Gulf South Bank Conference Presentation Exhibit 99.1

Forward-Looking Statements This presentation and oral statements made regarding the subject of this presentation contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “estimates,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans, “seeks,” and variations of such words and similar expressions are intended to identify such forward-looking statements which are not statements of historical fact. These statements are based on current expectations, estimates, forecasts and projections and management assumptions about the future performance of Spirit of Texas Bancshares, Inc. (“Spirit,” “STXB,” “we,” “us,” or “our”), as well as the businesses and markets in which we operate. These forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to assess. Factors that could cause our actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements include, among others: (1) the possibility that any of the anticipated benefits of Spirit’s recent acquisition of First Beeville Financial Corporation and The First National Bank of Beeville (together, “Beeville”) will not be realized or will not be realized within the expected time period; (2) the businesses of Spirit and Beeville may not be combined successfully, or such combination may take longer to accomplish than expected; (3) the cost savings from the Beeville acquisition may not be fully realized or may take longer to realize than expected; (4) operating costs, customer loss and business disruption following the Beeville acquisition, including adverse effects on relationships with employees, may be greater than expected; (5) the integration of the operations of Beeville will be materially delayed or will be more costly or difficult than expected; (6) our acquisition and integration of Beeville may continue to occupy management’s time and resources; (7) adverse governmental or regulatory policies may be enacted; (8) the interest rate environment may further compress margins and adversely affect net interest income; (9) continued diversification of assets and adverse changes to credit quality; (10) difficulties associated with achieving expected future financial results; (11) competition from other financial services companies in Spirit’s markets; or (12) an economic slowdown that would adversely affect credit quality and loan originations. For a more complete list and description of such risks and uncertainties, refer to Spirit’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 15, 2019, as well as other filings made by Spirit with the SEC. Copies of such filings are available for download free of charge from the Investor Relations section of Spirit’s website at www.sotb.com. Any forward-looking statement made by Spirit in this presentation speaks only as of the date on which it is made. Factors or events that could cause Spirit’s actual results to differ may emerge from time to time, and it is not possible for Spirit to predict all of them. As such, investors are cautioned not to place undue reliance on forward-looking statements. Except as required under the U.S. federal securities laws and the rules and regulations of the SEC, Spirit disclaims any intention or obligation to update any forward-looking statements after the distribution of this presentation, whether as a result of new information, future events, developments, changes in assumptions or otherwise. This presentation includes industry and trade association data, forecasts and information that Spirit has prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other information publicly available to Spirit, which information may be specific to particular markets or geographic locations. Some data is also based on Spirit’s good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Statements as to Spirit’s market position are based on market data currently available to Spirit. Although Spirit believes these sources are reliable, Spirit has not independently verified the information contained therein. While Spirit is not aware of any misstatements regarding the industry data presented in this presentation, Spirit’s estimate involve risks and uncertainties and are subject to change based on various factors. Similarly, Spirit believes that Spirit’s internal research is reliable, even though such research has not been verified by independent sources.

Experienced Executive Leadership Dean O. Bass Chairman and Chief Executive Officer David M. McGuire President, Director and Chief Lending Officer Founded the Company in 2008 Over 45 years of banking experience Founder, President and Chief Executive Officer of Royal Oaks Bank Former National Bank Examiner for the Office of the Comptroller of the Currency Former Director of the Texas Bankers Association Over 38 years of banking experience Co-Founder, President and Chief Lending Officer of Royal Oaks Bank Former Chief Executive Officer of Sterling Bank’s Fort Bend office Jerry D. Golemon Executive Vice President and Chief Operating Officer Over 39 years of banking experience Former Chief Financial Officer of Bank4Texas Holdings Former Chief Financial Officer, Director and Founder of Texas National Bank Certified Public Accountant Jeffrey A. Powell Executive Vice President and Chief Financial Officer Over 38 years of banking experience Former Chief Financial Officer of Hamilton State Bancshares Former EVP and Chief Accounting Officer for IBERIABANK Corporation Former SVP, Controller and Chief Accounting Officer of Citizens Republic Bancorp Source: Company documents

Banking Strategy and Philosophy Relationship Driven Commercial Banking Leverage Infrastructure to Increase Efficiency Deposit Gathering Focus Targeted Niche Banking Provide a broad array of financial services, primarily to small-to-medium-sized businesses with $3-$30 million in annual revenues, as well as individuals Superior service and personal relationships with customer base Sophisticated credit review process, dedicated senior compliance officers and robust internal and external loan review programs Growth expected to continue without significant additional non-interest expense related to infrastructure and personnel Enhanced treasury management products and services enable the bank to more effectively attract the operating accounts of larger businesses M&A focus on banks with quality core deposits Small Business Administration (“SBA”) Dedicated group of SBA lenders Used as a collateral enhancement One of the top SBA lenders in the state of Texas Foreign National Lending 1-4 single family residential loans to foreign national borrowers Tighter underwriting and lower LTVs than typical 1-4 single family residential loans Source: Company documents and website

