Filed Pursuant to Rule 424(b)(4)

Registration No. 333-169699

5,800,000 American Depositary Shares

ShangPharma Corporation

Representing 104,400,000 Ordinary Shares

This is our initial public offering. We are offering 3,200,000 American depositary shares, or ADSs, and certain of our shareholders identified in this prospectus are offering an additional 2,600,000 ADSs. Each ADS represents 18 of our ordinary shares, par value $0.001 per share. We will not receive any proceeds from the ADSs sold by the selling shareholders. No public market currently exists for our shares or ADSs.

The initial public offering price of our ADSs is $15.00 per ADS. Our ADSs have been approved for listing on the New York Stock Exchange under the symbol “SHP.”

Investing in our ADSs involves a high degree of risk. See “Risk Factors” beginning on page 11.

| | | | | | | | |

| | | Per ADS | | | Total | |

Public offering price | | $ | 15.00 | | | $ | 87,000,000 | |

Underwriting discounts and commissions | | $ | 1.05 | | | $ | 6,090,000 | |

Proceeds, before expenses, to ShangPharma Corporation | | $ | 13.95 | | | $ | 44,640,000 | |

Proceeds, before expenses, to the selling shareholders | | $ | 13.95 | | | $ | 36,270,000 | |

The selling shareholders have granted the underwriters a 30-day option to purchase up to 870,000 additional ADSs at the initial public offering price less underwriting discounts and commissions.

Delivery of our ADSs will be made on or about October 22, 2010.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | |

| Citi | | J.P. Morgan |

| |

| William Blair & Company | | Oppenheimer & Co. |

The date of this prospectus is October 18, 2010.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any related free writing prospectus that we have filed with the Securities and Exchange Commission, or the SEC. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to offer and sell these securities. Unless otherwise indicated, the information in this document may only be accurate as of the date of this document.

We have not taken any action to permit a public offering of the ADSs outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the ADSs and the distribution of the prospectus outside the United States.

Through and including November 12, 2010, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

PROSPECTUS SUMMARY

You should read the following summary together with the entire prospectus, including the more detailed information regarding us, the ADSs being sold in this offering, and our consolidated financial statements and related notes appearing elsewhere in this prospectus. You should consider carefully, among other things, the matters discussed in the section entitled “Risk Factors.” This summary and other sections of this prospectus contain information from a report, referred to in this prospectus as the Frost & Sullivan Report, which we commissioned Frost & Sullivan, an independent market research firm, to provide information on the industry in which we operate, including our market position in that industry.

Our Company

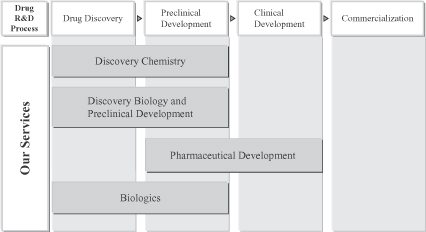

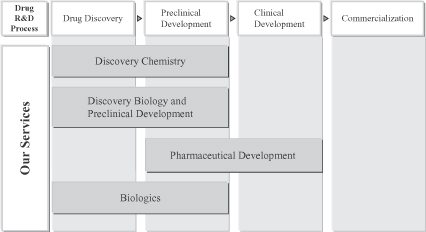

We are a leading China-based pharmaceutical and biotechnology research and development, or R&D, outsourcing company. We provide a broad range of high-quality, integrated services across the drug discovery and development process to international and Chinese pharmaceutical and biotechnology companies. Our services consist of discovery chemistry, discovery biology and preclinical development, pharmaceutical development and biologics services. We offer our services on a full-time-equivalent, or FTE, basis or a fee-for-service basis. Capitalizing on our broad service offerings, the experience and expertise of our skilled scientists and our state-of-the-art facilities and equipment, we help our customers discover and develop novel drug candidates efficiently. We have a diversified and loyal global customer base. We provide services to over 100 customers, including all of the top ten pharmaceutical and biotechnology companies in the world in terms of 2009 revenues ranked by Frost & Sullivan and a number of fast-growing biotechnology and specialty pharmaceutical companies, as well as renowned academic and research institutions in the U.S. and China. Most of our customers return to us for additional and often larger projects, and all of our top ten customers in each of 2008 and 2009 remain our customers in 2010.

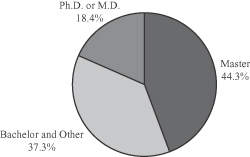

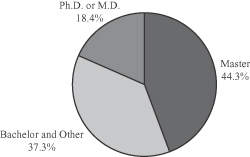

Our experienced and strong R&D team contributes significantly to our market leadership. We have successfully grown our scientific research staff from 988 as of December 31, 2007 to 1,525 as of June 30, 2010. Over 60% of our scientific research staff have post-graduate degrees, including many native Chinese scientists and managers who have returned to China after studying or working overseas with experience in global pharmaceutical and biotechnology companies and knowledge of Western business practices. These Western-educated native Chinese who have returned to China are commonly referred to as returnees. Based in China and headquartered in Shanghai, we are well-positioned to attract a large number of returnees and benefit from an abundant supply of highly skilled, domestically-trained scientific talent in China. We attract, retain and motivate our employees through a comprehensive training and career development program and equity incentive plans.

We conduct our laboratory activities in four primary facilities in China: (i) an approximately 450,000 square-foot laboratory and headquarters in Shanghai Zhangjiang Hi-Tech Park; (ii) an approximately 13,000 square-foot AAALAC-accredited animal facility in Shanghai Zhangjiang Hi-Tech Park; (iii) an approximately 36,000 square-foot R&D center in Chengdu; and (iv) an approximately 28,000 square-foot manufacturing facility in Nanhui, Shanghai. In addition, we are constructing an approximately 460,000 square-foot cGMP-quality multi-purpose manufacturing facility in Fengxian, Shanghai, designed to manufacture advanced intermediates and active pharmaceutical ingredients, or APIs, for preclinical testing and clinical trials. We are also constructing an approximately 150,000 square-foot laboratory services building in Fengxian, Shanghai primarily for pharmaceutical development services. Our strategic location in China provides us many advantages, including relatively low-cost labor, developed infrastructure and favorable government incentives as well as a large talent pool.

1

We have experienced significant growth in recent years. Our net revenues increased from $34.7 million in 2007 to $60.5 million in 2008 and $72.3 million in 2009, representing a compound annual growth rate, or CAGR, of 44.4%, and increased by 27.2% from $32.7 million in the six months ended June 30, 2009 to $41.6 million in the six months ended June 30, 2010. The number of our customers increased from 71 in 2007 to 99 in 2008, 134 in 2009 and 151 in the six months ended June 30, 2010. Our net income increased from $7.5 million in 2007 to $9.1 million in 2008 and $9.8 million in 2009, and increased from $4.6 million in the six months ended June 30, 2009 to $6.9 million in the six months ended June 30, 2010.

In 2008, 2009 and the nine months ended September 30, 2010, our founders granted restricted share units, or RSUs, convertible to 7,450,000, 2,100,000 and 2,200,000 ordinary shares, respectively, to certain members of our senior management and other employees under the Founder’s 2008 Equity and Performance Incentive Plan, or the Founder’s Plan. We have not recorded any share-based compensation expense in connection with these RSU grants because one of the vesting conditions for the RSUs is the completion of our initial public offering. As a result, immediately upon completion of this offering, we expect to incur a significant share-based compensation charge of approximately $2.5 million, which will materially and adversely affect our results of operations for the quarter in which this offering is completed.

