Exhibit (c)(2)

Exhibit (c)(2)

PROJECT SIGMA

Presentation to the Independent Committee of ShangPharma Corporation

December 21, 2012

STRICTLY PRIVATE AND CONFIDENTIAL

This presentation was prepared exclusively for the benefit and internal use of the J.P. Morgan client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J.P. Morgan.

The information in this presentation is based upon any management forecasts supplied to us and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. J.P. Morgan’s opinions and estimates constitute J.P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of the Company or any other entity. In relying on financial analyses and forecasts provided to J.P. Morgan or derived therefrom, J.P. Morgan has assumed that they have been reasonably prepared based on assumptions reflecting the best currently available estimates and judgments by management as to the expected future results of operations and financial condition of the Company to which such analyses or forecasts related. J.P. Morgan expresses no view as to such analyses or forecasts, the assumptions on which they were based or the likelihood that any forecasts, projections or estimates will be achieved. J.P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects.

Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U.S. federal and state income tax treatment and the U.S. federal and state income tax structure of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company relating to such tax treatment and tax structure insofar as such treatment and/or structure relates to a U.S. federal or state income tax strategy provided to the Company by J.P. Morgan.

J.P. Morgan’s policies prohibit employees from offering, directly or indirectly, a favorable research rating or specific price target, or offering to change a rating or price target, to a subject company as consideration or inducement for the receipt of business or for compensation. J.P. Morgan also prohibits its research analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investors. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

J.P. Morgan is a marketing name for investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by a combination J.P. Morgan Securities LLC, J.P. Morgan Limited, J.P. Morgan Securities plc and the appropriately licensed subsidiaries of JPMorgan Chase & Co. in Asia-Pacific, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, N.A. J.P. Morgan deal team members may be employees of any of the foregoing entities. This presentation does not constitute a commitment by any J.P. Morgan entity to underwrite, subscribe for or place any securities or to extend or arrange credit or to provide any other services.

SHANGPHARMA

PROJECT SIGMA

Agenda

Page

Situation overview 1

ShangPharma trading and valuation analysis 5

Appendix 13

PROJECT SIGMA

SHANGPHARMA

1

Executive summary

On July 6, 2012, ShangPharma announced that its Board of Directors has received a non-binding proposal letter from the Buyer Group, which consists of Michael Xin Hui, chairman and CEO of the Company, and TPG to take ShangPharma private for between $8.50 and $9.50 per ADS in cash

On August 3, 2012, J.P. Morgan was appointed by Independent Committee (“Independent Committee”) as its financial advisor to assist the Independent Committee in reviewing and evaluating the proposal, and provide a fairness opinion in connection with the proposal

On November 17, 2012: TPG provided its Final Offer Price of $9.00 per ADS

On December 21, 2012: Negotiation of transaction terms substantially completed

J.P. Morgan’s focus is to evaluate the fairness of the Buyer Group’s offer from a financial point of view, based on the standard valuation methodologies

SHANGPHARMA

SITUATION OVERVIEW

Key transaction metrics

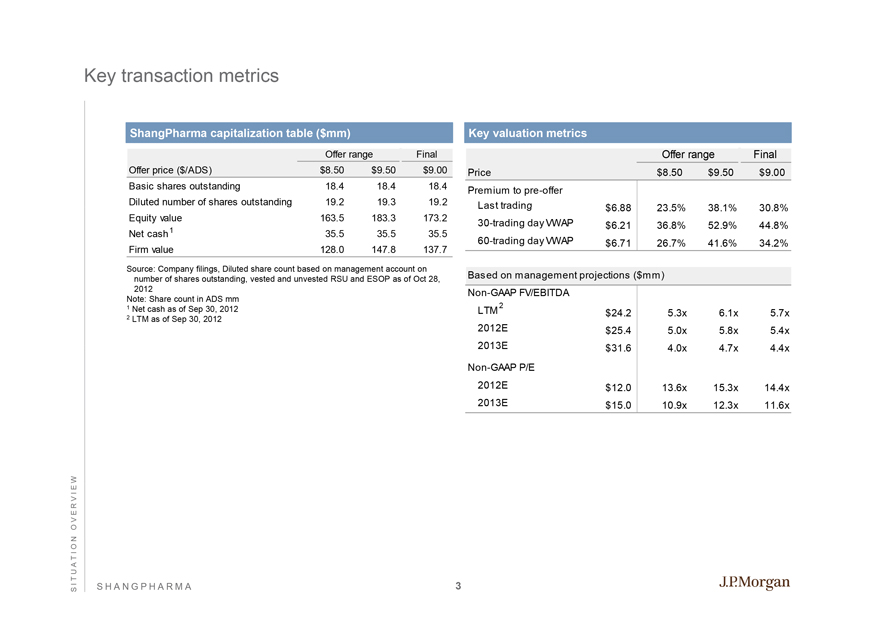

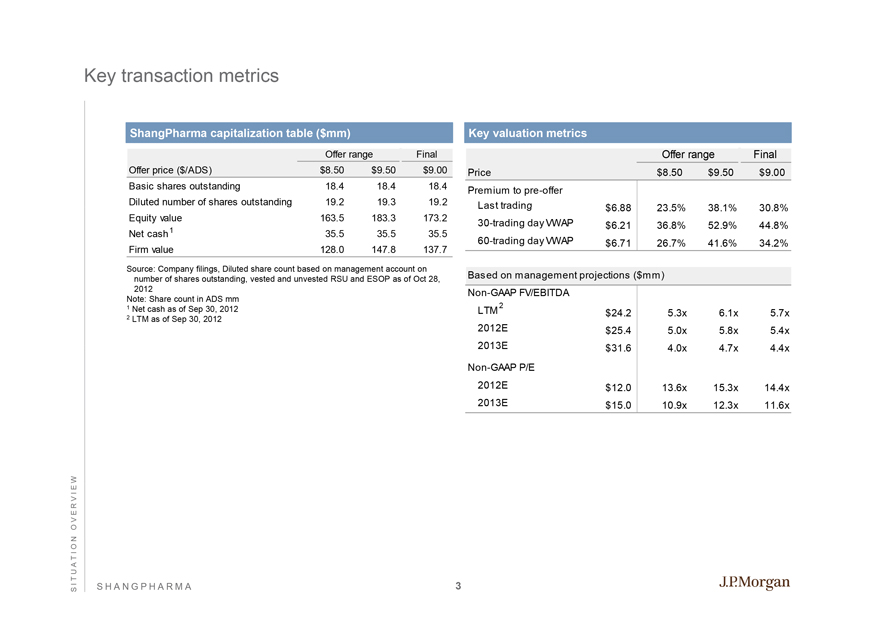

ShangPharma capitalization table ($mm)

Offer range Final

Offer price ($/ADS) $8.50 $9.50 $9.00

Basic shares outstanding 18.4 18.4 18.4

Diluted number of shares outstanding 19.2 19.3 19.2

Equity value 163.5 183.3 173.2

Net cash 1 35.5 35.5 35.5

Firm value 128.0 147.8 137.7

Source: Company filings, Diluted share count based on management account on number of shares outstanding, vested and unvested RSU and ESOP as of Oct 28, 2012 Note: Share count in ADS mm