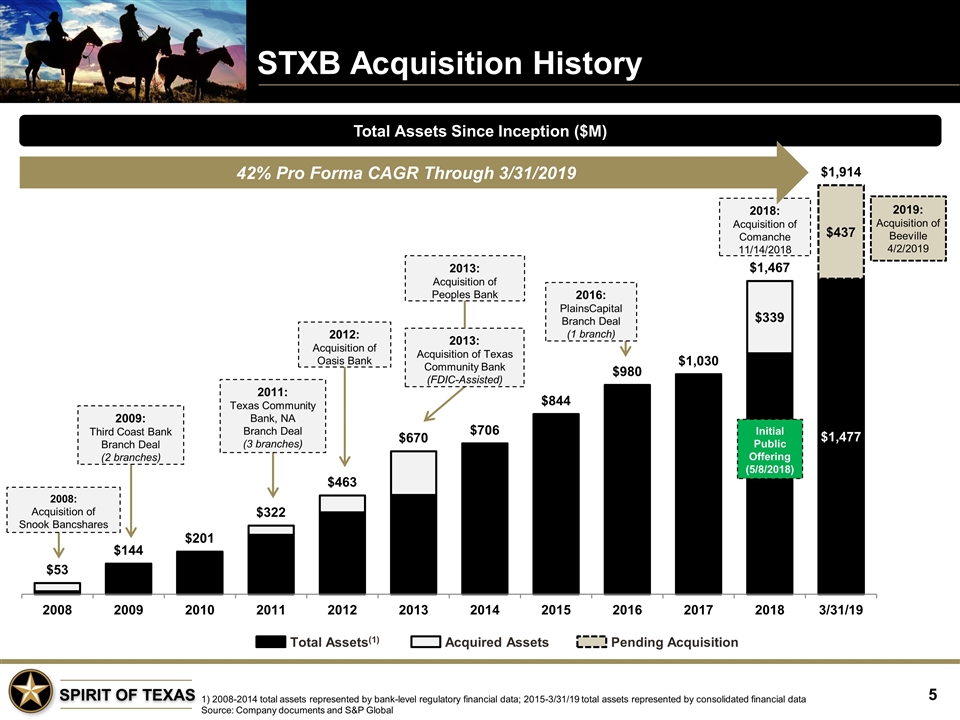

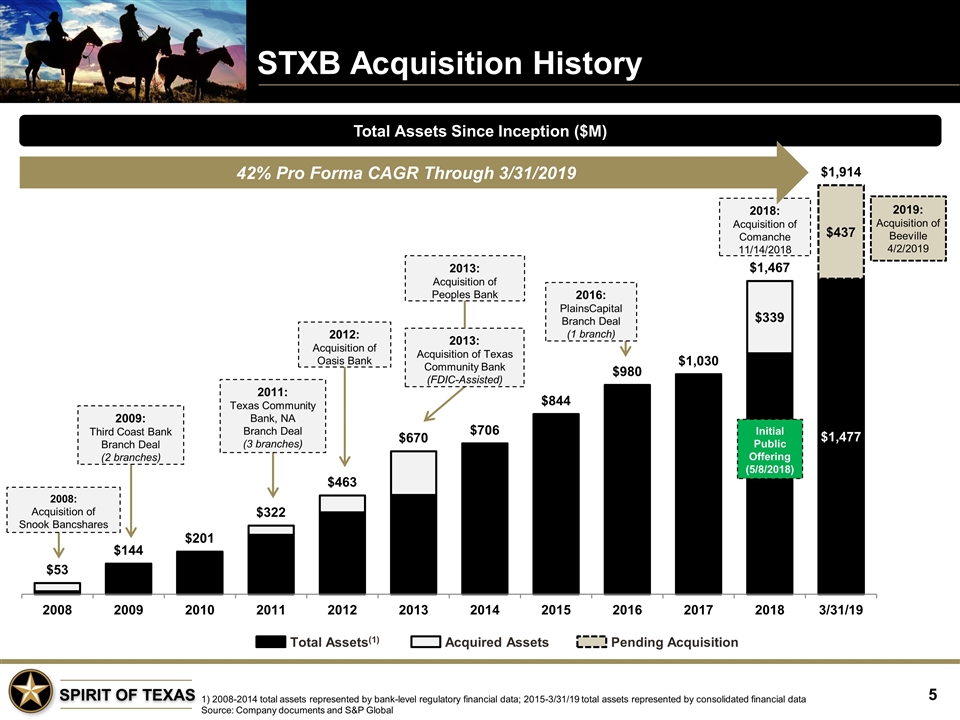

STXB Acquisition History 1) 2008-2014 total assets represented by bank-level regulatory financial data; 2015-3/31/19 total assets represented by consolidated financial data Source: Company documents and S&P Global Total Assets Since Inception ($M) 2008: Acquisition of Snook Bancshares 2009: Third Coast Bank Branch Deal (2 branches) 2011: Texas Community Bank, NA Branch Deal (3 branches) 2012: Acquisition of Oasis Bank 2013: Acquisition of Peoples Bank 2016: PlainsCapital Branch Deal (1 branch) 2013: Acquisition of Texas Community Bank (FDIC-Assisted) 2019: Acquisition of Beeville 4/2/2019 Total Assets(1) Acquired Assets Pending Acquisition 2018: Acquisition of Comanche 11/14/2018 Initial Public Offering (5/8/2018) 42% Pro Forma CAGR Through 3/31/2019

