UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010.

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-34895

SHANGPHARMA CORPORATION

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

No. 5 Building, 998 Halei Road

Zhangjiang Hi-Tech Park, Pudong New Area

Shanghai, 201203

The People’s Republic of China

(Address of principal executive offices)

William Dai, Chief Financial Officer

ShangPharma Corporation

No. 5 Building, 998 Halei Road

Zhangjiang Hi-Tech Park, Pudong New Area

Shanghai, 201203

The People’s Republic of China

(86 21) 5132-0088

Facsimile: (86 21) 5132-0110

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of exchange on which registered |

| American Depositary Shares, each of which represents 18 ordinary shares | | New York Stock Exchange |

| Ordinary shares, par value US$0.001 per share | | New York Stock Exchange* |

| * | Not for trading, but only in connection with the listing on New York Stock Exchange of the American depositary shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 335,600,000 ordinary shares, par value US$0.001 per share, as of December 31, 2010.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer þ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | |

| US GAAP | | þ | | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | | Other | | ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

TABLE OF CONTENTS

INTRODUCTION

Unless otherwise indicated and except where the context otherwise requires, references in this annual report on Form 20-F to:

| | • | | “ADSs” refers to our American depositary shares, each of which represents 18 ordinary shares, and “ADRs” refers to American depositary receipts, which, if issued, evidence our ADSs; |

| | • | | “China” or the “PRC” refer to the People’s Republic of China excluding, for the purpose of this annual report only, Hong Kong, Macau and Taiwan; |

| | • | | “RMB” or “Renminbi” refers to the legal currency of China and “$,” “dollar,” “US$” or “U.S. dollar” refers to the legal currency of the United States; |

| | • | | “shares” or “ordinary shares” refers to our ordinary shares, par value US$0.001 per share, and |

| | • | | “preferred shares” refers to our Series A convertible preferred shares, par value US$0.001 per share. |

Unless the context indicates otherwise, “we,” “us,” “our company,” “our,” and “ShangPharma” refer to ShangPharma Corporation, a Cayman Islands company, and its subsidiaries.

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. Known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include:

| | • | | our goals and strategies; |

| | • | | our future development, financial condition and results of operations; |

| | • | | the expected growth of the pharmaceutical and biotechnology outsourcing industry in China and globally; |

| | • | | market acceptance of our services; |

| | • | | our expectations regarding demand for our services; |

| | • | | our ability to stay abreast of market trends and technological advances; |

| | • | | our ability to effectively protect our customers’ intellectual property rights and not infringe on the intellectual property rights of others; |

| | • | | competition in the pharmaceutical and biotechnology outsourcing industry; |

| | • | | PRC and U.S. governmental policies and regulations relating to the pharmaceutical and biotechnology outsourcing industry; |

| | • | | litigation and government proceedings involving our company and industry; and |

| | • | | general economic and business conditions, particularly in the United States and China. |

2

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Other sections of this annual report include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should read thoroughly this annual report and the documents that we refer to in this annual report with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

PART I.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

A.Selected Financial Data

Selected Consolidated Financial Data

The following selected consolidated financial information for the periods and as of the dates indicated should be read in conjunction with our consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” in this annual report.

Our selected consolidated statement of income data presented below for the years ended December 31, 2008, 2009 and 2010 and our balance sheet data as of December 31, 2009 and 2010 have been derived from our audited consolidated financial statements included elsewhere in this annual report. Our audited consolidated financial statements are prepared in accordance with U.S. GAAP. Our selected consolidated statement of income data presented below for the years ended December 31, 2006 and 2007 and our balance sheet data as of December 31, 2006, 2007 and 2008 have been derived from our audited financial statements not included in this annual report.

3

Our historical results do not necessarily indicate results expected for any future periods.

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | (in millions of US$, except for share, per share, and per ADS data) | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net revenues | | | 17.8 | | | | 34.7 | | | | 60.5 | | | | 72.3 | | | | 90.3 | |

Cost of revenues | | | (10.1 | ) | | | (22.8 | ) | | | (40.5 | ) | | | (48.4 | ) | | | (60.2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 7.7 | | | | 11.9 | | | | 20.0 | | | | 23.9 | | | | 30.1 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Selling and marketing | | | (0.3 | ) | | | (0.5 | ) | | | (0.8 | ) | | | (1.7 | ) | | | (2.3 | ) |

General and administrative | | | (1.9 | ) | | | (4.0 | ) | | | (9.3 | ) | | | (12.0 | ) | | | (17.4 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | (2.2 | ) | | | (4.5 | ) | | | (10.1 | ) | | | (13.7 | ) | | | (19.7 | ) |

| | | | | | | | | | | | | | | | | | | | |

Profit from operations | | | 5.5 | | | | 7.4 | | | | 9.9 | | | | 10.2 | | | | 10.4 | |

Interest income | | | * | | | | 0.2 | | | | 0.2 | | | | * | | | | 0.1 | |

Interest expense | | | — | | | | — | | | | — | | | | — | | | | * | |

Other income | | | * | | | | 0.2 | | | | 0.9 | | | | 1.3 | | | | 4.8 | |

Other expenses | | | * | | | | (0.1 | ) | | | (1.6 | ) | | | (0.2 | ) | | | (0.2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income from operations before income taxes | | | 5.4 | | | | 7.7 | | | | 9.4 | | | | 11.4 | | | | 15.1 | |

Income taxes | | | (1.7 | ) | | | (0.2 | ) | | | (0.3 | ) | | | (1.6 | ) | | | (2.1 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation | | | 3.7 | | | | 7.5 | | | | 9.1 | | | | 9.8 | | | | 13.0 | |

Allocation to preferred shareholders | | | — | | | | (0.7 | ) | | | (2.3 | ) | | | (2.5 | ) | | | (2.7 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation’s ordinary shareholders | | | 3.7 | | | | 6.8 | | | | 6.8 | | | | 7.3 | | | | 10.3 | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation’s ordinary shareholders per share | | | | | | | | | | | | | | | | | | | | |

Basic | | | 0.2 | | | | 0.03 | | | | 0.03 | | | | 0.04 | | | | 0.04 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 0.2 | | | | 0.03 | | | | 0.03 | | | | 0.04 | | | | 0.04 | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to ShangPharma Corporation’s ordinary shareholder per ADS(1) | | | | | | | | | | | | | | | | | | | | |

