Exhibit 99.2

Investor Presentation July 2012 Australia Acquisition Corp. investments in Asian Coast Development (Canada) Ltd. Ferrous Resources Limited to be renamed Harbinger Global Corp .

2 AUSTRALIA ACQUISITION CORP. Disclaimer Important Information about the Tender Offer The tender offer for the outstanding securities of Australia Acquisition Corp. ("AAC") referred to herein has not yet commenced. This presentation is neither an offer to purchase nor a solicitation of an offer to sell any securities. The solicitation and the offer to purchase AAC's securities will be made pursuant to an offer to purchase and related materials that AAC intends to file with the SEC. At the time the offer is commenced, AAC will file a tender offer statement on Schedul e TO with the SEC. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) will contain important information that should be carefully read and considered before any decision is made with respect to the tender offer. These materials will be sent free of charge to all security holders of AAC when available. In addition, all of these materials (and all other materials filed by AAC with the SEC) will be available at no charge from the SEC through its website at www.sec.gov. Security holders may also obtain free copies of the documents filed with the SEC by AAC by directing a request to: Australia Acquisition Corp., Level 9 Podium, 530 Collins Street, Melbourne VIC 3000, Australia. Security holders of AAC are urged to read the tender offer documents and the other relevant materials when they become available before making any investment decision with respect to the tender offer because they will contain important information about the tender offer, the investments and the parties to the transaction. Additional Information About the Transaction and Where to Find It AAC intends to file other relevant materials with the SEC in connection with the investments pursuant to the terms of its charter and the stock purchase agreement. The materials to be filed by AAC with the SEC may be obtained free of charge at the SEC's website at www.sec.gov. Security holders also will be able to obtain free copies of the documents filed with the SEC by directing a request to: Australia Acquisition Corp., Level 9 Podium, 530 Collins Street, Melbourne VIC 3000, Australia.

3 AUSTRALIA ACQUISITION CORP. Table of Contents Section I. Executive Summary Section II. Asian Coast Development (Canada) Ltd. Section III. Ferrous Resources Limited

I. Executive Summary Australia Acquisition Corp.

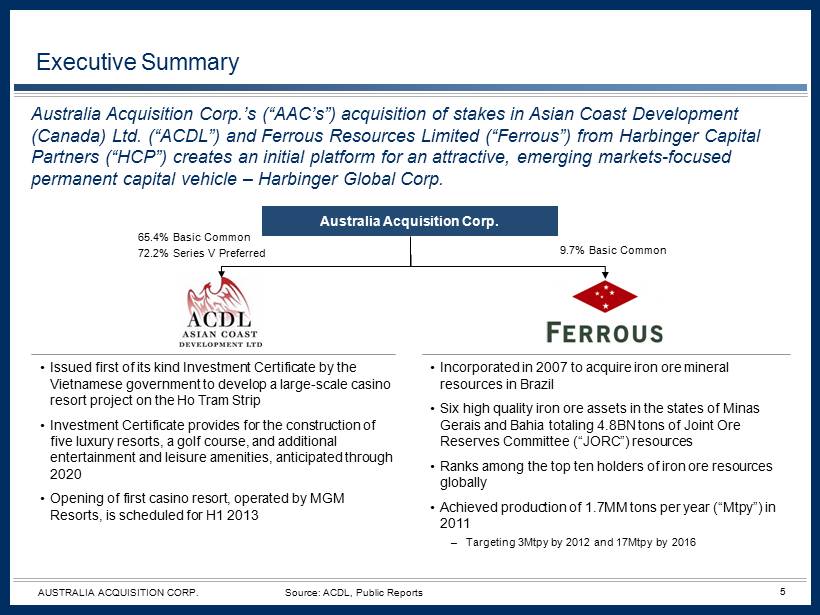

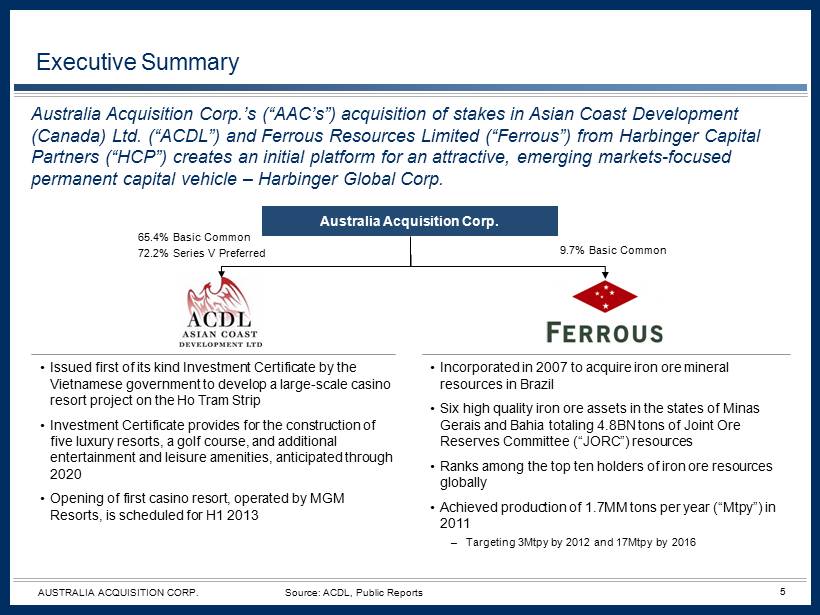

5 AUSTRALIA ACQUISITION CORP. Australia Acquisition Corp.’s (“AAC’s”) acquisition of stakes in Asian Coast Development (Canada) Ltd. (“ACDL”) and Ferrous Resources Limited (“Ferrous”) from Harbinger Capital Partners (“HCP”) creates an initial platform for an attractive, emerging markets - focused permanent capital vehicle – Harbinger Global Corp. Executive Summary Australia Acquisition Corp. • Incorporated in 2007 to acquire iron ore mineral resources in Brazil • Six high quality iron ore assets in the states of Minas Gerais and Bahia totaling 4.8BN tons of Joint Ore Reserves Committee (“JORC”) resources • Ranks among the top ten holders of iron ore resources globally • Achieved production of 1.7MM tons per year (“Mtpy”) in 2011 – Targeting 3Mtpy by 2012 and 17Mtpy by 2016 • Issued first of its kind Investment Certificate by the Vietnamese government to develop a large - scale casino resort project on the Ho Tram Strip • Investment Certificate provides for the construction of five luxury resorts, a golf course, and additional entertainment and leisure amenities, anticipated through 2020 • Opening of first casino resort, operated by MGM Resorts, is scheduled for H1 2013 9.7% Basic Common 65.4% Basic Common 72.2% Series V Preferred Source: ACDL, Public Reports

