UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22461

_________________________________________

Morgan Creek Global Equity Long/Short Institutional Fund

______________________________________________________________________________

(Exact name of registrant as specified in charter)

301 West Barbee Chapel Road, Suite 200, Chapel Hill, NC 27517

________________________________________________________________________

(Address of principal executive offices)(Zip code)

Corporation Service Company

2711 Centerville Road Suite 400

Wilmington, Delaware 19808

(Name and Address of Agent for Service)

Mark Vannoy, Treasurer

Morgan Creek Capital Management, LLC

301 West Barbee Chapel Road

Chapel Hill, North Carolina 27517

Registrant’s telephone number, including area code: (919) 933-4004

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Item 1. Report to Stockholders.

(a)

Annual Report

To Shareholders

For the Year Ended March 31, 2024

Morgan Creek Global Equity Long/Short Institutional Fund

| |

| | Morgan Creek Global Equity Long/Short Institutional Fund (A Delaware Statutory Trust) |

| | Annual Report to Shareholders | | |

| | | | |

| | For the Year Ended March 31, 2024 | | |

| | | | |

| | Contents | | |

| | |

Letter to Investors (Unaudited) | 1 |

Fund Performance (Unaudited) | 2 |

Report of Independent Registered Public Accounting Firm | 3 |

Financial Statements | |

Statement of Assets and Liabilities | 4 |

Schedule of Investments | 5 |

Statement of Operations | 8 |

Statement of Changes in Net Assets | 9 |

Statement of Cash Flows | 11 |

Notes to Financial Statements | 12 |

Board of Trustees (Unaudited) | 24 |

Fund Management (Unaudited) | 25 |

Other Information (Unaudited) | 26 |

Privacy Notice (Unaudited) | 29 |

Board Consideration Regarding Approval of Investment Advisory Agreement (Unaudited) | 30 |

| | Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Shareholders who invest directly with the Fund may elect to receive shareholder reports and other communications from the Fund electronically by calling 833-523-7533 to make such arrangements. For shareholders who invest through a financial intermediary, please contact that financial intermediary directly for information on how to receive shareholder reports and other communications electronically. You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 833-523-7533 to make such arrangements. For shareholders who invest through a financial intermediary, please contact that financial intermediary directly to inform them that you wish to continue receiving paper copies of your shareholder reports. If your common shares are held through a financial intermediary, your election to receive reports in paper will apply to all funds held with that financial intermediary. |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Letter to Investors (Unaudited)

For the fiscal year ended March 31, 2024, the Fund lost 11.7%. As a reminder, Morgan Creek made the difficult decision to liquidate MCGELSIF in early 2022 for reasons we believed to be in the best interest of all investors. The asset size of the Fund had decreased to levels where the fixed operating costs of continuing to manage the Fund were difficult to justify, and in light of poor performance at that time, we did not have confidence in our ability to raise sufficient new funds to reduce the expense ratio in a timely manner. The Fund officially commenced its liquidation after the 2022 fiscal year audit was completed and the first distribution was paid in August 2022. We encourage you to read the supplement to the Fund’s prospectus dated February 28, 2022 and filed with the SEC for more information about the liquidation.

The second distribution related to the Fund’s liquidation was made in May 2023 and the third distribution was made in May 2024. The third distribution brought cumulative distributions since the liquidation commenced to approximately 65% of the Fund’s July 1, 2022 NAV. We will be in touch as soon as we have more information about future distribution dates and amounts. Please note, distribution dates and amounts are largely determined by factors outside of our control, such as underlying manager performance and liquidity events in the private portfolio.

The remaining portfolio consists of one manager, the private holdings, which include manager side pockets, and a cash balance to cover the Fund’s projected operating expenses. The one remaining manager, Tiger Global, provides 25% liquidity per year. We expect the final tranche of our full redemption in Tiger Global to process on December 31, 2024. The private holdings have no pre-determined liquidity schedule. We continue to evaluate all available liquidity options in the context of value maximization.

In addition to the Fund’s Annual and Semi-Annual reports, Morgan Creek provides more frequent updates in the Fund’s quarterly letter. Please let us know if you would like a copy of the quarterly letters and we will provide them in their entirety instead of providing summaries here. In addition to these documents and the quarterly investor statement, we continue to send out a monthly performance estimate and monthly factsheet to the email address associated with the account on file. The factsheet and additional information about the Fund are also located online at – https://www.morgancreekcap.com/hedge-funds/.Q3 2022

| Regards,

Mark W. Yusko Chief Executive Officer & Chief Investment Officer |

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 1 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

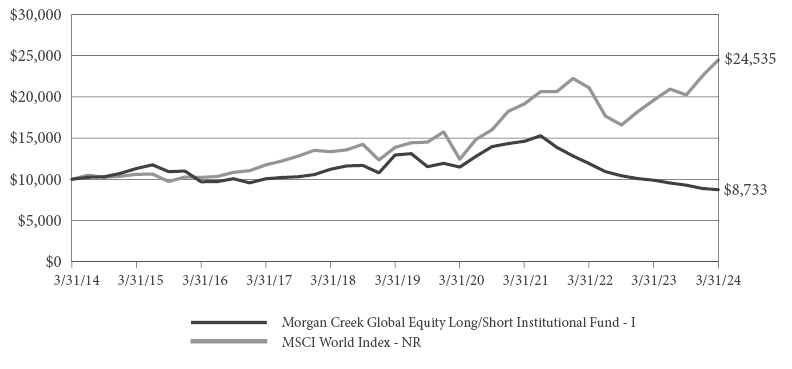

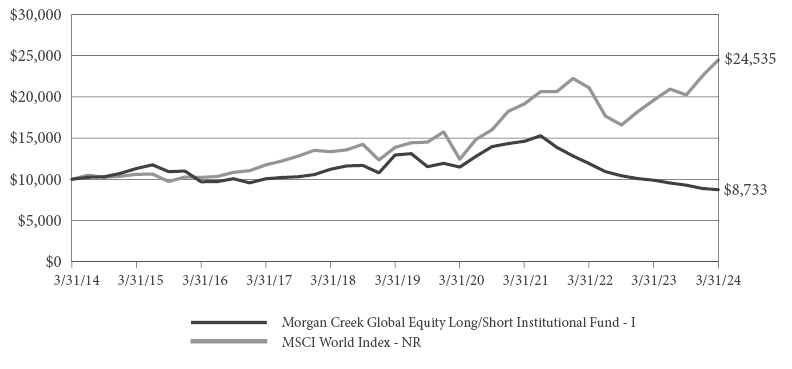

Fund Performance (Unaudited)

March 31, 2024

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception | | | Inception | |

Morgan Creek Global Equity Long/Short Institutional Fund - A - NAV | | | -11.68% | | | | -16.02% | | | | -8.05% | | | | | | | | -2.78% | | | | 4/30/2017 | |

MSCI World Index - NR | | | 25.07% | | | | 8.59% | | | | 12.07% | | | | | | | | 11.00% | | | | 4/30/2017 | |

Morgan Creek Global Equity Long/Short Institutional Fund - I - NAV | | | -11.68% | | | | -15.78% | | | | -7.58% | | | | -1.35% | % | | | 1.46% | | | | 9/30/2011 | |

MSCI World Index - NR | | | 25.07% | | | | 8.59% | | | | 12.07% | | | | 9.39% | % | | | 11.55% | | | | 9/30/2011 | |

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 2 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Morgan Creek Global Equity Long/Short Institutional Fund

Opinion on the financial statements

We have audited the accompanying statement of assets and liabilities of Morgan Creek Global Equity Long/Short Institutional Fund (the “Fund”), including the schedule of investments, as of March 31, 2024, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, the results of its operations and its cash flows for the year then ended, and the changes in net assets for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial highlights for the year ended March 31, 2022, and prior years ending March 31, 2021 and March 31, 2020, were audited by other auditors. Those auditors expressed an unqualified opinion on those financial statements and financial highlights in their report dated May 27, 2022.

