Exhibit 5.14

March 17, 2016

Vinson & Elkins L.L.P.

666 Fifth Avenue

26th Floor

New York, New York 10103

Ladies and Gentlemen:

We have acted as special counsel in the State of Indiana to the entities listed on Exhibit “A” hereto (each individually a “Local Entity” and, collectively, the “Local Entities”) in connection with the preparation of a Registration Statement on Form S-4 (the “Registration Statement”) filed by StoneMor Partners L.P., a Delaware limited partnership (the “Partnership”), Cornerstone Family Services of West Virginia Subsidiary, Inc., a West Virginia corporation (“Cornerstone” and, together with the Partnership, the “Issuers”), and certain other subsidiaries of the Partnership identified on the Registration Statement including the Local Entities (the “Guarantors”), with the Securities and Exchange Commission (the “Commission”) in connection with (a) the issuance by the Issuers of up to $175,000,000 aggregate principal amount of their 7 7⁄8% Senior Notes due 2021 (the “New Notes”) registered pursuant to the Registration Statement under the Securities Act of 1933, as amended (the “Securities Act”), in exchange for up to $175,000,000 aggregate principal amount of the Issuers’ outstanding 7 7⁄8% Senior Notes due 2021 (together with the New Notes, the “Notes”) and (b) the Guarantors’ unconditional guarantee of the payment of the New Notes (the “Guarantees”) also being registered pursuant to the Registration Statement under the Securities Act.

The New Notes will be issued under an Indenture, dated as of May 28, 2013 (as amended from time to time, the “Indenture”), among the Issuers, the Guarantors and Wilmington Trust, National Association, as trustee. The Indenture provides that it, the Guarantees and the Notes are to be governed by, and construed in accordance with, the laws of the State of New York.

Before rendering our opinions hereinafter set forth, we examined originals or copies, certified or otherwise identified to our satisfaction, of the Indenture, the Operating Agreement or Bylaws of each Local Entity, as applicable, certified by the secretary or another officer of such Local Entity, and such other documents as we considered appropriate as a basis for the opinions set forth below, and we reviewed such questions of law as we considered appropriate for purposes of the opinions hereafter expressed. In such examination, we have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified or photostatic copies, and we have assumed that the Indenture was duly authorized, executed and delivered by the parties thereto, except as we have specifically opined herein with respect to the Local Entities, that the Registration Statement, and any amendments thereto (including post-effective amendments), will have become effective and that the New Notes will be duly authorized, executed and delivered by each of the Issuers and will be issued and exchanged in compliance with applicable federal and state securities laws and in the manner described in the Registration Statement.

Vinson & Elkins L.L.P.

March 17, 2016

| 2 |

With respect to facts material to our opinions herein, we have relied, without independent investigation or verification, on representations from officers of the Local Entities and certificates from such officers and from public officials, and have assumed that all such representations and certifications of fact are true, accurate and complete. With respect to our opinion in paragraph 1 below as to the due formation and valid existence of the Local Entities, we have relied exclusively on certificates of status, dated as of recent dates (the “Entity Certificates”), from officials of the State of Indiana and/or written facsimile advice, dated as of recent dates, from Corporation Services Company.

Based on the foregoing, we are of the opinion that:

| 1. | Based solely upon our review of the Entity Certificates, each Local Entity is validly existing and subsisting as a limited liability company or corporation, as applicable, under the laws of the State of Indiana. |

| 2. | As of the date of the Indenture, each Local Entity had all corporate/limited liability company power and capacity to execute and deliver the Indenture, and as of the date hereof each Local Entity has all corporate/limited liability company power and capacity to perform its obligations thereunder. |

| 3. | All necessary action has been taken on the part of each Local Entity to authorize the execution and delivery of the Indenture and the performance by each Local Entity of its obligations thereunder (including its Guarantee as provided therein). |

| 4. | The Indenture has been duly executed and delivered by each Local Entity to the extent that execution and delivery are governed by the laws of the State of Indiana. |

The opinions expressed herein are limited in all respects to the laws of the State of Indiana, and we are expressing no opinion as to the effect of the federal laws of the United States of America or the laws of any other jurisdiction, domestic or foreign.