Our Services

We provide a broad range of high-quality, integrated services across the drug discovery and development process to help international and Chinese pharmaceutical and biotechnology companies discover and develop novel drug candidates efficiently. Our service offerings include the following:

| | • | | discovery chemistry, consisting primarily of medicinal chemistry, synthetic chemistry, library generation and analytical chemistry; |

| | • | | discovery biology and preclinical development, consisting primarily of assay development and high throughput screening, pharmacology, reagent generation, DMPK, ADME profiling, metabolite identification, bioanalytical services and non-GLP toxicology; |

| | • | | pharmaceutical development, consisting primarily of preformulation and formulation, process R&D, analytical development and research manufacturing; and |

| | • | | biologics, consisting primarily of therapeutic antibody generation, antibody optimizing and engineering, and analytical services for large molecules. |

We believe our customers value our ability to offer a wide range of quality services to meet their drug R&D needs, and we expect to expand our service offerings along the drug discovery and development value chain.

Our Industry

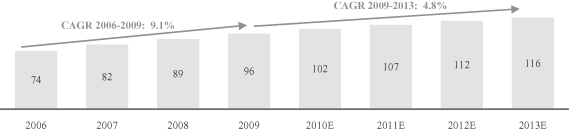

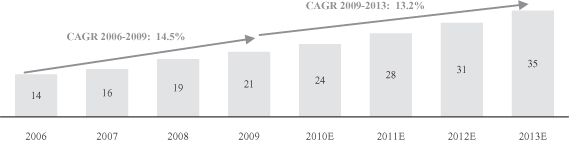

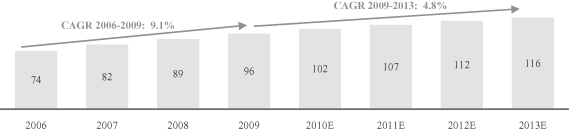

The global contract research organization, or CRO, industry has grown significantly in recent years and is expected to continue to expand, driven primarily by the ability of CROs to contain costs, provide increased flexibility, deliver a broad service platform and reduce time to market.

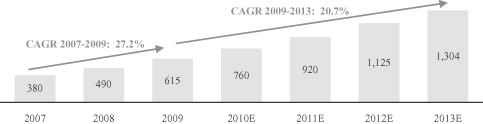

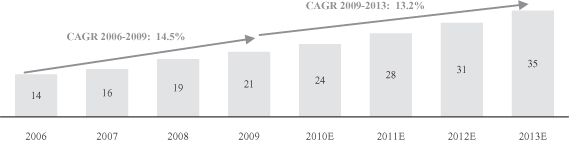

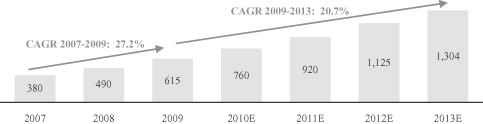

Outsourcing to emerging countries such as China has increased in recent years. According to Frost & Sullivan, the Chinese CRO market grew at a CAGR of 27.2% from $380 million in 2007 to $615 million in 2009, and is projected to grow at a CAGR of 20.7% to $1.3 billion in 2013. The principal growth drivers include lower-cost and high-quality services, a large talent pool, the increasing breath of R&D service offerings, a large supply of treatment naive patients, a growing domestic pharmaceutical market and strong government support.

2

Our Strengths and Strategies

We believe that the following strengths contribute to our success and differentiate us from our competitors:

| | • | | leading market position with proven track record; |

| | • | | seasoned management and experienced R&D team; |

| | • | | integrated service platform with comprehensive service offerings; |

| | • | | loyal and diversified global customer base; |

| | • | | efficient service provider with competitive cost structure; and |

| | • | | state-of-the-art facilities with flexible and scalable capacities. |

We aim to become one of the world’s leading pharmaceutical and biotechnology R&D outsourcing companies. To achieve this, we intend to pursue the following strategies:

| | • | | broaden our service offerings and enhance our service capabilities; |

| | • | | maintain and expand our customer base; |

| | • | | attract, train and retain scientific talent; |

| | • | | enhance our operating efficiency; and |

| | • | | selectively evaluate and pursue strategic alliance and acquisition opportunities. |

Our Challenges

We expect to face risks and uncertainties related to our ability to:

| | • | | attract, train, motivate and retain skilled scientists; |

| | • | | diversify our customer base and adapt to potential loss of sales to, or significant reduction in orders from, any of our major customers; |

| | • | | adapt our business to industry trends, such as fluctuations in the R&D budgets of pharmaceutical and biotechnology industry participants; |

| | • | | protect the intellectual property rights of our customers; |

| | • | | comply with applicable regulations and industry standards; |

| | • | | compete effectively in our industry, which may subject us to increasing pricing pressure and reduce the demand for our services; |

| | • | | expand and market our services and manage our growth; and |

| | • | | develop and maintain effective internal control over financial reporting. |

See “Risk Factors” for a detailed discussion of these and other risks that we face.

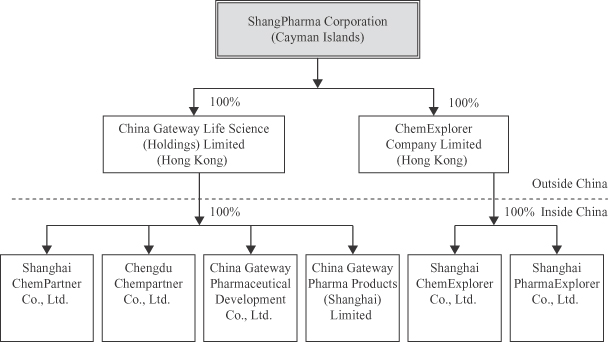

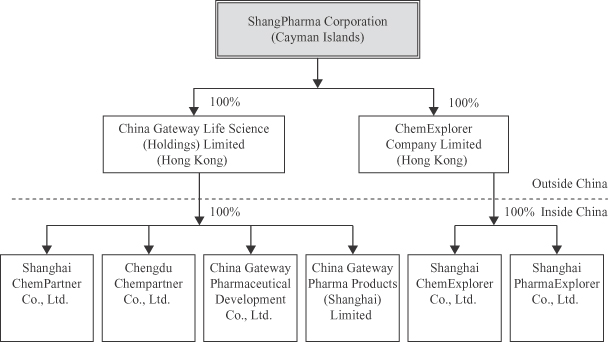

Corporate History and Structure

We are a Cayman Islands holding company and conduct substantially all of our business through our operating subsidiaries in China. We commenced operations in China in 2002 and established ShangPharma

3

Corporation as an offshore holding company in the Cayman Islands on August 30, 2007. We own 100% of all of our operating subsidiaries in China through two wholly-owned companies incorporated in Hong Kong, China Gateway Life Science (Holdings) Limited and ChemExplorer Company Limited.

The following diagram illustrates our corporate structure and the place of formation of our principal subsidiaries as of the date of this prospectus.

Our Corporate Information

Our principal executive offices are located at No. 5 Building, 998 Halei Road, Zhangjiang Hi-Tech Park, Pudong New Area, Shanghai, 201203, People’s Republic of China. Our telephone number at this address is (86-21) 5132-0088. Our registered office in the Cayman Islands is located at Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our agent for service of process in the United States is Law Debenture Corporate Services Inc. located at 400 Madison Avenue, 4th Floor, New York, New York 10017.

Investors should submit any inquiries to the address and telephone number of our principal executive offices. Our main website iswww.shangpharma.com. The information contained on our website is not a part of this prospectus.

4

Conventions That Apply to This Prospectus

Unless we indicate otherwise, all information in this prospectus assumes no exercise by the underwriters of their option to purchase up to 870,000 additional ADSs representing 15,660,000 ordinary shares from the selling shareholders.