Basis for opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of March 31 2024, by correspondence with the custodian and underlying fund managers, or by other appropriate auditing procedures where replies were not received. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ GRANT THORNTON LLP

We have served as the Fund’s auditor since 2023.

Iselin, New Jersey

May 29, 2024

morgan creek capital management, llc | annual report to SHAREHOLDERS | 3 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Statement of Assets and Liabilities

March 31, 2024 (in U.S. Dollars)

ASSETS: | | | | |

Investments in Portfolio Funds, at fair value (Cost, $3,765,736) | | $ | 2,908,439 | |

Cash and cash equivalents | | | 1,930,289 | |

Receivable for securities sold | | | 175,836 | |

Interest receivable | | | 15 | |

Total Assets | | $ | 5,014,579 | |

| | | | | |

LIABILITIES: | | | | |

Accrued expenses and other liabilities | | $ | 53,177 | |

Transfer agent fees payable | | | 23,863 | |

Administration fees payable | | | 22,415 | |

Tax expense payable | | | 13,225 | |

Management fees payable | | | 5,799 | |

Audit & legal fees payable | | | 1,838 | |

Total Liabilities | | | 120,317 | |

| | | | | |

Net Assets | | $ | 4,894,262 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 13,540,100 | |

Total distributable accumulated deficit | | | (8,645,838 | ) |

Net Assets | | $ | 4,894,262 | |

| | | | | |

PRICING OF SHARES: | | | | |

Class I | | | | |

Net Asset Value per Share: | | | | |

$4,795,747 / 8,850 Shares issued and outstanding, par value $0.01 per share, unlimited Shares authorized | | $ | 541.87 | |

| | | | | |

Class A | | | | |

Net Asset Value per Share: | | | | |

$98,515 / 207 Shares issued and outstanding, par value $0.01 per share, unlimited Shares authorized | | $ | 476.67 | |

Sales Charge Class A (Load) | | | 3.00 | % |

Maximum Offering Price Per Class A Share | | $ | 490.97 | |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 4 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Schedule of Investments

March 31, 2024 (in U.S. Dollars)

| | Investments | | Cost | | | Fair Value | | | Percent

of Net

Assets | | Domicile | Liquidity(1),(2) | Next

Available

Redemption

Date(3) | Initial

Acquisition

Date | |

| | Investments in Portfolio Funds | | | | | | | | | | | | | | | | | |

| | Asia | | | | | | | | | | | | | | | | | |

| | Private Investors III, LLC | | | | | | | | | | | | | | | | | |

| | 1,697 shares(4) | | $ | 1,661,084 | | | $ | 987,377 | | | | 20.17 | % | United States | 0-5 Years | N/A | 11/19/2014 | |

| | Teng Yue Partners Offshore Fund, L.P. | | | | | | | | | | | | | | | | | |

| | 18 shares(4)(5) | | | 18,434 | | | | 49,172 | | | | 1.00 | | Cayman Islands | Illiquid | N/A | 10/1/2015 | |

| | Total Asia | | | 1,679,518 | | | | 1,036,549 | | | | 21.17 | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Emerging Markets | | | | | | | | | | | | | | | | | |

| | New Century Holdings XI, L.P. | | | | | | | | | | | | | | | | | |

| | 26,174 shares(4) | | | 22,898 | | | | 28,402 | | | | 0.59 | | Cayman Islands | Illiquid | N/A | 10/2/2017 | |

| | Total Emerging Markets | | | 22,898 | | | | 28,402 | | | | 0.59 | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Energy & Natural Resources | | | | | | | | | | | | | | | | | |

| | MLO Private Investment, Ltd. | | | | | | | | | | | | | | | | | |

| | 41 shares, Series 01(4) | | | 68,358 | | | | 92,289 | | | | 1.89 | | Cayman Islands | Illiquid | N/A | 10/2/2017 | |

| | Total Energy & Natural Resources | | | 68,358 | | | | 92,289 | | | | 1.89 | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Technology | | | | | | | | | | | | | | | | | |

| | Carmenta Opportunities Fund, L.P. | | | | | | | | | | | | | | | | | |

| | 1,000 shares(4) | | | 88,000 | | | | 75,751 | | | | 1.55 | | United States | 0-5 Years | N/A | 7/15/2021 | |

| | Flight Deck Offshore Fund, L.P. | | | | | | | | | | | | | | | | | |

| | 213 shares(4) | | | 153,715 | | | | 73,661 | | | | 1.51 | | United States | 0-5 Years | N/A | 5/1/2021 | |

| | Maverick Holdings C, Ltd. | | | | | | | | | | | | | | | | | |

| | 1 shares(4) | | | 1,304 | | | | 1,377 | | | | 0.03 | | Cayman Islands | 0-5 Years | N/A | 2/1/2021 | |

| | Paulson Investment Company I, L.P. | | | | | | | | | | | | | | | | | |

| | 596 shares(4) | | | 595,670 | | | | 171,158 | | | | 3.49 | | United States | 0-5 Years | N/A | 6/30/2021 | |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 5 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Schedule of Investments (continued)

March 31, 2024 (in U.S. Dollars)

| | Investments | | Cost | | | Fair Value | | | Percent

of Net

Assets | | Domicile | Liquidity(1),(2) | Next

Available

Redemption

Date(3) | Initial

Acquisition

Date | |

| | Payara Fund III, L.P. | | | | | | | | | | | | | | | | | |

| | 1,000 shares(4) | | $ | 274,500 | | | $ | 189,363 | | | | 3.87 | % | United States | 0-5 Years | N/A | 7/15/2021 | |

| | Tiger Global Liquidating Account | | | | | | | | | | | | | | | | | |

| | 17 shares(4) | | | 172,865 | | | | 169,796 | | | | 3.47 | | United States | Illiquid | N/A | 12/31/2022 | |

| | Tiger Global, Ltd. | | | | | | | | | | | | | | | | | |

| | 569 shares, Class C(4) | | | 276,724 | | | | 687,260 | | | | 14.04 | | Cayman Islands | Annually | 12/31/2024 | 7/1/2013 | |

| | Total Technology | | | 1,562,778 | | | | 1,368,366 | | | | 27.96 | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Value Long/Short | | | | | | | | | | | | | | | | | |

| | Falcon Edge Global, Ltd | | | | | | | | | | | | | | | | | |

| | 238 shares, Series S(4) | | | 338,791 | | | | 358,346 | | | | 7.32 | | Cayman Islands | Illiquid | N/A | 4/3/2017 | |

| | Falcon Edge Global, Ltd | | | | | | | | | | | | | | | | | |

| | 100 shares, Series Standard Share Partners(4) | | | 93,393 | | | | 24,487 | | | | 0.50 | | Cayman Islands | Illiquid | N/A | 10/3/2016 | |

| | Total Value Long/Short | | | 432,184 | | | | 382,833 | | | | 7.82 | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Total Investments in Portfolio Funds | | $ | 3,765,736 | | | $ | 2,908,439 | | | | 59.43 | % | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | TOTAL INVESTMENTS | | $ | 3,765,736 | | | $ | 2,908,439 | | | | 59.43 | % | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Cash and cash equivalents(6) | | | | | | | 1,930,289 | | | | 39.44 | | | | | | |

| | Other Assets, less Liabilities | | | | | | $ | 55,534 | | | | 1.13 | % | | | | | |

| | Total Net Assets | | | | | | $ | 4,894,262 | | | | 100.00 | % | | | | | |

(1) | Available frequency of redemptions after initial lock-up period, if any. Different tranches may have different liquidity terms. |

