 2.56%, which will increase the Required Class E Invested Amount, or (ii) increase the amount required to be on deposit in the Reserve Fund by 2.20%, which we refer to collectively as the “First Step-up.”

If on any Distribution Date, the average monthly payment rate for the three preceding months is less than 22.50% and greater than or equal to 20.00%, then on such Distribution Date, the depositor will be required to either (i) increase the Subordination Factor by an additional 2.80%, which will increase the Required Class E Invested Amount, or (ii) increase the amount required to be on deposit in the Reserve Fund by an additional 2.40%, which we refer to collectively as the “Second Step-up.”

If on any Distribution Date, the average monthly payment rate for the three preceding months is less than 20.00%, then on such Distribution Date, the depositor will be required to either (i) increase the Subordination Factor by an additional 3.09%, which will increase the Required Class E Invested Amount, or (ii) increase the amount required to be on deposit in the Reserve Fund by an additional 2.65%, which we refer to collectively as the “Third Step-up.”

The increases pursuant to the First Step-up, Second Step-up and/or Third Step-up will be eliminated, and as a result, the Required Class E Invested Amount or the amount required to be on deposit in the Reserve Fund, as applicable, will decrease, if on any Distribution Date the average of the monthly payment rate for the three preceding months and the average of the monthly payment rates for the three months preceding each of the two prior Distribution Dates was greater than or equal to 25.00%, 22.50% or 20.00%, respectively. For additional information regarding the First Step-up, Second Step-up and Third Step-up, see the definitions of “Subordination Factor” and “Reserve Fund Required Percentage” in the “Glossary of Terms”.

Reserve Fund

A Reserve Fund will be established to assist in the payment of interest and principal on the Series 2018-2 notes. The depositor will deposit $3,333,333 (or 0.50% of the initial principal balance of the Series 2018-2 notes) into the Reserve Fund on the closing date. The amount required to be on deposit in the Reserve Fund will generally equal 0.50% of the Invested Amount of the Series 2018-2 notes. The amount required to be on deposit in the Reserve Fund may increase or decrease from time to time as described under “—The Series 2018-2 Class E Notes” and in the definitions of “Subordination Factor” and “Reserve Fund Required Percentage” in the “Glossary of Terms”. The depositor may also, in its discretion, increase or, upon satisfaction of the Series 2018-2 Rating Agency Condition but without the consent of any noteholder, decrease the amount required to be on deposit in the Reserve Fund; provided that the depositor may not increase the amount required to be on deposit in the Reserve Fund in its discretion if that increase would result in the aggregate amount of all such increases, together with all amounts added to the Class E Invested Amount and all amounts resulting from a discretionary increase in the Class E Invested Amount or in the Subordination Factor, exceeding 5% of the outstanding principal balance of the Series 2018-2 notes as of the date of the increase.

The trust may experience shortfalls in Principal and Interest Collections on the receivables. The indenture trustee will withdraw available amounts from the Reserve Fund when these shortfalls cause the trust to have insufficient amounts to:

| | • | | pay the monthly servicing fee and the monthly back-up servicing fee; and |

| | • | | make certain required distributions on the Series 2018-2 notes. |

On any Distribution Date, after the trust pays the monthly servicing fee and the monthly back-up servicing fee, and makes all deposits or payments due on the Series 2018-2 notes, the amount in the Reserve Fund may exceed the Reserve Fund Required Amount. If so, the trust will pay the excess to the holders of the Certificate Interest.

Overcollateralization

Overcollateralization is the amount by which the amount of trust assets allocated to the Series 2018-2 notes exceeds the outstanding principal balance of the investor notes. Overcollateralization will be available to absorb certain losses that the noteholders of the investor notes would otherwise incur. Generally, overcollateralization with respect to the Series 2018-2 investor notes will be equal to the Class E Invested Amount. As of any Determination Date, the Class E Invested Amount is required to be equal to or greater than the Required Class E Invested Amount. As of any Distribution Date, the Required Class E Invested Amount is a function of, among other things, the Subordination Factor for that date. On the closing date, the Subordination Factor will equal 12.50%. The Subordination Factor is subject to step-ups and step-downs as described under “—Series 2018-2 Class E Notes.” See the definitions of “Required Class E Invested Amount” and “Subordination Factor” in this prospectus.