Basic | | | 0.32 | | | | 0.59 | | | | 0.59 | | | | 0.63 | | | | 0.79 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 0.32 | | | | 0.59 | | | | 0.59 | | | | 0.63 | | | | 0.78 | |

| | | | | | | | | | | | | | | | | | | | |

Weighted average ordinary shares outstanding(2) | | | | | | | | | | | | | | | | | | | | |

Basic | | | 208,005,986 | | | | 208,005,986 | | | | 208,005,986 | | | | 208,005,986 | | | | 233,874,361 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 208,005,986 | | | | 230,381,122 | | | | 278,000,000 | | | | 278,051,299 | | | | 238,000,199 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Each ADS represents 18 ordinary shares. |

| (2) | In May 2008, we effected a bonus share issuance in the form of a share split by issuing an additional approximately 20,800 ordinary shares for each ordinary share outstanding and an additional approximately 20,800 preferred shares for each preferred share outstanding. As a result of the bonus share issuance, the number of ordinary shares and preferred shares increased to 208,005,986 and 69,994,014, respectively. The effect of the bonus share issuance is retroactively reflected for all periods presented herein. |

4

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | (in millions of US$) | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Cash | | | 2.3 | | | | 19.6 | | | | 15.8 | | | | 12.2 | | | | 49.2 | |

Total current assets | | | 6.0 | | | | 27.5 | | | | 28.7 | | | | 30.1 | | | | 73.1 | |

Total assets | | | 14.4 | | | | 45.3 | | | | 61.7 | | | | 70.0 | | | | 138.0 | |

Total current liabilities | | | 6.6 | | | | 11.5 | | | | 17.3 | | | | 15.5 | | | | 24.4 | |

Total liabilities | | | 6.3 | | | | 11.5 | | | | 17.3 | | | | 15.5 | | | | 24.4 | |

Series A convertible preferred shares | | | — | | | | 34.4 | | | | 34.4 | | | | 34.4 | | | | — | |

Total equity | | | 8.1 | | | | (0.6 | ) | | | 10.0 | | | | 20.1 | | | | 113.5 | |

Exchange Rate Information

We use U.S. dollars as our reporting currency in our consolidated financial statements and in this annual report. We conduct substantially all of our operations in China. A substantial portion of our sales are denominated in U.S. dollars, while a significant portion of our costs and expenses are denominated in Renminbi. This annual report contains translations of RMB into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB in this annual report were made at a rate of RMB6.6000 to US$1.00, the certified exchange rate published by the Board of Governors of the Federal Reserve Bank in effect on December 30, 2010. We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate, at the rates stated below, or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign currencies and through restrictions on foreign trade. On April 22, 2011, the certified exchange rate was RMB6.5067 to US$1.00.

The following table sets forth information concerning exchange rates between the RMB and the U.S. dollar for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report or will use in the preparation of our periodic reports or any other information to be provided to you. The source of these rates is the Federal Reserve Statistical Release.

| | | | | | | | | | | | | | | | |

| | | Exchange Rate | |

Period | | Period End | | | Average(1) | | | Low | | | High | |

2006 | | | 7.8041 | | | | 7.9579 | | | | 8.0702 | | | | 7.8041 | |

2007 | | | 7.2946 | | | | 7.5806 | | | | 7.8127 | | | | 7.2946 | |

2008 | | | 6.8225 | | | | 6.9193 | | | | 7.2946 | | | | 6.7800 | |

2009 | | | 6.8259 | | | | 6.8295 | | | | 6.8470 | | | | 6.8176 | |

2010 | | | 6.6000 | | | | 6.7603 | | | | 6.8330 | | | | 6.6000 | |

October | | | 6.6707 | | | | 6.6678 | | | | 6.6912 | | | | 6.6397 | |

November | | | 6.6670 | | | | 6.6538 | | | | 6.6892 | | | | 6.6330 | |

December | | | 6.6000 | | | | 6.6497 | | | | 6.6745 | | | | 6.6000 | |

2011 | | | | | | | | | | | | | | | | |

January | | | 6.6017 | | | | 6.5964 | | | | 6.6364 | | | | 6.5809 | |

February | | | 6.5713 | | | | 6.5761 | | | | 6.5520 | | | | 6.5965 | |

March | | | 6.5743 | | | | 6.5645 | | | | 6.5483 | | | | 6.5743 | |

April (through April 22) | | | 6.5067 | | | | 6.5315 | | | | 6.4920 | | | | 6.5477 | |

Source:Federal Reserve Statistical Release

| (1) | Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period. |

5

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Risks Related to Our Business and Industry

Our ability to execute projects, maintain, expand or renew existing customer engagements and obtain new customers depends largely on our ability to attract, train, motivate and retain skilled scientists.

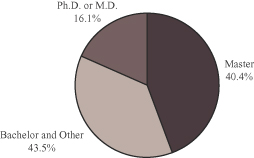

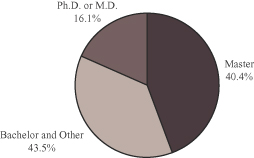

Our success largely depends on the R&D efforts of our skilled scientists and their ability to keep pace with changes in pharmaceutical and biotechnology R&D technologies and methodologies. In particular, our customers value highly skilled Western-trained scientists, preferably with large pharmaceutical and/or biotechnology company experience. Our success also depends on the depth and quantity of our scientific personnel. We face challenges in attracting new employees and maintaining consistent quality standards throughout our employee base at our current growth rate. Our employee base increased from 1,115 as of December 2007 to 1,897 as of December 31, 2010.

We compete with pharmaceutical, biotechnology and contract research firms and academic and research institutions for qualified and experienced scientists, particularly in chemistry and biology. To effectively compete, we may be required to offer higher compensation and other benefits that could materially and adversely affect our financial condition and results of operations. We may be unable to hire and retain enough skilled and experienced scientists to replace those who leave our company. Additionally, we may be unable to redeploy and retrain our professionals to keep pace with technological changes, evolving standards and changing customer preferences. Any inability to attract, train, motivate or retain skilled scientists may materially and adversely affect our business, financial condition, results of operations and prospects.

A limited number of our customers have accounted for and are expected to account for a high percentage of our revenues. The loss or significant reduction in orders from any of these customers could materially and adversely affect our business, financial condition, results of operations and prospects.

Our two largest customers in 2009 and 2010, Eli Lilly and Company, or Lilly, and GlaxoSmithKline plc, or GSK, respectively accounted for 27% and 10% of our net revenues in 2009 and 21% and 8% of our net revenues in 2010. No other customer accounted for more than 10% of our net revenues in 2009 or 2010. Our top ten customers, which varied in each of the last three years, accounted for approximately 77%, 65% and 63% of our net revenues in 2008, 2009 and 2010, respectively. Furthermore, we generated a significant majority of our net revenues during the same periods from sales to customers located in the United States.

