UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number: 001-34887

Net Element, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 90-1025599 | |

(State or other jurisdiction of | (I.R.S. Employer |

3363 NE 163rd Street, Suite 605 | 33160 | |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (305) 507-8808

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | NETE | The Nasdaq Stock Market, LLC (Nasdaq Capital Market) |

Securities registered pursuant tp Section 12(g) of the Exchange Act:

| Title of each class |

Warrants, each exercisable for one share of Common Stock |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ YES ☒ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ YES ☒ NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ YES ☐ NO

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ YES ☐ NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

|

|

Non-accelerated filer ☒ | Smaller reporting company ☒ |

|

|

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. □

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ YES ☒ NO

The aggregate market value of the registrant’s common equity, other than shares held by persons who may be deemed affiliates of the registrant, as of June 30, 2020 was approximately $32.4 million.

The registrant had 5,208,236 shares of common stock outstanding as of March 23, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

| Page |

|

| |

|

|

|

Item 1. | ||

|

|

|

Item 1A. | ||

|

|

|

Item 1B. | 35 | |

|

|

|

Item 2. | 35 | |

|

|

|

Item 3. | 36 | |

|

|

|

Item 4. | 36 | |

|

|

|

|

| |

|

|

|

Item 5. | 36 | |

|

|

|

Item 6. | 36 | |

|

|

|

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 37 |

|

|

|

Item 7A. | 46 | |

|

|

|

Item 8. | 46 | |

|

|

|

Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. | 46 |

|

|

|

Item 9A. | 46 | |

|

|

|

Item 9B. | 47 | |

|

|

|

|

| |

|

|

|

Item 10. | 48 | |

|

|

|

Item 11. | 50 | |

|

|

|

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 51 |

|

|

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 52 |

|

|

|

Item 14. | 53 | |

|

|

|

|

| |

|

|

|

Item 15. | 54 | |

|

|

|

Item 16. | 63 | |

|

|

|

| 64 | ||

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this "Report") includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the meaning of the federal securities laws. All statements other than statements of historical facts contained in this Report may be forward-looking statements, including, statements regarding our business operations, economic performance and financial condition, including in particular: our business strategy and means to implement the strategy; assumptions and projections about our industry; measures of future results of operations, such as revenue, expenses, operating margins, and earnings per share; other operating metrics such as shares outstanding and capital expenditures; our success and timing in developing and introducing new products or services and expanding our business, including with respect to joint ventures; the successful integration of future acquisitions; our future responses to and the anticipated impact of novel coronavirus COVID-19 (“COVID-19”); and the potential merger between the Company and Mullen Technologies, Inc. (“Mullen”) and the related transactions. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “continues,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “would” or “should” or, in each case, their negative or other variations or comparable terminology.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. These factors include, but are not limited to, the following:

| • | our ability (or inability) to continue as a going concern; | |

| • | the continued outbreak of a health epidemic or pandemic, including COVID-19; | |

| • | the impact of any new or changes made to laws, regulations, card network rules or other industry standards affecting our business; | |

| • | the impact of any significant chargeback liability and liability for merchant or customer fraud, which we may not be able to accurately anticipate and/or collect; | |

| • | our ability to secure or successfully migrate merchant portfolios to new bank sponsors if current sponsorships are terminated; | |

| • | our and our bank sponsors’ ability to adhere to the standards of Visa and MasterCard payment card brand; | |

| • | our reliance on third-party processors and service providers; | |

| • | our dependence on independent sales groups (“ISGs”) that do not serve us exclusively to introduce us to new merchant accounts; | |

| • | our ability to retain clients, many of which are small- and medium-sized businesses ("SMBs"), which can be difficult and costly to retain; | |

| • | our ability to pass along increases in interchange costs and other costs to our merchants; | |

| • | our ability to protect against unauthorized disclosure of merchant and cardholder data, whether through breach of our computer systems or otherwise; | |

| • | the effect of the loss of key personnel on our relationships with ISGs, card brands, bank sponsors and our other service providers; | |

| • | the effects of increased competition, which could adversely impact our financial performance; | |

| • | the impact of any increase in attrition due to an increase in closed merchant accounts and/or a decrease in merchant charge volume that we cannot anticipate or offset with new accounts; | |

| • | the effect of adverse business conditions on our merchants; | |

| • | our ability to adopt technology to meet changing industry and customer needs or trends; | |

| • | the impact of any decline in the use of credit cards as a payment mechanism for consumers or adverse developments with respect to the credit card industry in general; | |

| • | the impact of any adverse conditions in industries in which we obtain a substantial amount of our bankcard processing volume; | |

| • | the impact of seasonality on our operating results; | |

| • | the impact of any failure in our systems due to factors beyond our control; | |

| • | the impact of any material breaches in the security of third-party processing systems we use; | |

| • | the impact of any new and potential governmental regulations designed to protect or limit access to consumer information; | |

| • | the impact on our profitability if we are required to pay federal, state or local taxes on transaction processing; | |

| • | the impact on our growth and profitability if the markets for the services that we offer fail to expand or if such markets contract; | |

| • | significant losses we have incurred and may continue to experience in the future; | |

| • | foreign laws and regulations, which are subject to change and uncertain interpretation; | |

| • | geopolitical instability, including the recent outbreak and continuing spread of COVID-19, and other conditions that may adversely affect trends in consumer, business and government spending; | |

| • | the Company’s ability (or inability) to obtain additional financing in sufficient amounts or on acceptable terms when needed; | |

| • | the impact on our operating results as a result of impairment of our goodwill and intangible assets; | |

| • | our material weaknesses in internal control over financial reporting and our ability to maintain effective controls over financial reporting in the future; and | |

| • | ineffective risk management policies and procedures; | |

| • | our ability to protect our systems and data from continually evolving cybersecurity risks or other technological risks; | |

| • | the failure of the Mullen merger to be completed or a significant continued delay in the consummation of the merger, as well as business unceratinties whilc ethe merger is pending, and | |

| • | the risk factors included in Part I, Item 1A of this Annual Report on Form 10-K |

Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward- looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this Annual Report on Form 10-K. If these or other risks and uncertainties (including those described in Part I, Item 1A of this Report and our subsequent filings with the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”)) materialize, or if the assumptions underlying any of these statements prove incorrect, our actual results may be materially different from those expressed or implied by such statements. In addition, even if our results of operations, financial condition and liquidity, and industry developments are consistent with the forward-looking statements contained in this filing, those results or developments may not be indicative of results or developments in subsequent periods.

In light of these risks and uncertainties, we caution you not to place undue reliance on these forward-looking statements. Any forward-looking statement that we make in this filing speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statement or to publicly announce the results of any revision to any of those statements to reflect future events or developments, except as required by applicable law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

Net Element, Inc., (“Net Element”) a Delaware corporation, is a holding company that conducts its operations through its subsidiaries. Net Element and its subsidiaries are referred to collectively as the “Company,” “Net Element,” “we,” “us,” or “our,” unless the context requires otherwise.