(2) | 0-5 Years - Portfolio Funds will periodically redeem depending on cash availability. |

(3) | Investments in Portfolio Funds may be composed of multiple tranches. The Next Available Redemption Date relates to the earliest date after March 31, 2024 that redemption from a tranche is available. Other tranches may have an available redemption date that is after the Next Available Redemption Date. Redemptions from Portfolio Funds may be subject to fees. |

(4) | Non-income producing security. |

(5) | Although the Portfolio Fund has monthly, quarterly, or annual redemption rights, there are various gates, holdbacks, and/or side pockets imposed by the manager of the Portfolio Fund, which prevent the Fund from being able to redeem its entire position at the next available redemption date. |

(6) | As of 3/31 cash and cash equivalents consisted of UMB interest bearing deposit account with a yield of 0.01%. |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 6 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Schedule of Investments (continued)

March 31, 2024 (in U.S. Dollars)

| | | | Asset at Fair Values as of March 31, 2024 | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | | |

| | Total Investments | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

| | | | | | | | | | | | | | | | | | | |

| | Total Investments in Portfolio Funds Measured at NAV | | | | | | | | | | | | | | | 2,908,439 | | |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 7 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Statement of Operations

For the Period Ended March 31, 2024 (in U.S. Dollars)

Investment income | | | | |

Interest income | | $ | 129 | |

Total Investment Income | | | 129 | |

| | | | | |

Expenses | | | | |

Administration fee | | | 125,106 | |

Transfer agent fees | | | 116,884 | |

Audit fees | | | 65,000 | |

Trustees’ fees | | | 55,000 | |

Management fees | | | 25,575 | |

Legal fees | | | 33,999 | |

Registration fees | | | 31,895 | |

Custodian fees | | | 14,133 | |

Tax fees | | | 11,500 | |

Other expenses | | | 57,619 | |

Net Expenses | | | 536,711 | |

| | | | | |

Net Investment Loss | | | (536,582 | ) |

| | | | | |

Realized and unrealized gain (loss) from investments in Portfolio Funds and Securities | | | | |

Net realized gain from investments in Portfolio Funds and Securities | | | 853,733 | |

Net change in unrealized appreciation/depreciation on investments in Portfolio Funds | | | (964,494 | ) |

Net realized and unrealized loss from investments in Portfolio Funds and Securities | | | (110,761 | ) |

| | | | | |

Net Decrease in Net Assets Resulting from Operations | | $ | (647,343 | ) |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 8 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Statement of Changes in Net Assets

(in U.S. Dollars)

For the Year Ended March 31, 2024 | | | | |

| | | | | |

NET DECREASE IN NET ASSETS FROM OPERATIONS: | | | | |

Net investment loss | | $ | (536,582 | ) |

Net realized gain from investments in Portfolio Funds and Securities | | | 853,733 | |

Net change in unrealized appreciation/depreciation on investments in Portfolio Funds | | | (964,494 | ) |

Net decrease in net assets resulting from operations | | | (647,343 | ) |

| | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | |

Redemptions — Class I | | | (1,469,807 | ) |

Redemptions — Class A | | | (30,193 | ) |

Net decrease in net assets from capital share transactions | | | (1,500,000 | ) |

| | | | | |

Net Decrease in Net Assets | | | (2,147,343 | ) |

| | | | | |

NET ASSETS: | | | | |

Beginning of year | | | 7,041,605 | |

End of year | | $ | 4,894,262 | |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 9 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Statement of Changes in Net Assets (continued)

(in U.S. Dollars)

For the Year Ended March 31, 2023 | | | | |

| | | | | |

NET DECREASE IN NET ASSETS FROM OPERATIONS: | | | | |

Net investment loss | | $ | (591,779 | ) |

Net realized gain from investments in Portfolio Funds and Securities | | | 974,176 | |

Net change in unrealized appreciation/depreciation on investments in Portfolio Funds | | | (2,471,686 | ) |

Net decrease in net assets resulting from operations | | | (2,089,289 | ) |

| | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | |

Redemptions — Class I | | | (7,104,070 | ) |

Redemptions — Class A | | | (145,933 | ) |

Net decrease in net assets from capital share transactions | | | (7,250,003 | ) |

| | | | | |

Net Decrease in Net Assets | | | (9,339,292 | ) |

| | | | | |

NET ASSETS: | | | | |

Beginning of year | | | 16,380,897 | |

End of year | | $ | 7,041,605 | |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 10 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Statement of Cash Flows

For the Period Ended March 31, 2024 (in U.S. Dollars)

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net decrease in net assets resulting from operations | | $ | (647,343 | ) |

Adjustments to reconcile net decrease in net assets from operations to net cash used provided by operating activities: | | | | |

Contributions to Portfolio Funds | | | (27,688 | ) |

Proceeds from disposition of investments in Portfolio Funds and Securities | | | 1,872,384 | |

Net realized gain from investments in Portfolio Funds and Securities | | | (853,733 | ) |

Net change in unrealized appreciation/depreciation on investments in Portfolio Funds | | | 964,494 | |

(Increase)/Decrease in assets: | | | | |

Interest receivable | | | 4 | |

Increase/(Decrease) in liabilities: | | | | |

Administration Fees Payable | | | (30,315 | ) |

Transfer Agent Fees payable | | | (42,044 | ) |

Management fees payable | | | (3,014 | ) |

Audit and legal fees payable | | | (67,700 | ) |

Accrued expenses and other liabilities | | | 39,565 | |

Net cash provided by operating activities | | | 1,204,610 | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Redemptions - Class I | | | (1,469,807 | ) |

Redemptions - Class A | | | (30,193 | ) |

Net cash used in financing activities | | | (1,500,000 | ) |

| | | | | |

Net decrease in cash and cash equivalents | | | (295,390 | ) |

| | | | | |

Cash and cash equivalents | | | | |

Beginning of year | | $ | 2,225,679 | |

End of year | | $ | 1,930,289 | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | |

Non-cash sale of investments in Portfolio Funds | | $ | 391,674 | |

Non-cash receipt of Securities from Portfolio Funds and interest in Portfolio Funds | | $ | (391,674 | ) |

The accompanying notes are an integral part of these financial statements and should be read in conjunction therewith.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 11 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements

March 31, 2024

1. | Organization and Nature of Business |

Morgan Creek Global Equity Long/Short Institutional Fund (the “Fund”) was organized under the laws of the State of Delaware as a statutory trust on August 16, 2010. The Fund commenced operations on October 3, 2011 (“Commencement of Operations”) and operates pursuant to the Agreement and Declaration of Trust (the “Trust Instrument”). The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. While non-diversified for 1940 Act purposes, the Fund intends to comply with the diversification requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), as such requirements are described in more detail below.