1 | | Net cash as of Sep 30, 2012 |

Key valuation metrics

Offer range Final

Price $8.50 $9.50 $9.00

Premium to pre-offer

Last trading $ 6.88 23.5% 38.1% 30.8%

30-trading day VWAP $ 6.21 36.8% 52.9% 44.8%

60-trading day VWAP $ 6.71 26.7% 41.6% 34.2%

Based on management projections ($ mm)

Non-GAAP FV/EBITDA

LTM 2 $ 24.2 5.3x 6.1x 5.7x

2012E $ 25.4 5.0x 5.8x 5.4x

2013E $ 31.6 4.0x 4.7x 4.4x

Non-GAAP P/E

2012E $ 12.0 13.6x 15.3x 14.4x

2013E $ 15.0 10.9x 12.3x 11.6x

SHANGPHARMA

SITUATION OVERVIEW

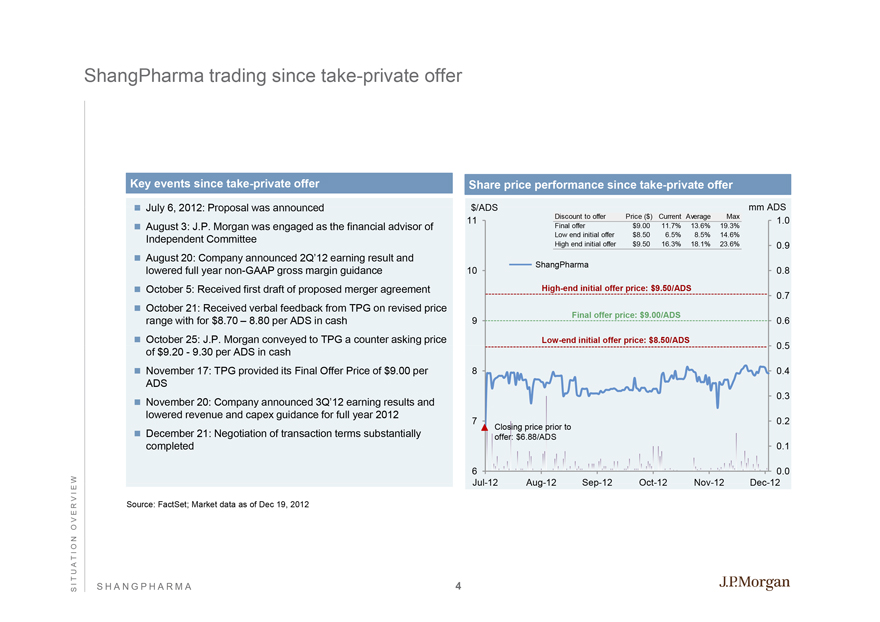

ShangPharma trading since take-private offer

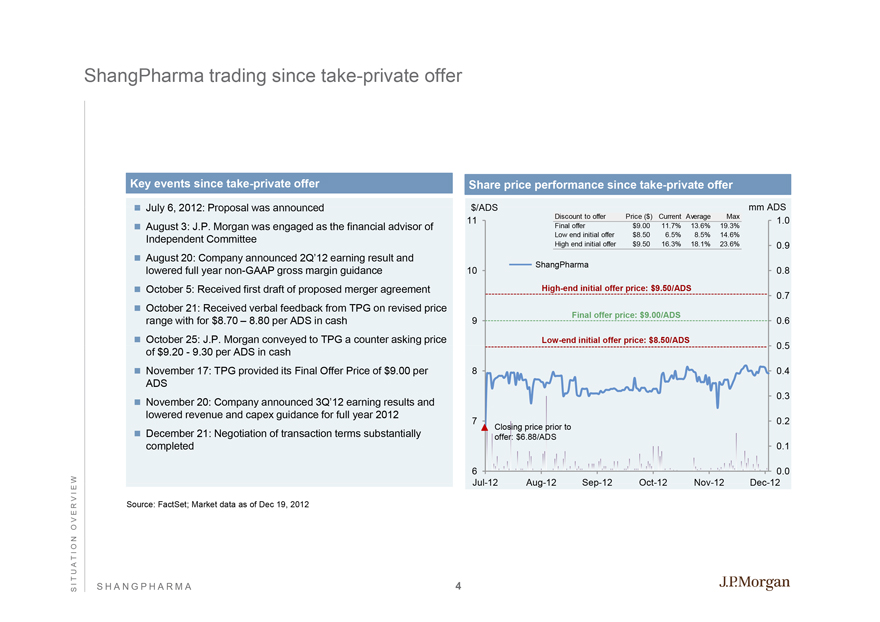

Key events since take-private offer

July 6, 2012: Proposal was announced

August 3: J.P. Morgan was engaged as the financial advisor of Independent Committee

August 20: Company announced 2Q’12 earning result and lowered full year non-GAAP gross margin guidance

October 5: Received first draft of proposed merger agreement

October 21: Received verbal feedback from TPG on revised price range with for $8.70 – 8.80 per ADS in cash October 25: J.P. Morgan conveyed to TPG a counter asking price of $9.20—9.30 per ADS in cash

November 17: TPG provided its Final Offer Price of $9.00 per ADS

November 20: Company announced 3Q’12 earning results and lowered revenue and capex guidance for full year 2012