Company Overview

Net Element is a global technology and value-added solutions group that supports electronic payments acceptance in a multi-channel environment including point-of-sale (POS), e-commerce and mobile devices. The Company operates two business segments as a provider of North American Transaction Solutions and International Transaction Solutions.

We offer a broad range of payment acceptance and transaction processing services that enable merchants of all sizes to accept and process over 100 different payment options in more than 120 currencies, including credit, debit, prepaid and alternative payments. We also provide merchants with value-added services and technologies including integrated payment technologies, POS solutions, fraud management, information solutions and analytical tools.

We are differentiated by our technology-centered value-added service offerings built around our payments ecosystem and our diversified business model, which enables us to provide our varied customer base with a broad range of transaction-processing services from a single source across numerous channels and geographic markets. We believe these capabilities provide several competitive advantages that will enable us to continue to penetrate our existing customer base with complementary new services, win new customers, develop new sales channels and enter new markets. We believe these competitive advantages include:

● | Our ability to provide competitive products through use of proprietary technologies; | |

● | Our ability to provide in one package a range of services that traditionally had to be sourced from different vendors; | |

● | Our ability to provide a single agnostic on-boarding and merchant management platform to our indirect non-bank sales force ("Sales Partners"); | |

● | Our ability to provide management and optimization tools to our Sales Partners amongst multiple networks and platforms; | |

● | Our ability to serve customers with disparate operations in several geographies with technology solutions that enable them to manage their business as one enterprise; and | |

● | Our ability to capture and analyze data across the transaction processing value chain and use that data to provide value-added services that are differentiated from those offered by pure-play vendors that serve only one portion of the transaction processing value chain (such as only merchant acquiring or POS). |

We have operations and offices located within the United States (“U.S.”) (domestic) and outside of the U.S. (international) where sales, customer service and/or administrative personnel are based. Through U.S. based subsidiaries, we generate revenues from transactional services, valued-added payment services and technologies that we provide to SMBs. Through wholly owned subsidiaries, we focus on transactional services, mobile payment transactions, online payment transactions, value-added payment services and technologies in selected international markets.

Our business is characterized by transaction related fees, multi-year contracts, and a diverse client base, which allows us to grow alongside our clients. Our multi-year contracts allow us to achieve a high level of recurring revenues with the same clients. While the contracts typically do not specify fixed revenues to be realized thereunder, they do provide a framework for revenues to be generated based on volume of services provided during such contracts’ term.

Products and Services Information

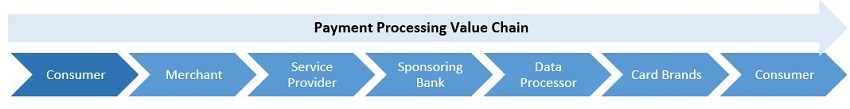

Our broad suite of services spans the entire transaction processing value chain of commerce enabling services and technologies and includes a range of front-end customer-facing solutions, as well as back-end support services and account reconciliation. We deliver our value-added solutions from a suite of proprietary technology products, software, cloud-based applications, processing services, fraud management offerings, and customer support programs that we configure to meet our client’s individual needs.

Many of our payment solutions are technology-enabled in that they incorporate or are incorporated into innovative, technology-driven solutions, including enterprise software solutions, designed to enable merchants to better manage their businesses.

Integrated and Vertical Markets. Our integrated and vertical market solutions provide advanced payments technology that is deeply integrated into business enterprise software solutions either owned by us or by our partners. We grow our business when new merchants implement our enterprise software solutions and when new or existing merchants enable payments services through enterprise software solutions sold by us or by our partners. Our primary technology-enabled solutions include integrated and vertical markets, ecommerce and multi-channel solutions, each as described below:

● | Unified Payments – doing business as Unified Payments, we provide businesses of all sizes and types throughout the United States with a wide range of fully-integrated payment acceptance solutions, value-added POS and business process management services;

| |

● | PayOnline – through our subsidiary, PayOnline Systems (“PayOnline”), we provide a wide range of value-added online solutions in the selected international markets utilizing our fully-integrated, agnostic electronic commerce platform that simplifies complex enterprise online transaction processing challenges from payment acceptance and processing through risk prevention and payment security via point-to-point encryption and tokenization solutions;

| |

● | Pay-Travel – integrated payment processing solutions to the travel industry, which includes integrations with various Global Distribution Systems (“GDS”) such as Amadeus®, Galileo®, Sabre®, additional geo filters and passenger name record (PNR) through Pay-Travel service offered by PayOnline;

| |

● | Aptito POS Platform – an integrated POS platform developed on Apple’s® iOS and Android® mobile operating systems for the hospitality, retail, service and on the go industries. Our goal with Aptito is to create an easy to use POS and business management solution, which incorporates everything a small business needs to help streamline every-day management, operations and payment acceptance;

| |

● | Restoactive – utilizing Aptito POS Platform architecture, we have developed and launched Restoactive, which seamlessly plugs into a current restaurant environment through integrations with some of the biggest POS and restaurant management platforms available on the market today;

| |

● | Unified m-POS – mobile POS application makes accepting payments on the go easy and secure. Mobile application is EMV-compliant, accepts traditional and contactless transactions such as Apple Pay®. Unified m-POS application is available for download in Apple’s App Store and Google Play;

| |

● | Zero Pay – zero-fee payment acceptance program for SMB merchants in the United States. Zero Pay program saves merchants costs involved in accepting credit and debit cards using mobile POS;

| |

● | Netevia – our internally developed future-ready multi-channel payments and merchant management platform. Connecting and simplifying payments across sales channels through a single integration point, Netevia delivers end-to-end payment processing through easy-to-use APIs. The Netevia platform is the core of the Company’s technology stack and includes multiple value-added modules that streamline payment processes and create additional revenue streams for our clients. | |

| ● | Blade - our internally developed, proprietary, fully automated, artificial intelligence powered underwriting solution with predictive scoring. Built for underwriting and on-boarding of new merchants, reducing potential risks and decision-making time while improving the customer experience. | |

| ● | Netevia Mastercard for SMB - The Netevia Mastercard®, powered by Aliaswire’s patented technology, is part of a unique platform that combines efficient and low-cost payment processing with the ability to save money on credit and debit card payment acceptance fees. |

Recent Developments

The outbreak and continuing spread of the COVID-19 pandemic has negatively affected businesses across the globe, in particular the service industry, which includes restaurants, a significant part of our business, as well as disrupted global supply chains and workforce participation, and created significant volatility and disruption of financial markets. Further, this has resulted in government authorities around the world implementing numerous measures to try to reduce the spread of COVID-19, such as travel bans and restrictions, quarantines, “shelter-in-place,” “stay-at-home” or similar orders, business limitations or total shutdowns. For example, many of our restaurant merchants that we service located within mainland United States, as well as hospitality and retail sector merchants, have been temporarily closed, have shortened operating hours and/or have otherwise been adversely affected by the impact and continuing spread of COVID-19. These merchants have experienced significant sales declines or no sales at all due to closure of their business. Additionally, the COVID-19 outbreak has negatively impacted our employee productivity, including affecting the availability of employees reporting for work.