Excess Spread

Excess spread for the Series 2018-2 Notes for any Distribution Date will be the amount by which Interest Collections during the related Collection Period allocated to Series 2018-2 exceeds certain fees of the trust relating to Series 2018-2, including interest payments on the Series 2018-2 notes. Any excess spread for a series of notes in Excess Interest Sharing Group One, including the Series 2018-2 notes, that is not used to cover shortfalls for that series of notes will be available on each Distribution Date to cover

8

certain shortfalls for other series of notes in Excess Interest Sharing Group One, including the Series 2018-2 notes, and any remaining excess spread will be distributed to the holders of the Certificate Interest.

Subordination of Series 2018-2 Investor Notes

Distributions on each class of Series 2018-2 investor notes will be subordinated to payments on each class of Series 2018-2 investor notes with a prior alphabetical designation, in each case, to the extent described herein.

Servicer Advances

The servicer may make a servicer advance to the trust to the extent that the servicer, in its sole discretion, expects to recoup those advances from subsequent Collections and other amounts available for that purpose.

Assets of the Trust

The primary asset of the trust is a revolving pool of receivables arising under floorplan financing agreements between Ally Bank and retail automotive dealers. These agreements are lines of credit that dealers use to purchase new and used motor vehicles manufactured or distributed by motor vehicle manufacturers and distributors. We refer to the dealers’ obligations under these agreements as “receivables” and the receivables are comprised of interest receivables and principal receivables.

Composition of the Pool of Accounts as of the Reporting Date

The following tables describe the pool of accounts as of May 1, 2018. See “The Pool of Accounts—Composition of the Pool of Accounts” for additional information.

Composition of the Pool of Accounts; Total Receivables as of the Reporting Date

| | | | |

Number of Accounts | | | 1,428 | |

Aggregate Principal Balance of All Receivables Outstanding | | $ | 11,915,639,481 | |

Aggregate Principal Balance of All Eligible Receivables Outstanding | | $ | 9,952,504,485 | |

Percent of Receivables Representing New Vehicles | | | 88.86 | % |

Percent of Receivables Representing Used Vehicles | | | 11.14 | % |

Percent of Receivables of General Motors Dealers | | | 65.52 | % |

Percent of Receivables of Chrysler Dealers | | | 26.05 | % |

Percent of Receivables of Other Dealers | | | 8.43 | % |

Average Principal Balance of Eligible Receivables in Each Account | | $ | 6,969,541 | |

Range of Principal Balances of Receivables in Accounts | | $ | 0 to 179,512,883 | |

Average Available New Credit Lines Per Dealer with New Credit Lines | | | 286 | |

Average Available Used Credit Lines Per Dealer with Used Credit Lines | | | 84 | |

Weighted Average Spread Charged (Under)/Over Prime Rate | | | (0.13 | )% |

Composition of the Pool of Accounts; New Receivables as of the Reporting Date

| | | | |

Aggregate Principal Balance of Receivables Outstanding | | $ | 10,587,898,242 | |

Average Principal Balance of Receivables Per Dealer With At Least One New Vehicle Credit Line | | $ | 7,768,084 | |

Composition of the Pool of Accounts; Used Receivables as of the Reporting Date

| | | | |

Aggregate Principal Balance of Receivables Outstanding | | $ | 1,327,741,239 | |

Average Principal Balance of Receivables Per Dealer With At Least One Used Vehicle Credit Line | | $ | 1,075,094 | |

The depositor performed a review of the pool accounts and the related receivables, including a review of the ongoing processes and procedures used by the sponsor and the servicer and a review of the underlying data and disclosure regarding the receivables. The depositor concluded that it has reasonable assurance that the disclosure regarding the pool accounts and the related receivables in this prospectus is accurate in all material respects. See “Depositor Review of the Pool Of Accounts.”