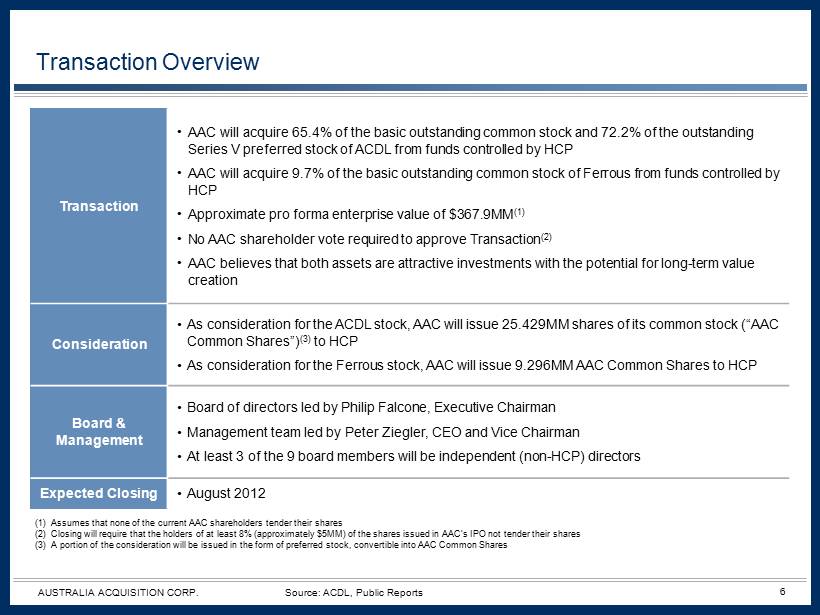

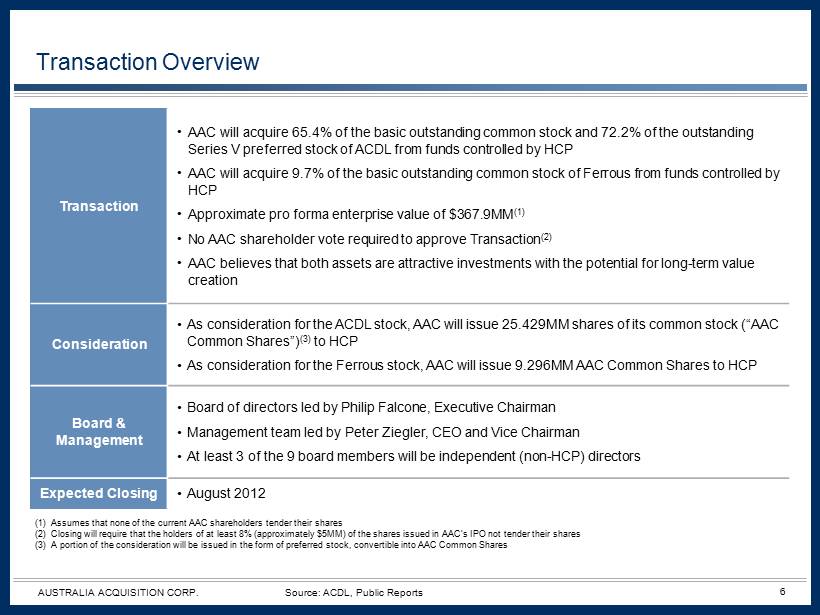

6 AUSTRALIA ACQUISITION CORP. Transaction • AAC will acquire 65.4% of the basic outstanding common stock and 72.2% of the outstanding Series V preferred stock of ACDL from funds controlled by HCP • AAC will acquire 9.7% of the basic outstanding common stock of Ferrous from funds controlled by HCP • Approximate pro forma enterprise value of $367.9MM (1) • No AAC shareholder vote required to approve Transaction (2) • AAC believes that both assets are attractive investments with the potential for long - term value creation Consideration • As consideration for the ACDL stock, AAC will issue 25.429MM shares of its common stock (“AAC Common Shares”) (3) to HCP • As consideration for the Ferrous stock, AAC will issue 9.296MM AAC Common Shares to HCP Board & Management • Board of directors led by Philip Falcone, Executive Chairman • Management team led by Peter Ziegler, CEO and Vice Chairman • At least 3 of the 9 board members will be independent (non - HCP) directors Expected Closing • August 2012 Transaction Overview (1) Assumes that none of the current AAC shareholders tender their shares (2) Closing will require that the holders of at least 8% (approximately $5MM) of the shares issued in AAC’s IPO not tender their shares (3) A portion of the consideration will be issued in the form of preferred stock, convertible into AAC Common Shares Source: ACDL, Public Reports

7 AUSTRALIA ACQUISITION CORP. HCP Shares (1)(2)(3) 36.0 Existing Public Shares (1) 6.4 AAC Sponsor Shares (1)(3) 0.9 Total Basic AAC Shares 43.3 Price per Share $10.00 Equity Value $432.6 Less: Cash (1) (64.6) Enterprise Value $367.9 Pro Forma Valuation HCP Shares (1)(2)(3) 83.2% Existing Public Shares (1) 14.8% AAC Sponsor Shares (1)(3) 2.0% (in MM, except per share data) Harbinger Global Corp. Pro Forma Valuation & Ownership Pro Forma Harbinger Global Corp. Ownership (1) Assumes that none of the current AAC shareholders tender their shares (2) Includes AAC Sponsor Shares awarded to HCP (3) Reflects release of 100% of insider securities from escrow at closing Source: Public Reports

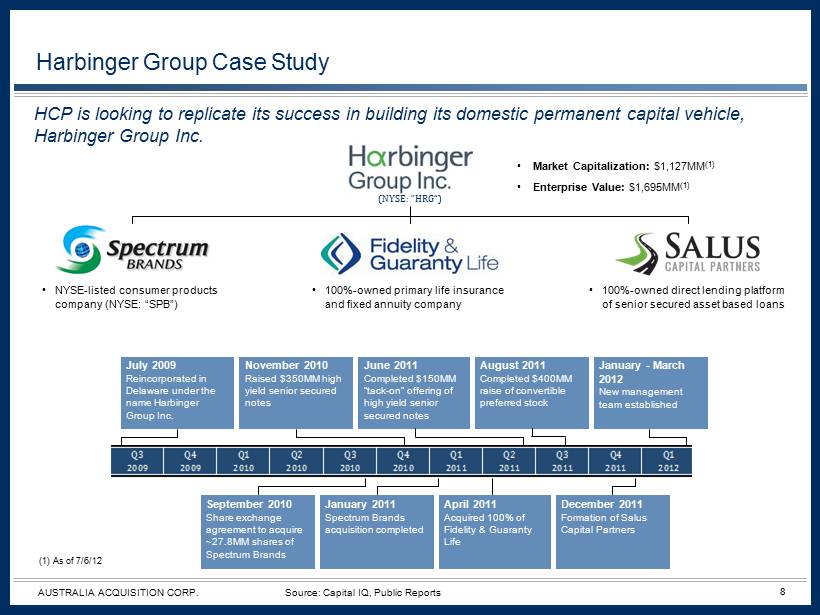

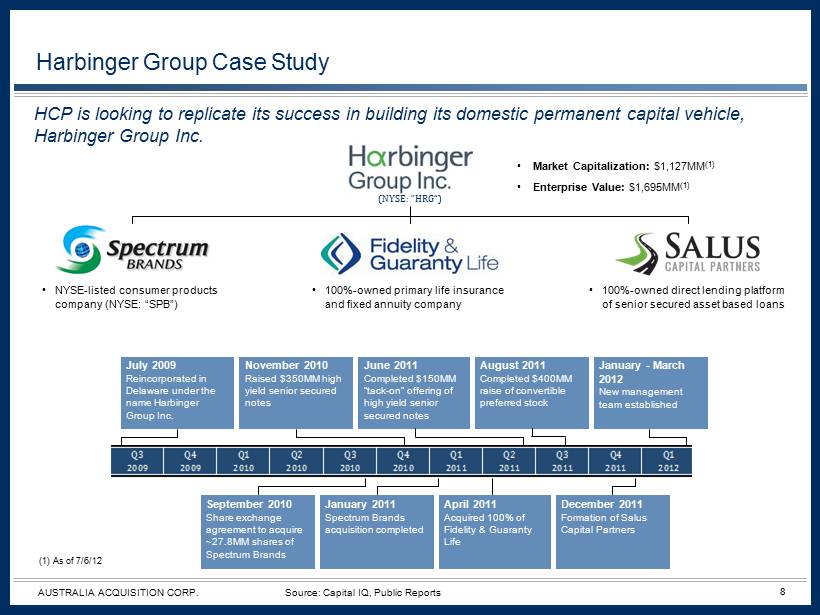

8 AUSTRALIA ACQUISITION CORP. Source: Capital IQ, Public Reports Harbinger Group Case Study HCP is looking to replicate its success in building its domestic permanent capital vehicle, Harbinger Group Inc. • Market Capitalization: $1,127MM (1) • Enterprise Value: $1,695MM (1) • NYSE - listed consumer products company (NYSE: “SPB”) • 100% - owned primary life insurance and fixed annuity company • 100% - owned direct lending platform of senior secured asset based loans September 2010 Share exchange agreement to acquire ~27.8MM shares of Spectrum Brands January 2011 Spectrum Brands acquisition completed April 2011 Acquired 100% of Fidelity & Guaranty Life December 2011 Formation of Salus Capital Partners July 2009 Reincorporated in Delaware under the name Harbinger Group Inc. November 2010 Raised $350MM high yield senior secured notes January - March 2012 New management team established June 2011 Completed $150MM “tack - on” offering of high yield senior secured notes August 2011 Completed $400MM raise of convertible preferred stock Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2009 2009 2010 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012 2012 (NYSE: “HRG”) (1) As of 7/6/12

9 AUSTRALIA ACQUISITION CORP. Acquire companies that Harbinger Global Corp. considers to be undervalued or fairly valued with attractive financial or strategic characteristics Harbinger Global Corp.’s strategy is to acquire substantial or controlling equity interests in companies levered to emerging markets across a diversified range of industries and to actively grow its operating subsidiaries Select great leadership teams, work with them to establish specific objectives, and regularly review their strategy and performance Take a long - term view for investing and seek opportunities that generate attractive returns and significant cash flow in order to maximize value for Harbinger Global Corp.’s stockholders Investment Strategy Buying Value Partnering with Management Building Durable Businesses