The Fund is structured as a regulated investment company and its investment objective is to generate greater long-term returns when compared to traditional equity market benchmarks, while exhibiting a lower level of volatility and a modest degree of correlation to these markets. The Fund seeks to achieve this objective primarily by investing in private funds and other pooled investment vehicles (collectively, the “Portfolio Funds”), and exchange traded funds, common stocks (including selling common stocks short), purchased options, and preferred stock, (collectively, the “Securities”) that are not expected to be highly correlated to each other or with traditional equity markets over a long-term time horizon. The Fund normally invests 80% of its assets in Portfolio Funds that will primarily engage in long/short equity strategies and equity securities that augment these strategies. Under normal circumstances, 80% or more of the investment portfolios of the Portfolio Funds on an aggregate basis will consist of equity securities and 40% or more of the investments portfolios of the Portfolio Funds on an aggregate basis will be non-U.S. securities. The Portfolio Funds are managed by third-party investment managers (the “Managers”) selected by the investment adviser. The Advisor (as defined below) pursuant to a “Hybrid Model” augments the core Portfolio Fund holdings of the Fund with direct investments in equity securities that are consistent with the investment ideas of the Managers (as defined below).

Morgan Creek Capital Management, LLC (the “Advisor”), a North Carolina limited liability company registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), serves as the Fund’s investment adviser. The Advisor is responsible for providing day-to-day investment management services to the Fund, subject to the oversight of the Fund’s Board of Trustees (the “Board” or each separately a “Trustee”).

The Board has overall responsibility for overseeing the Fund’s investment program and its management and operations. Two of the four Trustees are “Independent Trustees” who are not “interested persons” (as defined by the 1940 Act) of the Fund.

Investors in the Fund (“Shareholders”) are governed by the Trust Instrument and bound by its terms and conditions. The security purchased by a Shareholder is a beneficial interest (a “Share”) in the Fund. All Shares shall be fully paid and are non-assessable. Shareholders shall have no preemptive or other rights to subscribe for any additional Shares. The Fund offers and sells two separate classes of Shares designated as Class A (“Class A Shares”) and Class I (“Class I Shares”). Class A Shares and Class I Shares are subject to different fees and expenses. Class A Shares are offered to investors subject to an initial sales charge. Class I Shares are not subject to an initial sales charge and have lower ongoing expenses than Class A Shares. All shares issued prior to April 1, 2016 have been designated as Class I Shares in terms of rights accorded and expenses borne.

Investments in the Fund generally may be made only by U.S. persons who are “accredited investors” within the meaning of Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended and “qualified clients” within the meaning of Rule 205-3 promulgated under the Advisers Act. The Fund may decline to accept any investment in its

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 12 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

discretion. The Board (or its designated agent) may admit Shareholders to the Fund from time to time upon the execution by a prospective investor of the appropriate documentation. Shares will be issued at the current net asset value (“NAV”) per Share of the class plus an initial sales charge for Class A Shares.

The Board, from time to time and in its sole discretion, may determine to cause the Fund to offer to repurchase Shares from Shareholders pursuant to written tenders by Shareholders. The Advisor anticipates that it will recommend to the Board to cause the Fund to conduct repurchase offers on a quarterly basis in order to permit the Fund to conduct repurchase offers for Shares. However, there are no assurances that the Board will, in fact, decide to undertake any repurchase offer. The Fund will make repurchase offers, if any, to all Shareholders, on the same terms, which may affect the size of the Fund’s repurchase offers. A Shareholder may determine, however, not to participate in a particular repurchase offer or may determine to participate to a limited degree, which will affect the liquidity of the investment of any investor in the Fund. In the event of a tender for redemption, the Fund, subject to the terms of the Trust Instrument and the Fund’s ability to liquidate sufficient Fund investments in an orderly fashion determined by the Board to be fair and reasonable to the Fund and all of the Shareholders, shall pay to such redeeming Shareholder within 90 days the proceeds of such redemption, provided that such proceeds may be paid in cash, by means of in-kind distribution of Fund investments, or as a combination of cash and in-kind distribution of Fund investments. Shares will be redeemed at the current NAV per Share of the class.

On February 25, 2022 the Board decided it was in the best interest of the Fund and its Shareholders to liquidate the Fund as of May 31, 2022. The Board approved a Plan of Liquidation (the “Liquidation Plan”), which provides for the liquidation of the Fund, the pro rata distribution of the assets of the Fund to its shareholders and the closing of Fund shareholder accounts. As such all tender offers and sales were suspended effective April 1, 2022.

Under the Liquidation Plan, the Fund will make pro-rata distributions to Shareholders as the Underlying Portfolio Funds are liquidated. The Fund anticipates that the liquidation could take several years.

2. | Summary of Significant Accounting Policies |

Basis for Accounting

The accompanying financial statements of the Fund are prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) and in accordance with Accounting Standards Codification (“ASC”) as set forth by the Financial Accounting Standards Board (“FASB”). The Fund maintains its financial records in U.S. dollars and follows the accrual basis of accounting. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Management has determined that the Fund is an investment company in accordance with FASB ASC 946 “Investment Companies” for the purpose of financial reporting.

Investment in the Fund

The Fund is offered on a continuous basis through Morgan Creek Capital Distributors, LLC (the “Distributor”), an affiliate of the Advisor. The initial closing date for the public offering of Class I Shares was October 3, 2011. Class I Shares were offered at an initial offering price of $1,000 per Share, and have been offered in a continuous monthly offering thereafter at the Class I Shares’ then current NAV per Share. The initial closing date for the public offering of Class A Shares was April 1, 2017. Class A Shares were offered at an initial offering price of $1,000 per Share, and have been offered in a continuous monthly offering

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 13 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

thereafter at the Class A Shares’ then current NAV per Share. The Distributor may enter into selected dealer arrangements with various brokers, dealers, banks and other financial intermediaries (“Selling Agents”), which have agreed to participate in the distribution of the Fund’s Shares.

Valuation of Portfolio Funds

The Fund carries its investments in Portfolio Funds at fair value in accordance with FASB ASC 820 “Fair Value Measurements and Disclosures” (“ASC 820”) which clarifies the definition of fair value for financial reporting, establishes a hierarchal disclosure framework for measuring fair value and requires additional disclosures about the use of fair value measure.

The NAV of the Fund is determined as of the close of business at the end of any fiscal period, generally monthly, in accordance with the valuation principles described below, or as may be determined from time to time pursuant to policies established by the Advisor. The Fund’s NAV is calculated by the Fund’s administrator.

The Board has ultimate responsibility for valuation but has delegated the process of valuing securities for which market quotations are not readily available to the Valuation Committee (the “Committee”). The Committee is responsible for monitoring the Fund’s valuation policies and procedures (which have been adopted by the Board and are subject to Board oversight), making recommendations to the Board on valuation-related matters and ensuring the implementation of the valuation procedures used by the Fund to value securities, including the fair value of the Fund’s investments in Portfolio Funds. These procedures shall be reviewed by the Board no less frequently than annually. Any revisions to these procedures that are deemed necessary shall be reported to the Board at its next regularly scheduled meeting.