Except where the context otherwise requires and for purposes of this prospectus only:

| | • | | “we,” “us,” “our company,” “our” and “ShangPharma” refer to ShangPharma Corporation, a Cayman Islands company, and its subsidiaries; |

| | • | | “ADSs” refers to our American depositary shares, each of which represents 18 ordinary shares, and “ADRs” refers to American depositary receipts, which, if issued, evidence our ADSs; |

| | • | | “China” or the “PRC” refer to the People’s Republic of China excluding, for the purpose of this prospectus only, Hong Kong, Macau and Taiwan; |

| | • | | “RMB” or “Renminbi” refers to the legal currency of China and “$,” “dollar,” “US$” or “U.S. dollar” refers to the legal currency of the United States; and |

| | • | | “shares” or “ordinary shares” refers to our ordinary shares, par value $0.001 per share, and “preferred shares” refers to our Series A convertible preferred shares, par value $0.001 per share. |

5

The Offering

The following assumes that the underwriters will not exercise their option to purchase additional ADSs in the offering, unless otherwise indicated.

ADSs offered by us | 3,200,000 ADSs |

ADSs offered by the selling shareholders | 2,600,000 ADSs |

Offering price | $15.00 per ADS. |

ADSs outstanding immediately after this offering | 5,800,000 ADSs |

Ordinary shares outstanding immediately after this offering | 335,600,000 shares |

The ADSs | Each ADS represents 18 ordinary shares, par value $0.001 per share. |

The depositary will be the holder of the ordinary shares underlying your ADSs and you will have rights as provided in the deposit agreement.

Although we do not expect to pay dividends in the foreseeable future, if we declare dividends on our ordinary shares, the depositary will pay you the cash dividends and other distributions it receives on our ordinary shares, after deducting fees of up to $0.05 per ADS per distribution and expenses.

In addition, the depositary may charge a fee of up to $0.05 per ADS per calendar year (or portion thereof) for services it performs in administering the ADSs (which may be charged on a periodic basis during each calendar year and shall be assessed against holders of ADSs as of the record date or record dates set by the depositary during each calendar year).

| | You may surrender your ADSs to the depositary along with the ADS cancellation fees of $0.05 per ADS and receive the ordinary shares underlying your ADSs. |

We may amend or terminate the deposit agreement without your consent, and if you continue to hold your ADSs, you agree to be bound by the deposit agreement as amended.

You should carefully read the section in this prospectus entitled “Description of American Depositary Shares” to better understand the terms of the ADSs. You should also read the deposit agreement,

6

| | which is an exhibit to the registration statement that includes this prospectus. |

Listing | Our ADSs have been approved for listing on the New York Stock Exchange under the symbol “SHP.” Our ADSs and shares will not be listed on any other exchange or quoted for trading on any other automated quotation system. |

Option to purchase additional ADSs | The selling shareholders have granted to the underwriters an option, exercisable within 30 days from the date of this prospectus, to purchase up to an aggregate of 870,000 additional ADSs. |

Use of proceeds | Our net proceeds from this offering are expected to be approximately $41.0 million, after deducting underwriting discounts and commissions and the estimated offering expenses payable by us. We will not receive any proceeds from the ADSs sold by the selling shareholders. We anticipate using the net proceeds as follows: |

| | • | | approximately $15.0 million for the construction of our manufacturing facility and laboratory services building in Fengxian, Shanghai; |

| | • | | approximately $15.0 million for the purchase of equipment; |

| | • | | approximately $5.0 million for the expansion of our service offerings; |

| | • | | approximately $5.0 million for working capital needs; and |

| | • | | the balance for other general corporate purposes, including potential acquisitions (although we are not currently negotiating any such acquisitions). |

Depositary | JPMorgan Chase Bank, N.A. |

Risk factors | See “Risk Factors��� and other information included in this prospectus for a discussion of risks you should carefully consider before investing in the ADSs. |

Lock-up | We, all of our directors, executive officers and existing shareholders, and certain holders of options and RSUs, have agreed with the underwriters not to sell, transfer or otherwise dispose of any of our ordinary shares or ADSs representing our ordinary shares for 180 days after the date of this prospectus. See “Underwriting.” |

The number of ordinary shares that will be outstanding immediately after this offering:

| | • | | assumes the conversion of all outstanding preferred shares into 69,994,014 ordinary shares immediately prior to the completion of this offering; |

7

| | • | | excludes 36,046,200 ordinary shares issuable upon the exercise of options outstanding as of September 30, 2010 under our 2008 equity and performance incentive plan, as amended and restated on February 24, 2010, or the Plan, at a weighted average exercise price of approximately $0.55 per share; and |

| | • | | excludes 516,158 ordinary shares reserved for future issuance under the Plan. |

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The following summary consolidated statements of operations data for the years ended December 31, 2007, 2008 and 2009 and the summary consolidated balance sheet data as of December 31, 2008 and 2009 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The following summary consolidated statement of operations data for the six months ended June 30, 2009 and 2010 and the summary consolidated balance sheet data as of June 30, 2010 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus and have been prepared on the same basis as our audited consolidated financial statements. Our historical results do not necessarily indicate our expected results for any future periods. You should read this Summary Consolidated Financial Data together with our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Our consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended

June 30, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2009 | | | 2010 | |

| | | (in millions of $, except for share, per share and per ADS data) | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net revenues | | | 34.7 | | | | 60.5 | | | | 72.3 | | | | 32.7 | | | | 41.6 | |

Cost of revenues | | | (22.8 | ) | | | (40.5 | ) | | | (48.4 | ) | | | (21.8 | ) | | | (27.2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 11.9 | | | | 20.0 | | | | 23.9 | | | | 10.9 | | | | 14.4 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Selling and marketing | | | (0.5 | ) | | | (0.8 | ) | | | (1.7 | ) | | | (0.7 | ) | | | (1.1 | ) |

General and administrative | | | (4.0 | ) | | | (9.3 | ) | | | (12.0 | ) | | | (5.6 | ) | | | (6.9 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | (4.5 | ) | | | (10.1 | ) | | | (13.7 | ) | | | (6.3 | ) | | | (8.0 | ) |

| | | | | | | | | | | | | | | | | | | | |

Profit from operations | | | 7.4 | | | | 9.9 | | | | 10.2 | | | | 4.6 | | | | 6.4 | |

Interest income | | | 0.2 | | | | 0.2 | | | | * | | | | * | | | | * | |

Interest expense | | | — | | | | — | | | | — | | | | — | | | | * | |

Other income | | | 0.2 | | | | 0.9 | | | | 1.3 | | | | 0.8 | | | | 1.6 | |

Other expenses | | | (0.1 | ) | | | (1.6 | ) | | | (0.2 | ) | | | (0.1 | ) | | | (0.2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income from operations before income taxes | | | 7.7 | | | | 9.4 | | | | 11.4 | | | | 5.3 | | | | 7.8 | |

Income taxes | | | (0.2 | ) | | | (0.3 | ) | | | (1.6 | ) | | | (0.7 | ) | | | (0.9 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation | | | 7.5 | | | | 9.1 | | | | 9.8 | | | | 4.6 | | | | 6.9 | |

Allocation to preferred shareholders | | | (0.7 | ) | | | (2.3 | ) | | | (2.5 | ) | | | (1.2 | ) | | | (1.8 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation’s ordinary shareholders | | | 6.8 | | | | 6.8 | | | | 7.3 | | | | 3.4 | | | | 5.1 | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation’s ordinary shareholders per share | | | | | | | | | | | | | | | | | | | | |

Basic | | | 0.03 | | | | 0.03 | | | | 0.04 | | | | 0.02 | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 0.03 | | | | 0.03 | | | | 0.04 | | | | 0.02 | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation’s ordinary shareholders per ADS(1) | | | | | | | | | | | | | | | | | | | | |