Due to our customer concentration, any of the following events, among others, may cause material revenue fluctuations or declines and materially and adversely affect our business, financial condition, results of operations and prospects:

| | • | | order or contract reduction, delay or cancellation by one or more of our significant customers and our failure to identify and acquire additional or replacement customers; and |

| | • | | a substantial reduction by one or more of our significant customers in the price they are willing to pay for our services and products. |

6

Any failure to retain our existing customers or expand our customer base may result in our inability to maintain or increase our revenues.

Our existing customers may not continue to generate significant revenues for us once our engagements with them are concluded and our relationships with them may not present further business opportunities. We have entered into master services agreements with some customers, the terms of which typically range from one to five years. If we fail to build new customer relationships or our relationships with existing customers terminate, we may not be able to maintain or increase our revenues.

A reduction in R&D budgets by pharmaceutical and biotechnology companies may result in a reduction or discontinued use of our services, which may adversely affect our business.

Fluctuations in the R&D budgets of pharmaceutical and biotechnology industry participants could significantly affect the demand for our services. R&D budgets fluctuate due to, among other things, pharmaceutical and biotechnology industry downturns, consolidation of pharmaceutical and biotechnology companies, general economic conditions, and changes in available resources, spending priorities and institutional budgetary policies. The global pharmaceutical and biotechnology industry has experienced significant consolidation and, during the global financial crisis, some pharmaceutical and biotechnology companies experienced financial difficulties. We have experienced reductions, delays or cancellations of orders or contracts from certain customers and difficulties in collecting fees from certain customers who experienced financial difficulties or consolidation in the global financial crisis. For example, two of our North America-based biotechnology customers experienced financial difficulties during the global financial crisis and terminated their contracts with us in late 2008. We collected all of the accounts receivable from one of the two customers and part of the accounts receivable from the other one. The amount of uncollected accounts receivable was immaterial and fully reserved for. If pharmaceutical and biotechnology companies discontinue or decrease the use of our services due to factors such as a prolonged slowdown in the overall U.S. or global economy or further industry consolidation, our revenues and earnings could be lower than we expect and our revenues may decrease or fail to grow at historical rates.

The outsourcing trend in the drug R&D industry may decrease, which could slow our growth.

The success of our business depends primarily on the number of contracts and the size of the contracts that we obtain from pharmaceutical and biotechnology companies. Over the past several years, our business has benefited from increased levels of outsourcing of drug R&D by pharmaceutical and biotechnology companies. While the outsourcing trend is expected to continue for the next several years, a reversal or slowing of this trend could result in diminished growth in our expected growth areas and materially adversely affect our business, financial condition, results of operations and prospects.

If we fail to protect the intellectual property rights of our customers, we may be subject to liability for breach of contract and may suffer damage to our reputation.

Protection of intellectual property associated with pharmaceutical and biotechnology R&D services is critical to all our customers. Our customers generally retain ownership of associated intellectual property rights, including those they provide to us and those arising from the services we provide. Our success therefore depends in substantial part on our ability to protect the proprietary rights of our customers. This is particularly important for us because almost all of our operations are based in China, which has not traditionally enforced intellectual property protection to the same extent as in the United States. Despite measures we take to protect our customers’ and our own intellectual property, unauthorized parties may attempt to obtain and use information that we regard as proprietary. Any unauthorized disclosure of our customers’ proprietary information could subject us to liability for breach of contract and significantly damage our reputation, which could materially harm our business, financial condition, results of operations and prospects.

7

Any failure to comply with applicable regulations and industry standards or obtain various licenses and permits could harm our reputation and our business, results of operations and prospects.

A number of governmental agencies or industry regulatory bodies in China, the United States and Europe, impose strict rules, regulations and industry standards governing pharmaceutical and biotechnology R&D activities, which apply to our customers and us. Our failure to comply with such regulations could result in the termination of ongoing research, administrative penalties imposed by regulatory bodies or the disqualification of data for submission to regulatory authorities. This could harm our reputation, prospects for future work and operating results. For example, if we were to treat research animals inhumanely or in violation of international standards set out by the Association for Assessment and Accreditation of Laboratory Animal Care, or AAALAC, AAALAC could revoke any such accreditation and the accuracy of our animal research data could be questioned.

In addition, our subsidiaries in China need to obtain various licenses and permits to conduct their current operations. If any of our subsidiaries in China is unable to obtain all the requisite licenses and permits or fails to renew or update any of the licenses or permits timely, it may be subject to fines and other penalties, including suspension of its operations.

Compliance with environmental regulations can be expensive, and noncompliance with these regulations may result in significant monetary damages, fines and other penalties.

As our pharmaceutical and biotechnology R&D processes generate waste water, toxic and hazardous substances and other industrial wastes, we must comply with all national and local environmental laws and regulations in China. We are required to undertake environmental impact assessment procedures and pass the subsequent inspection and approval procedures before commencing our operations. We are also required to register with, or obtain approvals from, relevant environmental protection authorities for various environmental matters such as discharging waste generated in our operations. We did not complete certain environmental assessment or approval procedures for some of our facilities. We took remedial measures necessary to obtain the requisite approvals. We had received approvals of the environmental impact assessment report for our principal facilities in Shanghai by November 2010 and are now applying for the inspection and approval of such facilities. According to relevant PRC regulations, the local environmental protection authorities are required to complete the inspection and approval procedures within several months upon receipt of an application for such inspection and approval. However, we cannot assure you that the remedial measures we are taking will be completed timely and successfully. If for any reason the relevant government authorities in China determine that we are not in compliance with environmental laws and regulations, we may be required to pay fines or damages to third parties or suspend our operations. In addition, because the requirements imposed by environmental laws and regulations may change and more stringent regulations may be adopted, we may be unable to accurately predict the cost of complying with these laws and regulations, which could be substantial.

We are subject to safety and health laws and regulations in China, and any failure to comply could adversely affect our operations.