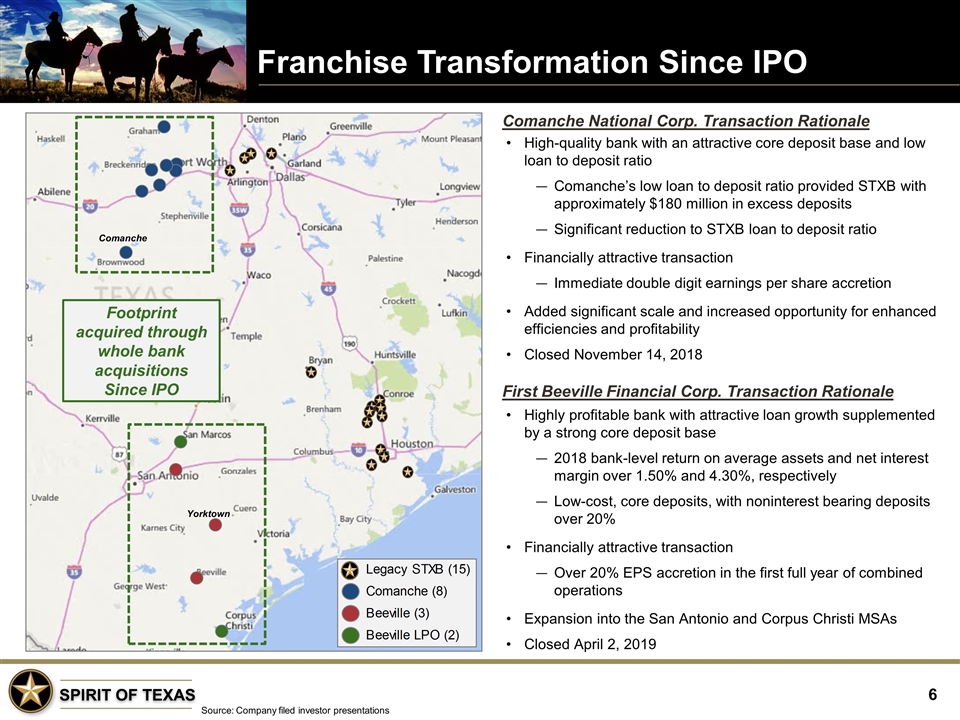

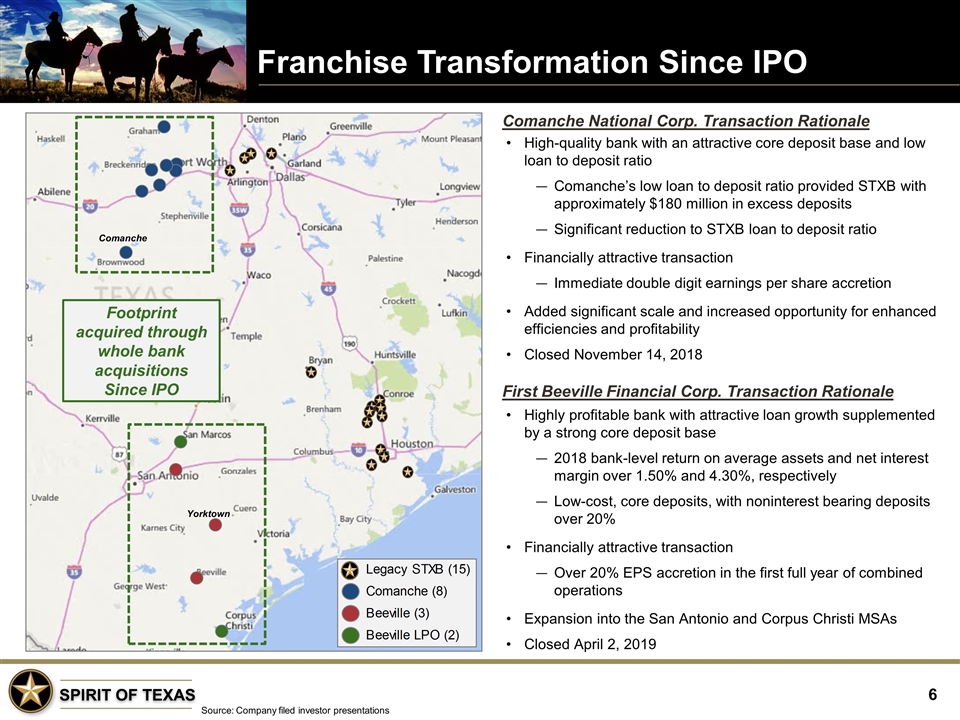

Franchise Transformation Since IPO Source: Company filed investor presentations Footprint acquired through whole bank acquisitions Since IPO Comanche National Corp. Transaction Rationale High-quality bank with an attractive core deposit base and low loan to deposit ratio Comanche’s low loan to deposit ratio provided STXB with approximately $180 million in excess deposits Significant reduction to STXB loan to deposit ratio Financially attractive transaction Immediate double digit earnings per share accretion Added significant scale and increased opportunity for enhanced efficiencies and profitability Closed November 14, 2018 First Beeville Financial Corp. Transaction Rationale Highly profitable bank with attractive loan growth supplemented by a strong core deposit base 2018 bank-level return on average assets and net interest margin over 1.50% and 4.30%, respectively Low-cost, core deposits, with noninterest bearing deposits over 20% Financially attractive transaction Over 20% EPS accretion in the first full year of combined operations Expansion into the San Antonio and Corpus Christi MSAs Closed April 2, 2019 Yorktown Comanche