Basic | | | 0.59 | | | | 0.59 | | | | 0.63 | | | | 0.30 | | | | 0.44 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 0.59 | | | | 0.59 | | | | 0.63 | | | | 0.30 | | | | 0.44 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Weighted average ordinary shares outstanding(2) | �� | | | | | | | | | | | | | | | | | | | |

Basic | | | 208,005,986 | | | | 208,005,986 | | | | 208,005,986 | | | | 208,005,986 | | | | 208,005,986 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 230,381,122 | | | | 278,000,000 | | | | 278,051,299 | | | | 278,000,000 | | | | 210,362,840 | |

| | | | | | | | | | | | | | | | | | | | |

Pro forma earnings per share attributable to ShangPharma Corporation’s ordinary shareholders (unaudited)(3) | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | 0.04 | | | | | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | | | | | | | | | 0.04 | | | | | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Pro forma weighted average ordinary shares outstanding (unaudited)(2) (3) (4) | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | 278,000,000 | | | | | | | | 278,000,000 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | | | | | | | | | 278,051,299 | | | | | | | | 280,356,854 | |

| | | | | | | | | | | | | | | | | | | | |

9

| (1) | Each ADS represents 18 ordinary shares. |

| (2) | In May 2008, we effected a bonus share issuance in the form a share split by issuing an additional approximately 20,800 ordinary shares for each ordinary share outstanding and an additional approximately 20,800 preferred shares for each preferred share outstanding. As a result of the bonus share issuance, the number of outstanding ordinary shares and preferred shares increased to 208,005,986 and 69,994,014, respectively. See “Related Party Transactions—Share Issuances and Splits.” The effect of the bonus share issuance is retroactively reflected for all periods presented herein. |

| (3) | For a description of the pro forma adjustments used to calculate pro forma earnings per share for the year ended December 31, 2009, see “Note 19—Unaudited Pro Forma Balance Sheet and Earnings Per Share for Conversion of Preferred Shares” to our consolidated financial statements included elsewhere in this prospectus. |

| (4) | For a description of the pro forma adjustments used to calculate pro forma earnings per share for the six months ended June 30, 2010, see “Note 15—Unaudited Pro Forma Balance Sheet and Earnings Per Share for Conversion of Preferred Shares” to our unaudited condensed consolidated financial statements included elsewhere in this prospectus. |

| | | | | | | | | | | | | | | | |

| | | As of December 31, | | | As of June 30, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2010 | |

| | | (in millions of $) | |

| | | | | | | | | (Pro forma)(1) | |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | |

Cash | | | 15.8 | | | | 12.2 | | | | 10.0 | | | | 10.0 | |

Total current assets | | | 28.7 | | | | 30.1 | | | | 31.9 | | | | 31.9 | |

Total assets | | | 61.7 | | | | 70.0 | | | | 78.8 | | | | 78.8 | |

Total current liabilities | | | 17.3 | | | | 15.5 | | | | 16.9 | | | | 16.9 | |

Total liabilities | | | 17.3 | | | | 15.5 | | | | 16.9 | | | | 16.9 | |

Series A convertible preferred shares | | | 34.4 | | | | 34.4 | | | | 34.4 | | | | — | |

Total equity | | | 10.0 | | | | 20.1 | | | | 27.5 | | | | 61.9 | |

| (1) | Pro forma basis reflects the conversion of all outstanding preferred shares on a 1-for-1 basis into an aggregate of 69,994,014 ordinary shares upon the completion of this offering. |

10

RISK FACTORS

You should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our ADSs could decline, and you may lose part or all of your investment.

Risks Related to Our Business and Industry

Our ability to execute projects, maintain, expand or renew existing customer engagements and obtain new customers depends largely on our ability to attract, train, motivate and retain skilled scientists.

Our success largely depends on the R&D efforts of our skilled scientists and their ability to keep pace with changes in pharmaceutical and biotechnology R&D technologies and methodologies. In particular, our customers value highly skilled Western-trained scientists, preferably with large pharmaceutical and/or biotechnology company experience. Our success also depends on the depth and quantity of our scientific personnel. We face challenges in attracting new employees and maintaining consistent quality standards throughout our employee base at our current growth rate. Our employee base increased from 1,115 as of December 2007 to 1,755 as of June 30, 2010, and is expected to increase in the second half of 2010.

We compete with pharmaceutical, biotechnology and contract research firms and academic and research institutions for qualified and experienced scientists, particularly in chemistry and biology. To effectively compete, we may be required to offer higher compensation and other benefits that could materially and adversely affect our financial condition and results of operations. We may be unable to hire and retain enough skilled and experienced scientists to replace those who leave our company. Additionally, we may be unable to redeploy and retrain our professionals to keep pace with technological changes, evolving standards and changing customer preferences. Any inability to attract, train, motivate or retain skilled scientists may materially and adversely affect our business, financial condition, results of operations and prospects.

A limited number of our customers have accounted for and are expected to account for a high percentage of our revenues. The loss or significant reduction in orders from any of these customers could materially and adversely affect our business, financial condition, results of operations and prospects.

Our two largest customers in 2009 and the six months ended June 30, 2010, Eli Lilly and Company, or Lilly, and GlaxoSmithKline plc, or GSK, respectively accounted for 27% and 10% of our net revenues in 2009 and 20% and 9% of our net revenues in the six months ended June 30, 2010. No other customer accounted for more than 10% of our net revenues in 2009 and the six months ended June 30, 2010. Our top ten customers, which varied in each of the last three years and the six months ended June 30, 2010, accounted for approximately 85%, 77%, 65% and 63% of our net revenues in 2007, 2008, 2009 and the six months ended June 30, 2010, respectively. Furthermore, we generated a significant majority of our net revenues during the same periods from sales to customers located in the United States.

Due to our customer concentration, any of the following events, among others, may cause material revenue fluctuations or declines and materially and adversely affect our business, financial condition, results of operations and prospects:

| | • | | order or contract reduction, delay or cancellation by one or more of our significant customers and our failure to identify and acquire additional or replacement customers; and |

| | • | | a substantial reduction by one or more of our significant customers in the price they are willing to pay for our services and products. |

Any failure to retain our existing customers or expand our customer base may result in our inability to maintain or increase our revenues.

Our existing customers may not continue to generate significant revenues for us once our engagements with them are concluded and our relationships with them may not present further business opportunities.

11

We have entered into master services agreements with some customers, the terms of which typically range from one to five years. If we fail to build new customer relationships or our relationships with existing customers terminate, we may not be able to maintain or increase our revenues.

A reduction in R&D budgets by pharmaceutical and biotechnology companies may result in a reduction or discontinued use of our services, which may adversely affect our business.

Fluctuations in the R&D budgets of pharmaceutical and biotechnology industry participants could significantly affect the demand for our services. R&D budgets fluctuate due to, among other things, pharmaceutical and biotechnology industry downturns, consolidation of pharmaceutical and biotechnology companies, general economic conditions, and changes in available resources, spending priorities and institutional budgetary policies. The global pharmaceutical and biotechnology industry has experienced significant consolidation and, during the global financial crisis, some pharmaceutical and biotechnology companies experienced financial difficulties. We have experienced reductions, delays or cancellations of orders or contracts from certain customers and difficulties in collecting fees from certain customers who experienced financial difficulties or consolidation in the global financial crisis. For example, two of our North America-based biotechnology customers experienced financial difficulties during the global financial crisis and terminated their contracts with us in late 2008. We collected all of the accounts receivable from one of the two customers and part of the accounts receivable from the other one. The amount of uncollected accounts receivable was immaterial and fully reserved for. If pharmaceutical and biotechnology companies discontinue or decrease the use of our services due to factors such as a prolonged slowdown in the overall U.S. or global economy or further industry consolidation, our revenues and earnings could be lower than we expect and our revenues may decrease or fail to grow at historical rates.