Investments in Portfolio Funds held by the Fund are valued as follows:

The Fund measures the fair value of an investment that does not have a readily determinable fair value, based on the NAV of the investment as a practical expedient, without further adjustment, unless it is probable that the investment will be sold at a value significantly different than the NAV in accordance with ASC 820. If the practical expedient NAV is not as of the reporting entity’s measurement date, then the NAV is adjusted to reflect any significant events that may change the valuation. In using the NAV as a practical expedient, certain attributes of the investment, that may impact the fair value of the investment, are considered in measuring fair value. Attributes of those investments include the investment strategies of the investees and may also include, but are not limited to, restrictions on the investor’s ability to redeem its investments at the measurement date. The Fund is permitted to invest in alternative investments that do not have a readily determinable fair value and, as such, has elected to use the NAV as calculated on the Fund’s measurement date as the fair value of the investments. Investments in Portfolio Funds are subject to the terms of the Portfolio Funds’ offering and governing documents. Valuations of the Portfolio Funds may be subject to estimates and are net of management and performance incentive fees or allocations payable to the Portfolio Funds as required by the Portfolio Funds’ operating documents.

The Advisor’s rationale for the above approach derives from the reliance it places on its initial and ongoing due diligence, which understands the respective controls and processes around determining the NAV with the Managers of the Portfolio Funds. The Advisor has designed an ongoing due diligence process with respect to the Portfolio Funds and their Managers, which assists the Advisor in assessing the quality of information provided by, or on behalf of, each Portfolio Fund and in determining whether such information continues to be reliable or whether further investigation is necessary.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 14 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

Where no value is readily available from a Portfolio Fund or Securities or where a value supplied by a Portfolio Fund or pricing service for a security is deemed by the Advisor not to be indicative of its fair value, the Advisor will determine, in good faith, the fair value of the Portfolio Fund or Securities subject to the approval of the Board and pursuant to procedures adopted by the Board and subject to the Board’s oversight. The Advisor values the Fund’s assets based on such reasonably available relevant information as it considers material. Because of the inherent uncertainty of valuation, the fair values of the Fund’s Portfolio Funds may differ significantly from the values that would have been used had a ready market for the Portfolio Funds held by the Fund been available.

Cash and Cash Equivalents

Cash and cash equivalents include cash and time deposits with an original maturity of 90 days or less, and are carried at cost, which approximates fair value. The Fund considers all highly liquid short-term investments, with maturities of ninety days or less when purchased, as cash equivalents. As of March 31, 2024, the Fund held $1,930,289 of cash equivalents in UMB interest bearing deposit account.

Income and Operating Expenses

The Fund bears its own expenses including, but not limited to, legal, accounting (including third-party accounting services), auditing and other professional expenses, offering costs, administration expenses and custody expenses. Interest income and interest expense are recorded on an accrual basis. Dividend income on Portfolio Funds and Securities and dividend expense on securities sold short is recorded on the ex-dividend date and net of foreign withholding taxes. Operating expenses are recorded as incurred.

Recognition of Gains and Losses

Change in unrealized appreciation/depreciation from each Portfolio Fund and Security is included in the Statement of Operations as net change in unrealized appreciation/depreciation on investments.

Investment transactions in Portfolio Funds and Securities are recorded on a trade date basis. Any proceeds received from Portfolio Fund redemptions and Security sales that are in excess of the Portfolio Fund’s or Security’s cost basis are classified as net realized gain from investments on the Statement of Operations. Any proceeds received from Portfolio Fund redemptions and Security sales that are less than the Portfolio Fund’s or Security’s cost basis are classified as net realized loss from investments on the Statement of Operations. Realized gains and losses from investments in Portfolio Funds and Securities are calculated based on the specific identification method.

Class Allocations and Expenses

Investment income, unrealized and realized gains and losses, common expenses of the Fund, and certain Fund-level expense reductions, if any, are allocated monthly on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 15 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

Income Taxation

The Fund intends to continue to comply with the requirements of Subchapter M of the Code applicable to regulated investment companies (“RICs”) and to distribute substantially all of its taxable income to its Shareholders. Therefore, no provision for federal income taxes is required. The Fund files tax returns with the U.S. Internal Revenue Service and various states. The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on a Portfolio Fund’s or Security’s income earned or gains realized or repatriated. Taxes are accrued and applied to net investment income, net realized capital gains and net unrealized appreciation, as applicable, as the income is earned or capital gains are recorded. The Fund has concluded there are no significant uncertain tax positions that would require recognition in the financial statements as of March 31, 2024. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in other expenses on the Statement of Operations. Generally, tax authorities can examine all tax returns filed for the last three years. The Fund’s major tax jurisdictions are the United States, the State of Delaware, and the State of North Carolina. As of March 31, 2024, the tax years 2020 to 2023 remain subject to examination.

The Fund did not use any capital loss carryovers during the year ended March 31, 2024.

As of March 31, 2024, the cost and related gross unrealized appreciation and depreciation for tax purposes were as follows

Cost of investments for tax purposes | | $ | 4,073,183 | |

Gross tax unrealized appreciation | | $ | 184,249 | |

Gross tax unrealized depreciation | | $ | (1,348,993 | ) |

Net appreciation on foreign currency and derivatives | | $ | 180 | |

Net tax unrealized appreciation on investments | | $ | (1,164,564 | ) |

Distribution of Income and Gains

The Fund declares and pays dividends annually from its net investment income. Net realized gains, if any, are distributed at least annually. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income for tax purposes.

The Fund generally invests its assets in Portfolio Funds organized outside the United States that are treated as corporations for U.S. tax purposes and are expected to be classified as passive foreign investment companies (“PFICs”). As such, the Fund expects that its distributions generally will be taxable as ordinary income to the Shareholders.

Pursuant to the dividend reinvestment plan established by the Fund (the “DRIP”), each Shareholder whose shares are registered in its own name will automatically be a participant under the DRIP and have all income, dividends and capital gains distributions automatically reinvested in additional Shares.

There were no dividend or capital gain distributions paid during the year ended March 31, 2024 or the year ended March 31, 2023.

Permanent differences primarily due to net operating losses resulted in the following reclassifications among the Fund’s components of net assets as of March 31, 2024:

Accumulated net investment loss | | $ | — | |

Accumulated net realized gain from investments | | $ | 437,577 | |

Paid-in Capital | | $ | (437,577 | ) |

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 16 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

As of March 31, 2024, the components of distributable accumulated deficit on a tax basis were as follows:

Undistributed ordinary income | | $ | — | |

Accumulated capital gains/losses | | | (7,481,274 | ) |

Other cumulative effect of timing differences | | | — | |

Unrealized appreciation/depreciation | | | (1,164,564 | ) |

Total distributable accumulated deficit | | $ | (8,645,838 | ) |

As of March 31, 2024, capital loss carryforwards available for federal income tax purposes were $3,528,880 for short-term and $3,952,394 for long-term. These amounts have no expiration.

Temporary differences are primarily due to differing book and tax treatments of passive foreign investment companies, wash sale and partnerships.

3. | Fair Value of Financial Instruments |

In accordance with ASC 820, the Fund discloses the fair value of its investments in Portfolio Funds and Securities in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The guidance establishes three levels of the fair value hierarchy as follows:

Level 1 - Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date;

Level 2 - Other significant observable inputs; and

Level 3 - Other significant unobservable inputs.

Inputs broadly refer to the assumptions that market participants use to make valuation decisions, including assumptions about risk. The Advisor generally uses the NAV per share of the investment (or its equivalent) reported by the Portfolio Fund as the primary input to its valuation; however, adjustments to the reported amount may be made based on various factors.

A Security’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Advisor. The Advisor considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by multiple, independent sources that are actively involved in the relevant market.