Since the outbreak of the COVID-19 pandemic, we took initiatives to help minimize the risks to our business and protect our shareholders. Our management team’s experience during the 2008 financial crisis proved to be very valuable in dealing with the on-going crisis. Our entire staff is fully committed and working diligently to support our merchants through these difficult times. Most of our merchants have contactless payment acceptance capabilities through their POS solutions, as well as, e-commerce and mobile contactless payment acceptance capabilities to eliminate the need for physical payments to help reduce the spread of COVID-19. The following initiatives, including an extensive business continuity plan, have been implemented:

Risk Management:

● | Enhanced risk controls and safeguards have been put in place for merchants that sell products with an extended delivery time frame, products paid in advance, catering, ticketing, transportation and travel related merchants |

● | For those employees that will be working from home, we have implemented a “remote work” policy and provided employees with the technology necessary to do so |

● | For those employees that require office attendance, we are taking significant steps to ensure seamless service delivery while safeguarding employees health |

Contactless Payments:

● | Most of our merchants have contactless payment acceptance capabilities through their POS devices from equipment manufacturers such as PAX, Poynt and Verifone which are fully integrated into Netevia and Aptito platforms |

● | We launched an initiative to deploy contactless payment acceptance equipment to merchants that don’t currently have it |

● | Mobile contactless payment acceptance is available through our Unified mPOS App which can be downloaded from Apple’s App Store and Google’s Google Play Apps |

● | Online ecommerce payments through shopping carts allow our merchants to sell their products and services to customers that prefer to shop from the convenience of their homes |

During March 2020, our Company evaluated its liquidity position, future operating plans, and its labor force, which included a reduction in the labor force and compensation to executives and other employees, in order to maintain current payment processing functions, capabilities, and continued customer service to its merchants. We are also seeking sources of capital to pay our contractual obligations as they come due, in light of these uncertain times. Management believes that its operating strategy will provide the opportunity for us to continue as a going concern as long as we are able to obtain additional financing. At this time, due to our continuing losses from operations, negative working capital, the course and possible changing conditions of the COVID-19 pandemic, including any measures to control the spread domestically and internationally, we cannot predict the impact of these conditions on our ability to obtain financing necessary for the Company to fund its future working capital requirements. Our Company has also decided to explore strategic alternatives and potential options for its business, including sale of the Company or certain assets, licensing of technology, spin-offs, or a business combination. Accordingly, on August 4, 2020, the Company entered into a merger agreement in connection with the contemplated merger (the “Merger”) with Mullen Technologies, Inc., a California corporation (“Mullen”), and certain related transactions, including a divestiture of the Company’s existing business operations. See “—Recent Developments—Mullen Merger and Related Transactions” for additional information. There can be no assurance, at this time, regarding the eventual outcome of our planned strategic alternatives, including the Merger and the related transactions. In most respects, it is still too early in the COVID-19 pandemic to be able to quantify or qualify the longer-term ramifications on our merchant processing business, our merchants, our planned strategic alternatives to enhance current shareholder value, our current investors, and/or future potential investors.

As part of our Company's plan to obtain capital to fund future operations, on March 27, 2020, our Company entered into a Master Exchange Agreement, (the “ESOUSA Agreement”) with ESOUSA Holdings, LLC ("ESOUSA"), a related party. Prior to entering into the ESOUSA Agreement, ESOUSA agreed to acquire an existing promissory note that had been previously issued by the Company, of up to $2,000,000 in principal amount outstanding and unpaid interest due to RBL Capital Group, LLC ("RBL"). Pursuant to the ESOUSA Agreement, the Company had the right, at any time prior to March 27, 2021, to request ESOUSA, and ESOUSA agreed upon each such request, to exchange this promissory note in tranches on the dates when the Company instructs ESOUSA, for such number of shares of the Company’s common stock (“Common Stock”) as determined under the ESOUSA Agreement based upon the number of shares of Common Stock (already in ESOUSA’s possession) that ESOUSA sold in order to finance its purchase of such tranche of the promissory note from RBL. ESOUSA will purchase each tranche of the promissory note equal to 88% of the gross proceeds from the shares of Common Stock sold by ESOUSA to finance the purchase of such exchange amount from RBL. Each such tranche shall be $148,000 unless otherwise agreed to by the Company and ESOUSA.

On April 23, 2020 and August 3, 2020, the Company entered into certain amendments to the ESOUSA Agreement, which together increased from $2,000,000 to $15,000,000 the principal amount and unpaid interest of one or more promissory notes of the Company or its direct or indirect subsidiaries that ESOUSA either purchased in whole or has an irrevocable right to purchase in tranches from RBL in connection with the ESOUSA Agreement.

On May 7, 2020, the Company entered into a promissory note (the “Note”) evidencing an unsecured loan (the “Loan”) in the amount of $491,493 made to the Company under the Paycheck Protection Program (the “PPP”). The Note matures on May 7, 2022 and bears interest at a rate of 1% per annum. Beginning December 7, 2020, the Company is required to make 17 monthly payments of principal and interest, with the principal component of each such payment based upon the level amortization of principal over a two-year period from May 7, 2020. Pursuant to the terms of the CARES Act and the PPP, the Company may apply to the Lender for forgiveness for the amount due on the Loan. The amount eligible for forgiveness is based on the amount of Loan proceeds used by the Company (during the eight-week period after the Lender makes the first disbursement of Loan proceeds) for the payment of certain covered costs, including payroll costs (including benefits), interest on mortgage obligations, rent and utilities, subject to certain limitations and reductions in accordance with the CARES Act and the PPP. No assurance can be given, at this time, that the Company will obtain forgiveness of the Loan in whole or in part.

On May 18, 2020, the Company entered into a promissory note in the amount of $159,899 made to the Company by the U.S. Small Business Administration under the Economic Injury Disaster Loan program.

Mullen Merger and Related Transactions

On August 4, 2020, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Mullen and Mullen Acquisition, Inc., a California corporation and wholly owned subsidiary of the Company (“Merger Sub”). Pursuant to, and on the terms and subject to the conditions of, the Merger Agreement, Merger Sub will be merged with and into Mullen, with Mullen continuing as the surviving corporation in the Merger. The parties to the Merger Agreement intend that the number of shares of the Company’s common stock outstanding immediately after the Merger effective time on a fully diluted and fully converted basis will not exceed 75,000,000, with 15% of such common stock outstanding immediately after the Merger effective time on a fully diluted and fully converted basis to be allocated to the persons that hold shares of the Company common stock immediately prior to the Merger effective time (the “Parent Pre-Merger Stockholders”) (subject to upward adjustment described below).

The parties to the Merger Agreement intend that, subject to the Company’s stockholders’ approval, the Company will effect a private placement of the Company common stock prior to the Merger effective time (the “Private Placement”) and to loan at 14% annual interest rate compounding monthly all or a portion of the net proceeds of the Private Placement to Mullen on an unsecured basis. In connection with such financing, for every one dollar of loan funding (including all accrued interest on such loans) provided by the Company to Mullen prior to the Merger effective time, the Parent Pre-Merger Stockholders will retain an additional 0.00000067% of the shares of the Company common stock to be outstanding on a fully diluted basis immediately after the Merger effective time.