The outsourcing trend in the drug R&D industry may decrease, which could slow our growth.

The success of our business depends primarily on the number of contracts and the size of the contracts that we obtain from pharmaceutical and biotechnology companies. Over the past several years, our business has benefited from increased levels of outsourcing of drug R&D by pharmaceutical and biotechnology companies. While the outsourcing trend is expected to continue for the next several years, a reversal or slowing of this trend could result in diminished growth in our expected growth areas and materially adversely affect our business, financial condition, results of operations and prospects.

If we fail to protect the intellectual property rights of our customers, we may be subject to liability for breach of contract and may suffer damage to our reputation.

Protection of intellectual property associated with pharmaceutical and biotechnology R&D services is critical to all our customers. Our customers generally retain ownership of associated intellectual property rights, including those they provide to us and those arising from the services we provide. Our success therefore depends in substantial part on our ability to protect the proprietary rights of our customers. This is particularly important for us because almost all of our operations are based in China, which has not traditionally enforced intellectual property protection to the same extent as in the United States. Despite measures we take to protect our customers’ and our own intellectual property, unauthorized parties may attempt to obtain and use information that we regard as proprietary. Any unauthorized disclosure of our customers’ proprietary information could subject us to liability for breach of contract and significantly damage our reputation, which could materially harm our business, financial condition, results of operations and prospects.

Any failure to comply with applicable regulations and industry standards or obtain various licenses and permits could harm our reputation and our business, results of operations and prospects.

A number of governmental agencies or industry regulatory bodies in China, the United States and Europe, impose strict rules, regulations and industry standards governing pharmaceutical and biotechnology R&D activities, which apply to our customers and us. Our failure to comply with such regulations could result in the termination of ongoing research, administrative penalties imposed by regulatory bodies or the disqualification of data for submission to regulatory authorities. This could harm our reputation, prospects for future work and

12

operating results. For example, if we were to treat research animals inhumanely or in violation of international standards set out by the Association for Assessment and Accreditation of Laboratory Animal Care, or AAALAC, AAALAC could revoke any such accreditation and the accuracy of our animal research data could be questioned.

In addition, our subsidiaries in China need to obtain various licenses and permits to conduct their current operations. If any of our subsidiaries in China is unable to obtain all the requisite licenses and permits or fails to renew any of the licenses or permits timely, it may be subject to fines and other penalties, including suspension of its operations.

Compliance with environmental regulations can be expensive, and noncompliance with these regulations may result in significant monetary damages, fines and other penalties.

As our pharmaceutical and biotechnology R&D processes generate waste water, toxic and hazardous substances and other industrial wastes, we must comply with all national and local environmental laws and regulations in China. We are required to undertake environmental impact assessment procedures and pass the subsequent inspection and approval procedures before commencing our operations. We are also required to register with, or obtain approvals from, relevant environmental protection authorities for various environmental matters such as discharging waste generated in our operations. We did not complete certain environmental assessment or approval procedures for some of our facilities. We are taking remedial measures necessary to obtain the requisite approvals. We have engaged a qualified assessment consultant to conduct environmental impact assessments. We had submitted the application for approval of the environmental impact assessment report for our principal facilities in Shanghai by the end of August 2010. According to relevant PRC regulations, the local environmental protection authorities are required to complete the inspection and approval procedures within several months upon receipt of an application for approval of the environmental impact assessment. However, we cannot assure you that the remedial measures we are taking will be completed timely and successfully. If for any reason the relevant government authorities in China determine that we are not in compliance with environmental laws and regulations, we may be required to pay fines or damages to third parties or suspend our operations. In addition, because the requirements imposed by environmental laws and regulations may change and more stringent regulations may be adopted, we may be unable to accurately predict the cost of complying with these laws and regulations, which could be substantial.

We are subject to safety and health laws and regulations in China, and any failure to comply could adversely affect our operations.

Our operations and facilities are subject to extensive safety and health laws and regulations. We must ensure that our operations and facilities comply with PRC standards and requirements on fire prevention, hazardous and radioactive materials handling, work environment safety and employees’ health conditions. We have not completed certain procedures for some of our facilities or projects required for compliance with these laws and regulations, such as having our relevant work environments inspected for occupational hazards. We are taking remedial measures to rectify such non-compliance. For example, we have had our material work areas inspected for occupational hazards. However, we may be subject to government orders to rectify non-compliance within a specified period, pay fines or suspend our operations. In addition, we cannot eliminate the risk of accidental contamination or injury from hazardous or radioactive materials used in our operations. If we fail to prevent contamination or injury, we could be liable for any resulting damages, which may materially and adversely impact our business, financial condition, results of operations and prospects.

Any failure by us to satisfy our customers’ audits and inspections could harm our reputation and our business, financial condition, results of operations and prospects.

Our customers routinely audit and inspect our facilities, processes and practices to ensure that we meet their standards for drug discovery and development. To date, we are not aware of any material negative findings from our customers’ audits and inspections. However, we may not be able to pass all such audits and inspections to our customers’ satisfaction, and any such failure may significantly harm our reputation and materially and adversely affect our business, financial condition, results of operations and prospects.

13

We face increasingly intense competition. If we do not compete successfully against new and existing competitors, demand for our services and related revenues may decrease and we may be subject to increasing pricing pressure.

The global pharmaceutical and biotechnology R&D outsourcing market is highly competitive, and we expect competition to intensify. We face competition based on several factors, including the quality and scope of services, the ability to protect confidential information and intellectual property, the ability to be responsive and efficient with respect to customers’ requests, depth of customer relationship and pricing. We compete with WuXi PharmaTech (Cayman) Inc., or WuXi PharmaTech, across the breadth of our service offerings. We also compete with industry participants in particular service areas, including Albany Molecular Research, Inc. in discovery chemistry and pharmaceutical development, and Cerep S.A. and Covance Inc. in discovery biology and preclinical development.

We expect to increasingly compete against multinational companies, both domestically and internationally, as we offer more complex and sophisticated services. Additionally, several major pharmaceutical and biotechnology companies have made in-house R&D investments in China, a trend we expect to continue. These in-house investments may result in increased competition for qualified personnel. Some of our larger competitors may have greater financial, research and other resources, broader scope of services, greater pricing flexibility, more extensive technical capabilities and greater name recognition than we do. Furthermore, consolidation within the global pharmaceutical and biotechnology R&D outsourcing markets may create stronger competitors than those we are facing today.

We also expect increased competition as new companies enter into our market and more advanced technologies become available. Our services and expertise may be rendered obsolete or uneconomical by technological advances or new approaches or technologies. Our competitors’ existing or new approaches or technologies they develop may be more effective than those we develop. Furthermore, increased competition may subject us to increasing pricing pressure and reduce demand for our services, which could reduce our margins and profitability.

We may fail to effectively expand and market our service offerings and capabilities, which may harm our growth opportunities and prospects, possibly resulting in related losses.