10 AUSTRALIA ACQUISITION CORP. Director Position Background Philip Falcone Executive Chairman • Founder, CEO, CIO, and Chairman of Harbinger Capital affiliated funds • Over two decades of experience in leveraged finance, distressed debt, and special situations • Graduated with an A.B. in Economics from Harvard University Peter Ziegler CEO, Vice Chairman • President of Ziegler Asset Partners • Formerly CEO of CPH Capital, 100% subsidiary of Consolidated Press Holdings Ltd. Consolidated Press Holdings Ltd. directly an d i ndirectly owns interests in a diverse portfolio including casinos and entertainment assets • Graduated with Honors in Commerce and Law and a Master of Financial Management from the University of Queensland; Chartered Accountant and Solicitor; former Partner of Ernst and Young Peter Bentley Director • Founder of Per Astra Ltd. • Formerly Industrial Consultant at Polygon and Vice President of Global Operations and Supply Chain at Huntsman Advanced Mater ial s • Graduated with an M.A. in Chemical Engineering from the University of Leeds Keith Hladek Director • CFO and Co - COO of Harbinger Capital Partners • Previous experience in accounting, operations, and valuations as controller for other asset managers • Graduated with a B.S. in Accounting from Binghamton University David Murgio Director • Vice President and Investment Counsel of Harbinger Capital Partners • Previous experience in the mergers and acquisitions group of Weil, Gotshal & Manges • Graduated with a B.A. from Dartmouth College, as well as a Masters Degree in International Affairs and a J.D. from Columbia U niv ersity Joseph Cleverdon Director • Managing Director - Investments of Harbinger Capital Partners • Previous experience in valuation, financings, restructurings, and M&A in the financial restructuring group of Houlihan Lokey • Lead analyst on Harbinger’s ACDL position for three years; serves on ACDL’s board of directors and multiple board committees Charbel Nader (1) Director • Former Executive Director and Head of Pitt Capital Partners‘ Melbourne office • Previous experience in investment banking, business development, and upper level management • Graduated with a Bachelor of Commerce and a Masters of Applied Finance from the University of Melbourne and is a Chartered Ac cou ntant Stephen Streeter (1) Director • President of Montecito Capital Market Advisors • Previous experience in business and tax consulting • Graduated with a B.S. from Andrews University and is a Certified Public Accountant Ian Zimmer (1) Director • Deputy Vice - Chancellor and Vice President of the University of Queensland, Australia • Served as a professor of accounting and held various academic appointments • Graduated with a Doctor of Science Degree and a Doctor of Philosophy in Accounting from the University of New South Wales Post - Merger Board of Directors and Management (1) Independent directors Source: Public Reports

11 AUSTRALIA ACQUISITION CORP. World class iron ore assets Significant consolidation opportunity High quality product with positive growth trends Self funded organic growth plan Investment Highlights First of its kind Investment Certificate Operating agreements with MGM Resorts and Pinnacle Entertainment Favorable expected taxation environment Robust gaming and tourism market in Asia Addressable mass segments and pent up domestic market

II. Asian Coast Development (Canada) Ltd. Australia Acquisition Corp.

13 AUSTRALIA ACQUISITION CORP. Key Investment Highlights FIRST OF ITS KIND INVESTMENT CERTIFICATE • Investment Certificate for the development of a large - scale casino resort project in Vietnam’s Ho Tram Strip • Development of four additional resort complexes and golf course, and anticipated sales of residential real estate, expected to be substantially accretive to value and meaningfully enhance revenue and profitability OPERATING AGREEMENTS WITH MGM RESORTS AND PINNACLE ENTERTAINMENT • MGM Resorts will operate and market the MGM Grand Ho Tram; hand over of Phase 1 on schedule for late 2012 and opening in H1 2013 • Pinnacle Entertainment in early stage planning for development and operation of the second casino resort ROBUST GAMING AND TOURISM MARKET IN ASIA • MGM Grand Ho Tram will focus marketing strategy on the robust VIP junket market in Asia • Population of close to 4BN in greater South Asian and Far East markets with a demonstrated high propensity to gamble; 13.9% expected growth in the regional market, with limited available supply ADDRESSABLE MASS SEGMENTS AND PENT UP DOMESTIC MARKET • Will address multiple domestic mass market segments immediately: local foreign passport / residency card holders, expatriates, foreign tourists, and Viet Kieu population in South Vietnam • Substantial increase in project revenue if locals gaming is allowed; large number of Vietnamese currently served by Cambodian casinos FAVORABLE EXPECTED TAXATION ENVIRONMENT • Anticipated tax deductibility on junket commissions • Tax holiday on non - gaming income Source: ACDL, PWC Global Gaming Outlook

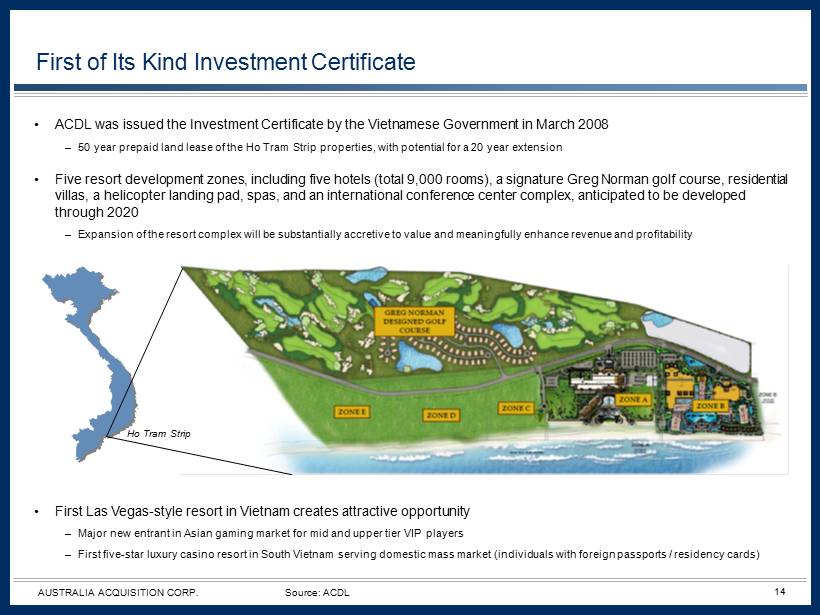

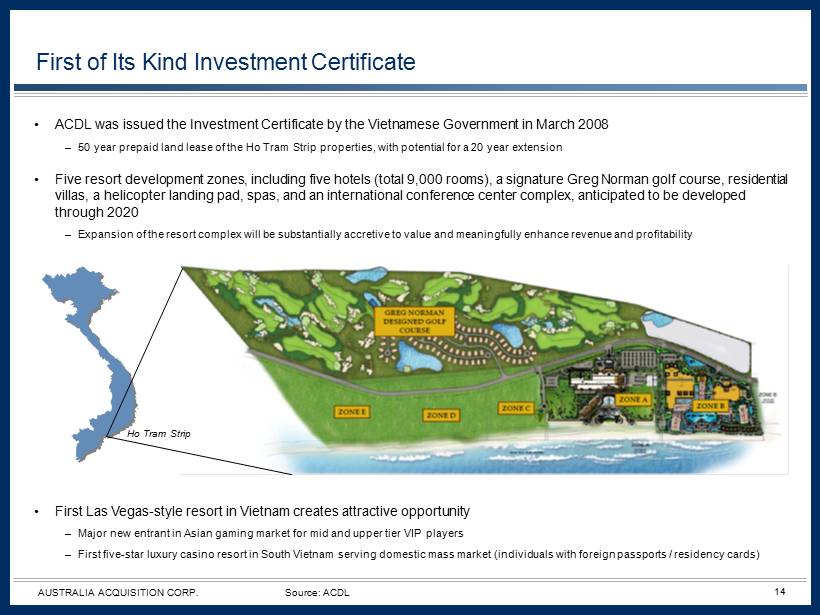

14 AUSTRALIA ACQUISITION CORP. • ACDL was issued the Investment Certificate by the Vietnamese Government in March 2008 – 50 year prepaid land lease of the Ho Tram Strip properties, with potential for a 20 year extension • Five resort development zones, including five hotels (total 9,000 rooms), a signature Greg Norman golf course, residential villas, a helicopter landing pad, spas, and an international conference center complex, anticipated to be developed through 2020 – Expansion of the resort complex will be substantially accretive to value and meaningfully enhance revenue and profitability • First Las Vegas - style resort in Vietnam creates attractive opportunity – Major new entrant in Asian gaming market for mid and upper tier VIP players – First five - star luxury casino resort in South Vietnam serving domestic mass market (individuals with foreign passports / residen cy cards) First of Its Kind Investment Certificate Ho Tram Strip Source: ACDL

15 AUSTRALIA ACQUISITION CORP. First of Its Kind Investment Certificate: MGM Grand Ho Tram – Overview • Zone A1 includes a first hotel tower with 541 rooms, a casino, a spa, several restaurants, and other amenities • Zone A2 includes a second hotel tower in the MGM Grand Ho Tram complex with an additional 559 rooms and additional gaming • Zone A2’s second hotel tower will share Zone A1’s facilities, providing operating leverage with significantly lower incremental investment Source: ACDL