9

The receivables are sold by Ally Bank to the depositor and then transferred by the depositor to the trust. The trust has granted a security interest in the receivables and other specified trust property to the indenture trustee for the benefit of the noteholders. The trust property also includes:

| | • | | security interests in the collateral securing the dealers’ obligations to pay the receivables, which will include the financed vehicles and may include other vehicles, parts inventory, equipment, fixtures, service accounts, real estate and guarantees; |

| | • | | amounts held on deposit in trust accounts maintained for the trust; |

| | • | | all rights of the depositor under the pooling and servicing agreement with Ally Bank and Ally Financial with respect to the receivables; and |

| | • | | all rights the trust has under the trust sale and servicing agreement with the depositor. |

In addition to the accounts designated for the trust as of the initial cut-off date for the trust, under circumstances and subject to the conditions described under “The Transfer and Servicing Agreements—Addition and Removal of Accounts,” the depositor has and may in the future designate additional accounts to the trust. Once an account has been designated for the trust, as new receivables arise in that account, the depositor will ordinarily transfer them to the trust on a daily basis. See “The Pool of Accounts—Addition and Removal of Accounts” and “The Transfer and Servicing Agreements—Addition and Removal of Accounts.”

The trust could apply the principal collections to pay down the principal balance on other notes issued by the trust, including notes included in any series of notes that consist of variable funding notes. The trust could also retain Principal Collections and invest them in Eligible Investments, if sufficient new receivables are not available.

However, upon the occurrence of certain events, if any, specified by this prospectus, all or a substantial portion of Principal Collections allocable to your series of notes may be retained by the trust, even though new receivables are available to the trust. Rather than pay these Principal Collections to the certificateholders or use them to repay any series of notes that consist of variable funding notes or any other series of notes, the trust will instead invest them in Eligible Investments in a note cash accumulation account dedicated to the noteholders of that series. The trust will continue to invest these funds in Eligible Investments until the planned date or dates for repayment of the notes of that series, or until any sooner repayment following the occurrence of an Early Amortization Event that requires repayment of the notes of that series.

Not all of the trust property will be available to pay the holders of the Series 2018-2 notes.

The servicer, Ally Bank as seller, or the depositor may be required to repurchase receivables from the trust in specified circumstances, as detailed in the prospectus under “The Transfer and Servicing Agreements—Representations and Warranties.”

Revolving Pool

As new receivables arise under the dealer accounts, subject to the eligibility criteria, Ally Bank will sell those receivables to the depositor and the depositor will transfer them to the trust on a daily basis. At the same time, prior to the date on which funds will first be set aside for principal payments on the Series 2018-2 notes, the trust will ordinarily treat Principal Collections allocable to the Series 2018-2 notes as Shared Principal Collections to pay down the principal balances on any other series of notes in Principal Sharing Group One. The trust may also retain Principal Collections and invest them in Eligible Investments if sufficient new receivables are not available. Excess Shared Principal Collections will be paid to the holders of the Certificate Interest. The trust will acquire receivables for so long as the Transfer and Servicing Agreements remain in effect.

The Transfer and Servicing Agreements have no scheduled termination date and will continue to be effective for an indeterminate amount of time.

All accounts added to the pool of accounts will be added in accordance with Regulation AB.

Excess Funding Account

In certain circumstances, the trust assets will also include funds held in the Excess Funding Account. If funds are on deposit in the Excess Funding Account, a portion of such funds, called the Series 2018-2 Excess Funding Amount, together with any other amounts on deposit in the Excess Funding Account that are allocated to the Series 2018-2 notes, will be treated as Available Series Principal Collections and will be available to make payments on the Series 2018-2 notes in the circumstances described under “The Notes—Excess Funding Account.”

10

Other Interests in the Trust

Overconcentration Interest

A portion of each of the trust’s receivables may be allocated to a separate interest in the trust, which we refer to as the Overconcentration Interest. Collections and defaults on the portion of the receivables allocated to the Overconcentration Interest will be allocated to Overconcentration Series of notes issued by the trust. The portion of the Overconcentration Interest not allocated to a series of notes will be allocated to the Certificate Interest.

Nonoverconcentration Interest

The portion of each of the trust’s receivables not allocated to the Overconcentration Interest will be allocated to the Nonoverconcentration Interest in the trust. Collections and defaults on the portion of the receivables attributable to the Nonoverconcentration Interest will be allocated to the Series 2018-2 notes, other Nonoverconcentration Series of notes issued by the trust and, in some cases, Overconcentration Series. The portion of the Nonoverconcentration Interest not allocated to a series of notes will be allocated to the Certificate Interest.