We intend to expand our existing services and offer new services across the drug discovery value chain. Initially focusing on discovery chemistry services, we introduced pharmaceutical development services in 2005 and discovery biology and preclinical development services in 2007. We began offering biologics services in early 2010. We are constructing an approximately 460,000 square-foot cGMP-quality multi-purpose manufacturing facility in Fengxian, Shanghai designed to manufacture advanced intermediates and APIs for preclinical testing and clinical trials. We are also constructing an approximately 150,000 square-foot laboratory services building in Fengxian, Shanghai primarily for pharmaceutical development services. To successfully develop and market our new services, we must:

| | • | | accurately assess and meet customer needs and market demands; |

| | • | | optimize our drug discovery and development processes to predict and control costs; |

| | • | | hire, train and retain scientists and other personnel; |

| | • | | provide services in a timely manner; |

| | • | | increase customer awareness and acceptance of our services; |

| | • | | obtain required regulatory clearances or approvals; |

| | • | | compete effectively with other R&D outsourcing providers; |

| | • | | price our services competitively; and |

| | • | | effectively integrate customer feedback into our business planning. |

14

If we are unable to expand our service offerings and create demand for those newly expanded services, our business, results of operations, financial condition and prospects may be materially and adversely affected.

We may be unable to expand our capacity and scale up our operations as anticipated, possibly resulting in material delay, increased costs and lost business opportunities.

We are developing an approximately 460,000 square-foot cGMP-quality multi-purpose manufacturing facility in Fengxian, Shanghai designed to manufacture advanced intermediates and APIs for preclinical testing and clinical trials. We are also constructing an approximately 150,000 square-foot laboratory services building in Fengxian, Shanghai primarily for pharmaceutical development services. We may not construct such facility or building in accordance with the anticipated timetable or within budget. We may lease or build additional animal facilities in Shanghai if the demand for our discovery biology and preclinical development services increases. In addition, we may lease additional lab and office facilities in Chengdu if the demand for our discovery chemistry services increases. Any material delay in bringing these facilities online or scaling up operations, or any substantial cost increases to complete them or scale up operations, could materially and adversely affect our financial condition and results of operations, and result in lost business opportunities.

If we fail to effectively manage our anticipated growth and execute our growth strategies, our business, financial condition, results of operations and prospects could suffer.

Pursuing our growth strategies, including integrating and expanding our facilities and service offerings to meet our customers’ needs, has resulted in and will continue to place substantial demands on our management and resources. Managing this growth and executing our growth strategies will require, among other things:

| | • | | enhancement of our pharmaceutical and biotechnology R&D capabilities; |

| | • | | effective coordination and integration of our research facilities and teams, particularly those located in different or newly opened facilities; |

| | • | | successful personnel hiring and training; |

| | • | | effective cost controls and sufficient liquidity; |

| | • | | effective and efficient financial and management controls; |

| | • | | increased marketing and sales support activities; |

| | • | | effective quality control; and |

| | • | | our ability to manage our various vendors and suppliers and leverage our purchasing power. |

Any failure to effectively manage our anticipated growth and execute our growth strategies could materially adversely affect our business, financial condition, results of operations and prospects.

If our company or our founders grant employees share options and other share-based compensation in the future, our net income may be adversely affected. In addition, we will incur non-cash share-based compensation charges in connection with the RSUs granted under the Founder’s Plan upon completion of this offering, which will materially and adversely impact our results of operations.

Our equity incentive plans and other similar types of incentive plans are important in order to attract and retain key personnel. Our company and our founders have granted our employees share options and restricted share units in the past pursuant to the Plan and the Founder’s Plan. As a result of the issuance of options and RSUs under these plans, we have in the past and expect in the future to incur share-based compensation expenses. We account for compensation costs for all share options, including share options granted to our employees, non-employee directors and officers using the fair value determined at the grant date and recognize the expense in our consolidated statement of operations. We also account for compensation costs for the conversion of RSUs into our ordinary shares. These compensation costs may materially and adversely affect our net income. Moreover, the additional expenses associated with share-based compensation may reduce the attractiveness of our equity incentive plans.

15

In 2008, 2009 and the nine months ended September 30, 2010, our founders granted RSUs convertible to 7,450,000, 2,100,000 and 2,200,000 ordinary shares, respectively, to certain members of our senior management and other employees under the Founder’s Plan. We have not recorded any share-based compensation expense in connection with these RSU grants because one of the vesting conditions for the RSUs is the completion of our initial public offering. As a result, immediately upon completion of this offering, we will incur a significant share-based compensation charge of approximately $2.5 million, which will materially and adversely affect our results of operations for the quarter in which this offering is completed.

In providing our pharmaceutical and biotechnology R&D outsourcing services, we face health and safety liability and product liability risks.

In providing our services in connection with drug discovery and development, we face a range of potential liabilities, which include risks that disease models and animals infected with diseases for research interests may be harmful, or even lethal, to themselves and humans despite preventive measures we take for the quarantine and handling of animals. We also face product liability risks should the drugs we assist in developing and manufacturing become subject to product liability claims. We provide services in the development, testing and manufacturing of drugs that may ultimately be used by humans, although we do not commercially market or sell the products to end users. If any of these drugs harm people, we may be subject to litigation and may be required to pay damages to those persons.

We do not have general liability or product liability insurance covering our whole business or all of our products and services. We currently maintain general liability insurance for four contracts covering, among other things, bodily injury and property damage arising out of the products or services provided under these contracts. The aggregate net revenues derived from these contracts in the six months ended June 30, 2010 accounted for 11.0% of our total net revenues in this period. The aggregate maximum coverage amount under the insurance policy for these contracts is $5 million for bodily injury and property damage arising out of our products or services and economic loss sustained by persons or entities due to deficiencies in our products or services. Damages awarded in a product liability action could be substantial and, to the extent not covered by our insurance, could materially and adversely impact our business, financial condition and results of operations.

Because many of our fee-for-service based contracts are contingent on successful completion and are of a fixed price nature, we may bear risk if we do not successfully or timely develop a service or enter contracts with pricing below our estimated cost due to competitive pressures or strategic objectives, or incur overrun costs.

A significant portion of our net revenues is based on fee-for-service contracts, which are contingent on successful completion and are often for a fixed price. Therefore, we bear financial risk if we do not successfully or timely complete services or if we price our fee-for-service based contracts below our estimated cost of completing these contracts or otherwise incur cost overruns. We also face pricing pressures from some of our competitors. To capture market share, we have, in the past, intentionally priced some fee-for-service based contracts below our estimated cost of completing these contracts. Below-cost pricing or significant cost overruns could materially and adversely affect our business, financial condition, results of operations and prospects.

The loss of services of our senior management and key scientific personnel could severely disrupt our business and growth.

Our success significantly depends upon the continued service of our senior management and key scientific personnel. We are highly dependent on Mr. Michael Xin Hui, our co-founder and chief executive officer, who has managed our business, operations and sales and marketing activities and maintained personal and direct relationships with our major customers since our inception, as well as other members of our management and other key scientific personnel. The loss of any one of them, in particular Mr. Hui, would materially and adversely affect our business. Although each member of our senior management and key scientific personnel has signed a noncompete agreement with us, we may be unable to successfully enforce these provisions in the event of a dispute. If we lose the services of any of our senior management members or key scientific personnel, we may be unable to locate suitable or qualified replacements, and may incur additional expenses to recruit and train new personnel, which could severely disrupt our business and growth.

16

A payment failure by any of our large customers could adversely affect our cash flows and profitability.

Historically, we have not experienced any significant bad debt or collection problems, but such problems may arise in the future. The failure of any of our customers to make timely payments could require us to write off accounts receivable or increase provisions made against our accounts receivable, either of which could adversely affect our cash flows and profitability.

Our limited operating history may make it difficult for you to evaluate our business and future prospects.

We commenced operations and began offering our pharmaceutical and biotechnology R&D outsourcing services in 2002. Our business model changes with the evolution of the pharmaceutical and biotechnology R&D outsourcing market in China and around the world. Accordingly, our operating history upon which you can evaluate the viability and sustainability of our business and its acceptance by industry participants is limited. These circumstances may make it difficult for you to evaluate our business and future prospects, and you should not rely on our past results or our historic growth rate as an indication of our future performance.