16 AUSTRALIA ACQUISITION CORP. First of Its Kind Investment Certificate: MGM Grand Ho Tram – Interior Gaming • 13,600 m 2 of total gaming floor space • 90 live table games, 480 slot machines, and 20 MSEG machines for a total of about 1,400 gaming positions • Baccarat, Blackjack, Sic Bo, and Caribbean Stud Hotel • First tower will have 541 rooms comprised of 486 standard rooms, 28 executive suites, 21 one - bedroom suites, 4 luxury suites, and 2 presidential suites • Rooms and suites will feature dramatic ocean and mountain views Food & Beverage • Nearly 1,000 restaurant seats, including two specialty restaurants, one fine dining restaurant, two “ultra” lounges, a food court, and a coffee lounge • Facility will incorporate a lobby bar, casino lounge bar, and refreshment venues on the casino floor • Will also feature other sit - down and casual dining options Source: ACDL

17 AUSTRALIA ACQUISITION CORP. MGM Grand Macau MGM Grand Las Vegas Operating Agreements with MGM Resorts and Pinnacle Entertainment – MGM Resorts OPERATOR OF FIRST RESORT • 50 - year Management Service Agreement for first resort • Experienced design and construction team currently working with ACDL and its consultants • President of MGM Grand Ho Tram hired and residing in Vietnam Selected Properties GLOBAL SCALE & UNPARALLELED EXPERIENCE • Generated $7.8BN of revenue in 2011 • Owns and operates 15 world - class destination resorts; engages in four other joint ventures • Thirty years of experience in Asia • Close relationships with junket operators, including through its 51% ownership of MGM Grand Macau Bellagio Mandalay Bay The MIRAGE CityCenter Source: ACDL, Public Reports

18 AUSTRALIA ACQUISITION CORP. River City Casino L’Auberge Baton Rouge Belterra Boomtown New Orleans L’Auberge Lake Charles EQUITY SPONSORSHIP & OPERATOR OF SECOND RESORT • In August 2011, Pinnacle acquired a 26% ownership stake in ACDL for $95MM (1) • Represents Pinnacle’s Asian expansion strategy • 50 - year Management Service Agreement for second resort • Pinnacle participation enhances operating and development capabilities Selected Properties Operating Agreements with MGM Resorts and Pinnacle Entertainment – Pinnacle Entertainment STRONG OPERATIONAL & DEVELOPMENT CAPABILITIES • Generated $1.1BN of revenue in 2011 • Owns and operates seven casinos located in Louisiana, Missouri, and Indiana, as well as a racetrack in Ohio • In addition, Pinnacle is developing L'Auberge Casino & Hotel Baton Rouge • Focus on operational excellence with diversified, return - focused pipeline Lumiere Place (1) $45MM for a 26% common equity interest and $50MM for a 26% preferred equity interest Source: ACDL, Public Reports

19 AUSTRALIA ACQUISITION CORP. $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 2011 2012E 2013E 2014E 2015E United States Asia Pacific GUANGZHOU –2.5 hours SHANGHAI –4 hours SEOUL 5.5 hours TOKYO 6 hours TAIPEI 3.5 hours HONG KONG / MACAU 2.5 hours MANILA 3 hours HANOI 2 hours SINGAPORE 2 hours KUALA LUMPUR 2 hours BANGKOK 1.5 hours PHNOM PENH 50 minutes KOLKATA 6.5 hours Approximate Flight Times to Ho Chi Minh City Robust Gaming and Tourism Market in Asia • 320MM people live in the Greater Mekong sub - region • 2.1BN people live in close proximity Projected Gaming Revenue (1) • United States CAGR from 2011 - 2015E: 5.4% • Asia Pacific CAGR 2011 - 2015E: 13.9% Source: ACDL, PWC Global Gaming Outlook (in BNs) ACDL is centrally located in the world’s fastest growing gaming market (1) Includes all betting activities within “brick and mortar” casinos MGM Grand Ho Tram will focus its marketing strategy on the robust VIP junket market in Asia

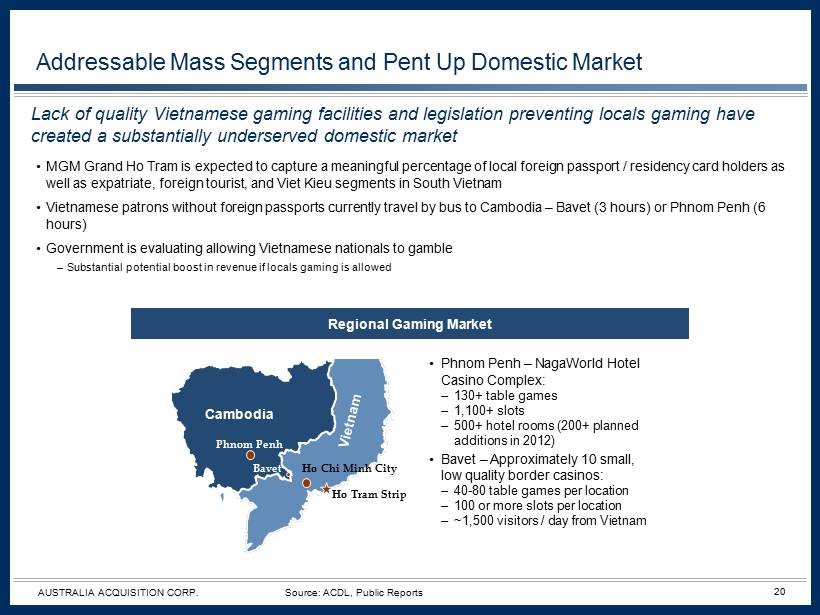

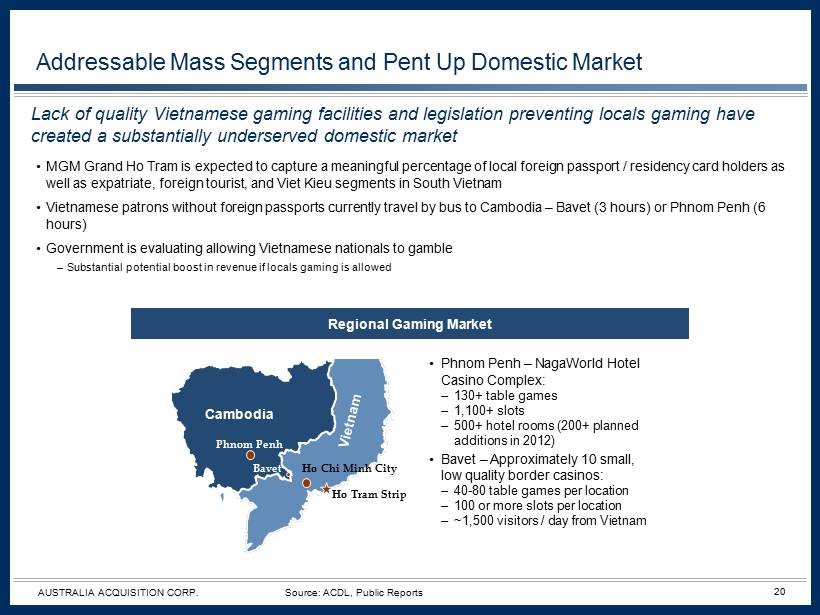

20 AUSTRALIA ACQUISITION CORP. Addressable Mass Segments and Pent Up Domestic Market Lack of quality Vietnamese gaming facilities and legislation preventing locals gaming have created a substantially underserved domestic market Regional Gaming Market • MGM Grand Ho Tram is expected to capture a meaningful percentage of local foreign passport / residency card holders as well as expatriate, foreign tourist, and Viet Kieu segments in South Vietnam • Vietnamese patrons without foreign passports currently travel by bus to Cambodia – Bavet (3 hours) or Phnom Penh (6 hours) • Government is evaluating allowing Vietnamese nationals to gamble – Substantial potential boost in revenue if locals gaming is allowed Source: ACDL, Public Reports • Phnom Penh – NagaWorld Hotel Casino Complex: – 130+ table games – 1,100+ slots – 500+ hotel rooms (200+ planned additions in 2012) • Bavet – Approximately 10 small, low quality border casinos: – 40 - 80 table games per location – 100 or more slots per location – ~1,500 visitors / day from Vietnam Bavet Phnom Penh Ho Chi Minh City Ho Tram Strip Cambodia