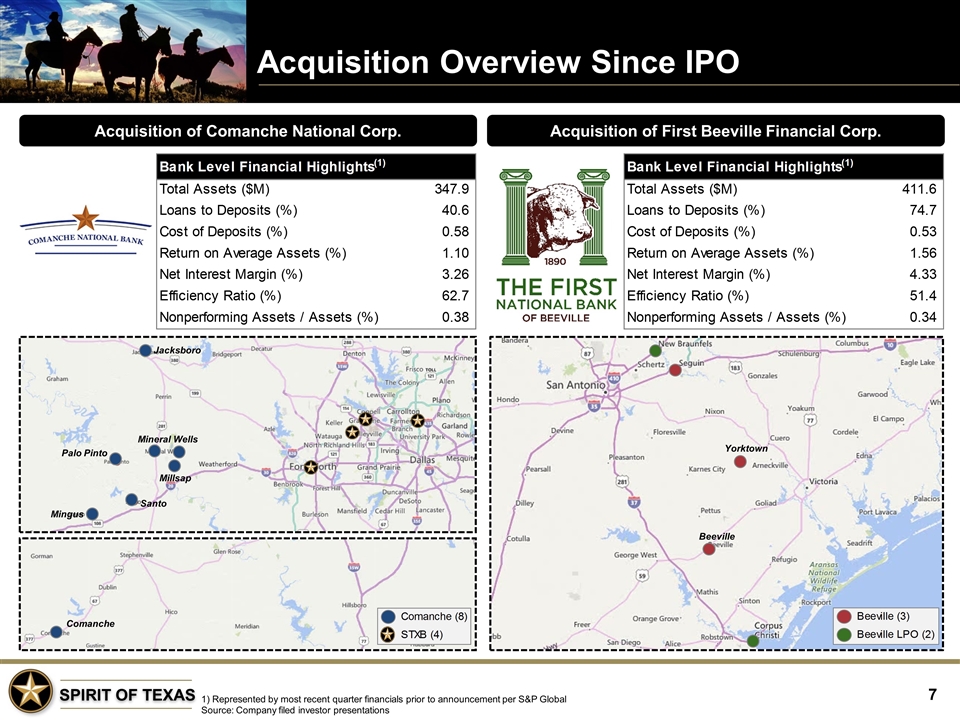

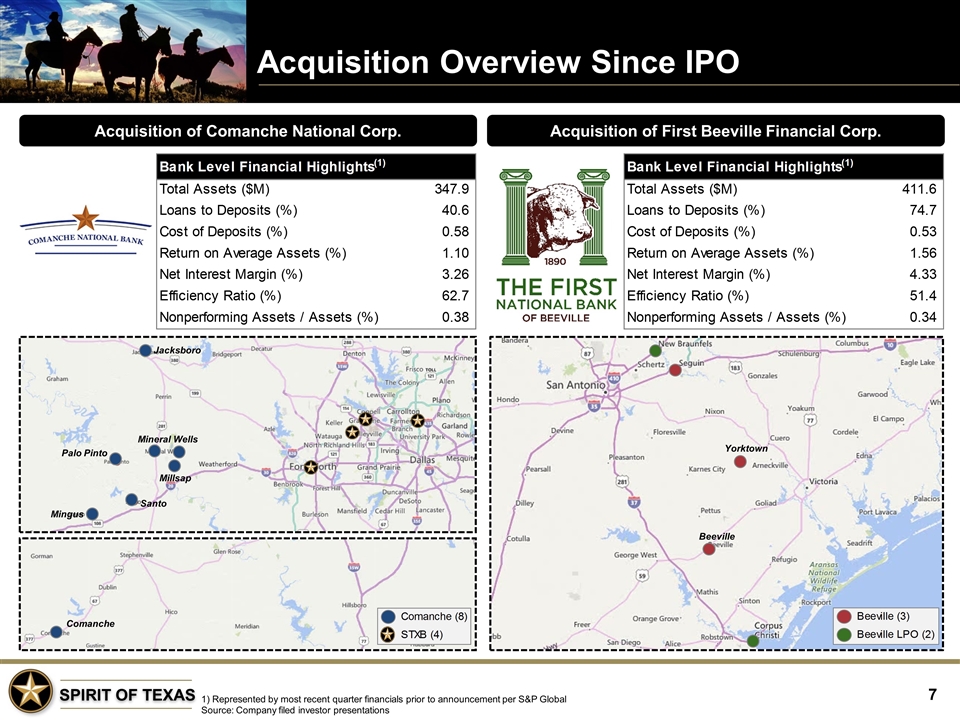

Acquisition Overview Since IPO 1) Represented by most recent quarter financials prior to announcement per S&P Global Source: Company filed investor presentations Acquisition of Comanche National Corp. Acquisition of First Beeville Financial Corp. Jacksboro Palo Pinto Mineral Wells Millsap Santo Mingus Comanche Beeville Yorktown