In preparing our consolidated financial statements, we have identified one material weakness and other deficiencies in our internal control over financial reporting. If we fail to develop and maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results or prevent fraud, and investor confidence in our company and the market price of our ADSs may be adversely affected.

Prior to this offering, we have been a private company with limited accounting personnel and other resources with which to address our internal control over financial reporting. In preparing our consolidated financial statements, we and our independent registered public accounting firm identified one material weakness and other deficiencies in our internal control over financial reporting as of December 31, 2009. As defined in the standards established by the U.S. Public Company Accounting Oversight Board, or the PCAOB, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

The material weakness identified related to a lack of sufficient competent personnel with appropriate levels of accounting knowledge and experience to perform period end reporting procedures, address complex U.S. GAAP accounting issues and prepare and review financial statements and related disclosures under U.S. GAAP. Neither we nor our independent registered public accounting firm undertook a comprehensive assessment of our internal control for purposes of identifying and reporting material weaknesses and other control deficiencies in our internal control over financial reporting as we and they will be required to do once we become a public company. Had we performed a formal assessment of our internal control over financial reporting or had our independent registered public accounting firm performed an audit of our internal control over financial reporting, additional deficiencies may have been identified.

Following the identification of the material weakness and other control deficiencies, we have taken measures and plan to continue to take measures to remedy these control deficiencies. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Internal Control over Financial Reporting.” However, the implementation of these measures may not fully address these deficiencies in our internal control over financial reporting, and we cannot conclude that they have been fully remedied. Our failure to correct these control deficiencies or our failure to discover and address any other control deficiencies could result in inaccuracies in our financial statements and impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. As a result, our business, financial condition, results of operations and prospects, as well as the trading price of our ADSs, could be materially and adversely affected. Moreover, ineffective internal control over financial reporting significantly hinders our ability to prevent fraud.

17

Upon completion of this offering, we will become subject to the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. Section 404 of the Sarbanes-Oxley Act requires that we include a report from management on the effectiveness of our internal control over financial reporting in our annual report on Form 20-F beginning with our annual report for the fiscal year ending December 31, 2011. In addition, beginning at the same time, our independent registered public accounting firm must report on the effectiveness of our internal control over financial reporting. If we fail to remedy the problems identified above, our management and our independent registered public accounting firm may conclude that our internal control over financial reporting is not effective. This could adversely impact the market price of our ADSs due to a loss of investor confidence in the reliability of our reporting processes. We will need to incur significant costs and use significant management and other resources in order to comply with Section 404 of the Sarbanes-Oxley Act.

Our business is sensitive to the current global economic crisis. A severe or prolonged downturn in the global or Chinese economy could materially and adversely affect our business, results of operations and financial condition.

The global financial markets have experienced significant disruptions since 2008, and most of the world’s major economies are in or are just emerging from recession. While there has been improvement in some areas, it is still unclear whether the recovery is sustainable. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of the world’s leading economies, including those of the United States and China. Continued concerns about the systemic impact of potential long-term and wide-spread recession, energy costs, geopolitical tensions, the availability and cost of credit, and the global housing and mortgage markets have contributed to increased market volatility and diminished expectations for economic growth around the world. Any prolonged slowdown in the global or Chinese economy or downturn in the pharmaceutical and biotechnology industry may negatively impact our business, results of operations and financial condition, and continued turbulence in the international markets may adversely affect our ability to access the capital markets to meet liquidity needs.

Our customer agreements contain provisions that are adverse to our interests or expose us to potential liability.

Our agreements with our customers generally provide that customers can terminate the agreements or reduce the scope of services under the agreements upon short notice. In a majority of our customer agreements, our customers have the unilateral right to terminate for convenience upon one to three months’ prior notice. Although we have not been materially and adversely affected by previous contract cancellations or modifications, if a customer terminates a contract with us, we are only entitled under the terms of the contract to receive revenue earned until the date of termination. Therefore, cancellation or modification of a large contract or cancellation or modification of multiple contracts could materially and adversely affect our business, financial condition, results of operations and prospects.

In certain of our customer agreements, we have assumed indemnification obligations for intellectual property infringement resulting from the misuse of confidential information by our employees or from the customer deliverables that we provide to the extent that we create the infringing aspect of the deliverables. As a result, we could be potentially exposed to substantial liability.

In addition, in some of our customer agreements, we agree, either by ourselves or together with third parties, not to compete with the customer. In some cases, we are required to seek the customer’s prior written consent before working for other customers on similar projects. Complying with these noncompete obligations may restrict our ability to expand certain service offerings, and failure to comply could significantly harm our business and reputation, as well as expose us to liability for breach of contract.

18

We use a limited number of suppliers, including a related party, Labpartner (Shanghai) Co., Ltd., for several of our service offerings, which, if interrupted, could disrupt or delay our services, reduce our sales and force us to use more expensive supply sources.

We use a limited number of sources for our supply of certain reagents and other chemicals required in our product and service offerings. In particular, we purchased significant amounts of reagents and other chemicals from Labpartner (Shanghai) Co., Ltd., or Labpartner, a related party, in each of 2007, 2008 and 2009. Disruptions or delays with respect to our suppliers may arise from health problems, export or import restrictions or embargoes, foreign government or economic instability, severe weather conditions, disruptions to the air travel system, contract disputes or other disruptions. If the supply of certain materials were interrupted, our services may be delayed. We also may not be able to secure alternative supply sources in a timely and cost-effective manner. If we are unable to obtain adequate supplies of required materials that meet our standards or at acceptable costs, or at all, our ability to accept and fulfill customer orders in the required quality and quantity and at the required time could be restricted, which in turn may materially and adversely affect our business, financial condition, results of operations and prospects.

We have limited insurance coverage, and any claims beyond our insurance coverage may result in our incurring substantial costs and a diversion of resources.

We maintain property insurance policies covering physical damage or loss of our equipment and office furniture, employer’s liability insurance generally covering death or work injury of employees, public liability insurance covering third party bodily injury and property damage incurred in connection with our business in China, and directors and officers liability insurance. We do not have general liability or product liability insurance covering our whole business or all of our products and services. We currently maintain general liability insurance for four contracts covering, among other things, bodily injury and property damage arising out of the products or services provided under these contracts. The aggregate net revenues derived from these contracts in the six months ended June 30, 2010 accounted for 11.0% of our total net revenues in this period. The aggregate maximum coverage amount under the insurance policy for these contracts is $5 million for bodily injury and property damage arising out of our products or services and economic loss sustained by persons or entities due to deficiencies in our products or services. We do not maintain business disruption insurance or key man life insurance. Any business disruption or litigation, or any liability or damage to, or caused by, our facilities or our personnel beyond our insurance coverage may result in substantial costs and a diversion of resources.

Our quarterly revenues and operating results may be difficult to predict and could fall below investor expectations, which could cause the market price of our ADSs to decline.

Our quarterly revenues and operating results have fluctuated in the past and may continue to fluctuate significantly due to numerous factors, including:

| | • | | the commencement, postponement, completion or cancellation of large contracts; |

| | • | | the progress of ongoing contracts; |

| | • | | the delivery schedule of our customers; |

| | • | | budget cycles of our customers; |

| | • | | changes in the mix of our revenues from our services based on a fee-for-service or FTE basis or the percentage of our fee-for-service based contracts that are contingent upon successful completion; |

| | • | | changes in the industry operating environment; |

| | • | | changes in government policies or regulations or their enforcement; |

| | • | | exchange rate fluctuations; |

19

| | • | | a downturn in general economic conditions in the United States, China or internationally; and |

| | • | | the timing of and charges associated with completed acquisitions or other events. |

Many of these factors are beyond our control, making our quarterly results fluctuate and difficult to predict. For example, revenues may not be recognized during the third quarter of 2010 due to changes in delivery schedules initiated by customers or delays in customer acceptance of deliverables. As a result, our revenues in the third quarter of 2010 may not grow as quickly as they have in previous quarterly periods. Fluctuations in our quarterly revenues and operating results could cause the trading price of our ADSs to decline below investor expectations.