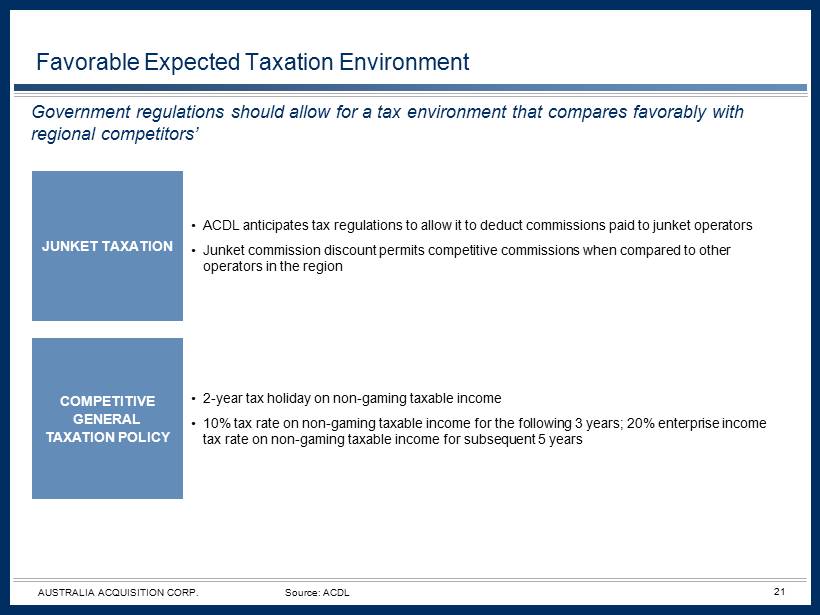

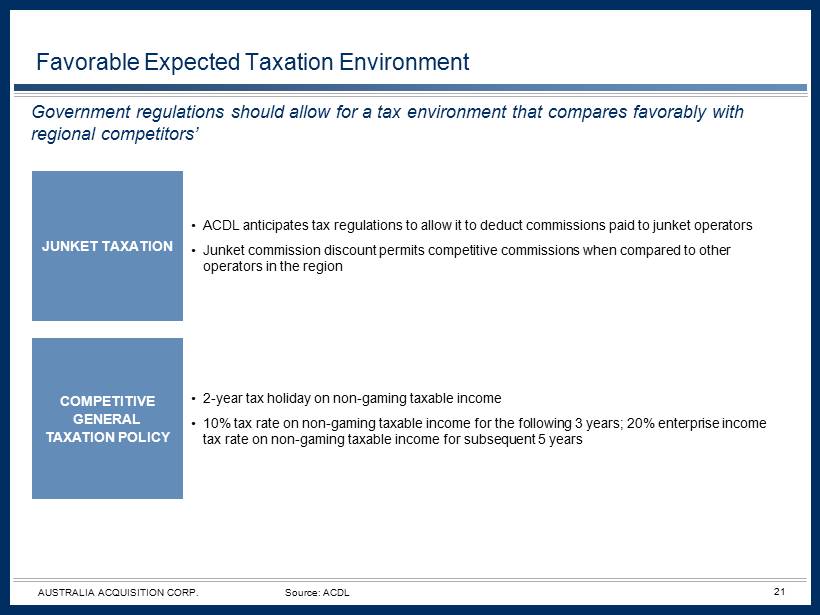

21 AUSTRALIA ACQUISITION CORP. • 2 - year tax holiday on non - gaming taxable income • 10% tax rate on non - gaming taxable income for the following 3 years; 20% enterprise income tax rate on non - gaming taxable income for subsequent 5 years JUNKET TAXATION • ACDL anticipates tax regulations to allow it to deduct commissions paid to junket operators • Junket commission discount permits competitive commissions when compared to other operators in the region COMPETITIVE GENERAL TAXATION POLICY Government regulations should allow for a tax environment that compares favorably with regional competitors’ Favorable Expected Taxation Environment Source: ACDL

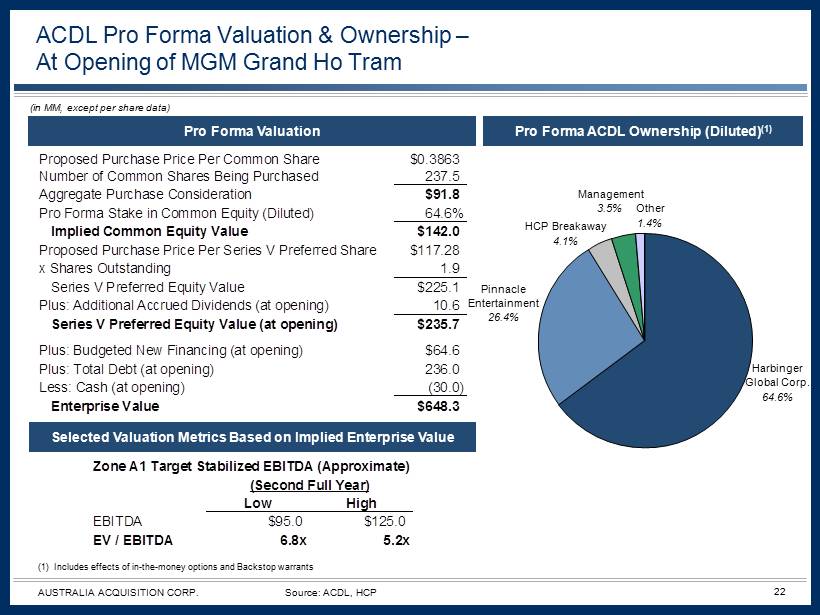

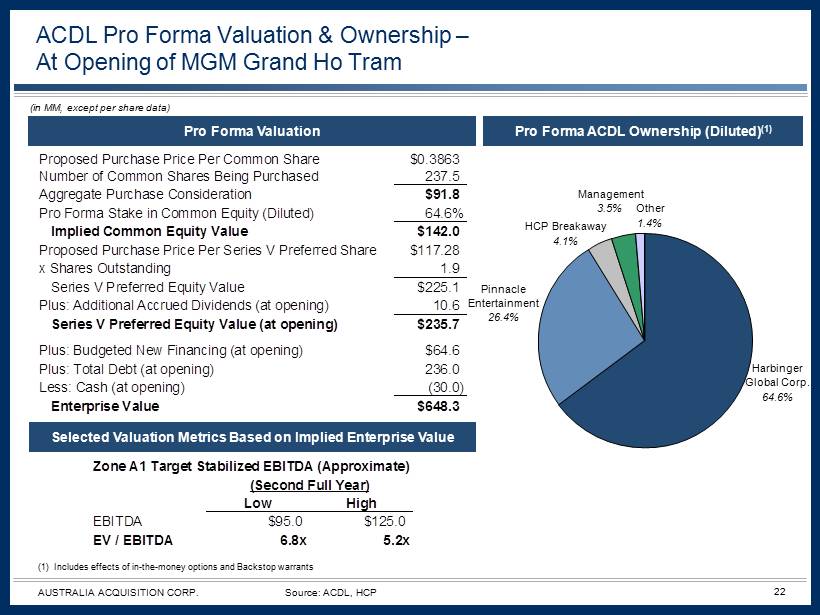

22 AUSTRALIA ACQUISITION CORP. Proposed Purchase Price Per Common Share $0.3863 Number of Common Shares Being Purchased 237.5 Aggregate Purchase Consideration $91.8 Pro Forma Stake in Common Equity (Diluted) 64.6% Implied Common Equity Value $142.0 Proposed Purchase Price Per Series V Preferred Share $117.28 x Shares Outstanding 1.9 Series V Preferred Equity Value $225.1 Plus: Additional Accrued Dividends (at opening) 10.6 Series V Preferred Equity Value (at opening) $235.7 Plus: Budgeted New Financing (at opening) $64.6 Plus: Total Debt (at opening) 236.0 Less: Cash (at opening) (30.0) Enterprise Value $648.3 Zone A1 Target Stabilized EBITDA (Approximate) (Second Full Year) Low High EBITDA $95.0 $125.0 EV / EBITDA 6.8x 5.2x Pro Forma Valuation (1) Includes effects of in - the - money options and Backstop warrants Pro Forma ACDL Ownership (Diluted) (1) Selected Valuation Metrics Based on Implied Enterprise Value ACDL Pro Forma Valuation & Ownership – At Opening of MGM Grand Ho Tram Source: ACDL, HCP (in MM, except per share data) Harbinger Global Corp. 64.6% Pinnacle Entertainment 26.4% HCP Breakaway 4.1% Management 3.5% Other 1.4%