The Parties to the Merger Agreement intend that, prior to the Merger effective time but, subject to and after the Company’s stockholders’ approval, the Company will divest itself of its existing business operations to another party, and will cause such party to assume all liabilities of the Company directly related to its operations of its existing business immediately prior to the closing of such divestiture (the “Divestiture”).

As contemplated by the Merger Agreement, on August 11, 2020, our Company as lender, borrowed an additional $500,000 from RBL and entered into an unsecured Promissory Note, dated August 11, 2020 (the “Note”), with Mullen. Pursuant to the Note, Mullen borrowed from the Company $500,000. Prior to maturity of the loan, the principal amount of the loan will carry an interest rate of 14% per annum compounded monthly and payable upon demand. This loan will mature on the earlier of (i) the date that the Merger Agreement is terminated for any reason by any party thereto and (ii) the Merger Effective Time (as defined in the Merger Agreement).

On December 29, 2020, the Company entered into the First Amendment (the “Amendment”) to the Merger Agreement with Mullen and the Merger Sub.

Prior to the parties’ execution and delivery of the Amendment, Section 8.1(b) of the Merger Agreement provided that the Merger Agreement may be terminated and the merger contemplated in the Merger Agreement (the “Merger”) and other transactions contemplated in the Merger Agreement may be abandoned at any time prior to the merger effective time, notwithstanding any requisite approval and adoption of the Merger Agreement and the transactions contemplated in the Merger Agreement by the shareholders of Mullen and/or the stockholders of the Company, by either Company or Mullen if the merger effective time shall not have occurred on or before December 31, 2020 (the “Outside Date”). Pursuant to the Amendment, the Company, Mullen and Merger Sub amended Section 8.01(b) of the Merger Agreement to extend the Outside Date to March 31, 2021.

In addition, pursuant to the Amendment, the Company, Mullen and Merger Sub agreed that, if the registration statement on Form S-4 (with the merger proxy statement included as part of the prospectus) is not filed with the SEC on or prior January 15, 2021, then Mullen will pay the Company an agreed sum of $13,333 per day (the “Late Fee”) until the such registration statement (with the merger proxy statement included as part of the prospectus) is filed with the SEC. All accumulated Late Fees will be due and payable by Mullen on the 5th day of each calendar month commencing February 5, 2021 and on the 5th day of each month thereafter until the above-refenced filing has occurred.

On March 30, 2021, the Company entered into the Second Amendment (the “Second Amendment”) to Agreement and Plan of Merger dated as of August 4, 2020, as amended by the First Amendment dated as of December 29, 2020 (the “Merger Agreement”) with Mullen Technologies, Inc., a California corporation (“Mullen”), Mullen Acquisition, Inc., a California corporation and wholly owned subsidiary of the Company (“Merger Sub”). Prior to the parties’ execution and delivery of the Second Amendment, Section 8.1(b) of the Merger Agreement, as amended, provided that the Merger Agreement may be terminated and the merger contemplated in the Merger Agreement (the “Merger”) and other transactions contemplated in the Merger Agreement may be abandoned at any time prior to the merger effective time, notwithstanding any requisite approval and adoption of this Agreement and the transactions contemplated in the Merger Agreement by the shareholders of Mullen and/or the stockholders of the Company, by either Company or Mullen if the merger effective time shall not have occurred on or before March 31, 2021 (the “Outside Date”). Pursuant to the Second Amendment, the Company, Mullen and Merger Sub amended Section 8.01(b) of the Merger Agreement to extend the Outside Date to April 30, 2021.

The foregoing description of the Second Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of such agreement, a copy of which is attached hereto as Exhibit 2.1 and incorporated herein by reference.

Consummation of the Merger, the Divestiture, the Private Placement and the other transactions contemplated in the Merger Agreement, is subject to customary conditions including, among others, the approval of the Company’s stockholders. There is no guarantee that the Merger, the Divestiture, the Private Placement or the other transactions contemplated in the Merger Agreement will be completed. For additional information, see the Company’s Current Report on Form 8-K filed on December 30, 2020, as amended.

We continue our mission to build value for our shareholders as we work through the crisis caused by the pandemic.

Outlook

Our strategy is to ensure that our business remains successful in a rapidly changing market under the current circumstances, creating sustainable value for all our stakeholders, including our clients, distribution partners and shareholders. We aim to achieve superior results for our clients by having a deep understanding of their payment acceptance needs, extensive market reach, strong product development and technology enablement.

Planned for 2021:

We will continue to focus on understanding our clients and addressing their payment acceptance needs in core market segments, in spite of the current CPVID-19 crisis, and the uncertainty in the state of the economy.

● | Continue managed growth in all key segments and expand our network of referral partners | |

● | Drive and improve client retention | |

● | Expand our client base in selected markets | |

| ● | Enable our clients with contactless payment acceptance technologies | |

● | Deliver value-added products to our clients to increase efficiencies and payment acceptance | |

● | Launch new tools to reach our clients, such as digital channels, and deepening partner relations |

We believe that new and disruptive technologies will provide us the opportunity to differentiate ourselves from our competition, continue developing and delivering innovative payment solutions in 2021, in spite of COVID-19.

● | Continue to enhance Netevia, our future-ready multi-channel payments platform, enabling intelligent routing of payments for the application development community | |

● | Continue to scale and enhance new product launches that will add value to our clients | |

● | Extend our capabilities in next-generation POS hardware and software, and deepening our partner proposition | |

● | Commence trials of advanced technologies around business intelligence and mobile based payments acceptance | |

● | Continue the further development of disruptive emerging technologies such as contactless payment technologies, payments enablement for Internet of Things (“IoT”), biometrics payment acceptance and artificial intelligence | |

● | Continue research and investments in future emerging payment technologies |

Realize the full potential of our business model.

● | Assess the current operations in light of current pandemic and the closure of businesses until the economy gears up and businesses achieve normal operations | |

● | Develop additional payment network relationships to integrate with our technologies | |

| ● | Diversify our client base to include relationships in the online sales and home delivery segments |

We continue to believe that disruptive technologies such as biometrics payments, contactless payment technologies, and artificial intelligence will play key roles in future commerce. These technologies will encourage innovation through development of value-added services and cater to both merchants and their customers.

We believe Netevia, our future-ready payments and merchant management platform will act as a framework and core for a number of value-added services that can connect merchants and consumers directly utilizing these disruptive technologies while increasing the economic efficiency of all transactions being made within the ecosystem. Specifically, Netevia delivers end-to-end payment processing through easy-to-use APIs and complements the Company’s ability to perform in a multi-channel environment, including point-of-sale (POS), e-commerce and mobile devices and will enable the Company to perform as a hub for disruptive emerging technology solutions.

Our Mission and Vision

Our mission is to power global commerce and allow our clients to conduct business globally through a centralized solution. We believe that by understanding the consumer behavior and the needs of our merchants is the most effective and, ultimately, the most profitable means to accomplish our mission and create long-term value for all stakeholders.