December 21: Negotiation of transaction terms substantially completed

Share price performance since take-private offer

Discount to offer Price ($) Current Average Max

Final offer $9.00 11.7% 13.6% 19.3%

Low end initial offer $8.50 6.5% 8.5% 14.6%

High end initial offer $9.50 16.3% 18.1% 23.6%

ShangPharma

High-end initial offer price: $9.50/ADS

Final offer price: $9.00/ADS

Low-end initial offer price: $8.50/ADS

Closing price prior to offer: $6.88/ADS

11 10 9 8 7 6

$/ADS

mm ADS

1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0

Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12

Source: FactSet; Market data as of Dec 19, 2012

SHANGPHARMA

SITUATION OVERVIEW

Agenda

Page

Situation overview 1

ShangPharma trading and valuation analysis 5

Appendix 13

PR O J E C TS I G M A

S H ANGPHARMA

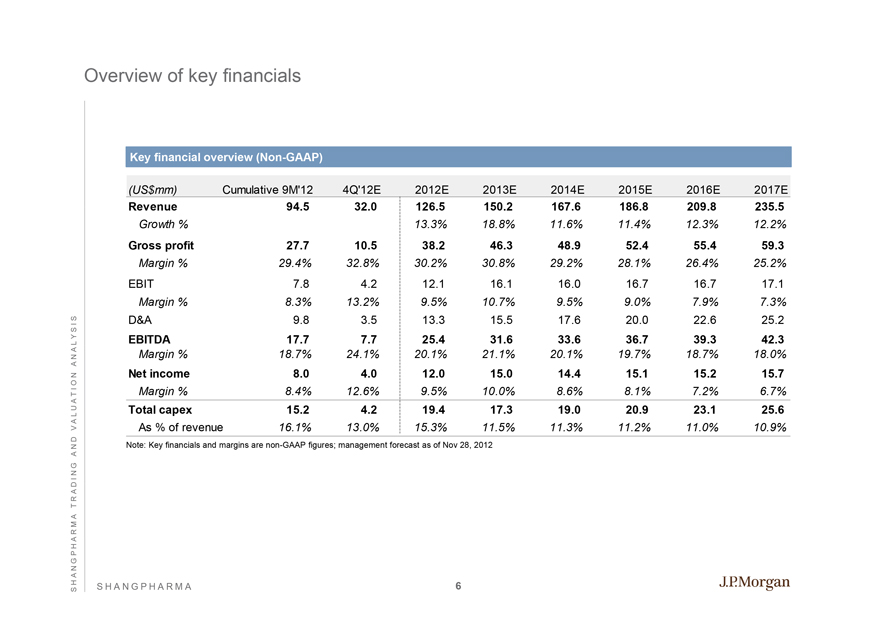

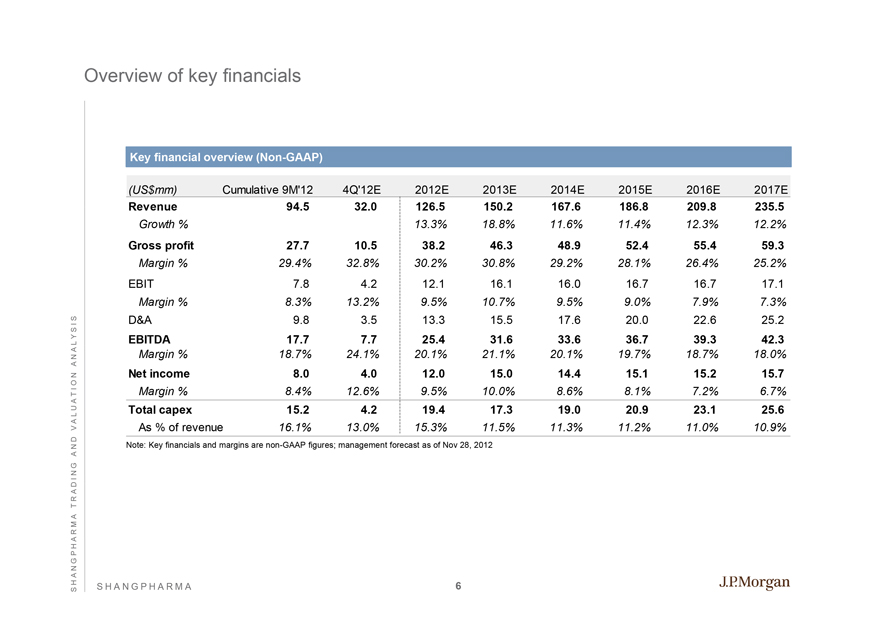

Overview of key financials

Key financial overview (Non-GAAP)

(US$mm) Cumulative 9M’12 4Q’12E 2012E 2013E 2014E 2015E 2016E 2017E

Revenue 94.5 32.0 126.5 150.2 167.6 186.8 209.8 235.5

Growth % 13.3% 18.8% 11.6% 11.4% 12.3% 12.2%

Gross profit 27.7 10.5 38.2 46.3 48.9 52.4 55.4 59.3

Margin % 29.4% 32.8% 30.2% 30.8% 29.2% 28.1% 26.4% 25.2%

EBIT 7.8 4.2 12.1 16.1 16.0 16.7 16.7 17.1

Margin % 8.3% 13.2% 9.5% 10.7% 9.5% 9.0% 7.9% 7.3%

D&A 9.8 3.5 13.3 15.5 17.6 20.0 22.6 25.2

EBITDA 17.7 7.7 25.4 31.6 33.6 36.7 39.3 42.3

Margin % 18.7% 24.1% 20.1% 21.1% 20.1% 19.7% 18.7% 18.0%

Net income 8.0 4.0 12.0 15.0 14.4 15.1 15.2 15.7

Margin % 8.4% 12.6% 9.5% 10.0% 8.6% 8.1% 7.2% 6.7%

Total capex 15.2 4.2 19.4 17.3 19.0 20.9 23.1 25.6

As % of revenue 16.1% 13.0% 15.3% 11.5% 11.3% 11.2% 11.0% 10.9%

Note: Key financials and margins are non-GAAP figures; management forecast as of Nov 28, 2012

SHANGPHARMA

SHANGPHARMA TRADING AND VALUATION ANALYSIS

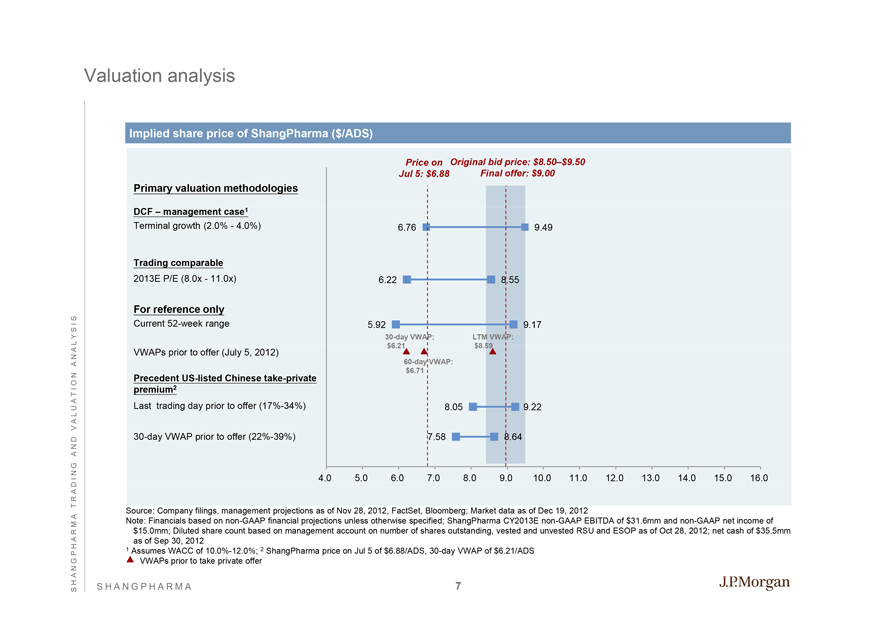

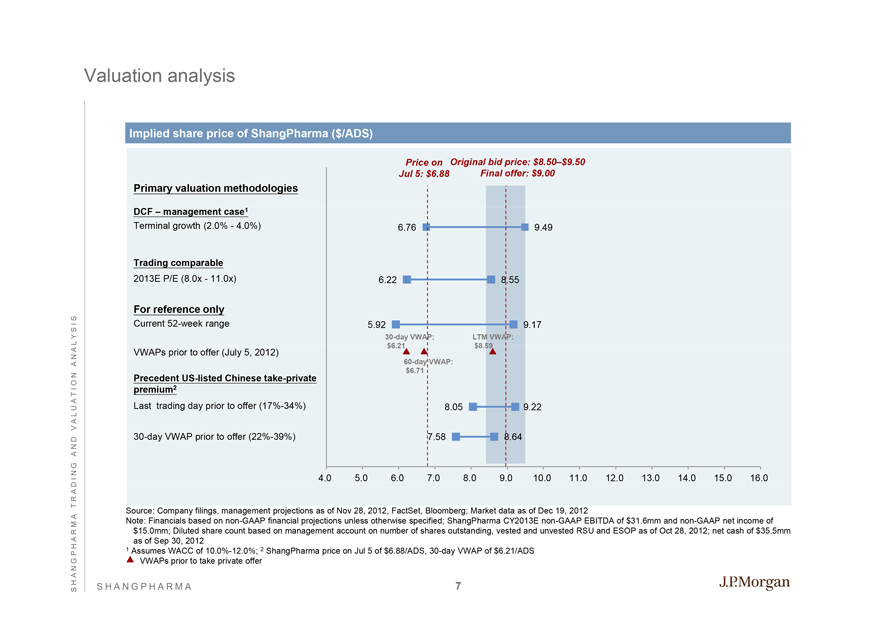

Valuation analysis

Implied share price of ShangPharma ($/ADS)