Our operations and facilities are subject to extensive safety and health laws and regulations. We must ensure that our operations and facilities comply with PRC standards and requirements on fire prevention, hazardous and radioactive materials handling, work environment safety and employees’ health conditions. We have not completed certain procedures for some of our facilities or projects required for compliance with these laws and regulations, such as having our relevant work environments inspected for occupational hazards. We are taking remedial measures to rectify such non-compliance. For example, we have had our material work areas inspected for occupational hazards. However, we may be subject to government orders to rectify non-compliance within a specified period, pay fines or suspend our operations. In addition, we cannot eliminate the risk of accidental contamination or injury from hazardous or radioactive materials used in our operations. If we fail to prevent contamination or injury, we could be liable for any resulting damages, which may materially and adversely impact our business, financial condition, results of operations and prospects.

8

Any failure by us to satisfy our customers’ audits and inspections could harm our reputation and our business, financial condition, results of operations and prospects.

Our customers routinely audit and inspect our facilities, processes and practices to ensure that we meet their standards for drug discovery and development. To date, we are not aware of any material negative findings from our customers’ audits and inspections. However, we may not be able to pass all such audits and inspections to our customers’ satisfaction, and any such failure may significantly harm our reputation and materially and adversely affect our business, financial condition, results of operations and prospects. We face increasingly intense competition. If we do not compete successfully against new and existing competitors, demand for our services and related revenues may decrease and we may be subject to increasing pricing pressure.

We face increasingly intense competition. If we do not compete successfully against new and existing competitors, demand for our services and related revenues may decrease and we may be subject to increasing pricing pressure.

The global pharmaceutical and biotechnology R&D outsourcing market is highly competitive, and we expect competition to intensify. We face competition based on several factors, including the quality and scope of services, the ability to protect confidential information and intellectual property, the ability to be responsive and efficient with respect to customers’ requests, depth of customer relationship and pricing. We compete with WuXi PharmaTech (Cayman) Inc., or WuXi PharmaTech, across the breadth of our service offerings. We also compete with industry participants in particular service areas, including Albany Molecular Research, Inc. in discovery chemistry and pharmaceutical development, and Cerep S.A. and Covance Inc. in discovery biology and preclinical development.

We expect to increasingly compete against multinational companies, both domestically and internationally, as we offer more complex and sophisticated services. Additionally, several major pharmaceutical and biotechnology companies have made in-house R&D investments in China, a trend we expect to continue. These in-house investments may result in increased competition for qualified personnel. Some of our larger competitors may have greater financial, research and other resources, broader scope of services, greater pricing flexibility, more extensive technical capabilities and greater name recognition than we do. Furthermore, consolidation within the global pharmaceutical and biotechnology R&D outsourcing markets may create stronger competitors than those we are facing today.

We also expect increased competition as new companies enter into our market and more advanced technologies become available. Our services and expertise may be rendered obsolete or uneconomical by technological advances or new approaches or technologies. Our competitors’ existing or new approaches or technologies they develop may be more effective than those we develop. Furthermore, increased competition may subject us to increasing pricing pressure and reduce demand for our services, which could reduce our margins and profitability.

We may fail to effectively expand and market our service offerings and capabilities, which may harm our growth opportunities and prospects, possibly resulting in related losses.

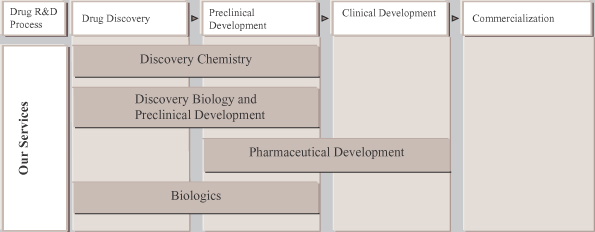

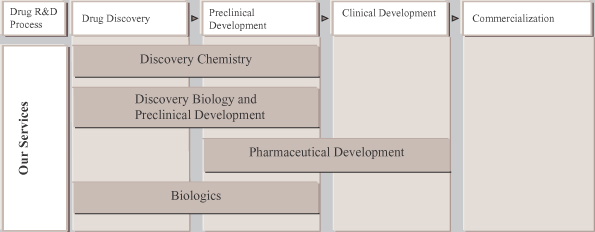

We intend to expand our existing services and offer new services across the drug discovery value chain. Initially focusing on discovery chemistry services, we introduced pharmaceutical development services in 2005 and discovery biology and preclinical development services in 2007. We began offering biologics services in early 2010. We are constructing an approximately 460,000 square-foot cGMP-quality multi-purpose manufacturing facility in Fengxian, Shanghai designed to manufacture advanced intermediates and APIs for preclinical testing and clinical trials. Phase A of the multi-purpose manufacturing facility commenced operations on its initial phase of production in January 2011. We are also constructing an approximately 150,000 square-foot laboratory services building in Fengxian, Shanghai primarily for pharmaceutical development services. To successfully develop and market our new services, we must:

| | • | | accurately assess and meet customer needs and market demands; |

| | • | | optimize our drug discovery and development processes to predict and control costs; |

9

| | • | | hire, train and retain scientists and other personnel; |

| | • | | provide services in a timely manner; |

| | • | | increase customer awareness and acceptance of our services; |

| | • | | obtain required regulatory clearances or approvals; |

| | • | | compete effectively with other R&D outsourcing providers; |

| | • | | price our services competitively; and |

| | • | | effectively integrate customer feedback into our business planning. |

If we are unable to expand our service offerings and create demand for those newly expanded services, our business, results of operations, financial condition and prospects may be materially and adversely affected.

We may be unable to expand our capacity and scale up our operations as anticipated, possibly resulting in material delay, increased costs and lost business opportunities.

We are developing an approximately 460,000 square-foot cGMP-quality multi-purpose manufacturing facility in Fengxian, Shanghai designed to manufacture advanced intermediates and APIs for preclinical testing and clinical trials. Phase A of the multi-purpose manufacturing facility commenced operations on its initial phase of production in January 2011. We are constructing an approximately 150,000 square-foot laboratory services building in Fengxian, Shanghai primarily for pharmaceutical development services. We may not construct Phase B of the multi-purpose manufacturing facility or the laboratory services building in accordance with the anticipated timetable or within budget. We may lease or build additional animal facilities in Shanghai if the demand for our discovery biology and preclinical development services increases. Any material delay in bringing these facilities online or scaling up operations, or any substantial cost increases to complete them or scale up operations, could materially and adversely affect our financial condition and results of operations, and result in lost business opportunities.

If we fail to effectively manage our anticipated growth and execute our growth strategies, our business, financial condition, results of operations and prospects could suffer.