We drive client growth through our in-depth knowledge of global transactional services and related value-added service offerings which separate us from the competition.

Our vision is to set the standard for multi-channel payments acceptance and value-added service offerings with focus on the creation of an unified global transaction acceptance ecosystem. We believe in disruptive emerging technologies and, as such, we have developed Netevia, our future-ready multi-channel payments platform to support development of value-added solutions designed for everyday commerce. Moving forward, we believe exciting projects and disruptive technologies like biometric payments and artificial intelligence will provide us the opportunity to continue developing innovative payments solutions, which will provide value to our clients.

In order to achieve this vision, we seek to further develop single on-boarding, global transaction acceptance ecosystem. Manifesting this vision requires scaling our direct and indirect connectivity to multiple payment and mobile networks internationally. By implementing this vision, we believe that we will be able to provide centralized, global multi-channel transactional platform to our clients internationally.

Our Strategy

Subject to the potential Merger between the Company and Mullen and the related transactions, including the Divestiture, our strategy is to capitalize on consumer appetite for digital payment methods, the perceived movement towards a cashless society. To continue to grow our business, our strategy is to focus on providing merchants with the ability to process a variety of electronic transactions across multiple channels. We seek to leverage the adoption of and transition to card, electronic and digital-based payments by expanding our market share through our distribution channels and services innovations. We also seek growth through strategic acquisitions to improve our offerings, scale and geography. We intend to continue to invest in and leverage our technology infrastructure and our people to increase our penetration in existing markets.

Key elements of our business strategy include:

● | Continued investment in our core technology and new technology offerings; | |

● | Allocation of resources and expertise to grow in commerce and payments segments; | |

● | Grow and control distribution by adding new merchants and partners; | |

● | Leverage technology and operational advantages throughout our global footprint; | |

● | Expansion of our cardholder and subscriber customer base; |

● | Continue to develop seamless multinational solutions for our clients; | |

● | Increase monetization while creating value for our clients; | |

● | Focus on continued improvement and operation excellence; and | |

● | Pursue potential domestic and international acquisitions of, investments in, and alliances with companies that have high growth potential, significant market presence or key technological capabilities. |

With our existing infrastructure and supplier relationships, we believe that we can accommodate revenue growth, after adjusting for the effects of the current pandemic. We believe that our available capacity and infrastructure will allow us to take advantage of operational efficiencies and increased margin as we grow our processing volume and expand to other geographical territories.

Market Overview

The financial technology and transaction processing industry is an integral part of today’s worldwide financial structure. The industry is continually evolving, driven in large part by technological advances. The benefits of card-based payments allow merchants to access a broader universe of consumers, enjoy faster settlement times and reduce transaction errors. By using credit or debit cards, consumers are able to make purchases more conveniently, whether in person, over the Internet, or by mail, fax or telephone, while gaining the benefit of loyalty programs, such as frequent flyer miles or cash back, which are increasingly being offered by credit or debit card issuers.

In addition, consumers are also beginning to use card-based and other electronic payment methods for purchases at an earlier age in life, and increasingly for small dollar amount purchases. Given these advantages of card-based payment systems to merchants and consumers, favorable demographic trends, and the resulting proliferation of credit and debit card usage, we believe businesses will increasingly seek to accept card-based payment systems in order to remain competitive.

We believe that cash transactions are becoming progressively obsolete. The proliferation of bankcards has made the acceptance of bankcard payments a virtual necessity for many businesses, regardless of size, in order to remain competitive. In addition, the advent and growth of e-commerce and crypto-currencies have marked a significant new trend in the way business is being conducted. E-commerce is dependent upon credit and debit cards, as well as other cashless payment processing methods.

The payment processing industry continues to evolve rapidly, based on the application of new technology and changing customer needs. We intend to continue to evolve with the market to provide the necessary technological advances to meet the ever-changing needs of our market place. Traditional players in the industry must quickly adapt to the changing environment or be left behind in the competitive landscape.

The recent outbreak and continuing spread of COVID-19 is currently impacting countries, communities, supply chains and markets, global financial markets, as well as, the largest industry group serviced by our Company. The Company cannot predict, at this time, whether COVID-19 will

continue to have a material impact on our future financial condition and results of operations due to understaffing in the service sector and the decrease in revenues and profits, particularly restaurants, and any possible future government ordinances that may further restrict restaurant and other service or retail sectors operations.

Business Segments

We operate two reportable business operating segments: (i) North American Transaction Solutions and (ii) International Transaction Solutions. Our segments are designed to establish lines of businesses that support our client base and further globalize our solutions. Management determines the reportable segments based on the internal reporting used by our Chief Operating Decision Maker to evaluate performance and to assess where to allocate resources. The principal revenue stream for all segments comes from service and transaction related fees.

North American Transaction Solutions

North American Transaction Solutions is currently our largest segment, where through our subsidiary TOT Payments, LLC, doing business as Unified Payments, we provide businesses of all sizes and types with a wide range of fully-integrated payment acceptance solutions at the point of sale, including Merchant Acquiring, e-commerce, mobile commerce, POS and other business solutions. Our largest service in this segment is Merchant Acquiring, which facilitates the acceptance of cashless transactions at the POS, whether a retail transaction at a physical business location, a mobile commerce transaction through a mobile or tablet device, which includes m-POS acceptance, Android Pay™, Apple Pay™ and Samsung Pay or an electronic commerce transaction over the web. Geographical presence for this segment is North America.

International Transaction Solutions

Through our subsidiary, PayOnline, we provide a wide range of value-added online and mobile solutions utilizing our fully-integrated, platform agnostic electronic commerce offering that simplifies complex enterprise online transaction processing challenges from payment acceptance and processing through risk prevention and payment security via point-to-point encryption and tokenization solutions. Our proprietary SaaS suite of solutions for electronic and mobile commerce gateway and payment processing platform is compliant at Level 1 of PCI DSS, streamlines the order-to-cash process, improves electronic payment acceptance and reduces the scope of burden of PCI DSS compliance. PayOnline holds a potential leadership position in the Russian Federation as one of the largest independent Internet Payment Services Providers (“IPSP”).

|

| North American Transaction Solutions |

| International Transaction Solutions |

|

|

|

|

|

Clients: |

| Businesses and business owners of all types and sizes. Current focus on SMB merchants |

| Online businesses, merchants requiring cross-border payment acceptance, content providers and mobile applications of all types and sizes |

|

|

|

|

|

Goals: |

| To help business grow commerce at the retail, online and m-POS. Enable multi-channel commerce |

| To help businesses transact online with ease and security and help digital merchants monetize their content in a mobile environment |

|

|

|

|

|

Key Solutions: |

| ● Integrated payments acceptance ● Value-added services ● Aptito POS technology ● m-POS technology ● Smart payment POS terminal ● Business performance analytics ● Marketing / loyalty |

| ● Integrated online and mobile billing solutions ● Complete cross-border toolkit for online business ● Integrated GDS transaction processing ● Mobile content monetization and management ● Security / risk management ● Marketing / loyalty |

|

|

|

|

|

Segment Revenue: |

|

| ||

Dollars Volume Processed: |

Our segments are designed to establish lines of businesses that support our client base and further globalize our solutions. Management determines the reportable segments based on the internal reporting used by our Chief Operating Decision Maker to evaluate performance and to assess where to allocate resources. The principal revenue stream for all segments came from service and transaction related fees during 2020 and 2019.