See “The Notes—Overconcentration Interest and Nonoverconcentration Interest” for a more detailed description of the allocations of trust assets between the Overconcentration Interest and the Nonoverconcentration Interest.

Other Series

The trust has issued other series of notes that are also secured by the assets of the trust. Annex A to this prospectus summarizes certain characteristics of each outstanding series of notes.

The trust may issue additional series of notes secured by the trust assets in the future. The trust may issue an additional series without your consent so long as the conditions described under “The Notes—New Issuances” are satisfied.

Certificate Interest

The interest in the trust’s assets not securing your series or any other series of notes is the Certificate Interest. The Certificate Interest will not provide subordination for the Series 2018-2 notes. The Certificate Interest is represented by the certificates, which are not offered by this prospectus.

The depositor will initially own the certificates, but will retain the right to sell all or portion of the certificates at any time.

Note Defeasance Account

The Indenture Trustee will establish a Note Defeasance Account in the name of the Indenture Trustee for the benefit of the Series 2018-2 noteholders. With respect to any collection period, the servicer will, at the direction of the depositor or, if Ally Financial or one of its affiliates is servicer, the servicer may, in its discretion, direct an amount of Available Series Interest Collections and, during an Early Amortization Period or the Controlled Accumulation Period, Available Series Principal Collections, to be withdrawn from the Collection Account or the Note Distribution Account, as applicable, and irrevocably deposited into the Note Defeasance Account.

Amounts on deposit in the Note Defeasance Account on any Distribution Date will be applied as described under “The Notes—Application of Collections.” Upon the deposit of any amount into the Note Defeasance Account, (i) none of the trust, the depositor or the servicer will have any further right to those amounts, (ii) the Series 2018-2 noteholders will have recourse, and will look solely to, the Note Defeasance Account for payments of those amounts, and (iii) the trust will have no further liability for, and will be deemed to be discharged and released from, its obligations with respect to the Series 2018-2 notes to the extent of the amount deposited, as such amounts are to be applied pursuant to the priorities of interest and principal payments.

See “The Notes—The Note Defeasance Account.”

Servicing Fees

Each month, the issuing entity will pay to: (i) the servicer a servicing fee, and (ii) the back-up servicer a back-up servicing fee, each as described under “Certain Fees and Expenses” and “The Servicer—Servicing Compensation and Payment of Expenses.” The servicing fee and the back-up servicing fee will receive priority over all distributions on the securities.

11

Tax Status

In the opinion of Mayer Brown LLP, special tax counsel, the offered notes will be characterized as indebtedness for federal income tax purposes to the extent the notes are treated as beneficially owned by a person other than the sponsor or its affiliates for such purposes and the trust will not be taxable as an association or a publicly traded partnership taxable as a corporation for federal income tax purposes.

Each holder of an offered note, by the acceptance of an offered note, will agree to treat such offered note as indebtedness for federal, state and local income and franchise tax purposes.

ERISA Considerations

Subject to further considerations discussed under the caption “Considerations for ERISA and Other U.S. Employee Benefit Plans,” an employee benefit plan subject to the Employee Retirement Income Security Act of 1974, as amended, “ERISA,” or a plan subject to Section 4975 of the Internal Revenue Code of 1986, as amended, the “Code,” or an entity whose underlying assets include “plan assets” by reason of an employee benefit plan’s or plan’s investment in the entity, may generally purchase the offered notes. We suggest that an employee benefit plan, any other retirement plan or arrangement, and any entity deemed to hold “plan assets” of any employee benefit plan or other plan, consult with its counsel before purchasing the offered notes. See “Considerations for ERISA and Other U.S. Employee Benefit Plans” in this prospectus for additional information.

Ratings

The depositor expects that the offered notes will receive credit ratings from at least one nationally recognized rating agency or “NRSRO” hired by the depositor.

The ratings of the offered notes will address the likelihood of the payment of principal and interest on the offered notes according to their terms. Each hired rating agency rating the offered notes will monitor the ratings using its normal surveillance procedures. Any rating agency rating the offered notes may change or withdraw an assigned rating at any time. Any rating action taken by one rating agency may not necessarily be taken by any other rating agency then rating the offered notes.