Primary valuation methodologies

DCF – management case1

Terminal growth (2.0%—4.0%)

Trading comparable

2013E P/E (8.0x—11.0x)

For reference only

Current 52-week range

VWAPs prior to offer (July 5, 2012)

Precedent US-listed Chinese take-private premium2

Last trading day prior to offer (17%-34%)

30-day VWAP prior to offer (22%-39%)

Price on Original bid price: $8.50–$9.50 Jul 5: $6.88 Final offer: $9.00

6.76

9.49

6.22

8.55

5.92

9.17

30-day VWAP: $6.21

LTM VWAP: $8.59

60-day VWAP: $6.71

8.05

9.22

7.58

8.64

4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0

Source: Company filings, management projections as of Nov 28, 2012, FactSet, Bloomberg; Market data as of Dec 19, 2012

Note: Financials based on non-GAAP financial projections unless otherwise specified; ShangPharma CY2013E non-GAAP EBITDA of $31.6mm and non-GAAP net income of $15.0mm; Diluted share count based on management account on number of shares outstanding, vested and unvested RSU and ESOP as of Oct 28, 2012; net cash of $35.5mm as of Sep 30, 2012

1 | | Assumes WACC of 10.0%-12.0%; 2 ShangPharma price on Jul 5 of $6.88/ADS, 30-day VWAP of $6.21/ADS |

VWAPs prior to take private offer

SHANGPHARMA

SHANGPHARMA TRADING AND VALUATION ANALYSIS

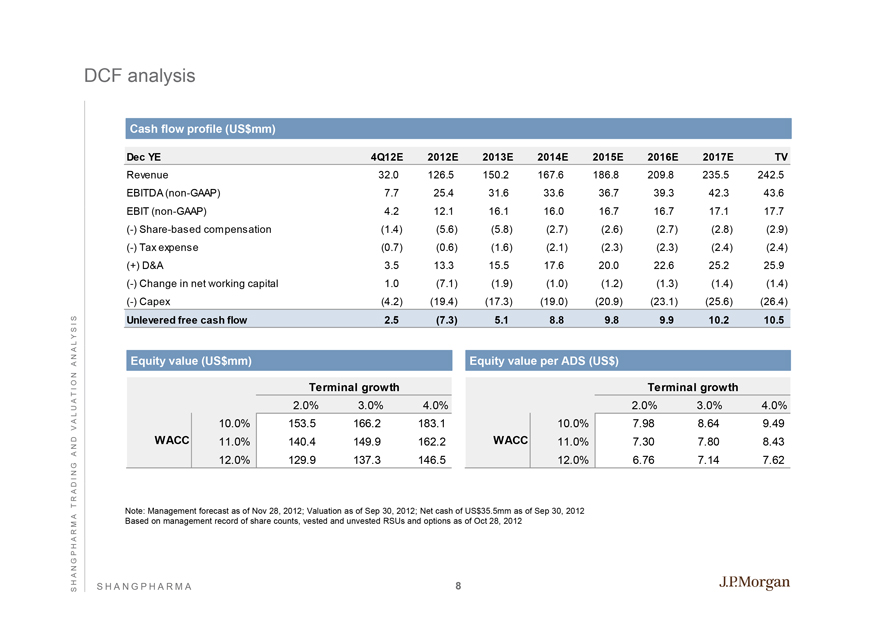

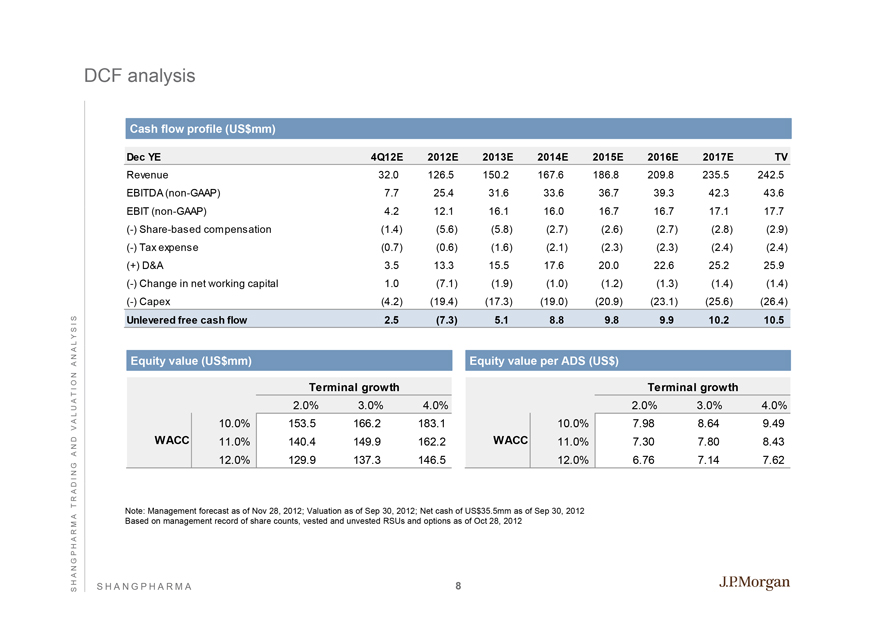

DCF analysis

Cash flow profile (US$mm)

Dec YE 4Q12E 2012E 2013E 2014E 2015E 2016E 2017E TV

Revenue 32.0 126.5 150.2 167.6 186.8 209.8 235.5 242.5

EBITDA (non-GAAP) 7.7 25.4 31.6 33.6 36.7 39.3 42.3 43.6

EBIT (non-GAAP) 4.2 12.1 16.1 16.0 16.7 16.7 17.1 17.7

(-) Share-based compensation (1.4) (5.6) (5.8) (2.7) (2.6) (2.7) (2.8) (2.9)

(-) Tax expense (0.7) (0.6) (1.6) (2.1) (2.3) (2.3) (2.4) (2.4)

(+) D&A 3.5 13.3 15.5 17.6 20.0 22.6 25.2 25.9

(-) Change in net working capital 1.0 (7.1) (1.9) (1.0) (1.2) (1.3) (1.4) (1.4)