Pursuing our growth strategies, including integrating and expanding our facilities and service offerings to meet our customers’ needs, has resulted in and will continue to place substantial demands on our management and resources. Managing this growth and executing our growth strategies will require, among other things:

| | • | | enhancement of our pharmaceutical and biotechnology R&D capabilities; |

| | • | | effective coordination and integration of our research facilities and teams, particularly those located in different or newly opened facilities; |

| | • | | successful personnel hiring and training; |

| | • | | effective cost controls and sufficient liquidity; |

| | • | | effective and efficient financial and management controls; |

| | • | | increased marketing and sales support activities; |

| | • | | effective quality control; and |

| | • | | our ability to manage our various vendors and suppliers and leverage our purchasing power. |

Any failure to effectively manage our anticipated growth and execute our growth strategies could materially adversely affect our business, financial condition, results of operations and prospects.

10

If our company or our founders grant employees share options and other share-based compensation in the future, our net income may be adversely affected.

Our equity incentive plans and other similar types of incentive plans are important in order to attract and retain key personnel. Our company and our founders have granted our employees share options in the past pursuant to the 2008 Equity and Performance Incentive Plan, or the Plan, and restricted share units pursuant to the Founder’s 2008 Equity and Performance Incentive Plan, or the Founder’s Plan, and the 2010 Share Incentive Plan, or the 2010 Plan. As a result of the issuance of options and RSUs under these plans, we have in the past incurred and expect in the future to incur share-based compensation expenses. We account for compensation costs for all share options, including share options granted to our employees, consultants, non-employee directors and officers using the fair value determined at the grant date and recognize the expense in our consolidated statement of operations. We also account for compensation costs for the conversion of RSUs into our ordinary shares. These compensation costs may materially and adversely affect our net income. Moreover, the additional expenses associated with share-based compensation may reduce the attractiveness of our equity incentive plans.

In providing our pharmaceutical and biotechnology R&D outsourcing services, we face health and safety liability and product liability risks.

In providing our services in connection with drug discovery and development, we face a range of potential liabilities, which include risks that disease models and animals infected with diseases for research interests may be harmful, or even lethal, to themselves and humans despite preventive measures we take for the quarantine and handling of animals. We also face product liability risks should the drugs we assist in developing and manufacturing become subject to product liability claims. We provide services in the development, testing and manufacturing of drugs that may ultimately be used by humans, although we do not commercially market or sell the products to end users. If any of these drugs harm people, we may be subject to litigation and may be required to pay damages to those persons.

We do not have general liability or product liability insurance covering our whole business or all of our products and services. We currently maintain general liability insurance for five contracts covering, among other things, bodily injury and property damage arising out of the products or services provided under these contracts. The aggregate net revenues derived from these contracts in 2010 accounted for 7% of our total net revenues in this period. The aggregate maximum coverage amount under the insurance policy for these contracts is US$5.0 million for bodily injury and property damage arising out of our products or services and economic loss sustained by persons or entities due to deficiencies in our products or services. Damages awarded in a product liability action could be substantial and, to the extent not covered by our insurance, could materially and adversely impact our business, financial condition and results of operations.

Because many of our fee-for-service based contracts are contingent on successful completion and are of a fixed price nature, we may bear risk if we do not successfully or timely develop a service or enter contracts with pricing below our estimated cost due to competitive pressures or strategic objectives, or incur overrun costs.

A significant portion of our net revenues is based on fee-for-service contracts, which are contingent on successful completion and are often for a fixed price. Therefore, we bear financial risk if we do not successfully or timely complete services or if we price our fee-for-service based contracts below our estimated cost of completing these contracts or otherwise incur cost overruns. We also face pricing pressures from some of our competitors. To capture market share, we have, in the past, intentionally priced some fee-for-service based contracts below our estimated cost of completing these contracts. Below-cost pricing or significant cost overruns could materially and adversely affect our business, financial condition, results of operations and prospects.

11

The loss of services of our senior management and key scientific personnel could severely disrupt our business and growth.

Our success significantly depends upon the continued service of our senior management and key scientific personnel. We are highly dependent on Mr. Michael Xin Hui, our co-founder and chief executive officer, who has managed our business, operations and sales and marketing activities and maintained personal and direct relationships with our major customers since our inception, as well as other members of our management and other key scientific personnel. The loss of any one of them, in particular Mr. Hui, would materially and adversely affect our business. Although each member of our senior management and key scientific personnel has signed a noncompete agreement with us, we may be unable to successfully enforce these provisions in the event of a dispute. If we lose the services of any of our senior management members or key scientific personnel, we may be unable to locate suitable or qualified replacements, and may incur additional expenses to recruit and train new personnel, which could severely disrupt our business and growth.

A payment failure by any of our large customers could adversely affect our cash flows and profitability.

Historically, we have not experienced any significant bad debt or collection problems, but such problems may arise in the future. The failure of any of our customers to make timely payments could require us to write off accounts receivable or increase provisions made against our accounts receivable, either of which could adversely affect our cash flows and profitability.

Our limited operating history may make it difficult for you to evaluate our business and future prospects.

We commenced operations and began offering our pharmaceutical and biotechnology R&D outsourcing services in 2002. Our business model changes with the evolution of the pharmaceutical and biotechnology R&D outsourcing market in China and around the world. Accordingly, our operating history upon which you can evaluate the viability and sustainability of our business and its acceptance by industry participants is limited. These circumstances may make it difficult for you to evaluate our business and future prospects, and you should not rely on our past results or our historic growth rate as an indication of our future performance.

In preparing our consolidated financial statements, we have identified one material weakness and other deficiencies in our internal control over financial reporting. If we fail to develop and maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results or prevent fraud, and investor confidence in our company and the market price of our ADSs may be adversely affected.

Prior to our initial public offering in October 2010, we were a private company with limited accounting personnel and other resources with which to address our internal control over financial reporting. In preparing our consolidated financial statements, we and our independent registered public accounting firm identified one material weakness and other deficiencies in our internal control over financial reporting as of December 31, 2009. As defined in the standards established by the U.S. Public Company Accounting Oversight Board, or the PCAOB, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

The material weakness identified related to a lack of sufficient competent personnel with appropriate levels of accounting knowledge and experience to perform period end reporting procedures, address complex U.S. GAAP accounting issues and prepare and review financial statements and related disclosures under U.S. GAAP. Neither we nor our independent registered public accounting firm undertook a comprehensive assessment of our internal control for purposes of identifying and reporting material weaknesses and other control deficiencies in our internal control over financial reporting as we and they are required to do now that we have become a public company. Had we performed a formal assessment of our internal control over financial reporting or had our independent registered public accounting firm performed an audit of our internal control over financial reporting, additional deficiencies may have been identified.