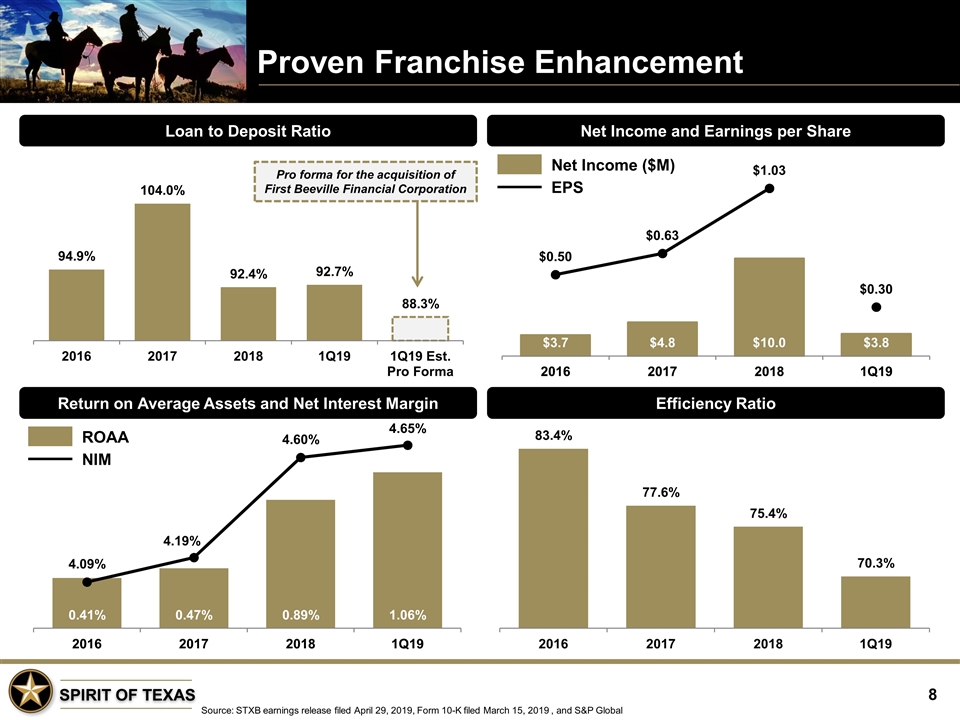

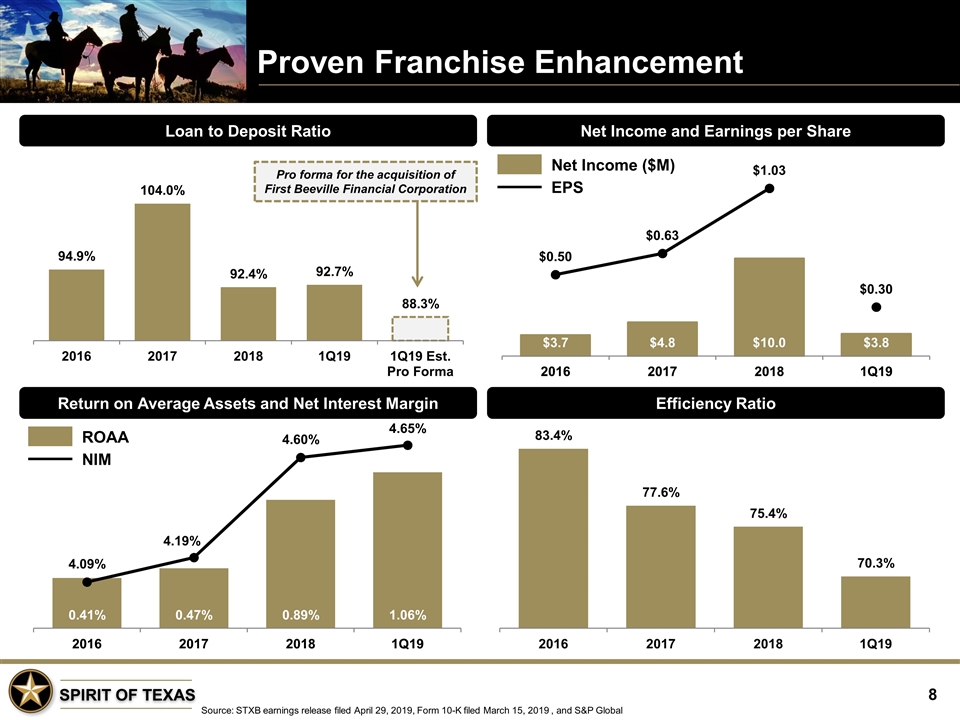

Proven Franchise Enhancement Loan to Deposit Ratio Net Income and Earnings per Share Return on Average Assets and Net Interest Margin Efficiency Ratio Pro forma for the acquisition of First Beeville Financial Corporation NIM ROAA EPS Net Income ($M) Source: STXB earnings release filed April 29, 2019, Form 10-K filed March 15, 2019 , and S&P Global

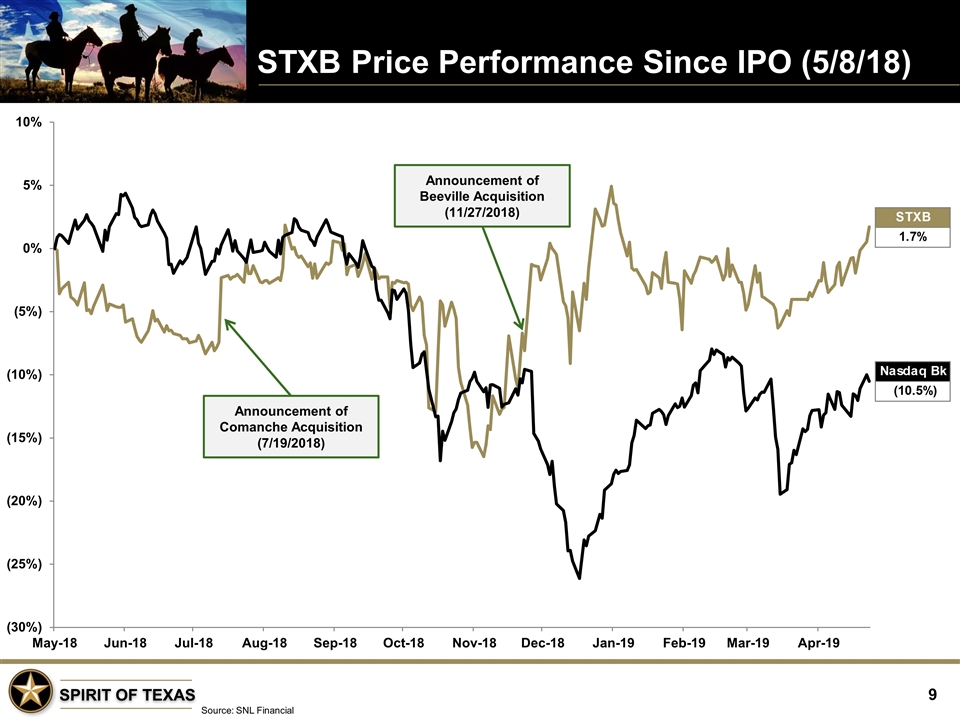

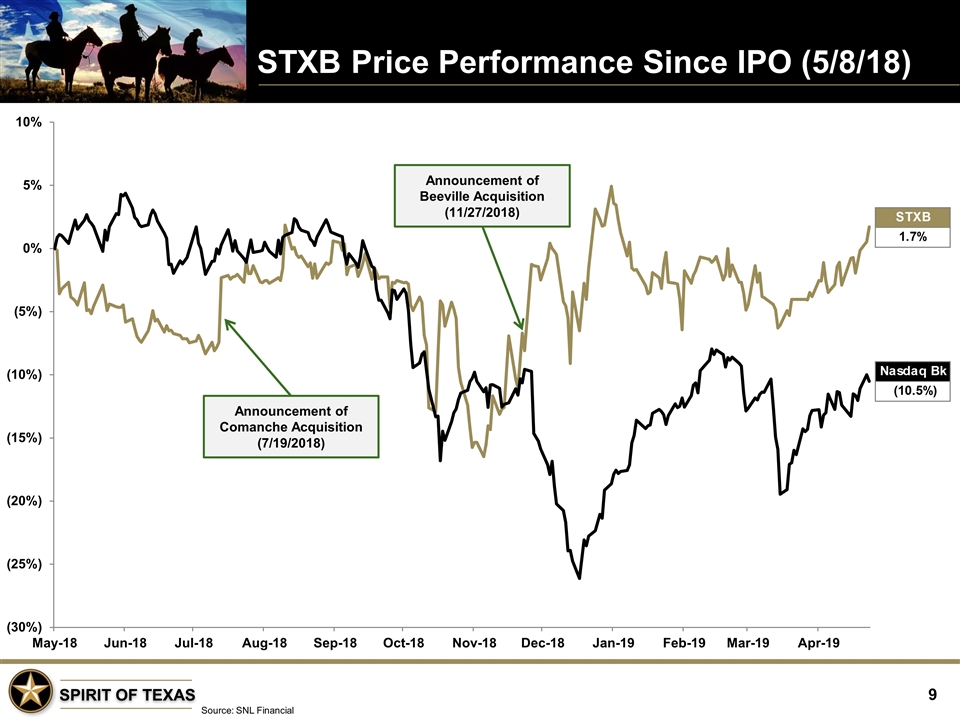

STXB Price Performance Since IPO (5/8/18) Source: SNL Financial Announcement of Comanche Acquisition (7/19/2018) Announcement of Beeville Acquisition (11/27/2018)