(-) Capex (4.2) (19.4) (17.3) (19.0) (20.9) (23.1) (25.6) (26.4)

Unlevered free cash flow 2.5 (7.3) 5.1 8.8 9.8 9.9 10.2 10.5

Equity value (US$mm) Equity value per ADS (US$)

Terminal growth Terminal growth

2.0% 3.0% 4.0% 2.0% 3.0% 4.0%

10.0% 153.5 166.2 183.1 10.0% 7.98 8.64 9.49

WACC 11.0% 140.4 149.9 162.2 WACC 11.0% 7.30 7.80 8.43

12.0% 129.9 137.3 146.5 12.0% 6.76 7.14 7.62

Note: Management forecast as of Nov 28, 2012; Valuation as of Sep 30, 2012; Net cash of US$35.5mm as of Sep 30, 2012 Based on management record of share counts, vested and unvested RSUs and options as of Oct 28, 2012

SHANGPHARMA

SHANGPHARMA TRADING AND VALUATION ANALYSIS

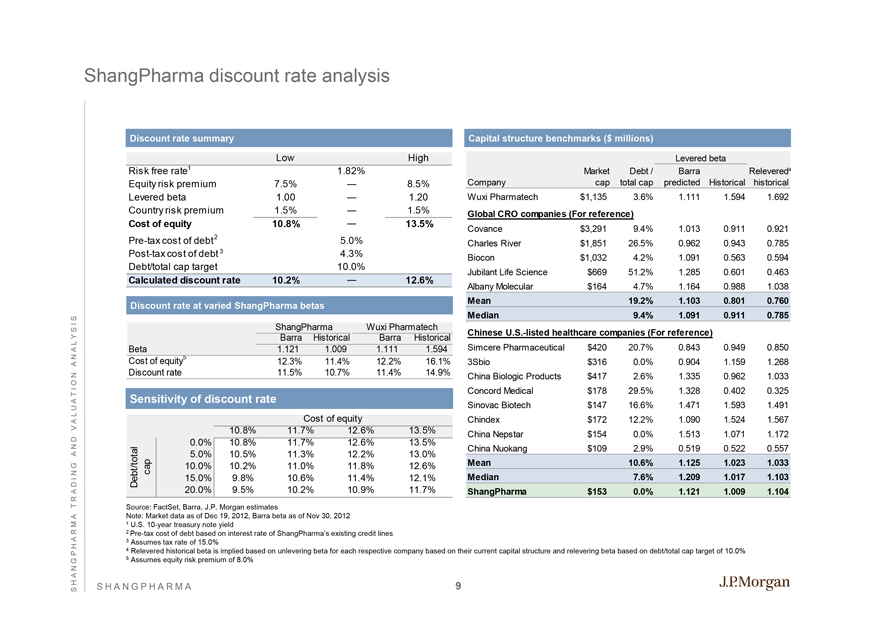

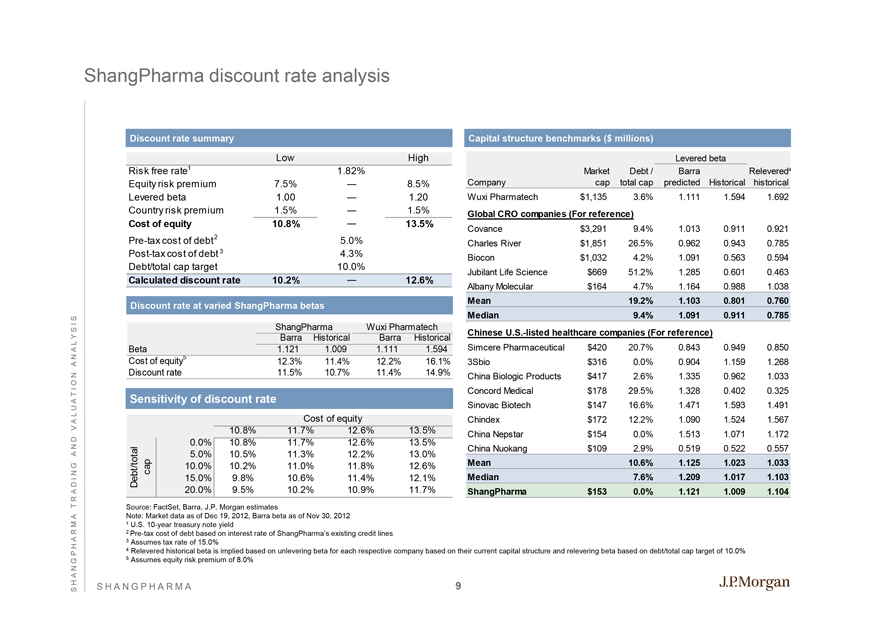

ShangPharma discount rate analysis

Discount rate summary

Low High

Risk free rate1 1.82%

Equity risk premium 7.5% — 8.5%

Levered beta 1.00 — 1.20

Country risk premium 1.5% — 1.5%

Cost of equity 10.8% — 13.5%

Pre-tax cost of debt2 5.0%

Post-tax cost of debt 3 4.3%

Debt/total cap target 10.0%

Calculated discount rate 10.2% — 12.6%

Discount rate at varied ShangPharma betas

ShangPharma Wuxi Pharmatech

Barra Historical Barra Historical

Beta 1.121 1.009 1.111 1.594

Cost of equity5 12.3% 11.4% 12.2% 16.1%

Discount rate 11.5% 10.7% 11.4% 14.9%

Sensitivity of discount rate

Cost of equity

10.8% 11.7% 12.6% 13.5%

0.0% 10.8% 11.7% 12.6% 13.5%

5.0% 10.5% 11.3% 12.2% 13.0%

cap 10.0% 10.2% 11.0% 11.8% 12.6%

Debt/total 15.0% 9.8% 10.6% 11.4% 12.1%

20.0% 9.5% 10.2% 10.9% 11.7%

Capital structure benchmarks ($ millions)

Levered beta

Market Debt / Barra Relevered4

Company cap total cap predicted Historical historical

Wuxi Pharmatech $1,135 3.6% 1.111 1.594 1.692

Global CRO companies (For reference)

Covance $3,291 9.4% 1.013 0.911 0.921

Charles River $1,851 26.5% 0.962 0.943 0.785

Biocon $1,032 4.2% 1.091 0.563 0.594

Jubilant Life Science $669 51.2% 1.285 0.601 0.463

Albany Molecular $164 4.7% 1.164 0.988 1.038

Mean 19.2% 1.103 0.801 0.760

Median 9.4% 1.091 0.911 0.785

Chinese U.S.-listed healthcare companies (For reference)