12

Following the identification of the material weakness and other control deficiencies, we have taken several measures to remedy the material weakness and control deficiencies and improve our internal control over financial reporting. We hired additional finance and accounting personnel, including a finance controller in late 2009, a finance manager in early 2010 and William Dai, our new chief financial officer in early 2011, all with significant U.S. GAAP and SEC reporting experience. These additional personnel are responsible for the preparation and review of financial statements and accompanying footnotes in accordance with U.S. GAAP and implementing or improving the internal reporting process under U.S. GAAP. In addition, we have (i) provided, and intend to continue to provide, on-going training to our accounting and operating personnel across different subsidiaries and departments to improve their U.S. GAAP accounting knowledge; (ii) established and strengthened our IT systems and controls related to the IT systems to ensure proper record keeping; (iii) developed comprehensive quarterly closing procedures that require certain documentation and records to be completed and reviewed; (iv) updated and improved our accounting manual; and (v) engaged an outside consultant to assist us in preparing for compliance with Section 404 of the Sarbanes-Oxley Act. We are also in the process of, among other things, evaluating our financial accounting system for adequacy and potential upgrade. We will continue to implement measures to support our internal control over financial reporting.

However, the implementation of these measures may not fully address the material weakness and other control deficiencies in our internal control over financial reporting, and the material weakness and other control deficiencies have not been fully remedied as of December 31, 2010. Our failure to correct these control deficiencies or our failure to discover and address any other control deficiencies could result in inaccuracies in our financial statements and impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. As a result, our business, financial condition, results of operations and prospects, as well as the trading price of our ADSs, could be materially and adversely affected. Moreover, ineffective internal control over financial reporting significantly hinders our ability to prevent fraud.

We are subject to the Sarbanes-Oxley Act of 2002. Section 404 of the Sarbanes-Oxley Act and related rules require public companies to include a report of management on their internal control over financial reporting in their annual reports. Annual reports generally must contain an assessment by management of the effectiveness of a public company’s internal control over financial reporting. In additional, an independent registered public accounting firm for a public company must attest to and report on management’s assessment of the effectiveness of the company’s internal control over financial reporting. This annual report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of the company’s registered public accounting firm due to a transition period established by rules of the Securities Exchange Commission for newly public companies. See “Item 15. Controls and Procedures.” These reports will be required to be included in our annual report on form 20-F beginning with our annual report for the fiscal year ending December 31, 2011. If we fail to remedy the problems identified above, our management and our independent registered public accounting firm may conclude that our internal control over financial reporting is not effective. This could adversely impact the market price of our ADSs due to a loss of investor confidence in the reliability of our reporting processes. Furthermore, we have incurred and anticipate that we will continue to incur significant costs and use significant management and other resources in order to comply with Section 404 of the Sarbanes-Oxley Act.

Our business, financial condition and results of operations may be adversely affected by the downturn in the global or Chinese economy.

The global financial markets have experienced significant disruptions since 2008 and the effect of the crisis persisted in 2009 and 2010. China’s economy has also faced challenges. To the extent that there have been improvements in some areas, it is uncertain whether such recovery is sustainable. A slowdown in the global or Chinese economy or the recurrence of any financial disruptions may have a material and adverse impact on financings available to us. The weakness in the economy could erode investors’ confidence, which constitutes the basis of the equity markets. The recent financial turmoil affecting the financial markets and banking system may significantly restrict our ability to obtain financing in the capital markets or from financial institutions on

13

commercially reasonable terms, or at all. Although we are uncertain about the extent to which the recent global financial and economic crisis and slowdown of the Chinese economy may impact our business in the long term, there is a risk that our business, results of operations and prospects would be materially and adversely affected by the global economic downturn and the slowdown of the Chinese economy.

Our customer agreements contain provisions that are adverse to our interests or expose us to potential liability.

Our agreements with our customers generally provide that customers can terminate the agreements or reduce the scope of services under the agreements upon short notice. In a majority of our customer agreements, our customers have the unilateral right to terminate for convenience upon one to three months’ prior notice. Although we have not been materially and adversely affected by previous contract cancellations or modifications, if a customer terminates a contract with us, we are only entitled under the terms of the contract to receive revenue earned until the date of termination. Therefore, cancellation or modification of a large contract or cancellation or modification of multiple contracts could materially and adversely affect our business, financial condition, results of operations and prospects.

In certain of our customer agreements, we have assumed indemnification obligations for intellectual property infringement resulting from the misuse of confidential information by our employees or from the customer deliverables that we provide to the extent that we create the infringing aspect of the deliverables. As a result, we could be potentially exposed to substantial liability.

In addition, in some of our customer agreements, we agree, either by ourselves or together with third parties, not to compete with the customer. In some cases, we are required to seek the customer’s prior written consent before working for other customers on similar projects. Complying with these noncompete obligations may restrict our ability to expand certain service offerings, and failure to comply could significantly harm our business and reputation, as well as expose us to liability for breach of contract.

We use a limited number of suppliers, including a related party, Labpartner (Shanghai) Co., Ltd., for several of our service offerings, which, if interrupted, could disrupt or delay our services, reduce our sales and force us to use more expensive supply sources.

We use a limited number of sources for our supply of certain reagents and other chemicals required in our product and service offerings. In particular, we purchased significant amounts of reagents and other chemicals from Labpartner (Shanghai) Co., Ltd., or Labpartner, a related party, in each of 2008, 2009 and 2010. Disruptions or delays with respect to our suppliers may arise from health problems, export or import restrictions or embargoes, foreign government or economic instability, severe weather conditions, disruptions to the air travel system, contract disputes or other disruptions. If the supply of certain materials were interrupted, our services may be delayed. We also may not be able to secure alternative supply sources in a timely and cost-effective manner. If we are unable to obtain adequate supplies of required materials that meet our standards or at acceptable costs, or at all, our ability to accept and fulfill customer orders in the required quality and quantity and at the required time could be restricted, which in turn may materially and adversely affect our business, financial condition, results of operations and prospects.

We have limited insurance coverage, and any claims beyond our insurance coverage may result in our incurring substantial costs and a diversion of resources.