The Advisor’s belief of the most meaningful presentation of the strategy classification of the Portfolio Funds and Securities is as reflected on the Schedule of Investments.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 17 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

Portfolio Funds are generally funds whose shares are issued pursuant to an exemption from registration under the 1940 Act or are issued offshore. The frequency of such subscription or redemption options offered to investors is dictated by such fund’s governing documents. The amount of liquidity provided to investors in a particular Portfolio Fund is generally consistent with the liquidity and risk associated with the Portfolio Funds (i.e., the more liquid the investments in the portfolio, the greater the liquidity provided to the investors).

Liquidity of individual funds varies based on various factors and may include “gates,” “holdbacks,” and “side pockets” (defined in the Fund’s prospectus) imposed by the manager of the fund, as well as redemption fees which may also apply. These items have been identified as illiquid or 0 - 5 years on the Schedule of Investments.

Assumptions used by the Advisor due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations.

As of March 31, 2024, the Fund held Investments in Portfolio Funds with a fair value of $2,908,439 that in accordance with ASC 820, are excluded from the fair value hierarchy and measured at NAV.

There were no changes in valuation technique and no transfers between the levels of the fair value hierarchy during the reporting period.

4. | Investments in Portfolio Funds and Securities |

The Fund has the ability to liquidate its investments in Portfolio Funds periodically, ranging from monthly to every five years, depending on the provisions of the respective Portfolio Funds’ operating agreements. As of March 31, 2024, the Fund was invested in thirteen Portfolio Funds. All Portfolio Funds in which the Fund invested are individually identified on the Schedule of Investments. These Portfolio Funds may invest in U.S. and non-U.S. equities and equity-related instruments, fixed income securities, currencies, futures, forward contracts, swaps, commodities, other derivatives, and other financial instruments.

The Managers of substantially all Portfolio Funds receive an annual management fee from 1% to 2% of the respective Portfolio Fund’s NAV. Management of the Portfolio Funds also receive performance allocations from 15% to 20% of the Fund’s net profit from its investments in the respective Portfolio Funds, subject to any applicable loss carryforward provisions, as defined by the respective Portfolio Funds’ operating agreements.

For the year ended March 31, 2024, aggregate investments and proceeds from sales of investments in Portfolio Funds and Securities were $27,688 and $1,872,384, respectively.

The Fund’s Share activities for the year ended March 31, 2024 were as follows:

| | | Balance as of

April 1, 2023 | | | Subscriptions | | | Redemptions | | | Distributions

Reinvested | | | Balance as of

March 31, 2024 | |

Class I | | | 11,245.97 | | | | | | | | (2,395.62 | ) | | | | | | | 8,850.35 | |

Class A | | | 262.62 | | | | — | | | | (55.95 | ) | | | — | | | | 206.67 | |

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 18 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

The Fund’s Share activities for the year ended March 31, 2023 were as follows:

| | | Balance as of

April 1, 2022 | | | Subscriptions | | | Redemptions | | | Distributions

Reinvested | | | Balance as of

March 31, 2023 | |

Class I | | | 21,718.26 | | | | | | | | (10,472,29 | ) | | | | | | | 11,245.97 | |

Class A | | | 507.13 | | | | — | | | | (244.51 | ) | | | — | | | | 262.62 | |

6. | Management Fee, Related Party Transactions and Other |

The Fund bears all of the expenses of its own operations, including, but not limited to, the investment management fee for the Fund payable to the Advisor, and administration fees, custody fees, and transfer agent fees.

In consideration for its advisory and other services, the Advisor shall receive a quarterly management fee, payable quarterly in arrears based on the NAV of the Fund as of the last business day of such quarter, prior to any quarter-end redemptions, in an amount equal to an annual rate of 1.00% of the Fund’s NAV. The Fund charged a reduced management fee at an annual rate of 0.50%. For the year ended March 31, 2024, the Fund incurred net management fees of $25,575.

Shareholders pay certain fees (e.g., the Management Fee) and expenses of the Fund and indirectly bear the fees (e.g., management fees of Portfolio Fund managers) and expenses of the Portfolio Funds in which the Fund invests. Similarly, Shareholders may indirectly pay incentive compensation to Portfolio Fund managers that charge their investors incentive compensation. The Fund’s expenses thus may constitute a higher percentage of net assets than expenses associated with other types of investment entities. Class A Shares and Class I Shares are subject to different fees and expenses.

ALPS Fund Services, Inc. (“ALPS”) provided accounting and administrative services to the Fund under an administrative services agreement.

UMB Bank (“UMB”) provided custody services to the Fund under a custody services agreement.

DST Asset Manager Solutions, Inc. (“DST”) provided transfer agency services to the Fund under a transfer agency services agreement.

Fees to ALPS, UMB and DST are payable monthly.

Distribution Plan

The Fund has adopted a Distribution Plan (the “Plan”), pursuant to Rule 12b-1 under the 1940 Act, with respect to its Class A Shares.

Under the Plan, the Fund may pay an aggregate amount on an annual basis not to exceed 0.85% of the value of the Fund’s average net assets attributable to its Class A Shares for services provided under the Plan. The Fund began waiving distribution and service fees effective April 1, 2022. For the year ended March 31, 2024, the Fund incurred no Class A distribution and service fees.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 19 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

7. | Risks and Contingencies |

The Fund’s investments in Portfolio Funds may be subject to various risk factors including market, credit, currency and geographic risk. The Fund’s investments in Portfolio Funds may be made internationally and thus may have concentrations in such regions. The Fund’s investments in Portfolio Funds are also subject to the risk associated with investing in Portfolio Funds. The Portfolio Funds are generally illiquid, and thus there can be no assurance that the Fund will be able to realize the value of such investments in Portfolio Funds in a timely manner. Since many of the Portfolio Funds may involve a high degree of risk, poor performance by one or more of the Portfolio Funds could severely affect the total returns of the Fund.

Although the Fund’s investments in Portfolio Funds are denominated in U.S. dollars, the Fund may invest in securities and hold cash balances at its brokers that are denominated in currencies other than its reporting currency. Consequently, the Fund is exposed to risks that the exchange rate of the U.S. dollars relative to other currencies may change in a manner that has an adverse effect on the reported value of that portion of the Fund’s assets which are denominated in currencies other than the U.S. dollars. The Fund may utilize options, futures and forward currency contracts to hedge against currency fluctuations, but there can be no assurance that such hedging transactions will be effective.

From time to time, the Fund may have a concentration of Shareholders holding a significant percentage of its net assets. Investment activities of these Shareholders could have a material impact on the Fund. As of March 31, 2024, one Shareholder maintains a significant holding in the Fund which represents 39.13% of the Fund’s NAV.

In order to obtain more investable cash, the Portfolio Funds may utilize a substantial degree of leverage. Leverage increases returns to investors if the Managers earn a greater return on leveraged investments than the Managers’ cost of such leverage. However, the use of leverage, such as margin borrowing, exposes the Fund to additional levels of risk including (i) greater losses from investments in Portfolio Funds than would otherwise have been the case had the Managers not borrowed to make the investments in Portfolio Funds, (ii) margin calls or changes in margin requirements may force premature liquidations of investment positions and (iii) losses on investments in Portfolio Funds where the Portfolio Funds fails to earn a return that equals or exceeds the Managers’ cost of leverage related to such Portfolio Funds.

In the normal course of business, the Portfolio Funds in which the Fund invests may pursue certain investment strategies, trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, leverage, short selling, global tactical asset allocation strategies, event-drive strategies and other related risks. The Fund’s risk of loss in each Portfolio Fund is limited to the value of the Fund’s interest in each Portfolio Fund as reported by the Fund.