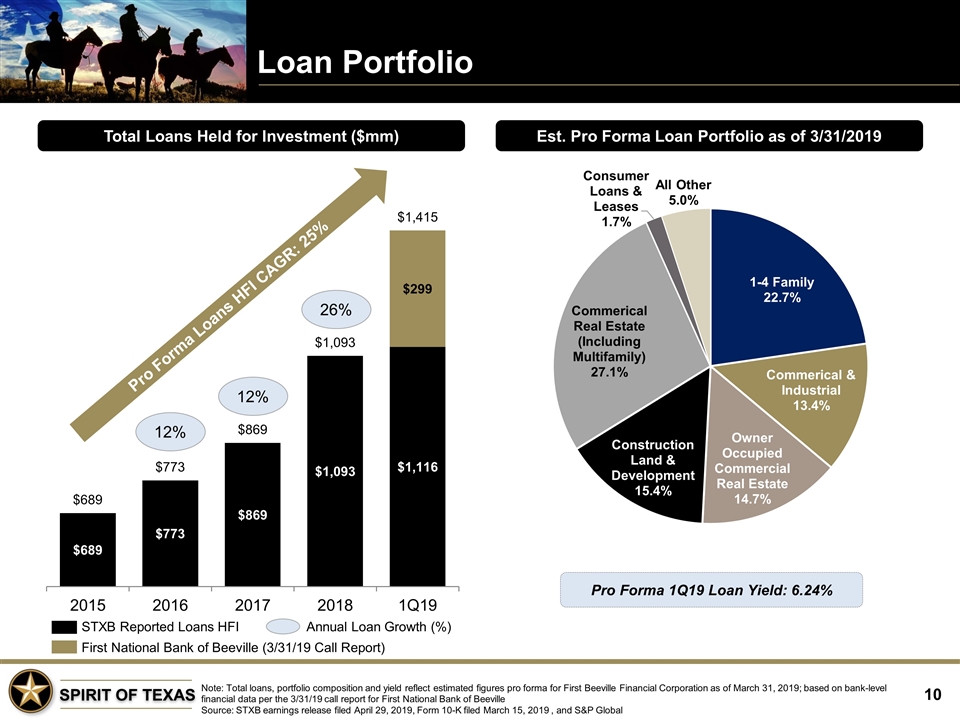

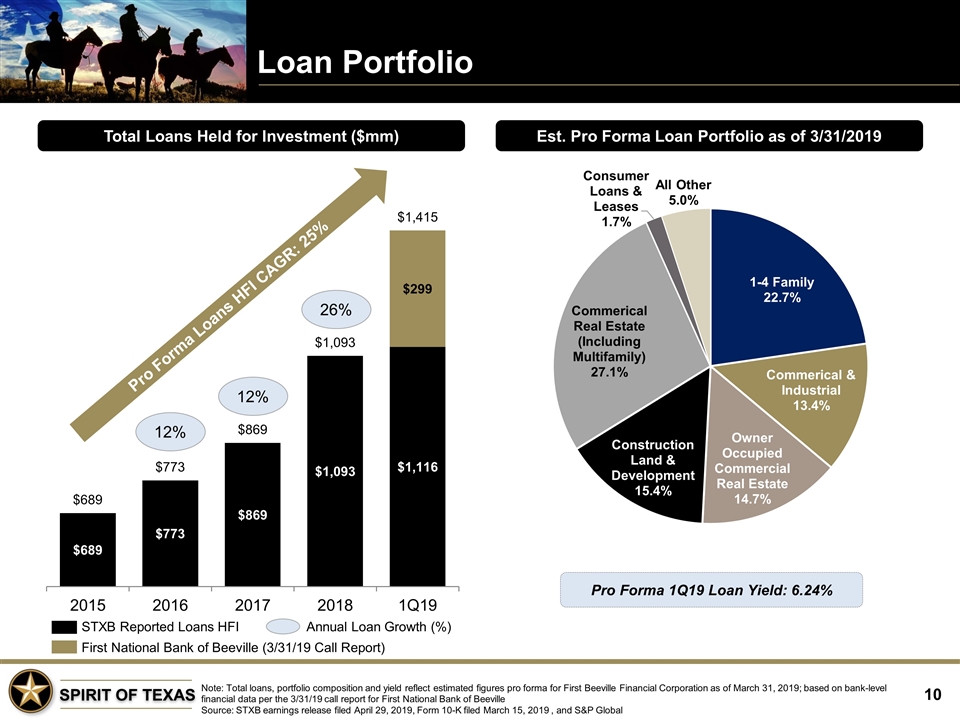

Loan Portfolio Annual Loan Growth (%) Total Loans Held for Investment ($mm) Est. Pro Forma Loan Portfolio as of 3/31/2019 Pro Forma 1Q19 Loan Yield: 6.24% Pro Forma Loans HFI CAGR: 25% STXB Reported Loans HFI Note: Total loans, portfolio composition and yield reflect estimated figures pro forma for First Beeville Financial Corporation as of March 31, 2019; based on bank-level financial data per the 3/31/19 call report for First National Bank of Beeville Source: STXB earnings release filed April 29, 2019, Form 10-K filed March 15, 2019 , and S&P Global 26% 12% 12% First National Bank of Beeville (3/31/19 Call Report)