We may need additional capital that we may be unable to obtain in a timely manner or on acceptable terms, or at all.

We may require additional capital in order to grow, remain competitive, develop new services and expand our capacity. Our ability to obtain capital is subject to a variety of uncertainties, including:

| | • | | our financial condition, results of operations and cash flows; |

| | • | | general market conditions for capital raising activities by healthcare and related companies; and |

| | • | | economic, political and other conditions in China, the United States and elsewhere. |

However, financing may not be available in amounts or on terms acceptable to us, if at all.

Our capital needs may require us to sell additional equity or debt securities that may dilute our shareholders or introduce covenants that may restrict our operations or our ability to pay dividends.

Our capital needs and other business reasons could require us to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity or equity-linked securities could dilute our shareholders. The incurrence of indebtedness would increase our debt service obligations and could result in operating and financing covenants that would restrict our operations or our ability to pay dividends.

Acquisitions or investments could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our business.

We anticipate that a portion of any future growth of our business might be accomplished by acquiring businesses, products or technologies. The success of any acquisition will depend upon, among other things, our ability to integrate acquired personnel, operations, products and technologies into our organization effectively, to retain and motivate key personnel of the acquired businesses and to retain their clients. In addition, we might not be able to identify suitable acquisition opportunities or obtain any necessary financing on acceptable terms. We might also spend time and money investigating and negotiating with potential acquisition or investment targets, but not complete a transaction. Any acquisition could involve other risks, including the assumption of additional liabilities and expenses, issuances of potentially dilutive securities or interest-bearing debt, transaction costs, reduction in our ADS price as a result of any of these or because of market reaction to a transaction and diversion of management’s attention from other concerns.

Recent healthcare reform creates uncertainty in the need for our services.

In March 2010, the United States Congress passed the Patient Protection and Affordable Care Act. Implementation of this newly enacted act, which is intended to control health care costs, may limit profits from the development of new drugs. Similar reform movements have occurred or may occur in parts of Europe and Asia. It is unclear how these reforms may affect R&D expenditures by pharmaceutical and biotechnology

20

companies, which creates uncertainty in the business opportunities available to us in the United States and other countries.

Negative attention from special interest groups may impair our ability to operate our business efficiently.

Some of the services we provide, or intend to provide, involve the use of large and small animals, as well as non-human primates. Certain special interest groups categorically object to the use of animals for research purposes. Historically, our core research model activities with small animals have not been the subject of animal rights media attention, and as we expand our service biology offerings into non-GLP toxicology, we anticipate that we will work extensively with large animals and non-human primates. However, research activities with animals have been the subject of adverse attention, negatively impacting our industry. Any negative attention or threats directed against our animal research activities could impair our ability to operate our business efficiently. In addition, if regulatory authorities were to mandate a significant reduction in safety testing procedures that utilize laboratory animals, as has been advocated by certain groups, our business could be materially and adversely affected.

Contamination in our animal populations can distort or compromise the quality of our research results, cause human infection, increase costs and decrease revenue.

Our research models must be free of certain infectious agents such as certain viruses and bacteria. The presence of these infectious agents in our animal facilities could distort or compromise the quality of our research results and could adversely impact human or animal health. Removing or preventing contamination typically requires cleaning, renovating, disinfecting, retesting and restarting our animal facilities, which result in clean-up and start-up costs and reduced revenue due to lost customer confidence in the accuracy of our research results. In some cases, we may import animals carrying infectious agents capable of causing diseases in humans. As a result, there could be a possible risk of human exposure and infection. Although we have not had serious contamination in the past, contamination may occur in the future, which could materially and adversely impact our financial results.

For our customers’ future drugs to be marketed in the United States, we may need to obtain clearance from the FDA and our operations will need to comply with FDA standards. Any adverse action by the FDA against us would negatively impact our ability to offer our services and harm our business and prospects.

As we expand our service offerings, we may need to obtain clearance by the U.S. Food and Drug Administration, or FDA, in the event that our customers’ clinical trials reach the stage of filing a New Drug Application, or NDA, with the FDA, to grant permission to market the drug in the United States. All facilities and manufacturing techniques used to manufacture drugs and biologics in the United States must conform to standards established by the FDA. The FDA may conduct scheduled periodic inspections of our facilities to monitor our compliance with regulatory standards. If the FDA finds that we have failed to comply with the appropriate regulatory standards, it may impose fines or take other actions against us or our customers, or we may no longer be able to offer our services to U.S. customers. The resulting corrective measures may be lengthy and costly. As a result, we may be unable to fulfill our contractual obligations. Any adverse action by the FDA would materially and adversely impact our reputation and our business, financial condition, results of operations and prospects. We may or may not obtain clearance from FDA standards in the event that we are inspected, or maintain such clearance over time.

New technologies or methodologies may be developed, validated and increasingly used in the global pharmaceutical and biotechnology R&D outsourcing industry that could reduce demand for our services.

The global pharmaceutical and biotechnology R&D outsourcing industry is evolving, and we must keep pace with new technologies and methodologies in the industry to maintain our competitive position. As a result, we must invest significant human and capital resources in R&D to enhance our technology and our existing

21

services and introduce new services utilizing advanced technologies. However, we may not be successful in adapting to or commercializing these new technologies if developed. New technologies could decrease the need for our existing technologies, and we may not be able to develop new service or technologies effectively or in a timely manner. Our failure to develop, enhance or adapt, to new technologies and methodologies could significantly reduce demand for our services and harm our business and prospects.

Our principal facilities may be vulnerable to natural disasters or other unforeseen catastrophic events.

We conduct our operations primarily at our headquarters in Shanghai Zhangjiang Hi-Tech Park and our R&D center in Chengdu. We also have animal facilities in Shanghai Zhangjiang Hi-Tech Park and a manufacturing facility in Nanhui, Shanghai. In addition, we are constructing a cGMP-quality multiple-purpose manufacturing facility and a laboratory services building in Fengxian, Shanghai. We depend on our facilities for our business. Natural disasters or other unanticipated catastrophic events, including power interruptions, water shortage, storms, fires, earthquakes, terrorist attacks and wars could significantly impair our ability to operate our business in its ordinary course. Our facilities and certain equipment located in these facilities would be difficult to replace in any such event and could require substantial replacement time. The occurrence of any such event may materially and adversely affect our business, financial condition, results of operations and prospects.

We face risks related to health epidemics and other outbreaks, which could significantly disrupt our staffing and may even result in temporary closure of our facilities.

Our business could be materially and adversely affected by the outbreak of avian influenza, severe acute respiratory syndrome, or SARS, or another epidemic. In April 2009, a new strain of influenza A virus subtype H1N1 was discovered in North America and quickly spread to other parts of the world, including China. In early June 2009, the World Health Organization declared the outbreak to be a pandemic, while noting that most of the illnesses were of moderate severity. The PRC Ministry of Health has reported a few hundred deaths caused by the influenza A (H1N1). Any outbreak of avian influenza, SARS, the influenza A (H1N1) or other adverse public health developments in China may materially and adversely affect our business operations. These occurrences could severely disrupt to our daily operations.

Risks Related to Doing Business in China