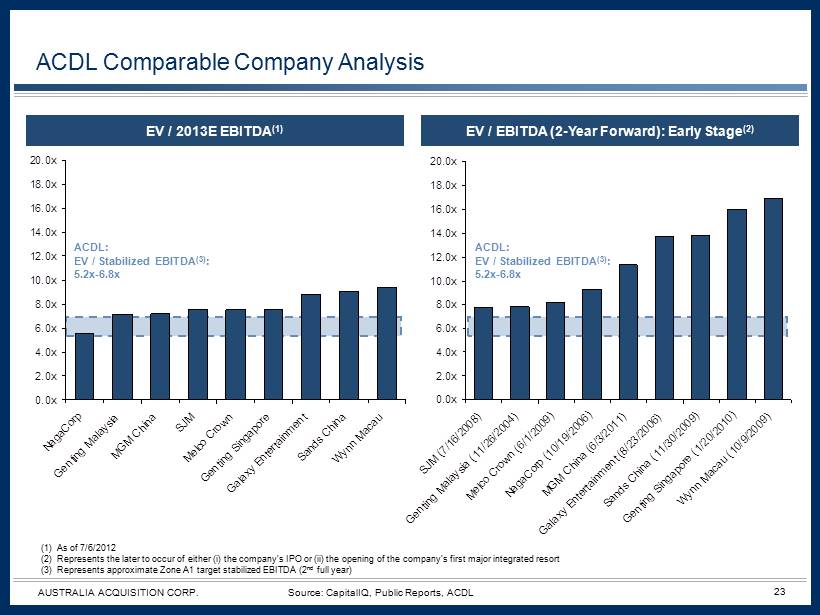

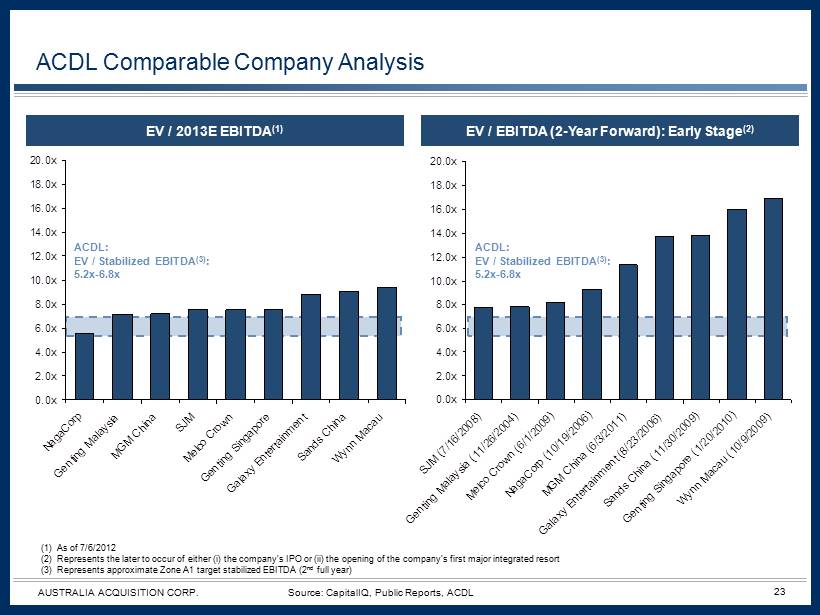

23 AUSTRALIA ACQUISITION CORP. EV / EBITDA (2 - Year Forward): Early Stage (2) EV / 2013E EBITDA (1) ACDL Comparable Company Analysis Source: CapitalIQ, Public Reports, ACDL (1) As of 7/6/2012 (2) Represents the later to occur of either (i) the company's IPO or (ii) the opening of the company's first major integrated re sort (3) Represents approximate Zone A1 target stabilized EBITDA (2 nd full year) ACDL: EV / Stabilized EBITDA (3) : 5.2x - 6.8x ACDL: EV / Stabilized EBITDA (3) : 5.2x - 6.8x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x 20.0x NagaCorp Genting Malaysia MGM China SJM Melco Crown Genting Singapore Galaxy Entertainment Sands China Wynn Macau 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x 20.0x SJM (7/16/2008) Genting Malaysia (11/26/2004) Melco Crown (6/1/2009) NagaCorp (10/19/2006) MGM China (6/3/2011) Galaxy Entertainment (8/23/2006) Sands China (11/30/2009) Genting Singapore (1/20/2010) Wynn Macau (10/9/2009)

III. Ferrous Resources Limited Australia Acquisition Corp.

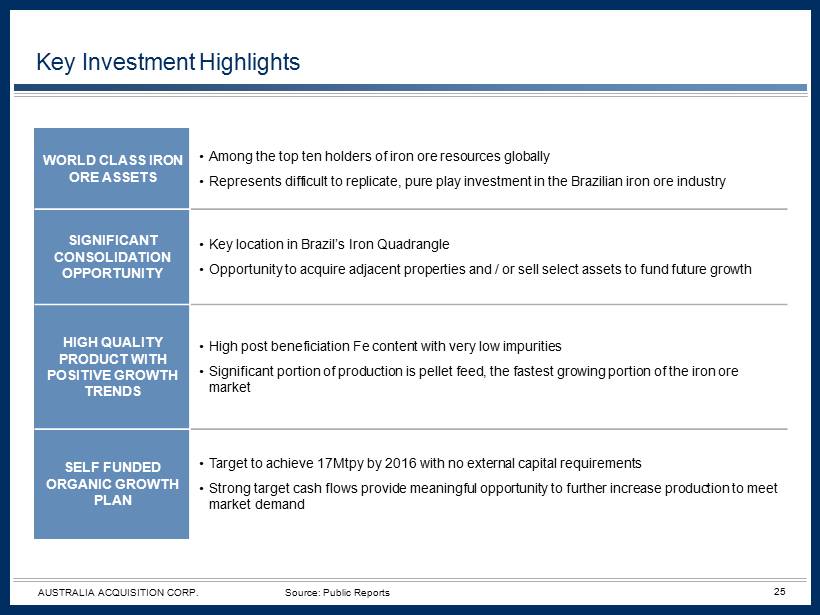

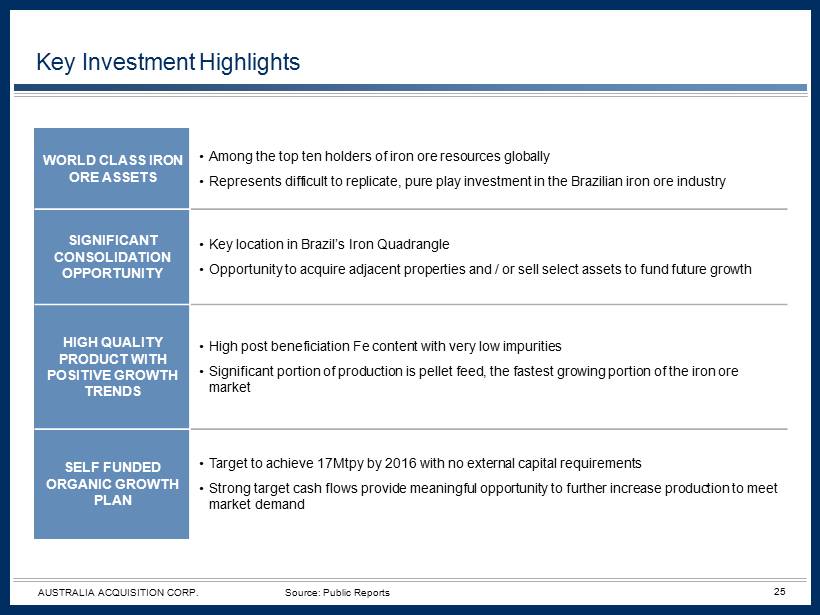

25 AUSTRALIA ACQUISITION CORP. Key Investment Highlights WORLD CLASS IRON ORE ASSETS • Among the top ten holders of iron ore resources globally • Represents difficult to replicate, pure play investment in the Brazilian iron ore industry SIGNIFICANT CONSOLIDATION OPPORTUNITY • Key location in Brazil’s Iron Quadrangle • Opportunity to acquire adjacent properties and / or sell select assets to fund future growth HIGH QUALITY PRODUCT WITH POSITIVE GROWTH TRENDS • High post beneficiation Fe content with very low impurities • Significant portion of production is pellet feed, the fastest growing portion of the iron ore market SELF FUNDED ORGANIC GROWTH PLAN • Target to achieve 17Mtpy by 2016 with no external capital requirements • Strong target cash flows provide meaningful opportunity to further increase production to meet market demand Source: Public Reports