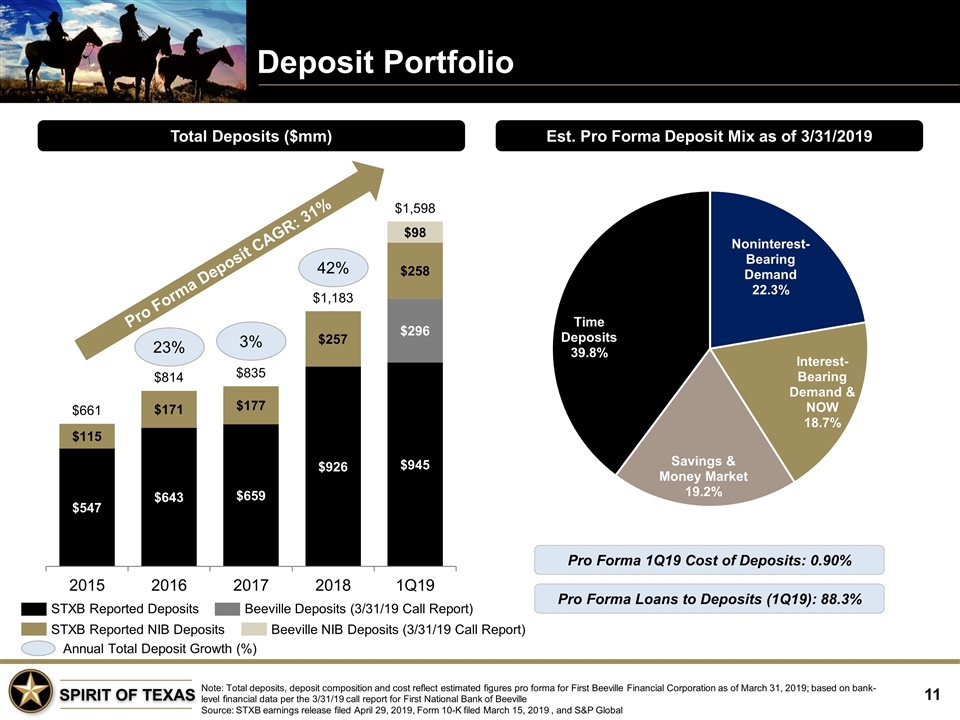

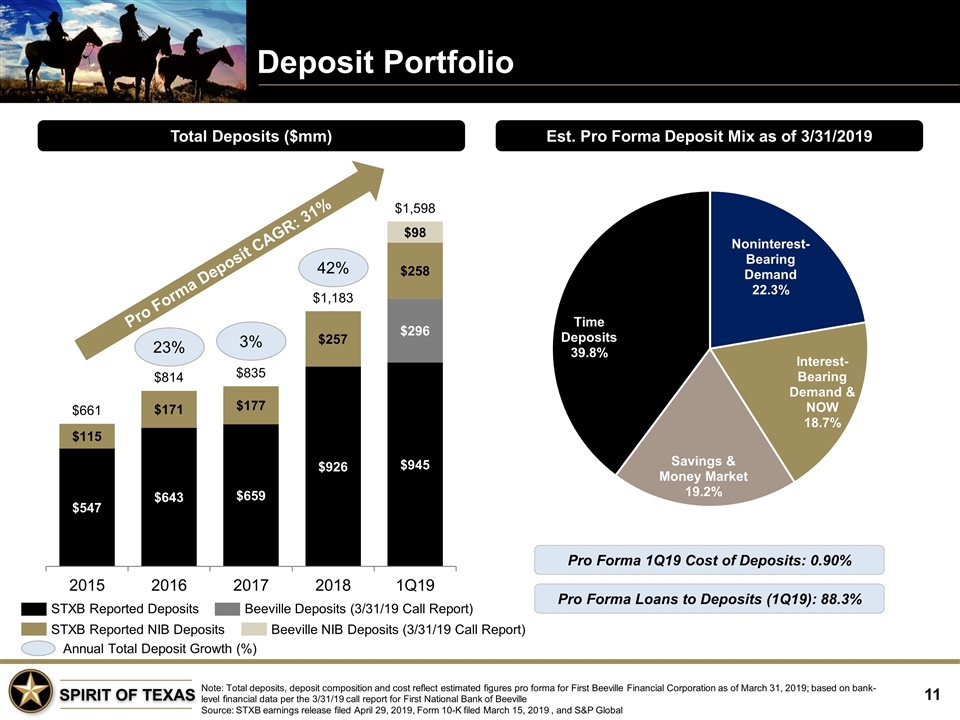

Deposit Portfolio Total Deposits ($mm) Est. Pro Forma Deposit Mix as of 3/31/2019 Pro Forma 1Q19 Cost of Deposits: 0.90% Pro Forma Loans to Deposits (1Q19): 88.3% 42% 3% 23% Pro Forma Deposit CAGR: 31% Annual Total Deposit Growth (%) STXB Reported Deposits STXB Reported NIB Deposits Beeville Deposits (3/31/19 Call Report) Beeville NIB Deposits (3/31/19 Call Report) Note: Total deposits, deposit composition and cost reflect estimated figures pro forma for First Beeville Financial Corporation as of March 31, 2019; based on bank-level financial data per the 3/31/19 call report for First National Bank of Beeville Source: STXB earnings release filed April 29, 2019, Form 10-K filed March 15, 2019 , and S&P Global