No transaction party will be responsible for monitoring any changes to the ratings on the offered notes.

Any of the hired rating agencies have discretion to monitor and adjust the ratings on the offered notes. The offered notes may receive an unsolicited rating that is different from or lower than the ratings provided by the rating agency or agencies hired to rate the offered notes. As of the date of this prospectus, we are not aware of any unsolicited ratings on the offered notes. A rating, change in rating or a withdrawal of a rating by a hired rating agency may not correspond to a rating, change in rating or withdrawal of a rating from any other rating agency. See “Risk Factors—The Ratings on the Offered Notes Are Not Recommendations; They May Change or Be Withdrawn” for more information.

Certain Investment Company Act Considerations

The issuing entity is not registered or required to be registered as an “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”). In determining that the issuing entity is not required to be registered as an investment company, the issuing entity is relying on the exemption provided by Section 3(c)(5)(A) under the Investment Company Act, although there may be additional exclusions or exemptions that the issuing entity could rely on as well. As of the closing date, the issuing entity will be structured so as not to constitute a “covered fund” for purposes of the regulations, commonly referred to as the “Volcker Rule,” adopted to implement Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Action Act of 2010, or the “Dodd-Frank Act.”

Risk Factors

Before making an investment decision, you should consider carefully the factors set forth under the caption “Risk Factors.”

12

RISK FACTORS

You should consider carefully the following risk factors in deciding whether to purchase the Series 2018-2 notes.

| | |

| |

Financial Market Disruptions and a Lack of Liquidity in the Secondary Market Could Adversely Affect the Market Value of the Series 2018-2 Notes and/or Limit Your Ability to Resell the Series 2018-2 Notes | | The offered notes will not be listed on any securities exchange. Therefore, in order to sell the Series 2018-2 notes, you will need to find a willing buyer. The underwriters may assist in the resale of the offered notes, but they are not required to do so. Additionally, events in the global financial markets, including the failure, acquisition or government seizure of several major financial institutions, the establishment of government bailout programs for financial institutions, problems related to financial assets, the de-valuation of various assets in secondary markets, the forced sale of asset-backed and other securities as a result of the de-leveraging of structured investment vehicles, hedge funds, financial institutions and other entities, the lowering of ratings on certain asset-backed securities and uncertainty surrounding the exit of the United Kingdom and potentially any other country from the European Union, have caused a significant reduction in liquidity in the secondary market for asset-backed securities. A period of illiquidity may adversely affect both the market value of the Series 2018-2 notes and your ability to sell the Series 2018-2 notes. As a result, you may be unable to obtain the price that you wish to receive for the Series 2018-2 notes or you may suffer a loss on your investment. Illiquidity can have a severely adverse effect on the prices of securities that are especially sensitive to credit or interest rate risk, such as the Series 2018-2 notes. |

| |

Economic Developments May Adversely Affect the Performance and Market Value of the Series 2018-2 Notes | | The United States has in the past experienced and in the future may experience a recession or period of economic contraction. During the economic downturn following the 2008 financial crisis, elevated unemployment, decreases in home values and lack of available credit led to increased delinquency and default rates by dealers on the receivables, as well as decreased consumer demand for used automobiles and declining market values of the automobiles securing the receivables; if another financial crisis or economic downturn were to occur again, delinquencies and losses on the receivables could continue to increase, which could result in losses on the Series 2018-2 notes. Significant increases in the inventory of used automobiles during an economic downturn may also depress the prices at which repossessed automobiles may be sold or delay the timing of these sales. |

| |

| | In addition, higher future energy and fuel prices could reduce the amount of disposable income that consumers have available to purchase automobiles from dealer inventories. Higher energy costs could cause business disruptions, which could cause unemployment and a further or deepening economic downturn. Decreased consumer demand could cause dealers to potentially become delinquent in making payments or default if they are unable to make payments on the receivables. The trust’s ability to make payments on the Series 2018-2 notes could be adversely affected if the related dealers are unable to make timely payments. |

| |

A Decline in the Financial Condition or Business Prospects of Ally Bank, Ally Financial, a Motor Vehicle Manufacturer or Dealers Could Result in Losses on the Series 2018-2 Notes | | The receivables owned by the trust are originated primarily through the financing provided by Ally Bank to franchised dealers of motor vehicle manufacturers. The level of principal collections therefore depends upon the motor vehicle manufacturers’ continuing ability to manufacture vehicles and to maintain franchise dealer relationships, upon Ally Bank’s ability to provide such financing and upon dealers’ ability to repay the receivables. Ally Bank’s ability to compete in the current industry environment will affect its ability to generate new receivables and could also affect payment patterns on the receivables. |