Our opinions are subject to the following further exceptions, exclusions, limitations, assumptions and qualifications:

(a) We render no opinion herein whatsoever regarding the enforceability of the Indenture and/or the Registration Statement;

(b) We express no opinion as to the applicability to, or the effect of noncompliance by, any Note purchaser under the Indenture with any state or federal laws applicable to the transactions contemplated by the Indenture and/or the Registration Statement because of the nature of the business of such Note purchaser under the Indenture;

Vinson & Elkins L.L.P.

March 17, 2016

| 3 |

(c) We render no opinion herein whatsoever regarding: (i) the compliance with, or any governmental or regulatory filing, approval, authorization, license or consent required by or under any (A) health or environmental law, (B) antitrust law, (C) securities law, (D) taxation law, (E) worker health or safety, subdivision, building code, use and occupancy, zoning or permitting or land use matter, (F) patent, trademark or copyright law, or (G) labor or employment law (including, but not limited to, pension and employee benefit law, rule or regulation); (ii) the compliance or noncompliance of any real estate, personal property or business operations of any Local Entity with federal, state or local laws, statutes, ordinances, rules or regulations; or (iii) the compliance with, or any governmental or regulatory filing, approval, authorization, license or consent required by the Covered State to operate a cemetery company, cemetery corporation, funeral establishment, funeral home and/or crematory, including, but not limited to, any licenses or regulatory filings required by the Indiana State Board of Funeral & Cemetery Service.

This opinion letter is strictly limited to the matters stated herein and no other or more extensive opinion is intended, implied or to be inferred beyond the matters expressly stated herein. This opinion letter is not a guaranty and should not be construed or relied on as such.

We express no opinion as to the impact on any guarantee made by the Local Entities, or on the corporate power and authority of the Local Entities, to enter into and perform obligations under any guarantee, of any applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium, and similar laws affecting creditors’ rights and remedies generally, and our opinions are made subject, as to enforceability, to general principles of equity, including principles of commercial reasonableness, good faith and faith dealing (regardless of whether enforcement is sought in a proceeding at law or in equity) and it is noted that confession of judgment or cognovit provisions are prohibited in Indiana and holding such an instrument or attempted enforcement of such an instrument is a crime under Indiana law (Indiana Code § 34-54-4-1).

This opinion letter is given as of the date hereof. We assume no obligation to update or supplement this opinion letter to reflect any facts or circumstances which may hereafter come to our attention or any changes in laws which may hereafter occur.

This opinion letter is rendered solely for the benefit of the addressee hereof in connection with the Registration Statement, and such addressee may rely on this opinion in connection with its opinion, dated the date hereof, filed with the Commission as an exhibit to the Registration Statement. This opinion letter may not be relied upon in connection with any other matter or by any other person or entity without our express prior written consent. This opinion may not be quoted or in any way published or provided to any person or entity without our express prior written consent; provided,

Vinson & Elkins L.L.P.

March 17, 2016

| 4 |

however, that we hereby consent to the filing of this opinion as an exhibit to the Registration Statement and the reference to our firm under the caption “Legal Matters” in the Prospectus forming part of the Registration Statement. In giving such consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

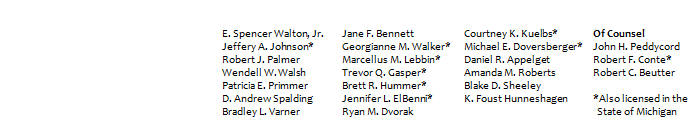

/s/ MAY•OBERFELL•LORBER

Vinson & Elkins L.L.P.

March 17, 2016

| 5 |

EXHIBIT A

Chapel Hill Funeral Home, Inc., an Indiana corporation

Covington Memorial Funeral Home, Inc., an Indiana corporation

Covington Memorial Gardens, Inc., an Indiana corporation

Forest Lawn Memorial Chapel, Inc., an Indiana corporation

Forest Lawn Memorial Gardens, Inc., an Indiana corporation

StoneMor Indiana, LLC, an Indiana limited liability company

StoneMor Indiana Subsidiary, LLC, an Indiana limited liability company