Simcere Pharmaceutical $420 20.7% 0.843 0.949 0.850

3Sbio $316 0.0% 0.904 1.159 1.268

China Biologic Products $417 2.6% 1.335 0.962 1.033

Concord Medical $178 29.5% 1.328 0.402 0.325

Sinovac Biotech $147 16.6% 1.471 1.593 1.491

Chindex $172 12.2% 1.090 1.524 1.567

China Nepstar $154 0.0% 1.513 1.071 1.172

China Nuokang $109 2.9% 0.519 0.522 0.557

Mean 10.6% 1.125 1.023 1.033

Median 7.6% 1.209 1.017 1.103

ShangPharma $153 0.0% 1.121 1.009 1.104

Source: FactSet, Barra, J.P. Morgan estimates

Note: Market data as of Dec 19, 2012, Barra beta as of Nov 30, 2012

1 U.S. 10-year treasury note yield

2 Pre-tax cost of debt based on interest rate of ShangPharma’s existing credit lines

3 Assumes tax rate of 15.0%

4 Relevered historical beta is implied based on unlevering beta for each respective company based on their current capital structure and relevering beta based on debt/total cap target of 10.0%

5 Assumes equity risk premium of 8.0%

S H ANGPHARMA

S H A N G P H A R M A T R A D IN G A N D V A L UA T I O N AN A LY SI S

9

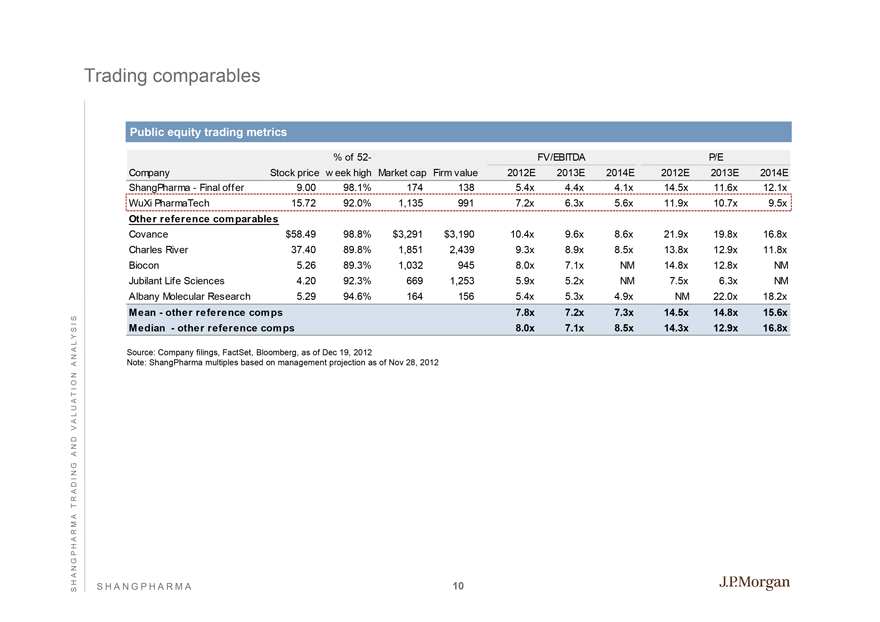

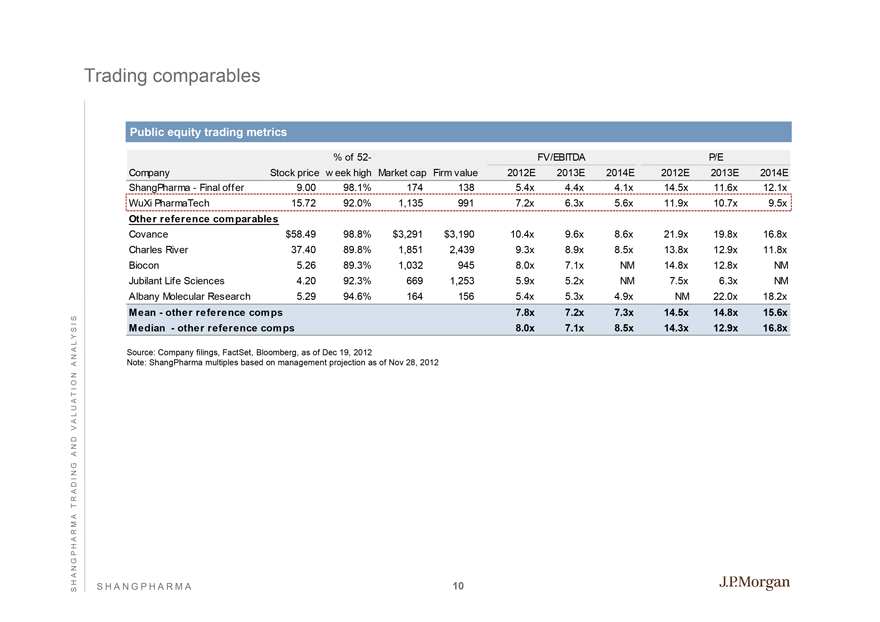

Trading comparables

Public equity trading metrics

% of 52- FV/EBITDA P/E

Company Stock price w eek high Market cap Firm value 2012E 2013E 2014E 2012E 2013E 2014E