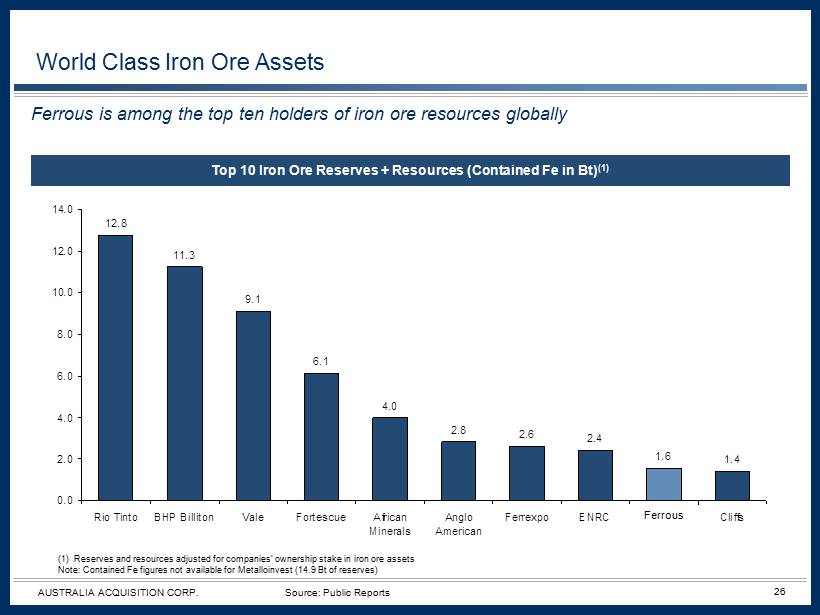

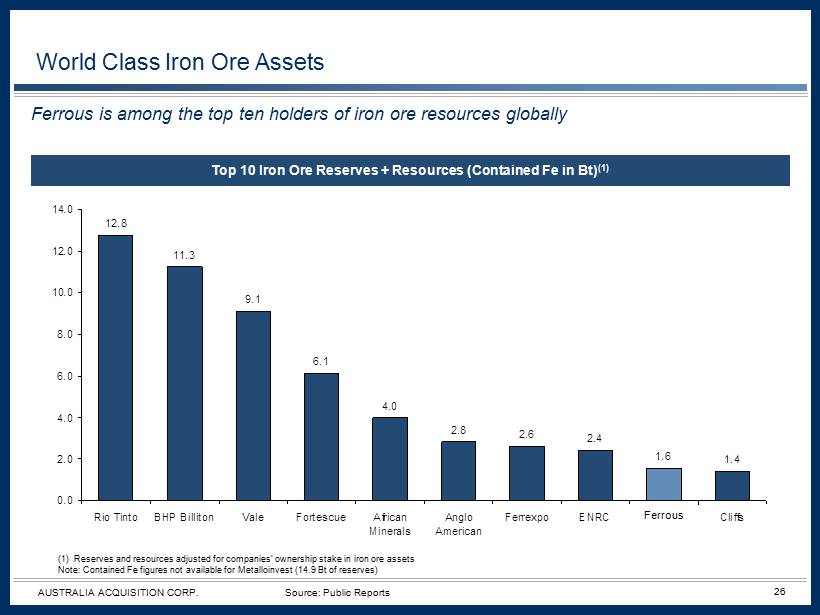

26 AUSTRALIA ACQUISITION CORP. 12.8 11.3 9.1 6.1 4.0 2.6 2.4 1.6 1.4 2.8 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 Rio Tinto BHP Billiton Vale Fortescue African Minerals Anglo American Ferrexpo ENRC Ferrous Cliffs Top 10 Iron Ore Reserves + Resources (Contained Fe in Bt) (1) World Class Iron Ore Assets Ferrous is among the top ten holders of iron ore resources globally (1) Reserves and resources adjusted for companies’ ownership stake in iron ore assets Note: Contained Fe figures not available for Metalloinvest (14.9 Bt of reserves) Source: Public Reports Ferrous

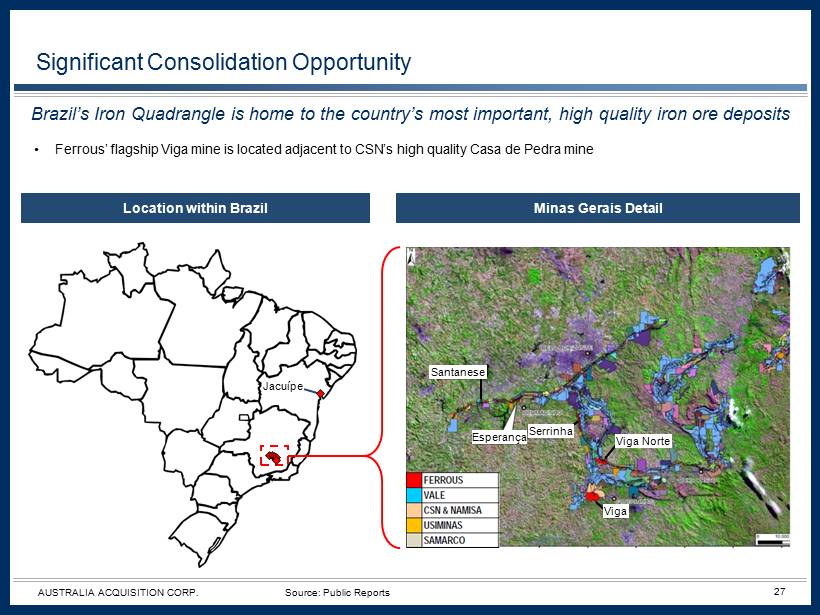

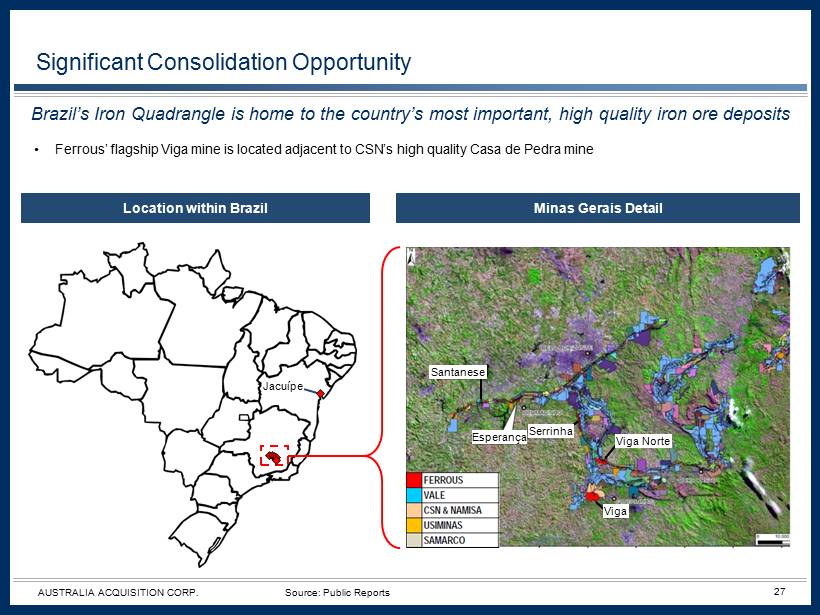

27 AUSTRALIA ACQUISITION CORP. Minas Gerais Detail Location within Brazil Significant Consolidation Opportunity Brazil’s Iron Quadrangle is home to the country’s most important, high quality iron ore deposits Jacuípe Esperança Viga Viga Norte Serrinha Santanese • Ferrous’ flagship Viga mine is located adjacent to CSN’s high quality Casa de Pedra mine Source: Public Reports