Revenues from each of our operating segments as a percentage of total revenues are displayed in the below table.

Year ended December 31, | ||||||||

2020 | 2019 | |||||||

Total revenues generated: | ||||||||

North American Transaction Solutions | 95 | % | 90 | % | ||||

International Transaction Solutions | 5 | % | 10 | % | ||||

No country outside the U.S. represents greater than 10% of our total revenues.

Comparative segment revenues and related financial information pertaining to our segments for the years ended December 31, 2020 and 2019 are presented in the tables in Note 16, Segment Information, to our consolidated financial statements (the “Consolidated Financial Statements”), which are included elsewhere in this Report.

North American Transaction Solutions Segment

Our North American Transaction Solutions segment revenues are primarily derived from processing payment acceptance transactions in a multi-channel environment for SMB merchants and includes fees for providing processing, loyalty and software services, and sales and support of POS devices. Revenues are generated from a variety of sources, including:

● | Discount fees charged to a merchant for processing of a transaction. The discount fee is typically either a percentage of the purchase amount or an interchange fee plus a fixed dollar amount or percentage; | |

● | Processing fees charged to merchants for processing of a transaction; | |

● | Processing fees charged to our Sales Partners who have outsourced their transaction processing to us; | |

● | Sales and support of POS devices; | |

● | Fees from providing reporting and other services; | |

● | Software license fees for Aptito POS platform, which includes hospitality and SMB retail point-of-sale application; | |

● | PCI compliance fees charged to a merchant for providing PCI compliance on annual basis; and | |

● | Business software license fees for merchant analytics and back office reporting. |

We typically provide our services as part of a broader payment acceptance solution to our business clients across multiple channels, including:

● | Retail Merchants – physical businesses or storefront locations, such as retailers, supermarkets, restaurants, hotels and other brink and mortar facilities, which we refer to as Retail; |

● | Mobile Merchants – physical businesses with remote or wireless storefront locations, such as small retail and service providers that use mobile devices with POS capabilities to accept electronic payments, which we refer to as Mobile; and |

● | Online – online businesses or website locations, such as retailers, digital content providers, and mobile application developers with Internet-based storefronts that can be accessed through a personal computer or a mobile device, where we refer to as e-commerce. |

North American Transaction Solutions Marketing. We employ a variety of go-to-market strategies in our North American Transaction Solutions segment. We mostly partner with indirect non-bank Sales Partners, such as independent sales agents, independent sales groups and referral partners that use our brand to market services (“ISG”), independent sales groups that we sponsor to Card Brands as registered Independent Sales Organizations (“ISO”) and which market services under their own brands, independent software vendors (“ISV”), value added resellers (“VAR”), and payment services providers (“PSP”) to sell our payment solutions to Small Business Merchants ("SMB"). We believe that this sales approach provides us with access to an experienced sales force to market our services with limited investment in sales infrastructure and management time. We believe our focus on the unique needs of SMB allows us to develop compelling offerings for our sales channels to bring to prospective merchants and provides us with a competitive advantage in our target market.

Sales & Marketing Support – Among the services and capabilities we provide are rapid application response time, merchant application acceptance by a proprietary and secure on-line sales portal, superior customer service, merchant reporting and robust analytics. In addition, by controlling the underwriting process we believe we offer the ISGs more rapid and consistent review of merchant applications than may be available from other service providers. Additionally, in certain circumstances, we offer our sales organizations tailored compensation programs and unique technology applications to assist them in the sales process. We keep an open dialogue with our Sales Partners to address their concerns as quickly as possible and work with them in investigating chargebacks or potentially suspicious activity with the aim of ensuring our merchants do not unduly suffer downtime or the unnecessary withholding of funds.

Sales & Marketing Compensation – As compensation for their referral of merchant accounts, we pay our Sales Partners an agreed-upon recurring commission, or percentage of the income we derive from the transactions we process from the merchants they refer to us. The amount of the recurring commissions we pay to our Sales Partners varies on a case-by-case basis and depends on several factors, including but not limited to the number and type of merchants each group refers to us. We provide additional incentives to our Sales Partners, including, from time to time, advances and merchant acquisition bonuses that are secured by income earned from the referred merchant and repayable from future compensation that may be earned by the groups in respect to the merchants they have referred to us. For the year ended December 31, 2020 and 2019, we had provided merchant acquisition incentives to Sales Partners in an aggregate amount of approximately $604,000 and $1.8 million, respectively. Our organic growth plan calls for future incentives to be funded to our Sales Partners for referred merchants.

North American Transaction Solutions. Our solutions are designed to help SMB merchants accept cashless payments in a multi-channel payment environment, which spans across POS, e-commerce, mobile devices and smart payment terminals.

Aptito POS Platform – An integrated POS platform developed on Apple’s® iOS and Android® mobile operating systems for the hospitality, retail, service and on the go industries. Our goal with Aptito is to create an easy to use POS and business management solution, which incorporates everything a small business needs to help streamline every-day management, operations and payment acceptance as well as provide efficient ways to decrease labor and operation expenses by automating routine processes through innovative technologies.

● | Aptito Restaurant POS – proprietary, fully integrated cloud-based POS and restaurant management system developed on Apple’s® iOS and Android® mobile operating system is designed to be used as a stand-alone all digital POS or be extended to include: m-POS, self-ordering kiosk, digital menus, pay at the table EMV and NFC ready card readers, cash drawers, receipt and kitchen printers. The need for uptime in a hospitality environment is paramount and as such our Aptito Restaurant POS local server allows our merchants to remain online, even if the Internet connection to the cloud is lost. Our local server solution is automatically synchronized with the cloud, providing 99.99% uptime. |

● | Aptito Retail POS – cloud-based POS solution is available on Apple® iOS and Android® mobile operating platforms and allows retailers to focus on their business and improve the in-store experience. Retailers are able to customize Aptito Retail POS based on their environment. Peripherals for Aptito Retail POS include a fully integrated cash drawer, thermal receipt printer, barcode scanner, barcode printer and EMV-compliant point of sale acceptance terminal. This allows retailers the ability to customize their POS solution based on their unique needs. The need for uptime in a retail environment is paramount and as such our Aptito Retail POS local server allows our merchants to remain online, even if the Internet connection to the cloud is lost. Our local server solution is automatically synchronized with the cloud, providing 99.99% uptime. |

● | Aptito Kiosk – innovative self-order kiosk gives customers complete control over their restaurant experience. Our innovative solution is a stellar addition to any hotel, fine dining or quick service restaurant and increases profit and decreases labor cost. |