13

| | |

| |

| | A decline in the financial condition of Ally Bank and Ally Financial and any franchised dealers and manufacturers could adversely affect the ability of Ally Bank to generate new receivables, to honor its commitment or to repurchase receivables due to breaches of representations or warranties, the performance of the receivables, the financial stability of the related dealers, the market value of the vehicles securing the receivables, or the ability of Ally Financial, as servicer, to service the receivables or to honor its commitment to purchase receivables due to breaches of its agreements, any of which could result in losses on the Series 2018-2 notes. |

| |

| | Investors should consider the ongoing business prospects of motor vehicle manufacturers, Ally Bank and Ally Financial in deciding whether to purchase any Series 2018-2 notes. |

| |

The Trust Could Make Principal Payments on the Series 2018-2 Notes Sooner than the Series 2018-2 Expected Maturity Date if an Early Amortization Event Occurs | | After the occurrence of an Early Amortization Event, which includes, but is not limited to, certain bankruptcy, insolvency, conservatorship or receivership events relating to Ally Bank, the depositor or the servicer (or Ally Financial, if Ally Financial is not the servicer), and certain bankruptcy, insolvency and receivership events that would result in the liquidation of a Significant Manufacturer or the Majority of Manufacturers, the basic documents require the trust to begin making principal payments on the Series 2018-2 notes, which may result in the repayment of principal on the Series 2018-2 notes sooner than the Series 2018-2 Expected Maturity Date. As of any date, a “Significant Manufacturer” means a motor vehicle manufacturer that the aggregate amount of all Eligible Principal Receivables held by the trust as of that date for which the related Vehicle Collateral Security is a vehicle manufactured by such manufacturer is 35.0% (or, in the case of Fiat Chrysler, 25.0%) or more of the Pool Balance, and a “Majority of Manufacturers” means two or more manufacturers that the aggregate amount of all Eligible Principal Receivables held by the trust as of that date for which the related Vehicle Collateral Security is a vehicle manufactured by one of those manufacturers is 50.0% or more of the pool balance. As shown under “The Pool of Accounts—Composition of the Pool of Accounts—Composition of the Pool of Accounts as of the Reporting Date,” as of the Reporting Date, General Motors was the only Significant Manufacturer for the trust. As the composition of the pool of accounts changes, the Significant Manufacturers of the trust may change. For information regarding the distribution of Eligible Principal Receivables held by the trust as of the Reporting Date, see “The Pool of Accounts—Composition of the Pool of Accounts—Make Distribution for the Pool of Accounts as of the Reporting Date.” However, if the Early Amortization Event is the result of a bankruptcy, insolvency or receivership, a trustee in bankruptcy, including the servicer as debtor-in-possession, or one of the parties to the basic documents, may contest the enforceability of those provisions, which could have the effect of delaying, or if successful, preventing the early repayment of principal. For more information regarding Early Amortization Events, see “The Notes—Early Amortization Events.” The earlier return of principal following an Early Amortization Event may occur at a time when you might not be able to reinvest those funds for a rate of return or maturity date as favorable as those on the Series 2018-2 notes. You should also consider carefully the factors with respect to a bankruptcy of Ally Bank and motor vehicle manufacturers set forth under the captions “Risk Factors—If Ally Bank Becomes Subject to Conservatorship or Receivership, You Could Experience Reduced or Delayed Payments on the Series 2018-2 Notes,” “Insolvency Aspects of the Accounts—Payments on the Notes and Certificates,” “Risk Factors—If a Motor Vehicle Manufacturer Files for Bankruptcy, You Could Experience Reductions and Delays in Payments on the Series 2018-2 Notes” and “Certain Reorganizations of a Motor Vehicle Manufacturer Under the Federal Bankruptcy Code Will Not Cause an Early Amortization Event for |