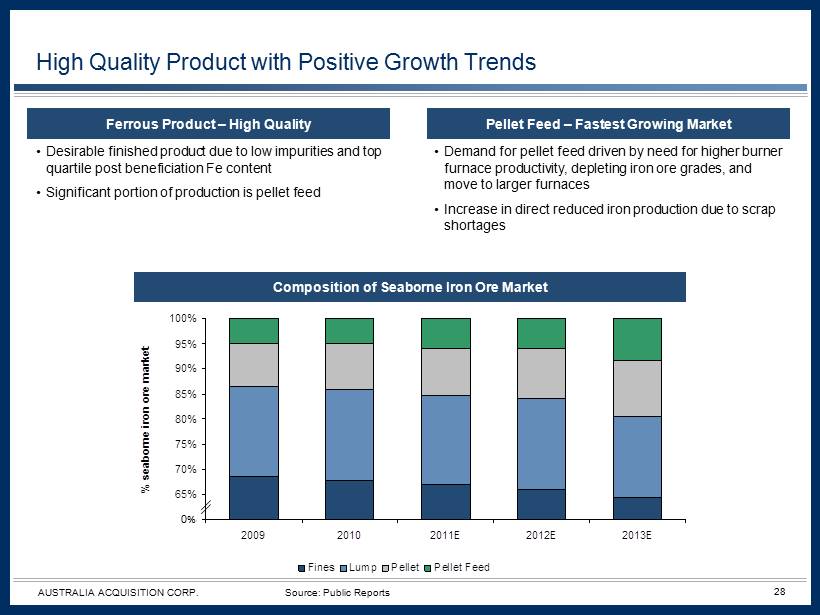

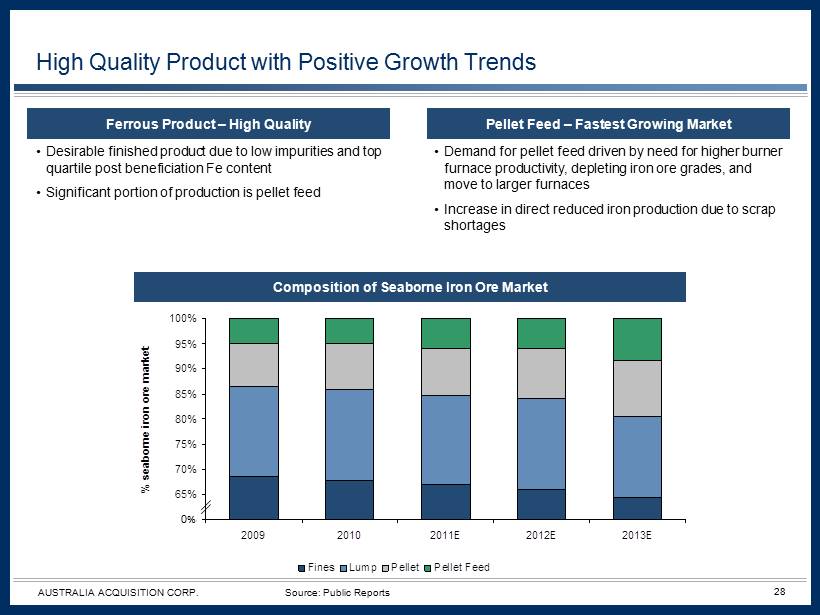

28 AUSTRALIA ACQUISITION CORP. 60% 65% 70% 75% 80% 85% 90% 95% 100% 2009 2010 2011E 2012E 2013E % seaborne iron ore market Fines Lump Pellet Pellet Feed Ferrous Product – High Quality • Desirable finished product due to low impurities and top quartile post beneficiation Fe content • Significant portion of production is pellet feed Pellet Feed – Fastest Growing Market High Quality Product with Positive Growth Trends • Demand for pellet feed driven by need for higher burner furnace productivity, depleting iron ore grades, and move to larger furnaces • Increase in direct reduced iron production due to scrap shortages Source: Public Reports Composition of Seaborne Iron Ore Market 0 %

29 AUSTRALIA ACQUISITION CORP. 17.0 3.0 1.7 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 20.0 2011 2012E 2016E Production (Mtpy) • Targeted 17Mtpy of production by 2016 using 3 rd party infrastructure with no external capital requirements – 18Mtpy Viga Railway Loading Terminal will allow Viga to directly access the market • Currently exploiting only 2 of 6 assets (Viga and Esperança) • EBITDA positive, with strong projected cash flows providing meaningful opportunity to further increase production to meet market demand Asset JORC Resources (Mt) % Fe Viga 1,537 34.4% Viga Norte 425 34.7% Esperança 338 30.8% Serrinha 1,142 36.0% Santanese 198 35.1% Jacuípe 1,132 27.2% Total 4,772 32.9% …with Considerable Additional Untapped Resources Staged Plan to Reach 17Mtpy… Self Funded Organic Growth Plan Source: Public Reports

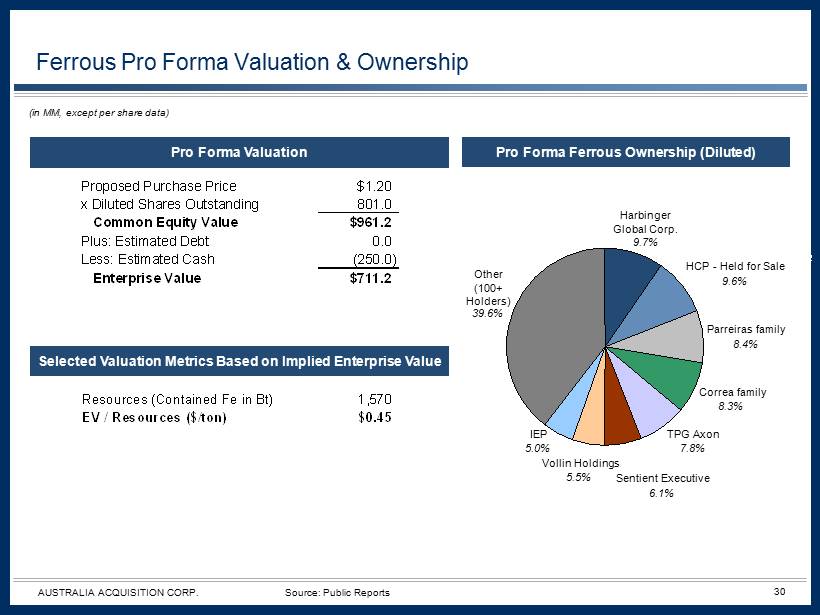

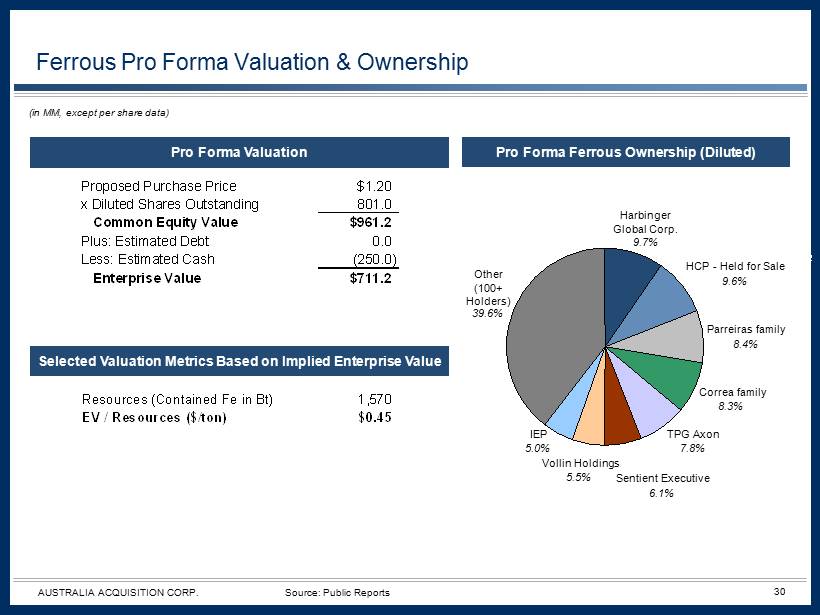

30 AUSTRALIA ACQUISITION CORP. Proposed Purchase Price $1.20 x Diluted Shares Outstanding 801.0 Common Equity Value $961.2 Plus: Estimated Debt 0.0 Less: Estimated Cash (250.0) Enterprise Value $711.2 Resources (Contained Fe in Bt) 1,570 EV / Resources ($/ton) $0.45 AAC 9.7% HCP - Held for Sale 9.6% Parreiras family 8.4% Correa family 8.3% TPG Axon 7.8% IEP 5.0% Other 39.6% Sentient Executive 6.1% Vollin Holdings 5.5% Selected Valuation Metrics Based on Implied Enterprise Value Pro Forma Valuation Ferrous Pro Forma Valuation & Ownership Source: Public Reports (in MM, except per share data) Pro Forma Ferrous Ownership (Diluted) Harbinger Global Corp. 9.7% HCP - Held for Sale 9.6% Parreiras family 8.4% Correa family 8.3% TPG Axon 7.8% Sentient Executive 6.1% Vollin Holdings 5.5% IEP 5.0% Other (100+ Holders) 39.6%

31 AUSTRALIA ACQUISITION CORP. $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 African Minerals Ferrexpo MMX Fortescue Cliffs NMDC Kumba $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 Minas Bahia / ENRC (10/10) Sphere Minerals / Xstrata (8/10) Brockman Resources / Wah Nam Int'l (12/11)Brockman Resources / Wah Nam Int'l (11/10) Baffinland Iron Mines / ArcelorMittal (11/10) FerrAus / Atlas Iron (6/11) Sundance Resources / Hanlong Mining (7/11) Bahia Minerals / ENRC (9/10) DMC Mining / African Iron (11/10) Giralia Resources / Atlas Iron (12/10) Thompson / Cliffs Natural Resources (1/11) EV / MtFe: Comparable Companies (1) EV / MtFe: Precedent Transactions Ferrous Comparable Company and Precedent Transaction Analysis Source: CapitalIQ, Public Reports (1) As of 7/6/2012 Note: Precedent Transactions format is Target / Acquiror Ferrous: $0.45 Ferrous: $0.45 $22.20