We maintain property insurance policies covering physical damage or loss of our equipment and office furniture, employer’s liability insurance generally covering death or work injury of employees, public liability insurance covering third party bodily injury and property damage incurred in connection with our business in China, and directors and officers liability insurance. We do not have general liability or product liability insurance covering our whole business or all of our products and services. We currently maintain general liability

14

insurance for five contracts covering, among other things, bodily injury and property damage arising out of the products or services provided under these contracts. The aggregate net revenues derived from these contracts in 2010 accounted for 7% of our total net revenues in this period. The aggregate maximum coverage amount under the insurance policy for these contracts is US$5.0 million for bodily injury and property damage arising out of our products or services and economic loss sustained by persons or entities due to deficiencies in our products or services. We do not maintain business disruption insurance or key man life insurance. Any business disruption or litigation, or any liability or damage to, or caused by, our facilities or our personnel beyond our insurance coverage may result in substantial costs and a diversion of resources.

Our quarterly revenues and operating results may be difficult to predict and could fall below investor expectations, which could cause the market price of our ADSs to decline.

Our quarterly revenues and operating results have fluctuated in the past and may continue to fluctuate significantly due to numerous factors, including:

| | • | | the commencement, postponement, completion or cancellation of large contracts; |

| | • | | the progress of ongoing contracts; |

| | • | | the delivery schedule of our customers; |

| | • | | budget cycles of our customers; |

| | • | | changes in the mix of our revenues from our services based on a fee-for-service or FTE basis or the percentage of our fee-for-service based contracts that are contingent upon successful completion; |

| | • | | changes in the industry operating environment; |

| | • | | changes in government policies or regulations or their enforcement; |

| | • | | exchange rate fluctuations; |

| | • | | a downturn in general economic conditions in the United States, China or internationally; and |

| | • | | the timing of and charges associated with completed acquisitions or other events. |

Many of these factors are beyond our control, making our quarterly results fluctuate and difficult to predict. Fluctuations in our quarterly revenues and operating results could cause the trading price of our ADSs to decline below investor expectations.

We may need additional capital that we may be unable to obtain in a timely manner or on acceptable terms, or at all.

We may require additional capital in order to grow, remain competitive, develop new services and expand our capacity. Our ability to obtain capital is subject to a variety of uncertainties, including:

| | • | | our financial condition, results of operations and cash flows; |

| | • | | general market conditions for capital raising activities by healthcare and related companies; and |

| | • | | economic, political and other conditions in China, the United States and elsewhere. However, financing may not be available in amounts or on terms acceptable to us, if at all. |

Our capital needs may require us to sell additional equity or debt securities that may dilute our shareholders or introduce covenants that may restrict our operations or our ability to pay dividends.

Our capital needs and other business reasons could require us to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity or equity-linked securities could dilute our shareholders. The incurrence of indebtedness would increase our debt service obligations and could result in operating and financing covenants that would restrict our operations or our ability to pay dividends.

15

Acquisitions or investments could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our business.

We anticipate that a portion of any future growth of our business might be accomplished by acquiring businesses, products or technologies. The success of any acquisition will depend upon, among other things, our ability to integrate acquired personnel, operations, products and technologies into our organization effectively, to retain and motivate key personnel of the acquired businesses and to retain their clients. In addition, we might not be able to identify suitable acquisition opportunities or obtain any necessary financing on acceptable terms. We might also spend time and money investigating and negotiating with potential acquisition or investment targets, but not complete a transaction. Any acquisition could involve other risks, including the assumption of additional liabilities and expenses, issuances of potentially dilutive securities or interest-bearing debt, transaction costs, reduction in our ADS price as a result of any of these or because of market reaction to a transaction and diversion of management’s attention from other concerns.

Recent healthcare reform creates uncertainty in the need for our services.

In March 2010, the United States Congress passed the Patient Protection and Affordable Care Act. Implementation of this newly enacted act, which is intended to control health care costs, may limit profits from the development of new drugs. Similar reform movements have occurred or may occur in parts of Europe and Asia. It is unclear how these reforms may affect R&D expenditures by pharmaceutical and biotechnology companies, which creates uncertainty in the business opportunities available to us in the United States and other countries.

Negative attention from special interest groups may impair our ability to operate our business efficiently.

Some of the services we provide, or intend to provide, involve the use of large and small animals, as well as non-human primates. Certain special interest groups categorically object to the use of animals for research purposes. Historically, our core research model activities with small animals have not been the subject of animal rights media attention, and as we expand our service biology offerings into non-GLP toxicology, we anticipate that we will work extensively with large animals and non-human primates. However, research activities with animals have been the subject of adverse attention, negatively impacting our industry. Any negative attention or threats directed against our animal research activities could impair our ability to operate our business efficiently. In addition, if regulatory authorities were to mandate a significant reduction in safety testing procedures that utilize laboratory animals, as has been advocated by certain groups, our business could be materially and adversely affected.

Contamination in our animal populations can distort or compromise the quality of our research results, cause human infection, increase costs and decrease revenue.

Our research models must be free of certain infectious agents such as certain viruses and bacteria. The presence of these infectious agents in our animal facilities could distort or compromise the quality of our research results and could adversely impact human or animal health. Removing or preventing contamination typically requires cleaning, renovating, disinfecting, retesting and restarting our animal facilities, which result in clean-up and start-up costs and reduced revenue due to lost customer confidence in the accuracy of our research results. In some cases, we may import animals carrying infectious agents capable of causing diseases in humans. As a result, there could be a possible risk of human exposure and infection. Although we have not had serious contamination in the past, contamination may occur in the future, which could materially and adversely impact our financial results.

For our customers’ future drugs to be marketed in the United States, we may need to obtain clearance from the FDA and our operations will need to comply with FDA standards. Any adverse action by the FDA against us would negatively impact our ability to offer our services and harm our business and prospects.

As we expand our service offerings, we may need to obtain clearance by the U.S. Food and Drug Administration, or FDA, in the event that our customers’ clinical trials reach the stage of filing a New Drug

16

Application, or NDA, with the FDA, to grant permission to market the drug in the United States. All facilities and manufacturing techniques used to manufacture drugs and biologics in the United States must conform to standards established by the FDA. The FDA may conduct scheduled periodic inspections of our facilities to monitor our compliance with regulatory standards. If the FDA finds that we have failed to comply with the appropriate regulatory standards, it may impose fines or take other actions against us or our customers, or we may no longer be able to offer our services to U.S. customers. The resulting corrective measures may be lengthy and costly. As a result, we may be unable to fulfill our contractual obligations. Any adverse action by the FDA would materially and adversely impact our reputation and our business, financial condition, results of operations and prospects. We may or may not obtain clearance from FDA standards in the event that we are inspected, or maintain such clearance over time.

New technologies or methodologies may be developed, validated and increasingly used in the global pharmaceutical and biotechnology R&D outsourcing industry that could reduce demand for our services.