14

| | |

| |

| | the Series 2018-2 Notes.” |

| |

Certain Reorganizations of a Motor Vehicle Manufacturer Under the Federal Bankruptcy Code Will Not Cause an Early Amortization Event for the Series 2018-2 Notes | | The only bankruptcy events relating to any motor vehicle manufacturer that will cause an Early Amortization Event for the Series 2018-2 notes will be (i) the filing of a petition by a Significant Manufacturer (or by another person that is undismissed after 90 days), or the entry of an order, under Chapter 7 of the federal bankruptcy code or similar provision of law that would result in the termination or liquidation of a Significant Manufacturer’s automobile manufacturing business, or (ii) a Significant Manufacturer undertakes to terminate or liquidate all or substantially all of its automobile manufacturing assets or business (or files a petition to or requests approval of any such action), but excluding any transfer, sale (including specified sales under the bankruptcy code and similar laws) that would result in the continued operation of a majority of the automobile manufacturing business of that Significant Manufacturer, following a Chapter 11 reorganization bankruptcy filing by a Significant Manufacturer or a similar event occurring concurrently with respect to each of the Majority of Manufacturers. No bankruptcy event with respect to any motor vehicle manufacturer other than a Significant Manufacturer or a Majority of Manufacturers will trigger an Early Amortization Event. |

| |

| | As of the Reporting Date, General Motors is the only Significant Manufacturer with respect to the trust. As the trust composition changes, additional, different or no motor vehicle manufacturers may constitute a Significant Manufacturer. A bankruptcy event relating to any motor vehicle manufacturer that is not a Significant Manufacturer or that is not part of a bankruptcy event with respect to a Majority of Manufacturers will not trigger an Early Amortization Event. As a result, the Series 2018-2 notes will continue in the Revolving Period even though it may be more difficult for the applicable motor vehicle manufacturer to manufacture and sell new vehicles and may impair Ally Bank’s ability to generate new receivables. See “Risk Factors—The Trust Is Dependent Primarily on Ally Bank to Generate New Receivables; Without New Receivables, the Trust May Be Unable to Make Payments on the Notes.” |

| |

Labor Disruptions or a Strike Could Negatively Impact the Origination of New Receivables and Any Payments on the Series 2018-2 Notes | | Labor disruptions or a strike with regards to General Motors, Fiat Chrysler or other motor vehicle manufacturers could negatively impact Ally Bank’s ability to generate new receivables and, if prolonged, could adversely affect the business prospects of the applicable motor vehicle manufacturers, the related dealers and Ally Bank. See “Risk Factors—The Trust Is Dependent Primarily on Ally Bank to Generate New Receivables; Without New Receivables, the Trust May Be Unable to Make Payments on the Notes,” and “Risk Factors—If a Manufacturer Files for Bankruptcy You Could Experience Reductions and Delays in Payments on the Series 2018-2 Notes” and “Risk Factors—Certain Reorganizations of a Motor Vehicle Manufacturer Under the Federal Bankruptcy Code Will Not Cause an Early Amortization Event for the Series 2018-2 Notes.” |

| |

Additions and Removals of Accounts Could Lead to Delays or Reductions in Payments on the Series 2018-2 Notes | | As described under “The Transfer and Servicing Agreements—Addition and Removal of Accounts,” accounts will be added to and removed from the pool of accounts from time to time. As a result of these additions and removals, the characteristics of the pool of accounts, including credit quality, may change. If the composition of the pool of accounts is not of the same credit quality as previously designated accounts, then delays and reductions in payments on the Series 2018-2 notes could result. |

| |

The Ratings on the Offered Notes Are Not Recommendations; They May Change or Be Withdrawn | | The depositor expects to hire at least one nationally recognized statistical rating organization, or “NRSRO,” to rate the offered notes. The offered notes may receive a rating from a rating agency not hired to rate the offered notes. A security rating is not a recommendation to buy, sell or hold the offered notes. The rating considers only the likelihood that the trust will pay interest on time and |

15

| | |

| |