● | Aptito Smart Payment Terminal – Aptito & Poynt, partnered to provide restaurants with a most robust seamless POS Solution using the latest technology available. By using the Aptito POS application on Poynt’s smart payment terminal, business owners can finally accept payments anywhere and get access to Poynt value-added applications marketplace to further expand Aptito POS capabilities. |

● | Restoactive – utilizing Aptito POS Platform architecture, we have developed and launched Restoactive, which seamlessly plugs into a current restaurant environment through integrations with some of the biggest POS and restaurant management platforms such as: MICROS®, POSitouch®, Aloha® and Symphony®. By integrating into the leading POS and restaurant management platforms, Restoactive is now accessible by over 500,000 restaurants in the United States. We believe Restoactive to be the first of its kind integrated platform, which introduces an all-in-one digital menu, kiosk and m-POS application into an existing POS environment without the need to displace existing restaurant management platforms. |

● | Unified m-POS – mobile application is available on Apple® iOS and Android® mobile operating platforms and makes it easier and safer to take business on the go. Whether at the local farmer’s market or at a customer’s site, Unified m-POS accepts payments with ease and security. Mobile application is EMV-compliant, accepts traditional and contactless transactions such as Apple Pay®. Unified m-POS allows merchants to send invoices to their customers and utilize the Zero Pay program to accept credit and debit payments while saving on processing fees. Unified m-POS application is available for download in Apple’s App Store and Google Play. |

In addition to enhancing our ability to drive core merchant acquiring sales, Aptito POS Platform allows us to earn incremental revenue from business clients. Currently, revenue model is based on a SaaS fee, which we bill on a per station basis and additional services fee, which we bill for additional applications we offer.

We also believe that Aptito POS Platform can help enhance client retention because we believe it will become core to our clients’ businesses and position us as a value-added partner. For example, business owners may use our business management tools to manage their employees’ work schedules, payroll, patron reservations, operate customer loyalty and gift card programs, manage inventory, and/or provide analytics on their business.

Other POS Platforms – We act as an authorized dealer for various POS manufacturers and POS software providers and deploy these systems where our proprietary products are not the best fit. Systems we offer are fully integrated with our payment acceptance capabilities.

Netevia Payments Platform – We believe Netevia, our future-ready payments platform will act as a framework and core for a number of value-added services that can connect merchants and consumers directly utilizing disruptive technologies while increasing the economic efficiency of all transactions being made within the ecosystem. Specifically, Netevia Payments Platform delivers end-to-end payment processing through easy-to-use APIs and complements the Company’s ability to perform in a multi-channel environment, including POS, e-commerce and mobile devices and will enable the Company to perform as a hub for disruptive emerging technology solutions. Netevia Payments Platform is the core of the Company’s technology stack.

● | Netevia Payment Gateway – Netevia's online payment gateway provides a set of APIs for online sellers to integrate payment acceptance, both B2C and B2B, into their platforms. Advanced merchant hierarchy and management functions include a virtual terminal and a suite of fraud management tools. |

● | Netevia Light POS – the combination of Netevia Light POS application and PAX Technology’s Android-based interactive smart payment terminals offers a robust and flexible state-of-the-art solution to help merchants seamlessly transact across multiple touch points, providing a convenient way of doing day-by-day operations through a modern, self-explainable user interface and user experience. A variety of functions, such as gratuity adjustment, on-screen signature capture, invoicing and support of the Zero Pay program makes this solution ideal for many types of businesses. |

● | Netevia Invoicing – invoicing solution that offers an ability to track and reconcile payments while allowing customers to receive and pay invoices via a Netevia HQ. Tasks that were once manual are now streamlined and automated, providing accounts receivable teams with a clear and complete view of invoice details and statuses. |

Merchant Management Platform – We have developed Netevia, a merchant management platform. Netevia HQ is a value-added module of Netevia Payments Platform and is designed to enhance responsiveness of our Sales Partners and improve sales efficiency. The cloud-based solution provides to both Sales Partners and merchants an integrated toolkit to more effectively manage a variety of sales, operations, reporting and accounting functions. The system is designed to improve conversion rates, technology advisory functions and to reduce deployment time for merchants. It also allows troubleshooting of merchant issues in real-time with built in underwriting and risk monitoring functions. Netevia HQ is currently one of the few cloud-based systems nationwide that allows Sales Partners to onboard and monitor merchants on multiple processing platforms through a single interface.

● | Netevia HQ for Sales Partners – allows Sales Partners to onboard merchants on multiple processing platforms available in the U.S. Its merchant underwriting and boarding process is seamless and paperless. Merchant Library allows Sales Partners to safely store and retrieve any agreement, form or contract related to merchants. Sales Partners that utilize the system are equipped with flexible merchant pricing options, risk management modules and residual and sales incentive calculations, which allow easier management of most of their day-to-day operations. Sales Partners compensation and merchant profitability can be managed using multi-level, single-click, drill-down navigation to pricing, detail, and summary statement information. |

● | Netevia HQ On the Go – fully integrated, digital onboarding interface designed for Sales Partners and merchants, streamlines and automates merchant account sign-up process, delivers real-time decisions and paperless boarding approval from online and mobile devices. Mobile boarding capability facilitates API-driven, instant boarding to multiple payment processing platforms and provides new merchants with a modular approach for providing their personal and business information. The platform manages underwriting, risk assessment, merchant ID assignments and is compliant with banking standards such as Know Your Customer regulations. |

● | Netevia HQ for Merchants – integrated reporting, accounting and analytics back office solution for SMB merchants with access to value-added solutions that increase productivity. A variety of reporting tools along with easy to understand charts enables merchants to analyze sales and improve performance. The ticket system allows merchants direct communication with Company’s service and technical support designed to improve the customer service experience. |

● | Unified Insights – the integrated Unified Insights module is a business dashboard focused on “Big Data” that gives merchants a 360-degree view of their business in a more usable format. With Unified Insights, merchants can compare current revenue, online reputation, and social media activity to their past performance and to similar business in their area. |

North American Transaction Solutions Competition. Many large and small companies compete with us in providing payment processing services and related services to a wide range of merchants. Many of our current and prospective competitors have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, more developed infrastructures, greater name recognition and/or more established relationships in the industry than we have. Because of this our competitors may be able to adopt more aggressive pricing policies than we can, develop and expand their service offerings more rapidly, adapt to new or emerging technologies and changes in customer requirements more quickly, take advantage of acquisitions and other opportunities more readily, achieve greater economies of scale, and devote greater resources to the marketing and sale of their services. There are also many smaller transaction processors that provide various services to small and medium sized merchants.

We believe that our specific focus on smaller merchants, in addition to our understanding of the needs and risks associated with providing payment processing services to small merchants and indirect non-bank sales forces, gives us a competitive advantage over larger competitors, which have a broader market perspective and priorities. We also believe that we have a competitive advantage over competitors of a similar or smaller size that may lack our extensive experience, value-added product offering and resources.