The global pharmaceutical and biotechnology R&D outsourcing industry is evolving, and we must keep pace with new technologies and methodologies in the industry to maintain our competitive position. As a result, we must invest significant human and capital resources in R&D to enhance our technology and our existing services and introduce new services utilizing advanced technologies. However, we may not be successful in adapting to or commercializing these new technologies if developed. New technologies could decrease the need for our existing technologies, and we may not be able to develop new service or technologies effectively or in a timely manner. Our failure to develop, enhance or adapt, to new technologies and methodologies could significantly reduce demand for our services and harm our business and prospects.

Our principal facilities may be vulnerable to natural disasters or other unforeseen catastrophic events.

We conduct our operations primarily at our headquarters in Shanghai Zhangjiang Hi-Tech Park and our R&D center in Chengdu. We have animal facilities in Shanghai Zhangjiang Hi-Tech Park and Fengxian, Shanghai and a manufacturing facility in Nanhui, Shanghai. In addition, we commenced operations on the initial phase of Phase A of a cGMP-quality multiple-purpose manufacturing facility located in Fengxian, Shanghai in January 2011. We are constructing an approximately 150,000 square-foot laboratory services building in Fengxian, Shanghai primarily for pharmaceutical development services. We depend on our facilities for our business. Natural disasters or other unanticipated catastrophic events, including power interruptions, water shortage, storms, fires, earthquakes, terrorist attacks and wars could significantly impair our ability to operate our business in its ordinary course. Our facilities and certain equipment located in these facilities would be difficult to replace in any such event and could require substantial replacement time. The occurrence of any such event may materially and adversely affect our business, financial condition, results of operations and prospects.

We face risks related to health epidemics and other outbreaks, which could significantly disrupt our staffing and may even result in temporary closure of our facilities.

Our business could be materially and adversely affected by the outbreak of avian influenza, severe acute respiratory syndrome, or SARS, or another epidemic. In April 2009, a new strain of influenza A virus subtype H1N1 was discovered in North America and quickly spread to other parts of the world, including China. In early June 2009, the World Health Organization declared the outbreak to be a pandemic, while noting that most of the illnesses were of moderate severity. The PRC Ministry of Health has reported a few hundred deaths caused by the influenza A (H1N1). Any outbreak of avian influenza, SARS, the influenza A (H1N1) or other adverse public health developments in China may materially and adversely affect our business operations. These occurrences could severely disrupt to our daily operations.

17

Risks Related to Doing Business in China

Fluctuations in exchange rates may materially and adversely affect your investment.

The value of the Renminbi against the U.S. dollar and other currencies is affected by, among other things, changes in China’s political and economic conditions and China’s foreign exchange policies. The conversion of Renminbi into foreign currencies, including U.S. dollars, is based on rates set by the People’s Bank of China. The PRC government allowed the Renminbi to appreciate by more than 20% against the U.S. dollar between July 2005 and July 2008. Between July 2008 and June 2010, this appreciation halted and the exchange rate between the Renminbi and the U.S. dollar remained within a narrow band. Since June 2010, the PRC government has allowed the Renminbi to appreciate slowly against the U.S. dollar again. It is difficult to predict how market forces or PRC or U.S. government policy may impact the exchange rate between the Renminbi and the U.S. dollar in the future.

The reporting and functional currency of ShangPharma Corporation is the U.S. dollar. Our offshore subsidiaries’ functional currency is the U.S. dollar. However, the functional currency of our PRC subsidiaries is the Renminbi. A significant majority of our revenues are denominated in U.S. dollars and most of our costs and expenses are denominated in Renminbi. The net proceeds from our initial public offering were denominated in U.S. dollars.

Appreciation or depreciation in the value of the Renminbi relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of earnings from and the value of any U.S. dollar-denominated investments we make.

Limited hedging options are available in China to reduce our exposure to exchange rate fluctuations. We began hedging our U.S. dollar exposure using forward contracts from the second half of 2008 based in part on our expected monthly revenues. We may continue to enter similar or other types of hedging transactions in the future. However, the availability and effectiveness of these hedges may be limited and we may not be able to adequately hedge our exposure or at all. In addition, our currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert between the Renminbi and foreign currency. As a result, fluctuations in exchange rates may materially and adversely affect your investment.

Adverse changes in the political and economic policies of the PRC government could materially and adversely affect the overall economic growth of China, which could adversely affect our business.

Substantially all of our assets are located in China and all of our revenues are derived from our operations there. Accordingly, economic, political and legal developments in China significantly affect our business, financial condition, results of operations and prospects. The Chinese economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the Chinese economy has grown significantly in the past 30 years, the growth has been uneven across different periods, regions and economic sectors of China. We cannot assure you that the Chinese economy will continue to grow, or that any such growth will be steady and uniform, or that if there is a slowdown, such a slowdown will not have a negative effect on our business.

The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. In response to the recent global and Chinese economic downturn, the PRC government has promulgated several measures aimed at expanding credit and stimulating economic growth. Since August 2008, the People’s Bank of China has decreased the statutory deposit reserve ratio and lowered benchmark interest rates several times. Beginning in early 2010, the

18

People’s Bank of China started to take measures including increasing the statutory deposit reserve and the benchmark interest rate to lower the pace of growth of the Chinese economy. It is unclear whether the PRC government will continue such policies, or whether PRC economic policies will be effective in creating stable economic growth. Any further slowdown in the economic growth of China could reduce demand for our solutions and services, which could materially and adversely affect our business, our financial condition and results of operations.

Uncertainties with respect to the PRC legal system could adversely affect us.

We conduct our business primarily through our PRC subsidiaries. Our operations in China are governed by PRC laws and regulations. Our PRC subsidiaries are foreign-invested enterprises and are subject to laws and regulations applicable to foreign investment in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is largely a civil law system based on written statutes. Unlike the common law system, prior court decisions may be cited for reference but have limited precedential value.

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing general economic matters. The overall effect of legislation over the past two decades has significantly enhanced the protections afforded to various foreign investments in China. However, China has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. Because these laws and regulations are relatively new, and published court decisions are limited and nonbinding in nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the violation occurs.

Any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. These uncertainties may also impede our ability to enforce the contracts entered into by our PRC subsidiaries. As a result, these uncertainties could materially and adversely affect our business and results of operations.

SAFE regulations may limit our ability to finance our PRC subsidiaries effectively and affect the value of your investment and may make it more difficult for us to pursue growth through acquisition.