ShangPharma—Final offer 9.00 98.1% 174 138 5.4x 4.4x 4.1x 14.5x 11.6x 12.1x

WuXi PharmaTech 15.72 92.0% 1,135 991 7.2x 6.3x 5.6x 11.9x 10.7x 9.5x

Other reference comparables

Covance $58.49 98.8% $3,291 $3,190 10.4x 9.6x 8.6x 21.9x 19.8x 16.8x

Charles River 37.40 89.8% 1,851 2,439 9.3x 8.9x 8.5x 13.8x 12.9x 11.8x

Biocon 5.26 89.3% 1,032 945 8.0x 7.1x NM 14.8x 12.8x NM

Jubilant Life Sciences 4.20 92.3% 669 1,253 5.9x 5.2x NM 7.5x 6.3x NM

Albany Molecular Research 5.29 94.6% 164 156 5.4x 5.3x 4.9x NM 22.0x 18.2x

Mean—other reference comps 7.8x 7.2x 7.3x 14.5x 14.8x 15.6x

Median—other reference comps 8.0x 7.1x 8.5x 14.3x 12.9x 16.8x

Source: Company filings, FactSet, Bloomberg, as of Dec 19, 2012

Note: ShangPharma multiples based on management projection as of Nov 28, 2012

S H ANGPHARMA

SH A N G P HA RM A T R A D IN G A N D V A L UA T I O N AN A LY SI S

10

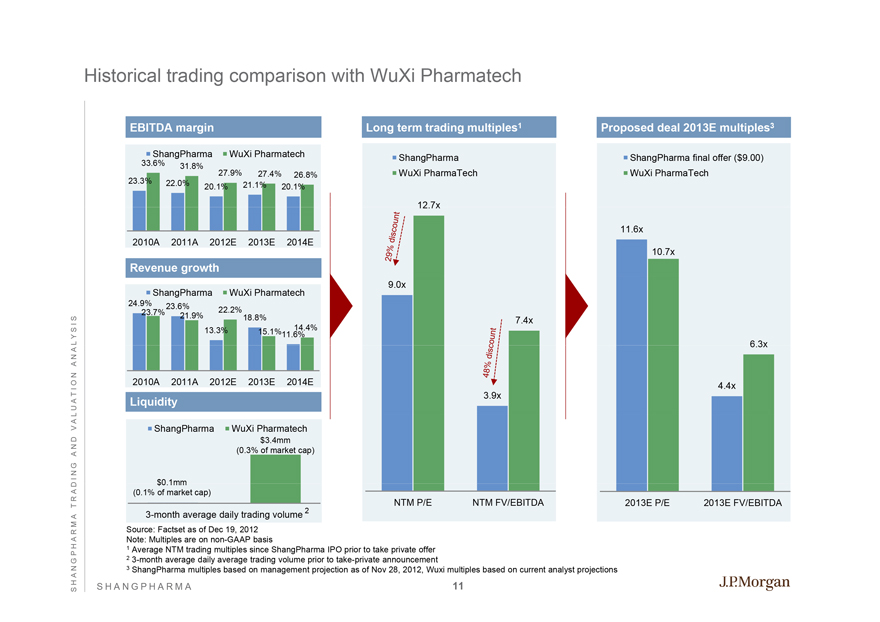

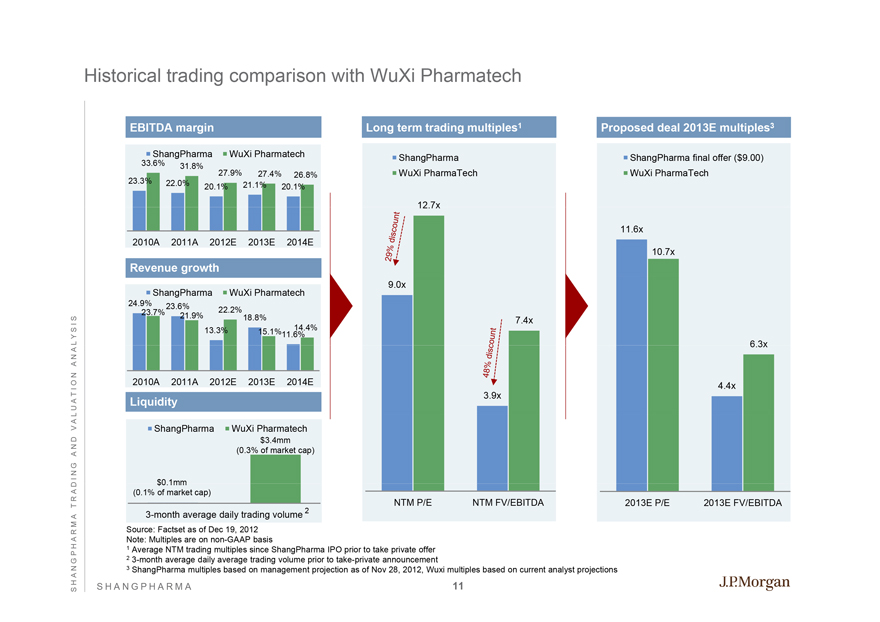

Historical trading comparison with WuXi Pharmatech

EBITDA margin

ShangPharma WuXi Pharmatech

33.6% 31.8%

23.3% 27.9% 27.4% 26.8% 22.0% 20.1% 21.1% 20.1%

2010A 2011A 2012E 2013E 2014E

Revenue growth

ShangPharma WuXi Pharmatech

24.9% 23.6%

23.7% 22.2% 21.9% 18.8%

13.3% 14.4% 15.1%11.6%

2010A 2011A 2012E 2013E 2014E

Liquidity

ShangPharma WuXi Pharmatech $3.4mm (0.3% of market cap)

$0.1mm (0.1% of market cap)

3-month average daily trading volume 2

Long term trading multiples1

ShangPharma WuXi PharmaTech

12.7x

29% discount

9.0x

48% discount

3.9x

7.4x

NTM P/E NTM FV/EBITDA

Proposed deal 2013E multiples3

ShangPharma final offer ($9.00) WuXi PharmaTech

11.6x

10.7x

6.3x

4.4x

2013E P/E 2013E FV/EBITDA

Source: Factset as of Dec 19, 2012 Note: Multiples are on non-GAAP basis

1 | | Average NTM trading multiples since ShangPharma IPO prior to take private offer |

2 | | 3-month average daily average trading volume prior to take-private announcement |

3 ShangPharma multiples based on management projection as of Nov 28, 2012, Wuxi multiples based on current analyst projections

S H A N G P H A R M A

SH A N G P HA RM A T R A D IN G A N D V A L UA T I O N AN A LY SI S

11

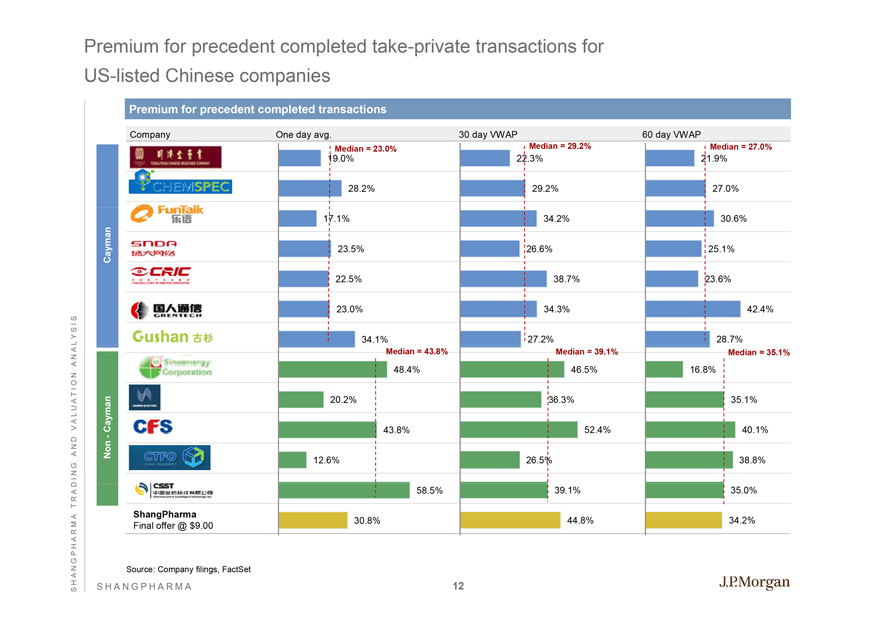

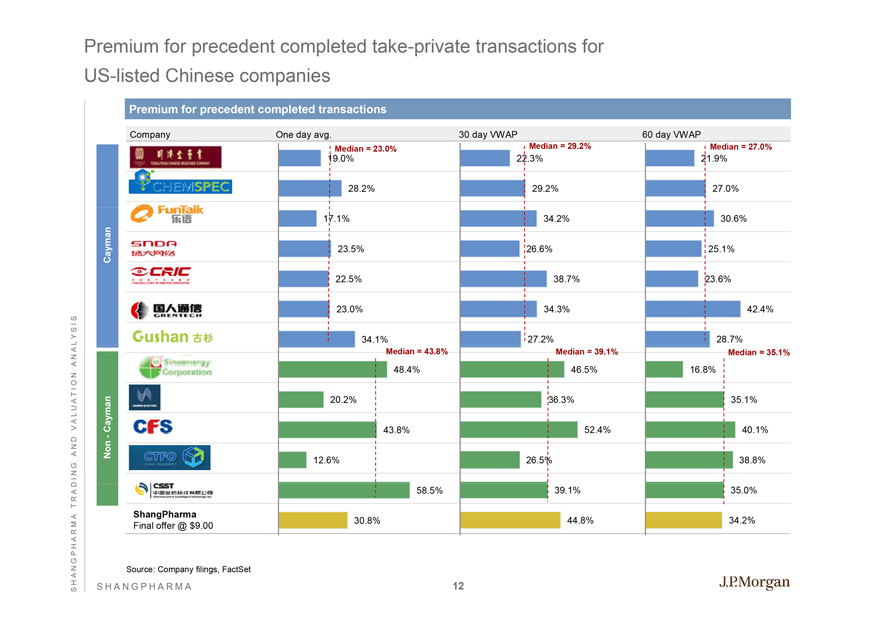

Premium for precedent completed take-private transactions for US-listed Chinese companies