Short sales involve the risk that the Fund will incur a loss by subsequently buying a security at a higher price than the price at which the Fund previously sold the security short. Any loss will be increased by the amount of compensation, interest or dividends, and transaction costs the Fund must pay to a lender of the security. In addition, because the Fund’s loss on a short sale stems from increases in the value of the security sold short, the extent of such loss, like the price of the security sold short, is theoretically unlimited. By contrast, the Fund’s loss on a long position arises from decreases in the value of the security held by the Fund and therefore is limited by the fact that a security’s value cannot drop below zero.

The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 20 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

The following summary represents per share data, ratios to average net assets(a) and other financial highlights information for Class I Shareholders:

Class I | | For the

Year Ended

March 31,

2024 | | | For the

Year Ended

March 31,

2023 | | | For the

Year Ended

March 31,

2022 | | | For the

Year Ended

March 31,

2021 | | | For the

Year Ended

March 31,

2020 | |

Net asset value - beginning of period | | $ | 613.54 | | | $ | 739.06 | | | $ | 1,010.99 | | | $ | 945.16 | | | $ | 1,125.10 | |

| | | | | | | | | | | | | | | | | | | | | |

Income/(Loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(b) | | | (59.41 | ) | | | (39.12 | ) | | | (37.73 | ) | | | (41.24 | ) | | | (39.42 | ) |

Net realized and unrealized gain/(loss) on investments | | | (12.26 | ) | | | (86.40 | ) | | | (137.30 | ) | | | 291.32 | | | | (84.94 | ) |

Total income/(loss) from investment operations | | | (71.67 | ) | | | (125.52 | ) | | | (175.03 | ) | | | 250.08 | | | | (124.36 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | (96.90 | ) | | | (184.25 | ) | | | (55.58 | ) |

Total distributions | | | — | | | | — | | | | (96.90 | ) | | | (184.25 | ) | | | (55.58 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value - end of period | | $ | 541.87 | | | $ | 613.54 | | | $ | 739.06 | | | $ | 1,010.99 | | | $ | 945.16 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(c) | | | (11.68 | %) | | | (16.98 | %) | | | (18.51 | %) | | | 27.26 | % | | | (11.31 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net asset(d)(e) | | | 9.32 | % | | | 6.31 | % | | | 4.07 | % | | | 3.99 | % | | | 4.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses after expense reimbursement and management fee reduction(e)(f) | | | 9.32 | % | | | 5.53 | % | | | 4.07 | % | | | 3.99 | % | | | 4.04 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses subject to expense reimbursement(e)(f) | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment loss to average net assets(g) | | | (9.31 | %) | | | (5.53 | %) | | | 4.05 | % | | | (3.93 | %) | | | (3.73 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 2 | % | | | — | % | | | 18 | % | | | 23 | % | | | 37 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands, rounded) | | $ | 4,796 | | | $ | 6,900 | | | $ | 16,051 | | | $ | 26,515 | | | $ | 19,490 | |

(a) | Average net assets is calculated using the average net asset value of the class at the end of each month throughout the year. |

(b) | Calculated based on the average shares outstanding methodology. |

(c) | Total return assumes a subscription of a Share in the class at the beginning of the period indicated and a repurchase of a Share on the last day of the period and assumes reinvestment of all distributions during the period when owning Shares of the class. Total return is not annualized for periods less than twelve months. |

(d) | Represents a percentage of expenses reimbursed per the prospectus. |

(e) | Ratio does not reflect the Fund’s proportionate share of Portfolio Funds’ expenses. |

(f) | Effective April 1, 2018, the Board approved eliminating the Expense Cap for the Class I Shares. |

(g) Ratio does not reflect the Fund’s proportionate share of Portfolio Funds’ income and expenses.

The above ratios and total return have been calculated for the Class I Shareholders taken as a whole. An individual Class I Shareholder’s ratios and total return may vary from these due to the timing of capital share transactions.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 21 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

The following summary represents per share data, ratios to average net assets(a) and other financial highlights information for Class A Shareholders:

Class A | | For the

Year Ended

March 31,

2024 | | | For the

Year Ended

March 31,

2023 | | | For the

Year Ended

March 31,

2022 | | | For the

Year Ended

March 31,

2021 | | | For the

Year Ended

March 31,

2020 | |

Net asset value - beginning of period | | $ | 539.72 | | | $ | 650.13 | | | $ | 904.48 | | | $ | 864.33 | | | $ | 1,038.06 | |

| | | | | | | | | | | | | | | | | | | | | |

Income/(Loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(b) | | | (52.26 | ) | | | (35.26 | ) | | | (40.56 | ) | | | (45.71 | ) | | | (46.27 | ) |

Net realized and unrealized gain/(loss) on investments | | | (10.79 | ) | | | (75.15 | ) | | | (121.32 | ) | | | 265.20 | | | | (76.09 | ) |

Total income/(loss) from investment operations | | | (63.05 | ) | | | (110.41 | ) | | | (161.88 | ) | | | 219.49 | | | | (122.36 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | (92.47 | ) | | | (179.34 | ) | | | (51.37 | ) |

Total distributions | | | — | | | | — | | | | (92.47 | ) | | | (179.34 | ) | | | (51.37 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value - end of period | | $ | 476.67 | | | $ | 539.72 | | | $ | 650.13 | | | $ | 904.48 | | | $ | 864.33 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(c) | | | (11.68 | %) | | | (16.98 | %) | | | (19.20 | %) | | | 26.18 | % | | | (12.06 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets(d)(e) | | | 9.32 | % | | | 6.31 | % | | | 4.97 | % | | | 4.87 | % | | | 5.32 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets including fee waivers and reimbursements(d)(e)(f) | | | 9.32 | % | | | 5.53 | % | | | 4.97 | % | | | 4.87 | % | | | 5.19 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses subject to expense reimbursement(d)(e)(f) | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment loss to average net assets(d)(g) | | | (9.31 | %) | | | (5.53 | %) | | | (4.96 | %) | | | (4.81 | %) | | | (4.90 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 2 | % | | | — | % | | | 18 | % | | | 23 | % | | | 37 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands, rounded) | | $ | 99 | | | $ | 142 | | | $ | 330 | | | $ | 413 | | | $ | 298 | |

(a) | Average net assets is calculated using the average net asset value of the class at the end of each month throughout the year. |

(b) | Calculated based on the average shares outstanding methodology. |

(c) | Total return assumes a subscription of a Share in the class at the beginning of the period indicated and a repurchase of a Share on the last day of the period and assumes reinvestment of all distributions during the period when owning Shares of the class. Total return is not annualized for periods less than twelve months. Total return does not reflect sales charge (load) of 3.00%. |

(d) | Ratio is annualized for periods less than twelve months. |

(e) | Ratio does not reflect the Fund’s proportionate share of Portfolio Funds’ expenses. |

(f) | Effective April 1, 2018, the Board approved eliminating the Expense Cap for the Class A Shares. |

(g) Ratio does not reflect the Fund’s proportionate share of Portfolio Funds’ income and expenses.

The above ratios and total return have been calculated for the Class A Shareholders taken as a whole. An individual Class A Shareholder’s ratios and total return may vary from these due to the timing of capital share transactions.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 22 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Notes to Financial Statements (continued)

March 31, 2024

Management has determined that there were no material events requiring additional disclosures in the financial statements through the date the financial statements were issued.