North American Transaction Solutions Industry Mix and Geography. In the United States, we have developed significant expertise in industries that we believe present relatively low risks as the customers are generally present and the products or services are generally delivered at the time the transaction is processed. These include:

● | Restaurants | |

● | Schools and educational services | |

● | Brick and mortar retailers | |

● | Convenience and liquor stores | |

● | Professional service providers | |

● | Hotel and lodging establishments |

Merchants we served in the North American Transaction Solutions segment during 2020 processed an average of $14,800 per month in cashless transactions with an average transaction value of approximately $41 per transaction. Larger payment processors have traditionally underserved these merchants. As a result, these merchants have historically paid higher transaction fees than larger merchants and have not been provided with tailored solutions and on-going services that larger merchants typically receive from larger payment processing providers.

Our card-present processing volume for the year ended December 31, 2020 represented 78% of the total North American Transaction Solution volume, and card-not-present processing volume represented 22%.

As of December 31, 2020, approximately 50.9% of our SMB merchants were restaurants, 11.2% were general merchandise, 11.9% were professional services, 9.7% were food store, and 8.5% were automotive. The high concentration in restaurants reflects the efforts of our sales team actively targeting our Aptito POS product line.

The following table reflects the percentage concentration of our merchant base by category:

2020 | 2019 | |||||||

Restaurants | 50.9 | % | 47.9 | % | ||||

General Merchandise | 11.2 | % | 13.1 | % | ||||

Professional Services | 11.9 | % | 11.5 | % | ||||

Food Stores | 9.7 | % | 9.3 | % | ||||

Automotive | 8.5 | % | 7.4 | % | ||||

Health / Beauty | 1.4 | % | 7.3 | % | ||||

Educational Services | 1.3 | % | 2.7 | % | ||||

Hotels / Motels | 1.3 | % | 0.4 | % | ||||

Other | 3.8 | % | 0.4 | % | ||||

In December 2020, SMB merchants located in the following states represented the following percentage of our SMB card processing volume: New York represented 25.9%, Florida represented 13.4% California represented 9.1%, New Jersey represented 6.1% and Texas represented 5.5%. No other state represented more than 5% of our total SMB card processing volume. Our geographic concentration tends to reflect states where we maintain a stronger sales force.

Please refer to Item 1A. Risk Factors, with respect to "Health concerns arising from the outbreak of a health epidemic or pandemic, including the coronavirus, may have an adverse effect on our business".

North American Transaction Solutions Risk Management. In the United States, we focus our sales efforts on low-risk bankcard merchants and have developed systems and procedures designed to minimize our exposure to potential merchant losses. While we also board higher risk merchants which provide a higher gross margin, these accounts are closely monitored by our risk underwriting department.

Effective risk management helps us minimize merchant losses for the mutual benefit of our merchants, Independent Sales Groups and ourselves. Our Underwriting and Risk Management Policy and procedures help to protect us from fraud perpetrated by our merchants. We believe our knowledge and experience in dealing with attempted fraud has resulted in our development and implementation of effective risk management and fraud prevention systems and procedures.

We employ the following systems and procedures to minimize our exposure to merchant and transaction fraud:

● | Merchant Application Underwriting – there are varying degrees of risk associated with different merchant types based on their industry, the nature of the merchant’s business, processing volumes and average transaction size. As such, varying levels of scrutiny are needed to evaluate a merchant application and to underwrite a prospective merchant account. These range from basic due diligence for merchants with low risk profiles to more comprehensive review for higher risk merchants. The results of this assessment serve as the basis for decisions regarding acceptance of the merchant account, criteria for establishing reserve requirements, processing limits, average transaction amounts and pricing. Once aggregated, these factors also assist the Company in monitoring transactions for those accounts when pre-determined criteria have been exceeded. |

● | Merchant Monitoring – we employ several levels of merchant account monitoring to help us identify suspicious transactions and trends. Daily merchant activity is sorted into a number of customized reports by our systems. Our risk management team reviews any unusual activity highlighted by these reports, such as larger than normal transactions or credits, and monitors other parameters that are helpful in identifying suspicious activity. We have daily windows to decide if any transactions should be held for further review and this provides us time to interview a merchant or issuing bank to determine the validity of suspicious transactions. We also place merchants who require special monitoring on alert status and have engaged a third-party web crawling solution that scans all merchant websites for content and integrity. |

● | Investigation and Loss Prevention – if a merchant exceeds any parameters established by our underwriting and/or risk management staff or violates regulations established by the applicable bankcard network or the terms of our merchant agreement, one of our investigators will identify the incident and take appropriate action to reduce our exposure to loss and the exposure of our merchant. This action may include requesting additional transaction information, withholding or diverting funds, verifying delivery of merchandise or even deactivating the merchant account. Additionally, Relationship Managers may be instructed to retrieve equipment owned by us. In addition, to protect ourselves from unexpected losses, we maintain a reserve account with our sponsoring bank, which can be used to offset any losses incurred at a given time. As of December 31, 2020, our reserve balance was approximately $781,000. The reserve is replenished as required by funding 0.03% of bankcard processing volume. In the case of our self-designated bin, this is triggered when it falls below $25,000. This reserve is included on our consolidated balance sheet under the caption “other long-term assets” and reflected as restricted cash for purposes of the statement of cash flows. |

● | Reserves – some of our merchants are required to post reserves (cash deposits) that are used to offset chargebacks incurred. Our sponsoring banks hold such reserves related to our merchant accounts as long as we are exposed to loss resulting from a merchant’s processing activity. In the event that a small company finds it difficult to post a cash reserve upon opening an account with us, we may build the reserve by retaining a percentage of each transaction the merchant performs until the reserve is established. This solution permits the merchant to fund our reserve requirements gradually as its business develops. As of December 31, 2020, total reserve deposits were approximately $13.3 million. We have no legal title to the cash accounts maintained at the sponsor bank in order to cover potential chargeback and related losses under the applicable merchant agreements. We also have no legal obligation to these merchants with respect to these reserve accounts. Accordingly, we do not include these accounts and the corresponding obligation to the merchants in our consolidated financial statements. |

North American Transaction Solutions Sponsoring Banks and Data Processors. Because we are not a “member bank” as defined by Visa, MasterCard, American Express and Discover (“Card Brands”), in order to authorize and settle payment transactions for merchants, we must be sponsored by a financial institution that holds member bank status with the Card Brands (“Sponsorship Bank” in the case of Visa and MasterCard) and various third-party vendors (“Data Processors”) to assist us with these functions. Card Brand rules restrict us from performing funds settlement or accessing merchant settlement funds and require that these funds be in the possession of a Sponsorship Bank until the merchant is funded.

Sponsoring Bank. We have agreements with several banks that sponsor us for membership in the Visa, MasterCard, American Express and Discover card brands and settle card transactions for our merchants. These agreements allow us to use the banks’ identification numbers, referred to as Bank Identification Number (“BIN”) for Visa transactions and Interbank Card Association (“ICA”) number for MasterCard transactions. The principal Sponsoring Bank through which we processed the majority of our transaction in the United States during 2020 was with Esquire Bank, N.A. In addition, we process transactions through BIN sponsorship agreements with Citizens Bank, N.A. and Wells Fargo Bank, N.A. From time to time, we may enter into agreements with additional banks.