Premium for precedent completed transactions

Company One day avg. 30 day VWAP 60 day VWAP

Median = 23.0% Median = 29.2% Median = 27.0%

19.0% 22.3% 21.9%

28.2% 29.2% 27.0%

17.1% 34.2% 30.6%

23.5% 26.6% 25.1%

Cayman

22.5% 38.7% 23.6%

23.0% 34.3% 42.4%

34.1% 27.2% 28.7%

Median = 43.8% Median = 39.1% Median = 35.1%

48.4% 46.5% 16.8%

20.2% 36.3% 35.1%

Non-Cayman 43.8% 52.4% 40.1%-

12.6% 26.5% 38.8%

58.5% 39.1% 35.0%

ShangPharma

30.8% 44.8% 34.2% Final offer @ $9.00

Source: Company filings, FactSet

S H A N G P H A R M A

SH A N G P HA RM A T R A D IN G A N D V A L UA T I O N AN A LY SI S

12

Agenda

Page

Situation overview 1

ShangPharma trading and valuation analysis 5

Appendix 13

PR O J E C TS I G M A

S H ANGPHARMA

13

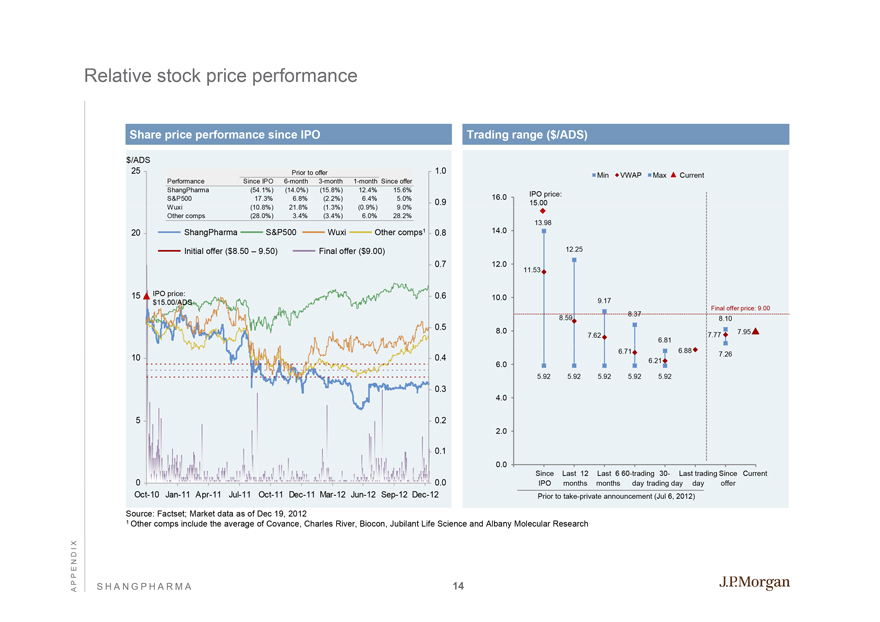

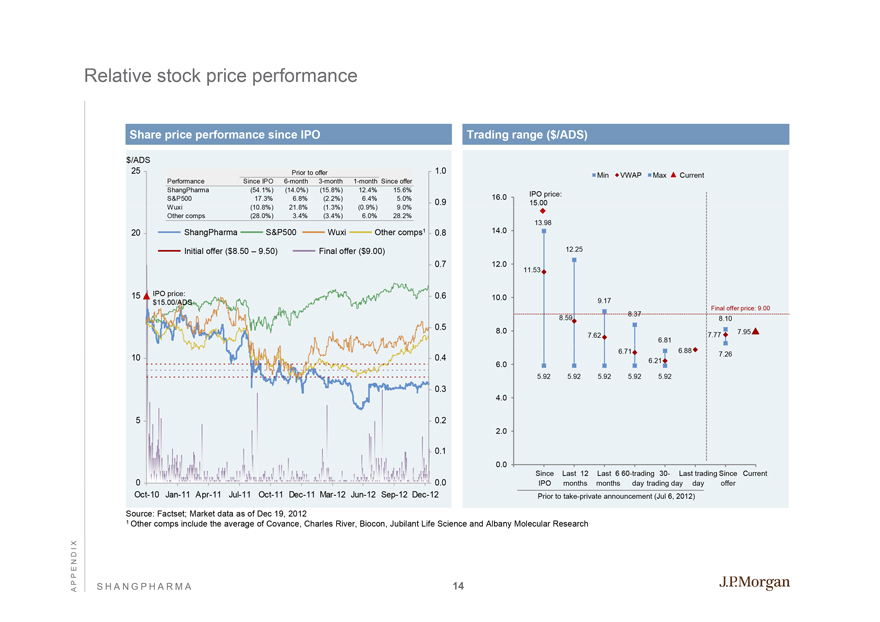

Relative stock price performance

Share price performance since IPO

$/ADS

25 Prior to offer 1.0 Performance Since IPO 6-month 3-month 1-month Since offer ShangPharma (54.1%) (14.0%) (15.8%) 12.4% 15.6% S&P500 17.3% 6.8% (2.2%) 6.4% 5.0% Wuxi (10.8%) 21.8% (1.3%) (0.9%) 9.0% Other comps (28.0%) 3.4% (3.4%) 6.0% 28.2%

20 ShangPharma S&P500 Wuxi Other comps1 0.8

Initial offer ($8.50 – 9.50) Final offer ($9.00)

0.7

15 IPO price: 0.6

$15.00/ADS

0.5

10 0.4

0.3

5 0.2

0.1

0

0.0

Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12

Trading range ($/ADS)

Min VWAP Max Current

16.0 IPO price:

15.00

13.98

14.0

12.25

12.0

11.53

10.0 9.17

8.37 Final offer price: 9.00

8.59 8.10

8.0 7.95

7.62 7.77

6.81

6.71 6.88

6.21 7.26

6.0

5.92 5.92 5.92 5.92 5.92

4.0

2.0

0.0

Since Last 12 Last 6 60-trading 30- Last trading Since Current IPO months months day trading day day offer Prior to take-private announcement (Jul 6, 2012)

Source: Factset; Market data as of Dec 19, 2012

1 Other comps include the average of Covance, Charles River, Biocon, Jubilant Life Science and Albany Molecular Research

AP P E N D IX

S H ANGPHARMA

14