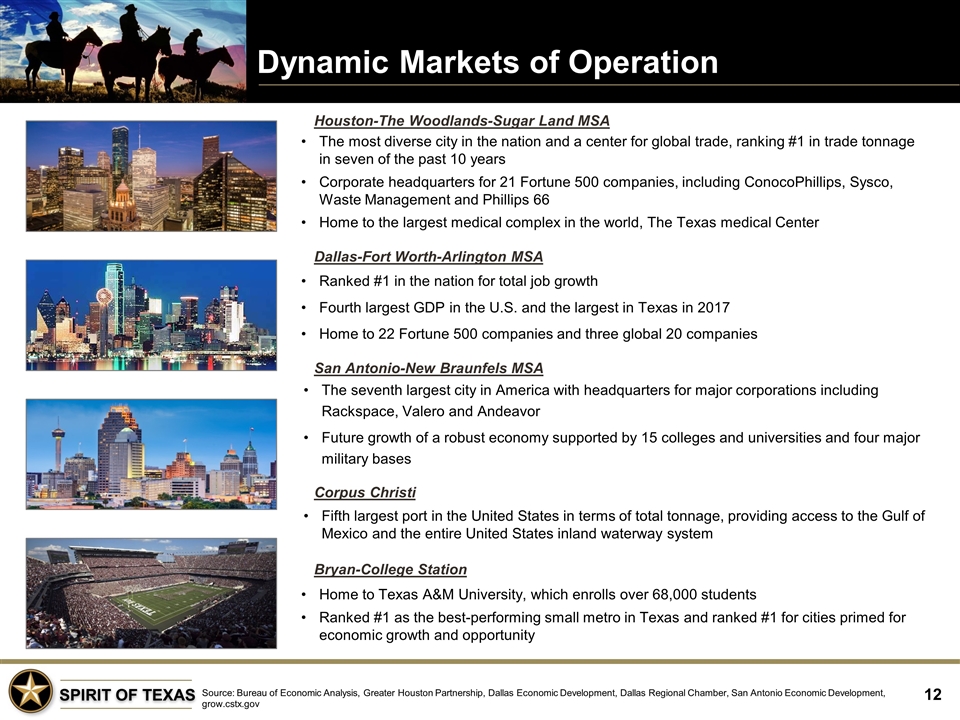

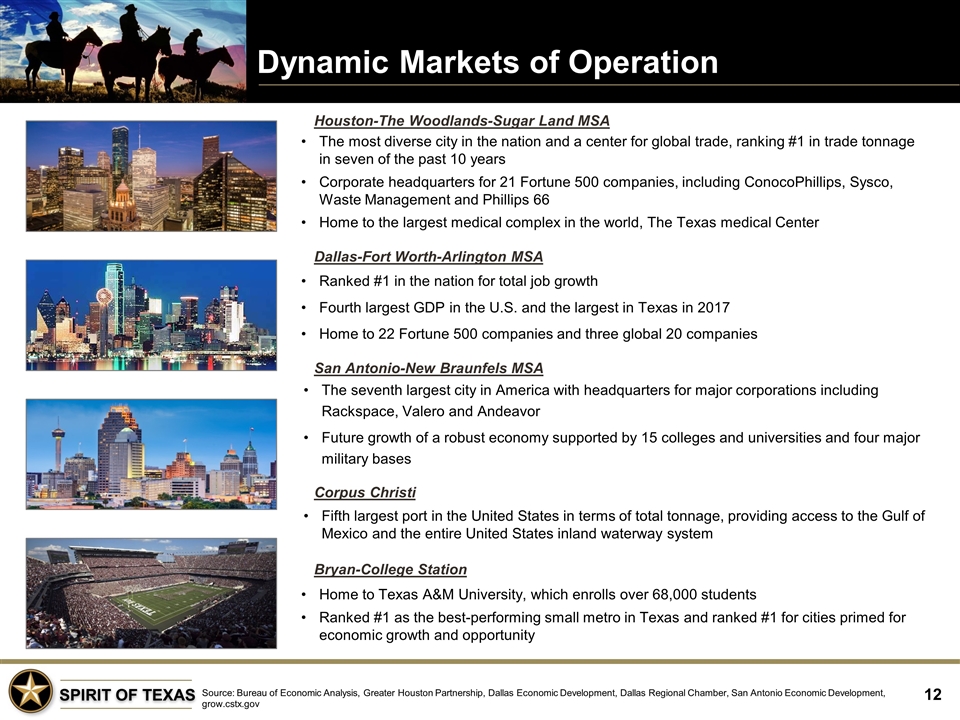

Dynamic Markets of Operation Source: Bureau of Economic Analysis, Greater Houston Partnership, Dallas Economic Development, Dallas Regional Chamber, San Antonio Economic Development, grow.cstx.gov Houston-The Woodlands-Sugar Land MSA Dallas-Fort Worth-Arlington MSA Bryan-College Station The most diverse city in the nation and a center for global trade, ranking #1 in trade tonnage in seven of the past 10 years Corporate headquarters for 21 Fortune 500 companies, including ConocoPhillips, Sysco, Waste Management and Phillips 66 Home to the largest medical complex in the world, The Texas medical Center Ranked #1 in the nation for total job growth Fourth largest GDP in the U.S. and the largest in Texas in 2017 Home to 22 Fortune 500 companies and three global 20 companies Home to Texas A&M University, which enrolls over 68,000 students Ranked #1 as the best-performing small metro in Texas and ranked #1 for cities primed for economic growth and opportunity San Antonio-New Braunfels MSA The seventh largest city in America with headquarters for major corporations including Rackspace, Valero and Andeavor Future growth of a robust economy supported by 15 colleges and universities and four major military bases Corpus Christi Fifth largest port in the United States in terms of total tonnage, providing access to the Gulf of Mexico and the entire United States inland waterway system

Investment Highlights Management Depth and Experience Top four executives each have over 35 years of banking experience Eight senior officers were former presidents of Texas banks Seasoned veterans across all departments Growing and Diverse Markets Texas is the second most populous state in the country, with projected population growth outpacing the U.S. Market diversification helps to reduce the impact of economic swings in specific geographies Acquisition Experience Nine transactions completed since inception – includes whole bank, branch and FDIC-assisted Two whole-bank acquisitions since the Company’s IPO in May of 2018 Loan and Deposit Growth Strong loan growth, with a compound annual growth rate of 25% since 12/31/2015 Enhanced treasury management products and services, coupled with strategic M&A have helped drive demand deposit generation, as evidenced by noninterest bearing deposit compounded annual growth rate of 42% Strong Credit Culture Chief Credit Officer and five Deputy Chief Credit Officers all have over 30 years of experience in credit analysis Average annual net charge offs to average loans from 2016 to 2018 of 12 bps Bank-level nonperforming assets to assets of 0.44% as of 1Q19 Strong Insider Ownership Total executive and board beneficial ownership of approximately 15.0% Source: S&P Global and Form DEF 14A