Subsequent events after the Statement of Assets and Liabilities date have been evaluated through the date the financial statements were available to be issued. Management has determined that, other than the event described below, no events or transactions occurred requiring adjustment or disclosure in the financial statements.

In May of 2024, there were redemptions paid to Shareholders pursuant to the Liquidation Plan totaling $1,000,000.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 23 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Board of Trustees (Unaudited)

Name(1) and

Year of Birth | Position(s) Held

with Registrant | Term of Office(2)

and Length of

Time Served | Principal Occupation(s) During Past Five

Years and Other Relevant Qualifications(3) | Number of

Morgan Creek-

Advised Funds

Overseen

by Trustee | Other Public

Company

Directorships

Held by

Trustee In the

Past Five Years |

Independent Trustees | | | | | |

Michael S. McDonald 1966 | Trustee | Since 2010 | Vice President of McDonald Automotive Group (automobile franchises) since 1989. | 1 | None |

Sean S. Moghavem 1964 | Trustee | Since 2010 | President of Archway Holdings Corp. since prior to 2010 to present; President of URI Health and Beauty LLC since prior to 2010 to present; President of Archway Holdings-Wilmed LLC from April 2008 to present. | 1 | None |

Interested Trustees(4) | | | | | |

Mark W. Yusko 1963 | Trustee, Chairman and President | Since 2010 | Mr. Yusko is Chief Investment Officer and Chief Executive Officer of Morgan Creek Capital Management, LLC since July 2004 and Chief Investment Officer, Hatteras Core Alternatives Funds, since 2005. Previously, Mr. Yusko served as President and Chief Executive Officer for UNC Management Co., LLC from January 1998 through July 2004, where he was responsible for all areas of investment management for the UNC Endowment and Affiliated Foundation Funds. | 1 | None |

(1) | The address for each of the Fund’s Trustees is c/o Morgan Creek Capital Management, LLC, 301 West Barbee Chapel Road, Chapel Hill, NC 27517. |

(2) | Trustees serve until their resignation, removal or death. |

(3) | The information above includes each Trustee’s principal occupation during the last five years. The Fund’s State of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call the Fund at 1-919-933-4004. |

(4) | Mr. Yusko is an “interested person,” as defined in the 1940 Act, of the Fund based on his positions with Morgan Creek Capital Management, LLC and its affiliates. Joshua S. Tilley resigned from the position of Trustee of the Trust on June 2, 2023. |

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 24 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Fund Management (Unaudited)

Name, Address(1) and

Year of Birth | Position(s) held

With Fund | Length of

Time Served | Principal Occupation(s) During Past Five Years |

Officers | | | |

Mark B. Vannoy 1976 | Treasurer | Since 2010 | Mr. Vannoy joined Morgan Creek in January 2006 and serves as CFO, Funds. Prior to Morgan Creek, Mr. Vannoy worked at Nortel Networks, Ernst & Young, and KPMG both in the United States and Cayman Islands. |

Taylor Thurman 1979 | Chief Compliance Officer and Secretary | Since 2011 | Mr. Thurman joined Morgan Creek in February 2006 and serves as COO – Investments. |

(1) | The address for each of the Fund’s officers is c/o Morgan Creek Capital Management, LLC, 301 West Barbee Chapel Road, Chapel Hill, NC 27517. |

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 25 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Other Information (Unaudited)

Proxy Voting Policies and Procedures and Proxy Voting Record

A copy of (1) the Fund’s policies and procedures with respect to the voting of proxies relating to the Portfolio Funds and Securities; and (2) how the Fund voted proxies relating to Portfolio Funds and Securities during the most recent year ended March 31 is available without charge, upon request, by calling the Fund at 1-919-933-4004. This information is also available on the Securities and Exchange Commission’s website at https://www.sec.gov.

Quarterly Schedule of Investments

The Fund also files a complete Schedule of Investments with the Securities and Exchange Commission for the Fund’s first and third fiscal quarters on Form N-PORT. The Fund’s Form N-PORT are available on the Securities and Exchange Commission’s website at http://www.sec.gov. The Fund’s Form N-PORT may be reviewed and copied at the Securities and Exchange Commission’s Public Reference Room in Washington, D.C. and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. Once filed, the most recent Form N-PORT will be available without charge, upon request, by calling the Fund at 1-919-933-4004.

Shareholder Tax Information

The Morgan Creek Global Equity Long/Short Institutional Fund designates the following as a percentage of taxable ordinary income distributions, or up to the maximum amount allowable, for the calendar year ended December 31, 2023:

Qualified Dividend Income: 0%

Dividend Received Deduction: 0%

In early 2024, if applicable, shareholders of record received this information for the distributions paid to them by the Fund during the calendar year 2023 via Form 1099. The Fund will notify shareholders in early 2024 of amounts paid to them by the Fund, if any, during the calendar year 2023.

Morgan creek capital management, llc | annual report to SHAREHOLDERS | 26 |

Morgan Creek Global Equity Long/Short Institutional Fund

(A Delaware Statutory Trust)

Board Consideration Regarding Approval of Investment Advisory Agreement December 4, 2023 (Unaudited)

At a meeting held on December 4, 2023 the Board of Trustees (the “Board”), including a majority of the independent Trustees (the “Independent Trustees”) of the Morgan Creek Global Equity Long/Short Institutional Fund (the “Fund”) was asked to consider and approve the renewal of the investment management agreement (the “Agreement”) between the Fund and Morgan Creek Capital Management, LLC (the “Adviser”) for an additional twelve months, ending December 31, 2024.

In considering the approval of the Agreement between the Fund and Adviser, the Independent Trustees requested and evaluated extensive materials from the Adviser and other sources, including, among other items: (a) an overview of the discretionary investment advisory services provided by the Adviser; (b) the breadth and experience of the investment management and research staff of the Adviser; (c) financial information about the Adviser; (d) marketing and distribution support to be provided by the Adviser to the Fund; (e) the current Form ADV of the Adviser; (f) the profitability, if any, of the Adviser with respect to the Fund; (g) the fees charged to other clients with similar investment objectives relative to fees charged to the Fund by the Adviser; and (h) the resources devoted to compliance with the Fund’s: (i) investment policy, (ii) investment restrictions, (iii) policies on personal securities transactions, (iv) other policies and procedures that form the Adviser’s portions of the Fund’s compliance program and (v) the Adviser’s responsibilities overseeing the Fund’s service providers.

The Independent Trustees, as well as the full Board, considered all factors it believed relevant with respect to the Adviser, including but not limited to: the nature and quality of services provided; investment performance relative to appropriate peer groups and indices, noting that the Fund is in liquidation; skills, breadth of experience and capabilities of personnel, including continued employment of key personnel; stability of management; comparative data on fees and expenses and again noting that the Fund is in liquidation; and potential benefits to the Adviser from its relationship to the Fund, including revenues to be derived from services provided to the Fund by its affiliates, if any.

In determining to approve the Agreement, the Board considered the following factors:

Investment Performance. The Independent Trustees reviewed the performance of the Fund for the 3-month, 6-month, one-year and two-year periods ended September 30, 2023, and since the Fund’s inception. The Independent Trustees also reviewed the Fund’s performance compared to the performance of its primary benchmark index, the MSCI World Index for various time periods.

It was noted that the Fund was currently in liquidation and that such liquidation was expected to last at least until 2025 and that the Fund was being managed to liquidate the Fund in an orderly manner.